#Mobile Payments

Explore tagged Tumblr posts

Text

The most visitor-friendly thing a city's transit system can do

Transit agencies do themselves and their customers a favor when they don't make would-be passengers buy a new stored-fare card or install a new app.

LONDON My packing list for this short trip to the U.K. did not include any plastic cards with embedded electronics, because London was one of the earlier cities in the world to grasp that you can persuade people to take transit if you will just shut up and take their money right before they board instead of first asking them to buy a reloadable transit fare card. By “money” I mean the kind…

View On WordPress

#Apple Pay#Elizabeth Line#G Pay#Google Pay#Google Wallet#LHR#London Underground#mobile payments#NFC#Randy Clarke#Samsung Pay#tap to pay#transit#Tube#Uber#UX

2 notes

·

View notes

Text

THE EVOLUTION OF MOBILE PAYMENTS AND THEIR IMPACT ON TRADITIONAL BANKING

The introduction of smartphones fundamentally transformed the landscape of mobile payments, It was the rise of smartphones and app-based ecosystems that truly revolutionized how people manage their finances and make transactions. Consumers could simply tap their phone on a payment terminal, using apps like Apple pay, Samsung pay, or Google wallet. In-app payments became popular with companies…

#apple pay#banking#Business#credit cards#financial#google pay#mobile payments#samsung pay#Technology

2 notes

·

View notes

Text

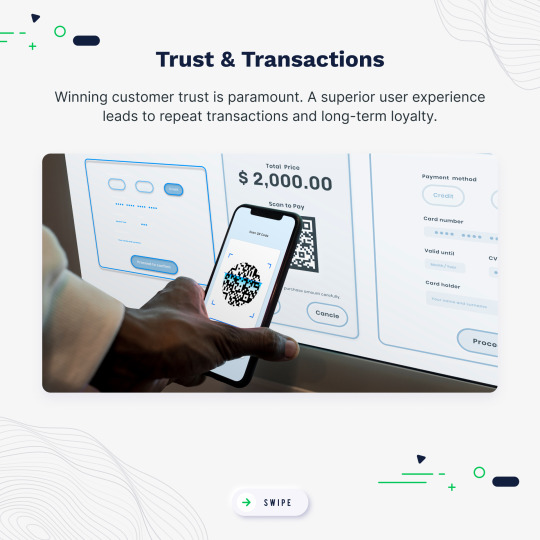

Struggling to keep your app users coming back? Swipe left to uncover the magic of Fintech in boosting customer loyalty! Discover how a Fintech app can turn those retention woes around and create a community of loyal users who can’t wait to log back in. Your solution to building lasting relationships is just a slide away! 🔄📲

#user interface#finance#banking#fintech#apps#innovation#customer loyalty#customer engagement#trends#mobile payments#mobiosolutions

2 notes

·

View notes

Text

🚀 QR Code Payments: The Future of Retail Transactions!

The retail world is changing faster than ever! With the rise of QR code payments, businesses are now embracing contactless payment solutions that make transactions faster, safer, and more convenient. Whether you’re a small business or a large retailer, integrating mobile payment technology is no longer an option—it’s a necessity.

💡 Why Are QR Code Payments Transforming Retail?

✅ Instant Transactions – No more waiting; just scan and pay! ✅ Secure Payments – Advanced QR code payment security prevents fraud. ✅ No Expensive Hardware Needed – Works with just a smartphone. ✅ Better Customer Experience – Speedy checkouts keep shoppers happy. ✅ Integration with Payment Gateways – Seamlessly process payments using top payment gateway providers.

As digital payment trends continue to evolve, businesses need reliable payment processors to keep up. The best payment processor for small businesses should offer low fees, fast settlements, and seamless QR code integration.

At Indiplex, we help businesses set up secure retail payment solutions, ensuring smooth QR code payments for customers. Whether you need high-risk payment processors or a trusted payment gateway provider, we’ve got you covered!

🔹 Is your business ready for the QR code revolution? Join the future of payments today! 🚀

#QRcodePayments #DigitalPayments #ContactlessPayments #RetailSolutions #MobilePayments #PaymentGateways #Indiplex

#atm machine#digital payments#donald trump#ecommerce#artists on tumblr#QR code#Payment gateway#mobile payments

0 notes

Text

Pagamenti digitali, Italia quarta in Europa per crescita delle transazioni cashless: +23,2% nel 2024

Pagamenti digitali, Italia quarta in Europa per crescita delle transazioni cashless: +23,2% nel 2024

Pagamenti digitali, Italia quarta in Europa per crescita delle transazioni cashless: +23,2% nel 2024 L’Osservatorio Europa Cashless di SumUp ha analizzato l’andamento dei pagamenti senza contanti nelle nazioni europee: Lettonia (+36,8%), Cipro (+33,6%) e Svezia (+27,1%) sono i paesi in cui le transazioni crescono di più. In Italia sono Ancona (+56,8% di pagamenti), Alessandria (+36,6%) e…

#Alessandria today#business digitale#cashless Europa#cashless in Italia#cashless Italia#commercianti digitali#commercio digitale#commercio digitale in Italia#contactless payments#crescita cashless#Crescita economica#Digitalizzazione#digitalizzazione delle imprese#economia cashless#fintech#futuro dei pagamenti#futuro dell’economia digitale#Google News#incremento pagamenti digitali#innovazione nei pagamenti#italianewsmedia.com#mercato digitale#mobile payments#nuove tendenze digitali#Osservatorio Europa Cashless.#pagamenti con carta#pagamenti digitali#pagamenti elettronici in Europa#pagamenti elettronici Italia#pagamenti online

0 notes

Text

Process payments anywhere with our mobile payment solutions PAX A920 Pro credit card machine loaded with the PayAnywhere app. Your business can accept payments, manage inventory and so much more. An excellent choice for any business on the go or on the countertop.

#business#entrepreneur#payments#mobile payments#credit card processing#merchant services#payment solutions

1 note

·

View note

Text

Innovations in Mobile Payment Systems for FMCG Purchases

Moving in the FMCG industry today is a bit like driving on a high-speed highway—every second counts, and there’s no room for slowing down. Continue reading Innovations in Mobile Payment Systems for FMCG Purchases

#AI-driven payments#Biometric payment#FMCG#loyalty programs#mobile payments#mobile wallets#near-field communication (NFC) technology#NFC#QR Code payment#retail

0 notes

Text

#UPI (Unified Payments Interface)#Credit Growth#Digital Payments#Amazon Pay#Fintech Innovations#Financial Inclusion#Payment Solutions#Instant Credit#Mobile Payments#E-commerce Payments

0 notes

Text

Future Trends in Mobile Payment Technology

Future Trends in Mobile Payment Technology

Mobile payment technology has seen remarkable growth over the past decade, transforming the way we conduct financial transactions. As we look to the future, several trends are poised to reshape the landscape of mobile payments, making them more secure, convenient, and accessible than ever before. Here are some key trends to watch out for in the coming years.

1. Biometric Authentication

Security is a paramount concern for mobile payments. Biometric authentication, such as fingerprint scanning, facial recognition, and even iris scanning, is becoming increasingly popular. These methods offer enhanced security compared to traditional PINs or passwords, reducing the risk of fraud and unauthorized access. As biometric technology becomes more advanced and widely adopted, we can expect it to become a standard feature in mobile payment systems.

2. Blockchain and Cryptocurrency Integration

Blockchain technology offers a decentralized and secure way to process transactions. Cryptocurrencies like Bitcoin and Ethereum are gaining traction as viable alternatives to traditional currency. Integrating blockchain with mobile payment systems can provide faster, cheaper, and more secure transactions. Moreover, it can enable cross-border payments without the need for intermediaries, thus reducing costs and transaction times.

3. Contactless Payments and NFC Technology

The COVID-19 pandemic accelerated the adoption of contactless payment methods, and this trend is here to stay. Near Field Communication (NFC) technology, which allows devices to communicate when in close proximity, is at the heart of contactless payments. Mobile wallets like Apple Pay, Google Pay, and Samsung Pay leverage NFC to enable users to make payments by simply tapping their phones at point-of-sale terminals. As more retailers adopt NFC-enabled terminals, contactless payments will become even more prevalent.

4. Artificial Intelligence and Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) are set to revolutionize mobile payment technology. AI can enhance security by detecting fraudulent activities in real-time, analyzing transaction patterns, and identifying anomalies. Additionally, AI-powered chatbots and virtual assistants can provide personalized customer support, making mobile payment experiences smoother and more user-friendly.

5. QR Code Payments

QR codes offer a simple and cost-effective way to facilitate mobile payments. By scanning a QR code with their smartphones, users can quickly and easily complete transactions. This method is particularly popular in developing countries, where traditional banking infrastructure may be lacking. As smartphone penetration continues to increase globally, QR code payments are expected to become more widespread.

6. Wearable Payment Devices

Wearable technology, such as smartwatches and fitness trackers, is increasingly being equipped with payment capabilities. These devices offer a convenient way to make payments without needing to carry a smartphone or wallet. As wearables become more sophisticated and feature-rich, they will likely play a larger role in the mobile payments ecosystem.

7. Enhanced User Experience

User experience is a critical factor in the adoption of mobile payment technologies. Future trends will focus on creating seamless, intuitive, and frictionless payment experiences. This includes faster transaction processing times, simplified user interfaces, and better integration with other mobile apps and services. Enhancing user experience will not only attract more users but also foster greater trust and loyalty.

8. 5G Technology

The rollout of 5G networks promises to significantly impact mobile payment technology. With faster data speeds and lower latency, 5G can enable quicker and more reliable transactions. This will be particularly beneficial for real-time payments and services that require instant verification and processing.

9. Voice-Activated Payments

Voice-activated technology is becoming more sophisticated, and its integration into mobile payment systems is a natural progression. Voice assistants like Siri, Google Assistant, and Alexa are already capable of performing a range of tasks. In the future, they could be used to authorize and process payments, making transactions even more convenient.

10. Financial Inclusion

One of the most exciting aspects of mobile payment technology is its potential to drive financial inclusion. Mobile payments can provide unbanked and underbanked populations with access to financial services, enabling them to participate in the digital economy. As mobile payment platforms become more inclusive and accessible, they will play a crucial role in reducing financial disparities and promoting economic growth.

Conclusion

The future of mobile payment technology is bright, with numerous innovations on the horizon. From biometric authentication and blockchain integration to AI advancements and 5G connectivity, these trends will shape the way we make and receive payments. As the technology continues to evolve, mobile payments will become more secure, efficient, and ubiquitous, paving the way for a cashless future. Embracing these trends will not only benefit consumers but also drive growth and innovation in the financial sector.

0 notes

Text

In this blog post, we discuss the benefits of modern mobile payments integration with the property management system and the opportunity to incorporate mobile payments into hotel industry operations at the front desk. Learn More....

#cloud technology#mobile payments#voip#digital trend#unified communications#hotel pbx#hotel phone system#hotel hospitality#ip telephony#phonesuite voiceware#phonesuite pbx#SIP Trunks#voip technology#voip services#mobilevoip#Voip Hospitality#Direct Bookings#hospitality phone#system providers#VoIP PBX#communications

1 note

·

View note

Text

HOW BLOCKCHAIN IS TRANSFORMING CROSS-BORDER PAYMENTS

Blockchain Technology has transformed cross-border payments by addressing many of the inefficiencies and limitations of traditional systems. Here are the top ways it is doing so: 1. Faster Transactions Traditional cross-border payments can take days to settle, especially when involving multiple intermediary banks. Blockchain enables near-instantaneous transactions by removing intermediaries…

0 notes

Text

Weekly output: Lifeline explainer, TikTok trends, Google kills Google Pay

BARCELONA–Hola desde MWC! I’m here for my 10th time to cover the giant tech event formerly known as Mobile World Congress. I’m here through Thursday morning, which the past nine years of covering MWC have taught me will be barely enough time to take in the show and probably not enough time for Barcelona tourism. Before I left, I wrote an extra post for Patreon readers sharing my notes on two…

View On WordPress

#ACP#Barcelona#Catalunya#Google Pay#Google Wallet#GPay#Lifeline#mobile payments#Mobile World Congress#MWC#NFC payments#Pew Research Center#Spain#tap to pay#TikTok

1 note

·

View note

Text

The Strategic Role of E-NACH in Digital Finance

Imagine a seamless way to authenticate transactions, reduce paperwork, and enhance financial services in India. Enter E-NACH, a digital marvel transforming the financial landscape. Let's explore the strategic significance of E-NACH in the realm of digital finance.

E-NACH: Revolutionizing Digital Finance

Electronic National Automated Clearing House (E-NACH) may sound like a tech buzzword, but its impact on the Indian financial sector is undeniable. It serves as a vital cog in the wheel of digital finance, ensuring smoother, more efficient transactions.

Also Read: Unveiling Why Entrepreneurs Prefer MSME Loans

1. Streamlined Verification Process

E-NACH simplifies the customer verification process for financial institutions. Instead of the traditional cumbersome paperwork and in-person verification, E-NACH enables banks and other entities to authenticate customers electronically. This not only saves time but also reduces the risk of manual errors.

2. Enhanced Security

In a world where data security is paramount, E-NACH steps up to the plate. It employs robust encryption and authentication mechanisms to safeguard sensitive customer information. This ensures that transactions are not only efficient but also secure, gaining the trust of users.

3. Paperless Transactions

Gone are the days of paper-based transactions. E-NACH eliminates the need for physical documents, making financial transactions eco-friendly and convenient. This shift towards a paperless environment aligns with India's digitalization efforts.

4. Financial Inclusion

E-NACH plays a pivotal role in advancing financial inclusion in India. Abhay Bhutada says that E-NACH brings accessibility to a wider range of mobile users. It enables individuals from remote and underserved areas to access financial services easily.

5. Faster Loan Approvals

For borrowers, E-NACH means quicker loan approvals. Lenders can verify applicants' credentials swiftly, reducing the waiting time for loan disbursal. This speed not only benefits customers but also fosters a competitive lending environment.

6. Cost-Efficiency

The cost savings associated with E-NACH are significant. Financial institutions can streamline their operations, reduce administrative overhead, and pass on these benefits to customers in the form of lower fees and better interest rates.

7. Regulatory Compliance

In an increasingly regulated financial landscape, compliance is non-negotiable. E-NACH helps institutions adhere to regulatory requirements seamlessly. It ensures that KYC (Know Your Customer) and AML (Anti-Money Laundering) norms are followed diligently.

Also Read: The Importance of Financial Literacy Education in Schools

8. Future-Ready Infrastructure

As India's financial landscape continues to evolve, E-NACH provides a scalable infrastructure that can adapt to changing needs. It accommodates new technologies and innovations, positioning the financial sector for sustained growth. Ganesh Ram, CEO of MF Utilities India, also highlights E-NACH's crucial role in the rapidly expanding SIP sector.

Conclusion

In a country where financial transactions are rapidly shifting to digital channels, E-NACH emerges as a strategic enabler. It streamlines verification, enhances security, promotes financial inclusion, and paves the way for a more efficient and cost-effective financial ecosystem. Embracing E-NACH is not just a choice; it's a necessity in today's digital finance landscape.

0 notes

Text

The Impact of Mobile Payments And Digital Wallets On Traditional Banking Systems

In a country like India, where smartphones are becoming increasingly common and digitalization is rapidly advancing, mobile payments and digital wallets have had a profound impact on traditional banking systems. Let's dive into the details of this revolutionary shift and explore its implications for the Indian audience.

Convenience At Your Fingertips

Mobile payments and digital wallets offer unparalleled convenience. With just a few taps on your smartphone, you can transfer money, pay bills, shop online, and even split expenses with friends. Say goodbye to carrying stacks of cash or waiting in long queues at the bank to deposit or withdraw money. Now, your smartphone is your bank.

Also Read: Your Ultimate Guide To Debt Consolidation

Financial Inclusion For All

One of the significant advantages of mobile payments and digital wallets is their ability to promote financial inclusion. In a country where a significant portion of the population is unbanked, these digital solutions provide access to basic financial services, empowering individuals who previously had limited options. Now, anyone with a smartphone can open a digital wallet and enjoy the benefits of banking services.

Enhanced Security

Traditional banking systems often rely on physical forms of identification, which can be lost, stolen, or forged. With mobile payments and digital wallets, security is greatly enhanced. Biometric authentication, such as fingerprint or facial recognition, adds an extra layer of protection. Furthermore, transaction histories and real-time notifications help users stay vigilant against fraudulent activities.

Boosting The Economy

The widespread adoption of mobile payments and digital wallets has also had a positive impact on India's economy. It has accelerated the transition to a cashless society, reducing the circulation of physical currency. This shift has led to increased transparency, efficiency, and accountability in financial transactions, making it easier to track and curb illicit activities.

Also Read: Benefits of Credit Score Tracking Apps: Monitoring and Improving Creditworthiness

Conclusion

The rise of mobile payments and digital wallets has revolutionized the Indian banking landscape. It has brought financial services to the masses, making transactions faster, more secure, and more convenient. As we embrace this technological transformation, one thing is certain: the way we handle our finances will never be the same again.

0 notes

Text

You can use a phone number to send money via Pay By Phone. Additionally, eChecks, wire transfers, and ACH/Direct Deposit are other methods of money transfer. Use the recurrent ACH feature to collect direct payments from clients before due dates or to make periodic direct deposits to your payees.

0 notes

Text

0 notes