#Nutraceuticals Market

Explore tagged Tumblr posts

Text

#Nutraceuticals Market#Saudi Arabia Nutraceuticals Market#Saudi Arabia Nutraceuticals Market Size#Saudi Arabia Nutraceuticals Market Share

0 notes

Text

Nutraceuticals Market 2024 — Size, Share, Trends, Growth Analysis, and Outlook by 2034

The Nutraceuticals market report offered by Reports Intellect is meant to serve as a helpful means to evaluate the market together with an exhaustive scrutiny and crystal-clear statistics linked to this market. The report consists of the drivers and restraints of the Nutraceuticals Market accompanied by their impact on the demand over the forecast period. Additionally, the report includes the study of prospects available in the market on a global level. With tables and figures helping evaluate the Global Nutraceuticals market, this research offers key statistics on the state of the industry and is a beneficial source of guidance and direction for companies and entities interested in the market. This report comes along with an additional Excel data-sheet suite taking quantitative data from all numeric forecasts offered in the study.

Get Sample PDF Brochure @ https://www.reportsintellect.com/sample-request/2910740

Key players offered in the market: Corbion Galactic ADM Musashino Chemical Laboratory Vertec BioSolvents Somaiya Group Natural Remedies Huade Biological Engineering Nature's Sunshine Danone Nestle Perrigo NBTY Mission Vivacare Esun

Additionally, it takes account of the prominent players of the Nutraceuticals market with insights including market share, product specifications, key strategies, contact details, and company profiles. Similarly, the report involves the market computed CAGR of the market created on previous records regarding the market and existing market trends accompanied by future developments. It also divulges the future impact of enforcing regulations and policies on the expansion of the Nutraceuticals Market.

Scope and Segmentation of the Nutraceuticals Market

The estimates for all segments including type and application/end-user have been provided on a regional basis for the forecast period from 2024 to 2034. We have applied a mix of bottom-up and top-down methods for market estimation, analyzing the crucial regional markets, dynamics, and trends for numerous applications. Moreover, the fastest & slowest growing market segments are pointed out in the study to give out significant insights into each core element of the market.

Nutraceuticals Market Type Coverage: - D-type L-type DL-type

Nutraceuticals Market Application Coverage: - Food Industry Ink Industry Medicine Industry Electronic Industry Paint Industry

Regional Analysis:

North America Country (United States, Canada) South America Asia Country (China, Japan, India, Korea) Europe Country (Germany, UK, France, Italy) Other Countries (Middle East, Africa, GCC)

Also, Get an updated forecast from 2024 to 2034.

Discount PDF Brochure @ https://www.reportsintellect.com/discount-request/2910740

The comprehensive report provides:

Reasons to Purchase Nutraceuticals Market Research Report

Covid-19 Impact Analysis: Our research analysts are highly focused on the Nutraceuticals Market covid-19 impact analysis. A whole chapter is dedicated to the covid-19 outbreak so that our clients get whole and sole details about the market ups & downs. With the help of our report the clients will get vast statistics as to when and where should they invest in the industry.

About Us: Reports Intellect is your one-stop solution for everything related to market research and market intelligence. We understand the importance of market intelligence and its need in today's competitive world.

Our professional team works hard to fetch the most authentic research reports backed with impeccable data figures which guarantee outstanding results every time for you.

Contact Us: [email protected] Phone No: + 1-706-996-2486 US Address: 225 Peachtree Street NE, Suite 400, Atlanta, GA 30303

#Nutraceuticals Market#Nutraceuticals Market trends#Nutraceuticals Market future#Nutraceuticals Market size#Nutraceuticals Market growth#Nutraceuticals Market forecast#Nutraceuticals Market analysis

0 notes

Text

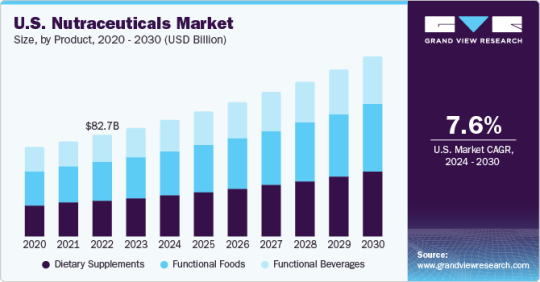

Nutraceuticals Market Is Expected To Grow Swiftly By 2030

The global nutraceuticals market size is projected to reach USD 599.71 billion by 2030, according to a new report by Grand View Research, Inc. The market is anticipated to grow at a CAGR of 9.6% from 2024 to 2030. Rising awareness regarding calorie reduction and weight loss in the major markets including the U.S., China, and India is expected to promote the application of the health and wellness segment and thus, in turn, will have a substantial impact on the industry.

Nutraceuticals are products that provide health advantages and additional nutrition to the human body. It comprises fortified nutrients, such as taurine, CoQ10, omega-3, calcium, zinc, and antioxidants, that develop the complete health of consumers. These nutrients further benefit in averting medical conditions such as hypertension, diabetes, heart diseases, and allergies. As nutraceuticals develop the digestive and immune systems and enhance the cognitive behavior of consumers, their demand is witnessing a surge at the global level.

The increasing trend among consumers to alter dietary habits is likely to boost the demand for nutraceuticals. The consumer belief that improper diet results in an increase in the costs of pharmaceuticals is anticipated to boost the demand for nutraceuticals. This would also help the government as it would result in lesser expenditure on healthcare and low social security costs.

A rise in disposable income, increasing consumer awareness concerning health issues, and rapid urbanization are likely to boost the market growth over the forecast years. A positive outlook towards medical nutrition owing to the high prevalence of weight management programs, along with cardiovascular diseases, is anticipated to propel the product demand.

The rise and evolution of wellness-focused diets such as keto and paleo are driving food producers to cater their products in this direction. Functional food products such as probiotics and omega-3 are highly used in yogurt and fish oils to reduce the risk of cardiovascular diseases and develop the quality of intestinal microflora, which is further projected to fuel the growth of the functional food segment over the coming years.

Request a free sample copy or view report summary: Nutraceuticals Market Report

Nutraceuticals Market Report Highlights

Based on ingredient, in 2023, probiotics held a dominant position in the market; with a share of 27.7% owing to the majority of food manufacturing companies using probiotics as a primary ingredient to provide better nourishment and reduce health problems caused by harmful bacteria

The vitamins segment captured a significant market share in 2023. The segment is expected to witness significant growth in the coming years

In terms of product, the functional foods segment dominated the market with a revenue share of 37.65% in 2023. Rising healthcare costs, coupled with the increasing geriatric population across the world, are anticipated to assist the segment growth over the forecast period

North America held the largest revenue share of over 34.90% in 2023. The growing health concerns amongst consumers and increasing awareness regarding nutraceuticals are likely to be the major drivers of the North America market.

The market represents a highly competitive landscape. Key market players dominate the market space and have been focusing on various strategic initiatives including mergers & acquisitions, product innovation, and portfolio expansion

Nutraceuticals Market Segmentation

Grand View Research has segmented the global nutraceuticals market based on ingredient, product, application, and region:

Nutraceuticals Ingredient Outlook (Revenue, USD Million, 2018 - 2030)

Aloe vera

Amino acids

Botanical Ingredients

Ashwagandha

Curcumin

Ginseng

Hemp

Others

Cannabidiol (CBD)

Carbohydrates

Carnitine

Food Color

Carotenoids

Astaxanthin

Lutein

Lycopene

Other carotenoids (Zeaxanthin, Betacarotene)

Spirulina

Collagen

Colostrum

Cultures and fermentation starters

Dairy ingredients

Emulsifiers

Enzymes

Essential oils

Fat replacers

Fats and oils

Fibers

Flavors

Fruit and vegetable products

Glucosamine / Chondroitin

Isoflavones

Juices and concentrates

Krill

Lipids / Fatty Acids

Marine ingredients

Minerals

Calcium

Iron

Magnesium

Selenium

Others

Omega-3s

Marine Derived

Plant-derived

Prebiotics

Probiotics

Proteins

Sweeteners

Stevia

Monkfruit

Others (Honey, sucrose, fructose, etc.)

Vitamins

Vitamin A

Vitamin B

Vitamin C

Vitamin D

Vitamin E

Vitamin K

Whey proteins

Other

Nutraceuticals Product Outlook (Revenue, USD Million, 2018 - 2030)

Dietary supplements

Functional foods

Functional beverages

Nutraceuticals Application Outlook (Revenue, USD Million, 2018 - 2030)

Allergy & intolerance

Animal nutrition

Healthy ageing

Bone & joint health

Cancer prevention

Children's health

Cognitive health

Diabetes

Digestive / Gut health

Energy & endurance

Eye health

Heart health

Immune system

Infant health

Inflammation

Maternal health

Men's health

Nutricosmetics

Oral care

Personalized nutrition

Post Pregnancy and reproductive health

Sexual health

Skin health

Sports nutrition

Weight management & satiety

Women's health

Other

Nutraceuticals Regional Outlook (Revenue, USD Million, 2018 - 2030)

North America

U.S.

Canada

Mexico

Europe

Germany

France

Italy

UK

Spain

The Netherlands

Asia Pacific

China

Japan

India

Australia & New Zealand

South Korea

Central & South America

Brazil

Argentina

Middle East & Africa

UAE

South Africa

List of Key Players in the Nutraceuticals Market

DSM

Amway

Pfizer Inc.

Nestle

The Kraft Heinz Company

The Hain Celestial Group, Inc.

Nature's Bounty

General Mills Inc.

Danone

Tyson Foods

0 notes

Text

Nutraceuticals Market - Growth, Statistics, By Application, Production, Revenue & Forecast To 2033

The global nutraceuticals market value will likely jump from US$ 418,080 million in 2023 to US$ 703,122.075 million by 2033. This anticipated growth is expected to be driven by a steady CAGR of 5.3% in nutraceutical sales over the next decade.

Access an overview of the Comprehensive Research Report by downloading the Sample PDF Summary: https://www.futuremarketinsights.com/reports/sample/rep-gb-15103

The nutraceutical sales are set to keep growing. People like them because they are easy to store, can do many good things at once, and people are learning more about them. The popularity of nutraceutical products is going up fast. People are learning more about how nutraceuticals and supplements can benefit their health. They help with health problems like obesity, heart disease, cancer, high cholesterol, arthritis, and diabetes.

People also like personalized nutrition, where they get food tailored to their needs. This is especially popular among people with stomach problems that regular medicine cannot fix. Many people want multivitamins and single vitamins from these products worldwide. Similarly, many athletes around the world are joining sports at the national and international levels. This is leading more people to opt for functional beverages.

More people live in cities, spend money on health, and deal with heart, chronic, and obesity problems. This is why the nutraceuticals market is growing rapidly. Functional foods have omega fatty acids that help individuals keep a healthy weight and improve blood circulation.

Many people have become aware of herbal products and natural foods lately. They prefer these over foods with chemicals. This trend is especially strong in North America and Europe. In these two regions, people are willing to spend more on natural products.

New types of nutraceuticals like gummies, jellies, and soft gels are also coming into the market. Preference for these variants is growing because they come in various shapes, sizes, flavors, and strengths. Kids are also getting into these nutraceuticals, which is developing the market.

New technology in the nutraceutical industry is making people want these products more. They are utilizing contemporary technologies like AI to give people personalized advice based on their diet and health. Consequently, AI is going to be important for the nutraceutical industry to grow all around the world during the forecast period.

“In the Nutraceuticals Market, probiotics play a transformative role in enhancing mental and physical health. These beneficial microorganisms are reshaping the industry by promoting better digestion, immune support, and improved overall well-being through nutraceutical products.” Says Nandini Roy Choudhury (Client Partner for Food & Beverages at Future Market Insights, Inc.

Key Takeaways from the Nutraceuticals Market:

In 2022, the United States asserted its dominance in the nutraceuticals industry, boasting a 23.4% global market share, underpinned by its robust research and development capabilities.

The nutraceuticals industry in the United Kingdom is poised for substantial growth, with a projected CAGR of 7.8% through 2033, driven by increasing consumer awareness of health and wellness.

Japan’s 2.4% share of the nutraceuticals industry in 2022 was bolstered by its reputation for producing high-quality and innovative health and wellness products.

India’s rapid development in the nutraceuticals industry, with a CAGR of 4.4% over the forecast period, is driven by a growing trend towards natural and organic products.

Germany’s significant 12.9% share of the global nutraceuticals industry in 2022 can be attributed to its reputation for high-quality manufacturing standards

China’s anticipated rise in the nutraceuticals industry, with a projected CAGR of 6.5% over the forecast period, is propelled by a surge in demand for dietary supplements.

Gain Immediate Access to Detailed Market Insights: Purchase Now to Uncover Segment-specific Information and identify Key Trends, Key Drivers, and their market shares. https://www.futuremarketinsights.com/checkout/15103

Key Players and Strategies for Success in the Nutraceuticals Market

In recent years, the nutraceuticals industry has emerged as a dynamic and rapidly expanding sector within the global market. In this dynamic landscape, key players employ multiple strategies to meet the evolving needs of consumers and establish their foothold in an increasingly competitive market. Here are key points about key players and strategies for success in the nutraceuticals market:

Invest in research to develop innovative and effective nutraceutical products.

Create strong branding and marketing campaigns to stand out in a competitive market.

Stay up-to-date with regulations and ensure products meet compliance standards.

Collaborate with healthcare professionals, fitness influencers, or retail chains to expand distribution.

Stay adaptable to changing consumer preferences and health trends in the market.

To get access to the Comprehensive Research Methodology, Request here!

Recent Developments The Nutraceuticals Market

In June 2022, Kellogg’s Special K introduced new Protein Snack Bars. These bars have 6 grams of protein and only 90 calories. They come in sweet berry vanilla and rich chocolaty brownie sundae flavors.

In April 2021, Nestlé NIDO 3+ unveiled a better recipe designed specifically for kids aged three to five. This new and improved recipe has just the right amount of Vitamin A, Zinc, and Iron, the nutrients young children need.

Information Source: https://www.futuremarketinsights.com/reports/nutraceuticals-market

0 notes

Text

Functional Food and Nutraceuticals Market - Forecast (2023 - 2028)

#functional foods market#function foods report#functional foods market report#omega-3 market size#functional food companies#functional food market share#nutraceuticals#functional food market#nutraceuticals market#nutraceuticals companies#nutraceuticals market size

0 notes

Text

The Global Nutraceuticals Market is projected to grow at a CAGR of around 7.2% during the forecast period, i.e., 2023-28.

0 notes

Text

Nutraceuticals Market Size, Share, Growth, Major Players, Industry Analysis by Forecast to 2030

According to ChemAnalyst report, “Global Nutraceuticals Market: Plant Capacity, Production, Operating Efficiency, Demand & Supply, Technology, End Use, Distribution Channel, Region, Competition, Trade, Customer & Price Intelligence Market Analysis, 2015-2030”, global nutraceuticals demand stood at 3.21 Million Tonnes in 2020 and are forecast to reach 5.60 Million Tonnes by 2030, growing at a healthy CAGR of 5.75% until 2030. Growing population and changing consumer preference towards healthy food with high nutritious and pharmaceutical value is expected to drive the demand of nutraceuticals for the forecast period. Additionally, increasing awareness about nutraceuticals is also another factor propelling the demand.

Nutraceuticals are food products that have both nutrient and pharmaceutical value. Nutraceuticals are basically foods which are necessary for well being and can be considered as extra physiological products. They can be considered as food therapies used to promote general well-being, control symptoms, and prevent diseases. Nutraceuticals are of several types including functional foods which include cereal, confectionary, dairy, and snacks, functional beverages which include energy drinks, sports drinks, dairy, fortified juices, and others, dietary supplements which include vitamins, minerals, enzymes, botanicals, proteins, fatty acids, and others. Due to their healthy properties, they find application in food therapeutics, and gym supplements industry.

Read Full Report Here: https://www.chemanalyst.com/industry-report/nutraceuticals-market-582

Nutraceuticals is basically food having both nutritious and pharmaceutical value. Their major application areas are food therapeutics and gym supplements industry. Growing awareness about healthy and balanced diet is a factor propelling demand growth for nutraceuticals. There are many diseases which are caused due to over and under eating in terms of nutrition. There are other diseases which are related to the overall metabolism of the body. Nutraceuticals target both the nutrition and metabolism of the body and provide the body with good and balanced nutrition. There are customized diets available for different body types which can help in the well-being through food habits only.

Nutraceuticals are related to food. Hence, the price is directly linked to the fluctuations in the prices of food items. In the first half of FY20 sudden outbreak of novel coronavirus followed by a rise in the demand of packaged healthy food rendered a major rise in the global nutraceuticals, hence the prices remained high for nutraceuticals during the coronavirus pandemic. Demand has picked up in the recent quarters and is projected to grow due to increasing demand from Asia Pacific and North America.

Regionally, Asia Pacific dominates the global nutraceuticals market and holds the largest market share in FY20. Asia’s nutraceuticals market is anticipated to grow in the economies like China due to increasing demand of healthy packaged food. Additionally growing population and increasing awareness about health and proper diet is another factor supporting demand rise in Asia Pacific.

Major players for Nutraceuticals globally include Cargill Incorporated, DuPont, Archer Daniels Midland Company, Danone, General Mills, Nestle S.A, Innophos, WR Grace, Amway Corporation, PepsiCo Inc., Kellogg Co., Nature’s bounty.

Request Sample Report: Nutraceuticals Market Report

“Being linked to the food industry, the global nutraceuticals industry has shown a robust growth alongside growing population and changing consumer preference towards healthy food. Regionwise, Asia pacific holds the major share of global nutraceuticals demand due to increasing population and awareness about benefits of balanced and healthy diet. In Asia Pacific, China serves as the key growth region with sufficiently installed capacities for nutraceuticals. With new competitors emerging across the Asia Pacific nutraceuticals market, players anticipate that there will be sufficient supply demand gaps in future. At this, it is extremely important to keep an eye which region will grab the biggest market share in the upcoming years.” said Mr. Karan Chechi, Research Director with TechSci Research, a research based global management consulting firm promoting ChemAnalyst.

About Us:

ChemAnalyst is a subsidiary of Techsci Research, which was established in 2008, and has been providing exceptional management consulting to its clients across the globe for over a decade now. For the past four years, ChemAnalyst has been a prominent provider of Chemical commodity prices in more than 15 countries. We are a team of more than 100 Chemical Analysts who are committed to provide in-depth market insights and real-time price movement for 300+ chemical and petrochemical products. ChemAnalyst has reverberated as a preferred pricing supplier among Procurement managers and Strategy professionals worldwide. On our platform, we provide an algorithm-based subscription where users can track and compare years of historical data and prices based on grades and incoterms (CIF, CFR, FOB, & EX-Works) in just one go.

The ChemAnalyst team also assists clients with Market Analysis for over 1200 chemicals including assessing demand & supply gaps, locating verified suppliers, choosing whether to trade or manufacture, developing Procurement Strategies, monitoring imports and exports of Chemicals, and much more. The users will not only be able to analyze historical data for past years but will also get to inspect detailed forecasts for the upcoming years. With access to local field teams, the company provides high-quality, reliable market analysis data for more than 40 countries.

ChemAnalyst is your one-stop solution for all data-related needs. We at ChemAnalyst are dedicated to accommodate all of our world-class clients with their data and insights needs via our comprehensive online platform.

Contact Us:

ChemAnalyst

B-44 Sector-57 Noida,

National Capital Region

Tel: 0120-4523990

Mob: +91-8882805349

Email: [email protected]

Website: https://www.chemanalyst.com/

0 notes

Text

Nutraceuticals Market is Anticipated to Reach US$1 Tn by 2030

The global nutraceuticals market is witnessing robust expansion on the back of numerous health benefits of nutraceuticals. Nutraceuticals are considered great for boosting the immune system and maintaining brain and cardiovascular health. Apart from this, consumers are becoming more aware of the convenience, flexibility, and advantages of consuming specific dietary supplements. This in turn is further expected to benefit the market.

Moreover, the recent pandemic has brought back the focus on the significance of a strong immune system. Consequently, stimulating robust growth waves across the nutraceuticals market. The growing emphasis on personalised nutrition further accelerates the demand for nutraceuticals.

Additionally, the expanding sports nutrition sector also aids in the overall market progression of the market. The synergy of these key factors is projected to unlock business opportunities across the global nutraceuticals market. Fairfield Market research predicts an upward growth trajectory for the market. The market is forecasted to hit the valuation of the US$1 Tn mark by 2030, registering a strong CAGR of 9.5% between 2023 and 2030.

For More Industry Insights: https://www.fairfieldmarketresearch.com/report/nutraceuticals-market

Growing Prevalence of Metabolic Diseases

The growing prevalence of metabolic disorders has led to an increased focus on consuming nutraceuticals. Moreover, elderly populations are being recommended to consume nutraceuticals. Nutraceuticals contain specific bioactive compounds, such as antioxidants, herbal extracts, omega-3 fatty acids, and probiotics, which aid in preventing age-old health conditions.

Furthermore, the rising incorporation of dietary supplements in infant nutrition products and mothers’ dietary lifestyles strengthens revenue opportunities for the nutraceuticals market.

Increased Traction for Single and Multi-vitamin Supplements

The market growth is further driven by an alarming rise in conditions such as diabetes, cancers, cardiovascular diseases, irritable bowel disease (IBD), and arthritis. However, in recent years, advances in technology and research have facilitated the development of enhanced nutraceutical products. Formulations that enable improved bioavailability, stability, and targeted delivery of active ingredients have expanded the range of nutraceutical offerings.

Additionally, the innovation in product types, such as fortified foods, and beverages, has positively influenced market growth. Besides this, the growing prominence of single and multi-vitamin supplements will contribute to the expansion of the global nutraceuticals market. Against this backdrop, the market is set to reach sound maturity over the forecast period.

North America Holds a Lion’s Share, Europe Follows Closely

North America is anticipated to maintain a lead in the global nutraceuticals market throughout the projected time frame. In 2022, the region held a prominent share of over 30%, closely followed by Europe at 26%. Continuous product differentiation is a key factor fostering growth across these regional markets.

Meanwhile, the trend of a sedentary lifestyle due to hectic schedules has promoted unhealthy consuming habits. Due to this, health problems such as IBD, and obesity have become common. As a result, consumers are seeking healthy food products, propagating the demand for nutraceuticals across these regions.

Key Companies

Some of the key market identities in the global nutraceuticals market include Cargill Inc, BASF Corporation, Lonza, DSM, Ingredion Incorporated, Corbion, Kerry PLC, Friesland Campina, Archer-Daniels-Midland Company, and Olam International Ltd. Product. To survive this competitive landscape, several market players are acquiring or merging with small and large manufacturers.

Get Sample Copy of Report at https://www.fairfieldmarketresearch.com/report/nutraceuticals-market/request-sample

#nutraceuticals market#nutraceuticals#nutraceuticals market size#nutraceuticals market share#nutraceuticals market trends#nutraceuticals market demand#nutraceuticals market research#food industry#food science#pharmacy#fairfield market research

0 notes

Link

Nutraceuticals Market size is estimated to reach $4,651 million by 2026, growing at a CAGR of 7.1% over 2021-2026. Nutraceuticals is a substance that may be considered food or amino acid part of a food that offers medical or health benefits, encompassing prevention and treatment of disease.

0 notes

Text

Algae Products Market to Reach $6.01 Billion by 2031

Meticulous Research®—a leading global market research company, published a research report titled ‘Algae Products Market Size, Share, Forecast, & Trends Analysis by Type (Hydrocolloids, Lipids, Carotenoids), Source (Seaweed, Microalgae {Chlorella, Spirulina}), Form (Dry, Liquid), Application (Food & Beverage, Nutraceuticals) - Global Forecast to 2031’.

According to this latest publication from Meticulous Research®, the algae products market is projected to reach $6.01 billion by 2031, at a CAGR of 7.9% from 2024 to 2031. The growth of the algae products market is driven by consumers’ increasing preference for algae-sourced products, the growth in vegetarianism, the rising demand for natural food colors, and the rapid growth of the nutraceuticals industry. However, complexities in algae production and low awareness regarding the benefits of algae restrain the growth of this market. Furthermore, the growing demand for biofuels is expected to generate growth opportunities for the players operating in this market. However, the risk of algae contamination is a major challenge impacting market growth.

Additionally, the increasing adoption of algae products is a prominent trend in the algae products market.

Key Players

The algae products market is characterized by a moderately competitive scenario due to the presence of many large- and small-sized global, regional, and local players. The key players operating in the algae products market are Algatechnologies Ltd. (A Part of Solabia Group) (Israel), BASF SE (Germany), BDI BioLife Science GmbH (Austria), Bluetec Naturals Co., Ltd (China), Cargill, Incorporated (U.S.), Cyanotech Corporation (U.S.), DIC Corporation (Japan), Lyxia Corporation (a subsidiary of Shenzhen Qianhai Xiaozao Technology Co., Ltd.)(U.S.), Seagrass Tech Private Limited (India), Tianjin Norland Biotech Co., Ltd. (China), Ingredion Incorporated (U.S.), HISPANAGAR S.A. (Spain), COMPAÑIA ESPAÑOLA DE ALGAS MARINAS S A (Spain), W Hydrocolloids, Inc. (Philippines), SNAP Natural & Alginate Products Pvt. Ltd. (India), and Harsha Enterprises (India).

The algae products market is segmented by type (hydrocolloids {carrageenan, alginate, agar, and other hydrocolloids}, algal protein, lipids, and carotenoids {astaxanthin, beta carotene, lutein, and other carotenoids}), by source (seaweed/macroalgae {red seaweed, brown seaweed, and green seaweed}, microalgae (spirulina, chlorella, Dunaliella salina, Haematococcus pluvialis, Nannochloropsis, and other sources), by form (dry and liquid), by application (food & beverage {food [dairy, bakery and confectionery, other food products], beverages}, nutraceuticals, cosmetics {skin care, hair care, other cosmetics products}, animal feed, and other applications), and geography (North America, Europe, Asia-Pacific, Latin America, the Middle East & Africa). The study also evaluates industry competitors and analyzes the regional and country-level markets.

Based on type, the algae products market is mainly segmented into hydrocolloids, algal proteins, lipids, and carotenoids. In 2024, the hydrocolloids segment is expected to account for the largest share of 51.1% of the global algae products market. The large market share of this segment can be attributed to factors such as the increasing consumption of seaweed-based products, the growing demand for biofuels, the rising demand for natural and plant-based ingredients, and the increasing demand for hydrocolloids from various industries.

Based on source, the algae products market is segmented into macroalgae/seaweed and microalgae. In 2024, the macroalgae/seaweed segment is expected to account for the larger share of 73.8% of the global algae products market. The large market share of this segment can be attributed to the abundant availability of seaweed as raw materials, driven by the increasing production of seaweed and growing awareness of the health benefits associated with seaweed products. Furthermore, the active components derived from seaweeds serve various purposes, acting as antioxidants, antibacterial and whitening agents, anti-aging solutions, and anti-acne treatments, contributing significantly to the growth of the seaweed products market.

Based on form, the global algae products market is segmented into dry and liquid. In 2024, the dry algae products segment is expected to account for the larger share of 72.1% of the global algae products market. The large market share of this segment is attributed to the longer shelf-life and ease of transportation and storage of dry algae products compared to liquid algae products and the increasing use of algae powder in the food, cosmetic, and feed industries.

Geographic Review

This research report analyzes major geographies and provides a comprehensive analysis of North America (the U.S. and Canada), Europe (Germany, France, U.K., Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, and Rest of Asia-Pacific), Latin America (Brazil, Mexico, Argentina, Chile, and Rest of Latin America), and the Middle East & Africa.

In 2024, Asia-Pacific is expected to account for the largest share of 39.2% of the global algae products market. Asia-Pacific algae products market is estimated to be worth USD 1.38 billion in 2024. The large share of this market is mainly attributed to the increasing demand for natural ingredients in the rapidly growing food and beverage, nutraceuticals, cosmetic, and animal feed industries. In addition, the presence of a large number of stakeholders engaged in providing algae products for these industries due to the availability of raw materials, favorable climatic conditions for algae production, and cheap labor availability supports the growth of this market. Several government initiatives to promote the cultivation and usage of algae in several industries and the growing demand for healthy food products are further expected to boost the Asia-Pacific algae products market.

Download Sample Report Here @ https://www.meticulousresearch.com/download-sample-report/cp_id=3579

Key Questions Answered in the Report:

What is the value of revenue generated by the algae products market?

At what rate is the global demand for algae products projected to grow for the next 5-7 years?

What is the historical market size and growth rate for the algae products market?

What are the major factors impacting the growth of this market at global and regional levels?

What are the major opportunities for existing players and new entrants in the market?

Which type, source, form, and application segments create major traction for the manufacturers in this market?

What are the key geographical trends in this market? Which regions/countries are expected to offer significant growth opportunities for the manufacturers operating in the algae products market?

Who are the major players in the algae products market? What are their specific product offerings in this market?

What recent developments have taken place in the algae products market? What impact have these strategic developments created on the market?

Contact Us: Meticulous Research® Email- [email protected] Contact Sales- +1-646-781-8004 Connect with us on LinkedIn- https://www.linkedin.com/company/meticulous-research Connect with us on Twitter- https://twitter.com/MeticulousR123

#Algae Products Market#Algae products#algae food products#hydrocolloids#lipids#dry#carotenoids#protein#algae#spirulina#cosmetics#nutraceuticals#food & beverages

0 notes

Text

Nutraceutical Ingredients Market Industry Report | Key Segments and Market Drivers 2025 - 2032

The Nutraceutical Ingredients Market is undergoing a significant transformation, with industry forecasts predicting rapid expansion and cutting-edge technological innovations by 2032. As businesses continue to embrace digital advancements and strategic shifts, the sector is set to experience unprecedented growth, driven by rising demand, market expansion, and evolving industry trends.

A recent in-depth market analysis sheds light on key factors propelling the Nutraceutical Ingredients market forward, including increasing market share, dynamic segmentation, and evolving consumer preferences. The study delves into crucial growth drivers, offering a detailed outlook on industry progress and future potential. Additionally, the report leverages SWOT and PESTEL analyses to assess market strengths, weaknesses, opportunities, and threats while examining economic, regulatory, and technological influences shaping the industry's trajectory.

Competitive intelligence plays a pivotal role in this sector's evolution, with leading companies innovating and expanding across key regions. The latest market insights provide a comprehensive overview of emerging opportunities, investment hotspots, and strategic business approaches.

For businesses and investors looking to stay ahead in the Nutraceutical Ingredients market, this report serves as a vital resource, offering data-driven insights and strategic recommendations to navigate market challenges and capitalize on future growth opportunities. As 2032 approaches, staying informed about industry trends will be crucial for maintaining a competitive edge in this fast-evolving landscape.

What is the projected market size & growth rate of the Nutraceutical Ingredients Market?

Market Analysis and Insights

Nutraceutical Ingredients Market

Data Bridge Market Research analyses that the global nutraceutical ingredients market will project a CAGR of 7.35% for the forecast period of 2022-2029. Growth and expansion of the food and beverages industry, growing focus on innovations in the food and beverages sector, rising consumer consciousness towards functional and fortified foods, surging prevalence of chronic diseases and disorders such as cancer, obesity, diabetes, and high blood pressure and increasing personal disposable income by the major companies are the major factors attributable to the growth of nutraceutical ingredients market.

Nutraceutical ingredients are the ingredients that are found in a wide range of food and beverage items that offer health benefits due to the presence of active ingredients. Nutraceutical ingredients improve an individual’s health, improve the immunity, delay the aging process, prevent chronic diseases and support body composition. Additionally, nutraceutical ingredients complete the basic nutritional requirement in undernourished children. Nutraceutical ingredients improve the body and mind functioning and presence of omega-3 fatty acids can help prevent oesophageal cancer.

Rising personal disposable income and growing consumer consciousness towards advantages of nutraceutical ingredients are the major factors fostering the growth of the market. Changing lifestyle, westernization, rising research and development initiatives taken by major companies especially in the developing economies and ever-rising global undernourished population are acting as market growth determinants. Improving distribution channel, rising awareness in regards to maintaining food safety, stringent regulations imposed by the government on maintaining the food quality, increased requirements for food fortification mandated by the government organizations, surging health consciousness among consumers and changing tastes and preferences of consumers will further induce growth in the market value.

However, ever-rising competition from food alternatives will pose a major challenge to the growth of the market. Fluctuations in the prices of raw materials and supply chain disruptions owing to the pandemic will further restrict the scope of growth for the market. Consumer scepticism associated with the adoption of various nutraceutical ingredients, high costs associated with these products and rise in the cost of research and development activities will also hamper the market growth rate.

This nutraceutical ingredients market report provides details of new recent developments, trade regulations, import export analysis, production analysis, value chain optimization, market share, impact of domestic and localised market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on nutraceutical ingredients market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Browse Detailed TOC, Tables and Figures with Charts which is spread across 350 Pages that provides exclusive data, information, vital statistics, trends, and competitive landscape details in this niche sector.

This research report is the result of an extensive primary and secondary research effort into the Nutraceutical Ingredients market. It provides a thorough overview of the market's current and future objectives, along with a competitive analysis of the industry, broken down by application, type and regional trends. It also provides a dashboard overview of the past and present performance of leading companies. A variety of methodologies and analyses are used in the research to ensure accurate and comprehensive information about the Nutraceutical Ingredients Market.

Get a Sample PDF of Report - https://www.databridgemarketresearch.com/request-a-sample/?dbmr=global-nutraceutical-ingredients-market

Which are the driving factors of the Nutraceutical Ingredients market?

The driving factors of the Nutraceutical Ingredients market include technological advancements that enhance product efficiency and user experience, increasing consumer demand driven by changing lifestyle preferences, and favorable government regulations and policies that support market growth. Additionally, rising investment in research and development and the expanding application scope of Nutraceutical Ingredients across various industries further propel market expansion.

Nutraceutical Ingredients Market - Competitive and Segmentation Analysis:

Global Nutraceutical Ingredients Market, By Type (Prebiotics, Amino Acids and Proteins, Omega-3 Fatty Acids, Vitamins, Minerals, Carotenoids, Plant Extracts and Phytochemical, Specialty Carbohydrates and Fibers), Form (Liquid and Powder), Application (Food, Beverages, Animal Nutrition, Dietary Supplements and Personal Care), Country (U.S., Canada, Mexico, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Brazil, Argentina, Rest of South America, UAE, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa) Industry Trends and Forecast to 2032

How do you determine the list of the key players included in the report?

With the aim of clearly revealing the competitive situation of the industry, we concretely analyze not only the leading enterprises that have a voice on a global scale, but also the regional small and medium-sized companies that play key roles and have plenty of potential growth.

Which are the top companies operating in the Nutraceutical Ingredients market?

Some of the major players operating in the nutraceutical ingredients market are Ajinomoto Co., Inc., Cargill, Incorporated, ADM, BASF SE, Associated British Foods Plc, Ingreidon., DSM, Arla Foods amba, Tate & Lyle, Fonterra Co-operative Group Limited, FrieslandCampina, Dow., DuPont, Kerry Group., Chr. Hansen A/S, Novozymes, Roquette Frères, Danisco A/S, Givaudan and Merck KGaA among others.

Short Description About Nutraceutical Ingredients Market:

The Global Nutraceutical Ingredients market is anticipated to rise at a considerable rate during the forecast period, between 2025 and 2032. In 2024, the market is growing at a steady rate and with the rising adoption of strategies by key players, the market is expected to rise over the projected horizon.

North America, especially The United States, will still play an important role which can not be ignored. Any changes from United States might affect the development trend of Nutraceutical Ingredients. The market in North America is expected to grow considerably during the forecast period. The high adoption of advanced technology and the presence of large players in this region are likely to create ample growth opportunities for the market.

Europe also play important roles in global market, with a magnificent growth in CAGR During the Forecast period 2025-2032.

Nutraceutical Ingredients Market size is projected to reach Multimillion USD by 2032, In comparison to 2025, at unexpected CAGR during 2025-2032.

Despite the presence of intense competition, due to the global recovery trend is clear, investors are still optimistic about this area, and it will still be more new investments entering the field in the future.

This report focuses on the Nutraceutical Ingredients in global market, especially in North America, Europe and Asia-Pacific, South America, Middle East and Africa. This report categorizes the market based on manufacturers, regions, type and application.

Get a Sample Copy of the Nutraceutical Ingredients Report 2025

What are your main data sources?

Both Primary and Secondary data sources are being used while compiling the report. Primary sources include extensive interviews of key opinion leaders and industry experts (such as experienced front-line staff, directors, CEOs, and marketing executives), downstream distributors, as well as end-users. Secondary sources include the research of the annual and financial reports of the top companies, public files, new journals, etc. We also cooperate with some third-party databases.

Geographically, the detailed analysis of consumption, revenue, market share and growth rate, historical data and forecast (2025-2032) of the following regions are covered in Chapters

What are the key regions in the global Nutraceutical Ingredients market?

North America (United States, Canada and Mexico)

Europe (Germany, UK, France, Italy, Russia and Turkey etc.)

Asia-Pacific (China, Japan, Korea, India, Australia, Indonesia, Thailand, Philippines, Malaysia and Vietnam)

South America (Brazil, Argentina, Columbia etc.)

Middle East and Africa (Saudi Arabia, UAE, Egypt, Nigeria and South Africa)

This Nutraceutical Ingredients Market Research/Analysis Report Contains Answers to your following Questions

What are the global trends in the Nutraceutical Ingredients market?

Would the market witness an increase or decline in the demand in the coming years?

What is the estimated demand for different types of products in Nutraceutical Ingredients?

What are the upcoming industry applications and trends for Nutraceutical Ingredients market?

What Are Projections of Global Nutraceutical Ingredients Industry Considering Capacity, Production and Production Value? What Will Be the Estimation of Cost and Profit? What Will Be Market Share, Supply and Consumption? What about Import and Export?

Where will the strategic developments take the industry in the mid to long-term?

What are the factors contributing to the final price of Nutraceutical Ingredients?

What are the raw materials used for Nutraceutical Ingredients manufacturing?

How big is the opportunity for the Nutraceutical Ingredients market?

How will the increasing adoption of Nutraceutical Ingredients for mining impact the growth rate of the overall market?

How much is the global Nutraceutical Ingredients market worth? What was the value of the market In 2024?

Who are the major players operating in the Nutraceutical Ingredients market? Which companies are the front runners?

Which are the recent industry trends that can be implemented to generate additional revenue streams?

What Should Be Entry Strategies, Countermeasures to Economic Impact, and Marketing Channels for Nutraceutical Ingredients Industry?

Customization of the Report

Can I modify the scope of the report and customize it to suit my requirements? Yes. Customized requirements of multi-dimensional, deep-level and high-quality can help our customers precisely grasp market opportunities, effortlessly confront market challenges, properly formulate market strategies and act promptly, thus to win them sufficient time and space for market competition.

Inquire more and share questions if any before the purchase on this report at - https://www.databridgemarketresearch.com/inquire-before-buying/?dbmr=global-nutraceutical-ingredients-market

Detailed TOC of Global Nutraceutical Ingredients Market Insights and Forecast to 2032

Introduction

Market Segmentation

Executive Summary

Premium Insights

Market Overview

Nutraceutical Ingredients Market By Type

Nutraceutical Ingredients Market By Function

Nutraceutical Ingredients Market By Material

Nutraceutical Ingredients Market By End User

Nutraceutical Ingredients Market By Region

Nutraceutical Ingredients Market: Company Landscape

SWOT Analysis

Company Profiles

Continued...

Purchase this report – https://www.databridgemarketresearch.com/checkout/buy/singleuser/global-nutraceutical-ingredients-market

Data Bridge Market Research:

Today's trends are a great way to predict future events!

Data Bridge Market Research is a market research and consulting company that stands out for its innovative and distinctive approach, as well as its unmatched resilience and integrated methods. We are dedicated to identifying the best market opportunities, and providing insightful information that will help your business thrive in the marketplace. Data Bridge offers tailored solutions to complex business challenges. This facilitates a smooth decision-making process. Data Bridge was founded in Pune in 2015. It is the product of deep wisdom and experience.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC: +653 1251 975

Email:- [email protected]

Browse More Reports:

Nutraceutical Ingredients Market

Refractories Market

Agricultural Robot Market

Silicone Coating Market

Commercial Restoration Waterproofing Membranes Market

#Nutraceutical Ingredients Market#Nutraceutical Ingredients Market Size#Nutraceutical Ingredients Market Share#Nutraceutical Ingredients Market Trends#Nutraceutical Ingredients Market Growth#Nutraceutical Ingredients Market Analysis#Nutraceutical Ingredients Market Scope & Opportunity#Nutraceutical Ingredients Market Challenges#Nutraceutical Ingredients Market Dynamics & Opportunities#Nutraceutical Ingredients Market Competitor's Analysis

0 notes

Text

The nutraceutical excipients market is projected to reach USD 6.1 billion by 2028 from USD 4.2 billion by 2023, at a CAGR of 7.7% during the forecast period in terms of value.

#Nutraceutical Excipients Market#Nutraceutical Excipients#Nutraceutical Excipients Market Size#Nutraceutical Excipients Market Share#Nutraceutical Excipients Market Growth#Nutraceutical Excipients Market Trends#Nutraceutical Excipients Market Forecast#Nutraceutical Excipients Market Analysis#Nutraceutical Excipients Market Report#Nutraceutical Excipients Market Scope#Nutraceutical Excipients Market Overview#Nutraceutical Excipients Market Outlook#Nutraceutical Excipients Market Drivers#Nutraceutical Excipients Industry#Nutraceutical Excipients Companies

0 notes

Text

Japan Nutraceuticals Market Report 2031

The Japan Nutraceuticals Market was estimated at USD 13.65 billion in FY2023 and is anticipated to reach to USD 28.80 billion by FY2031 witnessing a CAGR of 9.78% during the forecast period FY2024-2031. There is little doubt that the Japanese market should be regarded as one of the “up-and-coming” markets for nutraceutical ingredients and functional foods, even though the term “nutraceutical” is not commonly used in Japan and is not familiar to the majority of Japanese consumers.

With a focus on relatively small servings of seasonal fruits and vegetables, as well as fish and shellfish, and rice as the main food, the traditional Japanese diet has been regarded as being highly nutritious. In the past, people consumed relatively little fat, largely from plant sources rather than animals. However, not all Japanese had access to the entire traditional cuisine on a daily basis, and food-related health problems were not unusual. Many people, especially women, were and still are concerned about their calcium and iron intake. The high incidence of stomach cancer in Japan was thought to be mostly due to the frequent eating of pickled and salted foods in the traditional diet.

Several traditional Japanese dietary ingredients have lately been found to provide additional health advantages beyond only providing nutrients. For instance, common dietary supplements include “beni koji” (red yeast) foods for lowering cholesterol, konnyaku non-caloric fibre for weight loss, and green tea catechins for their anti-caries and anti-cancer properties. The recent success of these traditional ingredients on the market has encouraged Japanese (and foreign) businesses to look more into the possible health advantages of other traditional culinary ingredients.

Increased Spending on Technical Innovations

Demand for these products increases as a result of rising costs for their technological advancements. Over-the-counter drug abuse has a negative impact on consumer lifestyle. Functional foods and beverages have solved this issue to great effect. The idea of functional food was developed in Japan in the 1980s and was given government approval to help the country’s citizens’ overall health. Functional foods are the most popular product category consumed by the public because they have benefits to health beyond supplying nutrients. They could lessen the chance of developing chronic illnesses and boost general health. Muesli is one of the most prevalent modern examples, as its soluble fibre decreases blood cholesterol levels. Diets can easily include whole grains, veggies, legumes, nuts, and fruits. They are unable to change consumers’ unhealthy eating habits, though.

Antioxidants included in fruits and vegetables help to fight against disease. Modified functional foods are also available that have been supplemented with probiotics, fibre, vitamins, or minerals to improve their nutritional value. Fortified cereals, fortified grains, fortified bread and pasta, and other fortified foods are examples of modified functional foods. In June 2021, a new patented process was developed by TCI Japan’s Science of Probiotics, which uses high-efficiency fermentation technology to put 100 billion live probiotics—roughly equal to the number of probiotics in ten bottles of typical lactic acid bacteria drinks—into each tiny glass bottle of drink. Modern technology can also be used to keep the drinks’ live bacterial populations at high levels.

Growing Dependence on Supermarkets and Hypermarkets

Supermarkets and hypermarkets have recently gained significance in busy consumers’ lifestyles because consumers tend to buy all of their monthly necessities from there. As opposed to visiting various stores, everything is offered under one roof, saving time. Due to the consumers’ fascination with the packaging and display format, supermarkets are crucial in encouraging excessive shopping. They often display informational materials, product descriptions, and nutritional details, helping customers understand the benefits and usage of various nutraceutical products. This education fosters consumer awareness and encourages them to make informed choices. Additionally, discounts at supermarkets are drawing customers in even more. By carefully reading the labels and contrasting the pricing of similar products, the buyer can choose from a variety of alternatives. Overall, the presence of nutraceuticals in supermarkets and hypermarkets in Japan not only provides convenient access for consumers but also facilitates product awareness, education, and promotion.

Government Regulations

In Japan, the term “nutraceuticals” is not commonly used. Instead, these products are typically classified as “foods for specified health uses” (FOSHU) or “foods with nutrient function claims” (FNFC). FOSHU and FNFC are categories created by the Japanese government to regulate functional foods and health claims. Manufacturers of FOSHU products must submit an application to the Consumer Affairs Agency (CAA) for approval. The application should include scientific evidence supporting the claimed health benefits and safety of the product. The CAA evaluates the application and grants approval if the product meets the necessary requirements. FOSHU products are permitted to make specific health claims, provided they have been approved by the CAA.

FNFC products, on the other hand, can make nutrient function claims without going through the same rigorous approval process as FOSHU. Nutraceutical products in Japan must comply with safety standards set by the Ministry of Health, Labour and Welfare (MHLW). Certain ingredients may be restricted or require special approval. Manufacturers are responsible for ensuring the safety of their products and conducting appropriate testing. Proper labelling is essential for nutraceutical products. Labels should clearly state the product’s category (FOSHU or FNFC), specific health claims (if applicable), and instructions for use. It is important to comply with the guidelines provided by the MHLW regarding labelling regulations.

Popularity of Western Ingredients

Western ingredients often bring a sense of novelty and exoticism to the Japanese market. Consumers are intrigued by ingredients that are not traditionally found in Japanese cuisine or culture. The introduction of Western ingredients in nutraceuticals provides a unique selling proposition and attracts consumers looking for something different and innovative. Western ingredients, such as specific herbs, botanicals, or superfoods, are often associated with various health benefits. They may offer antioxidant properties, immune system support, anti-inflammatory effects, or other wellness benefits. The inclusion of these Western ingredients in nutraceutical products expands the range of health benefits available to consumers, thereby driving demand. Japan has a rich history of cultural exchange with the West. The inclusion of Western ingredients in nutraceuticals reflects this cross-cultural appeal.

Japanese consumers are often receptive to products that blend traditional Japanese ingredients with Western ones, as it combines familiar elements with new flavours and health benefits. International nutraceutical brands and manufacturers often incorporate Western ingredients into their product formulations. The presence of these global brands in the Japanese market helps introduce and popularize Western ingredients among Japanese consumers. The trust and reputation associated with these brands contribute to driving the demand for nutraceuticals containing Western ingredients. Lutein, glucosamine, and Coenzyme Q10 sales are moving up the list of top sellers. For instance, Coenzyme Q 10 is becoming increasingly popular in Japan. According to Health Industry News (Tokyo), the industry has been increasing at a rapid rate for continuous years. Lutein is now a big market, but a few years ago, the majority of customers had never ever heard of it. Future Japan will undoubtedly be influenced by the West more.

Aging Population

Japan is known to have one of the most rapidly aging populations in the world. This demographic shift is primarily a result of low birth rates and a high life expectancy. Factors such as increased access to healthcare, advancements in medical technology, and improvements in living standards have contributed to longer lifespans. As people age, there is an increased focus on health maintenance and disease prevention. Older adults often seek ways to support their overall well-being and manage age-related health concerns. Nutraceuticals offer a convenient and accessible option for older individuals to supplement their diets with functional foods and dietary supplements that are specifically formulated to address their health needs. With advancing age, individuals may experience specific health issues such as joint health, cognitive decline, cardiovascular health, and immune system support. Older adults may face challenges in meeting their nutritional needs due to factors such as reduced appetite, diminished nutrient absorption, and dietary restrictions. Age-related conditions such as osteoporosis and joint discomfort are prevalent there among the aging population. Nutraceuticals that promote vitality, energy, and overall well-being are found attractive to this demographic. Products targeting energy support, stress management, and overall wellness are marketed to older adults seeking to enhance their quality of life and remain active as they age. For instance, in October 2021, to help older individuals’ memory abilities, Morinaga Milk Industry has introduced a new line of functional foods that contain its probiotic strain that has been professionally examined.

Impact of COVID-19

The COVID-19 pandemic has had a conflicting effect on the overall nutraceutical market. Demand for nutraceutical products increased as a result of increased health awareness and rising demand for immunity-boosting supplements. Although the absence of transportation and the limited supply chain had an influence on quarterly growth in 2020, many companies in the country altered their business hours and shortened them to enable employees to replenish goods and clean stores overnight. These elements hindered the market’s growth for functional foods and beverages. In order to boost people’s health and immunity, the demand for nutritional supplements and functional foods soared throughout the pandemic. There has been a shift in consumer behaviour towards purchasing supplements that increase immunity, lowering the likelihood of contracting an infection. Following the pandemic, preventative health measures have become more popular and demand for them is only growing. These have become a necessary component of consumers’ life as a result of the effects of the pandemic all over the world.

Download Sample Report

“Japan Nutraceuticals Market Assessment, Opportunities, and Forecast, FY2017-FY2031F”, is a comprehensive report by Markets and Data, providing in-depth analysis and assessment of the current scenario of the nutraceuticals market in Japan, industry dynamics and opportunities, and forecasts (FY2024-FY2031). Additionally, the report profiles the leading players in the industry mentioning their respective market share, business model, competitive intelligence, etc.

Click here for full report- https://www.marketsandata.com/industry-reports/japan-nutraceuticals-market

Latest reports-

Contact

Mr. Vivek Gupta 5741 Cleveland street, Suite 120, VA beach, VA, USA 23462 Tel: +1 (757) 343–3258 Email: [email protected] Website: https://www.marketsandata.com

0 notes

Text

Functional Food and Nutraceuticals Market - Forecast(2023 - 2028)

#functional foods market#function foods report#functional foods market report#omega-3 market size#functional food companies#functional food market share#nutraceuticals#functional food market#nutraceuticals market#nutraceuticals companies#nutraceuticals market size#nutraceuticals report#Anti-Oxidants#Carotenoids#Fatty Acids#Minerals#Vitamins#">

0 notes