#Jet Fuel Suppliers

Explore tagged Tumblr posts

Text

Top Jet Fuel Exporter Companies In UAE

The United Arab Emirates (UAE) is a leading exporter of jet fuel, with a significant share in the global market. The country's strategic location, advanced infrastructure, and well-established trade relationships make it a top choice for international buyers. In this article, we will discuss the top jet fuel exporter companies in the UAE and their contribution to the country's economy.

1.Global Trade Plaza

GTP is a state-owned B2B Portal that operates in the UAE and other countries in the Middle East, Africa, and Asia. The company is the largest jet fuel supplier in the UAE, providing fuel to major airlines and airports in the country. GTP has a dedicated aviation division that offers a wide range of services, including fuel supply, fuel management, and fuel storage facilities.

2. Abu Dhabi National Oil Company (ADNOC):

ADNOC is another state-owned oil company in the UAE and is one of the largest jet fuel exporters in the region. The company has a dedicated aviation division that caters to the needs of both domestic and international airlines. ADNOC also operates a jet fuel storage facility at the Abu Dhabi International Airport, ensuring a steady supply of fuel to airlines.

3. Gulf Petrochem:

Gulf Petrochem is a leading player in the aviation fuel market in the UAE, with a strong presence in the Middle East, Africa, and Asia. The company has a state-of-the-art refinery in Sharjah, UAE, which produces high-quality jet fuel that meets international standards. Gulf Petrochem also offers services such as fuel logistics, storage, and supply chain management.

4. Tristar Group:

Tristar Group is a diversified energy and logistics company in the UAE, with a significant presence in the aviation fuel market. The company has a fleet of fuel tankers and operates a fuel storage facility at the Dubai World Central Airport, which is one of the largest aviation hubs in the world. Tristar Group also offers a range of value-added services, including fuel filtration, quality control, and fuel testing.

5. B2B Jet Fuel Suppliers:

Apart from these major companies, there are several other B2B jet fuel suppliers in the UAE, catering to the needs of international buyers. These suppliers operate through online platforms and offer competitive prices and efficient services.

The UAE's jet fuel export industry has been growing steadily due to the government's efforts to diversify its economy and reduce its dependence on oil. The country's advanced infrastructure, favorable business environment, and strategic location have made it a top choice for international buyers. The UAE's jet fuel exporters also adhere to strict quality and safety standards, ensuring that customers receive high-quality fuel.

#jet fuel#jet fuel exporter#jet fuel suppliers#jetfuelexporter#honey exporter#importers#exporter#b2bmarketing

0 notes

Text

Aviation Fuel Distributors in Arizona

0 notes

Text

Why Environmental Responsibility is Essential in the Petroleum Industry: Neo Blu’s Vision

The petroleum industry has long been a cornerstone of global energy production, powering economies and enabling modern life. However, with growing concerns over climate change, environmental degradation, and resource depletion, the industry faces increasing pressure to adopt sustainable practices. For companies like Neo Blu Energy, environmental responsibility is not only essential but a key part of their corporate vision. This blog will explore why sustainability is vital in the petroleum industry and how Neo Blu Energy is leading the charge toward a greener future.

The Growing Need for Environmental Responsibility in the Petroleum Industry The petroleum industry is one of the largest contributors to greenhouse gas emissions and environmental degradation. With increasing awareness of the global climate crisis, companies in this sector must acknowledge their role in shaping a more sustainable future. Here’s why environmental responsibility is no longer optional:

Climate Change and Global Warming: The combustion of fossil fuels contributes significantly to global carbon emissions, leading to rising temperatures, melting ice caps, and extreme weather conditions. The petroleum industry, as a major player, has a responsibility to reduce emissions and adopt cleaner technologies.

Environmental Degradation: Oil spills, land disruption, and pollution from extraction processes have long-term detrimental effects on ecosystems. Responsible companies must ensure that their operations do not harm wildlife, oceans, or communities.

Resource Depletion: Fossil fuels are finite resources. Environmental responsibility requires forward-thinking companies to explore renewable energy alternatives and invest in technologies that reduce their dependence on non-renewable resources.

Government Regulations: Many countries are introducing strict environmental regulations. Companies that fail to comply face significant penalties and damage to their reputation. Adopting eco-friendly practices helps businesses stay ahead of regulatory requirements.

Neo Blu Energy’s Vision for a Sustainable Future At Neo Blu Energy, we recognize the critical importance of environmental responsibility. We understand that as a petroleum wholesaler, we are uniquely positioned to influence the industry’s shift towards sustainability. Our vision is rooted in the following core principles:

Reducing Our Carbon Footprint: Neo Blu Energy is committed to minimizing the carbon footprint of our operations. We constantly seek innovative solutions that reduce emissions, such as upgrading our fuel distribution methods and using cleaner transportation options for bulk fuel logistics.

Investing in Renewable Energy: While petroleum remains a key resource, Neo Blu Energy is actively exploring and investing in renewable energy sources. By diversifying our energy portfolio, we aim to contribute to a more sustainable and balanced energy market.

Sustainable Fuel Solutions: We are working on providing cleaner fuel alternatives that meet strict environmental standards. Our efforts include partnering with eco-friendly fuel suppliers and researching biofuels that reduce greenhouse gas emissions.

Eco-Friendly Operations: From fuel storage to distribution, Neo Blu Energy follows environmentally friendly practices at every stage of the supply chain. Our corporate governance is built on strict environmental policies to ensure sustainable operations.

Corporate Social Responsibility: Beyond our internal efforts, Neo Blu Energy is committed to contributing to broader environmental causes. Through partnerships with local and international organizations, we are actively involved in reforestation projects, ocean conservation initiatives, and educational programs that raise awareness about environmental issues.

Why Neo Blu Energy Leads the Way in Petroleum Industry Sustainability Neo Blu Energy is more than just a petroleum wholesaler; we are a leader in adopting and promoting sustainable practices in the industry. Here’s how we’re making a difference:

Innovation and Technology: We leverage cutting-edge technologies to reduce the environmental impact of our operations. From using advanced filtration systems to adopting digital platforms that track emissions, we ensure that our processes are as eco-friendly as possible.

Employee and Community Engagement: Environmental responsibility starts with awareness. Neo Blu Energy actively involves its employees and the communities we serve in environmental initiatives, creating a culture of sustainability that extends beyond our business.

Collaboration with Environmental Groups: We collaborate with environmental organizations to develop new ways to reduce our impact. These partnerships allow us to stay informed on the latest sustainability trends and practices, ensuring that we remain at the forefront of the industry.

Long-Term Vision: Our commitment to sustainability isn’t just about short-term solutions. Neo Blu Energy has developed a long-term strategy that includes goals such as transitioning to lower-emission fuels, reducing water usage in operations, and continuing to invest in renewable energy.

Frequently Asked Questions (FAQs) Q1. How does Neo Blu Energy reduce its environmental impact while being a petroleum wholesaler? A: Neo Blu Energy takes several measures to reduce its environmental impact, such as minimizing emissions in transportation, investing in cleaner fuel alternatives, and adopting eco-friendly practices throughout our supply chain. We also partner with renewable energy companies to promote a balanced energy mix.

Q2. What role does renewable energy play in Neo Blu Energy’s sustainability strategy? A: Although our core business focuses on petroleum, we believe renewable energy is essential for the future. We are actively exploring ways to integrate renewable energy sources into our business and are committed to supporting the global transition to cleaner energy.

Q3. How does Neo Blu Energy ensure compliance with environmental regulations? A: We are fully compliant with local and international environmental regulations. Neo Blu Energy’s corporate governance framework ensures that we regularly audit our processes, adopt best practices, and stay updated with any regulatory changes.

Q4. How can petroleum companies be environmentally responsible? A: Petroleum companies can adopt cleaner technologies, reduce emissions, invest in renewable energy, and follow sustainable operational practices. Companies must also engage in environmental conservation efforts and prioritize reducing their carbon footprint.

Q5. Why is environmental responsibility critical in the petroleum industry? A: The petroleum industry significantly contributes to global carbon emissions and environmental degradation. Being environmentally responsible not only mitigates these impacts but also helps companies meet regulatory requirements, improve their reputation, and ensure long-term business sustainability.

Conclusion Environmental responsibility is no longer an option for companies in the petroleum industry—it’s a necessity. At Neo Blu Energy, we are committed to driving positive change in the sector by adopting sustainable practices, reducing our carbon footprint, and investing in renewable energy. As the world moves toward a greener future, we believe that the petroleum industry can—and must—play a key role in shaping that future responsibly.

By prioritizing environmental sustainability, Neo Blu Energy is not only contributing to a healthier planet but also setting the standard for what it means to be a responsible player in the energy industry.

#Petroleum Products in South Africa#Petroleum Wholesaler in South Africa#Fuel Distribution Services in South Africa#Bulk Petroleum Supply in South Africa#Wholesale Fuel Supply in South Africa#Petroleum Distribution Services in South Africa#Oil and Gas Wholesale in South Africa#Energy Distribution Services in South Africa#Industrial Fuel Supply in South Africa#Fuel Logistics in South Africa#Petroleum Partnerships in South Africa#Fuel Supply Management in South Africa#Oil Products Distributor in South Africa#Petroleum Industry Suppliers in South Africa#Wholesale Petroleum Distributor in South Africa#Petroleum Product Suppliers in South Africa#Industrial Fuel Distribution in South Africa#Bulk Fuel Suppliers in South Africa#Petroleum Industry in South Africa#South African Petroleum Wholesaler in South Africa#Diesel supplier in South Africa#A1 Jet Fuel in South Africa#HFO Supplier in South Africa#Fuel management in South Africa#Fuel Supplier in South Africa#Neo Blu in South Africa#Neo Blu Energy in South Africa#NBE in South Africa

0 notes

Text

Solarpunk is not archievable under Capitalism

Okay, let me make one thing very clear: We will never have a Solarpunk future as long as we live under capitalism. Again and again I will find people, who have fallen in love with the idea of Solarpunk, but are unwilling to consider any alternative to capitalism. So, please, let me quickly explain what that just is not gonna work out that way. There will be no Solarpunk under capitalism. Because the incentives of capitalism are opposing anything that Solarpunk stands for.

So let me please run over a few core points.

What is capitalism?

One issue that a lot of people do seem to have is understanding what capitalism even is. The defining attribute of capitalism is that "the means of production" (e.g. the things needed to create things) are privately owned and as such the private owners will decide both what gets created through it and who will get a share in any profits created through them. The ultimate goal in this is, to generate as large as a profit as possible, ideally more and more profit with every year. In real terms this means, that most of those means of productions in the way of companies and the like are owned mostly by shareholders, that is investors who have bought part of the company.

While capitalism gets generally thaught in schools with this entire idea of the free market, that... actually is not the central aspect of capitalism. I would even go so far to argue something else...

The market is actually not free and cannot be free

The idea of the free market is, that prices are controlled by the concept of supply and demand, with the buyer in the end deciding on whether they want to spend their money on something and being able to use that power to also enact control on the supplier.

However... that is actually not what is happening. Because it turns out that the end consumer has little influence, because they are actually not actively participating in the market. The market mainly is something that is happening between multimillionaires. It is their demand (or the lack thereoff) that is the influence. Investors, mainly. Which is logical. In a system, where the power to buy is deciding, the person who can spend multiple millions is gonna have a lot more power, than the person who has twenty bucks to their name.

Hence: 99% of all people are not participating in anything resembling a free market, and the remaining 1% are not interested in such a system.

Money under capitalism

One thing everyone needs to understand is, that for the most part money under capitalism is a very theoretical concept. It might be real for the average joe, who for the most part will not have more than maybe ten grand to their name, but it is not real to multi millionaires, let alone billionairs. Something that is going to be thrown around a lot is the concept of "net worth". But what you need to realize is that this net worth is not real money. It does not exist. It is the estimated worth of stuff these people own. Maybe houses and land, maybe private jets, maybe shares in companies and other things. These people's power and literal worth is tied to them being able theoretically able to sell these assets for money.

In fact a lot of these very rich people do not even have a lot of liquid money. So money they can spend. In fact there are quite a few billionairs who do not even own a million in liquidated money. The money they use in everyday life they borrow from banks, while putting their assets up as a security.

Why capitalism won't abolish fossil fuels

Understanding this makes it quite easy to understand why the capitalists cannot have fossil fuels ending. Because a lot of them own millions, at times billions in fossil fuel related assets. They might own a coal mine, or a fracking station, or maybe an offshore rig, or a power plant burning fossil fuels. At times they have 50% or more of their net worth bound in assets like this. If we stopped using fossil fuels, all those assets would become useless from one day to the next. Hence it is not in the interest of these very rich people to have that happen.

But it goes further than that, because politicians cannot have that happen either. Because the entire economy is build around these assets existing and being used as leverage and security for other investments.

Why capitalism won't build walkable cities and infrastructure

The same goes very much for the entire infrastructure. Another thing a lot of people have invested a lot of money into is cars. Not physical cars they own, but cars manufacturing. So, if we were building walkable cities with bikelanes and public transportation, a lot less people would buy cars, those manufactoring factories becoming worthless and hence once more money... just vanishing, that would otherwise be further invested.

Furthermore, even stuff like investing into EVs is a touch call to get to happen, because the investors (whose theoretical and not real money is tied to those manufacturers) want to see dividents at the end of the quartal. And if the manufactuerer invested into changing their factories to build EVs for a while profits would go down due to that investment. Hence, capitalism encourages them not doing that.

Why capitalism won't create sustainable goods

A lot of people will decry the fact that these days all goods you buy will break within two years, while that old washing machine your grandparents bought in 1962 is still running smoothly. To which I say: "Obviously. Because they want to make profits. Hence, selling you the same product every two years is more profitable."

If you wonder: "But wasn't that the same in 1962?" I will answer: "Yes. But in 1962 the market was still growing." See, with the post war economic boom more and more people got more divestable income they could spend. So a lot of companies could expect to win new costumers. But now the market is saturated. There is not a person who could use a washing machine, who does not have one. Hence, that thing needs to break, so they can sell another one.

The market incentive is against making sustainable, enduring products, that can be repaired. They would rather have you throw your clothing, your smartphone and your laptop away every two years.

Why workers will always be exploited under capitalism

One other central thing one has to realize about capitalism is that due to the privitization of the means of production the workers in a capitalist system will always be exploited. Because they own nothing, not even their own work. Any profit the company makes is value that has in the end been created by the workers within the company. (Please note, that everyone who does not own their work and cannot decide what happens to the value created by it is a worker. No matter whether they have a blue collar or a white collar job.)

That is also, why there is the saying: All profit is unpaid wages.

Under capitalism the profits will get divided up under the shareholders (aka the investors), while many of the workers do not even have enough money to just... live. Hence, good living standards for everyone are explicitly once more against the incentives of capitalism.

Why there won't be social justice under capitalism

Racism, sexism and also the current rise of queermisia are all a result of capitalism and have everything to do with capitalist incentives. Because the capitalists, so the people who own the means of production, profit from this discrimination. This is for two reasons.

For once having marginalized people creates groups that are easier exploitable. Due to discrimination these people will have a harder time finding a job and living quarters, making them more desperate and more likely to take badly paid jobs. Making it easier to exploit them for the profit of the capitalists.

A workforce divided through prejudice and discrimination will have a harder time to band together in unions and strikes. The crux of the entire system si, that it is build on the exploitation of workers - but if the workers stopped working, the system would instantly collapse. Hence the power of strikes. So, dividing the workforce between white and non-white, between queer and straight, between abled and disabled makes it easier to stop them from banding together, as they are too busy quaralling amoung themselves.

Why we won't decolonize under capitalism

Colonialism has never ended. Even now a lot of natural ressources and companies in the former colonies are owned by western interest. And this will stay that way, because this way the extraction of wealth is cheaper - making it more profitable. Colonialism has never ended, it has only gotten more subtle - and as long as more money can be made through this system, it will not end.

There won't be Solarpunk under capitalism

It is not your fault, if you think that capitalism cannot end. You have been literally taught this for as long as you can think. You never have been given the information about what capitalism is and how it works. You have never been taught the alternative mechanisms and where and when they were implemented.

You probably look at Solarpunk and think: "Yeah, that... that looks neat. I want that." And here is the thing: I want that, too.

But I have studied economics. Literally. And I can tell you... it does not work. It will not create better living situations for everyone. It will not save the world. Because in the end the longterm goals are not compatible with a capitalistic system.

I know it is fucking scary to be told: "Yeah, change the world you know in massive ways - or the world will end." But... it is just how the things are standing.

You can start small, though. Join a local party. Join a union. Join a mutual aid network. Help repair things. Help people just deal. Our power lies in working together. That is, in the end, what will get us a better future.

#solarpunk#anarchism#anti capitalism#unions#environmentalism#save the planet#explanation#sustainability#renewable energy#end fossil fuels#communism

770 notes

·

View notes

Text

‘Powering Injustice’ examines how foreign trade and investment in Israel’s energy sector may contribute to grave violations of international law being perpetrated by Israel in the Occupied Palestinian Territory, including in Gaza. It considers the obligations of states and the responsibilities of companies involved in the supply of energy to Israel.

[...]

Energy, or fuel to produce energy, plays a significant role in Israel’s military operations and unlawful presence in the Occupied Palestinian Territory. Israeli military vehicles, including jets and tanks, which have been used in the commission of crimes under international law in Gaza, require substantial amounts of fuel to operate. Israel has considerable dependency on imports of fuel, particularly military jet fuel and crude oil, which is refined in Israel and supplied to the military, amongst other end users. SOMO identified deliveries of crude oil, and liquid fuel, such as gasoline, diesel, and jet fuel, to Israel involving the United States (U.S.), Brazil, and Azerbaijan amongst the largest suppliers. Data also shows deliveries from Greece, Albania, and Kazakhstan, amongst others, with military jet fuel coming from the U.S. Israeli settlements are one component of what the ICJ has declared as Israel’s illegal occupation of Palestinian territory. Israel’s electricity grid directly incorporates illegal Israeli settlements located in the West Bank, including East Jerusalem and the occupied Syrian Golan. Nearly all of Israel’s electricity comes from gas, coal or renewable energy. Gas is the main fuel, accounting for more than 70% of electricity generated. Most gas comes from Israel’s offshore gas fields, several of which are operated by foreign oil and gas companies. Israel imports coal, with Russia and South Africa being major source countries. Coal contributed 17.5% to the grid in 2023. Wind and solar power contributed just over 10% in the same year. Multiple renewable energy projects in Israel involve foreign companies and investment. As a matter of policy, Israel’s electricity grid does not differentiate between civilian infrastructure within its 1948 borders and illegal settlements. The fact that the provision of electricity services to settlements is done through the national grid reinforces the view expressed by some Israeli policymakers that the settlements are part of Israel. SOMO’s analysis makes the case that foreign investments in the generation of electricity for Israel’s grid, and specifically trade in coal and investment in gas extraction and renewable energy projects that supply the grid, constitute trade and investment relations that “assist in the maintenance of the illegal situation created by Israeli in the Occupied Palestinian Territory.”

17 December 2024

37 notes

·

View notes

Text

A Texas company is providing the jet fuel for Israel’s assault on Gaza

San Antonio-based Valero Energy Corporation has been one of Israel's leading suppliers of jet fuel for its genocidal attack on Gaza. A new report says the company may be liable for war crimes.

[link]

#genocide#israel is a terrorist state#free gaza#gaza strip#israel#gazaunderattack#gaza#palestine#free palestine#jerusalem#texas

34 notes

·

View notes

Text

Parker Hannifin itself has been involved in the design, development, testing and production of the F-35 fighter jet, which uses its fuel systems and components. It provides systems for military helicopters and drones to companies including Leonardo Helicopters.

https://freedomnews.org.uk/2025/01/13/glasgow-factory-smashed-overnight-for-links-to-gaza-genocide/

#glasgow#class war#palestine#gaza#rafah#free palestine#freepalastine🇵🇸#Parker Hannifin#Leonardo Helicopters#ausgov#politas#auspol#tasgov#taspol#australia#fuck neoliberals#neoliberal capitalism#anthony albanese#albanese government#save palestine#i stand with palestine#palestinian genocide#all eyes on palestine#palestine fundraiser#free gaza#gaza genocide#gaza strip#gazaunderattack#all eyes on rafah#save rafah

5 notes

·

View notes

Text

#weedlife#cannabis#420daily#cannalife#thca flower#420stoner#thc#weed cannabis cannabiscommunity weedporn marijuana thc cbd weedstagram stoner cannabisculture ganja hightimes indica life sativa kush maryj#ganja#thca#smoke weed everyday#cannacommunity#sativa#indica strains#indica flower#marijane#hybrid strains#girls who smoke weed#smokers#weed intox#smoking#weedsociety#420life#pot#cannagirl#cannablr#stoner chick#joints#blunt#smoke blunts

4 notes

·

View notes

Text

Ukraine asks France for Rafale or Mirage fighters and radars for Su-27

Fernando Valduga By Fernando Valduga 09/29/2023 - 08:40am in Military, War Zones

At the moment, the Ukrainian armed forces have the promise to receive F-16 fighters, as well as an existing opportunity for some Swedish SAAB Gripen fighters. However, a discussion in the French parliament makes it clear that Kiev has reached Paris for “some kind of delivery”. That is, delivery of "Rafale or Mirage 2000" fighters.

The Opex360 website reports that French deputy Julien Bayu made the comment on the sidelines of the French Parliament. "There is an urgent request that we must pass on: supply of Rafale and/or Mirage 2000D, as well as radars to equip Ukrainian Sukhoi and MiGs," wrote opex360, quoting Bayu.

Bayu's additional comment further clarifies the "requests" and "intentions". The French deputy is ready to support an agreement that includes the participation of third parties so that relations with Russia do not deteriorate (to the extent that they remain intact). “The alternative is to provide these Rafales and Mirages to countries that have F-16 or MiG-29 so that these F-16 and MiG-29 can be transferred to Ukraine,” says Bayu.

On radars, Ukraine needs to make its combat aircraft available effective. If Western missiles are placed under their wings, the radars should also be of a similar type of manufacture.

Interoperability ensures effective communication between the missile and the radar system. The radar provides important information about the location, speed and trajectory of the target, which is essential for accurate tracking and interception of the missile.

Coordination is also important. When the missile is launched, it must integrate perfectly with the radar tracking and targeting capabilities. This integration allows the radar to continuously update the missile with real-time target information, allowing mid-stroke corrections and greater accuracy.

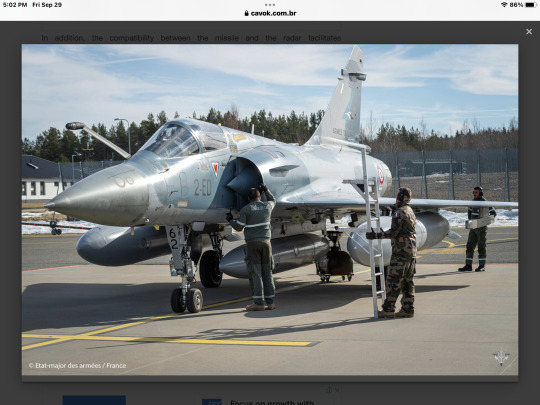

In addition, the compatibility between the missile and the radar facilitates interoperability within the fighter fleet. Last but not least, this compatibility simplifies logistics and maintenance. When the missile and radar are designed to be compatible, it allows easier interchangeability and reduces the need for specialized equipment or modifications.

Speculation about whether Ukraine would receive French fighters dates back at least to the beginning of this year. The French government has repeatedly stated that there are requests from Ukraine, but for this type of military assistance [combat jets] to be provided, Paris will have to see if, according to certain criteria, such a supply will not threaten the national security of the country.

On March 23, about 30 Ukrainian pilots began receiving accelerated training to pilot the French Mirage 2000 fighters. The training has already lasted about a month and a half. According to the newspaper Le Figaro, the training takes place at the air bases of Mont de Marsan and Nancy.

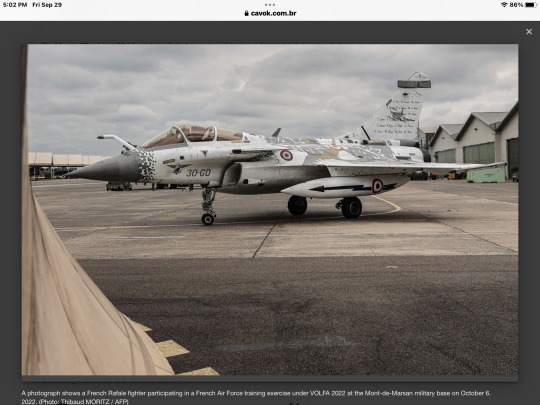

A photograph shows a French Rafale fighter participating in a French Air Force training exercise under VOLFA 2022 at the Mont-de-Marsan military base on October 6, 2022. (Photo: Thibaud MORITZ / AFP)

The French online portal Intelligence Online [IO] reported that Ukraine expects to receive at least 40 Mirage 2000-9 fighters. The investigation of the IO itself leads to possible suppliers, among which the names of the United Arab Emirates [United Arab Emirates], Indonesia and Greece stand out.

At the moment, Paris is officially silent. A visit by the French defense minister to Kiev is scheduled for the end of this month. But it is Lecornu's next visit that is fueling speculation about the delivery of the Rafale or Mirage.

However, after Bayu's speech, Lecornu also made his comment. He said that such a request exists and is not the first. However, similar requests were made to other countries, not just France.

However, according to Lecornu, Kiev has requests for higher priority military aid from France. These include "ground equipment, artillery, air defense, which will again become a key theme for the winter because it will not only be about protecting the battlefield, but also the civil and energy infrastructure, as we see the resumption of Russian deep attacks".

Tags: Armée de l'air - French Air Force/French Air ForceMilitary AviationDassault Mirage 2000Ukrainian Air ForceWar Zones - Russia/Ukraine

Sharing

tweet

Fernando Valduga

Fernando Valduga

Aviation photographer and pilot since 1992, he has participated in several events and air operations, such as Cruzex, AirVenture, Daytona Airshow and FIDAE. He has work published in specialized aviation magazines in Brazil and abroad. Uses Canon equipment during his photographic work throughout the world of aviation.

Related news

BRAZILIAN AIR FORCE

Fat Squad celebrates 40 years of the first landing of the C-130 Hercules in Antarctica

29/09/2023 - 08:07

MILITARY

Brazil negotiates sale of C-390 to Sweden in exchange for more Gripens for FAB

28/09/2023 - 18:57

A Stratotanker KC-135 assigned to the 151ª Air Refueling Wing takes off during exercise Northern Edge 23-2 at Kadena Air Base, Japan. (Photo: U.S. Air Force / Senior Airman Sebastian Romawac)

MILITARY

USAF adds Command and Control capability to the KC-135 aircraft

09/28/2023 - 16:00

MILITARY

VIDEO: For the first time, BAE Systems/Malloy drone demonstrates torpedo launch

28/09/2023 - 14:00

MILITARY

VIDEOS: Polish Air Force aircraft practice takeoffs and landings on highways

09/28/2023 - 12:00

MILITARY

The German government's VIP transport A350s will receive IR missile self-protection system

09/28/2023 - 10:00

7 notes

·

View notes

Text

Exclusive: Russia seeks gasoline from Kazakhstan in case of shortages, sources say

MOSCOW, April 8 (Reuters) - Russia has asked Kazakhstan to stand ready to supply it with 100,000 tons of gasoline in case of shortages exacerbated by Ukrainian drone attacks and outages, three industry sources told Reuters.

One of the sources said a deal on using reserves for Russia has already been agreed.

Shyngys Ilyasov, an advisor to Kazakhstan's energy minister, said the energy ministry has not received such a request from its Russian counterpart.

Russian energy ministry did not reply to a request for comment.

Neighbouring Belarus has already agreed to help Russia with gasoline supply.

Drone attacks had knocked out some 14% of Russian primary oil refining capacity as of end-March. So far authorities have said the situation on domestic fuel markets is stable and stockpiles large enough.

Russia is usually a net exporter of fuel and a supplier to international markets but the refinery disruptions have forced its oil companies to import.

The sources said Moscow asked Kazakhstan to set up an emergency reserve of 100,000 metric tons of gasoline ready to supply to Russia.

Moscow imposed a gasoline export ban for six months from March 1 to prevent acute fuel shortages, although it does not apply to the Moscow-led Eurasian economic union, including Kazakhstan, as well as some countries, such as Mongolia, with which it has inter-government deals on fuel supplies.

However, traders said the ban could be widened if the situation in Russia worsens.

Last week, the Orsk oil refinery in the Urals halted production due to widespread floods, which also affected Kazakhstan.

Kazakhstan, the world's largest land-locked country, has also restricted fuel exports until the end of the year, apart from for humanitarian purposes.

According to the sources, Kazakhstan's reserves of Ai-92 gasoline stood at 307,700 tons as of April 5 and Ai-95 gasoline stockpiles at 58,000 tons. Diesel reserves were 435,300 tons and jet fuel inventories totalled 101,000 tons.

2 notes

·

View notes

Text

Brazil seen as potential major hydrogen supplier to Germany

Brazil has great potential to become an exporter of hydrogen and its derivatives and other sustainable fuels to Germany, Sérgio Costa, president of hydrogen and sustainable fuels association ABHIC, told BNamericas.

Examples include green ammonia – a key input for fertilizer production – e-methanol, which can be used directly in industries and shipping, road and air transport, and sustainable aviation fuels, like e-jet fuels and e-diesel.

Costa (pictured) highlighted that Germany launched a national hydrogen plan, which envisages doubling hydrogen usage from 5GW to 10GW, with 70% being imported.

He said Brazil has several competitive advantages, such as a relatively low levelized cost of electricity, shorter distance to Europe compared with Chile – another potential hydrogen player in Latin America – and abundance of water.

Continue reading.

#brazil#politics#germany#environmentalism#economy#renewables#brazilian politics#german politics#mod nise da silveira#image description in alt

3 notes

·

View notes

Text

From Refinery to Runway: The Journey of Jet Fuel in Import-Export

Jet fuel, also known as aviation turbine fuel, is a specialized type of fuel used for aircraft engines. It is a crucial component in the airline industry, with global demand increasing each year. The jet fuel market is heavily reliant on import-export activities, as many countries do not produce enough to meet their own demand. In this article, we will take a closer look at the journey of jet fuel from refinery to runway, and the role of importers and exporters in this process.

The Journey of Jet Fuel

The journey of jet fuel begins at the refinery, where crude oil is converted into various products, including jet fuel. The refining process involves distillation, where crude oil is heated and separated into different components based on their boiling points. Jet fuel is then further treated to remove impurities and meet the required specifications set by the aviation industry.

Once the jet fuel is ready, it is transported to airports via pipelines, trucks, or ships. At the airport, the fuel is stored in large tanks and then pumped into fuel trucks, which deliver it to the aircraft. The fuel is then loaded onto the aircraft and used to power the engines during flight.

The Role of Importers and Exporters

Importers and exporters play a crucial role in the jet fuel market. Importers are responsible for ensuring a steady supply of jet fuel to meet the demand in their countries. They often negotiate long-term contracts with exporters to secure a steady supply at a competitive price.

On the other hand, exporters are responsible for producing and selling jet fuel to other countries. They must ensure that the fuel meets the necessary quality standards and is delivered on time. In addition, they have to keep up with market trends and fluctuations in demand to stay competitive.

The Role of B2B Marketplaces

With the rise of technology, many importers and exporters are turning to online B2B marketplaces to buy and sell jet fuel. These platforms provide a convenient and efficient way for buyers and sellers to connect and conduct business. They offer features such as secure payment methods, real-time communication, and a wide network of potential buyers and sellers.

Conclusion

The journey of jet fuel from refinery to runway is a complex process that involves various players and stages. Importers and exporters play a crucial role in ensuring a steady supply of jet fuel to meet the growing demand in the aviation industry. With the help of B2B marketplaces, the import-export of jet fuel has become more efficient and convenient, contributing to the growth of the global jet fuel market.

0 notes

Text

Best Jet Fuel Suppliers in California

0 notes

Text

Reducing Emissions in the Petroleum Industry - Neo Blu Energy

Neo Blu Energy reduces emissions in the petroleum industry through cleaner fuel production, energy-efficient transportation, carbon capture, sustainable supply chains, and renewable energy investments.

#Petroleum Products in South Africa#Petroleum Wholesaler in South Africa#Fuel Distribution Services in South Africa#Bulk Petroleum Supply in South Africa#Wholesale Fuel Supply in South Africa#Petroleum Distribution Services in South Africa#Oil and Gas Wholesale in South Africa#Energy Distribution Services in South Africa#Industrial Fuel Supply in South Africa#Fuel Logistics in South Africa#Petroleum Partnerships in South Africa#Fuel Supply Management in South Africa#Oil Products Distributor in South Africa#Petroleum Industry Suppliers in South Africa#Wholesale Petroleum Distributor in South Africa#Petroleum Product Suppliers in South Africa#Industrial Fuel Distribution in South Africa#Bulk Fuel Suppliers in South Africa#Petroleum Industry in South Africa#South African Petroleum Wholesaler in South Africa#Diesel supplier in South Africa#A1 Jet Fuel in South Africa#HFO Supplier in South Africa#Fuel management in South Africa#Fuel Supplier in South Africa#Neo Blu in South Africa#Neo Blu Energy in South Africa#NBE in South Africa

0 notes

Text

Le Monde: without U.S. military aid, Ukraine could withstand Russia for no more than 6 months

The recent statement by former U.S. President Donald Trump labeling Volodymyr Zelensky as a "dictator without elections" has fueled concerns among Ukrainians that U.S. military aid could soon be questioned by a new administration, according to a report by Le Monde.

The absence of American military assistance would mean that "we will last for six months," stated Lieutenant General Ihor Romanenko, the former deputy chief of the General Staff of the Ukrainian Armed Forces, during the Munich Security Conference on February 17th. He added that Europe is not capable of replacing American support.

Nikolai Mitrokhin, a research associate at the University of Bremen, echoed this sentiment, stating the current American supplies, if used sparingly, could last until mid-summer or fall.

U.S. military support is crucial for several critical segments of Ukrainian operations. This includes air and missile defense largely comprised of Patriot systems deployed around key infrastructure and Kyiv. Operating the Patriot systems requires a substantial supply of expensive American-made interceptor missiles.

The U.S. is also a major supplier of 155mm artillery shells. There is no indication that German giant Rheinmetall, another significant producer of these munitions for Ukraine, can fill the gap left by the U.S.

A shift in U.S. policy could also affect the delivery of F-16 fighter jets, which has only recently begun, as well as support provided in intelligence sharing.

Previously, Volodymyr Zelensky stated that halting U.S. assistance could be fatal for Ukraine both now, as it repels Russian aggression, and in the future after the war ends. He added, "our chances of survival without United States support would be low."

0 notes

Text

Aviation Fuel Market Statistics: Key Figures & Trends for 2024 & Beyond

The Aviation Fuel Market is projected to grow from USD 200.21 billion in 2024 to USD 325.98 billion by 2030, registering a CAGR of 8.5%. In terms of volume, the market will likely reach 132.80 billion gallons by 2030, from 86.20 billion gallons in 2024, at a CAGR of 7.5%. Aviation fuel is critical to the global aviation industry, supplying commercial, military, and private aircraft operations. As global air travel increases, key players in the aviation fuel market are driving innovations in production, distribution, and sustainability.

Major Players in the Aviation Fuel Market

Several major companies dominate the aviation fuel market, including oil producers, refiners, fuel distributors, and emerging sustainable fuel providers. These companies are investing heavily in research and development to meet regulatory standards, improve fuel efficiency, and promote sustainability.

Download Pdf Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=231148230

Key Companies in the Aviation Fuel Market:

1. ExxonMobil Corporation

ExxonMobil is a leading supplier of jet fuel and aviation lubricants. The company has been actively involved in refining and distributing aviation fuels worldwide. ExxonMobil is also focusing on sustainable aviation fuel (SAF) research to reduce carbon emissions and enhance energy efficiency.

2. Shell Aviation

Shell Aviation supplies jet fuel to airlines across more than 60 countries. The company is investing in SAF production through partnerships and research initiatives. Shell's commitment to reducing greenhouse gas emissions aligns with global sustainability goals.

3. BP (British Petroleum)

BP operates a strong aviation fuel segment under its Air BP division. The company has been pioneering SAF solutions and expanding its presence in emerging markets. BP's investments in biofuels and synthetic fuels are expected to drive significant industry changes.

4. TotalEnergies

TotalEnergies is a global player in aviation fuel, supplying commercial and military sectors. The company has been heavily investing in SAF production, aiming to establish a strong presence in renewable fuel markets. TotalEnergies is also expanding its global refining and distribution network.

5. Chevron Corporation

Chevron is another key player in aviation fuel production, offering reliable jet fuel solutions across multiple regions. The company is actively working on refining biofuels and SAF to meet carbon-neutral objectives.

6. Neste Corporation

Neste is one of the leading sustainable aviation fuel producers. The company specializes in renewable fuels derived from waste oils and bio-based feedstocks. Neste’s SAF solutions are widely adopted by airlines seeking low-carbon alternatives.

7. Honeywell International Inc.

Honeywell plays a crucial role in fuel efficiency technologies, offering advanced refining solutions for SAF production. The company collaborates with fuel producers and airlines to improve aviation fuel processing.

8. LanzaJet

LanzaJet is an emerging player in the SAF market, focusing on alcohol-to-jet (ATJ) fuel technology. The company is receiving significant investments from airlines and government bodies to scale up SAF production.

Market Dynamics: Key Drivers and Restraints

Driver: Rising Global Air Passenger and Cargo Traffic

The increasing number of airline passengers and cargo transportation needs is propelling aviation fuel demand. According to IATA, global passenger numbers are expected to grow at an average annual rate of 3.8%, adding over 4 billion journeys by 2043 compared to 2023. This expansion fuels the need for greater aviation fuel production.

Restraint: Volatility in Crude Oil Prices

Fluctuations in crude oil prices create challenges for airlines and fuel suppliers. Since aviation fuel costs account for 30-40% of an airline’s expenses, unpredictable price shifts impact profitability and long-term planning.

Opportunity: Growth in Sustainable Aviation Fuel (SAF) Adoption

The SAF segment is projected to reach 6,419 million gallons by 2030, growing at a CAGR of 80.6%. Companies are actively investing in renewable fuels derived from biomass, waste oils, and captured CO2, which are seen as key solutions for reducing aviation emissions.

Challenge: Supply Chain Disruptions

Geopolitical tensions, refinery issues, and logistics disruptions impact aviation fuel availability and cost. Companies are investing in resilient supply chain solutions to minimize these risks.

Ask For Sample Report: https://www.marketsandmarkets.com/requestsampleNew.asp?id=231148230

Regional Insights: North America Leads the Market

North America is expected to hold the largest share in the aviation fuel market, driven by:

High commercial air traffic volumes

Significant military aviation activities

Large-scale investments in SAF development

Established refining and distribution infrastructure

The aviation fuel market is undergoing a transformation driven by increasing air travel demand, crude oil volatility, and the push for sustainable solutions. Key players are actively shaping the industry by investing in SAF, refining technologies, and efficient distribution channels. As SAF adoption increases, companies that innovate in renewable aviation fuels will lead the market in the coming years.

#aviation fuel market#sustainable aviation fuel#aviation fuel key players#aviation fuel bp#aviation fuel ExxonMobil#aviation fuel Shell#aviation fuel

0 notes