#Loan on credit Card UAE

Explore tagged Tumblr posts

Text

Leading Car Loan Provider in Dubai, UAE | Gulf Financial Services

Get behind the wheel with ease in Dubai, UAE, with Gulf Financial Services. As a premier car loan provider, we offer competitive rates and flexible terms to suit your needs. Explore our range of financing options and drive away in your dream car today!

0 notes

Text

#best credit cards in uae#best rewards credit card#best travel credit card#credit card debt management#credit score#best travel credit cards#best personal loans in uae

0 notes

Text

Debt Relief Made Easy with LIN International Debt Solutions

LIN International offers proven Debt Solutions to lighten your financial burden. Discover our comprehensive approach to debt management and regain your financial stability.

#personal loan settlement and litigation services#credit card settlement plan#debt advisory and restructuring#dubai debt consolidation service#loan settlement services#mortgage restructuring services in the uae#credit card settlement#home loan settlement in uae

0 notes

Text

UAE Online Loan Aggregation Industry Holds Potential 7x Revenue Growth By 2024. Will UAE Online Loan Aggregation Industry Stand On This Projected Figure? Ken Research

REQUEST FOR SAMPLE REPORT

Buy Now

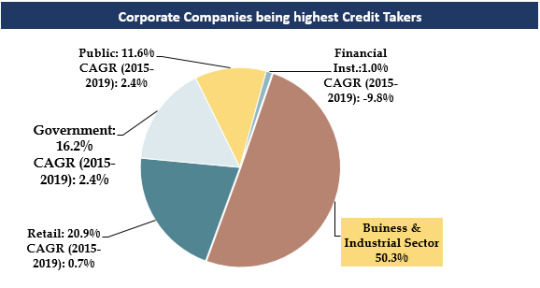

1. With rich, diverse & unparalleled infrastructure, the UAE Loan Industry driven by high corporate loan demand.

Trends and Developments in UAE Online Loan Aggregator Industry

Lending majorly dominated by national banks with wide distribution network, occupying >90% of all banks credit disbursal.

With major investment in hydrocarbon projects & other infrastructure projects, credit demand by government has been rising & expected to further rise in future as well.

Traditional methods of lending (Friends/family) are still preferred choice for availing loans by people with below avg credit history.

Banks are undertaking consolidation activities thereby reducing number of branches, cash offices & promoting digital banking services.

2. Technological Evolution in UAE Banking Services.

To Know More about this report, download a Free Sample Report

Adoption of Blockchain technology in enhancing “Know- Your-Customer” processes, useful in client onboarding, cross border transfers, payments & compliance reporting.

Tasharuk Platform: Launched by UBF to fight against cyber-attacks on banks. Platform enables cyber threat information sharing, identify threats & enhance defense systems.

Incorporating Artificial Intelligence in data analytics, combatting fraudulent activities & compliance improvement, further increasing focus on customer dealing & decision-making processes.

Increased penetration of virtual banking channels including Mobile (>85%), Online Banking (>90%), Branch/Call center (>90%) and ATMs (~100%).

Noticeable shift among customers to online medium for undertaking non-cash transactions of balance enquiries, fund transfers etc.

3. Housing Loan, one of the fastest growing retail loan segments.

Visit This link:- Request for Custom Report

In 2019, average house price in Dubai decreased by ~12% reaching to ~AED 2.58 Mn, thereby, shifting from investor led market to owner-occupied market.

While borrower’s previously preferred fixed interest rates but with Fed Reserve Predictions (2019), noticeable trend was observed for variable rate schemes.

Customers rising preferences for loan providers/aggregators offering other benefits like property management services & post-handover assistance services.

Dubai is dominated by expat population (11 times of Emirati population), who are observed to be preferring indirect channels due to high documentation & eligibility requirements.

Current lending process in The UAE is partially offline; however; with advancements & relaxations in regulations could help in making the process online.

For more insights on the market intelligence, refer to the link below:-

UAE Online Loan Aggregator Market

#BankOnUs Credit Cards Online Market Revenue#Car Loan Market UAE#Commercial Loan Market UAE#Commission Rate Online Aggregators UAE#COVID 19 Impact on UAE Loan Industry#Credit Cards Market UAE#Credit Outstanding in the UAE#Fee rate Loan disbursement UAE#Investments UAE Online Loan Aggregator Startups#Leading players of Loan Aggregator Market#Major Companies Loan Aggregator Market#Major Loan Providers in UAE#Number of Car Loans UAE#Number of Credit Card Users UAE#Number of House Loans UAE#Number of Loans Disbursed UAE#Number of Online Loan Market End Users#Number of Online Loans Disbursed UAE#Online Broker vs Online Aggregators UAE#Online Brokers in UAE#Online Distribution Loan UAE#Online Loan Aggregator Industry UAE#Outstanding Loans UAE#Personal Loan Market UAE#PolicyBazaar UAE Credit Cards Revenue#PolicyBazaar UAE Online Loan Market Share#Souqalmal UAE Personal Loan Revenue#Top 5 Online Loan Aggregator Startups UAE Top companies UAE Car Rental Market#Top Players Loan Aggregator Market#UAE Cash Loans Online Loan Market

0 notes

Text

A best credit card in dubai has become an important part of the life of many people. It not only fulfills the transaction needs but also upgrades the lifestyle. Know more

#financial companies in uae#mortgages in dubai#home loan in dubai#business loans in dubai#best credit card in dubai

0 notes

Text

Best Premium Banking Services in UAE

PRO Banking offers a range of banking solutions to suit your needs.Choose PRO Banking for Personal Loans,Investments,Insurance and much morePro Banking UAE is an individual bank in the computerized age that assumes a serious part in the public eye with commitment.The computerized age assists us with carrying banking nearer and nearer to our clients and their requirements.As a bank, we base on inclusivity, sensibility, social business, improvement & regular banking to say the least

#Bank Account#UAE bank account#Credit Card#Loans#Personal Loan#Business Loan#Investments#Car Loan#Company Setup#Insurance#Accounts#Emirati Banking#Banking Services#Mortgage

0 notes

Text

Sales Executive jobs in Dubai

Sales Executive jobs in Dubai

Personal loan sales or credit cards sales Executive required in Dubai Personal loan sales or credit cards sales Executive required in Dubai #CopiedPlease send your CV only to those who meet the conditions because the vacancy needs:-Personal loan sales or credit cards sales experience only.-Minimum 1 year UAE banking sales experience is mandatory.– fixed salary up to of AED 4000/- (based on…

View On WordPress

0 notes

Photo

We are #hiring Banking Sales Professionals in #dubai.

Walk-In Interview on 18th December 2022 at Sundus Dubai office.

Also visit - www.sundus.jobs

#Sundus#employment#opportunity#uae jobs#credit card#loan officer#sales#banking jobs#banking careers#personal loans#customer service#sales manager#jobs#banking sales#dubai sale#sales jobs#walkin#walkin drive#linkedin jobs#emiratisation#interview

1 note

·

View note

Text

If managing multiple debts has become overwhelming, a buyout loan from Money Maestro in the UAE can be the perfect solution. A buyout loan consolidates your existing debts, such as personal loans, credit card balances, or other financial obligations, into a single, manageable loan. With Money Maestro's competitive interest rates and flexible repayment options, you can reduce your monthly payments and streamline your finances. Whether you’re looking to lower your interest rates or just want the convenience of one monthly payment, Money Maestro’s Buyout Loans UAE make financial freedom within reach.buyoutloanUAE

#buyoutloanUAE#buyoutloaninDubai#buyoutloaninUAE#buyoutloanDuabi#buyoutloanmoneymaestro#buyoutloan#moneymaestro

0 notes

Text

Convenient Online Personal Loans in Dubai, UAE | Gulf Financial Services

Need a personal loan in Dubai, UAE? Apply conveniently online with Gulf Financial Services. Enjoy easy access to funds with our streamlined process. Explore our flexible terms and get the financial support you need. Apply now!

0 notes

Text

Unveiling the Top Credit Cards and Banking Solutions in the UAE

Welcome to the vibrant world of Banqmart, where we unlock a treasure trove of financial possibilities for residents in the UAE. In this blog, we will explore the best credit cards, personal loans, and savings account options that can make your dreams a reality. Whether you seek the finest rewards, maximum cashback, or exclusive privileges, Banqmart has you covered. Let’s dive in and discover the gems that await you!

1. Mashreq Solitaire Credit Card: A World of Exclusive Rewards The Mashreq Solitaire Credit Card is the true epitome of luxury and benefits. Designed to cater to your premium lifestyle, it offers an array of exclusive rewards, travel perks, and lifestyle benefits that redefine the way you experience credit cards. Unleash the power of prestige with the Mashreq Solitaire Credit Card.

2. Best Rewards Credit Card: Unlocking the Treasure Chest Embark on a rewarding journey with Banqmart’s best rewards credit cards. We showcase the top credit cards that shower you with points, miles, and cashback on every transaction, making your spending truly gratifying.

3. Best Cashback Credit Card in UAE: Maximizing Your Savings Banqmart presents the crème de la crème of cashback credit cards in the UAE. Experience the joy of getting cashback on your everyday purchases, whether it’s dining, shopping, or travel. Turn your expenses into savings effortlessly.

4. Best Credit Card in Dubai: Your Gateway to Opulence Discover the best credit cards tailored to meet Dubai’s distinctive needs. With unparalleled benefits, rewards, and privileges, these credit cards are your ultimate companions in the city of dreams.

5. Compare Credit Cards UAE: Find Your Perfect Match Banqmart’s credit card comparison tool simplifies your decision-making process. Compare the features, benefits, and fees of various credit cards to choose the one that aligns perfectly with your lifestyle.

6. Best Travel Credit Card: Elevate Your Journey Make your travel dreams come true with Banqmart’s selection of the best travel credit cards. Enjoy travel insurance, airport lounge access, and accelerated rewards on flights and hotels, ensuring your journeys are nothing short of extraordinary.

7. Minimum Salary for Credit Card in UAE: Eligibility Made Easy Worried about eligibility? We’ve got you covered. Explore the minimum salary requirements for credit cards in the UAE, helping you to find the card that fits your income level.

8. Best Credit Card Loans in UAE: Fulfilling Your Aspirations Banqmart’s credit card loans offer quick and easy access to funds. Discover the best credit card loans that provide flexibility and financial freedom, empowering you to achieve your goals.

9. Apply for Bank Credit Card UAE: A Seamless Process Learn how to apply for a credit card in the UAE with Banqmart’s step-by-step guide. We simplify the application process to ensure you have a hassle-free experience.

10. Best Credit Card in UAE 2023: Stay Ahead of the Game As we step into 2023, Banqmart brings you the latest and greatest credit card offerings in the UAE. Stay ahead of the curve with cutting-edge features and benefits that cater to your evolving needs.

11. Platinum Elite Mashreq Credit Card: An Unrivalled Level of Luxury Experience a world of exclusivity with the Platinum Elite Mashreq Credit Card. From premium concierge services to unmatched travel privileges, this card is designed to cater to your discerning tastes.

12. ADCB Touchpoints Platinum Credit Card: Where Points Meet Perfection Unlock a world of possibilities with the ADCB Touchpoints Platinum Credit Card. Earn touchpoints on every transaction and redeem them for flights, hotel stays, shopping vouchers, and more.

13. Best Cash Back Card in UAE: Putting Money Back in Your Pocket Discover the top cashback credit cards in the UAE that let you earn while you spend. Turn your purchases into cash rewards and enjoy a little extra in your wallet.

14. Minimum Salary for Credit Card: Understanding the Requirements Unravel the mystery of minimum salary requirements for credit cards in the UAE. Banqmart helps you comprehend the financial criteria and find a card that suits your income.

15. ADCB Titanium Credit Card Limit: Empowering Your Spending Explore the generous credit limits offered by the ADCB Titanium Credit Card. With higher spending power, seize every opportunity to indulge in the things you love.

16. Apply for Credit Card in UAE: A Convenient Digital Journey At Banqmart, we make applying for a credit card in the UAE simple and efficient. Learn about the necessary documents and steps involved in the application process.

17. Credit Cards Offering Cash Back: Get Rewarded for Every Swipe Reap the benefits of credit cards that offer cashback rewards on various categories. Discover the ones that align with your spending habits and maximize your savings.

18. ADCB Touchpoints Platinum Credit Card Eligibility: Are You Eligible? Check the eligibility criteria for the ADCB Touchpoints Platinum Credit Card and explore if you qualify for this rewarding financial companion.

19. Credit Card Loan UAE: Your Key to Financial Flexibility Unlock the potential of credit card loans in the UAE. Whether you need extra funds for emergencies or planned expenses, find out how these loans can come to your rescue.

20. Credit Card Apply Online UAE: Convenience at Your Fingertips Experience the ease and speed of applying for a credit card online in the UAE. Banqmart provides a user-friendly platform to apply for your preferred credit card with just a few clicks.

Banqmart presents an array of credit cards, personal loans, and banking solutions that cater to every individual’s unique needs and aspirations in the UAE. From premium credit cards that offer exclusive privileges to small business loans that empower entrepreneurs, our platform is a one-stop destination for financial solutions. Let Banqmart be your guide on your financial journey as we help you unlock the possibilities of a prosperous future.

#mashreq solitaire credit card#best rewards credit card#dubai credit card#best travel credit card#minimum salary for credit card in uae#apply for bank credit card uae#adcb touchpoints platinum credit card#minimum salary for credit card#adcb titanium credit card limit#adcb touchpoints platinum credit card eligibility#credit card apply online uae#credit card loan uae#adcb etihad guest platinum credit card

0 notes

Text

LIN International Debt Solutions: Your Path to Financial Freedom

Unlock financial peace with LIN International's Debt Solutions. Our experts craft tailored strategies to help you conquer debt and take control of your financial future

#personal loan settlement and litigation services#credit card settlement#credit card settlement plan#dubai debt consolidation service#debt advisory and restructuring#home loan settlement in uae#loan settlement services#mortgage restructuring services in the uae

0 notes

Text

What are the common legal issues faced by expatriates in Dubai?

Common Legal Issues Faced by Expatriates in Dubai

Expatriates living and working in Dubai may encounter various legal challenges unique to their status as foreign residents in the United Arab Emirates (UAE). While Dubai offers a dynamic and thriving environment for expatriates, navigating the legal landscape can sometimes be complex. Law firms in Dubai assist expatriates in addressing these common legal issues:

1. Employment Disputes: Expatriates in Dubai may face employment-related disputes, including issues related to contracts, wages, termination, and workplace discrimination. Law firms provide legal advice and representation to expatriates seeking to resolve employment disputes through negotiation, mediation, or litigation, ensuring their rights are protected under UAE labor laws.

2. Visa and Residency Matters: Obtaining and maintaining the necessary visas and residency permits is essential for expatriates living in Dubai. Common visa and residency issues faced by expatriates include visa renewals, sponsorship changes, and visa cancellations. Law firms offer guidance on visa requirements, documentation, and compliance with immigration regulations, helping expatriates navigate the visa process smoothly.

3. Property and Tenancy Disputes: Expatriates renting or owning property in Dubai may encounter disputes with landlords, property developers, or homeowners' associations. Common issues include lease agreements, rental disputes, property maintenance, and landlord-tenant disagreements. Law firms assist expatriates in resolving property and tenancy disputes through negotiation, arbitration, or litigation, ensuring their rights as property owners or tenants are protected.

4. Family Law Matters: Expatriates may face family law issues related to marriage, divorce, child custody, and inheritance in Dubai. Differences in legal systems and cultural norms can pose challenges for expatriates navigating family law matters. Law firms provide legal advice and representation to expatriates involved in family law disputes, guiding them through the legal process and advocating for their rights and interests.

5. Debt and Financial Disputes: Expatriates in Dubai may encounter debt-related issues, such as loan defaults, credit card debts, or financial disputes with creditors. Law firms assist expatriates in resolving debt and financial disputes through negotiation, debt restructuring, or legal proceedings, ensuring their financial interests are protected under UAE laws.

6. Business and Commercial Matters: Expatriates involved in business ventures or commercial transactions in Dubai may face legal issues related to company formation, contracts, intellectual property, and regulatory compliance. Law firms provide legal advice and assistance to expatriates navigating business and commercial matters, helping them understand their rights and obligations and comply with relevant legal requirements.

In summary, expatriates in Dubai may encounter various legal issues related to employment, immigration, property, family, finance, and business. Law firms in Dubai play a crucial role in assisting expatriates with these legal challenges, providing expert advice, representation, and support to ensure their rights are protected and their legal needs are addressed effectively.

0 notes

Text

We are a one-stop solution for all your business financing needs. Whether you own a retail space, office, warehouse ,business loans in dubai, or any industrial site etc. Know More!

#financial companies in uae#mortgages in dubai#home loan in dubai#business loans in dubai#best credit card in dubai

0 notes

Text

What Are the Common Legal Issues Faced by Expats in Dubai?

Expats in Dubai often encounter unique legal challenges due to the intersection of their home country’s laws and the legal framework of the United Arab Emirates (UAE). Understanding these common legal issues can help expatriates navigate their new environment more effectively. Here are some of the prevalent legal issues faced by expats in Dubai:

1. Employment Disputes

Contractual Issues: Expats may face issues related to employment contracts, such as discrepancies between the contract terms and the actual working conditions, unpaid salaries, or wrongful termination. It is crucial for expats to have a clear and comprehensive employment contract and to understand their rights under UAE labor law.

Work Permits and Visas: Obtaining and renewing work permits and visas can be a complicated process. Delays or errors in these documents can lead to legal issues, including fines or deportation.

2. Property and Real Estate Issues

Rental Disputes: Many expats face disputes with landlords over rental agreements, including issues related to rent increases, maintenance responsibilities, and eviction notices. Understanding the tenancy laws in Dubai is essential for resolving these disputes.

Property Purchases: Expats looking to purchase property in Dubai must navigate the complexities of property law, including ownership rights, financing, and legal documentation. Misunderstandings or missteps in the buying process can lead to significant financial and legal problems.

3. Family Law Matters

Marriage and Divorce: Family law issues, such as marriage and divorce, can be particularly challenging for expats. Differences between local laws and the laws of the expat’s home country can complicate these matters. It is important to seek legal advice to understand the implications of UAE family law.

Child Custody: In cases of divorce, child custody can become a contentious issue. The UAE has specific laws and regulations regarding custody, which may differ from those in the expat’s home country.

4. Financial and Debt Issues

Debt Recovery: Expats who face financial difficulties may encounter issues with debt recovery. Failure to repay loans or credit card debts can lead to legal actions, including travel bans and imprisonment.

Banking and Investment: Navigating the local banking system and understanding the legal implications of investments can be challenging for expats. Mismanagement or misunderstandings can result in financial losses or legal disputes.

5. Criminal Law

Public Behavior: Expats must be aware of the strict laws governing public behavior in Dubai. Actions that are considered acceptable in their home countries, such as public displays of affection or consuming alcohol in unauthorized places, can lead to legal issues in Dubai.

Drug Laws: The UAE has stringent drug laws, and even small quantities of illegal substances can result in severe penalties, including long-term imprisonment or deportation.

6. Residency and Immigration

Visa Overstay: Overstaying a visa can result in hefty fines, legal troubles, and deportation. It is crucial for expats to keep track of their visa status and ensure timely renewals.

Sponsorship Issues: Many expats rely on sponsorship for their residency. Changes in employment or personal circumstances can affect their sponsorship status, leading to legal complications.

7. Business and Corporate Law

Setting Up a Business: Expats interested in starting a business in Dubai must navigate a complex legal framework. This includes understanding the requirements for business licenses, ownership structures, and regulatory compliance.

Commercial Disputes: Business-related legal issues, such as disputes with partners, suppliers, or customers, can arise. Effective legal representation and understanding of local business laws are essential to resolving these disputes.

Conclusion

Expats in Dubai face a range of legal issues that can impact their personal and professional lives. Employment disputes, property issues, family law matters, financial problems, criminal law, residency and immigration challenges, and business law complexities are common areas where legal difficulties may arise. Seeking advice from experienced lawyers in Dubai can help expats navigate these challenges and ensure compliance with local laws. Being proactive and informed can significantly reduce the risk of legal problems and enhance the overall expat experience in Dubai.

0 notes

Text

MARKET GROWTH PROSPECTS OF BANKING SECTOR IN INDIA, 2023- 24 – DART CONSULTING FORECASTS HIGHER GROWTH IN THE NEXT FIVE YEARS

India’s banking sector is sufficiently capitalized and well-regulated. The financial and economic conditions are comparatively better even by comparing with well developed economies. Indian banks are generally resilient and have withstood the global downturn well as can be noted by reviewing previous years records.

The Indian banking industry has recently witnessed the rollout of innovative banking models like payments and small finance banks. In recent years, the Banks are increasingly focusing widening banking reach, through various schemes like the Pradhan Mantri Jan Dhan Yojana and Post payment banks. The rise of Indian NBFCs and fintech have significantly enhanced India’s financial inclusion and helped fuel the credit cycle in the country.

Here is a quick overview of key players in the industry.

HDFC Bank Ltd

HDFC Bank Ltd (HDFC) offers personal and corporate banking, private and investment banking, and other related financial solutions to individuals, MSMEs, government, and agriculture sectors, financial institutions and trusts, and non-resident Indians. It provides a range of deposit services and card products; loans for homes, cars, commercial vehicles, and other personal and business needs; insurance for life, health, and non-life risks; and investment solutions such as mutual funds, bonds, equities, and derivatives. HDFC also provides services such as cash management, corporate finance advisory, customized banking solutions, project and structured finance, trade financing, foreign exchange, internet banking, and payment and settlement services, among others. The bank operates in India through a network of branches, ATMs, phone banking, net banking, and mobile banking. It has overseas branches in Bahrain, Hong Kong, and the UAE, and representative offices in the UAE and Kenya. HDFC is headquartered in Mumbai, Maharashtra, India.

ICICI Bank Ltd

ICICI Bank Ltd (ICICI Bank) provides personal and corporate banking, investment banking, private banking, venture capital, life and non-life insurance solutions, securities broking, and asset management services to corporate and retail clients, high-net-worth individuals, and SMEs. It offers a wide range of products such as deposits accounts including savings and current accounts, and resident foreign currency accounts; investment products; and consumer and commercial cards. ICICI Bank offers to lend for home purchase, commercial business requirements, automobiles, personal needs, and agricultural needs. The bank offers services such as foreign exchange, remittance, import and export financing, advisory, trade services, personal finance management, cash management, and wealth management. It has an operational presence in Europe, Middle East, and Africa (EMEA), the Americas, and Asia. ICICI Bank is headquartered in Mumbai, Maharashtra, India.

State Bank of India

State Bank of India (SBI) is a universal bank. It provides a range of retail banking, corporate banking, and treasury services. The bank serves individuals, corporates, and institutional clients. Its major offerings include deposits services, personal and business banking cards, and loans and financing. The bank provides services such as mobile banking, internet banking, ATM services, foreign inward remittance, safe deposit locker, money transfer, mobile wallet, trade finance, merchant banking, project export finance, treasury, offshore banking, and cash management services. It operates in Asia, the Middle East, Europe, Africa, and North and South America. SBI is headquartered in Mumbai, Maharashtra, India.

Punjab National Bank

Punjab National Bank (PNB) offers retail and commercial banking, agricultural and international banking, and other financial services. Its retail and commercial banking portfolio offers credit and debit cards, corporate and retail loans, deposit services, cash management, and trade finance. Its international banking portfolio includes foreign currency accounts, money transfers, letters of guarantee, and world travel cards, and solutions to non-resident Indians. PNB also offers merchant banking, mutual funds, depository services, insurance, and e-services. The bank operates in India and has overseas operations in the UK, Bhutan, Myanmar, Bangladesh, Nepal, and the UAE. PNB is headquartered in New Delhi, India.

Bank of Baroda

Bank of Baroda (BOB) offers retail, agriculture, private and commercial banking, and other related financial solutions. It includes loans, deposit services, and payment cards. The bank offers loans for homes, vehicles, education, agriculture, personal and corporate requirements, mortgage, securities, and rent receivables, among others. It provides current and savings accounts; fixed and recurring deposits; debit, credit, and prepaid cards. The bank also provides insurance coverage for life, health, and general purposes. It offers services such as treasury, financing, mutual funds, cash management, international banking, digital banking, internet banking, start-Up banking, and wealth management. The bank has operations in Asia-Pacific, Europe, North America, and the Middle East and Africa. BOB is headquartered in Baroda, Gujarat, India.

Industry Performance

The health of the banking system in India has shown steady improvement, according to the Reserve Bank of India’s latest report on trends in the sector. From capital adequacy ratio to profitability metrics to bad loans, both public and private sector banks have shown visible improvement. And as credit growth has also witnessed an acceleration in 2021-22, banks have seen an expansion in their balance sheet at a pace that is a multi-year high. As of November 4, 2022, bank credit stood at Rs. 129.26 lakh crore (US$ 1,585.09 billion). As of November 4, 2022, credit to non-food industries stood at Rs. 128.87 lakh crore (US$ 1.58 trillion).

Given the increasing intensity, spread, and duration of the pandemic, economic recovery the performances of key companies in the industry was positive. The reported margin of the industry by analyzing the key players was around 13.7% by taking into consideration the last 3 years’ data. Details are as follows.

Companies Net Margin EBITDA/Sales

HDFC Bank Ltd. 23.5% 31.2%

ICICI Bank Ltd. 22.3% 30.4%

State Bank of India 10.0% 25.7%

Punjab National Bank 4.0% 10.0%

Bank of Baroda 8.9% 13.9%

Industry Margins 13.7% 22.2%

Industry Trends

The macroeconomic picture for 2023 portends mixed fortunes for consumer payment players. Higher rates should boost banks’ net interest margins for card portfolios, but persistent inflation, depletion of savings, and a potential economic slowdown could weigh on consumers’ appetite for spending. Digital identity is expected to evolve as a counterbalancing force to mitigate fraud risks in the long run. Transaction banking businesses are standing firm despite recent market uncertainties. For many banks, these divisions have been a steady source of revenues and profits.

Over the long term, banks will need to pursue new sources of value beyond product, industry, or business model boundaries. The new economic order that will likely emerge over the next few years will require bank leaders to forge ahead with conviction and remain true to their purpose as guardians and facilitators of capital flows. With these factors in mind, the industry is still showing huge growth potential, some of the growth divers that is propelling the industry are:

Rising rural income pushing up demand for banking

Rapid urbanisation, decreasing household size & easier availability of home loans has been driving demand for housing.

Growth in disposable income has been encouraging households to raise their standard of living and boost demand for personal credit.

The industry is attracting major investments as follows.

On June 2022, the number of bank accounts—opened under the government’s flagship financial inclusion drive ‘Pradhan Mantri Jan Dhan Yojana (PMJDY)’—reached 45.60 crore and deposits in the Jan Dhan bank accounts totaled Rs. 1.68 trillion (US$ 21.56 billion).

Some of the major initiatives taken by the government to promote the industry in India are as follows:

As per the Union Budget 2022-23:

National Asset reconstruction company (NARCL) will take over, 15 non-performing loans (NPLs) worth Rs. 50,000 crores (US$ 6.70 billion) from the banks.

National payments corporation India (NPCI) has plans to launch UPI lite this will provide offline UPI services for digital payments. Payments of up to Rs. 200 (US$ 2.67) can be made using this.

In the Union budget of 2022-23 India has announced plans for a central bank digital currency (CBDC) which will be possibly know as Digital Rupee.

Through analyzing the performance of the contributing companies for the last three years, we can ascertain that the sector witnessed compounded annual growth rate (CAGR) of 9.9% at the end of 2022. Details are as below.

Companies CAGR

HDFC Bank Ltd. 14.02%

ICICI Bank Ltd. 7.3%

State Bank of India 8.4%

Punjab National Bank 9.2%

Bank of Baroda 10.7%

Industry CAGR 9.9%

Working through partnerships both with NBFCs and FinTech is high on the agenda of the Indian banking sector, and this is an area of focus of the FICCI National Committee on Banking. Banks will have to play a very constructive role as India aspires to be the leading economy in future. The strengthened banking sector has the potential to contribute directly and indirectly to GDP, increase job creation and enhance median income. Technology interventions to strengthen the quality and quantity of credit flow to the priority sector will be an important aspect. The need for sustainable finance / green financing is also gaining importance.

With these attributes boosting the sector, the Indian banking industry is likely to grow 5% more than the reported growth rate and is expected to exhibit CAGR of 10.4% in the next five years from 2023 to 2027.

DART Consulting provides business consulting through its network of Independent Consultants. Our services include preparing business plans, market research, and providing business advisory services. More details at https://www.dartconsulting.co.in/dart-consultants.html

0 notes