#Hurricane Damage Insurance

Explore tagged Tumblr posts

Text

As the Hurricane Howls and Your Home Suffers – Rebuild with NL Public Adjusters

When a hurricane leaves your home damaged and your life in disarray, NL Public Adjusters is here to help you rebuild and recover. Our expert insurance claim services ensure you get the compensation you deserve. Trust us to guide you through the process, so you can focus on moving forward. Learn more at nlpublicadjusters.com

#Hurricane Damage Insurance#Insurance Adjuster#Hurricane Damage Attorney Adjuster In Florida#Hurricane Damage Insurance Adjuster In Florida

1 note

·

View note

Text

Hurricane Damage Insurance Claim Miami

When hurricanes strike, securing the right insurance coverage is crucial. Our Hurricane Damage Insurance Claim services in Miami help you navigate the claims process with ease, ensuring you get the compensation you deserve. From assessing damage to negotiating with insurance companies, we are here to support you every step of the way.

#Hurricane Damage Insurance Claim Miami#hurricane damage insurance claim in Miami#hurricane damage#hurricane damage insurance#hurricane damage insurance claim

0 notes

Text

#flood insurance#flood relief#insurance company#water damage#western north carolina#hurricane helene#florida#pro-tip

73 notes

·

View notes

Text

Eurylochus better chill. First it was Aeolus’s storm bag, then it was Helene, and now we’re having to deal with Milton? There’s only so much left we can endure, bro... Please stop opening wind bags.

#My insurance won’t cover these damages.#hurricane milton#epic the musical#Eurylochus#the odyssey#My family and I are okay. Polk county but like? we’re doing alright and we’re prepped

15 notes

·

View notes

Text

I am alive and Helene is kicking my ass

#mold and water damage to my crawlspace and insurance won’t cover bc Helene is an ‘act of god’#what the fuck am I paying for them#*then#we also really need a second car but we don’t have money!!#and if I make too much money I lose Medicaid#and I also can’t find a part time job bc we only have one car!!#I am going to scream#hurricane helene

4 notes

·

View notes

Text

Get the Help You Need with 411 Claims - Fast and Reliable Solutions

Turn to 411 Claims for fast and reliable solutions to your claim needs. Our expert team works diligently to simplify the process and secure the best outcomes for your property and insurance claims. To learn more visit www.411claimshelp.com today.

#Hurricane Claims Assistance#Insurance Claim Help#Hail Damage Roofing#Florida Hurricane Claims#Storm Damage Repair Assistance#Disaster Claims Experts#Emergency Claim Services

0 notes

Text

Florida Insurers Face $100 Billion Loss from Hurricane Milton

Hurricane Milton could deliver up to $100 billion in losses for global insurers, driving a surge in reinsurance premiums by 2025. The Category 4 hurricane is expected to make landfall near Florida’s Gulf Coast, with Tampa in its path. Milton follows closely behind Hurricane Helene, which struck just two weeks ago. Analysts at Morningstar DBRS estimate insured losses between $60 billion and $100…

#$100 billion#Category 4#Citizens Property Insurance#disaster recovery#economic damage#evacuation#financial pressure#flood risk#Florida#global insurers#hurricane#Hurricane Milton#insurance#insurance market#insured losses#Moody&039;s RMS Event Response#Morningstar DBRS#national insurers#news#reinsurance premiums#science#small insurers#state of emergency#storm surge#Tampa#weather

0 notes

Text

Expert Help with Hurricane Damage Insurance Claims

Dealing with the aftermath of a hurricane can be overwhelming, especially when navigating insurance claims. At Darryl Davis & Associates, we specialize in Hurricane Damage Insurance Claims, providing expert guidance to help you get the coverage you need. Our team works diligently to ensure your claim is handled professionally and efficiently, so you can focus on rebuilding. Trust us to stand by your side during this challenging time. For assistance with your Hurricane Damage Insurance Claims, contact us at (954) 709-3982. Our team at Darryl Davis & Associates is ready to help guide you through the claims process.

0 notes

Text

9 Tips For Filing Hurricane Damage Claim In Florida

When a hurricane strikes, it leaves behind damage that can devastate property owners. Dealing with the aftermath and handling the claims process can be overwhelming. A reputable public adjuster in Orlando provides professional assistance to property owners filing hurricane damage claims. Check out this blog to learn the nine essential tips for filing a Hurricane Damage Claim in Florida. These tips will help you understand the process and maximize your chances of a successful claim.

#public adjusters orlando fl#hurricane damage claims orlando fl#flood insurance claims orlando fl#public adjuster orlando fl#property damage assistance claim orlando fl#flood damage claims orlando fl#fire damage claims orlando fl

0 notes

Text

How to make a successful Water Damage Insurance Claims

If you live in a hurricane-prone area it is essential to be well prepared for water damage. Usually water damage is possible in various ways. Losses caused by water damage and intruding water can lead to huge loss of materials and property. One of the best ways to protect your home from water damage is by taking some preventative measures. It is possible to keep up with routine maintenance and make prompt repairs however if the damage is due to floods, hurricanes, tsunamis, storm surges and water from overflowing rivers, hire services of expert claim partner. Water damage insurance claims can provide coverage for these problems.

Moreover water damage from natural disasters like an earthquake, landslide or mudslide is covered by water damage insurance claims. Subsequent to ensuring the safety of the occupants you must call the concerned authorities and take necessary steps to prevent any further loss. If possible, take photos of the damaged area and also keep the receipts from services or purchases used because of the damage and subsequent loss.

You can report a claim to your insurer and while filing a claim, make sure you mention the type and the description of loss or damage to your personal belongings and home due to water damage. Depending on the extent of damage and the claim type, you might need the assistance of public adjuster.

Since water damage and hurricane damage claims can be complex and stressful for any property owner it is best to hire services of public adjuster immediately after the incidence. A public adjuster can help you address all the issues accordingly and find the best solution as efficiently as possible.

The Claim Partner has rich experience navigating the hurricane damage claim process as well as supporting hundreds of homeowners and business owners facing the financial consequences and psychological pressure.

If the roof damage is caused by wear and tear, weather conditions, or other events it is essential to call your public adjuster. It is possible that water enters from the damaged part and damage the insulation of your roof, causing it to clump and preventing it from keeping cool or warm. In such an event to prevent further damage call a professional at roof leak Fort Myers. At Claim Partner, they can help you file you claim and obtain the payout you deserve.

At Claim Partner, the team advocates for the rights of homeowners and business owners in the claim process, treating every case with utmost significance. They are a qualified public adjusting firm with 3+ years serving the state of Florida and nearby area.

0 notes

Text

Time to re-up this.

Things have changed since I wrote this in 2017, and I have not worked in insurance for a long time. Craigslist is out, Facebook marketplace is in. Adjusters have tablets and software that allows them to pull up your policy on the spot. Photographs are automatically time stamped.

But also: insurance companies are more desperate than ever to get you to sign off on an estimate.

Know your rights and responsibilities BEFORE the storm hits. Have your insurance agent on speed dial. Consider filming the insurance adjuster who comes out to inspect your property. If they refuse, film yourself following after them and narrating what they've looked at. If they get hostile about it, call your insurance agent and demand a different adjust, even if that causes a delay in the inspection.

Do NOT sign anything until you have time to review it.

$50,000 seems like a lot but I knew many people after the '04 hurricanes who got over that much and still were financially destroyed because the damage was actually over $100,000 in the end. I knew people whose homes were literally unsalvageable and had to be torn down but got less than $20,000 because they could not prove that one unlocked window had been closed before they evacuated.

I know you will be desperate for your money, but remember that NO ONE IS ON YOUR SIDE.

There is a reason I left the property insurance industry, despite it being the most well-paid job I ever had: it is evil.

The flip side of property insurance claiming

The flip side of property insurance claiming

Thinking about property insurance claims? I bet you are. So listen up:

I was a property insurance adjuster for Citizens Property Insurance from 2005-2007, dealing with the aftermath of the 2004 hurricane season, and I’m going to give you advice. I know you all know how to google and doing so will get you basic advice worth following (take pictures before/after, keep a claims journal to track all…

View On WordPress

72 notes

·

View notes

Text

McLaurin Law, PLLC

McLaurin Law, PLLC 4544 Post Oak Place Dr Ste 350 Houston TX 77027 713-461-6500 https://mdlawtex.com/

Welcome to McLaurin Law, PLLC, a premier legal firm serving clients in Houston, TX, and beyond. Our team of dedicated lawyers provides services in insurance law, personal injury law, and construction law. With a track record of success and a commitment to client satisfaction, we have built a strong reputation in the legal community.

At McLaurin Law, PLLC, we understand the complexities of insurance lawyer claims and strive to help individuals and businesses navigate the intricacies of insurance policies. Whether you are dealing with an insurance dispute, need a property damage claim attorney, or have professional liability issues, our skilled attorneys are here to provide effective legal solutions tailored to your needs.

#Insurance Lawyer#Insurance Claim Lawyer#Hurricane Claim Lawyer#Insurance Attorney#Insurance Claim Attorney#Attorneys Insurance Claims#Property Damage Claim Attorney#Insurance Lawyers Near Me#Life Insurance Lawyer#Business Insurance Claim Lawyers

1 note

·

View note

Text

Property Insurance Claim Specializing in Attorneys

Commercial property damage can have significant financial and operational implications for business owners. Whether it's due to natural disasters, accidents, or other unforeseen events, the aftermath of property damage can be overwhelming. In such situations, seeking the guidance of a commercial property damage attorney can make a world of difference. This blog post aims to shed light on the importance of commercial property damage attorneys and when it's appropriate to consult them.

I. Understanding Commercial Property Damage:

Commercial property damage refers to the physical harm inflicted upon buildings, structures, or other properties used for business purposes. It can result from various causes, including natural disasters (such as floods, hurricanes, or earthquakes), fires, vandalism, or accidents like burst pipes or electrical failures. Retail stores, offices, warehouses, and industrial facilities are examples of commercial properties that can suffer damage.

II. The Role of a Commercial Property Damage Attorney:

A commercial property damage attorney specializes in helping business owners navigate the complex process of property damage claims. Their expertise extends to various areas:

Expertise in property damage claims: Commercial property damage attorneys possess in-depth knowledge of property damage laws, regulations, and insurance policies. They understand the nuances of handling different types of damage claims and can provide valuable insights.

Assessing the extent of damage and estimating losses: These attorneys work closely with experts, such as insurance adjusters and contractors, to assess the extent of property damage accurately. They help determine the financial impact on the business and estimate the losses suffered.

Evaluating insurance coverage and policies: Understanding insurance policies and coverage can be complex. A commercial property damage attorney thoroughly reviews the insurance policy to ensure that the property owner receives the maximum compensation entitled under the terms of the policy.

Negotiating with insurance companies: Insurance companies often aim to settle claims for the lowest possible amount. Attorneys skilled in commercial property damage understand the tactics employed by insurance companies and negotiate on behalf of the property owner to secure fair compensation.

Pursuing legal action, if necessary: In cases where insurance companies deny claims, undervalue them, or engage in bad faith practices, a commercial property damage attorney can initiate legal action. They represent the property owner's interests in court and work towards achieving a favorable outcome.

#insurance appraisal attorneys#hurricane commercial insurance attorneys#commercial hail insurance attorney#hurricane damage insurance attorney

0 notes

Text

#New Orleans hurricane damage claims attorneys#hurricane damage claims attorney#New Orleans hurricane damage attorneys#New Orleans hurricane insurance attorneys#New Orleans hurricane damage insurance attorneys#New Orleans hurricane damage lawyers

1 note

·

View note

Text

Excerpt from this story from the New York Times:

At first glance, Dave Langston’s predicament seems similar to headaches facing homeowners in coastal states vulnerable to catastrophic hurricanes: As disasters have become more frequent and severe, his insurance company has been losing money. Then, it canceled his coverage and left the state.

But Mr. Langston lives in Iowa.

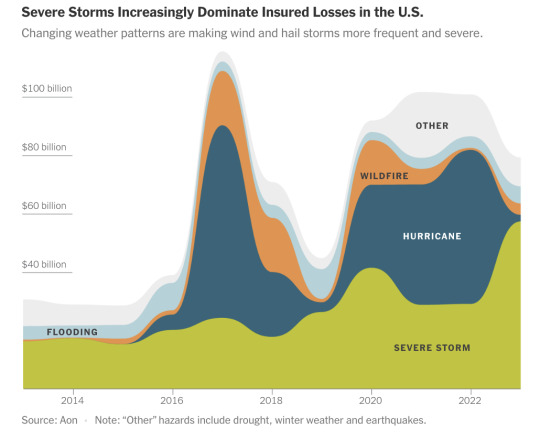

Relatively consistent weather once made Iowa a good bet for insurance companies. But now, as a warming planet makes events like hail and wind storms worse, insurers are fleeing.

Mr. Langston spent months trying to find another company to insure the townhouses, on a quiet cul-de-sac at the edge of Cedar Rapids, that belong to members of his homeowners association. Without coverage, “if we were to have damage that hit all 17 units, we’re looking at bankruptcy for all of us,” he said.

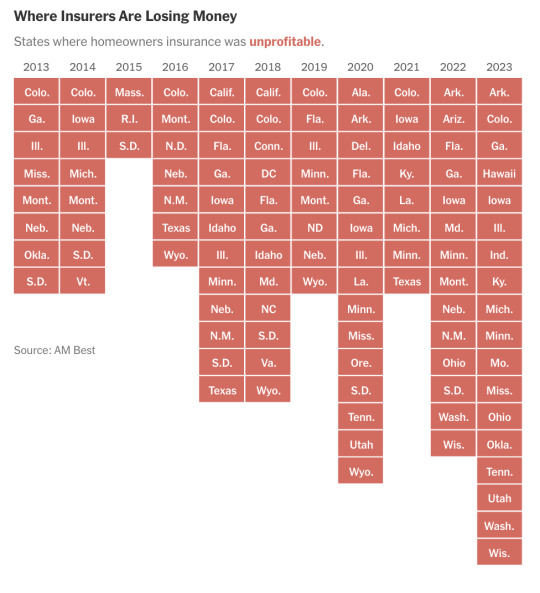

The insurance turmoil caused by climate change — which had been concentrated in Florida, California and Louisiana — is fast becoming a contagion, spreading to states like Iowa, Arkansas, Ohio, Utah and Washington. Even in the Northeast, where homeowners insurance was still generally profitable last year, the trends are worsening.

In 2023, insurers lost money on homeowners coverage in 18 states, more than a third of the country, according to a New York Times analysis of newly available financial data. That’s up from 12 states five years ago, and eight states in 2013. The result is that insurance companies are raising premiums by as much as 50 percent or more, cutting back on coverage or leaving entire states altogether. Nationally, over the last decade, insurers paid out more in claims than they received in premiums, according to the ratings firm Moody’s, and those losses are increasing.

The growing tumult is affecting people whose homes have never been damaged and who have dutifully paid their premiums, year after year. Cancellation notices have left them scrambling to find coverage to protect what is often their single biggest investment. As a last resort, many are ending up in high-risk insurance pools created by states that are backed by the public and offer less coverage than standard policies. By and large, state regulators lack strategies to restore stability to the market.

Insurers are still turning a profit from other lines of business, like commercial and life insurance policies. But many are dropping homeowners coverage because of losses.

Tracking the shifting insurance market is complicated by the fact it is not regulated by the federal government; attempts by the Treasury Department to simply gather data have been rebuffed by some state regulators.

The turmoil in insurance markets is a flashing red light for an American economy that is built on real property. Without insurance, banks won’t issue a mortgage; without a mortgage, most people can’t buy a home. With fewer buyers, real estate values are likely to decline, along with property tax revenues, leaving communities with less money for schools, police and other basic services.

And without sufficient insurance, people struggle to rebuild after disasters. Last year, storms, wildfires and other disasters pushed 2.5 million American adults out of their homes, according to census data, including at least 830,000 people who were displaced for six months or longer.

121 notes

·

View notes

Text

[re: this post]

The bad news is, I’m stranded because my condo has only one road in and out, and that’s 100% underwater rn

The other bad news is, my car is flooded even though I thought I moved it to higher ground

BUT … the heartening news is this:

This condo complex is roughly 2,500 units so tons of people live here. We were all without power from around 4pm yesterday until 10:30am today

So at daybreak everyone was outside surveying the damage and trying to figure out how to get their sunken cars started and how to get out (we’re just going to have to wait for the waters to recede iMho)

I took one look at my VERY RECENTLY PAID FOR CAR as it sat submerged, and started to head back inside. That’s when a neighbor I’d never met before asked me if my phone was charged. I told her no, it’s completely dead. She then directed me to another neighbor who found one outlet that, for some reason, still had power. There were about 10 or 15 people lined up and someone had gotten probably the longest extension cord w/outlets that I’ve ever seen in my life. If you weren’t already charging your phone on the outlet, there was one outlet spot where everyone was taking turns to get a quick 10 minute charge and make some calls. Apparently everyone had already voted to use one of the extension cord outlets full time for a coffee pot (because coffee, right?)

There was someone else outside whose car wasn’t submerged who was letting people use his car to charge their phones

And then I heard someone say, “Are there any elderly or disabled people living here who we need to go check on?” And I said, “OMG, what about the lady on the 7th floor? She’s in a wheelchair!” And someone else said that the elevator was out because of no power, and I was like, “So? Are the stairs broken? I can run up and go check on her.” And then someone else was like, “She died a couple of years ago.” And we were all like, “Ohhh.”

I’m rambling a bit, but the point is, it was super refreshing to see people working together and sharing and helping each other. This wasn’t a disaster by any stretch of the imagination. At worst, it has merely been a big inconvenience. But it was still nice to see neighbors (many of whom were strangers until this morning) being nice and helpful to each other

It reaffirms what I’ve always believed: in difficult times most people WILL work together—without any personal or monetary incentive. So please don’t believe greedy ass mutha fuckers when they opine about survival of the fittest and making a quick profit off of someone else’s suffering. It doesn’t have to be that way, and most often, it isn’t that way

And yeah, I know that my small experience wasn’t a dire situation and no lives were on the line (like they are where the hurricane actually made landfall), but I would like to believe that my microcosm is the norm for similar macrocosms

I believe that most people are good at heart, or at the very least, they WANT to be good and sometimes just need a nudge in the right direction

Anyway, I guess it’s about time for me to go do battle with my car insurance company (now talk about evil entities!) to see what up with my partially submerged vehicle

If anyone has done this insurance claim dance before, I’m open to some friendly advice bc this is brand new for me

Please have a great day today everyone ✌🏿

54 notes

·

View notes