#Income tax in USA

Explore tagged Tumblr posts

Text

USA Income Tax

1 note

·

View note

Text

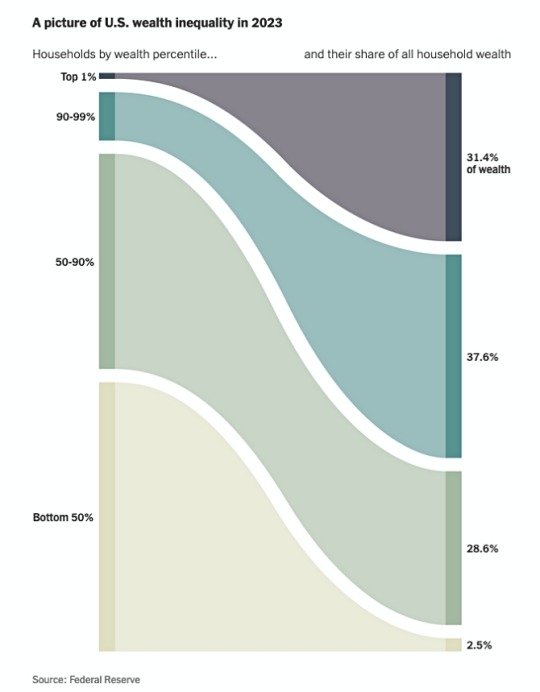

^^^ This is why people think things are getting worse. 1% of the US population owns 31.4% of the nation's wealth.

This is the result of massive tax breaks for the filthy rich which began under Republican Ronald Reagan in the early 1980s, were boosted twice by Republican George W. Bush in the 2000s, and got a big boost under Republican billionaire Donald Trump.

David Leonhardt at the New York Times writes...

The simplest explanation for the shift is that the old economic approach hasn’t worked very well for most Americans. Starting in the 1980s, the U.S. moved toward an economic policy that’s variously described as laissez-faire, neoliberal or market-friendly. It involved much lower taxes for the wealthy, less regulation of business, an expansion of global trade, a crackdown on labor unions and an acceptance of very large corporations. The people selling this policy — like Milton Friedman, a Nobel laureate in economics — promised that it would bring prosperity for all. It has not. Incomes for the bottom 90 percent of workers, as ranked by their earnings, have trailed economic growth, and wealth inequality has soared. For years, Americans have told pollsters that they were unhappy with the country’s direction. Perhaps most starkly, the U.S. now has the lowest life expectancy of any affluent country; in 1980, American life expectancy was typical. Conventional wisdom rarely changes quickly. Friedman and his fellow laissez-faire intellectuals spent decades on the fringes, before the 1970s oil crisis and other economic problems caused many Americans to embrace their approach. But conventional wisdom can change eventually. And after decades of unmet promises about the benefits of a neoliberal economy, more people have grown skeptical of it recently.

Massive tax breaks for the filthy rich as a means of boosting economic growth for all was once regarded as fringe economics – until Ronald Reagan took office. Even the man who became Reagan's vice president referred to such a policy in the 1980 primaries as "voodoo economics" – but to no avail. It has largely overshadowed economic policy for the past 40+ years.

There were only two exceptions. In 1993 when Democrat Bill Clinton raised taxes on the filthy rich. The economy soared and the 1990s became the most prosperous decade since the 1950s. And in 2013 Democrat Barack Obama let the Bush tax breaks expire. Sadly, Trump and the then GOP majorities on Capitol brought back the Bush tax breaks in 2017 and have been ironically blaming poor people for the subsequent rise in the national debt.

As president, Trump often contradicted his own populist rhetoric. (His one big piece of legislation was a tax cut that mostly benefited the rich.)

There needs to be a repeal of the Reagan-Bush-Trump tax giveaways to billionaires like Elon Musk.

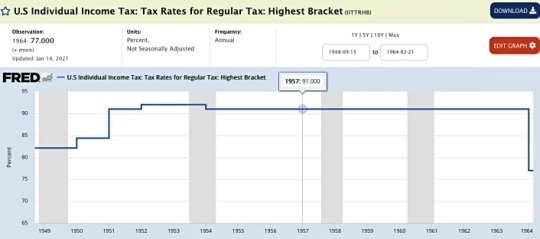

One stat which Republicans don't like hearing is that in the mid 1950s, the highest federal income tax rate was 91%.

Republicans are nostalgic about some stuff about the 1950s like Jim Crow laws and suppression of women and gays. But they don't talk about the federal tax rate on the filthy rich which helped build the Interstate Highway System and provided low cost college education to the masses.

We don't need to go back to a rate of 91% for the Musks, Trumps, and Zuckerbergs. But just under half that rate would dramatically restore economic balance in this country. And the ONLY way to get there is to keep promoting growing Democratic majorities in Congress and electing Democratic presidents. Votes for third party losers are about as helpful as used toilet paper.

#usa#wealth inequality#income inequality#republican tax breaks for the filthy rich#voodoo economics#ronald reagan#george w. bush#donald trump#billionaires are the main beneficiaries of republican rule#prosperity = higher taxes on the rich#vote blue no matter who#election 2024

13 notes

·

View notes

Text

#united states#usa#united states of america#capitalism#politicians#politics#capitalist#anti capitalism#reality#epidemic#shawn fain#employee#employment#employed#society#contribute#freeloader#labor#blue collar#working class#humanity#wall street#passive income#tax evasion#blue collar worker#united auto workers#real shit#true shit#speak the truth#speak on it

2 notes

·

View notes

Text

Hello, American followers! If your Adjusted Gross Income (AGI) for 2022 is $73,000 or less, you can file your return for free via the IRS.

From the IRS website: The Guided Tax Preparation service provides free online tax preparation and filing at an IRS partner site. The partner delivers this service at no cost to qualifying taxpayers. Taxpayers whose AGI is $73,000 or less qualify for a free federal tax return.

Don't pay Intuit, or H&R Block. If your taxes don't require professional assistance, you don't need to pay to file!

31 notes

·

View notes

Text

Why Tax Advisory Services in USA Are Your Compass

The United States tax code is notoriously intricate, a labyrinth of rules and regulations that can leave even the most seasoned business owner or individual feeling lost. This is where tax advisory services in USA come in, acting as your trusted guide through the complexities of the tax landscape. Mercurius & Associates LLP (MAS), a leading provider of tax advisory services in USA, understands the unique challenges faced by individuals and businesses. We offer a comprehensive suite of services tailored to your specific needs, helping you:

Minimize Tax Burden: Our expert advisors analyze your financial situation and identify opportunities for tax optimization, ensuring you keep more of your hard-earned money. Stay Compliant: We navigate the ever-changing tax code on your behalf, ensuring your filings are accurate and timely, avoiding costly penalties and audits. Plan for the Future: Whether you're a growing startup or a seasoned entrepreneur, MAS helps you develop tax-efficient strategies for long-term success. Here are just a few ways MAS can assist you: International Tax Planning: We guide you through the complexities of cross-border transactions and investments, mitigating your global tax risk. Business Entity Structuring: We help you choose the optimal business structure for tax efficiency and asset protection. Mergers & Acquisitions: We advise on the tax implications of M&A transactions, ensuring a smooth and profitable process. Estate & Gift Tax Planning: We safeguard your legacy by developing strategies to minimize estate and gift taxes. But MAS goes beyond just numbers. We believe in building strong relationships with our clients, providing personalized attention and clear communication throughout the process. We're not just your tax advisors; we're your partners in financial success. Investing in tax advisory services in USA is an investment in your future. Choosing MAS means you gain access to a team of experienced professionals who are passionate about helping you achieve your financial goals. Ready to take control of your taxes and unlock your financial potential? Contact MAS today for a free consultation and discover how our Tax advisory services in USA can guide you through the maze of the US tax code.

#audit#accounting & bookkeeping services in india#ajsh#income tax#auditor#businessregistration#chartered accountant#foreign companies registration in india#taxation#ap management services#Tax advisory services in USA

4 notes

·

View notes

Text

the whole libertarian bear village in NH (grafton) thing is especially funny to me personally because most people become libertarians because they don’t want the government to fuck with them, right. however generally speaking you can get the experience of ““who give a shit” -the government” from any small town in the state. the people you have to worry about bringing the force of the law on you are your neighbors- and if your town is small enough, they usually live half a mile or more away. live on a road that isn’t the main thoroughfare and you don’t even get it plowed for snow and you have to call your buddy who has a plow on his truck (or get one yourself!) just don’t be a pest.

grafton just removed basically all the ordinances that let your neighbors bother you about how you’re being a pain in the ass. it did very little in terms of changing anything legally besides slashing the town’s budget. the problem was almost 100% on the population going “well, it’s not my fucking business” about everything their neighbors did- an issue with the attitudes of the people in the town (20% population increase thanks to freestaters) rather than the town’s nitty gritty governance choices themselves.

basically what i’m saying is that there’s an opposite to suburban moms who run HOAs and it involves bears. try to find a happy medium.

#i do have some sympathies to ‘government is inherently coercive’ political ideologies#but the way you deal with the consequences of said ideology are the important bit between ‘functional’ and ‘train wreck’#anyway crank up those property taxes NH they’re a more progressive form of income tax than tax brackets themselves#and involve less busywork to fill out!#NH is in the news because people are harassing NHPR reporters about doing reporting things#by vandalizing their houses#so i started thinking about bear city usa again

2 notes

·

View notes

Text

Esmtaxservices has the best service and staff who speak English and Spanish... When contacting them, say they are calling from this Tumblr page. Thank you.

3 notes

·

View notes

Text

डोनाल्ड ट्रंप अमेरिका में खत्म करेंगे इनकम टैक्स, कहा, दूसरे देशों से वसूलेंगे टैरिफ; जानें दूसरे देशों पर क्या पड़ेगा असर

#News डोनाल्ड ट्रंप अमेरिका में खत्म करेंगे इनकम टैक्स, कहा, दूसरे देशों से वसूलेंगे टैरिफ; जानें दूसरे देशों पर क्या पड़ेगा असर

America News: डोनाल्ड ट्रंप अमेरिका के राष्ट्रपति बनने के बाद से नागरिकता से लेकर टैक्स दरों तक पर अपनी राय खुलकर रख रहे हैं. ‘मेक अमेरिका ग्रेट अगेन’ का नारा देकर सत्ता में दोबारा लौटे डॉनल्ड ट्रंप ने अब अपने देश के टैक्स सिस्टम को लेकर घोषणा की है. उन्होंने अमेरिका में आयकर खत्म करने का प्रस्ताव दिया है. वे इसकी भरपाई अन्य देशों से टैक्स वसूल करके करेंगे. उनका मकसद है अमेरिकी नागरिकों को…

0 notes

Text

Empowering Lives: How the EITC Can Boost Your Donations to Narayan Seva Sansthan USA

The Earned Income Tax Credit (EITC) is a valuable tax benefit for low-to-moderate-income working individuals and families. But did you know that this program can also amplify your impact when you support charitable causes? This article explores how the EITC can help you maximize your donations to organizations like Narayan Seva Sansthan USA, empowering them to provide life-changing support to those in need.

Understanding the EITC:

The EITC reduces the amount of taxes you owe or increases your refund. This valuable program provides a crucial financial boost to millions of Americans.

The Power of Charitable Giving:

Charitable donations to 501(c)(3) organizations like Narayan Seva Sansthan USA are tax-deductible. By supporting their mission to provide prosthetics, surgeries, and rehabilitation services to underprivileged and differently-abled individuals, you not only make a meaningful difference but also receive valuable tax benefits.

Combining the EITC with Charitable Giving:

When you claim the EITC, you may qualify for additional tax deductions, including those related to charitable donations. This can significantly increase your tax refund, providing you with more resources to support the causes you care about.

How it Works:

Claim the EITC: If you meet the eligibility criteria, claim the EITC on your tax return.

Make a Donation: Support Narayan Seva Sansthan USA through a charitable contribution.

Claim Your Deduction: Deduct the amount of your donation from your taxable income, further reducing your tax liability.

Maximizing Your Impact:

By combining the benefits of the EITC with the power of charitable giving, you can:

Reduce your tax burden: Lower your tax liability and potentially increase your tax refund.

Maximize your impact: Your increased refund can be used to make larger donations to organizations like Narayan Seva Sansthan USA.

Support a worthy cause: Contribute to life-changing programs that empower individuals with disabilities.

Conclusion:

The EITC offers a unique opportunity to maximize your giving potential. By claiming the EITC and supporting organizations like Narayan Seva Sansthan USA, you can make a significant difference in the lives of others while also benefiting from valuable tax advantages.

#tax donation#tax deduction#tax benefit donation#tax benefits#Income tax benefits#Taxation in US#Taxation of foreign income in USA#Tax Breaks for Charitable Donations#Tax Deductions in USA#income tax benefits#taxation in us#tax breaks for charitable donations#tax deductions in usa#tax relief#tax relief in USA

0 notes

Text

Federal Tax Comparison for 2024 and 2025: Understanding Tax Rates

Federal tax rates evolve yearly, and PaystubUSA’s comparison of 2024 and 2025 taxes ensures you're prepared. Our concise analysis highlights key updates, empowering you to make informed financial decisions. Choose PaystubUSA for reliable tax insights today.

#Federal Income Tax Calculator#Federal Income Tax Calculator USA#Federal Income Tax Calculator Paycheck#Federal Income Tax Calculator IRS#Federal Income Tax Calculator Payroll#US Federal Income Tax Calculator

0 notes

Text

youtube

Trump 2.0: A New World Order

He's back. And this time he means business. If only the left had got their house in order.

#Jonathan Pie#critique#USA#uk#politics#corruption#money money money#taxes#billionaire#wealth inequality#income inequality#oligarchy

0 notes

Text

^^^ In short, that is why American oligarchs and the filthy rich in general hate unions. Unions generally mean greater income equality.

People who are so nostalgic about the prosperity of the 1950s may not understand that it was a golden age of union membership.

And the federal income tax rates on the filthy rich in the 1950s were almost double what they are now.

#income inequality#the filthy rich#oligarchs#unions#union membership#usa#the economy#federal income tax rates

8 notes

·

View notes

Text

https://www.healthwealthcommunication.com/2025/01/forms-and-documents-relevant-forms-and.html

0 notes

Text

Tax Day 2025: The Earliest and Latest You Can File Your Taxes

It's here again: The 2025 tax season opens in just about a month away. And that means it's time to start getting your tax paperwork together and making a plan for how you're going to file your taxes. It's also time

more..

0 notes

Text

Overview of US and India Tax Systems for Expats and Visa Holders: Ultimate Guide

India Tax Systems: Expats and visa holders in both the United States and India face distinct tax obligations based on their residency status, income sources, and the tax treaties between the two countries. Below is an overview of the key features of the tax systems in both nations as they pertain to expatriates. Key Takeaways US Tax Obligations: Citizens and green card holders must report…

#Cross-Border Taxation#Dual Taxation#Expat Life#Expat Taxes#Financial Tips for Expats#Global Tax Issues#income tax#India#India Tax Laws#international taxation#tax advice#Tax and Finance#Tax and Finance Career#tax compliance#tax filing#Tax Filing for Expats#Tax Guide for Expats#Tax Obligations for Expats#Tax Planning#Tax Planning for Expats#Tax Residency Rules#tax tips#Tax Tips for Expats#tfin career#tfincareer#US#US Tax Laws#US Taxes for Indians#USA#Visa Holders

0 notes