#Inflationary pressures on economies

Explore tagged Tumblr posts

Text

Global Electricity Prices Averaged 0.162 per kWh in March 2024

In March 2024, the average global electricity price stood at USD 0.162 per kilowatt-hour (kWh) for residential users and USD 0.181 per kWh for businesses. Europe reported the highest residential electricity prices at USD 0.228 per kWh, while Asia had the lowest at USD 0.082 per kWh. The International Energy Agency (IEA) forecasts a 3.4% annual increase in global electricity demand through 2026,…

View On WordPress

#Asia#carbon emissions#Economic Growth#electricity costs#electricity demand#emerging economies energy growth#energy#energy consumption#energy efficiency#energy infrastructure#energy policy#energy prices#energy security#Energy Storage#energy technology#energy transition#Europe#fossil fuel prices#fossil fuels#global electricity prices#global electricity trends#global energy market#grid reliability#industrial electricity prices#inflation impact on energy#inflationary pressures#power generation#power sector analysis#renewable energy#renewable energy adoption

0 notes

Text

#us economy#united states#trump#mass deportation#migrants#migrant workers#inflationary pricing pressure

0 notes

Text

I wanna get this one out before the election since I think that is going to "cast in stone" some takes when it shouldn't given how much of a coinflip it is; Biden really fumbled the ball in the second half of his presidency. I was very pro-Biden at the beginning, I thought he did a great job. I don't think the stimulus was a huge source of inflation and meanwhile the economy came back roaring; obviously not mainly due to him but he did a good job on renewing Jerome Powell (a Trump appointee!) to the Fed, controlling the Strategic Oil Reserve, and "getting out of the way" on a bunch of issues from trade to Covid policy. His environmental policy around the energy transition was stellar, I approve of CHIPS, etc. And in foreign policy he is never going to get the credit he deserves for ending the Afghanistan debacle, and meanwhile the US response to the Russian invasion of Ukraine was about as good as you could possibly expect it to be out the gate.

He actually proved the haters wrong on his promise to "get things done in Congress" using his expertise - he did in fact get bipartisan bills passed and work with centrists like Manchin to get party bills over the line. It was a solid showing; I thought he was clearly better than Obama & Clinton.

But as time went on the wheels really came off. You can almost see the "ideas" running out, like once they had done the Covid drawdown and BBB/IRA, and the midterms made congress more unfavorable, "what's next?" left a void. There was a bunch of bad "party handout" stuff that is completely at odds with how things work today. Foolish moves like the student debt relief - unpopular, unwise in an inflationary environment, a handout to the wealthy, and dubiously legal - or all the kowtowing to the worst unions in the US that still resulting in declining labor vote share! A lack of follow-through on the bills showed the admin's lack of policy chops; the IRA is severely hampered by the lack of permitting reform for energy projects, but the admin applied virtually no pressure to making that happen because, eh, not their vibe I guess? The huge holes in procurement that Ukraine war exposed has been met with very tepid responses as well, just a sort of "throw money at it" default that has fixed little.

Israel is of course peak inertia. I am a realist, I understand fully that there is no world where the US responds to a terrorist attack on an ally by cutting them off - and I think the Biden admin has had its wins in this category, the amount of aid entering Gaza is certainly higher due to US pressure. But it is just embarrassing how obviously Biden himself treated Netanyahu and co as like, credible partners, when they just aren't? Again, Trump would just happily support them doing w/e no matter how many the killed, it wouldn't be embarrassing for him to watch that happen. For Biden, with his stated goals, it is weakness. He could have easily done better.

And we can't ignore the responsibility to the next generation - it is your job as President to set up your successor for victory. Immigration is a classic policy example of that dropped ball - a fear of seeming "Trump-like" in the face of an unsympathetic electorate and an admin itself not actually committed to massive increases in admitted asylum cases. It would be one thing if it was Biden's hill to die on, but it wasn't; just years of muddle before finally doing in ~2024 what they could have done in ~2021, too late to move the needle on the backlash.

Which leads us to the elephant in the room, as all things must. He did end his nomination in the end, again I don't think he is some awful president. But he took a lot of heavy pressure to get there. And the weirdest thing is...he is the one who scheduled a debate before the convention? That isn't normal! It was very obviously a test, to show he was fit - and he failed it. And then refused to admit it. What if George Clooney didn't aim for his head in the press at the 11th hour? What if Nancy Pelosi didn't bring out the big guns? Would he have not bowed down to reality?

And while I have been quite impressed by Harris's campaign so far, and not having a primary has been an advantage, it has still been very rushed. Orgs take time to emerge, you can't actually just snap your fingers and get 30 interviews booked or a docket of vetted VPs. I think Tim Walz a mistake, personally! Not a big one, but a weak choice when someone like Josh Shapiro is right there and "pivot to the center" is your stated strategy. But it is hard to blame her when she probably threw it together in a few weeks while also doing 20 stump speeches a month and debate prepping and all that! I can't say that specific decision would change, but others would. Hell, time could have helped - her favourables in a ton of categories have slowly been ticking up, if she was the candidate since January things could be different. We will never know of course, but the more distance from Biden the better.

I think in 2023 and 2024 it is in fact very hard to find any solid wins for the Biden administration. I can think of a few but they outnumbered handily by the missteps. And I think that, if Kamala wins, a lot of this is going to be papered over. All the political missteps will be like "eh, who cares! We won, right?" But that is not how effective strategy works. For one, if Kamala wins it is only because Trump is the opponent; a normie Republican would probably have trounced her. But more importantly your strategy should pretty much never be "eh whatever" to maximizing your electoral odds. Every action should either be A: this will keep us winning, or B: this won't but it will make the world a better place and so it is where we are spending our points. Biden has had a lot of "neither option" these past two years; too many, in my opinion, to be considered a good president anymore.

But I will give him decent at least, it is a tough job!

57 notes

·

View notes

Text

Popular convenience store chain 7-Eleven has announced the closure of 444 underperforming stores across North America, as the Japanese-owned corporation responds to changing consumer habits and ongoing inflationary pressures.

According to its Tokyo-based parent company Seven & I Holdings, the closure will only affect around three percent of 7-Eleven's over 13,000 stores across the United States, Canada and Mexico.

The closures, announced on Oct. 10, were reportedly influenced by a variety of factors, including slowing sales, declining traffic, inflationary pressures and a decrease in cigarette purchases, but most notably a pullback in consumer spending among middle- and low-income earners.

"Pullback in consumer spending has persisted beyond prior expectations," the company stated in its earnings release. This earnings report revealed that inflation was one of the major influences, noting that since 2019, the prices of rent, utilities, groceries and fuel have all risen by more than 25 percent.

"The North American economy remained robust overall thanks to the consumption of high-income earners, despite a persistently inflationary, elevated interest rate and deteriorating employment environment," the report reads. "In this context, there was a more prudent approach to consumption, particularly among middle -and low-income earners."

This, in turn, has led consumers to prioritize quality and value, with 69 percent of shoppers indicating a desire for higher-quality products and 60 percent focusing on getting the best value for their money.

26 notes

·

View notes

Text

Why Brazil should brace itself for slower growth in 2025

Brazil's economy is expected to register slower growth in 2025, while fiscal problems and inflationary pressure will persist.

The economy should expand 2.01%, compared with projected growth of 3.49% in 2024, according to the weekly survey of the central bank with 100 economists.

“We need to remember that in recent years, most economists have been wrong in their predictions for Brazil’s GDP, which has surprisingly performed well, with better results than expected,” Roberto Troster, former chief economist at banking federation Febraban, told BNamericas.

“However, we cannot disregard that there are now more signs that economic performance [in 2025] will be weaker than [in 2024], such as higher interest rates and persistent fiscal challenges that impact the government’s ability to invest in the economy,” Troster, now an economist at Troster & Associados, said.

Continue reading.

3 notes

·

View notes

Text

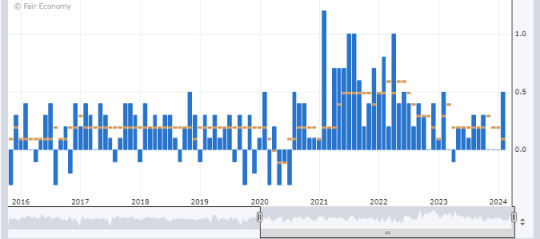

Survey: Small businesses are feeling more optimistic about the economy after the election

A survey shows small business owners are feeling more optimistic about the economy following the election

Survey: Small businesses are feeling more optimistic about the economy after the electionBy MAE ANDERSONAP Business WriterThe Associated Press

A recent survey shows small business owners are feeling more optimistic about the economy following the election.

The National Federation of Independent Businesses’ Small Business Optimism Index rose by eight points in November to 101.7, its highest reading since June 2021.

The Uncertainty Index declined 12 points in November to 98, following October’s pre-election record high of 110.

NFIB Chief Economist Bill Dunkelberg said small business owners became more certain about future business conditions following the presidential election, breaking a nearly three-year streak of record high uncertainty.

“Owners are particularly hopeful for tax and regulation policies that favor strong economic growth as well as relief from inflationary pressures,” he said in a statement. “In addition, small business owners are eager to expand their operations.”

The net percent of owners expecting the economy to improve rose 41 points from October to a net 36%, the highest since June 2020.

Some owners are also hoping 2025 will be a good time to grow. The percent of small business owners believing it is a good time to expand their business rose eight points to a 14%. This is also the highest reading since June 2021.

***Unless you live in Washington State. They are doing everything to destroy small businesses.

3 notes

·

View notes

Text

Forex Gold Trading: Key Insights and Strategies for Success

Gold trading has been a fundamental part of the global financial system for centuries, and it continues to be a preferred investment choice for traders and investors alike. In the context of forex gold trading, this commodity stands out not only because of its intrinsic value but also for the opportunities it offers in terms of volatility and safe-haven demand. Whether you're a seasoned forex trader or just starting, understanding the dynamics of the gold market—especially the influence of gold prices, interest rates, and the balance of supply and demand—can help you make informed trading decisions.

The forex gold market functions on the principle of buying and selling gold against other currencies, most often the US dollar. Traders speculate on the price movements of gold, trying to predict whether the price will rise or fall based on various economic and geopolitical factors. Gold, as a precious metal, has a unique position in the world economy, offering both a hedge against inflation and a safe haven during times of financial uncertainty. Because it is not tied to any single country's currency, gold prices tend to rise when confidence in fiat currencies declines, particularly the US dollar.

A central factor in gold trading is the constant interplay of supply and demand, which determines the value of gold in the market. Gold mining production is a slow and resource-intensive process, and it can't be increased quickly to respond to rising demand. This makes gold a relatively inelastic asset, meaning its supply doesn't increase rapidly even when prices rise. This limited supply, combined with global demand for gold, especially in times of economic instability, results in significant price movements. Central banks, investors, and even jewelry markets are the primary sources of demand for gold. However, in times of geopolitical unrest, financial crises, or periods of economic uncertainty, investors turning to gold as a safe-haven asset can result in rapid price increases. In this context, trading gold offers opportunities for those who can anticipate these shifts in the market.

One of the most important factors affecting gold prices in the forex market is interest rates. Central banks, like the Federal Reserve in the United States, influence interest rates as part of their monetary policy. Interest rates are a key component of the cost of holding gold. When interest rates rise, other financial instruments, such as bonds or savings accounts, offer higher returns, making them more attractive than non-yielding assets like gold. As a result, higher interest rates can put downward pressure on gold prices, as investors move their money into assets that provide returns. Conversely, when interest rates are lowered, the opportunity cost of holding gold decreases, making gold more attractive. This often leads to an increase in demand for gold, driving prices higher.

The relationship between gold prices and interest rates is also influenced by inflation. When inflation is rising, the value of currency tends to decrease, and gold is seen as a hedge against this loss of purchasing power. As a result, inflationary environments often lead to increased demand for gold, further driving up its price. In times of low or stable inflation, however, interest rates become the primary driver for gold prices. Investors often keep a close eye on central bank policy and economic data, as changes in interest rates or inflation can create significant price movements in gold.

The gold market is also highly sensitive to geopolitical events and other external factors. Global political instability, such as wars or trade conflicts, can increase demand for gold as investors seek to protect their assets from the potential fallout of uncertain situations. Similarly, economic crises or financial market crashes can prompt a shift toward gold, as it is perceived as a safer store of value than volatile currencies or stocks. This is why gold is often referred to as a "safe haven" asset. When uncertainty rises, the demand for gold increases, causing prices to rise as well.

Another key aspect of forex gold trading is understanding the price movement of gold in relation to other currencies. Gold is most commonly quoted in US dollars, so the strength or weakness of the dollar plays a crucial role in determining the price of gold. When the US dollar strengthens, gold becomes more expensive for holders of other currencies, reducing demand and putting downward pressure on prices. On the other hand, when the US dollar weakens, gold becomes more affordable for international investors, which can lead to increased demand and rising prices.

Traders who engage in forex gold trading must also consider the different ways they can participate in the market. Many traders buy and sell physical gold, but this is less common in the forex market, where gold is typically traded in the form of contracts for difference (CFDs), futures contracts, or spot trading. Spot trading allows traders to buy or sell gold at current market prices, while futures contracts allow traders to speculate on the future price of gold. CFDs allow traders to take positions on gold without actually owning the physical metal, which can be an attractive option for those looking to capitalize on short-term price movements.

The advantage of trading gold in the forex market is its high liquidity. The gold market is one of the most liquid markets in the world, meaning that traders can enter and exit positions with ease, even in large volumes. This makes gold a highly attractive asset for short-term traders who seek to capitalize on price fluctuations. However, it also means that the market can experience significant volatility, as shifts in market sentiment or external events can lead to rapid changes in gold prices. As such, understanding the factors that influence gold prices and having a well-structured trading strategy is essential for success.

When trading gold, it is essential to use risk management strategies to protect your capital. Gold prices can be volatile, and sudden price swings can result in large losses if traders are not prepared. One way to manage risk is by using stop-loss orders, which allow traders to automatically exit a position if the price moves against them by a predetermined amount. Another strategy is to trade smaller position sizes, which helps limit exposure to potential losses. Traders should also consider diversifying their portfolios by trading other assets alongside gold to reduce risk and avoid overexposure to a single market.

One of the key benefits of forex gold trading is the ability to profit from both rising and falling gold prices. Traders can buy gold when they expect prices to increase or sell gold when they anticipate prices will fall. This flexibility makes gold an attractive asset for both bullish and bearish traders. However, predicting the direction of gold prices is not always easy, as it requires an understanding of multiple factors, including economic data, geopolitical events, and market sentiment. Traders who are successful in the gold market are often those who stay informed about global events and continuously adapt their strategies based on changing conditions.

As with any trading market, forex gold trading carries risks. The market is influenced by a range of factors, including global economic conditions, interest rates, inflation, and geopolitical events. Sudden changes in any of these factors can lead to unpredictable price movements, making it essential for traders to have a solid understanding of the market and the tools needed to manage risk. While gold trading offers significant opportunities, it also requires skill, discipline, and careful planning.

In summary, forex gold trading presents a wealth of opportunities for traders who understand the key factors that drive gold prices. The balance of supply and demand, interest rates, geopolitical events, and the strength of the US dollar all play significant roles in determining the price of gold. By staying informed about these factors and using sound trading strategies, traders can navigate the gold market and take advantage of price movements. Whether using gold as a safe haven or capitalizing on short-term price swings, gold trading offers a unique and dynamic way to participate in the global forex market.

2 notes

·

View notes

Text

Poland’s economic growth is projected to be the third-highest in the European Union next year, driven by strong domestic consumption and public investment, according to the European Commission’s Autumn 2024 Economic Forecast.

Poland’s economy is expected to grow by 3.0% this year, rebounding sharply from near stagnation in 2023, when growth was just 0.1%. The European Commission said: “Private consumption is set to be the main growth driver, supported by rapidly rising wages, increased government spending on support to families, improved consumer sentiment and receding inflationary pressures.” In 2025, Poland’s GDP is expected to grow by 3.6%, making it one of the fastest-growing economies in the EU. This will be driven by reconstruction efforts after severe flooding in September and strong domestic demand. By 2026, Poland's growth is expected to slow to 3.1% due to weaker consumption and investment, according to the Commission.

Employment is projected to decrease by 0.3% in 2024, with modest gains thereafter as the workforce ages and shrinks. Rising employment among Ukrainian refugees is expected to offset these trends partially.

EU economic trends

The broader EU economy, by contrast, is forecast to grow at a slower pace. Real GDP is projected to expand by 0.9% in 2024 and accelerate to 1.5% in 2025. Growth is expected to reach 1.8% in 2026, driven by stronger consumer demand and a rebound in investment.

In the euro area, growth is forecast at 0.8% in 2024, increasing to 1.3% in 2025 and 1.6% in 2026. Ireland and Malta are the only EU countries expected to outpace Poland's growth in 2025, with Ireland rebounding from a deep slump caused by instability in multinational sectors. Malta, meanwhile, continues its steady momentum, supported by strong domestic demand, growing tourism, robust employment and recovering wages. Despite the expected slowdown in employment growth from 0.8% in 2024 to 0.5% in 2026, the EU labor market remained strong in 2024. Unemployment reached a historic low of 5.9% in October and is projected to stabilize at 6.1% in 2024, gradually declining to 5.9% by 2026.

The EU’s Commissioner for Economy, Paolo Gentiloni, said: “The European economy is slowly recovering. As inflation continues to ease and private consumption and investment growth pick up, with unemployment at record lows, growth is set to gradually accelerate over the next two years.”

3 notes

·

View notes

Text

Mastering Economics Homework: Unveiling Complex Queries and Solutions

Entering the realm of economics, one often encounters challenging questions that demand critical thinking and analytical prowess. As students navigate through their coursework, they may find themselves pondering, Can I pay someone to do my economics homework? While this query reflects a common concern among students, the journey toward mastering economics involves far more than outsourcing assignments. In this blog, we delve into a master level question, providing an insightful answer that illuminates key concepts in economics.

Question: Consider a scenario where a country experiences a sudden increase in its money supply due to monetary policy interventions. Analyze the potential short-term and long-term effects of this increase on key economic variables such as inflation, unemployment, and economic growth.

Answer: The scenario described presents a classic case of the macroeconomic impact of monetary policy actions, particularly focusing on the consequences of an expansionary monetary policy characterized by an increase in the money supply. Let's dissect the potential short-term and long-term effects on key economic variables:

Short-term Effects: In the short term, the injection of additional money into the economy is likely to stimulate aggregate demand. With more money circulating, consumers and businesses may increase spending, leading to a rise in aggregate demand. This surge in demand could have several immediate effects:

Inflationary Pressure: One of the primary short-term effects of an increase in the money supply is the potential for inflationary pressure. As demand outstrips supply in various sectors of the economy, prices may begin to rise. This inflationary effect is driven by the classical quantity theory of money, which posits a direct relationship between the money supply and the price level in the economy.

Decrease in Unemployment: The boost in aggregate demand resulting from the expansionary monetary policy could lead to increased production and hiring by firms to meet the higher levels of demand. As businesses expand operations and hire more workers, unemployment rates may decline in the short run.

Economic Growth: The initial impact of the increase in the money supply is likely to spur economic growth, as higher levels of spending stimulate production and investment. This short-term boost in economic activity can contribute to an uptick in the overall GDP growth rate.

Long-term Effects: While the short-term effects of monetary expansion may seem favorable, it is essential to consider the potential long-term repercussions:

Inflationary Expectations: Persistent increases in the money supply can lead to changes in inflation expectations among households, businesses, and financial markets. If economic agents anticipate continued inflationary pressures, it may influence their behavior, leading to wage-price spirals and further exacerbating inflationary trends.

Resource Misallocation: Over time, prolonged monetary expansion can distort price signals and lead to misallocation of resources in the economy. Excessive money creation may artificially stimulate certain sectors while neglecting others, resulting in inefficiencies and imbalances in resource allocation.

Long-Term Unemployment: While expansionary monetary policy may initially reduce unemployment, sustained inflationary pressures could undermine long-term employment stability. Businesses may become wary of hiring additional workers amid uncertain economic conditions, leading to prolonged periods of unemployment.

Diminished Purchasing Power: Continual inflation erodes the purchasing power of money, reducing the real value of savings and fixed-income assets over time. This erosion in purchasing power can disproportionately affect individuals on fixed incomes, retirees, and low-income households.

In conclusion, the effects of an increase in the money supply due to monetary policy interventions are multifaceted, encompassing both short-term stimuli and long-term challenges. While such policies can effectively mitigate economic downturns and stimulate growth in the short run, policymakers must carefully balance the trade-offs and consider the long-term implications for inflation, unemployment, and overall economic stability. Mastering the complexities of monetary policy requires a deep understanding of economic theory and empirical evidence, underscoring the importance of rigorous study and critical analysis in the field of economics.

In crafting this comprehensive response, we've explored the intricate dynamics at play in the realm of macroeconomics, highlighting the nuanced interplay between monetary policy actions and key economic variables. By dissecting this master level question and providing a thorough answer, we've shed light on the complexities inherent in economics homework assignments, reinforcing the value of academic rigor and analytical thinking in mastering the discipline.

9 notes

·

View notes

Text

Saudi Arabia's Oil Gambit: A Potential Blow to Putin's War Chest

The global oil market faces potential upheaval as Saudi Arabia contemplates a strategic shift that could significantly impact the Russian war economy. Experts suggest that Riyadh's frustration with uncoordinated production cuts among oil-producing nations may lead to a dramatic increase in Saudi crude output. This move aims to secure market share and profits, even at the cost of lower oil prices. The ramifications of such a decision could prove detrimental to Moscow's financial stability. For the past decade, oil and gas revenues have been the primary source of income for the Russian state, accounting for up to half of its budget. The Russian war economy heavily relies on these funds to sustain its military operations in Ukraine. Energy analyst Mikhail Krutikhin warns of the "enormous risk" this poses to Russia's state budget. He emphasizes the unpredictability of various factors, including the upcoming U.S. presidential election, that could further complicate the situation for Moscow.

Oil market experts have little doubt that Saudi Arabia has the enormous production and export capacity to change tactics and gun for market domination through volume instead. | Fayez Nureldine/AFP via Getty Images Economist Alexandra Prokopenko projects that a $20 drop in oil prices could result in a substantial loss of revenue for Russia, equivalent to approximately 1% of its GDP. This financial squeeze would force the Kremlin to make difficult choices between reducing expenditures – an unlikely option during wartime – or accepting inflationary pressures and high interest rates. The potential Saudi strategy shift comes in response to persistent quota violations by some OPEC+ members, including Russia. Despite agreeing to production limits, Moscow has consistently exceeded its allocated quota, currently set at 8.98 million barrels per day. This overproduction has contributed to keeping oil prices well below the $100 per barrel target sought by Saudi Arabia and other producers. Ajay Parmar, an oil markets expert at ICIS, explains that Saudi Arabia's move could serve as a warning to other producers. By prioritizing market share over high prices, Riyadh aims to compel compliance with agreed-upon production limits. Despite Western sanctions imposed due to the Ukraine conflict, Russia's fossil fuel profits have increased by 41% in the first half of this year. The country has employed various tactics to circumvent restrictions, including the use of a "shadow fleet" of aging vessels to transport crude oil and exploiting loopholes that allow for the sale of refined products. While a drop in oil prices would undoubtedly strain Russia's finances, experts like Heli Simola from the Bank of Finland caution that it may not immediately halt the country's military operations. The Russian war economy has demonstrated resilience, and the Kremlin appears determined to continue its campaign in Ukraine despite growing economic challenges. As the situation unfolds, the global community watches closely to see how Saudi Arabia's potential oil strategy shift will reshape the energy market and impact Russia's ability to finance its ongoing military activities. Read the full article

2 notes

·

View notes

Text

Starbucks is reducing its corporate employees’ holiday bonuses by 40% due to declining sales and financial struggles.

Key Facts:

– Bonus Cuts: Corporate staff will receive only 60% of their usual holiday bonuses this December. – Sales Slump: The company experienced its worst year since 2020, with revenue increasing less than 1% and operating income dropping 8%. – Customer Cutbacks: Cash-strapped customers are spending less on expensive menu items amid rising prices. – Operational Issues: Long wait times and controversies have further impacted customer satisfaction and sales. – Leadership Changes: New CEO Laxman Narasimhan is implementing strategies to revitalize the brand and regain customer trust.

The Rest of The Story:

Starbucks is facing significant financial challenges, prompting a substantial cut in holiday bonuses for its corporate employees. The company’s revenue growth has stalled, and operating income has declined, marking its most challenging year since the pandemic began. Customers are scaling back on premium beverages due to increased prices, leading to a slump in sales. Additionally, operational hurdles like lengthy wait times and public controversies have strained the company’s relationship with its clientele.

In response, CEO Laxman Narasimhan, who took over in September, is spearheading initiatives to rejuvenate the brand. These include hiring more baristas to improve service efficiency and redesigning store spaces to make them more inviting, reminiscent of Starbucks’ early days as a “third place” between work and home. Despite these efforts, employees at various levels are feeling the impact of the company’s financial downturn through reduced bonuses and halted merit raises for senior staff.

Commentary:

The financial woes of Starbucks are a reflection of the broader economic challenges many Americans face today. High inflation, often attributed to current economic policies, has eroded purchasing power, leaving consumers with less disposable income for non-essential luxuries like a $5 latte. The concept of “Bidenomics” has been criticized for contributing to rising costs of living, making it harder for average people to justify spending on premium-priced coffee when budgets are tight.

Moreover, the steep prices at Starbucks have long been a point of contention. In an era where every dollar counts, consumers are opting for more affordable alternatives or skipping the coffee shop altogether. This shift in consumer behavior underscores the need for economic policies that alleviate inflationary pressures and help restore financial confidence among the populace.

Looking ahead, there’s optimism that future leadership changes at the national level could steer the economy in a more favorable direction. Pro-growth strategies and fiscal policies aimed at curbing inflation could rejuvenate consumer spending. Such economic revitalization would not only benefit companies like Starbucks but also provide much-needed relief to consumers feeling the pinch of current economic strains.

The Bottom Line:

Starbucks’ decision to cut employee bonuses highlights the challenges businesses face amid economic hardships and shifting consumer behaviors. Addressing the root causes of these financial struggles is crucial for both the company’s recovery and the broader economic well-being.

14 notes

·

View notes

Text

Understanding the Core PPI and Its Impact on Currency and Gold Markets!

The Producer Price Index (PPI) serves as a vital economic indicator, shedding light on changes in the prices of finished goods and services sold by producers. However, when analyzing PPI data, one must pay close attention to the Core PPI, which excludes the volatile components of food and energy prices. This exclusion is significant because food and energy prices often exhibit erratic fluctuations that can skew the overall PPI reading.

A noteworthy shift occurred in February 2014 when the calculation formula for the Core PPI underwent a modification. This alteration aimed to provide a more accurate representation of underlying inflation trends by eliminating the influence of volatile food and energy prices.

It's crucial to recognize that food and energy prices typically constitute around 40% of the overall PPI. Consequently, when analyzing the Core PPI, which excludes these volatile components, one may find a more stable and reliable measure of inflationary pressures.

Now, let's delve into the implications of Core PPI releases on currency and gold markets.

When the Core PPI data release exceeds market expectations, it signals that inflationary pressures are building up in the economy. This can lead to an appreciation of the dollar as investors anticipate potential interest rate hikes by the central bank to curb inflation. A stronger dollar makes gold, which is priced in dollars, relatively more expensive for investors holding other currencies. As a result, the price of gold may decline in response to a stronger dollar.

Conversely, if the Core PPI data release falls below expectations, it suggests subdued inflationary pressures. In such a scenario, the dollar may weaken as investors adjust their expectations regarding future monetary policy actions. A weaker dollar tends to make gold more attractive as a hedge against currency depreciation, leading to an increase in its price.

For instance, let's consider a hypothetical scenario where the Core PPI data release indicates a higher-than-expected increase in producer prices. This prompts investors to anticipate tighter monetary policy by the Federal Reserve, causing the dollar to strengthen. Consequently, the price of gold, denominated in dollars, declines as it becomes less appealing to investors.

On the other hand, if the Core PPI data release comes in below expectations, signaling subdued inflation, investors may interpret this as a dovish signal from the central bank. In response, the dollar weakens, leading to an increase in the price of gold as investors seek refuge in the precious metal amid currency uncertainty.

In conclusion, the Core PPI serves as a crucial economic indicator that can influence both currency and gold markets. By understanding its significance and the factors driving its movements, traders and investors can make informed decisions to navigate the ever-changing landscape of financial markets.

2 notes

·

View notes

Text

Lula Serves Brazil a Toxic Blend of Spending Curbs and Tax Cuts

As unforced political errors go, this one by Brazil’s President Luiz Inácio Lula da Silva is hard to believe.

A much-awaited budget reduction announcement by his government, designed to allay concerns over the country’s growing debt burden, backfired spectacularly due to a mix of politicking and communications blunders. The real dropped to a record low, worsening inflation expectations, and spreading the idea that Latin America’s largest economy will have to face higher interest rates for longer.

The root of the problem was trying to pair a necessary budget reduction worth 70 billion of reais (almost $12 billion) with tax relief for lower income Brazilians in a bid to make the announcement more electorally palatable. As strategy goes, that’s kind of like my going to the gym in the morning in order to be able to eat a massive burger with fries in the afternoon: I may feel momentarily gratified, but I know I won’t be better off after all. Investors called out this strategy’s nonsense too. Economists at JPMorgan Chase & Co. expect that the key rate will now need to go up to a whopping 14.25% next year to tame the renewed inflationary pressures. Disastrous and, worse, unnecessary.

Continue reading.

4 notes

·

View notes

Note

I know the other people you mentioned, but who is Kelton?

Stephanie Kelton is a professor, economist, and one of the chief proponents of Modern Monetary Theory. In her book The Deficit Myth, she argues that the primary method of thinking about deficits at the macro-level is wrong. This theory has become very popular among progressive policy makers and forms a significant underpinning of their economic policy proposals, such as the Federal Job Guarantee, while the theory is considered to be fringe nonsense by economists, more of an article of faith that proscribes its adherents to positions of privileged policy advisors rather than a concrete theory that can be modeled. Per the Banque of France: "Overall, it appears that MMT is based on an outdated approach to economics and that the meaning of MMT is a more that of a political manifesto than of a genuine economic theory."

MMT has been rather notorious for its refusal to create testable models, a neglect in monetary policy over fiscal policy, and an insistence on always being right, which is intellectually exhilarating among its proponents for its conspiracy-minded claims, but frustrating for the scientifically-minded who prefer data and hard evidence. One of the chief shortcomings among the MMT crowd is that fiscal policy crowds out monetary policy, largely due to the relatively constant inflationary rates for decades previous to the point where those not knowledgeable in economic history forget about it.

Fortunately, Kelton has exposed her lack of knowledge on macroeconomics and monetary policy when it comes to the 2020's inflation spiral. Kelton famously predicted back in 8 April 2021 (so before the Russian war in Ukraine placed inflationary pressures on food and fuel), stated that "Have you considered the possibility that raising rates might move inflation higher?" This was useful, because it was something that was empirical, something that could be tested and measured. Again in a stroke of good fortune, we did receive data - Erdogan had pursued Fisherist policies that were in line with what Kelton was predicting. If she was right, then we would have seen inflation in Turkey drop in response to Erdogan's policies. The opposite happened - inflation skyrocketed in comparison to other regional markets; Turkey's inflation rate was well in excess of other economies, peaking over 80% in 2022. So Kelton was completely wrong in this regard. While one bad prediction shouldn't invalidate everything, the consistently poor performance of MMT in an ideal world would leave this theory relegated to the dustbin.

It didn't happen, of course, but I never expected it to. The scientific method is anathema to public policy discourse.

Thanks for the question, Anon.

SomethingLikeALawyer, Hand of the King

8 notes

·

View notes

Text

As An Aside

I have always found it ridiculous that governments like to report the average wage instead of the median wage.

The two are not the same. In fact, the presence of outliers (of which there are many) results in significant differences.

In 2021, the Australian Bureau of Statistics said that the average yearly wage (pre-tax) was around $90,000. Great, right? Or maybe not. The median yearly wage for that same period was around $63,000. That’s a difference of roughly $27,000, and those two figures paint very different pictures.

The average makes you think that many Australians are earning close to six figures. The median tells you that half are earning less than $63,000. When the discrepancy between the average and the median is this large, I see no reason to use the average other than to obfuscate.

In a similar vein, I find the reporting of only the raw GDP (Gross Domestic Product) while telling everyone that things aren’t that bad to be abhorrent. The raw GDP of a country is largely irrelevant when it comes to how good or bad things are for people. What you want to look at is GDP per capita (i.e., per person) and how that compares to previous years.

Australia’s government has loudly proclaimed that things aren’t that bad. GDP is still growing! But what they haven’t talked about is that we may very well see a GDP per capita recession within the next year. In other words, if GDP is the pie, then the pie has gotten bigger. But how much of the pie each person gets has gotten smaller. In other words, no, things are not peachy for everybody.

What really gets me is that Australia somehow has some of the highest natural gas prices in the world despite being a next exporter of gas. This in turn has led to apocalyptic increases in energy prices along the east coast that are absolutely going to cause real suffering amongst people, particularly those of lower economic means because their budgets are already severely stressed due to inflation, rising interest rates, and housing costs.

This speaks to systematic and repeated failure at the state and federal level because a net exporter of a natural resource should not be paying higher prices for that resource than the people it’s exporting it too. Previous governments have given companies in the eastern states the ability to export natural gas without having to sufficient reserves to control domestic prices. So of course what do they do? Sell as much of it overseas as they can, which screws over the price in the eastern states of Australia as well. That this is allowed is lunacy. Whoever decided not to mandate a decent level of reserves for domestic use to keep prices low was an idiot. Yes, the gas companies make more money, and you can tax them for that, but the rest of the economy suffers. Every single person and business who relies on energy (because electricity is usually generated with natural gas) ends up paying more.

More to the point, with many countries facing enormous inflationary pressures, increasing energy prices only add to the problem. It’s easy for reserve banks and governments to say to people “don’t ask for a wage increase or inflation will get worse” but at a certain point people no longer care. If renting or owning a home costs more, and keeping the lights or heating on costs more, and buying food costs more, and putting petrol in the tank costs more, people are rightfully going to ask “how the hell do I pay for all of these increase?”. People will ask why companies aren’t doing their part to lower inflation and are instead profiteering.

We saw this in Britain where repeated attempts to control inflation largely failed, and people basically went “screw it” and pushed for wage increases anyway because with inflation continuing to rise, they had no choice. Without increased wages, they couldn’t survive.

It’s really a multi-level failure in policy. Central banks have the equivalent of a hammer (interest rates), but controlling inflation cannot be done with interest rates alone. Too many federal governments (Australia’s amongst them) have simply thrown up their hands and said that controlling inflation is impossible for anyone but the central bank (i.e., the Reserve Bank). But governments have a critical role in managing inflation because they operate the legislative levers that can help to control supply and demand in critical areas like housing, energy, and basic consumption (e.g., food). They can - and must - assist the central bank because monetary policy in the form of interest rates is toothless without legislative support that addresses key areas of the economy.

For fuck’s sake, this shit is so obvious that the government has to know, but it’s politically expedient to do nothing and let the Reserve Bank (in Australia’s case) take the heat because actually doing something might require being unpopular for a while.

Also, I should point out the absolute futility of trying to cool down demand in the housing sector by building 30,000 homes over the next five years... while also bringing in more than a million migrants. Now, I am a migrant myself. I have nothing against migration when it is properly handled. But do the math. If housing is an issue right now (and the rental situation in many parts of Australia has basically become Mad Max) what do you think is going to happen if you continue to bring in more people than you can build houses for?

You get a housing crisis. You get places where rental prices can increase by upward of 25% in a single year. And this just drives inflation higher and higher because people need more money just to keep a roof over their heads.

The saddest thing (and honestly it would be funny if it wasn’t real life) is that some idiot in the government is going to look at the skyrocketing housing prices and conclude that all is well. After all, look at how much Australian’s are worth! Yeah. If you count the skyrocketing house prices as part of net worth, maybe the net worth of Australian’s as a whole will increase, but you’re creating an absolutely miserable situation for everyone else.

8 notes

·

View notes

Text

Between 1991 and 2001, Japan’s once red-hot economy was in trouble. An asset bubble had formed in both its housing and stock markets, and when the Bank of Japan implemented a series of steep interest rate hikes as a way to tame inflationary pressures, you could almost hear the bubble pop.

Japan’s stock market tanked, and asset prices fell. Several big banks, which were overleveraged with speculative investments, either failed outright or needed to be bailed out by the government. Businesses folded, and unemployment rose. Japan became mired in a decade-long recession.

The country was actually experiencing a liquidity trap: It seemed like everything Japan’s central bank did to help didn’t work. Interest rates were cut, but fearful for the future, Japan’s citizens sat on their savings instead of spending them.

Prepare for hyperdeflation everyone

14 notes

·

View notes