#How To Save Money

Explore tagged Tumblr posts

Text

{ MASTERPOST } Everything You Need to Know about Saving Money and Being Frugal

We’re all in this together. Don’t give up.

On food and groceries:

How to Shop for Groceries like a Boss

Why Name Brand Products Are Beneath You: The Honor and Glory of Buying Generic

If You Don’t Eat Leftovers I Don’t Even Want to Know You

You Are above Bottled Water, You Elegant Land Mermaid

You Should Learn To Cook. Here’s Why.

On entertainment and socializing:

The Frugal Introvert’s Guide to the Weekend

7 Totally Reasonable Ways To Save Money on Cheap Entertainment

Take Pride in Being a Cheap Date

The Library Is a Magical Place and You Should Fucking Go There

Your Library Lets You Stream Audiobooks and eBooks FOR FREEEEEEE!

What’s the Effect of Social Media on Your Finances?

You Won’t Regret Your Frugal 20s

On health:

How to Pay Hospital Bills When You’re Flat Broke

Run With Me if You Want to Save: How Exercising Will Save You Money

Our Master List of 100% Free Mental Health Self-Care Tactics

Why You Probably Don’t Need That Gym Membership

How to Get DIRT CHEAP Pet Medication, Without a Prescription

On other big expenses:

Businesses Will Happily Give You HUGE Discounts if You Ask This Magic Question

Understand the Hidden Costs of Travel and Avoid Them Like the Plague

Other People’s Weddings Don’t Have to Make You Broke

You Deserve Cheap, Fake Jewelry… Just Like Coco Chanel

3 Times I Was Damn Grateful for My Emergency Fund (and Side Income)

When (and How) to Try Refinancing or Consolidating Student Loans

The Real Story of How I Paid Off My Mortgage Early in 4 Years

Season 2, Episode 2: “I’m Not Ready to Buy a House—But How Do I *Get Ready* to Get Ready?”

The Most Impactful Financial Decision I’ve Ever Made… and Why I Don’t Recommend It

On buying secondhand and trading:

Almost Everything Can Be Purchased Secondhand

I Am a Craigslist Samurai and so Can You: How to Sell Used Stuff Online

The Delicate Art of the Friend Trade

On giving gifts and charitable donations:

How Can I Tame My Family’s Crazy Gift-Giving Expectations?

In Defense of Shameless Regifting

Make Sure Your Donations Have the Biggest Impact by Ruthlessly Judging Charities

The Anti-Consumerist Gift Guide: I Have No Gift to Bring, Pa Rum Pa Pum Pum

How to Spot a Charitable Scam

Ask the Bitches: How Do I Say “No” When a Loved One Asks for Money… Again?

On resisting temptation:

How to Insulate Yourself From Advertisements

Making Decisions Under Stress: The Siren Song of Chocolate Cake

The Magically Frugal Power of Patience

6 Proven Tactics for Avoiding Emotional Impulse Spending

On minimalism and buying less:

Don’t Spend Money on Shit You Don’t Like, Fool

Everything I Know About Minimalism I Learned from the Zombie Apocalypse

Slay Your Financial Vampires

The Subscription Box Craze and the Mindlessness of Wasteful Spending

On saving money:

How To Start Small by Saving Small

Not Every Savings Account Is Created Equal

The Unexpected Benefits (and Downsides) of Money Challenges

Budgets Don’t Work for Everyone—Try the Spending Tracker System Instead

From HYSAs to CDs, Here’s How to Level Up Your Financial Savings

Season 2, Episode 10: “Which Is Smarter: Getting a Loan? or Saving up to Pay Cash?”

The Magic of Unclaimed Property: How I Made $1,900 in 10 Minutes by Being a Disorganized Mess

We will periodically update this list with newer articles. And by “periodically” I mean “when we remember that it’s something we forgot to do for four months.”

Bitches Get Riches: setting realistic expectations since 2017!

Start saving right heckin’ now!

If you want to start small with your savings, consider signing up for an Acorns account! They round up your every purchase to the nearest dollar and save and invest the change for you. We like them so much we’ve generously allowed them to sponsor us with this affiliate link:

Start investing today with Acorns

#frugal#saving money#personal finance#money tips#financial tips#financial literacy#financial freedom#money#debt#money management#how to save money

853 notes

·

View notes

Text

Hi everyone,

I got an inbox asking to share some tips for financing when you’re autistic. I found a helpful guid from the National Autistic Society:

Budgeting

The first step to managing your money is to work out a budget and stick to it. Budgeting will help you:

* keep track of what you are spending

* help you to avoid going overdrawn on your bank account by spending money that you don't have

* decide whether you can afford to buy something that you would like

* deal with debt by planning repayments that you can manage

* work out how much money you may have to save.

Bank, building society or post office accounts

Most people now have one of these types of account. The benefits of these are:

* it will keep your money safe

* you can pay bills more simply by direct debits or standing orders

* internet banking is now widely available. This reduces the need to visit banks and other services that autistic people may find difficult

* benefit payments can only be paid into an account

* you can have a debit card, making it easier to pay for purchases and you can shop online

* you may be able to earn interest on the money you have

* you can pay bills by direct debit or standing order, which are sometimes rewarded by a reduction in what you pay for services

* you can use your cashpoint card to access money easily from cash machines in the UK and sometimes abroad

* your bank or building society may be able to give you an overdraft or loan.

Debit, credit and store cards

There are a number of different cards that you can use to make a payment. These include:

* cashpoint and debit cards

* credit cards

* store cards.

Borrowing money, making payments and debt

It's easy to think of a loan or overdraft as free money, but it’s actually expensive as you have to pay back the original amount plus interest. Try to only borrow money when you need to and repay it as soon as you can. There are many ways of borrowing money, including:

* borrowing money from family or friends

* having an overdraft

* taking out a personal loan or secured loan

* applying for a credit card.

The full article will be below, as it goes into more detail. I hope this helps many of you.

National Autistic Society

#autism#actually autistic#autism and finance#how to manage financial issues#tips on financing#how to save money#feel free to share/reblog#National Autistic Society

160 notes

·

View notes

Text

What goes through my head every time I try getting things for the Gods:

Im so fucking broke right now, I have like 15 dollars to my name, I had over 200 at the end of Christmas (my family’s catholic, only got to do small acts for Yule), wtf happened, I only got a couple things for myself since than?! ૮(˶ㅠ︿ㅠ)ა

Please tell me if you know where to get cheap witch shit, like I will politely eat your ass if you share, pretty please with a cherry on top, I’m fucking desperate, bro! (ᵕ—ᴗ—)🙏

Luv you, remember to be kind to yourself, bubs 𓆩♡𓆪

#brokeback mountain#im broke#like wtf#wtf happened#christmas#pagan polytheism#praise the old gods#help a homie out#help a girl out#please help#thrifting#save money#paganblr#pagan witch#baby witch#i dont fucking know#how did this happen#how to save money#im poor#broke bitch#luv u#:3

4 notes

·

View notes

Text

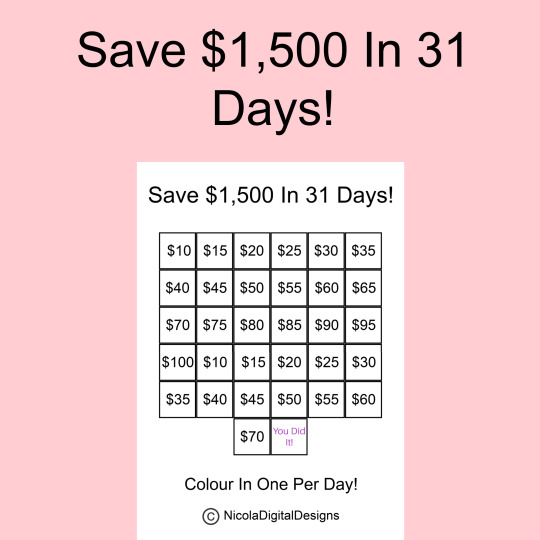

How I Saved $1,500 in 31 Days!

Copyright NicolaDigitalDesigns. Hello and welcome to my blog SavingSmartly, today I will be writing about how I saved $1,500 in 31 days! This year I decided that I was going to up the stakes on every saving challenge I complete and first I achieved saving $1,000 in 31 Days so next up I upped the amount by $500, so this saving challenge was $1,500 in 31 Days. Earning and saving an extra $500 in…

View On WordPress

#Budget#Budget Tips#Earn Money From Home#Earn More Money#Earn More Money Goals#Earn More Sales#Earn More Than Your Wage#Goals#How To Earn More#How To Earn More Money#How To Manifest Anything#How To Manifest Money#How To Save Money#Manifest Money#Money#Money Challenge#Save $1000#Save $1000 In 1 Month#Save $1000 In 30 Days#Save $1000 In 31 Days#Save $1500 In 1 Month#Save $1500 In 30 Days#Save $1500 In 31 Days#Saving Money#Saving Money Challenge#Saving Money Tips#Saving Tips#Savings Challenge#SavingSmartly

3 notes

·

View notes

Text

How to Actually Reinvent yourself | 2024 Goals: New Year Planning & Goal Setting

youtube

In This Video: how to actually Reinvent Yourself in 2024 and 2024 Goals: New Year Planning & Goal Setting Related Tutorial. Unlock Your Financial Freedom. This video more explains 2024 Goals: New Year planning & Goal Setting plan with me.

This Video was Created by Modern Savvy CPA. Most of the people asked how to actually reinvent themselves in 2024 and they have no ideas New Year Planning & Goal Setting 👉Click This Link for New helpful videos: https://www.youtube.com/@themodernsav...

#frugal living#frugal#finance#money saving#money#how to save money#finance management#business#investing#frugal aesthetic#finance tips#finance news#usa news#usa today#usa 2024#trendingnow#trending#frugal lucre#follow#follow4follow#Youtube#new video#podcast#youtubeseo

2 notes

·

View notes

Text

Unveiling Millionaire Secrets: Keys to Financial Success

Introduction:

Becoming a millionaire is a goal many aspire to achieve, and while there is no one-size-fits-all formula for success, there are common strategies and mindsets that millionaires often share. Unlocking the secrets to financial prosperity involves a combination of smart financial decisions, disciplined saving, and a strategic mindset. Let's delve into some millionaire secrets that can pave the way to financial abundance.

1. **Financial Literacy:**

Millionaires understand the importance of financial education. They invest time in learning about money management, investing, and market trends. By staying informed, they make informed decisions that contribute to their wealth accumulation.

2. **Disciplined Saving and Budgeting:**

One key secret to building wealth is disciplined saving. Millionaires often follow a budget, allocating a portion of their income to savings and investments. Consistent saving, even in small amounts, can accumulate over time and create a financial cushion.

3. **Strategic Investing:**

Successful millionaires don't just save money; they invest wisely. They diversify their portfolios, balancing risk and reward. Whether it's in stocks, real estate, or other assets, strategic investing is a cornerstone of wealth creation.

4. **Entrepreneurial Mindset:**

Many millionaires have an entrepreneurial spirit. They seek opportunities, take calculated risks, and are not afraid of failure. Entrepreneurship allows them to build businesses, create multiple streams of income, and capitalize on innovative ideas.

5. **Long-Term Vision:**

Patience is a virtue when it comes to building wealth. Millionaires often have a long-term perspective, understanding that financial success is a gradual process. They resist the urge for quick gains and focus on sustainable growth over time.

6. **Continuous Learning:**

The wealthiest individuals are avid learners. They stay curious, adapt to changing markets, and embrace new technologies. Continuous learning enables them to stay ahead of the curve and make informed decisions in an ever-evolving financial landscape.

7. **Networking and Relationship Building:**

Networking is a powerful tool in the world of wealth creation. Successful millionaires often surround themselves with like-minded individuals, mentors, and professionals. Building strong relationships opens doors to new opportunities, collaborations, and valuable insights.

8. **Financial Discipline:**

Discipline extends beyond saving; it also involves avoiding unnecessary debt and making well-thought-out financial decisions. Millionaires prioritize needs over wants, distinguishing between essential expenses and luxury purchases.

9. **Resilience in the Face of Challenges:**

Financial setbacks are inevitable, but millionaires are resilient. They view challenges as opportunities to learn and grow. Instead of succumbing to failure, they use setbacks as stepping stones to future success.

Conclusion:

While there is no guaranteed path to becoming a millionaire, understanding and adopting the habits and mindsets of successful individuals can certainly increase one's chances of financial prosperity. The journey to wealth involves a combination of financial literacy, disciplined saving, strategic investing, and a resilient mindset. By incorporating these millionaire secrets into your own financial journey, you can pave the way to a more secure and prosperous future.

Click here to learn more https://www.digistore24.com/redir/372576/RueColeman/

#how to earn money#cryptocurreny trading#how to make money online#crypto#how to save money#how to become a millionaire#how to make#how to#philanthropy#ghostsoap#steps of becoming a millionaire

4 notes

·

View notes

Text

My Top 5 Money-Saving Hacks for Consistent Financial Wins 💸💡

Saving money doesn’t have to be complicated. In fact, it’s all about building simple habits that make a huge impact over time. If you’re looking to save more and spend smarter, you’re in the right place! I’m sharing my top 5 money-saving hacks that will help you create better financial habits and see real wins in your bank account. Let’s dive right in! 🏦 1. Automate Your Savings 🏧 One of the…

#automatic savings#Budgeting for Beginners#budgeting hacks#Budgeting Tips#cash back deals#cut subscriptions#discount shopping#finance habits#finance tips#Financial Freedom#financial habits#financial hacks#how to build savings#how to save money#money management#Money Mindset#money-saving ideas#money-saving strategies#money-saving tips#personal finance#Personal Finance Tips#save money#save money fast#save more money#smart shopping#spending tips#track spending

0 notes

Text

How to Save Money for Your Business While Raising Kids

Let’s talk about something we all know too well: the juggling act of managing family finances while chasing that dream of starting or growing your business. It’s no small feat! Between soccer practice, grocery runs, and impromptu toy shopping sprees, saving money can feel like a far-fetched fantasy. But guess what? It’s not impossible! Here’s a lighthearted yet practical guide to help you save…

#how can we save money#how can you save money#how to save money#save money#saving money#saving money challenge

0 notes

Text

How to save money:

The most cost-efficient way to wash your clothes is to keep them on in the shower, and wash them as you wash your body.

Try to use plumbing less. Put plastic tubs under every faucet in the house to save as much water as possible. Plug the tub during showers.

Turn off the well.

#advice#self help#self improvement#help#helpful#lifestyle#home advice#new homeowner#get rich quick#how to save money#money tips#useful#life advice#adulting#adult adhd#adhd

0 notes

Text

0 notes

Text

Best Investment Apps to Save Money: Your Ultimate Guide to Smart Investing

In today’s fast-paced financial landscape, managing your money effectively is more crucial than ever. Utilizing an investment app can be a powerful tool to help you save money while making informed investment decisions. This guide explores how these apps work, their benefits, and tips on smart investing.

1. Understanding Investment Apps

Best investment apps are digital platforms designed to help users invest their money easily and efficiently. They allow individuals to buy stocks, bonds, mutual funds, and other assets directly from their smartphones or computers. Many of these apps provide educational resources, investment tracking, and real-time market data, making it easier for users to navigate the complexities of investing.

2. Benefits of Using an Investment App

Accessibility: Investment apps democratize investing by making it accessible to everyone. You don’t need extensive financial knowledge or a significant amount of capital to get started. With just a few taps on your smartphone, you can begin building your investment portfolio.

Lower Fees: Traditional brokerage firms often charge high fees for managing investments. In contrast, many investment apps offer low or zero commissions, allowing you to keep more of your money. This is particularly beneficial for beginners who want to maximize their savings.

User-Friendly Interfaces: Investment apps are designed with the user in mind. They often feature intuitive interfaces that guide users through the investment process, making it easier to understand how to save money while investing. Many apps also include educational materials to help users learn about various investment strategies.

Real-Time Tracking: With an investment app, you can monitor your investments in real time. This feature allows you to make informed decisions quickly, capitalizing on market opportunities as they arise.

3. Tips for Smart Investing

Set Clear Goals: Before diving into investing, it's essential to define your financial goals. Whether you're saving for retirement, a home, or education, knowing your objectives will guide your investment strategy.

Diversify Your Portfolio: Avoid putting all your eggs in one basket. Diversification can help reduce risk and improve returns over time. Consider spreading your investments across various asset classes, such as stocks, bonds, and real estate.

Educate Yourself: Take advantage of the educational resources provided by investment apps. Understanding the basics of investing and market trends can empower you to make better decisions.

Start Small: If you’re new to investing, consider starting with a small amount of money. This approach allows you to learn and adjust your strategy without risking significant capital.

Regularly Review Your Investments: Periodic reviews of your investment portfolio are essential. This practice helps you stay aligned with your financial goals and make necessary adjustments based on market conditions.

Final Thoughts

Utilizing an investment app can be a smart how to save money and grow your wealth over time. With their accessibility, lower fees, and user-friendly features, these apps empower individuals to take control of their financial futures. By setting clear goals, diversifying your investments, and continuously educating yourself, you can make informed decisions that pave the way for financial success. Embrace the world of investing, and start using an investment app today to achieve your financial goals!

1 note

·

View note

Text

youtube

In This Tutorial: Frugal Living Tips 2024: How to Save $10k FAST in 2024. This Video More Details explains how To Save $10,000 FAST In 2024 (Money Saving Tips). The best way is to break down the goal into smaller achievable bits. This Video More Explain how to save 10000 in 2024 to the $385 rule to save money fast This topic set up a budget with me and this Video was Created by The Modern Savvy CPA. Looking to save money fast in 2024?

Check out these frugal living tips that can help you save 10k within a year! From budgeting to cutting expenses, we’ll show you how to be a frugal money saver and reach your financial goals. When people ask how to save money with low income first, Then I would say watch this video. This Video fully explains how to save money with low-income, Complete Frugal Living Tips and Money Saving Challenge.

This video related to frugal money saver and happy planner 2024 ideas. Most of the people asked There are old-fashioned money-saving tips that actually work. Living a frugal minimalist lifestyle, Here are some frugal living tips to save money using simple living to budget your money.

Enjoy these minimalism money-saving tips to save money fast These Tips are Created by The Modern Savvy CPA. Nowadays most of people are interested " 66 frugal living tips for the coming recession to save you money" Don't worry this topic upload our channel Next week. 👉Click This Link for Our official channel's New helpful videos: https://www.youtube.com/@themodernsav...

#frugal living#frugal#finance#money saving#money#how to save money#finance management#business#investing#frugal aesthetic#finance tips#finance news#usa news#usa today#usa 2024#trendingnow#trending#frugal lucre#follow#follow4follow#Youtube

4 notes

·

View notes

Text

Tips to Save Money as Students in Bangalore

Living in Bangalore as a student can be exciting, but managing finances can be challenging, especially with rising living costs. Here are a few tips to help you save money while still enjoying the student life:

· Choose Affordable Accommodation: Instead of traditional rentals, consider co-living spaces like Colive rental accommodation. These provide fully-furnished spaces with amenities like Wi-Fi, housekeeping, and even community activities, all included in one package. It’s cost-effective and saves the hassle of paying for utilities separately. Check out Colive reviews to choose the best location and accommodation that fits your budget.

· Public Transport & Shared Rides: Bangalore’s public transport system, including BMTC buses and the metro, is budget-friendly and reliable. For short distances, consider using ride-sharing options like carpooling or bike rentals.

· Budget-friendly Food Options: Avoid frequent dining out by cooking simple meals at home. Many co-living spaces provide communal kitchens where you can prepare meals. Also, explore affordable food spots, especially around student areas, which offer decent meals at low prices.

· Student Discounts: Many businesses in Bangalore offer student discounts on a variety of services, including movie tickets, tech gadgets, and even gym memberships. Always carry your student ID to avail any of these benefits.

· Limit Unnecessary Subscriptions: Review your monthly subscriptions such as streaming services or gym memberships. Opt for student plans where available or share subscriptions with roommates or friends. If you choose Colive then several add on features like fitness room and cinema room come inclusive at several properties to make the stay super comfortable.

· Buy Used Books and Materials: Instead of buying new textbooks or study materials, explore second-hand bookstores or online platforms where students sell their old books. You can also share materials with classmates or access free resources from libraries to minimize spending.

By being mindful of your accommodation, travel, food, and discounts, you can save a substantial amount while making the most of your student life in Bangalore.

#co-living#student life#tips to save money#student life in bangalore#how to save money#colive#colive reviews

1 note

·

View note

Text

Saving money as a student is important! To help you start challenging yourself to save money! Here is a saving challenge, the amount and currency can be changed also the colors of the circles according to your country and you favorite colors.

Message me here if you’d like a copy! This is free 🫶

#money saving#studyblr#savings#money#money management#study life#how to save money#saving money#saving habits

0 notes

Text

New sharp standard one bed flat for rent visit website cute new 1bedrooms available now affordable housing with pop false ceiling lights TV console stable power supply available at Rumuosi area in port Harcourt city rivers state Nigeria

#nigeria#lagos#abuja#wike#nysc#vietnam#bangladesh#rivers state#youtube#portharcourt#pakistan#india#abeokuta#wuse#fulani#howtomakemoneyonfacebook#bobrisky#how to save money#how to save tax#how to save a life#bestpostingtimes#messagetrends#nepal#verydarkblackman#verydarkman#fubara#DhakaBangladesh#warri

1 note

·

View note

Text

0 notes