#Indonesia palm oil

Explore tagged Tumblr posts

Text

Palm oil Exporters in Indonesia: Key Insights & Trends in 2024

Indonesia, the world’s leading producer and exporter of palm oil, plays a pivotal role in the global edible oil market. In 2024, the country's palm oil industry continues to thrive, contributing significantly to its economy and meeting global demand. With robust export strategies, advancements in sustainable practices, and evolving market dynamics, palm oil exporters in Indonesia are setting benchmarks for success. This article delves into the current trends, export data, and the global standing of Indonesia in the palm oil trade.

Indonesia’s Dominance in the Palm Oil Market

Indonesia has consistently held the top spot among palm oil exporting countries, accounting for over 50% of the world’s supply. The vast plantations in Sumatra and Kalimantan, coupled with favorable climatic conditions, enable the production of high-quality palm oil. In 2024, Indonesia’s palm oil production is estimated to exceed 50 million metric tons, reaffirming its global leadership.

Key Drivers of Indonesia’s Palm Oil Exports

Growing Global Demand: Palm oil is a versatile product used in food, cosmetics, biofuels, and pharmaceuticals. Its affordability and utility make it a staple in various industries worldwide.

Strategic Export Policies: The Indonesian government has introduced incentives and reduced export levies to boost shipments, ensuring competitiveness in the international market.

Sustainability Practices: To address environmental concerns, exporters are adopting sustainable certifications such as RSPO (Roundtable on Sustainable Palm Oil), appealing to eco-conscious markets.

Top Destinations for Indonesian Palm Oil in 2024

According to Indonesia export data, the primary importers of its palm oil are India, China, and the European Union. These regions collectively account for a significant share of Indonesia’s exports, driven by their industrial and consumer needs.

India: The largest importer of Indonesian palm oil, India uses it extensively in the food industry, particularly for cooking and snack production.

China: With its growing demand for processed foods, China relies on palm oil as a key ingredient in manufacturing.

European Union: Despite stringent sustainability requirements, the EU remains a significant market, focusing on certified sustainable palm oil.

Emerging Markets

Countries in Africa and the Middle East are emerging as promising destinations for Indonesian palm oil, driven by increasing urbanization and economic growth.

Key Players Among Palm Oil Exporters in Indonesia

The Indonesian palm oil export industry is dominated by both large-scale corporations and smallholder farmers. Prominent companies like Wilmar International, Golden Agri-Resources, and Musim Mas lead the market, ensuring a steady supply to global buyers.

Role of Smallholder Farmers

Approximately 40% of Indonesia’s palm oil is produced by smallholders. Efforts to integrate them into sustainable supply chains have been a focal point in 2024, enhancing their productivity and market access.

Palm Oil Export Challenges in 2024

While Indonesia’s dominance in the palm oil market remains unchallenged, it faces several challenges:

Environmental Concerns: Deforestation and habitat destruction have sparked global criticism. Although steps have been taken to promote sustainable practices, the industry must accelerate its green initiatives.

Trade Barriers: Countries like the EU have introduced restrictions on unsustainable palm oil, requiring exporters to meet stringent certification standards.

Price Volatility: Fluctuating global oil prices and competition from alternative oils like soybean and sunflower oil affect revenue stability.

Analyzing Indonesia Export Data for Palm Oil

Recent Indonesia export data highlights the impressive growth trajectory of the palm oil sector. In 2023, the country exported nearly 35 million metric tons of palm oil, generating revenue of approximately $30 billion. Early 2024 data indicates a 5% increase in export volumes, driven by higher demand in Asian and African markets.

Export Categories

Crude Palm Oil (CPO): The unprocessed form of palm oil remains the most exported category.

Refined Products: These include palm kernel oil and derivatives used in cosmetics and biofuels.

By-products: Palm oil residues are increasingly being utilized in animal feed and energy production.

Sustainability and Its Impact on Palm Oil Exports

Sustainability is no longer optional but a necessity for maintaining global market access. In 2024, Indonesian exporters are investing heavily in eco-friendly practices to meet international standards.

Initiatives by the Government

One Map Policy: This initiative streamlines land-use planning to minimize deforestation and optimize plantation management.

Mandatory Certification: The government has mandated ISPO (Indonesian Sustainable Palm Oil) certification for all palm oil producers to boost credibility in global markets.

Corporate Efforts

Leading exporters are focusing on traceability and transparency in their supply chains, ensuring compliance with buyer requirements. Collaborative efforts with NGOs and international organizations are also fostering a greener image for the industry.

Future Outlook for Indonesia’s Palm Oil Industry

The future of Indonesia palm oil exports looks promising, with a focus on innovation, sustainability, and market diversification. Key trends include:

Increased Biofuel Demand: The global push for renewable energy will likely boost the demand for palm oil-based biofuels.

Digital Transformation: Leveraging technology to optimize production, track exports, and enhance market intelligence.

Expanding Trade Partnerships: strengthening ties with emerging markets in Africa and South America.

Predictions for 2024 and Beyond

Indonesia’s palm oil export volume is expected to grow by 7% annually.

Certified sustainable palm oil will dominate global demand.

Investments in research and development will yield innovative palm oil applications, further diversifying its use.

Conclusion Indonesia’s palm oil export industry in 2024 underscores its critical role in the global economy. With palm oil exporters in Indonesia leading the charge, the country continues to set benchmarks in production, sustainability, and trade. While challenges persist, proactive measures by the government and industry stakeholders ensure Indonesia remains at the forefront of the palm oil market. The combination of robust export strategies, adherence to global standards, and market diversification positions Indonesia as a powerhouse among palm oil exporting countries for years to come.

By analyzing Indonesia export data and adapting to evolving trends, the industry is poised to capitalize on emerging opportunities while addressing challenges head-on.

#palm oil exporters in Indonesia#Indonesia palm oil#Indonesia palm oil exports#Indonesia palm oil export data#palm oil exports Indonesia#palm oil exporting countries#Indonesian palm oil exporters list#palm oil#indonesia

0 notes

Text

Indonesia Says a Half Million Acres of Palm Plantations will be Turned Back into Forests https://www.goodnewsnetwork.org/indonesia-says-a-half-million-acres-of-palm-plantations-will-be-turned-back-into-forests/

#good news#science#environmentalism#nature#environment#palm oil#palm plantations#indonesia#forests#reforestation

185 notes

·

View notes

Text

"As countries around the world begin to either propose or enforce zero-deforestation regulations, companies are coming under growing pressure to prove that their products are free of deforestation. But this is often a far from straightforward process.

Take palm oil, for instance. Its journey from plantations, most likely in Indonesia or Malaysia, to store shelves in the form of shampoo, cookies or a plethora of other goods, is a long and convoluted one. In fact, the cooking oil or cosmetics we use might contain palm oil processed in several different mills, which in turn may have bought the raw palm fruit from several of the many thousands of plantations. For companies that use palm oil in their products, tracing and tracking its origins through these obscure supply chains is a tough task. Often it requires going all the way back to the plot level and checking for deforestation. However, these plots are scattered over vast areas across potentially millions of locations, with data being in various states of digitization and completeness...

Palmoil.io, a web-based monitoring platform that Bottrill launched, is attempting to help palm oil companies get around this hurdle. Its PlotCheck tool allows companies to upload plot boundaries and check for deforestation without any of the data being stored in their system. In the absence of an extensive global map of oil palm plots, the tool was developed to enable companies to prove compliance with regulations without having to publicly disclose detailed data on their plots. PlotCheck now spans 13 countries including Indonesia and Malaysia, and aims to include more in the coming months.

Palm oil production is a major driver of deforestation in Indonesia and Malaysia, although deforestation rates linked to it have declined in recent years. While efforts to trace illegally sourced palm oil have ramped up in recent years, tracing it back to the source continues to be a challenge owing to the complex supply chains involved.

Recent regulatory proposals have, however, made it imperative for companies to find a way to prove that their products are free of deforestation. Last June, the European Union passed legislation that prohibits companies from sourcing products, including palm oil, from land deforested after 2020. A similar law putting the onus on businesses to prove that their commodities weren’t produced on deforested land is also under discussion in the U.K. In the U.S., the U.S. Forest Bill aims to work toward a similar goal, while states like New York are also discussing legislation to discourage products produced on deforested land from being circulated in the markets there...

PlotCheck, which is now in its beta testing phase, allows users to input the plot data in the form of a shape file. Companies can get this data from palm oil producers. The plot data is then checked and analyzed with the aid of publicly available deforestation data, such as RADD (Radar for Detecting Deforestation) alerts that are based on data from the Sentinel-1 satellite network and from NASA’s Landsat satellites. The tool also uses data available on annual tree cover loss and greenhouse gas emission from plantations.

Following the analysis, the tool displays an interactive online map that indicates where deforestation has occurred within the plot boundaries. It also shows details on historical deforestation in the plot as well as data on nearby mills. If deforestation is detected, users have the option of requesting the team to cross-check the data and determine if it was indeed caused by oil palm cultivation, and not logging for artisanal mining or growing other crops. “You could then follow up with your supplier and say there is a potential red flag,” Bottrill said.

As he waits to receive feedback from users, Bottrill said he’s trying to determine how to better integrate PlotCheck into the workflow of companies that might use the tool. “How can we take this information, verify it quickly and turn it into a due diligence statement?” he said. “The output is going to be a statement, which companies can submit to authorities to prove that their shipment is deforestation-free.” ...

Will PlotCheck work seamlessly? That’s something Bottrill said he’s cautiously optimistic about. He said he’s aware of the potential challenges with regard to data security and privacy. However, he said, given how zero-deforestation legislation like that in the EU are unprecedented in their scope, companies will need to sit up and take action to monitor deforestation linked to their products.

“My perspective is we should use the great information produced by universities, research institutes, watchdog groups and other entities. Plus, open-source code allows us to do things quickly and pretty inexpensively,” he said. “So I am positive that it can be done.”"

-via Mongabay, January 26, 2024

--

Note: I know it's not "stop having palm oil plantations." (A plan I'm in support of...monocrop plantations are always bad, and if palm oil production continues, it would be much better to produce it using sustainable agroforestry techniques.)

However, this is seriously a potentially huge step/tool. Since the EU's deforestation regulations passed, along with other whole-supply-chain regulations, people have been really worried about how the heck we're going to enforce them. This is the sort of tool we need/need the industry to have to have a chance of genuinely making those regulations actually work. Which, if it does work, it could be huge.

It's also a great model for how to build supply chain monitoring for other supply chain regulations, like the EU's recent ban on companies destroying unsold clothes.

#deforestation#palm oil#indonesia#malaysia#agriculture#european union#united states#save the forest#open source#technology#mapping#forestry#satellite#good news#hope#climate solutions#environment

122 notes

·

View notes

Text

When the colonized world in Asia and Africa acquired independence between 1945 and 1960, Socfin managed to survive without taking a major hit.

But decolonization didn’t mean the end of foreign control of Indigenous land in the developing world; it just changed its shape.

Although many plantations in former colonies were expropriated and nationalized in the 1950s and ‘60s, soon afterwards, due to the legacy of decades of colonial rule and the subsequent lack of local expertise and capital needed to meet the requirements of the World Bank’s economic incentive programs, the newly independent governments drew on foreign capital to keep the businesses and exports running.

#palm oil#colonialism#imperialism#france#europe#capitalism#indonesia#belgium#climate and environment#racism

15 notes

·

View notes

Text

EU: Include Civil Society in Anti-Deforestation Task Force

(Brussels, May 31, 2024) – The European Commission should include independent civil society groups in ongoing key talks with Malaysia and Indonesia over its anti-deforestation rules, a delegation of Indigenous, human rights, and environmental organizations said today.

In June 2023, the two Southeast Asian countries formed a task force with the European Commission to resolve tensions over the implementation of a vital new European Union law to tackle global deforestation. But frontline organizations representing the rights of communities affected by deforestation have largely been left out of the task force meetings.

“We are hopeful that the EU deforestation law will support us to advance human and environmental rights locally, especially as policies to safeguard these rights are still lacking for us,” said Celine Lim, managing director of SAVE Rivers, an Indigenous organization from Sarawak, Malaysia

The delegation, which is meeting with EU officials in Brussels through May 31, 2024, consists of members from SAVE Rivers, RimbaWatch, Bruno Manser Fonds, KERUAN, and Human Rights Watch.

The European Union Deforestation-free Products Regulation (EUDR), adopted in May 2023, restricts the sale of certain products on the EU market if they are linked to deforestation or violations of land rights or human rights. Malaysia and Indonesia are the world’s biggest producers of palm oil and significant exporters of timber to the EU. The regulation covers both commodities.

The joint task force convened in Jakarta in August 2023 and again in Brussels in February 2024, with another meeting set for Brussels in September. The task force needs to hear from frontline communities most affected by deforestation and environmental organizations in their countries to genuinely understand the impact of the palm oil and timber industries, the delegation said.

3 notes

·

View notes

Text

Javanese landscape

4 notes

·

View notes

Text

youtube

#dw documentary#documentaries#pollution#plastic waste#deforestation#climate change#climate disaster#Bali#Indonesia#palm oil#palm trees#forest#orangutans#animal habitat#habitat destruction

1 note

·

View note

Text

Most Exported Indonesia Commodity

Indonesia's export economy thrives on its abundant natural resources and diverse range of commodities. This bustling economy is significantly bolstered by the export of key products, which play a vital role in job creation and national growth.

Key aspects of Indonesia's export landscape include:

Diverse Commodities: The country's exports encompass various sectors, from agriculture to minerals.

Economic Growth: Commodities contribute substantially to Indonesia's GDP, highlighting their importance in sustaining economic stability.

Global Presence: Indonesia stands as a leading exporter for several products, such as palm oil, coal, and rubber, which positions the nation strategically on the global market.

With these factors combined, it is evident that the focus on commodity exports not only enhances Indonesia's economic standing but also underscores its potential for future growth in international trade. The most exported Indonesia commodity reflects this dynamic and serves as a cornerstone for development within the country.

For more information about indonesia product you can read on supplierindo.com

Key Commodities Exported by Indonesia

Palm Oil

Indonesia is the largest exporter of palm oil in the world, a position it has held due to its ideal climate and vast agricultural land. The country produces around 46 million tonnes of palm oil each year, making a significant contribution to its export economy.

1. Global Market Share

Indonesia accounts for about 56% of the world's palm oil production. This dominance translates into an export value of around USD 26.4 billion, making it a critical player in the global edible oils market.

2. Uses in Various Industries

Palm oil's versatility is evident in its wide range of applications:

Food Industry: Used in cooking oils, margarine, and processed foods.

Cosmetics and Personal Care: Commonly found in soaps, shampoos, and lotions due to its moisturizing properties.

Biofuels: Increasingly utilized in biodiesel production, aligning with sustainable energy goals.

The economic impact of palm oil exports is profound. It not only supports local farmers but also generates employment opportunities throughout the supply chain. Despite facing challenges such as environmental concerns and sustainability issues, palm oil remains a vital commodity for Indonesia's economy.

As this sector continues to grow, innovations in sustainable cultivation practices are emerging. These efforts aim to address both market demands for ethical sourcing and the environmental footprint associated with palm oil production. The ongoing evolution of this industry highlights Indonesia's commitment to balancing economic growth with environmental stewardship.

Coal Briquettes

Coal is crucial for Indonesia's export economy and is one of the top exported commodities in the country.

Quantities Exported

Indonesia exports around 241.1 million tonnes of coal every year, which is about 6.3% of the total global supply.

Economic Impact

The annual value of these exports is approximately USD 11.98 billion, highlighting how important coal is as an energy resource.

Comparison with Other Coal-Exporting Countries

While Australia and Russia are also significant players in the coal market, Indonesia still holds the title of largest exporter.

Competitive pricing and abundant reserves give Indonesia an advantage in the global market.

These factors help Indonesia maintain a strong position despite competition from other countries.

The importance of coal exports goes beyond just economic numbers; they play a crucial role in ensuring energy security for many nations and supporting Indonesia's economic growth. Various industries, such as power generation and manufacturing, heavily rely on coal, further establishing it as one of Indonesia's most exported commodities.

Petroleum Gas

Indonesia is one of the largest exporters of petroleum gas in the world, ranking seventh in global exports. The economic impact of these gas exports is significant, contributing approximately USD 6.22 billion annually to Indonesia's economy. This revenue plays a crucial role in supporting various sectors and enhancing job creation.

Key points about Indonesia's petroleum gas sector:

Global Market Position: Indonesia's position as a key player in the global petroleum market supports its economic stability.

Economic Contribution: Gas exports bolster the trade balance and provide funds for infrastructure and development projects.

Future Trends: An increasing focus on sustainable energy sources may influence future petroleum demand, potentially shifting investment towards renewable energies.

Indonesia’s diverse range of top exported commodities highlights the importance of petroleum gas in maintaining its competitive edge in the global markets.

Copper Ore and Other Notable Exports (Rubber, Cocoa, Coffee)

Indonesia is a key player in the global market for several top exported commodities.

Copper Ore

Indonesia is one of the largest exporters of copper ore, with significant reserves mainly found in Papua.

The country’s export value for copper ore reaches approximately USD 3.48 billion, driven by high demand from countries such as China and Japan.

Mineral resources like copper are crucial to Indonesia's economy, supporting infrastructure development and technological progress.

Natural Rubber

Indonesia is one of the leading producers of natural rubber, accounting for about 26.7% of global production.

The economic impact of rubber goes beyond agriculture; it plays a vital role in creating jobs and developing rural areas.

With an annual export value close to USD 3.33 billion, major markets include the United States and European countries.

Cocoa

As a major cocoa producer, Indonesia has a significant impact on the global chocolate industry.

Annual cocoa exports have a positive effect on Indonesia’s economy, benefiting local farmers and communities.

The production levels reach approximately 0.48 million tonnes, demonstrating the country’s capability in this sector.

Coffee

Indonesia has a long-standing tradition of coffee cultivation, making it one of the top contributors to the global coffee market with 9.4 million bags produced each year.

Its unique flavors have positioned Indonesian coffee prominently in specialty markets worldwide.

There is still great potential for growth in coffee exports due to increasing international demand.

These commodities not only showcase Indonesia’s rich natural resources but also highlight their importance in both local and global markets.

Footwear Industry Growth (Cost-effective Manufacturing)

Indonesia's footwear industry has become one of the top exported commodities. With its ability to manufacture products at a lower cost, the sector has experienced significant growth, benefiting the country's economy. Here are some key trends:

Key Trends

Increased Production: There is a rising demand for affordable footwear in global markets.

Diverse Product Range: The industry offers a wide variety of products, including athletic shoes and formal wear, to cater to different consumer preferences.

Major Markets

The main markets for Indonesian footwear products include:

United States: The US is the largest importer of Indonesian footwear, taking advantage of the country's competitive pricing.

European Union: The EU is a growing market driven by sustainable and eco-friendly options.

Asia-Pacific Region: Regional trade agreements have led to an increasing interest in Indonesian footwear from countries in the Asia-Pacific region.

The economic impact of this growth is significant. It supports local employment opportunities and strengthens Indonesia's position as one of the largest exporters in the global footwear market. As the industry continues to evolve, it remains flexible and adaptable to changing consumer trends.

Paper Product Exports (Pulp and Paperboard)

Indonesia is a major player in the global paper product market, making it one of the top exported commodities from the country. The main types of paper products exported include:

Pulp: A raw material used in various paper-making processes.

Paperboard: Essential for packaging and consumer goods.

Printing and Writing Papers: Widely used in educational and corporate sectors.

These products have various uses worldwide, such as packaging for food items, stationery, and publishing materials.

The economic impact on local industries is significant. The pulp and paper sector creates jobs, promotes sustainable forest management, and stimulates investments in rural areas. This industry also plays a crucial role in supporting Palm oil exports, reinforcing Indonesia's position as the largest exporter of multiple commodities while highlighting the interconnectedness of these sectors in driving economic growth.

Rice Production Challenges Faced by Indonesian Farmers

Rice serves as a crucial staple food source, both globally and locally. In Indonesia, rice is not just a dietary necessity; it is a cultural symbol that connects communities. The country ranks among the top producers of rice, contributing approximately 9.5% of the global rice supply.

Key challenges faced by Indonesian farmers include:

Climate Change: Erratic weather patterns disrupt planting and harvesting schedules, leading to reduced yields.

Pest and Disease Management: Farmers struggle with pests and diseases that affect crop quality and quantity.

Market Access: Many farmers face difficulties in accessing markets to sell their produce at fair prices.

Despite these hurdles, Indonesia's rice production holds significant economic impact. The sector supports millions of livelihoods and contributes to food security. While palm oil exports capture attention as one of the largest commodities, rice remains essential for sustenance in local communities. As farmers navigate these challenges, the resilience of Indonesia’s agricultural sector becomes increasingly important for maintaining its position in the global market while ensuring food availability for its population.

Major Markets for Indonesian Exports (China, US, Japan)

Indonesia's export economy thrives on robust relationships with key trading partners. The most significant markets for Indonesia's commodities include:

1. China

Indonesia has established a strong trade connection with China, serving as one of its largest suppliers of raw materials. Notable exports include palm oil and coal. In recent years, the export value to China has seen substantial growth, reflecting the increasing demand for these commodities.

2. United States

The U.S. is another critical market, particularly for agricultural products such as coffee and rubber. The economic relationship emphasizes mutual benefits through trade agreements that enhance market access, fostering consistent export volumes. This relationship is further strengthened by the ongoing U.S.-Indonesia relations, which have been mutually beneficial.

3. Japan

Japan remains a vital partner for Indonesia in sectors like automotive and electronics. Exports such as copper ore and palm oil are integral to Japanese manufacturing processes. The countries have engaged in various collaborations that strengthen their economic ties.

The importance of these markets cannot be overstated; they account for a substantial portion of Indonesia's total commodity exports. Strengthening these relationships continues to be essential for the ongoing growth of Indonesia's economy and its position in global trade. Moreover, with the energy sector roadmap towards net-zero emissions being implemented, it is expected that these trading relationships will evolve to incorporate more sustainable practices.

Challenges Facing Indonesian Exports (Trade Barriers & Environmental Concerns)

Indonesia's export economy encounters several obstacles that hinder its potential growth.

Trade Barriers

Regulations and Tariffs: Numerous countries impose strict regulations and tariffs on imported goods, impacting the competitiveness of Indonesian commodities.

Quality Standards: Exporting to regions such as the European Union often requires compliance with stringent quality standards, which can be challenging for local producers.

Environmental Concerns

Deforestation: Palm oil production has faced criticism due to its contribution to deforestation. This environmental issue raises concerns among international buyers who prioritize sustainable sourcing.

Pollution: The extraction and processing of resources like coal and gas can lead to significant pollution. Countries are increasingly scrutinizing the environmental impact of their imports, affecting demand for Indonesian commodities.

These challenges in exporting commodities not only affect Indonesia’s position in global markets but also have long-term implications for sustainable economic growth. Addressing these barriers is essential for enhancing the resilience of Indonesia's export sector while promoting environmentally friendly practices.

The Future of Indonesian Commodity Exports (Sustainability Practices Moving Forward)

The landscape of Indonesian commodity exports is poised for significant changes. Consider the following trends:

1. Predictions for Growth or Decline

Palm oil and coal briquettes are expected to maintain strong demand, driven by global consumption patterns.

Conversely, industries like rubber and cocoa may see fluctuations due to changing climate conditions and market saturation.

2. Technological Advancements Impacting Production

Innovations in agricultural technology are enhancing yield efficiency, particularly in palm oil and rice production.

Blockchain technology improves supply chain transparency, ensuring better traceability of exported commodities.

3. Sustainability Practices Being Adopted

Many exporters are implementing sustainable farming practices to mitigate environmental impact. This includes certifications for sustainable palm oil and responsible mining practices for copper ore.

Government initiatives also encourage eco-friendly production methods, aligning with global sustainability goals.

The future of Indonesia's export economy will rely heavily on balancing economic growth with responsible resource management. Adapting to these trends will be crucial for maintaining Indonesia's position as a leader in the global commodity market.

FAQs (Frequently Asked Questions)

What are the main commodities exported by Indonesia?

Indonesia primarily exports palm oil, coal, petroleum gas, copper ore, rubber, cocoa, coffee, footwear products, and paper products. These commodities play a significant role in the country's export economy and global markets.

How does palm oil production impact Indonesia's economy?

Palm oil is one of Indonesia's largest exports, contributing significantly to the national economy. The country holds a substantial global market share in palm oil production, which is used in various industries including food, cosmetics, and biofuels.

What challenges do Indonesian farmers face in rice production?

Indonesian farmers encounter several challenges in rice production, including trade barriers, environmental concerns, and fluctuating market demands. Despite rice being a staple food commodity both locally and globally, these challenges can impact export statistics.

Which countries are the major markets for Indonesian exports?

The major markets for Indonesian exports include China, the United States, and Japan. These countries have established economic relationships with Indonesia that significantly influence its export dynamics.

What environmental concerns are associated with Indonesian commodity exports?

Environmental concerns related to Indonesian commodity exports include deforestation linked to palm oil production and the ecological impacts of mining activities for minerals like copper ore. Addressing these issues is crucial for sustainable export practices.

What is the future outlook for Indonesian commodity exports?

The future of Indonesian commodity exports looks towards sustainability practices and technological advancements. Predictions indicate potential growth or decline in specific commodities based on market trends and environmental regulations.

1 note

·

View note

Text

Myths and Facts about Palm Cooking Oil | GAPKI Discover the facts about palm cooking oil with GAPKI. Learn its benefits, nutritional value, and the differences between palm and other cooking oils. For more details on the Indonesian Palm Oil Association (GAPKI), visit https://gapki.id/en and explore how palm oil supports sustainable growth today!

#palm cooking oil#cooking oil palm#food containing palm oil#palm vegetable oil#vegetable oil palm#Jakarta Oil palm#Indonasia Oil palm#palm oil production in Jakarta#palm oil production in Indonesia

1 note

·

View note

Text

Mectech Palm Oil Refinery Plant- A Legacy of Innovation and Excellence

Oil processing, often known as refining, is the conversion of crude oil into usable products such as petrol, diesel, kerosene, and other petrochemicals. The refining process consists of multiple essential steps, including separation, conversion, treatment, blending, and other refining processes.

Oil refining is a complicated and energy-intensive process that necessitates advanced equipment and technology. It is an important link in the worldwide energy supply chain, providing fuel for transportation, heating, and electricity generation, as well as raw materials for the petrochemical sector.

Of all the oil refining and processing industries, palm oil refinery is the most important sector as it is a very complex oil and for its production it requires good quality plant.

Palm Oil Refining

Palm oil refining industries are among the world's most important manufacturing sectors, and palm oil has grown to become the world's most traded vegetable oil. Indonesia and Malaysia are the main producers, with exporting enterprises for crude palm oil.

Crude palm oil is derived from palm oil's mesocarp. Extracted Crude Palm oil contains some undesirable contaminants, which must be eliminated partially or fully throughout the palm oil refining process to produce good edible oil with increased stability and keepability.

Palm oil is currently a popular cooking oil in many tropical nations, including South East Asia, Africa, and sections of Brazil. Its popularity is attributed due to its higher heat resistance as compared to any other vegetable oil and also because of its lower cost and good oxidative stability.

Palm's unique and finest quality is that it generates two forms of oil: palm oil and palm kernel oil.

Palm oil is derived from the flesh of the palm fruit, whereas palm kernel oil is extracted from the seeds or kernel of the palm fruit using the palm kernel oil process.

Palm oil is derived from fresh palm fruit flesh through pressing and centrifugation at a palm oil facility. To avoid deterioration of Palm Oil, it must be extracted from fresh palm fruit. As a result, countries that cultivate palm oil remove it to prevent it from deteriorating. The crude palm oil's colour is yellow-red or dark yellow, and its taste is sweet.

The crude palm oil extracted contains undesired contaminants, which hurt the oil's physical appearance, quality, oxidative stability, and shelf life. To eliminate the aforementioned pollutants, the oil is sent to a palm oil refinery plant, where it is refined, bleached, and deodorised. After refining the palm oil, the RBD oil is sent to the fractionation unit to extract palm olein and stearin.

Palm Oil Refinery Plant

Palm oil refining is divided into the sections below:

In most palm oil refining plants, the refining process is a vital stage in the manufacture of edible oils and fats. The finished product's properties that must be monitored include flavour, shelf life, stability, and colour.

Crude vegetable oil can be refined in two ways: physically or chemically. During crude palm oil refining, FFA is removed to obtain a maximum FFA level of 0.1%.

Physical refining typically has a smaller environmental impact than chemical refining.

Bleaching edible oils and fats is an important step in the refining process for crude oils and fat. It does eliminate numerous contaminants, which hurt the physical look and quality of the oil. Generally, the oil is taken to the bleaching section first, and the gums are treated with phosphoric acid so that they may be separated in the pressure leaf filter after bleaching.

During this stage, the adsorptive activity of bleaching earth removes trace metal complexes like iron and copper, colouring pigments, phosphatides, and oxidative products.

This bleached oil is next filtered through industrial filters such as a filter press, a hermetically sealed vertical leaf pressure filter, a plate, or a frame filter.

Mectech's unique bleacher design keeps the bleaching earth in full suspension, resulting in no dead zones and lower utility use. Mectech Bleacher guarantees high-quality oil because the bleaching procedure for crude palm oil is carried out under controlled conditions.

Mectech also excels in supplying facilities for rice bran oil processing refinery in India and abroad. Mectech Rice Bran Oil Extraction Machinery in India and abroad offers the following advantages.

#Oil processing#often known as refining#is the conversion of crude oil into usable products such as petrol#diesel#kerosene#and other petrochemicals. The refining process consists of multiple essential steps#including separation#conversion#treatment#blending#and other refining processes.#Oil refining is a complicated and energy-intensive process that necessitates advanced equipment and technology. It is an important link in#providing fuel for transportation#heating#and electricity generation#as well as raw materials for the petrochemical sector.#Of all the oil refining and processing industries#palm oil refinery is the most important sector as it is a very complex oil and for its production it requires good quality plant.#Palm Oil Refining#Palm oil refining industries are among the world's most important manufacturing sectors#and palm oil has grown to become the world's most traded vegetable oil. Indonesia and Malaysia are the main producers#with exporting enterprises for crude palm oil.#Crude palm oil is derived from palm oil's mesocarp. Extracted Crude Palm oil contains some undesirable contaminants#which must be eliminated partially or fully throughout the palm oil refining process to produce good edible oil with increased stability an#Palm oil is currently a popular cooking oil in many tropical nations#including South East Asia#Africa#and sections of Brazil. Its popularity is attributed due to its higher heat resistance as compared to any other vegetable oil and also beca#Palm's unique and finest quality is that it generates two forms of oil: palm oil and palm kernel oil.#Palm oil is derived from the flesh of the palm fruit

0 notes

Text

In her fascinating study of the dense networks of entanglement, contradiction, and conflict in Indonesia’s forests, many of which are today being razed for palm oil plantations, anthropologist Anna Tsing encourages us to recognize that capitalism advances through the friction between its universal logic of accumulation and the particular cultures, lifeways, and structures of power in each locale. Contrary to the dreams of a “friction-free” capitalism promised by billionaire, philanthropist, and self-styled intellectual Bill Gates, capitalism is defined by conflict and tension. Gates is only the latest of a long line of capitalist thinkers to dream that the free market, if allowed to flourish without regulation, will create a smooth world where the hardworking and talented, no matter their origins or station in life, could compete to succeed, and that this competitive striving would have beneficial effects for global society at large: greater wealth and greater innovation. Even many critics of capitalism fall prey to the myth of frictionlessness in their attempts to explain the nefarious clockwork of this demonic machine that metabolizes people and the earth not only into profit, but into the energy that fuels system’s endless reproduction and expansion. Tsing’s insistence that we look to the friction encourages us to recognize that what moves this machine forward (and halts its “progress”) is the friction that stems from forms of complicity and resistance, acquiescence and refusal that define every point where the abstract system of capitalism encounters the material realities of the entangled earth and its people.

Max Haiven, Palm Oil: The Grease of Empire

79 notes

·

View notes

Text

Saving this for me. Items possibly targeted for tariffs.

Saving this for me. Items possibly targeted for tariffs. • Bananas, Mangoes, and Pineapples (from Central and South America) • Avocados (from Mexico) • Citrus fruits like oranges and lemons (from Mexico and Spain) • Berries (e.g., strawberries, blueberries) (from Mexico, Chile) • Tomatoes, Bell Peppers, and Cucumbers (from Mexico and Canada) • Asparagus (from Peru and Mexico) Seafood (Fresh, Frozen, and Canned) • Fresh/Frozen Shrimp (from Thailand, India, Ecuador) • Salmon (from Norway, Chile) • Tilapia (from China) • Tuna (canned) (from Thailand, the Philippines) • Sardines (from Portugal, Morocco) • Mackerel (canned) (from Japan, Norway) Grains and Legumes • Rice (from Thailand, India, Vietnam) • Quinoa (from Peru and Bolivia) • Chickpeas and Lentils (from Canada, India) Nuts and Seeds • Cashews (from Vietnam and India) • Brazil Nuts (from Bolivia, Brazil) • Almonds (from Spain, Australia) • Chia Seeds (from Mexico and Argentina) Dairy Products • Cheese varieties like Parmesan, Gouda, Feta (from Italy, Netherlands, Greece) • Butter (from Ireland, New Zealand) • Yogurt (Greek-style from Greece, other varieties from Europe) Canned Foods and Packaged Items • Tomato paste and puree (from Italy) • Canned olives and olive oil (from Spain, Italy, Greece) • Canned coconut milk (from Thailand) • Canned beans (from Mexico, Central America) • Canned corn (from Canada, Brazil) • Canned anchovies and sardines (from Morocco, Portugal) • Canned fruit (e.g., pineapple, mango, peaches) (from Thailand, Philippines, Mexico) • Canned tuna and salmon (from Thailand, the Philippines, Chile) Spices and Herbs • Vanilla (from Madagascar) • Black Pepper (from Vietnam, India) • Cinnamon (from Sri Lanka) • Turmeric (from India) • Paprika (from Spain, Hungary) Beverages • Coffee beans (from Brazil, Colombia, Vietnam) • Tea leaves (from India, Sri Lanka, China) • Cocoa beans (from Côte d’Ivoire, Ghana) Oils and Fats • Olive oil (from Spain, Italy, Greece) • Coconut oil (from the Philippines, Indonesia) • Palm oil (from Malaysia, Indonesia) Alcoholic Beverages • Wine (from France, Italy, Chile, Spain) • Beer (particularly certain Mexican brands) • Whiskey and Scotch (from Scotland, Ireland) Sweeteners • Cane sugar (from Brazil, Mexico) • Maple syrup (from Canada) Condiments and Sauces • Soy sauce (from Japan, China) • Fish sauce (from Thailand, Vietnam) • Sriracha and other chili sauces (from Thailand) • Italian pasta sauces (canned/jarred) (from Italy)

83 notes

·

View notes

Text

In Danny Phantom, the characters can be interpreted in a variety of ways without making them out of character (in part because they don’t have very consistent characterization sometimes).

A good example is Sam. A lot of people don’t like Sam because she seems hypocritical. She hates the rich but is rich herself. She preaches about vegetarianism, but she can more than afford it. She even has her own greenhouse!

Now, I actually like Sam and don’t interpret her as a hypocrite. I think she is just jumps the gun too quickly. I don’t think she is trying to take a moral high ground, but is just trying to be an activist. But, she’s 14 in the show and is bound to make mistakes. Her heart is in the right place.

I headcannon that she learns to do more research as she gets older and chills out a lot. I feel like adult Sam would go out of her way to be conscientious of where her food (and other goods) come from. Like, I think she’d eat honey because it doesn’t harm bees but would avoid palm oil because of deforestation in Malaysia and Indonesia, etc.

I also think she would offer her friends vegan/vegetarian food instead of trying to force them. And maybe try to find foods that taste like meat for Tucker to try.

I also feel like her friends would incorporate more vegetarian/vegan food in their diets (even if they don’t become vegetarian/vegan).

169 notes

·

View notes

Photo

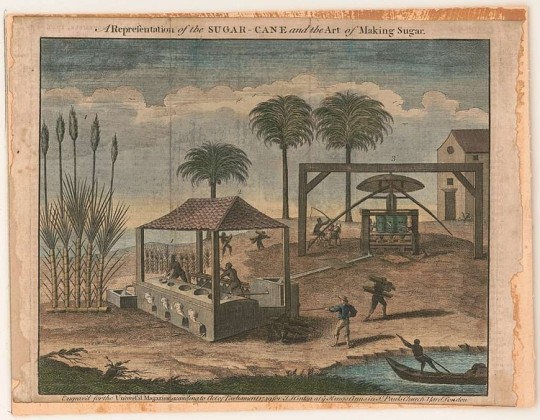

Sugar & the Rise of the Plantation System

From a humble beginning as a sweet treat grown in gardens, sugar cane cultivation became an economic powerhouse, and the growing demand for sugar stimulated the colonization of the New World by European powers, brought slavery to the forefront, and fostered brutal revolutions and wars.

The geographic center of sugar cane cultivation shifted gradually across the world over a span of 3,000 years from India to Persia, along the Mediterranean to the islands near the coast of Africa and then the Americas, before shifting back across the globe to Indonesia. A whole new kind of agriculture was invented to produce sugar – the so-called Plantation System. In it, colonists planted large acreages of single crops which could be shipped long distances and sold at a profit in Europe. To maximize the productivity and profitability of these plantations, slaves or indentured servants were imported to maintain and harvest the labor-intensive crops. Sugar cane was the first to be grown in this system, but many others followed including coffee, cotton, cocoa, tobacco, tea, rubber, and most recently oil palm.

Beginnings of Sugar Cultivation

There is no archeological record of when and where humans first began growing sugar cane as a crop, but it most likely occurred about 10,000 years ago in what is now New Guinea. The species domesticated was Saccharum robustum found in dense stands along rivers. The people in New Guinea were among the most inventive agriculturalists the world has known. They domesticated a broad range of local plant species including not only sugar cane but also taro, bananas, yam, and breadfruit.

The cultivation of sugar cane moved steadily eastward across the Pacific, spreading to the adjacent Solomon Islands, the New Hebrides, New Caledonia, and ultimately to Polynesia. Cultivation of sugar cane also moved westward into continental Asia, Indonesia, the Philippines, and then Northern India. During this advancement, S. officinarum ("nobel canes") hybridized with a local wild species called S. spontaneum to produce a hybrid, S. sinense ("thin canes"). These hybrids were less sweet and not as robust as pure S. officinarum but were hardier and could be grown much more successfully in subtropical mainlands.

Sugar cane was for eons just chewed as a sweet treat, and it was not until about 3,000 years ago that people in India first began squeezing the canes and producing sugar (Gopal, 1964). For a long time, the Indian people kept the whole process of sugar-making a closely guarded secret, resulting in rich profits through trade across the subcontinent. This all changed when Darius I (r. 522-486 BCE), ruler of the Persian Achaemenid Empire, invaded India in 510 BCE. The victors took the technology back to Persia and began producing their own sugar. By the 11th century CE, sugar constituted a significant portion of the trade between the East and Europe. Sugar manufacturing continued in Persia for nearly a thousand years, under a revolving set of rulers, until the Mongol invasions of the 13th century destroyed the industry.

Continue reading...

27 notes

·

View notes

Text

A writer’s guide to forests: woodlands made by man

Forests are for the most part, the realm of nature. But what about those with a less than natural origin? Here are some woodlands that are shaped artificially.

Parks and gardens- Trees look nice, there’s no denying it. As long as there have been people who admire trees, there have been gardens and parks. Grassy meadows, neatly trimmed hedges and flower beds may get all the attention, but an accenting grove, or a rambling woodland always adds to the aesthetic. Wealthy aristocrats would import trees from far away places, while more modest landowners and public spaces grow native species. Though the results do look quite natural, they are nonetheless human creations.

Orchard- Fruit and nut bearing trees have always been favored as a reliable source of food. And so people since nearly the beginning of agriculture have been planting orchards to provide for them. Trees are planted in rows, evenly spaced apart for the ease of harvesting. Smaller orchards, those catering to families who pick their own fruit, and those that grow fairly delicate fruits still do the harvesting by hand, while many more rely on machines to do the heavy lifting.

Tree farm/ plantation- Many trees types cultivated are deciduous species, but there are some instances when conifers are preferred. Being relatively fast growing, and usually possessing a single, straight trunk, they are the ideal tree type for use as lumber and paper products. Of course, one cannot forget the need every November and December for Christmas trees.

Palm plantation- The tropics are ideal for growing oil palms. Thousands of acres are devoted to the tree, as so much of our food and other products these days relies on palm oil. This is not a good thing as the demand means that vast areas of rainforest have had to be cleared. In Indonesia, the problem is particularly evident, as the growth of palm plantations is one of the main factors behind the decline of orangutan numbers.

Coconut grove- Almost anywhere you go in the tropics will have coconut palms. Buoyant, the nut floats easily on the currents, and where it is too isolated for a coconut to reach naturally (such as Hawaii), people have brought it with them. As well as the coconuts, the palms themsevles are also used; palm fronds can be used for roofing, and the fibers are used in weaving.

Bonsai forest- The art of growing miniature trees has been practiced for centuries. Some trees are collected in the wild, harsh natural conditions causing the trees to grow slowly and stay small, but many more are shaped over many years. While many bonsai are grown singularly, groves and forests are also popular choices. These can be either monospecific, or mixed, and can be part of a larger landscape creation that includes rocks, water, and figures.

There are plenty of examples of forest areas that are man-made. Don’t feel like you have to confine your story to a natural woodland. Use what you find around you to inspire the setting and drive your characters and the plot. What happens on the earth can easily be applied to science fiction or fantasy. Put your own spin on it (maybe your characters are small and live in a bonsai forest…of course they could also be normal sized people who happen to be in a giant sized bonsai planting).

Edit: As pointed out in the comments/reblogs, I seemed to have forgotten woodlots, so I am going to include those.

Woodlot- Common areas open to members of the community include a mixture of open pastureland and forested areas. People would have their flocks and herds forage here in spring and summer, whilst they managed and harvested the trees. Trees in woodlots would not be felled, instead the branches would be cut back and allowed to regrow. The resulting growth produces straight branches that are used in constructing walls, fences, as well as firewood and charcoal. (Communal pastures and woodlots are not really thought of these days, as many areas were lost over the years due to industrialization, urbanization, and the enclosure of land by the aristocracy)

#writing#creative writing#writing guide#writing inspiration#writing prompts#worldbuilding#writer#writers#writers and poets#writing community#writer on tumblr#writeblr

60 notes

·

View notes

Text

Brazil organizations criticize the postponement of the EU anti-deforestation law and mention agribusiness lobby

Law prevents European countries from buying products from deforested areas

After pressure from the Brazilian government and countries like Indonesia and the Ivory Coast, the European Commission presented a proposal on Wednesday (2) to postpone the anti-deforestation law, which was due to come into force in December of this year.

The European Union Regulation for Deforestation-Free Products (EUDR), determines that European importers must ensure that imported products do not come from areas deforested after December 31, 2020.

The new law affects products from the coffee, soy, palm oil, wood, leather, beef, cocoa and rubber production chains. Estimates say it will affect 15% of all Brazilian exports and 34% of Brazilian exports to the European Union, according to the Ministry of Development, Industry, Trade and Services.

In a statement published on its website, the ministry argues that the law lacks clarity and adequate regulation. The commission's proposal suggests a postponement to December 2025 for products exported by large companies, and to June 2026 for micro and small companies. The EU Parliament and Council will analyze the request.

According to the Climate Observatory, the possible postponement represents a “shameful step backwards." To refute the European Commission's proposal, 25 civil society organizations signed a letter entitled “Every second counts to protect global forests and ecosystems.”

Continue reading.

#brazil#brazilian politics#politics#environmental justice#europe#european union#european politics#environmentalism#international politics#image description in alt#mod nise da silveira

13 notes

·

View notes