#Loan Against Rented Property

Explore tagged Tumblr posts

Text

Home Loan for Resale Property - INR PLUS

financial institutions like INR PLUS have tailored loan products that cater to the specific needs of buyers looking to invest in such properties. These loans are designed to enable individuals to finance the purchase of a second-hand property with ease and convenience.

https://inrplus.in/blog/2023/06/10/is-applying-for-lap-loan-against-property-a-good-idea/

1 note

·

View note

Text

Get Loan for low cibil score- INR PLUS

CIBIL provides a mechanism to dispute errors on your credit report, and ensuring that it is accurate can help boost your score.

0 notes

Text

Get Loan for low cibil score- INR PLUS

CIBIL provides a mechanism to dispute errors on your credit report, and ensuring that it is accurate can help boost your score.

0 notes

Text

Apply Loan Against Industrial Property with Easy Steps

In the realm of business expansion or financial hurdles, securing capital plays a pivotal role. For industrial ventures seeking a financial boost, opting for a Loan Against Industrial Property stands as a pragmatic solution. With the right approach and tailored guidance, navigating this process can be both efficient and beneficial.

Understanding the Concept:

A Loan against industrial property involves leveraging the value of one's industrial assets to secure a loan. Industrial properties, including manufacturing units, warehouses, or industrial lands, serve as viable collateral for obtaining substantial financial support from lending institutions.

Why Choose a Loan Against Industrial Property?

Collateral Advantage: By using a tangible asset as collateral, borrowers showcase a higher level of security to lenders, thereby increasing their chances of loan approval.

Lower Interest Rates: Due to the reduced risk associated with secured loans, borrowers can often benefit from lower interest rates compared to unsecured alternatives.

Flexible Repayment Terms: Lenders understand the unique nature of industrial ventures and hence may offer flexible repayment schedules based on the borrower's business cycles.

Financial Stability: Access to a substantial loan can provide the necessary financial stability for expanding operations, purchasing new machinery, or even tiding over temporary financial setbacks.

Steps to Obtain a Loan Against Industrial Property:

Property Assessment: The first step involves a thorough evaluation of the industrial property to determine its market value and feasibility as collateral.

Documentation Preparation: Prepare the necessary documentation, including property papers, business financials, and any other relevant records required by the lender.

Choosing the Right Lender: Research and select a lender who specializes in industrial property loans and offers competitive terms that align with your financial needs.

Loan Application Submission: Submit a well-crafted loan application along with all the requisite documents for a smooth processing experience.

Approval and Disbursement: Upon approval, finalize the terms of the loan agreement and await the disbursement of funds to address your financial requirements.

INR Plus - Your Financial Partner:

At INR Plus, we understand the intricate needs of industrial ventures and offer tailored solutions to help businesses thrive. Our streamlined process ensures a hassle-free experience for those seeking Loans Against Industrial Properties. With a commitment to transparency, integrity, and customer satisfaction, we stand as your trusted financial partner in times of need.

Conclusion:

In the realm of industrial enterprises, the option to secure a Loan Against Industrial Pproperty stands as a beacon of financial stability and growth. By following a structured approach, collaborating with the right financial institution, and leveraging your industrial assets judiciously, obtaining the necessary funds becomes a manageable task. Choose the path of financial empowerment today and propel your industrial venture towards success.

Invest in your industrial dreams with a loan against property - a definitive stepping stone towards a prosperous future!

For further information

Please contact:

INR Plus

Visit: https://inrplus.in/

Contact: +91-9891751729

Mail At: [email protected]

Add- Rainbow Fincorp

101, Vardhman Prakash Plaza Sector -20 Dwarka

Near Hyundai Showroom. New Delhi-110075

#loan against industrial property#loan against rented property#Loan Against Property without map#Loan Against Lal Dora Property#loan against property in gurgaon

0 notes

Text

Inrplus Loan Services Against Rented Property

Inrplus Loan Services is a leading financial institution that has recognized the unique needs of property owners who have decided to rent out their homes. While traditional loan services primarily focus on homeowners, Inrplus has introduced a specialized loan program to cater to the growing demand for financing options in the rental market.

1 note

·

View note

Text

Inrplus Loan Services Against Rented Property

As the rental market continues to thrive, financial institutions like Inrplus are pioneering the way forward. By providing specialized loan against rented property, they are not only meeting the demands of property owners but also stimulating growth and development in the real estate market. With Inrplus Loan Services, landlords can confidently navigate the financing landscape and unlock the full potential of their rental property investments.

Contact us for more details:-

https://www.inrplus.in/loan-against-property.php

Contact Number:- 9891751729 "Rainbow Fincorp 101, Vardhman Prakash Plaza Sector -20 Dwarka Near Hyundai Showroom. New Delhi-110075"

1 note

·

View note

Text

From Rented House to Your Own Home. Read this- https://homefirstindia.com/blog/article/rented-house-vs-owned-house-age-old-question/

0 notes

Text

“I ate paint once,” Danny nonchalantly threw out in the middle of game night.

The entire table stopped. Heads whipped towards Danny.

“Yeah, me too. Cardamom yellow was my favorite. Ugly as hell but the chemicals just tasted right.” Tim replied, using the distraction to nab some of Bruce’s money. Monopoly money, that is. Everyone’s heads snapped towards Tim, only Cass and Danny (who was part of the scheme) caught him cheating.

“Really? I think mine was those spray can blue cosmos paint. But that might have been more my thing for space than the actual taste.”

“WHY WERE YOU EATING PAINT?!” Dick asked, looking like he wanted to lunge over the table and shake Danny until he puked out paint. Bruce looked like he was about to have a heart attack.

“Yeah, what the fuck, Tim?” Jason snickered.

“In my defense,” Danny grinned. “I was left unsupervised. Also, Steph, you owe me $24 in rent.”

“Ugh! I’m almost out of money! Can’t you loan me some, Alfred?”

“I am sorry, Miss Stephanie, you are not qualified for another loan. In fact, one of your properties is about to be confiscated as per the collateral agreement.”

“Noooo!” Stephanie made dramatic dying noises.

“What was your excuse, Timothy?” Damian asked, eyes glued to the board and determined to win the game.

“Hey, I was probably less supervised than Danny was.”

“Yeah,” Danny perked up. “My parents brought us down to their lab all of the time. Taught us a lot of stuff.”

“Really? Like what?” Duke asked, casually slapping away Tim’s sneaky hands.

“Oh, like what a rocket launcher sounded like up close! And how to build a laser gun! Oh! And what human organs looked like when they’re fresh!” Danny chirped, collecting his money from a stunned Stephanie’s hands. He looked up.

“Oh, don’t worry! I at least learned what not to do when it comes to lab safety. And we wore hazmat suits to protect ourselves from the radiation.” Danny smiled in a ditzy fashion as the table fell silent in a horrified manner. Cass tapped his arm amusedly, but allowed his bullshit to stand. After all, it’s not like he lied.

“Radiation?” Duck’s voice raised a couple of octaves. Oh yeah, Danny’s going to laugh about that pitch for a long while.

“Organs?!” Jason’s hands closed around the plastic house he was holding rather forcefully.

“Do you even know what basic lab safety practices are, Danny?” Damian demanded, finally looking up with brows furrowed. He rolled the dice and grabbed a mystery card. He gets $100 from Alfred.

“How old were you??” Duke asked.

“Like… 8, when they first brought me in?”

“Eight.” Bruce rumbled, slipping into a more Batman like persona. When Danny sent him a confused look, Bruce straightened back into his Bruce persona. “Wow, they must have trusted you a lot!”

“Sure?”

“What were their names again?” Stephanie asked sweetly, Cass nodding at him.

“Jack and Maddie Fenton.” Not that they’ll find them here, considering his parents are dead and in another universe.

“Cool, cool, cool!” Stephanie blinked, beaming as her hands formed lethal fists underneath the table.

Danny blinked and tilted his head in an unassuming way, pretending like he had no idea what Stephanie was thinking of. He sneakily handed over $600 to Cass in order to complete his monopoly on his side of the board.

Danny stood up and spread his hands out, one hand clutching his new found victory.

"Well, lady and gents, you've all been floundering against the inevitable tide of capitalism. I am here, as a reminder that you can never win against the hopelessness that will be your financial ruin! I, Danny Fenton, have obtained a quarter of the board and therefore have won against even your best efforts!" He cackled, holding up his fan of properties triumphantly. He shot a mischievous grin at Cass, who held up a solemn thumbs up in support for his monetary takeover.

"... Danny, are you... planning on a career in villainy?" Bruce asked, after a brief and total wave of shocked silence. Damian looked like he was having a conniption at having been bested, unknowingly. Yeah, Danny was disarming like that.

"Yeah, that was concerning." Tim piped up, nabbing a ten from a shell-shocked Damian.

"Hey! The Riddler gives surprisingly good monologues! And he's really loud, so it's hard not to pick up on things. Duke, your turn." Danny sat back down, pouting. The villainy comment was a little too close to his fears.

"Damn it." Duke, who had rolled, landed smack middle of Danny's territory. He handed over a sheaf of bills to a grinning Danny.

"Wait a minute! You have cheated!" Damian bolted upwards from his seat, finally done running through the purchases he remembered Danny making. "You acquired that property not within the games' rules!"

"Okay, first of all, the rule book is a suggestion, like lab safety rules," Danny saw the others open their mouths to protest, but he quickly shut it down. "Second, there's totally no rules about selling and buying places from a private owner so suck on it. And thirdly? Cass sold it to me, so you all can take it up with her."

"Diabolical!" Damian muttered indignantly.

"... Dammit." Dick sighed, falling back into the chair and balancing on its two legs. He couldn't say anything, considering his current of bankruptcy.

"Danny. Danny, I'll buy a property from you." Jason said, eyeing one of Danny's other properties near his own cluster.

"What do you have that would interest me?" Danny asked, falling back into his Vlad-like imitation.

"Ew, don't do that," Steph reached over to jab him in the arm.

"Yeah, Jason, what do you have?" Duke said, the lovely subtle instigator that he is.

"Red Hood's signature."

The others blue-screen, gaping at the actual audacity Jason had to offer up something that would take him no effort. Danny, prepared with a poker face that came with lying straight to Jazz's ever perceptive eyes about whether he nabbed the last of her ice cream or not, was prepared.

"Red Hood? The condom guy working out of the... um. Upper East Side?" Danny asked, pretending to hesitate. He knows where Jason operated. That doesn't mean he couldn't simply pretend otherwise. For science, of course.

...

...

...

The table howled with laughter, Jason's indignant spluttering unable to say anything against Danny's wide eyed look of innocence. Cass leaned against the table, chuckles falling out of her mouth and eyes crinkled in mirth. Dick had fallen out of his chair, helplessly wheezing on the floor. Duke is hiding his face in his hands, mirroring Bruce's pose as they both shake from silent laughter. Damian is smirking, wicked and sharp as he smugly stared at Jason. Stephanie and Tim are leaning against each other, repeating "the CONDOM GUY" in alternating and increasingly louder voices. Alfred had a smile on his face and a tight grip on the bills in front of him that betrayed his amusement.

"He's a crime lord!" Jason exclaimed, indignant.

"Uh, okay. Well, I mean, why would I want a crime lord's signature? I don't want to be on his radar. Or echolocation or whatever. He's... a Bat, right? That's what you guys call that group, yeah?"

"How do you know the Rogues better than the vigilantes?!" Jason glared at his unhelpful family. Those assholes better prepare for a load of rubber bullets the next time they're on patrol near Crime Alley.

"Hey, it's not my fault the vigilantes here are unsociable. Maybe if they monologued more, I'd know who they are."

"Wouldn't- wouldn't that make them more villain like?" Tim asked, stuttering from his laughter.

"I dunno?" Danny replied, enjoying his the family's unabashed joy. "I mean, they're pretty legit and they help people already so I guess they don't need to be sociable... but still I swear I haven't heard anything about Batman other than that he grunts and is mean towards criminals."

Is mean towards criminals, Duke mouthed at a recovering Dick who was in the process of heaving himself back up. It sent him careening back down to the floor with restrained giggles. Cass tapped Danny, reminding him to eat some food.

"Tt. Of course not. They're efficient at their jobs and have no need to be seen as welcoming to criminals." Damian puffed up.

"Yeah, but they've gotta feel safe, right?" Danny shrugged as he plucked a cookie from the cookie platter. "The... one with the sword, what was it?"

"Robin." Damian supplied, eyes narrowed and trained on him.

"Yeah, the baby bird. The kids think his swords are cool so they trust him. But like, the others? The flippy blue one? Not so much."

"Wait," Dick said from the floor. "They don't trust Nightwing?"

"Nah, they trust him to protect them, but he has a history of bringing the kids to the police, you know?"

"What's wrong with that?"

Danny shrugged. "ACAB. But also because everybody knows that half the guys in the GCPD and CPS are child traffickers."

"Wait, what?" Jason and Tim straightened.

Bruce piped in, the emotional whiplash of amusement to concern to amusement to concern visibly making itself known on the man's baffled face. "I thought Batman and Commissioner Gordon took care of that?"

"Sure, the obvious ones." Danny hesitated. Well, he's pretty sure they think he's a meta so... "There's... a meta trafficking ring that they're a part of. That's. That's kind of what I was running from."

Danny looked up pleadingly. Cass placed a hand on his arm in comfort, not knowing that he was fibbing about running from them.

Danny was on the streets helping his own Alley metas to run from them.

Danny is as feral as she was, and that meant he could hide just as much as she could read off of him. Cass was the best and he felt kind of bad about lying to her, successfully or not.

"Uh. Some people said you know Batman, Bruce. I know- uh, that might not be the case but if you do, could you ask him to look into it?" Danny made his eyes tear up. "And maybe he wouldn't care about me much, I mean, I know he doesn't really like metas but if he helps out, I could totally like, leave the city once the kids are safe, promise."

Ooh, Danny put a little too much sincerity into that. He could practically hear the hearts breaking in the game room as everyone glared at Bruce.

"You won't have to leave."

"... Promise?" And Danny's voice was a little too desperate, too hopeful, because Bruce's eyes tugged down in sadness.

"Promise." He rumbled, all Bruce Wayne and all Batman. Danny's core warmed. Danny also saw the rest of the family's faces darken in pure agreement. And partial wrath.

"Yeah! We'll kick Batman's ass if he even thought about kicking you out!" Stephanie proclaimed.

"He's far more proficient in combat than you are, Brown." Damian immediately leapt to Batman's defense and that was that.

Well, later, as Danny was "sleeping" and Phantom was hovering in the cave, invisible and intangible, he got confirmation that his Alley meta kids were going to be safe, soon.

After all, the entire Batclan was suiting up and baying for blood, with Oracle's all encompassing presence behind them, fingers reaching for their enemies' weak points.

#batman#danny phantom#dc x dp#jason todd#bruce wayne#tim drake#dick grayson#red hood#nightwing#red robin#duke thomas#the signal#damian wayne#robin#stephanie brown#the spoiler#cassandra cain#black bat#oracle#barbara gordon#bamf danny phantom#danny phantom playing victim but he's an unreliable narrator#and was totally marked for trafficking before brucie wayne picked him up#danny trauma dumping on family game night#lab safety? danny doesn't know her#danny experiencing familial affection: who me??#danny winning monopoly like a capitalist villain that Sam unknowingly told him how to be via her rants#danny ate paint as an experiment#I'd like it to go on record that've I have never eaten paint

7K notes

·

View notes

Link

Bank Guarantee Charges

A Bank guarantee is a promise to bear all the losses of debtor by the bank if he/she fails to pay. There are several kinds of bank guarantees. Based on the type of the BG (Bank Guarantee) fees are charged on a quarterly basis on the What is Bank Guarantee Charges value of 0.75% or 0.50% during the BG validity period. Apart from this, the bank may also charge the application processing fee, documentation fee, and handling fee.

Banks do not charge an interest rate on BG and SLOC. Instead, the customer has to pay a commission or fee of the amount that is guaranteed. Apart from that there is a scheme called the bank guarantee charges reimbursement scheme related to bank guarantee charges.

The Ministry of Micro, Small, and Medium Enterprises in collaboration with the National SC-ST Hub (NSSH) has launched the Bank Guarantee Charges Reimbursement Scheme. The Bank Guarantee Charges Reimbursement Scheme to provide financial assistance against the bank charges paid in obtaining Performance Bank Guarantees Charges (PBGC) for SC-ST owned Micro and Small Enterprises (MSEs).

The objective of the Bank Guarantee Charges Reimbursement Scheme is to enhance the marketing capabilities and competitiveness of SC/ST-owned Micro and Small Enterprises (MSEs). It also provides a platform for interaction with large institutional buyers. This scheme promotes the enterprise and updates the enterprise about the global market scenario.

#what is bank guarantee charges#performance bank guarantee charges#bank guarantee#bank overdraft#loan against rent receivable#loan against property#business loan#financeseva

1 note

·

View note

Text

as far as i can tell that claim about [usamerican] women not being allowed to hold bank accounts prior to the 60s is just incorrect and based on a misunderstanding of what antidiscrimination laws in the 70s were meant to accomplish. which is something i think is actually worth splitting hairs over because 1) wealthy socially powerful white women did hold property, get loans, get credit, collect rents, &c in the colonial period as well as the 200 years following the revolution, & obfuscating that means failing to understand how class, race, & gender actually related to & informed one another, and 2) the narrative forming around de jure rights and an extremely binary black and white notion of discrimination also obscures the ways discrimination against women in the financial sphere actually happened (often piecemeal, locally, varying by institution, with things like subjective biased evaluations of their financial prospects from banks, as well as the role of massive social norms and pressures that cumulatively steered them away from independent possession of capital in the first place) -- which matters because so many of these things still do happen, even to white women but very specifically and heavily to black americans in particular, and this is also lost when we act like ECOA or whatever ended credit discrimination in one fell swoop. also people who make this claim tend to have a very poor understanding of what effect marriage had on a woman's financial status, because again they have an extremely basic understanding of how the category "women" was handled by financial institutions and seem to see it as one monolith when in reality marriage was more of like, another factor that informed (lessened) the degree to which financial institutions considered a woman to be an independent legal person

429 notes

·

View notes

Text

Wall Street Journal goes to bat for the vultures who want to steal your house

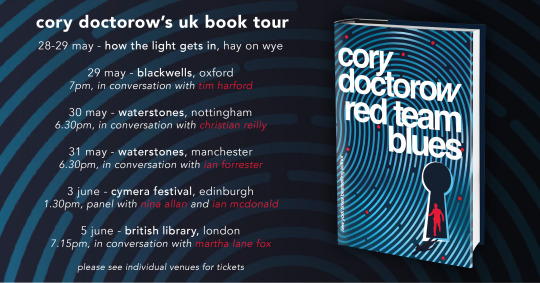

Tonight (June 5) at 7:15PM, I’m in London at the British Library with my novel Red Team Blues, hosted by Baroness Martha Lane Fox.

Tomorrow (June 6), I’m on a Rightscon panel about interoperability.

The tacit social contract between the Wall Street Journal and its readers is this: the editorial page is for ideology, and the news section is for reality. Money talks and bullshit walks — and reality’s well-known anticapitalist bias means that hewing too closely to ideology will make you broke, and thus unable to push your ideology.

That’s why the editorial page will rail against “printing money” while the news section will confine itself to asking which kinds of federal spending competes with the private sector (creating a bidding war that drives up prices) and which kinds are not. If you want frothing takes about how covid relief checks will create “debt for our grandchildren,” seek it on the editorial page. For sober recognition that giving small amounts of money to working people will simply go to reducing consumer and student debt, look to the news.

But WSJ reporters haven’t had their corpus colossi severed: the brain-lobe that understands economic reality crosstalks with the lobe that worship the idea of a class hierarchy with capital on top and workers tugging their forelacks. When that happens, the coverage gets weird.

Take this weekend’s massive feature on “zombie mortgages,” long-written-off second mortgages that have been bought by pennies for vultures who are now trying to call them in:

https://www.wsj.com/articles/zombie-mortgages-could-force-some-homeowners-into-foreclosure-e615ab2a

These second mortgages — often in the form of home equity lines of credit (HELOCs) — date back to the subprime bubble of the early 2000s. As housing prices spiked to obscene levels and banks figured out how to issue risky mortgages and sell them off to suckers, everyday people were encouraged — and often tricked — into borrowing heavily against their houses, on complicated terms that could see their payments skyrocket down the road.

Once the bubble popped in 2008, the value of these houses crashed, and the mortgages fell “underwater” — meaning that market value of the homes was less than the amount outstanding on the mortgage. This triggered the foreclosure crisis, where banks that had received billions in public money forced their borrowers out of their homes. This was official policy: Obama’s Treasury Secretary Timothy Geithner boasted that forcing Americans out of their homes would “foam the runways” for the banks and give them a soft landing;

https://pluralistic.net/2023/03/06/personnel-are-policy/#janice-eberly

With so many homes underwater on their first mortgages, the holders of those second mortgages wrote them off. They had bought high-risk, high reward debt, the kind whose claims come after the other creditors have been paid off. As prices collapsed, it became clear that there wouldn’t be anything left over after those higher-priority loans were paid off.

The lenders (or the bag-holders the lenders sold the loans to) gave up. They stopped sending borrowers notices, stopped trying to collect. That’s the way markets work, after all — win some, lose some.

But then something funny happened: private equity firms, flush with cash from an increasingly wealthy caste of one percenters, went on a buying spree, snapping up every home they could lay hands on, becoming America’s foremost slumlords, presiding over an inventory of badly maintained homes whose tenants are drowned in junk fees before being evicted:

https://pluralistic.net/2022/02/08/wall-street-landlords/#the-new-slumlords

This drove a new real estate bubble, as PE companies engaged in bidding wars, confident that they could recoup high one-time payments by charging working people half their incomes in rent on homes they rented by the room. The “recovery” of real estate property brought those second mortgages back from the dead, creating the “zombie mortgages” the WSJ writes about.

These zombie mortgages were then sold at pennies on the dollar to vulture capitalists — finance firms who make a bet that they can convince the debtors to cough up on these old debts. This “distressed debt investing” is a scam that will be familiar to anyone who spends any time watching “finance influencers” — like forex trading and real estate flipping, it’s a favorite get-rich-quick scheme peddled to desperate people seeking “passive income.”

Like all get-rich-quick schemes, distressed debt investing is too good to be true. These ancient debts are generally past the statute of limitations and have been zeroed out by law. Even “good” debts generally lack any kind of paper-trail, having been traded from one aspiring arm-breaker to another so many times that the receipts are long gone.

Ultimately, distressed debt “investing” is a form of fraud, in which the “investor” has to master a social engineering patter in which they convince the putative debtor to pay debts they don’t actually owe, either by shading the truth or lying outright, generally salted with threats of civil and criminal penalties for a failure to pay.

That certainly goes for zombie mortgages. Writing about the WSJ’s coverage on Naked Capitalism, Yves Smith reminds readers not to “pay these extortionists a dime” without consulting a lawyer or a nonprofit debt counsellor, because any payment “vitiates” (revives) an otherwise dead loan:

https://www.nakedcapitalism.com/2023/06/wall-street-journal-aids-vulture-investors-threatening-second-mortgage-borrowers-with-foreclosure-on-nearly-always-legally-unenforceable-debt.html

But the WSJ’s 35-paragraph story somehow finds little room to advise readers on how to handle these shakedowns. Instead, it lionizes the arm-breakers who are chasing these debts as “investors…[who] make mortgage lending work.” The Journal even repeats — without commentary — the that these so-called investors’ “goal is to positively impact homeowners’ lives by helping them resolve past debt.”

This is where the Journal’s ideology bleeds off the editorial page into the news section. There is no credible theory that says that mortgage markets are improved by safeguarding the rights of vulture capitalists who buy old, forgotten second mortgages off reckless lenders who wrote them off a decade ago.

Doubtless there’s some version of the Hayek Mind-Virus that says that upholding the claims of lenders — even after those claims have been forgotten, revived and sold off — will give “capital allocators” the “confidence” they need to make loans in the future, which will improve the ability of everyday people to afford to buy houses, incentivizing developers to build houses, etc, etc.

But this is an ideological fairy-tale. As Michael Hudson describes in his brilliant histories of jubilee — debt cancellation — through history, societies that unfailingly prioritize the claims of lenders over borrowers eventually collapse:

https://pluralistic.net/2022/07/08/jubilant/#construire-des-passerelles

Foundationally, debts are amassed by producers who need to borrow capital to make the things that we all need. A farmer needs to borrow for seed and equipment and labor in order to sow and reap the harvest. If the harvest comes in, the farmer pays their debts. But not every harvest comes in — blight, storms, war or sickness — will eventually cause a failure and a default.

In those bad years, farmers don’t pay their debts, and then they add to them, borrowing for the next year. Even if that year’s harvest is good, some debt remains. Gradually, over time, farmers catch enough bad beats that they end up hopelessly mired in debt — debt that is passed on to their kids, just as the right to collect the debts are passed on to the lenders’ kids.

Left on its own, this splits society into hereditary creditors who get to dictate the conduct of hereditary debtors. Run things this way long enough and every farmer finds themselves obliged to grow ornamental flowers and dainties for their creditors’ dinner tables, while everyone else goes hungry — and society collapses.

The answer is jubilee: periodically zeroing out creditors’ claims by wiping all debts away. Jubilees were declared when a new king took the throne, or at set intervals, or whenever things got too lopsided. The point of capital allocation is efficiency and thus shared prosperity, not enriching capital allocators. That enrichment is merely an incentive, not the goal.

For generations, American policy has been to make housing asset appreciation the primary means by which families amass and pass on wealth; this is in contrast to, say, labor rights, which produce wealth by rewarding work with more pay and benefits. The American vision is that workers don’t need rights as workers, they need rights as owners — of homes, which will always increase in value.

There’s an obvious flaw in this logic: houses are necessities, as well as assets. You need a place to live in order to raise a family, do a job, found a business, get an education, recover from sickness or live out your retirement. Making houses monotonically more expensive benefits the people who get in early, but everyone else ends up crushed when their human necessity is treated as an asset:

https://gen.medium.com/the-rents-too-damned-high-520f958d5ec5

Worse: without a strong labor sector to provide countervailing force for capital, US politics has become increasingly friendly to rent-seekers of all kinds, who have increased the cost of health-care, education, and long-term care to eye-watering heights, forcing workers to remortgage, or sell off, the homes that were meant to be the source of their family’s long-term prosperity:

https://doctorow.medium.com/the-end-of-the-road-to-serfdom-bfad6f3b35a9

Today, reality’s leftist bias is getting harder and harder to ignore. The idea that people who buy debt at pennies on the dollar should be cheered on as they drain the bank-accounts — or seize the homes — of people who do productive work is pure ideology, the kind of thing you’d expect to see on the WSJ’s editorial page, but which sticks out like a sore thumb in the news pages.

Thankfully, the Consumer Finance Protection Bureau is on the case. Director Rohit Chopra has warned the arm-breakers chasing payments on zombie mortgages that it’s illegal for them to “threaten judicial actions, such as foreclosures, for debts that are past a state’s statute of limitations.”

But there’s still plenty of room for more action. As Smith notes, the 2012 National Mortgage Settlement — a “get out of jail for almost free” card for the big banks — enticed lots of banks to discharge those second mortgages. Per Smith: “if any servicer sold a second mortgage to a vulture lender that it had charged off and used for credit in the National Mortgage Settlement, it defrauded the Feds and applicable state.”

Maybe some hungry state attorney general could go after the banks pulling these fast ones and hit them for millions in fines — and then use the money to build public housing.

Catch me on tour with Red Team Blues in London and Berlin!

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/06/04/vulture-capitalism/#distressed-assets

[Image ID: A Georgian eviction scene in which a bobby oversees three thugs who are using a battering ram to knock down a rural cottage wall. The image has been crudely colorized. A vulture looks on from the right, wearing a top-hat. The battering ram bears the WSJ logo.]

#pluralistic#great financial crisis#vulture capitalism#debts that can’t be paid won’t be paid#zombie debts#jubilee#michael hudson#wall street journal#business press#house thieves#debt#statute of limitations

129 notes

·

View notes

Text

Anarchy can differ from other anti-capitalist ideologies in being a lived practice. If anarchy is the end goal, then it must be the means as well. This often turns out looking like working as little as possible, living communally with friends, getting by using scams, and experimenting with social relationships. Unfortunately, these more interesting and liberating tendencies based in subverting daily life are receding as gentrification closes off possibilities for living cheap in the cities. What remains in the U.S. anarchist space is activism. Lacking this daily life component, anarchy slides back into leftism.

May 68, the Situationists, and the Sixties counterculture brought ideas into anti-capitalism concerned with the first-person practice of everyday life. Rather than find and organize a supposed revolutionary subject, these tendencies start from the assumption that anyone can benefit from both present-day subversion and a revolution against capitalism and the state. They encourage rejecting imposed social roles, including those of worker, consumer, citizen, spouse, and student.

Though perhaps not apparent back then, these tendencies have a material basis. After World War Two, the new petite-bourgeois and upwardly mobile union workers in the US began moving out of urban areas. In Europe, economic crises and other political developments left vacant office and housing structures in certain large cities. It was in these contexts that said autonomous anti-capitalism found space for practice.

At risk of oversimplification, anarchy in the United States since the 80’s has been an echo of the Autonomen tendency originating in Berlin. Besides Situationist ideas and histories of revolt throughout Europe, why did this milieu begin there? After WW2, the city was militarized and split along Cold War lines, prompting many Germans to leave. After a global recession in the mid-Seventies, Germany did not return to its pre-recession unemployment levels. (Trading Economics) In Berlin there were financial scandals and an informal capital strike by big landlords in response to rent control laws. They actually had incentive to abandon their buildings and get low-interest loans from the city to build expensive condominiums. These factors led to there being hundreds of unoccupied housing and office buildings. (Katsiaficas, 89) Material conditions were ripe for large-scale squatting and, subsequently, the potential to quit work and experiment with the revolution of everyday life.

The story is similar in other places where the Autonomen were strong. Squatting in Hamburg began during the 1980-1982 recession. In Amsterdam, despite a housing shortage, there was no dearth of habitable space. According to The Economist, “Property speculators, for their part, have left property deliberately unoccupied to avoid carrying out repairs or in hope of an upturn in the market.” (The Economist 3/28/81) Squatters there would also take over empty office buildings. (The Economist 5/3/80) Similar, anarchy in the United States was present in New York City’s Lower East Side during the 80’s and 90’s where there were vacant buildings and a large squatting milieu.

We are now in the era of gentrification. The petite-bourgeois and capital are invading cities and driving up rent prices. Thus, the inspiring lifestyle of rejecting work seems less reasonable. Though it’s possible that property values will stagnate in suburban or rural areas, there are limits to what this anti-political tendency can do outside cities. Population density makes for a higher probability of encounter. This is why artistic, literary, and political scenes exist in cities. Contrary to capitalist ideals of entrepreneurship and genius, intellectual and creative milieus thrive with close contact to like-minded people. So, these Situationist-inspired ideas require two things: hubs of people, and the ability to take both time and space. Postwar urbanity fit the bill.

Admittedly, anarchists and the Autonomen aren’t purely lifestylists. Activism and outward-facing social struggle have always played a role in these milieus. But now that practices related to everyday life are diminishing, activism is the only thing anarchy can live through. Hence anarchy in the United States becoming infected by Leftist mores and values. We’ve seen an increase in charity initiatives, as well as the impression that anarchy is only a thing we practice when and where moments of crisis or struggle occur. The day-to-day emphasis is gone. Unless you count time spent at meetings, Leftism doesn’t care about daily life.

Anarchist scenes have retreated in large cities, and we are relocating to college towns that are not yet as expensive to live in. People new to radical politics are often calling themselves “leftists” now. Could it be that, due to anarchy’s inability to produce visibly interesting and liberating lifestyles, anarchy doesn’t seem that different from communism or socialism? Is it now just another button to wear on the coat, an idea that no longer escapes the cave of opinion into the sun of daily life?

Identity has become prominent in anarchist and similar milieus recently. Because the potential for altering the routines of life are diminishing, the desire to grab hold of the reins of ones’ existence look elsewhere. This has led to an emphasis on political, gender, sexual, and racial identities. In contrast, the Autonomen collapsed identities into one. People who used to identify as communists, socialists, libertarians, anarchists, etc, just became Autonomen. The potential for transforming daily life made identity irrelevant.

This reduction of possibility also explains the recent replacement of the Situationists with Max Stirner as the primary theoretical reference point for post-left anarchy. Stirner is more apt for the isolated individual who can no longer go to a city and find a milieu, or just drop out. Stirner writes:

Given up as serf to a master, I think only of myself and my advantage; his blows strike me indeed, I am not free from them; but I endure them only for my benefit, perhaps in order to deceive him and make him secure by the semblance of patience, or, again, not to draw worse upon myself by contumacy. But, as I keep my eye on myself and my selfishness, I take by the forelock the first good opportunity to trample the slaveholder into the dust. (Stirner)

This reads as someone who is stuck in a bad situation, with no room to maneuver. Their mind is liberated, but their body isn’t. The situation is reversed in this quote from Situationist Raoul Vaneigem:

People who talk about revolution and class struggle without referring explicitly to everyday life, without understanding what is subversive about love and what is positive in the refusal of constraints, such people have a corpse in their mouth. (Vaneigem)

He writes about refusing constraints as if it’s just that easy, as if it’s the body that’s free, and the mind trapped.

This is not a call to abandon the Situationists or dropout culture. Far from it, this piece was written with two goals in mind:

To provide a materially-based theory of anarchy’s hollowing that complements my previous aesthetic analysis.

To give a clear idea of newer obstacles and limits to the subversion of daily life, in the hope that this will help us better fight against or maneuver around them.

Works Cited

Economist, The (London, England), “Swat the Squatters”, Amsterdam Correspondent. Saturday, March 28, 1981, Vol. 278, Issue 7178, p.46.

Economist, The (London, England), “Will to Rule”, Amsterdam Correspondent. Saturday, May 3, 1980, Vol. 275, Issue 7131, p.77.)

Katsiaficas, George. The Subversion of Politics: European Autonomous Social Movements and the Decolonization of Everyday Life. AK Press (California, USA), 2006. 9781904859536

Stirner, Max. The Ego and His Own. Benjamin Tucker (USA), 1907. Retrieved from: http://theanarchistlibrary.org/library/max-stirner-the-ego-and-his-own

Trading Economics – “Germany Unemployment Rate”, https://tradingeconomics.com/germany/unemployment-rate

Vaneigem, Raoul. Treatise on Etiquette for the Younger Generations. LBC Books (California, USA) 2012. 09946061017

#gentrification#urban#scholium#small farms#solarpunk#small farm movement#community building#practical anarchy#practical anarchism#anarchist society#practical#revolution#anarchism#daily posts#communism#anti capitalist#anti capitalism#late stage capitalism#organization#grassroots#grass roots#anarchists#libraries#leftism#social issues#economy#economics#climate change#climate crisis#climate

11 notes

·

View notes

Text

Villain Crimes Tag!

Let's go with the main villains from What Lurks In The Hollow for this one. Again: given that this is a post about very, very bad people (after all they are the villains of this WIP) it will contain TWs for some pretty nasty things.

Rules: List all the real-world crimes your villains are guilty of committing!

Mayor Samuel Whitaker

Serial Killings/Multiple First Degree Murders (most of the victims were minors, ages 5-17, but some adults as well)

Demonic Rituals + Ritualistic Sacrifices of Human Beings

Ritualistic Torture, most notably the torture of a 15-year-old (Jace Donovan, Savvanah Hahn's stepbrother who went missing kidnapped by a "mysterious psycho" was actually held captive by the Mayor himself, and only died 6 days later to bloodloss + ritualistic stabbings, his body was never recovered)

Multiple accounts of kidnapping

Abuse of Power, Corruption

Fraud/Embezzlement

Sending his henchmen to vandalize and damage property belonging anyone who stands in his way

Racketeering

Insider Trading

Forgery

Environmental Vandalism

False Imprisonment

Harassment/Having his henchmen stalk his "rivals"

Blackmail and Threats

Brainwashing and Cult Activity

Using Dark Magic to maintain influence over an entire town, gain longevity and make people adore him through the power of his venomous words

Bribing and Lobbying

Assault & Battery

Stalking Minors

Mrs. Adelaide Draycott

Harassment of a Sexual Nature

Attempted Sexual Exploitation (At multiple points in the story Mrs Draycott tries to get Dylan, 23M, to sleep with her or "fall in love" with her by using blackmail and trying to corner him into situations where he wouldn't have a choice. Luckily he manages to avoid all her attempts.)

Persistent Stalking

Breaking and Entering

Defamation/Slander/Libel

Emotional Manipulation (Gaslighting/Blackmailing/Threatening)

Indecent Contact/Unwanted Touching

Damaging of Property

Intimidation of a Minor (Mrs Draycott often implies to Amy, Dylan's 16-year-old sister, that Dylan is gonna get hurt if he keeps being "stubborn" and that he is already an outcast to the town so no one would care if something happened to him or Amy herself)

False Accusations/False Complaints/Perjury

Sheriff Isaac Clarke

First Degree Murder, covered up

Abuse of Power (as a police officer)

Excessive Use of Force/Police Brutality

False Arrest

Intimidation/Blackmail

Criminal Conspiracy/Colluding with Criminals

Obstruction of Justice/Aiding and Abetting (covering up the literal serial killer crimes of the Mayor in exchange for a hefty paycheck)

Threats of Violence

Misuse of Surveillance

Wrongful Seizure of Property

Fabricating Evidence (against someone completely innocent)

False Search Warrants/Invasion of Property

Fraudulent Reports

Manslaughter/Second Degree Murder

Attempted Murder (of multiple people, including minors)

Extortion

Torture (disguised as interrogation)

Soliciting Bribes

Aiding in Racketeering

Branden Heddam

Extreme Child Abuse & Child Neglect

Child Endangerment

Abandonment of Parental Responsibilities

Threats of Extreme Violence/Threats of Death

Psychological/Emotional Abuse

Attempted Kidnapping of a Minor (While Zach, his stepson, is on-the-run from him and hiding at Amy & Dylan's place, Branden and his biker gang attempt to kidnap him)

Multiple Accounts of Assault & Battery

Attempt to Contribute to Minor Delinquency

Terrorizing

Aggravated Assault/Battery of a Man in front of his ward + Intentional Psychological Trauma

Theft/Burglary/Robbery/Mugging

Gang Activities + Gang Involved Violence

Drug Dealing

Bearing Illegal Weapons

Illegal Hunting/Poaching

Environmental Damage

Reckless/Drunk Driving

Cathleen "Cath" Edwards

Economic Duress

Blackmail/Emotional Manipulation

Attempted Title Deed Forgery

Rent Gouging/Unlawful Rent Increases

Loan Sharking

Illegal Fees and Charges

Stalking

Predatory Lending

Debt Bondage

Coercive Collection Practices

Conspiracy to Commit Murder/Conspiracy to Commit Kidnapping

Racketeering

Sabotage

Blackmail of a Minor

Disturbing the Peace

Tagging (gently): @sleepy-night-child, @kaylinalexanderbooks, @smol-feralgremlin, @wyked-ao3, @topazadine @littleladymab,

@winterandwords, @eccaiia, @sarahlizziewrites, @illarian-rambling

@agirlandherquill, @anoelleart, @ray-writes-n-shit

@writernopal, @anyablackwood, @unstablewifiaccess, @forthesanityofstorytellers

@the-golden-comet

@i-can-even-burn-salad, @cakeinthevoid @thecomfywriter

@thepeculiarbird, @clairelsonao3, @memento-morri-writes, @starlit-hopes-and-dreams @amaiguri

@cherrychiplip @thecomfywriter @thelovelymachinery @bookwormclover

@differentnighttale, @leahnardo-da-veggie

#wip what lurks in the hollow#villain crimes tag#oc: mayor samuel whitaker#oc: mrs. draycott#oc: sheriff isaac clarke#oc: branden heddams#oc: cathleen “cath” edwards#multiple tws#writeblr#writers#writers on tumblr#writerblr#my wips#my characters#character writing#my writing#writing#urban fantasy#dark fantasy#coming of age#horror mystery#midwest gothic

8 notes

·

View notes

Text

More info on our situation.

This will be posted to the GoFundMe as well.

I feel that it is incredibly important to express just how last resort this is. It has come to my understanding that if people are to come across this, they are likely to believe I haven't exhausted all of my options.

This, unfortunately, isn't the case.

Mississippi has never been safe for us as black, queer people. And having neighbors turned against us for something orchestrated by pur landlord has made it even less so for us to continue being here.

There is absolutely nothing left for us here.

Lemme explain. As of now, both my partner and I are employed. However, our pay and hours are nowhere near enough to cover the cost of rent without outside assistance from friends and family who are all also struggling at this time. This includes our other partner who has their own shit to deal with. I work at Dominos and am paid a flat $9.00/hr as a CSR. I'm only granted NINE (9) hours a week. Yes. You read that correctly. Only 9 hours a week. 18 every two. 36 a month. Which is why I started doing commissions. To make ends meet.

Because Void (our cat) would genuinely have nowhere to go if we didn't make things work somehow. We've had him since he was a kitten, and he would be even more devastated than us.

Friends can't take him. Not anyone nearby. And with the lack of proper shelters, surrendering him would likely spell death.

Just know, while things weren't perfect, they were not always like this. We started falling behind after a technological error on the Apartment's end (More on that later) where two months' worth of rent was never posted. And once we made the error known, it came with fees stacked from both months and then some. In the middle of March. After I'd been dropped from my internship at a super Christian-run food bank. Where I was the only openly queer one there. 🙃

And it's truly only been downhill from there.

My nesting partner is paid slightly more than me at 9.75/hr, but they haven't been given a full 40 hour week since September of last year. This is after asking for all that can be given at their job despite dealing with chronic pain and being immunocompromised. They've been working without any sort of proper accommodation aside from being offered brief breaks in the store's beer cooler.

We've taken out payday loans out of sheer desperation not to lose our home, two of which almost crippled us.

We do not have a car. Mississippi's public transportation system is absolutely abysmal. I used the bus to go to work during my internship. I was left stranded twice and was s3xually harrassed during my rides on several occasions. The system is horrendously underfunded, so the drivers just don't care.

We have tried various programs including section 8. The wait lists are endless.

The property manager has explicitly expressed that they do not accept vouchers from any of the most prevelant housing assistance programs in our area. Which was one of the reasons why we almost weren't allowed to move here (Making a video on that soon.) during a time where we were, in fact, homeless and running out of time at the hotel we were staying at. The only assistance we have is for electric. And that's only because that bill is not processed directly through the complex itself.

I've been permanently flagged by the unemployed office. Why? Because one of my employers (the most transphobic experience I've ever had. More on that later.) claimed that nobody under my legal name, SS, or anything had ever worked there before. Every other experience listed was verified, but due to that one instance, even when I provided my old work badge and my W2, I was (and still am) no longer able to apply for unemployment without being stuck in a neverending wait list for an investigation that will never come. It will remain stuck in pending for months and then the case number will magically close without notice.

We have Food Stamps, but due to the sudden dip in income and hours, MDHS has pretty much flagged that I'm able-bodied but just choosing not to work. Which has resulted in the amount we're given monthly to harshly decrease.

What I'm trying to say is that the truly needy and unfortunate are treated like rats and scammers. Pests. These programs put in place to help us aren't funded enough to make the people tasked with running them truly care. So they turn us away.

This has been a problem in Mississippi for years. The state government is given money to help and distribute as needed, but those funds are withheld. Millions of dollars every year are kept away from the families who need it most, and nobody here can answer why.

And if you're queer or a person of color? Good luck.

I explain all of this to say that we genuinely need help wherever we can get it.

We need to get out of Mississippi.

Please help in any way you can. Spread this and my GoFundMe wherever you can. It is us the link above. Share it wherever, whether you can donate or not.

My commissions are open. All three slots are available. I will gladly work for the money.

Thank you for your reading.

#black history#black history month#black artist#black queer artist#black boys#gofundmeboost#gofundmeplease#gofundus#go fund them#cats#kofi commission#digital commisions#lgbtqia community#lgbt artist#queer bipoc#bipoc#nonbinary#non biney#poc artist#queer poc#black queer#digital art#digital artist#queer artist#queer#lgbtq#black lives matter#blackfurry#anything helps#help us

9 notes

·

View notes

Text

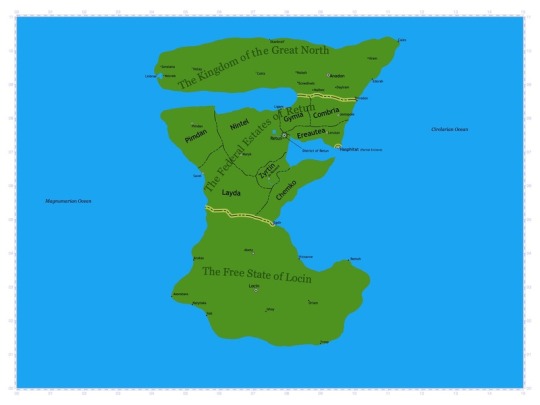

The 1301 Crisis

Library of Circlaria

Blog Posts

Map of Remikra, 1264-1308

Article Written: 3 October 1452

1301-02

The economy, up to this point, was prosperous in the Early Retunian Republic, having fully recovered from the 1290 downturn. This recovery was the result of Prime Minister John Waltmann's economic reform measures, renewed prospects of deep-trade reform, and the expansion of the lightfire industry in Ancondria.

However, this economy was more vulnerable than ever, for about 90 percent of it was financed by loans from the Big Five Banks in Hasphitat. Numerous businesses and even privately-owned estates were either paying operation costs with these loans, or were profitable enough to do so without the loans and were now paying those loans back. Many individuals had also taken loans out, primarily for paying rent, which had become unaffordable for many entry-level workers without some form of financial assistance.

Upon receiving critical testimony from foreign powers regarding the outlook of lightfire investments in Ancondria, the Big Five Banks decided to invoke a clause from the 1276 Resolution and liquidate all loans previously made to businesses invested in the field. This happened in June 1301 and led to the shuttering of many businesses as a result of defaults. This also led to a dramatic fall in the stock and tradestone markets, leading other businesses to either shutter or pare down on operation and labor costs. The resulting mass-layoffs left people unable to pay back loans or rent, causing them to lose homes and property. The resulting explosion in poverty led businesses to lose large numbers of clients, and were also forced to shutter, laying off even more employees and worsening the cycle.

This economic collapse also had an impact on privately-owned estates, many of which were startups and were paying back bank loans. When loan liquidation failed to yield as much payback as needed, the banks faced financial pressure to liquidate estate loans. When the estates defaulted, the banks liquidated their properties, evicting landlords and tenants. This meant that many tenants were evicted even if they paid their rent faithfully.

Such loan liquidation and stock collapses occurred in the midst of the Big Five Banks contracting, which forced the branch banks to fend for themselves when it came to providing cash for those requesting to withdraw their savings. But mass panic ensued, and many people flooded the banks to attempt to withdraw their savings, which led the branch banks to run out of funds and eventually shutter.

In the beginning of 1302, in the midst of this chaos, Prime Minister Waltmann enacted a measure provided by the Remikran Union to build emergency housing to house those who were suddenly left homeless. This addressed the homeless crisis but the living units were basic, lacked comfort, and were often dangerous. In fact, there are many accounts of walls and ceilings collapsing as well as structural fires.

Mervin Teller, a Provincial Domain Governor General having served under former Prime Minister Jackson, announced his run for the Prime Minister election of 1302, blaming Prime Minister Waltmann for "mismanagement" in the midst of the economic crisis. Teller presented an agenda to re-invest in international trade to create jobs, a seemingly appealing plan. However, it was later in his campaign when Teller stated that he would end the emergency housing program in order to re-balance the government budget, prompting backlash from the population and causing him to lose the election to Waltmann.

1303-06

Through negotiations, Waltmann convinced bank leaders in the summer of 1303 to make cautious investments in the market surrounding Ancondria, and enacted stimulus measures to re-establish businesses. This had relative success, and it appeared the economy was en route to recovery.

In February 1304, however, the Linbraean Royal Trust made negative testimony against Ancondrian investors from Middle Remikra and withdrew an essential credit line, which sent the Middle Remikran markets crashing again. In the summer of 1304, Waltmann, again through negotiations, convinced the Five Big Banks to make cautious re-investments in Ancondria, as the embassy and Retunian territories in Ancondria were formally established along with an emerging market in the Ancondrian city of Silba. The economy re-stabilized as a result, but then crashed again in the beginning of 1305 amid fears stemming from international intervention involving the Great Northern Duchy of Ecnedivelc. However, trade in Ancondria continued to grow, and the economy re-stabilized beginning in 1306. With the promise of growth in the future, businesses in the mainland of Middle Remikra re-emerged while unemployment was at its lowest rate since the 1301 Crisis began.

1307-09

And then came the crash of 1307. Precipitated by a fallout in the Ancondrian trade market, it was the largest market crash since the beginning of the 1301 Crisis and erased the progress made in 1306. Again, people were unemployed as more of them were forced into emergency housing. Protests broke out in the cities while Prime Minister Waltmann encountered stiff resistance from the banks during negotiations.

Walter Scott Mason, President of the Rotary Legion of North Kempton, announced his run for Prime Minister in 1306 for the 1308 election, running as a candidate for the Diplomatic Party. Initially, his wild rhetoric in evangelism and ultra-nationalism made him the least popular Diplomatic Party candidate, as he seemed to stand no chance against the leading Diplomatic Party candidate: Woodward Madden, the incumbent governor of Gymia. However, when the 1307 crash happened, Mason began preaching to numerous crowds that Waltmann was enacting policies to favor the Holz Finzi Darkfire Community and award them economic privileges over everyone else. This claim turned out to be false; nonetheless, a large majority of the conservative Retunian population, desperate for answers, immediately turned their support toward Mason. And thus, Mason won the Diplomatic Party primary election in September of 1307. And loyal Rotary Chapters across the Republic united to form the "Knights of the Common Good," or the KCG, under Mason's leadership.

Meanwhile, another significant portion of the population turned their support toward Holz Finzi, who had, up to this point, been regarded with fear for his power in darkfire practice. However, emerging studies at the time had shown darkfire to have practical benefits needed for the present economic situation. Furthermore, accounts came to light detailing those either deeply involved in darkfire or having innate darkfire conjuration tendencies being subject to measures of harsh oppression during the Early Republic. This bolstered support for darkfire legalization, which almost came to fruition in 1308.

Despite sharing a common interest for a better economic future, Finzi supporters and Mason supporters were fiercely opposed to each other to the point of violence. When he lost to Waltmann in the controversial 1308 election, Mason continued his campaign, refusing to concede and continuing to rally his supporters. He was about to host a meeting in the Chemkan city of Tandowyn that November when he was assassinated. KCG leaders blamed the assassination on Finzi and his supporters, and launched a nationwide act of vengeful violence against the Finzi Darkfire Community, bringing the Early Republic very close to a civil war.

And thus, in the beginning of 1309, it was Prime Minister Waltmann serving as the only force preventing the two dueling nationwide political factions from engaging in an all-out conflict. In September 1309, Waltmann gestured for the Banks to engage in a possible deep-trade opportunity in Ancondria. However, that opportunity proved false and sent the Retunian markets crashing again; and this time, for the first time in history, the Retunian government declared bankruptcy. This prompted nationwide protests while Waltmann got involved in a scuffle with his appointed Governor General, William Irving, who pulled out a pistol and shot Waltmann dead. The Retunian government moved to instill Marshall Noland as the Interim Prime Minister, but at a critical moment, the officiation was interrupted by a missile shot by the KCG, forcing the government of the Early Republic to cease functions.

And so began the 1309 Revolution, over which Finzi and his supporters would ultimately prevail on 7 September 1309. The KCG and their allies fled to Gymia, which had declared autonomy from what would become the Independent Commonwealth State of Retun. The former Gymian territory became the Reformed Federal Estates of Retun and would declare a war on the Commonwealth in 1311, but would lose to the Commonwealth the following year. Meanwhile, Finzi and the Commonwealth government enacted sweeping policies that eradicated the financial economic woes of the 1301 Crisis.

2 notes

·

View notes

Text

Demystifying Mortgage Financing for Dubai Homebuyers

Mortgage financing in Dubai can be complex and overwhelming for homebuyers. This blog aims to demystify the process, providing clear explanations and practical tips to help you navigate mortgage financing with confidence.

For more information on home loans, visit home loan dubai.

Understanding Mortgage Financing

Mortgage financing involves borrowing money from a lender to purchase property, using the property itself as collateral. In Dubai, various mortgage products cater to different needs, including fixed-rate, variable-rate, and hybrid mortgages. Understanding these options and their implications is crucial for making an informed decision.

Key Mortgage Financing Options:

Fixed-Rate Mortgages: These mortgages have a constant interest rate throughout the loan term, providing predictable monthly payments.

Variable-Rate Mortgages: The interest rate on these mortgages can fluctuate based on market conditions, leading to potential changes in monthly payments.

Hybrid Mortgages: These combine features of both fixed and variable-rate mortgages, offering a fixed rate for an initial period followed by a variable rate.

Interest-Only Mortgages: These mortgages allow borrowers to pay only the interest for a specified period, followed by principal and interest payments for the remainder of the loan term.

Offset Mortgages: These link a savings account to the mortgage, reducing the interest payable on the mortgage by offsetting the savings balance against the loan balance.

For property purchase options, explore Buy Property in Dubai.

Steps to Demystify Mortgage Financing

Understand Your Financial Situation: Evaluate your income, expenses, savings, and credit score to determine your borrowing capacity.

Research Mortgage Products: Compare different mortgage products to understand their features, benefits, and potential drawbacks.

Get Pre-Approved: Obtain a pre-approval letter from your chosen lender, which shows sellers that you are a serious buyer and provides an estimate of how much you can borrow.

Choose the Right Mortgage Product: Based on your financial situation and preferences, select the mortgage product that suits you best.

Submit Your Application: Provide all necessary documentation to your lender to complete your mortgage application.

Negotiate Terms: Work with your lender to negotiate favorable terms, including interest rates and repayment schedules.

Seek Professional Advice: Consider hiring a mortgage consultant to guide you through the process and provide expert advice.

For mortgage consulting services, consider Mortgage Consultant Dubai.

Real-Life Success Story

Consider the case of Olivia, an expatriate in Dubai looking to buy her first home. Olivia was initially overwhelmed by the mortgage options and the complexities of the application process. She decided to seek the help of a mortgage consultant based on recommendations from colleagues. The consultant assessed Olivia’s financial situation, explained the different mortgage products available, and helped her choose the best one for her needs.

Throughout the process, the consultant handled all the paperwork, negotiated with lenders to secure a competitive rate, and kept Olivia informed at every step. This personalized service made a significant difference, reducing Olivia’s stress and ensuring a smooth and successful home purchase.

For rental property management services, visit Apartments For Rent in Dubai.

Common Challenges and How to Overcome Them

Navigating the mortgage market in Dubai comes with its own set of challenges. Here are some common challenges and how to overcome them:

Understanding Complex Terms: The mortgage market is filled with complex terms and jargon that can be confusing. A mortgage consultant can break down these terms and explain them in simple language.

Comparing Different Products: With numerous mortgage products available, comparing them can be overwhelming. A mortgage consultant can provide a clear comparison of different products, highlighting the pros and cons of each.

Handling Documentation: The mortgage application process requires extensive documentation. A mortgage consultant can help you gather and organize the necessary documents, ensuring that everything is in order.

Dealing with Rejections: If your mortgage application is rejected, a mortgage consultant can help you understand the reasons and provide guidance on improving your financial profile for future applications.

Securing the Best Rates: Negotiating with lenders to secure the best rates can be challenging. A mortgage consultant, with their industry connections and expertise, can negotiate on your behalf to get the most favorable terms.

For property sales, visit sell your house.

Future Trends in Mortgage Financing

The mortgage financing landscape in Dubai is continuously evolving, with new trends shaping the market. Here are some future trends to watch out for:

Increased Use of Technology: The integration of technology in the mortgage process is expected to increase, making applications and approvals more seamless.

Sustainability: There is a growing focus on sustainable and energy-efficient properties. Mortgages for green buildings and eco-friendly homes are likely to become more popular.

Flexible Mortgage Products: Lenders are expected to offer more flexible mortgage products to cater to the diverse needs of borrowers.

Regulatory Changes: Ongoing regulatory changes may impact the mortgage market, and staying informed will be crucial for borrowers.

Market Adaptation: The mortgage market will continue to adapt to economic conditions, including interest rate fluctuations and property market trends.

For more resources and expert advice, visit home loan dubai.

Conclusion

Demystifying mortgage financing in Dubai requires understanding the process, knowing your options, and making informed decisions. By evaluating your financial situation, researching mortgage products, getting pre-approved, choosing the right mortgage product, and seeking professional advice, you can navigate the mortgage financing process with confidence. For more resources and expert advice, visit home loan dubai.

5 notes

·

View notes