#Hurricane Damage Insurance Claim

Explore tagged Tumblr posts

Text

Hurricane Damage Insurance Claim Miami

When hurricanes strike, securing the right insurance coverage is crucial. Our Hurricane Damage Insurance Claim services in Miami help you navigate the claims process with ease, ensuring you get the compensation you deserve. From assessing damage to negotiating with insurance companies, we are here to support you every step of the way.

#Hurricane Damage Insurance Claim Miami#hurricane damage insurance claim in Miami#hurricane damage#hurricane damage insurance#hurricane damage insurance claim

0 notes

Text

How to make a successful Water Damage Insurance Claims

If you live in a hurricane-prone area it is essential to be well prepared for water damage. Usually water damage is possible in various ways. Losses caused by water damage and intruding water can lead to huge loss of materials and property. One of the best ways to protect your home from water damage is by taking some preventative measures. It is possible to keep up with routine maintenance and make prompt repairs however if the damage is due to floods, hurricanes, tsunamis, storm surges and water from overflowing rivers, hire services of expert claim partner. Water damage insurance claims can provide coverage for these problems.

Moreover water damage from natural disasters like an earthquake, landslide or mudslide is covered by water damage insurance claims. Subsequent to ensuring the safety of the occupants you must call the concerned authorities and take necessary steps to prevent any further loss. If possible, take photos of the damaged area and also keep the receipts from services or purchases used because of the damage and subsequent loss.

You can report a claim to your insurer and while filing a claim, make sure you mention the type and the description of loss or damage to your personal belongings and home due to water damage. Depending on the extent of damage and the claim type, you might need the assistance of public adjuster.

Since water damage and hurricane damage claims can be complex and stressful for any property owner it is best to hire services of public adjuster immediately after the incidence. A public adjuster can help you address all the issues accordingly and find the best solution as efficiently as possible.

The Claim Partner has rich experience navigating the hurricane damage claim process as well as supporting hundreds of homeowners and business owners facing the financial consequences and psychological pressure.

If the roof damage is caused by wear and tear, weather conditions, or other events it is essential to call your public adjuster. It is possible that water enters from the damaged part and damage the insulation of your roof, causing it to clump and preventing it from keeping cool or warm. In such an event to prevent further damage call a professional at roof leak Fort Myers. At Claim Partner, they can help you file you claim and obtain the payout you deserve.

At Claim Partner, the team advocates for the rights of homeowners and business owners in the claim process, treating every case with utmost significance. They are a qualified public adjusting firm with 3+ years serving the state of Florida and nearby area.

0 notes

Text

Get the Help You Need with 411 Claims - Fast and Reliable Solutions

Turn to 411 Claims for fast and reliable solutions to your claim needs. Our expert team works diligently to simplify the process and secure the best outcomes for your property and insurance claims. To learn more visit www.411claimshelp.com today.

#Hurricane Claims Assistance#Insurance Claim Help#Hail Damage Roofing#Florida Hurricane Claims#Storm Damage Repair Assistance#Disaster Claims Experts#Emergency Claim Services

0 notes

Text

Expert Help with Hurricane Damage Insurance Claims

Dealing with the aftermath of a hurricane can be overwhelming, especially when navigating insurance claims. At Darryl Davis & Associates, we specialize in Hurricane Damage Insurance Claims, providing expert guidance to help you get the coverage you need. Our team works diligently to ensure your claim is handled professionally and efficiently, so you can focus on rebuilding. Trust us to stand by your side during this challenging time. For assistance with your Hurricane Damage Insurance Claims, contact us at (954) 709-3982. Our team at Darryl Davis & Associates is ready to help guide you through the claims process.

0 notes

Text

9 Tips For Filing Hurricane Damage Claim In Florida

When a hurricane strikes, it leaves behind damage that can devastate property owners. Dealing with the aftermath and handling the claims process can be overwhelming. A reputable public adjuster in Orlando provides professional assistance to property owners filing hurricane damage claims. Check out this blog to learn the nine essential tips for filing a Hurricane Damage Claim in Florida. These tips will help you understand the process and maximize your chances of a successful claim.

#public adjusters orlando fl#hurricane damage claims orlando fl#flood insurance claims orlando fl#public adjuster orlando fl#property damage assistance claim orlando fl#flood damage claims orlando fl#fire damage claims orlando fl

0 notes

Text

McLaurin Law, PLLC

McLaurin Law, PLLC 4544 Post Oak Place Dr Ste 350 Houston TX 77027 713-461-6500 https://mdlawtex.com/

Welcome to McLaurin Law, PLLC, a premier legal firm serving clients in Houston, TX, and beyond. Our team of dedicated lawyers provides services in insurance law, personal injury law, and construction law. With a track record of success and a commitment to client satisfaction, we have built a strong reputation in the legal community.

At McLaurin Law, PLLC, we understand the complexities of insurance lawyer claims and strive to help individuals and businesses navigate the intricacies of insurance policies. Whether you are dealing with an insurance dispute, need a property damage claim attorney, or have professional liability issues, our skilled attorneys are here to provide effective legal solutions tailored to your needs.

#Insurance Lawyer#Insurance Claim Lawyer#Hurricane Claim Lawyer#Insurance Attorney#Insurance Claim Attorney#Attorneys Insurance Claims#Property Damage Claim Attorney#Insurance Lawyers Near Me#Life Insurance Lawyer#Business Insurance Claim Lawyers

1 note

·

View note

Text

#New Orleans hurricane damage claims attorneys#hurricane damage claims attorney#New Orleans hurricane damage attorneys#New Orleans hurricane insurance attorneys#New Orleans hurricane damage insurance attorneys#New Orleans hurricane damage lawyers

1 note

·

View note

Text

Excerpt from this story from the New York Times:

At first glance, Dave Langston’s predicament seems similar to headaches facing homeowners in coastal states vulnerable to catastrophic hurricanes: As disasters have become more frequent and severe, his insurance company has been losing money. Then, it canceled his coverage and left the state.

But Mr. Langston lives in Iowa.

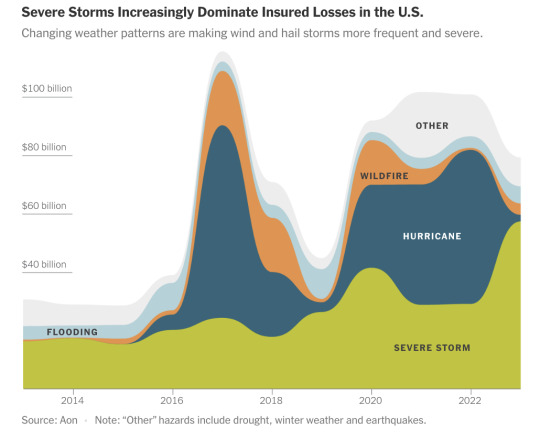

Relatively consistent weather once made Iowa a good bet for insurance companies. But now, as a warming planet makes events like hail and wind storms worse, insurers are fleeing.

Mr. Langston spent months trying to find another company to insure the townhouses, on a quiet cul-de-sac at the edge of Cedar Rapids, that belong to members of his homeowners association. Without coverage, “if we were to have damage that hit all 17 units, we’re looking at bankruptcy for all of us,” he said.

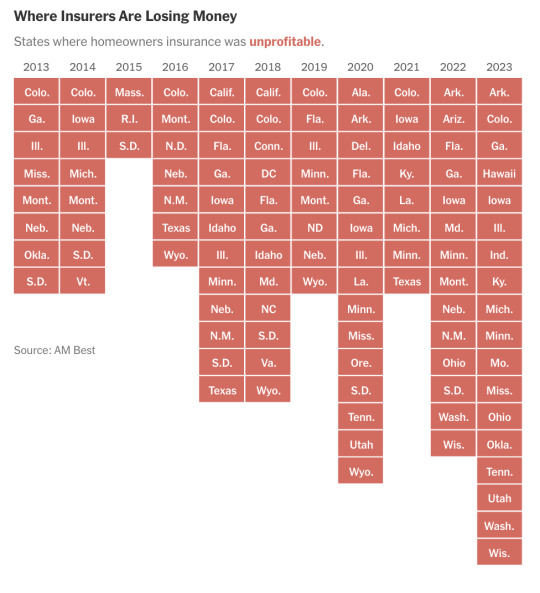

The insurance turmoil caused by climate change — which had been concentrated in Florida, California and Louisiana — is fast becoming a contagion, spreading to states like Iowa, Arkansas, Ohio, Utah and Washington. Even in the Northeast, where homeowners insurance was still generally profitable last year, the trends are worsening.

In 2023, insurers lost money on homeowners coverage in 18 states, more than a third of the country, according to a New York Times analysis of newly available financial data. That’s up from 12 states five years ago, and eight states in 2013. The result is that insurance companies are raising premiums by as much as 50 percent or more, cutting back on coverage or leaving entire states altogether. Nationally, over the last decade, insurers paid out more in claims than they received in premiums, according to the ratings firm Moody’s, and those losses are increasing.

The growing tumult is affecting people whose homes have never been damaged and who have dutifully paid their premiums, year after year. Cancellation notices have left them scrambling to find coverage to protect what is often their single biggest investment. As a last resort, many are ending up in high-risk insurance pools created by states that are backed by the public and offer less coverage than standard policies. By and large, state regulators lack strategies to restore stability to the market.

Insurers are still turning a profit from other lines of business, like commercial and life insurance policies. But many are dropping homeowners coverage because of losses.

Tracking the shifting insurance market is complicated by the fact it is not regulated by the federal government; attempts by the Treasury Department to simply gather data have been rebuffed by some state regulators.

The turmoil in insurance markets is a flashing red light for an American economy that is built on real property. Without insurance, banks won’t issue a mortgage; without a mortgage, most people can’t buy a home. With fewer buyers, real estate values are likely to decline, along with property tax revenues, leaving communities with less money for schools, police and other basic services.

And without sufficient insurance, people struggle to rebuild after disasters. Last year, storms, wildfires and other disasters pushed 2.5 million American adults out of their homes, according to census data, including at least 830,000 people who were displaced for six months or longer.

121 notes

·

View notes

Text

[re: this post]

The bad news is, I’m stranded because my condo has only one road in and out, and that’s 100% underwater rn

The other bad news is, my car is flooded even though I thought I moved it to higher ground

BUT … the heartening news is this:

This condo complex is roughly 2,500 units so tons of people live here. We were all without power from around 4pm yesterday until 10:30am today

So at daybreak everyone was outside surveying the damage and trying to figure out how to get their sunken cars started and how to get out (we’re just going to have to wait for the waters to recede iMho)

I took one look at my VERY RECENTLY PAID FOR CAR as it sat submerged, and started to head back inside. That’s when a neighbor I’d never met before asked me if my phone was charged. I told her no, it’s completely dead. She then directed me to another neighbor who found one outlet that, for some reason, still had power. There were about 10 or 15 people lined up and someone had gotten probably the longest extension cord w/outlets that I’ve ever seen in my life. If you weren’t already charging your phone on the outlet, there was one outlet spot where everyone was taking turns to get a quick 10 minute charge and make some calls. Apparently everyone had already voted to use one of the extension cord outlets full time for a coffee pot (because coffee, right?)

There was someone else outside whose car wasn’t submerged who was letting people use his car to charge their phones

And then I heard someone say, “Are there any elderly or disabled people living here who we need to go check on?” And I said, “OMG, what about the lady on the 7th floor? She’s in a wheelchair!” And someone else said that the elevator was out because of no power, and I was like, “So? Are the stairs broken? I can run up and go check on her.” And then someone else was like, “She died a couple of years ago.” And we were all like, “Ohhh.”

I’m rambling a bit, but the point is, it was super refreshing to see people working together and sharing and helping each other. This wasn’t a disaster by any stretch of the imagination. At worst, it has merely been a big inconvenience. But it was still nice to see neighbors (many of whom were strangers until this morning) being nice and helpful to each other

It reaffirms what I’ve always believed: in difficult times most people WILL work together—without any personal or monetary incentive. So please don’t believe greedy ass mutha fuckers when they opine about survival of the fittest and making a quick profit off of someone else’s suffering. It doesn’t have to be that way, and most often, it isn’t that way

And yeah, I know that my small experience wasn’t a dire situation and no lives were on the line (like they are where the hurricane actually made landfall), but I would like to believe that my microcosm is the norm for similar macrocosms

I believe that most people are good at heart, or at the very least, they WANT to be good and sometimes just need a nudge in the right direction

Anyway, I guess it’s about time for me to go do battle with my car insurance company (now talk about evil entities!) to see what up with my partially submerged vehicle

If anyone has done this insurance claim dance before, I’m open to some friendly advice bc this is brand new for me

Please have a great day today everyone ✌🏿

54 notes

·

View notes

Text

Yesterday my car got towed after we filed for total loss with our insurance from the hurricane. We were emptying out our vehicle of stuff and realized the car was totally fucking dead, all the electronics did fry from water damage. Just like the claims guy said it would (he warned us to just call it a total loss bc at some point it would die on us). So wild that literally a few days prior it was working, we were driving in it and had no idea how dangerous it was nor the extent of the hidden damages. We had mold already underneath the car seats we didn't see! 😩

Honestly really sad to just see it go. It was a milestone car! First one we bought together, soo many roadtrips, our lil tie to when we had our first adventure living in Colorado since we bought it there, and the first car we paid off. Weh.

Sentimental silliness but it is what it is. Now I'm licherally TRAPPED in my house without any vehicle transportation lmao (I should've had renting a vehicle on my damn insurance policy ugh lol) until insurance shit settles and we can go out and get a new car.

#Aev rambles#Fuck you hurricane Milton!!!!#😔#Anyways just life things! Gotta feel sad about it first before moving on 😩

24 notes

·

View notes

Text

On Tuesday morning, five days after Hurricane Helene ripped through Boone, North Carolina, David Marlett was on his way to the campus of Appalachian State University. The managing director of the university’s Brantley Risk & Insurance Center, Marlett was planning to spend the day working with his colleagues to help students and community members understand their insurance policies and file claims in the wake of the storm. He didn’t sound hopeful. “I’m dreading it,” he said. “So many people are just not going to have coverage.”

Helene made landfall southeast of Tallahassee, Florida, last week with winds up to 140 miles per hour, downing trees and bringing record-breaking storm surges to areas along the Gulf Coast before charging up through Georgia. But perhaps its most shocking impacts have been on inland North Carolina, where it first started raining while the storm was still over Mexico. At least 57 people are dead in Buncombe County in the west of the state alone. Communities like Boone received dozens of inches of rainfall despite being hundreds of miles from the coast. Waters rose in main streets, sinkholes and mudslides wreaked havoc, and major roads were blocked, flooded, or degraded by the storm.

Now, there’s a good chance that many homeowners in North Carolina won’t see any payouts from their insurance companies—even if they have policies they thought were comprehensive.

“The property insurance market for homes was already a patchwork system that really doesn’t make a lot of sense,” Marlett says. “Now you’re adding in the last couple of years of economic uncertainty, inflation, climate change, population migration—it’s just an unbelievably bad combination happening all at once.”

For North Carolinians, the issue right now has to do with what, exactly, private insurance is on the hook for when it comes to a storm. An average homeowner policy covers damage from wind, but private homeowners’ insurance plans in the US do not cover flooding. Instead, homeowners in areas at risk of flooding usually purchase plans from the National Flood Insurance Program (NFIP).

The way a hurricane wreaks havoc on a state is a crucial deciding factor for insurers’ wallets. Hurricane Ian, which hit Florida as a category 4 storm with some of the highest wind speeds on record, caused $63 billion in private insurance claims. In contrast, the bulk of the $17 billion in damage caused by 2018’s Hurricane Florence, which tore up the North Carolina coast, was water damage, not wind; as a result, private insurers largely avoided picking up the check for that disaster.

This breakout of flood insurance from home policies dates back to the 1940s, says Donald Hornstein, a law professor at the University of North Carolina and a member of the board of directors of the North Carolina Insurance Underwriting Association. Private insurance companies decided that they did not have enough data to be able to accurately predict flooding and therefore could not insure it. “In some ways, that calculation of 50 years ago is still the calculation insurers make today,” he says.

While the NFIP, which was created in the late 1960s, provides virtually the only backup against flood damage, the program is saddled with debt and has become a political hot potato. (Project 2025, for instance, recommends phasing out the program entirely and replacing it with private options.) Part of the problem with the NFIP is low uptake. Across the country, FEMA statistics show that just 4 percent of homeowners have flood insurance. Some areas hit by Helene in Appalachia, initial statistics show, have less than 2.5 percent of homeowners signed up for the federal program.

“Even in coastal areas, not many people buy that, much less here in the mountains,” Marlett says. “People have never seemed to fully understand that flood is a separate policy.”

Flooding is not unprecedented in the mountains of North Carolina: Hurricane Ivan swept through Appalachia in 2004, and flash floods from rivers are not unheard of. Purchasing flood insurance is mandatory with a government-backed mortgage in some areas of the country, based on flood zones set by FEMA. But the data is based on extremely outdated floodplain maps that have not taken the most recent climate science on record rainfall into account.

“The biggest non-secret in Washington for decades is how hopelessly out of date these flood maps are,” Hornstein says.

Even if water wasn’t the cause of destruction for some homeowners in North Carolina, the storm’s disastrous mudslides—another risk supercharged by climate change—may not be covered either. Many home insurance policies have carve-outs for what are known as “earth movements,” which includes landslides, sinkholes, and earthquakes. In some states, like California, insurers are mandated to offer additional earthquake insurance, and homeowners can purchase private additional policies that cover earth movements. But in a state like North Carolina, where earthquake risk is extremely low, homeowners may not even know that such policies exist.

It’s also been a tough few years for the insurance industry across the country. A New York Times analysis from May showed that homeowners’ insurers lost money in 18 states in 2023—up from eight states in 2013—largely thanks to expensive disasters like hurricanes and wildfires. Payouts are increasingly costing insurers more than they are getting in premiums. Homeowners are seeing their policies jump as a result: According to statistics compiled by insurance comparison shopping site Insurify, the average annual cost of home insurance climbed nearly 20 percent between 2021 and 2023. In Florida, which has the highest insurance costs in the country, the average homeowner paid over $10,000 a year in 2023—more than $8,600 above the national rate.

Florida has made headlines in recent months as ground zero for the climate-change insurance crisis. More than 30 insurance companies have either fully or partially pulled out of Florida over the past few years, including big names like Farmers’ and AAA, after mounting losses from repeated major hurricanes like 2022’s Ian, the most expensive natural disaster in the state’s history. Florida’s insurer of last resort, now saddled with risk from multiple homeowners, has proposed a rate increase of 14 percent, set to go into effect next year.

In comparison, North Carolina’s insurance market looks pretty good. No insurers have exited the state since 2008, while homeowners pay an average of $2,100 per year—high, but avoiding the sky-high rates of states like Florida, California, and Texas.

“What traditionally has happened is that there’s a rate increase every few years of 8 to 9 percent for homeowner’s insurance,” says Hornstein. “That has kept the market stable, especially when it comes to the coast.”

But as natural disasters of all kinds mount, it’s tough to see a way forward for insurance business as usual. The NFIP is undergoing a series of changes to update the way it calculates rates for flood insurance—but it faces political minefields in potentially expanding the number of homeowners mandated to buy policies. What’s more, many homeowners are seeing the prices for their flood insurance rise as the NFIP adjusts its rates for existing floodplains using new climate models.

Many experts agree that the private market needs to reflect in some way the true cost of living in a disaster-prone area: in other words, it should be more expensive for people to move to a city where it’s more likely your house will be wiped off the map by a storm. The cost of climate change does not seem to be a deterrent in Florida, one of the fastest-growing states in the country, where coastal regions like Panama City, Jacksonville, and Port St. Lucie are booming. (Some research suggests that the mere existence of the NFIP shielded policyholders from the true costs of living in flood-prone areas.)

Asheville, at the heart of Buncombe County, was once hailed as a climate haven safe from disasters; the city is now reeling in the wake of Helene. For many homeowners, small business owners, and renters in western North Carolina, the damage from Helene will be life-changing. FEMA payouts may bring, at best, only a fraction of what a home would be worth. Auto insurance generally covers all types of damage, including flooding—a small bright spot of relief, but not enough to offset the loss of a family’s main asset.

“People at the coast, at some point after the nth storm, they start to get the message,” Hornstein says. “But for people in the western part of the state, this is just Armageddon. And you can certainly forgive them for not having before appreciated the fine points of these impenetrable contracts.”

Marlett says that there are models for insurance that are designed to better withstand the challenges of climate change. New Zealand, for instance, offers policies that cover all types of damage that could happen to your house; while these policies are increasingly tailored price-wise to different types of risk, there’s no chance a homeowner would experience a climate disaster not covered by their existing policies. But it’s hard, he says, to see the US system getting the wholesale overhaul it needs, given how long the piecemeal system has been in place.

“I sound so pessimistic,” he said. “I’m normally an optimistic person.”

30 notes

·

View notes

Text

Alicia Sadowski and Isabella Corrao at MMFA:

In the aftermath of Hurricane Helene, right-wing media falsely claimed that Vice President Kamala Harris and the Biden administration are ignoring millions of Americans impacted by intense flooding. Media personalities and MAGA influencers have falsely and dishonestly claimed that victims are only entitled to $750 in aid, when in reality that is just the start of federal benefits.

FEMA can provide assistance for victims of Hurricane Helene, but chronic underfunding and climate change, not undocumented migrants, threaten future aid availability

In addition to FEMA providing residents of Florida, Georgia, North Carolina, South Carolina, and Virginia with “a one-time $750 payment to help with essential items like food, water, baby formula and other emergency supplies,” victims can also qualify for “disaster-related financial assistance to repair storm-related damage to homes and replace personal property.” After visiting the wreckage in Georgia, Harris reiterated that “FEMA is also providing tens of thousands more dollars for folks to help them be able to deal with home repair, to be able to cover a deductible when and if they have insurance, and also hotel costs.” [The White House, 10/2/24, 10/2/24]

After President Joe Biden signed a stopgap spending bill in September, Department of Homeland Security Secretary Alejandro Mayorkas said FEMA can properly respond to Helene recovery efforts. FEMA spokesperson Daniel Llargués said that FEMA is in a “good position” to respond to Hurricane Helene relief efforts after the agency received $20.3 billion under the spending bill. Biden has suggested bringing lawmakers back to Washington to provide additional funding for disaster relief, but Speaker Mike Johnson (R-LA) has claimed “there’s no necessity for Congress to come back”. [The New York Times, 9/26/24, 10/2/24; Roll Call, 10/3/24; FEMA, 10/3/24]

Future concerns for FEMA’s funding are attributable to chronic underfunding by Congress and increased costs associated with extreme weather disturbance as a result of climate change, not aid given to undocumented immigrants. Mayorkas warned that FEMA “does not have the funds to make it through the [hurricane] season.” A DHS spokesperson clarified, however, that aid provided to undocumented immigrants through the Shelter and Services Program is “a completely separate, appropriated grant program that was authorized and funded by Congress and is not associated in any way with FEMA's disaster-related authorities or funding streams." [The Associated Press, 10/3/24; Axios, 7/14/23; Bipartisan Policy Center, 7/23/24; Newsweek, 10/3/24]

Right-wing media have pushed the cartoonishly false claim that Hurricane Helene survivors are only entitled to $750 in aid, when in fact that the $750 is the beginning.

The right-wing noise machine also dishonestly blamed undocumented immigrants by baselessly accusing them of plundering FEMA funding.

#Hurricane Helene#FEMA#Disaster Relief Funding#Disaster Aid#Disaster Relief#Kamala Harris#Immigration#Jesse Watters#Joe Biden#Sean Hannity#Laura Ingraham#Brigitte Gabriel#Sean Davis#Stephen Miller#Sara Carter#Mike Cernovich

17 notes

·

View notes

Text

Maritimes Against Climate Change

One week ago my group Maritimes Against Climate Change held a rally to bring the community together and hold the fossil fuel companies, who get tax breaks while destroying our world, accountable.

Here was the speech I was supposed to do, but had to wrap it up due to me recovering from a cold and the weather:

"Hello everyone, thank you all for coming despite the weather. We can all see that Canada still has a little bit of cold left in her despite what were here for.

Over the last couple of years, outright Climate Denialism has been waning. Many people see with their own eyes that "October used to be cold" or "we would get long lasting snow before December".

Denying that humanity is the cause usually follows, that's easy to disprove, then denying that its a problem is next, which if you come across that I have some information to help argue that point:

Cost of Environmental Events: Atlantic Canada has experienced significant financial losses due to extreme weather events. For instance, Hurricane Fiona in 2022 caused damages exceeding $800 million, underscoring the vulnerability of our infrastructure and communities. CBC

Fisheries and Aquaculture: Warming ocean temperatures and changes in salinity are affecting fish stocks and aquaculture operations. Notably, the lucrative lobster industry in Nova Scotia has faced challenges due to shifting populations and increased competition.

Agriculture: Increased frequency of droughts and heavy rainfall events disrupt crop yields, impacting food security and rural economies. The 2023 drought in Atlantic Canada led to significant agricultural challenges, with some regions receiving only a quarter of their usual rainfall. Agriculture and Agri-Food Canada

Fishing and agriculture are the backbones of our communities, farmers in particular are in tune and rightfully worried about the climate crisis, because their crops and their livelihoods are on the line.

For more individual impacts to counter the "it doesnt effect me specifically" crowd:

Insurance and Financial Services: The rise in climate-related disasters has led to higher insurance claims and premiums. In 2021, severe weather caused $2.1 billion in insured damages across Canada, with Atlantic Canada being particularly affected. IBC

Health: Rising temperatures are increasing heat-related illnesses, while poor air quality during wildfire seasons poses respiratory risks. In 2023, Atlantic Canada experienced an unprecedented wildfire season, leading to health advisories and evacuations. CBC

Housing: Coastal and riverine flooding threaten homes and necessitate relocation or expensive retrofitting. Sea-level rise projections indicate that the Atlantic region will experience the largest local sea-level rise in Canada, increasing the risk of flooding and erosion. CNN

Thank you to Climatlantic for these statistics.

As I say a lot in these marches, in New Brunswick, we have the forest to our left and the sea to the right, both integral to our survival but with climate change, can also be a risk. I have nightmares all the time of me, my parents, my grandparents, my friends, my future family being evacuated because their homes are no longer safe. I do not wish that upon anyone on this earth.

Finally, the last state of climate denialism is also the one that hurts the most, because it comes not from a place of ignorance, but apathy, hopelessness. The viewpoint that we cant solve it, that its too late.

And i get it, the world is a big place, a lot of moving parts, lobbying is so rampant it easily makes you feel small. But you are not alone. The average New Brunsweicker is closer to being homeless than ever having as much as the people who influence the world's politics, but the thing is, there are way more if us. And if we come together in solidarity and tackle the same problem, we can influence the policies that effect we the people.

For many years we have seen that corporate greed has not only hurt the environment, but our communities as well. Multimillion dollar Companies continue to choose profits over the people that brought them to that place. Rising costs of everything has been straining all of us thin, and the climate crisis, exacerbated by the fossil fuel industry will not help. We need to be vocal that the reason that these companies as well as our politicians are at the place they are is due to the blood sweat and tears of the hardworking individuals of our communities. Every time we try to make companies pay their fair share, they make their customers or even their own employees shoulder the burden.

We need to stand in solidarity with workers and demand for policies that not only change, but improve the lives of all New Brunsweickers. Making sure that the future of Maritimers aren't thought of with fear and worry, but hope.

And how do we get our voices herd? Rallying our communities. Organizing events, bringing these towns, cities, communities together all under a single driving force, our future. Starting small with local governments, municipalities, up to provincial and hopefully to a national scale, we will bring the voice of the people to where it needs to be. Just as one kid rallied the world for climate action before covid, I plan to rally the maritimes for the same cause. Our voices need to be loud! Our mission needs to put the lives of New Brunsweickers first! The environment of will be a priority of course but we will never forget that this will be done by New Brunsweickers for New Brunsweickers.

This fight needs to be workers, the everyday person, versus the companies and CEOs that effect us all. We need to show them that we stand together and wont stand for this treatment anymore! So rally your fellow workers, strike, picket, march, get involved with local government, local groups, everything. Because if we won't do it, who will?"

6 notes

·

View notes

Text

411 Claims Help: Expert Assistance for Your Claim Needs

411 Claims Help provides expert assistance for all your claim needs, ensuring you receive the compensation you're entitled to. Our experienced team guides you through the entire claims process with professionalism and care. To learn more visit www.411claimshelp.com today.

#Hurricane Claims Assistance#Insurance Claim Help#Hail Damage Roofing#Florida Hurricane Claims#Storm Damage Repair Assistance#Disaster Claims Experts#Emergency Claim Services

0 notes

Text

Storm to Solution: Navigating Hurricane Damage Insurance Claims with Expertise

Darryl Davis Public Adjuster is a trusted resource for hurricane damage insurance claims in Coral Springs, Florida. With extensive experience in property damage claims, Darryl Davis helps businesses secure maximum compensation for hurricane-related losses. Give us a call at (954) 709-3982.

1 note

·

View note

Note

How are you doing now after the hurricane?

I'm okay! Still waiting on our insurance claims guy to show up and look at the damage to our fence and house so I can, uh, do anything about it. But our damage was not structural so it's not like it's anything more than an annoyance right now. Internet still cuts out occasionally, but the power has stayed on since it came back.

I verified that our mated pair of cardinals both survived the hurricane and are still in my backyard, which is way more important to my mental health than it probably should be. And also that our neighborhood has recently come to house a very bold raccoon.

We still have half a tree laying across our backyard. I'm not sure what we should do about it. It seems content right where it is. And also way too heavy to move.

12 notes

·

View notes