#Outsourcing For Insurance Business

Explore tagged Tumblr posts

Text

SourceThrive offers ultimate insurance process outsourcing solutions for U.S.-based insurance agencies, brokers, wholesalers, and carriers, providing timely and accurate insurance quotes to streamline operations and enhance efficiency.

#business process outsourcing#insurance outsourcing#insurance process outsourcing#reinstatement insurance#invoicing services

0 notes

Text

Data Protection: Legal Safeguards for Your Business

In today’s digital age, data is the lifeblood of most businesses. Customer information, financial records, and intellectual property – all this valuable data resides within your systems. However, with this digital wealth comes a significant responsibility: protecting it from unauthorized access, misuse, or loss. Data breaches can have devastating consequences, damaging your reputation, incurring…

View On WordPress

#affordable data protection insurance options for small businesses#AI-powered tools for data breach detection and prevention#Are there any data protection exemptions for specific industries#Are there any government grants available to help businesses with data security compliance?#benefits of outsourcing data security compliance for startups#Can I be fined for non-compliance with data protection regulations#Can I outsource data security compliance tasks for my business#Can I use a cloud-based service for storing customer data securely#CCPA compliance for businesses offering loyalty programs with rewards#CCPA compliance for California businesses#cloud storage solutions with strong data residency guarantees#consumer data consent management for businesses#cost comparison of data encryption solutions for businesses#customer data consent management platform for e-commerce businesses#data anonymization techniques for businesses#data anonymization techniques for customer purchase history data#data breach compliance for businesses#data breach notification requirements for businesses#data encryption solutions for businesses#data protection impact assessment (DPIA) for businesses#data protection insurance for businesses#data residency requirements for businesses#data security best practices for businesses#Do I need a data privacy lawyer for my business#Do I need to train employees on data privacy practices#Does my California business need to comply with CCPA regulations#employee data privacy training for businesses#free data breach compliance checklist for small businesses#GDPR compliance for businesses processing employee data from the EU#GDPR compliance for international businesses

0 notes

Text

there is no ethical consumption under capitalism

Years ago now, I remember seeing the rape prevention advice so frequently given to young women - things like dressing sensibly, not going out late, never being alone, always watching your drink - reframed as meaning, essentially, "make sure he rapes the other girl." This struck a powerful chord with me, because it cuts right to the heart of the matter: that telling someone how to lower their own chances of victimhood doesn't stop perpetrators from existing. Instead, it treats the existence of perpetrators as a foregone conclusion, such that the only thing anyone can do is try, by their own actions, to be a less appealing or more difficult victim.

And the thing is, ever since the assassination of United Healthcare CEO Brian Thompson, I've kept on thinking about how, in this day and age, CEOs of big companies often have an equal or greater impact on the day to day lives of regular people than our elected officials, and yet we have almost no legal way to redress any grievances against them - even when their actions, as in the case of Thompson's stewardship of UHC, arguably see them perpetrating manslaughter at scale through tactics like claims denial. That this is a real, recurring thing that happens makes the American healthcare insurance industry a particularly pernicious example, but it's far from being the only one. Because the original premise of the free market - the idea that we effectively "vote" for or against businesses with our dollars, thereby causing them to sink or swim on their individual merits - is utterly broken, and has been for decades, assuming it was ever true at all. In this age of megacorporations and global supply chains, the vast majority of people are dependent on corporations for necessities such as gas, electricity, internet access, water, food, housing and medical care, which means the consumer base is, to all intents and purposes, a captive market. We might not have to buy a specific brand, but we have to buy a brand, and as businesses are constantly competing with one another to bring in profits, not just for the company and its workers, but for C-suites and shareholders - profits that increasingly come at the expense of workers and consumers alike - the greediest, most inhumane corporations set the financial yardstick against which all others are then, of necessity, measured. Which means that, while businesses are not obliged to be greedy and inhumane in order to exist, overwhelmingly, they become greedy and humane in order to compete, because capitalism encourages it, and because there are precious few legal restrictions to stop them from doing so. At the same time, a handful of megacorporations own so many market-dominating brands that, without both significant personal wealth and the time and resources to find viable alternatives, it's all but impossible to avoid them, while the ubiquity of the global supply chain means that, even if you can keep track of which company owns which brand, it's much, much harder to establish which suppliers provide the components that are used in the products bearing their labels. Consider, for instance, how many mainstream American brands are functionally run on sweatshop labour in other parts of the world: places where these big corporations have outsourced their workforce to skirt the already minimal labour and wage protections they'd be obliged to adhere to in the US, all to produce (say) electronics whose elevated sticker price passes a profit on to the company, but without resulting in higher wages for either the sweatshop workers overseas or the American employees selling the products in branded US stores.

When basically every major electronics corporation is engaged in similar business practices, there is no "vote" our money can bring that causes the industry itself to be better regulated - and as wealthy, powerful lobbyists from these industries continue to pay exorbitant sums of money to politicians to keep government regulation at a minimum, even our actual votes can do little to effect any sort of change. But even in those rare instances where new regulations are passed, for multinational corporations, laws passed in one country overwhelmingly don't prevent them from acting abusively overseas, exploiting more desperate populations and cash-poor governments to the same greedy, inhumane ends. And where the ultimate legal penalty for proven transgressions is, more often than not, a fine - which is to say, a fee; which is to say, an amount which, while astronomical by the standards of regular people, still frequently costs the company less than the profits earned through their unethical practices, and which is paid from corporate coffers rather than the bank accounts of the CEOs who made the decisions - big corporations are, in essence, free to act as badly as they can afford to; which is to say, very. Contrary to the promise of the free market, therefore, we as consumers cannot meaningfully "vote" with our dollars in a way that causes "good" businesses to rise to the top, because everything is too interconnected. Our choices under global capitalism are meaningless, because there is no other system we can financially support that stands in opposition to it, and while there are still small businesses and companies who try to operate ethically, both their comparative smallness and their interdependent reliance on the global supply chain means that, even if we feel better about our choices, we're not exerting any meaningful pressure on the system we're trying to change. Which means that, under the free market, trying to be an ethical consumer is functionally equivalent to a young woman dressing modestly, not going out alone and minding her drink at parties in order to avoid being raped. We're not preventing corporate predation or sending a message to corporate predators: we're just making sure they screw other worker, the other consumer, the other guy.

All of which is to say: while I'd prefer not to live in a world where shooting someone dead in the street is considered a valid means of redressing grievances, what the murder of Brian Thompson has shown is that, if you provide no meaningful recourse for justice against abusive, exploitative members of the 1%, then violence done to those people will have the feel of justice, because it fills the void left by the lack of consequences for their actions. It's the same reason why people had little sympathy for the jackass OceanGate CEO who killed himself in his imploding sub, or anyone whose yacht has been attacked by orcas - it's just intensified here, because where the OceanGate CEO was felled by hubris and the yachts were random casualties, whoever killed Thomspon did so deliberately, because of what he did. It was direct action against a man whose policies very arguably constituted manslaughter at scale; a crime which ought to be a crime, but which has, to date, been permitted under the law. And if the law wouldn't stop him, can anyone be surprised that someone might act outside the law in retaliation - or that regular people would cheer for them when they did?

3K notes

·

View notes

Text

#rannsolve#texas#usa#business#data entry services#data entry service provider#Insurance Data Entry#united states of america#rannsolveinc#documentmanagementsystem#outsource data entry#data conversion services#data management#insurance#data analytics

0 notes

Text

Talent Management in Denver - Hybrid Payroll

What is a talent management system?

A talent management system refers to a suite of software applications and strategies designed to effectively recruit, develop, retain, and manage a company’s workforce. It encompasses various HR functions and processes related to attracting, nurturing, and retaining talent within an organization.

Key components of a talent management system typically include:

Recruitment and Applicant Tracking: Tools for sourcing, attracting, and managing job applicants. This includes job postings, resume screening, and applicant tracking systems.

Performance Management: Systems for setting goals, evaluating performance, providing feedback, and identifying areas for employee development.

Learning and Development: Platforms for training, skill development, and career advancement opportunities, such as online courses, workshops, and personalized learning paths.

Succession Planning: Strategies and tools for identifying and developing future leaders within the organization to fill key roles when needed.

Employee Engagement and Retention: Methods to gauge employee satisfaction, gather feedback, and create strategies to enhance workplace satisfaction and retention.

Analytics and Reporting: Tools that collect and analyze data on various HR metrics to provide insights for better decision-making.

The goal of a talent management system is to align an organization’s workforce with its business goals, ensuring that it attracts and retains top talent while fostering employee growth and development. These systems help streamline HR processes, enhance employee engagement, and contribute to overall organizational success.

Is talent management a HR?

Talent management is closely associated with HR (Human Resources) as it involves strategies and practices related to the acquisition, development, and retention of employees within an organization. In many companies, talent management falls under the umbrella of HR functions.

While HR traditionally focuses on various aspects of employee management, such as hiring, compensation, benefits, and compliance, talent management specifically emphasizes the strategic approach to attracting, nurturing, and retaining top talent. It’s often considered a more proactive and long-term perspective within the broader field of HR.

Talent management extends beyond traditional HR functions by emphasizing the identification of high-potential employees, succession planning, leadership development, and creating an environment that fosters employee growth and engagement.

In summary, while talent management is closely related to HR, it represents a more specialized and strategic aspect of managing human capital within an organization.

#Hospitality Ancillary Insurance#Hemp Payroll Company Denver#Construction Onboarding Services#Hr Solutions For Financing Business#Payroll Outsourcing Services Denver#Payroll Management Solutions

0 notes

Text

#sblknowledgeservices#insurance outsourcing#insurance claims#insurance busiess process#insurance bpo service#bpo services#business process outsourcing

0 notes

Text

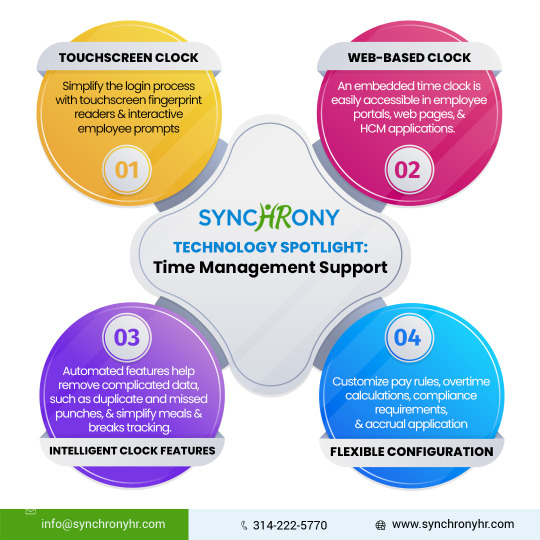

Technology Spotlight: Time Management Support

As an HR outsourcing (HRO) organization, SynchronyHR offers clients a one-stop shop for leading payroll, benefits, and HR technology.

https://www.synchronyhr.com/post/technology-spotlight-time-management-support

#hr outsourcing#payroll outsourcing#workers compensation insurance#businessgrowth#employee benefits for small business#professional employer organization#employee benefits#risk management services#synchronyhr#peo companies

0 notes

Text

Cigna’s nopeinator

I'm touring my new, nationally bestselling novel The Bezzle! Catch me THURSDAY (May 2) in WINNIPEG, then Calgary (May 3), Vancouver (May 4), Tartu, Estonia, and beyond!

Cigna – like all private health insurers – has two contradictory imperatives:

To keep its customers healthy; and

To make as much money for its shareholders as is possible.

Now, there's a hypothetical way to resolve these contradictions, a story much beloved by advocates of America's wasteful, cruel, inefficient private health industry: "If health is a "market," then a health insurer that fails to keep its customers healthy will lose those customers and thus make less for its shareholders." In this thought-experiment, Cigna will "find an equilibrium" between spending money to keep its customers healthy, thus retaining their business, and also "seeking efficiencies" to create a standard of care that's cost-effective.

But health care isn't a market. Most of us get our health-care through our employers, who offer small handful of options that nevertheless manage to be so complex in their particulars that they're impossible to directly compare, and somehow all end up not covering the things we need them for. Oh, and you can only change insurers once or twice per year, and doing so incurs savage switching costs, like losing access to your family doctor and specialists providers.

Cigna – like other health insurers – is "too big to care." It doesn't have to worry about losing your business, so it grows progressively less interested in even pretending to keep you healthy.

The most important way for an insurer to protect its profits at the expense of your health is to deny care that your doctor believes you need. Cigna has transformed itself into a care-denying assembly line.

Dr Debby Day is a Cigna whistleblower. Dr Day was a Cigna medical director, charged with reviewing denied cases, a job she held for 20 years. In 2022, she was forced out by Cigna. Writing for Propublica and The Capitol Forum, Patrick Rucker and David Armstrong tell her story, revealing the true "equilibrium" that Cigna has found:

https://www.propublica.org/article/cigna-medical-director-doctor-patient-preapproval-denials-insurance

Dr Day took her job seriously. Early in her career, she discovered a pattern of claims from doctors for an expensive therapy called intravenous immunoglobulin in cases where this made no medical sense. Dr Day reviewed the scientific literature on IVIG and developed a Cigna-wide policy for its use that saved the company millions of dollars.

This is how it's supposed to work: insurers (whether private or public) should permit all the medically necessary interventions and deny interventions that aren't supported by evidence, and they should determine the difference through internal reviewers who are treated as independent experts.

But as the competitive landscape for US healthcare dwindled – and as Cigna bought out more parts of its supply chain and merged with more of its major rivals – the company became uniquely focused on denying claims, irrespective of their medical merit.

In Dr Day's story, the turning point came when Cinga outsourced pre-approvals to registered nurses in the Philippines. Legally, a nurse can approve a claim, but only an MD can deny a claim. So Dr Day and her colleagues would have to sign off when a nurse deemed a procedure, therapy or drug to be medically unnecessary.

This is a complex determination to make, even under ideal circumstances, but Cigna's Filipino outsource partners were far from ideal. Dr Day found that nurses were "sloppy" – they'd confuse a mother with her newborn baby and deny care on that grounds, or confuse an injured hip with an injured neck and deny permission for an ultrasound. Dr Day reviewed a claim for a test that was denied because STI tests weren't "medically necessary" – but the patient's doctor had applied for a test to diagnose a toenail fungus, not an STI.

Even if the nurses' evaluations had been careful, Dr Day wanted to conduct her own, thorough investigation before overriding another doctor's judgment about the care that doctor's patient warranted. When a nurse recommended denying care "for a cancer patient or a sick baby," Dr Day would research medical guidelines, read studies and review the patient's record before signing off on the recommendation.

This was how the claims denial process is said to work, but it's not how it was supposed to work. Dr Day was markedly slower than her peers, who would "click and close" claims by pasting the nurses' own rationale for denying the claim into the relevant form, acting as a rubber-stamp rather than a skilled reviewer.

Dr Day knew she was slower than her peers. Cigna made sure of that, producing a "productivity dashboard" that scored doctors based on "handle time," which Cigna describes as the average time its doctors spend on different kinds of claims. But Dr Day and other Cigna sources say that this was a maximum, not an average – a way of disciplining doctors.

These were not long times. If a doctor asked Cigna not to discharge their patient from hospital care and a nurse denied that claim, the doctor reviewing that claim was supposed to spend not more than 4.5 minutes on their review. Other timelines were even more aggressive: many denials of prescription drugs were meant to be resolved in fewer than two minutes.

Cigna told Propublica and The Capitol Forum that its productivity scores weren't based on a simple calculation about whether its MD reviewers were hitting these brutal processing time targets, describing the scores as a proprietary mix of factors that reflected a nuanced view of care. But when Propublica and The Capitol Forum created a crude algorithm to generate scores by comparing a doctor's performance relative to the company's targets, they found the results fit very neatly into the actual scores that Cigna assigned to its docs:

The newsrooms’ formula accurately reproduced the scores of 87% of the Cigna doctors listed; the scores of all but one of the rest fell within 1 to 2 percentage points of the number generated by this formula. When asked about this formula, Cigna said it may be inaccurate but didn’t elaborate.

As Dr Day slipped lower on the productivity chart, her bosses pressured her bring her score up (Day recorded her phone calls and saved her emails, and the reporters verified them). Among other things, Dr Day's boss made it clear that her annual bonus and stock options were contingent on her making quota.

Cigna denies all of this. They smeared Dr Day as a "disgruntled former employee" (as though that has any bearing on the truthfulness of her account), and declined to explain the discrepancies between Dr Day's accusations and Cigna's bland denials.

This isn't new for Cigna. Last year, Propublica and Capitol Forum revealed the existence of an algorithmic claims denial system that allowed its doctors to bulk-deny claims in as little as 1.2 seconds:

https://www.propublica.org/article/cigna-pxdx-medical-health-insurance-rejection-claims

Cigna insisted that this was a mischaracterization, saying the system existed to speed up the approval of claims, despite the first-hand accounts of Cigna's own doctors and the doctors whose care recommendations were blocked by the system. One Cigna doctor used this system to "review" and deny 60,000 claims in one month.

Beyond serving as an indictment of the US for-profit health industry, and of Cigna's business practices, this is also a cautionary tale about the idea that critical AI applications can be resolved with "humans in the loop."

AI pitchmen claim that even unreliable AI can be fixed by adding a "human in the loop" that reviews the AI's judgments:

https://pluralistic.net/2024/04/23/maximal-plausibility/#reverse-centaurs

In this world, the AI is an assistant to the human. For example, a radiologist might have an AI double-check their assessments of chest X-rays, and revisit those X-rays where the AI's assessment didn't match their own. This robot-assisted-human configuration is called a "centaur."

In reality, "human in the loop" is almost always a reverse-centaur. If the hospital buys an AI, fires half its radiologists and orders the remainder to review the AI's superhuman assessments of chest X-rays, that's not an AI assisted radiologist, that's a radiologist-assisted AI. Accuracy goes down, but so do costs. That's the bet that AI investors are making.

Many AI applications turn out not to even be "AI" – they're just low-waged workers in an overseas call-center pretending to be an algorithm (some Indian techies joke that AI stands for "absent Indians"). That was the case with Amazon's Grab and Go stores where, supposedly, AI-enabled cameras counted up all the things you put in your shopping basket and automatically billed you for them. In reality, the cameras were connected to Indian call-centers where low-waged workers made those assessments:

https://pluralistic.net/2024/01/29/pay-no-attention/#to-the-little-man-behind-the-curtain

This Potemkin AI represents an intermediate step between outsourcing and AI. Over the past three decades, the growth of cheap telecommunications and logistics systems let corporations outsource customer service to low-waged offshore workers. The corporations used the excuse that these subcontractors were far from the firm and its customers to deny them any agency, giving them rigid scripts and procedures to follow.

This was a very usefully dysfunctional system. As a customer with a complaint, you would call the customer service line, wait for a long time on hold, spend an interminable time working through a proscribed claims-handling process with a rep who was prohibited from diverging from that process. That process nearly always ended with you being told that nothing could be done.

At that point, a large number of customers would have given up on getting a refund, exchange or credit. The money paid out to the few customers who were stubborn or angry enough to karen their way to a supervisor and get something out of the company amounted to pennies, relative to the sums the company reaped by ripping off the rest.

The Amazon Grab and Go workers were humans in robot suits, but these customer service reps were robots in human suits. The software told them what to say, and they said it, and all they were allowed to say was what appeared on their screens. They were reverse centaurs, serving as the human faces of the intransigent robots programmed by monopolists that were too big to care.

AI is the final stage of this progression: robots without the human suits. The AI turns its "human in the loop" into a "moral crumple zone," which Madeleine Clare Elish describes as "a component that bears the brunt of the moral and legal responsibilities when the overall system malfunctions":

https://estsjournal.org/index.php/ests/article/view/260

The Filipino nurses in the Cigna system are an avoidable expense. As Cigna's own dabbling in algorithmic claim-denial shows, they can be jettisoned in favor of a system that uses productivity dashboards and other bossware to push doctors to robosign hundreds or thousands of denials per day, on the pretense that these denials were "reviewed" by a licensed physician.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/04/29/what-part-of-no/#dont-you-understand

#pluralistic#cigna#computer says no#bossware#moral crumple zones#medicare for all#m4a#whistleblowers#dr debby day#Madeleine Clare Elish#automation#ai#outsourcing#human in the loop#humans in the loop

242 notes

·

View notes

Text

Watcher's Expenses

I didn't major in accounting: I took three classes and it grinded my brain to a fine powder. However, after graduating with a business admin degree, being a former eager fan of their videos, and from a cursory glance over their socials, there's a lot to consider in their spending behavior that really could start racking up costs. Some of these things we've already noticed, but there are other things I'd like to highlight, and I'll try to break it down into the different categories of accounting expenses (if I get something wrong, let me know. I was more concentrated in marketing 🤷♀️). I'm not going to hypothesize numbers either, as that would take out more time than I'm willing to afford-- you can assume how much everything costs. Anyways, here's my attempt at being a layman forensic accountant:

Note: All of this is assuming they're operating above board and not engaging in any illegal practices such as money laundering, tax evasion, not paying rent, etc.

Operating Expenses

Payroll: 25+ staff salaries and insurance

Overhead Expenses

CEO/founder salaries

Office space leasing or rent (In L.A, one of the most expensive cities in the US)

Utilities (water, electricity, heating, sanitation, etc.)

Insurance

Advertising Costs

Telephone & Internet service

Cloud Storage or mainframe

Office equipment (furniture, computers, printers, etc.)

Office supplies (paper, pens, printer ink, etc.)

Marketing costs (Social media marketing on Instagram, Youtube, SEO for search engines, Twitter, etc. Designing merchandise and posters, art, etc. )

Human Resources (not sure how equipped they are)

Accounting fees

Property taxes

Legal fees

Licensing fees

Website maintenance (For Watchertv.com, Watcherstuff.com, & Watcherentertainment.com)

Expenses regarding merchandising (whoever they contract or outsource for that)

Inventory costs

Potentially maintenance of company vehicles

Subsequent gas mileage for road trips

Depreciation (pertains to tangible assets like buildings and equipment)

Amortization (intangible assets such as patents and trademarks)

Overhead Travel and Entertainment Costs (I think one of the biggest culprits, evident in their videos and posts)

The travel expenses (flights, train trips, rental cars, etc. For main team and scouts)

Hotel expenses for 7-8 people at least, or potentially more

Breakfasts, lunches and dinners with the crew (whether that's fully on their dime or not, I don't know; Ryan stated they like to cover that for the most part)

Recreational activities (vacation destinations, amusement parks, sporting activities etc.)

The location fees

Extraneous Overhead costs (not sure exactly where these fall under, but another culprit, evident in videos and posts)

Paying for guest appearances

Expensive filming & recording equipment (Cameras, sound equipment, editing software subscriptions, etc.)

The overelaborate sets for Ghost files, Mystery Files, Puppet History, Podcasts etc. (Set dressing: Vintage memorabilia, antiquated tech, vintage furniture, props, etc.)

Kitchen & Cooking supplies/equipment

Office food supply; expensive food and drink purchases for videos

Novelty items or miscellaneous purchases (ex. Ghost hunting equipment, outfits, toys, etc.)

Non-Operating Expenses

These are those expenses that cannot be linked back to operating revenue. One of the most common examples of non-operating expenses is interest expense. This is because while interest is the cost of borrowing money from a creditor or a bank, they are not generating any operating income. This makes interest payments a part of non-operating expenses.

Financial Expenses

Potential loan payments, borrowing from creditors or lenders, bank loans, etc.

Variable Expenses

Hiring a large amount of freelancers, overtime expenditure, commissions, etc.

PR consultations (Not sure if they had this before the scandal)

Extraordinary Expenses

Expenses incurred outside your company’s regular business activities and during a large one-time event or transactions. For example, selling land, disposal of a significant asset, laying off of your employees, unexpected machine repairing or replacement, etc.

Accrued Expenses

When your business has incurred an expense but not yet paid for it.

------------------------------------------------------------------------------------------------------------------------

(If there's anything else I'm missing, please feel free to add or correct things)

To a novice or a young entrepreneur, this can be very intimidating if you don't have the education or the support to manage it properly. I know it intimidates the hell out of me and I'm still having to fill in the gaps (again, if I've mislabeled or gotten anything wrong here, please let me know). For the artistic or creative entrepreneur, it can be even harder to reconcile the extent of your creative passions with your ability to operate and scale your business at a sustainable rate. That can lead to irresponsible, selfish, and impulsive decisions that could irreparably harm your brand, which is a whole other beast of its own.

My guess at this point is that their overhead and operation expenses are woefully mismanaged; they've made way too many extraneous purchases, and that they had too much confidence in their audience of formerly 2.93 million to make up for the expenses they failed to cover.

It almost seems as if their internal logic was, "If we make more money, we can keep living the expensive lifestyle that we want and make whatever we want without anyone telling us we can't, and we want to do it NOW, sooner rather than later because we don't want wait and compromise our vision." But as you can see, the reality of fulfilling those ambitions is already compromised by the responsibility of running a business.

And I wrote this in another post here, but I'll state it again: Running a business means you need to be educated on how a business can successfully and efficiently operate. Accounting, marketing, social media marketing, public relations, production, etc; these resources and internet of things is available and at your disposal. If they had invested more time in educating themselves on those aspects and not made this decision based on artistic passion (and/or greed), they would have not gotten the response they got.

Being a graphic designer, I know the creative/passionate side of things but I also got a degree/got educated in business because I wanted to understand how to start a company and run it successfully. If they’re having trouble handling the responsibility of doing that, managing production costs, managing overhead expenses, and especially with compensating their 25+ employees, then they should hire professionals that are sympathetic to their creative interests, but have the education and experience to reign in bad decisions like these.

Anyways, thanks for coming to my TedTalk. What a shitshow this has been.

#watcher#watcher entertainment#ryan bergara#shane madej#steven lim#watcher tv#watchergate#accounting

67 notes

·

View notes

Text

Y'all I am so fucking tired of the like, privatization of healthcare and also the way medicaid works. I've been trying to get this blood work done that I need before my surgery next month and there are apparently only two types of clinics I can go to, SonoraQuest, which has reasonable hours and is open on Saturdays, or LabCorp which is only open on weekdays and closes at 3pm.

Turns out I actually can't go to SonoraQuest because they don't take Medicaid, something I found out after going there and sitting in the lobby for an hour. I have to go to LabCorp.

The problem with LabCorp is that my fiancé works until 3:30pm and he's having a very busy week and thus hasn't been able to leave early to take me. I can't take public transit because I'm disabled and don't have a wheelchair yet and going on foot or with my rollator would ruin my ability to do anything for the rest of the day and possibly the next couple of days too. I can't take a lyft or Uber because my fiancé is the sole breadwinner for our household(I can't work) and right now his shit idiot credit union is straight up breaking the law and repeatedly flagging his cards for *possible* fraud despite there being no fraud, and he's gone through like 5 debit cards in the last two months over this(he's gone in to complain about all the ways this is fucking him over big time and they told him there's literally nothing they can do). He's moving his money to a new credit union atm but that takes time, so he legit cannot access his money and thus he can't give me any to pay for the ride. (The bus also costs money I don't have so that's another reason I can't take it.)

I decided this is all horseshit and called the hospital my surgery will be at and asked if there is somewhere else I can go because this isn't working, and the lady told me I can just go to the hospital for it and that they're open until 7pm. So I went there yesterday, only to find out that the people who do the blood work at the hospital is fucking SonoraQuest and they close at 4pm.

LabCorp does have a service where they'll send a mobile team to your house to collect the blood, but it costs $35 which again. We cannot access my fiancé's money atm. Also that's more than a lyft would cost so even if I had access to money I would prefer to go there myself.

So I am hoping my fiancé will be able to get off work early today so we can go down to LabCorp when they're open and hopefully they won't tell me I need an appointment or that coming in like an hour before they close isn't allowed.

Anyway call me a boomer but there is no fucking world in which I shouldn't be able to just go to my fucking neurosurgeon's office and have a nurse take my blood. Like I should just be able to do that. Or just walk into the hospital which overall does take my insurance and have one of the like 100s of nurses take my goddamn blood. This used to be how this shit worked. Why the fuck have we outsourced this to for profit clinics that suck ass, forcing me to try to move heaven and earth to get myself to a clinic with insanely unreasonable hours, stressing me the fuck out. Also why does having Medicaid mean I have to go to the worse clinic like this always happens, the clinics that take Medicaid are always garbage compared to the ones that don't it's such crap that the poor folks have to put up with sub-par medical services just bcs we're poor.

Anyway I'm going to go scream into a pillow for a while and hope to god I'm able to get this out of the way today bcs if not I'm probably just gonna have to call the neurosurgeon and let them know I might not be able to do the blood work because unfortunately it's fucking impossible.

18 notes

·

View notes

Text

Exploring Career and Job Opportunities in Davao City Philippines

Davao City, recognized as one of the Philippines' most progressive cities, continues to experience remarkable economic growth, creating a vibrant job market that attracts professionals from across the country. The city's diverse economy offers numerous employment opportunities, from entry-level positions to executive roles, making it an attractive destination for job seekers at all career stages.

The Business Process Outsourcing (BPO) sector stands as one of the largest employers in Davao City, providing thousands of jobs across various specializations. Companies in this sector actively recruit customer service representatives, technical support specialists, and quality assurance analysts, offering competitive salaries and comprehensive benefits packages. The industry's continued expansion has created numerous opportunities for career advancement, with many organizations promoting from within and providing extensive training programs.

Part-time employment opportunities have also flourished in Davao City, catering to students, professionals seeking additional income, and individuals preferring flexible work arrangements. The retail sector, food service industry, and education field offer numerous part-time positions with varying schedules and responsibilities. These roles often provide valuable work experience and can serve as stepping stones to full-time careers.

The Information Technology sector in Davao has seen significant growth, with many companies seeking software developers, web designers, and IT support specialists. This growth has been fueled by the city's improving technological infrastructure and the increasing number of tech-focused businesses establishing operations in the region. Tech professionals can find opportunities in both established companies and startups, with many positions offering competitive compensation and the possibility of remote work arrangements.

Davao's hospitality and tourism industry continues to expand, creating jobs in hotels, restaurants, travel agencies, and tour operations. The sector offers positions ranging from entry-level service roles to management positions, with many employers providing training and development opportunities. The industry's growth has also sparked demand for professionals in events management and tourism marketing.

The education sector presents numerous opportunities for both full-time and part-time employment. Educational institutions regularly seek teachers, tutors, and administrative staff. The rise of online learning has created additional opportunities for English language teachers and academic consultants who can work flexible hours from home or teaching centers.

Job hiring in Davao, the digital economy has opened new avenues for employment. E-commerce specialists, digital content creators, and social media managers are in high demand as businesses increasingly establish their online presence. These positions often offer the flexibility of remote work while providing competitive compensation packages.

Professional development resources are readily available in Davao City, with numerous institutions offering skills training programs and industry certifications. Job seekers can access career counseling services, resume writing assistance, and interview coaching through various employment support organizations. These resources prove invaluable in helping candidates prepare for and secure desired positions.

The financial services sector in Davao has also experienced substantial growth, creating opportunities for banking professionals, insurance specialists, and investment consultants. These positions typically offer attractive compensation packages, including performance bonuses and health benefits, making them highly sought after by experienced professionals.

Davao's agricultural sector continues to evolve, combining traditional farming with modern agribusiness practices. This has created opportunities for agricultural technologists, food processing specialists, and supply chain professionals. The sector offers both technical and management positions, with many companies providing specialized training and development programs.

For those entering Davao's job market, proper preparation is essential. Successful job seekers typically maintain updated resumes, prepare comprehensive portfolios, and stay informed about industry developments. Professional networking, both online and offline, plays a crucial role in discovering opportunities and advancing careers in the city.

The future of Davao's job market looks promising, with emerging industries creating new employment opportunities. The city's commitment to economic development, coupled with its strategic location and robust infrastructure, continues to attract businesses and investors, ensuring a steady stream of job opportunities for qualified candidates.

Whether seeking full-time employment or part-time job in Davao City offers a diverse range of opportunities across multiple industries. Success in this dynamic job market often comes to those who combine proper preparation with continuous skill development and effective networking. As the city continues to grow and evolve, its job market remains a beacon of opportunity for professionals seeking to build meaningful careers in Mindanao's premier business hub.

#Davao City#recognized as one of the Philippines' most progressive cities#continues to experience remarkable economic growth#creating a vibrant job market that attracts professionals from across the country. The city's diverse economy offers numerous employment op#from entry-level positions to executive roles#making it an attractive destination for job seekers at all career stages.#The Business Process Outsourcing (BPO) sector stands as one of the largest employers in Davao City#providing thousands of jobs across various specializations. Companies in this sector actively recruit customer service representatives#technical support specialists#and quality assurance analysts#offering competitive salaries and comprehensive benefits packages. The industry's continued expansion has created numerous opportunities fo#with many organizations promoting from within and providing extensive training programs.#Part-time employment opportunities have also flourished in Davao City#catering to students#professionals seeking additional income#and individuals preferring flexible work arrangements. The retail sector#food service industry#and education field offer numerous part-time positions with varying schedules and responsibilities. These roles often provide valuable work#The Information Technology sector in Davao has seen significant growth#with many companies seeking software developers#web designers#and IT support specialists. This growth has been fueled by the city's improving technological infrastructure and the increasing number of t#with many positions offering competitive compensation and the possibility of remote work arrangements.#Davao's hospitality and tourism industry continues to expand#creating jobs in hotels#restaurants#travel agencies#and tour operations. The sector offers positions ranging from entry-level service roles to management positions#with many employers providing training and development opportunities. The industry's growth has also sparked demand for professionals in ev#The education sector presents numerous opportunities for both full-time and part-time employment. Educational institutions regularly seek t

4 notes

·

View notes

Text

Why Payroll Outsourcing in Delhi is Essential for Business Efficiency

Streamline Your Business with Payroll Outsourcing in Delhi

As businesses expand and compliance regulations become more demanding, many organizations are now turning to payroll outsourcing in Delhi to simplify their internal operations. Managing payroll in-house can be tedious, especially when dealing with frequent legal updates, tax deductions, and employee benefits. Outsourcing this function not only ensures accuracy but also provides companies the freedom to focus on core business activities.

What is Payroll Outsourcing?

Payroll outsourcing is the process of hiring an external service provider to manage a company's entire payroll system. This includes calculating employee salaries, processing tax filings, managing provident fund (PF) and employee state insurance (ESI) contributions, generating payslips, and ensuring legal compliance. For businesses in Delhi—a city teeming with startups, SMEs, and large enterprises—this approach has become a practical necessity.

Benefits of Payroll Outsourcing

1. Cost and Time Efficiency Managing payroll internally can consume significant time and resources. With outsourcing, companies save on the cost of hiring specialized staff or purchasing expensive payroll software. It also eliminates the need for constant training to stay up-to-date with changing laws.

2. Regulatory Compliance Indian payroll laws are complex and ever-evolving. From income tax rules to statutory deductions like PF, ESI, and gratuity, compliance is critical to avoid penalties. A payroll outsourcing provider in Delhi ensures all calculations and filings are handled accurately and on time.

3. Enhanced Accuracy Manual payroll processing can lead to errors in salary calculations or tax filings. With automated systems and expert oversight, outsourced payroll services offer greater accuracy and reliability, reducing the chances of employee dissatisfaction or legal issues.

4. Data Security and Confidentiality Reputable payroll outsourcing firms use secure, cloud-based systems with encryption to protect sensitive employee data. This minimizes the risk of data breaches and ensures confidentiality is maintained at all times.

5. Scalability and Flexibility As your workforce grows or contracts, outsourcing partners can easily scale their services to match your needs. Whether you’re hiring 10 or 100 new employees, your payroll operations remain smooth and efficient.

Services Included in Payroll Outsourcing

Most payroll outsourcing providers in Delhi offer comprehensive solutions that include:

Monthly salary processing and disbursement

Payslip generation and distribution

Tax deductions and filings (TDS, PF, ESI, etc.)

Year-end tax form preparation (Form 16)

Compliance with labor laws and statutory reporting

Attendance and leave management integration

Reimbursement and bonus management

Employee helpdesk support for payroll queries

Advanced service providers may also offer integration with HR software, mobile apps for employees, and dashboards for real-time payroll analytics.

Why Delhi-Based Companies Should Consider Payroll Outsourcing

Delhi is a highly competitive and regulatory-sensitive business environment. Companies in this region must be agile and compliant while controlling costs. Payroll outsourcing is especially beneficial here because local providers have expertise in regional labor rules, state-specific regulations, and offer fast turnaround times for urgent payroll processing needs.

Additionally, Delhi is home to a wide pool of professional payroll service providers who offer tailored solutions for different industries—from IT and education to manufacturing and healthcare.

Choosing the Right Payroll Partner

Before selecting a payroll outsourcing company in Delhi, consider the following:

Experience and Reputation: Look for a provider with proven experience and client testimonials.

Technology Platform: Ensure they use a secure, modern payroll system.

Compliance Knowledge: They should stay updated with the latest changes in tax and labor laws.

Customization Options: Your business may have unique payroll structures or benefits.

Customer Support: Timely and responsive communication is essential for resolving issues quickly.

Final Thoughts

In a fast-moving market like Delhi, where talent retention, compliance, and cost control are key concerns, outsourcing payroll can offer a significant competitive advantage. It streamlines processes, ensures accuracy, and reduces operational stress—allowing companies to concentrate on strategic goals.

Whether you're a small business owner or the HR head of a growing enterprise, payroll outsourcing in Delhi could be the smartest step you take this year toward efficiency and peace of mind.

2 notes

·

View notes

Text

Top 10 IT Software and Consulting Companies in Lucknow

Top 10 IT Software and Consulting Companies in Lucknow

Lucknow, the City of Nawabs, is steadily emerging as a significant hub for IT software and consulting services. With a growing talent pool and increasing digital adoption across industries, several companies are making their mark in this vibrant ecosystem. If you're looking for top-notch IT solutions in Lucknow, here's a list of 10 prominent players:

1. Tata Consultancy Services (TCS)

A global IT giant with a significant presence in Lucknow, TCS offers a comprehensive suite of IT services and consulting. Their expertise ranges from application development and maintenance to enterprise solutions, cloud services, and digital transformation initiatives. TCS is known for its strong delivery capabilities, global reach, and deep industry knowledge.

2. HCLTech

Another major player in the IT services domain, HCLTech has a well-established center in Lucknow. They provide a wide array of services, including software development, infrastructure management, digital process operations, and engineering and R&D services. HCLTech is recognized for its focus on innovation and its ability to deliver end-to-end IT solutions.

3. Wipro

Wipro, a leading global information technology, consulting, and business process services company, also has operations in Lucknow. They offer a broad spectrum of services, including IT consulting, application development, infrastructure services, and business process outsourcing. Wipro is known for its strong client relationships and its commitment to delivering value through technology.

4. Capgemini

Capgemini is a multinational IT services and consulting company with a presence in Lucknow. They provide services across consulting, technology, and outsourcing domains. Capgemini's expertise includes application development, infrastructure management, cybersecurity, and digital transformation services.

5. Augurs Innovation Pvt Ltd

Augurs Innovation Pvt Ltd is a prominent IT software and consulting company based in Lucknow. Known for its cutting-edge software development and robust consulting services, they offer expertise in custom software development, web and mobile application development, cloud solutions, data analytics, and IT consulting. Their client-centric approach and commitment to delivering high-quality, innovative solutions have earned them a strong reputation in the local market.

6. Tech Mahindra

Tech Mahindra, a part of the Mahindra Group, is a leading provider of digital transformation, consulting, and business re-engineering services 1 and solutions. Their Lucknow center contributes to their global delivery network, offering services in areas like software development, network services, and customer experience management.

7. NIIT Technologies (Coforge)

Coforge, formerly known as NIIT Technologies, is a global digital services and solutions company with a presence in Lucknow. They specialize in providing services to industries such as banking and financial services, insurance, travel and transportation, and healthcare. Their offerings include application development, cloud services, and digital process automation.

8. Infosys BPM

While primarily focused on business process management, Infosys BPM in Lucknow also provides IT-enabled services and solutions. They leverage technology to optimize business processes and deliver enhanced customer experiences. Their services include finance and accounting, customer service, and supply chain management.

9. Concentrix

Concentrix is a global customer experience (CX) solutions company with a significant operation in Lucknow. While their core focus is on customer engagement, they also provide technology solutions and support to enhance CX delivery.

10. Ericsson Global Services Pvt Ltd

Ericsson's presence in Lucknow is primarily focused on providing telecom-related IT services and solutions. They contribute to the company's global services delivery capabilities, offering expertise in areas like network management, software development for telecom infrastructure, and support services.

This list showcases a selection of the leading IT software and consulting companies operating in Lucknow. The city's dynamic growth in the technology sector continues to foster innovation and attract businesses seeking reliable IT partners. When making a decision, consider your specific requirements and evaluate these companies based on their expertise, experience, and client feedback.

3 notes

·

View notes

Text

The Benefits of Outsourcing Payroll Services in UK

One of the most crucial parts of managing a business is payroll. For smooth operations, employees must be paid on time and accurately according to tax laws. According to Manag, internal payroll is complicated, time-consuming, and error-prone.

For this reason, many UK-based companies outsource their payroll services. Through outsourcing, a company can save Time, reduce costs, ensure strict compliance with HMRC regulations, and focus on expanding its operations. The following article describes the major benefits of outsourcing UK payroll services and why firms of any size should opt for it.

1. Decrease Administrative Load and Save Time

Payroll processing consumes much time and labor, especially in organizations with hundreds of employees. Activities like following up on pensions, determining earnings, and making tax deductions can take up to 30 hours monthly.

UK-based business organizations may diminish the administrative burden and allow the HR and finance teams to focus on critical roles such as employee training and business expansion.

2. Confirms Conformity to UK Payroll Legislation

HMRC, Her Majesty's Revenue and Customs, controls the UK's payroll. The following are some rules by which companies have to be governed:

PAYE ensures that everyone gets the proper deductions for taxes and national insurance. Automatic-enrolment pension schemes: managing the pension contributions of the employees.

Payroll details will be filed with HMRC through RTI returns.

Payroll processing mistakes may lead to penalties or legal issues.

Payroll outsourcing ensures that experts handle compliance, reducing the likelihood of fines and legal complications.

3. Reduces Processing Charges for Payroll

Though some companies believe handling payroll in-house will save money, the cost is often much higher due to the software, employee training, and probable errors. A firm can save by paying a flat rate to an outside source for its payroll service instead of keeping a payroll department in-house.

4. Fewer Payroll Errors

Payroll inaccuracies, especially errors in making the proper taxation, delayed or unduly made salaries, etc, can eventually cause HMRC penalties and irate employees. The UK utilizes professional payroll solutions that employ professionals for payroll together with automated platforms that ensure reliability and minimize possible costly mistakes

5. Has Private and Security-Payroll Processing

Internal payroll processing might lead to fraud and data theft. Payroll companies that are outsourced encrypt, have a secure system, and follow the GDPR to keep the sensitive information of the workers' payroll secure and confidential.

6. Satisfaction of Workers

Worker satisfaction goes up when payrolls are made correctly and within Time. Employees want:

✔ Correct salary disbursals

✔ Easy online payslips

✔ A clear tax and deduction statement

Outsourced payroll services guarantee employees receive their pay on Time, every Time, which means employees will trust and be satisfied in the workplace.

10. Business Growth Focus

Outsourcing payroll services gives business owners and managers Time to focus on strategic growth initiatives rather than wasting Time on payroll administration. Payroll in expert hands means businesses can scale operations, improve services, and enhance customer satisfaction.

Conclusion

Outsourcing payroll services in the UK is wise for businesses that want to save Time, reduce costs, and ensure compliance with UK payroll regulations. Professional payroll providers can help companies minimize errors, improve employee satisfaction, and focus on growing their business without payroll-related stress.

Whether you run a small startup or a large enterprise, outsourcing payroll ensures accurate, secure, and hassle-free payroll management—making it a worthwhile investment for any business.

3 notes

·

View notes

Text

Contract Labour Compliance Services in India: Ensuring Legal Compliance & Risk Management

India's corporate landscape heavily depends on contract labour across various industries such as manufacturing, construction, IT, and services. However, employing contract workers requires strict adherence to the Contract Labour (Regulation & Abolition) Act, 1970, and other relevant labour laws. Failure to comply can lead to serious legal repercussions, financial penalties, and reputational harm.

This is where Contract Labour Compliance Services become essential in helping businesses maintain legal conformity and mitigate risks.

Key Elements of Contract Labour Compliance

1. Registration & Licensing Support

Assisting principal employers and contractors in obtaining registration certificates and labour licenses as required by law.

Managing renewals and modifications to ensure continuous compliance.

2. Agreement & Documentation Compliance

Drafting well-structured contract agreements between employers and contractors.

Maintaining essential documents, including work orders, deployment records, and terms of engagement.

3. Maintenance of Statutory Registers & Records

Managing contractor registers, employment records, wage registers, and attendance records.

Ensuring timely submission of mandatory reports to regulatory authorities.

4. Wages & Benefits Compliance

Ensuring compliance with minimum wage regulations, overtime payments, bonuses, and other statutory benefits.

Monitoring adherence to Provident Fund (PF), Employee State Insurance (ESI), and other social security contributions.

5. Audit & Inspection Support

Conducting internal compliance audits to identify and resolve potential risks proactively.

Assisting businesses during labour department inspections to ensure seamless compliance.

6. Grievance Redressal & Dispute Resolution

Addressing contract workers' concerns related to wages, working conditions, or unfair treatment.

Implementing effective grievance redressal mechanisms to ensure lawful and fair resolutions.

7. Compliance Training & Awareness Programs

Educating HR teams, contractors, and management on contract labour laws and compliance best practices.

Conducting regular training sessions to enhance compliance awareness across the organization.

Why Businesses Should Prioritize Contract Labour Compliance Services

Avoid Legal Penalties: Non-compliance may result in hefty fines, license cancellations, and legal proceedings.

Maintain Workforce Stability: Proper compliance fosters a satisfied, secure, and productive workforce.

Boost Corporate Reputation: Ethical compliance enhances brand credibility and corporate social responsibility.

Enhance Operational Efficiency: Outsourcing compliance management saves time and resources, enabling businesses to focus on core functions.

As labour laws continue to evolve, businesses must take a proactive stance on contract labour compliance. Engaging expert compliance service providers helps organizations navigate complex legal requirements, minimize risks, and efficiently manage their contract workforce.

For companies in India looking for a structured approach to contract labour compliance, collaborating with professionals is not just an advantage—it’s a necessity!

Need expert assistance with Contract Labour Compliance? Connect with experienced compliance professionals today!

#ContractLabour#LabourCompliance#HRCompliance#IndianLabourLaws#LabourRegulations#WorkforceManagement#BusinessCompliance#EmploymentLaws#CorporateGovernance#RiskManagement#LegalCompliance#LabourLawIndia#StatutoryCompliance#WorkplaceRegulations#ContractorCompliance

2 notes

·

View notes