#mATM ATM

Explore tagged Tumblr posts

Text

Revolutionizing Retail Banking with Gmaxepay: Empowering Every Retailer to Become a Micro ATM (MATM)

In today’s fast-paced digital age, financial inclusivity is not just a buzzword—it’s a necessity. With the rise of fintech solutions, businesses and individuals in rural and urban areas alike are now empowered to access seamless banking services. Gmaxepay, a trailblazer in the fintech space, is paving the way by offering innovative solutions that allow retailers to transform into Micro ATMs (MATMs). Let’s dive into how Gmaxepay is bridging the gap between financial technology and community banking.

0 notes

Text

Looking for the best Air Ticketing App? Look no further! Our app simplifies your travel experience with quick flight bookings, competitive fares, and real-time updates. Enjoy exclusive deals and a user-friendly interface that makes planning your next trip a breeze. Whether you're booking a last-minute flight or planning a vacation, our Air Ticketing App has you covered. Download now for seamless travel management and start your adventure today! Don’t miss out—your next journey is just a tap away!

0 notes

Text

Beffy mATM Services

Beffy offers the best micro ATM services with software, mobile apps and micro ATMs. The best parts of micro ATMs are the highest cost for cash withdrawals, portable devices and ease of use. Micro ATM machines accept all bank cards and use biometrics for secure cash withdrawal transactions. Micro ATM, which is also called mini ATM. Unlike POS devices. The Micro-ATM solution enables bank correspondents (BCs) to perform basic banking services and financial transactions such as deposits, withdrawals, payments (transfer of funds), balance inquiries and small statements using biometric devices. Provide to customers. The platform allows business correspondents (who may own local Kirana stores) to make instant transactions.

#BaLANCEinquiry#AADHARPAY#transfers#moneytransferapp#MobileRechargeApp#mpos#mobilepointofsal#Comments#CashWithdrawal#withdrawals#beffy#beffyfinserv

0 notes

Text

Voso Store offering seamless matm services. Experience secure and efficient financial transactions. Simplify your banking needs with MATM services by Voso Store. Access quick and reliable Micro ATM Services at Voso Store for hassle-free transactions.

0 notes

Text

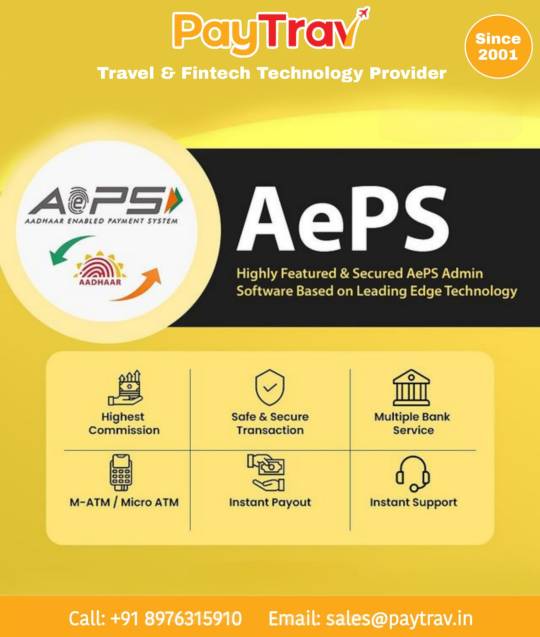

AEPS API provider in mumbai-Paytrav

Paytrav is a widely successful AEPS API Provider Company in India. Paytrav AePS API enables Business Correspondent to conduct banking transactions using only the customer’s Aadhaar Number and Biometric Identification.

Some prerequisites are, KYC (Know Your Customer) details to open a new account, and Aadhaar number should be linked with the respective bank account. This AePS API Provider activates the service 1-2 minutes post Aadhaar seeding.

The elements required for transactions are Micro ATM, Aadhaar number, Bank name, Biometrics (Fingerprint and/or IRIS), and assisted mode. The transaction cost will be Nil for the customer while Business Correspondent may get charged or paid based on the bank’s discretion.

AePS service allows performing transactions like Balance Enquiry, Cash Withdrawal, Cash Deposits, Aadhaar to Aadhaar Funds Transfer, Payment Transactions (C2B, C2G Transactions). Only the Best AePS API Provider Company can deliver such benefits.

अच्च्छी आमदनी की तलाश करें पूरी। Edupoint- mATM & AEPS ,Recharge की बेहतरीन सर्विस और ज़बरदस्त कमीशन के साथ बढ़ाएं अपनी पहचान भी और इनकम भी!

"Retailer, Distributor, Master Distributor-ID k liye contact kre !

📞 Contact @ 089-763-15-910

Click Now-https://paytrav.in/

1 note

·

View note

Text

Get a Franchise and Join the Entrepreneurial Revolution

We, at VOSO store, offer most profitable franchise business in India. We support the establishment of enterprises with the highest profit margins. We are a retail technology business. A brand-new method for turning your physical store into a digital store is VOSO Store. Through a unique portal, we link retailers and brands to serve end-user offerings. With the VOSO business opportunity start business in India, our store partners are exponentially growing their commercial enterprise. To connect them with a wide range of services and goods through our store partners and to offer our store partners one-of-a-kind support through our facilitator model, VOSO is on a mission to reach an untapped region of the country.

With the aid of our retail partners, we are making improvements to streamline the online service process for every citizen. Retailers and merchants are increasingly using VOSO as their preferred platform for accepting online payments for a variety of services. Our team is always working to improve the functionality and seamlessness of the online portal and payment system. We make it possible for our partners to use all current and upcoming services by offering VOSO Store partnership. VOSO has stores in more than 700 cities and 6000 pin codes. Our store numbers are constantly increasing. The core value of VOSO is to provide a practical platform for all utility services to all segments of society, particularly in rural and suburban areas, to increase their level of digital literacy.

Through a range of VOSO services like travel booking, utility bill payment, domestic money transfer, PAN card, recharges, and insurance. VOSO enable its store partners to establish strong connections with their potential customers in this rapidly evolving age, enabling them to obtain services at competitive rates and earn more money than they did previously. VOSO's B2B portal also saves time, energy, and money by connecting you with all the top services at a single touch before they are even built.

Bills payment With the Baharat bill payment system, VOSO store works with the portion of bills and upgrades the security and speed of bill payments. BBPS services are available at our stores. You can pay a charge for utility bill payments i.e. (Fastag, Gas Bills, Water Bills, Electricity bill payments, DTH and Mobile recharges, etc.)

VOSO mATM services (micro ATM service) Voso mATM services now allow you to provide mATM services to your customers and earn the highest commission per transaction. mATMs are devices that allow users to withdraw cash and check balances from any Kirana shop, local store, or e-service portal without having to go to banks and wait in long lines. Merchants can use mATM devices to provide cash withdrawals, cash deposits, and money transfers from one bank account to another, as well as balance checks while earning commissions on each successful mATM transaction.

Domestic Money Transfer (DMT) Our store partners can send money across India using the VOSO portal. These transactions are completed in a matter of seconds, and money is securely transferred to the receiver's account via VOSO's secure payment method. Additionally, VOSO offers expert assistance for any issues that may arise during the transaction. With the help of this crucial service, we guarantee low transaction costs and high earning potential for our partners.

AePS Paying with an aadhar card is possible with the AEPS or aadhar enabled bill payment system. The NCPI created the AePS payment model, which enables customers to make basic payment transactions with their aadhar cards, including cash deposits, bank-to-bank transfer balance inquiries, mini statements, aadhar to aadhar funds transfer authentication, BHIM aadhar pay, and many more. By utilizing AePS, merchants can also provide extra services to their clients and users, such as eKYC, best finger detection, demo auth, tokenization, and Aadhar seeding status.

Booking services Our partners can book buses, flights, or train tickets for any location in the country. We offer expert training and one-on-one support. The VOSO portal and mobile app now make it simple to book bus tickets. You can now compare ticket plans and amenities and select the best one for your clients from any location in India. With the assistance of VOSO partner stores, we take the initiative to provide the best facility with the lowest costs and the best service so that everyone can enjoy a hassle-free journey. We have the highest commission rates.

Conclusion VOSO store provide most profitable franchise business in India which lead to high profit margin business for store partners. VOSO considers its partners to be its greatest asset. We are committed to the overall growth of our store partners and provide the best services with the highest earning potential. Join VOSO store to earn high profit.

0 notes

Photo

Micro ATMs and How it works in Rural India.

You might have seen, retailers are holding small handheld devices for payments. Maybe you are wondering, what is this device called and what are its uses? After demonetization, these devices gained a lot of popularity. The portable handheld POS devices called Micro ATM has become a buzz word. Micro ATMs is a card swiping machine, through which you can withdraw cash, deposit cash, or enquire your balance easily. The people living in rural areas suffered a lot during the demonetization period and being a developing nation, building infrastructure in the rural areas was not possible. Micro ATMs are a great way for money transactions in the unbanked and under banked areas. Even old or handicapped people can withdraw money through these devices, as these mobile ATMs can reach your doorstep.

Advantages of Micro ATM in rural areas

People who live in villages and rural areas where infrastructure is poor, people are not updated with the latest technologies, and digital payments are rare. For rural people,

They don’t have to visit banks for cash deposit

They don’t have to visit ATMs for cash withdrawal or balance inquiry.

Any retailers or business correspondents can use Micro ATMs and provide financial solutions to the customers.

The retailer can add an extra source of income

Gain a good commission

Retailers can able to increase the number of footfalls to their shops

Old people or women can contact the local retailers for any cash needs.

Ease to operate and connect with the mobile phones.

A portable device that you can carry in your pocket.

Micro ATMs from iServeU (a leading fintech company) are affordable and highly functional.

Instant payment solution

How to operate Micro ATM:

The operation of Micro ATM is simple and easy. You just need to connect the micro ATM with your mobile phones via Bluetooth. One needs to switch on the device and swipe the card after entering the amount for withdrawal. You can avail of the device for just Rs. 2,500 from iServeU online portal.

Micro ATMs can be used for:

You can open your bank Account

Make ATM card transaction

Aadhaar enabled payments (AEPS)

Easy Cash withdrawal/ cash deposit

Mini statement

Balance inquiry

Fund transfer

The bottom line:

iServeU is a leading fintech company that provides a financial solution to every section of society. iServeU is trying to reach the maximum number of villages and rural areas all over India, so people can avail of the banking services with ease and promote a cashless economy initiated by the Government of India. As a retailer, you can easily convert your shop into a banking services provider and earn a decent amount of commission. For more info, visit us on iserveu.in.

2 notes

·

View notes

Link

RBP FINIVIS provides Enterprises and Businesses numerous solutions for enhanced financial transactions such as AePS API, Micro ATM SDK, Micro ATM API, (BBPS) bharat bill payment system API, Domestic money transfer API (DMT), and many more.............

#aeps api#aeps api provider company in india#aeps portal#aadhaar enabled payment system#aadhaar pay#aeps service#aeps commission#aeps cash withdrawal#micro atm device#micro atm device cost#mego micro atm#mego pay micro atm#mego pay app#matm device#mini atm device#micro atm api provider company in india#micro atm sdk provider#bharat bill pay#bharat bill payment system#bbps api#dmt api#money transfer api#domestic money transfer api#dmt service#api service#api provider in india#banking#digital banking#fintech

3 notes

·

View notes

Link

1 note

·

View note

Text

Micro ATM-How iServeU is Bringing ATMs to the Palm of Your Hands

10 years ago if I told you that soon there would be an app on which you can enter any location you wanted to go, and a cab would come to pick you up navigating through an electronic map automatically in a couple of minutes, you’d ask if I have totally lost it. But Uber is real now and used by millions of people every day. Today, it is almost impossible to imagine commute without these apps. The point here is technology has simplified every tedious task over time making things portable. Speaking of portability, there was a time when people had to visit a bank for simple transactions like balance inquiry or cash withdrawal. To make things easier ATMs came to rescue and the thing became easy but this ever-growing physical world demands more accessibility and speed, calling in for the next generation of ATMs – ‘Micro ATM or mATM’

In November 2018, iServeU became the first company in India to launch a Micro ATM. A Micro ATM or mATM is an alternate way of Aadhaar Enabled Payment System (AEPS) to withdraw cash and inquiry bank balance using a Debit card. The mATM service is a simple and reliable way of performing bank transactions without any extra charges or limitations. iServeU’s Micro ATM processes transactions through an android app using a card reader ATM device. This product operates under the National Financial Switch (NFS) and guidelines of NPCI which ensures the safety and security of your transactions. The Micro ATM uses Bluetooth connectivity to pair with an Android smartphone or tablet and the customer’s Debit card and ATM PIN are the only requirements to initiate a withdrawal or balance inquiry transactions.

Micro ATM is an on-the-go transactional service which is way more different from a traditional mPOS device or Cash@POS Service. With mPOS devices, you can perform transactions on Sale and Cash@POS mode. In POS service, above Rs. 2000/- amount there are some certain MDR charges for both Debit and Credit card. For credit card, MDR charges are even higher. In Sale transactions below Rs. 2000/- MDR charges are also there in POS services. The best thing about mATM service is that there are no Sale or Cash@POS modes. There are no MDR charges for any transactions. You can withdraw as per your card issuer banks’ limitations. iServeU aims to provide a significant number of Micro ATM services, mostly in rural areas to simplify conventional banking. Click here to learn more.

#DMT#MoneyTransfer#AEPS#FinTech#BBPS#Deposit#Micro ATM#Domestic Money Transfer#Aadhaar Enabled Payment System#Insurance#mATM#White Label Provider#Loan Software#Aadhaar Payment#API

1 note

·

View note

Link

Start providing mATM services or micro ATM services to your retail customers to earn the highest commission on every mATM transaction. Among the Voso portal, mATM is one of Voso's best services that provide a great business opportunity to earn high commission by providing mATM services.

Offer mATM services to your customers through VOSO and earn the highest commission on each successful transaction. With high commissions on each transaction, grow your business exponentially.

0 notes

Text

Empowering Retailers with Gmaxepay’s Innovative MATM Solutions

In the evolving landscape of digital finance, Gmaxepay is at the forefront of providing cutting-edge solutions that make financial services accessible to everyone. As a fintech company focused on transforming the way people interact with money, Gmaxepay introduces VillagePe, a Micro ATM (MATM) service that empowers every retailer to become a financial services provider. This innovative approach opens new revenue streams for retailers while offering convenience to customers who seek reliable and quick access to cash and basic banking services. Let’s explore how Gmaxepay and its MATM solution are making waves in the fintech industry.

0 notes

Text

Get the Best Mini ATM Machine with Fingerprint at Lowest Price in India

Mini ATM Devices are the one of the finest innovation of today’s time. With these sleek-designed devices you can drive more sales and customers at your shop. These devices help you to offer various services at your shop with existing services.

With your Micro ATM Business, Offer Micro ATM Cash Withdrawal Services to your customers and save them from going to farther areas for bank and ATMs.

Get a rise in your monthly income with the Mini ATM Machines with Fingerprint at Lowest Price from Dogma.

0 notes

Text

Get Micro ATM API Solution to Start Your FinTech Business

RBP Finivis Pvt Ltd is India’s largest B2B fintech platform delivering various banking API & SDK solutions to individuals and businesses of all sizes. One such API solution is micro atm api that has made us one of the finest micro atm api provider company in India. This simple functionality of api offers ordinary citizens easy access to secure financial services like cash withdrawal, etc. while businesses can make a good commission and better-earning opportunities without much investment and effort.

What Role does API Play for the Growth of Digital Banking?

An API plays an important role in making the banking system interoperable. Application Programming Interface is a software application that empowers and allows to connect various banking networks to interchange products and services needed to offer customers. This enables banks to offer even more features and feasible services that have made banking services available to each and every corner of the country. However, the time has now come to digitally transform India with the invention of APIs.

A Mini Version of ATM is an Outcome of API Solution

Micro atm is a mini version of an atm that does not occupy much space for its set-up. It is a portable device that can be carried anywhere. It can carry out basic banking transactions within a few seconds at a click. This amazing device came into existence only because of the arrival of advancements in the technology with the introduction of API (Application Programming Interface)

We with our experienced and pro-active technical team of developers developed & designed fully customized and highly scalable API solutions for businesses. With this advanced payment gateway, entrepreneurs can use their business ideas and strategies in the fintech industry without having much technical knowledge. In other words, we will be available 24*7 for their technical quarries and will solve them as early as possible.

Benefits of Micro ATM With Its Features:

· One can extend banking services anywhere in remote locations using a micro atm machine

· Cheap – It is a low-cost option for the existing traditional ATMs

· Portable – It is a portable device, easy to carry, easy to set up anywhere.

· Interoperable – It can work for any bank using debit cards.

· Secure – Connects banking network through GPRS technology for carrying banking transactions, making it safe and secure

Working of Micro ATM is Similar to Usual ATMs

First of all, you need to undergo a verification process of your debit card. For verification card swipe option is available. Once the verification is completed micro atm screen will display various transaction options. You need to select the option and the device will process the transaction. On a successful transaction, a message will be displayed on the screen and a receipt will be generated. You will also receive an SMS alert from your bank about the transaction.

Conclusion

To offer customers a powerful payment solution, RBP as a micro atm api provider company become a force in supplying the best banking platform. With our fully automated banking api solutions, businesses will enjoy unlimited flexibility and fly at great heights with success all around.

aadhaar se cash withdrawal krnye ka app

#micro atm api#micro atm#micro atm api provider#micro atm api provider company#matm api#matm api proivder#mini atm api provider#mini atm api provider company#micro atm sdk#micro atm device#cash withdrawal api#digital payments api#fintech api#banking api

1 note

·

View note

Text

ADDPAY Digital Centre

AEPS/MATM/DMT/Pan Card/IRCTC/Neo-Banking/Loans etc..

https://play.google.com/store/apps/details?id=etsoft.addpayretailer

https://www.facebook.com/addpayindia

Earn higher commission on every transaction

#banking#MATM#AddPay#india#distributor#commission#digital#retailers#panindia#GST#ITR#AEPS#MicroATM#addpay#gst#aeps#micro atm#fintech#neo banks

0 notes

Text

DigiPe AEPS

AEPS services is a bank-led model which allows online interoperable financial transaction at PoS (Point of Sale / #MicroATM) through the Business Correspondent of any bank using the #Aadhaar authentication. For registration Visit: https://digipe.co contact:- 9853996666 Mail us:- [email protected]

#digipe#matm#debit card#cash withdraw#commission#dmt#kyc#money transfer#train tickets#hotel booking#bus tickets#flight tickets#financial services#payment services#bill payment#digital payments#travel services#mini atm#prepaid cards#aeps#pos#mpos#visa prepaid cards#pan card#dth subscription#multi recharge

0 notes