#Global Electric Vehicle Telematics Market trend

Explore tagged Tumblr posts

Text

The Electric Vehicle Telematics industry Size, Share And New Trends 2022–2028

The integration of telecommunications and informatics technology in electric vehicles is referred to as electric vehicle telematics. With the use of this technology, owners of electric vehicles may remotely check the charging status, battery life, position, and other diagnostic data of their vehicles. Telematics for electric vehicles can also give drivers real-time traffic updates and route suggestions. Electric car telematics is significant since it may make driving more enjoyable overall for electric vehicle owners while also advancing environmentally friendly transportation methods.

read more: https://introspectivemarketresearch.com/reports/electric-vehicle-telematics-market/

#Global Electric Vehicle Telematics Market#Global Electric Vehicle Telematics Market share#Global Electric Vehicle Telematics Market size#Global Electric Vehicle Telematics Market industry#Global Electric Vehicle Telematics Market trend

0 notes

Text

Electric Vehicle Relay Market is driving towards Connected Mobility Trends

The electric vehicle relay market comprises various critical components that control and manage power distribution in electric vehicles. Relays form an integral part of wiring systems in electric vehicles as they switch electrical connections and circuits based on input signals. They offer reliable switching, high current carrying capacity, and durability—critical requirements for EVs. Major relay types used in EVs include main relays, pre-charge relays, high-voltage relays, and battery management system (BMS) relays to optimize power distribution across different EV systems and enhance safety. The global electric vehicle relay market is estimated to be valued at USD 12.09 Bn in 2024 and is expected to reach USD 30.45 Bn by 2031, exhibiting a compound annual growth rate (CAGR) of 14.1% from 2024 to 2031.

Growing environmental concerns and stringent emission norms worldwide have accelerated the adoption of electric vehicles in recent years. This increasing demand for EVs from both commercial and passenger vehicle segments has fueled the need for reliable and efficient components like relays. With continuous advancements in EV technologies, relays are playing a vital role in enabling connected features, autonomous driving capabilities, advanced battery management, and infotainment systems integration. Key Takeaways Key players operating in the electric vehicle relay market are TE Connectivity, Omron Corporation, Panasonic, Fujitsu, Littelfuse, and Mouser Electronics. These players have been investing in developing new-age automotive-grade relays with enhanced switching capabilities and long lifecycles to meet evolving industry requirements. Growing environmental awareness and government initiatives offering subsidies and tax rebates on EV purchases have accelerated the global EV sales in recent years. This rising EV adoption rate is driving the demand for various EV components like relays from automotive OEMs and component suppliers. Major automotive companies are also expanding their global footprint to capitalize on the large untapped Electric Vehicle Relay Market Growth, especially in developing markets of Asia and Latin America. This is expected to boost the electric vehicle relay market globally during the forecast period. Market Key Trends One of the key trends gaining traction in the electric vehicle relay market is the increasing use of smart relays integrated with advanced technologies like IoT and cloud connectivity. These smart relays enable remote monitoring of relay health and failure diagnosis. They help improve reliability, support predictive maintenance needs of EVs, and aid in developing advanced telematics solutions. This rising focus on implementing Industry 4.0 standards is estimated to drive innovation and boost the electric vehicle relay adoption across connected vehicle platforms.

Porter’s Analysis Threat of new entrants: Low as there is moderate risk involved, high investment required and established brand loyalty. However, increasing demand for electric vehicles may attract new players over time. Bargaining power of buyers: Moderate as the buyers have multiple established brands to choose from. However, specific vehicle requirements increase switching costs for buyers. Bargaining power of suppliers: Moderate as raw material suppliers have established relationships with major manufacturers. However, rising demand increases supplier bargaining power over prices. Threat of new substitutes: Low as electric vehicles rely on relays for critical functions. However, continuous technology innovation may introduce substitutes. Competitive rivalry: High among the existing players to gain market share. Manufacturers compete based on product quality, innovation, pricing and expansion to new geographies. Geographical Regions Currently, North America accounts for the largest share of the global electric vehicle relay market value owing to high vehicle production and sales, supportive government initiatives and presence of major automobile manufacturers. The Asia Pacific region is expected to witness the fastest growth during the forecast period due to rising initiatives towards emission reductions, focus on developing charging infrastructure and surge in electric vehicle adoption especially in China and Japan. Countries like India and South Korea are also contributing to market growth.

Get more insights on Electric Vehicle Relay Market

Alice Mutum is a seasoned senior content editor at Coherent Market Insights, leveraging extensive expertise gained from her previous role as a content writer. With seven years in content development, Alice masterfully employs SEO best practices and cutting-edge digital marketing strategies to craft high-ranking, impactful content. As an editor, she meticulously ensures flawless grammar and punctuation, precise data accuracy, and perfect alignment with audience needs in every research report. Alice's dedication to excellence and her strategic approach to content make her an invaluable asset in the world of market insights.

(LinkedIn: www.linkedin.com/in/alice-mutum-3b247b137 )

#Coherent Market Insights#Electric Vehicle Relay Market#Electric Vehicle Relay#Automotive Relays#Power Relays#Signal Relays#Time Delay Relays#Passenger Cars#Commercial Vehicles

0 notes

Text

Heavy Construction Equipment Market to Grow at 4.3% CAGR by 2030, Boosted by Infrastructure Needs

The Heavy Construction Equipment Market is on a remarkable growth trajectory. With its value estimated at USD 189.7 billion in 2023, it is forecasted to surpass USD 255 billion by 2030. The market is expected to grow at a steady CAGR of 4.3% from 2024 to 2030. This article delves into the factors driving this growth, challenges, trends, and future prospects in the industry.

Introduction

The construction industry is a massive global sector, driven by infrastructure projects, urbanization, and increased government spending on building projects. Heavy construction equipment plays a crucial role in this sector, helping to improve efficiency and reduce manual labor. This market includes machinery like bulldozers, cranes, excavators, and loaders, which are essential for construction, mining, and other heavy-duty applications.

Access Full Report @ https://intentmarketresearch.com/latest-reports/cast-elastomer-market-3137.html

The Growing Demand for Heavy Construction Equipment

In recent years, the heavy construction equipment market has witnessed unprecedented growth, fueled by rapid urbanization, industrial expansion, and infrastructure development. Countries around the world are investing in modernizing their transportation networks, including roads, bridges, and airports, which has created a surge in demand for equipment.

Key Market Drivers

Urbanization and Infrastructure Development

One of the primary factors driving the heavy construction equipment market is urbanization. More than half of the global population now lives in urban areas, and this number is expected to rise, requiring more infrastructure to support it. Governments worldwide are launching mega projects, especially in developing countries, to meet this demand.

Increasing Investment in Renewable Energy Projects

As the world shifts towards more sustainable energy solutions, the demand for heavy construction equipment has grown. Wind farms, solar power plants, and hydropower projects all require specialized machinery, contributing to market expansion.

Technological Advancements in Equipment

Innovation in the design and functionality of heavy construction equipment has been another key driver. Modern machines are more efficient, safer, and often equipped with smart technology like GPS, telematics, and automation, which helps companies save time and reduce operational costs.

Rising Mining Activities

Mining is another sector contributing significantly to the heavy construction equipment market. As demand for minerals and other natural resources grows, especially for electric vehicle batteries and renewable energy storage, mining activities have increased. This has led to greater demand for equipment such as dump trucks, loaders, and drilling machines.

Challenges in the Heavy Construction Equipment Market

High Capital Costs

Despite its growth, the heavy construction equipment market faces some challenges. One major issue is the high initial investment required to purchase machinery. Many construction companies, particularly small and medium-sized enterprises (SMEs), find it difficult to afford this equipment.

Stringent Environmental Regulations

Increasing concerns about carbon emissions and environmental impact have led to stricter regulations on the operation of heavy machinery. These regulations can increase the cost of compliance for manufacturers and construction companies.

Labor Shortages and Skills Gap

Another significant challenge is the shortage of skilled operators who can handle these advanced machines. As technology evolves, the skills required to operate heavy construction equipment become more specialized, leading to a gap in the workforce.

Market Trends

Growing Adoption of Electric and Hybrid Equipment

With the push towards sustainable solutions, manufacturers are focusing on electric and hybrid heavy construction equipment. These machines not only reduce emissions but also have lower operating costs compared to traditional diesel-powered machines. Companies like Caterpillar and Volvo have already introduced hybrid models, and the trend is expected to continue.

Integration of Automation and AI

Automation is making its way into the construction industry. Self-driving trucks, autonomous excavators, and drones are gradually becoming more common on job sites, enhancing productivity and reducing the need for human intervention. This trend is expected to transform how projects are executed.

Rise of Rental Services

The growing demand for rental services is another trend shaping the market. With high capital costs and the temporary nature of many projects, many companies are opting to rent rather than buy equipment. Rental companies are also providing more specialized machinery, allowing construction firms to scale their operations more flexibly.

Smart and Connected Equipment

The integration of the Internet of Things (IoT) has revolutionized the way construction equipment is monitored and managed. Sensors embedded in machines can track usage, maintenance needs, and even predict breakdowns, helping companies improve efficiency and reduce downtime.

Download Sample Report @ https://intentmarketresearch.com/request-sample/cast-elastomer-market-3137.html

Future Prospects of the Heavy Construction Equipment Market

The future of the heavy construction equipment market looks promising. With growing investments in infrastructure, renewable energy projects, and smart city initiatives, the demand for advanced equipment will only continue to rise.

Expansion in Developing Economies

Developing economies in Asia, Africa, and Latin America will play a key role in the growth of this market. As these regions continue to urbanize and industrialize, there will be an increasing need for construction machinery.

Technological Innovations

Further innovations, such as electric-powered heavy machinery and more advanced autonomous systems, will keep shaping the future of this market. Innovations will not only focus on efficiency but also on sustainability, addressing environmental concerns and reducing the carbon footprint of the construction industry.

Resilience Against Economic Slowdowns

Despite the occasional economic downturns, the heavy construction equipment market has shown resilience. Governments continue to invest in infrastructure projects, which ensures steady demand for these machines. Additionally, the need for mining and renewable energy projects remains high, offering a buffer against economic fluctuations.

Conclusion

The heavy construction equipment market is poised for significant growth in the coming years. As urbanization, infrastructure development, and technological advancements continue to accelerate, the market will expand, offering new opportunities for manufacturers and rental companies alike. With sustainability and innovation at its core, the future looks bright for this industry.

FAQs

What is driving the growth of the heavy construction equipment market? The growth is primarily driven by urbanization, infrastructure development, renewable energy projects, and technological advancements in equipment.

What challenges does the heavy construction equipment market face? Challenges include high capital costs, stringent environmental regulations, and a shortage of skilled operators.

How is technology shaping the future of heavy construction equipment? Technology is playing a key role, with advancements such as electric and hybrid machinery, automation, and IoT integration improving efficiency and reducing costs.

Why is there a rise in rental services for heavy construction equipment? Rental services are growing due to the high costs of purchasing equipment and the flexibility that renting provides, especially for short-term projects.

What role do developing economies play in the future of the heavy construction equipment market? Developing economies are expected to drive demand as they continue to urbanize and invest in infrastructure, contributing to the growth of the market.

About Us

Intent Market Research (IMR) is dedicated to delivering distinctive market insights, focusing on the sustainable and inclusive growth of our clients. We provide in-depth market research reports and consulting services, empowering businesses to make informed, data-driven decisions.

Our market intelligence reports are grounded in factual and relevant insights across various industries, including chemicals & materials, healthcare, food & beverage, automotive & transportation, energy & power, packaging, industrial equipment, building & construction, aerospace & defense, and semiconductor & electronics, among others.

We adopt a highly collaborative approach, partnering closely with clients to drive transformative changes that benefit all stakeholders. With a strong commitment to innovation, we aim to help businesses expand, build sustainable advantages, and create meaningful, positive impacts.

Contact Us

US: +1 463-583-2713

0 notes

Text

Global Hyundai Mobis Market Assessment and Future Growth Strategies 2024 - 2031

The Hyundai Mobis market has witnessed significant transformations over the past few years, fueled by advancements in automotive technology and shifting consumer preferences. This article delves into the key aspects of the Hyundai Mobis market, including its structure, growth drivers, challenges, and future prospects.

Introduction to Hyundai Mobis

The global Hyundai Mobis market is poised for substantial growth, driven by technological advancements, increasing demand for safety features, and sustainability initiatives. While challenges such as supply chain disruptions

Hyundai Mobis is a leading automotive parts manufacturer and a key player in the global automotive industry. Established in 1977, the company is a subsidiary of the Hyundai Motor Group and specializes in the production of various automotive components, including chassis, infotainment systems, and advanced driver assistance systems (ADAS).

Market Overview

Current Market Size

As of 2023, the global Hyundai Mobis market is estimated to be valued at approximately $X billion, reflecting a steady growth rate of Y% year-on-year. The company's robust supply chain and innovation in automotive technologies have contributed to its significant market share.

Key Regions

The Hyundai Mobis market is distributed across several key regions:

Asia-Pacific: This region accounts for the largest share of the market, driven by the high demand for vehicles in countries like South Korea, China, and Japan.

North America: The North American market is experiencing growth due to increasing vehicle production and technological advancements in automotive safety and convenience.

Europe: The European market is focusing on sustainability and electric vehicles, which presents new opportunities for Hyundai Mobis.

Key Drivers of Growth

Technological Advancements

The automotive industry is rapidly evolving, with technological innovations such as electric vehicles (EVs), autonomous driving, and connected cars. Hyundai Mobis is at the forefront of these developments, investing heavily in research and development to produce cutting-edge components.

Increasing Demand for Safety Features

With growing concerns over road safety, there is an increasing demand for advanced driver assistance systems (ADAS). Hyundai Mobis is expanding its ADAS offerings, which is expected to significantly boost its market presence.

Sustainability Initiatives

The shift towards sustainable transportation is reshaping the automotive landscape. Hyundai Mobis is focusing on eco-friendly technologies, including electric and hybrid vehicle components, aligning with global sustainability goals.

Challenges in the Market

Supply Chain Disruptions

The automotive industry has faced numerous challenges due to supply chain disruptions, especially in the wake of the COVID-19 pandemic. Hyundai Mobis has had to navigate these issues to maintain production levels and meet customer demand.

Competition

The automotive parts market is highly competitive, with numerous players vying for market share. Hyundai Mobis faces competition from both established manufacturers and new entrants specializing in innovative automotive technologies.

Regulatory Compliance

As governments worldwide implement stricter regulations concerning vehicle emissions and safety standards, Hyundai Mobis must ensure its products comply with these regulations, which can increase operational costs.

Future Outlook

Market Trends

Electrification: The shift towards electric vehicles is set to accelerate, with Hyundai Mobis expanding its electric powertrain components and battery systems.

Connected Vehicles: The rise of connected vehicles will drive demand for advanced infotainment systems and telematics solutions.

Smart Manufacturing: Automation and AI will play a crucial role in enhancing production efficiency and reducing costs.

Strategic Initiatives

Hyundai Mobis is likely to focus on strategic partnerships and collaborations to enhance its technology offerings and expand its market reach. Investing in startups specializing in mobility technologies may also provide a competitive edge.

Conclusion

The global Hyundai Mobis market is poised for substantial growth, driven by technological advancements, increasing demand for safety features, and sustainability initiatives. While challenges such as supply chain disruptions and competition exist, the company’s commitment to innovation and strategic planning positions it well for future success. As the automotive industry continues to evolve, Hyundai Mobis is set to play a pivotal role in shaping its future.

0 notes

Text

Automotive Power Electronics Market - Forecast(2024–2030)

Automotive Power Electronics Market Overview

Automotive Power Electronics Market Size is valued at $5.4 Billion by 2030, and is anticipated to grow at a CAGR of 4.2% during the forecast period 2024 -2030. The automotive power #electronics market is experiencing significant growth, driven #primarily by the increasing demand for #electric vehicles (EVs). This surge is fueled by a global shift towards sustainable transportation and stringent emission #regulations. The rapid #technological advancements in #semiconductor materials and power management solutions are enhancing the efficiency and performance of automotive power electronics, thereby #accelerating market expansion.

Additionally, consumer preferences are evolving towards vehicles that offer better energy efficiency, safety, and convenience, all of which are enabled by sophisticated power electronic systems. Manufacturers are investing heavily in research and development to innovate and stay competitive in this dynamic market. Furthermore, government incentives and subsidies for EVs are further propelling the adoption of automotive power electronics. This market trajectory is expected to continue its upward trend, as the integration of power electronics in vehicles becomes more prevalent, aligning with the broader goals of energy conservation and environmental sustainability.

Sample Report:

COVID-19/Russia-Ukraine War Impact

The COVID-19 pandemic significantly disrupted the automotive power electronics market, initially causing production halts and supply chain disruptions. As factories shut down and demand for vehicles plummeted, manufacturers faced challenges in maintaining operations and meeting financial targets. However, the pandemic also accelerated the adoption of electric vehicles (EVs), driven by increased awareness of environmental issues and government incentives. This shift spurred innovations in power electronics, essential for EVs’ efficiency and performance. Consequently, despite short-term setbacks, the industry experienced a renewed focus on developing advanced power electronics solutions, paving the way for long-term growth and resilience in a post-pandemic era.

The Russo-Ukraine War has significantly impacted the automotive power electronics sector, primarily through disruptions in the supply chain and fluctuations in raw material prices. The conflict has caused instability in the region, affecting the production and transportation of essential components like semiconductors and rare earth metals, crucial for power electronics. This disruption has led to increased costs and delays, compelling manufacturers to seek alternative sources and adjust their supply chains. Additionally, the economic sanctions imposed on Russia have further strained international trade relations, exacerbating the challenges faced by the automotive industry. Consequently, companies are re-evaluating their strategies to mitigate risks and ensure resilience in their operations, focusing on diversifying suppliers and investing in local manufacturing capabilities to reduce dependency on geopolitically sensitive regions.

Inquiry Before Buying:

Automotive Power Electronics Market

The report “Automotive Power Electronics Market Forecast (2024–2030)”, by Industry ARC, covers an in-depth analysis of the following segments of the Automotive Power Electronics Market: By Component: Microcontroller Unit, Power Integrated Circuit, Sensors, Others By Vehicle Type: Passenger Cars, Commercial Vehicles By Electric Vehicle Type: Battery Electric Vehicles, Hybrid Electric Vehicles, Plug-In Hybrid Electric Vehicles By Application: Powertrain & Chassis, Body Electronics, Safety & Security, Infotainment & Telematics, Energy Management System, Battery Management System By Geography: North America (USA, Canada, and Mexico), South America (Brazil, Argentina, Colombia, Chile, and Rest of South America), Europe (UK, Germany, France, Italy, Netherlands, Spain, Russia, and Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, Malaysia, and Rest of APAC), and Rest of the World (Middle East, and Africa)

Key Takeaways

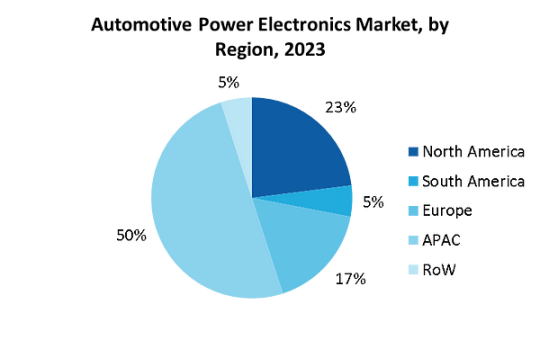

Asia-Pacific dominated the Automotive Power Electronics market with a share of around 50% in the year 2023.

The automotive industry’s need to meet stricter safety regulations and reduce emissions, coupled with rising consumer demand for electric vehicles, will propel the growth of the automotive power electronics market throughout the forecast period.

Apart from this, thrust to equip vehicles with advanced power solutions is driving the growth of Automotive Power Electronics market during the forecast period 2024–2030.

For More Details on This Report — Request for Sample

Automotive Power Electronics Market Segment Analysis — By Vehicle Type

The demand for automotive power electronics in passenger cars is escalating due to government initiatives promoting the integration of advanced electronics. This surge is driven by policies aimed at enhancing vehicle efficiency, safety, and environmental performance. For instance, in March 2024, the European Union introduced new regulations mandating the inclusion of advanced driver-assistance systems (ADAS) in all new cars, significantly boosting the need for sophisticated power electronics. Similarly, the U.S. government has increased funding for electric vehicle (EV) infrastructure, encouraging automakers to incorporate more power-efficient electronic components. Additionally, China’s recent tax incentives for electric and hybrid vehicles, announced in January 2024, have accelerated the adoption of power electronics to improve performance and range. These initiatives are fostering innovation and production of cutting-edge electronic components, such as inverters and onboard chargers, essential for modern passenger cars. As a result, automotive manufacturers are increasingly investing in power electronics to comply with regulations, meet consumer expectations, and gain a competitive edge in the evolving market.

Schedule a Call :

Automotive Power Electronics Market Segment Analysis — By Electric Vehicle Type

The demand for automotive power electronics in hybrid electric cars is rapidly increasing due to the global imperative to decarbonize the transport sector and reduce reliance on fossil fuels. Governments worldwide are implementing stringent regulations and incentives to promote the adoption of hybrid and electric vehicles. In January 2024, the European Union introduced enhanced subsidies for hybrid vehicle purchases, coupled with stricter emission standards, significantly boosting the market for power electronics. Similarly, the U.S. launched the “Clean Transport Initiative” in April 2023, providing substantial tax breaks and grants for hybrid car manufacturers to innovate and scale up production. Additionally, Japan’s latest energy policy, announced in February 2024, includes a comprehensive plan to phase out internal combustion engines, further propelling the demand for hybrid vehicles equipped with advanced power electronics. These components, such as power inverters, converters, and battery management systems, are essential for enhancing the efficiency and performance of hybrid electric cars. As a result, automotive companies are accelerating investments in power electronics technology to meet regulatory requirements, cater to consumer preferences, and contribute to a sustainable future.

Automotive Power Electronics Market Segment Analysis — By Geography

On the basis of geography, Asia-Pacific held the highest segmental market share of around 50% in 2023, The Asia-Pacific region is the largest market for automotive power electronics, driven by high vehicle production rates and the increasing adoption of advanced electronics in automobiles. Countries like China, Japan, and South Korea are leading in vehicle manufacturing, with major automakers integrating sophisticated power electronic components to enhance vehicle efficiency and performance. For example, in March 2024, Toyota introduced a new hybrid model equipped with cutting-edge power electronics, significantly improving energy management and fuel efficiency. Similarly, BYD in China launched an electric vehicle series in February 2024, featuring advanced inverters and converters, which contribute to extended driving ranges and faster charging times. These innovations reflect the region’s robust focus on technological advancements and sustainable transportation solutions. The strategic partnerships between automotive giants and technology firms, such as Hyundai’s collaboration with LG Electronics to develop next-generation battery management systems in April 2023, further underscore the region’s leadership in this sector. This confluence of high production volumes and technological integration ensures that the Asia-Pacific market remains at the forefront of automotive power electronics development.

Buy Now:

Automotive Power Electronics Market Drivers

The rising market for the electric vehicles is the key factor driving the growth of Global Automotive Power Electronics market

The growing demand for automotive power electronics is being significantly driven by the expanding electric vehicle (EV) market. As global initiatives to reduce carbon emissions intensify, consumers and manufacturers alike are shifting towards EVs, which rely heavily on power electronics for various critical functions. These components, including inverters, converters, and battery management systems, are essential for optimizing the performance, efficiency, and range of electric vehicles. Automakers are ramping up production of EVs, incorporating advanced power electronics to meet regulatory standards and consumer expectations for sustainability and high performance. The technological advancements in power electronics are also enabling faster charging, improved energy management, and enhanced vehicle safety, further boosting their demand. Consequently, the automotive industry is experiencing a surge in innovation and investment in power electronics to support the burgeoning EV market, positioning it as a pivotal element in the future of transportation.

Automotive Power Electronics Market Challenges

The high cost of electric vehicles is expected to restrain the market growth

The high cost of electric vehicles (EVs) negatively impacts the automotive power electronics market by limiting consumer adoption and market growth. Despite the technological advancements and environmental benefits of EVs, their higher price compared to traditional vehicles remains a significant barrier. This cost premium is largely due to expensive components such as batteries and advanced power electronics systems, including inverters and converters, which are essential for EV functionality. As a result, potential buyers are often deterred by the initial investment required, slowing the transition to electric mobility. Consequently, manufacturers face challenges in achieving economies of scale, which further drives up costs. This cyclical issue restricts market expansion and inhibits broader implementation of power electronics innovations, ultimately stalling progress towards widespread EV adoption and the associated benefits of reduced emissions and improved energy efficiency in the automotive sector.

Automotive Power Electronics Industry Outlook

Product launches, mergers and acquisitions, joint ventures and geographical expansions are key strategies adopted by players in the Automotive Power Electronics Market. The key companies in the Automotive Power Electronics Market are:

STMicroelectronics N.V.

Infineon Technologies AG

Fuji Electric Co., Ltd.

NXP Semiconductors N.V.

Renesas Electronics Corporation

Toshiba Corporation

Mitsubishi Electric

Huawei Digital Power

Robert Bosch GmbH

Hitachi Energy

Recent Developments

In May 2022, STMicroelectronics joined forces with Microsoft to make development of highly secure IoT devices easier.

In March 2023, Infineon Technologies announced the acquisition of GaN Systems, a global leader in gallium nitride (GaN)-based power conversion solutions. This move strengthened Infineon’s position in the market.

For more Automotive Market reports, please click here

0 notes

Text

"Smart Cars Need Smart Sensors: The Evolution of Automotive Technology"

Market Overview and Report Coverage

The automotive sensor market for Original Equipment Manufacturers (OEM) is experiencing significant growth due to the increasing demand for advanced vehicle safety systems, emission controls, and enhanced driving experiences. Automotive sensors are critical components that monitor and control various aspects of a vehicle's performance, including engine functions, safety features, and environmental impact. The rise of electric vehicles (EVs), autonomous driving technologies, and stringent emission regulations are key factors driving the expansion of this market.

According to Infinium Global Research, the global automotive sensor market for OEMs is expected to witness robust growth from 2023 to 2030. The ongoing advancements in sensor technology, including miniaturization, improved accuracy, and integration with artificial intelligence, are further accelerating the adoption of automotive sensors in modern vehicles. Additionally, the increasing focus on connected cars and the integration of Internet of Things (IoT) technologies is propelling market growth.

Market Segmentation

By Type:

Pressure Sensors: These sensors are used to monitor various pressure levels in the vehicle, including tire pressure, fuel pressure, and oil pressure. The demand for pressure sensors is growing due to their critical role in ensuring vehicle safety and performance.

Temperature Sensors: Temperature sensors monitor engine temperature, exhaust gas temperature, and other critical temperatures within the vehicle. They are essential for optimizing engine performance and reducing emissions.

Position Sensors: Position sensors include throttle position sensors, camshaft position sensors, and crankshaft position sensors. These sensors provide vital data for engine control and are crucial for the smooth operation of the vehicle.

Oxygen Sensors: Oxygen sensors play a key role in controlling the air-fuel mixture in the engine, optimizing fuel efficiency, and reducing emissions. The increasing emphasis on emission control standards is driving the demand for these sensors.

Speed Sensors: Speed sensors are used to monitor the speed of the vehicle's wheels, transmission, and engine. They are critical components for anti-lock braking systems (ABS), traction control systems, and electronic stability control systems.

Other Sensors: This category includes various other sensors, such as rain sensors, light sensors, and occupancy sensors, which enhance the comfort, convenience, and safety of the vehicle.

By Application:

Powertrain: Automotive sensors in the powertrain are essential for monitoring and controlling the engine, transmission, and exhaust systems. They help improve fuel efficiency, reduce emissions, and enhance overall vehicle performance.

Safety and Security: Sensors used in safety and security applications include those for airbags, seat belts, collision detection, and lane departure warning systems. The growing emphasis on vehicle safety standards is driving the demand for these sensors.

Body Electronics: Sensors in body electronics are used for climate control, lighting, infotainment systems, and other convenience features. The increasing consumer demand for enhanced in-car experiences is boosting the adoption of these sensors.

Chassis: Sensors in the chassis are used for braking systems, suspension control, and steering systems. They play a crucial role in ensuring vehicle stability and handling, especially in advanced driver-assistance systems (ADAS).

Telematics and Infotainment: Sensors in telematics and infotainment systems enable connected car features, such as GPS navigation, vehicle tracking, and entertainment systems. The growing trend towards connected and autonomous vehicles is driving the adoption of these sensors.

Sample pages of Report: https://www.infiniumglobalresearch.com/form/1059?name=Sample

Regional Analysis:

North America: The North American market, led by the United States, is expected to maintain a strong position in the global automotive sensor market. The region’s focus on innovation, safety standards, and the development of autonomous vehicles is driving market growth.

Europe: Europe is a mature market for automotive sensors, with countries like Germany, France, and the UK leading the adoption of advanced sensor technologies. The region's stringent emission regulations and focus on automotive safety are key growth drivers.

Asia-Pacific: The Asia-Pacific region is anticipated to experience the fastest growth, driven by the rapid expansion of the automotive industry in countries like China, Japan, and India. The increasing demand for electric vehicles and the growing focus on vehicle safety are contributing to market growth.

Latin America and Middle East & Africa: These regions are also expected to witness significant growth, fueled by rising automotive production, increasing disposable incomes, and a growing focus on vehicle safety and emission standards.

Emerging Trends in the Automotive Sensor Market (OEM)

Several key trends are shaping the future of the automotive sensor market. The integration of sensors with artificial intelligence and machine learning is enabling predictive maintenance and enhancing the capabilities of advanced driver-assistance systems (ADAS). The shift towards electric and autonomous vehicles is driving the development of new sensor technologies, including LiDAR, radar, and ultrasonic sensors. Additionally, the increasing demand for connected cars is leading to the integration of IoT technologies, enabling real-time data collection and analysis for improved vehicle performance and safety.

Major Market Players

Bosch: A global leader in automotive sensor technology, Bosch offers a wide range of sensors for various applications, including powertrain, safety, and ADAS. The company’s strong focus on innovation and quality has helped it maintain a leading position in the market.

Continental AG: Continental is another key player in the automotive sensor market, known for its advanced sensor solutions for safety, powertrain, and body electronics. The company is heavily invested in developing sensors for autonomous and electric vehicles.

Denso Corporation: Denso, a leading automotive supplier, provides a variety of sensors used in powertrain, safety, and body electronics applications. The company’s commitment to developing environmentally friendly and energy-efficient technologies is driving its growth in the market.

Sensata Technologies: Sensata specializes in developing sensors for safety, powertrain, and chassis applications. The company’s focus on reliability and performance has made it a preferred choice for OEMs around the world.

Aptiv PLC: Aptiv is known for its advanced automotive sensors and systems, particularly in the areas of safety and connectivity. The company is at the forefront of developing sensor technologies for connected and autonomous vehicles.

Report Overview : https://www.infiniumglobalresearch.com/market-reports/global-automotive-sensor-market-oem

0 notes

Text

Hey 👋 everyone here are some recent updates and trends in the trucking industry as of late:

### PTAG Industry Updates for Friday :

1. Freight Rates:

- Freight rates have shown slight improvements in certain regions. While the overall market remains competitive, some lanes are experiencing rate increases due to higher demand and tighter capacity.

2. Fuel Prices:

- Diesel prices have stabilized after experiencing fluctuations earlier in the month. This stabilization is providing some relief to trucking companies dealing with high operational costs.

3. Regulatory Changes:

- The FMCSA (Federal Motor Carrier Safety Administration) is reviewing potential changes to hours-of-service regulations. These changes could impact driver scheduling and operational efficiency.

- There is ongoing discussion about new emissions standards aimed at reducing the industry's carbon footprint, which could lead to future investments in cleaner technologies.

4. Technological Advancements:

- More companies are adopting telematics and fleet management software to improve efficiency and reduce costs. Real-time data tracking is helping fleet managers optimize routes and monitor vehicle performance.

- Autonomous trucking technology is making headlines with several companies announcing successful test runs and partnerships aimed at accelerating the deployment of self-driving trucks.

5. Driver Shortage:

- The trucking industry continues to face a significant driver shortage. Efforts to attract new drivers include increased pay, better benefits, and more flexible working conditions.

- Training programs and partnerships with vocational schools are expanding to help address the shortage and bring in new talent.

6. Sustainability Initiatives:

- Many trucking companies are investing in electric and alternative fuel vehicles to reduce emissions. Grants and incentives from government bodies are encouraging these investments.

- There’s a growing trend towards implementing sustainability practices, such as route optimization and reducing idling times, to minimize environmental impact.

7. Market Trends:

- E-commerce growth continues to drive demand for last-mile delivery services. Companies are expanding their fleets and logistics networks to keep up with the increased volume of online shopping.

- The supply chain disruptions caused by global events are prompting a reevaluation of logistics strategies, with many companies looking to diversify their supply chains to mitigate risk.

8. Economic Indicators:

- Economic recovery indicators, such as increased manufacturing output and consumer spending, are positively affecting freight volumes. However, the pace of recovery varies across different sectors.

By staying informed about these trends and updates, trucking industry professionals can better navigate the challenges and opportunities in the markets.

#PTAG #PTAGnews #Trucking #TruckingNews #StayInformed #fridaymotivation #finishstrong #PositiveVibes #DriveLocalSupportLocal #ptagbusiness #IndependentTrucking #owneroperator #smallbusinessbigdreams

0 notes

Text

The Automotive Market: Trends, Key Players, and Future Outlook

The global automotive market is undergoing a profound transformation, driven by rapid advancements in technology, shifting consumer preferences, and a global push toward sustainability. This market, which has long been a pillar of the global economy, is now at the forefront of innovation, embracing new paradigms in mobility, connectivity, and energy efficiency. This blog delves into the current trends shaping the automotive industry, profiles the key players driving these changes, and offers a forward-looking conclusion on what the future holds.

Market Trends

The automotive industry is currently being shaped by several major trends that are redefining the very nature of mobility and transportation.

1. Electrification and the Rise of Electric Vehicles (EVs)

One of the most significant trends in the automotive market is the shift from traditional internal combustion engine (ICE) vehicles to electric vehicles (EVs). Governments around the world are implementing stringent emissions regulations and offering incentives to promote the adoption of EVs. This has led to a surge in demand for electric vehicles, with global EV sales reaching over 10 million units in 2023, representing a 50% increase from the previous year.

The electrification trend is not limited to passenger vehicles; commercial vehicles, including trucks and buses, are also transitioning to electric power. This shift is being driven by advances in battery technology, which have led to increased range, reduced charging times, and lower costs. As a result, major automakers are investing heavily in EV research and development, with many planning to phase out ICE vehicles entirely in the coming decades.

2. Autonomous Driving and Advanced Driver Assistance Systems (ADAS)

The development of autonomous vehicles (AVs) is another transformative trend in the automotive industry. Companies like Waymo, Tesla, and General Motors are leading the charge in developing self-driving technology. While fully autonomous vehicles are not yet a common sight on roads, significant progress has been made in advanced driver assistance systems (ADAS), which include features like lane-keeping assistance, adaptive cruise control, and automatic emergency braking.

These technologies are improving vehicle safety and enhancing the driving experience, and they are becoming standard in new vehicles. The trend towards autonomy is also being supported by advancements in artificial intelligence (AI), machine learning, and sensor technologies, which are critical for enabling vehicles to navigate complex environments.

3. Connectivity and the Internet of Vehicles (IoV)

The automotive market is increasingly interconnected, with vehicles becoming part of a broader digital ecosystem known as the Internet of Vehicles (IoV). Connected vehicles can communicate with each other, as well as with infrastructure and other devices, enabling a range of new services and applications. For example, connected vehicles can receive real-time traffic updates, access remote diagnostics, and even enable over-the-air software updates.

This trend is driving innovation in areas such as infotainment, telematics, and vehicle-to-everything (V2X) communication. Automakers are partnering with tech companies to develop new services that enhance the driving experience and improve vehicle safety. As connectivity becomes more prevalent, it is expected to lead to the development of new business models and revenue streams in the automotive industry.

4. Shared Mobility and the Changing Concept of Vehicle Ownership

The traditional concept of vehicle ownership is evolving, with a growing trend toward shared mobility solutions. Ride-hailing services like Uber and Lyft, as well as car-sharing platforms like Zipcar, are gaining popularity, particularly in urban areas. These services offer consumers greater flexibility and convenience, reducing the need for personal vehicle ownership.

The shared mobility trend is also being driven by the rise of electric and autonomous vehicles, which are well-suited to shared use. In addition, younger generations, particularly millennials and Gen Z, are showing a preference for access over ownership, further fueling the growth of shared mobility. As this trend continues to gain momentum, it is expected to have a significant impact on vehicle sales and the overall structure of the automotive market.

5. Sustainability and the Circular Economy

Sustainability is becoming a key focus for the automotive industry as concerns about climate change and environmental impact grow. Automakers are adopting circular economy practices, which involve designing products with end-of-life in mind, recycling materials, and reducing waste. This approach is not only good for the environment but also makes good business sense, as it can lead to cost savings and new revenue opportunities.

In addition to electrification, other green technologies are being explored, such as hydrogen fuel cells and sustainable materials. The automotive industry is also investing in renewable energy sources for manufacturing and aiming to achieve carbon neutrality across the value chain. These efforts are being driven by both regulatory pressures and consumer demand for more sustainable products.

Key Market Players

Several major players dominate the global automotive market, each contributing to the industry's evolution and shaping its future trajectory. These companies are not only the largest automakers by volume but also leaders in innovation, sustainability, and new mobility solutions.

1. Toyota Motor Corporation

Toyota has long been a leader in the global automotive market, known for its pioneering work in hybrid technology and its commitment to sustainability. The company's hybrid models, such as the Prius, have been highly successful, and Toyota is now making significant investments in electric vehicles. Toyota's market share remains strong, particularly in Asia, where it is the dominant player. In 2023, Toyota sold over 9.5 million vehicles worldwide, maintaining its position as the world's largest automaker.

Toyota's strategy includes a balanced approach to electrification, with a focus on both battery-electric vehicles (BEVs) and hydrogen fuel cell vehicles (FCEVs). The company is also investing in autonomous driving technology through its subsidiary, Toyota Research Institute (TRI), and is exploring new business models in shared mobility.

2. Volkswagen Group

Volkswagen is another global automotive giant, with a strong presence in Europe and China. The company is aggressively pursuing electrification, with plans to invest over €70 billion in electric mobility, hybridization, and digitalization by 2030. Volkswagen's electric vehicle lineup, which includes models like the ID.3 and ID.4, is gaining traction in key markets, and the company aims to become the world's leading electric car manufacturer.

In addition to its focus on EVs, Volkswagen is also investing in autonomous driving and digital services. The company is developing its own software platform, Volkswagen Automotive Cloud, which will enable connected services and over-the-air updates. Volkswagen's long-term strategy is to transform into a software-driven mobility provider, offering a range of services beyond traditional vehicle sales.

3. Tesla, Inc.

Tesla has revolutionized the automotive industry with its focus on electric vehicles and sustainable energy. The company is the leader in the electric vehicle market, with a market share of approximately 20% of global EV sales. Tesla's Model 3 and Model Y are among the best-selling electric vehicles worldwide, and the company continues to innovate with new models like the Cybertruck and the Tesla Semi.

Tesla's success is driven by its vertically integrated business model, which includes its own battery production, software development, and a global network of charging stations. The company's focus on autonomy is also a key differentiator, with its Autopilot and Full Self-Driving (FSD) systems being among the most advanced on the market. Tesla's vision of a sustainable future extends beyond vehicles, as it also produces solar energy products and energy storage solutions.

4. General Motors (GM)

General Motors is one of the oldest and largest automakers in the world, with a strong presence in North America and China. The company is undergoing a major transformation, with a focus on electric and autonomous vehicles. GM has committed to an all-electric future, with plans to phase out internal combustion engines by 2035. The company's electric vehicle lineup includes models like the Chevrolet Bolt EV and the upcoming Hummer EV.

GM is also investing heavily in autonomous driving technology through its subsidiary, Cruise. The company plans to launch a fully autonomous ride-hailing service in the near future, positioning itself as a leader in the new mobility landscape. GM's strategy also includes partnerships with tech companies to develop connected services and digital platforms.

5. Hyundai Motor Group

Hyundai Motor Group, which includes both Hyundai and Kia, is rapidly expanding its presence in the global automotive market. The company is investing heavily in electric vehicles, with plans to launch 23 new EV models by 2025. Hyundai's Ioniq and Kia's EV6 are among the company's flagship electric vehicles, and both have received strong reviews for their performance and design.

In addition to electric vehicles, Hyundai is also exploring hydrogen fuel cell technology. The company is one of the few automakers that is actively developing FCEVs, with models like the Hyundai Nexo leading the way. Hyundai's long-term strategy includes a focus on sustainable mobility and smart cities, with investments in autonomous driving, connectivity, and shared mobility solutions.

Conclusion

The automotive market is in the midst of a profound transformation, driven by trends such as electrification, autonomy, connectivity, shared mobility, and sustainability. These trends are reshaping the industry, leading to the development of new business models, the emergence of new competitors, and the evolution of consumer preferences. Key players like Toyota, Volkswagen, Tesla, General Motors, and Hyundai are at the forefront of these changes, investing heavily in research and development to stay ahead of the curve. These companies are not only leaders in vehicle production but also pioneers in the development of new technologies and mobility solutions.

#automotive Market#automotive industry#automotive industry companies#automotive industry trends#future of automotive industry#automotive industry growth

0 notes

Text

Sustainable Driving: Eco-Friendly Car Rental Initiatives

As climate change continues to be a pressing global issue, the need for sustainable transportation has never been more urgent. Sustainable driving is no longer a niche market; it's becoming the standard for the car rental industry. As businesses and individuals alike seek greener ways to travel, rental companies are responding with a range of eco-friendly initiatives.

From the adoption of advanced technology to the introduction of sustainable business practices, let's know the growing trend of sustainable car rentals and how it's reshaping the industry.

Eco-friendly fleets

Eco-friendly fleets are becoming a staple in the car rental industry, with many companies offering electric, hybrid, and fuel-efficient vehicles. These luxury car rental options provide a greener alternative to traditional gas-powered cars, helping to reduce carbon emissions and promote sustainable driving. As more consumers demand eco-friendly vehicles, rental companies increasingly expand their green fleet offerings to cater to this growing market.

Technology advancements in sustainable car rentals

Advancements in technology are playing a crucial role in making car rentals more sustainable. From online booking systems that optimise vehicle availability to apps that allow for easy access to business car rental services, technology is enhancing the overall efficiency of car rentals. Additionally, telematics and smart driving features in modern vehicles help to monitor and reduce fuel consumption, further contributing to sustainability efforts.

Enhanced mobility solutions

Enhanced mobility solutions, like integrated platforms and flexible rentals, make it easier for travellers to choose sustainable transportation. These options let customers combine car rentals with public transit and biking, creating a seamless, eco-friendly travel experience that meets the needs of today's environmentally conscious consumers.

Sustainable business practices

Car rental companies also adopt sustainable business practices to reduce their environmental impact. This includes everything from using renewable energy sources in their operations to implementing recycling programs and reducing waste. By incorporating sustainability into every aspect, business car rental companies are meeting customer demand for greener options and setting a standard for the industry.

Customer demand and awareness

As awareness of environmental issues grows, so does the demand for sustainable car rental options. Consumers are increasingly seeking companies offering eco-friendly vehicles and sustainable business practices. In response, rental companies are stepping up their efforts to meet this demand by expanding their green offerings and educating customers about the benefits of sustainable driving.

In a nutshell

The car rental industry is pivotal in promoting sustainable driving through innovative initiatives such as carsharing, eco-friendly fleets, and enhanced mobility solutions. As technology advances and customer demand for greener options continues to rise, the industry is well-positioned to lead the way in sustainable transportation.

For travellers seeking a combination of convenience and sustainability, The International Travel House offers a range of eco-friendly yet luxury car rental options that cater to both leisure and business needs. With a commitment to reducing carbon emissions and promoting greener travel choices, ITH is setting the standard for sustainable car rentals.

0 notes

Text

Track Laying Equipment Market Global Insights and Trends to 2024-2032

The Reports and Insights, a leading market research company, has recently releases report titled “Track Laying Equipment Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2024-2032.” The study provides a detailed analysis of the industry, including the global Track Laying Equipment Market Growth share, size, trends, and forecasts. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Report Highlights:

How big is the Track Laying Equipment Market?

The global track laying equipment market size reached US$ 479.8 million in 2023. Looking forward, Reports and Insights expects the market to reach US$ 776.8 million in 2032, exhibiting a growth rate (CAGR) of 5.5% during 2024-2032.

What are Track Laying Equipment?

Track laying equipment encompasses a range of machinery and vehicles utilized in constructing and upkeeping railway tracks. It includes track laying machines, which lay and align track sections precisely, along with ballast regulators, tampers, and track finishers that ensure track stability and alignment. Additionally, rail cranes, track maintenance vehicles, and rail grinders are used for repairing and maintaining railway tracks. These machines are essential for maintaining the safety and efficiency of railway operations by preserving the track structure's integrity.

Request for a sample copy with detail analysis: https://www.reportsandinsights.com/sample-request/1906

What are the growth prospects and trends in the Track Laying Equipment industry?

The track laying equipment market growth is driven by various trends and factors. The track laying equipment market is steadily growing, propelled by rising investments in railway infrastructure development and maintenance projects globally. Increasing demand for cost-effective and efficient solutions to expand and upgrade existing railway networks is driving the need for track laying equipment. Furthermore, technological advancements, including the incorporation of GPS and automated control systems in track laying equipment, are contributing to market expansion. However, challenges such as high initial investment costs and the presence of alternative transportation modes could impede market growth to a certain extent. Hence, all these factors contribute to track laying equipment market growth.

What is included in market segmentation?

The report has segmented the market into the following categories:

By Equipment Type:

Track Laying Machines

Tamping Machines

Ballast Regulators

Ballast Cleaning Machines

Track Renewal Machines

Others

By Application:

New Track Construction

Track Maintenance and Rehabilitation

By End-User:

Railway Infrastructure Companies

Contractors and Construction Companies

Government Organizations

Others

By Track Type:

High-Speed Tracks

Conventional Tracks

Urban Transit Tracks

By Propulsion Type:

Diesel-Powered

Electric-Powered

Hybrid-Powered

By Automation Level:

Manual

Semi-Automated

Fully Automated

By Component:

Engines and Power Systems

Control Systems

Track Laying Attachments

Hoppers and Dumpers

Sensors and Measurement Systems

Others

By Sales Channel:

Direct Sales

Distributors/Dealers

Online Retailers

By Ownership:

Public Ownership

Private Ownership

By Project Type:

Greenfield Projects

Brownfield Projects

By Capacity:

Small (< 5 tons)

Medium (5 - 10 tons)

Large (> 10 tons)

By Mode of Operation:

Self-Propelled

Towed/Trailer-Mounted

By Technology:

GPS and Navigation Systems

Remote Control Systems

Telematics and Data Analytics

By After-Sales Services:

Maintenance and Repair

Spare Parts and Component Supply

Segmentation By Region:

North America:

United States

Canada

Europe:

Germany

The U.K.

France

Spain

Italy

Russia

Poland

BENELUX

NORDIC

Rest of Europe

Asia Pacific:

China

India

Japan

South Korea

Australia

New Zealand

ASEAN

Rest of Asia Pacific

Latin America:

Brazil

Mexico

Argentina

Rest of Latin America

Middle East & Africa:

Saudi Arabia

United Arab Emirates

South Africa

Egypt

Israel

Rest of MEA

Who are the key players operating in the industry?

The report covers the major market players including:

Caterpillar Inc.

Komatsu Ltd.

Liebherr Group

Hitachi Construction Machinery Co., Ltd.

Volvo Construction Equipment

CNH Industrial N.V.

Hyundai Construction Equipment Co., Ltd.

JCB Ltd.

Terex Corporation

Doosan Infracore Co., Ltd.

Sany Group Co., Ltd.

XCMG Group

Zoomlion Heavy Industry Science and Technology Co., Ltd.

Atlas Copco AB

View Full Report: https://www.reportsandinsights.com/report/Track Laying Equipment-market

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

Reports and Insights consistently mееt international benchmarks in the market research industry and maintain a kееn focus on providing only the highest quality of reports and analysis outlooks across markets, industries, domains, sectors, and verticals. We have bееn catering to varying market nееds and do not compromise on quality and research efforts in our objective to deliver only the very best to our clients globally.

Our offerings include comprehensive market intelligence in the form of research reports, production cost reports, feasibility studies, and consulting services. Our team, which includes experienced researchers and analysts from various industries, is dedicated to providing high-quality data and insights to our clientele, ranging from small and medium businesses to Fortune 1000 corporations.

Contact Us:

Reports and Insights Business Research Pvt. Ltd. 1820 Avenue M, Brooklyn, NY, 11230, United States Contact No: +1-(347)-748-1518 Email: [email protected] Website: https://www.reportsandinsights.com/ Follow us on LinkedIn: https://www.linkedin.com/company/report-and-insights/ Follow us on twitter: https://twitter.com/ReportsandInsi1

#Track Laying Equipment Market share#Track Laying Equipment Market size#Track Laying Equipment Market trends

0 notes

Text

Automotive Wiring Harness Market Set to Soar to USD 119.31 Billion by 2033 with 8% CAGR

The global Automotive Wiring Harness Market is expected to reach a staggering value of USD 119.31 Billion by 2033, according to Future Market Insight. This projection reflects a CAGR of 8%, highlighting substantial growth compared to the projected value of USD 55.26 billion in 2023.

The automotive industry is experiencing a remarkable trend towards vehicle electrification, driven by the urgent need for improved fuel efficiency and reduced emissions. As electric and hybrid vehicles become more prevalent, the demand for sophisticated wiring systems and harnesses increases. These wiring systems and harnesses connect various components such as batteries, motors, inverters, and charging infrastructure. The rising demand results from the need for efficient and reliable connections in these vehicles.

Request for the Report of Automotive wiring Harness Market: https://www.futuremarketinsights.com/reports/sample/rep-gb-37

The global automotive industry is undergoing a remarkable transformation with the increasing adoption of electric vehicles. As the demand for cleaner and greener transportation solutions rises, so does the need for high-voltage wiring harnesses. These harnesses efficiently transmit power between the battery, motor, and electronic components. The surge in electric vehicle adoption drives the automotive wiring harness market.

A growing concern for road safety has increased the demand for advanced vehicle safety features. Examples of these features include Advanced Driver Assistance Systems (ADAS), collision avoidance systems, lane departure warnings, and adaptive cruise control. To support these technologies, robust and intricate wiring harnesses are essential. Wiring harnesses facilitate the seamless integration of sensors, cameras, and control units.

The integration of advanced infotainment systems, telematics, and connectivity features in modern vehicles demands sophisticated wiring systems. These wiring harnesses enable the smooth transfer of data and seamless communication between diverse vehicle components. As consumer demand for connected cars continues to soar, the need for state-of-the-art wiring harnesses becomes increasingly pronounced.

Nowadays, vehicles are equipped with electronic systems, infotainment features, navigation systems, and connectivity options. The demand for seamless integration and functionality increases the need for efficient and reliable wiring harnesses. Wiring harnesses are critical in transmitting data and power effectively throughout the vehicle. As in-car connectivity and advanced infotainment systems continue to evolve, the demand for advanced wiring harnesses is expected to rise further.

Governments worldwide implement stringent regulations for vehicle safety, fuel efficiency, and emission standards. These regulations require specific safety features and technologies in vehicles, leading to the need for additional wiring harnesses. Automotive manufacturers strive to comply with these regulations. Safety features like airbags, anti-lock braking systems (ABS), and electronic stability control (ESC) rely heavily on robust wiring harnesses for their optimal functionality. As a result, the demand for automotive wiring harnesses intensifies.

The aftermarket segment presents substantial growth prospects for the automotive wiring harness market. As vehicles age, the need for wiring harness replacement and repair becomes increasingly prevalent. This creates significant opportunities for manufacturers and suppliers operating in the market. Moreover, the proliferation of electric vehicle charging stations necessitates the usage of wiring harnesses to support power transmission and facilitate seamless connectivity.

Key Takeaways from the Automotive Wiring Harness Market

The automotive wiring harness industry in the United Kingdom is anticipated to rise sizably, exhibiting a CAGR of 7.6% through 2033.

The United States held a 17.8% share of the global automotive wiring harness industry in 2022.

With a CAGR of 7.8% over the forecast period, India is predicted to develop rapidly in the automotive wiring harness industry.

In 2022, Japan had a 5.2% share of the automotive wiring harness industry globally.

The automotive wiring harness industry in China is expected to flourish speedily, registering a CAGR of 8.2% over the forecast period.

Germany accounted for 4.7% of the global automotive wiring harness industry in 2022.

Competitive Landscape in the Automotive Wiring Harness Market

Key players are actively engaged in various strategies to maintain their market position and meet the evolving demands of the automotive industry. These strategies include product innovation, research and development, partnerships and collaborations, mergers and acquisitions, and geographic expansion. Companies are focusing on developing advanced wiring harness solutions that offer higher efficiency, increased durability, and improved performance. Additionally, they are investing in technologies such as electrification and autonomous driving to cater to the growing demand for electric vehicles and advanced driver-assistance systems.

Key Companies Profiled In The Automotive Wiring Harness Market

LEONI Group

Samvardhana Motherson Group

Sumitomo Electric

Yazaki Group

Fujikura Ltd.

Lear Corporation

Furukawa Electric Co. Ltd

YURA Tech Corporation

Nexans

Key Segments Profiled In The Automotive Wiring Harness Market

By Product Type:

Chassis & Safety

Conventional Chassis

Semi-Forward Chassis

Full Forward Chassis

Body

Roof

Door & Window

Facia

Seat

Interior

HVAC

Engine

Sensors

By Vehicle Type:

Passenger Cars

Compact

Mid-Sized

SUV

Luxury

Light Commercial Vehicles

Heavy Commercial Vehicles

Electric Vehicles

BEV

PHEV

By Sales Channel:

First Fit

Replacement

By Region:

North America

Latin America

Europe

Asia Pacific

Middle East and Africa (MEA)

Recent Developments by Key Players

In July 2022, Sumitomo Wiring Systems Ltd celebrated the opening of a state-of-the-art manufacturing plant dedicated to producing automotive wiring harness products. The facility is located within the Royal Group Phnom Penh Special Economic Zone in Cambodia.

In May 2022, Marelli introduced its new Wireless Distributed Battery Management System. It enables a significant reduction in wiring harness by 90%. This innovative system enhances the flexibility, efficiency, and reliability of electric vehicles while also offering cost savings.

0 notes

Text

The Future of Automotive Car Parts: Trends and Innovations

The automotive industry is undergoing a significant transformation, driven by advancements in technology, changing consumer preferences, and a growing emphasis on sustainability. This shift is profoundly impacting the automotive car parts market, which is evolving to meet the demands of modern vehicles and their users. In this article, we explore the latest trends and innovations shaping the future of online automotive car parts.

Electrification and the Rise of EV Parts

As electric vehicles (EVs) become more popular, the demand for EV-specific parts is rising. Traditional internal combustion engine (ICE) vehicles require a wide array of parts that are not necessary for EVs, such as exhaust systems and fuel injectors. Instead, EVs need high-performance batteries, electric motors, and advanced thermal management systems. Companies are investing heavily in the research and development of these components, leading to improved battery life, faster charging times, and more efficient powertrains.

Advanced Driver Assistance Systems (ADAS) Components

Safety is a top priority for both consumers and manufacturers. Advanced Driver Assistance Systems (ADAS) are becoming standard in new vehicles, necessitating a range of specialized parts. These include sensors, cameras, radar systems, and LiDAR technology. ADAS components enhance vehicle safety by providing features such as automatic emergency braking, lane-keeping assistance, and adaptive cruise control. The continuous improvement of these technologies is driving the demand for high-quality, reliable parts that can seamlessly integrate with vehicle systems.

3D Printing and Customization

3D printing technology is revolutionizing the online automotive parts industry by enabling rapid prototyping and customization. This technology allows manufacturers to produce complex parts quickly and cost-effectively. For consumers, 3D printing opens up new possibilities for personalized vehicle components, from custom interior trims to unique exterior accessories. As 3D printing becomes more accessible, we can expect to see a surge in aftermarket parts tailored to individual preferences.

Sustainability and Eco-Friendly Materials

With increasing awareness of environmental issues, there is a growing demand for sustainable automotive parts. Manufacturers are exploring eco-friendly materials and processes to reduce their carbon footprint. This includes the use of recycled plastics, natural fibers, and biodegradable materials. Additionally, advancements in manufacturing techniques are leading to more energy-efficient production methods. The shift towards sustainability is not only beneficial for the environment but also aligns with the values of environmentally conscious consumers.

Connected Car Technology

The integration of Internet of Things (IoT) technology into vehicles is driving the development of connected car parts. These components enable vehicles to communicate with each other and with infrastructure, enhancing safety and convenience. Key connected car parts include telematics systems, vehicle-to-everything (V2X) communication modules, and infotainment systems. The growth of smart cities and autonomous driving technology is further propelling the need for sophisticated connected car components.

Aftermarket Growth and E-Commerce

The aftermarket automotive parts sector is experiencing robust growth, fueled by the rise of e-commerce. Consumers are increasingly turning to online platforms to purchase car parts, driven by the convenience of home delivery and the wide selection available. Online marketplaces and specialized automotive parts websites offer a range of products, from OEM (Original Equipment Manufacturer) parts to aftermarket alternatives. The growth of e-commerce is also enabling smaller manufacturers and suppliers to reach a global audience.

Conclusion

The automotive car parts industry is at the forefront of technological innovation, driven by the rapid evolution of the automotive sector. From the rise of electric vehicles and advanced driver assistance systems to the integration of IoT technology and the push for sustainability, the future of automotive car parts is dynamic and promising. As consumers and manufacturers continue to embrace these trends, the industry will undoubtedly see further advancements that enhance vehicle performance, safety, and customization. Whether you’re a car enthusiast or a professional in the industry, staying informed about these trends will be key to navigating the exciting future of automotive car parts.

0 notes

Text

Global Class 5 Truck Market Insights and Forecasting Trends Review 2024 - 2031

The global Class 5 truck market is a significant segment of the commercial vehicle industry, catering to a diverse range of applications, from delivery services to construction. This article examines the market's dynamics, including key drivers, trends, challenges, and future outlook.

Overview of the Class 5 Truck Market

Class 5 trucks, as defined by the Federal Highway Administration (FHWA) in the United States, have a Gross Vehicle Weight Rating (GVWR) between 16,001 and 19,500 pounds. These trucks are versatile, often used for local deliveries, service vehicles, and small freight transport, making them crucial to various sectors.

Definition and Characteristics of Class 5 Trucks

Class 5 trucks are characterized by:

Weight Capacity: GVWR ranging from 16,001 to 19,500 pounds.

Engine Options: Typically equipped with diesel or gasoline engines, offering a balance between power and fuel efficiency.

Body Styles: Available in various configurations, including cutaway vans, box trucks, and chassis cabs, catering to different business needs.

Accessibility: Designed for urban and suburban environments, allowing for easy maneuverability in tight spaces.

Market Drivers

Several factors are driving the growth of the global Class 5 truck market:

Increasing E-Commerce Demand

The rapid growth of e-commerce has led to a surge in demand for delivery vehicles. Class 5 trucks are well-suited for last-mile delivery, making them a preferred choice for logistics companies.

Urbanization and Infrastructure Development

As urban areas expand, the need for efficient transportation solutions increases. Class 5 trucks are ideal for navigating congested city streets and delivering goods to urban locations.

Government Regulations and Initiatives

Supportive government policies aimed at promoting commercial vehicle usage, including tax incentives and grants, are further boosting the Class 5 truck market.

Market Trends

The Class 5 truck market is witnessing several notable trends:

Electrification of Commercial Vehicles

With the growing emphasis on sustainability, manufacturers are increasingly investing in electric Class 5 trucks. Electric models are gaining traction due to their lower operational costs and environmental benefits.

Advanced Safety Features

There is a rising demand for trucks equipped with advanced safety technologies, such as collision avoidance systems, lane departure warnings, and adaptive cruise control, to enhance driver and road safety.

Customization and Specialization