#Loan against salary account

Explore tagged Tumblr posts

Text

How to Get a Personal Loan Against Your Salary Account

A personal loan can be a convenient financial tool, especially when you have an immediate need for funds. If you have a salary account, securing a personal loan becomes even easier, as banks often offer special benefits to account holders. In this article, we will explore how to get a personal loan against your salary account, its benefits, eligibility criteria, and the application process.

Benefits of Taking a Personal Loan Against Your Salary Account

Quick Approval and Disbursal – Banks have pre-approved offers for salary account holders, ensuring faster processing.

Lower Interest Rates – Preferential interest rates may be available to those who maintain a salary account with the lending bank.

Minimal Documentation – Banks already have your financial details, reducing paperwork.

Higher Loan Amounts – Your salary account history helps in determining your creditworthiness, increasing your chances of approval for a higher loan amount.

Flexible Repayment Terms – Banks provide better repayment options based on your monthly salary credits.

Eligibility Criteria for a Personal Loan Against Your Salary Account

You must be a salaried individual with a stable income.

Your salary should be credited to the same bank where you are applying for the loan.

A good credit score (typically above 700) increases approval chances.

Your monthly income should meet the bank’s minimum requirement for loan eligibility.

Some banks may require a minimum job tenure with the current employer.

Steps to Apply for a Personal Loan Against Your Salary Account

Check Your Loan Eligibility

Log in to your bank’s net banking portal to check if you have a pre-approved offer.

Use the bank’s loan eligibility calculator to estimate the amount you can borrow.

Compare Interest Rates and Offers

Research various banks and financial institutions to compare interest rates.

Look for promotional offers and discounts for existing customers.

Gather Required Documents

Identity proof (Aadhaar, PAN, Passport, etc.)

Address proof (Utility bills, rental agreement, etc.)

Salary slips for the last 3-6 months

Bank statements reflecting salary credits

Employment proof (offer letter, employee ID, etc.)

Apply Online or Visit a Branch

Many banks allow you to apply through their website or mobile app.

Alternatively, you can visit the nearest branch and submit your application in person.

Loan Approval and Disbursal

The bank verifies your documents and assesses your credit profile.

Upon approval, the loan amount is disbursed directly to your salary account.

Factors Affecting Loan Approval

Credit Score – A higher score results in better interest rates and approval chances.

Salary Account History – Consistent salary deposits improve loan eligibility.

Employer’s Reputation – Employees of reputed organizations may receive preferential terms.

Existing Liabilities – If you have multiple loans, your debt-to-income ratio affects approval.

Pros and Cons of a Personal Loan Against Your Salary Account

Pros:

✔ Easy access to funds with minimal documentation. ✔ Competitive interest rates and flexible repayment options. ✔ Faster processing and approval due to existing bank relationship.

Cons:

✖ Limited to the bank where your salary is credited. ✖ A poor credit score may lead to rejection or high-interest rates. ✖ Borrowing beyond your repayment capacity can lead to financial stress.

Alternative Options

Credit Cards – Suitable for short-term borrowing but with higher interest rates.

Salary Advances – Some employers offer salary advances as an alternative to personal loans.

Overdraft Facility – Banks provide overdraft options against salary accounts with flexible repayment terms.

Conclusion

Obtaining a personal loan against your salary account is a convenient and efficient way to secure financial assistance when needed. By maintaining a good credit score, choosing a reputed lender, and borrowing responsibly, you can make the most of this facility while ensuring smooth repayment. Always compare offers and read the loan terms carefully before proceeding with your application.

#finance#personal loan online#nbfc personal loan#personal loans#personal loan#loan services#personal laon#fincrif#loan apps#bank#Personal loan#Salary account loan#Instant personal loan#Loan against salary account#Personal loan for salaried employees#Low-interest personal loan#Quick personal loan approval#Eligibility for salary account loan#Personal loan without collateral#Best personal loan offers#Bank loan for salaried professionals#Easy personal loan application#Documents required for personal loan#How to apply for a personal loan#Fast disbursal personal loan

0 notes

Text

Dandelion News - January 22-28

Like these weekly compilations? Tip me at $kaybarr1735 or check out my Dandelion Doodles!

1. Sunfish that got sick after aquarium closed has recovered — thanks to human cutouts

“A solitary sunfish […] appeared unwell days after the facility closed last month for renovations. As a last-ditch measure to save the popular fish, its keepers hung their uniforms and set up human cutouts outside the tank. The next morning, the sunfish ate for the first time in about a week and has been steadily recovering[….]”

2. Costco stands by DEI policies, accuses conservative lobbyists of 'broader agenda'

“[Each of the board of directors and 98% of shareholders voted to reject a measure against DEI.] Costco's board wrote that “our commitment to an enterprise rooted in respect and inclusion is appropriate and necessary[….]””

3. Nearly $37 Million Will Support Habitat Restoration in Coastal Louisiana

“The project will restore nearly 380 acres of marsh and construct more than 7,000 feet of terraces in St. Bernard Parish. […] Coastal wetlands help protect communities [… from] wind, waves, and flooding[… and] support a statewide seafood industry valued at nearly $1 billion per year.”

4. Cooling green roofs seemed like an impossible dream for Brazil's favelas. Not true!

“[… A Brazilian nonprofit] teaches favela residents how to build their own green roofs as a way to beat the heat without overloading electrical grids[…,] dampen noise pollution, improve building energy efficiency, prevent flooding by reducing storm water runoff and ease anxiety.”

5. Bacteria found to eat forever chemicals -- and even some of their toxic byproducts

“"Many previous studies have only reported the degradation of PFAS, but not the formation of metabolites. We not only accounted for PFAS byproducts but found some of them continued to be further degraded by the bacteria," says the study's first author[….]”

6. A father and daughter’s to turn oil data into life-saving water

“The aquifer [discovered through oil-owned seismic data], it turned out, was vast enough to provide water for 2 million people for more than a century.”

7. Trump’s funding pause won’t impact federal student loans, Pell Grants

“[… T]he temporary pause will not impact “assistance received directly by individuals,” including federal direct student loans and Pell Grants, which are government subsidies that help low-income students pay for college.”

8. In Uganda, a women-led reforestation initiative fights flooding, erosion

“[… T]he Kasese municipality has established nurseries to provide free tree seedlings, particularly to women, to support reforestation efforts. [… They] plant Ficus trees near their homesteads to provide shade and help control erosion, and Dracaena trees on their fields to retain soil moisture.”

9. [A Texas school board] votes yes to provide low-cost housing to staff at no cost to the district

“The program will include 300 homes[…] only a short commute to campuses. […] Rent will be determined on a sliding scale based on their salaries, with those making less receiving a larger discount. The proposed community would include amenities, like childcare facilities[….]”

10. Heat pumps keep widening their lead on gas furnaces

“Americans bought 37% more air-source heat pumps than the next-most-popular heating appliance, gas furnaces, during the first 11 months of the year. That smashes 2023’s record-setting lead of 21%.”

January 15-21 news here | (all credit for images and written material can be found at the source linked; I don’t claim credit for anything but curating.)

#hopepunk#good news#fish#sunfish#mola mola#aquarium#us politics#costco#dei#diversity equity and inclusion#louisiana#habitat restoration#green infrastructure#brazil#global warming#science#forever chemicals#recycling#water#water scarcity#big oil#student loans#federal aid#reforestation#gardening#low income#affordable housing#housing#school#heat pump installation

134 notes

·

View notes

Text

Short Term Loans UK Direct Lender Can Help You Save Money

Who in this day and age needs a quick fix for their financial issues? Loans are becoming a more and more popular choice; in England, short term loans UK direct lender are available. Continue reading to find out how to obtain the appropriate sum of money to augment your monthly income or assist with unforeseen costs if you have an accident or a chronic illness.

Payday loans, often known as salary advance loans, give people who need money quickly access to it. They provide protection against unanticipated costs or fill shortfalls in weekly or monthly budgets. As the name suggests, they are short term cash loans that are intended to be paid back on the creditor's subsequent paycheck. Even though you might anticipate higher interest rates with short term loans UK direct lender, they are quick and practical in an emergency. Therefore, it is crucial that all borrowers think about the potential dangers and make agreements for responsible lending.

In the UK, How Does Short Term Cash Operate?

Since 2014, short term cash loans have been regulated by the Financial Conduct Authority (FCA). But since these loans are subject to varied state regulations, it's critical to comprehend the general terms and circumstances in your area. Typically, short term loans UK direct lender are for modest sums of money between £100 and £1,500. Usually, the borrower has until their next paycheck to reimburse it. In order to keep payday loans from becoming more expensive, the FCA in the UK also set a restriction on their interest rates. It forces lenders to be open and honest about the entire cost of the loan, including any fees. A certified public accountant may be used by lenders to take repayment straight out of the borrower's bank account. Borrowers have the option to terminate the CPA and set up a different repayment plan, though. A borrower must also be aware that the laws and procedures governing payday loans UK are subject to change.

How to Apply for a Short Term Loans UK

Examine and contrast lenders: Begin by investigating and contrasting several UK lenders. Always choose a trustworthy lender with clear conditions and competitive interest rates.

Verify your eligibility: Examine each reputable lender's eligibility conditions to make sure you meet them, including those related to age, bank account, residence, income, and credit score. Obtain Necessary Information: Prior to completing the loan application, collect financial and personal information, including proof of address, income, bank statements, and identity (passport, driver's license).

Online Application: Online short term loans UK direct lender applications are accepted by the majority of payday lenders. Go to the lender's website and complete the application with current, correct information.

Examine the terms and conditions: Your final short term loans UK agreement's terms and conditions must be read and comprehended. Get in touch with your lender right away if you require any clarification or adjustments on fees, due dates, or possible penalties for late payments.

Money Received: Within a few minutes of e-signing the loan contract, the money is transferred straight into the approved bank account.

https://classicquid.co.uk/

#short term loans uk direct lender#short term loans uk#short term cash#short term loans for bad credit#same day loans online#short term cash loans#short term loans direct lenders

4 notes

·

View notes

Text

Cash Disbursed in 15 Minutes for Short Term Loans UK

Applying for short term loans UK is one option if you're in the UK and need money quickly for unforeseen bills. The unique feature of this credit quick and easy online system is that you can apply for a short term loan direct lender in a matter of minutes rather than having to wait in line. In fifteen minutes after your application is approved, the lender will send the funds directly into your bank account. Also, there are no tedious formalities involved with using this online platform, such as faxing papers, filling out extensive paperwork, or paying fees.

Short term loan are provided to borrowers on a short-term basis by lenders who are available around-the-clock. One handy aspect is that because the short term loans UK is unsecured, you don't have to pledge your collateral as security against the lender. For a brief repayment period of 30 days following the original date of approval, the real amount you can obtain ranges from £100 to £2500. The use of money is not a concern for you. You can therefore use the money for any of the following financial purposes. Tuition for a child's education Balance owing on credit cards installment payments for a home loan Travel costs expenditures for the household phone or light bill payments

Be encouraged despite your bankruptcy, foreclosure, arrears, late payments, CCJs, IVA, foreclosure, or defaults! On the other hand, short term loans UK direct lender are available to you in a convenient way. The lender does not conduct a credit check. It is intended that these funds accept applications with any kind of credit score. Remember that in order to avoid incurring more fees from the lender, you must make the repayment on schedule. Your credit score can be improved and you can receive financial aid on par with fair credit ratings if you make your payments on time.

To endow money, there are numerous lenders offering a variety of loan options on the internet; however, you must ensure that the agreement meets your needs with ease. If you do not have a debit card, you must select (in a lender's fierce competition) short term loans direct lenders before completing an application. You must meet certain requirements in order to be considered for the chosen loan, including being a UK citizen, being eighteen years old, working for a reputable company for the last six months, and routinely receiving your salary directly into your bank account. Apply for a short term loans UK direct lender now, doesn’t hesitate!

A £1000 loan can be used for a variety of purposes; it can be used as a same day loans UK, to make a critical purchase, to pay expenses during a difficult financial time, or for other purposes. There are many situations in which a £1000 loan will be sufficient, thus a larger loan is not always required. Simply put, borrowing money could be done to pay for unforeseen costs like auto repairs or unpaid payments that you had forgotten about. https://paydayquid.co.uk/

6 notes

·

View notes

Text

Mastering Your Finances: A Step-by-Step Guide on How to Create a Budget

Creating a budget is a foundational step towards achieving financial stability and realizing your financial goals. Whether you’re aiming to save for a major purchase, pay off debt, or simply gain better control over your finances, a well-crafted budget is an invaluable tool. This comprehensive guide will take you through the essential steps on how to create a budget, empowering you to make informed financial decisions and secure a more secure financial future.

How to Create a Budget?

1. Set Clear Financial Goals

Before diving into the budgeting process, define your financial goals. Whether it’s building an emergency fund, saving for a vacation, or paying off student loans, having specific and measurable goals will guide your budgeting decisions.

2. Gather Financial Information

Collect information about your income, expenses, and debts. Compile pay stubs, bank statements, bills, and any other relevant financial documents. This step provides a comprehensive overview of your financial situation.

3. Categorize Your Expenses

Divide your expenses into fixed and variable categories. Fixed expenses, such as rent or mortgage payments and insurance, remain consistent each month. Variable expenses, like groceries and entertainment, can fluctuate. Categorizing expenses helps identify areas for potential savings.

4. Calculate Your Monthly Income

Determine your total monthly income, including salary, bonuses, freelance income, or any other sources of income. Understanding your monthly income is crucial for establishing a realistic budget.

5. List Your Fixed Expenses:

Write down all fixed expenses, such as rent or mortgage, utilities, insurance, and loan payments. These are recurring costs that remain relatively constant each month.

6. Identify Variable Expenses

Make a list of variable expenses, including groceries, dining out, entertainment, and transportation. Variable expenses can be adjusted based on your financial goals and priorities.

7. Include Savings and Debt Repayment

Prioritize saving and debt repayment in your budget. Allocate a portion of your income to an emergency fund, or retirement savings, and pay off outstanding debts. Treating savings as a non-negotiable expense ensures consistent progress toward financial goals.

8. Factor in Irregular Expenses

Account for irregular or annual expenses, such as insurance premiums, property taxes, or holiday spending. Divide these expenses by 12 to incorporate them into your monthly budget, preventing unexpected financial strain.

9. Subtract Expenses from Income

To better understand how to create a budget, subtract your total expenses from your total income. The result should ideally be a positive number, indicating that your income covers all your expenses. If the result is negative, adjustments may be needed to align your budget with your income.

10. Adjust and Prioritize

If your expenses exceed your income, revisit your budget and identify areas where you can cut back. Prioritize essential expenses and savings goals while minimizing non-essential spending. Adjusting your budget ensures financial sustainability.

11. Embrace the 50/30/20 Rule

Consider following the 50/30/20 rule, where 50% of your income goes to needs (housing, utilities), 30% to wants (entertainment, dining out), and 20% to savings and debt repayment. This rule provides a simple guideline for balanced budgeting.

12. Use Budgeting Tools

Leverage technology to simplify budgeting. Numerous apps and online tools can help you track spending, set financial goals, and visualize your budget in real-time. Choose a tool that aligns with your preferences and makes budgeting more accessible.

13. Track and Review Regularly

Budgeting is an ongoing process, and the answer to “how to create a budget” might differ from person to person. Regularly track your spending against your budget, making adjustments as needed. Reviewing your budget ensures that it remains aligned with your financial goals and adapts to changes in your income or expenses.

14. Emergency Fund Planning

Prioritize building and maintaining an emergency fund within your budget. Having a financial safety net provides peace of mind and protects against unexpected expenses.

15. Seek Professional Advice

If you find budgeting challenging or have complex financial situations, consider seeking advice from financial professionals. Financial advisors can offer personalized guidance to help you achieve your financial objectives.

16. Mindful Spending Habits

Cultivate mindful spending habits as a key aspect of budgeting. Regularly assess your discretionary expenses and identify areas where you can make conscious choices to reduce unnecessary spending. This might include packing lunch instead of dining out or opting for cost-effective entertainment options.

17. Cash Flow Management

Effective budgeting involves managing cash flow strategically. Ensure that you have sufficient funds available for essential expenses and prioritize payment of bills to avoid late fees. Understanding your cash flow cycle helps prevent financial stress and keeps your budget on track.

18. Automate Savings Contributions

Simplify your savings strategy by automating contributions to savings accounts. Setting up automatic transfers ensures that a portion of your income is consistently directed towards savings goals, reinforcing the habit of saving.

19. Celebrate Financial Milestones

Acknowledge and celebrate financial milestones within your budget. Whether it’s reaching a savings goal, paying off a significant portion of debt, or achieving a specific financial target, celebrating successes reinforces positive financial habits and motivates continued progress.

20. Financial Education and Literacy

Invest time in expanding your financial education. Understanding financial principles, investment options, and economic trends empowers you to make informed decisions. Numerous resources, including books, online courses, and workshops, can enhance your financial literacy and contribute to long-term financial success.

Conclusion

Knowing how to create a budget is a fundamental step toward financial empowerment and security. By following these comprehensive steps, you can gain better control over your finances, make informed decisions, and work towards achieving your financial goals. Remember, budgeting is a dynamic process that evolves with your financial journey, so stay committed, stay flexible, and enjoy the benefits of financial well-being.

#BudgetingTips#moneymanagement#SmartSpending#financialwellness#moneymatters#financialliteracy#financialgoals#MoneySmart#wealthbuilding

2 notes

·

View notes

Text

Banking sector in UK provides a dedicated service both to Clients and job seekers

The banking sector is the key component of the financial system. Credit institutions conduct settlements, ensure the safeguarding of clients’ funds in bank accounts, and transform these funds into loans to the economy. A Bank is a financial institution licensed to receive deposits and make loans and to invest and earn profit. A Bank is a financial institution licensed to receive deposits and make loans. Two of the most common types of banks are commercial/retail and investment banks. Banks also engaged in providing payment services, thereby facilitating all entities to carry out their financial transactions. On the other hand, banks can create vulnerabilities of systemic nature, partly due to a mismatch in maturity of assets and liabilities and their interconnectedness. Therefore, the soundness of banks is important, as it contributes towards maintaining confidence in the financial system, and any failure may have the potential to impact on activities of all other financial and non-financial entities, and finally the economy. With the passage of time, the activities covered by banking business have widened and now various other services are also offered by banks. The banking services these days include issuance of debit and credit cards, providing safe custody of valuable items, lockers, ATM services and online transfer of funds across the country/world.

As the financial hub of the world, the UK offers some of the most diverse and exciting jobs in banking. In addition to more traditional banking roles, there are career opportunities at any of the numerous banks headquartered here. Banks look for economists, marketing, and HR, statisticians, media and government relations specialists and, connected to the explosion of financial technology, IT professionals. What’s often less well known is the contribution the industry makes to the UK’s regions and the career opportunities available via graduate schemes, apprenticeships or for those looking to return to work. Working for a bank is so varied; it could mean working in head office in marketing, HR or in any number of other roles including IT. As banking organizations are so large, there is always the chance to progress through the organization into other roles. Banks are well known for having well trained staff so whatever your job role is, you will be given the skills required to do the job and many of these skills are required for your job and many of these skills should be transferable. A career in banking offers both a competitive salary and excellent benefits. As a new starter you can expect around 23 days holiday a year and this will rise to 30 days after you’ve been there a while. Banking Sector recruitment agency in London is international in nature and some roles can offer excellent opportunities for travelling and working in other countries.

The fast-paced nature of the banking and financial services industry requires people who embrace change and can adapt quickly. They have the scale, insight and deep understanding in banking and financial services to help shape your hiring strategy. Using a customer-first and data-driven approach to meet your business needs within banking and financial services, they make it easy for you to deliver against the complex talent and recruitment landscape you need to navigate. Their dedicated financial services recruitment teams assist organizations in recruiting permanent, temporary and contract banking & financial services staff. They are active in these markets and have built a strong database and network of contacts across all areas of risk, audit, cyber security, treasury, business resilience and legal. Banking Sector recruitment agency in London consultants specialize on specific areas of banking and so they are able to offer advice and direction based on an in-depth understanding of your area of interest or requirement. With global operations and offices across the UK, their reach enables them to source the financial services skills and experience you need to support your business priorities.

Specific recommendations on prudential and market policy should help the industry better support the wider UK economy. They are also adamant about the “digital first” approach the UK should be taking, with the aim of leading global innovation in areas such as data sharing, open banking and digital IDs. The shift to remote working and virtual customer service has dramatically changed how services are delivered. Without the usual in-person customer engagement, lenders have been forced to find creative, innovative and collaborative solutions in a short space of time to ensure the customer demand is met. For an incumbent bank, digital transformation has become a herculean task in an age saturated with technological options, requiring traditional lenders to embrace unpredictability, maintain agility and digitize to the core, which requires support from agile fetch players. From building an agile platform to meet the expectations of demanding customers, creating an optimized digital operating model, going beyond diversity and building a strong work culture, Top Banking Sector recruitment agency in London must address central challenges to lay the foundation for success.

#BankingSectorrecruitmentagencyinLondon#BestBankingSectorrecruitmentagencyinLondon#TopBankingSectorrecruitmentagencyinLondon

2 notes

·

View notes

Text

Travel Tales Pt. 1

This thing started because I wanted to impress a man, yall.

Mid-December 2022, a few days after my birthday, I started flirting with a guy I knew for a few years and found fairly attractive, but never gave any energy to, and the first conversation we had was the spark that lit the match. The following is a snippet of said conversation:

Him - “I’m going to St. Lucia in a few days.” Me - “Make sure and visit Gros Islet and Rodney Bay, the marina is beautiful on a clear moonlit night. You see all the lights from the stars and the boats reflecting on the water and hear the waves slapping against the pier. It’s so calm and serene….” Him - “Hmmm… you’ve been everywhere, I can’t carry you anywhere new!” Me, intrigued - “I haven’t even scratched the surface on places I wanna go, especially in the Caribbean.” Him - “Where do you want to go next?” Me, thinking nothing of what I was saying, cuz I had no intention of actually going anywhere - “Jamaica maybe? Or Barbados, as it’s quite close to home (Tobago).”

Fast forward 4 months, I have my plane ticket to Jamaica in hand and am about to book my Airbnb in Ocho Rios. I am in no way encouraging anyone to do it this way, it is quite inadvisable to travel with someone who you have no real ties with. If you take anything away from reading this, it is that IT LITERALLY TAKES ONE DECISION.

I said yes that day in December. He intoxicated me with the idea of it being just a series of steps to get to the goal. No limits, no hesitation. Logistics would come later. It always seems impossible before you do it, before you take the first leap.

The last time I traveled was 2016 to the aforementioned St. Lucia, with my mom and daughter, who was a toddler at that time. If I’m not mistaken, the decision to go was somewhat similar, with me doing the convincing. Our saving grace was that a close relative was working on the island at the time, so accommodations and transportation was covered (and so expenses were lessened, hallelujah!). Basically, I think I’m due for a couple-hours long plane trip to a new place.

I’m making it sound rather click-bait-y, aren’t I? I haven’t said one thing yet about where the money being spent was coming from, and DUN-DUN-DUNNNN, if Mr. Mysterious is still my plus-one.

Let’s touch on the first part first - the finances.

I currently have a savings account in a local credit union with about $25K in savings, which was one of my savings goals. I am currently permanently employed, bringing in $50K a year before taxes, BUT I was living paycheck to paycheck until last year October, where I made my first official business investment that is bringing in an extra $2K a month, for at least the next year or so. While I have used some of that money to pay off the loan used to make the investment, some of that money was used to fund this trip. I also made the decision to allocate some of my salary towards the trip as well, instead of eating too much into the investment returns. More on this later.

I had identified the PERFECT travel time. I pat myself on the back every time I think about how this played out. In T&T, there’s a public holiday on the 30th of May, and another one on the 8th of June in 2023. Recall that I am employed, and obviously that means I would want to exploit all public holidays (anytime a holiday fell on a Thursday, best believe I was coughing on the phone the Friday so I could be home for 4 whole days…cough cough). I also did some preliminary research on the island and I realized that the island was bigger than home (i.e. I couldn’t drive around the entire island in a day comfortably while sightseeing), so a short 3- or 4- day trip would leave me wanting, or extremely exhausted by trying to squeeze everything into such a short time. After conferring with Mr. Mysterious, I decided that a week-long stay was the sweet spot - enough time to explore some of the tourist-y things to do, while allowing for relaxation and regular life as well. Put those two together, and we get a full 7 days in Jamaica, a prep day before and a rest day after.

Things are falling into place so seamlessly! That only gave me further confirmation that this trip was supposed to happen. Nothing can stop me now! ……..*crickets*

Mr. Mysterious, who has been talking to me almost every single day since that fateful December day, suddenly ghosted me March-month end. No explanation, just radio silence. Granted, we had had a bit of a tiff concerning something unrelated right before the ghosting, but I don’t think it was serious enough to warrant THIS?! I wouldn’t know though, cuz he’s a ghost 👻. I can’t ask. I waited a few days, and sent a follow-up “Hope you are well” text, expecting a response at least, but I've been left on read till this day. I was shook, cuz the safety net I was banking on with this trip was that I wasn’t alone, so the burden of solo travel would be at least lessened. And he also was a seasoned traveler, the exact opposite to me, so that was another thing that made me breathe a bit easier. He knew the ins and outs of international travel and could guide me along. For the first few nights after accepting the disappointment of the absolute curry duck (Trini stale joke) I had just experienced, the trip loomed in front of me, again gigantic and seemingly impossible once again. All the insecurities I had silenced with a proud middle finger at the start of the journey came back up, cackling in my face: Can you even afford to go on this trip alone? How will you get around? You will be stuck in Jamaica for 7 whole days…what were you even thinking? Are you even still considering going, after this shake-up? The nasty chatter got louder in my head. I admit, I looked up whether I could get a full refund of my ticket (no), and if I could ask somebody, anybody to take Mr. Mysterious’ place (also no, that’s unreasonable).

So, I pulled up my big girl panties and made the big girl decision to do my first solo trip to Jamaica in June 2023. I mean, it would have happened eventually - I had put traveling on my vision board, BUT I didn’t expect God to drop me into the deep end like this?!! Damn!

On a more serious note, what I won’t do is question how things are playing out. I have learned long ago that even if things don’t work out exactly how I planned it to, things always work out in the end. Maybe I would be so caught up in building my future career that I won’t have time to travel as much as I like. Maybe this is exactly what I need to build some more confidence in myself and my abilities. Maybe this is what I need to clear out the fuzz in my head - time away from everything, in a hammock, spending much-needed alone time. It will be revealed to me why this happened when it happened, how it happened, in due time. I’m not even stressed or pressed. Also, I am on the last leg of my degree, and having put blood, sweat and tears into the last couple years, I convinced myself that I needed to reward myself for sticking with it and completing it. While an international trip was not on my list of things I thought up of for the celebration (it was more along the lines of a celebratory dinner at a nice restaurant with a few glasses of wine), I sold myself on the idea, as I was intoxicated by Mr. Mysterious’ siren song. I deserve!

Let me touch on some of the things I had the good fortune of having and utilizing in this prep time, leading up to the actual flight dates. Remember, planning had started a whole 6 months before, so I had allotted time for procrastination and plan changes. We’ll discuss Google Flights, using a calendar in a specific way, and what I plan to do.

I’m on a tight budget, and so my main issue was allocating my limited resources in the best way possible to be able to cover every essential. Before the ghosting situation, my main expenses were the plane tickets, and spending money (Mr. Mysterious gallantly offered to handle the accommodation costs). Google Flights had come in CLUTCH! The site has a calendar to see when the cheapest flights were, compared by dates, as well as the option to track flights’ price changes. AS I had already outlined the PERFECT travel dates, I just scrolled down to the dates, and lo and behold, the prices I saw were among the cheapest for the month. I had used the price tracking option, as I started accumulating funds for the purchase of the ticket. Things were chugging along well! No reason why something would go off-kilter, right? Right??

I remember vividly waking up one morning and seeing that the price of the ticket had become a few hundred dollars more expensive.

My heart dropped. I hadn’t gotten all the money at that time, and it was honestly discouraging to have to stretch my already-stretched budget to accommodate this extra expenditure. Nevertheless, she persisted. I had accumulated my $4k in cash, ready to buy tickets by early February. Sis was READY and DETERMINED. I had listened to a podcast that celebrated doing the Thing that involved one taking a giant step with no going backsies. That Thing for me was spending $4k on a trip. It seems silly and trivial now, but my heart was set on doing the Thing. My dreams were consumed by the fantasy excursions Mr. Mysterious and I were going to experience on this beautiful island. Then another confirmation that I was supposed to go on this trip - the airline I was planning to go with had a Valentine’s day sale:

This was it, yall. I was going to Jamaica. This was the sign from God I needed. And I didn’t even see it, it was Mr. Mysterious who sent me a screenshot from his IG feed. My heart sang for that entire week. I was going to Jamaica! I did the Thing, and bought my tickets on Valentine’s Day!

Going on in the background of all this was my 12-week planning on Notion. I had counted 12 weeks into the future from the week I decided to go in mid-December, and created a calendar with a task to complete for each week. These tasks included making a list of locations to visit when we got there, making lists of things to pack, things that I need to have organized before and during the trip, etc. This gave me the time I required to do any future-based thinking, grouped neatly into manageable segments so I wouldn’t feel overwhelmed when I sat and thought about things. I chose Notion simply because I had previous experience using the calendar when I was planning out semester tasks and due dates, and I had always found it to be very easy to use. Plus, you could decorate it. I had embraced my full “speak it into existence” self, and put up pictures and affirmations - a virtual vision board, if you will. Also, this 12-week spread would give me a couple ‘free’ weeks before the actual trip, instead of being exact with the timing. Maybe God knew what He was guiding me to do, cuz with this change in the plan, I would need some extra time to sort stuff out.

To be honest, I still don’t believe that Mr. Mysterious ghosted me. I keep oscillating between the reasoning that he probably has something major going on in his life and needs some time to himself, and the Bad Bitch alter-ego, looking down at him with a upturned nose, lumping him with all the other fuckboys I had the unfortunate luck of meeting and interacting with. The insecure baby girl inside of me has so many questions, mainly if I had done something wrong, but if I am to take my mental health and self-confidence journey seriously, I have to be okay with whatever happens around me, regardless of whether it is positive or negative in my perception. When I start overthinking about it, I stop and visualize myself being a boat in the middle of a vast ocean, in a thunderous storm. Waves as tall as houses are rocking me side to side, up and down, but I still stay afloat, above the waves. I stay confident that this storm will end, and I will complete the journey I planned to, in one piece. I am confident in God’s plan; when thing don’t go my way I stress a lil bit, then release my hold on the outcome I wanted, knowing better will come.

We have reached the point where we discuss the now. Yes, I lied about not being stressed or pressed. I am very much stressing and pressing. I now face some nail-biting, belly-hurting decisions. Best believe that I am not making light of the situation. I know it is so much more dangerous to be a female solo traveler. The decisions I choose to make have unknown consequences and repercussions that I have no clue is in my future. The travel blogs I’ve read seem to gloss over this fact, varnishing it with pretty titles such as “Do’s and Don’ts To Keep You Safe”, maybe because it is an ugly truth that danger is lurking no matter where you go.

Maybe I really do need the time away from the usual routine to view my life through fresh, new eyes. Maybe this really is the Thing I need to start off the rest of my life with. God knows I’ve been feeling hamster-wheel-y for the past few months. Maybe this will be the worst thing I will have ever done, a complete waste of money and time. Regardless of what the outcome is, if I am to experience it, I will. Being adaptable to change, instead of resistant to it may very well be the lesson I have to learn from this experience.

As of now, the most immediate pivot I have to make is that I have to tack on a few extra hundred US to cover Airbnb accommodations for the entire week, as well as more spending money as I have no ‘safety net’ in Mr. Mysterious anymore, per se. As I type this, I remember a quote I saw recently:

And with that, I bid you adieu. I will post an update when I get closer to The Date. Thanks for sticking with my dramatic ass till the end. I would LOVE to hear any tips for beginner solo traveling, and comment with more places that I can visit in Jamaica. I appreciate your love and support!

Kisses,

S.

3 notes

·

View notes

Text

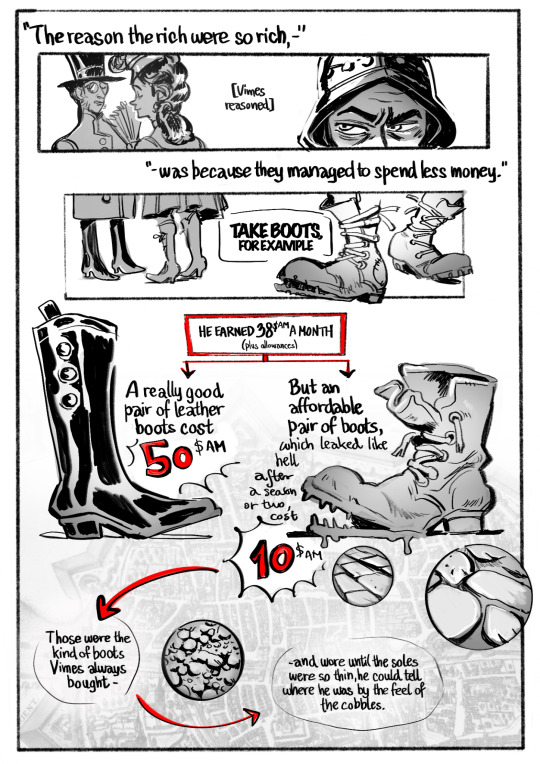

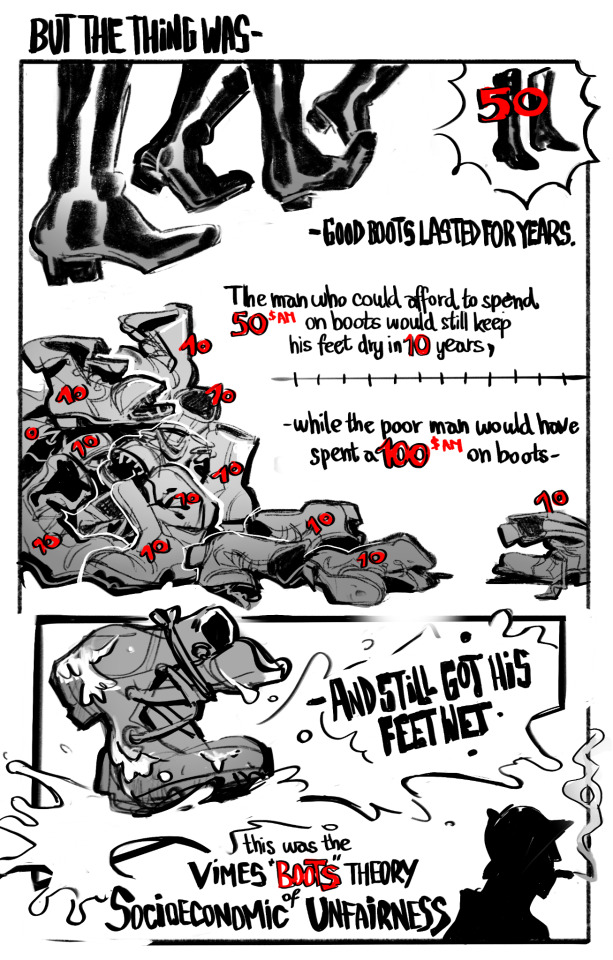

The Vimes' theory simplifies a lot which causes it to leave out a variety of factors, but you're making one fatal assumption in your reasoning - that Vimes is saving $10 over the course of one month. Sometimes it is simply people spending money stupidly, but it's never said how long he saves for and he could potentially be saving all year for that one pair of boots, which would put him in an entirely different situation where poverty wages means that he has to spend more to survive on less and can't put anything aside to invest in a better situation. When the French Revolution started, the price of a loaf of bread was 1 day's wages for the average worker.

There's a great story that I like to use as an addition to Vimes' theory of a teacher who has their class line up in a field for a race, and whoever wins gets $20. When everybody is lined up, the teacher says, "Anybody who grew up with both parents, take a step forward." "Anybody whose parents make more than $100,000 a year, take a step forward." "Anybody whose parents set up a savings account in their name, take a step forward." Etc. When they finish listing things off, they tell the kids to turn around and look at where everybody else is standing. Some of the kids are on the starting line, some of them are halfway to the finish line already.

The truly rich, those who start halfway or more towards the finish line, aren't making tons of money to buy shoes with, however - they're largely enjoying the benefits of generational wealth. Their parents, or grandparents, or great-grandparents made money or invested into something that has passively accrued value - like houses - and now they benefit from that without having to put in any effort. And that's the answer to the most important question of where did the rich get the $50. Rather than earning $50, they borrow $50 against that house they inherited, buy those shoes, and then pay back the loan with another loan. Rinse and repeat for anything and everything, and when they die, the interest on their loans goes with them. And in accruing that generational wealth, they've locked the majority of the population out from having the same opportunities while also having all the time in the world to actually make money if they feel like putting in the effort. In the 60s, you could buy a house on the salary you'd make selling rugs in a furniture store. Today, a house is out of the price range of over 50% of Americans - and that's with 2 salaries in the family.

You might have grown up in a decent neighborhood. Other people might grow up in a neighborhood where the only chance of getting out is a sports scholarship or the local gangs. Regardless, you're both closer to being homeless than you are to being rich. The person who worked hard and has a million dollars in the bank is closer to being homeless than they are to being a billionaire. And maybe with their million dollars they can finally afford $50 boots. Maybe they still can't.

happy glorious 25th of may

142K notes

·

View notes

Text

How to Get a Credit Card with a Low CIBIL Score: A Step-by-Step Guide?

Getting a credit card with a low CIBIL score can be challenging, but it’s not impossible. Many banks and financial institutions offer secured credit cards against fixed deposits, making them an ideal choice for individuals with poor credit history. Additionally, some lenders provide credit cards for low-credit individuals with higher interest rates or lower credit limits. To improve approval chances, you should apply for cards with minimal eligibility criteria, maintain a stable income, and clear any outstanding dues. Regularly checking your credit report and improving your score by making timely payments can help in the long run. This step-by-step guide will help you understand the best options and strategies to get a credit card despite a low CIBIL score.

Understanding the Importance of CIBIL Score

A CIBIL score is a three-digit number that represents your creditworthiness. It typically ranges from 300 to 900, with a score above 750 being considered excellent. Banks and financial institutions use this score to determine your eligibility for credit cards and loans. If your score is low, it indicates a history of delayed payments, defaults, or high credit utilization, making it difficult to get approval for a credit card. However, there are still ways to obtain one even with a poor credit score.

Opting for a Secured Credit Card

One of the best ways to get a credit card for low cibil score is by opting for a secured credit card. These cards are issued against a fixed deposit, reducing the risk for banks and increasing the chances of approval. The credit limit is usually a percentage of the fixed deposit amount, often around 80-90%. Secured credit cards not only provide financial flexibility but also help in improving your credit score over time if used responsibly. Since they are linked to a fixed deposit, they are easier to obtain and do not require a strong credit history.

Applying for Credit Cards with Relaxed Eligibility Criteria

Some banks and fintech companies offer credit cards designed specifically for individuals with low credit scores. These cards may have higher interest rates and lower credit limits, but they provide an opportunity to build a positive credit history. It is advisable to check the eligibility criteria before applying, as multiple rejections can further harm your credit score. Cards such as entry-level or beginner credit cards have flexible approval requirements and can be a viable option for those struggling with a low CIBIL score.

Improving Your Credit Score Before Applying

While you may still get a credit card with a low CIBIL score, it is always beneficial to improve your score before applying. Paying off outstanding debts, reducing credit utilization, and making timely payments can have a significant impact on your credit score. Checking your credit report for errors and disputing any discrepancies can also help improve your score. A higher credit score increases the likelihood of getting approved for better credit cards with lower interest rates and higher credit limits.

Demonstrating a Stable Income Source

A steady income is one of the key factors that banks consider when approving credit card applications. If you have a low CIBIL score but can show proof of a stable income, your chances of approval increase. Providing salary slips, income tax returns, or bank statements as proof of consistent earnings can reassure lenders about your ability to repay the borrowed amount. Some banks may approve credit cards for individuals with low credit scores if they have a reliable income source.

Applying Through Your Existing Bank

If you have a savings or salary account with a particular bank, you may have a better chance of getting a credit card from them. Banks often consider long-term customers with a good banking relationship, even if their credit score is not perfect. Visiting your bank and discussing your options with a representative can be helpful. Some banks also offer pre-approved credit cards to existing customers based on their transaction history and account balance.

Using Alternative Credit-Building Tools

In addition to secured credit cards, some fintech companies offer credit-building tools such as credit-builder loans or small credit lines. These financial products are designed to help individuals establish or improve their credit scores. Using these tools responsibly by making timely repayments can gradually increase your creditworthiness, making it easier to qualify for better credit cards in the future. Additionally, using services that report utility and rent payments to credit bureaus can also contribute to an improved credit score over time.

Conclusion

Getting a credit card with a low CIBIL score is challenging but possible with the right strategies. Opting for secured credit cards, choosing lenders with relaxed eligibility criteria, and demonstrating a stable income can improve your chances of approval. Additionally, taking steps to improve your credit score by making timely payments, reducing credit utilization, and monitoring your credit report can help you access better financial opportunities in the future. By following these steps, you can gradually build a strong credit profile and gain access to more favorable credit card offers.

0 notes

Text

How to Get a Personal Loan Without a Bank Account

In today’s world, having a bank account is usually a requirement for obtaining a personal loan. However, if you do not have a bank account, there are still ways to access financial assistance. Whether you need urgent funds for medical expenses, home repairs, or other personal needs, some lenders offer alternative lending solutions. This article will explore how to secure a personal loan without a bank account and what options are available for borrowers in such situations.

Is It Possible to Get a Personal Loan Without a Bank Account?

Yes, it is possible, but it can be challenging. Many lenders require a bank account to deposit loan amounts and set up automatic repayments. However, some financial institutions and alternative lenders provide options for borrowers without traditional banking relationships. These loans often come with higher interest rates and different repayment structures.

Alternative Ways to Get a Personal Loan Without a Bank Account

1. Credit Unions and Community Lenders

Credit unions and community-based lenders may offer personal loans without requiring a bank account. They often consider factors like income, employment status, and credit history rather than just banking details.

2. Microfinance Institutions

Microfinance institutions provide small loans to individuals who lack access to traditional banking. These lenders operate with minimal paperwork and may disburse funds through prepaid cards, mobile wallets, or cash payments.

3. Payday Loans and Cash Advance Lenders

Payday loans are short-term, high-interest loans that do not necessarily require a bank account. Instead, lenders may request proof of income and a valid identification document before approving the loan.

4. Pawnshop Loans

Pawnshops provide secured loans against valuable items such as gold, electronics, or vehicles. Since these loans are collateral-based, they do not require a bank account. However, failure to repay the loan can result in the loss of your pledged asset.

5. Salary-Based Loans from Employers

Some companies offer salary advances or employer-backed loans. If you work for an employer that provides this benefit, you may be able to borrow against your future paycheck without needing a bank account.

6. Digital Wallet and Mobile Loan Apps

With the rise of fintech companies, many digital wallets and loan apps offer instant loans. Some of these apps allow users to receive funds in mobile wallets rather than bank accounts, making them an ideal choice for those without traditional banking.

Steps to Take When Applying for a Personal Loan Without a Bank Account

1. Check Your Credit Score

Even without a bank account, having a good credit score can increase your chances of loan approval. If your credit history is poor, consider improving it before applying.

2. Gather Required Documents

Lenders will still require proof of income, identification, and sometimes a guarantor. Be prepared to provide salary slips, business income records, or other financial proof.

3. Choose the Right Lender

Research and compare lenders that provide loans without requiring a bank account. Check their interest rates, repayment terms, and customer reviews to find the best option.

4. Provide an Alternative Mode of Payment

Some lenders may disburse funds through checks, prepaid debit cards, or mobile wallets. Be sure to ask about available payment options in advance.

5. Consider a Co-Signer or Guarantor

If your credit score or financial standing is not strong enough, having a co-signer with a bank account can increase your chances of loan approval.

6. Understand the Loan Terms

Read and understand all loan terms, including interest rates, fees, and penalties for late payments. Avoid predatory lenders who charge excessively high rates.

Pros and Cons of Getting a Personal Loan Without a Bank Account

Pros:

Provides access to emergency funds for individuals without a bank account.

Some lenders offer flexible repayment terms.

Alternative lending options may not require a strong credit history.

Cons:

Higher interest rates and fees compared to traditional bank loans.

Limited loan amounts and strict repayment terms.

Risk of losing collateral if opting for a pawnshop loan.

Final Thoughts

While obtaining a personal loan without a bank account can be challenging, it is not impossible. By exploring alternative lending options, preparing necessary documents, and choosing a reputable lender, you can successfully secure a loan that fits your needs. However, be cautious of high-interest rates and ensure that the repayment terms are manageable to avoid financial stress in the future.

If you are considering taking a personal loan, always conduct thorough research to find the best financial solution tailored to your situation.

#finance#fincrif#bank#personal loan#loan services#personal loans#personal loan online#nbfc personal loan#loan apps#personal laon#Personal loan#Loan without a bank account#No bank account loan#Alternative personal loan options#Instant loan without a bank account#Payday loans without a bank account#Microfinance personal loan#Digital wallet loans#No bank account required loan#Salary advance loans#Cash loan without a bank account#Personal loan for unbanked individuals#Fintech personal loan#Personal loan eligibility without a bank account#Quick cash loan without a bank account

2 notes

·

View notes

Text

How to Get a Credit Card Without CIBIL for Online Shopping

In today’s digital world, online shopping has become a necessity rather than a luxury. Whether you are buying gadgets, fashion items, or groceries, a credit card simplifies payments and provides exclusive discounts, cashback, and reward points. However, getting a Credit Card Without CIBIL Score can be challenging, especially for first-time users, students, and those with poor credit history. If you are looking for the Best Credit Card for Shopping Online but don’t have a CIBIL score, this guide will help you explore available options.

Why is CIBIL Score Important for Credit Cards?

CIBIL score is a three-digit number ranging from 300 to 900, representing your creditworthiness. Banks and financial institutions use this score to determine your eligibility for credit cards and loans. Generally, a score above 750 is considered good, while a lower score can lead to rejection. However, there are several ways to get a Credit Card Without CIBIL Score and still enjoy seamless online shopping benefits.

6 Ways to Get a Credit Card Without CIBIL Score

Apply for a Secured Credit Card

One of the easiest ways to get a Credit Card Without CIBIL Score is by opting for a secured credit card. These cards are issued against a fixed deposit (FD) in your name. The credit limit is usually a percentage of your FD amount, making it a risk-free option for banks. Some of the best-secured credit cards in India include:

SBI Card PRIME Against FD

ICICI Bank Instant Platinum Credit Card

Axis Bank Insta Easy Credit Card

These cards not only help you shop online but also build your credit history over time.

Choose a Credit Card from NBFCs or FinTech Companies

Many non-banking financial companies (NBFCs) and fintech firms offer credit cards without strict CIBIL requirements. These companies assess eligibility based on alternative data such as income, employment status, and spending patterns. Some of the Best Free Credit Cards in India from NBFCs include:

Slice Super Card

OneCard Credit Card

LazyPay Credit Card

These cards provide interest-free periods, easy repayment options, and excellent rewards for online shopping.

Get an Add-on Credit Card

If a family member has a good credit history, you can request an add-on or supplementary card under their existing credit card. This allows you to enjoy the benefits of a Best Credit Card for Shopping Online without undergoing a strict credit check. Many banks like HDFC, ICICI, and SBI offer add-on credit cards with similar benefits as primary cards.

Opt for a Prepaid or Virtual Credit Card

Prepaid credit cards or virtual cards work like debit cards but provide credit-like features. You load money onto the card and use it for transactions. Some top prepaid credit cards in India include:

Paytm HDFC Bank Credit Card

Kotak 811 Prepaid Card

Niyo Global Card

These cards are accepted by major online shopping platforms and offer cashback and discounts similar to traditional credit cards.

Apply for a Credit Card with a Co-Applicant

Another way to secure a Credit Card Without CIBIL Score is by applying with a co-applicant who has a strong credit profile. Banks are more likely to approve applications when a financially stable individual backs them. Co-applicants share the responsibility of repayments, reducing the risk for lenders.

Open a Salary Account with the Bank

If you receive a regular salary in a particular bank, you may be eligible for a credit card without a CIBIL check. Many banks offer pre-approved credit cards to their salary account holders based on their income and employer reputation. Some of the best options include:

HDFC MoneyBack Credit Card

Axis Bank Neo Credit Card

ICICI Platinum Chip Credit Card

Features to Look for in a Credit Card for Online Shopping

When choosing the Best Credit Card for Shopping Online, consider the following features:

Cashback and Reward Points

Look for a card that offers high cashback or reward points on online transactions. Some top cards provide up to 5-10% cashback on e-commerce purchases.

No Annual Fee or Low Charges

If you’re getting your first credit card, go for a Best Free Credit Card in India that doesn’t charge an annual fee. Many fintech companies offer zero-cost credit cards with great benefits.

EMI Conversion Options

Check if the credit card allows you to convert high-value purchases into easy EMIs. This helps in managing expenses without financial strain.

Wide Acceptance and Security

Ensure the card is accepted on all major online shopping platforms like Amazon, Flipkart, Myntra, and Paytm. Additionally, choose a card with advanced security features like OTP verification and transaction alerts.

Best Free Credit Cards in India for Online Shopping

Here are some top free credit cards that are great for online shopping:

Credit Card

Features

Amazon Pay ICICI Credit Card

5% cashback on Amazon, no annual fee

Flipkart Axis Bank Credit Card

5% cashback on Flipkart, airport lounge access

HDFC Millennia Credit Card

5% cashback on Amazon, Flipkart & PayZapp

SBI SimplyCLICK Credit Card

Extra rewards for online shopping

OneCard

No joining fee, instant approval

How to Apply for a Credit Card Without CIBIL Score?

Follow these steps to apply for a credit card with no credit history:

Step 1: Choose the Right Card

Based on your requirements, select a secured, fintech, or prepaid credit card that suits your spending habits.

Step 2: Check Eligibility Criteria

Ensure you meet the minimum income and document requirements specified by the issuer.

Step 3: Apply Online or Visit a Branch

Most banks and fintech companies allow online applications. Fill out the form, upload necessary documents, and submit.

Step 4: Verify and Wait for Approval

The bank will review your application and may call for additional verification. If approved, your credit card will be delivered within a few days.

Conclusion

Getting a Credit Card Without CIBIL Score for online shopping is possible with the right approach. Whether you opt for a secured credit card, fintech card, or add-on card, there are multiple ways to start your credit journey. Always use your credit card responsibly, pay bills on time, and gradually build a strong credit score to access better financial products in the future. If you’re looking for the Best Credit Card for Shopping Online, consider options with high rewards, zero fees, and EMI facilities. Start today and enjoy seamless online shopping with a smart credit card choice!

#Best Credit Card for Shopping Online#Credit Card Without Cibil Score#Best Free Credit Card in India

0 notes

Text

Short Term Loans Online: Rapidly Resolve the Present Financial Crisis

Those who have experienced financial assault must fulfill all conditions in order to receive last-minute funds during an emergency. Having a six-month-old, an active bank account, being at least eighteen, being permanently a citizen of the United States, and having a stable job are among the prerequisites. Those unfortunate applicants who meet the conditions can rely on short term loans online, which fall under the category of short-term cash, to get the immediate resources they require. Therefore, for people who are employed, the extra formalities are not taken into consideration. As a result, do all required tasks and secure the urgent funds in the $100–$1000 range, which will cover all undesirable financial issues.

In addition to proof of a steady job, pay stubs, a six-month-old current or savings bank account number, age verification, an email address, a bank statement, a valid cell phone number, work experience verification, and the office's contact details, the miserable salaried people are required to present all important information. A brace of basic facts is used to determine whether to offer short term payday loans to salaried people who are ringing with unwanted financial difficulties. All problems must be resolved without causing any inconveniences utilizing the money that was raised. They could be able to pay off all of their obligations and debts in a short period of time as a result.

What Makes Online Short Term Loans Applications Necessary?

Let's be truthful. In life, the unexpected happens. Things happen out of the blue. You may need some quick cash to get by in some situations. These loans are ideal for covering anything from last-minute auto repairs to vacation expenses to medical bills. A short term loans online usually never has an interest charge, so keep that in mind. Therefore, in some cases, it might be less costly than a typical loan. The last option is to apply for a short term cash loans if you want to buy a property of sale right immediately. Short term loans online are getting closer to your bank or mortgage broker. Because the lender will require a larger cash deposit, your cash acquisition may be a little higher in this case. However, it is still significantly less costly than a traditional mortgage.

On occasion, you might possibly wish to think about obtaining a loan with short term cash. In this case, you are free to make weekly, biweekly, or monthly payments as long as you still hold the collateral. Again, because you are not obliged to make a lump sum payment, this might occasionally be a less costly option than a conventional loan. Additionally, you might want to consider auto and boat loans because they can be more affordable and easier to qualify for than standard mortgages. The cars can also be used as security.

In such cases, you might also want to think about taking out online personal loans. We must be truthful. Things happen in life. There are many situations in which we need a bit more money than we already possess. A personal loan that is unsecured is a great option. Collateral is not required, and you can repay the loan every week, every two weeks, or every month. All you're doing is giving the lender permission to take out a loan against your income. To be eligible for a online installment loans, however, you need to meet the minimum requirements. As a general rule, unsecured personal loans have higher interest rates than secured loans.

https://loanslucre.com/

#online short term personal loans#short term cash loans#short term loans online#online personal loans#online installment loans

1 note

·

View note

Text

Get Quick Cash in a Pleasant Manner with Short Term Loans Direct Lenders

The short term loans when salaried people need money to relieve financial strains, debit cards are not available on demand. Payday loans are well known for providing amounts between £100 and £1000 with terms of 14 to 30 days for repayment. The provided cash can be continuously used to pay for laundry, medical bills, power, unexpected auto repairs, outstanding bank overdrafts, credit card payments, child's school or tuition fees, and a variety of other expenses.

Other than that, bad credit histories like local court judgments, individual voluntary agreements, bankruptcies, foreclosures, missed payments, and all of those things are permitted to apply for short term loans direct lenders without going through the credit check system, enabling you to make the quickest cash provision possible wherever you are and at any time. You must promptly return the money because these are unsecured loans.

Before applying, there are a few particular requirements that you must meet, like being 18 years old, a permanent employee with a stable source of income, and having an active bank account. Also, the short term loans UK direct lender is approved and sent into your account the same business day after you submit an online application on the website.

Getting the best Same Day Loans UK for you

Risk considerations that lenders consider before approving a same day loans UK for a borrower with poor credit include defaults, foreclosure, skipping payments, payments that are past due, late payments, CCJs, IVAs, and even liquidation. That's why; it is never easy to make the money from lenders in the open market. Nonetheless, there are payday loans without a debit card available in the market to assist folks, regardless of their credit histories. Cause behind of it is that these loans are endowed to people against their income status.

Paying for short-term financial obligations like power, phone, groceries, school or tuition fees, medical emergency bills, unforeseen travel expenses, laundry, etc., can be done successfully and without issue. However keep in mind that you must reach the stipulated repayment date on time.

You must first be a resident of the UK who is at least 18 years old, be a permanent employee, and have an active checking account in order to receive instant approval for same day loans UK. You must now complete a brief online application form with the necessary information and submit it for confirmation in order for the money to be safely transferred into your bank account within 30 minutes of the submission date.

Same day loans function similarly to [personal loans]. If your same day loans direct lenders application is approved, you will have to pay interest on the amount you borrowed and repay it over time in equal monthly payments. You'll need to discover a credit-worthy person who is willing to pay off your debt if you are unable to pay it back when you apply for a same day cash loan. Your guarantee minimizes the loan provider's risk to lend to you. When you apply for the loan, your guarantor will have their credit history reviewed, be asked about their income, and be required to submit documentation proving their identification and income.

https://paydayquid.co.uk/

4 notes

·

View notes

Text

Overdraft Facility in HDFC: Instant Cash, High Credit Limits & Flexible Repayment

The present times are going fast and financial flexibility is very important. In other words, it is at times that anyone, be it a salaried person, a business person, or a professional, might want instant access to some extra money.

The overdraft facility offered at HDFC is a great financial product giving customers the choice to withdraw more than is available in their account thus ensuring smooth cash management.

An Overdraft Facility in HDFC is a loan that is provided over a short period of time to enable an individual or businesses to withdraw cash in excess of their available balance and up to a limit so assigned to him.

This facility is of utmost importance during times of cash crises when it serves as a buffer against urgent financial requirements.

HDFC Bank provides the overdraft facility in HDFC at attractive terms, offers higher credit limits, and gives its customers an opportunity to repay in a manner of their preference.

Features of Overdraft Facility in HDFC

1. Instant Cash Availability

Fast access to cash from this overdraft facility in HDFC is one of its salient features. Contrary to traditional loans, which require time for approval and disbursal, an overdraft ensures that funds are at hand whenever the need arises.

2. High Credit Limits

High credit limits are available with HDFC Bank as per the creditworthiness of the applicant and his banking relationship. This helps individuals and firms to meet their exceptional expenditure without waiting for normal loan approvals.

3. Flexible Repayment Options

The overdraft facility in HDFC offered by HDFC allows the borrower to repay at their own convenience. Unlike traditional loans, which have fixed EMIs, an overdraft allows borrowers to repay the amount as and when they can, relieving them of some financial burden during their crisis.

4. Interest Charged Only on Used Amount

Another major benefit is that interest is payable only on the amount used and not the entire approved limit. This makes overdrafts quite cheaper in terms of a business solution when compared to others.

5. Minimal Documentation

The overdraft scheme of HDFC requires almost no documentation, which is an attractive feature for all those looking for quick cash without an exhaustive app-lication process.

6. Renewable Facility

Most overdraft facilities, including the one from HDFC Bank, are renewable on an annual basis. If you keep a good repayment record, renewal won’t be a problem, and the bank may consider extending your overdraft limit without any hassle.

Who are the Potential Users of the Overdraft Facility from HDFC Bank?

Various customers can avail of the overdraft facility in HDFC. They include the following group:

A salaried individual with a stable income.

Self-employed professionals such as - doctors, architects, and consultants.

Business owners require additional funds for their operations.

SMEs as well as large corporations for managing their working capital.

What are the Steps for Applying for Overdraft in HDFC?

Applying for an overdraft facility is very simple in HDFC. You can go as follows:

Eligibility - Check if you meet the qualifying condition by the bank concerning income, credit score, and previous relationships with the bank.

Application Form Submission - One may also apply online or visit the branch to fill in the application form.

Documentation - submit all the basic documents: identity proof, address proof, income proof, and bank statements.

Approval & Disbursement - When the approval is done, the overdraft limit is set, and funds are made available for use.

Why Arena Fincorp for Help?

HDFC Bank is a premier institution for overdraft facility in HDFC , but it is always a "smear test" when there is professional guidance from financial service providers as Arena Fincorp. Their service focuses majorly on individuals and businesses in procuring overdraft facilities at the most possible terms.

Their specialization assures one the easiest way possible to have an overdraft limit based on one's financial needs.

Overdraft vs. Personal Loan: Which is Better?

Most people confuse a personal loan with overdraft facility; however, here is a comparison between the two to make you understand the reason why an overdraft is better:

Feature

Overdraft Facility in HDFC

Personal Loan

Interest Charged

Only on used amount

Entire loan amount

Repayment Flexibility

High

Fixed EMIs

Approval Time

Fast

Takes time

Documentation

Minimal

Extensive

Usage Flexibility

Can be used multiple times within the limit

One-time disbursement

Many could suggest that going for the Sahi chits of the Shriram City Union Finance might return his principal.

Overdraft management tips

Generally, an overdraft facility in HDFC allows one to indulge in frivolities and procrastination, but wise use of the included facility helps prevent unnecessary debt. Here are some:

Use the overdraft facility for only critical expenses and emergencies.

Monitor the utilization to avoid incurring heavy interest amounts.

Repay periodically to maintain a healthy credit vita.

Consult professionals like Arena Fincorp for better financial planning and overdraft management.

Conclusion

HDFC overdraft is a wonderful financial instrument that offers detailed ready cash facilities along with high credit limits and flexible repayment options. Be it unexpected expenditure, business cash flow problems, or personal financial shortfalls, one can use overdraft to cushion life.

To confirm that you are getting the best offer, consult with financial service providers such as Arena Fincorp for professional advice. With proper advice, you will be able to get the most from this facility without compromising your financial status.

Thus, if your need is money at hand with minimal documentation and flexible repayment, the overdraft facility in HDFC is just the perfect choice for you.

0 notes

Text

A Complete Guide to Filing Your Income Tax Return (ITR) in India

A Complete Guide to Filing Your Income Tax Return (ITR) in India

Introduction Filing your Income Tax Return (ITR) is a crucial responsibility for every taxpayer in India. It ensures compliance with tax laws and helps individuals claim refunds, carry forward losses, and maintain a clean financial record. Whether you are a salaried employee, a business owner, or a freelancer, understanding the ITR filing process is essential.

In this blog, we will discuss the importance of filing ITR, eligibility criteria, types of ITR forms, and the step-by-step process to file your return.

Why is Filing an Income Tax Return Important?

Legal Compliance – Filing ITR is mandatory if your income exceeds the taxable limit.

Claiming Refunds – If excess tax has been deducted, filing ITR allows you to claim a refund.

Loan & Visa Approvals – ITR receipts act as proof of income, which is required for loans and visa applications.

Avoiding Penalties – Non-filing of ITR can attract penalties and legal consequences.

Carrying Forward Losses – If you have incurred losses, you can carry them forward to adjust against future income.

Who Needs to File an ITR?

You must file an ITR if: ✅ Your annual income exceeds ₹2.5 lakh (₹3 lakh for senior citizens and ₹5 lakh for super senior citizens). ✅ You have foreign income or assets. ✅ You have deposited more than ₹1 crore in a bank account. ✅ Your electricity bill exceeds ₹1 lakh in a financial year. ✅ You have spent more than ₹2 lakh on foreign travel.

Types of ITR Forms

The Income Tax Department has different ITR forms for various categories of taxpayers:

ITR-1 (Sahaj): For salaried individuals with income up to ₹50 lakh.

ITR-2: For individuals & HUFs with income from salary, capital gains, and multiple sources.

ITR-3: For individuals & HUFs with income from business or profession.

ITR-4 (Sugam): For individuals, HUFs, and firms under the presumptive taxation scheme.

ITR-5, 6, 7: For LLPs, companies, and trusts.

Step-by-Step Process to File Your ITR Online

Gather Documents – Keep your PAN, Aadhaar, Form 16, investment proofs, and bank details ready.

Visit the e-Filing Portal

Login or Register – Use your PAN to log in or create an account.

Select the Correct ITR Form – Choose the appropriate ITR form based on your income source.

Fill in the Details – Enter your income, deductions, and tax computation.

Validate and Submit – Cross-check all details, verify using Aadhaar OTP or net banking, and submit.

E-Verify Your Return – Complete e-verification to avoid processing delays.

Conclusion