#powermodulus

Explore tagged Tumblr posts

Text

Automotive Power Electronics Market - Forecast(2024–2030)

Automotive Power Electronics Market Overview

Automotive Power Electronics Market Size is valued at $5.4 Billion by 2030, and is anticipated to grow at a CAGR of 4.2% during the forecast period 2024 -2030. The automotive power #electronics market is experiencing significant growth, driven #primarily by the increasing demand for #electric vehicles (EVs). This surge is fueled by a global shift towards sustainable transportation and stringent emission #regulations. The rapid #technological advancements in #semiconductor materials and power management solutions are enhancing the efficiency and performance of automotive power electronics, thereby #accelerating market expansion.

Additionally, consumer preferences are evolving towards vehicles that offer better energy efficiency, safety, and convenience, all of which are enabled by sophisticated power electronic systems. Manufacturers are investing heavily in research and development to innovate and stay competitive in this dynamic market. Furthermore, government incentives and subsidies for EVs are further propelling the adoption of automotive power electronics. This market trajectory is expected to continue its upward trend, as the integration of power electronics in vehicles becomes more prevalent, aligning with the broader goals of energy conservation and environmental sustainability.

Sample Report:

COVID-19/Russia-Ukraine War Impact

The COVID-19 pandemic significantly disrupted the automotive power electronics market, initially causing production halts and supply chain disruptions. As factories shut down and demand for vehicles plummeted, manufacturers faced challenges in maintaining operations and meeting financial targets. However, the pandemic also accelerated the adoption of electric vehicles (EVs), driven by increased awareness of environmental issues and government incentives. This shift spurred innovations in power electronics, essential for EVs’ efficiency and performance. Consequently, despite short-term setbacks, the industry experienced a renewed focus on developing advanced power electronics solutions, paving the way for long-term growth and resilience in a post-pandemic era.

The Russo-Ukraine War has significantly impacted the automotive power electronics sector, primarily through disruptions in the supply chain and fluctuations in raw material prices. The conflict has caused instability in the region, affecting the production and transportation of essential components like semiconductors and rare earth metals, crucial for power electronics. This disruption has led to increased costs and delays, compelling manufacturers to seek alternative sources and adjust their supply chains. Additionally, the economic sanctions imposed on Russia have further strained international trade relations, exacerbating the challenges faced by the automotive industry. Consequently, companies are re-evaluating their strategies to mitigate risks and ensure resilience in their operations, focusing on diversifying suppliers and investing in local manufacturing capabilities to reduce dependency on geopolitically sensitive regions.

Inquiry Before Buying:

Automotive Power Electronics Market

The report “Automotive Power Electronics Market Forecast (2024–2030)”, by Industry ARC, covers an in-depth analysis of the following segments of the Automotive Power Electronics Market: By Component: Microcontroller Unit, Power Integrated Circuit, Sensors, Others By Vehicle Type: Passenger Cars, Commercial Vehicles By Electric Vehicle Type: Battery Electric Vehicles, Hybrid Electric Vehicles, Plug-In Hybrid Electric Vehicles By Application: Powertrain & Chassis, Body Electronics, Safety & Security, Infotainment & Telematics, Energy Management System, Battery Management System By Geography: North America (USA, Canada, and Mexico), South America (Brazil, Argentina, Colombia, Chile, and Rest of South America), Europe (UK, Germany, France, Italy, Netherlands, Spain, Russia, and Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, Malaysia, and Rest of APAC), and Rest of the World (Middle East, and Africa)

Key Takeaways

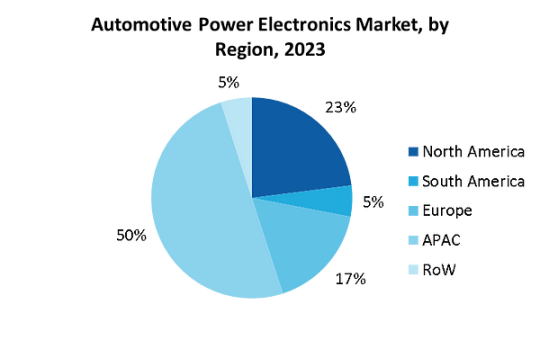

Asia-Pacific dominated the Automotive Power Electronics market with a share of around 50% in the year 2023.

The automotive industry’s need to meet stricter safety regulations and reduce emissions, coupled with rising consumer demand for electric vehicles, will propel the growth of the automotive power electronics market throughout the forecast period.

Apart from this, thrust to equip vehicles with advanced power solutions is driving the growth of Automotive Power Electronics market during the forecast period 2024–2030.

For More Details on This Report — Request for Sample

Automotive Power Electronics Market Segment Analysis — By Vehicle Type

The demand for automotive power electronics in passenger cars is escalating due to government initiatives promoting the integration of advanced electronics. This surge is driven by policies aimed at enhancing vehicle efficiency, safety, and environmental performance. For instance, in March 2024, the European Union introduced new regulations mandating the inclusion of advanced driver-assistance systems (ADAS) in all new cars, significantly boosting the need for sophisticated power electronics. Similarly, the U.S. government has increased funding for electric vehicle (EV) infrastructure, encouraging automakers to incorporate more power-efficient electronic components. Additionally, China’s recent tax incentives for electric and hybrid vehicles, announced in January 2024, have accelerated the adoption of power electronics to improve performance and range. These initiatives are fostering innovation and production of cutting-edge electronic components, such as inverters and onboard chargers, essential for modern passenger cars. As a result, automotive manufacturers are increasingly investing in power electronics to comply with regulations, meet consumer expectations, and gain a competitive edge in the evolving market.

Schedule a Call :

Automotive Power Electronics Market Segment Analysis — By Electric Vehicle Type

The demand for automotive power electronics in hybrid electric cars is rapidly increasing due to the global imperative to decarbonize the transport sector and reduce reliance on fossil fuels. Governments worldwide are implementing stringent regulations and incentives to promote the adoption of hybrid and electric vehicles. In January 2024, the European Union introduced enhanced subsidies for hybrid vehicle purchases, coupled with stricter emission standards, significantly boosting the market for power electronics. Similarly, the U.S. launched the “Clean Transport Initiative” in April 2023, providing substantial tax breaks and grants for hybrid car manufacturers to innovate and scale up production. Additionally, Japan’s latest energy policy, announced in February 2024, includes a comprehensive plan to phase out internal combustion engines, further propelling the demand for hybrid vehicles equipped with advanced power electronics. These components, such as power inverters, converters, and battery management systems, are essential for enhancing the efficiency and performance of hybrid electric cars. As a result, automotive companies are accelerating investments in power electronics technology to meet regulatory requirements, cater to consumer preferences, and contribute to a sustainable future.

Automotive Power Electronics Market Segment Analysis — By Geography

On the basis of geography, Asia-Pacific held the highest segmental market share of around 50% in 2023, The Asia-Pacific region is the largest market for automotive power electronics, driven by high vehicle production rates and the increasing adoption of advanced electronics in automobiles. Countries like China, Japan, and South Korea are leading in vehicle manufacturing, with major automakers integrating sophisticated power electronic components to enhance vehicle efficiency and performance. For example, in March 2024, Toyota introduced a new hybrid model equipped with cutting-edge power electronics, significantly improving energy management and fuel efficiency. Similarly, BYD in China launched an electric vehicle series in February 2024, featuring advanced inverters and converters, which contribute to extended driving ranges and faster charging times. These innovations reflect the region’s robust focus on technological advancements and sustainable transportation solutions. The strategic partnerships between automotive giants and technology firms, such as Hyundai’s collaboration with LG Electronics to develop next-generation battery management systems in April 2023, further underscore the region’s leadership in this sector. This confluence of high production volumes and technological integration ensures that the Asia-Pacific market remains at the forefront of automotive power electronics development.

Buy Now:

Automotive Power Electronics Market Drivers

The rising market for the electric vehicles is the key factor driving the growth of Global Automotive Power Electronics market

The growing demand for automotive power electronics is being significantly driven by the expanding electric vehicle (EV) market. As global initiatives to reduce carbon emissions intensify, consumers and manufacturers alike are shifting towards EVs, which rely heavily on power electronics for various critical functions. These components, including inverters, converters, and battery management systems, are essential for optimizing the performance, efficiency, and range of electric vehicles. Automakers are ramping up production of EVs, incorporating advanced power electronics to meet regulatory standards and consumer expectations for sustainability and high performance. The technological advancements in power electronics are also enabling faster charging, improved energy management, and enhanced vehicle safety, further boosting their demand. Consequently, the automotive industry is experiencing a surge in innovation and investment in power electronics to support the burgeoning EV market, positioning it as a pivotal element in the future of transportation.

Automotive Power Electronics Market Challenges

The high cost of electric vehicles is expected to restrain the market growth

The high cost of electric vehicles (EVs) negatively impacts the automotive power electronics market by limiting consumer adoption and market growth. Despite the technological advancements and environmental benefits of EVs, their higher price compared to traditional vehicles remains a significant barrier. This cost premium is largely due to expensive components such as batteries and advanced power electronics systems, including inverters and converters, which are essential for EV functionality. As a result, potential buyers are often deterred by the initial investment required, slowing the transition to electric mobility. Consequently, manufacturers face challenges in achieving economies of scale, which further drives up costs. This cyclical issue restricts market expansion and inhibits broader implementation of power electronics innovations, ultimately stalling progress towards widespread EV adoption and the associated benefits of reduced emissions and improved energy efficiency in the automotive sector.

Automotive Power Electronics Industry Outlook

Product launches, mergers and acquisitions, joint ventures and geographical expansions are key strategies adopted by players in the Automotive Power Electronics Market. The key companies in the Automotive Power Electronics Market are:

STMicroelectronics N.V.

Infineon Technologies AG

Fuji Electric Co., Ltd.

NXP Semiconductors N.V.

Renesas Electronics Corporation

Toshiba Corporation

Mitsubishi Electric

Huawei Digital Power

Robert Bosch GmbH

Hitachi Energy

Recent Developments

In May 2022, STMicroelectronics joined forces with Microsoft to make development of highly secure IoT devices easier.

In March 2023, Infineon Technologies announced the acquisition of GaN Systems, a global leader in gallium nitride (GaN)-based power conversion solutions. This move strengthened Infineon’s position in the market.

For more Automotive Market reports, please click here

0 notes