#Loan documentation requirements

Explore tagged Tumblr posts

Text

Legal & Financial Aspects of Personal Loans: Everything You Need to Know

Personal loans are a popular financial tool that many individuals rely on to meet their urgent needs, whether it’s for medical expenses, home renovations, education, or debt consolidation. While personal loans offer great flexibility and convenience, it’s important to understand the legal and financial aspects of borrowing. This will help you make informed decisions and avoid any pitfalls during the loan application, repayment, and settlement process.

In this article, we will explore the legal and financial aspects of personal loans, including the key factors to consider, eligibility criteria, documentation requirements, and how to ensure you are making a financially sound decision when opting for a personal loan.

1. What Are Personal Loans?

A personal loan is an unsecured loan offered by financial institutions such as banks and NBFCs (Non-Banking Financial Companies). Unlike loans that require collateral (e.g., home loan, car loan), personal loans are unsecured, meaning they don’t require any asset as security. They are generally used for personal expenses, such as:

Medical emergencies

Home renovations

Debt consolidation

Educational expenses

Travel or weddings

Since no collateral is involved, personal loans typically have higher interest rates compared to secured loans. However, they come with flexible terms, allowing borrowers to use the loan for any purpose, without restrictions.

2. Legal Aspects of Personal Loans

When it comes to personal loans, understanding the legal framework is crucial for both the borrower and the lender. Below are the key legal aspects that every borrower should be aware of:

2.1. Loan Agreement

A loan agreement is the contract between the borrower and the lender, outlining the terms and conditions of the loan. It is a legally binding document that protects both parties. It typically includes:

Loan amount

Interest rate

Repayment tenure

EMI (Equated Monthly Installment) schedule

Fees and charges

Penalties for delayed payments

Rights and obligations of both parties

2.2. Legal Implications of Default

If you fail to repay your personal loan, it may result in legal consequences such as:

Late fees: Banks often charge penalties for missed or late payments.

Damage to credit score: Missing payments or defaulting can severely impact your credit rating.

Legal action: In extreme cases, the lender can take legal action to recover the amount.

In some cases, the lender may initiate a civil suit or approach a debt recovery tribunal to recover dues. Therefore, it’s important to have a clear repayment strategy and seek professional advice if you're struggling with repayments.

3. Financial Aspects of Personal Loans

Understanding the financial aspects of personal loans is just as important as knowing the legal implications. Here are key financial factors to consider before taking out a personal loan:

3.1. Interest Rates

Personal loans come with varying interest rates depending on several factors such as your credit score, loan amount, tenure, and the lender's policies. The interest rate on personal loans typically ranges from 10% to 25% per annum. Borrowers with good credit scores are likely to receive lower interest rates, while those with poor credit scores may face higher rates.

🔗 Best Loan Providers with Competitive Rates:

IDFC First Bank Personal Loan

Bajaj Finserv Personal Loan

3.2. Processing Fees

Lenders typically charge a processing fee to cover the administrative costs of approving and disbursing the loan. The processing fee usually ranges from 1% to 3% of the loan amount. It's essential to factor this fee into the overall loan cost when deciding whether to apply.

3.3. Prepayment and Foreclosure Charges

Many lenders allow you to repay the loan early or close the loan before the agreed tenure, but this often comes with prepayment or foreclosure charges. These charges may range from 1-5% of the outstanding loan amount. Always check for these clauses before signing the loan agreement.

3.4. Loan Tenure and EMI

The loan tenure is the period over which you repay the loan. Personal loans generally have a tenure of 1 to 5 years, but it can extend up to 7 years in some cases. The longer the tenure, the smaller the EMI (Equated Monthly Installment), but this also means you’ll pay more interest over the loan term.

It's important to balance loan tenure with your financial situation to avoid paying unnecessarily high interest while keeping your monthly payments manageable.

4. Eligibility Criteria for Personal Loans

Before applying for a personal loan, lenders have certain eligibility criteria that you must meet. These criteria include:

4.1. Income Level

Lenders require you to have a steady income to ensure that you can repay the loan. Generally, salaried employees and self-employed individuals can apply for personal loans, provided they meet the minimum income requirement.

4.2. Credit Score

Your credit score plays a crucial role in the approval of a personal loan. A score of 750 or above is considered ideal for getting a personal loan at favorable rates. Borrowers with lower scores may face higher interest rates or even rejection of their application.

4.3. Employment Status

Lenders often prefer borrowers who are employed in reputed companies or have stable self-employment. You’ll need to provide proof of employment or business registration to demonstrate your financial stability.

4.4. Age Criteria

Typically, applicants need to be between 21 and 60 years old to qualify for a personal loan. Younger borrowers may find it easier to secure a loan, while older borrowers might face restrictions based on repayment tenure and their ability to meet loan obligations.

5. Documentation Required for Personal Loans

When applying for a personal loan, you'll need to provide various documents for verification purposes. Common documentation includes:

Identity proof: Aadhaar, PAN card, passport, or voter ID

Address proof: Utility bill, rental agreement, passport, etc.

Income proof: Salary slips, bank statements, ITR (Income Tax Returns)

Employment proof: Offer letter (for new employees) or employment certificate (for salaried employees)

Bank statements: Last 6 months

Having your documents ready ensures a smooth loan approval process.

6. How to Choose the Right Personal Loan Provider

When selecting a lender for your personal loan, consider the following factors:

Interest rates: Compare the rates offered by different lenders to ensure you’re getting the best deal.

Processing fees: Make sure the lender's fees are reasonable and won’t significantly increase the loan cost.

Repayment terms: Choose a lender that offers flexible repayment terms and a suitable tenure.

Customer service: Opt for a lender with responsive customer service to assist you in case of any issues during the loan tenure.

Make an Informed Loan Decision

Understanding the legal and financial aspects of personal loans is vital to ensure that you make the best decision for your financial situation. By considering factors like interest rates, eligibility, and repayment terms, you can select the ideal personal loan provider.

Before applying, always read the loan agreement carefully, ensure you meet the eligibility criteria, and check for hidden fees that could affect your overall loan cost.

🔗 Apply for a Personal Loan Today:

Explore Personal Loans

By staying informed about both the legal and financial aspects, you can make the most out of your personal loan and avoid any surprises along the way.

#Legal aspects of personal loans#Financial aspects of personal loans#Personal loan terms and conditions#Personal loan eligibility criteria#Understanding personal loan interest rates#Loan agreement legalities#Legal implications of defaulting on loans#Personal loan repayment options#Personal loan processing fees#Loan documentation requirements#finance#personal loan online#nbfc personal loan#bank#loan services#personal loans#personal loan#personal laon#loan apps#fincrif#fincrif india#Personal loan for salaried employees#Personal loan for self-employed individuals#Personal loan eligibility for freelancers#Interest rate calculation for personal loans#Prepayment charges on personal loans#Loan foreclosure charges#How to read a personal loan agreement#Personal loan with minimal documentation#Understanding personal loan penalties

0 notes

Link

Documents Required for Business Loan

Documents that are necessary to avail a documents required for business loan. It can be provided to individuals, self-employed professionals like Chartered Accountant, lawyers, doctors, CS, Engineers, etc., self-employed individuals, (Small Medium Enterprises (SMEs), Micro Small Medium Enterprises (MSMEs), etc. There are several lenders, NBFCs (Non-Banking Financial Companies), or financial institutions that provide business loans to meet the business requirements. The borrower can get a maximum business loan amount of up to Rs. 5 crores at an affordable interest rate of @14.50% with a flexible repayment schedule.

Listed below are the documents required for business loans.

For identity Proof (anyone)

Aadhaar Card

PAN Card

Voter ID

Passport

Driving License

For address Proof (anyone)

Aadhaar Card

PAN Card

Voter ID

Driving License

Utility Bill

Electricity Bill

Rent/Lease Agreement

For Income Proof

A minimum of 6 months of bank statement is required.

Recent Income Tax Return (ITR) with computation of income (if filed).

Profit & Loss Statement for the last 2 years (and should be audited by Chartered Accountant (CA).

Balance Sheet

Company Identity & Address Proof

Certification of Incorporation

MOA and AOA

Board Resolution

Copy proof of Continuation (anyone)

Trade License

ITR

Proof of Establishment

Sale Tax Certificate

Other Mandatory Documents -

Sole Proprietorship (if applicable)

Copy of certified partnership deed (if applicable)

#necessary to avail a documents required for business loan#maximum business loan amount#startup loan#stand up loan#personal loan#msme loan#business loan#financeseva

2 notes

·

View notes

Text

Discover everything you need to know about commercial loans, including types, eligibility, benefits, challenges, and application processes. Empower your business with tailored financial solutions for growth, cash flow management, and operational support.

#commercial loans#business loans#types of commercial loans#commercial loan eligibility#documents for commercial loans#loan terms and conditions#collateral requirements#tax benefits of commercial loans#loan application process#financial flexibility#operational cash flow loans#commercial loan challenges#benefits of commercial loans#quick loan disbursal#commercial loan guidance

1 note

·

View note

Text

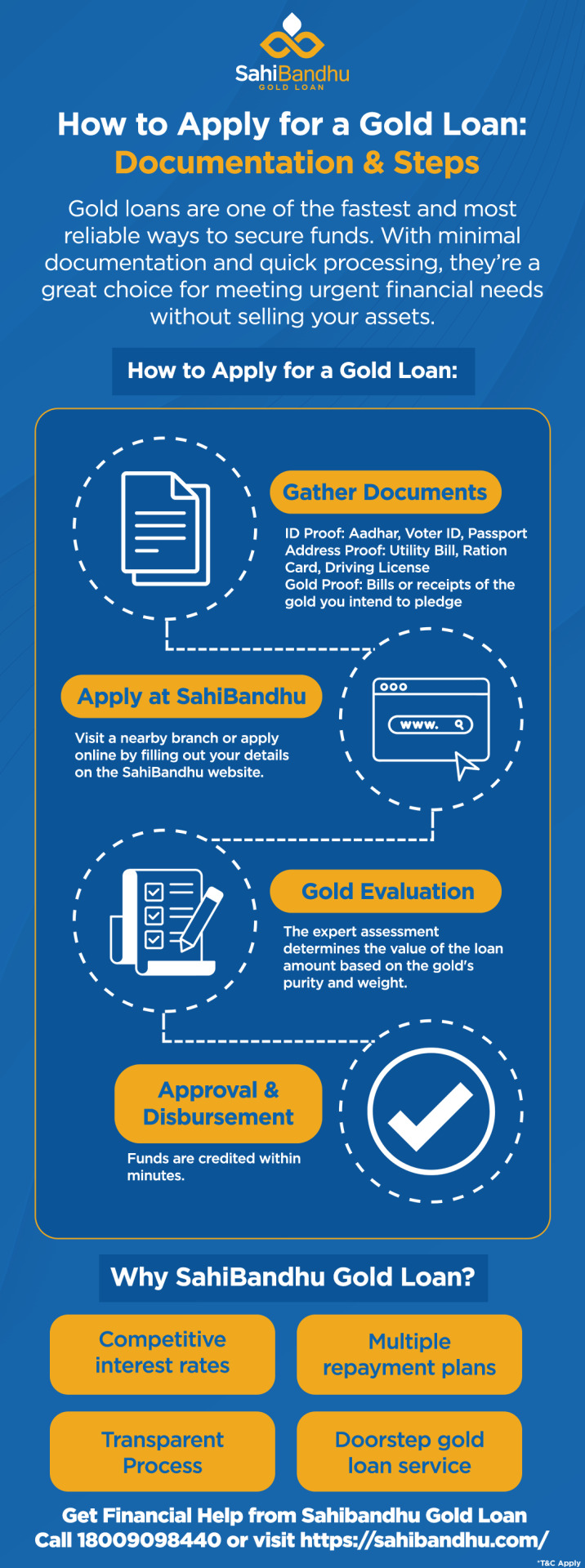

Discover the essential steps and documents needed to apply for a gold loan. Simplify the process and secure funds with ease.

#gold loan#gold loan documents#documents required for gold loan#gold loan documents and process#SahiBandhu gold loans

0 notes

Text

Documents Required for Personal Loan – Everything You Need to Know

Ensure your loan application is hassle-free by preparing the documents required for personal loan: identity proof, income statements, and address verification—everything you need.

0 notes

Text

it remains just so incredible to me that there are literally laws locked behind paywalls in the US

like the law is fully in effect and enforceable but you have to pay sometimes hundreds of dollars to even know what it is

#squiggalicious#it’s p common in safety laws for them to do what’s called adoption by reference#basically instead of having a whole long explanation of an extremely specific part of one single thing#they just point at the rules written by some other industry guiding force and say ‘follow their guidelines’#so those guidelines Are the legal requirement.#but get this!#that industry leader is not required to provide those guidelines for free! nor do they usually!#so an osha standard will say like ‘do a b and c; and also follow guidelines of ASTM xyz’#then you look up ASTM xyz and you have to pay $90-$400 to view them#you can still be cited by osha for not following those laws even though you literally do not have free access to them#isn’t that neat?#it’s especially pernicious that this is common in workplace safety law of all places#where employees often have to cite specific laws just to get their employers to comply with minimum safety requirements#yknow. so the employee doesnt get hurt or killed by their employer’s negligence.#anyway for anyone struggling with this: see if your local library has an inter-library loan program and try to get it through there#i was able to get multiple paywall’d guideline documents this way. it’s slow but it’s free

0 notes

Text

Financial needs can arise unexpectedly, and for self-employed individuals, accessing quick and convenient funding can be crucial for managing business operations, personal expenses, or seizing growth opportunities. Instant personal loans have emerged as a popular solution for self-employed individuals seeking quick access to funds without the lengthy approval processes traditionally associated with loans. This article delves into the intricacies of instant personal loans for the self employed, explores the benefits and challenges, and highlights some of the best loan providers in the market.

Understanding Instant Personal Loans

Instant personal loans are a type of unsecured loan that can be approved and disbursed quickly, often within a few hours or days. Unlike traditional loans, which may require collateral, instant personal loans are based on the borrower's creditworthiness and financial stability. These loans are designed to provide immediate financial assistance for various purposes, including business expansion, debt consolidation, medical emergencies, and more.

Benefits of Instant Personal Loans for Self Employed

1. Quick Approval and Disbursement

One of the primary advantages of instant personal loans is the speed at which they are approved and disbursed. For self-employed individuals who may need funds urgently, this feature can be incredibly beneficial. Many online lenders and financial institutions have streamlined their processes to ensure minimal paperwork and quick turnaround times.

2. Flexible Usage

Unlike business loans, which are often restricted to specific business-related expenses, instant personal loans offer flexibility in terms of usage. Self-employed individuals can use the funds for a variety of purposes, whether it's to manage personal expenses, invest in business growth, or cover unexpected costs.

3. No Collateral Required

Instant personal loans are typically unsecured, meaning they do not require collateral. This is particularly advantageous for self-employed individuals who may not have significant assets to pledge as security. The loan approval is based on the borrower's credit history and income, making it accessible to a broader range of applicants.

4. Improved Cash Flow Management

For self-employed individuals, managing cash flow can be a constant challenge. Instant personal loans provide a financial cushion that can help smooth out cash flow fluctuations, ensuring that personal and business expenses are covered even during lean periods.

Challenges Faced by Self Employed in Securing Loans

While instant personal loan for self employed offers numerous benefits, self-employed individuals often face unique challenges when applying for loans:

1. Income Variability

Self-employed individuals typically have irregular income streams, which can make it challenging for lenders to assess their repayment capacity. Lenders may require detailed documentation of income over an extended period to evaluate the borrower's financial stability.

2. Limited Credit History

Self-employed individuals, especially those who have recently started their businesses, may have limited or no credit history. This can make it difficult for lenders to assess their creditworthiness, potentially leading to higher interest rates or loan rejection.

3. Stringent Documentation Requirements

Lenders often require extensive documentation to verify income, business operations, and other financial details. Gathering and submitting these documents can be time-consuming and cumbersome for self-employed individuals.

Best Loan Providers for Instant Personal Loans

Finding the right lender is crucial for securing an instant personal loan with favorable terms. Here are some of the best loan providers that cater to self-employed individuals:

1. HDFC Bank

HDFC Bank offers instant personal loans with quick approval and disbursement processes. Self-employed individuals can benefit from competitive interest rates and flexible repayment options. The bank also provides pre-approved loan offers to existing customers, streamlining the application process.

2. ICICI Bank

ICICI Bank is known for its customer-friendly approach and efficient loan processing. The bank offers instant personal loans to self-employed individuals with minimal documentation and attractive interest rates. ICICI Bank's online application platform ensures a hassle-free experience for borrowers.

3. Bajaj Finserv

Bajaj Finserv is a leading non-banking financial company (NBFC) that provides instant personal loans with quick approval and flexible repayment options. Self-employed individuals can benefit from the company's easy-to-use online application process and personalized loan offers.

4. My Mudra

My Mudra offers instant personal loans with competitive interest rates and minimal documentation requirements. The bank's quick approval and disbursement processes make it an attractive option for self-employed individuals seeking immediate financial assistance.

5. Fullerton India

Fullerton India is another prominent NBFC that offers instant personal loans to self-employed individuals. The company provides flexible loan terms, quick disbursal, and a seamless online application process, making it a popular choice among borrowers.

Tips for Self Employed to Secure Instant Personal Loans

Securing an instant personal loan as a self-employed individual can be challenging, but the following tips can help improve your chances of approval:

1. Maintain a Strong Credit Score

A strong credit score is essential for securing any type of loan. Self-employed individuals should focus on building and maintaining a good credit score by paying bills on time, reducing outstanding debt, and regularly checking their credit reports for errors.

2. Prepare Comprehensive Financial Documentation

Lenders require detailed financial documentation to assess the borrower's income and repayment capacity. Self-employed individuals should prepare comprehensive financial records, including income statements, tax returns, bank statements, and business financials, to streamline the application process.

3. Show Consistent Income Streams

Demonstrating consistent income streams can improve your chances of loan approval. Self-employed individuals should provide evidence of regular income, such as recurring client payments, contracts, or long-term projects, to reassure lenders of their financial stability.

4. Consider Co-Applicants or Guarantors

Having a co-applicant or guarantor with a stable income and good credit history can strengthen your loan application. Lenders may be more willing to approve loans with additional financial backing, reducing the perceived risk.

5. Research and Compare Loan Offers

Different lenders offer varying terms and conditions for instant personal loans. Self-employed individuals should research and compare loan offers from multiple providers to find the best loan provider that meets their needs. Factors to consider include interest rates, repayment terms, processing fees, and customer reviews.

Conclusion

Instant personal loans provide a valuable financial resource for self-employed individuals seeking quick and convenient access to funds. While the process of securing a loan can be challenging due to income variability and stringent documentation requirements, the benefits of quick approval, flexible usage, and no collateral make these loans an attractive option. By maintaining a strong credit score, preparing comprehensive financial documentation, and researching the best loan provider, self-employed individuals can improve their chances of securing an instant personal loan with favorable terms.

In today's competitive lending market, institutions like HDFC Bank, ICICI Bank, Bajaj Finserv, My Mudra, and Fullerton India stand out as some of the best loan providers for instant personal loans. These institutions offer quick approval processes, competitive interest rates, and flexible repayment options, making them ideal choices for self-employed individuals seeking immediate financial assistance.

Whether it's for managing business operations, covering personal expenses, or seizing growth opportunities, instant personal loans can provide the financial support that self-employed individuals need to thrive. By understanding the intricacies of these loans and carefully selecting the best loan provider, self-employed individuals can navigate their financial needs with confidence and ease.

#personal loan for self employed#instant personal loan for self employed#documents required for personal loan for self employed

0 notes

Text

A Complete Guide of Documents Required for Loan

Taking out a loan is essential to achieving personal or business financial goals. However, when you go to a bank for a loan, you need to see and understand many documents. Whether you are a homemaker, a business owner, or someone with personal needs, you may need a loan at any time. If you are thinking of taking a loan, you first need to understand your requirements, assess your assets, and then you will also need various documents. In today's blog, we will discuss in detail the documents required for various types of loans, so that whenever you go to take a loan, you are not disappointed.

Why are documents required for loan applications?

Lenders ask for various documents required for loan applications to assess your certified repayment ability and the viability of your monetary needs. These documents help them evaluate the risk associated with lending you money. Whether you’re applying for a personal loan, business loan, or a mortgage, being well-prepared with the necessary documents can expedite the approval process.

Documents Required for Loan Approval

When applying for a personal loan, here are the primary documents required for loan processing:

Proof of Identity: This includes government-issued IDs like a passport, driver’s license, or national ID card.

Proof of Address: Utility bills, rental agreements, or property tax receipts can serve this purpose.

Income Proof: Recent salary slips, bank statements, and tax returns demonstrate your ability to repay the loan.

Employment Verification: For employment verification, you might need a letter from your employer or an employment agreement.

Credit Report: A current credit report helps lenders evaluate your credit history and score.

Business Loans: Specific Documents Required for Loan Applications

For business loans, the documents required for loan approval are more comprehensive, reflecting the complexity and scale of the financial assessment:

Business Project Report: This outlines your business plan, including market analysis, financial projections, and business goals.

Bankable Project Report: A detailed version of your business project report that includes thorough financial analysis and risk assessment, making it more suitable for lenders.

Customized Bankable Project Report: Tailored to meet specific lender requirements, this report can increase your chances of loan approval.

Prototype Project Report: For startups or new business ventures, this report includes prototypes or models of your product or service, showcasing feasibility and innovation.

Read Blog- Mudra Loan - Apply Online, Interest Rate, Types, Eligibilty, Bank List

How to Make a Perfect Project Report for Business Loan

Mortgage Loans: Important Documents Required for Loan Processing

Applying for a mortgage requires a detailed examination of your financial status and property details. Here are the essential documents required for loan approval in this category:

Property Documents: Sale deed, property tax receipts, and a no-objection certificate (NOC) from the builder or society.

Down Payment Proof: Bank statements or receipts showing the source of the down payment funds.

Income and Employment Verification: Similar to personal loans, but often with additional documentation such as business financial statements if self-employed.

Credit Report and Score: A good credit score can significantly impact your mortgage terms and interest rates.

Insurance Documents: Proof of home insurance to protect the property against unforeseen events.

Tips for Preparing Your Documents Required for Loan Applications

Organize Your Documents: Ensure all documents required for loan applications are well-organized and easily accessible. This includes making copies and keeping digital backups.

Check for Completeness: Double-check that you have all necessary documents required for loan approval before submitting your application to avoid delays.

Update Information: Make sure all your documents are current, including your credit report, bank statements, and tax returns.

Customise Your Reports: If you’re submitting a business loan application, consider preparing a customized bankable project report to align with specific lender requirements.

Common Challenges and Solutions

Missing Documents: One of the common challenges applicants face is missing some documents required for loan approval. To avoid this, create a checklist based on the lender’s requirements and cross-check each item.

Incomplete Business Reports: For business loans, an incomplete or poorly prepared business project report or bankable project report can hinder your application. Investing time and possibly consulting a financial expert to create a comprehensive and customized bankable project report can make a significant difference.

Low Credit Score: Having a low credit score can make it difficult to get approved for a loan. It's important to keep an eye on your credit report regularly and work on improving your score. You can do this by paying off debts, fixing any mistakes on your report, and being mindful of how much credit you use.

Conclusion

Understanding and preparing the documents required for loan applications is an important step in the loan approval process. Whether you’re seeking a personal loan, business loan, or mortgage, being organized and thorough with your documentation can significantly enhance your chances of success. From personal identification to a detailed business project report, every document plays an important role in presenting a clear and trustworthy picture to lenders.

Taking the time to gather and prepare the necessary documents not only streamlines the application process but also demonstrates your commitment and reliability to potential lenders. By using the advice given in this detailed guide, you can confidently manage the process of applying for a loan and come closer to reaching your financial objectives.

How to get a project report?

Get your Customized Bankable Project Report with IID

0 notes

Text

Loan against Property documents required?

Borrowing a Property Loan in India by pledging your real estate not only allows you to utilize the assets you already have as collateral but also fulfils your immediate cash needs. However, it is not before you acquire the world of property loans, you start to know the documents running the loan process and you're able to have a perfect borrowing experience.When applying for a loan against property, you'll need to gather the following property loan documents required,

Property Documents: You need to have the real deeds that confirm that you are the actual owner of the property, these include the sale deeds, title deed, and possession certificate. These documents are responsible for the establishing of the legal ownership of the given amenity, while lending the money, they serve as collateral.

#Loan Against Property#Property Loan in India#property loan documents required#property loan scheme#property loan for woman#financenu

0 notes

Text

Benefits of Personal Loans for Self-Employed

Flexibility in Usage: One of the primary benefits of personal loans is their flexibility. Whether you need funds for business expansion, home renovation, education, medical emergencies, or even a vacation,loan for self employed can be used for any purpose.

No Collateral Required: Most personal loans are unsecured, meaning you don't need to pledge any assets as collateral. This is particularly advantageous for self-employed individuals who may not have significant assets to offer.

Quick Disbursement: Personal loans are typically processed and disbursed quickly. This can be crucial for self-employed individuals who may need immediate funds to manage business cash flow or other urgent expenses.

Improving Credit Score: Timely repayment of personal loans can help self-employed individuals build and improve their credit score, making it easier to secure loans in the future.

Eligibility Criteria for Self-Employed Individuals

While eligibility criteria can vary between lenders, here are some common factors that self-employed individuals need to meet:

Age: Most lenders require applicants to be between 21 to 60 years of age.

Income Stability: Self-employed individuals must demonstrate a stable source of income. Lenders usually prefer applicants with a minimum of 2-3 years of business continuity.

Credit Score: A good credit score is crucial. A score of 750 and above is generally considered favorable by lenders.

Annual Turnover: Some lenders may have specific requirements regarding the annual turnover of the applicant's business.

Repayment Capacity: Lenders assess the applicant's repayment capacity by evaluating their income, existing debts, and other financial obligations.

Documentation Requirements

Self-employed individuals need to provide several documents to support their loan application. These may include:

Proof of Identity: Aadhar card, PAN card, passport, voter ID, or driving license.

Proof of Address: Utility bills, rental agreement, or any government-issued address proof.

Income Proof:

Income tax returns (ITR) for the last 2-3 years.

Profit and loss statement.

Balance sheet.

Bank statements for the last 6 months to 1 year.

Business Proof:

Certificate of business existence.

Trade license or registration certificate.

Partnership deed, if applicable.

Steps to Secure a Personal Loan for Self-Employed

Evaluate Your Requirements: Determine the loan amount you need and the purpose of the loan. This will help you choose the right loan product and lender.

Check Your Credit Score: Before applying, check your credit score. If your score is low, take steps to improve it, such as paying off existing debts and correcting any errors in your credit report.

Research Lenders: Different lenders have different criteria and interest rates. Research and compare various lenders to find the one that best suits your needs.

Gather Necessary Documents: Collect all the required documents mentioned above. Having these ready can expedite the loan approval process.

Apply Online or Offline: Most lenders offer both online and offline application processes. Choose the one that is most convenient for you.

Submit Your Application: Fill out the application form accurately and submit it along with the required documents.

Await Approval: After submitting your application, the lender will review it and may contact you for further verification or information.

Loan Disbursement: Once approved, the loan amount will be disbursed to your bank account. This process usually takes a few days.

Tips for Getting Your Personal Loan Approved

Maintain a Good Credit Score: A high credit score increases your chances of loan approval. Ensure timely payment of bills and avoid defaulting on any loans.

Show Stable Income: Demonstrating a stable and consistent income is crucial. Regularly update your financial statements and maintain good business practices.

Reduce Existing Debt: Lenders look at your existing debt obligations. Reducing your current debt can improve your debt-to-income ratio, making you a more attractive borrower.

Apply with a Co-Applicant: If you have a low credit score or unstable income, applying with a co-applicant (such as a spouse or family member with a stable income) can improve your chances of approval.

Be Transparent: Provide accurate and complete information in your application. Misleading or false information can lead to rejection.

Common Challenges Faced by Self-Employed Applicants

Income Variability: The fluctuating nature of self-employment income can be a red flag for lenders. Demonstrating consistent earnings over a period can mitigate this concern.

High-Interest Rates: Self-employed individuals may face higher interest rates due to perceived risk. Comparing different lenders and negotiating terms can help secure a better rate.

Stricter Documentation: Self-employed applicants often need to provide more extensive documentation compared to salaried individuals. Keeping well-organized financial records can simplify this process.

Limited Credit History: If you are new to self-employment or have limited credit history, building a strong credit profile through timely payments and responsible financial behavior is essential.

Conclusion

Instant personal loan for self employed as a self-employed individual can be challenging, but it is not impossible. By understanding the eligibility criteria, gathering the necessary documents, and presenting a stable financial profile, you can improve your chances of approval. Personal loans offer flexibility and can be a valuable financial tool for managing various personal and business needs. Remember to research and compare different lenders to find the best terms and interest rates for your situation. With careful planning and preparation, you can successfully navigate the loan application process and secure the funds you need.

#self employed personal loan#personal loan for self employed#instant personal loan for self employed#instant loan for self employed#loan for self employed#self employed loans online#documents required for personal loan for self employed

0 notes

Text

Best Personal Loans for Summer Vacations

A summer vacation is the perfect time to relax, explore new places, and create unforgettable memories. However, travel expenses—including flights, hotels, sightseeing, and shopping—can quickly add up, making it difficult to finance your dream holiday. This is where a personal loan for travel can help.

A vacation loan allows you to enjoy your trip without financial stress, providing quick funds with flexible repayment options. In this article, we’ll explore the best personal loans for summer vacations, their benefits, eligibility criteria, and tips to choose the right loan for your travel plans.

🔗 Looking for a Travel Loan? Apply Here: Check Personal Loan Offers

1. Why Choose a Personal Loan for Your Summer Vacation?

A personal loan for travel is an unsecured loan that helps cover travel-related expenses without requiring collateral. Unlike credit cards, which come with high interest rates, a personal loan offers:

✔ Lower interest rates compared to credit cards ✔ Flexible repayment terms (12 to 60 months) ✔ Quick approval and disbursal ✔ No restriction on travel destinations

Whether you’re planning a domestic vacation or an international trip, a personal loan can provide the financial flexibility to make your travel dreams a reality.

2. Best Personal Loans for Summer Vacations

Here are some of the top personal loans for travel that offer competitive interest rates, fast processing, and flexible repayment options:

2.1. IDFC First Bank Personal Loan

Loan Amount: ₹50,000 to ₹40 lakh

Interest Rate: 10.75% - 22% p.a.

Repayment Tenure: 12 to 60 months

Quick online approval & minimal documentation 🔗 Apply Here: IDFC First Bank Personal Loan

2.2. Bajaj Finserv Personal Loan

Loan Amount: ₹50,000 to ₹25 lakh

Interest Rate: 11% - 20% p.a.

Instant loan disbursal within 24 hours

No collateral required 🔗 Apply Here: Bajaj Finserv Personal Loan

2.3. Axis Bank Personal Loan

Loan Amount: ₹50,000 to ₹40 lakh

Interest Rate: 10.49% - 17.5% p.a.

Quick processing & pre-approved offers available 🔗 Apply Here: Axis Bank Personal Loan

2.4. Tata Capital Personal Loan

Loan Amount: ₹75,000 to ₹35 lakh

Interest Rate: 10.99% - 19% p.a.

100% digital application process 🔗 Apply Here: Tata Capital Personal Loan

2.5. Incred Personal Loan

Loan Amount: ₹50,000 to ₹10 lakh

Interest Rate: 11% - 24% p.a.

Suitable for salaried & self-employed individuals 🔗 Apply Here: Incred Personal Loan

3. Eligibility Criteria for Travel Loans

To qualify for a personal loan for a vacation, you need to meet certain eligibility criteria set by the lender:

✔ Age: 21 to 60 years ✔ Employment: Salaried or self-employed individuals ✔ Minimum Income: ₹15,000 - ₹25,000 per month (varies by lender) ✔ Credit Score: 700+ preferred for lower interest rates ✔ Employment Stability: Minimum 1 year of work experience

Having a higher credit score improves your chances of getting a lower interest rate and higher loan amount.

4. Documents Required for a Vacation Loan

📌 Identity Proof: Aadhaar Card, PAN Card, Passport 📌 Address Proof: Utility Bill, Rental Agreement, Passport 📌 Income Proof: Salary slips (for salaried individuals), ITR (for self-employed) 📌 Bank Statements: Last 3-6 months for income verification

Lenders may also require employment verification for salaried individuals and business proof for self-employed borrowers.

5. How to Choose the Best Personal Loan for Your Summer Vacation

5.1. Compare Interest Rates

Look for lenders offering competitive interest rates to reduce the cost of your loan.

5.2. Check Loan Tenure & EMI Options

Opt for a flexible repayment tenure that allows you to manage EMIs comfortably.

5.3. Look for Quick Disbursal

Choose lenders that offer instant approvals and same-day loan disbursal for urgent travel plans.

5.4. Assess Hidden Fees

Check for processing fees, prepayment charges, and late payment penalties before applying.

5.5. Read Customer Reviews

User reviews can give insights into customer service, ease of application, and loan processing speed.

🔗 Compare Personal Loan Options & Apply Here: Get a Personal Loan

6. Tips for Managing Your Vacation Loan Effectively

✔ Borrow Only What You Need – Avoid over-borrowing to prevent financial stress. ✔ Choose a Comfortable EMI – Use an EMI calculator to select a manageable repayment option. ✔ Make Timely Repayments – Avoid late payment fees and maintain a good credit score. ✔ Look for Prepayment Options – If possible, repay early to save on interest costs.

7. Alternatives to Personal Loans for Travel

If you don’t want to take a personal loan, here are some alternatives:

✔ Travel Credit Cards: Earn reward points, cashback, and travel discounts on purchases. ✔ Savings & Fixed Deposits: If you have enough savings, using them can help you avoid paying interest. ✔ Employer Salary Advances: Some companies offer salary advance loans at lower interest rates.

Should You Take a Personal Loan for Travel?

A personal loan for summer vacations can be a smart choice if you want to enjoy your trip without financial burden. It offers fast access to funds, flexible repayment options, and lower interest rates compared to credit cards.

✔ If you need quick funds and prefer structured repayments, a personal loan is a great option. ✔ If you have existing savings, consider using them first to minimize debt.

🔗 Ready to Apply for a Travel Loan? Compare the Best Offers Here: Check Personal Loan Options

With the right financial planning and loan selection, you can enjoy a stress-free summer vacation without worrying about expenses!

#finance#nbfc personal loan#personal loans#loan services#fincrif#personal loan online#personal loan#loan apps#bank#personal laon#Best personal loans for summer vacations#Travel loan for summer holidays#Vacation loan options in India#Instant personal loan for travel#Best personal loans for international travel#How to finance a vacation with a personal loan#Top banks offering travel loans#Personal loan for family vacations#Low-interest personal loans for travel#Quick loan approval for holiday trips#Best lenders for vacation loans#Personal loan vs credit card for travel#Loan eligibility for travel financing#Documents required for a vacation loan#Tips for repaying a travel loan#EMI options for travel personal loans#Fast disbursal loans for vacations#How to get a holiday loan without a credit score#Best NBFCs for travel loans#Zero collateral travel loan options

0 notes

Link

Document Required for Business Loan

If you have a lack of cash and you are not able to manage the cash flow. So, you can opt for a business loan to upgrade business equipment and grow the business by the option of business loans. Each bank has specific requirements, criteria, and eligibility factors.

The list of documents is given below. These documents required for business loans are essential documents it may vary from lender to lender. You can visit our website financeseva to check your eligibility for a business loan and you can apply from there.

To apply for a business loan, you need to submit the following documents along with the business loan application:

Identity proof: For individual, company, or firm – submit valid identity proof and PAN (Permanent Account Number) Card.

Address proof: Voter ID Card, Ration Card, Passport or Driving License

Bank Statements: Latest bank statements for at least 6 months

Income Documents: This unsecured business loans would include the latest ITR (Income Tax Return) along with the computation of income, balance sheet, profit & loss account for the past two years. Make sure that the financials are audited by a reputed chartered accountant.

Proof of Continuation: In business continuation proof, you can submit ITR/trade license, sale certificate/establishment

Other mandatory documents: Sole proprietorship declaration, partnership deed, certified true copy of memorandum & articles of association and board resolutions.

These are basic documents that are required for the application for a business loan.

#documents required for business loans#unsecured business loans#startup loan#stand up loan#working capital loan#capital loan#personal loan#business loan#financeseva

2 notes

·

View notes

Text

Embark on your global education adventure with Unipay! Our platform facilitates seamless transitions for students pursuing education abroad. From application assistance to financial transactions, Unipay ensures a hassle-free journey towards academic excellence beyond borders. Unlock your potential today. To know more in details, visit our website today: https://unipayforex.com

#education loan#overseas education loan#education loan abroad#education loan documents required#education loan tax benefit#education loan tax deduction#education loan apply online#education loan rules#abroad education loan#education loan for abroad#study abroad education loan

0 notes

Text

Understand the pivotal role of the moratorium period in financing higher education abroad, delving into aspects like the repayment process, essential documents required for study loans in Canada, and the availability of loans from nationalized banks for education abroad.

#repayment process#education loans for abroad studies#documents required for study loan in Canada#loan from nationalized banks

0 notes

Text

Documents Required for Home Loan in 2024 - IIFL Home Loans

Check out the list of the documents required for home loan like income proof, identity proof, PAN card & more for easy disbursement of housing loan. Apply Now!

0 notes

Text

Documents Required for Business Loan Approval: Complete Guide

Discover the essential documents required for a business loan application process. Prepare effectively for financing success with expert guidance.

0 notes