#Hurricane Damage Insurance Adjuster In Florida

Explore tagged Tumblr posts

Text

As the Hurricane Howls and Your Home Suffers – Rebuild with NL Public Adjusters

When a hurricane leaves your home damaged and your life in disarray, NL Public Adjusters is here to help you rebuild and recover. Our expert insurance claim services ensure you get the compensation you deserve. Trust us to guide you through the process, so you can focus on moving forward. Learn more at nlpublicadjusters.com

#Hurricane Damage Insurance#Insurance Adjuster#Hurricane Damage Attorney Adjuster In Florida#Hurricane Damage Insurance Adjuster In Florida

1 note

·

View note

Text

Climate change impacts Brazil's insurance market

Extreme weather events alter risk models and will affect policy pricing

Insurance coverage for damage caused by disasters may not be new to the market, but climate change has added complexities to this equation. The increasing frequency and severity of extreme weather events have raised alarms in the sector regarding coverage and risk classification models, prompting companies to adjust to this new reality. Natural disasters resulted in losses of $120 billion in just the first half of the year, according to reinsurer Munich Re, with 68% stemming from extreme weather events like storms, floods, and wildfires.

Insured losses during this period amounted to $62 billion, significantly higher than the $37 billion average over the past decade. Brazil typically accounts for 1.5% of this figure. The country, historically not prone to significant disaster-induced losses, is now seeing more intense catastrophes, such as the floods in Rio Grande do Sul, which incurred nearly R$6 billion in losses, according to industry sources.

A separate study by the Swiss Re Institute highlighted that 27 disasters resulted in $5.1 billion in insured losses and nearly $16 billion in economic losses in Latin America in 2023.

The majority of global insured losses (76%) are linked to extreme weather events. Examples include severe storms and tornadoes in the United States, causing $45 billion in losses, and historic rainfall in the Persian Gulf, with $8.3 billion in losses due to flooding in Dubai, United Arab Emirates. Despite the year already nearing its end, the reinsurer states that estimating 2024 losses is challenging due to the world’s peculiar circumstances. This is exemplified by Hurricane Milton in Florida, considered one of the worst in terms of size and speed, yet its impact was less severe than anticipated.

Continue reading.

#brazil#brazilian politics#politics#environmentalism#economy#climate change#environmental justice#image description in alt#mod nise da silveira

3 notes

·

View notes

Text

The National Oceanic and Atmospheric Administration (NOAA) maintains a website documenting climate-related disasters that cause over $1 billion in losses. The agency lists 18 such events in 2022, including droughts and wildfires in the Southwest, floods in Kentucky and Missouri, hailstorms in the Upper Midwest, hurricanes in Florida, and tornadoes in the Southeast. The message of the data is clear: All U.S. communities will face disruptions to our daily lives from climate change, but the nature, frequency, and severity of these disruptions will vary widely across places in any given year.

While individual people and communities cannot alter the course of a hurricane or alleviate drought, there are numerous ways for them to lower their exposure to climate risk or mitigate the physical and financial impacts of climate-related events. Actions such as purchasing disaster insurance and building climate-resilient infrastructure should be part of holistic strategies to protect communities. But to take these actions, residents and their local governments first need to know what the relevant risks are. For example, while coastal Floridians know they are at a higher risk of hurricanes than their inland peers, it is much harder for them to assess the relative risk of wind damage and storm surges within their specific counties or neighborhoods. It’s similarly difficult to predict localized risks from more chronic climate stresses such as sea level rise and extreme heat.

And yet, more and higher-quality, higher-resolution data is becoming available for local assessment. At the same time, predicting the impacts of climate events on communities—damages to homes, businesses, and infrastructure—is becoming an ever more important and sophisticated part of the real estate and financial services industries. But two types of consumers who would greatly benefit from local climate risk data—households and local governments—still have limited access to this information.

In this brief, we discuss how households and local governments could use local climate risk data, explore the current availability of that data, and outline several challenges facing public and private data providers.

People and municipalities can use local climate risk data to adjust how and where they build

Providing people and local policymakers with geographic climate risk data allows them to alter their investment decisions and personal behavior in a variety of ways depending on what information they are given and their preferences and access to resources.

Take people’s housing choices. In choosing where to live and how much to pay for a home, people want to know the quality of local public schools, crime rates, proximity to parks, and the quality of local transportation. How climate change affects different neighborhoods—now and in the future—should factor into housing choices as well. A recent experiment conducted by the real estate company Redfin and a team of academic researchers found that when potential homebuyers were shown online listings disclosed to have high flood risks, they shifted their search toward lower-risk properties.

Households can respond to climate disclosures like those in the Redfin study in a variety of ways. Some may choose neighborhoods at higher elevation or decide not to live in a coastal community altogether. Others might place higher value on the lifestyle benefits of being near the ocean, but choose to rent rather than purchase a home to limit their financial risk. And awareness of local climate risks isn’t just important for people in the process of relocating. Climate risks have changed and will continue to change over time; people who bought their homes 10 years ago may not have been in areas with a high flood or fire risk at the time, but now face greater risks. Being aware of changes in climate risks helps households decide whether to purchase additional insurance, install a sump pump in the basement, or invest in stronger, wind-resistant windows, to name a few adaptive strategies.

Local governments would also benefit from greater awareness of place-specific variations in climate risk. Which bus stops, homes, and public spaces face the greatest exposure to extreme heat and would benefit from cooling features such as tree canopies or green roofs? Which neighborhoods are most likely to flood during major rain events, and how can cities use rain gardens or sewer upgrades to manage the deluge? Which roadways are the least resilient to major climate events and either need to be fortified or potentially abandoned?

The current state of local climate data needs improvement

While climate risk data has long been a part of how we plan and build American communities, older information systems are no longer fit for new climate realities. As early as 2011, a landmark publication from the National Academies of Sciences, Engineering, and Medicine called attention to the need for “widely-accepted approach[es] for conducting vulnerability assessments” and describes available data as “lacking.” Ten years later, the Government Accountability Office found that the Federal Emergency Management Agency’s flood hazard maps—which inform the National Flood Insurance Program—no longer “reflect the best available climate science or include information on current flood hazards.” Notably, many properties that do not fall inside these flood hazard zones—and therefore do not carry flood insurance—experienced flooding in large storms such as Hurricane Sandy. Recent wildfires in California and Colorado also revealed how many property insurance policies were misaligned to current risks.

Now, rapid innovations in environmental monitoring and digitized parcel data are helping public agencies, businesses, nonprofits, and community-based organizations modernize climate risk data. This data makes it possible to estimate risks of flooding, drought, wildfires, extreme heat, pollution, or coastal erosion for each parcel of land—if not each 10-square-meter coordinate—in the country. Some datasets develop metrics for specific climate risks or future emissions scenarios, while others produce indexes the general public can more easily understand. For example, the Environmental Protection Agency’s interactive mapping tool allows users to see risk levels for drought, wildfire, sea level rise, and aggregate flood risk for small neighborhoods (census block groups), as well as pollution from multiple sources. This granular data complements larger-scale data, such as the Climate Impact Lab’s county-level impact maps, which our colleagues have used to assess regional vulnerabilities in the U.S.

Improved climate risk data can result in compelling use cases for private investors and policymakers, such as granularly measuring urban heat islands, outlining climate resilience strategies for subsidized housing, developing new risk ratings to fundamentally transform the National Flood Insurance Program, estimating regional economic losses in the event of natural disasters, and tracking environmental justice burdens across disadvantaged communities. The different types of metrics and the geographic scales at which they are available offer flexibility in answering different policy or research questions. For example, while insurance firms may want to know expected damages for a given property across all climate risk categories, a county parks department may be more interested in drought and heat metrics at a neighborhood scale.

Of course, producing new, high-quality data and applications is not cheap. Environmental monitoring agencies such as NOAA will need federal funding to continue investing in equipment and staff expertise. And private data providers will need access to cash flow—whether through paying customers or outside investment—to keep updating and improving their products.

What risks do new data sources present, and how will society address them?

For all the potential benefits of more granular climate data, publishing it carries some risks.

One issue is the possibility of false certainty. Even with climate models constantly improving, emerging data sources will still have wide margins of error, particularly around predicting the most uncertain climate events, such as hurricanes. Yet it’s easy to imagine some individuals treating a single data source as gospel, even though there can be significant variation among similar data products and there is limited transparency regarding underlying analytical models. Governments and industry will need to find ways to manage uncertainty with their constituents and customers.

Another concern is how data could impact equity. America’s history of redlining offers a clear example of how mapping perceived risks can lead to disinvestment and discrimination. To the extent that climate risks overlap with racial, economic, and social characteristics, vulnerable communities could face additional barriers, such as higher property insurance rates or a lack of new infrastructure in places of need. Policymakers will need to write regulations that ensure ratings agencies, insurers, government agencies, and others are not discriminating against any people or places.

The price of data could create a barrier to adoption for public agencies, nonprofit organizations, and individuals as well. Datasets that are produced and managed by federal statistical agencies such as the Census Bureau and Bureau of Labor Statistics are made publicly available at no charge to users. But data products created by private firms are typically sold to individual subscribers such as insurance companies and credit rating agencies—often for substantial fees. Financial institutions are able and willing to pay for these services to mitigate fiduciary risk associated with climate change, but most civic organizations have tighter budgets. One example of using the data for public good comes from the nonprofit Climate Central, which has used their own proprietary data to conduct groundbreaking scientific research on flood risk in order to build global citizen awareness of climate vulnerability. The country’s wealthiest cities and counties may be inclined to spend local tax dollars to buy high-quality climate data, which could lead to wiser investments in infrastructure or the ability to counter predatory real estate practices. But it could also further exacerbate capacity differences between those wealthier communities and poorer ones that can’t afford such data.

Addressing these concerns won’t be easy, and will require experimentation. Processes like the Treasury Department’s Climate Data and Analytics Hub pilot are promising efforts. Finding the right balance between transparency and equity will require cities, states, and the real estate industry to test different approaches to implementation. Adaptation strategies that work for second-home owners in Miami may not work for low-income households in Houston’s flood-prone neighborhoods, so placing diverse voices into the policy discussion is essential.

6 notes

·

View notes

Text

Top Florida Business Insurance Tips

Florida's business landscape is unique: sunny weather, bustling tourism, and hurricane season. As a business owner, securing the right Florida business insurance is essential to safeguard your assets, employees, and business operations. This guide will cover the top tips for navigating Florida business insurance and ensuring your company is fully protected from unexpected risks.

Know the Key Types of Coverage You Need

When it comes to Florida business insurance, understanding the types of coverage available is crucial for protecting your business. Several policies are essential for most companies in Florida:

General Liability Insurance: This is the foundation of any business insurance plan. It protects your company against claims of injury or damage caused by your business operations or products. General liability insurance provides financial protection if a customer slips and falls at your store or you're sued for defamation.

Property Insurance: Florida is vulnerable to extreme weather events like hurricanes, floods, and storms. Property insurance ensures that your building, inventory, and equipment are covered in the event of damage due to natural disasters or accidents.

Workers' Compensation Insurance: Florida law mandates that businesses with employees carry workers' compensation insurance. This insurance covers medical expenses and lost wages for employees who are injured on the job. With it, your business could avoid hefty fines or lawsuits.

Professional Liability Insurance: This coverage helps protect service-based businesses against negligence claims or errors in the services provided. This is especially important for professionals like consultants, architects, or doctors.

Factor in Florida's Unique Risks

Living in Florida presents unique risks, especially with its exposure to hurricanes, floods, and other severe weather conditions. For business owners in high-risk areas, it's essential to have additional coverage:

Flood Insurance: Florida's coastal location and storm patterns make flooding a significant concern. Many standard property insurance policies do not cover flood damage, so purchasing a separate flood insurance policy is crucial, especially if you are in a flood zone.

Hurricane Coverage: In addition to basic property insurance, you should consider hurricane coverage, which helps with the repair costs and business interruptions caused by storms. Many Florida business insurance policies include windstorm coverage for hurricane damage, but it's important to confirm this with your insurer.

While these policies might seem like added expenses, they are critical for businesses in Florida that face these risks regularly.

Stay Up to Date with Florida's Changing Regulations

Florida's business insurance requirements can change over time, and it's important to stay informed about updates that might affect your coverage. For instance, changes in labor laws, worker safety regulations, or the state's risk exposure can impact the type and level of insurance coverage you need. For example, Florida has specific requirements for businesses in certain industries, such as construction or healthcare, where additional coverage may be necessary.

Reviewing your Florida business insurance policies annually ensures that your business remains compliant and protected from any new legal or financial obligations that may arise.

Annual Insurance Review is Crucial

Your business will evolve, and so should your insurance policy. Whether expanding to a new location, launching new products, or increasing your employee base, your insurance needs will shift. That's why reviewing your policy regularly and adjusting coverage as necessary is important.

For example, if your business acquires new equipment, expands its inventory, or hires more employees, you may need to increase your coverage to reflect these changes. Conducting an annual review helps prevent gaps in coverage and ensures that your policy remains in line with your business's growth.

Work with a Local Insurance Agent

Navigating the intricacies of Florida business insurance can be challenging, especially with the state's unique risks and regulations. Partnering with a local insurance agent who understands Florida's insurance landscape is invaluable. A local agent can help you:

Identify the best types of coverage for your specific business needs.

Find providers that offer competitive rates and comprehensive coverage.

Stay updated on changing state laws and regulations affecting business insurance.

By working with an expert who understands your local environment, you'll ensure that your business is adequately protected without overpaying for unnecessary coverage.

Conclusion

Protecting your business in Florida requires more than just a standard insurance policy. To ensure your business is shielded from financial loss and unforeseen events, it's important to evaluate your insurance needs carefully. Whether it's general liability, property coverage, or workers' compensation, understanding the right policies and staying proactive with annual reviews can help you avoid costly gaps in coverage.

Investing time and resources in comprehensive Florida business insurance will give you peace of mind, knowing that your business is ready to face any challenges that come your way. By considering the risks unique to Florida, understanding the key policies, and working with a trusted insurance professional, your business can thrive without worrying about unexpected financial setbacks.

0 notes

Text

Panama City Public Adjuster: Advocating for Policyholders

When disaster strikes and property damage occurs, navigating the insurance claims process can be overwhelming. A Panama City Public Adjuster serves as a professional advocate for policyholders, ensuring that insurance claims are handled efficiently and fairly. Whether dealing with hurricane damage, fire, or water-related losses, a public adjuster can make a significant difference in securing the compensation you deserve.

What Does a Panama City Public Adjuster Do?

A Panama City Public Adjuster is a licensed professional who works on behalf of policyholders to manage insurance claims. Unlike insurance company adjusters, who represent the insurer's interests, public adjusters advocate solely for the policyholder. Their expertise in insurance policies, claim procedures, and damage assessment ensures that you get the maximum settlement possible for your claim.

Key Roles of a Public Adjuster

Damage Assessment A public adjuster conducts a thorough inspection of your property to document the extent of the damage. They assess every aspect, including structural damage, personal property loss, and potential future costs, such as repairs or replacement.

Policy Review Understanding the terms of your insurance policy is critical. A public adjuster interprets your policy to determine coverage limits, exclusions, and deductibles, ensuring you know what to expect during the claims process.

Claim Preparation Filing a comprehensive insurance claim requires meticulous documentation. A public adjuster compiles all necessary evidence, such as photographs, repair estimates, and detailed reports, to strengthen your case.

Negotiation with Insurance Companies Insurance companies may attempt to minimize claim payouts. A public adjuster acts as your representative, negotiating with the insurer to secure a fair settlement based on the documented damages and policy coverage.

Why Hire a Panama City Public Adjuster?

Living in Panama City, Florida, means dealing with unpredictable weather patterns, including hurricanes and tropical storms that can cause extensive property damage. When disaster strikes, hiring a public adjuster can provide peace of mind and ensure that your insurance claim is managed professionally.

Benefits of Working with a Public Adjuster

Maximizing Your Claim Public adjusters have the expertise to uncover damages that might otherwise go unnoticed. This ensures that your claim reflects the full extent of your losses, leading to a more favorable settlement.

Saving Time and Effort Handling an insurance claim can be time-consuming, especially if you’re dealing with other post-disaster responsibilities. A public adjuster takes on the complex tasks of claim preparation and negotiation, allowing you to focus on recovery.

Avoiding Common Pitfalls Mistakes in filing a claim can result in delays or denied settlements. A public adjuster ensures that all documentation is accurate and complete, reducing the likelihood of errors that could impact your claim.

Expert Negotiation Skills Insurance companies have experienced adjusters working for them. A public adjuster levels the playing field by bringing their negotiation skills and industry knowledge to the table, ensuring your interests are protected.

When Should You Hire a Public Adjuster?

Hiring a Panama City Public Adjuster is beneficial in various scenarios, including:

After Major Storms or Hurricanes: Florida's Gulf Coast is prone to hurricanes, which often result in significant property damage.

Complex or Large Claims: If the damage to your property is extensive or involves multiple structures, a public adjuster can simplify the process.

Disputes Over Claim Amounts: If you believe your insurer’s settlement offer is too low, a public adjuster can advocate for a higher payout.

Denial of Claims: In cases where your claim has been denied, a public adjuster can review the denial and work to reverse the decision.

Finding a Reliable Panama City Public Adjuster

When choosing a public adjuster, look for someone with a strong reputation and proven experience in handling claims similar to yours. Verify their licensing and credentials, and consider reading reviews or asking for referrals from past clients. A good public adjuster should communicate clearly, prioritize your needs, and have an in-depth understanding of Florida insurance laws.

Summary

A Panama City Public Adjuster is a valuable ally for policyholders navigating the insurance claims process. From assessing damages to negotiating with insurers, their expertise ensures that you receive a fair and comprehensive settlement. Whether facing hurricane damage or a denied claim, a public adjuster simplifies the process and advocates for your best interests. In the aftermath of a disaster, their assistance can make all the difference in achieving a successful claim outcome.

0 notes

Text

Public Adjusters Are Helping Florida Residents

In recent years, Florida residents have faced unprecedented challenges with property damage from hurricanes, flooding, and severe weather events. As insurance claims become increasingly complex and insurers tighten their policies, public adjusters have emerged as crucial advocates for homeowners seeking fair compensation for their losses. These licensed professionals are playing a vital role in helping Floridians navigate the complicated insurance claims process and recover from disaster-related damages.

Understanding the Role of Florida Public Adjusters

Unlike insurance company adjusters who work for the insurer, public adjusters are independent professionals who represent the policyholder's interests exclusively. They work on behalf of property owners to evaluate damage, document losses, interpret policy coverage, and negotiate with insurance companies to secure fair settlements. In Florida's challenging insurance market, their expertise has become particularly valuable.

Key Ways Public Adjusters Are Helping Florida Residents

Success Stories and Impact

Recent data shows that Florida property owners who work with public adjusters often receive significantly higher claim settlements than those who handle claims on their own. For example:

Navigating Recent Insurance Challenges

Florida's insurance market has faced significant challenges, with multiple insurers leaving the state or becoming insolvent. Public adjusters have become increasingly important in helping property owners:

Consumer Protection and Advocacy

Beyond individual claim assistance, public adjusters serve as important consumer advocates in Florida's insurance marketplace. They:

Looking Ahead

As Florida continues to face climate-related challenges and an evolving insurance market, public adjusters will likely play an even more crucial role in helping property owners recover from losses. Their expertise in documentation, negotiation, and policy interpretation has become essential in ensuring fair claim settlements.

For Florida residents facing property damage claims, public adjusters offer a valuable service that often proves worth their fee, which is typically a percentage of the claim settlement. Their work not only helps individual property owners but also contributes to the overall stability and fairness of Florida's insurance marketplace.

0 notes

Text

Why You Should Consider a Public Adjuster in Florida After a Loss

When disaster strikes, whether through a hurricane, fire, or water damage, dealing with the aftermath can be overwhelming. In Florida, where severe weather events are common, the aftermath of such losses can leave homeowners and business owners grappling with insurance claims that are often complex and daunting. This is where a public adjuster can play a crucial role. Here’s why you should consider hiring a public adjuster in Florida after a loss.

Understanding Public Adjusters

A public adjuster is a licensed professional who advocates for policyholders when filing insurance claims. Unlike insurance adjusters, who work for the insurance companies, public adjusters work solely for the insured. Their primary role is to assess damages, compile evidence, and negotiate with the insurance company on your behalf. This representation is especially vital in Florida, where the unique challenges posed by the insurance landscape can complicate claims.

Expertise in Insurance Claims

One of the most significant advantages of hiring a public adjuster is their expertise in navigating the insurance claims process. They understand the intricacies of insurance policies, including the terms and conditions that can affect your claim. Given the high stakes involved—potentially thousands of dollars in repairs or replacement costs—having someone with this knowledge on your side can make a substantial difference.

Public adjusters are trained to evaluate the extent of damage and document it comprehensively. They utilize their experience to ensure that all aspects of your loss are accounted for, often identifying hidden damages that might be overlooked. This thorough documentation is critical because it can significantly influence the outcome of your claim.

Maximizing Your Claim Settlement

Insurance companies often aim to minimize their payouts, which can result in a low initial offer for your claim. Public adjusters work diligently to maximize your settlement. They have the skills to negotiate effectively with insurance adjusters and understand how to present your case in the best light.

In many cases, policyholders who hire public adjusters end up receiving a settlement that is considerably higher than what they would have received on their own. Statistics show that, on average, policyholders represented by public adjusters receive significantly more compensation than those who navigate the claims process independently. This can cover not only immediate repairs but also additional living expenses, lost income, and other associated costs.

Saving Time and Reducing Stress

The aftermath of a loss is often chaotic and stressful. Managing repairs, temporary relocations, and the emotional toll of the event can be overwhelming. By hiring a public adjuster, you can alleviate some of this burden. They take on the labor-intensive tasks associated with the claims process, allowing you to focus on your recovery and rebuilding efforts.

From filing the claim to negotiating with the insurance company, a public adjuster handles the paperwork and communications, ensuring that everything is completed accurately and promptly. This can significantly reduce the time it takes to resolve your claim and start receiving the funds necessary for recovery.

Navigating Florida’s Unique Insurance Environment

Florida’s insurance market is unique, particularly due to its vulnerability to hurricanes and tropical storms. The state has seen significant changes in insurance regulations and company policies, which can complicate claims. Public adjusters are familiar with the local landscape and can navigate these complexities effectively.

They can provide insight into specific laws and regulations that may affect your claim, ensuring that you are fully informed about your rights as a policyholder. This localized knowledge is invaluable in a state where the insurance market is in constant flux.

Advocacy and Representation

Having a public adjuster means having an advocate who is focused on your best interests. They understand the emotional and financial stress that comes with a loss, and their goal is to ensure you receive a fair settlement. This advocacy extends beyond mere paperwork; they represent you in discussions and negotiations with the insurance company, providing a buffer against the often adversarial nature of these interactions.

Preventing Fraud and Ensuring Fairness

Unfortunately, the aftermath of a loss can sometimes attract unscrupulous individuals looking to exploit vulnerable homeowners. Public adjusters are licensed professionals who adhere to ethical standards and regulations. They can help you avoid scams or unlicensed contractors, ensuring that you work with reputable companies during your recovery.

Conclusion

In Florida, the decision to hire a public adjuster after a loss can have far-reaching implications for your recovery. From their expertise in navigating complex insurance claims to their ability to maximize your settlement, public adjusters offer invaluable support during a challenging time. By taking on the burden of negotiations and paperwork, they allow you to focus on what matters most—your recovery.

If you find yourself facing a loss, consider the benefits of enlisting a public adjuster in Florida. Their knowledge, advocacy, and dedication to your best interests can make a significant difference in the outcome of your insurance claim and your overall recovery experience. In a state where natural disasters are part of life, having a trusted ally by your side can provide peace of mind and help you rebuild with confidence.

0 notes

Text

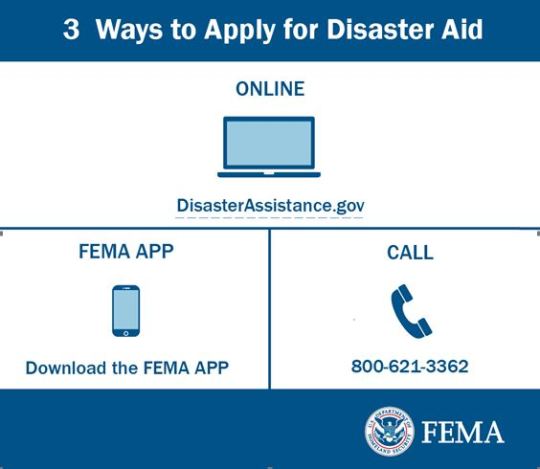

What to Expect After the Hurricane

Florida is no stranger to hurricanes. Over the last few decades, countless Floridians have faced the traumatic aftermath of powerful storms like Wilma, Ivan, Ian, Irma, Andrew, Charlie, and Helene. Many of which reached Category 3 to 5. Each storm has left its mark, causing not just physical damage, but also deep emotional scars. Many residents now carry the weight of anxiety and trauma from these experiences, making the aftermath of each new storm even more daunting. You are not alone. While we do our best to prepare, stocking up on food, canned goods, batteries, and securing shutters, there are always a few crucial items or steps that may slip our minds when disaster strikes due to the panic and anxiety. As you gather supplies and prepare, here are some additional tips to consider, along with important contacts to keep handy: What to Expect After the Storm 1. Assessing Damage: Before the storm hits, take photos of your property and save them in a secure folder on your phone or cloud storage. After ensuring your safety post-storm, assess the damage to your home. Document everything with photos for your insurance claim. 2. Contact Your Insurance Provider: Reach out to your insurance company as soon as possible to report any damage and initiate the claims process. Having documentation ready will expedite this process. Be sure to file the claim yourself. Do not have attorney's, adjusters or the insurance agent file for you. Your agent can help walk you through filing the claim, but it is important for you to do it yourself to assure all is explained and documented correctly, leaving nothing left for questioning to avoid delays. 3. Stay Informed: Stay updated with local news for recovery efforts and safety advisories. If power and internet are down, use Viber, Zello Walkie Talkie, or WhatsApp as an easy form of communication as these do not require internet to use them. Also, if you have an iPhone, you can also activate the satellite options on your for-emergency connectivity when outdoors. Your car can also serve as a charging station for your devices. Do not run the car or generator in an enclosed space to prevent carbon monoxide poisoning. Safety First. Resources for Assistance - FEMA Assistance: If you’ve been affected, you may qualify for federal assistance. Visit FEMA’s Disaster Assistance website or call 1-800-621-FEMA (1-800-621-3362) for more information. - Shelter and Safety: For immediate shelter needs, contact the Red Cross by visiting redcross.org or texting "Shelter" to 43362. - Local Community Resources: Many organizations are stepping up to offer support. Check with local churches, community centers, and non-profits for food, supplies, and temporary housing. As you navigate the aftermath of the storm, remember that you are not alone. The community is here to rally around you in your time of need. Our hearts and prayers go out to all those affected by recent hurricanes, those facing hardship and devastation, and those in the path of upcoming storms. Together, we can support one another through these challenging times. Stay strong, and don’t hesitate to reach out for help. We’re all in this together. Read the full article

0 notes

Text

Urgent Advice: Why You Should Consult a Property Damage Claim Lawyer Immediately

Dealing with property damage can be overwhelming, especially when it comes to filing an insurance claim. Whether it’s due to a fire, storm, or another unforeseen event, the claims process can be complicated and filled with frustrating delays. This is where a property damage claim lawyer steps in, ensuring that you get the compensation you deserve. In Florida, where extreme weather events like hurricanes are common, getting professional help can make a big difference. If you're not sure whether you should consult a lawyer, here are five reasons why acting now is crucial.

1. Maximizing Your Compensation

Insurance companies often look out for their own interests, not yours. They may try to minimize your payout or even deny your claim entirely. A property damage claim lawyer understands the tactics insurers use and will fight to ensure that your claim reflects the true cost of your damages. Without legal help, you might settle for much less than you're entitled to, leaving you struggling to cover repair costs.

A lawyer can also work alongside a public adjuster in Florida, a professional who assesses property damage and helps with the claims process. Together, they form a powerful team that ensures all angles of your claim are covered. While a public adjuster will focus on evaluating the damage, a lawyer will handle the legal aspects, making sure your rights are fully protected.

2. Navigating Complex Insurance Policies

Insurance policies are often written in complex, technical language that is hard to interpret without legal expertise. A property damage claim lawyer will help you understand the fine print of your policy, ensuring that you know exactly what’s covered and what’s not. They’ll explain your options and recommend the best course of action, especially if your claim is denied or undervalued.

Additionally, Florida has unique insurance regulations that can impact your claim. A public adjuster in Florida is familiar with these local laws and can collaborate with your lawyer to ensure you’re following the right steps, minimizing delays and errors that could hurt your case.

3. Handling Claim Denials and Disputes

It's not uncommon for insurance companies to deny property damage claims, citing reasons such as insufficient evidence, policy exclusions, or missed deadlines. If this happens, time is of the essence. Consulting a property damage claim lawyer immediately after a denial will help you file an appeal, present stronger evidence, and challenge the insurer’s decision.

A lawyer can also work on your behalf to negotiate settlements with the insurance company. With the right legal representation, you can avoid costly court battles and still get the compensation you deserve. In cases where disputes escalate, having an attorney who specializes in property damage claims can be a game-changer in achieving a favorable outcome.

4. Faster Claims Processing

Time is critical when it comes to property damage, especially if the damage has left your home uninhabitable or your business unable to operate. Filing an insurance claim without professional assistance can lead to delays, paperwork errors, or miscommunications that prolong the process.

By hiring a property damage claim lawyer, you ensure that your claim is handled efficiently and correctly. Lawyers are experienced in navigating the bureaucratic hurdles of insurance companies, meaning they know how to fast-track your claim. Partnering with a public adjuster in Florida can also speed things up, as the adjuster will provide the detailed damage reports necessary for a swift resolution.

5. Protecting Your Rights

Insurance companies often pressure policyholders into settling quickly for less than what their claim is worth. Without a lawyer, you might feel forced into accepting an unfair offer. A property damage claim lawyer protects your rights, ensuring that the insurance company doesn't take advantage of you.

The lawyer will make sure that all the legal procedures are followed correctly, from filing deadlines to documentation, so that your case is rock solid. If your insurer refuses to negotiate, your lawyer will be prepared to take the case to court, standing by your side every step of the way.

Why You Should Act Now

Delaying the decision to hire a property damage claim lawyer could cost you. Insurance companies often impose strict deadlines for filing claims, and missing these deadlines can result in your claim being denied outright. Additionally, the longer you wait, the harder it becomes to gather evidence and prove your case.

In Florida, where extreme weather can cause severe property damage, time is of the essence. Consulting a property damage claim lawyer and working with a public adjuster in Florida immediately after the damage occurs will help you avoid mistakes and maximize your chances of a successful claim.

Final Thoughts

When it comes to property damage, getting professional help is crucial. A property damage claim lawyer can navigate the complexities of insurance policies, handle disputes, and ensure that you receive the compensation you’re entitled to. Acting quickly is essential, so don’t wait. Contact a lawyer today and protect your rights.

0 notes

Text

https://www.cbsnews.com/news/florida-whistleblowers-hurricane-ian-insurance-60-minutes-transcript/ #homeinsurance #insuranceclaim #homeinsurancecoverage #insurancewhistleblower #HurricaneHelene #HurricaneHelene2024

1 note

·

View note

Text

youtube

Adjusters in Florida say insurance companies altered Hurricane Ian damage reports to underpay homeowners. Whistleblowers detail what they found.

There’s only a couple ways this can go. The state can either let the insurance companies continue to screw us or the state can force them to play fair, in which case these companies will either make the cost of insurance even more unaffordable or just pull out of Florida all together.

And considering the blatant refusal of the Dept. of State and federal agencies to investigate this? Yeah, it's not getting any better.

0 notes

Text

Florida faces ongoing flooding threats for the next several days as a front remains stalled over the Sunshine State.

Many areas in North and Central Florida have received 3 to 5 inches of rainfall, with some Doppler radar estimates indicating over a foot of rain in certain communities.

Climate and Average Weather Year Round in 75217-Dallas-TX:

https://www.behance.net/gallery/201825745/Weather-Forecast-For-75217-Dallas-TX

Scenes of flooding, which have frequently affected Jacksonville, Tampa, and other communities north of Interstate 4 in Florida, are likely to persist over the next several days due to a stalled frontal boundary that is driving showers and thunderstorms.

The heavy rainfall began early last week across the Florida Peninsula and shows no signs of easing, as tropical moisture continues to flow into the Sunshine State.

Many areas in North and Central Florida have received 3 to 5 inches of rain, with some Doppler radar estimates indicating over a foot of rainfall in certain communities.

The area around Tampa International Airport saw significantly higher rainfall, with over 8 inches recorded in just 48 hours.

youtube

The rainfall totals and flooding are comparable to what a hurricane might bring, despite the absence of a storm, as the 2024 hurricane season has been relatively quiet so far.

The National Weather Service office in Jacksonville noted, "We don’t need 'rain with a name' to experience flooding impacts."

More rain is expected on football Sunday and into the coming week.

Storms may affect several NFL games in Florida on Sunday. In South Florida, the heat will be a bigger concern than the rain when the Miami Dolphins take on the Jacksonville Jaguars. Heat index values are expected to reach up to 100 degrees, with a Heat Advisory in effect for Miami-Dade, Palm Beach, and Broward counties through Sunday evening.

In the Tampa Bay region, off-and-on rain showers are forecast as the Tampa Bay Buccaneers face the Washington Commanders.

With the frontal boundary lingering across the state, precipitation chances will remain high. Forecast models predict an additional 3-7 inches of rain over the next week, with some isolated areas experiencing more.

The flood threat will be greatest in areas where rain bands persistently impact the same regions, generally south of the frontal boundary.

On Sunday, Flood Warnings are in effect for several rivers in North and Central Florida. Minor flooding is anticipated along the St. Johns River in Astor. In Southwest Florida, minor flooding is also expected for the Alafia River at Lithia in Hillsborough County, the Myakka River in Myakka River State Park in Sarasota County, and the Peace River at Arcadia in DeSoto County.

While damage from the flooding has been relatively limited so far, impacts are expected to worsen as the already saturated ground reduces water absorption.

Most flooding incidents have involved drivers attempting to navigate through water that was too deep for their vehicles.

What to do if your car is flooded:

See more:

https://weatherusa.app/zip-code/weather-96752

https://weatherusa.app/zip-code/weather-96753

https://weatherusa.app/zip-code/weather-96754

https://weatherusa.app/zip-code/weather-96755

https://weatherusa.app/zip-code/weather-96756

If your vehicle is partially submerged in floodwaters, AAA experts advise against starting the engine, as this could cause further damage.

Instead, begin by photographing the damage both inside and outside of the car for your insurance company.

Contact your insurance representative, who will guide you through the next steps. This will likely involve working with a claims adjuster and arranging for the vehicle to be towed to a certified mechanic.

Mike Porcelli, a mechanic and automotive technology consultant, previously informed FOX Weather that many insurance companies may declare a vehicle a total loss even if no visible damage is apparent.

Weather Forecast For 28411 - Wilmington NC:

"Modern vehicles rely heavily on computers. Everything from power windows and lights to the engine and transmission is controlled by these systems," Porcelli explained. "If water floods the car's interior, it can damage these computers, which are often located under seats or in the dashboard."

0 notes

Text

Eye of the Storm: America's Unbreakable Spirit in the Face of Hurricane Havoc

As Hurricane Zephyr barrels towards the Gulf Coast, a tale of resilience, innovation, and human spirit unfolds across America's southern states. This Category 4 monster, with winds howling at 150 mph, threatens to rewrite the coastline and test the mettle of millions in its path. In Biloxi, Mississippi, local fisherman Tom Hawkins stands defiantly on his weathered dock. "I've seen storms come and go," he says, eyes fixed on the horizon, "but this time, we're ready." Tom's not alone. The entire community has rallied, transforming the local high school into a high-tech command center, complete with satellite imagery and AI-powered prediction models. Meanwhile, in New Orleans, memories of Katrina loom large. But instead of fear, there's a palpable sense of determination. Mayor Lisa Johnson showcases the city's revolutionary flood defense system. "We've learned from the past," she declares, standing atop a massive floodgate. "This time, we're not just surviving; we're thriving." As Zephyr inches closer, an army of volunteers mobilizes. In Houston, chef Maria Rodriguez coordinates a network of food trucks, ready to feed thousands. "In times like these, a hot meal is more than food," she says, stirring a massive pot of gumbo. "It's hope." The storm's impact reaches far beyond the coast. In Atlanta, logistics expert David Chen works tirelessly, rerouting supply chains to ensure critical resources reach those in need. "It's like a giant game of chess," he explains, eyes glued to multiple screens. "Every move counts." But it's not just about preparation. Innovation blooms in the face of adversity. In Florida, engineer Sarah Patel unveils her team's latest creation: inflatable storm shelters that can be rapidly deployed in emergencies. "We're turning science fiction into science fact," she beams, as the structure inflates behind her. As Zephyr makes landfall, the nation holds its breath. But amidst the howling winds and lashing rain, stories of heroism emerge. Coast Guard pilot Jake Simmons flies daring rescue missions, plucking stranded residents from rooftops. "It's what we train for," he shouts over the roar of his helicopter. "But nothing prepares you for the look of relief on someone's face when you reach out your hand." In the storm's aftermath, as communities begin to assess the damage, the true strength of the American spirit shines through. Neighbors help neighbors, strangers become friends, and a nation comes together to rebuild. This hurricane is more than a natural disaster; it's a testament to human resilience, ingenuity, and compassion. As one local put it, "Zephyr may have blown through our towns, but it can't blow away our spirit." For those looking to support hurricane victims or learn more about disaster preparedness, visit [insert link to hurricane relief organization]. Remember, in the face of nature's fury, our greatest strength lies in our unity. Are you ready to maximize your chances for recovery? Contact us now for a FREE CONSULTATION at 8338582031 with both a state appraiser and an attorney! Get immediate advice from both a public adjuster and an attorney when you reach out to us. Receive a preliminary assessment of your property damage and an estimate of potential insurance compensation. Benefit from the expertise of construction professionals for accurate property damage evaluation.

#HurricaneZephyr#StormResilience#GulfCoastStrong#USHurricane#DisasterPreparedness#StormSurvivors#HurricaneRelief#AmericanSpirit#CoastalCommunities#EmergencyResponse#ClimateAction#StormInnovation#HurricaneHeroes#WeatherAlert#CommunityStrength#RebuildingTogether#StormSafety#Hurricaneseason#DisasterRecovery#CoastGuardRescue#storm#seattle storm#before the flood#hurricane#carolina hurricanes#California#Colorado#Florida#Georgia#Illinois

1 note

·

View note

Text

Understanding the Role of a Fort Myers Public Adjuster

In Fort Myers, Florida, public adjusters are essential allies for homeowners and business owners facing the complexities of insurance claims. Given the region's susceptibility to hurricanes and severe weather, having a knowledgeable advocate can significantly impact the recovery process after a loss. This article explores the vital role of public adjusters in Fort Myers, the services they provide, and the benefits they offer to the local community.

What is a Fort Myers Public Adjuster?

Definition and Purpose

A Fort Myers public adjuster is a licensed professional who represents policyholders in their insurance claims. Unlike adjusters who work directly for insurance companies, public adjusters advocate solely for the insured. Their primary goal is to help clients navigate the claims process, accurately assess damages, and negotiate fair settlements with insurance providers. This representation is particularly critical in a region that often experiences natural disasters, ensuring that clients receive the compensation they deserve.

Importance in Fort Myers’ Insurance Landscape

Fort Myers is vulnerable to various natural disasters, including hurricanes and tropical storms. These events can cause significant property damage, making it essential for policyholders to have expert guidance when filing claims. Public adjusters play a crucial role in helping clients understand their rights, the terms of their insurance policies, and the steps needed to secure fair compensation after a loss.

Services Offered by Fort Myers Public Adjusters

Comprehensive Damage Assessment

One of the core services provided by Fort Myers public adjusters is a thorough assessment of damages. After an incident, such as a storm, flood, or fire, these professionals conduct detailed inspections of the affected property. They meticulously document the extent of the damage with photographs, written reports, and detailed evaluations, which serve as vital evidence for the insurance claim. Their expertise ensures that every aspect of the damage is accounted for, maximizing the potential for compensation.

Claim Preparation and Submission

Public adjusters assist clients in preparing and submitting their insurance claims accurately and efficiently. This involves gathering all necessary documentation, including repair estimates, receipts, and proof of loss. By creating a comprehensive claim package, public adjusters streamline the submission process and reduce the likelihood of delays or disputes that may arise from incomplete or inaccurate information.

Negotiation with Insurance Companies

Negotiating with insurance companies can be a daunting task for policyholders, especially when dealing with significant losses. Fort Myers public adjusters are skilled negotiators who advocate for their clients' best interests. They handle all communications with the insurer, working diligently to secure a fair settlement that accurately reflects the true value of the loss. Their knowledge of local regulations and industry standards enhances their ability to achieve favorable outcomes for clients.

Benefits of Hiring a Fort Myers Public Adjuster

Increased Settlement Amounts

Research has shown that policyholders who engage public adjusters often receive higher settlements than those who navigate the claims process independently. Public adjusters have the expertise to identify all potential areas of compensation, ensuring that clients are fully compensated for their losses.

Reduced Stress and Time Savings

Filing an insurance claim can be overwhelming, particularly after experiencing significant property damage. By hiring a public adjuster, clients can relieve themselves of the stress associated with managing the claims process. Public adjusters take on the responsibility of handling all aspects of the claim, allowing clients to focus on their recovery and rebuilding efforts.

Expertise in Insurance Policies

Fort Myers public adjusters possess extensive knowledge of insurance policies and the claims process. Their familiarity with local laws and regulations allows them to navigate complex claims effectively. This expertise can significantly impact the outcome of a claim, ensuring that clients are well-represented throughout the process.

Summary

Fort Myers public adjuster are invaluable advocates for policyholders navigating the complexities of insurance claims. Their expertise in damage assessment, claim preparation, and negotiation ensures that clients receive the compensation they deserve. By understanding the importance of hiring a public adjuster, residents of Fort Myers can confidently manage the claims process, particularly in the aftermath of natural disasters and property damage. With the support of a skilled public adjuster, individuals and businesses can effectively address their claims and focus on rebuilding their lives.

0 notes

Text

Common Findings by Public Adjusters in Florida Insurance Claims

Public adjusters in Florida frequently encounter a range of issues when handling insurance claims. Their role is to advocate for policyholders and ensure fair settlements. Here are some of the most common findings:

1. Water Damage

Water damage is perhaps the most prevalent issue in Florida insurance claims. Public adjusters often find:

Florida's humid climate and propensity for heavy rainfall make water damage a persistent problem. Public adjusters frequently discover that the extent of water damage is more significant than initially assessed by insurance company adjusters.

2. Wind Damage from Hurricanes and Storms

Given Florida's vulnerability to hurricanes and tropical storms, wind damage is another common finding:

Public adjusters often find that insurers underestimate the full scope of wind damage, particularly when it comes to long-term effects on a building's integrity.

3. Roof Damage

Roof issues are frequently at the center of Florida insurance claims. Public adjusters commonly discover:

The subtropical climate and intense sun exposure in Florida can accelerate roof aging, making it crucial for public adjusters to differentiate between normal wear and insurable damage.

4. Sinkhole and Subsidence Issues

Florida's geology makes it prone to sinkholes and land subsidence. Public adjusters often find:

These claims can be particularly complex, requiring specialized geological assessments that public adjusters may recommend to support the claim.

5. Mold and Microbial Growth

Mold is a frequent finding in Florida insurance claims, often resulting from:

Public adjusters frequently discover mold issues that extend beyond visible areas, requiring comprehensive testing and remediation plans.

6. Hurricane Preparedness Failures

In the aftermath of hurricanes, public adjusters often find that damage was exacerbated by:

These findings can complicate claims, as insurers may argue that the policyholder failed to take reasonable precautions.

7. Underpayment or Denial of Valid Claims

A significant role of public adjusters is identifying instances where insurers have:

Public adjusters often find substantial discrepancies between insurer-provided estimates and the actual costs of restoring property to its pre-loss condition.

8. Code Upgrade Requirements

Florida's building codes have evolved significantly, especially in response to hurricane threats. Public adjusters frequently identify:

These code-related issues can significantly impact the overall claim value and are often overlooked in initial insurance company assessments.

9. Hidden Damages

Public adjusters are trained to look beyond surface-level damage. They often uncover:

These hidden damages can substantially increase the value of a claim and are crucial for ensuring comprehensive property restoration.

Public adjusters in Florida play a vital role in ensuring fair and comprehensive insurance claim settlements. Their expertise in identifying and documenting these common issues helps policyholders receive the full benefits they're entitled to under their insurance policies. As Florida continues to face unique environmental and climatological challenges, the role of public adjusters in advocating for policyholders remains crucial in navigating the complex landscape of insurance claims.

0 notes

Text

Finding the Best Public Adjusters in Tampa, Florida: A Complete Guide

Tampa, Florida, is a bustling metropolitan area celebrated for its warm climate, vibrant culture, and proximity to the Gulf of Mexico. However, like many regions in the Sunshine State, Tampa faces natural disasters, including hurricanes, storms, floods, and fire damage. Property owners often encounter significant hurdles when recovering from these events, particularly regarding insurance claims.

Filing an insurance claim can be overwhelming, filled with complex policy language and negotiations that leave homeowners and business owners feeling stressed. This is where public adjusters in Tampa come into play. They represent property owners, ensuring they receive the full compensation they deserve under their insurance policy. Unlike insurance adjusters who work for the insurer, public adjusters are independent advocates focused solely on maximizing the policyholder’s claim.

This article will delve into the role of public adjusters in Tampa, what to consider when hiring one, and why partnering with a public adjuster can enhance your chances of a favorable insurance settlement.

The Role of a Public Adjuster in Tampa

When property damage occurs, the insurance claim process begins. Typically, insurance companies dispatch their own adjuster to assess the damage and determine compensation. However, these adjusters represent the insurer's interests, which can result in settlements that fall short of covering repair costs or losses.

Public adjusters are licensed professionals who advocate for policyholders. Their primary goal is to ensure fair compensation for your losses in line with your policy. They thoroughly evaluate the damage, review your policy, and negotiate with the insurance company on your behalf.

In a city like Tampa, where weather-related damage is common, public adjusters provide invaluable expertise in handling specific types of claims, including those related to hurricanes, floods, and wind damage. Hiring a public adjuster can alleviate the stress and confusion often associated with the claims process, allowing you to focus on recovery while they manage paperwork, inspections, and negotiations.

Why Hire a Public Adjuster in Tampa, Florida?

Expert Knowledge of Local Conditions Tampa’s Gulf Coast location makes it particularly vulnerable to hurricanes, tropical storms, and flooding, which can lead to complicated insurance claims. Public adjusters in Tampa are familiar with the unique challenges associated with these claims and understand the local insurance landscape. Their knowledge of local building codes, weather patterns, and common damage causes allows them to accurately assess losses and ensure the insurance company considers all relevant factors when determining compensation.

Maximizing Your Insurance Claim One of the significant benefits of hiring a public adjuster in Tampa is their ability to increase the settlement amount. Insurance companies often propose low initial settlements, hoping policyholders will accept them. Public adjusters are adept at navigating policy language and negotiating with insurers to secure the highest possible payout. In a region where residents and businesses frequently face storm-related risks, having an experienced public adjuster can make a critical difference between an inadequate offer and a settlement that covers all repair and restoration costs.

Handling Complex Claims Property damage claims can be intricate. After significant incidents like hurricanes or floods, claims may involve various damage types, including structural issues, water damage, mold growth, and loss of personal belongings. Public adjusters are skilled in managing complex claims, ensuring that every aspect of the damage is accounted for. For instance, after a hurricane, public adjusters in Tampa assess both visible damage, like broken windows and roof damage, as well as hidden problems, such as water infiltration and mold. Their thorough evaluations help ensure nothing is overlooked.

Saving You Time and Reducing Stress Filing an insurance claim can be time-consuming and stressful, especially while trying to rebuild your home or business. Public adjusters handle the entire claims process, allowing you to concentrate on recovery. They manage everything from initial property inspections to negotiations with the insurance company, keeping you informed throughout. By hiring a public adjuster, you save time and minimize the risk of errors in your claim, which could lead to delays or reduced settlements.

How to Choose the Best Public Adjuster in Tampa

Licensing and Credentials Before hiring a public adjuster, confirm that they are licensed to operate in Florida. The Florida Department of Financial Services regulates public adjusters, and you can verify their licensing status online, ensuring they meet the necessary qualifications and adhere to state standards.

Experience with Tampa Claims Given Tampa's susceptibility to specific property damage types, such as hurricanes and flooding, it's vital to select a public adjuster experienced in these claims. An adjuster familiar with the local insurance environment and the unique challenges posed by Florida’s climate will be better positioned to secure a favorable outcome.

Conclusion

Public adjusters in Tampa, Florida, offer crucial support to property owners navigating insurance claims. Whether dealing with hurricane damage, flooding, or other losses, a skilled public adjuster can help ensure you receive the compensation you deserve. By carefully choosing a licensed, experienced, and reputable public adjuster, you can approach the claims process with confidence and increase your chances of a favorable settlement.

0 notes