#Miniatm

Explore tagged Tumblr posts

Text

Mini ATM

A Mini ATM is a small, portable electronic device that allows individuals to perform basic banking transactions without visiting a physical bank branch. These devices are often used by agents or small business owners in rural or remote areas to provide banking services to customers who may not have easy access to traditional banking infrastructure.

0 notes

Text

What are the advantages of using EDHA?

As a financial service provider company EDHA Money Serves the nation with the fastest online payment solution for rural India. Here, distributors, retailers and consumers are connected with a safe and secure business chain.

#edhamoney#banking services#digital transactions#financial services#aeps#miniatm#mobile recharge#insurance#investment

0 notes

Photo

Don't worry for high Micro ATM price device because Dogma Soft helps to grow your business in India.

Mostly people don't know that how to check bank transaction, balance inquiry through mobile phone, and they face many technical problems regarding online payment. Mini ATM Machine with fingerprint device is capable for solve this problem. Mini ATM device has been introduced by the fintech Industry and this industry is growing industry. So, If anyone want to open a business, this is a good opportunity. As a shopkeeper or retailer, you can also provide Mini ATM services such as cash withdrawals, balance inquiries, and mini statements to your customers and earn more. Dogma Soft’s Micro ATM price is very reasonable than other companies. So, Through Dogma Soft Mini ATM device a person can help people to providing Mini ATM services and grow thier business.

So, don’t wait for a good time and buy a Mini ATM Machine with Fingerprint device from Dogma Soft to grow your earning.

0 notes

Text

கிரெடிட் கார்டு மூலம் பணம் எடுப்பது குறித்து :

cash from creditcard About withdrawing money by credit card : Transferring Money from Credit Card to Bank Account Online .Find out how to transfer money from credit card to your bank account in a few simple steps, make credit card payment & more. Transferring Money from Credit Card to Bank Account Online .Find out how to transfer money from credit card to your bank account in a few simple steps, make credit card payment & more. Credit Card to Bank Account Money Transfer How To Transfer Money From Credit Card To Bank Account Yes, you can transfer mon jiey from a credit card to a bank account in multiple ways. You can do it online or via direct transfer methods such as…. Credit Card Cash Withdrawal - Top 3 Factors to Consider Withdrawing cash on a Credit Card? Here are the dos and don'ts! Cash advance fee: This is the fee charged every time you withdraw cash using your Credit Card. How to Withdraw Money from Credit Card: Simple Steps Yes, you can withdraw money from a credit card through a process called cash advance. You can Want to transfer money from credit card to bank account? Discover ways to move funds from credit card to bank account and manage your finances effectively. Transferring Money from Credit Card to Bank Account Online .Find out how to transfer money from credit card to your bank account in a few simple steps, make credit card payment & more. கிரெடிட் கார்டு மூலம் பணம் எடுப்பது குறித்து Credit card and corporate credit card and business card to cash Creditcard to cash payment will be made immediately Credit card to cash Payment! instant settlement ! Need money on credit card Need payment from credit card Withdraw money easily by credit card From credit card to cash கிரெடிட் கார்டு மற்றும் corporate credit card இல் இருந்து உடனே பணம் எடுத்து கொடுக்கிறோம்! இந்த குறைந்த கட்டணம் எங்கும் கிடைக்காது ! 1.80 % (Credit card to cash) Lowest charges ever :2% Swipe machine payment immediately! instant settlement ! (Easy & fast & secured ) World wide service available Credit card to cash Send money from credit card to bank account instantly Transfer money from credit card to bank account without any charges How to transfer money from credit card to bank account Transferring money from credit card to bank account online Transfer money from credit card to bank account Best app to transfer money from credit card to bank CreditCardtoCash #cardtobankdebosite #SWIPEMACHINE #MoneyExchange #miniATM #swipe #WithdrawCash #creditcard #CreditCardPayment #BankDeposit #cash #money #moneypoint #cashpoint #corporatecreditcard #businesscreditcard #Creditcardcashwithdrawal #Cashadvance #Creditcardtocashtransfer #ATMwithdrawal #Creditcardcashconversion #Cashextraction #Cardtocash #Instantcash #Creditcardcashdispensation #Cashwithdrawalfee #Cashadvancelimit #Creditcardcashaccess #Cashwithdrawallimit #ATMcashwithdrawal #Creditcardcashservices #Cashdispensationfee #Cardholderagreement #Cashadvanceinterest #Creditcardcashbenefits #Cashbackrewards #Creditcardcashoffers #Cashwithdrawalproces #Cardtocashconversion #Instantcashaccess #Creditcardcashsupport #Cashwithdrawaloptions #Creditcardcashservicesfee #ATMcashdispensation #Creditcardcashfacilities #Cashwithdrawalterms #Creditcardcashconditions #Cashdispensationterms #Cardholdercashaccess #Creditcardcashaccount #Cashwithdrawalhistory#Creditcardcashstatement#Cashtransactionfee#ATMcashwithdrawallimit

Creditcardcashtransfer#Cashconversionrate#Creditcardcashexchange#Internationalcashwithdrawal#Creditcardcashtravel

Cashwithdrawalinsurance#Creditcardcashprotection#Cashtransactionsecurity#Cardholdercashsecurity

Creditcardcashsafety#Cardholder cash updates#Credit card cash management#Cash transaction tracking

Credit card cash record#Cash withdrawal statement#Credit card cash reporting

Cash transaction analysis#Credit card cash insights

Cash withdrawal optimization#Credit card cash planning#Cash transaction budgeting

Credit card cash forecasting#Cash withdrawal strategy#Credit card cash advice

Cash transaction guidance#Cardholder cash support#Credit card cash assistance

Cash withdrawal help#Credit card cash customer service#Credit card cash solutions#Cash withdrawal solutions

Creditcardcashexperts#Cashtransection #Creditcardcashservicesteam#cash withdrawal support team#Creditcardcashassistanceteam#Creditcardcashcustomercar#Cashtransactioncustomercare#Creditcardcashclientservices#Cashtransactionclientservices#Cardholdercashclientsupport#Creditcardcashclientcare

0 notes

Text

கிரெடிட் கார்டு மூலம் பணம் எடுப்பது குறித்து : About withdrawing money by credit card : Transferring Money from Credit Card to Bank Account Online .Find out how to transfer money from credit card to your bank account in a few simple steps, make credit card payment & more. Transferring Money from Credit Card to Bank Account Online .Find out how to transfer money from credit card to your bank account in a few simple steps, make credit card payment & more. Credit Card to Bank Account Money Transfer How To Transfer Money From Credit Card To Bank Account Yes, you can transfer mon jiey from a credit card to a bank account in multiple ways. You can do it online or via direct transfer methods such as…. Credit Card Cash Withdrawal - Top 3 Factors to Consider Withdrawing cash on a Credit Card? Here are the dos and don'ts! Cash advance fee: This is the fee charged every time you withdraw cash using your Credit Card. How to Withdraw Money from Credit Card: Simple Steps Yes, you can withdraw money from a credit card through a process called cash advance. You can Want to transfer money from credit card to bank account? Discover ways to move funds from credit card to bank account and manage your finances effectively. Transferring Money from Credit Card to Bank Account Online .Find out how to transfer money from credit card to your bank account in a few simple steps, make credit card payment & more. கிரெடிட் கார்டு மூலம் பணம் எடுப்பது குறித்து Credit card and corporate credit card and business card to cash Creditcard to cash payment will be made immediately Credit card to cash Payment! instant settlement ! Need money on credit card Need payment from credit card Withdraw money easily by credit card From credit card to cash கிரெடிட் கார்டு மற்றும் corporate credit card இல் இருந்து உடனே பணம் எடுத்து கொடுக்கிறோம்! இந்த குறைந்த கட்டணம் எங்கும் கிடைக்காது ! 1.80 % (Credit card to cash) Lowest charges ever :2% Swipe machine payment immediately! instant settlement ! (Easy & fast & secured ) World wide service available Credit card to cash Send money from credit card to bank account instantly Transfer money from credit card to bank account without any charges How to transfer money from credit card to bank account Transferring money from credit card to bank account online Transfer money from credit card to bank account Best app to transfer money from credit card to bank CreditCardtoCash #cardtobankdebosite #SWIPEMACHINE #MoneyExchange #miniATM #swipe #WithdrawCash #creditcard #CreditCardPayment #BankDeposit #cash #money #moneypoint #cashpoint #corporatecreditcard #businesscreditcard #Creditcardcashwithdrawal #Cashadvance #Creditcardtocashtransfer #ATMwithdrawal #Creditcardcashconversion #Cashextraction #Cardtocash #Instantcash #Creditcardcashdispensation #Cashwithdrawalfee #Cashadvancelimit #Creditcardcashaccess #Cashwithdrawallimit #ATMcashwithdrawal #Creditcardcashservices #Cashdispensationfee #Cardholderagreement #Cashadvanceinterest #Creditcardcashbenefits #Cashbackrewards #Creditcardcashoffers #Cashwithdrawalproces #Cardtocashconversion #Instantcashaccess #Creditcardcashsupport #Cashwithdrawaloptions #Creditcardcashservicesfee #ATMcashdispensation #Creditcardcashfacilities #Cashwithdrawalterms #Creditcardcashconditions #Cashdispensationterms #Cardholdercashaccess #Creditcardcashaccount #Cashwithdrawalhistory#Creditcardcashstatement#Cashtransactionfee#ATMcashwithdrawallimit

Creditcardcashtransfer#Cashconversionrate#Creditcardcashexchange#Internationalcashwithdrawal#Creditcardcashtravel

Cashwithdrawalinsurance#Creditcardcashprotection#Cashtransactionsecurity#Cardholdercashsecurity

Creditcardcashsafety#Cardholder cash updates#Credit card cash management#Cash transaction tracking

Credit card cash record#Cash withdrawal statement#Credit card cash reporting

Cash transaction analysis#Credit card cash insights

Cash withdrawal optimization#Credit card cash planning#Cash transaction budgeting

Credit card cash forecasting#Cash withdrawal strategy#Credit card cash advice

Cash transaction guidance#Cardholder cash support#Credit card cash assistance

Cash withdrawal help#Credit card cash customer service#Credit card cash solutions#Cash withdrawal solutions

Creditcardcashexperts#Cashtransection #Creditcardcashservicesteam#cash withdrawal support team#Creditcardcashassistanceteam#Creditcardcashcustomercar#Cashtransactioncustomercare#Creditcardcashclientservices#Cashtransactionclientservices#Cardholdercashclientsupport#Creditcardcashclientcare

0 notes

Text

Micro atm

In India, the traditional banking system remains out of reach for many people due to a lack of knowledge about financial and technological literacy, especially in non-metropolitan cities. This creates a problem because a vast majority of the population still depends on cash-based transactions. And since banks and ATMs are not always easy to reach in India, people often face problems when trying to withdraw cash.

Hence, payRup has introduced its microATM, a handheld device that will enable retail and merchant/shop store owners all over the country to turn their shops into miniATMs!

Ways in which MicroATM benefits you as an eShop merchant:

1.By using payRup’s microATM machine, you can offer cash withdrawal and balance inquiry services to your customers. This innovative method improves customer satisfaction and loyalty, allowing your business to offer a more convenient and innovative cash handling solution.

2. By offering seamless cash withdrawals, the MicroATM simplifies tasks like money withdrawals and balance checks, thereby eliminating confusing steps and long queues and making withdrawals simple, seamless, and stress-free.

Gain commission on every swipe, avail micro-ATM services, and enjoy commissions.

MicroATM is a great source of revenue for merchant and shop owners as it is a great opportunity to offer financial services to the unbanked Indian population. payRup’s microATM empowers your business growth and helps you turn your eShop into a miniATM! . If you are not a merchant on payRup and want to avail microATM and other services, visit eshop.payrup.com. Join PayRup eShop now!

0 notes

Text

Introducing BANKIT Lite App: A One-stop Solution for all Banking needs

In today's fast-paced world, digital banking has become an essential part of our lives. However, there are a few segments of society that lack access to basic financial services. People living in unbanked areas and people who don’t own smartphones, laptops, and internet connection are the worst sufferers.

BANKIT Lite is a revolutionary platform that empowers senior citizens to bridge this gap and provide banking services to the underserved population. BANKIT Lite understands the importance of utilizing one's time and skills to serve the community. By providing senior citizens with an opportunity to contribute to society, BANKIT Lite enables them to empower the digitally underserved members of their community with essential banking, financial, and payment services.

This platform serves as a catalyst for senior citizens to make a positive difference and utilize their free time effectively!

Services BANKIT Lite Offers

BANKIT Lite offers a range of services that empower senior citizens to provide comprehensive banking assistance to their community members. These services include:

Domestic Money Transfer Service: Senior citizens can facilitate secure money transfers to any bank in India. This service enables people to transfer money to any bank account conveniently, fostering economic transactions within the community.

Aadhaar ATM Service: A service that allows people to withdraw cash from their bank accounts using Aadhaar-based authentication. Senior citizens can assist their community members in accessing cash conveniently and securely.

MiniATM Service: BANKIT Lite enables senior citizens to offer cash withdrawal through miniATM, allowing people to withdraw cash from their bank accounts easily. This service eliminates the need for individuals to visit distant bank branches, making banking more accessible for the underserved population.

Prepaid Recharges Service: BANKIT Lite allows to assist individuals in recharging their prepaid services effortlessly. Whether it's mobile recharge or DTH services, retired individuals can help community members stay connected without any hassle.

Utility Bill Payments: senior citizens can provide a convenient service for paying utility bills. Whether it's electricity, water, gas, or other services, BANKIT Lite enables retirees to assist their community members in managing their bills conveniently.

How to Use BANKIT Lite App?

BANKIT Lite App is a revolutionary mobile application designed to provide convenient and easy-to-use digital banking, financial, and payment services to senior citizens. With this app, users can perform a variety of transactions such as money transfers, cash withdrawals, recharge, and more, all from the comfort of their own homes.

If you’re interested in using the BANKIT Lite App, follow these simple steps:

Download the app: You can download the BANKIT Lite App from the Google Play Store.

Register: Once you have downloaded the app, register by providing your name, mobile number, and other required details. This step is crucial as it will allow you to create your account and access all the features of the app.

Purchase Plan: Depending on your need, purchase a BANKIT Lite plan. You can also purchase a MiniATM device and biometric device to use the cash withdrawal service of BANKIT Lite.

KYC: To use the BANKIT Lite App, you will need to complete the KYC (Know Your Customer) process. This process is mandatory and involves verifying your identity by providing certain documents such as your Aadhaar card and PAN card. Once your KYC is complete, you will be able to access all the features of the app.

Start transacting: You can now start transacting using the BANKIT Lite App. Choose the transaction type you want to perform, enter the required details, and confirm the transaction.

Earn commissions: The BANKIT Lite App offers an excellent opportunity for senior citizens to earn commissions by performing transactions on the app. With every transaction they perform, they can earn a commission, which will be credited to their account. This is a great way to earn some extra money from the comfort of their own home.

Empowerment of Senior Citizens with Digital Banking Business

Senior citizens can play an active role in their community by offering essential banking services to the underserved population. With a mission to enable people to serve their community and a vision to increase financial inclusion, BANKIT Lite provides a convenient, user-friendly, and inclusive platform for senior citizens to make a significant impact.

By bridging the gap between people and digital banking, BANKIT Lite empowers senior citizens to serve their community members, including those who are digitally underserved. Through services like Domestic Money Transfer, Aadhaar ATM, MiniATM, prepaid recharges, and utility bill payments, senior citizens can become the banker of their neighbourhood, providing their community with accessible and modern financial services.

By joining BANKIT Lite, senior citizens not only contribute to their community's welfare but also find purpose and fulfilment in utilizing their skills and free time effectively. They become key drivers of financial inclusion, empowering the underprivileged and unbanked sections of society.

So, if you're a senior citizen looking for a meaningful way to make a difference in your community, consider joining BANKIT Lite. Together, we can bridge the gap in digital banking and financial services, empower the underserved, and increase financial inclusion.

Join BANKIT Lite today and become a part of the movement towards a more inclusive and empowered society. Together, let's serve our community and create positive change through convenient and user-friendly banking services. Remember, it's never too late to make a difference. Start your journey with BANKIT Lite and leave a lasting impact on your community!

1 note

·

View note

Photo

Don't let your business plan go in vain, when you have on option of chasing the multiple services to start a great business with why less investment Dogma Soft franchise which offers over 100 services like APES, PAN Center, Mobile Recharge, Car & Bike Insurance, BBPS etc. where You’ll earned money by providing all these facilities to your customers in your area.

#AEPS#miniATM#MoneyTransfer#BBPS#AEPsServiceProvider#ElectricityBillPayments#Car&BikeInsurance#Franchisee#Services#PrepaidCardRecharge#DThRecharge#InsurancePayment#NewBusiness#Startups#StartupIndia#SmallBusiness#DogmaSoft

1 note

·

View note

Text

Aeps Services

AEPS stands for "Aadhaar Enabled Payment System." It is a digital payment system in India that allows customers to perform basic banking transactions using their Aadhaar number and biometric authentication, such as fingerprint or iris scan. AEPS Services typically include the following:

0 notes

Text

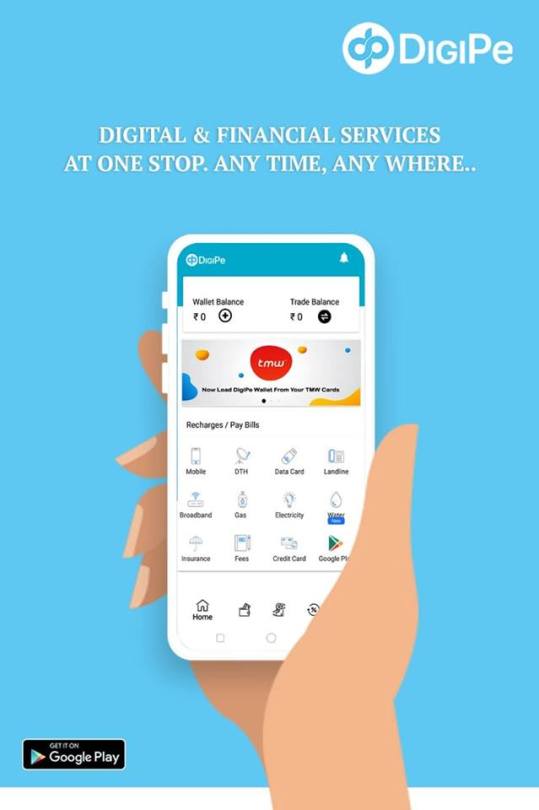

DigiPe Digital and Financial Services

Get all Digital and Financial Services at One stop. DigiPe

Visit: https://digipe.co

contact:- 9853996666

Mail us:- [email protected]

#financialservices#paymentservices#billpayment#digitalpayments#moneytransfer#travelservices#miniatm#prepaidcards#bankingservices#dth/mobilerecharge#digipe

1 note

·

View note

Photo

मात्र 480/- रुपये में Dogma Soft Limited जैसी विश्वसनीय कंपनी (1 लाख से आधिक फ्रैंचाइज़ी) की Franchisee लेकर अपने महीने की Income बढ़ाएं, अभी जुड़े व नीचे दी सर्विसेज का लाभ उठाए :

AEPS, पैन कार्ड पोर्टल, मनी ट्रांसफर सर्विस, बिजली बिल, रिचार्ज, EMI पेमेंट, कार/ बाइक इंश्योरेंस के साथ एक ही पोर्टल में 100 से आधिक IT Services अभी ले

Get Additional Services like Mini ATM, GST Registration/Taxation Center etc with 100+ IT Services & 500+ Products on Single wallet with the Most Powerful Earning Platform: Dogma Soft

1 note

·

View note

Text

கிரெடிட் கார்டு மூலம் பணம் எடுப்பது குறித்து : About withdrawing money by credit card : Transferring Money from Credit Card to Bank Account Online .Find out how to transfer money from credit card to your bank account in a few simple steps, make credit card payment & more. Transferring Money from Credit Card to Bank Account Online .Find out how to transfer money from credit card to your bank account in a few simple steps, make credit card payment & more. Credit Card to Bank Account Money Transfer How To Transfer Money From Credit Card To Bank Account Yes, you can transfer mon jiey from a credit card to a bank account in multiple ways. You can do it online or via direct transfer methods such as…. Credit Card Cash Withdrawal - Top 3 Factors to Consider Withdrawing cash on a Credit Card? Here are the dos and don'ts! Cash advance fee: This is the fee charged every time you withdraw cash using your Credit Card. How to Withdraw Money from Credit Card: Simple Steps Yes, you can withdraw money from a credit card through a process called cash advance. You can Want to transfer money from credit card to bank account? Discover ways to move funds from credit card to bank account and manage your finances effectively. Transferring Money from Credit Card to Bank Account Online .Find out how to transfer money from credit card to your bank account in a few simple steps, make credit card payment & more. கிரெடிட் கார்டு மூலம் பணம் எடுப்பது குறித்து Credit card and corporate credit card and business card to cash Creditcard to cash payment will be made immediately Credit card to cash Payment! instant settlement ! Need money on credit card Need payment from credit card Withdraw money easily by credit card From credit card to cash கிரெடிட் கார்டு மற்றும் corporate credit card இல் இருந்து உடனே பணம் எடுத்து கொடுக்கிறோம்! இந்த குறைந்த கட்டணம் எங்கும் கிடைக்காது ! 1.80 % (Credit card to cash) Lowest charges ever :2% Swipe machine payment immediately! instant settlement ! (Easy & fast & secured ) World wide service available Credit card to cash Send money from credit card to bank account instantly Transfer money from credit card to bank account without any charges How to transfer money from credit card to bank account Transferring money from credit card to bank account online Transfer money from credit card to bank account Best app to transfer money from credit card to bank CreditCardtoCash #cardtobankdebosite #SWIPEMACHINE #MoneyExchange #miniATM #swipe #WithdrawCash #creditcard #CreditCardPayment #BankDeposit #cash #money #moneypoint #cashpoint #corporatecreditcard #businesscreditcard #Creditcardcashwithdrawal #Cashadvance #Creditcardtocashtransfer #ATMwithdrawal #Creditcardcashconversion #Cashextraction #Cardtocash #Instantcash #Creditcardcashdispensation #Cashwithdrawalfee #Cashadvancelimit #Creditcardcashaccess #Cashwithdrawallimit #ATMcashwithdrawal #Creditcardcashservices #Cashdispensationfee #Cardholderagreement #Cashadvanceinterest #Creditcardcashbenefits #Cashbackrewards #Creditcardcashoffers #Cashwithdrawalproces #Cardtocashconversion #Instantcashaccess #Creditcardcashsupport #Cashwithdrawaloptions #Creditcardcashservicesfee #ATMcashdispensation #Creditcardcashfacilities #Cashwithdrawalterms #Creditcardcashconditions #Cashdispensationterms #Cardholdercashaccess #Creditcardcashaccount #Cashwithdrawalhistory#Creditcardcashstatement#Cashtransactionfee#ATMcashwithdrawallimit

Creditcardcashtransfer#Cashconversionrate#Creditcardcashexchange#Internationalcashwithdrawal#Creditcardcashtravel

Cashwithdrawalinsurance#Creditcardcashprotection#Cashtransactionsecurity#Cardholdercashsecurity

Creditcardcashsafety#Cardholder cash updates#Credit card cash management#Cash transaction tracking

Credit card cash record#Cash withdrawal statement#Credit card cash reporting

Cash transaction analysis#Credit card cash insights

Cash withdrawal optimization#Credit card cash planning#Cash transaction budgeting

Credit card cash forecasting#Cash withdrawal strategy#Credit card cash advice

Cash transaction guidance#Cardholder cash support#Credit card cash assistance

Cash withdrawal help#Credit card cash customer service#Credit card cash solutions#Cash withdrawal solutions

Creditcardcashexperts#Cashtransection #Creditcardcashservicesteam#cash withdrawal support team#Creditcardcashassistanceteam#Creditcardcashcustomercar#Cashtransactioncustomercare#Creditcardcashclientservices#Cashtransactionclientservices#Cardholdercashclientsupport#Creditcardcashclientcare

0 notes

Text

Micro ATM Banking Solutions

In India, the traditional banking system remains out of reach for many people due to a lack of knowledge about financial and technological literacy, especially in non-metropolitan cities. This creates a problem because a vast majority of the population still depends on cash-based transactions. And since banks and ATMs are not always easy to reach in India, people often face problems when trying to withdraw cash.

Hence, payRup has introduced its microATM, a handheld device that will enable retail and merchant/shop store owners all over the country to turn their shops into miniATMs!

Ways in which MicroATM benefits you as an eShop merchant:

1.By using payRup’s microATM machine, you can offer cash withdrawal and balance inquiry services to your customers. This innovative method improves customer satisfaction and loyalty, allowing your business to offer a more convenient and innovative cash handling solution.

2. By offering seamless cash withdrawals, the MicroATM simplifies tasks like money withdrawals and balance checks, thereby eliminating confusing steps and long queues and making withdrawals simple, seamless, and stress-free.

Gain commission on every swipe, avail micro-ATM services, and enjoy commissions.

MicroATM is a great source of revenue for merchant and shop owners as it is a great opportunity to offer financial services to the unbanked Indian population. payRup’s microATM empowers your business growth and helps you turn your eShop into a miniATM! . If you are not a merchant on payRup and want to avail microATM and other services, visit eshop.payrup.com. Join PayRup eShop now!

0 notes

Text

Read Latest Blogs & Updates Here | EDHA

Discover and read articles on financial services, digital payment solutions, online transactions and many more. Update yourself with the latest news and updates on EDHA.

#edhamoney#blogs#insurance#investment#bill payment#aeps#miniatm#mobile recharge#banking services#ecommerce

0 notes

Photo

Prepping a business is the first step towards fulfilling your dream of being an entrepreneur and to make this dream a reality with a leading company like Dogma Soft that has brought you the opportunity to have your own business at just Rs.480 / - in which you can earn additional income by using more than 100+ IT AEPS, Pan Card, Money Transfer, Prepaid Card Recharge, Insurance, TrainTickets Booking services such as:

जहाँ आप सबसे कम पैसो में यानि मात्र Rs.480 / - में अपना खुद का व्यवसाय शुरू कर सकते है वो भी Dogma Soft Limited जैसी Top Company के साथ तो इंतजार किस बात का क्योंकि कमाई है कई गुना ज्यादा ! यहाँ आपको 100 से भी अधिक सेवाओं के साथ अधिक पैसा कमाए जैसे - AEPS, Pan Card, Money Transfer, Prepaid Card Recharge, Insurance, TrainTickets Booking Services etc.

#AEPS#miniatm#MoneyTransfer#BBPS#MobileRechrge#PanCard#franchisee#ServiceProvider#BusBooking#FlightBooking#aepsserviceprovider#ServiceCenter#InsuranceService#NewBusiness#OnlineEntrepreneurship#Covid19#DogmaSoft

1 note

·

View note

Text

Mini ATM

A "Mini ATM" is a small, portable device that allows individuals to perform basic banking transactions and access their bank accounts without visiting a traditional bank branch. These devices are often used in rural or remote areas where access to physical bank branches is limited. Here are some common features and functions of a Mini ATM:

0 notes