#Green Cryptocurrency

Text

In this blog post, we will explore the sustainability challenges of blockchain technology and the emergence of green cryptocurrencies. We will also discuss the potential of blockchain to help us address climate change.

0 notes

Text

Uranus Retrograde, Re-plow field of dreams

Deutsch: Maler der Grabkammer des SennudemEnglish: Painter of the burial chamber of Sennedjemالعربية: رسام حجرة دفن سننجم, Public domain, via Wikimedia Commons

Uranus in Taurus turns Retrograde September 1st at 11:18 am EDT it’s annual review time for doing the backstep, retracing its’ revolutionary, slow plodding, dragging its hoofs energy, forwards movent over the next 5 months. Uranus turns…

#Astrology psychic Tarot card reader Tara Greene#Best Tarot reader#Bitcoin#Canada&039;s 1 Psychic Voted and Certified Psychic#Cosmic Inteligence Agency#cryptocurrency#financial#Neptune in Pisces#Pluto at 29 Capricorn#protests#Tara Greene Toronto Astrologist and Tarot reader#Uranus in Taurus Retrograde#very rare celestial phenomena#world news

2 notes

·

View notes

Text

Join us on a fascinating exploration of the evolving landscape of digital money as we compare Central Bank Digital Currencies (CBDCs) with cryptocurrencies. Delve into the key differences, advantages, and challenges associated with both CBDCs and cryptocurrencies, shedding light on their potential impact on our financial systems and everyday lives. Discover the potential benefits of CBDCs, such as increased financial inclusion and improved transaction efficiency, while also exploring the decentralized nature and privacy aspects of cryptocurrencies. Whether you're a cryptocurrency enthusiast or simply intrigued by the future of money, this journey will provide valuable insights and inspire engaging discussions. Buckle up for an intriguing exploration of CBDCs vs cryptocurrencies - the future of digital money awaits!

#blockchain#cryptocurrency#crypto#green technology#technology#blockchain technology#bitcoin#metaverse#defi#nftnews#cbdc#digital currency#btc#ethereum#cryptocurrency news

2 notes

·

View notes

Text

Investment Strategies for a Changing Market: Insights for 2024 and Beyond

As we venture into 2024, the global investment landscape is marked by rapid technological advancements, evolving geopolitical dynamics, and shifting economic paradigms. The post-pandemic recovery, inflationary pressures, interest rate fluctuations, and the ongoing digital revolution are shaping the financial markets in unprecedented ways. For investors, this dynamic environment presents both challenges and opportunities. To navigate this changing market successfully, it is crucial to adopt adaptable and forward-thinking investment strategies. In this blog post, we will explore key insights and strategies that can help investors thrive in 2024 and beyond.

1. Diversification: The Cornerstone of Risk Management

Diversification remains a fundamental principle of sound investing, particularly in an uncertain market environment. By spreading investments across different asset classes, sectors, and geographic regions, investors can reduce their exposure to specific risks and enhance the stability of their portfolios.

a. Asset Class Diversification

In 2024, traditional asset classes such as equities, bonds, and real estate continue to play a crucial role in portfolio construction. However, the inclusion of alternative investments—such as commodities, private equity, and cryptocurrencies—can provide additional diversification benefits. Commodities, for instance, often perform well during inflationary periods, while private equity offers exposure to high-growth companies not available in public markets. Cryptocurrencies, despite their volatility, can offer high returns and serve as a hedge against traditional financial systems.

b. Geographic Diversification

Globalization has made it easier for investors to access markets worldwide. In the current economic climate, emerging markets in Asia, Latin America, and Africa offer attractive growth prospects. These regions are experiencing rapid economic development, driven by demographic trends, technological adoption, and increasing consumer demand. By investing in these markets, investors can tap into high-growth opportunities while mitigating the risks associated with any single economy.

c. Sector Diversification

The economic landscape is constantly evolving, and different sectors perform differently depending on the macroeconomic environment. For instance, technology and healthcare sectors have shown resilience during economic downturns, while energy and industrial sectors tend to perform well during periods of economic expansion. In 2024, sectors like renewable energy, biotechnology, and cybersecurity are expected to experience significant growth, driven by technological advancements and societal shifts. By diversifying across sectors, investors can capture growth opportunities while managing sector-specific risks.

2. Embracing Technological Innovation

Technological innovation continues to be a major driver of economic growth and market performance. The rise of artificial intelligence, automation, blockchain, and the Internet of Things (IoT) is transforming industries and creating new investment opportunities.

a. Investing in Tech Giants and Innovators

Tech giants such as Apple, Amazon, Google, and Microsoft have become integral to the global economy, and their dominance is expected to continue in 2024. These companies are leaders in innovation, with extensive research and development capabilities that enable them to stay ahead of competitors. In addition to these established players, investors should also consider smaller, high-growth companies at the forefront of technological advancements. Startups in fields like artificial intelligence, biotechnology, and clean energy offer significant growth potential, albeit with higher risk.

b. Leveraging Fintech and Digital Finance

The financial industry is undergoing a digital transformation, driven by fintech innovations such as digital payments, robo-advisors, and blockchain technology. These innovations are making financial services more accessible, efficient, and secure. In 2024, fintech companies are likely to continue disrupting traditional financial institutions, offering investors lucrative opportunities. Additionally, the rise of decentralized finance (DeFi) platforms, which use blockchain technology to offer financial services without intermediaries, presents new avenues for investment.

c. Capitalizing on the Metaverse and Virtual Reality

The concept of the metaverse—a virtual world where people interact, work, and play—is gaining traction, with major companies investing heavily in its development. Virtual reality (VR) and augmented reality (AR) technologies are expected to play a crucial role in the metaverse, creating new investment opportunities in entertainment, gaming, real estate, and even digital art. While still in its early stages, the metaverse represents a long-term growth area for investors willing to take on higher risk for potentially high rewards.

3. Sustainable and Impact Investing

As concerns about climate change, social inequality, and corporate governance continue to grow, sustainable and impact investing is becoming increasingly important. Environmental, Social, and Governance (ESG) factors are now integral to the investment decision-making process for many investors.

a. Integrating ESG Criteria

In 2024, companies that prioritize sustainability and ethical practices are expected to outperform their peers, as consumers, regulators, and investors demand greater accountability. By integrating ESG criteria into their investment strategies, investors can identify companies that are well-positioned for long-term success. For instance, companies with strong environmental practices may be better prepared to navigate regulatory changes related to climate change, while those with good governance structures are likely to manage risks more effectively.

b. Focusing on Green Energy and Climate Solutions

The transition to a low-carbon economy is accelerating, driven by government policies, technological advancements, and changing consumer preferences. Investments in renewable energy, energy efficiency, and clean technologies are expected to see significant growth in 2024 and beyond. Companies involved in the production of solar, wind, and hydrogen energy, as well as those developing electric vehicles and energy storage solutions, offer compelling investment opportunities. Additionally, investors should consider companies that are working to mitigate climate risks, such as those involved in carbon capture and climate resilience projects.

c. Supporting Social Impact Initiatives

Impact investing, which seeks to generate positive social and environmental outcomes alongside financial returns, is gaining traction among investors. In 2024, areas such as affordable housing, education, healthcare, and sustainable agriculture are expected to attract significant investment. By supporting companies and projects that address pressing social challenges, investors can contribute to societal progress while achieving financial returns.

4. Adapting to Economic and Geopolitical Shifts

The global economy is constantly influenced by a range of factors, including inflation, interest rates, fiscal policies, and geopolitical events. To succeed in this environment, investors must be agile and responsive to changing conditions.

a. Navigating Inflation and Interest Rate Risks

Inflationary pressures and interest rate hikes are expected to continue in 2024, presenting challenges for fixed-income investments and consumer spending. To mitigate these risks, investors should consider inflation-linked bonds, real assets such as real estate and commodities, and dividend-paying stocks. Additionally, floating-rate bonds, which adjust their interest payments based on changes in interest rates, can offer protection against rising rates.

b. Monitoring Geopolitical Developments

Geopolitical events, such as trade tensions, conflicts, and regulatory changes, can have significant impacts on financial markets. In 2024, investors should closely monitor developments in major economies such as the United States, China, and the European Union. Trade relations, especially between the U.S. and China, will continue to influence global supply chains and market sentiment. Additionally, political instability in emerging markets could create both risks and opportunities for investors. To manage geopolitical risks, investors should consider diversifying their portfolios across regions and sectors, as well as staying informed about global events.

c. Hedging with Safe-Haven Assets

In times of economic uncertainty, safe-haven assets such as gold, government bonds, and the U.S. dollar tend to perform well. These assets provide stability and protection against market downturns. In 2024, gold is expected to remain a popular hedge against inflation and currency devaluation. Similarly, U.S. Treasuries and other high-quality government bonds can offer safety and income in a volatile market. Investors should consider allocating a portion of their portfolios to these safe-haven assets to balance risk and reward.

5. Active vs. Passive Investing: Striking the Right Balance

The debate between active and passive investing continues to be relevant in 2024. While passive investing, through index funds and ETFs, offers low-cost exposure to broad markets, active investing allows for more targeted strategies and the potential for higher returns.

a. Benefits of Passive Investing

Passive investing is a popular strategy for its simplicity, low costs, and consistent performance. By tracking market indexes, passive funds provide broad diversification and reduce the risk of underperforming the market. In a changing market, where predicting short-term movements can be challenging, passive investing offers a reliable way to capture overall market growth. For long-term investors, a core portfolio of passive funds can provide steady returns with minimal effort.

b. Opportunities in Active Investing

Active investing, on the other hand, involves selecting individual stocks, bonds, or funds based on research and market analysis. In a rapidly changing market, active managers can capitalize on opportunities and avoid potential pitfalls that passive funds might miss. For instance, active investors can target undervalued companies, emerging sectors, or regions with strong growth potential. Additionally, active strategies can be tailored to specific investment goals, such as income generation or capital preservation.

c. Combining Active and Passive Approaches

For many investors, a combination of active and passive strategies offers the best of both worlds. By maintaining a core portfolio of passive investments and supplementing it with active strategies, investors can achieve diversification, reduce costs, and enhance returns. For example, an investor might use index funds to gain broad market exposure while actively selecting individual stocks in high-growth sectors or emerging markets. This balanced approach allows investors to adapt to changing market conditions while staying aligned with their long-term objectives.

6. Long-Term Perspective: Staying Focused on Goals

Amidst market fluctuations and economic uncertainty, it is essential for investors to maintain a long-term perspective. Short-term market movements can be unpredictable, and reacting to them impulsively can lead to suboptimal investment decisions.

a. Staying Disciplined During Market Volatility

Market volatility is inevitable, especially in a rapidly changing environment. Investors should avoid making emotional decisions based on short-term market movements. Instead, they should stay disciplined and focused on their long-term investment goals. A well-diversified portfolio, aligned with the investor’s risk tolerance and time horizon, can help weather market turbulence and achieve steady growth over time.

b. Regular Portfolio Review and Rebalancing

Regularly reviewing and rebalancing the portfolio is crucial to ensure that it remains aligned with the investor’s goals and risk tolerance. Market changes can cause the portfolio’s asset allocation to drift away from its target mix. Rebalancing involves selling overperforming assets and buying underperforming ones to restore the desired allocation. This disciplined approach helps manage risk and keeps the portfolio on track to achieve long-term objectives.

c. Adapting to Life Changes

Investors’ financial goals and risk tolerance can change over time due to life events such as retirement, marriage, or the birth of a child. It is important to adapt the investment strategy to reflect these changes. For example, as investors approach retirement, they may want to shift towards more conservative investments to preserve capital and generate income. Conversely, younger investors with a longer time horizon may opt for more aggressive growth strategies. By regularly reassessing their investment goals and adjusting their strategies accordingly, investors can stay aligned with their evolving needs.

As we navigate the complexities of 2024 and beyond, the investment landscape will continue to evolve, presenting both challenges and opportunities. By adopting a diversified, forward-thinking approach, embracing technological innovations, integrating ESG criteria, and staying responsive to economic and geopolitical shifts, investors can position themselves for success in a changing market. Whether through active or passive strategies, the key to long-term success lies in maintaining a disciplined, goal-oriented approach and staying focused on the big picture. With the right strategies in place, investors can confidently navigate the uncertainties of 2024 and beyond, achieving their financial objectives while seizing new opportunities in the ever-changing world of investing.

#Investment Strategies 2024#Diversification in Investments#Global Market Trends 2024#Technological Innovation in Investing#Sustainable Investing#ESG Investing#Capital Markets 2024#Geopolitical Risks in Investing#Passive vs Active Investing#Long-Term Investment Strategies#Emerging Markets Investment#Fintech and Digital Finance#Metaverse Investment Opportunities#Impact Investing 2024#Alternative Investments#Cryptocurrency Investing#Green Energy Investments 2024#Scott Biffin#singapore#australia

1 note

·

View note

Text

The Green Debate: Crypto's Environmental Impact 🌱💻

Hey there, Tumblr crew! Raul here, ready to dive into a topic that's been sparking some heated discussions in the crypto community lately: the environmental impact of cryptocurrencies. Now, grab your reusable water bottle and join me as we navigate through this green debate.

Picture this: a lush green landscape stretching as far as the eye can see, teeming with life and vitality. Now, overlay that serene scene with a stark digital footprint—a reminder of the energy-intensive processes powering the world of cryptocurrency. It's a striking image that encapsulates the heart of the ongoing debate surrounding crypto's environmental sustainability.

On one side of the debate, you have environmentalists raising concerns about the carbon footprint of crypto mining operations. These energy-intensive processes require significant computing power, leading to high electricity consumption and greenhouse gas emissions. Critics argue that the environmental cost of crypto mining is at odds with our collective efforts to combat climate change and preserve our planet's precious resources.

But wait, it's not all doom and gloom! On the flip side, proponents of crypto point to the potential for innovation and sustainability within the industry. Some cryptocurrencies are exploring alternative consensus mechanisms, such as proof-of-stake, which require significantly less energy than traditional proof-of-work systems. Additionally, initiatives like carbon offset programs and renewable energy adoption are gaining traction within the crypto community, aiming to mitigate the environmental impact of crypto operations.

So, where does that leave us? As with any complex issue, the answer isn't black and white. It's more like a vibrant tapestry of shades of green (pun intended). While crypto undoubtedly presents environmental challenges, it also holds promise as a catalyst for positive change. By fostering innovation, promoting sustainability, and holding ourselves accountable, we can work towards a greener, more sustainable future for crypto and beyond.

As we navigate this green debate, let's keep the conversation going. What are your thoughts on crypto's environmental impact? Do you have any ideas for mitigating its footprint? Share your insights in the comments below, and let's spark some eco-friendly discussions together!

Until next time, stay green and keep the conversation buzzing!

Peace, love, and sustainable vibes, Raul 🌱💚

0 notes

Text

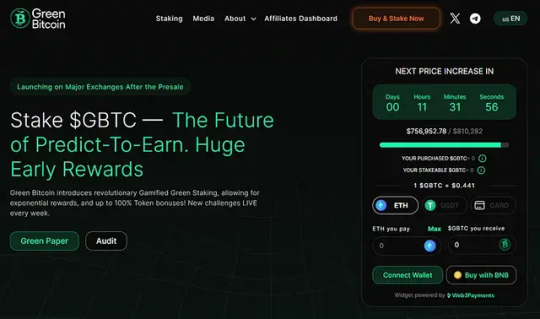

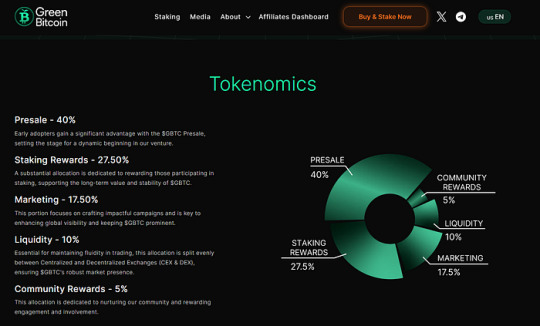

Green Bitcoin token pre-sale — an opportunity for investors

Green Bitcoin — Sustainable cryptocurrencies with the potential for large profits

Green Bitcoin is a new cryptocurrency project that combines the legacy of Bitcoin with an environmentally friendly blockchain Ethereum . This project offers an innovative solution that allows users to earn big money while contributing to environmental protection.

Go to the project website by clicking here

How does Green Bitcoin work ?

Green Bitcoin uses a staking model that allows users to earn rewards for locking their tokens . Green Bitcoin (GBTC) tokens are mined sustainably using only renewable energy sources.

In addition to staking , Green Bitcoin also offers a unique Bitcoin price prediction system . Users can earn rewards by correctly predicting Bitcoin’s future price trends .

Go to the project website by clicking here

Why is it worth investing in Green Bitcoin ?

There are many reasons why you should consider investing in Green Bitcoin . Firstly, this project is environmentally sustainable. Green Bitcoin uses only renewable energy sources, which helps reduce its impact on the environment.

Secondly, Green Bitcoin offers the potential for large profits.

Users can earn rewards for staking and predicting Bitcoin prices .

Thirdly, Green Bitcoin is a new and innovative project that has the potential for development. This project is only in the pre — sale phase, which means that now is a good time to get on board .

Go to the project website by clicking here

What threats should be expected?

Of course, like any cryptocurrency project , Green Bitcoin comes with some risks. One of the main risks is that this project may fail. Please note that Green Bitcoin is still in development and there is no guarantee that it will be successful.

Another risk is that the price of GBTC may drop. The price of GBTC depends on many factors, including the overall cryptocurrency market , the development of the Green Bitcoin project , and general economic conditions.

Go to the project website by clicking here

Coinspect and security audit

Coinspect is a cryptocurrency security company that offers security audits for cryptocurrency projects .

A security audit is a crucial step for any cryptocurrency project that wants to ensure the security of its users and assets.

Coinspect security audit includes the following elements:

· Code Assessment: Analyzing the project’s source code for potential security vulnerabilities.

· Infrastructure Assessment: Analysis of the project infrastructure, including servers, networks and databases.

· Process Assessment: Analyze the project’s security processes, such as risk management and access control.

Coinspect uses a team of cryptocurrency security experts who are experienced in conducting security audits for cryptocurrency projects . This company also has a good reputation in the cryptocurrency industry .

As Green Bitcoin points out , the audit can be viewed via the link on their official website — https://coinsult.net/projects/green-bitcoin .

Go to the project website by clicking here

Bitcoin Purchasing Methods

Green Bitcoin can be pre-purchased as follows:

· Metamask

· Wallet Connect

· Best Wallet

· BNB Chain — If you purchase on BNB during the pre-sale, you will not be eligible for the 350% annual staking return .

Green Bitcoin — an ecological alternative to Bitcoin

As environmental awareness increases around the world, more and more people are looking for ways to reduce their impact on the environment. Also in the cryptocurrency industry , there are more and more projects that focus on sustainable development. One of them is Green Bitcoin .

Green Bitcoin is a new cryptocurrency project that uses only renewable energy sources for mining. Thanks to this, its CO2 emissions are much lower than those of traditional Bitcoin .

Go to the project website by clicking here

What are the benefits of Green Bitcoin ?

In addition to lower CO2 emissions, Green Bitcoin also offers other benefits such as:

· Lower mining costs: Green Bitcoin is cheaper to mine than traditional Bitcoin , which may lead to lower prices for GBTC tokens .

· Increased security: Green Bitcoin is considered more secure than traditional Bitcoin because it does not require as many nodes to verify transactions.

Go to the project website by clicking here

Is Green Bitcoin the future of cryptocurrencies ?

It’s still too early to say whether Green Bitcoin will be successful. However, this project has the potential to become a popular alternative to traditional Bitcoin in a world that focuses on ecology.

Go to the project website by clicking here

GBTC pre-order page

Green Bitcoin official pre-sale website — https://greenbitcoin.xyz

Click to go ( click )

Summary

Green Bitcoin is an ecological alternative to traditional Bitcoin . This project uses only renewable energy sources for extraction, which makes its CO2 emissions much lower. Green Bitcoin also offers other benefits such as lower mining costs and higher levels of security.

Before investing in cryptocurrencies or a pre -sale project, you should carefully analyze the risks and potential benefits. It is also important to remember that you should not invest more money than you can afford to lose.

Attention!

This article is not an encouragement to invest in cryptocurrencies , pre -sale projects or providing investment advice. Investing in cryptocurrencies and pre -sale projects involves high risk.

Green Bitcoin Scam ? - Coinsult Audit

Green Bitcoin is a new cryptocurrency project that combines the legacy of Bitcoin with the eco-friendly Ethereum blockchain. The project offers an innovative solution that allows users to earn big money while contributing to environmental protection.

Go to the project website by clicking here

Coinsult Audit

The Green Bitcoin GBTC protocol has been audited by Coinsult. The audit was conducted by a team of experienced blockchain security experts.

The audit concluded that the Green Bitcoin GBTC protocol is safe and secure. The audit did not identify any critical security vulnerabilities.

The Coinsult audit is a significant sign of confidence in the Green Bitcoin GBTC protocol. The audit confirms that the protocol is safe and secure, and can be used by users without concern for their security.

Audit page: https://coinsult.net/projects/green-bitcoin/

Go to the project website by clicking here

No KYC Audit — What is it?

KYC collects and verifies customer information. This helps exchanges build trust in the cryptocurrency industry, and also protects their users and their assets. KYC is standard for cryptocurrency exchanges. The verification process cannot be denied to provide security to market participants, but for some it is unnecessary, and even annoying.

Go to the project website by clicking here

Environmental Impact

Green Bitcoin GBTC aims to reduce the environmental impact of bitcoin. Bitcoin is considered to be one of the most energy-intensive cryptocurrencies.

The Green Bitcoin GBTC protocol uses the proof-of-stake mechanism, which is more energy-efficient than proof-of-work, which is used by bitcoin. Proof-of-stake requires less energy to verify transactions.

Users who store bitcoins on the Green Bitcoin GBTC protocol can help reduce the environmental impact of bitcoin.

Go to the project website by clicking here

Attention!

This article is not an encouragement to invest in cryptocurrencies, pre-sale projects or providing investment advice. Investing in cryptocurrencies and pre-sale projects involves high risk.

#crypto#cryptocurrencies#cryptocurency news#cryptoexchange#ethereum#binance#bnbchain#bnb#coinbase#green bitcoin#GBTC#pre-sale#foryou#forypupage#investing#trader

0 notes

Text

Ukraine's TPS Extension and Redesignation: Implications and Impact

https://visaserve.com/lawyer/2023/08/18/TEMPORARY-PROTECTED-STATUS-(TPS)/Ukraines-TPS-Extension-and-Redesignation-Implications-and-Impact_bl53902.htm

#TPS #TemporaryProtectedStatus #UkraineTPS #DHS #ImmigrationNews #Ukraine #ExtensionAndRedesignation #USImmigration #TPSEligibility #EmploymentAuthorization

http://wew.visaserve.com

#immigration#visa#h-1b#green card#perm#h-1b visa#uscis#india#us#usa#canada visa#marriage#green card from marriage to a us citizen#npz law group#visa card buy with cryptocurrency#visaserve#david nachman#ludka zimovcak#snehal batra#michael phulwani#gagan mundra#canadavisa#toronto

0 notes

Text

Bitcoin Mining Can Assist In Decarbonizing Energy Grids, Researchers Insist

Researchers have identified that while Bitcoin mining has the potential to contribute to decarbonization efforts. But, it is confronted with notable practical obstacles on its path.

The question of whether Bitcoin mining benefits or harms the environment has been a subject of inquiry. In a groundbreaking academic paper addressing this issue, blockchain experts endeavored to provide an answer.…

View On WordPress

#Adoption#Bitcoin#Blockchain#BTC#crypto#Cryptocurrency#decarbonization#decentralization#green energy#mining#Nitcoin mining

0 notes

Photo

BITCOIN AND OTHER CRYPTOS TOWARDS SUSTAINABILITY

from fossil fuels to renewable energy through changes to the blockchain and green cryptocurrencies

@gw-360

#greencrypto#bitcoin#crypto#blockchain#btc#ethereum#bitcoinmining#cryptocurrencies#criptovalute#ambiente#green#sostenibilita#sustainability#sostenibile#risparmioenergetico#savetheplanet#inquinamento#sustainable#rinnovabili#gw360#greenwhereabouts#gwblog

0 notes

Text

Revolutionary love, Venus conjunct Pluto in Aquarius

Venus in Aquarius Venus conjunct Pluto at 0 degrees Aquarius February 16 at 12:38 pm PST, 3:48 am EST/ 8:48 am GMT is a once in a lifetime event and a start of a brand New Venus Pluto love and changing of values cycle

Today is a way better day to celebrate a brand new made over renovated Valentine’s Day “as above so below.” Venus and Pluto are both wealth planets, use this conjunction to create…

View On WordPress

#Aquarius#Astrology psychic Tarot card reader Tara Greene#Canada&039;s 1 Psychic Voted and Certified Psychic#Cryptocurrency and astrology#Harry Styles#LGBQT#love and dating#Oprah#Taylor Swift Venus sign#Timothee Chalamet#Toronto&039;s best astrologer tarot reader#Venus conjnct Pluto#Venus conjunct Pluto#women

4 notes

·

View notes

Text

Ethereum, the second largest cryptocurrency, enters the green deal with The Merge

Ethereum, the second largest cryptocurrency, enters the green deal with The Merge

Credit: Google

Ethereum represents an important cryptocurrency for the crypto ecosystem, and The Merge represents a great opportunity to combine the excellent economic opportunities provided by this crypto with the green deal. It is estimated that 99.95 percent of electricity will be saved after this momentous breakthrough.

Credit: Google

Ethereum, like all cryptocurrencies, relies not only on…

View On WordPress

0 notes

Text

“Carbon neutral” Bitcoin operation founded by coal plant operator wasn’t actually carbon neutral

I'm at DEFCON! TODAY (Aug 9), I'm emceeing the EFF POKER TOURNAMENT (noon at the Horseshoe Poker Room), and appearing on the BRICKED AND ABANDONED panel (5PM, LVCC - L1 - HW1–11–01). TOMORROW (Aug 10), I'm giving a keynote called "DISENSHITTIFY OR DIE! How hackers can seize the means of computation and build a new, good internet that is hardened against our asshole bosses' insatiable horniness for enshittification" (noon, LVCC - L1 - HW1–11–01).

Water is wet, and a Bitcoin thing turned out to be a scam. Why am I writing about a Bitcoin scam? Two reasons:

I. It's also a climate scam; and

II. The journalists who uncovered it have a unique business-model.

Here's the scam. Terawulf is a publicly traded company that purports to do "green" Bitcoin mining. Now, cryptocurrency mining is one of the most gratuitously climate-wrecking activities we have. Mining Bitcoin is an environmental crime on par with opening a brunch place that only serves Spotted Owl omelets.

Despite Terawulf's claim to be carbon-neutral, it is not. It plugs into the NY power grid and sucks up farcical quantities of energy produced from fossil fuel sources. The company doesn't buy even buy carbon credits (carbon credits are a scam, but buying carbon credits would at least make its crimes nonfraudulent):

https://pluralistic.net/2023/10/31/carbon-upsets/#big-tradeoff

Terawulf is a scam from top to bottom. Its NY state permit application promises not to pursue cryptocurrency mining, a thing it was actively trumpeting its plan to do even as it filed that application.

The company has its roots in the very dirtiest kinds of Bitcoin mining. Its top execs (including CEO Paul Prager) were involved with Beowulf Energy LLC, a company that convinced struggling coal plant operators to keep operating in order to fuel Bitcoin mining rigs. There's evidence that top execs at Terawulf, the "carbon neutral" Bitcoin mining op, are also running Beowulf, the coal Bitcoin mining op.

This is a very profitable scam. Prager owns a "small village" in Maryland, with more that 20 structures, including a private gas station for his Ferrari collection (he also has a five bedroom place on Fifth Ave). More than a third of Terawulf's earnings were funneled to Beowulf. Terawulf also leases its facilities from a company that Prager owns 99.9% of, and Terawulf has *showered * that company in its stock.

So here we are, a typical Bitcoin story: scammers lying like hell, wrecking the planet, and getting indecently rich. The guy's even spending his money like an asshole. So far, so normal.

But what's interesting about this story is where it came from: Hunterbrook Media, an investigative news outlet that's funded by a short seller – an investment firm that makes bets that companies' share prices are likely to decline. They stand to make a ton of money if the journalists they hire find fraud in the companies they investigate:

https://hntrbrk.com/terawulf/

It's an amazing source of class disunity among the investment class:

https://pluralistic.net/2024/04/08/money-talks/#bullshit-walks

As the icing on the cake, Prager and Terawulf are pivoting to AI training. Because of course they are.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/08/09/terawulf/#hunterbrook

#pluralistic#greenwashing#hunterbrook#zero carbon bitcoin mining#bitcoin#btc#crypto#cryptocurrency#scams#climate#crypto mining#terawulf#hunterbrook media#paul prager#pivot to ai

371 notes

·

View notes

Text

October 1, 2022 - NATIONAL GREEN CITY DAY - NATIONAL CRYPTOCURRENCY MONTH - NATIONAL HAIR DAY – NATIONAL BLACK DOG DAY – NATIONAL HOMEMADE COOKIES DAY – NATIONAL FIRE PUP DAY – NATIONAL PUMPKIN SPICE DAY

October 1, 2022 – NATIONAL GREEN CITY DAY – NATIONAL CRYPTOCURRENCY MONTH – NATIONAL HAIR DAY – NATIONAL BLACK DOG DAY – NATIONAL HOMEMADE COOKIES DAY – NATIONAL FIRE PUP DAY – NATIONAL PUMPKIN SPICE DAY

OCTOBER 1, 2022 | NATIONAL GREEN CITY DAY | NATIONAL CRYPTOCURRENCY MONTH | NATIONAL HAIR DAY | NATIONAL BLACK DOG DAY | NATIONAL HOMEMADE COOKIES DAY | NATIONAL FIRE PUP DAY | NATIONAL PUMPKIN SPICE DAY

NATIONAL GREEN CITY DAY | October 1

On October 1 we celebrate National Green City Day to highlight the progress and innovations cities are making to become more sustainable. Read more…

NATIONAL…

View On WordPress

#adoption#allspice#bake#Canine#cinnamon#cloves#economic#firefighter#ginger#Growth#innovations#NATIONAL BLACK DOG DAY#National Cryptocurrency Month#National Fire Pup day#National Green City Day#National Hair Day#National Homemade Cookies Day#National Pumpkin Spice Day#nutmeg#October 1#products#styles#sustainable#tools

0 notes

Text

Oak N Ferry - Now accepting crypto payments using the #pin_network

608 Ferry Road, Christchurch, New Zealand

#pin#payitnow#pinpayments#pinnetwork#oaknferry

0 notes

Text

Hi, so I wrote a little fic, and I posted it. I gave it to Dani, she laughed at it, I asked if I should edit it, she said "fuck it we ball"

The entire fic will be below the cut because it's short enough to post here, but if you'd like to leave comments or kudos, it is also posted on my AO3. It's only 1k words.

Dress Up As...

This is the stupidest party they have ever thrown. They know that.

This was the stupidest party they had ever thrown, and they all knew it. No one was sure whose idea it had originally been, and no one was quite brave enough to own up to it. But it was their last party at Hillerska — their last third years’ party — and it seemed like a pity to go out without throwing at least one entirely stupid blowout.

The theme was truly very simple: Dress Up Like…

Throughout the entire week before, each third year had one at a time drawn a card out of a hat to find out what or who they would be dressing up as for the party. Every person had a different theme. No one should or would be dressed for the same party. In theory, that’s what made it fun.

What made it decidedly not fun was the fact that no one was allowed to redraw their theme. Once the card was in their hand, they could not switch with anyone or draw a second theme. That factor made the whole thing more than a little stressful. Because not everyone had the clothes they needed just lying around. Some of them had even resorted to stealing from First Years just to complete their looks.

But now it was the night of the party, and one by one they started to trickle in, costumes ready and on full display.

Some were better than others.

Henry wore a black tank top and bright green basketball shorts, chunky sneakers and a backward baseball cap. The entire night, he carried around a can of beer and would randomly start shouting about his human rights. Dress Up Like… An American.

Walter, his ever present counterpart, looked truly ridiculous. More so than usual. He showed up in short-shorts and a crop top, an LED flower crown sitting pretty atop his head. He had a mesh shawl overtop that went farther down than his pants did, and somehow he had managed to find what could only be described as cowboy boots. Dress Up Like… A Pinterest Girlie.

Stella wore a baby pink nightgown with a fairy pattern and clearly not matching blue bunny slippers. She had her hair tied up into pigtails and she was carrying around a worn-in looking stuffed bear. She was drinking her alcohol through a sippy-cup and every once in a while switched to suck on a lollipop. Dress Up Like… A Five-Year-Old.

Fredrika had it (arguably) the easiest out of all of them. She was quite literally wearing a bedsheet that she’d pinned into a toga and some sandals she’d managed to find on short notice. She’d gone the extra step to make herself a wreath for her hair, but pretty much everyone was mad at her for her lucky draw. Dress Up Like… An Ancient Roman.

Alexander had somehow gotten his hands on neon spandex. He went all out for his costume, even finding someone to give him a perm. There was a neon sweatband on his head that had “mysteriously” gone missing from the locker room a week ago. He’d completed his look with sunglasses that were too big for his face and Henry’s orange wrist-watch. Dress Up Like.. The 80s.

Madison wore a muscle tank and tight biker shorts. She was carrying around a big bin of vanilla protein powder and every time someone asked her a question she would respond with “do you even lift, bro?” She’d gone as far as to draw on faint mustache hairs and no one was actually sure if she was kidding about having bought into cryptocurrency as a way to commit to the bit. Dress Up Like… A Gym Bro.

Sara had spent all week stressing about her costume, only to give in and ask Henry if she could borrow his tuxedo. The one she knew he had just lying around because it was Henry, and of course he had a tuxedo lying around. She’d stolen a ring box from Simon to keep in her pocket, as well, and she had found a top hat somewhere in their mother’s box of old Halloween costumes. Dress Up Like… A Groom.

It was a lucky coincidence that Felice was her counterpart in all of that. They looked ridiculous, but at least they looked ridiculous together. Felice had taken the time to go to the thrift store in Bjärstad for her costume, though. Not even the students of Hillerska had wedding dresses lying around. She was able to find one for relatively cheap, too, and it had come with a veil. The dress was nice if you pretended it wasn’t from the 70s and ignored the suspicious stain. Sara had gotten her a bouquet to really sell the look. Dress Up Like… A Bride.

Wilhelm had borrowed his entire outfit from Felice. It was a blue dress and some gold jewelry. Nothing too scandalous, though he was still sure Jan-Olof’s heart would fail if he saw it. They still hadn’t told him about Wille piercing his ears yet. Wilhelm had opted to wear his own shoes for the night, as much as Felice begged him to try out high heels. He’d promised her he’d try another time when he wouldn’t have to commit to an entire night in them whilst slightly drunk. Dress Up Like… Your Best Friend.

It was Simon that truly caught everyone’s eye, though. With the exception of a long coat and scarf that they knew wasn’t his, he looked like he wasn’t dressed up at all. Everything he wore was seemingly something he wore every day. A sweatshirt and jeans, converse and a silver chain hanging around his neck.

“Oh, come on, Simon! You could have at least tried,” Fredrika called out, somehow already tipsy despite the party having just started.

“I’m dressed up,” Simon said. He shrugged off the coat and scarf before depositing himself in Wilhelm’s lap.

It was an obvious lie.

“Simon, you wear that all the time,” Henry pointed out.

Simon nodded, running his fingers through the hairs on the back of Wille’s head. “Yes, I do, and I’m still dressed up.”

Wilhelm looked like the cat who caught the canary and, most of the time, the rest of them would take that as a clue to just accept Simon’s words as truth and move on. But not tonight. No, they had all made asses of themselves trying to commit to this stupid ass party plan and they would be damned if Simon ruined it. They would force him to go home and change if they had to. They’d drag him by the ear back to Bjärstad and stand guard until he emerged looking just as idiotic as the rest of them.

“I would bet all the money in my wallet that you are not dressed up properly,” Walter said. It would have been a serious threat, too, had he not looked so ridiculous.

“Are you sure about that?” Simon asked, a smirk tugging at his lips.

“I’d like to join in this bet!” Maddie declared, pulling her wallet out of her waistband. And, soon, they were all betting some kind of money on the fact that Simon had not properly committed to their stupid plan.

Wilhelm didn’t say a word. He just sat back with a smug look on his face as Simon got all of his friends to bet him a small fortune. He, of course, knew what Simon was supposed to be dressed up as. He, of course, knew Simon was about to be several thousand kronor richer.

When everyone had placed their bets on the table, his own sister included, Simon pulled his card out of the coat he’d earlier discarded. He knew they were going to challenge him on his costume. He’d come prepared for this.

He cleared his throat, sitting up straighter, though it was difficult with Wilhelm’s arms wrapped tightly around his stomach. “Everything I’m wearing — boxers included — is something Wilhelm has, at some point, stolen from me,” he announced. He threw his card down on top of the make-shift money pot and then leaned back into his boyfriend with a satisfied smirk. “Read it and weep, bitches.”

Dress Up As… Royalty.

#young royals#young royals fanfiction#young royals fanfic#fanfiction#fanfic#wilmon fanfic#zee writes shit

62 notes

·

View notes