#IRS Direct File

Explore tagged Tumblr posts

Text

Incorrect information above; see below:

Folks, I'm furious and scared as hell about what Musk and Trump is doing; but let's check our sources first.

We have to, given that Musk is a ketamine-deluded bullshit factory.

Can't Have Nice Things

The Ketamine King Musk has shutdown the IRS's Free Tax Filing system.

Of all the things a government could off, a way to Freely calculate and file your taxes seems like a good one. But the richest man in the world thinks we shouldn't have that.

#elon musk#elon fucking musk#irs#tax filing#irs direct file#elon musk bullshit#doge#fuck doge#signal boost#check your sources

29K notes

·

View notes

Text

Hey, if you're in the US, it's tax season again!

Want to make it easy to deal with? And not pay someone else to do it for you? The IRS has continued to expand their free online services - if you live in any of these states (and don't have a more complicated situation), you can file directly with the government and cut out a lot of the cruft in the middle!

(That's almost half the country on-board now; if your state _isn't_ on the list, why don't you contact your governor and state legislature, and ask why they won't let the government money you spend on the IRS be used to provide government services for you...)

Go here: IRS Direct File

Also, not to get political, but this would be a great time to do your taxes early, and support your professional civil servants by taking advantage of the services they provide. There's too many assholes out there who want to take it away from you, because they don't think the government should work for people; don't let them win.

(More below the cut, because I want to send out a simpler version with less of my personal commentary. :)

Now, story time - this was available for me last year and I didn't use it; had a lot of stress going on and so just paid online for one of the big companies that I've used for years to file my taxes, because it was simple and what I already knew how to do. But this year, I wanted to give it a shot, and I thought it'd be useful to report back on the experience.

First thing you need to do is verify your identity; in my case a photo of both sides of my drivers license (other documents like a passport were also an option), and a brief video of my face. I gave them my phone number, and was texted a link that hooked in to my in-process filing so that I just took the pictures directly. Pretty simple, and the rainbow colors on the video were a nice distraction from seeing an unshaven early-morning version of myself. :)

Next was the time to fill in my forms. This is where I should say that there are still some situations where you'll have to do it another way:

You don't have to be from Illinois - I just am, so that's what it'll say here because I screen-shotted this as I went. But notable things they can't yet support are if you moved between states during the year, if you have self-employment or business income, any rental income, or any cryptocurrency income. (Hopefully these will be coming eventually; would love this to be as comprehensive as possible.)

I had to fill in the information from my W2 and assorted forms; there was a note about possibly pulling it directly from my employer's filing, but it wasn't working for me. OTOH, I wasn't able to upload the PDF last year with my paid tax preparation either, so nothing lost there.

Actually, overall it was I think smoother than the service I paid for - a series of check boxes and forms guiding me where to look for what numbers to type in; some complicated questions because the tax code is complicated, but as good an explanation from the IRS as to what it meant as anyplace else. Additionally the IRS doesn't feel the need to add flashy animations or advertise other paid services I might want to engage with, so I never had to fight the feeling that maybe it would be easier if I just gave them another $75. Love to just engage with a service that my taxes have already paid for.

All told, took maybe 30 minutes, at least half of which was setting up and verifying my account with the IRS, which I won't need to do again next year. Then another 10 minutes for my state taxes, which the IRS couldn't do directly for me, but _did_ have a helpful link to my state's free online filing and auto-filled out as much as they could.

Anyway, all told can't recommend this enough. If you have baseless tax anxiety, it's professional, simple, and free - what more could you ask for?

(If you have a basis for tax anxiety, I can't help you, sorry. I am not a tax lawyer, or any sort of government professional. :)

#IRS#taxes#US government#Direct File#IRS Direct File#free tax filing#I support getting the government you paid for and deserve#If you're not in the US I hope your taxes are simple and easy this year too

0 notes

Text

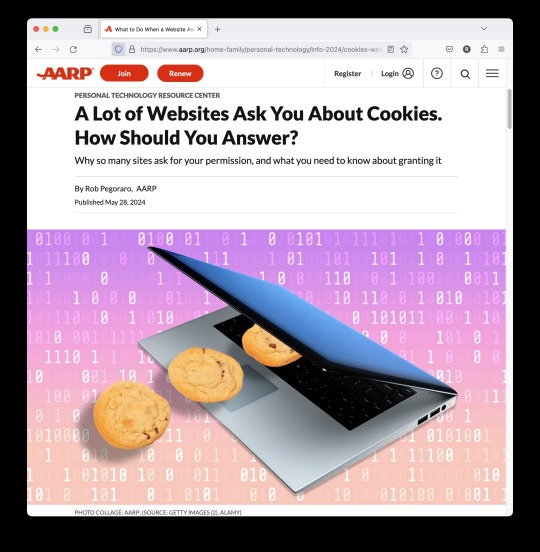

Weekly output: World Mobile, IRS Direct File, Mozilla Creep-O-Meter, 5G ambitions at small carriers (x2), eSIM strategies, Dashlane

This week took me to Atlanta and back to moderate two panels at the Competitive Carriers Association’s conference there, with that group of regional wireless carriers picking up my airfare and lodging. This trip also yielded my first Atlanta dateline since a 1998 Washington Post recap of the Electronic Entertainment Expo and added a new transit stored-value card to my collection. 10/16/2023:…

View On WordPress

#5G broadband#Atlanta#CCA#Competitive Carriers Association#Dashlane#digital privacy#e-file taxes#fixed wireless access#FWA#Intuit#IRS direct file#Mozilla#password managers

0 notes

Text

Yeah, I’ve been encouraging my co-workers to use it and quickly.

I naively gave a sigh of relief once it opened this year. Surely they couldn’t close down the site until April 16-ish at the earliest…

Musk steals a billion dollars from low-income Americans and sends it to Intuit

I'm about to leave for a 20+ city book tour for my new novel PICKS AND SHOVELS. Catch me on Feb 14 in BOSTON for FREE at BOSKONE , and on Feb 15 for a virtual event with YANIS VAROUFAKIS. More tour dates here.

Let me tell you about the most wasteful US federal government spending I know about. It's a humdinger. You and everyone you know are mired in it for weeks, or perhaps months, every year. It will cost you, personally, thousands of dollars over your lifetime. I'm talking about filing your taxes.

Not paying your taxes. Paying your taxes is fine. It keeps the country running, though not because the government needs our "tax dollars" to pay for things. The government annihilates the money it taxes away from us, and creates new money to pay for programs. The USA needs US citizens' dollars to build highways the same way Starbucks needs its Starbucks gift cards to make lattes – that is, not at all:

https://theglobepost.com/2019/03/28/stephanie-kelton-mmt/

I'm talking about filing your taxes. In nearly every case, a tax return contains a bunch of things the IRS already knows: how much interest your bank paid you, how much your employer paid you, how many kids you have, etc etc. Nearly everyone who pays a tax-prep place or website to file their tax return is just sending data to the IRS that the IRS already has. This is insanely wasteful.

In most other "advanced" countries (and in plenty of poorer countries, too), the tax authority fills in your tax return for you and mails it to you at tax-time. If it looks good to you, you just sign the bottom and send it back. If there are mistakes, you can correct them. You can also just drop it in the shredder and hire an accountant to do your taxes for you, if, for example, you run a small business, or are self-employed, or have other complex tax needs. A tiny minority of tax filers fall into that bucket, and they keep the tax-prep industry in other countries alive, albeit in a much smaller form than in the USA.

In the US, we have a duopoly of two gigantic tax-prep outfits: H&R Block, and Intuit, owners of Turbotax. These companies make billions from low-income, working Americans every year, charging them to format a bunch of information the IRS already has, and then sending it to the IRS on their behalf. These companies lobbied like crazy for the right to tax you when you pay your taxes.

In 2003, it looked like the IRS would start sending Americans pre-completed returns, so H&R Block and Turbotax went into lobbying overdrive, whipping up a "public private partnership" called the "Free File Alliance," that promised to do free tax prep for most Americans. But once the threat of IRS free filing was killed, they turned Free File into a sick joke. Americans who tried to use Free File were fraudulently channeled into filing products that cost money – sometimes hundreds of dollars – to use, a fact that was only revealed after the taxpayer had spent hours keying in their information. Free File sites were also used to peddle unrelated financial products to tax filers, with deceptive language that implied that buying these services was needed to file your return:

https://www.propublica.org/article/inside-turbotax-20-year-fight-to-stop-americans-from-filing-their-taxes-for-free

The big winner from the Free File scam was Intuit, which bought Turbotax in 1993. They made about one billion dollars per year ripping off Americans they'd promised to file free tax returns for. After outstanding work by Propublica, lawmakers and the IRS were finally pressured to create an IRS-based free filing service that would cut Intuit out of the loop. Intuit went on a lobbying blitz without parallel, giving out $3.5m in bribes in 2022 in a bid to kill the Treasury Department's study of a free filing service:

https://pluralistic.net/2023/02/20/turbotaxed/#counter-intuit

In 2022, nearly every US state attorney general settled their lawsuits against Intuit for the Turbotax ripoff, bringing in $141m:

https://www.agturbotaxsettlement.com/Home/portalid/0

In 2023, the FTC won a case against Intuit over the scam:

https://www.ftc.gov/business-guidance/blog/2023/09/nine-takeaways-initial-decision-intuit-turbotax-action

But Intut was undeterred. They came back in 2023 with a campaign to say that ripping off American tax-filers was antiracist and anyone who wanted the IRS to make filing free was, therefore, a racist:

https://pluralistic.net/2023/09/27/predatory-inclusion/#equal-opportunity-scammers

Strangely, no one bought that one. By May, 2023 the IRS had announced its own, in-house free file program:

https://pluralistic.net/2023/05/17/free-as-in-freefile/#tell-me-something-i-dont-know

Now, no one is forcing you to use this program. Do you have a family accountant that your grandparents started using in the Eisenhower administration? Just keep going to them. Do you like using Turbotax? Keep using it! Wanna do your own taxes? Here's the forms:

https://www.irs.gov/pub/irs-pdf/f1040s.pdf

But if you want to file your taxes for free, and you earn $125,000/year or less, here's the IRS's service:

https://www.irs.gov/filing/irs-direct-file-for-free

Better use it quick, though. Elon Musk has just announced that he's killing it. Yeah, I know, no one elected him. That doesn't seem to matter to anyone, least of all Democrats on the Hill, who are still showing up for work every day and trying to engender a "spirit of comity" rather than screaming and throwing eggs:

https://apnews.com/article/irs-direct-file-musk-18f-6a4dc35a92f9f29c310721af53f58b16

Musk called IRS free file a "far left" program and announced that he had "deleted it." By the way, the median Trump voter's income is about $72k, meaning more than half of Trump voters qualified for free file:

https://fivethirtyeight.com/features/the-mythology-of-trumps-working-class-support/

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2025/02/11/doubling-up-on-paperwork/#rip-freefile

Image: Wcamp9 (modified) https://commons.wikimedia.org/wiki/File:Elon_Musk_-_March_28,_2024_%28cropped%29.jpg

CC BY 4.0 https://creativecommons.org/licenses/by/4.0/deed.en

#irs direct file#irs#direct file#us taxes#fuck elon musk#fuck trump#fuck turbotax#fuck h and r block

275 notes

·

View notes

Text

In a post on X, unelected government official Elon Musk revealed that he has cut the staff of the Internal Revenue Service that oversaw the system that allows Americans to file their taxes for free easily on its website.

A right-wing MAGA influencer called the "direct file" tax program a "far left government wide computer office" that was "built by Elizabeth Warren."

He claimed, "Direct file puts the government in charge of preparing people's tax returns for them," he claimed.

768 notes

·

View notes

Text

"Direct File" doesn't seem to be gone, (yet,) but it's really fucking scary that Musk is talking about getting rid of it

Direct Files helps you with your fucking taxes. Something that doesn't matter to Musk who doesn't pay taxes, but matters a whole lot to 99% of Americans.

#donald trump#trump#republicans#trump supporters#conservatives#conservative#republican#elon musk#direct file#irs#taxes#president elon musk

185 notes

·

View notes

Text

hmmm inc anyone needs help choosing where to file their taxes esp if you do state ones, i used cashapp this yr for federal and they arent filing my states yet but supposedly itll all be free when i do those too. just my experience:

- freetaxusa was entirely free but they dont efile state tax returns so i had to print mine out and mail them which was annoying and not free

- i filled everything out on taxslayer this yr only to realize it switched me from free to classic fsr at some point "because something i filled out determined i dont qualify for their free version" but idk what that was (so wanted to charge me $60 to finish filing them) it didnt warn me and mine should be free according to the irs + fiance had similar income and they did all his for free. so. idk i guess im avoiding them bc that sucked

#just putting this out there inc it helps anyone. the ca ones are limited to like single state taxes and a few other things but if it applies#and like me your state doesnt allow the direct online filing w the irs.. i feel like this was a pretty good option

4 notes

·

View notes

Text

something important that I want to add here - the Free File program linked above, which is a partnership with third party tools, is a great option - but what the tweet is referencing is a NEW program where you can file directly with the IRS. Direct File debuted last year, and while it expanded this year, is still available only if you’re in certain states.

If you’re in these states I really encourage you to try out the Direct File program!! Popular use and user feedback can only help the program grow.

127K notes

·

View notes

Text

ABD’de 30 Milyon Kişi İçin Vergi Kolaylığı: IRS, Ücretsiz Vergi Beyan Programını 25 Eyalete Genişletti!

💰 IRS’ten büyük vergi kolaylığı! 📑🚀 📢 Direct File programı artık 25 eyalette kullanılabilecek. ✅ 30 milyon kişi ücretsiz ve hızlı vergi beyanı yapabilecek. ⚠️ Sermaye kazancı veya kira geliri olanlar bu programdan yararlanamayacak. IRS’in Direct File Programı 25 Eyalete Genişletildi! 📌 ABD Gelir İdaresi (IRS), geçen yıl pilot olarak başlattığı ücretsiz vergi beyan programını genişletiyor. 📢…

0 notes

Text

psa for usamericans

if you live in any of the states below: the tax filing resource you should be looking for is IRS Direct File; you can file federal taxes directly on the IRS' website, they have a free support helpline if you're stuck, they'll also redirect you to a free preparer for state taxes, and it should work with most tax situations

if you live in any other state (or aren't eligible for Direct File) and your total income for the year was $84,000 or less, you're eligible for IRS Free File; this only covers federal taxes, and works through external providers, but will guarantee that you can use their tax preparation services for free

if you are eligible for Direct File, though, you should use it! obviously very few things about the current political situation are certain right now, but it is a genuinely good and revolutionary way to handle tax paperwork and it's a lot more likely to stick around and expand into more states if more people actually know how to access it and end up using it

#maple.txt#taxes#have seen like 3 different PSAs talking about direct file and how cool it is before promptly linking exclusively to free file#so this is my attempt to correct the record

13K notes

·

View notes

Text

How Goldman Sachs's "tax-loss harvesting" lets the ultra-rich rake in billions tax-free

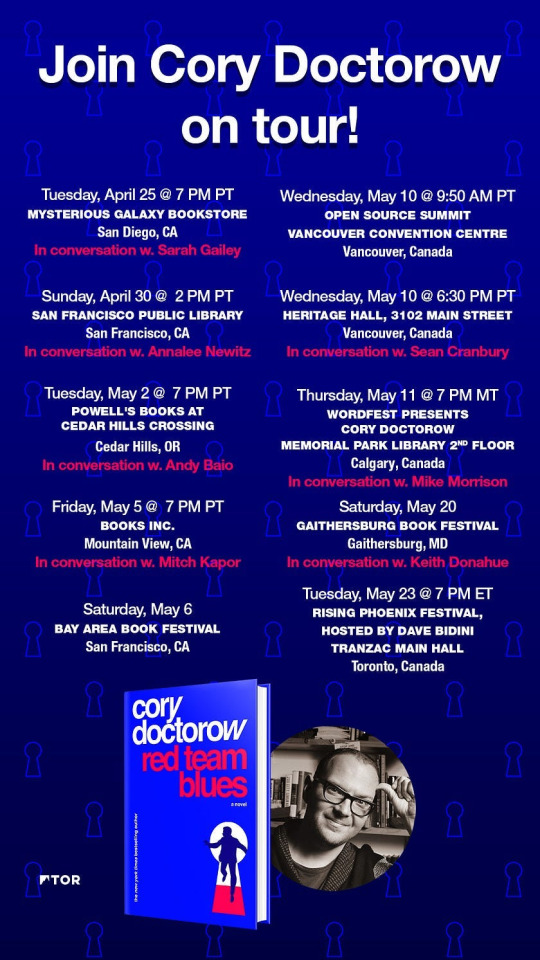

Tomorrow (Apr 25) I’ll be in San Diego for the launch of my new novel, Red Team Blues, at 7PM at Mysterious Galaxy Books, hosted by Sarah Gailey. Please come and say hi!

_,.-'~'-.,__,.-'~'-.,__,.-'~'-.,__,.-'~'-.,__,.-'~'-.,_

With the IRS Files, Propublica ripped away the veil of performative complexity disguising the scams that the ultra-rich use to amass billions and billions (and billions and billions) of dollars, paying next to no tax, or even no tax at all. Each scam is its own little shell game, a set of semantic and accounting tricks used to gussy up otherwise banal rip-offs.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/04/24/tax-loss-harvesting/#mego

The finance sector has a cute name for this kind of complexity: MEGO, which stands for "my eyes glaze over." If you're trying to rip off a mark, you just pad out the prospectus, make it so thick they decide there must be something good in there, the same way that any pile of shit that's sufficiently large must have a pony under it...somewhere.

Propublica's writers haven't merely confirmed just how little America's oligarchs pay in tax - they've also de-MEGO-ized each of these scams, like the way that Peter Thiel used the Roth IRA - a tax-shelter for middle-class earners to help save a few thousand dollars for retirement - to make $5 billion without paying one cent in tax:

https://pluralistic.net/2021/06/26/wax-rothful/#thiels-gambit

One of my favorite IRS Files reports described how Steve Ballmer - the billionaire ex-CEO of Microsoft - laundered vast fortunes into a state of tax-free grace by creating hundreds of millions in "losses" from his basketball team, the LA Clippers. Ballmer paid 12% tax on the $656 million he took out of the Clippers - while the players whose labor generated that fortune paid 30-40% on their earnings:

https://pluralistic.net/2021/07/08/tuyul-apps/#economic-substance-doctrine

That was Propublica's first Ballmer story, back in the summer of 2021. But they ran a followup last February that I missed (it came out while I was on a book tour in Australia), and it's wild: a tale of "loss harvesting," a form of fuckery involving Goldman Sachs that's depraved even by their own standards:

https://www.propublica.org/article/irs-files-taxes-wash-sales-goldman-sachs

Loss farming is a scam that was invented in the 1920s, whereupon it was promptly banned by Congress. But Goldman and other plutocrat Renfields have come up with tiny modern variations on this century-old con that the IRS is either unable or unwilling to address.

Here's how it works. Say you've got a stock portfolio where some of the stocks have gone up and others have gone down. You want to sell the high stocks and hang onto the low ones until they bounce back. But if you sell those stocks that have gone up, you have to "realize" the profit from them and pay 20% capital gains tax on them (capital gains tax is the tax you pay on money you get from owning things; it's much lower than income tax - the tax you pay for doing things).

But you pay tax on your net capital gains - the profits you've made minus the losses you've suffered. What if you sold those loser stocks at the same time? If you made a million on the good stocks and lost a million on the bad ones, your net income is zero - and so is your tax bill.

The problem is that selling stocks when they've gone down is a surefire way to go broke. Every investing book starts with this advice: you will be tempted to hold onto your stocks that are going up, because they might continue to go up. You'll be tempted to sell your stocks that are going down, because they may continue to go down. But if you do that, you'll only sell the stocks that have lost money, and never sell the stocks that have made money, and so you will lose everything.

Back when the pandemic started, your shares in movie theater chains were in the toilet, while your stock in tech companies shot through the roof. If you sold the tech stocks then and held onto your movie stocks and sold them now, you'd have cleaned up - today, tech stocks are down and movie theater stocks are up. But if you sold the cinema shares when they bottomed out, and held onto your tech stocks when they were peaking, you'd be busted today.

So selling your loser stocks to offset the gains from your winners is a bad idea. That's where loss-farming comes in: what if you sold your tech stocks at their peak, and sold your bottomed-out cinema stocks at the same time, but then bought the cinema stocks again, right away? That way you'd have the "loss" from selling the cinema stocks, but you'd still have the stocks.

That's called "wash trading," and Congress promptly banned it. If you've heard of wash-trading, it's probably something you picked up during the NFT bubble, which was a cesspit of illegal wash-trading. Remember all those eye-popping NFT sales? It was just grifters with multiple wallets, buying NFTs from themselves, making it seem like there was this huge, white-hot market for monkey JPEGs. Wash-trading.

Turns out that crypto really did democratize finance...fraud.

Wash-trading has been illegal for a century, but brokerages have invented modern variations on the theme that are legal-ish, and the most lucrative versions of these scams are only available to billionaires, through companies like Goldman Sachs.

There are a bunch of these variations, but they all boil down to this: there are lots of ways to sell an asset and buy it again, while making it look like you bought a different asset. Like, say you're invested in Chinese tech companies through an exchange-traded fund (ETF) that bundles together "all the Top Chinese tech stocks."

Maybe you bought this fund through Vanguard, the giant brokerage. Now, say Chinese stocks are way down, because the Chinese government is doing these waves of lockdowns on the factory cities. If you could sell those Chinese stocks now, you'd get a massive loss, enough to wipe out all the profits from all your good stocks.

But of course, China's going to figure out the lockdown situation eventually, so you don't want to actually get rid of those stocks right now, especially since they're worth so much less than you paid for them. So right after you sell your Vanguard Chinese tech ETF shares, you buy the same amount of Schwab's Chinese tech-stock ETF.

An ETF of "leading Chinese tech companies" is going to have basically the same companies' stock in it, no matter whether it's sold by Vanguard, State Street or Schwab. But as far as the IRS is concerned, this isn't a wash-trade, because you sold a thing called "Vanguard ETF" and bought a thing called "Schwab ETF" and these are different things (even if the main difference is the name on the wrapper, and not what's inside).

There's other ways to do this. For example, lots of companies have different "classes" of stock. Under Armour sells both Class A (voting) and Class C (nonvoting) stocks. Though voting stock is worth a little more than nonvoting stock, they both rise and fall together - if the Class A shares are up 10%, so are the Class C shares. So you can dump your Under Armour Class A's, buy Under Armour Class C's and own essentially the same amount of Under Armour stock - but as far as the IRS is concerned, you just sold your interest in one company and bought an interest in a different company, and you can take a big loss and write down your profits from other stock trades.

The IRS does prohibit wash-trading, but only in the narrowest sense. Brokerages are obliged to report trades in which a customer buys and sells exactly the same security, with the same unique ID (the CUSIP number), within 60 days. Beyond that, IRS guidance is extraordinarily wishy-washy, calling on filers to "consider all the facts and circumstances" of their transactions. Sure, that'll work.

Propublica found zero instances of the IRS targeting any of these trades, ever, for enforcement. That's especially true of the most egregious version of loss-harvesting, a special version that only the ultra-rich can take advantage of, called "direct indexing." You might know about "index funds," where a brokerage sells a single fund that tracks a broad index of stocks - for example, you can buy an S&P 500 index that goes up and down with the total value of the top 500 stocks in America.

Direct indexing is something that giant banks like Goldman Sachs offer to their very richest clients. The brokerage buys a mix of stocks that are likely to track the whole index, and puts those shares directly into the client's account. Rather than owning shares in a fund that owns the stocks, you own the stocks directly. That means that when you want to harvest some losses, you can sell just a few of the stocks in the index, rather than your shares in the whole fund.

Here's how that works. In 2017, the US index was up 20%; global indexes were up even more. Steve Ballmer made a bundle. But Goldman Sachs, acting on Ballmer's behalf, sold s few of the stocks in the portfolio and harvested a $100,000,000 loss, that Ballmer could use to trick the IRS into treating his massive profits as though he'd made very little taxable income.

Goldman uses a whole range of tricks to keep billionaires like Ballmer in a lower tax-bracket than the janitors who clean the floors after his team's games. They not only buy and sell different classes of stock in companies like Discovery and Fox; they also buy and sell the same company's stock in different countries. For example, they sold Ballmer's shares in Shell in one country, and then immediately bought the same amount of shares in another country. The IRS doesn't treat this as a wash-trade, despite the fact that the shares have the same value, and, indeed, companies like Shell routinely merge their overseas and domestic shares with no change in valuation.

Thanks to Goldman's ruses - and the IRS's willingness to accept them - Ballmer's wealth has swollen to grotesque proportions. He generated $579 million in losses from 2014-18, and as a result, got to keep at least $138m that he'd have otherwise had to pay to the IRS.

Goldman's not the only one in on this game: Iconiq Captial - a firm that also offers marriage partner scouting for its richest clients - has $13.2 billion under management on behalf of just 337 people. Among those high-rollers: Mark Zuckerberg, whose $88m in gains from Iconiq investments were offset by $34m in imaginary losses that the company manufactured with wash-trades.

In theory, the simplest form of wash-trading - selling your Vanguard China fund and buying a Schwab China fund - is available to any investor. Leaving aside the fact that the top 1% of Americans own most of the stock, this is still a deceptive proposition. This kind of wash-trading only benefits investors who hold their shares outside of a sheltered retirement account, which is a vanishing minority indeed.

Instead, the primary beneficiaries of this activity are the usual suspects: convicted monopolists like Ballmer, or useless scions of wealthy families, like the kids of Walmart founder Sam Walton, who emerged into this world through very lucky orifices and are thus effectively exempt from the need to work or pay tax for life.

Jim Walton is Sam Walton's youngest orifice-lottery-winner. Young Jim saw a $10 billion increase in his wealth from 2014-18, making him the tenth richest person in America. Thanks to wash-trading, he declared only $111 million of that $10 billion on his taxes, and paid $0.00 in tax on that $10 billion gains.

One way that the rich are especially well-situated to exploit loss-harvesting is in converting short-term gains - which are taxed at 40% - into long-term gains, which are taxed at 20%. For people who make a lot of money buying and selling shares as pure speculation, flipping them in less than a year, wash-trading can create the appearance of long-term holdings. Analyzing their trove of leaked IRS files, Propublica showed that Americans who report over $10 million in income almost never report short-term gains. Instead, two-thirds of the richest Americans report short-term losses.

One fascinating wrinkle is that rich people may not even know this is going on. Whatsapp co-founder Brian Acton, managed to "lose" $2.9 million when he sold $17 million in shares - the same day he bought $17 million in shares in nearly the same companies from another brokerage. Then, a few months later, he reversed those transactions, selling his new fund and buying the old one and harvesting another $600,000 in losses.

When Propublica asked Acton about this, he told them he was "not really aware of any events like that...Broadly my wealth is managed by a wealth management firm and they manage all the day to day transactions."

This is completely believable and consistent with the extraordinarily frank account of how elite money-management works that Abigail Disney described in 2021, where the ultra-rich are insulated from the scams, tricks and wheezes that lawyers and accountants dream up to keep their fortunes steadily mounting with no action needed on their part:

https://pluralistic.net/2021/06/19/dynastic-wealth/#caste

Could the IRS block this kind of wash-trading? Yes, but they'd need action from Congress. The most effective way to do this would be to force shareholders to "mark to market" the value of their holdings, taxing them each year on the fluctuations in their portfolio.

Propublica notes that this is incredibly unlikely to happen, though. As an alternative, Congress could change the rule that blocks investors from claiming losses when they buy and sell "substantially identical" shares with a rule that applies to "substantially similar" stocks. This proposal comes from Columbia Law's David Schizer, who says the law "ought to be updated to reflect how people invest today instead of how they invested 100 years ago."

But for any of that to have an effect, the IRS would have to change its auditing and enforcement practices, which currently see low-income earners (who can't afford fancy tax-lawyers who'll tie up the IRS for months or years) being disproportionately targeted, while America's super-rich, ultra-rich, and stupid-rich are allowed to submit the most hilariously, obviously fictional returns and get away with it.

_,.-'~'-.,__,.-'~'-.,__,.-'~'-.,__,.-'~'-.,__,.-'~'-.,_

Catch me on tour with Red Team Blues in San Diego, Burbank, Mountain View, Berkeley, San Francisco, Portland, Vancouver, Calgary, Toronto, DC, Gaithersburg, Oxford, Hay, Manchester, Nottingham, London, and Berlin!

_,.-'~'-.,__,.-'~'-.,__,.-'~'-.,__,.-'~'-.,__,.-'~'-.,_

[Image ID: A dilapidated shack. A sign reading 'Internal Revenue Service Building' stands next to it. From its eaves depends another sign, reading 'Internal Revenue Service' and bearing the IRS logo. From the window of the shack beams the grinning face of billionaire Steve Ballmer. Behind the shack is a DC avenue terminating in the Capitol Dome.]

_,.-'~'-.,__,.-'~'-.,__,.-'~'-.,__,.-'~'-.,__,.-'~'-.,_

Image: Matthew Bisanz (modified) https://commons.wikimedia.org/wiki/File:NYC_IRS_office_by_Matthew_Bisanz.JPG

CC BY-SA 3.0 https://creativecommons.org/licenses/by-sa/3.0/deed.en

--

Ted Eytan (modified) https://commons.wikimedia.org/wiki/File:2021.02.07_DC_Street,_Washington,_DC_USA_038_13205-Edit_%2850920473547%29.jpg

CC BY-SA 2.0 https://creativecommons.org/licenses/by-sa/2.0/deed.en

--

Bart Everson (modified) https://www.flickr.com/photos/editor/1287341637

Eric Garcetti (modified) https://commons.wikimedia.org/wiki/File:Steve_Ballmer_2014.jpg

CC BY 2.0 https://creativecommons.org/licenses/by/2.0/

#pluralistic#paper losses#direct indexing#tax-loss harvesting#steve ballmer#propublica#irs files#the rich are different from you and me#mego#wash trading#tax evasion#goldman sachs#vampire squid#mark zuckerberg

88 notes

·

View notes

Text

If you don't see your state in the above, text 'RESIST' to '50409' and tell your state legislatures you want them to allow filing taxes directly with the IRS.

Lmk if you do; I'll sign and boost it!

The IRS is piloting this new tool where you can file your taxes for free. If you’re in the following states:

Arizona

California

Florida

Massachusetts

Nevada

New Hampshire

New York

South Dakota

Tennessee

Texas

Washington state

Wyoming

You may be eligible. Let’s help them roll this out so we don’t need to rely on third party companies who just want to grab our money for something that should be free.

#ivy speaks#activate your activism#resistbot#50409#IRS#taxes#direct file#tax season#finance#news#IRS free file tool#free tax filing#tax filing pilot program#direct filing#IRS direct file#free taxes#tax filing eligibility#Arizona taxes#California taxes#Florida taxes#Massachusetts taxes#Nevada taxes#New Hampshire taxes#New York taxes#South Dakota taxes#Tennessee taxes#Texas taxes#Washington state taxes#Wyoming taxes#tax legislation

663 notes

·

View notes

Text

0 notes

Text

"Direct File": un nuevo servicio gratuito para reportar impuestos online en 12 estados

El pasado 22 de marzo, Ethnic Media Services (EMS) organizó una conferencia para conocer las novedades en la presentación de impuestos 2024. El Centro de Asistencia al Contribuyente (IRS) ha activado Direct File, un nuevo servicio que ayuda a las personas a ahorrar tiempo y dinero al presentar los impuestos online. El servicio es gratuito y está disponible en 12 estados. El disertante fue Kevin…

View On WordPress

0 notes

Text

IRS Direct File

Hey, if you're in the US, it's tax season again!

Want to make it easy to deal with? And not pay someone else to do it for you? The IRS has continued to expand their free online services - if you live in any of these states (and don't have a more complicated situation), you can file directly with the government and cut out a lot of the cruft in the middle!

(That's almost half the country on-board now; if your state _isn't_ on the list, why don't you contact your governor and state legislature, and ask why they won't let the government money you spend on the IRS be used to provide government services for you...)

ALT

Here: IRS Direct File

Also, not to get political, but this would be a great time to do your taxes early, and support your professional civil servants by taking advantage of the services they provide. There's too many assholes out there who want to take it away from you, because they don't think the government should work for people; don't let them win. :)

#IRS#taxes#US government#free tax filing#Direct File#I suport getting the government you paid for and deserve#If you're not in the US#hope your taxes are simple and easy too

122 notes

·

View notes

Text

Weekly output: T-Mobile buys much of UScellular, cookie-permissions dialogs, Verizon taps AST SpaceMobile, Android update, IRS keeps Direct File, Affordable Connectivity Program ends

The end of May coinciding with the end of a four-day workweek was a pleasant bonus of Memorial Day’s spot on the calendar this year. Another bonus: I had my last client-paid copy for the month filed by 2:09 p.m. Friday. Patreon readers got one other post, a rant about the woeful UX of a Hilton offer for double points on upcoming hotel stays. That didn’t get published until almost 9 p.m. on…

View On WordPress

#ACP#Affordable Connectivity Program#Android feature drop#AST SpaceMobile#cookies#Direct File#IRS#RCS#satellite broadband#T-Mobile#tax-prep software#texting typo#tracking cookies#U.S. Cellular#UScellular#verizon

0 notes