#Mini ATM Machine in India

Explore tagged Tumblr posts

Text

Best Deals on Aadhaar Micro ATM Machines | Lowest Prices in India

Get the best micro ATM devices at unbeatable prices in India. Explore our range of mini ATM machines with Aadhaar integration, ensuring seamless transactions at the lowest cost.

#aadhaar micro atm price#Best micro atm device#Mini ATM Machine at Lowest Price#Mini ATM Machine in India

0 notes

Text

What is Atm and how does Atm works?

Introduction:

ATM: Automated Teller Machine

ATM stands for Automated Teller Machine. ATM is an electro-mechanical machine that is used for making financial transactions from a bank account. These machines are used to withdraw money from personal bank accounts.

Basic ATM Parts

The ATM is a user-friendly machine. It features various input and output devices to enable people easily withdraw or deposit money. The basic input and output devices of an ATM are given below:

Input Devices:

· Card Reader: This input device reads the data of the card, which is stored in the magnetic strip on the back side of the ATM card. When the card is swiped or inserted into the given space, the card reader captures the account details and passes them to the server. Based on account details and the commands received from the user, the server allows the cash dispenser to dispense the cash.

· Keypad: It helps the user to provide the details asked by the machine-like personal identification number, amount of cash, receipt required or not, etc. The PIN number is sent in encrypted form to the server.

Output Devices:

· Speaker: It is provided in the ATM to produce the audio feedback when a key is pressed.

· Display Screen: It displays the transaction-related information on the screen. It shows the steps of cash withdrawal one by one in sequence. It can be a CRT screen or an LCD screen.

· Receipt Printer: It provides you with the receipt with details of transactions printed on it. It tells you the date and time of the transaction, the withdrawal amount, the balance, etc.

· Cash Dispenser: It is the main output device of the ATM as it dispenses the cash. The high-precision sensors provided in the ATM allow the cash dispenser to dispense the correct amount of cash as required by the user.

How ATM works

What ATM does

Now a day, ATMs have a lot of functionalities along with their basic use of cash dispensing. Some of them are:

· Cash and cheque deposit

· Fund transfer

· Cash withdrawal and balance inquiry

· PIN change and mini statement

· Bill payments and mobile recharge etc.

· The first ATM was used to dispense cash for customers by a Chemical bank in New York (USA) in 1969.

ATM deposits are also growing in popularity. If their bank permits it, account customers can deposit money and checks.

Important/Interesting Facts about ATM

Inventor of ATM: John Shepherd Barron.

· ATM Pin Number: John Shepherd Barron thought to keep a 6 digits PIN for the ATM, but it was not easy for his wife to remember a 6 digits pin, so he decided to prepare a 4-digit ATP PIN.

· World’s first floating ATM: State Bank of India (Kerala).

· First ATM in India: Installed by HSBC (Hongkong and Shanghai Banking Corporation) in 1987.

· First ATM in the World: It was installed on 27 June 1967, at the Barclays Bank of London.

· First Person to use ATM: The famous comedy actor Reg Varney was the first person to withdraw cash from the ATM.

· ATM without an Account: In Romania, which is a European country, one can withdraw money from an ATM without having a bank account.

· Biometric ATM: Biometric ATM is used in Brazil. As the name suggests, the user is required to scan his or her fingers at these ATMs before withdrawing money.

· World’s Highest ATM: It is installed in Nathu-La mainly for army personnel. Its height is 14,300 feet above sea level and is operated by the Union Bank of India.

Limits on ATM withdrawals

Banks have restrictions on the amount of money you can withdraw from an ATM each day, as we have already indicated. Put your hand or some other body part as a cover so nobody can see you type your PIN. This can help prevent fraud. Additionally, since each ATM can only hold a certain amount of money, capping the amount per withdrawal enables the bank to control the movement of cash.

Place and Security

Using ATMs that are situated in well-lit public areas is one way to prevent being a victim of crime when doing so. When you get your money, do not count it at the ATM; instead, wait until you are in a more private setting, like your car.

Conclusion :

The ATM is very important nowadays to use it is time-saving and u can withdraw the money as per your requirement. ATM can give you instant money as per your requirement.

0 notes

Text

Mini ATM is a small device use for doing common bank transactions like cash withdrawal and balance inquiry. This machine is very easy to use and secure. Mini ATM Service that proforms like ATMs machine where you can do all types of transactions of your customers.

0 notes

Text

Top AEPS Service Provider Company in India | PayPrime

If you're apprehensive of AEPS business and want a free companion about AEPS. Then our platoon direct connect with you and give you with complete details about AEPS business and AEPS software result. Book Free Demo Now for Best AEPS software provider in India.

What is AEPS?

AEPS full form is an Aadhaar- enabled payment system. This is a unique payment system( Aadhaar banking system) that allows banking through a unique Identity number( Aadhaar card number) and fingerprint authentication. By using AEPS service, a bank customer can access all banking complexes without going bank or ATM.

To use AEPS service through Aadhaar, the client’s primary bank account must be linked with an Aadhaar card.

In short, we will say that is the brand new manner of virtual banking wherein you want an Aadhaar card to apply banking than virtual cards.

This Aadhaar banking machine is maximum famous now no longer simplest in rural regions however additionally in city and semi-city regions.

AEPS changed into the first-rate alternative for banking withinside the Covid-19 section wherein all banks and ATMs are closed. After Covid-19, AEPS transactions ruin all facts and supported a cashless society in India.Payprime provides Best AEPS Admin Portal.

Why Was AEPS Service Started?

The primary motto at the back of beginning AEPS carrier is to offer banking centers to all sectors of society. Before the AEPS system, there have been lots of locations in India with a loss of banks and ATMs. This is the cause human beings have been not able to make a contribution to the economy.

The authorities understood all of the troubles and commenced AEPS offerings primarily based totally on Aadhaar authentication. This changed into the grasp inventory through the authorities that modified the muse of banking in India.

Today a large a part of the populace makes use of banking thru AEPS and contributes to the economy. Along with this, AEPS generated big employment.

Anyone can begin their very own AEPS commercial enterprise and might make it a good-looking supply of Income.

Why Payprime is No 1 AEPS Company in India?

Payprime software program is one of the pinnacle withinside the listing of AEPS Admin portal and AEPS Reseller Software carrier vendors Company in India over the past eight regular years. We have a large group of specialists who've information in custom software program improvement and cellular app improvement, etc.

Our group studies and examine the present troubles withinside the enterprise and different elements of experts brainstorm and discover the quality solutions.

We recognize patron requirements (needs) and offer them high-quality answers primarily based totally on marketplace trends, client needs, and drawing close enterprise trends.

Our validated technique facilitates them get the best-match answer for commercial enterprise at the bottom investment. On-going studies on era and consumer issues facilitates us to make our device extra up to date and advanced.

This is the motive these days we're the pinnacle AEPS carrier issuer employer in India and serving greater than 1500+ glad customers to extrade their lifestyles with the exceptional carrier and support.

Payprime AEPS Software Features that Make a Difference

We offer you with wellknown AEPS software program primarily based totally at the latest technology

Our b2b AEPS software program is absolutely customized

You can create limitless individuals to your downline

Admin has all manage over AEPS software, wallet, and members

We offer you with lifetime loose tech support

You can offer the exceptional AEPS carrier thru more than one banks

The achievement ratio is 99.7%

We offer you with guide schooling so you can apprehend the AEPS software program easily

You can offer all simple banking offerings like aeps coins withdrawal, coins deposit, stability enquiry, fund transfer, mini statement, Aadhaar pay, payout and UPI collection

We provide you the very best AEPS fee as in step with NPCI norms

Our AEPS software program is straightforward to use, rapid and incredibly secured

You can add on all offline services for free

Along with the AEPS portal, we provide your website and the best aeps app for business

Unique member panel design attracts more customers

Conclusion

So right here we mentioned pinnacle 10 AEPS carrier issuer organization listing in India. You can begin your B2B AEPS portal with these groups and can make it a right supply of Income.

You can boost your income by increasing AEPS transactions.

You can additionally add on more than one offerings in your AEPS portals like cellular recharge software, utility consignment payment, and cash switch software program which can improve your earnings propositionally.

I hope this article will assist you to make a fruitful choice about the deciding on great AEPS carrier issuer in India for business.

1 note

·

View note

Photo

Don't worry for high Micro ATM price device because Dogma Soft helps to grow your business in India.

Mostly people don't know that how to check bank transaction, balance inquiry through mobile phone, and they face many technical problems regarding online payment. Mini ATM Machine with fingerprint device is capable for solve this problem. Mini ATM device has been introduced by the fintech Industry and this industry is growing industry. So, If anyone want to open a business, this is a good opportunity. As a shopkeeper or retailer, you can also provide Mini ATM services such as cash withdrawals, balance inquiries, and mini statements to your customers and earn more. Dogma Soft’s Micro ATM price is very reasonable than other companies. So, Through Dogma Soft Mini ATM device a person can help people to providing Mini ATM services and grow thier business.

So, don���t wait for a good time and buy a Mini ATM Machine with Fingerprint device from Dogma Soft to grow your earning.

0 notes

Photo

Worrying about the high Micro ATM Price in the Market? Don’t worry, read this.

Although a mini ATM machine with a fingerprint is one of the best payment solutions available in the market as of now, many companies charge very huge costs for it. Some companies even charge monthly rent for using this machine, which becomes very heavy on the pockets of small business/retail shop owners. So what can they do?

Well, the only solution for this is finding a company that offers quality services at low prices. Dogma Soft Limited is one of the micro ATM service provider companies that offer the best devices at an affordable cost. The company uses cutting-edge technology, to minimize the cost while making sure the quality of service is top-notch. Dogma Soft dispenses the lowest Micro ATM Price in India with all the modern features and 24*7 Customer Support.

0 notes

Text

How can you access AEPS service through IGS Digital Center Limited?

What is AEPS?

aepsis a unique identification number based payment platform that enables customers to conveniently send, receive, withdraw cash, deposit cash and check balance using Aadhaar-verification.

The objective of AEPS system is to enable all sections of the society by providing basic banking services in remote areas. The National Payments Corporation of India (National Payments Corporation Limited) started the AEPS service to promote digital payments in India. AEPS makes payments fast, easy and secure, along with facilitating online services like cash withdrawal and deposits.

The biggest advantage of AEPS transaction is that it does not require any file or signature to complete the transaction. Through AEPS all customers can use their Aadhaar number to do financial transactions at Point of Sale (PoS) or Micro ATM through Aadhaar authentication.

While using AEPS, customers first need to provide the bank representative with the Aadhaar number linked to the bank account and have the thumb or finger impression scanned on a biometric machine. Any kind of transaction can be completed only after this process is completed. So AEPS is more secure and better online system than normal transaction system.

All payments through AEPS can be completed through a Business Correspondent (Bank BC) or a Bank Correspondent using a Micro ATM. But the most important condition for using AEPS service is that for this your bank account should be linked with Aadhaar.

What are the benefits of using AEPS?

Below are some of the benefits of using the AEPS system that you will get when you use this transaction system:

The system is very simple and user friendly and it takes only a few minutes to do any type of transaction or avail banking service using Aadhaar authentication.

AEPS is a very secure mode of payment which works on the basis of Aadhaar authentication only, thus protecting the customers from fraud and risky transactions.

This system helps the underprivileged section of India to ensure financial inclusion.

The AEPS system is used to provide benefits of various government schemes to remote areas and villages.

What are the documents required to use AEPS service?

Normally no specific documents are required to use the AEPS service. You must have a valid bank account number, Aadhaar number and bank name to use the AEPS service.

How can you complete AEPS transaction through IGS Digital Center Limited?

By becoming an authorized member of IGS Digital Center Limited center you can provide facility of Cash Withdrawal, Cash Deposit, Balance Check and Money Transfer etc. to your customers through AEPS.

To do AEPS through IGS Digital Center Limited follow the following steps-

Visit your nearest authorized IGS Digital Center Limited member.

After that the IGS representative will enter your 12 digit Aadhaar card number in a point on sale machine.

Next, you need to choose the type of transaction you want, such as deposit cash, withdraw cash, transfer funds within or outside the bank, balance enquiry, or get mini balance statement, etc.

Select the bank where you have your account and fill the complete details of the transaction amount.

Confirm the transaction details by placing your thumb impression on the biometric scanner.

Your transaction will be completed.

When the transaction is complete, obtain a receipt from the IGS representative.

IGS Digital Center Limited is India's best online service provider company, by becoming a member of which you can earn handsomely by providing more than 300 government and non-government services to your customers. Services provided by IGS Digital Center Limited include AEPS service,dmr service, Bill Payment Service(BBPS), Recharge Service,travel booking services, CA Services, Legal Services and IT Services etc. are the major ones.

1 note

·

View note

Text

How to start customer service point and earn upto 1 Lakh a Month?

You can bring in great earning opportunities by opening acustomer service pointfor the banks, where numerous significant tasks of banks are easily handled. You can make a decent choice of self-employment by opening aCSP center.

Let us momentarily understand whatcustomer service pointis? And the role of aCSP service provider.

What is Customer Service Point?

The rules of reserve banks opening forCSPshave bought a decent earning opportunity for many. Essential banking services such as account opening, cash deposit, cash withdrawal and many other banking services are provided at these centers.

These centers are made with the goal of reducing the overcrowding in the bank. An increase in government schemes and subsidies has made customers reach banks on a regular basis. To reduce this, banks open their mini-branches as customer service points and give good commissions to theCSP service provider.

What is the Work of CSP Provider?

Customers can visit theCSP pointAND open an account, cash deposit, cash withdrawal, IMPS/money transfer, social security transfer and AEPS/ATM transactions. Not just this, CSPs can also provide FD and RD, Aadhar seeding and loan A/c deposit in mini branch.

Including Side Hustles with CSPs

CSP providercan likewise include other services with their banking services.

For example, a CSP providercan set up a Xerox machine in theCSP center, so that customers don’t have to go around searching an Xerox shop for prints.

Best CSP Business Correspondent:

After nailing it in AEPS,HalliPayhas now made a foray into the financial inclusion sector with India’s largest banks.

Bank of India

Bank of Baroda

SBI (State Bank of India)

Punjab National Bank

Advantage of Becoming CSP Retail Partner with HalliPay:

Trusted source of income from nationalized banks and add smart commissions to your earnings.

High Number of Walk In Customers.

Our professionals are always ready to help and give essential guidance once a customer is ready to proceed with CSP application.

Get your application directly accepted from AGM.

Eligibility & Equipment:

You should have passed intermediate. (10+2)

You should have space for opening a CSP center.

No Unpaid Loans.

You should have a printer (epson PLQ 22CS)

You should have a laptop or system.

You should have a character / Police verification certificate.

Conclusion:

If you are searching for a trustworthy business opportunity with low investment, it isn’t just lucrative yet, it also gives a rewarding experience.

While simultaneously presenting you to the country’s largest banking systems.

HalliPay CSPcan be your best approach in 2022

For more information, CALL NOW:

91 7892186561

Originally published at https://hallipay.com on November 28, 2022.

1 note

·

View note

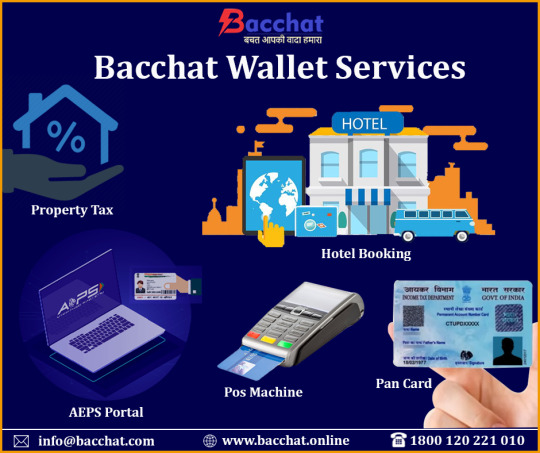

Photo

#BacchatWallet is Professional In Mobile Recharge, Money Transfer Services & POS Machine Provider in India. Bacchat Services is a unit of TelecomServices India Limited - India's leading Recharge & money transfer services since 2013. We have been serving India through our business of recharge API, Payment API, Utility Bill Payment, and, Mini ATM Machines at over 3,50,000+ retail outlets. & 1000+ distributors. Visit👉: https://www.bacchat.online/ Phone☎️: 1800 120 221 010 Email📧:[email protected]

#online money transfer#Money Transfer Services#Mobile Recharge Services#utility services provider#Utility Payment Services#Card Swipe Machine#POS Machine#Domestic Money Transfer Services#PAN Card Service#aadhaar enabled payment system#aeps portal#mini atm machine#toll payments#Pay Toll Online#school fees payment online#online hotel booking#bulk sms service provider in india#ticket booking service#property tax online payment#credit card payment services#loan payment services#FastTag API

1 note

·

View note

Text

Domestic Money Transfer

Domestic Money Transfer (DMT) is remittance service offered through Retail agents, Business Correspondents (Agents/CSPs) who are appointed by various service providers pan India who collect cash on customer behalf and transfer money to bank account as requested by customer.

#mini atm services#atm machine apply#mini atm#micro atm machine#micro atm machine price#best domestic money transfer service in india#aadhaar based payment system app#aadhaar based payment system#best aeps service provider#aeps service provider

0 notes

Video

tumblr

Roundpay Merchant App is highly secure gives an ease of access to the merchants to work effectively & efficiently. Roundpay App Features: ★ Easy Merchant Registration: Simple process to become Roundpay Money Merchant / Agent all you need is mobile number & basic KYC documents ★ Mobile and DTH Recharge: Recharge your Customer's prepaid mobile and DTH for all telecom operators like Jio, Airtel, Vodafone, Idea, Reliance,BSNL,Dish TV, Sun Direct,Videocon D2H & others. ★ Cash Withdrawal (Micro-ATM): Merchants can help customers to withdraw cash from ANY bank account (SBI, PNB, Allahabad Bank, Bank of Baroda, ICICI + 180 more banks) with Aadhaar number & fingerprint only ★ Easy movement of money to Bank : Roundpay Merchant can transfer earned money in bank account in few taps. ★ Money Transfer (DMT): Merchants/Agents can take cash from customers and transfer money to any bank accounts across India. ★ MPOS – Merchants can accept payments through credit cards/ debit cards with the help of their mobile phone and MPOS machine. ★ Bharat Bill Payment (BBPS): Merchant can fetch & pay utility bills of their customers which includes: Gas, Electricity, Water,Education Fees,Insurance Premium) ★ Railway Ticket:Become IRCTC authorized agent and use Roundpay wallet as payment method at booking check out ★ Travel: Roundpay Merchant can book Domestic and Internation Flights Ticket Air, Domestic and Internation Hotels Oyo Rooms for their customers. ★ Pancard Services: Merchant can create new PAN card for their customers online From UTI With Help of Our Expert. ★ Wallet Upload: On the go wallet upload feature using digital payments like UPI, NetBanking, Credit Card, Debit Card. ★ App Notifications: Stay updated with various attractive offers. ★ Transaction History: Roundpay provides you with a detailed Account Statement of your online shop. See all your transaction and how much have you earned on them. Control your online business with relevant reports at your disposal. ★ 24*7 Availability: Provide hassle free services to customer available 24*7 ★ User Friendly Interface: Fast, simple & easy interface ★ Secure & Robust: Secure mobile app with multiple layers of authentication to ensure security and Most advanced Level (RD service) AEPS integration from four biometric companies - Morpho, Mantra

visit here for information: https://www.roundpay.in/

Source Link: https://youtu.be/YoQIorj6C-Q

#Mobile Recharge API Provider India#mini atm machine#aadhar micro atm#Aadhaar Enabled Payment System#Recharge API Provider In India

0 notes

Text

BUSINESS OPPORTUNITIES IN FINTECH SECTOR IS EXPANDING IN INDIA

India is one of the fastest growing major economies in the world and is now shining with the Financial Technology services. BRIC countries (Brazil, Russia, China and India), Mexico, Saudi Arabia, South Korea, Indonesia, Kenya, Iran, Turkey and Zimbabwe are the emerging markets for the FinTech industry. India and China are the top most emerging countries which are contributing in the FinTech industry and enabling the growth of e-commerce sector. Though India’s Financial Technology (FinTech) sector is young but it is surely going under a transformational phase and is also growing rapidly with the fast-paced technological and inventive changes. Financial Technology is the latest innovation that is mainly focusing on competing with the traditional financial services.

The FinTech sector is emerging with the innovation in the technology, which overall is changing the landscape of the digital payments in the country. Several startups are switching to this dynamic and emerging sector making financial services more accessible to the general public and also to revolutionize the country with the radical and technological changes in the traditional finance industry. The FinTech sector comprises an immense range of financial and technological businesses like mobile payments, money transfer, SME finance, banking, cryptocurrency and many more.

FinTech companies are saving massively on the cost and offering true customer experience by enabling digital tools. The biggest change that FinTech has brought is it has eliminated the paperwork from the financial process by enabling the work fully digital. Thus it has also reduced the time consumed to do the paperwork. The banking sector itself is undergoing Financial Technology services and is entering into the market by creating valuable changes in the banking models, providing the customers with the beneficial financial services by enabling digital tools in their services.

A FinTech company based out in Delhi, RealCash Technologies Limited is providing payment solutions to the independent businesses of all sizes and types nationally with its mobile point-of-sale terminal which enables the merchants to accept card payments and payments via leading e-wallets very easily. RealCash is equipped to meet the emerging needs of digital payments’ landscape and believes that accessing electronic payments should be easy, user-friendly and should require low-cost infrastructure. RealCash is growing in the Indian market with its Channel Partner Program which is comprised of very less investment models to bring in seamless and innovative financial services for the overall population. It is very easy, inexpensive and profitable to become a Channel Partner of RealCash Technologies Limited.

#mpos#mobile pos#mobile point of sale#swipe machine#mini ATM#mpos terminal#domestic money transfer#mpos device#mpos in india#merchant services#card swipe machine

1 note

·

View note

Text

One Stop Solution for All B2B Banking Services

If you are planning to start your own mini banking business and looking for a solution that can provide all banking solutions then this is for you.

Ezulix software is a leading mini banking solution provider company in India. Our skilled and experienced professional team developed an advanced standard b2b solution with unique features and a complete banking solution.

By using our Ezulix mini banking portal you can offer all the following services to your members and can earn the highest commission-

AEPS Cash Deposit

AEPS Cash withdrawal

Mini Statement

Balance Enquiry

AEPS Fund Transfer

Micro ATM

UPI Collection

These are all the services that an admin portal avail to their CSC bank mitra and can make a profit.

Features of Ezulix Mini Bank Portal That Attract Business for You?

We provide you standard b2b admin portal through which you create unlimited mini bank all over India.

Along with this, you can make any changes in your portal as per your choice. Admin has all control on his down line as well as packages and services.

There are few feature of our mini bank portal that make it awesome in market.

Fully Customized & Based on Latest Technology

99.7% Success Ratio in banking transaction

Unique design with all banking services

Members can take 24*7 real time settlement

mATM machine is accomplished with mPOS features

Highest commission based on NPCI norms

Lowest surcharge on domestic money transfer

Accept payment through UPI & earn commission

We provide you free manual training and lifetime free tech support so that you can run your business easily and smoothly.

For more details visit my blog or apply for a free live demo.

1 note

·

View note

Photo

Micro ATMs and How it works in Rural India.

You might have seen, retailers are holding small handheld devices for payments. Maybe you are wondering, what is this device called and what are its uses? After demonetization, these devices gained a lot of popularity. The portable handheld POS devices called Micro ATM has become a buzz word. Micro ATMs is a card swiping machine, through which you can withdraw cash, deposit cash, or enquire your balance easily. The people living in rural areas suffered a lot during the demonetization period and being a developing nation, building infrastructure in the rural areas was not possible. Micro ATMs are a great way for money transactions in the unbanked and under banked areas. Even old or handicapped people can withdraw money through these devices, as these mobile ATMs can reach your doorstep.

Advantages of Micro ATM in rural areas

People who live in villages and rural areas where infrastructure is poor, people are not updated with the latest technologies, and digital payments are rare. For rural people,

They don’t have to visit banks for cash deposit

They don’t have to visit ATMs for cash withdrawal or balance inquiry.

Any retailers or business correspondents can use Micro ATMs and provide financial solutions to the customers.

The retailer can add an extra source of income

Gain a good commission

Retailers can able to increase the number of footfalls to their shops

Old people or women can contact the local retailers for any cash needs.

Ease to operate and connect with the mobile phones.

A portable device that you can carry in your pocket.

Micro ATMs from iServeU (a leading fintech company) are affordable and highly functional.

Instant payment solution

How to operate Micro ATM:

The operation of Micro ATM is simple and easy. You just need to connect the micro ATM with your mobile phones via Bluetooth. One needs to switch on the device and swipe the card after entering the amount for withdrawal. You can avail of the device for just Rs. 2,500 from iServeU online portal.

Micro ATMs can be used for:

You can open your bank Account

Make ATM card transaction

Aadhaar enabled payments (AEPS)

Easy Cash withdrawal/ cash deposit

Mini statement

Balance inquiry

Fund transfer

The bottom line:

iServeU is a leading fintech company that provides a financial solution to every section of society. iServeU is trying to reach the maximum number of villages and rural areas all over India, so people can avail of the banking services with ease and promote a cashless economy initiated by the Government of India. As a retailer, you can easily convert your shop into a banking services provider and earn a decent amount of commission. For more info, visit us on iserveu.in.

2 notes

·

View notes

Text

Start Earning with Mini-ATM Device at Your Shop

Are you thinking about to provide cash withdrawal and balance enquiry facility to your customers ?

Then Mini / Micro ATM Machine Device is fast, easy and best payment solution to manage all payment needs with highest commission that is available in affordable price.

Dogma Soft Limited deals in other IT & Fintech Services apart from Micro ATM Service Facility where you can get a Dogma’s Panel and start earning in your area.

#MiniATM #MiniatmDevice #MiniatmServiceProvider #MiniatmService #NewBusiness #BusinessIdeas #HighCommission #Shop #ITservices #FintechService #AEPS #PanCardCenter #DomesticMoneyTransfer #FranchiseBusiness #Jaipur #Rajasthan #India

1 note

·

View note

Text

AEPS Whitelabel Software in India

AEPS Whitelabel Software in India

Aadhaar Enabled Payment System By BHIMPAY

AEPS WHITELABEL SOFTWARE IN INDIA

What is AEPS ? Aadhaar enabled Payment System (AEPS) AEPS is commonly and widely known as Aadhaar Enabled Payment System. It was introduced by NPCI(National Payment Corporation of India) as its contribution to the Digital India Campaign. The transactions are carried out by a mini ATM or POS machine which is…

View On WordPress

1 note

·

View note