#Global Commercial Greenhouse Market

Text

The Commercial Greenhouse Market witnessed substantial growth, valued at USD 39.6 Billion in 2023, and is poised to reach USD 68.7 Billion by 2028, reflecting a CAGR of 11.6% during the forecast period 2023-2028.

#Commercial Greenhouse Market#Commercial Greenhouse Market Size#Commercial Greenhouse Market Share#Commercial Greenhouse Market Forecast#Commercial Greenhouse Market Trends#Commercial Greenhouse Market Overview#Commercial Greenhouse Market Growth#Commercial Greenhouse Market Report#Global Commercial Greenhouse Market#Commercial Greenhouse Industry#Greenhouse Market

0 notes

Text

About a fifth of food is wasted, sometimes through profligacy or poor planning, sometimes from a lack of access to refrigeration or storage, according to the UN Food Waste Index report, published on Wednesday, at a global cost of about $1tn a year.

Households are responsible for most of the world’s food waste – about 60% of the 1bn tonnes of food thrown away annually. But commercial food systems are also a substantial contributor: food services accounted for 28% of waste, and retail for about 12% in 2022, the latest data available.

These figures exclude an additional 13% of food that is lost in the food supply chain, between harvest and market, often from rejection or spoilage of edible food.

Not only is this waste squandering natural resources, it is also a big contributor to the climate and biodiversity crises, accounting for close to 10% of global greenhouse gas emissions and displacing wildlife from intensive farming, as more than a quarter of the world’s agricultural land is given over to the production of food that is subsequently wasted.

Inger Andersen, the executive director of the UN Environment Programme, which wrote the report in conjunction with the UK’s Waste and Resources Action Programme (Wrap), described food waste as “a global tragedy”, and contrasted this with the fact that a third of people face food insecurity, unsure of where their future meals will come from.

66 notes

·

View notes

Text

One country in the [climate-change] firing line is Cape Verde. The West African island nation, where 80% of the population lives on the coast, is already feeling the brunt of rising sea levels and increasing ocean acidity on its infrastructure, tourism, biodiversity and fisheries.

The country desperately needs to both mitigate and adapt to these problems, but – as with many Global South countries at present – simply lacks the budget to do it: Cape Verde’s debt reached an all-time high of 157% of GDP in 2021.

In a bid to address both issues simultaneously, the country has signed a novel agreement with Portugal to swap some of its debt for investments into an environmental and climate fund. The former Portuguese colony owes the Portuguese state €140m ($148m) and Portuguese banks €400m.

On a state visit to Cape Verde on 23 January, Portuguese Prime Minister António Costa announced the debt would be put towards Cape Verde’s energy transition and fight against climate change. Costa earmarked projects involving energy efficiency, renewable energy and green hydrogen as possible targets for the fund.

“This is a new seed that we sow in our future cooperation,” said Costa. “Climate change is a challenge that takes place on a global scale and no country will be sustainable if all countries are not sustainable.”

“Debt-for-climate swaps” allow countries to reduce their debt obligations in exchange for a commitment to finance domestic climate and nature projects with the freed-up financial resources. The concept has been knocking about since the 1980s, typically geared at nature conservation. However, after recent deals for Barbados, Belize and the Seychelles, and huge $800m and $1bn agreements in the offing for Ecuador and Sri Lanka, is this financial instrument finally coming of age?

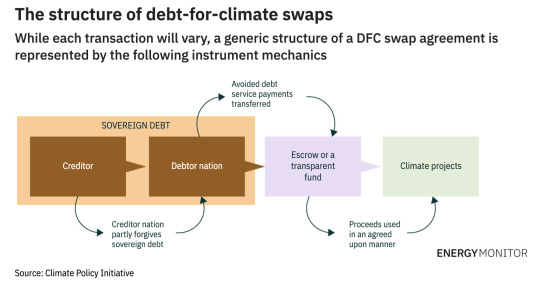

How It Works

Debt-for-climate swaps typically follow a formula. First, a creditor [here, a group or government that money is owed to] agrees to reduce debt, either by converting it into local currency, lowering the interest rate, writing off some of the debt, or a combination of all three. The debtor will then use the saved money for initiatives aimed at increasing climate resilience, lowering greenhouse gas emissions or protecting biodiversity.

The original 'debt-for-nature swaps' began as small, trilateral deals, with NGOs buying sovereign debt owed to commercial banks to redirect payments towards nature projects. They have since evolved into larger, bilateral deals between creditors and debtors...

Debt-for-climate swaps free up fiscal resources so governments can improve resilience and transition to a low-carbon economy without causing a fiscal crisis or sacrificing spending on other development priorities. [These swaps] can create additional revenue for countries with valuable biodiversity or carbon sinks by allowing them to charge others to protect those assets, thereby providing a global public good.

Swaps can even result in an upgrade to a country’s sovereign credit rating, as was the case in Belize, which makes government borrowing cheaper [and improves the country's economy.]

Right now, these [swaps] are needed more than ever, with low-income countries dealing with multiple crises that have put huge pressure on public debt...

Debt-for-climate swaps: “Increasing in size and scale”

Although debt-for-climate swaps are not new, until recently the amount of finance raised globally from the instrument has been modest – just $1bn between 1987 and 2003, according to one OECD study. Just three of the 140 swaps over the past 35 years have had a value of more than $250m, according to the African Development Bank. The average size was a mere $26.6m.

However, the market has steadily picked up pace over the past two decades... In 2016, the government of the Seychelles signed a landmark agreement with developed nation creditor group the Paris Club, supported by NGO The Nature Conservancy (TNC), for a $22m investment in marine conservation.

The government of Belize followed suit in 2021 by issuing a $364m blue bond – a debt instrument to finance marine and ocean-focused sustainability projects – to buy back $550m of commercial debt to use for marine conservation and debt sustainability.

Then, last year, Barbados completed a $150m transaction, supported by the TNC and the Inter-American Development Bank, allowing the country to reduce its borrowing costs and use savings to finance marine conservation.

“Two or three years ago, we were talking about $50m deals,” says Widge. “Now they have gone to $250–300m, so they are definitely increasing in size and scale.”

Indeed, the success of the deals for the Seychelles, Belize and Barbados, along with the debt distress sweeping across the Global South, has sparked an uptick of interest in the model.

Ecuador is reported to be in negotiations with banks and a non-profit for an $800m deal, and Sri Lanka is discussing a $1bn transaction – which would be the biggest swap to date."

-via Energy Monitor, 2/1/23

Note: I'm leaving out my massive rant about how the vast majority of this debt is due to the damages of colonialism. And also countries being forced to "PAY BACK" COLONIZERS FOR THEIR OWN FREEDOM for decades or in some cases centuries (particularly infuriating example: Haiti). Debt-for-climate swaps are good news, and one way to help right this massive historic and ongoing economic wrong

#climate change#developing countries#economics#debt for climate#debt relief#cape verde#barbados#seychelles#ecuador#sri lanka#portugal#belize#global south#conservation#biodiversity#good news#hope#international politics

52 notes

·

View notes

Text

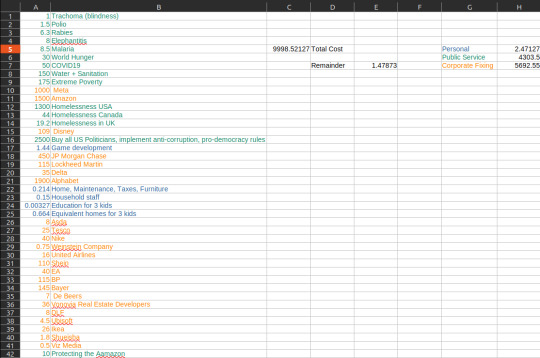

What to do with 10 trillion dollars

I spent way too much time actually answering a reddit question of "How would you spend 10 trillion dollars if you needed to in 20 years. You will die after 20 years." So, I figured I'd share it here.

With only $10 trillion dollars you can't stabilize greenhouse gases or get rid of fossil fuels, which are 13t and 44t respectively. I'm using a variety of sources, so don't expect citations.

I did slightly overpay for things, strategically, partially because I can only imagine doing the things I would do would make it more expensive than it would otherwise be. You'll see.

I'm presuming I don't get assassinated.

What you can do (I did the math) figures are in Billions:

Personal (2.44/10000):

1.44 on remaking 8 games as mid-line AAA games (I chose Legend of Dragoon, FF8, Witcher 1, and the Legacy of Kain series).

.214 on 50 years of housing and buying yourself a $130,000,000 home in NYC. Includes taxes, maintenance, and furniture.

.15 on household staff for 50 years, with at double the normal pay

.000327 to put 3 kids through the best pre-k and best college in the country

.664 setting up each of those 3 kids with their own equivalent home and staff setup

Public Service (4303/10000):

Big one out of the way. 2500bn in lobbying/buying up American politicians to enact structural reforms I want to see. You would think this would be way too much, since the presidential election in 2020 only had 14.4 in it. This amounts to averaging 250 in spending every election cycle, even off-year. I counter with the global commercial banking market having a market cap of 2800 in 2023. The defense industry is almost 480. Health insurance in the US is 1600. This is an expensive, long-drawn fight. This is likely the single most important thing on the list. Anti-corruption measures, labor rights, pro-democracy reforms, including ultimately making it illegal for other people to buy more elections.

a cumulative total of 1803 spent on:

curing the most common cause of blindness worldwide

eradicating polio, rabies, elephantitis, malaria, world hunger, COVID19 issues, Water + Sanitation access, extreme poverty, homelessness in USA, Canada, and UK (I looked for China, Indonesia, Nigeria, Egypt, and Pakistan but couldn't find real numbers),

protecting the Amazon rainforest

Corporate Fixing (5692/10000):

Buying up and changing (converting to Co-Ops, converting to non-profits, dissolving, or something in line with those:

Meta

Amazon

Disney

JP Morgan Chase

Lockheed Martin

Delta

Alphabet

Asda

Tesco

Nike

The Weinstein Company

United Airlines

Shein

EA

BP

Bayer (side-note: they own/are Monsanto now)

De Beers

Vonovia Real Estate Developers

DLE

Ubisoft

Ikea

Shueisha

and Viz Media

It leaves me with 1.4bn left over. I'm comfortable with saying an additional billion would likely be used up administratively as things get a bit more expensive than I thought they would.

Honestly, I could likely blow it on close friends and family who need it. If you have an issue with the house spending being for 50 years instead of 30, that can just be shuffled around a bit to include more people in my personal life to meet the same number.

Leaving me with 470 million to spend elsewhere in the next 20 years. Expensive vacations, nice cars, donating to "smaller" issues as I see worthwhile, giving family and friends money for their ventures/dreams, etc. make me think it wouldn't actually be hard to lose track of that much money in those many years.

Hell, if I want to I can probably spend a million bucks on food a year just for my family. Probably more, if I actively try to do so.

9 notes

·

View notes

Text

From Extraction to Usage: The Lifecycle of Natural Gas

The journey of natural gas from the depths of the earth to the blue flames on a stove is a complex and multifaceted process. As a fossil fuel, natural gas plays a pivotal role in the global energy supply, accounting for approximately 24% of global energy consumption. This narrative will traverse through the lifecycle of natural gas, highlighting the intricacies involved in its extraction, processing, transportation, and usage, as well as its environmental and economic impacts.

Extraction and Production:

Natural gas extraction begins with geological surveys to identify promising reserves, followed by drilling either on land or offshore. In 2022, the United States, one of the largest producers, extracted approximately 99.6 billion cubic feet per day. The extraction often employs techniques like hydraulic fracturing, which alone contributed to around 67% of the total U.S. natural gas output in 2018. The extracted gas, containing various hydrocarbons and impurities, requires substantial processing to meet commercial quality standards.

Processing and Purification:

Once extracted, natural gas undergoes several processing steps to remove water vapor, hydrogen sulfide, carbon dioxide, and other contaminants. This purification is essential not only for safety and environmental reasons but also to increase the energy efficiency of the gas. Processing plants across the globe refine thousands of cubic feet of raw gas each day, ensuring that the final product delivered is almost pure methane, which is efficient for burning and less polluting than unprocessed gas.

Transportation:

Transporting natural gas involves an expansive network of pipelines covering over a million miles in the United States alone. In regions where pipeline infrastructure is not feasible, liquified natural gas (LNG) provides an alternative. LNG exports from the U.S. reached record highs in 2022, with approximately 10.6 billion cubic feet per day being shipped to international markets. LNG carriers and storage facilities are integral to this global trade, making natural gas accessible worldwide.

Storage:

Strategic storage ensures that natural gas can meet fluctuating demands, particularly during peak usage periods. Underground storage facilities can hold vast quantities; for instance, the U.S. can store approximately 4 trillion cubic feet of gas, helping to manage supply and stabilize prices. These reserves play a critical role in energy security and in buffering any unexpected disruptions in supply.

Distribution:

Natural gas distribution is the final leg before reaching end-users. Companies manage complex distribution networks to deliver gas to industrial facilities, power plants, commercial establishments, and residences. The U.S. alone has over 2 million miles of distribution pipelines, ensuring that natural gas accounts for nearly 30% of the country’s electricity generation and heating for about half of American homes.

Usage and Consumption:

The versatility of natural gas makes it a preferred source for heating, cooking, electricity generation, and even as a feedstock for producing plastics and chemicals. In the residential sector, an average American home might consume about 200 cubic feet per day for heating and cooking. For electricity, combined-cycle gas turbine plants convert natural gas into electricity with more than 60% efficiency, significantly higher than other fossil-fueled power plants.

Environmental Considerations and Future Prospects:

While natural gas burns cleaner than coal, releasing up to 60% less CO2 for the same energy output, it is not without environmental challenges. Methane, a potent greenhouse gas, can escape during various stages of the natural gas lifecycle. However, advances in technology and regulatory measures aim to mitigate these emissions. As the world leans towards a lower-carbon future, the role of natural gas is pivotal, with investments in carbon capture and storage (CCS) technologies and the potential integration with renewable energy sources.

4 notes

·

View notes

Text

5 Megatrends Impacting Power Transformation Globally

In a period of rapid technological development and growing sustainability concerns, the global power industry confronts a significant evolution. Traditional power systems are being modified by several megatrends that promote creativity, effectiveness, and long-term viability.

Here, we’ll look at five major megatrends that are affecting the global transformation of power

1. Transition in global economic power

Global economic dominance is evolving, with emerging economies gaining prominence. Despite their remarkable economic development, nations like China, India, and Brazil are experiencing a rise in energy consumption. The power industry will be greatly affected by this shift in economic power. To meet the expanding energy needs of these burgeoning economies, new power infrastructure, transmission networks, and sustainable energy sources must be developed.

2. Population dynamics

The demographic shift is an important megatrend that has a major effect on the power transition. Due to population growth, urbanization, and changing demographics, there is a growing need for power, particularly in developed nations. Countries with established economies and aging populations require continuous electricity for essential services like healthcare. To deal with these developments, the power industry must invest in efficient, environmentally friendly energy generation and distribution systems.

3. Rapid Urbanization

Urbanization is altering the global power industry. Megacities’ expansion has resulted in an upsurge in the amount of energy required by the residential, commercial, and industrial sectors. The creation of smart cities must be given top priority by the electricity sector to meet these objectives. This entails constructing efficient power networks, utilizing renewable energy sources, and deploying innovative technology for optimal power generation and delivery.

4. Technological advancement

Technology is revolutionizing production, transmission, and consumption in the power sector. Blockchain, Internet of Things, big data, and AI innovations optimize power systems for dependability and efficiency. Consumers are empowered by decentralized generation, grid automation, and smart energy management. These developments lead to lower expenses and greater authority in the changing electricity landscape.

5. Climate Change/Resource Scarcity

The evolution of the electricity sector is being fueled by climate change and resource scarcity. To minimize greenhouse gas emissions, emphasis is put on renewable energy sources. Enhancing energy efficiency, studying energy storage, and alternate fuels are also prioritized. These initiatives are meant to encourage sustainability and alleviate the consequences of climate change.

Conclusion

Lastly, the five megatrends highlighted have a substantial worldwide impact on power transition. Adapting to these megatrends is critical for the power industry to meet growing energy demands, promote economic growth, and resolve the environmental challenges of the twenty-first century.

MEC, an established engineering consultant, offers clients across the globe with highly specialized and performance-oriented technical proficiency. We’ve got you addressed, from conception to commission to production. Engage with us to develop optimal strategies that boost productivity and radiate prospects for success. Explore our website to learn more about our services and expertise in a wide range of market sectors.

2 notes

·

View notes

Text

The Swedish pulp producer Renewcell has just opened the world's first commercial-scale, textile-to-textile chemical recycling pulp mill, after spending 10 years developing the technology.

While mechanical textiles-to-textiles recycling, which involves the manual shredding of clothes and pulling them apart into their fibres, has existed for centuries, Renewcell is the first commercial mill to use chemical recycling, allowing it to increase quality and scale production. With ambitions to recycle the equivalent of more than 1.4 billion T-shirts every year by 2030, the new plant marks the beginning of a significant shift in the fashion industry's ability to recycle used clothing at scale.

"The linear model of fashion consumption is not sustainable," says Renewcell chief executive Patrik Lundström. "We can't deplete Earth's natural resources by pumping oil to make polyester, cut down trees to make viscose or grow cotton, and then use these fibres just once in a linear value chain ending in oceans, landfills or incinerators. We need to make fashion circular." This means limiting fashion waste and pollution while also keeping garments in use and reuse for as long as possible by developing collection schemes or technologies to turn textiles into new raw materials.

Each year, more than 100 billion items of clothing are produced globally, according to some estimates, with 65% of these ending up in landfill within 12 months. Landfill sites release equal parts carbon dioxide and methane – the latter greenhouse gas being 28 times more potent than the former over a 100-year period. The fashion industry is estimated to be responsible for 8-10% of global carbon emissions, according to the UN.

Just 1% of recycled clothes are turned back into new garments. While charity shops, textiles banks and retailer "take-back" schemes help to keep those donated clothes in wearable condition in circulation, the capabilities of recycling clothes at end-of-life are currently limited. Many high street stores with take-back schemes, including Levi Strauss and H&M, operate a three-pronged system: resell (for example, to charity shops), re-use (convert into other products, such as cleaning cloths or mops) or recycle (into carpet underlay, insulation material or mattress filling – clothing is not listed as an option).

Much of the technical difficulty in recycling worn-out clothes back into new clothing comes down to their composition. The majority of clothes in our wardrobes are made from a blend of textiles, with polyester the most widely produced fibre, accounting for a 54% share of total global fibre production, according to the global non-profit Textile Exchange. Cotton is second, with a market share of approximately 22%. The reason for polyester's prevalence is the low cost of fossil-based synthetic fibres, making them a popular choice for fast fashion brands, which prioritise price above all else – polyester costs half as much per kg as cotton. While the plastics industry has been able to break down pure polyester (PET) for decades, the blended nature of textiles has made it challenging to recycle one fibre, without degrading the other. (Read more about why clothes are so hard to recycle.)

By using 100% textile waste – mainly old T-shirts and jeans – as its feedstock, the Renewcell mill makes a biodegradable cellulose pulp they call Circulose. The textiles are first shredded and have buttons, zips and colouring removed. They then undergo both mechanical and chemical processing that helps to gently separate the tightly tangled cotton fibres from each other. What remains is pure cellulose.

6 notes

·

View notes

Text

Induction Motor Market - Forecast(2022 - 2027)

Induction Motor Market Size is forecast to reach $54.2 billion by 2026, at a CAGR of 6.5% during 2021-2026. An induction motor is an AC electric motor in which torque is produced by the reaction between a varying magnetic field generated in the stator and the current induced in the coils of the rotor. It is used in a majority of machinery, as it is more powerful and eco-friendly compared to the conventional motors in the market. North America has significant share in global induction motor market due to a developed usage of an induction motor in the significant industrial manufacturing, aerospace & defense, and automotive companies. In addition to the growing preference for electric vehicles in the U.S. is also stimulating the growth in North America.

Report Coverage

The report: “Induction Motor Market Report– Forecast (2021-2026)”, by IndustryARC covers an in-depth analysis of the following segments of the Induction Motor market

By Rotor Type: Inner Rotor, Outer Rotor

By Type: Single Phase, Three Phase

By Efficiency Class: IE1, IE2, IE3, IE4

By Voltage: Upto 1KV, 1-6.6 KV, Above 6.6KV

By Vertical: Industrial, Commercial, Residential, Agriculture, Automotive and Others

By Geography: North America (U.S, Canada, Mexico), South America(Brazil, Argentina and others), Europe(Germany, UK, France, Italy, Spain, Russia and Others), APAC(China, Japan India, SK, Aus and Others), and RoW (Middle East and Africa)

Request Sample

Key Takeaways

The rising demand for efficient energy usage over concerns of environmental impact of energy generation from conventional sources such as coal and natural gas, is expected to help grow the Induction Motor market in APAC.

The inner rotor segment is growing at a significant CAGR rate of 7.1% in the forecast period. In inner rotor type motors, rotors are positioned at the centre and surrounded by stator winding.

Automotive sector is expected to witness a highest CAGR of 8.9% the forecast period, owing to various factors such as increase in sales of electric vehicles due to rising concerns over greenhouse gases emissions, and favourable government policies in countries such as India, China and so on.

Induction Motor companies are strengthening their position through mergers & acquisitions and continuously investing in research and development (R&D) activities to come up with solutions to cater to the changing requirements of customers.

Induction Motor Market Segment Analysis - By Rotor Type

Three Phase segment is growing at a significant CAGR of 11.1%

in the forecast period. A three phase induction motor is a type of AC induction motors which operates on three phase supply. These three phase induction motors are widely used AC motor to produce mechanical power in industrial applications. Almost 70% of the machinery in industrial applications uses three-phase induction motors, as they are cost-effective, robust, maintenance-free, and can operate in any environmental condition. Moreover, induction motors are the most used in industry since they are rugged, inexpensive, and are maintenance free. In addition they are widely used in the mining metals and cement, automotive, oil and gas, healthcare, manufacturing industries and so on. Increase awareness of environmental protection across industries also contributes to the growth of three phase induction motors, as they have a low emission rate. Moreover, the shift towards industrial automation, coupled with the rising consumer confidence & promising investment plans triggers demand for the three phase induction motor in industrial application. Furthermore, the advent of Industry 4.0 and technological advancements enables a wide adoption base for the three phase induction motors. In 2019, Oriental Motor USA introduced their latest high efficiency three-phase AC induction motors equipped with a terminal box and a high strength right-angle hypoid gearhead, these new three-phase motors have the capacity of two new wattages of 30W and 40W and expands the KIIS Series Standard AC motors product line-up.

Inquiry Before Buying

Induction Motor Market Segment Analysis - By Vertical

Automotive sector is expected to witness a highest CAGR of 8.9% in the forecast period, owing to various factors such as increase in sales of electric vehicles due to rising concerns over greenhouse gases emissions, and favorable government policies in countries such as India, China and so on. In addition, the shift towards industrial automation, coupled with the rising consumer confidence & promising investment plans triggers demand for the induction motor in industrial application. Furthermore, the advent of Industry 4.0 enables a wide adoption base for the induction motors. Moreover, growing number of product launches by major manufacturers will drive the market growth in the forecast period. In September 2019, Motor and drive manufacturer WEG released the M Mining series of slip-ring induction motors which are designed especially for use in the dusty environments of iron ore operations and the cement sector. In July 2019, Ward Leonard launched 2000 HP induction motor WL29BC200 which is designed tote into a package of 15000 HP for the oil and gas industry. In September 2019, Tata Motors launched Tigor EV for private buyers as well as cab aggregators and EESL staff. he Tata Tigor electric uses a 72 V, 3-Phase Induction motor

Induction Motor Market Segment Analysis - By Geography

Induction Motor market in Asia-Pacific region held significant market share of 38.5% in 2020. Increasing compliance for energy efficient motors and rising adoption of motor-driven electric vehicles are the key factors driving market growth. The rising demand for efficient energy usage over concerns of environmental impact of energy generation from conventional sources such as coal and natural gas, is expected to help grow the Induction Motor market. In addition advancements in the agriculture sector and enormous investments in industrialization in countries such as China, India, South Korea, and Australia is driving the market growth. Further, the increasing production and sales of electric vehicles in countries including China and Japan is also analyzed to drive the market growth.

Schedule a Call

Induction Motor Market Drivers

Robust Structure of Motor

The rough physical structure of the motor is predicted to be a major driving factor for the growth of the induction motor market. Induction motor are robust in nature and can be operated in any climatic conditions. Moreover, the absence of slip rings and brushes in the motor induction eliminates the chances of sparks, which makes the operation safe even in the most explosive working conditions. In addition, induction motor is cost effective, highly reliable and the maintenance is very less, which is expected to propel the growth of the induction motor market in the forecast period 2021-2026.

Rise in Production of Electric Vehicles

The electric car market has witnessed rapid evolution with the ongoing developments in automotive sector and favourable government policies and support in terms of subsidies and grants, tax rebates. As induction motors especially three phase are widely used in electric vehicles because of high efficiency, good speed regulation and absence of commutators is analysed to drive the market growth. In addition these motor also serves as an alternative of a permanent magnet in the electric vehicles. Hence rise in production of electric vehicles is analysed to drive the market. In 2019, Ford has invested $1.45 billion in Detroit plants in U.S., to make electric, autonomous and sports utility vehicles, which is mainly aimed to increase the production of the vehicles thereby impacting on the high procurement of the induction motors. In 2019, Toyota announced plans to invest $749M in expanding the U.S. manufacturing facilities to increase the production of the electric and hybrid vehicles. In 2020, General Motors had committed boost its electric vehicle production by investing more than $7 billion. Moreover governments of several countries have been investing heavily for the development of electric vehicles. In 2019 German government has committed to invest more than $3 billion to expand electric car market growth in the region. Hence these investments and developments are analysed to be the key drivers for the growth of the electric vehicle market and thereby the growth of induction motor market during the forecast period 2021-2026.

Buy Now

Induction Motor Market Challenges

Easy availability of low-quality Induction Motors

The market for Induction Motors is highly fragmented, with a significant number of domestic and international manufacturers. Product quality is a primary parameter for differentiation in this market. The organized sector in the market mainly targets industrial buyers and maintains excellent product quality, while the unorganized sector offers low-cost alternatives to tap local markets. Local manufacturers of Induction Motors in most countries target the unorganized sector and compete strongly with the global suppliers in the respective markets. Leading market players are currently exposed to intense competition from such unorganized players supplying inexpensive and low-quality Induction Motors. This acts as a key challenge for the growth of the market.

Induction Motor Market Landscape

Product launches, acquisitions, Partnerships and R&D activities are key strategies adopted by players in the Induction Motor market. Induction Motor top 10 companies include ABB Ltd. AMETEK, Inc., Johnson Electric Holdings Limited, Siemens AG, Rockwell Automation, Toshiba Corp., Hitachi Ltd., Nidec Corporation, ARC Systems Inc., among others.

Acquisitions/Product Launches

In 2021 BorgWarner launched HVH 320 Induction Motors in four variants. They are offered to light-duty passenger cars and heavy-duty commercial vehicles.

In 2020, ABB has launched new range of low voltage IEC induction motors, which are compactly designed and reduces the overall size of the equipment by minimizing space and total cost of ownership.

For more Electronics related reports, please click here

#induction motor Market#induction motor Market Size#electric motor#induction motor Market Share#induction motor Market Analysis#electromagnetic induction#induction motor Market Revenue#asynchronous motor#induction motor Market Trends#induction motor Market Growth#induction motor Market Research#induction motor Market Outlook#induction motor Market Forecast#induction motor Market Price

3 notes

·

View notes

Text

Green energy solar panels London

Solar energy for Home solar panels

Home solar panels in London Solar energy begins with the sunlight. Photovoltaic panel (also referred to as "PV panels") are used to convert light from the sunlight, which is made up of particles of power called "photons", right into electrical power that can be used to power electric loads. A solar panel can be used for a variety of applications consisting of remote power systems for cabins, telecom tools, remote sensing, and also of course for the production of electrical power by domestic and also commercial solar electrical systems. In a healthy grid-connected solar installment arrangement, a solar array produces power during the day that is after that used in the residence during the night. Internet metering apps enable solar generator proprietors to make money if their system produces more power than what is required in the residence. Utilizing solar panels is a really sensible way to generate electrical power for lots of applications. A solar electrical system is potentially more economical by minimizing your electrical power expenses and also can offer power for upwards of 3 decades if appropriately maintained. With the development of global climate change, it has actually become more crucial that we do whatever we can to lower the pressure on our environment from the discharge of greenhouse gases by minimizing your carbon impact. Solar panels have no moving components and also require little maintenance. They are ruggedly constructed and also last for years when appropriately maintained. Last, yet not the very least, of the benefits of solar panels and also solar power is that, once a system has actually spent for its initial installment costs, the electrical power it produces for the rest of the system's life expectancy, which could be as long as 15-20 years depending on the high quality of the system, is free! Prices for solar panels has actually reduced considerably in the last couple of years. This is fantastic because, combined with appropriate rewards, NOW is the most effective time ever to buy a solar power system. As well as consider this: a solar power system in advance costs regarding the like a mid-sized vehicle! Obviously, you would certainly require to contrast the cost of a solar installment versus the financial benefits of the decrease in electrical power usage from the power energy grid. A solar firm market photovoltaic panels and also offer solar panel installment along with photovoltaic cleaning and also repair work services. The solar firm will certainly be able to encourage you regarding solar electrical power, readily available solar tax obligation credits or solar financings amongst various other points. Room is a essential consideration. The typical rooftop solar system dimension is around 3-4kW and also this will normally occupy around 15-20m2 roof location. An unshaded, South facing roof is optimal for maximum electric output. East or West facing roofs might still be taken into consideration, yet North facing roofs are not suggested. A system facing East or West will certainly generate about 15-20% less power than one facing directly South. Any type of neighboring structures, trees or chimneys might shade your roof and also have a adverse impact on the performance of your rooftop planetary system. Solar PV panels are taken into consideration 'allowed growths' and also frequently do not require planning consent. If you're preparing to mount a solar PV system in your home, you must register it with your Distribution Network Operator (DNO).

solar panels

solar panel

solar panels install

solar lights

solar

solar garden lights

solar

solar systems

solar panels installation

solar system

https://greenenergysolarpanelslondon.blogspot.com/

2 notes

·

View notes

Text

Plant Genetic Engineering Market Size, Share and Growth by Forecast 2024-2032 | Reed Intelligence

Plant Genetic Engineering Market Insights

Reed Intelligence has recently added a new report to its vast depository titled Global Plant Genetic Engineering Market. The report studies vital factors about the Global Plant Genetic Engineering Market that are essential to be understood by existing as well as new market players. The report highlights the essential elements such as market share, profitability, production, sales, manufacturing, advertising, technological advancements, key market players, regional segmentation, and many more crucial aspects related to the Plant Genetic Engineering Market.

Get Free Sample Report PDF @ https://reedintelligence.com/market-analysis/global-plant-genetic-engineering-market/request-sample

Plant Genetic Engineering Market Share by Key Players

Urban-gro

LumiGrow

Sollum Technologies

G2V Optics

Agnetix

OSRAM GmbH

LED iBond

Atop Lighting

Kroptek

Technical Consumer Products

Heliospectra

Illumitex

Important factors like strategic developments, government regulations, market analysis, end users, target audience, distribution network, branding, product portfolio, market share, threats and barriers, growth drivers, latest trends in the industry are also mentioned.

Plant Genetic Engineering Market Segmentation

The report on Global Plant Genetic Engineering Market provides detailed segmentation by type, applications, and regions. Each segment provides information about the production and manufacturing during the forecast period of 2024-2032. The application segment highlights the applications and operational processes of the industry. Understanding these segments will help identify the importance of the various factors aiding to the market growth.

The report is segmented as follows:

Segment by Type

Smart LED Light

Smart Software and Service

Segment by Application

Commercial Greenhouses

Indoor Vertical Farms

Hydroponics

Plant Science Research

Plant Genetic Engineering Market Segmentation by Region

North America

U.S.

Canada

Europe

Germany

UK

France

Asia Pacific

China

India

Japan

Australia

South Korea

Latin America

Brazil

Middle East & Africa

UAE

Kingdom of Saudi Arabia

South Africa

Get Detailed Segmentation @ https://reedintelligence.com/market-analysis/global-plant-genetic-engineering-market/segmentation

The market research report on the Global Plant Genetic Engineering Market has been carefully curated after studying and observing various factors that determine the growth, such as environmental, economic, social, technological and political status of the regions mentioned. Thorough analysis of the data regarding revenue, production, and manufacturers gives out a clear picture of the global scenario of the Plant Genetic Engineering Market. The data will also help key players and new entrants understand the potential of investments in the Global Plant Genetic Engineering Market.

Key Highlights

It provides valuable insights into the Global Plant Genetic Engineering Market.

Provides information for the years 2024-2032. Important factors related to the market are mentioned.

Technological advancements, government regulations, and recent developments are highlighted.

This report will study advertising and marketing strategies, market trends, and analysis.

Growth analysis and predictions until the year 2032.

Statistical analysis of the key players in the market is highlighted.

Extensively researched market overview.

Buy Plant Genetic Engineering Market Research Report @ https://reedintelligence.com/market-analysis/global-plant-genetic-engineering-market/buy-now

Contact Us:

Email: [email protected]

#Plant Genetic Engineering Market Size#Plant Genetic Engineering Market Share#Plant Genetic Engineering Market Growth#Plant Genetic Engineering Market Trends#Plant Genetic Engineering Market Players

0 notes

Text

Steel Rebar Prices | Pricing | Trend | News | Database | Chart | Forecast

Steel Rebar prices are a critical element in the construction industry, significantly influencing project costs and timelines. Rebar, or reinforcing bar, is an essential material used to strengthen and hold concrete structures together. Fluctuations in its price can affect a wide range of industries, from residential construction to large-scale infrastructure projects. The pricing of steel rebar is influenced by various factors, including the cost of raw materials, global supply and demand, geopolitical events, and environmental regulations. Understanding these factors is crucial for businesses and contractors looking to manage construction budgets and anticipate cost changes.

The primary driver of steel rebar prices is the demand from the construction sector. As the global population grows and urbanization intensifies, the need for housing, commercial buildings, and infrastructure projects increases, driving up demand for construction materials like steel rebar. In emerging economies, particularly in Asia and the Middle East, large-scale infrastructure development has been a key driver of rebar consumption. Countries such as China, India, and Saudi Arabia have been at the forefront of this demand surge, as they invest in roads, bridges, and residential developments to support their growing populations. When construction activity is robust, the demand for steel rebar rises, leading to higher prices. Conversely, when the construction sector slows, either due to economic downturns or seasonal factors, the demand for rebar diminishes, putting downward pressure on prices. However, the global nature of the steel industry means that local price fluctuations are often influenced by international market conditions.

Get Real Time Prices for Steel Rebar: https://www.chemanalyst.com/Pricing-data/steel-rebar-1441Raw material costs are another significant factor in determining steel rebar prices. Rebar is primarily made from steel, which in turn is produced from iron ore and recycled scrap metal. The cost of these raw materials can fluctuate based on mining production levels, geopolitical events, and global market demand. Iron ore, a key component in steelmaking, is particularly susceptible to price changes due to supply disruptions or increased demand from major steel-producing nations like China. When the price of iron ore rises, steel manufacturers face higher production costs, which are then passed on to consumers in the form of higher rebar prices. Similarly, scrap steel, which is commonly used in electric arc furnaces for rebar production, can experience price volatility. If scrap steel becomes scarce or if recycling rates drop, the price of rebar is likely to increase as a result of higher input costs.

Geopolitical factors also play a significant role in shaping steel rebar prices. Trade tensions, tariffs, and sanctions can disrupt the flow of steel products and raw materials across borders, leading to price fluctuations. For instance, in recent years, the United States imposed tariffs on steel imports, including rebar, as part of broader trade disputes with countries like China. These tariffs increased the cost of imported rebar in the U.S. market, driving up prices for domestic construction companies. In addition to trade policies, political instability in key iron ore and steel-producing regions can impact supply chains. If production is halted due to conflict or government intervention, the reduced availability of rebar on the market can push prices higher.

Environmental regulations are increasingly influencing steel rebar prices as governments around the world impose stricter limits on carbon emissions and industrial pollution. The steel industry is one of the largest contributors to greenhouse gas emissions, and as a result, many countries are implementing policies to encourage cleaner production methods. Steel manufacturers are investing in new technologies to reduce their carbon footprints, such as using hydrogen in place of coal in steel production. While these initiatives are vital for reducing environmental impact, they come with significant costs, which are often reflected in the price of finished products like rebar. In countries with more stringent environmental regulations, steel producers face higher operating costs, which can lead to higher rebar prices. Conversely, in regions where environmental laws are less strict, steel manufacturers may have a cost advantage, allowing them to offer rebar at more competitive prices.

Currency exchange rates can also influence steel rebar prices, particularly in international markets. Since steel is a globally traded commodity, fluctuations in the value of major currencies like the U.S. dollar, euro, or Chinese yuan can impact the cost of buying and selling rebar across borders. When a country’s currency weakens relative to others, it becomes more expensive to import steel products, leading to higher domestic prices for rebar. On the other hand, if a currency strengthens, imported steel becomes cheaper, potentially lowering rebar prices. Exchange rate volatility adds an additional layer of complexity for companies operating in multiple markets, as they must factor in currency risk when budgeting for rebar purchases.

Technological advancements in steel production have the potential to impact steel rebar prices by improving efficiency and reducing costs. Innovations such as automation, data analytics, and energy-efficient production processes can help steel manufacturers lower their operating expenses, which may translate into lower rebar prices for consumers. However, the adoption of new technologies often requires significant capital investment, and not all manufacturers may be able to afford these upgrades. As a result, there could be disparities in rebar pricing between companies that adopt cutting-edge technologies and those that continue using traditional production methods.

Market speculation and trading in steel futures can also contribute to fluctuations in rebar prices. Like other commodities, steel is traded on futures markets, where prices are influenced by traders' expectations of future supply and demand. If traders anticipate a shortage of steel or increased demand for rebar, they may drive up futures prices, which can lead to higher spot prices for rebar in the short term. Conversely, if traders expect demand to decrease or if supply increases, futures prices may drop, potentially lowering the current price of rebar. This speculative element can add volatility to the market, making it challenging for construction companies to predict future rebar costs accurately.

In summary, steel rebar prices are influenced by a complex interplay of factors, including construction demand, raw material costs, geopolitical events, environmental regulations, supply chain disruptions, currency fluctuations, technological advancements, and market speculation. These factors create significant volatility in rebar pricing, which can have a profound impact on the construction industry and broader economy. Understanding these dynamics is essential for businesses and contractors looking to manage costs and mitigate risks in an unpredictable market.

Get Real Time Prices for Steel Rebar: https://www.chemanalyst.com/Pricing-data/steel-rebar-1441

Contact Us:

ChemAnalyst

GmbH - S-01, 2.floor, Subbelrather Straße,

15a Cologne, 50823, Germany

Call: +49-221-6505-8833

Email: [email protected]

Website: https://www.chemanalyst.com

#Steel Rebar#Steel Rebar Price#Steel Rebar Prices#Steel Rebar Pricing#Steel Rebar News#Steel Rebar Monitor#Steel Rebar Database

0 notes

Text

Smart Agriculture Market Dynamics, Top Manufacturers Analysis, Trend And Demand, Forecast To 2030

Smart Agriculture Industry Overview

The global smart agriculture market size was valued at USD 22.65 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 13.7% from 2024 to 2030.

Increasing automation of commercial greenhouses and growing implementation of the controlled environment agriculture (CEA) concept in greenhouses, in a bid to obtain a higher yield and maintain optimum growing conditions, are the key factors driving demand during the forecast period. Cultivators realize the potential benefits of growing plants inside a greenhouse, which has led to the development of commercial greenhouses. Cultivators have shifted from the conventional lighting systems to LED grow lights as the latter can easily be integrated into a CEA setup. Although LED grows lights are high in cost, they are an ideal option for indoor farming, owing to their long-term benefits in terms of energy efficiency.

Gather more insights about the market drivers, restrains and growth of the Smart Agriculture Market

Smart agriculture companies are shifting their focus toward the development of equipment that is integrated with advanced sensors and cameras. Key technologies driving the market demand include livestock biometrics, such as RFID, biometrics, and GPS to help cultivators automatically obtain information regarding livestock in real-time. Furthermore, infrastructural health sensors are used for monitoring material conditions and vibrations in buildings, factories, bridges, farms, and other infrastructure. Coupled with an intelligent network, infrastructural health sensors help provide information to the maintenance team in real-time. In addition, agricultural robots are being used to automate farming processes, such as soil maintenance, weeding, fruit picking, harvesting, planting, plowing, and irrigation, among others.

To sustain profits, farmers are increasingly adopting smarter and more efficient agriculture technologies to deliver high-quality products to the smart agriculture market in sufficient quantities. Mobile technology aids in offering innovative types and applications that are used across the agricultural value chain.

Machine-to-Machine (M2M) applications are particularly suited for the agricultural sector, enabling farmers to monitor equipment, assess the environmental impact on production, precisely manage livestock and crops, and keep track of tractors and other agricultural equipment. M2M is an integral part of IoT, which describes the coordination of multiple devices, appliances, and machines connected to the internet through multiple networks.

The COVID-19 pandemic has brought widespread disruption to the global supply chain, resulting in food shortages and inflation. Necessary measures are required to strengthen the food supply chain and prepare for any future crisis. The ongoing pandemic has highlighted the significance of being able to carry out agricultural operations remotely. The ability of smart agricultural practices to help farmers recoup losses in a relatively shorter lead time is expected to drive future market growth.

Browse through Grand View Research's Next Generation Technologies Industry Research Reports.

The global agriculture 4.0 market was estimated at USD 67.73 billion in 2023 and is projected to grow at a CAGR of 11.6% from 2024 to 2030.

The global AI in food & beverages market size was valued at USD 8.45 billion in 2023 and is projected to grow at a CAGR of 39.1% from 2024 to 2030.

Key Companies & Market Share Insights

Some of the key players operating in the market include Ag Leader Technology, AGCO Corporation, AgJunction, Inc., AgEagle Aerial Systems Inc., Autonomous Solutions, Inc., Argus Control Systems Ltd, BouMatic Robotic B.V., CropMetrics, CLAAS KGaA mbH, CropZilla, Deere & Company, DICKEY-john, DroneDeploy, DeLaval Inc, Farmers Edge Inc, Grownetics, Inc., Granular, Inc., Gamaya, GEA Group Aktiengesellschaft, Raven Industries, Trimble Inc., Topcon Positioning System among others.

AGCO Corporation is a U.S.-based agriculture equipment manufacturer. The company develops and sells products and solutions such as tractors, combines, foragers, hay tools, self-propelled sprayers, smart farming technologies, seeding equipment, and tillage equipment.

Deere & Company is engaged in the manufacturing & construction of agricultural and forestry machinery; drivetrains and diesel engines for heavy equipment; and lawn care machinery. Additionally, the company also manufactures and provides other heavy manufacturing equipment. The company serves diverse industries such as agriculture, forestry, construction, landscaping & grounds care, engines & drivetrain, government and military, and sports turf.

Prospera Technologies and Agrible, Inc. are some of the emerging market participants in the target market.

Prospera Technologies is a global service provider of agriculture technology for managing and optimizing irrigation and crop health. The company provides AI-based sensors and cameras that aid farmers in crop monitoring.

Agrible is a U.S.-based agriculture solution provider. The company helps customers in more than 30 countries optimize water use, crop protection, fertilization, fieldwork, research trials, food supply chains, and sustainability initiatives

Key Smart Agriculture Companies:

Ag Leader Technology

AGCO Corporation

AgJunction, Inc.

AgEagle Aerial Systems Inc.

Autonomous Solutions, Inc.

Argus Control Systems Ltd

BouMatic Robotic B.V.

CropMetrics

CLAAS KGaA mbH

CropZilla

Deere & Company

DICKEY-john

DroneDeploy

DeLaval Inc

Farmers Edge Inc

Grownetics, Inc.

Granular, Inc.

Gamaya

GEA Group Aktiengesellschaft

Raven Industries

Trimble Inc.

Topcon Positioning System

Recent Developments

In July 2023, Deere & Company announced the acquisition of Smart Apply, Inc. The company planned to leverage Smart Apply’s precision spraying to assist growers in addressing the challenges associated with input costs, labor, regulatory requirements, and environmental goals.

In May 2023, AgEagle Aerial Systems Inc. announced that it had entered into a 2-year supply agreement with Wingtra AG. This agreement is purposed to secure the supply of RedEdge-P sensor kits for incorporation with WingtraOne VTOL drones. This is specifically resourceful for those seeking to benefit materially from unparalleled, high precision, and plant-level detail in commercial agriculture, environmental research, forestry, and water management applications.

In April 2023, AGCO Corporation announced a strategic collaboration with Hexagon, for the expansion of AGCO’s factory-fit and aftermarket guidance offerings. The new guidance system was planned to be commercialized as Fuse Guide on Valtra and Massey Ferguson tractors.

In February 2023, Topcon Agriculture unveiled the launch of Transplanting Control, an exceptional guidance control solution for specialty farmers. This turnkey solution was designed to boost efficiency, reduce labor, and proliferate production. Further, it delivers GNSS-driven guidance, autosteering & control, thereby proving advantageous for the growers of perennial trees, vegetables, and fruits.

In January 2023, ASI Logistics in collaboration with SICK, Inc. announced the successful implementation of autonomous yard truck operations. In this collaboration, ASI Logistics leveraged its groundbreaking Vehicle Automation Kit (VAK) along with the industry-leading LiDAR systems of SICK.

In March 2022, Raven announced its business expansion in South Dakota and Arizona to enhance the development of AI-driven technologies for tailoring cutting-edge solutions. The strategy was also aimed at allowing access to a nearby test farm for same-day testing.

In October 2021, BouMatic announced the acquisition of SAC Group to leverage automatic and conventional milking systems. The transaction demonstrated the company’s incessant commitment to delivering best-in-class dairy farm solutions to consumers across the world.

In May 2021, AGCO announced a targeted spraying solutions strategic collaboration with Raven Industries Inc., BASF Digital, and Robert Bosch GmbH. The objective of this deal was to assess the targeted spraying technology for enhancing crop protection product applications by limiting crop input costs and addressing environmental sustainability.

Order a free sample PDF of the Smart Agriculture Market Intelligence Study, published by Grand View Research.

0 notes

Text

The Unspoken Advantages of Monitoring and Lowering Your Carbon Footprint

Agile Advisors, a leading Carbon footprint consultant In Dubai, the impact of lowering your carbon footprint on climate change is among its most important advantages. The Earth's atmosphere becomes denser with greenhouse gasses, which trap heat and cause adverse weather patterns, ecological disruption, and increased global temperatures. Individuals and organizations may lessen these consequences by reducing actions that emit these gases, such as utilizing fossil fuels for power or transportation. This keeps the environment from worsening and helps slow global warming. Identifying areas of your home or business where energy use is highest by measuring your carbon footprint can help you find opportunities to increase efficiency. People and organizations may lower their carbon footprint by implementing renewable energy sources like solar or wind power, upgrading to energy-efficient equipment, and cutting back on wasteful energy consumption.

Being a Carbon footprint consultant in Agile Advisors, improving air quality is directly related to lowering carbon emissions. Increased carbon emissions release additional dangerous pollutants into the atmosphere, such as particulate matter and nitrogen oxides, which can cause heart difficulties, respiratory illnesses, and other health issues. Cleaner air, due to fewer emissions, can decrease communities' health risks, particularly in metropolitan areas. This helps the environment and results in considerable energy bill savings. Businesses that take significant steps to lessen their carbon footprint benefit the environment and their brand. Nowadays, customers are increasingly inclined to support businesses that practice environmental responsibility. Implementing carbon reduction initiatives may give businesses a competitive edge in the market, improve their brand, and draw in eco-aware clients.

As a Carbon footprint consultant In UAE, reducing carbon emissions can also result in obtaining sustainability certifications like LEED or ISO, which enhance a business's reputation. The Paris Agreement's aim to keep temperature increases below two °C is one of the ambitious objectives governments and international organizations have set to slow global warming. You contribute to these worldwide endeavors by calculating and minimizing your carbon footprint. Furthermore, firms who take the initiative to become more sustainable may find it easier to comply with regulations and stay out of trouble for breaking carbon reduction laws. Technology innovation is frequently a result of attempts to lower carbon emissions. Businesses prioritizing sustainability could investigate novel approaches, goods, or services that are more economical, environmentally friendly, and energy-efficient.

We as a Carbon footprint consultant In Dubai, accepting these technologies leads to development and leadership opportunities in the sector in addition to lowering the carbon impact. For instance, investing in electric cars, creating low-carbon technology, or improving recycling procedures might open up new economic prospects. Public and commercial entities that have committed to reducing carbon footprints encourage the development of clean technologies and services that lessen human influence on the environment. Lowering your carbon footprint and helping the environment can benefit you personally, economically, and socially. The benefits of cutting carbon emissions include anything from raising creativity and reducing energy costs to enhancing health and air quality. Each tiny effort facilitates a more significant movement toward a more resilient, sustainable, and healthful future for all.

We believed as Carbon footprint consultant, minimizing your carbon footprint is directly related to protecting priceless natural resources like forests, water, and wildlife. Deforestation and exploiting fossil fuels are only two examples of the many activities that lead to significant carbon emissions while simultaneously depleting limited resources. Adopting sustainable behaviors, such as reducing trash or utilizing renewable energy, can help preserve these resources and ensure their availability for future generations. Carbon emissions reductions frequently result in economic benefits through energy conservation, waste reduction, or transportation optimization optimization. For instance, businesses may cut expenses by increasing energy efficiency and decreasing material waste. At the same time, individuals can save money on utility bills by implementing sustainable practices like installing solar panels, carpooling, or utilizing public transportation.

0 notes

Text

HCS GROUP GMBH: PIONEERING THE CYCLOPENTANE MARKET WITH ADVANCED SOLUTIONS

According to a recent industry report by UnivDatos Market Insights, the global Cyclopentane market is projected to reach USD 695.35 million by 2032, growing at a CAGR of 6.91% from 2024 to 2032

HCS Group GmbH (ICIG) stands as a key player in the specialty chemicals industry, renowned for its high-purity hydrocarbons and innovative chemical solutions. As a leading manufacturer in the cyclopentane market, HCS Group is dedicated to sustainability, technological advancements, and meeting the evolving needs of various industries, including refrigeration, insulation, and pharmaceuticals.

COMMITMENT TO SUSTAINABILITY AND INNOVATION

HCS Group emphasizes sustainability by adopting eco-friendly production methods and reducing its operations' environmental impact. The company has made significant strides in producing cyclopentane with minimal greenhouse gas emissions, aligning with global efforts to combat climate change.

Eco-Friendly Production: HCS Group introduced a new line of eco-friendly cyclopentane products. These innovations are designed to reduce the carbon footprint and enhance energy efficiency in applications like refrigeration and insulation. For instance, in 2023, Haltermann Carless, a company of HCS Group and a pioneer of sustainable hydrocarbon solutions, introduced ISCC Plus certified mass balance n-/iso- and Cyclopentane. The materials have a significantly lower carbon footprint than their conventional counterparts, supporting the insulating industry in advancing towards a circular economy.

Technological Advancements: The company continuously invests in research and development to improve the quality and performance of cyclopentane. HCS Group's advanced manufacturing processes ensure high purity and efficiency, making their cyclopentane ideal for various industrial uses.

EXPANDING PRODUCTION CAPABILITIES AND MARKET REACH

To meet the growing global demand for cyclopentane, HCS Group expanded its production facilities and distribution network. For instance, in 2021, Haltermann Carless, a company of HCS Group, opened a new hydrogenation plant at the German site in Speyer to become the largest Cyclopentane producer worldwide. The plant has a production capacity of around 100,000 tons of hydrogenated products, including Cyclopentane, which can be processed annually depending on the feedstock used.

Request Free Sample Pages with Graphs and Figures Here https://univdatos.com/get-a-free-sample-form-php/?product_id=63784

MEETING INDUSTRY DEMANDS WITH HIGH-PERFORMANCE SOLUTIONS

HCS Group's cyclopentane is widely used in the insulation industry, particularly in producing polyurethane foam for refrigerators and freezers. The company's focus on high-performance and sustainable products has positioned it as a preferred supplier for industries seeking reliable, eco-friendly solutions.

Application in Insulation: The company's cyclopentane products are essential in manufacturing energy-efficient insulation materials, which reduce energy consumption in residential and commercial buildings.

Pharmaceutical Applications: HCS Group also supplies high-purity cyclopentane to the pharmaceutical industry, synthesizing various chemicals and drugs.

CONCLUSION

HCS Group GmbH's unwavering commitment to sustainability, innovation, and customer satisfaction positions it as a leader in the cyclopentane market. The company's continuous efforts to improve product quality, expand production capabilities, and meet industry demands drive its success in the global market. As the demand for eco-friendly and high-performance cyclopentane solutions grows, HCS Group remains at the forefront of innovation, empowering customers to achieve their sustainability and efficiency goals. Driven by increasing demand for energy-efficient insulation materials and sustainable chemical solutions. As a key player in the industry, HCS Group is well positioned to capitalize on these opportunities and drive innovation and growth in the global cyclopentane market.

Contact Us:

UnivDatos Market Insights

Email - [email protected]

Contact Number - +1 9782263411

Website -www.univdatos.com

0 notes

Text

Powering the Skies: Trends and Innovations in the Aircraft Electrical Systems Market

The Aircraft Electrical Systems Market is projected to be valued at USD 25.80 billion in 2024 and is anticipated to grow to USD 35.52 billion by 2029, with a compound annual growth rate (CAGR) of 6.60% over the forecast period from 2024 to 2029. This growth is fueled by a surge in demand for advanced electrical solutions across both commercial and military aviation sectors. As airlines and manufacturers shift towards more electric aircraft (MEA) designs, aircraft electrical systems are evolving rapidly to meet the needs of modern aviation

Key Drivers of Growth

Electrification of Aircraft: The aerospace industry is transitioning to more electric aircraft architectures to enhance fuel efficiency, reduce maintenance costs, and improve reliability. The traditional reliance on hydraulic and pneumatic components is being replaced with modern power electronics. This shift supports a reduction in greenhouse gas emissions and noise pollution, aligning with the global push for more sustainable aviation.

Surge in Commercial Aviation: The commercial aviation segment is expected to exhibit the highest growth rate during the forecast period. The resurgence of global air traffic, which has rebounded to over 94% of pre-pandemic levels, is driving demand for new aircraft, further fueling advancements in electrical systems. Airbus and Boeing, for instance, have seen an uptick in aircraft deliveries in recent years, with major deals such as Indigo’s order for 500 Airbus A320neo aircraft in 2023.

Emerging Electric Propulsion: While fully electric aircraft are still in development, hybrid-electric systems are gaining traction as a transitional solution. Companies like AutoFlight have made strides with electric vertical takeoff and landing (eVTOL) aircraft, achieving record-breaking flights on single charges, demonstrating the growing viability of electric aviation.

Military Aviation Advancements: The military aviation segment is also driving growth, with increasing defense budgets and modernization programs. In 2023, the U.S. Air Force undertook substantial contracts to upgrade electrical systems in its fleet. The demand for advanced electrical components, particularly in military applications, is expected to bolster the market during the forecast period.

Regional Insights

North America currently holds the largest market share, supported by a strong aviation industry and numerous aircraft modernization programs. The region’s dominance is likely to continue as it leads innovation in both commercial and military electrical systems.

Conclusion

The aircraft electrical systems market is positioned for robust growth as aviation moves towards more electrified and sustainable solutions. With advancements in electric propulsion, increasing aircraft orders, and continuous innovations in power systems, the future of aviation is set to be more electric than ever.

For a detailed overview and more insights, you can refer to the full market research report by Mordor Intelligence.

https://www.mordorintelligence.com/industry-reports/aircraft-electrical-systems-market

#aircraft electrical systems market#aircraft electrical systems market size#aircraft electrical systems market share#aircraft electrical systems market trends#aircraft electrical systems market forecast#aircraft electrical systems market analysis

0 notes

Text

Exploring Careers in Renewable Energy Engineering: A Guide

As the world shifts towards sustainability, careers in renewable energy engineering has emerged as one of the most promising and impactful fields in today's job market. With governments and companies increasing investments in clean energy, the demand for skilled professionals continues to grow. For individuals interested in making a difference while working in a cutting-edge field, pursuing a career in renewable energy engineering offers both personal fulfillment and professional opportunities.

Why Choose a Career in Renewable Energy Engineering?

Renewable energy engineering involves designing, developing, and maintaining technologies that harness energy from renewable sources such as wind, solar, hydro, and geothermal. The global push for green energy has made this field crucial in reducing carbon footprints and promoting sustainable development.

Here are a few key reasons why a career in this sector is so rewarding:

High Demand for Jobs: As countries commit to reducing greenhouse gas emissions, the renewable energy sector continues to expand. This growth has led to increased demand for engineers skilled in sustainable technologies.

Diverse Opportunities: Renewable energy engineers work in various sectors, including solar and wind farms, hydroelectric projects, energy storage, and smart grid technologies. These roles can vary from research and development to operations, maintenance, and consulting.

Global Impact: This field offers the chance to be part of a global solution to environmental challenges. Engineers in this space contribute to a cleaner and greener future, helping to combat climate change.

Innovation and Technology: Renewable energy engineering is an ever-evolving field. From improving solar panels to developing new methods of energy storage, engineers in this sector are at the forefront of technological innovation.

Key Career Paths in Renewable Energy Engineering

Solar Energy EngineerSolar energy engineers design and develop photovoltaic systems that convert sunlight into electricity. They work on residential, commercial, and industrial projects to optimize energy generation and storage systems. This role requires knowledge in areas like electrical engineering, energy storage, and project management.

Wind Energy EngineerWind energy engineers focus on designing wind turbines and optimizing wind farm layouts to maximize energy efficiency. These professionals analyze data, test designs, and manage the construction and maintenance of wind energy facilities.

Hydropower EngineerHydropower engineers design and oversee projects that harness the energy of moving water. Their work involves managing dam construction, optimizing water flow, and ensuring that energy output meets demand while minimizing environmental impact.

Energy Storage EngineerAs renewable energy systems continue to grow, the need for efficient energy storage has become critical. Energy storage engineers develop technologies like batteries and other systems to store energy for later use, improving the reliability and stability of renewable power sources.

Sustainability ConsultantSome renewable energy engineers pivot into consultancy roles, helping businesses and governments transition to sustainable practices. These consultants evaluate energy usage, suggest improvements, and develop plans to implement renewable technologies.

Skills Required for Renewable Energy Engineering

To thrive in renewable energy engineering, professionals need a blend of technical expertise and practical knowledge. Key skills include:

Strong foundation in engineering principles: Proficiency in electrical, mechanical, or civil engineering is critical.

Renewable energy technologies knowledge: Understanding solar, wind, geothermal, and hydroelectric power systems is essential.

Problem-solving: Engineers must develop innovative solutions to the complex challenges of clean energy generation.

Project management: Many roles involve overseeing large-scale projects, from design to completion.

Communication skills: Engineers must be able to collaborate with teams and explain technical concepts to non-technical stakeholders.

Career Outlook and Growth Potential

The renewable energy sector is growing rapidly, with numerous job opportunities across the globe. According to industry experts, renewable energy engineering will be one of the most in-demand professions over the next decade. The International Renewable Energy Agency (IRENA) predicts that renewable energy could support up to 42 million jobs globally by 2050.

Conclusion

Careers in renewable energy engineering offer the opportunity to be part of a transformative movement toward sustainability. As the world strives to reduce carbon emissions and embrace clean energy, engineers in this field will play a vital role in shaping the future. Whether you're interested in solar power, wind energy, hydropower, or energy storage, there are diverse career paths available with ample room for growth.

At NES Fircroft, we deliver award-winning workforce solutions to engineering and technical sectors across the globe, supporting over 25,000 contractors. If you're ready to take the next step in your renewable energy engineering career, discover more about our job opportunities and services.

#careers in renewable energy engineering#careers in renewable energy#employer of record#employer of record company ies#employer of record services

0 notes