#Lower insurance rates

Explore tagged Tumblr posts

Text

Easy self-paced online traffic school. 100% Internet-based course

Online traffic school courses California traffic ticket dismissal DMV approved traffic school Traffic violation points removal Speeding ticket resolution course Defensive driving education Court accepted certificates Lower insurance rates Convenient online classes Traffic ticket school FAQs

California drivers.

Know more about: traffic.trafficticket247.com

#Online traffic school courses#California traffic ticket dismissal#DMV approved traffic school#Traffic violation points removal#Speeding ticket resolution course#Defensive driving education#Court accepted certificates#Lower insurance rates#Convenient online classes#Traffic ticket school FAQs#California drivers.

78 notes

·

View notes

Text

Online traffic school courses California traffic ticket dismissal DMV approved traffic school Traffic violation points removal Speeding ticket resolution course Defensive driving education Court accepted certificates Lower insurance rates Convenient online classes Traffic ticket school FAQs California drivers

#Online traffic school courses#California traffic ticket dismissal#DMV approved traffic school#Traffic violation points removal#Speeding ticket resolution course#Defensive driving education#Court accepted certificates#Lower insurance rates#Convenient online classes#Traffic ticket school FAQs#California drivers

91 notes

·

View notes

Text

Teaching driving and traffic school for two decades.

Our staff understands what courts and the dmv want from Traffic School and we provide it to you in our easy-to-use online service. We take care of your ticket so it will never be seen by any insurance company.

Defensive driving education Court accepted certificates Lower insurance rates Convenient online classes Traffic ticket school FAQs , California Drivers,

Online traffic school, Speeding, California, Points, License

#Online traffic school#Speeding#California#Points#License#Defensive driving education#Court accepted certificates#Lower insurance rates#Convenient online classes#Traffic ticket school FAQs#California Drivers

83 notes

·

View notes

Text

Why Take Traffic School?

The best reason to take our easy, fast, and cheap traffic school online is your insurance rates will rise 20% extra for the next three years without it.

Fast & Easy Course

Only takes about two hours to do the traffic school from start to finish.

At Your Own Pace Anytime

Take the course anytime from any device during any time of the day. Saves your spot as you go so you never lose your work.

No Extra Fees Required

Our course gives you everything you need for $34.95.

Good for Any Courthouse

On signup you choose your courthouse you paid your ticket to, that is where we send your completion to.

Online traffic school courses

#Online traffic school courses#California DMV approved#Traffic ticket dismissal#Lower insurance rates#Court accepted certificates#Speeding ticket resolution#Defensive driving education#Traffic violation points removal#Convenient online classes#Customer support services#California drivers

76 notes

·

View notes

Text

Simple points to cut your car insurance rates

With regards to auto protection, Perth drivers are all very much aware this can be a standout amongst the most unreasonable parts of vehicle proprietorship. While essential auto protection is required, regularly the expense of the vehicle and the measure of exceptional fund warrants an all the more unreasonable and far reaching level of spread. Luckily, there are various approaches to cut the expense of auto protection, Western Australia drivers can profit by.

Alter Your Excess: A standout amongst the best approaches to lessen the expense of auto insurance online, Perth drivers ought to consider is to modify your arrangement overabundance. On the off chance that you decide on a higher overabundance, it could have a huge impact of decreasing the expense of your approach. While you have to approach this procedure with a little thought to guarantee that it is still monetarily reasonable in the occasion of a mischance, you will find that you can quickly profit by this.

Survey Your Coverage: While extensive protection is a smart thought in the event that you have a more up to date vehicle with exceptional account, it is regularly restrictive on the off chance that you have a more seasoned auto. On the off chance that the estimation of your auto is not that high, you may find that you are paying great over the chances on an exhaustive arrangement. You have to evaluate your scope and decide how much the strategy would pay out in the occasion the vehicle is composed off. In the event that after the abundance, you would just be left with several hundred dollars, it may not be worth paying for the additional scope.

Advise the Company About Anti Theft Devices: Most cutting edge autos as of now have aloof and dynamic hostile to burglary and well being frameworks fitted as standard. While the back up plan is prone to as of now know about standard components on your vehicle, it is still worth telling them the particular gadgets. This is particularly the case on the off chance that you have had an after sales gadget fitted. You might be wonderfully astonished at the rebate you can meet all requirements for as your vehicle has a diminished shot of being stolen.

Avoid Drivers: While you may have high schoolers in your family who might love to drive your vehicle, odds are keeping them on your strategy is extraordinarily expanding the expense of your car insurance USA. American drivers ought to consider barring certain drivers from their scope to lessen the expenses. This means you may need to confine which autos in your family unit youthful drivers may utilize yet you are prone to find that the expense of your protection drops significantly.

Try not to Put in a Small Claim: Auto protection is intended to shield you from a noteworthy money related misfortune, so you should consider whether it is monetarily reasonable to put in any littler cases. For instance, in the event that you have a minor knock and the evaluation for the harm is just a few hundred dollars over your arrangement abundance, it is likely a smart thought to handle it autonomously.

If you are searching for an aggressive quote on your auto protection, Perth drivers ought to get in touch with us. We are an approved Subaru dealership with a wide determination of both new and utilized vehicle, and access to restrictive protection bargains. Our business group would be cheerful to answer your inquiries and give a quote.

#car insurance#cheap car insurance#auto insurance#insurance#how to lower insurance#lower car insurance#how to lower car insurance#how to lower your car insurance#car insurance rates#car insurance discounts#best auto insurance#car insurance explained#vehicle insurance#how to get cheap insurance#how to get lower car insurance rates#lower insurance rates#best car insurance#where to get the best rates on car insurance#insurance rate#car insurance quotes

0 notes

Text

Worldwide Insurance Companies along with detailed information

Gathering a complete list of all insurance companies worldwide, along with detailed information about each, is a vast and complex task. The number of insurance companies globally is in the thousands, varying across regions and industries (life, health, property, casualty, etc.). Additionally, companies frequently merge, change names, or cease operations, which makes maintaining an up-to-date list…

#Allianz#Auto Insurance#AXA#Berkshire Hathaway#Business Insurance#Check for Discounts and Benefits#China Life Insurance#clarity of policy information#Credit Score#Critical Illness Insurance#customer experience#customer service#financial stability#Group Health Insurance#High ratings#Homeowners Insurance#Individual Health Insurance#insurance companies#Insurance company#insurance company&039;s#investment#Investment Performance#Life insurance#lower risk#MetLife#Monitor and Review#Munich Re#New York Life insurance#Northwestern Mutual#Pet Insurance

5 notes

·

View notes

Text

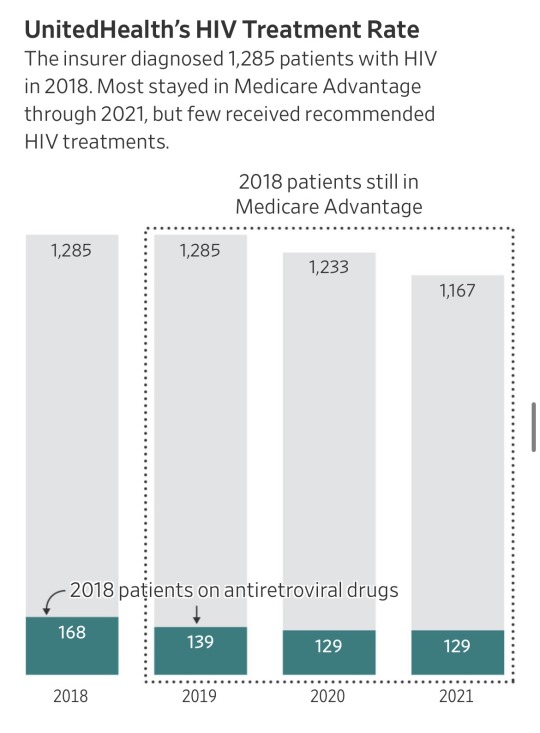

“It seems like almost all of those people don’t have HIV,” said Jennifer Kates, HIV policy director at KFF, a health-research nonprofit. “If they did, that would be substandard care at a pretty severe level,” she said.

Ya’ll. United Health just got accused of $17 billion in medicare fraud.

Basically they made up diagnosis which are improbable or impossible, “forgot” to remove ones which had been cured, and overall allegedly stole billions from taxpayers.

The government pays insurers a base rate for each Medicare Advantage member. The insurers are entitled to extra money when their patients are diagnosed with certain conditions that are costly to treat.

… About 18,000 Medicare Advantage recipients had insurer-driven diagnoses of HIV, the virus that causes AIDS, but weren’t receiving treatment for the virus from doctors, between 2018 and 2021, the data showed. Each HIV diagnosis generates about $3,000 a year in added payments to insurers.

… He said internal company data for 2022 showed a treatment rate for patients UnitedHealth diagnosed with HIV of more than triple what the Journal found. He said the pandemic disrupted care, lowering treatment rates during the period analyzed by the Journal, and that the analysis failed to account for patients who started treatments in future years.

The Medicare data, however, show UnitedHealth’s patients with insurer-driven HIV diagnoses were on the antiretrovirals at low rates even before the pandemic, and hardly any started the drugs in the years after UnitedHealth diagnosed them.

Source: https://www.wsj.com/health/healthcare/medicare-health-insurance-diagnosis-payments-b4d99a5d

I bet United Health really wishes it was a different week right now.

UPDATE/EDIT: Article is from July. I didn’t notice myself since it came up in my news feed. Don’t always trust the internet to be time accurate. 😎My guess is it is getting promoted due to current events. However, there are some updates concerning actions taken based on the report which you can look into by checking the authors’ other articles.

17K notes

·

View notes

Text

The economic indicators speak of nothing less than an economic catastrophe. Over 46,000 businesses have gone bankrupt, tourism has stopped, Israel’s credit rating was lowered, Israeli bonds are sold at the prices of almost “junk bonds” levels, and the foreign investments that have already dropped by 60% in the first quarter of 2023 (as a result of the policies of Israel’s far-right government before October 7) show no prospects of recovery. The majority of the money invested in Israeli investment funds was diverted to investments abroad because Israelis do not want their own pension funds and insurance funds or their own savings to be tied to the fate of the State of Israel. This has caused a surprising stability in the Israeli stock market because funds invested in foreign stocks and bonds generated profit in foreign currency, which was multiplied by the rise in the exchange rate between foreign currencies and the Israeli Shekel. But then Intel scuttled a $25 billion investment plan in Israel, the biggest BDS victory ever. These are all financial indicators. But the crisis strikes deeper at the means of production of the Israeli economy. Israel’s power grid, which has largely switched to natural gas, still depends on coal to supply demand. The biggest supplier of coal to Israel is Colombia, which announced that it would suspend coal shipments to Israel as long as the genocide was ongoing. After Colombia, the next two biggest suppliers are South Africa and Russia. Without reliable and continuous electricity, Israel will no longer be able to pretend to be a developed economy. Server farms do not work without 24-hour power, and no one knows how many blackouts the Israeli high-tech sector could potentially survive. International tech companies have already started closing their branches in Israel. Israel’s reputation as a “startup nation” depends on its tech sector, which in turn depends on highly educated employees. Israeli academics report that joint research with universities abroad has declined sharply thanks to the efforts of student encampments. Israeli newspapers are full of articles about the exodus of educated Israelis. Prof. Dan Ben David, a famous economist, argued that the Israeli economy is held together by 300,000 people (the senior staff in universities, tech companies, and hospitals). Once a significant portion of these people leaves, he says, “We won’t become a third world country, we just won’t be anymore.”

19 July 2024

6K notes

·

View notes

Text

#loan junction#loan in lucknow#finance agencies near me#loan provider near me#personal loan in lucknow#home loan service provider in lucknow#Loan Against Property service provider in lucknow#Business Loan service provider in lucknow#Personal Loan service provider in lucknow#Auto Loan service provider in lucknow#Commercial Property Loan service provider in lucknow#Gold loan service provider in lucknow#How to Choose the Life Insurance Policy?#best loan eligibility check website in lucknow#Home loan calculator#home loan eligibility#Mortgage loan#Mortgage loan calculator#lower rate loan provider#Online loan provider#Online personal loan provider#hdfc home loan#icici bank home loan#sbi home loan interest rate

1 note

·

View note

Text

How to Save on Car Insurance: Smart Ways to Lower Your Rate?

Remember the time when you almost hit the neighborhood tree with your car? Well, fortunately, nothing happened, but what if…Even we wouldn’t like to complete the sentence.

Insuring your car, today stands out to be one of the most important things. But given the inflation out there, it’s difficult to get your hands on economical yet good insurance for your car. Keep this very thing in mind, Car Kharido Becho 24 has come up with this blog on saving a decent amount on your vehicle’s insurance costs. Go through these tips to reduce your car insurance costs:

Compare Insurance Providers: Shop around and compare insurance policies from different providers to find the best coverage at the most affordable price. Don’t settle for the first offer you receive.

Opt for a Higher Deductible: You can lower your insurance premium by choosing a higher deductible. However, make sure you can afford to pay the deductible amount in case of a claim. By selecting a higher deductible, you can lower your premium amount. Just ensure you can afford to pay the deductible in case of a claim.

source link

0 notes

Text

Lower your insurance rates with this one weird trick

690 notes

·

View notes

Note

On insurance: I still live with my parents and don't know a lot yet about the sorts of things adults usually have to spend money on. I've always been skeptical of things like insurance and credit cards because it seems to me they wouldn't be selling that if they didn't expect to make money from it. I talked to my cousin a while ago about credit cards and basically came to the conclusion that they do that because they're betting on the customer getting sloppy and letting their debts stack up, and the way you beat that and get money from credit card companies is just by being careful.

I'm a little more confused about insurance though because it seems much more straightforwardly like a gamble they will simply not take if it won't pay off for them. Like, you don't go to a casino because every game they play at a casino is one they've done the math on and have determined that statistically most people will lose money on most of the time. Is insurance not kinda the same? Where they estimate the risk and then charge you an amount calculated to make sure it probably won't be worth it for you?

I know if you have a car you legally need car insurance so everyone knows you can pay for another car if you crash into someone, and I gather that here in the US at least health insurance companies have some kinda deal with hospitals so that the prices go down or something, and there's a reason I don't fully understand why not having health insurance is Really Bad. But we get to pet insurance, or like when I buy a concert ticket and it offers ticket insurance in case I can't make it to the show, and surely if they thought they were gonna lose money on that they just wouldn't sell it, right? Or they'd raise the price of it until it became worth the risk that something bad actually will happen? Wouldn't it only be worth it to buy insurance if you know something the insurance company doesn't?

So the deal is that most people don't use their insurance much, and often insurance companies will incentivize doing things that will make you use your insurance less.

So, for example, you can get a discount on car insurance if you have multiple cars because people who insure multiple cars are more likely to be responsible drivers (the ability to pay for multiple cars stands in as a representation of responsibility here). The longer you go without an accident, the lower your premiums get because that means that you are not costing your insurance company anything but you are paying into the system. The car insurance company's goal is to have the most responsible, safest drivers who never get into car accidents because they can predict (roughly) how much they're going to have to pay out to their customers and they want the number they pay out to be lower than what's paid in. So they try to discourage irresponsible drivers by raising their rates and encourage responsible drivers by giving them discounts.

Health insurance companies often do the same thing: I recently got a gift card from my health insurance company because I had a visit from a nurse who interviewed me about my overall health and made sure I had stable blood pressure and access to medications. It is literally cheaper for my insurance company to give me a $100 giftcard and hire a nurse to visit me than it is for me to go to my doctor's office a couple of times, so they try to make sure that their customers are getting preventative care and are seeing inexpensive medical professionals regularly so that they don't have to suddenly see very expensive professionals after a long time without care.

Insurance in the US has many, many, many problems and should be replaced with socialized healthcare for a huge number of reasons but right now, because it is an insurance-based system, you need to have insurance.

We're going to use Large Bastard as an example.

Large Bastard had insurance when he had his heart attack and when he needed multiple organs transplanted. He didn't *want* to be paying for insurance, because he thought he was healthy enough to get by, but I insisted. His premium is four hundred dollars a month, and his out of pocket maximum is eight thousand dollars a year. That means that every year, he pays about $5000 whether he uses his insurance or not, and if he DOES need to use the insurance, he pays the first $8k worth of care, so every year his insurance has the possibility of costing him thirteen thousand dollars.

The bill for his bypass surgery was a quarter million dollars.

The bill for his transplant was over one and a half million dollars.

His medication each month is around six hundred dollars. He needs to have multiple biopsies - which are surgeries - each year, and each one costs about twenty thousand dollars.

Without health insurance, he would very likely be dead, or we would be *even more* incapable of paying for his healthcare than we are right now. He almost ditched his insurance because he was a healthy-seeming 40-year-old and he didn't think he'd get sick. And then he proceeded to be the sickest human being I've ever known personally who did not actually die.

Health insurance costs a lot of money. It costs less money for people who are young and who are expected to be healthy. But the thing is, everybody pays into health insurance, and very, very few people end up using as much money for their medical expenses as Large Bastard did. There are a few thousand transplants in the US ever year, but there are hundreds of millions of people paying for insurance.

This ends up balancing out (sort of) so that people who pay for insurance get a much lower cost on care if they need it, hospitals get paid for the care they provide, and the insurance company makes enough money to continue to exist. Part of the reason that people don't like this scheme is because "insurance company" could feasibly be replaced by "government" and it would cost less and provide a better standard of care, but again, with things as they are now, you need to have insurance. Insurance companies are large entities that are able to negotiate down costs with the providers they work with, you are not. If you get hit by a car you may be able to get your medical bills significantly reduced through a number of means, but you're very unlikely to get your bills lower than the cost of insurance and a copay.

Because of the Affordable Care Act, which is flawed but which did a LOT of good, medical insurance companies cannot refuse to treat you because of preexisting conditions and also cannot jack up your premiums to intolerable rates - since Large Bastard got sick, he has had the standard price increases you'd expect from aging, but nothing like the gouging you might expect from an insurance company deciding you're not worth it.

Pet insurance works on the same model. Millions of people pay for the insurance, thousands of people end up needing it, a few hundred end up needing a LOT of it, and the insurance companies are able to make more money than they hand out, so they continue to exist. This is part of why it's less expensive to get pet insurance for younger animals - people who sign up puppies and kittens are likely to be paying for a very long time and are likely to provide a lot of preventative care for their animals, so they're a good bet for the insurer. Animals signed up when they are older are more likely to have health problems (and pet insurance CAN turn animals away for preexisting conditions) and are going to cost the insurance companies more, so they cost more to enroll (and animals over a certain age or with certain conditions may be denied entirely).

This weighing risk/reward is called actuarial science, and the insurance industry is built on it.

But yeah it's kind of betting. The insurance company says "I'll insure ten thousand dogs and I'm going to bet that only a hundred of them will need surgery at some point in the next year" and if they're correct, they make money and the dogs who need surgery get their surgery paid for out of the premiums from the nine thousand nine hundred dogs who didn't need surgery.

Your assessment of credit is correct: credit card companies expect that you will end up carrying a balance, and that balance will accrue interest, and the interest is how they make the money.

And it is EASY to fuck up financially as an adult. REALLY EASY. But you are still likely to need a good credit score so you will need a credit history. That means that the correct way to use a credit card is to have a card, but not carry a balance.

To do this, never buy anything on the card that you can't afford. In order to avoid needing the card for emergencies, start an emergency fund that is at least 3 months of your total pay *before* you get a credit card. That seems like a *lot* of savings to have, but from the perspective of someone who has had plenty of mess-ups, it's a lot easier to build up a $10k emergency fund than it is to pay off a $10k credit card debt.

If you don't understand how interest works on credit cards, or why a 10k savings is different than a 10k debt, here are some examples working with $10k of debt, 23% interest (an average-ish rate for people with average credit), and various payments.

With that debt and that interest, here's how much it costs and how long it would take to pay off with $200 as the monthly payment:

Fourteen years, and it would cost you about twenty four thousand dollars in interest, for a total amount paid of about thirty four thousand dollars.

To save $10k at $200 a month would take four years and two months.

Here's the same debt at $300 a month:

4.5 Years and it costs about six grand (again, just in interest - sixteen thousand dollars total). Saving ten thousand dollars at three hundred dollars a month would take just under three years.

Here's the same debt at $400 a month:

3 years, about $4000 dollars (fourteen thousand dollars total). Saving ten thousand dollars at $400 a month takes just over two years.

The thing is, with all of these models you're going to end up paying one way or another. Insurance vs out of pocket is you weighing the risk of losing a fair amount of money by signing up but not using the system, or potentially losing a catastrophic amount of money by not signing up.

For credit cards they really only work if you know you're never going to need them for an emergency, because an emergency is what you're not going to be able to pay off right away. I didn't have an emergency fund when Large Bastard had his heart attack and needed surgery, or when we moved between states suddenly, or when we moved between states suddenly AGAIN and needed to pay storage costs, or when Large Bastard needed a transplant, or when Tiny Bastard got in a fight with my MiL's dog, and the fact that I didn't have an emergency fund is still costing me a lot of money.

So, young folks out there: what's the takeaway?

Get insurance. Get the best deal possible, which usually ends up being the one you sign up for early. You may think you can let it ride without insurance, but man in the six months between when I graduate college (and lost my school insurance) and when care kicked in after 90 days at my job I got electrocuted and needed to go to the ER. If that hadn't been a worker's comp payout I would have had thousands of dollars in bills. Something could happen. You could break your leg, you could get hit by a car, you could suddenly find out that you actually have heart disease at twenty, you could develop cancer. Have insurance, you need insurance. You legally need car insurance in the US, and you financially need health insurance. If you have a pet, I think it's a good idea for them to have pet insurance.

Credit cards are not for emergencies, they are not for fun, they are not for buying things that are just ever so slightly out of your budget, they are for taking advantage of the credit card company and managing to get by in a system that demands you have a credit score. ONLY put purchases on your credit card that you already have cash for. Before you get a credit card, build up an emergency savings so that you aren't tempted to put emergency charges on your card.

If you DO end up with an interest-bearing debt, pay it off as fast as possible because letting it linger costs you a LOT of money in the long run.

Stay the fuck away from tobacco and nicotine products they are fucking terrible for you, they are fucking expensive, and they are not worth it put the vapes down put the zyns down put the cigarettes down I will begin manifesting in your house physically i swear to fuck. Knock that shit off and put the cash that you'd be spending on nicotine into a savings account.

Take care, sorry everything sucks, I promise that in some ways it actually sucks less than it did before and we're working on trying to make it suck even less but it's taking a while.

758 notes

·

View notes

Text

I used to work at JoAnn's and let me give you a tip. Don't buy fabric there if you can help it. It's overpriced low quality crap. You can absolutely find fabric for just as cheap online and if you're a "have to touch it before I know if I'll hate it or not" person lots of online places sell samples.

Case in point: Robert Kaufman Kona solids. I've seen claims online that the Kona solid quilting cotton, which is the highest quality quilting cotton solids JoAnn's sells, is different and lower quality than the Kona cotton you can get at a quilt shop. I can't speak to the validity of those claims but I 100% would not be surprised if it were true. But let's set that aside and just see how JoAnn's prices measure up.

As you can see, the regular price at JoAnn's is $9.99. The regular price at this random quilting online store I spent 20 seconds on duckduckgo to find is $7.95. Sure, the sale price is 15¢ cheaper at JoAnn's. But JoAnn's is constantly playing this "our fabrics are cheap because they're on sale! Don't look at how much they regularly cost anywhere else" psychological warfare game which I do NOT appreciate.

I'm sure if you looked harder than the 20 seconds I spent on duckduckgo you could find Kona cotton for cheaper than JoAnn's has it and you wouldn't have to wonder about the quality claims. And all their fabric is like this. Maybe a decade ago it was a good deal but now? There's a reason they've gone bankrupt.

Just because I could, I compared fabric wholesale direct's price for solid color polyester Jersey knit fabric, which is regularly priced at $5.99 and is currently on sale for $5.09. JoAnn's comparable fabric starts again at $9.99/yard and that fabric is currently on sale for $6.99. There are 10 colors of the JoAnn's $6.99 fabric and 45 colors of the FWD $5.09 fabric FWD does free shipping over $99 and flat rate shipping at $7.95 for anything below that. Depending on how much you buy, you'll potentially be paying the same or less for the FWD fabric and 1. It's probably higher quality and 2. There's 4 times as many color options.

JoAnn's is good for if you need less than a yard and have the time and ability to go to the store in person. And yeah, if you're shopping in person, you don't have to pay shipping. But the quality of all their fabric is low and the "sale" prices are around the same as a place with higher quality fabric.

I buy embroidery floss and thread at JoAnn's cuz embroidery floss is cheaper in person than on DMC's website and you can't trust product photos of thread to be color accurate. And I buy sewing notions there sometimes cuz it's convenient. But even the scissors I spent $30 on there a decade ago (who knows how much they are now) were $17 at Walmart when I lost the first pair and had to replace them 4 years later.

Also they treat their employees like shit and currently no one besides store managers gets health insurance through them because the only full time position in their stores is the store manager. And even before the bankruptcy they shortstaffed and did everything in their power to avoid paying for benefits and overtime. It was the worst job I ever had and that's saying something because I worked at Walmart and had a "this creepy guy went to JAIL over what he did to me" experience there.

#v gets educational instead of just being a hater#(ok I'm partly being a hater but I HAVE RECEIPTS)#v's fiber arts tag#sewing

727 notes

·

View notes

Note

hi, i'm a fat person who is just starting to learn to love and appreciate my body and i'm very new to the fat community and all that.

i was wondering if you could maybe explain the term ob*se and how it is a slur. i've never heard anything about it being a slur before(like i said, i'm very new here) and was wondering if you could tell me the origin and history of the word or mayy provide links to resources about it? i want to know more about fat history and how to support my community but i'm unsure of how to start

Welcome!

Obesity is recognized as a slur by fat communities because it's a stigmatizing term that medicalizes fat bodies, typically in the absence of disease. Aside from the word literally translating to "having eaten oneself fat" in latin, obesity (as a medical diagnosis) straight up doesn't actually exist. The only measure that we have to diagnose people with obesity is the BMI, which has been widely proven to be an ineffective measure of health.

The BMI was created in the 1800s by a statistician named Adolphe Quetelet, who did NOT sudy medicine, to gather statistics of the average height and weight of ONLY white, european, upper-middle class men to assist the government in allocating resources. It was never intended as a measure of individual body fat, build, or health.

Quetelet is also credited with founding the field of anthropometry, including the racist pseudoscience of phrenology. Quetelet’s l’homme moyen would be used as a measurement of fitness to parent, and as a scientific justification for eugenics.

Studies have observed that about 30% of so-called "normal weight" people are "unhealthy" whereas about 50% of so-called "overweight" people are “healthy”. Thus, using the BMI as an indicator of health results in the misclassification of some 75 million people in the United States alone. "Healthy" lifestyle habits are associated with a significant decrease in mortality regardless of baseline body mass index.

While epidemiologists use BMI to calculate national "obesity" rates, the distinctions can be arbitrary. In 1998, the National Institutes of Health lowered the overweight threshold from 27.8 to 25—branding roughly 29 million Americans as "overweight" overnight—to match international guidelines. Articles about the "obesity epidemic" often use this pseudo-statistic to create a false fear mongering rate at which the United States is becoming fatter. Critics have also noted that those guidelines were drafted in part by the International Obesity Task Force, whose two principal funders were companies making weight loss drugs. Interesting!!!

So... how can you diagnose a person with a disease (and sell them medications) solely based upon an outdated measure that was never meant to indicate health in the first place? Especially when "obesity” has no proven causative role in the onset of any chronic condition?

There is a reason as to why fatness was declared a disease by the NIH in 1998, and some of it had to do with acknowledging fatness as something that is NOT just about a lack of willpower - but that's a very complicated post for another time. You can learn more about it in the two part series of Maintenance Phase titled The Body Mass Index and The Obesity Epidemic.

Aside from being overtly incorrect as a medical tool, the BMI is used to deny certain medical treatments and gender-affirming care, as well insurance coverage. Employers still often offer bonuses to workers who lower their BMI. Although science recognizes the BMI as deeply flawed, it's going to be tough to get rid of. It has been a long standing and effective tool for the oppression of fat people and the profit of the weight loss industry.

More sources and extra reading material:

How the Use of BMI Fetishizes White Embodiment and Racializes Fat Phobia by Sabrina Strings

The Bizarre and Racist History of the BMI by Aubrey Gordon

The Racist and Problematic History of the Body Mass Index by Adele Jackson-Gibson

What's Wrong With The War on Obesity? by Lily O'Hara, et al.

Fearing The Black Body: The Racial Origins of Fat Phobia by Sabrina Strings

#inbox#resources#the bmi is bullshit#fat liberation#fat acceptance#fat activism#bmi#medical fatphobia

973 notes

·

View notes

Text

Get Military Auto Insurance By Methods With Full Coverage

Among the various benefits on offer, the insured receive coverage on an immediate basis. The policies also provide basic coverage. The premium structure changes when the clients are posted on active duty. They are provided business mileage coverage as well. For customers who are living outside the territorial limits of the United States of America there is the option of BFG policies. This is perhaps one of the biggest benefits of military car insurance cover.

Where To Get Car Insurance? Here Is One Stop Solution To Get Car Insurance Quote Online for Free!

Communication with the USAA: As far as getting car insurance covered in the United States of America is concerned, the first step would be to get in touch with the United States Automobile Association (USAA). It is one of the leading insurers in the North American country as far as car insurance for members of the national armed forces are concerned. They normally provide fantastic deals for insurance and offer great quotes as well for military car insurance coverage.

Contacting Former Providers: This facility is available to both members as well as non-members. One can go to the official website of USAA and check out the products and services section, where they will get a section on insurance. They can consequently choose auto insurance from the section over there. It is here that they will find a feature called get a quote, which they can use get the quotes that they need. They may also get quotes for auto insurance cheapest rates with suspended license.

Contacting the Armed Force Insurance: One can also get in touch with the Armed Forces Insurance or AFI, which is regarded as one of the leading providers of auto insurance for people serving with the United States military. The website of this insurer has a feature called Quote and Compare in its first page itself. Here they can get quotes instantly and then compare them to find out which suits them the most.

Comparing Online Insurance Rates: It would be a mistake to assume that the abovementioned ones are the only service providers in this domain. There could always be other providers of military car insurance in the United States of America that can provide lucrative offers as well. There are plenty of websites where one will get complete information on online quotes car insurance for military.

Getting Insured: While looking up these websites it is always better to state whether one is presently active in the United States military or if he or she has served it previously in some capacity or the other.

One can get in touch with the service providers by way of telephones and email so that any and every information regarding benefits such as discounts can be had. For more information in this regard please look up our website!

#car insurance#auto insurance#insurance#cheap car insurance#best auto insurance#auto insurance coverage#cheapest full coverage auto insurance#car insurance quotes#think insurance#how to get cheap car insurance#car insurance companies#how to lower insurance#insurance advice#cheap auto insurance#best rated car insurance#best car insurance#car insurance explained#get cheaper car insurance#insurance quote#car insurance for teenagers

0 notes

Text

"I'm just a girl" and "girl math" need to be stopped

Ok I know this has been around for a while but honestly this makes me so annoyed.

Stop calling your bad financial decisions "girl math" they are just bad financial decisions because you're just contributing to the stereotype that girls are shopping addicts, financially irresponsible, and not good at math. Like why can't girl math be making good financial decisions. It especially annoys me when they do it with a guy and show that the guy is reasonable while they're not. so many girls and women didn't break barriers for you all to pull this shit and make us look stupid.

also stop saying im just a girl when you do stupid shit as if that makes it ok, it doesn't. don't use it as an excuse because you make us all look bad. for example when you say im just a girl when you get in a car accident you just contribute to the stereotype that women can't drive even though women actually have lower insurance rates cause we get into less accidents so please just learn how to fucking drive properly instead of using our gender as an excuse.

also it's crazy to me that there's fully grown women out there just doing things so incorrectly and they're saying "im just a girl" like no ma'am you are a full grown woman take some responsibility and get a hold of yourself.

#coquette#lana del rey#girlblogger#just girly posts#just girly things#just girly thoughts#lizzy grant#lana del rey aka lizzy grant#female manipulator#manic pixie dream girl#it girl#girlhood#girl interrupted#girlblogging#girly things#gaslight gatekeep girlboss#cinnamon girl#the right person will stay#girlblog#lana del ray#coquette aesthetic#just girly post#waif#girl blogger#female manipulators#lana del ray moodboard#feminine beauty#dollette aesthetic#my year of rest and relaxation#lana del ray aesthetic

202 notes

·

View notes