#Isostatic Pressing Market

Explore tagged Tumblr posts

Text

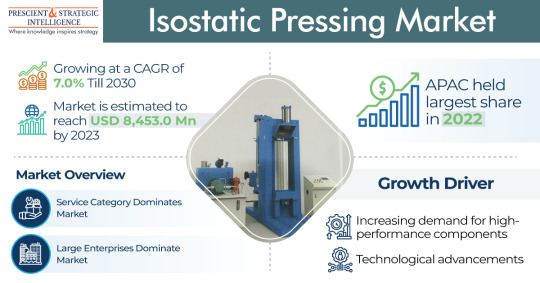

Isostatic Pressing Market Demand, Trends, Report 2023-2030

BlueWeave Consulting, a leading strategic consulting and market research firm, in its recent study, estimated Global Isostatic Pressing Market size at USD 7.75 billion in 2023. During the forecast period between 2024 and 2030, BlueWeave expects Global Isostatic Pressing Market size to expand at a significant CAGR of 8.08% reaching a value of USD 12.35 billion by 2030. The growth of Global Isostatic Pressing Market is influenced by an increasing demand for advanced materials, including ceramics and composites, drives market growth as isostatic pressing is used in their production. Also, the aerospace and automotive industries rely on the isostatic pressing technology for manufacturing precision components, contributing to market expansion. Further, the growing energy sector fuels the demand for isostatic pressing in manufacturing parts for power generation equipment. Also, the medical and semiconductor industries benefit from their applications in manufacturing high-precision components. On top of that, technological advancements and innovations in isostatic pressing techniques further propel the market's growth by enhancing efficiency and versatility.

Sample Request: https://www.blueweaveconsulting.com/report/isostatic-pressing-market/report-sample

Opportunity - Rising Demand for Low Cost Titanium and Alloys

Global Isostatic Pressing Market is projected to record significant growth from a spurring demand for low cost titanium and alloys from the automotive sector. Isostatic pressing is a manufacturing process used to shape and consolidate powdered materials into desired forms. The process is ideal for producing complex and precise shapes, such as ceramics, metal parts, and composites. Isostatic pressing is generally used in automotive industry to create high-density, high-strength components with minimal defects and uniform properties. Thus, the process of isostatic pressing enables automobile manufacturers to produce low cost titanium and alloys.

Impact of Escalating Geopolitical Tensions on Global Isostatic Pressing Market

Global Isostatic Pressing Market witnesses notable impacts from the increasing geopolitical tensions across the world. As wars and conflicts result in economic and trade sanctions and supply chain disruptions, demand for isostatic pressing machinery and services could decline across various industries, including aerospace and automotive, resulting in reduced production and postponed capital investments. However, Global Isostatic Pressing Market also saw some resilience due to an increased demand for isostatic pressing in the medical and pharmaceutical sectors for manufacturing critical components, such as ventilator parts and medical devices.

Large Sized Isostatic Pressing Segment Leads Global Market by HIP Capacity

The large sized pressing segment holds a major share in Global Isostatic Pressing Market by HIP (hot-isostatic pressing) capacity. The segment encompasses a wide range of industrial applications that require substantial force and pressure for shaping materials. Large-sized pressing equipment is utilized in various industries, including aerospace, automotive, and manufacturing, to create components and products that demand high precision and strength. The demand for large-sized pressing equipment is often driven by the need for efficiently producing sizable parts or achieving intricate designs in critical applications, making it a prominent and significant segment in Global Isostatic Pressing Market by hip capacity.

Competitive Landscape

Global Isostatic Pressing Market is fiercely competitive. Major companies in the market include American Isostatic Presses (API), DORST Technologies GmbH & Co.KG, Bodycote PLC, Engineered Pressure Systems (EPSI), Fluitron, Inc., Kobe Steel, Ltd, Nikkiso Co. Ltd, Pressure Technology, Inc., Shanxi Golden Kaiyuan Co. Ltd, Kittyhawk Products, Quad City Manufacturing Lab, Aerosint SA, Höganäs AB, Kobe Steel Ltd, and Quintus Technologies AB. These companies use various strategies, including increasing investments in their R&D activities, mergers, and acquisitions, joint ventures, collaborations, licensing agreements, and new product and service releases to further strengthen their position in Global Isostatic Pressing Market.

Contact Us:

BlueWeave Consulting & Research Pvt. Ltd

+1 866 658 6826 | +1 425 320 4776 | +44 1865 60 0662

0 notes

Text

Isostatic Pressing Market Size & Share[256 Pages Report] The global isostatic pressing market size is expected to be worth USD 7.6 billion in 2024 and USD 9.9 billion by 2029, with a 5.4% CAGR during the forecast period.

0 notes

Text

Isostatic Pressing Market Strategies and Resources to Grow Your Company, 2032

Isostatic pressing is a highly effective manufacturing process used to shape and densify materials, such as metals and ceramics, through uniform pressure application. This technique is particularly valuable in producing complex geometries with high density and minimal porosity. By ensuring that pressure is applied uniformly from all directions, isostatic pressing enhances the mechanical properties of materials, making it a preferred choice in industries like aerospace, automotive, and electronics.

The isostatic pressing process can be categorized into two main types: hot isostatic pressing (HIP) and cold isostatic pressing (CIP). HIP involves heating the material during the pressing process, which promotes densification and improves material properties, while CIP is performed at room temperature. Both methods are crucial for achieving high-quality components that meet the demanding specifications of various applications.

The Isostatic Pressing Market is on the rise due to its applications in producing high-density materials across various industries, including aerospace, automotive, and electronics. The demand for advanced manufacturing techniques that ensure uniform pressure distribution is driving innovations in isostatic pressing technologies, leading to improved material properties and performance.

Future Scope

The future of isostatic pressing is promising, as advancements in materials science and manufacturing technologies continue to evolve. The demand for high-performance components with intricate designs is expected to drive the adoption of isostatic pressing across various sectors. Innovations in automation and process control will further enhance efficiency and precision, making isostatic pressing a cornerstone of advanced manufacturing practices.

As industries strive for more sustainable and efficient manufacturing processes, isostatic pressing is well-positioned to meet these needs. The ability to produce components with minimal waste and high yield makes it an attractive option for manufacturers looking to reduce their environmental footprint. Additionally, the ongoing development of new materials, including advanced ceramics and composites, will expand the range of applications for isostatic pressing.

Trends

Current trends in isostatic pressing include the integration of additive manufacturing techniques, enabling the production of complex shapes that were previously challenging to achieve. This hybrid approach allows manufacturers to combine the benefits of additive and subtractive manufacturing, resulting in improved design flexibility and reduced lead times.

There is also an increasing focus on sustainable practices, with efforts to optimize material usage and minimize waste during the pressing process. Manufacturers are exploring ways to recycle and repurpose materials, further enhancing the sustainability of isostatic pressing. Additionally, advancements in simulation and modeling technologies are improving process design and outcomes, allowing for more precise control over the pressing parameters.

Application

Isostatic pressing is widely used across various sectors, including aerospace for producing lightweight, high-strength components, automotive for manufacturing parts with stringent quality requirements, and electronics for creating high-performance substrates and capacitors. Its ability to produce dense, high-quality materials makes it indispensable in applications that demand superior mechanical properties.

In aerospace applications, isostatic pressing is used to manufacture components such as turbine blades and structural elements that require exceptional strength-to-weight ratios. In the automotive industry, it plays a critical role in producing high-performance components, such as brake discs and engine parts, that must withstand extreme conditions. In electronics, isostatic pressing is essential for creating substrates used in advanced circuit boards and capacitors, ensuring reliable performance in electronic devices.

Key Points

Effective for shaping and densifying materials through uniform pressure.

Increasing demand for high-performance components drives adoption.

Trends include integration with additive manufacturing and sustainable practices.

Applied in aerospace, automotive, and electronics sectors.

Read More Details: https://www.snsinsider.com/reports/isostatic-pressing-market-4528

Contact Us:

Akash Anand — Head of Business Development & Strategy

Email: [email protected]

Phone: +1–415–230–0044 (US) | +91–7798602273 (IND)

0 notes

Text

Isostatic Pressing Market Size, Overview 2024 - 2030

0 notes

Text

[239 Pages Report] The global Isostatic pressing market is expected to grow from USD 8.1 billion in 2023 to USD 11.7 billion by 2028, registering a CAGR of 7.6%.

0 notes

Text

What is the Application of Isostatic Pressing in Aerospace Industry?

The method of isostatic pressing was initiated during the mid-1950s and has gradually developed from a research interest to a practical tool of manufacturing. Various sectors utilize this method for powder consolidation or casting defect healing. The procedure is utilized for various materials, such as metals, ceramics, composites, carbon, and plastics. Isostatic pressing enforced a constant,…

View On WordPress

#advanced materials#industrial applications#isostatic pressing innovations#isostatic pressing market#isostatic pressing technology#Market Analysis#Market dynamics#market trends#material forming#material shaping

0 notes

Text

The Global Isostatic Pressing Market is anticipated to grow at a CAGR of around 7.9% during the forecast period, i.e., 2023-28. The growth of the market would be propelled mainly by the increasing investments by the significantly expanding aerospace & defense industry in the installation of HIP (Hot Isostatic Pressing) technology, advancements in material science ceramics, and the ever-evolving demand for high-density & low-porosity materials in 3D printed parts.

#Global Isostatic Pressing Market#Global Isostatic Pressing MarketNews#Global Isostatic Pressing Marketgrowth#Global Isostatic Pressing Market price#Global Isostatic Pressing Market Share#Global Isostatic Pressing MarketSize#Global Isostatic Pressing Market Industry

0 notes

Text

Future of Powder Metallurgy Market: Insights from Industry Experts

The global powder metallurgy market size is estimated to reach USD 6.36 billion by 2030, according to a new report by Grand View Research, Inc., expanding at a CAGR of 12.9% over the forecast period. Increasing initiatives to reduce the weight of aerospace parts by using additive manufacturing along with a rise in demand for lightweight auto parts from the automotive industry drives the market growth.

The aircraft manufacturers are focusing on saving the cost and weight of aircraft parts, which increases the demand for 3D printing materials to deliver high-performance and cost-effective aircraft elements. An increase in the number of 3D printers in terms of feature, size, and material compatibility in the long run coupled with strong competitive strategies to expand through various partnerships and joint ventures is further expected to drive the market growth.

The growing demand from the healthcare industry for personalized prosthetics along with increasing usage of medical devices propels the sales mostly from the metal additive manufacturing market space. In the industrial sector, rapid prototyping and on-site production are estimated to offer promising growth opportunities to market vendors over the projected period.

The COVID-19 pandemic led to the shutdown of manufacturing and metallurgy industries and affected both upsides and downsides in the year 2020. The key end-use sectors of the powder metallurgy industry, including the automotive, aerospace, and consumer goods sectors, have observed a negative trend in FY 2020. For instance, in April 2021, Toyota Motor Corp. experienced a decline in worldwide sales by 5.1% in the fiscal year ending March 2021. This has stalled automotive and other industrial production activities and caused a severe decline in demand for powder metals, such as iron, steel, and aluminum.

Gather more insights about the market drivers, restrains and growth of the Powder Metallurgy Market

Powder Metallurgy Market Report Highlights

• The steel material segment is estimated to witness a CAGR of 12.0%, in terms of revenue, over the projected period. The low cost and easy availability of steel are expected to drive the segment growth

• The Metal Injection Molding (MIM) process segment led the global market in 2020 and is projected to witness steady growth over the coming years owing to the significance of the process in the components manufacturing industry

• The aerospace & defense application segment accounted for the largest revenue share of more than 51.0% in 2022. The aerospace & defense industry is highly focused on adapting new technologies with a high investment budget, which is the key driving factor for the segment

• Large-scale OEMs, generally from the aircraft industry, are investing significantly in metal 3D printing to manufacture aeronautical parts, which is expected to drive the OEMs end-use segment at the fastest CAGR over the forecast years

• North America accounted for the highest share of more than 34.0% in 2022. Increased funding for the R&D and standardization in the technology segment in leading European countries is expected to propel the market growth

Powder Metallurgy Market Segmentation

Grand View Research has segmented the global powder metallurgy market on the basis of material, process, application, end-use, and region:

Powder Metallurgy Material Outlook (Volume, Tons; Revenue, USD Billion, 2018 - 2030)

• Titanium

• Nickel

• Steel

• Aluminum

• Cobalt

• Others

Powder Metallurgy Process Outlook (Volume, Tons; Revenue, USD Billion, 2018 - 2030)

• Additive Manufacturing

• Powder Metal Hot Isostatic Pressing

• Metal Injection Molding

Powder Metallurgy Application Outlook (Volume, Tons; Revenue, USD Billion, 2018 - 2030)

• Aerospace & Defense

• Automotive

• Oil & Gas

• Industrial

• Medical & Dental

Powder Metallurgy End-use Outlook (Revenue, USD Billion; Volume, Tons, 2018 - 2030)

• OEMs

• AM Operators

Powder Metallurgy Regional Outlook (Volume, Tons; Revenue, USD Billion, 2018 - 2030)

• North America

o U.S.

• Europe

o Germany

o France

o U.K.

• Asia Pacific

o China

o Japan

• Central & South America

o Brazil

• Middle East & Africa

Order a free sample PDF of the Powder Metallurgy Market Intelligence Study, published by Grand View Research.

#Powder Metallurgy Market#Powder Metallurgy Market Size#Powder Metallurgy Market Share#Powder Metallurgy Market Analysis#Powder Metallurgy Market Growth

0 notes

Text

0 notes

Text

0 notes

Text

Isostatic Pressing Market by Offering (System, Services), Type (Hot and Cold), HIP Capacity (Small, Medium, & Large), CIP Process (Wet & Dry), Industry (Automotive, Aerospace, Medical, Precision Machine Manufacturing) & Region - Global Forecast to 2029

0 notes

Text

Powder Metallurgy Market - Forecast(2024 - 2030)

Powder Metallurgy Market Overview

Request Sample Report :

COVID-19 Impact

The onset of Covid-19 in the entire nation had a negative impact on the automotive industry. There was an overall revenue impact across the automotive industry. The pandemic also impacted all the stakeholders present in the value chain for the short as well as medium term. Shortage of raw material, shifting of production to other countries, liquidity crunch to delays in availability of models, deferred launches, and shrinkage in consumer demand were some of the main issues faced by the automotive stakeholders, owing to which the production and demand of automobiles had significantly fallen. For instance, according to the China Passenger Car Association (CPCA), China’s passenger car sales in June fell 6.5% year on year to 1.68 million units. The unstable automotive production and demand have significantly impacted the market of powder metallurgy as the demand for powder metal was also uncertain during the period. A prolonged truncation of consumer demand due to the lockdown has significantly affected auto manufacturers’ revenues and cash flows. Even after the restriction is eased in 2021, with discretionary spending taking a backseat, further declines in the market for passenger vehicles are expected.

Powder Metallurgy Market Report Coverage

The report: “Powder Metallurgy Market — Forecast (2021–2026)”, by IndustryARC, covers an in-depth analysis of the following segments of the powder metallurgy Industry.

By Material: Ferrous (Iron, Steel, and Stainless Steel), Non-Ferrous (Copper, Aluminium, Cobalt, Tin, Nickel, Magnesium, Zinc, Titanium, Molybdenum, and Others By Process: Conventional Process, Metal Injection Moulding, Hot Isostatic Pressing, and Metal Additive Manufacturing By Application: Porous Products, Bearing and Bushes, Filters (Ceramic Filter, Fiber Metal Filter, and Others), Refractory Metal Composites, Electric Motors, Cemented Carbides, Machinery Parts (Gears, Sprockets, Rotors, and Others), Tungsten Wires, Medical Implants, Magnetic Materials, Cutting Tools and Dies, and Others By End-Use Industry: Medical & Healthcare, Automobile (Transmission, Engine Parts, and others), Oil & Gas, Electrical and Electronics (Refrigerators, Vacuum Cleaners, Circuit Breakers, Electric Motors, Sewing Machines, and Others), Industrial (Hydraulics, Motors/Controls, and Others), Aerospace (Aero-engine, Land-based Gas Turbine, Airframes, and Others), Household Appliances, Recreation and Leisure, and Others By Geography: North America (USA, Canada, and Mexico), Europe (UK, Germany, France, Italy, Netherlands, Spain, Russia, Belgium, and Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia and New Zealand, Indonesia, Taiwan, Malaysia, and Rest of APAC), South America (Brazil, Argentina, Colombia, Chile, and Rest of South America), Rest of the World (Middle East, and Africa)

Inquiry Before Buying :

Key Takeaways

Asia-Pacific dominates the powder metallurgy market, owing to the increasing demand and production of lightweight vehicles in the region. For instance, according to OICA, the production of passenger cars has increased by 2.6 % in Malaysia in 2019.

There are many cases in which powder metallurgy over casting has a strong benefit. The benefits of the powder metallurgy process are particularly apparent when dealing with high-value and high-melting-point materials, owing to which there is increasing adoption of powder metallurgy over die casting, which will propel the market growth.

There are growing interests in producing customized medical implants using additive manufacturing and in producing porous implant structures (to match bone stiffness and to aid osteointegration) by powder metallurgy processing, which may boost the market growth.

For More Details on This Report — Request for Sample

Powder Metallurgy Market Segment Analysis — By Material

The ferrous segment held the largest share in the powder metallurgy market in 2020. Ferrous powdered metals such as iron, steel, and more offer the highest level of mechanical properties. Ferrous metal powders are also known for their extensive characteristics such as durability, hardness, tensile strength, lower costs, broad flexibility, and more. The ferrous powdered metal is largely employed in the automotive industry for designing bearings, gears, or other auto parts, owing to its good strength and flexibility. Furthermore, ferrous metals are also widely utilized in various other end-use industries such as construction, piping, aerospace, electronics, and more. Thus, it is anticipated that these extensive characteristics and wide applications of ferrous powder metallurgy are the major factors driving its demand during the forecast period.

Powder Metallurgy Market Segment Analysis — By Application

The bearings segment held the largest share in the powder metallurgy market in 2020 and is growing at a CAGR of 7.4% during 2021–2026, owing to its self-lubricating property. Bearings that are made from powder metallurgy are known as self bearings of sintered metal. They are economical, suitable for high production rates, and precision tolerances can be produced. The majorities of porous-metal bearings consist of either bronze or iron with pores that are interconnected. These voids take up 10 percent of the total volume to 35 percent. In operation, lubricating oil is deposited in these voids and feeds to the bearing surface through the interconnected pores. Sintered-metal self-lubricating bearings are widely used in home appliances, small motors, machine tools, aircraft, and automotive accessories, business machines, instruments, and farm and construction equipment, owing to which it holds a prominent share in the powder metallurgy application segment.

Schedule A Call :

Powder Metallurgy Market Segment Analysis — By End-Use Industry

The automotive segment held the largest share in the powder metallurgy market in 2020 and is growing at a CAGR of 8.6% during 2021–2026. Powder metal parts display excellent controlled porosity and self-lubricating properties that allow gases and liquids to be filtered. Powder metallurgy is also a strongly recommended method in the manufacture of components involving complex bends, depressions, and projections. Flexibility in the development of mechanical parts of different compositions, such as metal-non-metal and metal-metal hybrids, allows high dimensional precision in the production of automobile parts and ensures consistent properties and measurements with very little scrap and waste of material. The most popular vehicle parts that are manufactured through the method of powder metallurgy are the bearings and gears. A variety of metals, including ferrous, and non-ferrous are used in automotive components including chassis, steering, exhaust, transmission, shock absorber parts, engine, battery, seats, air cleaners, brake disc, and more. The powder metallurgy is often used in these components as it improves the net shape, utilizes heat treatment, enhances surface treatment, and improves the precision of these components. Thus, the demand for powder metallurgy in the automotive sector is growing due to such factors.

Powder Metallurgy Market Segment Analysis — By Geography

Asia-Pacific region held the largest share in the powder metallurgy market in 2020 up to 45%, owing to the increasing automotive manufacturing coupled with population growth in the region. China is the world’s largest vehicle market, according to the International Trade Administration (ITA), and the Chinese government expects automobile production to reach 35 million by 2025. In 2019, according to OICA, the automotive production in Malaysia and Vietnam has increased up to 571632, and 250000, i.e., 1.2%, and 5.5%. India’s annual production in 2019 was 30.91 million vehicles, according to Invest India, compared to 29.08 million in 2018, recording a healthy 6.26 percent growth. Also, by 2026, the US$118 billion Indian car industry is projected to cross US$300 billion. The increasing automation production in the Asia Pacific will eventually boost the demand for powder metallurgy to manufacture various automobile components, which will likely influence the growth of the powder metallurgy market in the APAC region.

Powder Metallurgy Market Drivers

Flourishing Aerospace Industry

Powder metallurgy is used extensively in aerospace, because of its advantages of high strength/weight ratio, high heat capacity, and high modulus of elasticity. Within aerospace, powder metallurgy finds its most significant application in turbine engines, compressors, fan sections, discs, airframes, fasteners, and landing gear. Tungsten metallurgy based tungsten carbide has received considerable attention in the aerospace industry because of its high strength at very high temperatures. Tungsten carbide is sintered through a selective laser sintering process based on the additive manufacturing process. In 2019, China was the second-largest civil aerospace and aviation services market in the world and one of the fastest-growing markets, according to the International Trade Administration (ITA). China will need 7,690 new aircraft over the next 20 years, valued at US$1.2 trillion, according to Boeing (Commercial Market Outlook 2018–2037). China also currently accounts for 15 percent of the world’s commercial aircraft fleet, and it will be almost 20 percent by 2037. According to Boeing, the demand for 2,300 airplanes worth US$320 billion is projected in India over the coming 20 years. Boeing’s current market outlook (BMO) forecasts demand for 2,520 new aircraft in the Middle East by 2030. With the flourishing aerospace industry, the demand for aircraft components will also gradually increase, which will drive the market growth.

Buy Now :

Expanding Electrical and Electronics Sector

The powder metallurgy method offers the opportunity to cost-effectively produce net form components from a variety of materials. A market segment that has exhibited the ability to take advantage of powder metallurgy’s flexibility has been in electromagnetic applications such as household appliances, industrial applications, and more. Magnetic materials are essential elements in the electronic industry in recent times. From the motors and turbines that provide the power for the industry to the high-frequency transformers that power computers, magnetic materials are becoming increasingly important for consumers. The electronic sector is booming in various regions, which will further drive the market growth as there is an increasing demand for powder metallurgy from the electrical and electronics sector. For instance, the consumer electronics and appliances sector in India is expected to become the fifth-largest in the world by 2025, according to Invest India. India could create an US$800 billion to US$1 trillion digital economy by 2025, and India’s digital economy could fuel 18–23 percent of overall economic activity by 2025. According to the Government of Canada, revenues in the ICT sector reached an estimated US$210 billion in 2019. ICT sector revenues grew from US$158 billion to US$200 billion from 2013 to 2018, a 26.9 percent increase.

Powder Metallurgy Market Challenges

Various Drawbacks Associated with Powder Metallurgy

The cost of metal powders compared to the cost of raw material used for casting or forging a component is relatively higher. At the time the cost of tooling and equipment is also higher. When production volumes are limited, this is especially a limitation. Also, low melting point metal powders such as zinc, tin, and cadmium give thermal difficulties during sintering operation, as most oxides of these metals cannot be reduced at temperatures below the melting point. Furthermore, large or complex-shaped parts, and uniformly high — density products are difficult to produce by the powder metallurgy process. Without any degradation, a few powders are also difficult to store. All these drawbacks associated with the powder metallurgy may hinder the market growth during the forecast period.

Powder Metallurgy Market Landscape

Technology launches, acquisitions, and R&D activities are key strategies adopted by players in the powder metallurgy market. Major players in the powder metallurgy market are Arcam AB, Carpenter Technology Corp., ExOne GmbH, GKN Plc, Höganäs AB, Materialize NV, Melrose Industries PLC, Sumitomo Electric Industries, Ltd., and Hitachi Chemical Co., Ltd.

Acquisitions/Technology Launches

In May 2019, Epson Atmix Corp. installed a new production line at its Kita-Inter Plant in Japan for producing amorphous alloy powder. The company invested around ¥800 million (USD 7.43 million) for the installation of a new line and it plans to further increase its production capacity in stages and reach 6,000 tons per year by 2023.

In October 2019, GKN Powder Metallurgy a leading metal powder and parts manufacturers acquired specialist polymer 3D printing service provider Forecast 3D. The acquisition presents a significant expansion of GKN powder metallurgy’s additive capabilities.

Relevant Reports

Powder Coatings Market — Forecast (2021–2026)

Report Code: CMR 0113

Ferromanganese Market — Forecast (2021–2026)

Report Code: CMR 0382

For more Chemicals and Materials Market reports, please click here

#PowderMetallurgy#Metalworking#AdvancedManufacturing#PowderMetals#AdditiveManufacturing#MetalPowder#IndustrialMaterials

0 notes

Text

0 notes

Text

[239 Pages Report] The global Isostatic pressing market is expected to grow from USD 8.1 billion in 2023 to USD 11.7 billion by 2028, registering a CAGR of 7.6%.

0 notes

Text

Shaping the Future: Insights into the Isostatic Pressing Market

The global isostatic pressing market is projected to be USD 13,568.1 million by 2030 growing at a CAGR of 7.0% during the forecast period. sectors including energy, aerospace, medical devices, automotive, and manufacturing regularly use isostatic pressing. In this regard, the requirement for such technology is significantly impacted by the growing requirement for contemporary materials and…

View On WordPress

#advanced forming technology#advanced materials#aerospace industry#automotive components#ceramic components#engineering ceramics#high-pressure manufacturing#industrial manufacturing#industry trends#isostatic pressing#isostatic pressing applications#isostatic pressing process#manufacturing efficiency#market growth#material compaction#metal parts production#powdered metals#precision engineering

0 notes