#India Textile Market

Explore tagged Tumblr posts

Text

India Textile Market Size, Share, Trends, Analysis Report 2024-2032

IMARC Group has published a market research report titled “India Textile Market Report by Product (Natural Fibers, Polyesters, Nylon, and Others), Raw Material (Cotton, Chemical, Wool, Silk, and Others), Application (Household, Technical, Fashion and Clothing, and Others), and Region 2024-2032” offers a comprehensive analysis of the industry, which comprises insights on the India textile market…

View On WordPress

0 notes

Text

#bohostyle#marketing#branding#handmade#quilting#sales#home decor#business#business growth#accounting#rural women crating#rural life#rural women#ruralcore#rural india#rural women artist#recycledmaterials#recycling#reduce reuse recycle#recycled costumes#reducewaste#upcylced#upcycle#textile waste recycling#save environment#avoid fast fashion#slow fashion#clothing recycling#patchwork#kanthawork

3 notes

·

View notes

Text

Top Clothing Wholesalers in India | Wholesale Women’s Fabrics & Dress Materials

Disha Enterprise is a leading clothing wholesaler in India, offering a wide range of high-quality women's fabrics, dress materials, and ready-made garments. Whether you're looking for wholesale women’s clothing or online wholesale dress materials, we provide reliable products to boost your inventory. Shop now for premium wholesale options that cater to your business needs!

#Clothing wholesalers in india#Wholesale Women Clothing#online wholesale dress material#Wholesale textile market in Ahmedabad#online clothing wholesalers

1 note

·

View note

Text

India Textile Chemicals Market Analysis, Growth, Report 2023-2030

BlueWeave Consulting, a leading strategic consulting and market research firm, in its recent study, estimated India Textile Chemicals Market size by value at USD 23.14 billion in 2023. During the forecast period between 2024 and 2030, BlueWeave expects India Textile Chemicals Market size to expand at a CAGR of 7.29% reaching a value of USD 40.27 billion by 2030. The Textile Chemicals Market in India is propelled by the growing apparel industry and increasing disposable incomes. Significant investments have been made in the textile sector, with major players, such as Archroma, Croda, Huntsman, and Rossari, expanding their portfolios through partnerships, investments, and mergers to meet changing market demands. These companies are also enhancing their presence in India by investing in research and development, manufacturing, service capabilities, and innovative chemical solutions. For example, Cosmo Speciality Chemicals introduced Silky SF, an economical cationic softener that provides excellent softness for various textiles. Their R&D facility features advanced analytical instruments like DMA, FTIR, imaging IR, SEM-EDS, TGA-MS, DSC, and optical microscopes for molecular-level product development.

By volume, BlueWeave estimated India Textile Chemicals Market size at 3.4 million tons in 2023. During the forecast period between 2024 and 2030, BlueWeave expects India Textile Chemicals Market size by volume is projected to grow at a CAGR of 7.6% reaching the volume of 6.02 million tons by 2030. The demand for technical textiles across India is rising due to the expansion of multiple industries, with the automotive sector being a major end user. It, in turn, is projected to further fuel the growth of India Textile Chemicals Market over the forecast period.

Sample Request @ https://www.blueweaveconsulting.com/report/india-textile-chemicals-market/report-sample

Government’s Supportive Initiatives & Programs to Actively Support Textile Industry

The Government of India has launched several initiatives to bolster the textile industry, significantly impacting the Textile Chemicals Market. The PM MITRA scheme aims to establish Mega Integrated Textile Regions and Apparel Parks, fostering investment and innovation while creating a robust industrial infrastructure. Complementing this, the Production-Linked Incentive (PLI) Scheme incentivizes companies in the textile sector, particularly focusing on synthetic fibers and technical textiles, to enhance domestic manufacturing and reduce imports. Also, the Samarth Initiative promotes skill development within the industry, aiming to train a significant workforce and uplift women, which is crucial for sustainability. The National Technical Textiles Mission (NTTM) further supports innovation and research in technical textiles, enhancing India's global market position. Together, these government schemes not only strengthen the textile industry but also create a favorable environment for growth in the textile chemicals market, driving demand for innovative and sustainable chemical solutions.

West India Dominates Indian Textile Chemicals Market by Region

Western India serves as a key center for the textile manufacturing sector, featuring prominent companies such as Reliance Industries Ltd, Arvind Ltd, and Jindal Worldwide Ltd. Substantial government investments in textile technical parks, along with supportive policies in Gujarat and Maharashtra, are anticipated to enhance the demand for textile chemicals. The west India market, characterized by 300-500 participants due to government subsidies, has experienced consistent growth driven by rising exports and an increasing emphasis on technical textiles. Additionally, stringent environmental regulations in China have created opportunities for Indian producers. The growing focus on high quality, wrinkle-resistant, anti-microbial, and anti-fungal textiles is also propelling the demand for textile chemicals. Western India’s leadership in the textile sector is expected to continue, bolstered by numerous textile mills in the western region.

Competitive Landscape

India Textile Chemicals Market is fragmented, with numerous players serving the market. The key players dominating India Textile Chemicals Market include Archroma, Croda, Huntsman International, Rossari Biotech Ltd, CHT India Pvt Ltd, Kiri Industries, Bodal Chemicals, Indofil Industries, Fibro Organic, and Jaysynth Dyestuff. The key marketing strategies adopted by the players are facility expansion, product diversification, alliances, collaborations, partnerships, and acquisitions to expand their customer reach and gain a competitive edge in the overall market.

Contact Us:

BlueWeave Consulting & Research Pvt. Ltd

+1 866 658 6826 | +1 425 320 4776 | +44 1865 60 0662

0 notes

Text

The Growth of Textile Exports from India: An Informative Overview

India, a country with a rich history and cultural heritage, has always been renowned for its textile industry. With a legacy that spans thousands of years, the Indian textile sector has not only served the domestic market but has also made a significant impact on the global stage. In recent years, there has been substantial growth in textile exports from India, driven by various factors such as government policies, technological advancements, and international trade agreements. This article delves into the dynamic growth of textile exports from India, highlighting key aspects that have contributed to India's success in the global textile market.

Overview of Textile Exports from India

Textile exports from India have seen a remarkable surge over the past decade. According to recent data, India is one of the world's largest exporters of textiles and apparel, accounting for a significant share of the global market. The country's diverse range of textile products, including cotton, silk, wool, and synthetic fibers, has enabled it to cater to various segments of the international market.

Several factors have contributed to the growth of textile exports from India. First and foremost is the availability of abundant raw materials. India is one of the largest producers of cotton, jute, and silk, which has provided a stable supply of high-quality raw materials for the textile industry. Additionally, the country has a large and skilled workforce, which has further bolstered the sector's competitiveness in the global market.

Leading Textile Exporters in India

Textile exporters in India have played a pivotal role in driving the country's export growth. These exporters range from large conglomerates to small and medium-sized enterprises (SMEs), each contributing to the sector's success. Some of the leading textile exporters in India have established themselves as global players, with a strong presence in markets such as the United States, European Union, and the Middle East.

Among the top textile exporters in India, notable names include Reliance Industries, Arvind Limited, Welspun India, and Vardhman Textiles. These companies have invested significantly in modern manufacturing facilities, research and development, and marketing efforts to enhance their global footprint. Furthermore, their commitment to quality, innovation, and sustainability has earned them a reputation as reliable suppliers in the international market.

The Textile Export Industry in India

The textile export industry in India is characterized by its diverse range of products and strong manufacturing capabilities. The industry encompasses various segments, including spinning, weaving, knitting, dyeing, printing, and garment manufacturing. Each segment contributes to the overall value chain, making India a one-stop destination for textile products.

Moreover, the industry has benefited from favourable government policies aimed at promoting exports. Initiatives such as the Scheme for Integrated Textile Parks (SITP), the Merchandise Exports from India Scheme (MEIS), and the Amended Technology Upgradation Fund Scheme (ATUFS) have provided financial incentives and support to textile exporters. These policies have not only stimulated investment in the sector but have also enhanced its global competitiveness.

Technological advancements have also played a crucial role in the growth of India's textile export industry. The adoption of modern machinery and automation has improved production efficiency, reduced labour costs, and enhanced product quality. Furthermore, the industry's focus on sustainability and eco-friendly practices has resonated well with international buyers, who are increasingly seeking sustainable and ethically produced textiles.

Comprehensive List of Textile Products Exported from India

India's textile exports encompass a wide array of products, reflecting the country's diverse manufacturing capabilities. A list of textile products exported from India includes:

Cotton textiles

Including cotton yarn, fabrics, and garments.

Silk textiles

Including silk fabrics and garments.

Woolen textiles

Including woolen yarn, fabrics, and garments.

Synthetic textiles

Including polyester, nylon, and acrylic yarns and fabrics.

Handloom textiles

Including traditional handwoven fabrics and garments.

Technical textiles

Including industrial fabrics, medical textiles, and agro textiles.

Home textiles

Including bed linen, towels, curtains, and upholstery fabrics.

Garments

Including men's, women's, and children's apparel.

This extensive range of products has enabled India to cater to diverse market segments and meet the varying demands of international buyers.

India Textile Exports Data Analysis

The analysis of India textile exports reveals some interesting trends and insights. The country's textile and apparel exports have grown consistently, with a compound annual growth rate (CAGR) of around 10% over the past few years. The key markets for Indian textile exports include the United States, the European Union, the United Arab Emirates, and China.

The data also highlights the increasing share of value-added products in India's export basket. While traditional products such as cotton and silk continue to dominate, there has been a noticeable shift towards higher-value products such as technical textiles and garments. This shift is indicative of the industry's focus on innovation, quality, and branding, which are essential for competing in the global market.

Furthermore, the export data underscores the importance of small and medium-sized enterprises (SMEs) in driving export growth. SMEs account for a significant portion of India's textile exports and have shown remarkable resilience and adaptability in responding to market changes. Their agility and entrepreneurial spirit have been instrumental in tapping new markets and expanding India's global footprint.

Conclusion

In conclusion, the growth of textile exports from India is a testament to the sector's robust capabilities, strategic initiatives, and relentless pursuit of excellence. The combined efforts of government policies, technological advancements, and the dedication of textile exporters have propelled India to the forefront of the global textile market. As the industry continues to evolve, it is poised to seize new opportunities and overcome challenges, ensuring sustained growth and success in the years to come.

For stakeholders in the textile industry, understanding the factors driving this growth and staying informed about emerging trends will be crucial for navigating the dynamic landscape of international trade. Whether you are a business owner, investor, or industry professional, leveraging the insights provided in this article can help you make informed decisions and capitalize on the vast potential of India's textile export sector. However, if you need textile HS codes, export data, or global trade data, you can connect with ExportImportData.in

Frequently Asked Questions (FAQs)

Q1. What are the primary factors contributing to the growth of textile exports from India?

The primary factors contributing to the growth of textile exports from India include the availability of abundant raw materials, a skilled workforce, favorable government policies, technological advancements, and a diverse range of products. Additionally, India's focus on quality, innovation, and sustainability has enhanced its competitiveness in the global market.

Q2. Which countries are the main importers of Indian textiles?

The main importers of Indian textiles include the United States, European Union, United Arab Emirates, China, and several other countries in Asia, Africa, and the Middle East. These countries have a high demand for Indian textiles due to their quality, variety, and competitive pricing.

Q3. What types of textile products does India export?

India exports a wide range of textile products, including cotton yarn and fabrics, silk textiles, woolen textiles, synthetic textiles, handloom textiles, technical textiles, home textiles, and garments. This diverse product range allows India to cater to various market segments and meet the demands of international buyers.

Q4. How has technology impacted the textile export industry in India?

Technology has significantly impacted the textile export industry in India by improving production efficiency, reducing labour costs, and enhancing product quality. The adoption of modern machinery and automation has enabled textile manufacturers to produce high-quality products at competitive prices. Additionally, technological advancements have supported the industry's focus on sustainability and eco-friendly practices.

Q5. What government policies have supported the growth of textile exports from India?

Several government policies have supported the growth of textile exports from India, including the Scheme for Integrated Textile Parks (SITP), the Merchandise Exports from India Scheme (MEIS), and the Amended Technology Upgradation Fund Scheme (ATUFS). These policies provide financial incentives, subsidies, and support for infrastructure development, technological upgradation, and marketing efforts, thereby enhancing the sector's global competitiveness.

Also Read: The Rise of Basmati Rice Export from India

#textile#textile exports from India#textile exporters in India#top textile exporters in India#Textile export industry in India#list of textile products exported from India#India textile exports#textile export data#global trade data#global market

0 notes

Text

0 notes

Text

India's textile industry, among the world's largest and oldest, is crucial to its economy, supporting millions and significantly contributing to GDP. In 2022, exports hit $16 billion, projected to exceed $45 billion by 2031. Let's explore recent export statistics, key exporters, and trends using modern HS codes, Get access to textile export data textile exports from india textile exporter in india textile exporting countriesindian textile exports statistics textile hs code

list of textile products exported from india

#export#import#trade data#import data#export data#international trade#global trade data#trade market#custom data#import export data#global business#textile hs code#textile export data#textile exports from india#list of textile products exported from india#indian textile exports statistics#textile export data of india#textile exporter in india#textile exporting countries#textile

0 notes

Text

0 notes

Text

From Click to Stitch: Exploring Wool Shopping Online in India

In the vast and vibrant landscape of India, the tradition of wool crafting stretches back centuries, embodying a rich heritage of textile artistry and warmth. As we navigate the digital era, the convenience and accessibility of purchasing materials online have transformed the way artisans, hobbyists, and fashion enthusiasts engage with this age-old craft. This article delves into the multifaceted advantages of opting to buy wool online in India, weaving through the ease of access, variety, and the broader implications for the crafting community and the environment.

The Digital Transformation of Wool Crafting

The advent of online shopping has revolutionized the way we access materials and resources. For those looking to buy wool online in India, the digital marketplace offers a plethora of options, from local artisanal yarns to internationally acclaimed brands. This shift not only saves time but also opens up a world of exploration from the comfort of one's home.

A Tapestry of Variety

One of the most significant benefits of buying wool online is the sheer variety available at your fingertips. Whether you're in search of specific types like Merino, Alpaca, or Cashmere, or you need wool with particular properties such as hypoallergenic, moisture-wicking, or eco-friendly, online stores cater to every possible requirement. This variety ensures that every project, whether it be a cozy winter scarf or a delicate shawl, starts with the perfect base material.

Quality and Authenticity at Your Doorstep

Quality is paramount when it comes to selecting wool for your projects. Online vendors often provide detailed descriptions, high-resolution images, and customer reviews to help buyers make informed decisions. Furthermore, many platforms verify the authenticity of their products, ensuring that you get what you pay for. This level of transparency is especially crucial for those investing in luxury wool, as it guarantees the material's origin, treatment, and handling.

Price Points for Every Pocket

Competitive pricing is another advantage of choosing to buy wool online in India. With the ability to browse and compare prices across different websites, buyers can find the best deals that align with their budget. Online stores often run sales and discounts, especially during festive seasons, making high-quality wool more accessible to a broader audience.

Supporting Local Artisans and Sustainable Practices

A noteworthy aspect of the online wool market is the opportunity it provides to support local artisans and sustainable practices. Many online platforms showcase wool sourced from small-scale farmers and co-operatives, promoting ethical sourcing and fair trade. By choosing these products, buyers contribute to the livelihood of local communities and encourage sustainable farming and production methods.

Convenience and Customization

The convenience of online shopping cannot be overstated. With round-the-clock access, easy navigation, and secure payment options, purchasing wool online is a hassle-free experience. Moreover, many online stores offer customization options, allowing buyers to order wool in specific weights, lengths, or colors, tailor-made for their projects.

Building a Community

Online wool purchasing also plays a pivotal role in building and nurturing crafting communities. Through forums, review sections, and social media, crafters can share experiences, advice, and inspiration. This sense of community not only enriches the crafting experience but also fosters a culture of learning and sharing among enthusiasts of all skill levels.

The Environmental Edge

Shopping for wool online can also have environmental benefits. By reducing the need for physical store visits, it cuts down on carbon emissions associated with travel. Additionally, many online stores emphasize eco-friendly practices, from sustainable sourcing to minimal packaging, further reducing the carbon footprint of your crafting materials.

Challenges and Considerations

While the benefits are plentiful, buyers should be mindful of potential challenges. Color accuracy can vary between screens, and the tactile nature of wool means that texture and feel are best experienced in person. However, reputable online stores often offer sample services or flexible return policies to mitigate these issues.

Conclusion

The journey to buy wool online in India is more than a convenience; it's a gateway to a world of diversity, quality, and community. It supports sustainable and ethical practices, connects artisans and crafters, and provides a platform for exploration and growth. As we continue to embrace the digital age, the tradition of wool crafting finds a new dimension, enriched by the global connections and possibilities it brings. Whether you are a seasoned knitter, a budding crochet enthusiast, or a designer in search of the perfect material, the online wool marketplace stands ready to meet your needs, thread by thread, color by color, and skein by skein.

#buy wool online in India#buy wool online#wool shopping#online shopping#knitting materials#yarns#Indian wool market#craft supplies#knitting enthusiasts#wool varieties#online stores#Indian textiles#wool quality#sustainable wool#wool sourcing#wool prices#wool colors#knitting projects#crafting community#wool reviews#wool types

0 notes

Text

Exploring Investment Opportunities in India's Booming Technical Textiles Sector

The Indian technical textiles industry is experiencing an unprecedented surge in growth, presenting lucrative investment opportunities in India for both domestic and international investors. According to the esteemed textiles secretary Rachna Shah, the sector is poised to reach an astounding $50 billion within the next five years, a remarkable leap from its current value of $22 billion. This surge in demand and expansion is a result of the country's unwavering commitment to research and development, focus on skilling, and collaboration with various governmental bodies to enhance the technical textiles landscape.

During a recent event jointly organised by FICCI, BIS, and the Ministry of Textiles, Secretary Rachna Shah highlighted the significant progress witnessed by the technical textiles segment both in India and on the global stage. Currently, the global technical textiles market stands at approximately $260 billion, and it is projected to further surge to a staggering $325 billion by 2025-26. India, with its current market size of $22 billion, is making tremendous strides and is determined to elevate it to an impressive $40-50 billion within the next five years.

To support the growth of the technical textiles sector, the Indian government has adopted a multifaceted approach. One of the crucial elements of this approach is the emphasis on research and development activities, covering a wide range of fibres and applications. By investing in cutting-edge technology and innovation, India is fostering a culture of excellence in technical textiles, making it an attractive destination for investments.

The government is also dedicated to establishing a well-structured skilling ecosystem to nurture a skilled workforce essential for the sector's expansion. By focusing on developing a proficient and knowledgeable talent pool, India is ensuring a sustainable growth trajectory in the technical textiles industry.

Secretary Rachna Shah revealed that the Ministry of Textiles is collaborating closely with various inter-ministries and departments within the government, as well as state governments, to increase the demand and penetration of technical textiles. By creating a robust network of collaborations, the Indian government is fostering an environment conducive to the sector's growth.

Technical textiles are highly specialized products with specific performance requirements. Thus, the Indian government is prioritizing the development of standards and regulations to ensure the quality and safety of these products. By adhering to stringent standards, India aims to bolster the trust of both domestic and international buyers in its technical textile offerings.

Mapping technical textiles with Harmonized System of Nomenclature (HSN) codes is an essential step taken by the government to streamline trade tracking. This mapping will help in effectively monitoring the trade of technical textiles and facilitate smoother transactions for investors and manufacturers alike.

The Ministry of Textiles has already notified two quality control orders (QCOs) for 31 technical textiles categories, including geotextiles and protective textiles, which will be effective from 7th October. Furthermore, draft QCOs for 28 additional items, such as Agro Textiles and Medical Textiles, have been posted on the WTO's website to invite feedback from industry stakeholders. This move reflects the government's commitment to maintaining the quality and standard of technical textiles.

Secretary Rachna Shah stressed the importance of a collaborative approach between certification agencies, industry players, and various government ministries to ensure the success of initiatives and foster continued growth in the technical textiles sector. Such collaborations will create a win-win situation for all stakeholders involved.

As India's technical textiles industry continues to witness remarkable growth, it presents an array of investment opportunities in India for astute investors. With the government's unwavering support, focus on research and development, and commitment to skill development, the sector is primed for exponential expansion. The future of technical textiles in India is bright, and for those looking to invest in a promising and dynamic industry, now is the opportune time to seize the moment.

This post was originally published on: Foxnangel

#Business expansion#business growth#business opportunities in india#Foreign Direct Investment#Fox&Angel#FoxNAngel#Indian market#Indian textiles industry#technical textiles industry

1 note

·

View note

Text

Charting the Unstoppable Rise of Gautam Adani and the Adani Group

“From Mundra Port to Global Heights” Gautam Shantilal Adani, born on June 24, 1962, in Ahmedabad India, is an Indian billionaire industrialist with a net worth of over $100 billion and the founder/ chairman of the Adani Group. Adani Group Adani Group is an Indian multinational conglomerate, headquartered in Ahmedabad, involved in port development, natural gas, food and infrastructure,…

View On WordPress

#Business#GLOBAL EVENTS#GLOBAL HEIGHTS#Global Impact#GLOBAL MARKET#INDIA#INDUSTRIALIST#Innovation#INNOVATION HUBS#MUNDRA PORT#POLITICAL RELATIONS#POLITICS#TECHNOLOGY#TEXTILE MERCHANT

0 notes

Text

Future of Indian Handicraft Industry: Visionary Perspective

Gain insight into the future of the Indian handicraft industry from a visionary perspective. Explore the potential growth, innovation, and sustainability initiatives that can shape the industry's trajectory. Discover how traditional craftsmanship and modern influences can converge to create unique opportunities and propel the industry forward. Stay ahead of the curve and unlock the potential of the Indian handicraft sector with this visionary outlook.

#art and craft#art metal#craft skills#crocheted goods#exports from india#hand printed textiles#handicraft business in india#handicraft goods#Handicraft industry#handicraft industry in india#handicraft market in india#handicraft products#handicrafts business#handicrafts exports#handicrafts industry#handicrafts sector#handprinted textiles and scarves#human resources#india handicrafts#Indian artistry#indian craft#indian handicraft exporter#indian handicraft industry#Indian Handicrafts#indian handicrafts industry#international marketing#local artisans#national handicraft#raw material#textile industry in India

0 notes

Text

The India Textile Chemicals Market is projected to grow at a CAGR of around 11% during the forecast period, i.e., 2023-28. A robust domestic consumption and export growth coupled with an increase in import substitution drive the market across various end-user industries. From June 2017 to May 2018, the textile industry received nearly $4 billion in investments, according to the India Brand Equity Foundation with continuous partnerships, investments, and mergers, key players like Archroma, Croda, Huntsman, Rossari, and others are expanding their portfolios to cater to the emerging needs of the textile market. Besides, through internal investments in R&D, manufacturing and service capabilities, and innovative chemicals, these companies are all set to put a strong foothold in the Indian market.

#India Textile Chemicals Market#India Textile Chemicals Market growth#India Textile Chemicals Market size#India Textile Chemicals Market industry

0 notes

Text

Muslins (cotton fabrics) made in India for the European market in the late 18th and early 19th centuries.

Fabrics designed to be sold and made up in Europe featured a relatively subdued colour palette, distinct from those intended for sale locally, or in Thailand or Indonesia. They were mostly naturalistic florals on white or cream grounds. The designs were block-printed or hand-painted; sometimes, some elements were painted and others embroidered (as in images five and eight).

Block printing uses hand-carved wooden blocks, which are then painted and pressed onto a length of fabric repeatedly to form a design. Each colour and design element requires a separate block.

Printing block of carved wood, India, 19th century

Beverly Lemire, a scholar who writes a lot about textiles and the production of consumer tastes and markets in Europe in this period, writes:

Textiles played a crucial role in defining gender, rank, and race in British imperial expansion during the long eighteenth century. This period saw an emphasis on whiteness in skin and cloth, symbolizing social status and racial hierarchy, with laundering, largely performed by low-ranked and racialized women, maintaining pristine garments representing social “whiteness.” Everyday clothing, its care, and the opulent societal lifestyle of the elite, characterized by events such as masquerade balls, upheld the imperial ethos of race and reinforced social hierarchies. A critical history of empire must examine fabrics and their use, as well as the motivations behind material whiteness. [Empire and the Fashioning of Whiteness: Im/Material Culture in the British Atlantic World, c. 1660–1820]

[Source and more information on fabric # one / two / three / four / five / six / seven / eight]

85 notes

·

View notes

Text

Allie

“My travels inspire my style – recently I’ve been to India and Guatemala, so I’m into bold colors, specialty dyed or woven textiles, bangles, long flowy things, cowboy boots. I’m always drawn to Italian fashion, and love buying things made in Italy. My sweater is Schostal Originals, top from CDMX street market, vest from a Paris pound store, skirt and shoes from Savers, bag Ratio, necklace Long May Love Rule, and glasses Lexxola.“

May 11, 2024 ∙ Bed-Stuy

109 notes

·

View notes

Note

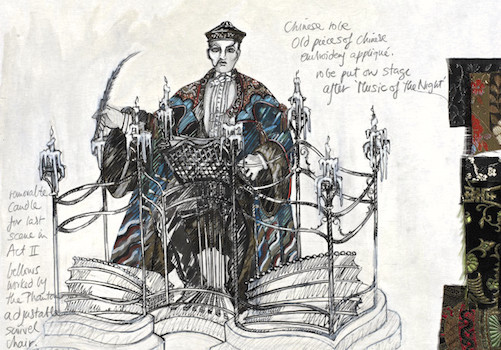

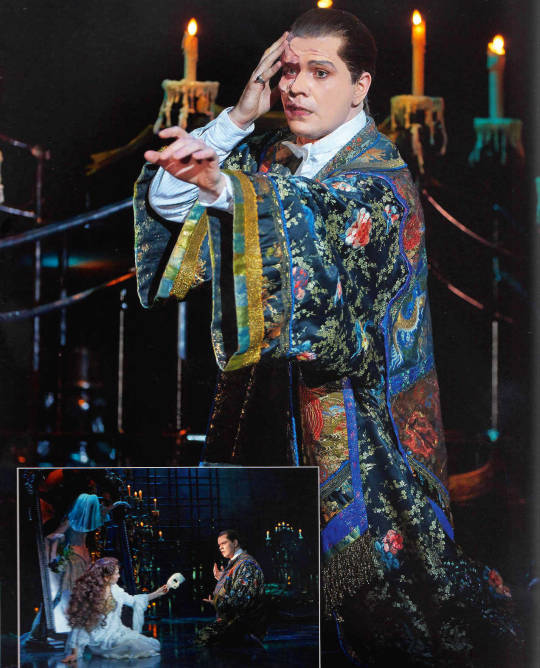

Hi there. Idk if this question has been asked before, but where do they find the fabric for the mandarin coat?

I'd say there are as many answers as there are versions of the costume. But some pointers:

Many of the early versions were made with partly antique embroidered textiles from the Qing dynasty. These were a popular collector's item in the 19th and 20th century, to the point where some of them were never intended for use in China, they were made as souvenirs. The original design by Maria Bjørnson suggests antique Chinese fabrics, with a hem showing the classic water-and-mountain motif, the collar being a cloud collar usually seen in women's attires, and the hat a decorated winter hat.

Even if all these costumes are made from scratch rather than bought, I thought it could be interesting to compare it to a similar authentic Chinese robe - without the collar - dated to the 1890s and sold by Augusta Auctions some years ago:

This robe has a badge - an insignia of rank and position of a Mandarin official in the Qing dynasty. These were used both on the chest and back, and the bird or otherwise animal told onlookers all they needed to know, if the person was a civil or military employee, and how high up in the system they were. The badge is not featured in Bjørnson's design, but it has showed up in a few costumes. Maybe most proninently in Michael Crawford's original West End costume, which Bjørnson would have supervised:

To my eye it looks like many of the elder costumes (up until c. 2005) used a lot of antique or vintage fabrics, but used on a new base. Details to look for is distinct gold couching, re-used badges, special dragon embroideres, antique collars and tabards, fringework etc. I am quite convinced some of these are antique or vintage details, like the China blue tabard with water and mountain motif used by John Owen-Jones in West End c. 2002:

The cuff and details on one of the original Australian robes, and continued to shine in the World Tour up until 2015 or so:

The tabard of the Swedish/Danish version, first made in 1989 and still in use in 2019 (maybe not too visible in the stage photo, but definitely when seen up close backstage!):

As a contrast, newer costumes tends to be brassier and bigger, with less embroidery and more appliquées and trims. It looks to me like they mostly rely on new fabrics and materials, maybe with some elements of elder embroidery. This collar made for Ben Lewis in West End is a good example:

And the recent German version, here seen on Mathias Edenborn in Hamburg. It's a costume I got to study up close and I couldn't spot any particular details that looked old:

And this Broadway robe with what looks like a very new firefly pattern brocade and embroidered gold trims appliquéed on:

So why this change? I guess it depends on what is available. Qing textiles has become more rare on the open market, and more expensive. Elder textiles are also more fragile, while new textiles will handle wear and tear, dry cleaning etc. better. Some of these costumes are used on stage up to eight times a week, after all.

Due to the fragility of elder textiles, they may have to cover the embroidery with fine mesh. This dulls down the effect and makes the costume heavier, so it's not always ideal. Better then to use new stuff. Here's an early 1990 West End one covered with mesh, to protect the embroidery:

A last aspect is of course that by using elder textiles you may put specific meaning-bearing motifs on which ideally shouldn't be there. The beautiful embroidered Indian fabric with elephants and swastikas - in India a symbol of the sun and good luck - which appeared in an unfortunate Danish Elissa skirt is a good example. Luckilly the costume crew knew what they were doing by including the five bats - for good luck - on this Broadway Mandarin robe:

If you plan on making your own costume, I would say: Create the base of a Chinese brocade (silk or synthetic) with predominantely black or dark blue base and polychrome pattern. As an inspiration, here's the robe, collar and tabard - fairly undecorated - in making for Scott Davies (top) and Ben Lewis (bottom) in West End, with photos generously shared by head-of-costume Ceris Donovan:

For the back: Go for a main motif, and build everything around that. And layer! Gems upon trims upon embroideries upon fabrics. The more structure, embroidery, couching and details the various materials has, the better. And then add some on top of that.

Note that it varies if a production do both the robe, cloud collar and tabard. Some production only do two of these, some do all three. But whatever the case, the costume with hat should create angles, texture and lines that makes him stand out from the previous scene, where he wore black and white and tight-fitting clothes.

In West End I think they source it in the many amazing fabric shops in Brixton and Soho, including Borovicks, as well as antique dealers. For Broadway I know a lot was bought in the fabric district in NYC. Other productions may be equipped with fabrics and trims from these, or they may source their own materials locally. I also noticed that the Chinese (left) and Japanese (right) productions tend to use more red and purple fabrics for their versions, which I would think was also locally sourced:

So yeah. As many answers as there are versions out there...

61 notes

·

View notes