#National property tax appeal

Explore tagged Tumblr posts

Text

Maximize Savings with Expert Commercial Property Tax Reduction Services

O'Connor Consultants are experts in commercial property tax reduction services, providing tailored solutions by reviewing financials and working with property owners and CPAs to maximize tax savings. Learn more at https://www.nationalpropertytax.com/commercial-and-multifamily/

#Commercial property tax assessors#Commercial Property Tax Reduction Services#National property tax appeal#Commercial real estate appraisers#Commercial property tax reduction

0 notes

Text

Risk-Free Property Tax Appeal | National Property Tax

Discover our Property Tax Appeal with No upfront costs! Pay only upon savings. Visit O'Connor without fear of penalties for filing an appeal. Get to know more from https://www.nationalpropertytax.com/process/

0 notes

Text

Understanding the Southern Perimeter’s Republican Lean: A Multi-Factor Analysis

The political landscape of the United States is often discussed in terms of blue and red states, with certain regions consistently leaning Republican or Democrat. However, the southern perimeter of the continental U.S.—stretching from California to Florida—presents a unique case study. Despite cultural diversity, varying industries, and demographic shifts, this region generally leans Republican. This alignment, which includes border states with Mexico and those along the Gulf Coast, emerges from a complex interplay of geography, economics, historical values, and cultural attitudes.

1. Geographical and Climatic Influences

The southern perimeter is defined by its warmer climates, which attract specific demographics, most notably retirees. States like Florida have become retirement havens, drawing older populations from traditionally Democratic northern regions. This migration brings a demographic that often prioritizes conservative values such as lower taxes, property rights, and fiscal conservatism, aligning well with Republican ideologies. The subtropical to desert-like climate also shapes industries in these states, favoring agriculture, tourism, and energy sectors that lean conservative due to their reliance on limited government intervention and favorable regulatory policies.

Additionally, the shape and layout of these states play a role. California’s extensive north-south reach and diverse climate foster a mix of political ideologies, making it more complex, though its highly populated coastal cities tend toward Democratic dominance. By contrast, Arizona and Texas, with expansive rural and desert regions along the border, amplify conservative values centered on self-reliance and individualism, often associated with frontier mentality.

2. Historical and Cultural Factors

Southern states, including those on the southern perimeter, have a strong cultural legacy of conservatism rooted in a combination of frontier independence, skepticism of federal oversight, and a tradition of states’ rights. This tradition resonates with Republican ideology, which emphasizes limited government, individual liberties, and a cautious approach to social change. While California may stand as an exception due to its urban liberal hubs, the states from Texas through Florida reflect this traditional conservatism that has persisted over decades, reinforced by political institutions and local values.

Texas, in particular, embodies this “frontier spirit.” The state’s long history as a republic, combined with its emphasis on rugged individualism and suspicion of centralized power, aligns with Republican principles. Arizona, with its substantial rural population and similar desert environment, mirrors this mindset. The “frontier mentality” persists in these areas, where local culture values autonomy and self-reliance—traits that naturally dovetail with conservative ideologies.

3. Economics and Industry Patterns

Economic structures in these states contribute heavily to their conservative leanings. Texas, for example, is a major oil producer, while Florida’s economy is driven by tourism and agriculture. These industries often thrive under conservative economic policies, which typically favor deregulation, low taxes, and minimal government interference. Republican economic policies are seen as beneficial by stakeholders in these sectors, making the party an appealing choice for many business owners and workers.

Moreover, certain industries in these states feel the impact of immigration more directly, leading to support for stricter border policies and a more conservative stance on national security. Agriculture and construction in Arizona, Texas, and Florida rely heavily on immigrant labor but also face challenges from undocumented immigration, shaping local attitudes toward Republican policies that prioritize border enforcement and immigration control.

4. Proximity to the Mexican Border and the “Diversity Paradox”

For border states like Texas and Arizona, proximity to Mexico brings border security and immigration issues to the forefront of local politics. This isn’t just about geographical closeness; it’s about the daily reality of cross-border dynamics that influence attitudes toward national security, cultural integration, and economic impacts. The southern perimeter’s conservative alignment is often reinforced by a sense of “us vs. them,” a cultural boundary that shapes perceptions of national identity and sovereignty.

Counterintuitively, the high diversity in these border states does not automatically translate to liberal leanings. Instead, the influx of new populations can sometimes trigger a conservative backlash, as local communities respond to perceived cultural and economic shifts. This “diversity paradox” suggests that in some cases, increasing diversity can actually entrench conservative ideologies as groups seek to preserve traditional values in the face of demographic changes. California and New Mexico differ here, as both have deeply rooted Hispanic and Native American populations that pre-date current immigration concerns, leading to a multicultural identity that integrates rather than reacts to diversity.

5. Rural-Urban Divide and Population Distribution

The rural-urban divide is a significant factor in understanding Republican dominance in the southern perimeter states. Urban centers in Texas (Austin, Houston, and Dallas), Arizona (Phoenix), and Florida (Miami) tend to lean Democratic, but the vast rural areas and smaller towns remain conservative strongholds. Given that these rural and suburban regions often have disproportionate legislative influence due to gerrymandering and districting practices, Republican preferences are amplified politically.

In these rural areas, the appeal of Republican ideology is tied to a distrust of federal intervention and a commitment to traditional social values. The conservative emphasis on “law and order” and the right to bear arms resonates with rural populations who prioritize self-sufficiency and often feel culturally alienated from urban liberalism. This dynamic creates a political landscape where urban and rural values clash, but the rural-dominated districts sustain Republican influence at state and federal levels.

6. Geopolitical Significance and National Policy

Border security, immigration, and national security are not merely abstract political issues in the southern perimeter states; they are local realities. The Republican party’s stance on border control and immigration resonates with communities directly impacted by these policies. For residents in states like Texas and Arizona, issues of border security are personal and immediate, influencing their political alignment. The southern perimeter’s exposure to these cross-border dynamics fuels support for policies that emphasize strict immigration enforcement, contributing to the region’s Republican leanings.

Furthermore, the high visibility of national debates on immigration and security in these states places them in a unique geopolitical position. Residents of the southern perimeter often view federal immigration policies through the lens of local impact, which can heighten conservative stances on enforcement and sovereignty, particularly during times of political polarization on these issues.

The southern perimeter’s Republican alignment, spanning from California to Florida, is a product of interwoven geographical, economic, cultural, and historical factors. From the lure of warm climates drawing conservative-leaning demographics to the economic structures that benefit from conservative policies, each element reinforces the region’s political leanings. The combination of rural influence, frontier mentality, and proximity to the Mexican border creates a unique political identity that sustains Republican dominance.

While California and New Mexico serve as exceptions due to their own unique geographic and cultural compositions, the southern perimeter as a whole demonstrates the impact of physical geography and local demographics on political identity. This analysis underscores how politics in border states cannot be reduced to simple assumptions about diversity or proximity to Mexico; instead, it is the product of complex, localized dynamics that shape conservative values and Republican support across the region.

#south#southern border#souther states#border#southern perimeter#border states#border patrol#republican#conservatives#geography#history#analysis#political science#mexico#california#arizona#texas#new mexico#louisiana#mississippi#alabama#florida#georgia#south carolina#politics#united states#america#north america

7 notes

·

View notes

Text

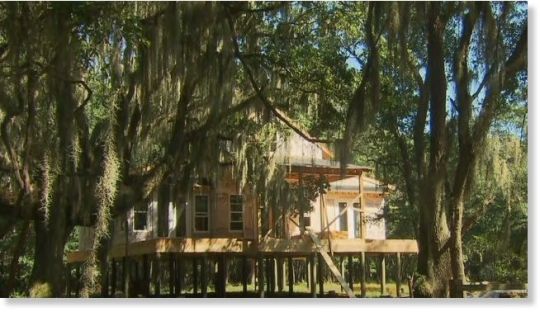

Black Residents Of Gullah-Geechee Enclave In Georgia Angered After Zoning Changes Pose Threat To Their Community

This small enclave is home to a majority of Black residents who are members of the Hogg Hummock community, which is also sometimes referred to as Hog Hammock. According to The Cultural Landscape Foundation, “Hog Hammock was one of fifteen African American Saltwater Geechee settlements on Sapelo Island, Georgia.

The Geechee are descendants of enslaved West Africans brought to work on Sea Island plantations along the Atlantic coast.” Sapelo island is located approximately 60 miles south of Savannah, Georgia and is only reachable by boat.

Almost three decades ago, the county adopted the zoning restrictions, “with the stated intent to help Hogg Hummock’s 30 to 50 residents hold on to their land,” the Associated Press reports.

But the McIntosh County’s elected commissioners recently voted 3-2 vote to change the restrictions. Now, Black residents fear that wealthy buyers will be prioritized over them, which could lead to increases in taxes.

Residents also anticipate this could cause them to be pressured to sell their land, most of which has been in their family for generations. Atlanta resident Yolanda Grovner originally had a plan where she would ultimately retire on her island native father’s land that he owns in Hogg Hummock, but now she worries this might not be able to happen. Yolanda’s father George Grovner attended the meeting wearing a sticker, which read “Keep Sapelo Geechee,” in defiance of these planned zoning changes.

“It’s going to be very, very difficult,” said Yolanda, continuing, “I think this is their way of pushing residents off the island.”

In recent years, the population on Hogg Hummock has been shrinking because some families have sold their land to outsiders. David Stevens, Chairman of the Commission, said he’s been a visitor on Sapelo Island since the 1980s, and places the blame for these changes on those who are selling their land.

This could be partly true, as the vote followed new construction builds. The commissioners ruling “raised the maximum size of a home in Hogg Hummock to 3,000 square feet (278 square meters) of total enclosed space. The previous limit was 1,400 square feet (130 square meters) of heated and air-conditioned space,” per the Associated Press.

Stevens stated, “I don’t need anybody to lecture me on the culture of Sapelo Island.” “If you don’t want these outsiders, if you don’t want these new homes being built...don’t sell your land,” Stevens concluded.

But the remaining residents have vowed to keep fighting these ordinance changes, and it’s not a new phenomenon for them to fight with the local government either. In 2012, dozens of residents and landowners were able to successfully appeal property tax increases.

In addition, many have spent years “fighting the county in federal court for basic services such as firefighting equipment and trash collection before county officials settled last year,” writes the Associated Press.

Maurice Bailey is a native of Hogg Hummock whose mother Cornelia Bailey had deep roots to the island. Bailey was a Sapelo Island celebrity, keeping the community’s voice alive with her storytelling before she died in 2017. Maurice said, “We’re still fighting all the time,” adding, “They’re not going to stop. The people moving in don’t respect us as people. They love our food, they love our culture. But they don’t love us.”

Some legal experts have hinted at due process violations as well as concerns about encroachment under the equal protection clause.

This issue becomes more complicated given the racial demographics of the county. Hogg Hummock is on the National Register of Historic Places, and in order for the Gullah-Geechee community to receive protections “to preserve the community, residents depend on the local government in McIntosh County, where 65% of the 11,100 residents are white,” says the Associated Press.

#Black Residents Of Gullah-Geechee Enclave In Georgia Angered After Zoning Changes Pose Threat To Their Community#sapelo#georgia sea islands#Gullah Geechee#Lowlands#Hogg Hummock#Sapelo Island#Gullah Geechee community

33 notes

·

View notes

Text

Kenyan MPs are due to vote on whether to impeach Deputy President Rigathi Gachagua in a political row that has gripped the nation following his recent fallout with President William Ruto.

The lawmakers accuse Gachagua of corruption, practising ethnically divisive politics and undermining the government, among a host of other charges.

The 59-year-old politician, popularly known as “Riggy G”, has described the allegations against him as "outrageous" and "sheer propaganda", maintaining they are part of a plot to hound him out of office.

He is expected to appear before parliament to defend himself before the vote, after which impeachment proceedings will move to the Senate.

Political tensions have been running high in the East African country since June when deadly demonstrations erupted over unpopular tax hikes, exposing a deep rift between Ruto and Gachagua.

Ruto sacked most of his cabinet and brought in members of the main opposition following the anti-tax protests, in which more than 50 people were killed.

Several MPs allied to Gachagua were summoned by police last month, accused of funding the protests - though no charges were brought.

Ahead of the vote, security has been heightened in the capital, Nairobi, with police patrols and major roads leading to parliament blocked to the public.

About 20 lawyers have been hired to defend Gachagua against the impeachment motion, local media reports.

A total of 291 MPs, more than the 117 required by the constitution, signed the motion to initiate the impeachment process last week.

Gachagua has failed in numerous court bids to stop the proceedings going ahead.

In a televised speech on Monday, Gachagua accused Mwengi Mutuse, the MP who drafted the motion, of lying, calling it “shameful and sensational”.

The motion lists 11 grounds for impeachment, including accusations that Gachagua amassed assets worth 5.2bn Kenyan shillings ($40m, £31m) in two years in unexplained wealth.

"I am innocent of all these charges," Gachagua said.

"I have no intention whatsoever to resign from this job. I will fight to the end."

The deputy president said some of the properties listed in the motion belonged to his late brother.

He also defended the controversial renovation for his official residence in the capital.

When big decisions are to be taken by MPs, the constitution stipulates that the public must be consulted first.

According to a parliamentary report, more than 200,000 responses were received as part of that process - of which 65% supported Gachagua's impeachment, while nearly 34% opposed it.

On Sunday, Gachagua appealed to Ruto and the MPs to forgive him for any wrongdoing during his tenure. He later clarified that his apology was not an admission of guilt.

Ruto is yet to comment about the impeachment motion publicly, but he is on record in the early days of his presidency as saying that he would never publicly humiliate his deputy.

For the motion to pass, it requires the support of at least two-thirds of members of the National Assembly, the lower house of parliament.

It is expected to sail through given that the main opposition has now joined forces with the president's party.

Gachagua, a wealthy businessman from the vote-rich Mount Kenya region, battled previous corruption scandals to become Ruto's running mate in a closely fought election in August 2022.

He is from the Kikuyu community, the country’s largest ethnic group, while President Ruto is a Kalenjin, an ethnic group which mainly lives in the Rift Valley.

These two communities were at loggerheads after elections in 2007 - ethnic violence in which 1,200 people died nationwide.

If the Senate backs the motion too, Gachagua would become the first deputy president to be impeached under the constitution adopted in 2010.

In 1989, then Vice-President Josephat Karanja resigned from office when he faced a similar motion.

2 notes

·

View notes

Text

Commercial Property in Noida: Why You Should Invest

Investing in commercial property in Noida is a decision with significant potential for growth and return on investment. Noida, a rapidly expanding city in Uttar Pradesh, offers a vibrant environment for commercial enterprises, making it an attractive destination for investors. Here’s why investing in commercial property is a good choice:

1. Booming Real Estate Market

Real estate market is experiencing a surge in demand, driven by its status as a major business and industrial hub. The city's strategic location near Delhi and its well-developed infrastructure have made it a prime area for commercial investments. With numerous IT parks, office spaces, and retail centers being developed, commercial property and commercial projects are poised for substantial appreciation.

2. Favorable Business Environment

The city provides a conducive environment for businesses with its modern amenities and robust infrastructure. Noida's well-maintained roads, efficient public transport system, and proximity to the national capital enhance its appeal as a business destination. Additionally, the presence of numerous multinational companies and startups boosts the demand for commercial spaces, ensuring steady rental yields for property investors.

3. Infrastructure Developments

Ongoing infrastructure projects in Noida 142, such as the Noida-Greater Noida Expressway, the upcoming Jewar Airport, and the extension of the metro network, are expected to further enhance the city's connectivity and accessibility. These developments not only improve the quality of life but also increase the value of commercial properties in Noida, making it a strategic investment for the future.

4. Diverse Investment Options

Noida offers a wide range of commercial property options, from office spaces in Noida and retail outlets to industrial properties and warehouses. This diversity allows investors to choose properties that align with their investment goals and risk appetite. Whether you're looking for a high-yield office space in a prime location or a retail property in a bustling market area, Noida's commercial real estate market has something to offer.

5..Quality of Life

Investing in Noida also means investing in a city with a high quality of life. With numerous residential communities, recreational facilities, educational institutions, and healthcare centers, Noida offers a well-rounded living experience. This quality of life factor contributes to the overall appeal of commercial properties, as businesses seek locations that offer a balanced lifestyle for their employees.

6. Economic Growth

Noida's economic growth is a key factor driving the demand for commercial property in Noida. The city's thriving IT and manufacturing sectors, coupled with a growing retail market, contribute to its economic dynamism. As businesses expand and new ventures emerge, the need for commercial spaces continues to rise, creating lucrative opportunities for investors.

7. Government Incentives

While avoiding the term 'government,' it's worth noting that various policy initiatives and incentives support the growth of commercial real estate in Noida. These include relaxed regulations for business setup, tax benefits for property developers, and schemes aimed at promoting investment in infrastructure and real estate. Such measures enhance the overall investment climate in the city.

8. Proximity to Delhi

Noida's proximity to Delhi, the capital city, adds to its attractiveness as a commercial investment destination. The ease of access to Delhi's business hubs, administrative offices, and global connectivity through the international airport makes Noida an ideal location for companies looking to establish a presence in the region.

9. High Rental Yields

The demand for commercial spaces in Noida is driving up rental yields. Businesses seeking prime locations for their operations are willing to pay a premium for well-located properties with modern amenities. This trend translates into attractive returns for property investors who can capitalize on the growing demand for commercial spaces

10. Future Prospects

The prospects of commercial properties are promising. With continuous urbanization, infrastructure improvements, and economic growth, the city's commercial real estate market is expected to thrive. Investors who enter the market now can benefit from the long-term appreciation of property values and sustained rental income.

Conclusion

Investing in commercial property in Noida presents numerous advantages, from the city's booming real estate market and favorable business environment to its ongoing infrastructure developments and diverse investment options. With high rental yields, economic growth, and proximity to Delhi, Noida stands out as a prime destination for commercial real estate investment. As the city continues to evolve and expand, investors have the opportunity to secure valuable assets and enjoy substantial returns on their investments.

#commercial property in noida#commercial space in noida#commercial project in noida#commercial property#commercial space#noida#uttar pradesh#india#delhi ncr#real estate

2 notes

·

View notes

Text

Rare public criticism of nationalizations from the captains of Russia’s economy

Russia’s top economic officials joined a panel at the St. Petersburg Economic Forum on Thursday a delivered rare public criticism of the federal government’s ongoing seizures of major enterprises. The heads of the Central Bank, Elvira Nabiullina, the Finance Ministry, Anton Siluanov, and the Economic Development Ministry, Maxim Reshetnikov, discussed the nationalization of pasta manufacturer “Makfa” and the “Solikamsk Magnesium Plant.” State Duma Budget and Taxes Committee Chairman Andrey Makarov moderated the panel and raised pointed questions about the two recent nationalizations, asking if it’s possible even to talk about respect for private property rights and an independent judiciary if both majority and minority shareholders can be so easily dispossessed.

Siluanov first tried to defend the nationalizations, pointing out that the government plans to offload these assets, not manage the companies itself. Nabiullina fired back that the issue concerns investor confidence and the violation of shareholders’ rights, not what the state plans to do with their property. She added that the Central Bank has filed a lawsuit to protect “the minority shareholders” (presumably referring to the appeal against the seizure of minority shares in Solikamsk Magnesium Plant). Reshetnikov said this case would be a “litmus test” for Russian institutions that have come under new “demands and requirements” (since the February 2022 invasion of Ukraine). He warned that Russia would be forced to develop a series of nuanced new laws to protect property rights if the court rules against the Central Bank. Siluanov agreed that Russia’s investment climate relies on respect for property rights and said, “We hope the court will review the matter and reach a balanced decision.”

Journalists at Agentstvo Media report that Maxim Oreshkin, a deputy chief of staff in the Putin administration, was also a panelist but said nothing of substance during the conversation.

2 notes

·

View notes

Text

Biden reacts to the GOP's proposal to gut social security

* * * * *

LETTERS FROM AN AMERICAN

March 21, 2024

HEATHER COX RICHARDSON

MAR 22, 2024

In the past few weeks, Josh Kovensky of Talking Points Memo has deepened our understanding of the right-wing attempt to impose Christian nationalism on the United States through support for Trump and the MAGA movement. On March 9, Kovensky explored the secret, men-only, right-wing society called the Society for American Civic Renewal (SACR), whose well-positioned, wealthy, white leaders call for instituting white male domination and their version of Christianity in the U.S. after a “regime” change.

On March 19, Kovensky explained how that power was reaching into lawmaking when he reported on a September 2023 speech by Russ Vought, a key architect of the plans for Trump’s second term, including Project 2025. In the speech, which took place in the Dirksen Senate Office Building, Vought explained the right wing’s extreme border policies by explicitly marrying Christian nationalism and an aversion to the pluralism that is a hallmark of American democracy. Vought argued that the U.S. should model immigration on the Bible’s Old Testament, welcoming migrants only “so long as they accepted Israel’s God, laws, and understanding of history.”

These religious appeals against the equality of women and minorities seem an odd juxtaposition to a statement by United Auto Workers (UAW) union president Shawn Fain in response to the claim of the Trump campaign that Trump’s “bloodbath” statement of last Saturday was about the auto industry. Fain is also a self-described Christian, but he rejects the right-wing movement.

“Donald Trump can’t run from the facts,” Fain said in a statement to CBS News. “He can do all the name-calling he wants, but the truth is he is a con man who has been directly part of the problem we have seen over the past 40 years—where working class people have gone backward and billionaires like Donald Trump reap all the benefits….

“Trump has been a player in the class war against the working class for decades, whether screwing workers and small businesses in his dealings, exploiting workers at his Mar a Lago estate and properties, blaming workers for the Great Recession, or giving tax breaks to the rich. The bottom line is Trump only represents the billionaire class and he doesn’t give a damn about the plight of working class people, union or not.”

In the 1850s the United States saw a similar juxtaposition, with elite southern enslavers heightening their insistence that enslavement was sanctioned by God and their warnings that the freedom of Black Americans posed an existential threat to the United States just as white workers were beginning to turn against the system that had concentrated great wealth among a very few men. While white southern leaders were upset by the extraordinary popularity of Harriet Beecher Stowe’s Uncle Tom’s Cabin, the 1852 novel that urged middle-class women to stand up against slavery, it was Hinton Rowan Helper’s 1857 The Impending Crisis of the South: How to Meet It that made them apoplectic.

Hinton Helper was a white southerner himself and showed no abolitionist sympathies in his deeply racist book. What that book did was to show, using the statistics that had recently been made available from the 1850 census, that the American South was falling rapidly behind the North economically. Helper blamed the system of slavery for that economic backwardness, and he urged ordinary white men to overthrow the system of enslavement that served only a few wealthy white men. The cotton boom of the 1850s had created enormous fortunes for a few lucky planters, as well as a market for Helper’s book among poorer white men who had been forced off their land.

White southern elites considered Helper’s book so incendiary that state legislatures made it illegal to possess a copy, people were imprisoned and three allegedly hanged for being found with the book, and a fight over it consumed Congress for two months from December 1859 through January 1860. The determination of southern elites to preserve their power made them redouble their efforts to appeal to voters through religion and racism.

In today’s America, the right wing seems to be echoing its antebellum predecessors. It is attacking women’s rights; diversity, equity, and inclusion programs; immigration; LGBTQ+ rights and so on. At the same time, it continues to push an economic system that has moved as much as $50 trillion from the bottom 90% to the top 10% since 1981 while exploding the annual budget deficit and the national debt.

Yesterday the far-right Republican Study Committee (RSC), which includes about two thirds of all House Republicans, released a 2025 budget plan to stand against Biden’s 2025 budget wish list. The RSC plan calls for dramatic cuts to business regulation, Social Security, Medicaid, and so on, and dismisses Biden’s plan for higher taxes on the wealthy, calling instead for more than $5 trillion in tax cuts. It calls the provision of the Inflation Reduction Act that permits the government to negotiate with pharmaceutical companies over prices “socialist price controls.”

Biden responded to the RSC budget, saying: “My budget represents a different future. One where the days of trickle-down economics are over and the wealthy and biggest corporations no longer get all the breaks. A future where we restore the right to choose and protect other freedoms, not take them away. A future where the middle class finally has a fair shot, and we protect Social Security so the working people who built this country can retire with dignity. I see a future for all Americans and I will never stop fighting for that future.”

Biden’s version of America has built a strong economy in the last two years, with extremely low unemployment, extraordinary growth, and real wage increases for all but the top 20%. Inequality has decreased. Today the White House announced the cancellation of nearly $6 billion in federal student loan debt for thousands of teachers, firefighters, and nurses. Simply by enforcing laws already on the books that allow debt forgiveness for borrowers who go into public service, the administration has erased nearly $144 billion of debt for about 4 million borrowers.

At the same time, the administration has reined in corporations. Today the Department of Justice, along with 15 states and the District of Columbia, sued Apple, Inc., for violating the 1890 Sherman Antitrust Act. They charge that the company, which in 2023 had net revenues of $383 billion and a net income of $97 billion, has illegally established a monopoly over the smartphone market to extract as much revenue as possible from consumers. The company’s behavior also hurts developers, the Department of Justice says, because they cannot compete under the rules that Apple has set.

At the end of February, the Federal Trade Commission (FTC) sued to block the merger of Kroger and Albertsons, a $24.6 billion takeover affecting 5,000 supermarkets and 700,000 workers across 48 states. The merger would raise grocery prices, narrow consumer choice, and hurt workers’ bargaining power, the FTC said. The attorneys general of Arizona, California, the District of Columbia, Illinois, Maryland, Nevada, New Mexico, Oregon and Wyoming joined the FTC’s lawsuit.

The benefits of the administration’s reworking of the government for ordinary Americans have not gotten traction in the past few years, as right-wing media have continued to insist that Biden’s policies will destroy the economy. But as Shawn Fain’s position suggests, ordinary white men, who fueled the Reagan Revolution in 1980 when they turned against the Democrats and who have made up a key part of the Republican base, might be paying attention.

In June 2023 the AFL-CIO, a union with more than 12.5 million members, endorsed Biden for president in 2024 in its earliest endorsement ever. In January the UAW also endorsed Biden. Yesterday the United Steelworkers Union, which represents 850,000 workers in metals, mining, rubber, and other industries, added their endorsement.

Just as it was in the 1850s, the right-wing emphasis on religion and opposition to a modern multicultural America today is deeply entwined with preserving an economic power structure that has benefited a small minority. That emphasis is growing stronger in the face of the administration’s effort to restore a level economic playing field. In the 1850s, those who opposed the domination of elite enslavers could only promise voters a better future. But in 2024, the success of Biden’s policies may be changing the game.

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

#Biden#Biden White House#Social Security#GOP Budget#RSC#Republican Study Committee#Christian Nationalism#AFL-CIO#unions#antebellum american#history#Heather Cox Richardson#Letters From An American#ACSR#American Civic Renewal#Project 2025

4 notes

·

View notes

Text

There are many behaviors that some people engage in, that other people would like to make them stop, because their ideologies say these behaviors are immoral.

The actors may be doing these things because the behaviors bring them joy, may be a cultural or family tradition, are in some way optimal solutions for their personal, local, and socioeconomic challenges, or because they hold a competing ideology that says the behavior is obligatory and so they are generally resistant to change.

Generally, if a behavior is sufficiently unacceptable to members of a community, they will have an explicit rule against it, with enforcement measures. In the case of nations, these rules are laws and enforced by the state using violence or intimidation via state power. (That is, if traffic tickets are not paid, eventually the state will revoke the offender’s driver’s license, at which point they are committing the more serious offense of driving with a suspended license, and so on until the offender is eventually taken into police custody and imprisoned for traffic crimes or shot trying to resist arrest. Property taxes are similar: ignore them long enough and eventually the arm of the state authorized to do violence will show up to force compliance and shoot you if you resist.)

It is perhaps human nature to want to forbid others from doing things you find morally offensive. The problem is that, in a multicultural society and global order, the range of things that someone finds offensive and someone else considers an essential part of their own culture in some way, where both groups are in sufficient proximity to be aware of each other’s existence and opinions is very large.

In addition to the legacy cultures and ideologies (eg. French culture, Islam, Hinduism, multiple branches of Christianity), recently developed ideologies and cultures are of course well-suited to modern conditions (eg. Feminism, The LGBTQ Community, environmentalism, animal rights). Each culture/ideology has behavioral precepts that they consider worthy of enforcement on nonbelievers.

As a result, there are many behaviors that many people wish to use any power they are capable of accessing to forbid or otherwise prevent.

Since achieving these goals frequently requires convincing some unbelievers that the despised behavior is in some way in their interest to not practice and to forbid, unfortunately, it is necessary to look with a measure of suspicion upon the motives of anyone who is trying to make entreaties to unbelievers about how the despised behavior ought to be banned for global reasons such as public health, climate change/sustainability, or using more specialized arguments such as disgust or cuteness, or using beliefs the speaker does not share to appeal to the holders of those beliefs to join them in coalition in seeking to force others to cease the behavior, especially known members of cultures/ideologies that despise the particular behavior for their own reasons.

That is, eg. an evangelical Christian who proclaims that abortion causes cancer and a Hindu or animal rights activist who proclaims that eating beef causes cancer should all be considered as acting in a somewhat disingenuous way and their evidence examined closely, as the deeper motives for making these claims is not primarily a desire to keep people from getting cancer, but to dissuade nonbelievers from behaving in a way they consider immoral.

Please do note that the “deeper motive” may be lodged in the source a not particularly intelligent rank and file adherent got this information about the despised behavior causing cancer rather than directly in the speaker, as a spear-carrier is neither interested nor capable of evaluating the tale of cancer, but most likely thoughtlessly accepted it via their own just world fallacy and is proclaiming this out of some genuine concern for the health of the nonbelievers, which is not a hostile or disingenuous intent.

#original post#probably still possible to willfully misunderstand this#needs more tags#arrested for traffic crimes

21 notes

·

View notes

Text

Palm Beach County Real Estate Prices GROW in Beginning of 2023!

The results are in and Palm Beach County real estate values have GROWN in January 2023 versus January of 2022! Single family home prices are up 4.9%. Townhouses and Condominiums are up 5.1%. Data from Beaches board of Realtors shows this grow and is great news for homeowners, sellers, and buyers confirming stability and comfort in our local Florida real estate.

Palm Beach County, Florida is currently experiencing a significant growth in real estate prices. According to recent data, the median home value in the county has increased, making it one of the fastest-growing real estate markets in the state.

There are many reasons for this growth, one of which is the state's overall attractiveness as a place to live and work. Florida has long been a popular destination for retirees and snowbirds looking for warm weather and sunny skies. However, the state has also become a hot spot for young professionals and families seeking a lower cost of living and better quality of life. A strong school system with A ratings has also helped families make the choice to live the Florida lifestyle for entire families.

One of the main reasons real estate prices in Palm Beach County are continuing to rise is due to its strong job market. Remote work has become a reality and unlike ever before people have the opportunity to work and live in Florida. As technology applicable to business advances, the choice to live in Florida is likely to continue. Local employment opportunities in the area have been increasing steadily, creating more demand for housing and pushing up home values. The county’s infrastructure and growing number of businesses also make it an attractive option for those looking to move or invest in a property.

The state's low taxes and lack of a state income tax are also attractive to buyers, particularly those coming from high-tax states like New York and California. With more and more businesses embracing remote work and the ability to work from anywhere, Florida's appeal as a tax-friendly and affordable place to live is only expected to increase.

Furthermore, Palm Beach County is one of the most desirable places for lifestyle due to its warm climate and easy access to beaches, boating, fishing, shopping, and entertainment. Florida in general has a lot of value to offer for the dollar. Weekdays and evenings can often feel like weekends as social hubs like Palm Beach Island and Delray Beach are busy with shopping and dining every day and night of the week. It makes sense that warm weather, luxury living, and work life balance are reflected in our property values.

However, the growth in real estate prices has not been without its challenges. The rise in home values has made it more difficult for first-time buyers and lower-income families to enter the market, creating concerns about affordability.

Florida home prices are showing to be solid in comparison than the national average because of the county’s desirable location and many attractions. Analysts predict Palm Beach County and Florida in general to hold value and are likely inch forward year over year due to our unique value proposition a top place in the world to live!

Contact Greenfield Waters Florida Realty and learn more about your property value and to discuss where Floridians are moving to find value!

It’s our pleasure to help,

Eric Gunther

www.greenfieldwaters.com

#palm beach island#palm beach#florida real estate#real estate#eric gunther realtor#eric gunther#eric gunther greenfield waters#greenfield waters florida realty#greenfield waters

2 notes

·

View notes

Text

Expert Commercial Property Tax Assessors: Maximize Your Savings Today

You pay nothing unless we save you money! Commercial Property Tax Assessors use mass appraisal methods, often leading to errors. We handle the entire appeal process for both residential and commercial properties, ensuring accurate assessments without any risk to you. Visit https://www.nationalpropertytax.com/commercial-and-multifamily/ for detailed information.

#Commercial property tax assessors#Commercial Property Tax Reduction Services#National property tax appeal#Commercial real estate appraisers#Commercial property tax reduction#Commercial property tax consultant#National commercial property tax#National property tax

0 notes

Text

South Florida’s Suburban Growth: A Real Estate Perspective

South Florida’s real estate market has become a significant player in the national real estate landscape, known for its diverse offerings, luxury properties, and high demand for homes that accommodate a wide range of buyers. The market is evolving rapidly, and many new trends have surfaced that are worth exploring.

One major trend has been the rise in the demand for luxury properties. According to Omar Hussain, “South Florida’s real estate market continues to attract luxury buyers who are looking for unique, high-end homes that provide both exclusivity and access to all the amenities that the region offers.” The region’s growing reputation as a haven for luxury real estate has been fueled by an influx of international buyers and those seeking tax benefits.

The market dynamics are heavily influenced by both domestic and international buyers. Over the past decade, the influx of foreign capital has significantly shaped the market. As Omar Hussain points out, “The appeal of South Florida to international buyers cannot be overstated. The mixture of lifestyle and investment potential keeps foreign interest strong year-round.” This steady demand helps bolster the region’s property values, particularly in high-end neighborhoods.

Another critical factor driving South Florida’s market is its growing appeal as a second-home destination. Buyers from colder climates and high-tax states are flocking to South Florida, looking for homes that offer both a vacation lifestyle and a strategic financial investment. “South Florida has always been known for its second-home market, but now we’re seeing a shift where these homes are becoming primary residences for many,” says Omar Hussain.

In the luxury sector, eco-friendly homes are becoming an essential trend. Buyers are increasingly interested in properties that provide sustainability features alongside luxury elements. Developers are now incorporating more green energy sources, smart home technology, and environmentally friendly construction materials to cater to this growing demand.

At the same time, South Florida’s urban centers, like Miami, have been experiencing a boom in the condo market. Miami’s urban core is evolving, and the real estate boom has transformed neighborhoods with high-end developments. Downtown Miami, Brickell, and Edgewater have emerged as top markets for investors and end-users alike. This trend is driven by a combination of job growth, a desire for walkable neighborhoods, and the availability of luxury amenities.

Waterfront properties are at the core of what makes South Florida real estate so attractive. Whether it’s a beachfront mansion or a high-rise condominium with water views, these homes remain among the most desirable properties in the region. Omar Hussain explains, “Waterfront properties, particularly in areas like Miami Beach, are a pinnacle of the luxury market. Buyers are willing to pay a premium for the combination of privacy, luxury, and access to water.”

Another trend impacting the market is the rise of remote work. As more people embrace flexible work arrangements, they are looking for homes that offer office spaces, large outdoor areas, and access to leisure activities like boating and golfing. South Florida’s properties are well-suited to these needs, making the region a top choice for relocating professionals and entrepreneurs.

In conclusion, the South Florida real estate market continues to grow and evolve, driven by a unique combination of factors that make it one of the most dynamic markets in the country. With luxury properties at the forefront, eco-friendly homes on the rise, and continued interest from both domestic and international buyers, the future looks bright. Omar Hussain Chicago sums it up perfectly: “South Florida will always be a top destination for real estate investment, whether for personal use or financial growth. The combination of lifestyle and market strength is unbeatable.”

Originally Posted: https://omarhussainchicago.com/south-florida-suburban-growth/

0 notes

Text

The Impact of Window Replacement on Birmingham’s Property Taxes and Resale Value

As Birmingham homeowners look for ways to improve their properties, one of the most effective upgrades to consider is window replacement. While new windows can enhance the aesthetics, energy efficiency, and comfort of a home, they can also significantly impact property taxes and resale value. In this article, we will explore how window replacement can influence these two critical aspects, helping homeowners make informed decisions about their investments.

1. Understanding Property Taxes in Birmingham

Property taxes are based on the assessed value of your home, which is determined by local government assessments. Various factors influence this assessed value, including the home’s size, condition, location, and recent improvements, such as renovations and upgrades. Here’s how window replacement in Birmingham can play a role:

a. Increased Property Value

When you replace your old windows with new, energy-efficient models, it often leads to an increase in the overall value of your property. Assessors take note of these improvements when evaluating your home, potentially resulting in a higher assessed value.

Energy Efficiency: Homes with new windows that feature advanced energy-efficient technologies may receive a higher appraisal due to their lower utility costs and enhanced comfort.

Aesthetic Appeal: Upgraded windows improve the curb appeal of your home, which can positively influence the market value. A visually appealing home is more attractive to buyers and appraisers alike.

b. Potential Impact on Property Taxes

While an increase in property value can be beneficial, it can also lead to higher property taxes. Here’s how this works:

Assessment Increases: If the local tax assessor determines that your home’s value has increased due to improvements like window replacement, they may adjust your property tax assessment accordingly. This can result in higher annual property taxes.

Tax Incentives: On the other hand, many municipalities offer tax incentives or rebates for energy-efficient upgrades. Homeowners in Birmingham should research any local programs that may help offset the cost of window replacement or provide property tax benefits.

2. Resale Value and Market Demand

When considering window replacement, homeowners often focus on the impact on resale value. Replacing windows can be a significant selling point for potential buyers and can lead to a quicker sale and potentially higher offers. Here are some factors to consider:

a. Appeal to Buyers

In Birmingham’s competitive real estate market, homes with new windows stand out to buyers. Key aspects that enhance resale value include:

Energy Efficiency: Modern windows are designed to provide superior insulation, reducing heating and cooling costs. Many buyers prioritize energy efficiency, making homes with new windows more desirable.

Warranty and Quality: New windows often come with warranties, giving buyers confidence in their investment. High-quality materials and workmanship can significantly boost a home's appeal.

b. Return on Investment (ROI)

Investing in window replacement can yield a high return on investment, making it a smart financial decision. According to national averages, homeowners can expect to recoup a significant portion of their investment when selling their home. Specific factors influencing ROI include:

Market Trends: In a seller’s market, homeowners may see even higher returns as demand for energy-efficient homes increases.

Local Comparables: Properties in your neighborhood with upgraded windows may set the standard for market value, influencing the resale price of your home.

3. Choosing the Right Windows for Maximum Impact

To maximize the benefits of window replacement in Birmingham, it’s essential to choose the right windows and materials. Here are some considerations to keep in mind:

a. Energy-Efficient Options

Selecting energy-efficient windows can make a significant difference in both property value and resale potential. Look for windows with the following features:

Low-E Coatings: These coatings reflect heat while allowing natural light to enter, improving energy efficiency.

Double or Triple Glazing: Multiple panes of glass provide better insulation, enhancing comfort and lowering energy bills.

Energy Star Certification: Windows that meet Energy Star standards are recognized for their efficiency and can attract environmentally-conscious buyers.

b. Style and Design

The style and design of your windows should complement your home’s architecture. Consider the following options:

Traditional Styles: Double-hung or casement windows are often preferred in Birmingham's historic neighborhoods, enhancing the property’s charm.

Modern Designs: Sleek, contemporary windows can appeal to buyers looking for a modern aesthetic, particularly in new developments.

4. Long-Term Benefits of Window Replacement

Beyond the immediate impact on property taxes and resale value, window replacement in Birmingham offers long-term benefits that contribute to a homeowner’s overall investment:

a. Energy Savings

New windows reduce energy costs by improving insulation and preventing drafts. Homeowners can experience significant savings on utility bills, which adds to the overall value of the home.

b. Enhanced Comfort

Upgraded windows improve indoor comfort by regulating temperatures and reducing noise pollution. A comfortable living environment is a significant selling point for potential buyers.

c. Maintenance and Durability

Modern windows are designed for durability and low maintenance, meaning homeowners will spend less time and money on repairs. This longevity is attractive to buyers looking for a hassle-free property.

5. Conclusion

Window replacement is a valuable investment for Birmingham homeowners, offering substantial benefits in terms of property taxes and resale value. While new windows can lead to increased assessed values and potentially higher property taxes, they also enhance a home’s appeal to buyers and can provide significant returns on investment.

To maximize these benefits, homeowners should choose energy-efficient options that align with local market preferences. By carefully selecting windows that enhance both aesthetic and functional qualities, Birmingham homeowners can ensure their investment pays off both in terms of property value and resale potential.

At Vinyl Window Solutions, we specialize in high-quality window replacements that not only improve your home’s appearance but also enhance energy efficiency and comfort. Contact us today to learn how we can help you increase your home’s value while preparing it for the future!

0 notes

Text

Stockbridge Apartment Building

3328 Euclid Ave.

Cleveland, OH

The Stockbridge Apartment Building is a dark-brick balconied building located at 3328 Euclid Avenue across the street from the gleaming glass headquarters of Applied Industrial Technologies near East 30th Street in Cleveland, Ohio. Built in 1911 and formerly the Stockbridge Hotel, it is listed on the National Register of Historic Places. This 1911 edifice was designed as far more than a typical apartment house or hostelry. It opened with only 10 suites of 16 rooms each. Those 4,000-square-foot units were created for the industrial barons whose palatial estates surrounded it, and a number of them moved in for the winter season.

But the Stockbridge also became a mirror of Cleveland's transformation through the 20th century. When the Stockbridge opened, it seemed at the time that Cleveland's Millionaires' Row was still thriving in its sixth decade. At least it looked that way to those who drove their carriages -- horseless or not -- down Euclid Avenue to view the wrought-iron gates, vast lawns and turreted mansions of those estates. Oilman George Canfield had picked up on something, likely while talking to his moneyed friends at the private clubs and lodges they belonged to, over drinks and cigars.

The Gilded Age was developing a hint of tarnish, and even the barons who never worried about money were beginning to worry, just a little, about money. While they once didn't have to consider property taxes, by the end of the first decade of the 20th century, they were facing considerable tax bills. And heating a mansion -- if that's the right word for something that ranged from 10,000 to 40,000 square feet -- during a Cleveland winter was costly. So was maintaining a year-round staff of perhaps 100 people to make these palaces function as smoothly as they should. A home that would give these men proximity to their businesses and, perhaps, their social lives (including opera and the theater district) and let them be near downtown during the winter seemed like it would appeal.

And it did. Several closed up their mansions for the season and moved into the Stockbridge. Among the first residents in Canfield's Stockbridge were Henry Sherwin, co-founder of the Sherwin-Williams Co., and bank owner Harry Wick. The son of President James Garfield, also named James, moved in with his wife. But the Stockbridge Hotel, designed for the comfort of millionaires, heralded the beginning of the end of a certain level of opulence, especially near downtown.

Canfield -- the oil baron who had once worked for John D. Rockefeller and would go on to build Cleveland's first gas station -- hired George Steffens as his architect. Steffens was experienced at designing private homes and apartment buildings, and in the Stockbridge, he created a building that combined the Georgian Revival style with Tudoresque touches -- including the shape of the rooftop gables and a coat of arms painted on the top tier of balconies.

A multitude of luxurious details was apparent inside, from the lined-in-marble entryway to the substantial and intricately carved banisters and brass fixtures in the elevators. Beamed ceilings and massive fireplaces and mantels lorded over enormous living rooms. Bathrooms were lined in white porcelain tile, with deep tubs and pedestal sinks. None of the suites contained a kitchen, though, because these wealthy men didn't need them. They would either do their fine dining at the restaurant in the basement or eat at their clubs; the Tavern Club is just a block away at East 36th Street. Or they could order a meal that would come to their suite via the dumbwaiter. The hotel provided maids, housekeeping and linen services, though with 16 rooms for each suite, it was easy enough to house the few servants necessary for personal services. The sixth floor even had a ballroom, should a resident want to throw a formal gala.

Soon, millionaire residents were replaced by people who were merely wealthy. So over the years, time and bad taste took its toll. A rectangular awning eventually obscured the building front, and a garish neon sign announcing the "hotel" went up. Even into the early 1930s, some of the tenants -- including Miss Lotta Brewbaker, a music teacher at The Arcade -- were listed in the city's social register, the Blue Book. Then, as the huge suites got carved up to create more rooms, some visitors were vaudevillians, including Bob Hope and Jack Benny, who appeared at the nearby Hippodrome. The headliners would stay in the front; roadies and the rest of the entourage would stay in the more utilitarian Stockbridge Annex, built in 1923, in the back.

Over the years, longtime Stockbridge residents included doctors, lawyers, secretaries, chefs and waiters. Temporary residents included the cartoonist Herblock and performers from the Metropolitan Opera, which would tour Cleveland each spring. Some of the itinerant entertainers were not as lofty but fascinating in their own right -- Ice Follies and roller-derby girls, circus performers or wrestlers appearing at the nearby Arena (at East 38th Street and Euclid), and sometimes burlesque dancers from the Roxy or the New Era.

Still, the Stockbridge's spirit held fast. In the mid- '70s, a young man who worked as a clerk for a union bought the place. Jim Stack was only in his 20s, and he was looking for an investment. When he learned some Stockbridge history, he was hooked and moved in himself. His dad loaned him the money for the down payment, and he paid it back in six months. The rent he collected -- by then, 40 units had been created from the original 10 suites -- left just enough for him to make repairs here and there. Then he got a federal loan in the mid- '80s for about $700,000, all of which he put into rehabbing the building. He hired architect Bob Gaede to bring back as much splendor as he could. Stack applied for and won the Stockbridge a spot with the National Register of Historic Places on August 8, 1985.

Quieter, longtime residents leavened the tone of more frolicsome, temporary guests -- and were entertained by them. Magician Doug Henning and his troupe stayed there in the '70s and '80s, and would sometimes put on a show for residents in the lobby. Even into the early '90s, on some afternoons the desk clerk, Pat Riddle, played the piano in the lobby parlor for fellow residents sitting in wingback chairs. Riddle was known for wearing white gloves while performing Gershwin and Porter and other standards, to protect her vermilion manicure.

By the late '80s, Stack was married with two children and moved to a suburb. It was getting too complicated to manage a building downtown, so he sold it. In 1989, Cleveland writer Mary Mihaly wrote a story for Cleveland magazine on the still-reinvigorated Stockbridge that Stack had created. Today, the Stockbridge is not quite as cozy. The lobby parlor is gone, because a wall was added to create a mailroom. There are no celebrity photographs hanging. The building is, in fact, in receivership. Tanya Sams is managing the building for the receiver, a job she considers special, for personal reasons and her love of history.

Information taken from https://www.cleveland.com/arts/2011/04/the_stockbridge_in_cleveland_h.html

0 notes

Text

Exploring the Future Characteristics of the Smart Glass Market

The global smart glass market was estimated to be valued at USD 6.59 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 9.9% from 2023 to 2030. This growth can be largely attributed to an increasing emphasis on energy conservation initiatives, including the development of green buildings and eco-friendly structures. These efforts are being further supported by a favorable regulatory environment that provides financial incentives and tax benefits, which positively influences market dynamics. Additionally, a rise in investments and the establishment of large-scale industrial production capabilities have bolstered the growth of the glass industry.

Recent architectural trends are also contributing to the demand for smart glass solutions. For instance, the extensive incorporation of window structures within buildings, a greater emphasis on glazing areas, and a desire to maximize interaction with the external environment are driving this demand. In multi-story buildings, smart glass solutions effectively address energy-saving needs and safety concerns. Many building owners and architects are actively pursuing sustainable initiatives that not only enhance energy efficiency but also promote occupant health and overall well-being.

The transition from traditional wooden windows to advanced glass solutions is being made seamless, as new technologies can easily replace older installations. Products like anti-glare windows and electrochromic films are transforming the glass technology landscape. As various end-use industries begin to recognize the unique aesthetic appeal and functional attributes of smart glass, the demand for these innovative products is expected to grow significantly in the near future.

Gather more insights about the market drivers, restrains and growth of the Smart Glass Market

Market Characteristics

The smart glass market is currently in a high growth stage, with an accelerating pace of expansion. A notable feature of this market is its high degree of innovation, driven by advancements in materials science, nanotechnology, and enhanced connectivity. Significant investments in research and development have led to the emergence of smart glass solutions that provide dynamic tinting capabilities, improved energy efficiency, and interactive functions. The integration of smart glass with home automation systems, along with a rising demand for sustainable building solutions, further propels this innovation.

Moreover, the market is characterized by a robust level of merger and acquisition (M&A) activity among leading players. Companies are strategically aligning themselves to capitalize on the increasing need for innovative glass technologies. These M&A activities typically aim to boost research capabilities, broaden product lines, and secure competitive advantages in a rapidly evolving market landscape.

The influence of government regulations on the smart glass market is moderate. Governments in various countries are promoting self-regulation within the industry and are actively updating regulations to keep pace with technological advancements, striving to balance privacy concerns with innovation. Additionally, increased governmental investment in research and development through grants, funding, and public-private partnerships is supporting the growth of the smart glass industry while also addressing national interests.

The threat of substitutes in the smart glass market remains relatively low, thanks to the unique properties and functionalities that smart glass technology offers. Its capability to switch between transparent and opaque states makes it suitable for various applications across architecture, automotive, and electronics sectors. As the demand for energy-efficient and responsive solutions rises, the distinctive benefits of smart glass establish it as a strong contender, effectively diminishing the potential impact of substitute products.

The concentration of end users in the smart glass market varies, with a medium to high distribution. This market serves a diverse range of industries, including automotive, construction, and electronics, resulting in a broad consumer base. While applications like smart windows in buildings appeal to a wide audience, specialized applications, such as Augmented Reality (AR) smart glass displays, tend to attract a more concentrated user base within specific sectors.

Order a free sample PDF of the Smart Glass Market Intelligence Study, published by Grand View Research.

0 notes

Text

Is Zillow Accurate? Evaluating the Reliability of Zestimates

How Does Zillow Calculate Its Zestimates?

Zillow uses a proprietary algorithm to determine a home’s estimated value based on public data. This includes:

Tax records: Historical property tax assessments and sale prices.

Comparable home sales: Recent sales of similar homes in the area.

Market trends: Broader real estate market conditions, including current listings and local price trends.

Zillow updates its estimates regularly to reflect changes in the housing market, but the underlying formula remains an automated system. For homes currently on the market, Zillow claims that Zestimates are accurate within 10% of the final sale price about 95% of the time.

How Accurate Is Zillow, Really?

While Zillow provides a helpful starting point for understanding a home’s value, the accuracy of its Zestimates can vary significantly based on several factors.

1. On-Market vs. Off-Market Homes

On-Market Homes: Zestimates tend to be more accurate for homes actively listed for sale. Zillow has access to real-time listing prices, buyer demand, and other data that can improve the precision of the estimate. For these homes, Zillow’s national median error rate is around 1.9%.

Off-Market Homes: For homes that are not currently listed, Zillow’s estimates rely on older or incomplete data, which can lead to a higher margin of error. The median error rate for off-market homes is around 6.9%, meaning the Zestimate could be quite different from what the home would actually sell for.

2. Location-Based Accuracy

Zillow’s accuracy also depends on where the property is located. In densely populated areas with a high volume of home sales, Zestimates tend to be more accurate because there is more data available for the algorithm to use. However, in rural areas or slower markets with fewer comparable sales, Zestimates can be less reliable.

3. Unique or Custom Properties

If a home has unique features—such as custom construction, luxury upgrades, or historical significance—Zillow may struggle to provide an accurate estimate. The algorithm works best for homes that closely match others in the area. Unique homes can sometimes be over- or under-valued because they don’t have a large enough pool of comparable properties to draw from.

What Zillow Gets Right

Zillow’s greatest strength is in providing a fast and free way to get a rough estimate of a home’s value. For most homes in typical neighborhoods, Zestimates are reasonably accurate and give homeowners a good idea of what their property is worth. Here are a few advantages of using Zestimates:

Speed and Convenience: You can quickly check the estimated value of any home, anywhere, at any time.

Comparable Sales Data: Zillow offers access to public data on comparable home sales in your area, giving you more context for your home’s value.

Market Monitoring: If you’re watching the market for trends, Zestimates can help track changes in home values over time.

What Zillow Gets Wrong

Despite its benefits, Zillow’s Zestimate tool has its limitations:

Lack of Human Insight: Zestimates are generated by algorithms that rely on data points, but they lack the nuanced understanding of a local real estate agent. Factors like the condition of the home, neighborhood appeal, or recent renovations might not be fully reflected in the estimate.

Outdated Data: For off-market homes, Zestimates may rely on outdated tax records or older sales, which can skew the estimate. If a homeowner has made upgrades that aren’t included in public records, the Zestimate might undervalue the property.

Local Market Nuances: Real estate is highly localized. While Zestimates can provide a general value, they don’t always account for hyper-local factors like a top-rated school district, new development, or shifting neighborhood trends.

Should You Rely on Zillow’s Zestimate?

So, is Zillow accurate enough to rely on when buying or selling a home? While it can provide a good starting point, the Zestimate should not be your only source of information. Here’s what you should consider:

1. Use Zillow as a Reference, Not the Final Word

Zillow’s Zestimate can give you a ballpark figure, but it’s essential to supplement it with other sources of information, such as a professional home appraisal or a Comparative Market Analysis (CMA) from a real estate agent.

2. Consult a Local Real Estate Expert

A real estate agent who knows the local market can offer insights that Zillow can’t. They will consider the current condition of your home, recent neighborhood trends, and other factors that automated tools might overlook. For a more accurate estimate, it’s always best to work with a local professional.

3. Compare with Other Valuation Tools

Other online tools, like Redfin or Realtor.com, also provide home value estimates. By comparing values from multiple platforms, you can get a more comprehensive picture of your home’s worth.

Conclusion: How to Make Zillow Work for You

Zillow’s Zestimates are a great tool for getting a general sense of a home’s value, but they are not always 100% accurate. Use them as a starting point, then gather additional information from other sources before making any real estate decisions.

Work with One Team for the Most Accurate Home Valuation

If you're looking for a precise and personalized home valuation, look no further than One Team. Our experienced real estate professionals have in-depth knowledge of the local market, and we can provide you with a comprehensive valuation that goes beyond what automated tools can offer.

Whether you're buying or selling, we’ll guide you every step of the way to ensure you make informed decisions. For accurate home valuations and expert advice, contact One Team today at (609) 557-3585. We’re here to help you navigate the real estate market with confidence!

#one team#real estate agency near me#real estate agent#best real estate agents in collingswood#real estate agents in collingswood#new jeresy#real estate#realestate#realtor#best real estate agents in philadelphia

0 notes