#Global GDP comparison

Explore tagged Tumblr posts

Text

Richard Wolff on the failure of the Ukraine conflict

Richard Wolff The Ukraine Conflict Is a Costly Failure

youtube

Richard Wolff on the failure of the Ukraine conflict.

#Ukraine#Ukraine war#Russia#conflict#economic growth#International Monetary Fund#Lloyd Austin#military support#US military support#China#India#proxy war#proxy war analysis#Ukrainian devastation#GDP#Global GDP comparison#Richard Wolff#Youtube

0 notes

Text

India and China: The Economic Tug of War

China and India are two titans poised on the great field of the world economy. Being the two most populated countries in the world, they both have a different story of development, invention, and promise. Many of us are wondering with an eye toward the future: how long until India catches up to its neighbour if it continues on its current trajectory of economy?

China's GDP, estimated to be valued at $17 trillion as of 2023, is far larger than India's remarkable $3.5 trillion. China, with its enormous labor force and infrastructure, has been the unchallenged leader in manufacturing, establishing itself as the "world's factory." Contrarily, India has made a name for itself in the services industry by demonstrating its expertise in software and IT services at the forefront of the development and growth. Nevertheless, things are improving. India has been increasing its GDP faster than China, often by a significant margin. While China is experiencing a slowdown in its economy due to an aging population and an imminent debt crisis, India is benefiting from a demographic dividend. Its youthful population has a unique opportunity for economic growth, accounting for over 65% of the total....expand more to read.

#India and China: The Economic Tug of War#comparison of Indian economy with Chinese economy#economic growth comparison of India with china#India vs China#GDP growth rates of India with China#future of Indian economy#economic parity of India with Pakistan#emerging markets India#global economy analysis#Insightful analysis of Indian economy with China. Insightfultake on Indian and Chinese economy.

2 notes

·

View notes

Text

quick palestine fact sheet:

there are nearly 7 million palestinian refugees globally

1.5 million individuals live in the 58 recognized palestine refugee camps around palestine (i.e. in gaza, syria, east jerusalem, etc) recognized by the unrwa

67% of gaza's population are refugees

there are 905,000 registered palestine refugee children: 635,000 in gaza and 269,000 in the west bank

palestinian refugees frequently cannot access public health insurance and are barred from many professions; some areas bar them from education and formal work

in gaza poverty rates are nearly 82% and the unemployment rate is some of the highest in the world at nearl 47% as of august 2022

one recent study showed that 88% of palestinian children show signs of war-related post traumatic stress disorder

37% of adults in the gaza strip qualify for diagnosis for ptsd; however, this number should be approached cautiously, accounting for preconceptions about mental health, access to diagnosis, and hermeneutic injustice: the number is likely far higher

48,000 people in gaza have some form of a disability: more than one fifth of this number are children

palestinians are not allowed, by israeli law, to have citizenship; they have no freedom of movement, and can be subject to forced evictions, detention, and torture.

the per capita gdp of palestine is US$3,678 as of december 2021; this is in comparison to a gdp per capita of USD$52,000 in israel

palestine does not have a formal military. the us stopped aid to palestine, around $60 million, in 2019. palestinian security services receives around $27 million from the national budget.

hamas, a separate entity from the pss, receives around $300 million per year. in comparison, israel spends in excess of USD$23.6 billion annually on their military.

in the midst of disinformation campaigns by global powers, fight facts with facts- and with protests, rallying, donating, elevating the voices of palestinians. keep showing up. keep educating yourself and others. never give up hope. palestine will be free.

566 notes

·

View notes

Text

Astoundingly flawed logic

So riddle me this, if Israel is committing genocide with the intent to kill all Palestinians

And has one of the best global militaries, with a budget surpassing Palestine's entire gdp

And even has nuclear weapons

Then how is Palestine still here, how is Gaza still here, how are millions of Palestinians in one of the most densely packed areas of the entire world, all still here. It literally does not fit the definition. There isn't intention to kill. It's the opposite, they've warned Gazans before bombing.

Whether in some cases they haven't warned, or if the civilians just lied, it's a war, they have no obligation to warn for bombing, the Brits and Americans sure as hell didn't warn Dresden, a bombing that killed 20,000 in a single strike, which is very close to the Palestinian civilian death toll, and yet Dresden wasn't a genocide too. Wanna know why? We didn't want to kill every single German. One interesting thing though, when Israel was founded and invaded by the Arab nations around it, what were their intentions? To block the existence of Israel.

Most likely by eradicating all Israeli civilians and soldiers in the area, to remove any possible claim Israel had over the area. Speaking of claims, Jewish people who founded Israel had lived in the area long before some of the Arab settlers had. Some of the Islamic Caliphates are regarded as the most successful settler colonial efforts in history, spreading to Spain, Morocco, the Turkic Steppes, and settling the region of Palestine too, and this all happened after the Jewish people who had founded the city of Jerusalem. There were I think around 400,000 Jews living there before Israel was created, maybe a bit less but around there. It's not a colonial state, in fact it was freed after being a British colony, no different to the way other British colonies were freed. South Africa used to include modern Namibia, but those two states separated, yet I don't hear anyone bickering about Namibia's right to exist. I know it goes vastly deeper than that comparison, but it still somewhat works.

Anyway, let's say you're living in modern Afghanistan as a woman, where your rights are being actively crushed by a group who used to be designated as a terror group before ruling the country. Are you going to try live your life peacefully and avoid being executed over the simplest things, or going into the streets, protesting, then getting beheaded. I think 99% of people would rather keep living to fight another day, than die a martyr. That's why they're Martyrs, they're the rare 1%, people like the ones who helped hide Anne Frank, or hid Jewish people in their homes. I strongly oppose Hamas, but you don't see me flying over to Palestine protesting against them, same way you don't go over to Israel to protest the Israeli government, or go live with Palestinians to show solidarity. Knowing something is evil and wanting it to end without knowing how, and acting against that evil, are both being against it, one is just activism, the other is opposition. Not many people wanna be activists when the crime is death. Is that enough proof for you?

99 notes

·

View notes

Photo

Workers' share of GDP across the world

by u/JoeFalchetto

Source here.

Here for more info about what it entails.

Compensation of employees is the total in-cash or in-kind remuneration payable to the employee by the enterprise for the work performed by the employee during the accounting period. Compensation of employees includes:

(i) wages and salaries (in cash or in kind) and

(ii) social insurance contributions payable by employers.

This concept views compensation of employees as a cost to employer, thus compensation equals zero for unpaid work undertaken voluntarily. Moreover, it does not include taxes payable by employers on the wage and salary bill, such as payroll tax.

Richer countries tend to have higher labor share of GDP. Some interesting exception are Honduras, Nigeria, and Lesotho on one side, Ireland and the Gulf States on the other.

Caveat: comparisons only make sense in economies of similar GDP per capita. Austria has a lower labor share than Moldova, but employees are better compensated in Austria.

I chose the color scheme to be centered around the global average, which is 53.9%.

78 notes

·

View notes

Text

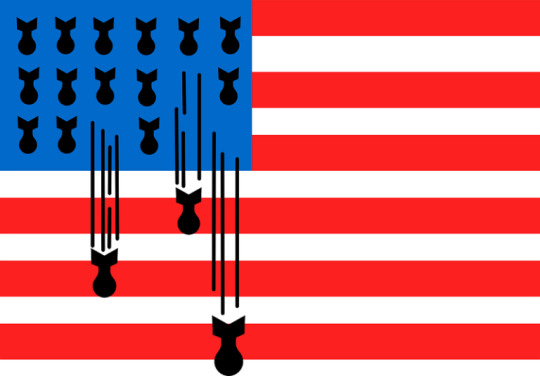

Photo source

Just for a bit of perspective:

🇺🇲💵 US Weapons Exports in 2022 totalled $205.6 Billion, up 49% over the same one-year period from 2021.

This makes Weapons Exports the third largest export category for the United States when commercial and government arms sales are tallied; with the largest export category being Mineral Fuels, Oils, and distillation products and the second largest export category being Machinery, Nuclear Reactors and Boilers.

These were the top five largest US Exports by category:

Mineral Fuels, Oils, Distillation products- $378.56 Billion

Machinery, Nuclear Reactors, Boilers- $229.59 Billion

Weapons Exports- $205.6 Billion

Electrical, Electronic Equipment- $197.75 Billion

Vehicles, other than railway/tramway- $134.89 Billion

US Government Arms exports alone were valued at $51.9 Billion in 2022, accounting for 40% of global government arms sales.

By comparison, Russian arms exports for 2022 are estimated at the equivalent of $10.8 Billion, while Chinese arms exports accounted for roughly 5% of global arms sales or roughly $6.5 Billion. Though admittedly, using US dollars as a comparison point can be limited in its ability to accurately represent the actual number and quality of weapons being sold.

#source

#source2

**The US no longer produces and exports the goods and services you would expect of a nation of its size, population and GDP. The US, which as recently as the 1970's led the world in global production, now only produces and exports overpriced weapons of war and a cultural hegemony that eats insidiously away at the bonds that hold communities together; for a divided nation is easier to conquer and a divided people are easier to rule.

#global arms sales#arms sales#weapons sales#arms exports#weapons exports#us news#us politics#geopolitics#geopolitics news#geopolitical news#geopolitical events#news#world news#international affairs#international news#international politics#global news#socialism#communism#marxism leninism#socialist politics#socialist news#socialist#communist#marxism#marxist leninist#politics#worker solidarity#workersolidarity#WorkerSolidarityNews

9 notes

·

View notes

Text

PATTAYA, Thailand—The neon-lit red light district screams of sex.

In an apartment near Pattaya’s infamous Walking Street, Auchanaporn Pilasata studies her reflection in the mirror, applies another layer of plum-shade lipstick, and touches up her black eyeliner. In the corner of her mirror are two photographs: one from when she looked like a scrawny 15-year-old boy, and another, post-transition, as the stunning woman she is today.

The 37-year-old, who goes by Anna, has been a transgender sex worker for 17 years. While transitioning, she left a low-paying job in a cosmetics packaging factory on the outskirts of Bangkok to become a cabaret dancer in nearby Pattaya, a beach town with a reputation for wild nightlife. She took a temporary job at a “special” massage parlor to earn some cash. Her very first client propositioned her for sex.

“He said, ‘I give you 3,000 baht [$85]. One hour,’” Anna recalled. “[When] I worked in factory, [I made] 6,000 baht in one month. This is the beginning [of] my story [as a] sex worker.”

Thailand has long been one of the world’s major sex tourism destinations. Estimates of sex work’s contribution to GDP vary widely because the industry operates almost entirely underground. But in 2015, the black market research company Havocscope valued it at $6.4 billion per year—about 1.5 percent of the country’s GDP that year.

Despite earning billions annually, the industry is effectively illegal, controversial among Thais, and highly stigmatized. Now, the debate over sex work is spilling into public forums, with a progressive lawmaker introducing a bill in parliament to legalize it. Its proponents argue that criminalization has deprived sex workers of basic labor rights and protections enjoyed by other workers, making them more vulnerable to health risks, harassment, exploitation, and violence—while making sex work itself no less visible.

Visiting Thailand and not noticing any sex workers? It’s like going to “KFC and you never see fried chicken,” Anna said.

The majority of sex workers in the world are women, and a 2017 projection by the Thai Department of Disease Control conservatively estimated that 129,000 of 144,000 sex workers in the country were female. But it’s men who make the decisions about what they can do with their bodies.

Women held 16 percent of Thailand’s parliamentary seats in 2021, the same figure as 10 years ago. By comparison, women made up 20 percent of Saudi Arabia’s governing assembly and 28 percent of the U.S. Congress that year.

The fight for legalization is an uphill battle. Conservative factions within the country and global anti-trafficking organizations remain strongly opposed to sex work. The U.S. Agency for International Development calls Thailand a “source, transit, and destination country” for trafficking, and opponents of the bill say the sex industry enables widespread abuse of women and children across the country and in neighboring Cambodia, Laos, and Myanmar.

Historical reports of sex work existing in Thailand date back to the 1300s. The modern sex industry in Thailand boomed while serving a wave of Chinese immigrants in the early 1900s, Japanese soldiers during World War II, and U.S. soldiers during the Vietnam War. But many Thais grew resentful of its visibility and notoriety. The country adopted the Suppression of Prostitution Act in 1960, followed by the 1996 Prevention and Suppression of Prostitution Act, which outlawed almost all of the activities associated with sex work and income earned from it.

The push against prostitution was further bolstered in the 2000s, when the U.S. government, the religious right, and abolitionist feminists came together in an unlikely alliance. Their goal was to eliminate prostitution. The U.S. movement gained traction globally as those forces traveled to campaign against sex work in countries abroad, including Thailand.

Within Thailand, officials often downplay the prevalence of prostitution in order to present a more positive view of the country to the outside world and appease constituents opposed to sex work. After a Jan. 14 inspection, police said they were “satisfied” after finding no “illegal prostitutes” working in Pattaya, much to the amusement of social media commentators.

“Why don’t they ask all the girl [sic] standing all around if they have seen some sexworkers,” one Facebook user posted.

In practice, the revenues from sex work sustain a robust illicit economy and can be an important lifeline for women whose backgrounds range from educated college graduates to poor rural farmers. Many believe that some form of legal recognition, either decriminalization or legalization, would help to reduce violence against sex workers and give them rights and benefits that would help them, particularly during difficult financial times.

In 2020, when the COVID-19 pandemic brought the world to a standstill and global tourism dried up, around 91 percent of Thai sex workers lost their jobs due to lockdowns, border closures, and social-distancing measures, according to the World Health Organization. As illegal workers, they did not qualify for government relief benefits during the pandemic.

“A lot of [sex workers] could not pay the rent and they had to sleep on the street,” said Supachai Sukthongsa, the Pattaya manager of Service Workers in Group (SWING), a services and support group. “They worked and cleaned up at the bar in exchange for small money and food, just enough to survive day by day.”

The pandemic also reduced access to health care services. Whether they get their business through dating apps, pimps, or on the street, sex workers face numerous risks to their health and safety. The Sex Workers Project, an advocacy organization based in New York, found that sex workers globally face a 45 percent to 75 percent chance of experiencing violence on the job. Transgender women such as Anna face an added layer of danger from clients who turn violent after discovering their identities.

“When I go to the police station,” Anna said, they don’t “help me because [of] my job, because I work illegal work here in Thailand.”

Sex workers frequently accuse Thai police of extorting or ignoring them. Researchers such as Ronald Weitzer, a sociologist and professor with expertise in sex work in Thailand, also accuse police of being heavily involved in sex tourism and profiting off of the industry.

“The authorities, especially the police, have a vested interest in keeping prostitution illegal,” Weitzer said. “They get payoffs.”

Gen. Surachate Hakparn, deputy commissioner-general of the Royal Thai Police, said he believes legalizing sex work could cut down on such activities.

“I admit that there is corruption going on, but it’s only a fraction of police officers doing that,” he said. “From a law enforcement perspective, if it is legalized, it’s good for the police. We don’t need to keep disciplining our subordinates about corruption. And we can put the resources and time into something else.”

Globally, the legal status of sex work is divided into three broad categories: criminalization, legalization, and decriminalization.

The legalization model regulates the registration, health care, and welfare of sex workers. In contrast, the decriminalization model simply removes penalties for pursuing the activity.

There are also hybrid models, such as the Nordic model in countries such as Sweden and Norway, which blend elements of legalization and decriminalization.

It’s the criminalization model that’s employed by about half the world, including most of the United States. It involves the criminalization of every party: the seller, the buyer, and third parties such as pimps or traffickers.

According to the 2018 Global Slavery Index, published by an Australian human rights organization, Thailand is home to about 610,000 human trafficking victims. Although the United Nations Office on Drugs and Crime says most of these victims are trafficked for manual labor, some women and girls are forced into sex work.

While the U.S. government says the Thai government is doing an increasingly good job fighting against trafficking, hard-line anti-traffickers remain vehemently against legalization.

“It’s consumption with nothing in return,” said Sanphasit Koompraphant, the chairperson of Thailand’s Anti-Trafficking Alliance. “It’s sexual exploitation.”

But the criminalization model most anti-traffickers support has come increasingly under attack from sex work activists.

A growing body of research shows that criminalization forces sex workers to operate under more dangerous conditions, increasing risks of sexually transmitted infections, physical abuse, and exploitation—including by police. Aside from stigmatizing the work, bans also mean that many sex workers will end up with a criminal record if caught soliciting, making it harder for them to get other jobs and pushing them deeper into the sex industry.

Weitzer argues that criminalizing sex work has not succeeded in stopping its proliferation and has strong parallels to the U.S. war on drugs.

“The evidence is clear that it’s a complete failure,” he said.

In June 2022, Tunyawaj Kamolwongwat, a progressive parliamentarian with the upstart Move Forward Party, drafted a bill that would establish designated zones for legal sex work. To ensure compliance with its proposed regulations, he said the bill calls for random checks to be carried out to verify licenses, the age of the sex workers, and whether illegal drugs are present.

He said the bill also outlines how the industry will be taxed and specifies locations where it can’t be practiced or advertised, such as near temples and schools.

“It has to [be] away from the children,” Tunyawaj said.

But some sex workers also oppose legalization. Juno Mac, a prominent sex worker and activist, said legalization can create a “two-tiered system” in which wealthier establishments can afford to comply with regulations, while marginalized sex workers operating independently cannot.

Rather than the special regulation and taxation that comes with legalization, Mac prefers decriminalization, which treats sex work like any other work.

Weitzer noted that decriminalization also has limitations, with the lack of regulations allowing existing bad actors—rampant throughout the industry—to continue exploiting workers.

But its supporters say the decriminalization model is more likely to help sex workers better integrate into mainstream society.

“If [we have] legalization, that means that we have the specific law to say this kind of job [is] legal. But we don’t want to have a specific law,” said Surang Janyam, the founder and director of SWING. “If we have specific laws for sex workers, we should have specific laws with every occupation. Decriminalize will [make us] equal as other people.”

Whether through legalization or decriminalization, Weitzer said the odds are stacked against changing the legal status of sex work.

“The majority of legislators are opposed to it, and every time it’s been proposed in the past, I don’t think it’s even gotten out of committee,” Weitzer said.

The last major push was in 2003, when proposed legislation was debated but failed to pass.

Tunyawaj’s June 2022 bill was not reviewed by the board of the parliamentary committee for youth, women, and other vulnerable groups until November 2022. At that point, the committee recommended transferring it to Thailand’s Ministry of Social Development and Human Security. The draft bill will be reviewed again in the next term of the government, and Tunyawaj hopes that having the backing of the Ministry will improve its chances. The fate of the bill now rests in the hands the new government, which will be elected in May.

If reelected, Tunyawaj promises to “keep pushing this bill.”

His coalition is growing. Surachate said the main thing missing is political will.

“The government can solve this matter, if they take it seriously,” he said.

Navaon Siradapuvadol contributed reporting to this article.

This story was supported by the United Nations Foundation.

22 notes

·

View notes

Text

2023 / 18

Aperçu of the Week:

"Experience is the hardest kind of teacher. It gives you the test first and the lesson afterward."

(Oscar Wilde)

Bad News of the Week:

What's true in security policy is also true in fiscal policy: if the U.S. isn't fit, the whole world gets sick. The world's (still) largest economy sets the tone. Many global trade flows, e.g. for energy, are conducted in U.S. dollars, and in many countries it has replaced the domestic currency - whether unofficially, as in Zimbabwe, or even officially, as in El Salvador. So what happens to the U.S. economy or the U.S. dollar has global implications.

In the process, there seems to be a kind of parallel universe. Normally, in the economy, when a so-called insolvency threatens, all the alarm bells go off: Employees look for new jobs, suppliers stop supplying, the bank cancels the credit line, creditors are left sitting on their claims. The company is simply bankrupt, at the end of its rope, with no future prospects. Except, perhaps, for a few fillet pieces that the competition buys up at bargain prices. This does not apply to the USA. Because it is effectively bankrupt. And no one seems to care.

The current debt level - only of the state, not of its companies (banking crisis) or citizens (mortgage and credit card crisis) - amounts to $31.38 trillion. This is significantly more than the gross domestic product (GDP) of $26.85 trillion. In fact, this can never be repaid. For comparison: in Germany, $2.73 trillion in debt is compared to a GDP of $5.32 trillion. And we feel that this is bad. The creditors of the USA sit primarily abroad - whether friendly like Japan or even downright hostile like China. And sleep apparently nevertheless calmly. And that even in the face of the current (once again) concrete threat of insolvency.

Normally, and this has been the case for decades, this is nothing more than a ritual: the money is no longer enough, Republicans and Democrats agree - sometimes with more, sometimes with less dispute - to ignore the debt ceiling, which is actually regulated by law, they obtain money on the markets without any problems and act as if nothing had happened. Until next time. Business as usual.

This year, things may turn out differently. Because the trench warfare between the duopoly parties could reach a new level. Which this time might not be done with a few government agencies and national parks closed for two weeks. Already since the in many ways ridiculous election of Kevin McCarthy as Republican majority leader in the House of Representatives, this has been publicly announced. Because the ultra-right MAGA freaks like Marjorie Taylor Green or Matt Gaetz have made it clear that they will play hard ball on this issue at the latest: rather cuts in social services as well as environmental protection than a suspension of the debt ceiling. For party-political reasons and without a shred of interest in economic or financial policy. At the same time, Treasury Secretary Janet Yellen warns that so far it has only been possible to avert default through "a series of extraordinary measures".

Strange that the U.S. nevertheless has a credit rating of AAA. Is that perhaps because the three relevant agencies, Standard & Poor, Moody's and Fitch, are all U.S.-based private firms? Or that no one wants to admit that there may be a systematic problem after all? In every banking crisis - and we have one right now that is nowhere as dramatic as in the U.S. - the term "too big to fail" makes the rounds. The land of unlimited opportunity, unreal projection surface for the hopes and dreams of large parts of the world's population, must not be allowed to fail. That is psychology. It's certainly not mathematics.

Good News of the Week:

More and more often, I notice on the train and in the supermarket that I'm the only one still wearing an FFP2 mask. Yet I'm not an overly anxious person. I am merely part of a vulnerable group for whom it is still better not to become infected with the corona virus. But that is my personal decision. And no longer a legal requirement. Because there isn't one anymore. Except in many doctors' offices, where masks are still mandatory if that's what the doctor wants - which objectively would have made sense even earlier, because after all, that's basically where a disproportionate number of viruses and bacteria are buzzing around.

Basically, I'm glad that the Word Health Organization (WHO) officially lifted the international health emergency due to Corona on Friday. After more than three years of a worldwide pandemic. In the balance, there are more than 20 million deaths. A health system that reached its limits and exceeded them in many countries. A mass death of retailers and cultural institutions. Lots of children and young people with mental health problems - or at least major failures as they grew up.

Many health policy decisions were right. Many were wrong. Some fellows discovered their social empathy. Some a penchant for conspiracy theories. Friendships and bonds of solidarity have grown. Or were destroyed. As is so often the case in life, the task now is to learn from the past for the future. Because it will not be the last challenge that human society will have to face - looking at the news, the multi-crisis still dominates.

Therefore, it is nice that we have at least left behind the frightening side effects of the Corona pandemic. Which will accompany us from now on as a "completely normal" respiratory disease with a potentially fatal outcome. Like the flu. Because let's face it: normality can be very reassuring.

Personal happy moment of the week:

Last Monday was May 1, a public holiday in Germany. And while on "Labor Day" (actually absurd that this day of all days is a public holiday) demonstrations of the trade unions for more workers' rights take place everywhere in Germany, the accent in Bavaria is elsewhere. Namely on the maypole. A tradition according to which an approximately 30 meter high, white-blue painted trunk is erected with muscle power - accompanied by music, dance and beer. Cancelled the last years because of Corona, it was nice to be able to celebrate this festival again this year. Even the rain had a mercy and took a break for the crucial three hours.

I couldn't care less...

...that the United Kingdom has a new head of state since yesterday, King Charles III. And so do Canada, Australia, New Zealand and 13 other Commonwealth countries. All the pomp, his costumes and rituals etc. show me one thing above all: monarchies are no longer in keeping with the times. And are not democratic.

As I write this...

...I am listening to music. Right now John Legend. And think about the fact that this is probably the only undoubtedly exclusively positive achievement of mankind: art. Whether it's music, poetry, performing or visual art, analog or digital, live or documented. The kind of creativity that does not seek a concrete use value, but stimulates, entertains, inspires, polarizes, makes you think. L'art pour l'art is something very beautiful.

Post Scriptum

Germany reached its "earth overload day" last week. So if all of humanity were as wasteful with resources as we are, it would need three Earths. We only buy green electricity and drive an all-electric car or use public transportation. We try not to throw away food and collect everything that can be recycled. We order as little as possible from Amazon (okay: also because we simply can't stand the working conditions of this company and its owner himself) and basically try to reduce our consumption (okay: this also saves money and has an educational value). And yet we are more part of the problem than part of the solution. Sigh...

#thoughts#aperçu#good news#bad news#news of the week#happy moments#politics#oscar wilde#usa#debt ceiling#congress#bankruptcy#coronavirus#ffp2#who#labor day#first of may#united kingdom#charles iii#windsors#john legend#music#creativity#germany#earth overload day#arts#commonwealth#restrictions#maga#insolvency

2 notes

·

View notes

Photo

Ever wondered what makes the Australian dollar tick? Planning a trip Down Under and need to understand the Aussie currency rate? Or maybe you’re an investor curious about the fluctuations of the AUD? Then you’ve come to the right place. This in-depth guide will explore every aspect of the Australian dollar exchange rate, from its history and influencing factors to how you can best navigate its volatility. We’ll unravel the complexities, making it easy to understand, even if you’re not a financial expert. Get ready to become more savvy about the Australian currency rate!

Understanding the Australian Dollar (AUD) Exchange Rate

The Australian dollar, often abbreviated as AUD, is the official currency of Australia. Its value, relative to other currencies like the US dollar (USD), the Euro (EUR), or the British pound (GBP), constantly changes. This fluctuation is what we call the exchange rate. Understanding this rate is crucial for anyone dealing with international transactions involving Australia, whether it’s travel, trade, or investment.

What Influences the AUD Exchange Rate?

Several factors play a significant role in determining the AUD’s value. Let’s break them down:

1. Commodity Prices: Australia is a major exporter of commodities like iron ore, gold, and coal. Therefore, the price of these commodities on the global market heavily influences the AUD. When commodity prices rise, the demand for the AUD increases, strengthening its value. Conversely, falling commodity prices weaken the AUD.

Iron Ore: A significant driver of AUD strength.

Gold: Acts as a safe haven asset, impacting the AUD during times of global uncertainty.

Coal: Another key export commodity influencing the AUD’s value.

2. Interest Rates: The Reserve Bank of Australia (RBA), Australia’s central bank, sets interest rates. Higher interest rates generally attract foreign investment, increasing demand for the AUD and strengthening its value. Lower interest rates have the opposite effect.

RBA Decisions: Closely watched by investors and traders.

Global Interest Rate Comparisons: The AUD’s value is also influenced by interest rates in other major economies.

3. Economic Growth: A strong Australian economy, characterized by high employment and consumer spending, typically boosts the AUD. Conversely, economic slowdown or recessionary fears weaken the currency.

GDP Growth: A key indicator of economic health.

Employment Figures: High employment rates usually support a stronger AUD.

4. Political Stability: Political uncertainty or instability can negatively impact investor confidence, leading to a weaker AUD. Conversely, a stable political environment generally supports a stronger currency.

Government Policies: Impact investor sentiment and the AUD’s value.

Geopolitical Events: Global events can also affect the AUD.

5. Global Market Sentiment: Overall global economic conditions and investor sentiment play a significant role. During times of global uncertainty, investors often seek safe haven assets, potentially weakening the AUD.

Risk Appetite: Investors’ willingness to take on risk affects currency markets.

Global Economic Outlook: A positive global outlook generally supports the AUD.

Tracking the Australian Dollar Exchange Rate

Staying informed about the AUD’s exchange rate is essential for making informed decisions. Several resources can help you track these fluctuations:

Where to Find Real-Time AUD Exchange Rates

Online Currency Converters: Numerous websites provide real-time exchange rates, including Google Finance, XE.com, and many others. These are usually very accurate and updated frequently.

Financial News Websites: Major financial news outlets like Bloomberg, Reuters, and the Financial Times provide up-to-the-minute exchange rate information, along with analysis and commentary.

Your Bank’s Website: Most banks provide exchange rate information on their websites, although these rates might not always be the most competitive.

Understanding Exchange Rate Charts

Learning to interpret exchange rate charts is a valuable skill. These charts typically show the AUD’s value against another currency over time. Understanding trends, highs, and lows can help you anticipate potential fluctuations.

Line Charts: Show the AUD’s value over a specific period.

Candlestick Charts: Provide more detailed information, including opening, closing, high, and low prices for a given period.

Strategies for Managing AUD Exchange Rate Risk

For individuals and businesses regularly dealing with the AUD, managing exchange rate risk is crucial. Here are some strategies:

Hedging Strategies

Forward Contracts: These contracts lock in an exchange rate for a future transaction, eliminating the risk of unfavorable fluctuations.

Futures Contracts: Similar to forward contracts, but traded on an exchange.

Options Contracts: Give you the right, but not the obligation, to buy or sell AUD at a specific rate within a certain timeframe.

Timing Your Transactions

Monitoring Exchange Rate Trends: By carefully tracking the AUD’s movement, you can potentially time your transactions to take advantage of favorable rates.

Using Exchange Rate Alerts: Many online currency converters allow you to set up alerts that notify you when the AUD reaches a specific level.

The History of the Australian Dollar

The Australian dollar was introduced in 1966, replacing the Australian pound. Since then, its value has fluctuated significantly, influenced by various economic and political factors. Understanding its historical performance can provide valuable context for current trends. You can find detailed historical data on many financial websites, allowing you to see how the AUD has performed against other major currencies over the years. This historical perspective can be incredibly useful in understanding long-term trends and potential future movements.

The Australian Dollar and the Global Economy

The Australian dollar plays a significant role in the global economy, particularly within the Asia-Pacific region. Its value is closely linked to global commodity prices and economic growth, making it a key indicator of global economic health. Furthermore, the AUD’s performance can influence trade flows and investment decisions between Australia and its major trading partners. Understanding the AUD’s position within the global economy is crucial for anyone involved in international trade or investment.

Conclusion: Navigating the Australian Currency Rate

The Australian currency rate is a dynamic and complex subject, influenced by a multitude of factors. However, by understanding these factors and utilizing the resources available, you can navigate the complexities of the AUD and make informed decisions. Remember to stay informed, monitor trends, and consider hedging strategies to manage risk effectively. Whether you’re planning a trip, making an investment, or engaging in international trade, a solid understanding of the AUD exchange rate is key to success.

So, what are your thoughts on the Australian dollar? Have you had any experiences dealing with its exchange rate? Share your insights and experiences in the comments below! And don’t forget to share this post with anyone who might find it helpful. Let’s keep the conversation going!

0 notes

Text

GDP Auditing Services: Ensuring Accuracy and Compliance in Economic Reporting

Gross Domestic Product (GDP) auditing services play a crucial role in the economic landscape by providing a structured, systematic approach to verifying, analyzing, and reporting economic data. GDP is one of the most significant indicators of a country’s economic health, reflecting the total monetary value of all goods and services produced over a specific period. Given its importance, the accuracy and reliability of GDP data are paramount for policymakers, investors, and other stakeholders.

This article delves into the concept of GDP auditing services, their importance, processes, challenges, and the impact they have on global economies.

What are GDP Auditing Services?

GDP auditing services involve the comprehensive examination and verification of data and methodologies used to calculate GDP. These services are conducted by professionals who specialize in economic analysis, statistics, and compliance. The primary objective is to ensure that the GDP figures reported by governments or organizations are accurate, consistent, and comply with international standards.

Key components of GDP auditing services include:

Data Collection Verification: Examining the accuracy and completeness of raw data collected from various sectors.

Methodology Review: Evaluating the calculation methods to ensure they align with accepted standards, such as those outlined by the System of National Accounts (SNA).

Compliance Assessment: Ensuring adherence to international reporting guidelines and regulatory requirements.

Error Identification and Rectification: Detecting discrepancies, anomalies, or errors in the data and providing recommendations for corrections.

The Importance of GDP Auditing Services

Accurate GDP figures are fundamental for several reasons:

1. Policy Formulation

Governments rely on GDP data to design and implement economic policies. Accurate figures help policymakers identify economic strengths and weaknesses, allocate resources efficiently, and plan for future growth.

2. Investor Confidence

Investors use GDP data to assess a country’s economic stability and growth potential. Reliable auditing services ensure that the data investors rely on is trustworthy, promoting confidence in the market.

3. International Comparisons

GDP figures are often used to compare economic performance across countries. Auditing ensures that these comparisons are fair and based on accurate, standardized data.

4. Compliance and Transparency

Auditing services enhance transparency in economic reporting, reducing the risk of data manipulation or misrepresentation. This is particularly crucial for maintaining the credibility of government institutions.

Processes Involved in GDP Auditing Services

The auditing process is meticulous and involves several stages:

1. Planning and Preparation

Auditors begin by understanding the scope of the audit, identifying key data sources, and reviewing the methodologies used in GDP calculation. They also establish objectives and timelines for the audit.

2. Data Verification

This step involves cross-checking raw data from various sectors, such as agriculture, manufacturing, services, and trade. Auditors ensure that the data is complete, accurate, and free from duplication.

3. Methodology Assessment

Auditors examine the techniques and formulas used to calculate GDP. This includes reviewing factors such as:

Production Approach: Verifying the value-added contributions of various industries.

Expenditure Approach: Ensuring accurate summation of consumption, investment, government spending, and net exports.

Income Approach: Checking the aggregation of wages, profits, and taxes.

4. Compliance Checks

Auditors evaluate the GDP reporting against international guidelines, such as those provided by the International Monetary Fund (IMF) and the World Bank. Compliance ensures that the figures meet global standards.

5. Reporting and Recommendations

Once the audit is complete, auditors compile their findings into a detailed report. This report highlights any discrepancies, provides recommendations for improvement, and outlines steps for future compliance.

Challenges in GDP Auditing Services

Despite their importance, GDP auditing services face several challenges:

1. Data Quality Issues

Inaccurate or incomplete data is a common problem, particularly in developing countries where data collection infrastructure may be lacking.

2. Complex Methodologies

The calculation of GDP involves intricate methodologies that require specialized knowledge. Errors in these methods can lead to significant inaccuracies.

3. Limited Resources

Auditing GDP data is resource-intensive, requiring skilled professionals, advanced tools, and sufficient funding.

4. Political Interference

In some cases, governments may attempt to influence GDP figures for political gain. Auditors must navigate such challenges while maintaining objectivity.

5. Rapid Economic Changes

Globalization and technological advancements have made economies more dynamic. Keeping up with these changes poses a challenge for auditors.

The Role of Technology in GDP Auditing Services

Technological advancements have significantly improved the efficiency and accuracy of GDP auditing services. Key technologies include:

1. Data Analytics

Advanced analytics tools help auditors process vast amounts of data quickly and identify patterns or anomalies.

2. Artificial Intelligence (AI)

AI-powered systems can automate repetitive tasks, enhance data accuracy, and provide predictive insights.

3. Blockchain Technology

Blockchain ensures data integrity and transparency by creating tamper-proof records.

4. Cloud Computing

Cloud-based platforms facilitate real-time data sharing and collaboration among auditors, improving efficiency.

The Global Impact of GDP Auditing Services

GDP auditing services have far-reaching implications for global economies:

1. Economic Stability

Accurate GDP data contributes to economic stability by enabling informed decision-making and effective resource allocation.

2. Global Development Goals

Reliable data helps countries track progress toward global development goals, such as those outlined in the United Nations’ Sustainable Development Goals (SDGs).

3. Trade and Investment

Transparent GDP reporting enhances trust among trading partners and attracts foreign investment.

4. Crisis Management

During economic crises, accurate GDP figures are essential for assessing the situation and implementing recovery measures.

Future Trends in GDP Auditing Services

As the world becomes increasingly interconnected, GDP auditing services are likely to evolve in several ways:

1. Increased Use of Automation

Automation will streamline processes, reduce human error, and improve efficiency.

2. Integration of Real-Time Data

Auditors will increasingly rely on real-time data from sources such as IoT devices and digital transactions.

3. Focus on Sustainability Metrics

Future audits may incorporate environmental and social metrics to provide a more comprehensive view of economic performance.

4. Global Collaboration

International cooperation among auditors, governments, and organizations will enhance standardization and knowledge sharing.

Conclusion

GDP auditing services are indispensable for ensuring the accuracy, transparency, and reliability of economic data. By providing thorough assessments and adhering to global standards, these services play a vital role in fostering economic stability, promoting investor confidence, and supporting informed decision-making.

As challenges continue to evolve, the integration of advanced technologies and global collaboration will be key to the future of GDP auditing services. Stakeholders must prioritize these audits to maintain trust and credibility in economic reporting, ultimately contributing to the sustainable growth and development of nations worldwide.

0 notes

Text

also thinking about how the political party that’s constantly yapping about the economy also aggressively supports “traditional” home structures, despite stay at home parents kinda being bad for the economy.

1) the unpaid domestic labor that stay at home parents perform doesn’t contribute to the GDP and 2) unemployed stay at home parents obviously don’t have jobs and don’t “produce” economic activity

please don’t think I’m anti stay at home parents btw.

but countries with significant gender inequality tend to have much lower GDPs by comparison. gender inequality costs the world approximately $12 trillion in global GDP (World Economic Forum).

so I find it quite strange that the party that’s always whining about the economy seems to want to bring back social policies that would *hurt* our economy.

something something proof they don’t actually care about the economy (I could’ve told you that in about 8 other ways) they just hate women and minorities

Sources:

https://www.weforum.org/impact/gender-gap-accelerators-benefits-over-850000-women/#:~:text=Gender%20inequality%20costs%20the%20world,up%20to%20a%2035%25%20loss

#econ ramblings#I really like econ#economy#econ#economics#economic justice#economic theory#economic development#gender#gender ideology#gender theory#gender equality#gender inequality#women’s rights#lowkey my current hyperfixation

0 notes

Text

Is Dubai Real Estate in a Bubble?

Dubai's property market has got people talking. Some think it's growing well, while others worry it might be in a bubble. Property prices are going up fast, and foreign money is coming in. People wonder if this growth can last or if things will go downhill. If you want to invest, you need to know what's going on. Let's see if Dubai's property market is in a bubble.

What Is a Real Estate Bubble?

A real estate bubble happens when property prices shoot up fast. This occurs due to many things like high demand or speculation. This growth can't last and ends in a sharp drop or crash. You can spot a bubble by looking for signs like:

Quick increases in price

Buying based on speculation

Buyers with too much debt

Too much supply

Let's look at whether these factors apply to Dubai's real estate market right now.

Main Concern About Dubai Real Estate

Concern 1: "Property Prices Are Going Up Too Fast—Can This Last?"

Yes, property prices in Dubai have been going up. In 2024 alone, prices went up by over 12%, with July property sales hitting AED 49.6 billion ($13.5 billion)—a 31.63% increase compared to July 2023. But this growth has support from strong basics like Dubai's growing economy, increasing population, and more foreign investment.

Dubai still costs less than big cities like London and New York. Here's a comparison:

Average Property Price per sq.ft: Dubai ($680) vs. London ($1,500)

Rental Yield: Dubai (7.5%) vs. London (3.5%)

Concern 2: "Is Speculation Pushing the Market Up—Could This Mean a Bubble?"

Speculation played a big part in Dubai's 2008 crash, but new rules have made speculative buying harder. Things like mortgage limits and bigger down payments have made it tough for short-term investors to flood the market.

A UBS report from 2023 gave Dubai a low bubble risk score compared to cities like Toronto and Frankfurt. Dubai scored 0.14 on the index (scores above 1.5 show bubble risk) pointing to a healthier and more sustainable market.

Concern 3: "The Market Has Too Many Luxury Properties—Is Supply Too High?"

Dubai has many luxury developments, but this doesn't mean the market has too much supply. Rich people from Europe, Asia, and Africa see Dubai as a safe place to invest. In fact foreign buyers put $4.4 billion into Dubai's housing market in 2024—76% more than in 2023.

What's more, mid-tier and affordable segments have an impact on significant growth. For instance:

Transactions in the AED1,000-AED 2,000 per sq.ft range had an increase of 64.1%.

Luxury properties priced above AED8,000 per sq.ft made up just 0.2% of total transactions in May 2024.

This diversification across price segments ensures a balanced market.

Concern 4: "Does Debt-Fueled Growth Drive the Boom?"

Dubai's growth now doesn't rely much on debt. Developers use more equity financing instead of loans, which cuts down risks from credit market changes. Stricter rules for lending and lessons from the 2008 crash have led to more careful practices.

Concern 5: "Will Higher Interest Rates Crash the Market?"

Dubai's real estate deals involve cash, unlike many global markets. In Q3 2023, cash buyers made up twice as many deals as mortgage buyers (16,485 cash deals vs. 8,238 mortgage deals). This means higher interest rates don't affect the market as much.

Concern 6: "Does Foreign Investment Have Two Sides?"

Foreign investment has a major impact on Dubai real estate market but doesn't make it too dependent or at risk. Rules like long-term visas for people who buy property have made Dubai more appealing worldwide. Also high rental returns (7-8%) keep international buyers interested.

Concern 7: "Can Dubai's Economy Support Its Real Estate Growth?"

Dubai's economy has branched out a lot over time:

Real estate adds just 7.3% to GDP.

Other booming areas include transportation (13.4%), finance (13.1%), and trade (22.9%).

This variety cuts down reliance on just real estate and backs lasting growth.

Concern 8: "What Happens During a Global Recession?"

No market can avoid recessions, but Dubai's tax-free setup and reputation as a safe spot make it tough during worldwide economic slumps. Many investors see Dubai real estate as a solid asset when times are uncertain.

Concern 9: "Are Government Regulations Effective?"

Dubai has put in place tight rules to stop speculative bubbles:

Limits on mortgage lending

Taxes on quick property sales

Required escrow accounts for developers

These steps boost openness and long-term stability.

Concern 10: "Is Oversupply Still a Problem?"

Supply issues worried people before, but adjusting project schedules and more people needing homes fixed this problem. Experts predict Dubai will have 5.2 million residents by 2030, which means people will keep wanting houses.

The Strong Points of Dubai Real Estate

If you want to invest in Dubai property, consider these key benefits:

High Rental Yields: Average yields of 7-8% much higher than cities like London or New York.

Tax-Free Environment: No property or capital gains tax boosts returns.

Pro-Growth Policies: Long-term visas and business-friendly rules attract investors.

Safe Haven Status: Stability and security make Dubai a top investment spot.

World-Class Infrastructure: Projects like Expo City and Master Plan 2040 increase appeal.

Conclusion: Is Dubai Real Estate in a Bubble?

Looking at the latest numbers and patterns, Dubai's property market isn't in a bubble. Unlike the risky boom we saw before, today's growth has its roots in solid basics, government watchfulness, and varied demand.

As someone putting money in, keep your eyes on chances that'll pay off down the road instead of ups and downs right now. Spread your money across different types of properties, take advantage of high rent returns, and keep up with what's happening around the world. With its changing economy and strong market basics, Dubai is still one of the top spots in the world to invest your money.

0 notes

Text

Forex Market Trends and Key Trading Indicators This Week

Market Overview

This week, economic data releases will impact global forex markets. In Australia, the Reserve Bank of Australia (RBA) will announce its Cash Rate decision, with little chance of a rate cut. U.S. inflation and labor market data will dominate the headlines, including the Consumer Price Index (CPI) report on Wednesday. Canada’s Bank of Canada (BOC) will also release its rate decision on Wednesday, while the Swiss National Bank (SNB) and the European Central Bank (ECB) will make announcements on Thursday. The UK will release GDP data on Friday. For in-depth market updates, visit Rich Smart FX.

Market Analysis

GOLD

Prices remain stagnant, with limited support and a bearish outlook due to a stronger U.S. dollar. Technical indicators show mixed signals, with MACD gains but low momentum, suggesting a period of consolidation. Learn more about gold trading strategies at GFS Markets.

SILVER

After a brief rally, silver faces selling pressure. The MACD shows strengthening bearish momentum, and the RSI remains flat, indicating potential further declines. For silver market insights, check out DBGM FX.

DXY

The U.S. dollar weakened after falling below 105.840. Despite short-term weakness, the dollar is expected to recover in the long term, with bullish momentum reflected in technical indicators. Gain insights into currency trading at Axel Private Market.

GBPUSD

The British pound is strengthening, driven by expectations of a U.S. rate cut. While technical signals are mixed, underlying buying momentum suggests potential gains for the pound. Explore more at Top Max Global.

AUDUSD & NZDUSD

Both the Australian and New Zealand dollars are facing significant selling pressure, with MACD showing increasing bearish momentum and RSI indicating weak buying interest. For real-time forex analysis, visit World Quest FX.

EURUSD

The euro faces selling pressure, but oversold conditions could lead to a short-term reversal. Traders are watching for buying continuation based on technical signals. For trading platforms comparison, check Rich Smart.

USDJPY

The USD/JPY pair shows consolidation, with low momentum ahead of the Bank of Japan’s rate decision in December. Learn effective strategies for yen trading at Axel Private Market.

USDCHF

The Swiss franc has gained strength against the U.S. dollar, though overbought conditions suggest a potential pause in the rally.

USDCAD

The Canadian dollar remains strong, but caution is advised as it approaches overbought levels.

COT Report Analysis

AUD - STRONG GBP - STRONG CAD - WEAK EUR - WEAK JPY - STRONG CHF - WEAK USD - WEAK NZD - WEAK GOLD - STRONG SILVER - STRONG

This analysis highlights key forex market trends and trading indicators for the week ahead, helping traders assess entry and exit strategies and make informed decisions. For additional trading tools and resources, visit Rich Smart FX.

#Scalping indicators#Trading entry and exit#Automated trading signals#Forex portfolio strategy#Forex market trends

0 notes

Text

Mongolia’s unsustainable mining bonanza

Mongolia’s dependence on mining has intensified in recent decades. Following the discovery of major coal deposits and gold-copper ore in the early 2000s, its economic significance surpassed that of the traditional livestock sector. In 2022, mining accounts for nearly a quarter of gross domestic product (GDP), up from a tenth in 2000.

Since the advent of large-scale mining in 2004, Mongolia’s economy has grown at an average rate of 7.2 per cent per year, making it one of the world’s fastest-growing economies. Growth has translated to sustained poverty reduction and improvements in quality of life without a significant increase in income inequality. Significant mineral revenues and a high level of external borrowing have provided support to a generous (but inefficient) social assistance system and a large public investment program.

Yet Mongolia’s rapid growth has been obscured by its extreme macroeconomic volatility and frequent boom-and-bust cycles. Growth has almost entirely come through capital accumulation and the intensive use of natural capital rather than sustained productivity growth. The elimination of extreme poverty owes more to the generous social transfer system than to the creation of abundant well-paying jobs. Climate change and the COVID-19 pandemic are exacerbating these challenges.

Instead of using mineral wealth to reduce its dependence on the extractive sector, Mongolia has become addicted to it. Such complacency is ill-timed, especially as demand for key minerals is likely to tumble due to climate change concerns, a shift in investors’ preference toward sustainability, China’s ambitious goal to reduce coal consumption and the pandemic shock.

The focus on preserving mining-driven prosperity has meant the underutilisation of other factors of production. Mongolia ranked 51st globally in the World Bank’s Human Capital Index, higher than its income-level ranking (92nd), largely due to high educational attainment. But Mongolia does not make full use of this human capital. The country is an outlier among peers in the utilisation of human-capital wealth in its production process.

Mongolia’s performance on institutional capital (for example, rule of law and corruption control) has also deteriorated in recent decades. The country has substantially underperformed compared to its aspirational peers, as its growth remains dominated by the exploitation of natural capital.

Is Mongolia’s prosperity being built at the expense of future growth? A growing number of experts believe that the country is becoming over-reliant on mining-led growth. The government is only saving one cent of each dollar earned from its mineral output. With such a measly amount of mineral revenue saved, it raises the question of where the money has gone. A comparison of the spending pattern before the advent of mineral wealth (1998–2003) and after (2004–19) is revealing.

The public spending pattern did not change in the first few years of increased mineral revenue, overlapping with a period of a declining ratio of public sector debt to GDP. But coinciding with the 2008 general elections and continuing through the next two elections — in 2012 and 2016 — there were spikes in spending on social transfers (3.1 per cent of GDP), public investment (6.3 per cent of GDP) and wages and pensions of civil servants (1.8 per cent of GDP). Since mineral revenues account for 6.7 per cent of GDP during this period, so some of the additional spending was financed through new borrowings.

Political convenience, not economic merit, determines how mineral revenue is utilised. Under the assumption that mineral revenues were largely spent on the above three items, nearly 56 per cent of mineral revenues were spent on public investment, 28 per cent on social transfers and 16 per cent on wages and pensions. Mongolia’s public investment program and generous social transfers —inefficient by global standards — have been cited as a possible cause for anaemic productivity growth.

There are encouraging signs of mineral revenues being invested more prudently. Instead of using revenues to top up social transfers and public investment programs, the government has allocated a large part to productive funds and to retire high-cost debts. The period 2017–19 marked a decisive shift in fiscal management — fiscal balance in surplus in two of the three years, three consecutive years of decline in the public debt-to-GDP ratio and more than 2.5 per cent of GDP transferred to the Fiscal Stability Fund and the Future Heritage Fund.

While significant, these improvements are susceptible to reversal should their political architects leave office. The current administration of Mongolian President Ukhnaagiin Khurelsukh should build on its track record by introducing institutional changes that ensure mineral revenues are prudently used irrespective of which party and people are in power.

0 notes

Text

BDB is a Industrial market research companies in India

BDB India Private Limited is a leading global business strategy consulting and market research company in India. Since 1989, BDB has been providing clients with solutions to expand their businesses in the Indian and international marketplace. We are an ISO certified company. BDB India is the leading global business strategy consulting and market research firm for automotive industry. BDB is a Industrial market research companies in IndiaView More at: https://bdbipl.com/

TRENDS AND TRANSITIONS IN CONSTRUCTION IN INDIA

As we approach 2024, the building construction sector is on the verge of a sea change. Sustainable practices and technological breakthroughs have the potential to reshape the landscape, promoting innovation and changing established norms. In this blog article, we will look at the major trends and changes that will shape the industry in the future year. In comparison to the previous year, the construction industry entered 2023 with a 7% increase in nominal value added and a 6% increase in nominal gross output. Nominal construction spending continued to rise in the third quarter of 2023. However, assuming current patterns in real GDP data continue, it is vital to emphasize that much of the topline growth will most likely be driven by price inflation rather than volume. In addition to dealing with continued inflation, the industry is dealing with price instability in raw materials and rising labor expenses. Another key concern that continues to influence the sector is the persistent shortage of trained workers.

The construction sector in India consists of urban development and real estate. The former includes water supply, transportation, schools, and healthcare, while the latter includes residential, office, and hotel space. With a positive prognosis for the construction industry, there is room for innovation and improvement. This is where technology can help to accelerate and improve efficiency.

2024 WILL BE THE YEAR OF HIGH-TECH CONSTRUCTION, FUELED BY THE FOLLOWING TECHNOLOGIES

Augmented Reality(AR)and Artificial Intelligence(AI) AR and AI are two cutting-edge technologies that are transforming the construction industry. AR overlays digital information onto the real world, while AI enables machines to perform tasks that would normally require human intelligence. AR creates interactive 3D models and provides digital instructions, improving design and safety. AI automates tasks, predicts maintenance, and identifies risks, improving efficiency and quality. As these technologies continue to evolve, they are likely to become even more essential in the construction industry, enabling construction professionals to work smarter and more effectively

Generative AI

Generative AI is a cutting-edge technology that streamlines the design process by delivering extremely efficient and imaginative designs in less time. It creates several design solutions that meet particular needs by considering building codes and other constraints. It may also analyze previous data to identify and mitigate prospective construction risks. It is one of the powerful technologies that is revolutionizing the industry’s design process, resulting in more innovative, efficient, and cost-effective designs.

Building Information Modelling (BIM)

It is a sophisticated technology that allows architects, engineers, and construction experts to communicate in real-time on a project, anticipate difficulties, and optimize building performance. Although it has been available for several years, BIM is predicted to become more common in construction in 2023 because it provides easier cooperation and communication among project stakeholders, resulting in enhanced project results and lower costs. BIM is an important tool for the construction sector since it allows professionals to collaborate effortlessly and produce better buildings.

3Dprinting

This is a groundbreaking technique that has generated a variety of objects ranging from models to entire buildings. IIT-Madras, for example, has India’s first 3D-printed house. In Ahmedabad, the Indian Army also unveiled the world’s first 3D printed residential unit, a disaster-resistant construction. We anticipate to see more companies experimenting with 3D printing to manufacture structures and components this year.

Drones

Drones, also known as unmanned aerial vehicles (UAVs), have changed the way building sites are surveyed and inspected. They provide a variety of advantages, including better safety, faster data collecting, and cost savings. Drones with high-resolution cameras may take comprehensive photographs and videos of building sites, offering significant insights that can assist project managers and engineers in making educated decisions.

View More at: https://bdbipl.com/

0 notes

Text

In Why Empires Fall: Rome, America, and the Future of the West, Peter Heather and John Rapley set themselves to an all-too-familiar task, drawing lessons from the fall of the Roman Empire to apply to the ever-imminent and somehow never-yet-arriving collapse of the U.S.-led global order. Indeed, comparison between the United States and Rome, particularly its decline, is a well-worn and time-tested genre.

Yet the book has a distinctly British perspective. That’s unsurprising given that the authors write from King’s College London and the University of Cambridge, respectively, but it is an uncomfortable fit for a Western global order in which the Pacific is every bit as important at the Atlantic. As a result, while Heather and Rapley provide a masterful vision of the whole of the late Roman Empire, they write on the apparent decline of the modern Western “empire” from a perspective on its periphery.

Much of the United States’ global world is missing from the narrative. While the European Union, Brexit, and NATO come up frequently, much of the Pacific economic and diplomatic infrastructure barely appears: The Trans-Pacific Partnership, Quadrilateral Security Dialogue, and Association of Southeast Asian Nations are all absent from the volume. The U.K. National Health Service has an index entry, but the United States-Mexico-Canada Agreement, née NAFTA, does not. It is the fall of Rome but as it might have been written from Roman Greece or, indeed, Roman Britain, shaped more by British declinism than U.S. realities. This, too, is a well-worn comparison; worries that the British Empire might overextend and then decline like the Roman Empire had go back at least to the late 1800s, to British Prime Minister William Gladstone and Rudyard Kipling. As a history of Rome, the book is fascinating, but as a lesson for our times, it is shaky.

Heather and Rapley’s fundamental insight is a deceptively simple one: that empires by their very nature alter the structures of wealth and power that enabled their emergence in the first place. Rome’s Mediterranean empire created new economic and political power centers both in the provinces and across the frontier. In the same way, they argue that the empire of “the West” has transformed the global landscape. The globalized economy created by the West, initially for the purpose of extraction, nevertheless created fertile soil for the creation of new centers of wealth and production in the developing world. As the centers of economic production shifted along the trade lanes the Western powers had themselves created, their own economies deindustrialized, and the share of global GDP produced in the West began to decline.

At the same time, these new elites’ interests did not perfectly match those of the old imperial center, leading to strain. Heather and Rapley trace in particular the story of the Tatas, one of Bombay’s most successful business families, both in their newly developed wealth but also in their political shift away from Britain and toward Indian nationalism in the 1890s; it is but one example of a story that recurred throughout Europe’s old empires and is no doubt replaying today across the developing world.

The West must, Heather and Rapley maintain, resist the temptation to try to turn back the clock to “‘make America great again’ (or the UK, or the EU).” Instead, it should adapt to this new world of its own creation by banding together into a larger bloc that includes not merely the imperial powers but developing ones that “share important cultural and institutional legacies with the old Western powers” while engaging in reform at home to reduce socially corrosive economic inequality.

Heather and Rapley open with an overly neat narrative of how the understanding of the late Roman world has changed. Their potted historiography suggests that the gloomy vision of economic decline advanced by Edward Gibbon was decisively replaced decades ago by archaeology that showed thriving provincial economies in the late imperial period. But the debates about the nature of the late Roman economy and its decline—debates in which Heather is one of the key competing voices—are complex and ongoing. Yet quite a few indicators still point to serious economic decline in the fourth and fifth centuries. Wolfgang Liebeschuetz’s The Decline and Fall of the Roman City compiles evidence that urban decay was well underway in many parts of the Roman Empire well before the final fifth-century collapse, while work by Andrew Wilson and Justin Leidwanger suggests that the decline in maritime trade, beginning in the 300s, was real and significant, if geographically uneven. Willem Jongman, meanwhile, has put together a diverse array of prosperity indicators to suggest that living standards were already declining in this period, in an article provocatively titled “Gibbon Was Right.” The reader is given little sense of this debate, merely one broad consensus being transformed into another apparently secure consensus.

Yet the vision of the late Roman world that Heather and Rapley go on to present is a compelling one and splendidly delivered. Rome’s economic integration, initially established so that the imperial center could more efficiently exploit its conquered provinces, led to the emergence of new wealth and new elites in the provinces, which in turn shifted the centers of power. This is delightfully illustrated by the contrast between the provincial poet-turned-politician Decimus Magnus Ausonius hailing from fourth-century Gaul and his contemporary, the snobbish blue-blooded Roman senator Quintus Aurelius Symmachus.

Across the frontier, exposure to the Roman economy created new centers of population and wealth outside Rome’s borders. That wealth, combined with the military pressure of living next door to the fearsome Roman military machine, in turn empowered leaders across the Rhine and Danube to form ever larger, more durable, and more formidable polities. At the same time, renewed Roman aggression in the East in the second century C.E. led to the emergence of a stronger peer competitor, the Sassanid Empire, locking Rome into a series of expensive conflicts it could ill afford. Rome shaped its own enemies—and as a demonstration of the thesis that empires decline in part because they transform their own foundations and then fail to adapt to those changes, the treatment of the late Roman Empire is both capable and useful.

The narrative of the late empire is in turn interwoven with analogies to the West. While the book is titled Why Empires Fall, it does not compare two empires but rather one empire, the Roman one, with a rather loose grouping of states and cultures, the West. Many of these Western states had actual empires—and saw other Western imperial powers as their main competitors. The alchemy by which the authors transformed the sweep of European and Euro-American power from 1800 to the present into a singular empire of “the West” can be a deceptive one. For one, this lumps together three rather distinct eras: a period of multipolarity defined primarily by Western European empires before the World Wars; a period of bipolarity defined by the United States and the Soviet Union from World War II to 1991; and finally an era of U.S. preeminence from 1991 to, arguably, the present.

The conflation of these eras into a single “West” serves to obscure real differences in these three different periods. The great movement of the West’s Asian and African “periphery” out of extreme poverty belongs not to the colonial era before the World Wars but to the postwar era and indeed primarily to the post-Cold War era. Likewise, the rapid growth of the Chinese economy and concomitant rising influence of the People’s Republic of China have been largely a post-Cold War phenomenon.

This need not be fatal to the book’s underlying argument about empires and transformation, but it implies not one monolithic Western imperial order so much as a succession of imperial orders, each undermining its own foundations in turn. Treating the colonial European empires as of one piece with today’s international order obscures as much as it clarifies, not because the United States is destined for imperium sine fine but simply because the U.S.-led world order is not a direct continuation of the British one, nor is the experience of the shifting centers of wealth and power in the world the same in the United States as in the United Kingdom.

Yet, as a description of the state of U.S. hegemony, the book feels oddly dated, with many of the signs of decline cited in its closing chapters having recently been halted or even reversed. It’s a reminder of how uncertain geopolitical narratives actually are—the view from 2023 looks very different from the view from 2019. China, far from inevitably rising, has stumbled, and the question being asked is no longer when the Chinese economy will exceed the United States but if it will ever reach nominal economic parity in the first place.

China’s penchant for directing a very high share of its national income into investment, hailed as an advantage by Heather and Rapley, increasingly looks like a trap as Chinese growth slows and debt levels soar above even those in the United States, while the government struggles to boost private consumption. Meanwhile, as the authors mention briefly, Western alliances have shown renewed strength in their response to Russian aggression in Ukraine, leaving the position of the United States as the leader of a large coalition of mostly wealthy, mostly democratic states looking quite a bit stronger. And income inequality, cited by the authors as a rising sign of social rot, has been declining in the United States since 2022, while the U.S. economy strengthens and shows limited but significant growth in real wages.

Except, of course, that none of this applies in the United Kingdom, where income inequality rose last year and the economy continues to flirt with recession and the country’s role as a major power continues to slip into the past. The authors describe outreach to countries such as India and South Africa as “engagement with the old periphery,” yet for the United States these are not old colonies but potential new friends. Indeed, as an analogy for the collapse of the British Empire, the book’s approach is altogether apt.

The British Empire created new classes of provincial elites whose interests aligned only imperfectly with the old imperial center, much like late Roman elites and their cross-frontier “barbarian” peers. Then, when great-power competition in the form of two World Wars sapped the strength and wealth of the imperial center, much as Roman warfare with the Sassanids did, the whole thing began to fragment. And just as the Roman response to weakness was often intensified insularity that rendered what remained of the empire still weaker, the U.K. has itself turned inward, increasingly shunning needed engagement with both the European community and new immigrants, a parallel the authors themselves note.