#Stock Investing

Explore tagged Tumblr posts

Text

ÚLTIMA HORA: 🇩🇪 La compañía de seguros más grande de Alemania compra el 24,75 % del bono convertible 2031 de MicroStrategy

2 notes

·

View notes

Text

0 notes

Text

#asx200#australia#investment#stock market#personal finance#stocks#financial freedom#asx#finance#dividend stocks#growth stocks#growth strategies#penny stocks#long term investing#stock investing#stock price

1 note

·

View note

Text

Pengaruh implementasi kebijakan moneter terhadap investasi saham

Implementasi kebijakan moneter memiliki pengaruh signifikan terhadap investasi saham, karena kebijakan ini dapat mempengaruhi kondisi ekonomi secara luas dan ekspektasi investor terhadap pasar saham. Berikut adalah beberapa pengaruh utama kebijakan moneter terhadap investasi saham:

1. Perubahan Suku Bunga: Kebijakan moneter, khususnya yang dilakukan bank sentral, sering kali melibatkan penyesuaian suku bunga.

Suku Bunga Turun: Jika bank sentral menurunkan suku bunga, biaya pinjaman menjadi lebih murah, yang dapat mendorong perusahaan untuk berinvestasi dan ekspansi. Investor seringkali melihat ini sebagai sinyal positif, sehingga harga saham cenderung naik karena ekspektasi pertumbuhan laba.

Suku Bunga Naik: Kenaikan suku bunga cenderung membuat pinjaman lebih mahal dan dapat menurunkan keuntungan perusahaan. Investor mungkin melihat ini sebagai risiko terhadap profitabilitas perusahaan, yang dapat menyebabkan harga saham turun.

2. Likuiditas Pasar: Kebijakan moneter yang ekspansif (misalnya, pelonggaran kuantitatif atau QE) menambah likuiditas dalam sistem keuangan. Dengan meningkatnya likuiditas, investor cenderung memiliki lebih banyak dana untuk diinvestasikan, yang dapat meningkatkan permintaan terhadap saham dan meningkatkan harga saham.

3. Ekspektasi Inflasi: Kebijakan moneter juga memengaruhi ekspektasi inflasi.

Jika inflasi diperkirakan naik dan suku bunga rendah, investor mungkin akan mengalihkan dananya ke aset yang memberikan imbal hasil lebih tinggi, seperti saham, yang dapat meningkatkan harga saham.

Sebaliknya, jika inflasi meningkat tajam dan suku bunga tinggi, daya tarik investasi saham bisa menurun karena kenaikan biaya yang dihadapi perusahaan.

4. Nilai Tukar Mata Uang: Kebijakan moneter dapat berdampak pada nilai tukar mata uang. Suku bunga rendah biasanya melemahkan mata uang domestik, yang bisa menguntungkan perusahaan yang mengekspor barang (karena harga ekspor menjadi lebih kompetitif). Hal ini bisa menarik investor ke saham-saham perusahaan eksportir.

5. Sentimen Investor: Kebijakan moneter juga memengaruhi psikologi pasar. Misalnya, penurunan suku bunga sering dilihat sebagai sinyal dukungan bagi pertumbuhan ekonomi, yang dapat meningkatkan kepercayaan investor terhadap saham. Sebaliknya, kebijakan pengetatan (tightening) bisa memunculkan kekhawatiran tentang perlambatan ekonomi dan berpotensi menurunkan minat terhadap saham.

Secara keseluruhan, kebijakan moneter memainkan peran besar dalam membentuk iklim investasi di pasar saham karena memengaruhi suku bunga, likuiditas, inflasi, dan sentimen ekonomi.

0 notes

Text

GIFT Nifty Indicates Muted Opening; UCO Bank Hikes Lending Rates by 5bps for Certain Tenures

for more details click here

#William J. O'Neil (William O Neil)#CANSLIM#Indian Stock Market#Stock Market Research#Market Outlook#Stock Screener#Stock Watchlists#Chart Pattern#Stock Analysis#Breakout Stocks#Stocks to Watch#Stocks to Buy#Growth Stocks#Stock Investing#Stock Trading#Momentum Investing#IPO Stocks#Fundamental Analysis#Technical Analysis#Stock M#arket Courses#Best Sector To Invest#Top Stock Advisory Services

1 note

·

View note

Text

5 Great Reasons About Angel One Stock

What are your thoughts on Angel One stock? Share your experiences and insights in the comments below!

Angel One Stock: Your Wingman in the Wild World of Stock Trading? Buckle up, investors! We’re about to embark on a thrilling journey into the heart of Angel One, the discount brokerage that’s been making waves in the Indian stock market. Think Robinhood, but with a spicy Indian twist. But here’s the twist—we’re not just talking about using their platform to trade stocks. No, no, we’re going…

View On WordPress

#Angel Broking#Angel One#Discount Brokerage#Financial Analysis#Indian stock market#Investment Tips#NRI Investing#Online Trading#Stock Investing#Wealth Management

0 notes

Text

Gráfico mensual

La vela cerró con una barra de pin sacando la liquidez por encima de $100k y liquidó a todos los toros emocionados.

Esta vela hará que muchos traders se vuelvan bajistas ya que la ven como "Doji" o estrella fugaz. Si lo simplifico, la ven como una señal bajista.

Estructuralmente no ha cambiado nada en Bitcoin, el gráfico se ve absolutamente bien. Una vela no es suficiente para decidir la dirección futura, pero es suficiente para atrapar a las personas que se enfocan en las velas.

Como dije, después de esta vela, muchos traders se volverán bajistas y comenzarán a llamar por precios más bajos.

Quiero ver que baje por debajo del último mínimo mensual para hacer que la gente crea que está a punto de caer fuertemente.

Comenzarán a vender sus posiciones y a vender en corto.

Esto establecerá una buena trampa para los bajistas que llaman por precios mucho más bajos

1 note

·

View note

Text

Key Questions to Ask Before Investing in Stocks

Introduction 1. What is the Company’s Business Model? 2. How Strong is the Company’s Financial Health? 3. What is the Company’s Competitive Advantage? 4. What is the Company’s Growth Potential? 5. What is the Company’s Management Team Like? 6. What are the Risks and Challenges the Company Faces? 7. What is the Valuation of the Stock? Conclusion

View On WordPress

0 notes

Text

Investment Strategies

let’s delve into some detailed investment strategies with examples applicable to the Indian stock market: 1. Long-Term Investing: Strategy: Invest in fundamentally strong companies with a long-term horizon, aiming to benefit from compounding. Example: Invest in a well-established company like HDFC Bank (HDFCBANK) known for its stable growth, strong financials, and consistent dividend…

View On WordPress

#BSE (Bombay Stock Exchange)#Equity Market#Exchange-Traded Funds (ETFs)#Foreign Institutional Investors (FIIs)#Foreign Portfolio Investment (FPI)#Indian Stock Market#Indian Stock Market BSE (Bombay Stock Exchange) NSE (National Stock Exchange) Sensex Nifty Stock Exchanges Stock Indices Equity Market Inves#Investment in India#Market Analysis#Market Performance#Market Regulation#Market Trends#Market Volatility#Mutual Funds#NSE (National Stock Exchange)#Sensex#Stock Exchanges#Stock Indices#Stock Investing#Stock Trading

0 notes

Video

Trending Stocks Today | 24th Oct 2024 | How to find trending stocks in t...

1 note

·

View note

Text

0 notes

Text

Navigating the Stock Market: Tips for Successful Stock Investing

Investing in the stock market can be both exciting and intimidating. With its potential for substantial returns, it’s no wonder that many individuals are drawn to this dynamic and ever-changing field. However, achieving success in stock investing requires a solid understanding of market dynamics, a well-thought-out strategy, and disciplined decision-making. In this blog post, we will explore some…

View On WordPress

#Competitive advantages#Diversification#Emotional decision-making#Financial analysis#Financial Goals#Index funds#Investment Strategy#Long-term investing#Market efficiency#Market fluctuations#Passive investing#Phil Town#Portfolio management#Random walk down Wall Street#Risk Management#Rule 1#Stock investing#Stock Market#Successful investing#Undervalued companies

1 note

·

View note

Text

GIFT Nifty Indicates Positive Opening; Hindustan Petroleum to Invest Rs 2,212 Crore in Raipur Pipeline Project

More details visit here

#William J. O'Neil (William O Neil)#CANSLIM#Indian Stock Market#Stock Market Research#Market Outlook#Stock Screener#Stock Watchlists#Chart Pattern#Stock Analysis#Breakout Stocks#Stocks to Watch#Stocks to Buy#Growth Stocks#Stock Investing#Stock Trading#Momentum Investing#IPO Stocks#Fundamental Analysis#Technical Analysis#Stock M#arket Courses#Best Sector To Invest#Top Stock Advisory Services

1 note

·

View note

Text

death's cradle

#ave mujica#bandori#mutsumi wakaba#wakaba mutsumi#mortis#mutsumortis#<- investing in the mutsumortis stocks. as they say#my art

418 notes

·

View notes

Text

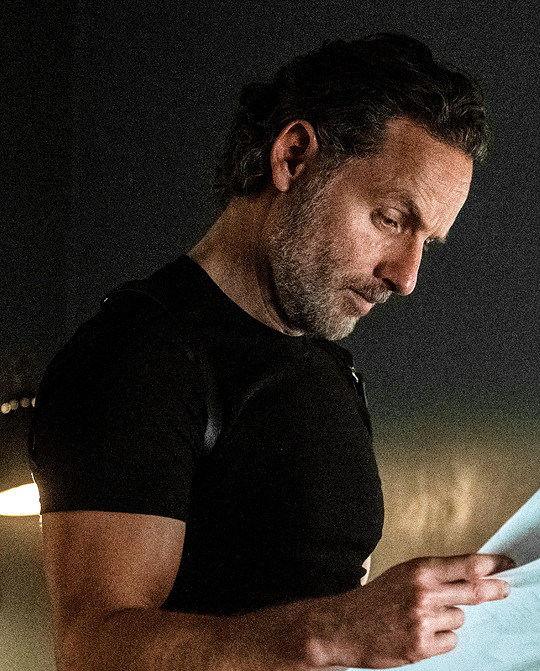

The Ones Who Live - 1x01 - Years

#i need to.....#Rick Grimes#*#rg#The Ones Who Live#EXCUSE ME#if i said you had a beautiful body would you hold it against me#i love arm#anyone remember those sticky hand things you'd get from grocery store quarter machines#that'd be my existence#just rest your head on a tiddy and have a think ya know#S O L I D#nice rack rick#so well proportioned and fit without being bulky i hate bulky#the mold broke#no it didn't you could make a mold#gonna invest in those kneeling pads people who garden a lot use#and stock in Halls or Ricola#until i can't walk tomorrow#until the neighbors call the cops

1K notes

·

View notes