#Indian stock Market

Text

Investment Options in India: Diversify Your Portfolio in 2024

Diversification is a fundamental principle of investing, essential for managing risk and optimizing returns. In 2024, as investors navigate an ever-changing economic landscape, diversifying their portfolios becomes even more critical. India, with its vibrant economy, diverse markets, and growth potential, offers a plethora of investment options for both domestic and international investors. In this comprehensive guide, we explore various investment avenues in India in 2024, from traditional options like stocks and real estate to emerging opportunities in startups and alternative assets.

1. Equities: Investing in the Stock Market

Investing in equities remains one of the most popular ways to participate in India's economic growth story. The Indian stock market, represented by indices such as the Nifty 50 and Sensex, offers ample opportunities for investors to capitalize on the country's booming sectors and emerging companies.

- Blue-Chip Stocks: Invest in established companies with a proven track record of performance and stability.

- Mid and Small-Cap Stocks: Explore growth opportunities by investing in mid and small-cap companies with high growth potential.

- Sectoral Funds: Diversify your portfolio by investing in sector-specific mutual funds or exchange-traded funds (ETFs) targeting industries such as technology, healthcare, and finance.

2. Mutual Funds: Professional Fund Management

Mutual funds provide an excellent avenue for investors to access a diversified portfolio managed by professional fund managers. In India, mutual funds offer a range of options catering to different risk profiles and investment objectives.

- Equity Funds: Invest in a diversified portfolio of stocks, including large-cap, mid-cap, and small-cap companies.

- Debt Funds: Generate stable returns by investing in fixed-income securities such as government bonds, corporate bonds, and treasury bills.

- Hybrid Funds: Combine the benefits of equity and debt investments to achieve a balanced risk-return profile.

- Index Funds and ETFs: Track benchmark indices like the Nifty 50 and Sensex at a lower cost compared to actively managed funds.

3. Real Estate: Tangible Assets for Long-Term Growth

Real estate continues to be a popular investment option in India, offering the dual benefits of capital appreciation and rental income. While traditional residential and commercial properties remain attractive, investors can also explore alternative avenues such as real estate investment trusts (REITs) and real estate crowdfunding platforms.

- Residential Properties: Invest in apartments, villas, or plots of land in prime locations with high demand and potential for appreciation.

- Commercial Properties: Generate rental income by investing in office spaces, retail outlets, warehouses, and industrial properties.

- REITs: Gain exposure to a diversified portfolio of income-generating real estate assets without the hassle of direct ownership.

- Real Estate Crowdfunding: Participate in real estate projects through online platforms, pooling funds with other investors to access lucrative opportunities.

4. Startups and Venture Capital: Betting on Innovation and Entrepreneurship

India's startup ecosystem has witnessed exponential growth in recent years, fueled by a wave of innovation, entrepreneurial talent, and supportive government policies. Investing in startups and venture capital funds allows investors to participate in this dynamic ecosystem and potentially earn high returns.

- Angel Investing: Provide early-stage funding to promising startups in exchange for equity ownership, betting on their growth potential.

- Venture Capital Funds: Invest in professionally managed funds that provide capital to startups and emerging companies in exchange for equity stakes.

- Startup Accelerators and Incubators: Partner with organizations that support early-stage startups through mentorship, networking, and access to resources.

5. Alternative Assets: Diversification Beyond Traditional Investments

In addition to stocks, bonds, and real estate, investors can diversify their portfolios further by allocating capital to alternative assets. These assets offer unique risk-return profiles and can act as a hedge against market volatility.

- Gold and Precious Metals: Hedge against inflation and currency fluctuations by investing in physical gold, gold ETFs, or gold savings funds.

- Commodities: Gain exposure to commodities such as crude oil, natural gas, metals, and agricultural products through commodity futures and exchange-traded funds.

- Cryptocurrencies: Explore the emerging asset class of digital currencies like Bitcoin, Ethereum, and others, which offer the potential for high returns but come with higher volatility and risk.

Conclusion

Diversifying your investment portfolio is essential for mitigating risk, maximizing returns, and achieving long-term financial goals. In 2024, India offers a myriad of investment options across various asset classes, catering to the preferences and risk profiles of different investors.

Whether you prefer the stability of blue-chip stocks, the growth potential of startups, or the tangible assets of real estate, India provides ample opportunities to diversify your portfolio and capitalize on the country's economic growth story. By carefully assessing your investment objectives, risk tolerance, and time horizon, you can construct a well-diversified portfolio that withstands market fluctuations and delivers sustainable returns in the years to come.

This post was originally published on: Foxnangel

#best investment options in india#diversify portfolio#share market#stock market#indian stock market#mutual funds#real estate#startups in india#venture capital#foxnangel#invest in india

4 notes

·

View notes

Text

Importance of chart analysis for equity investments

Image by freepik

Chart analysis, or technical analysis, can be quite helpful for equity investment in the Indian stock market. Here are several reasons why it is beneficial:

Benefits of Chart Analysis in the Indian Stock Market

1.Trend Identification

The Indian stock market, like any other, exhibits trends over time. Chart analysis helps in identifying these trends, allowing investors to ride…

#chart analysis#equity investment#Financial Markets#Indian stock market#investment strategies#market analysis#Market Sentiment#Stock Charts#Stock Market#Stock Trading#Support and Resistance#Technical Analysis#Technical Indicators#Trading Patterns#Trend Identification#Volume Analysis

3 notes

·

View notes

Text

Global Market Meltdown: What Caused the Panic?

Lately, there's been a lot of buzz about the significant downturn in global markets. It's hard not to notice when investors from Japan to India and the United States are losing billions. I wanted to dig deeper into what exactly caused this economic upheaval, so I watched an insightful video that breaks down the primary reasons behind this panic. Here’s a more detailed look at the key points discussed.

Global Market Downturn

The global markets have been on a rollercoaster, but lately, it's been a steep downhill ride. From Japan to India, and even the mighty United States, markets have experienced significant declines. Investors are feeling the heat, with billions of dollars seemingly evaporating overnight. The sense of unease is palpable, and everyone is asking the same question: what's causing this chaos?

Impact on India

India, with its rapidly growing economy, hasn't been immune to this downturn. In fact, the Indian markets saw a substantial loss, with approximately 17 lakh crores wiped off, equating to over $2 billion in a single day. That's an astronomical figure, and it's left many investors and analysts scratching their heads.

Weak Corporate Earnings

One of the primary reasons for this downturn in India is the disappointing first-quarter results from the country’s top 50 companies. There was minimal growth and a decline in profits, which has spooked investors. When corporate giants fail to meet expectations, the ripple effect can be severe, leading to a widespread market selloff.

Rupee Devaluation

Adding to the woes, the Indian rupee hit an all-time low against the US dollar, trading at nearly 84 rupees per dollar. A weak rupee makes imports more expensive and exacerbates inflation, which in turn can erode consumer confidence and spending. This devaluation has added another layer of complexity to an already volatile market.

Recession Fears in the US

Over in the United States, the fear of a looming recession is causing major jitters. Rising unemployment and a slowdown in the manufacturing sector are key indicators that all is not well. Recent data shows that 4.3% of Americans are unemployed, the highest rate in nearly three years. This spike in unemployment, coupled with other economic slowdowns, has investors on edge.

Manufacturing Slowdown

The US manufacturing sector, a critical component of the economy, has been experiencing a significant slowdown. This sector's health often serves as a bellwether for the broader economy. When manufacturing slows down, it not only impacts the sector itself but also sends shockwaves through supply chains, affecting various other industries.

Tensions in West Asia

The geopolitical landscape is another major factor contributing to the market instability. The worsening situation in West Asia, particularly involving Iran and its proxies targeting Israel, has escalated tensions. These geopolitical conflicts create uncertainty and risk, which markets despise. The potential for conflict in this volatile region adds to the already heavy load of negative sentiment.

Impact on Global Markets

The negative sentiment isn't confined to India and the US; it's a global phenomenon. Markets worldwide are facing headwinds. The decline in oil prices and a significant selloff in cryptocurrencies are clear indicators that investors are skittish. The interconnectedness of global markets means that turmoil in one region can quickly spread, creating a domino effect.

Decline in Oil Prices

Oil prices have been another critical factor. Traditionally, oil is seen as a barometer for global economic health. A decline in oil prices can signal weakening demand and economic slowdown. This recent drop in oil prices has only added to the growing list of concerns for investors.

Cryptocurrency Selloff

Cryptocurrencies, once the darlings of the investment world, have not been spared either. A significant selloff in cryptocurrencies has been observed, which further highlights the risk-averse sentiment prevailing among investors. The volatility of these digital assets can be both a cause and a consequence of broader market instability.

Climate Change Concerns

Interestingly, the video also touched on an often-overlooked aspect: climate change. While not directly related to the market meltdown, the mention of climate change serves as a reminder that long-term environmental issues can and will have economic repercussions. The call for action, starting with individual efforts like planting trees, underscores the need for a collective approach to combat these challenges.

Individual Efforts

It's easy to feel helpless in the face of such overwhelming economic and environmental issues. However, small actions, such as planting trees and adopting sustainable practices, can collectively make a significant impact. The idea is to start a revolution from the ground up, emphasizing that everyone has a role to play.

Conclusion

The global market meltdown is a multifaceted issue with no single cause. From weak corporate earnings and currency devaluation in India to recession fears in the US and geopolitical tensions in West Asia, several factors have converged to create the current economic turmoil. The interconnected nature of global markets means that instability in one region can quickly spread, affecting economies worldwide.

For those looking to navigate these turbulent times, staying informed is crucial. Websites like TickerInvest.com provide invaluable insights into stock market investments and the latest financial news. Their expert analysis can help you make informed decisions and stay ahead of the curve.

FAQs

What caused the global market meltdown in 2024? The meltdown was caused by a combination of factors, including weak corporate earnings in India, recession fears in the US, geopolitical tensions in West Asia, and a decline in oil prices and cryptocurrencies.

How has the downturn impacted India? India saw a significant loss, with approximately 17 lakh crores wiped off the market. Contributing factors include weak corporate earnings and the devaluation of the rupee.

Why are recession fears rising in the US? Rising unemployment and a slowdown in the manufacturing sector are key indicators of potential recession, causing concern among investors.

What role do geopolitical tensions play in market instability? Tensions in regions like West Asia create uncertainty and risk, which negatively impact market stability and investor confidence.

How are oil prices and cryptocurrencies affecting the market? A decline in oil prices and a selloff in cryptocurrencies reflect broader economic concerns and risk-averse sentiment among investors.

What can individuals do to help combat climate change? Individual efforts like planting trees and adopting sustainable practices can collectively make a significant impact in addressing climate change.

About TickerInvest.com

TickerInvest.com is a premier platform for financial news, stock market analysis, and investment strategies. Whether you're a seasoned investor or just starting out, TickerInvest.com offers a wealth of resources to help you make informed decisions. Their expert analysis, in-depth articles, and real-time market data ensure you stay ahead of the curve. For anyone looking to maximize their investment returns, TickerInvest.com is an invaluable tool. Check them out today and take your investing game to the next level!

#stock market#stock trading#finance#investing stocks#indian stock market#stock market crash#investing

2 notes

·

View notes

Text

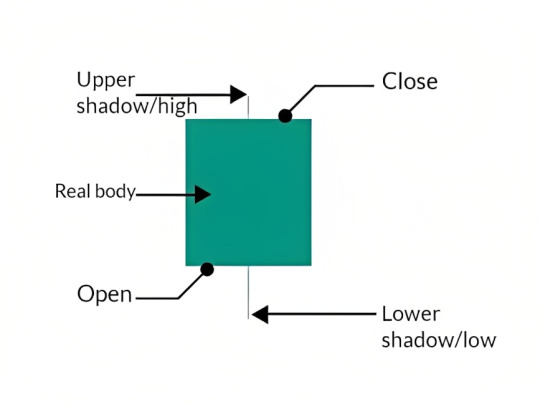

How is a candlestick drawn in stock market?

A candlestick is a widely used chart in technical analysis.The candles tick consists of the following parameters,

1)Open

2)Close

3)Low

4)High

5)Upper shadow

6)Lower shadow

The above parameters together help to draw a single candlestick.However these 6 components are more than just a constructive element for a candlestick.

They provide information related to market behaviour, bull and bearish activities, who is gonna dominate the market etc.

To understand the stockmarket very easily, the first step is to learn the above parameters in detail.

Click Candlestickspot.online to read about them in detail.

#stock market#stock trading#technical analysis#fundamental analysis#forex trading#crypto traders#candlestick pattern#indian stock market

6 notes

·

View notes

Text

Share Trading Course in Bengali

Are you looking to improve your share trading abilities and engage in successful stock market trading? Look no further than our share trading course in Bengali! Our course is taught in Bengali, so you can learn in the language you're most comfortable with. Also, you will be guided by our knowledgeable professors, they will guide you every step of the way, providing personalized support and feedback to ensure you master the material. Sign up right away to get started on the path to financial freedom.

3 notes

·

View notes

Text

Happy Vishwakarma Puja ! ✨🙏

On this auspicious occasion of Vishwakarma Puja, we pay homage to Lord Vishwakarma, the divine architect and symbol of craftsmanship, creativity, and success. May the blessings of Lord Vishwakarma guide us in constructing solid financial portfolios, creating long-term wealth, and achieving sustained success. Let’s harness the power of vision and innovation to shape our financial future with confidence and purpose.

Wishing all traders and investors a prosperous Vishwakarma Puja.

Visit our Website — https://www.ryz.market/blogs

#vishwakarma puja#stock market#share market#stock broker#indian stock market#futures trading#nifty50#investing#trading stocks#stock trading

1 note

·

View note

Text

0 notes

Text

GIFT Nifty Indicates Muted Opening; UCO Bank Hikes Lending Rates by 5bps for Certain Tenures

for more details click here

#William J. O'Neil (William O Neil)#CANSLIM#Indian Stock Market#Stock Market Research#Market Outlook#Stock Screener#Stock Watchlists#Chart Pattern#Stock Analysis#Breakout Stocks#Stocks to Watch#Stocks to Buy#Growth Stocks#Stock Investing#Stock Trading#Momentum Investing#IPO Stocks#Fundamental Analysis#Technical Analysis#Stock M#arket Courses#Best Sector To Invest#Top Stock Advisory Services

0 notes

Text

MSCI EM IMI इंडेक्स में भारत ने चीन को पछाड़ा, भारतीय शेयर बाजार में आएगा 4.5 अरब डॉलर का निवेश

MSCI EM IMI इंडेक्स में भारत ने चीन को पछाड़ा, भारतीय शेयर बाजार में आएगा 4.5 अरब डॉलर का निवेश

#News #MSCIEMIMI #EmergingMarkets #InvestmentStrategy #StockMarket #FinanceGoals #FinancialIndependence #GlobalMarkets #InvestmentTips #WealthManagement

Morgan Stanley IMI Index: मॉर्गन स्टेनली के एमएससीआई इमर्जिंग मार्केट इंवेस्टेबल इंडेक्स (MSCI EM IMI) में सितंबर, 2024 के दौरान भारत ने वेटेज के मामले में चीन को पीछे छोड़ दिया है। सूत्रों ने ये जानकारी देते हुए कहा कि MSCI EM IMI में भारत का वेटेज चीन के 21.58 प्रतिशत की तुलना में 22.27 प्रतिशत रहा।

एक्सपर्ट्स का अनुमान है कि एमएससीआई ईएम आईएमआई में हुए इस बदलाव के बाद भारतीय शेयर बाजार में…

#mobilklasik morgan mobil#4.5 billion dollars investment#angeles city#anlagestrategie#canadian etf#Collector#etf-vergleich#european investor#geldanlage#India overtook China#Indian stock market#investment advisor#investment banking after graduation#investment banking analyst#kapitalanlage#kumita ng pera gamit ang cellphone#make money online#morgan stanley#morgan stanley report on share market#morgan stanley update#MSCI EM IMI index#pagkakitaan online#pampanga#scalable capital#shweta arora#standard and poors#wiley

0 notes

Text

Decoding the Indian Stock Market: A Dive into Different Analysis Techniques

In the vibrant ecosystem of the Indian stock market, investors leverage various analysis techniques to navigate through volatility and identify potential opportunities. Understanding these methodologies is crucial for both new and seasoned investors aiming to make informed decisions. Let’s explore the key types of analysis used in the Indian stock market. https://www.signalz.in/

1 note

·

View note

Text

How to become a technical analyst?

Becoming a technical analyst involves developing a strong foundation in financial markets, acquiring the necessary skills, and gaining practical experience. Here's a step-by-step guide:

1. Educational Background

Finance/Economics Degree: While not mandatory, a degree in finance, economics, or a related field provides a strong foundation.

Self-study: Even if you don't have a formal finance background, self-study can be sufficient. Many technical analysts are self-taught through books and online resources.

2. Learn the Basics of Technical Analysis

Books: Start with foundational books like "Technical Analysis of the Financial Markets" by John Murphy, "Japanese Candlestick Charting Techniques" by Steve Nison, or "Technical Analysis Explained" by Martin J. Pring.

Online Courses: Platforms like Coursera, Udemy, and Investopedia offer courses on technical analysis.

3. Familiarize Yourself with Charting Tools

Charting Software: Get comfortable with charting software like TradingView, MetaTrader, or ThinkorSwim. These tools are essential for technical analysis.

Indicators: Learn about commonly used indicators such as Moving Averages, RSI, MACD, Bollinger Bands, and Fibonacci Retracements.

4. Understand Market Psychology

Study Market Sentiment: Understanding market psychology is crucial. Read about behavioral finance and how emotions drive market movements.

Practice Identifying Patterns: Learn to identify chart patterns like Head and Shoulders, Double Top/Bottom, Flags, and Triangles.

5. Get Certified

Certified Market Technician (CMT): Consider obtaining a CMT designation, which is globally recognized and covers in-depth technical analysis.

NSE Academy's Technical Analysis Courses: If you're in India, the National Stock Exchange (NSE) offers certified courses in technical analysis.

6. Develop a Trading Strategy

Paper Trading: Before risking real money, practice with paper trading to test your strategies without financial risk.

Risk Management: Learn the importance of stop-loss, position sizing, and risk-reward ratios.

7. Gain Practical Experience

Start Trading: Begin with small trades to gain experience. Keep a trading journal to analyze your trades and learn from mistakes.

Internships/Jobs: Seek internships or entry-level positions at brokerage firms, hedge funds, or investment firms to gain hands-on experience.

8. Stay Updated

Continuous Learning: Markets evolve, so it's essential to stay updated with new techniques and tools. Attend webinars, read industry blogs, and follow market news.

Networking: Join financial communities, attend seminars, and engage with other traders to learn and share knowledge.

9. Develop Patience and Discipline

Psychological Discipline: Successful technical analysts are disciplined and patient, avoiding emotional decisions during trading.

Long-term Focus: Technical analysis requires a long-term focus on learning and consistent practice to achieve success.

By following these steps, you can build the necessary skills and knowledge to become a proficient technical analyst.

0 notes

Text

Jackson Hole: Will Fed Chair Jerome Powell Signal Rate Cuts? Potential Impact on Indian Stock Market Analyzed by Experts

As the Jackson Hole Economic Symposium approaches, global financial markets are focused on U.S. Federal Reserve Chair Jerome Powell, who is expected to provide insights into a potential rate cut in September. Analysts suggest that Powell may hint at a 25 basis points (bps) cut, with some even considering the possibility of a 50 bps reduction, depending on recent economic indicators.

The Jackson Hole Symposium, hosted annually by the Federal Reserve Bank of Kansas City, gathers central bankers from around the world to discuss pressing economic issues. This year’s event, scheduled from August 22 to 24, will explore the theme "Reassessing the Effectiveness and Transmission of Monetary Policy."

While many anticipate Powell to clearly signal a rate cut, experts caution that the Fed Chair has emphasized the importance of remaining data-dependent. Nevertheless, the likelihood of a 25 bps cut in September seems increasingly strong.

Expert Opinions on Impact

Madhavi Arora, Lead Economist at Emkay Global Financial Services, noted that market expectations are leaning towards a September rate cut, with Powell likely to prepare the groundwork during his Jackson Hole address. Arora highlighted that markets are currently pricing in a 78% probability of a 25 bps cut. Indian markets, particularly the rate-sensitive IT sector, have already factored in the possibility of rate cuts, but a confirmed cut could still boost sentiment.

Sahil Shah, Managing Director and Chief Investment Officer at Equirus, pointed out that Indian interest rate cycles often mirror U.S. trends. He emphasized that U.S. rate cuts typically benefit technology stocks, which could positively impact Indian IT services. However, Shah also reminded investors that market performance is influenced by various factors beyond interest rates, such as India’s valuation and growth prospects.

Narinder Wadhwa, Managing Director & CEO of SKI Capital, believes that a dovish stance from the Fed could lead to increased foreign portfolio inflows into the Indian stock market. Sectors like IT and pharmaceuticals, with significant exposure to the U.S. market, could see strong gains. However, Wadhwa warned that the extent of the impact would depend on the magnitude of the rate cut and Powell’s commentary on future policy directions.

Manish Chowdhury, Head of Research at StoxBox, expects that Powell and other Fed officials will provide clear hints on the future interest rate trajectory. He anticipates a 25 bps cut in September, which could be positive for Indian equities, particularly in the realty and IT sectors.

Amit Goel, Co-founder and Chief Global Strategist at Pace 360, believes Powell will adopt a cautious approach, suggesting that while the risks now favor rate cuts, the Fed will refrain from signaling a September cut as a certainty. Goel predicts a 25 bps cut in September, noting that a larger 50 bps cut could send an alarmist message about the U.S. economy's health.

Potential Impact on Indian Markets

If Powell signals a rate cut, it could act as a catalyst for Indian markets by attracting foreign investments and boosting sentiment in rate-sensitive sectors. However, experts advise caution, as global markets may experience volatility in response to the Fed’s policy signals. The Reserve Bank of India (RBI) may also consider adjusting its policies in response to the Fed’s actions, further influencing the Indian stock market.

As the world awaits Powell’s address at Jackson Hole, investors should be prepared for potential market shifts driven by the Fed's monetary policy direction.

#Jackson Hole#Jerome Powell#Federal Reserve#Interest Rates#Rate Cut#Indian Stock Market#IT Sector#U.S. Economy#Global Markets#Monetary Policy

0 notes

Text

Stock Market Rebound: Sensex Surges Over 1,000 Points; Nifty Climbs to 24,387

The Indian stock market made a strong comeback on Friday, with the 30-share BSE Sensex jumping 1,098.02 points to 79,984.24 in early trade. Similarly, the NSE Nifty surged 270.35 points to reach 24,387.35. This rebound comes after Thursday's decline and follows a significant rally in the US and Asian markets.

Market Movers

The recovery was broad-based, with all 30 Sensex firms trading in the green. Notable gainers included Tata Motors, Tech Mahindra, Mahindra & Mahindra, HCL Technologies, Power Grid, NTPC, Tata Consultancy Services, and Reliance Industries.

Global Cues

Asian markets, including Tokyo, Seoul, Shanghai, and Hong Kong, were also trading sharply higher. The positive momentum from the US markets, which ended significantly higher on Thursday, further boosted investor sentiment. According to V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services, the sharp rebound in US markets suggests that recession fears may have been exaggerated, as lower-than-expected initial jobless claims indicate a stable labor market.

FII Activity

Foreign Institutional Investors (FIIs) were net sellers on Thursday, offloading equities worth ₹2,626.73 crore, according to exchange data.

Commodity Market

On the commodities front, global oil benchmark Brent crude rose by 0.14% to USD 79.27 per barrel.

The stock market's sharp rise on Friday follows a volatile session on Thursday, where the BSE benchmark declined 581.79 points, or 0.73%, to settle at 78,886.22. The NSE Nifty also retreated by 180.50 points, or 0.74%, to close at 24,117.

As the markets continue to navigate global and domestic cues, investors remain cautiously optimistic about the potential for further gains.

0 notes

Text

Penny stock - Good or bad for investment??

Image by Mateus Andre on Freepik

Choosing penny stocks for investment in the Indian equity market requires careful analysis and a strategic approach due to the high risks and potential for high rewards associated with these low-priced stocks. Here’s a step-by-step guide to help you make informed decisions:

1. Research and Analysis

Fundamental Analysis:

Financial Health: Check the company’s…

#financial research#high risk high reward#Indian stock market#Investment Strategy#investment tips#Market Sentiment#penny stocks#portfolio diversification#Risk Management#stock investment#stock market analysis#Stock Trading#Technical Analysis

1 note

·

View note

Text

Beating estimates, the Indian market performed phenomenally this year, marked by the launch and high performance of significant projects in various sectors of the economy. This remarkable year has seen a rally in mid- and small-cap stocks and a historic number of IPOs. Overall, the Nifty 50 gained 17.40% and the S&P BSE Sensex gained 16.48% in the current year so far.

1 note

·

View note

Text

Eid Mubarak from Ryz Market

“On this Eid-e-Milad, may the blessings of peace and success guide your trades, and may your investments grow steadily, just like your faith.”

Website - www.ryz.market

#stock market#share market#stock trading#indian stock market#futures trading#investing#nifty50#trading stocks

1 note

·

View note