#property tax online payment

Explore tagged Tumblr posts

Text

Property Tax Online Payment | Bajaj Finserv

Property owners can avail the facility of Property Tax Online Payment with Bajaj Finserv through their app. This method of payment is beneficial, as it saves you time and effort and allows you to pay your property tax from the comfort of your home or office. In addition, this method of payment is also secure and convenient, as all the data is encrypted with the highest level of security.

0 notes

Text

ULB Haryana Property Tax Payment 2024: How to Pay Online?

ULB Haryana Property Tax image

Property tax stands as a crucial revenue source in India, fueling the maintenance of state infrastructure. If you’re a resident of Haryana seeking to streamline your property tax payment, this guide is tailored for you. In Haryana, residents have the convenience of paying property tax through both online and offline channels.

1. Online Payment Methods

Residents can conveniently settle their property tax dues through the official No Dues Certificate (NDC) portal of Haryana. Alternatively, offline payments can be made at designated bank branches or municipal offices.

2. Understanding ULB Haryana Property Tax

The Directorate of Urban Local Bodies (ULB) in Haryana plays a pivotal role in urban governance. Responsible for strategic planning and governance, this department drives urban infrastructure development, maintenance, and enhancement, thereby promoting sustainable growth and community well-being.

3. Key Functions of ULB Haryana:

Setting the policy framework for Urban Development in Haryana.

Facilitating the operations of Urban Local Bodies (ULB) in Haryana.

Maintenance of civic amenities across Haryana.

4. Eligibility Criteria for Online Property Tax Payment

To make online property tax payments in Haryana, individuals must meet specific eligibility criteria, including:

Being 18 years or older.

Owning a property in Haryana.

Being a permanent resident of Haryana.

5. Necessary Documents for Online Property Tax Payment

The following documents are mandatory for online property tax payments in Haryana:

Unique property ID in Haryana.

Property owner’s name.

Aadhaar card of the property owner.

Address proof of the property owner.

Old property ID (if applicable).

6. Registering on the Haryana ULB Portal

Here’s a step-by-step guide to registering as a user on the Haryana NDC portal:

Visit the official website of the Directorate of Urban Local Bodies Haryana.

Click on ‘Online Services’ at the top of the homepage.

Proceed to the ‘Online Services’ page and select the property tax payment link.

Click on ‘New User Registration’ on the homepage.

Fill in the necessary details on the ‘User Registration’ page and hit Register.

Enter the OTP received on your registered mobile number to complete the registration process successfully.

7. Seamless Online Payment Process

Follow these steps to pay property tax online in Haryana:

Visit the official website of No Dues Certificate Management System Haryana.

Log in using your preferred method (Mobile, Email ID, PID), and select ‘Make Payment/Generate NDC.’

Enter your Property ID (PID) and click ‘Search.’

Choose ‘Pay Property Tax’ and review the payment details.

Click on ‘Pay Now’ to complete the transaction securely.

8. Checking Application Status and Property ID

Here’s how to check the application status and property ID in Haryana:

Visit the official portal of No Dues Certificate Management System Haryana.

Click on ‘Check Application Status’ and enter your Application Number to view the status.

To check the property ID, select ‘Citizen’ as User Type, enter your mobile number, and follow the prompts to view your property ID.

In conclusion, leveraging the digital platforms provided by the Directorate of Urban Local Bodies Haryana, property tax payments have become seamless and hassle-free. Say goodbye to long queues and embrace the convenience of managing your tax obligations from the comfort of your home.

#online ulb haryana property tax#ulb haryana online house tax#ulb haryana property tax faridabad#ulb haryana property tax payment

0 notes

Text

Pay Property Tax Online Easily and Securely | Step-by-Step Guide

Discover how to pay property tax online with our simple guide. Save time and avoid hassles by paying your taxes from home. Start now! for more information:

#property tax online#pay property tax online#property tax calculator#land tax online#pay tax online#house tax online#building tax online#online property tax payment#check property tax online#house tax payment online#house tax bill online#online land tax payment

0 notes

Text

#Tumkur property tax#Online payment#Tax management#Tumkur City Corporation#E-governance#Late payment penalties#Property assessment

0 notes

Text

How to pay municipal service tax and property tax through online?

Simplify Municipal Service Tax Payments with PayRup

Emily: Hey Tom, have you paid your municipal service taxes yet? Tom: Not yet Emily. It’s such a chore every year. Emily: You should try PayRup it’s a lifesaver. I used it last month for my taxes. Just download the app input your property details, and pay your municipal service taxes from your phone. Tom: Is it safe to use Emily? Emily: Absolutely Tom. It’s secure and user-friendly making tax payments a breeze. Plus it’s one less thing to worry about!

0 notes

Text

Securely Pay Your Municipal Taxes From Anywhere Any Time

Pay your municipal bills online at Payrup. Make municipal taxes using a platform that is completely safe and secure. receive a rebate when paying your municipal tax bill online. Get municipality tax payment today at Payrup visit the website.

0 notes

Text

Sites in Grama (Village) Panchayat Limits can pay property taxes online in Karnataka

The State Government and the RDPR department have enabled online tax payment for sites and other properties with Property ID in the State of Karnataka and the site owners can register their mobile numbers and log into the website and pay the taxes.

View On WordPress

#Online tax payment for the sites in rural areas in karnataka#panchayat sites#Property tax for village or grama panchayat sites#RDPR Karnataka has enabled online tax payment for sites#Taxes can be paid online for panchayat sites#village panchayat sites

0 notes

Note

About YFind: I was talking about it with a group of friends and many of us found it shady, but could only get part of the information in English. We do unfortunately not speak Thai, but we are curious, sceptical and very much looking forwards to seeing how this develops.

Any chance you could translate the terms and conditions?

I will say... you're right to be skeptical. They're just vague enough to prevent any potential future lawsuits against the company, but not the other way around...

Here we go:

Terms and Conditions

The written synopsis must be submitted in Thai. The synopsis should be submitted according to the following format: 1.1 Page 1 - Must include the writer's relevant information: Legal First and Last Name, Age, Address, Telephone and/or Mobile Number, E-mail, Line ID or other social channels for contact - Title - Genre - A brief description of the story's original inspiration (if any) 1.2 Pages 2-4 - A 3-page synopsis, size A4, to be submitted as a WORD or PDF document named according to the following format (1 submission per one 1 applicant limit): Title_First-LastName (please use your legal First and Last name, do not use a pen name)

Each applicant can submit up to 2 synopses, not restricted to the same genre, according to the specified format. Applicants can only submit once, with no more than 2 synopses included in their submission. Once the document has been successfully submitted into the system, information can no longer be edited or changed. In the event that an applicant has submitted duplicate (or more than one) documents, only the first submission will be considered and accepted.

Applicants must be Thai citizens. There are no age restrictions.

Submissions must not purposefully replicate any previous publications, broadcasts, or depictions in media. This includes works that have been previously submitted in other contests, whether in written form, online, or through other various channels.

Submissions must be the sole creative work of the writer, who must identify as the sole applicant. Submissions must not infringe upon copyright or intellectual property rights. Applicants must not defame(insult) someone else by plagiarizing, reproducing or revising their work to submit as their own. The use of AI or other technology to create a synopsis is strictly prohibited and will be found in violation of the rules and regulations. If submissions are later found to be within violation of the law or any of its regulations, the Company and those whose rights have been violated are authorized to take legal action.

The winning submission's rights will become the copyright of the Company. The Company can use it's rights as it deems appropriate, not limited to reproduction, adaptation, and novel and/or poetry publication: The property can be produced as a drama (series) and/or film to be distributed to the general public through any partnered media company; The Company can collect any benefits relating to the copyright of the property, including sales, payments, and transfers for authorized lending of the property to others; Benefits can be collected from any commercial or non-commercial use of the property; And/or the Company can make any international distribution decisions throughout the span of it's property's copyright protection and/or the rights of the property according to the law. The Company can do so without having to pay compensation to and without asking permission from the applicant. All winning submissions will receive a reward when notified by the company. Upon notification, the owner of the submission must sign the appropriate 'copyright and rights transfer' documents. Failure to do so will disqualify winners from receiving a reward.

The reward cannot be exchanged or transferred. The prize money is subject to the withholding of tax according to the rate specified by law.

The Company reserves the right to investigate the validity and integrity of each submission according to the ownership conditions for receiving the prize money. If any work is found to not be in accordance with the Company's conditions, the Company can immediately disqualify the applicant without notifying them. Applicants must agree and accept any decisions of the Company, and/or the person designated by the Company, throughout every step of the selection process, including their selected winners who will receive the reward according to the Company's wishes. All final decisions remain at the discretion of the Company, and/or the person designated by the Company, without need of explanation. Applicants do not have any right to complain or object.

#GMMtv#some of the legal jargon goes over my head#so be wary of its accuracy#answered#talk thai to me

17 notes

·

View notes

Text

'Irish actors claim they have been treated like the poor relations in the film industry for decades despite big government tax breaks for major studios.

LA-based actor Alan Smyth revealed that Colin Farrell, Ruth Negga and Cillian Murphy have signed a petition for fair and equal pay for native performers and crew.

Over 2,500 people have added their signatures online.

It says the Irish diaspora in the US and worldwide strongly support the efforts of Irish Actors Equity, which is in talks with several government ministers to secure a guarantee “that Irish performers will not be subject to lesser terms and conditions regarding their intellectual property rights than international performers in similar roles”.

“This, unfortunately, has been the case for many years,” it states.

The petition is still open as Irish Equity plans to hold a solidarity rally with the striking SAG-AFTRA union and the Writers Guild of America today.

Smyth, who is from Dundalk, has first-hand experience of the set-up on both sides of the Atlantic. He has reaped the benefits of the American system where actors traditionally got residual cheques whenever their performances are aired.

The threat now, he says, is that the so-called “streamer” networks are imposing drastic cuts to the value of the residuals.

Hence, the strikes.

“It’s a lot worse in Ireland,” said the actor, who has starred in a number of big TV dramas, including CSI: NY and Criminal Minds.

“The system in Ireland is that the Irish cast and crew for the most part, unless it’s Colin or Cillian, are put on buyout contracts so don’t get residual payments.

“The awful thing about it is the Irish Government gives tax breaks to film and TV productions. Within the productions, the Irish cast and crew are paid far less than anyone brought over from England or the US. It’s 100pc discriminatory.

“Colin, Cillian and Ruth Negga have got behind the petition. They know how hard it is until you get to a point where you’re doing really, really well. I can really see how hurtful it is in Ireland.”

Actor Gerry O’Brien lodged a cheque for $800 (€735) yesterday for his role as an Irish man in Pirates of the Caribbean years ago. The payment covers just a quarter of the year.

He got a US contract for the job, rather than the typical Irish buyout one.

In contrast, he has earned just €54 in residuals in the last 20 years here. That was for an RTÉ TV series.

O’Brien said Equity wants a contract for Irish actors like that on offer to their British counterparts. The coveted UK contract sets out minimum pay rates, residual arrangements and other terms and conditions.

Irish production companies offer the buyout contracts on behalf of the major international studios when they are in town, he says.

A Dublin-based actor (27) did not want to be named for fear he would be “blacklisted” when going for jobs.

He has been following the Hollywood strike very closely.

“It shines a light on just how unfair the industry is,” he said.

“Those at the top are earning incredible amounts of money and profit. In a large part, it is due to those at the bottom scraping a living.

“I graduated from drama school in 2017. Last year, I made the most money I ever made working as an actor and that was €14,000. Obviously that is not sustainable.

“If you work on an Irish film, you get paid for the day of work and never see another penny. I routinely sign off my rights for €600 or €700 a day.

“I’m delighted that Cillian Murphy and Colm Meaney are coming out in support of small fry actors like myself.”

Actor Owen Roe has won many theatre awards during his career and his film appearances including Breakfast on Pluto, Intermission, Wide Open Spaces and Michael Collins.

He said actors here are “not prepared to go on strike” but it is an opportunity to inform younger ones of their rights.

“It’s far more competitive as well . There is AI and all those things. The whole buyout situation is not good for us.”

He was glad to see Cillian Murphy and other stars walk out of the Oppenheimer premiere in support of their US union.

“They don’t have to financially, I’d imagine,” he said. “It gives confidence to people who feel they are being exploited.

“I think it will be interesting to see what happens in America. If the whole thing of buyouts and residuals gets sorted. The attitude that we’re cheaper is offensive,” he said.'

#Cillian Murphy#Oppenheimer#Alan Smyth#Colin Farrell#Irish Equity#SAG-AFTRA#Ruth Negga#Owen Roe#Breakfast on Pluto#CSI: NY#Criminal Minds#Gerry O Brien#Pirates of the Caribbean#Colm Meaney#Intermission#Wide Open Spaces

89 notes

·

View notes

Text

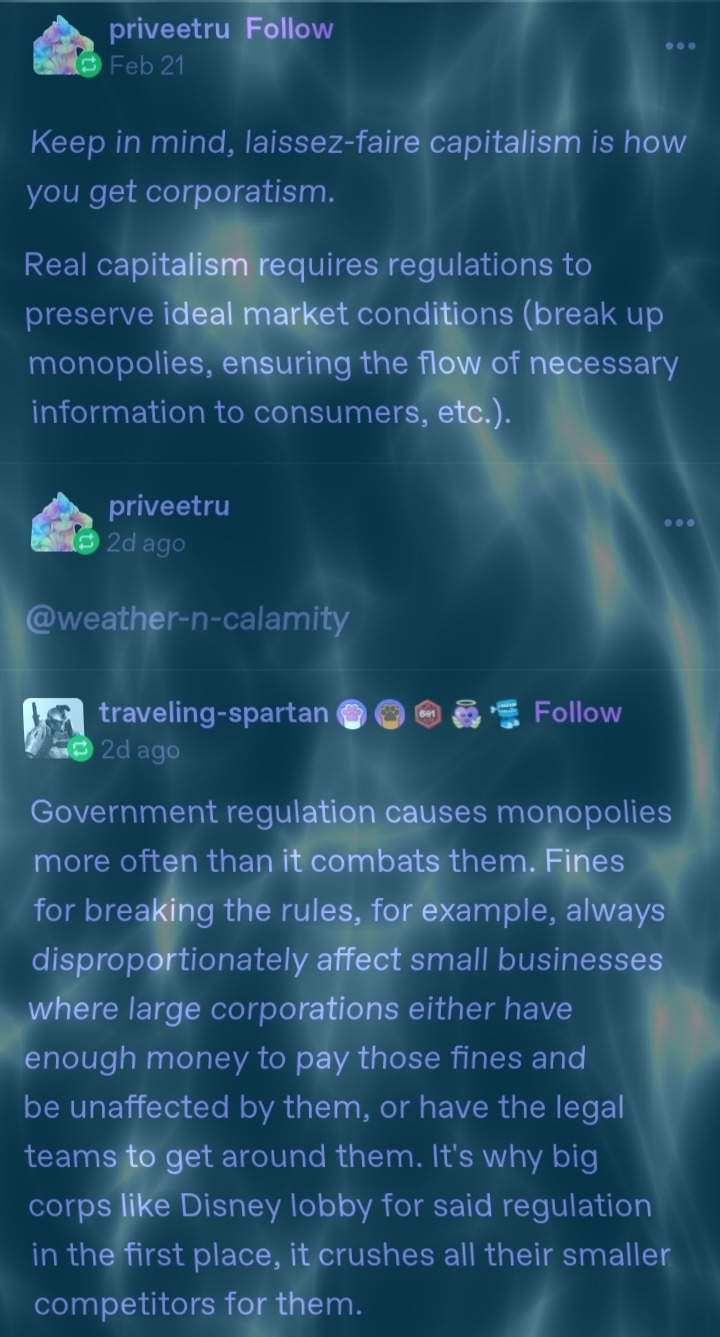

@traveling-spartan @priveetru

gonna be responding to this in a separate post because i've already left two comments on the post this was in reply to and i suspect that the OP already would consider that two too many.

at any rate:

Government regulation causes monopolies more often than it combats them.

[...]

It's why big corps like Disney lobby for said regulation in the first place, it crushes all their smaller competitors for them.

for what it's worth the data doesn't seem to be backing this up. if both these claims were true, you'd expect to see a multitude of pieces of regulation that disney supported, and few if any pieces of regulation that disney opposed, but this quick overview of some of disney world's political spending on florida trend [x] doesn't show that. now admittedly this is just the partial info for the disney world division in florida specifically, and not a general overview of all their political spending, so if anyone has more complete data i'd be interested to hear it. that said, i think it's a decent slice of data to start with.

in fairness, here we can find one notable example of disney lobbying for regulation- namely when they funded efforts to support Amendment 3, which would have prevented any more large casino chains from opening in florida, so that disney world could avoid competing with major casino chains like Genting and Las Vegas Sands. and, to be fair, as noted in the article this was a pretty major driver of campaign spending.

however, A: this was primarily aimed at combating rival megacorps, not combating small businesses, (and naturally the casino megacorps disney was fighting were spending their lobbying money to combat said regulation) and B: this was the only time in the article we see disney fighting for regulation rather than against. examples in the article of disney lobbying against regulation include:

By virtue of its size and economic importance, Disney has always been an influential voice in state politics. But the company had found itself on the losing end in a series of lobbying battles — among them, a fight with the National Rifle Association about whether employees could bring guns to work.

this is an important example of how regulation of private enterprise is sometimes necessary to preserve our fundamental rights- if disney can say employees can't bring guns to work even if they keep them in their parked car, what's to stop landlords from saying tenets can't bring guns in their apartment? if you value the right to bear arms, you should understand why sometimes the power of private enterprise over employees and customers must sometimes be curbed.

Disney also battled with personal-injury attorneys about whether parents could sign away the liability rights of their children and with counties and hotel chains about how online travel companies should be taxed.

[...]

Disney’s 2018 spending included $1 million on Amendment 2, which keeps a tax cap in place that limits increases in the taxable value of commercial and other non-homestead property from rising more than 10% per year. Records show Disney was by far the largest donor to a Florida Chamber of Commerce-backed political committee used to promote the amendment. The cap saved Disney more than $6 million last year alone through reduced property tax payments to Orange County and the South Florida Water Management District.

[...]

As prominent as Disney has made itself on the campaign trail, lawmakers who have worked with the company say it still tries hard to maintain a low profile while lobbying — to avoid having its brand linked with potentially controversial public policies. Disney, for example, has exerted “significant influence” on the Legislature to not pass a law requiring employers to use the e-Verify system to ensure they aren’t employing undocumented workers, says former Senate President Don Gaetz, a Republican from Okaloosa County.

[...]

Cloaked or not, the company enjoyed a number of successes in the 2019 legislative session. Late in the session, as lawmakers finalized a broad tax package, Disney — working through the Florida Retail Federation — persuaded lawmakers to add an extra sales-tax break that will help big retailers who order too much inventory and wind up not selling it all. Retailers generally don’t have to pay sales tax when they order inventory because they are planning to resell it to consumers. The sale to consumers is the transaction that’s supposed to be taxed. But retailers must pay the tax on whatever they don’t sell, since they have become the end user of the product. Disney has for years donated its leftover inventory to charities. So the company persuaded the Legislature to create a sales tax exemption for the leftover inventory that goes to charity. Economists expect the new tax break will save retailers about $5 million a year. Disney won’t say how much it expects to save itself. Disney also worked quietly to reshape a bill, which it objected to in 2018, that would have exposed hotel operators to civil lawsuits if they failed to do enough to prevent human trafficking.

i'll leave it for the reader to consider why disney would want to combat regulation which might cause them to be held accountable for facilitating human trafficking.

Disney even won some changes in state rules for how tourist venues manage all the stuff — from hats to strollers to phones — that visitors lose or leave behind. Generally, businesses are supposed to alert law enforcement and must hold on to lost property for 90 days before they can dispose of it. But that has become cumbersome for Disney — and for Universal Orlando, Central Florida’s other big theme-park resort — which must devote lots of warehouse space simply to holding lost-and-found items. Disney helped write a bill establishing new rules for theme parks, hotels and some other commercial venues that requires them to hold the property for just 30 days and then donate it directly to charity.

looking outside the article to other examples of disney's political lobbying, we find them lobbying against minimum wage laws [x]

Five years ago, on Nov. 6, 2018, the city’s voters approved Measure L, which mandated that “area resort workers” — Disneyland employees, basically — must be paid a living wage if the parent company receives city subsidies. The Walt Disney Company, which at the time was paying some of its workers the state-mandated $11 an hour minimum, fought the measure bitterly, and the ordinance spent most of the next five years kicking around the state court system as a class-action lawsuit sought to force the company to comply. Only in late October, when the California Supreme Court declined to hear Disney’s final appeal, did Measure L become settled city law.

we can also find disney lobbying against heat safety regulations (and against raises to the minimum wage at the same time, a twofer) [x]

House Bill 433 prohibits local governments from passing legislation that protects workers from extreme heat and laws requiring companies to raise the minimum wage beyond the state’s current $12 an hour. But now, we’re learning more about how this bill was passed and the role that Disney World played in helping to remove basic protections from outdoor workers, including cast members. According to Jason Garcia of Seeking Rents, the Florida Chamber of Commerce and Associated Industries of Florida donated more than $2 million to mostly Republican legislatures and another $1 million to the Florida Republican Party. The two lobbying groups expected House Bill 433 to become law for those donations.

[...]

Local government officials in South Florida were considering passing heat protections after the death of migrant farm workers of heat stroke. These laws would have prohibited work in extreme Florida heat and mandatory water breaks for workers. The possibility of these laws stopping work became dangerous to businesses in Florida, which would have had to shut down in extreme heat. Thus, donations to politicians were made to get this bill passed.

[...]

The law was wildly unpopular, with hundreds of civic groups opposing it. That outrage nearly killed the bill. However, according to Garcia, with just one day left in the legislative session, lobbyists sent texts to lawmakers to ensure the bill’s passage.

so what can we see from all this? first, that there are more pieces of regulation that large businesses lobby against than regulations that they lobby for, so the claim that businesses are the primary force behind pushing regulation is patently false and B: when businesses do support regulation in order to pursue their financial interests, this is mainly in order to combat rival large corporations, not small businesses. because fundamentally large businesses don't have to worry that much about competition from small businesses, because fundamentally small businesses can't compete. a small business would have had to expand to the point of being a large corporation long before it would be something disney would have to worry about "competing" with instead of just buying out or ignoring entirely. you think that a megacorp like disney is worried about competition from a little mom and pop shop? get real.

Fines for breaking the rules, for example, always disproportionately affect small businesses where large corporations either have enough money to pay those fines and be unaffected by them, or have the legal teams to get around them.

a few responses to this. the first is, so what? laws against murder, rape, assault, etc are all easier for the rich to dodge, and yet we don't decide murder should be legal. the solution to that imbalance is to be more serious about holding rich people accountable for these crimes, or for fine-related punishment to scale the fine to income, not to get rid of the laws altogether. if a regulation outlaws genuinely abusive or harmful behavior from a company, the way that small companies can avoid that fine is by simply not engaging in abusive or harmful behavior.

secondly, plenty of regulations nonetheless have specific exemptions for small businesses anyway. for example

In general, if your business is under $50 million in annual sales and your fuel or additive has traditional chemistry, then you are exempt from the health effects testing requirements. If you have non-traditional chemistry and are under $10 million in annual sales, you are exempt from some of the testing. EPA staff can discuss testing requirements.

[x]

or for another example:

The Federal Food, Drug, and Cosmetic Act requires packaged foods and dietary supplements to bear nutrition labeling unless they qualify for an exemption (A complete description of the requirements). One exemption, for low-volume products, applies if the person claiming the exemption employs fewer than an average of 100 full-time equivalent employees and fewer than 100,000 units of that product are sold in the United States in a 12-month period. To qualify for this exemption the person must file a notice annually with FDA. Note that low volume products that bear nutrition claims do not qualify for an exemption of this type. Another type of exemption applies to retailers with annual gross sales of not more than $500,000, or with annual gross sales of foods or dietary supplements to consumers of not more than $50,000. For these exemptions, a notice does not need to be filed with the Food and Drug Administration (FDA). On May 7, 2007, the Food and Drug Administration (FDA) launched a new web-based submission process for small businesses to file an annual notice of exemption from the nutrition labeling requirements. The new process will make it easier for businesses to update their information. In addition, firms eligible for the exemption will receive an electronic reminder when it is time to resubmit their nutrition labeling small business exemption notice.

[x]

or yet another:

Manufacturers of consumer products covered by the Department of Energy (DOE) standards with annual gross revenues not exceeding $8 million from all its operations, including the manufacture and sale of covered products, for the 12-month period preceding the date of application, may apply for a temporary exemption from all or part of an energy or water conservation standard. (42 U.S.C. 6295 (t))

[x]

so, no, regulations are not a sinister trick of large corporations to crush small business, because if they were they wouldn't specifically exempt small businesses.

does this mean that @priveetru was right? are regulations an important part of maintaining ideal market conditions and thus creating Real Capitalism, which is Good?

also no.

first, it's all "real capitalism". more regulated, less regulated, it's still Real Capitalism. and as demonstrated by the things going on around us, right now, real capitalism is Bad.

as @traveling-spartan pointed out, large corporations can simply afford to pay or dodge any fees for breaking regulation (though overall they would prefer not to have to, hence why they usually fight against regulation) and small businesses are often exempt from regulations in the first place. so who do regulations actually prevent from economic malfeasance?

nobody. not a soul. they're a completely ineffective bandaid on a bazooka wound which accomplishes nothing.

regulated or unregulated, all market economies tend towards consolidation. on a long enough timeline, all small businesses either are successful enough to become large businesses, are unsuccessful enough to go out of business, or are average enough to get bought out. it's an inevitable part of capitalism as it actually exists, and no matter what fantasy you chase after of a hypothetical, imaginary, impossible "real" capitalism, whether this fantasy is laissez-faire or tightly regulated, you will never escape that reality.

if you want to solve the problem, you can't keep chasing after an imaginary "real capitalism". instead you need to move past capitalism altogether. if you want to address the fact that bill gates and other billionaires are monopolizing farmland and therefore gaining control over our very subsistence, the solution to that isn't to sit around praying to the invisible hand of the free market to save us, and it's also not begging and pleading the existing bourgeoisie state to Le Heckin Tax The Billionaires. the real solution is for regular working class people like us to rise up and take back what is rightfully ours, and create a new state that actually serves the needs of the working people and not just the owning class.

14 notes

·

View notes

Text

Some thoughts about media consumption, fanwork and fandom issues that came about while pondering the Welcome Home situation.

I want to think out loud about how wild and complicated this situation seems to have gotten due to the way in which online fandom has normalized media-consuming practices, to the point in which it's become automatic and homogenizes art and media, regardless of where it comes from.

Fanwork hasn't only become an expected part of fandom activity, fans these days know how to monetize content before learning about intellectual property or developing any nuance on the origins of art, perceived in a depersonalized way as just "content".

In the past decade, it became customary on tumblr for Fandom Elders and Not So Elders to receive hate whenever they pointed out that, for example, adding self-profiting links on fics in AO3 is not allowed for legal reasons.

There was a very famous tumblr take that went as far as to suggest that fic writers "couldn't charge for and successfully sell" their fics because "writing is dismissed" in fandom, in comparison to fan art. This take didn't acknowledge that both forms of profit are actually illegal (added note: public domain in some countries still is legally bound to a tax payment), or that fanfic was historically more attacked by mainstream authors, which reinforced the culture of copyright understanding, or that fan art tends to be more easily separated from canon due to visual likeness differences, etc.

The general perception became that profiting from fanwork is "a safe thing to do" even if, in reality, profiting from copyrighted material without the legal authorization of the copyright holder is a decision fans should make knowingly of the legal consequences it carries for themselves and the fanwork community and platforms.

There was a fandom push and pull with this reality because of moral grounds and a popular perception of unequal footing between the fan part and the canon part.

It was perceived, in general, that fan content comes from an independent creator and canon comes from a Company or a Professional Author with Company Backing (publisher, studio, etc.) who wouldn't miss the few coins an indie artist can take from a piece of art.

This idea was reinforced by the fact that there were times in which big corporations shut down fan projects (even non profit ones) to later copy those projects themselves and profit from the idea. It happened with Lionsgate in the Hunger Games days, it happened with Disney and Etsy sellers, it happened in many places with many things.

The idea that, even if illegal, the practice of profiting from copyrighted material from corporations or certain authors could be seen as justified grew to a point of normalization.

So, the era in which the fanfiction battle that established the concept of non profit as a condition for allowing fan content to exist, had ended. It gave way to an increasingly normalized perception of it being allowed.

This also happened at the time in which online monetization of content became more accessible.

Sites like ko-fi or patreon could be used to pay for content creators "in general" rather than tying them to the profit of sales of specific content that contained copyrighted material. These loopholes allowed creators to successfully profit through fan content that was otherwise illegal to be monetized.

The problematic repercussions of this normalization, like I said, was that people learned to monetize before they learned what they could monetize. Or what they should.

Around 2018 there was a situation in which some rpdr queens got into arguments with fan artists who were selling their fan art as unauthorized merch.

These artists were doing what they were accustomed to do in the past years in fandom, do art of media they enjoyed and sell it online.

They didn't stop to think that they were actually selling products of indie artists whose primary source of income after performing is merch, nor did they think about the fact that drag performers are real people and not blorbos from shows. They didn't think that they were reproducing the likeness of a person (as curated as a drag persona can be) and selling it, feeling a sense of entitlement to the art that carried said likeness.

Normalization of media consumption in which you produce work and then sell it was so ingrained that the source didn't matter anymore. A mainstream Big Company like Disney was seen in the same way that an indie drag performer who asked fanwork creators not to profit from their identity.

Media is exchangeable and fanwork is created in the same way for anything, no matter what it is. Everything is a blorbo we feel automatically entitled to the moment it hits our orbit.

And I say this as a person who has been in fandom for ages and who values fanwork immensely. This doesn't come from a place of judgement, it comes from a place of care and of questioning the space around me.

In any case, cue 2023 sudden sensation Welcome Home.

It isn't just that Welcome Home is an independently created piece of transmedia, run by one single individual. It's also that said piece of media is, as of the moment of this situation, mostly developed via artwork.

Contrary to drag performers, webseries or podcasts, which can also be independently produced and become subject of massive fandoms, Welcome Home's source material is, at the beginning stage, mostly non-contextualized artwork and breadcrumbs of lore.

So, it skyrocketing to fandom fame and getting massive crowds of people from different walks of fandom life (the kids from the lost media reddits, the creepypasta youtubers, the fnaf kids, the tumblr puppet lovers, the puzzle enthusiasts, etc., etc.) while being a meta media piece (a transmedia piece about a made-up lost media piece) blurred the lines of source and fandom like nothing I've ever seen before.

How do you establish which art is canon when there are fan artists posting fan content that looks exactly like the real thing? And when you, as an indie creator, use the same platforms to showcase your work as they do to share their fan art?

How do you establish canon products (like puppets or dioramas) if you can't show yet the ones you made and fans are posting theirs already in the same platforms?

How can you put boundaries on what is or isn't part of the puzzle when overnight you have millions of people hungrily looking through your professional portfolio for clues that aren't meant to be there? Making you part of the puzzle because they single-handedly decided that your passion project is an ARG?

How do you stop the people who are profiting from cosplaying your characters for personal donations, selling fan art of your work in merch or using your characters and universe for commissions?

People who are, again, posting their photos and art and links on the same social medias you do and using for their monetization the same platforms as you do?

How do you set yourself apart from people impersonating you in social media, sometimes even unknowingly, because they're using your artwork for their profiles without permission or clarification?

How do you establish your ownership and identity without compromising personal information that you weren't thinking of sharing at all?

How do you keep your canon clear of outside influence if people are posting fanfics and roleplays faster than you are meant to tell your story? In the same platforms you use for work and enjoyment?

You know how, in Disney Parks, adults aren't allowed to cosplay out of special ticketed events because they want to avoid little kids from confusing a random person with a character performer, who is trained to accommodate and be accessible to little kids? Because they're responsible for how kids are treated in the parks by their employees and character performers?

Imagine fan art that is so much like the canon art, which didn't even get time to be set into clear boundaries and context yet, depicting things you didn't intend to depict for the audience you're aiming for, in a way in which it looks exactly like yours, posted in platforms that you use for your work.

How can you establish the boundaries of what is or isn't your canon content or your responsibility? If you're just one person? And this thing exploded overnight?

The normalization of fan content practices and, in tow, of profit from it, went faster than the story could be told.

Even outside of the very serious issue of people profiting from the work of an indie creator, from characters they've worked on for years and were excited to share with the world, there's also the fact that this exploded so much and so fast and with something in such an early stage of development that it's insane to think of how you can even start to draw lines of what is and isn't your work, as a singular person trying to put your idea out there.

Not just for the sake of storytelling, the sake of your art, the sake of your integrity as an author and the sake of your creative process, but also as the one responsible for the thing itself with a clear idea of what you're presenting and to whom.

It's overwhelming just to think about it.

I don't have answers, and even if I have opinions, I'm not trying to tell anyone what to do or how to behave, you're all responsible for your own actions. Objective information is out there, each fandom platform has its own rules and regulations, fandom has its sources of legal advice, and there are official guidelines from the WH author that are clear as to what they would like you not to do (1, 2, 3). Each piece of media is different, each person's way of interacting with it is different, I'm not your mom, there's the info, do whatever you want.

All I have is mad respect to an author whose work I'm enjoying immensely, my best wishes as someone who wants to be a storyteller, and my support.

Still, I just had to stop and think in some length about this because it's A LOT. It's wild. It's a situation I've personally never seen before in this extent.

And it's disorienting how fast we got here and where we're going. So I needed a space to think out loud to the void.

#luly rambles#welcome home#fanwork discourse#things that could make people upset at me but anyway#i'm pondering about fandom online and capitalism i guess#long post when expanded

38 notes

·

View notes

Text

Property Tax Online Payment | Bajaj Finserv

Property owners can avail the facility of Property Tax Online Payment with Bajaj Finserv through their app. This method of payment is beneficial, as it saves you time and effort and allows you to pay your property tax from the comfort of your home or office. In addition, this method of payment is also secure and convenient, as all the data is encrypted with the highest level of security.

0 notes

Text

This day in history

On June 21, I'm doing an ONLINE READING for the LOCUS AWARDS at 16hPT. On June 22, I'll be in OAKLAND, CA for a panel and a keynote at the LOCUS AWARDS.

#15yrsago Soviet-era punks https://englishrussia.com/2009/06/11/soviet-punks/

#15yrsago Junk science and cocaine scares https://www.badscience.net/2009/06/this-is-my-column-this-is-my-column-on-drugs-any-questions/

#10yrsago The Return of Zita the Space Girl https://memex.craphound.com/2014/06/13/the-return-of-zita-the-space-girl/

#10yrsago Bot alerts you every time the Supreme Court silently alters its rulings https://web.archive.org/web/20140613031445/http://gigaom.com/2014/06/12/clever-piece-of-code-exposes-hidden-changes-to-supreme-court-opinions/

#10yrsago Academic publisher tried to stop publication of paper on price-gouging in academic publishing https://www.techdirt.com/2014/06/12/academic-publisher-fights-publication-paper-criticizing-publishers-price-increases-profits/

#10yrsago How Hayek bred a race of elite monsters https://www.nakedcapitalism.com/2014/06/bill-black-hayek-helped-worst-get-top-economics-ceos.html

#10yrsago Snowdenbot performs tele-diagnosis and offers aid to reporter who had first epileptic seizure https://www.tagesspiegel.de/kultur/he-is-not-alone-4821781.html

#10yrsago Apple adds privacy-protecting MAC spoofing (when Aaron Swartz did it, it was evidence of criminality) https://www.eff.org/deeplinks/2014/06/umbrella-hurricane-apple-limits-mobile-device-location-tracking

#5yrsago Couture fashion company Vetements is selling an unauthorized €800 Pirate Bay hoodie https://torrentfreak.com/red-hot-vetements-fashion-brand-is-selling-a-845-pirate-bay-hoodie/

#5yrsago In Alabama, it’s traditional for sheriffs who lose their elections to steal and waste money, destroy public property https://www.propublica.org/article/alabama-sheriffs-undermine-successors-after-losing-reelection

#5yrsago After American juvenile offenders are released, they can be re-imprisoned for failing to make restitution payments https://www.themarshallproject.org/2019/06/11/punishing-kids-with-years-of-debt

#5yrsago Majority of American millionaires support a wealth tax on American millionaires https://www.commondreams.org/news/2019/06/12/even-1-know-they-arent-paying-their-fair-share-new-poll-shows-60-millionaires

#5yrsago Facebook execs are worried that Zuck’s emails show he never took his FTC privacy obligations seriously https://www.wsj.com/articles/facebook-worries-emails-could-show-zuckerberg-knew-of-questionable-privacy-practices-11560353829

#5yrsago Hong Kong’s #612strike protest movement: a million strong, leaderless, wireless and smart as hell https://memex.craphound.com/2019/06/13/hong-kongs-612strike-protest-movement-a-million-strong-leaderless-wireless-and-smart-as-hell/

#1yrago Saving the news from Big Tech with end-to-end social media https://pluralistic.net/2023/06/13/certified-organic-reach/#e2e

5 notes

·

View notes

Text

What You Need to Know About Calgary's Property Taxes

Navigating the intricacies of property taxes is essential for homeowners and prospective buyers alike. Calgary’s property taxes can impact your budget and long-term financial planning. Here’s a detailed guide on what you need to know about Calgary's property taxes in 2024.

Understanding Property Taxes

Property taxes in Calgary are levied annually by the municipal government to fund various public services such as education, emergency services, infrastructure maintenance, and public transportation. The tax amount is based on the assessed value of your property, which is determined by the City of Calgary's Assessment Department.

How Property Taxes Are Calculated

Property Assessment: The City of Calgary assesses properties each year to determine their market value as of July 1 of the previous year. This assessed value reflects what your property would likely sell for in an open market.

Mill Rate: The mill rate is a figure set by the City Council and the Provincial Government, representing the amount of tax payable per $1,000 of the assessed value of the property. For 2024, the combined municipal and provincial mill rate has been updated to reflect the latest budget requirements and economic conditions.

Calculation: Your property tax is calculated by multiplying the assessed value of your property by the mill rate. For example, if your property is assessed at $500,000 and the mill rate is 0.0085, your property tax would be $4,250 annually.

Changes in 2024

Several changes have been implemented in 2024 that homeowners need to be aware of:

Assessment Updates: The assessment process has been refined to ensure more accurate valuations, considering factors such as market trends, property renovations, and neighborhood developments.

Mill Rate Adjustments: The mill rate for 2024 has been adjusted to accommodate the city’s budget requirements, including increased funding for public transportation and infrastructure projects. This adjustment may result in a slight increase in property taxes for some homeowners.

Provincial Education Tax: The provincial portion of the property tax, which funds education, has seen a minor increase. This change aims to support the rising costs of education and ensure quality schooling for Calgary’s growing population.

Paying Your Property Taxes

Property taxes in Calgary are due annually, with several payment options available:

Monthly Payment Plan (TIPP): The Tax Instalment Payment Plan allows homeowners to pay their property taxes in monthly instalments, making it easier to manage finances.

One-Time Payment: You can also pay your taxes in full by the due date, typically at the end of June.

Online Payments: The City of Calgary provides an online portal for convenient tax payments.

Appeals and Disputes

If you believe your property assessment is incorrect, you have the right to appeal:

Review Your Assessment: Carefully review the assessment notice sent by the City. Ensure that all details, such as property size and features, are accurate.

File an Appeal: If discrepancies are found, file an appeal with the Assessment Review Board before the specified deadline. The appeal process includes a review of the assessment and an opportunity to present evidence supporting your claim.

Tax Relief Programs

Several tax relief programs are available to assist eligible homeowners:

Senior Property Tax Deferral Program: Seniors can defer all or part of their property taxes through this program.

Low-Income Property Tax Assistance: Homeowners with low income may qualify for assistance to reduce their tax burden.

Conclusion

Staying informed about property taxes is crucial for Calgary homeowners. With the changes in 2024, it’s important to understand how assessments, mill rates, and tax relief programs affect your finances. By staying proactive and informed, you can effectively manage your property tax obligations and take advantage of available resources.

For further details, visit Sherry Johnston Exp Realty official website or contact Sherry Johnston realtor directly.

#Sherry Johnston exp realty#Sherry Johnston Realtor#real estate agent calgary#calgary realtor#exp realty calgary#calgary real estate agents#best realtors in calgary#top calgary real estate agents#best real estate agent calgary#best real estate agent near me#best realtor near me#calgary real estate

2 notes

·

View notes

Text

The Ultimate Guide to Buying Luxury Properties in Dubai

Introduction to Luxury Properties in Dubai

Dubai's real estate market is synonymous with luxury, offering a wide range of high-end properties that attract investors and homebuyers from around the world. From opulent villas and expansive penthouses to exclusive apartments in prestigious neighborhoods, Dubai's luxury real estate sector is thriving. This guide provides a comprehensive overview of the process of buying luxury properties in Dubai, offering valuable insights and practical tips to help you secure your dream home.

For more information on home loans, visit Home Loan UAE.

Why Invest in Luxury Properties in Dubai?

Dubai is a global hub that combines modernity with tradition, making it an attractive destination for luxury real estate investment. Here are several compelling reasons to invest in luxury properties in Dubai:

Strategic Location: Dubai's geographical location serves as a crucial gateway between the East and the West, making it a central hub for business and tourism.

World-Class Amenities: Luxury properties in Dubai come equipped with world-class amenities, including private beaches, state-of-the-art fitness centers, and high-end retail and dining options.

Tax Benefits: Dubai offers tax-free income on rental yields and capital gains, making it an attractive destination for investors.

High Rental Yields: The city provides some of the highest rental yields in the world, making it a lucrative investment opportunity.

Strong Economy: Dubai's robust and diversified economy supports a stable real estate market, providing a secure investment environment.

For property purchase options, explore Buy Commercial Properties in Dubai.

Understanding the Luxury Property Market in Dubai

The luxury property market in Dubai is characterized by its diversity and opulence. Properties range from high-rise apartments with breathtaking views to sprawling villas with private pools and gardens. Key areas known for luxury properties include:

Palm Jumeirah: An iconic man-made island offering exclusive beachfront villas and luxury apartments.

Dubai Marina: Known for its stunning skyline and waterfront living, Dubai Marina offers high-rise luxury apartments and penthouses.

Downtown Dubai: Home to the Burj Khalifa and Dubai Mall, Downtown Dubai offers luxury apartments in a vibrant urban setting.

Emirates Hills: Often referred to as the "Beverly Hills of Dubai," this gated community offers expansive villas and mansions.

Steps to Buying Luxury Properties in Dubai

Define Your Requirements: Determine your budget, preferred location, property type, and essential amenities.

Research the Market: Conduct thorough research on the luxury property market in Dubai. Use online portals, consult real estate agents, and attend property exhibitions.

Secure Financing: If you require financing, explore mortgage options. For more details, visit Mortgage Financing in Dubai.

Hire a Real Estate Agent: Engage a reputable real estate agent specializing in luxury properties to guide you through the process.

View Properties: Schedule viewings of shortlisted properties to assess their suitability.

Make an Offer: Once you find the right property, make an offer through your agent.

Legal Checks and Documentation: Ensure all legal checks are completed, and necessary documentation is in place.

Finalize the Purchase: Complete the payment and transfer the property title to finalize the purchase.

For rental options, visit Apartments For Rent in Dubai.

Financial Considerations

Investing in luxury properties requires careful financial planning. Here are some key financial considerations to keep in mind:

Budgeting: Determine your budget, including the purchase price, closing costs, maintenance fees, and potential renovation costs.

Mortgage Options: Explore different mortgage options to find the best rates and terms. A mortgage consultant can provide valuable advice and assistance.

Down Payment: Be prepared to make a significant down payment, typically ranging from 20% to 30% of the property value.

Currency Exchange: If you are an international buyer, consider the implications of currency exchange rates on your investment.

Legal Considerations

Title Deed: Ensure the property has a clear title deed issued by the Dubai Land Department (DLD).

No Objection Certificate (NOC): Obtain an NOC from the developer if purchasing an off-plan property.

Property Registration: Register the property with the DLD to formalize ownership.

Legal Advice: Consider hiring a legal advisor to assist with the legal aspects of the purchase.

Choosing the Right Real Estate Agent

A reputable real estate agent can make the process of buying a luxury property much smoother. Here are some tips for choosing the right agent:

Experience and Reputation: Choose an agent with extensive experience and a strong reputation in the luxury property market.

Market Knowledge: Ensure the agent has in-depth knowledge of the specific areas and properties you are interested in.

Client Testimonials: Look for client testimonials and reviews to gauge the agent's performance and reliability.

Communication Skills: Select an agent who communicates effectively and is responsive to your needs and concerns.

Viewing and Selecting Properties

When viewing luxury properties, consider the following factors:

Location: The location of the property is crucial. Consider proximity to amenities, views, and the overall neighborhood.

Quality of Construction: Assess the quality of construction, materials used, and overall craftsmanship.

Amenities and Features: Ensure the property offers the amenities and features that are important to you, such as private pools, gyms, and security.

Future Development Plans: Research any future development plans in the area that could impact the value and desirability of the property.

Making an Offer and Negotiating

Once you find the perfect property, making an offer and negotiating terms is the next step. Here are some tips:

Offer Price: Work with your agent to determine a fair offer price based on market value and recent sales.

Negotiation Strategy: Have a clear negotiation strategy and be prepared to make counteroffers.

Inclusions and Exclusions: Clearly outline what is included in the sale, such as furnishings, fixtures, and appliances.

Contingencies: Include contingencies in your offer to protect your interests, such as financing and inspection contingencies.

Closing the Deal

The final step in buying a luxury property is closing the deal. This involves several key tasks:

Final Walkthrough: Conduct a final walkthrough of the property to ensure it is in the agreed-upon condition.

Finalizing Financing: Secure your mortgage and ensure all financing details are in order.

Signing the Contract: Review and sign the sales contract, ensuring all terms and conditions are clearly outlined.

Transfer of Ownership: Complete the transfer of ownership with the Dubai Land Department.

For more resources and expert advice, visit Home Loan UAE.

Real-Life Success Story

Consider the case of James, an investor from the UK, who purchased a luxury penthouse in Dubai Marina. With the help of a local real estate agent and a mortgage consultant, James secured a competitive mortgage rate and finalized the purchase within three months. His investment has since appreciated in value, providing substantial rental income.

Conclusion

Buying luxury properties in Dubai can be a rewarding investment, provided you navigate the process with due diligence and expert guidance. By following the steps outlined in this guide and leveraging professional services, you can secure a luxury property that meets your needs and investment goals. For more resources and expert advice, visit Home Loan UAE.

2 notes

·

View notes

Text

Mastering Your Finances: A Step-by-Step Guide on How to Create a Budget

Creating a budget is a foundational step towards achieving financial stability and realizing your financial goals. Whether you’re aiming to save for a major purchase, pay off debt, or simply gain better control over your finances, a well-crafted budget is an invaluable tool. This comprehensive guide will take you through the essential steps on how to create a budget, empowering you to make informed financial decisions and secure a more secure financial future.

How to Create a Budget?

1. Set Clear Financial Goals

Before diving into the budgeting process, define your financial goals. Whether it’s building an emergency fund, saving for a vacation, or paying off student loans, having specific and measurable goals will guide your budgeting decisions.

2. Gather Financial Information

Collect information about your income, expenses, and debts. Compile pay stubs, bank statements, bills, and any other relevant financial documents. This step provides a comprehensive overview of your financial situation.

3. Categorize Your Expenses

Divide your expenses into fixed and variable categories. Fixed expenses, such as rent or mortgage payments and insurance, remain consistent each month. Variable expenses, like groceries and entertainment, can fluctuate. Categorizing expenses helps identify areas for potential savings.

4. Calculate Your Monthly Income

Determine your total monthly income, including salary, bonuses, freelance income, or any other sources of income. Understanding your monthly income is crucial for establishing a realistic budget.

5. List Your Fixed Expenses:

Write down all fixed expenses, such as rent or mortgage, utilities, insurance, and loan payments. These are recurring costs that remain relatively constant each month.

6. Identify Variable Expenses

Make a list of variable expenses, including groceries, dining out, entertainment, and transportation. Variable expenses can be adjusted based on your financial goals and priorities.

7. Include Savings and Debt Repayment

Prioritize saving and debt repayment in your budget. Allocate a portion of your income to an emergency fund, or retirement savings, and pay off outstanding debts. Treating savings as a non-negotiable expense ensures consistent progress toward financial goals.

8. Factor in Irregular Expenses

Account for irregular or annual expenses, such as insurance premiums, property taxes, or holiday spending. Divide these expenses by 12 to incorporate them into your monthly budget, preventing unexpected financial strain.

9. Subtract Expenses from Income

To better understand how to create a budget, subtract your total expenses from your total income. The result should ideally be a positive number, indicating that your income covers all your expenses. If the result is negative, adjustments may be needed to align your budget with your income.

10. Adjust and Prioritize

If your expenses exceed your income, revisit your budget and identify areas where you can cut back. Prioritize essential expenses and savings goals while minimizing non-essential spending. Adjusting your budget ensures financial sustainability.

11. Embrace the 50/30/20 Rule

Consider following the 50/30/20 rule, where 50% of your income goes to needs (housing, utilities), 30% to wants (entertainment, dining out), and 20% to savings and debt repayment. This rule provides a simple guideline for balanced budgeting.

12. Use Budgeting Tools

Leverage technology to simplify budgeting. Numerous apps and online tools can help you track spending, set financial goals, and visualize your budget in real-time. Choose a tool that aligns with your preferences and makes budgeting more accessible.

13. Track and Review Regularly

Budgeting is an ongoing process, and the answer to “how to create a budget” might differ from person to person. Regularly track your spending against your budget, making adjustments as needed. Reviewing your budget ensures that it remains aligned with your financial goals and adapts to changes in your income or expenses.

14. Emergency Fund Planning

Prioritize building and maintaining an emergency fund within your budget. Having a financial safety net provides peace of mind and protects against unexpected expenses.

15. Seek Professional Advice

If you find budgeting challenging or have complex financial situations, consider seeking advice from financial professionals. Financial advisors can offer personalized guidance to help you achieve your financial objectives.

16. Mindful Spending Habits

Cultivate mindful spending habits as a key aspect of budgeting. Regularly assess your discretionary expenses and identify areas where you can make conscious choices to reduce unnecessary spending. This might include packing lunch instead of dining out or opting for cost-effective entertainment options.

17. Cash Flow Management

Effective budgeting involves managing cash flow strategically. Ensure that you have sufficient funds available for essential expenses and prioritize payment of bills to avoid late fees. Understanding your cash flow cycle helps prevent financial stress and keeps your budget on track.

18. Automate Savings Contributions

Simplify your savings strategy by automating contributions to savings accounts. Setting up automatic transfers ensures that a portion of your income is consistently directed towards savings goals, reinforcing the habit of saving.

19. Celebrate Financial Milestones

Acknowledge and celebrate financial milestones within your budget. Whether it’s reaching a savings goal, paying off a significant portion of debt, or achieving a specific financial target, celebrating successes reinforces positive financial habits and motivates continued progress.

20. Financial Education and Literacy

Invest time in expanding your financial education. Understanding financial principles, investment options, and economic trends empowers you to make informed decisions. Numerous resources, including books, online courses, and workshops, can enhance your financial literacy and contribute to long-term financial success.

Conclusion

Knowing how to create a budget is a fundamental step toward financial empowerment and security. By following these comprehensive steps, you can gain better control over your finances, make informed decisions, and work towards achieving your financial goals. Remember, budgeting is a dynamic process that evolves with your financial journey, so stay committed, stay flexible, and enjoy the benefits of financial well-being.

#BudgetingTips#moneymanagement#SmartSpending#financialwellness#moneymatters#financialliteracy#financialgoals#MoneySmart#wealthbuilding

2 notes

·

View notes