#Geopolitical Risk Factors

Explore tagged Tumblr posts

Text

Stock market setup: Nifty 50, global trades.

The Nifty 50 reflects India’s economy and is closely tied to global market dynamics. Currency fluctuations, global trade, economic health, and geopolitical risks influence its performance. As global trade and investments shape it, the Nifty 50 becomes essential for tracking India’s economic progress in a global context.

#Nifty 50#Indian Economy#Global Market Dynamics#Currency Impact#Global Trade Influence#Geopolitical Risk Factors#Economic Indicators#Stock Market Trends#India’s Economic Growth

0 notes

Text

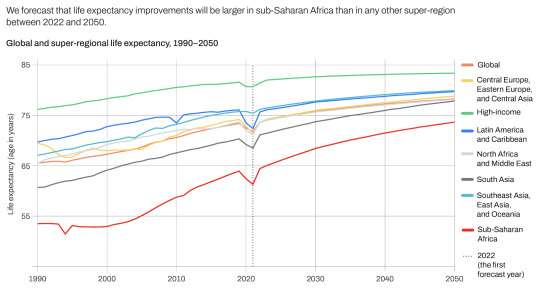

"Global life expectancy is forecasted to increase from 73.6 years of age in 2022 to 78.1 years of age in 2050 (a 4.5-year increase).

Life expectancy increases are projected to be greater in countries with lower life expectancies, reducing global disparities.

There will be a continued shift in disease burden from communicable, maternal, neonatal, and nutritional diseases to non-communicable diseases (NCDs).

The latest findings from the Global Burden of Disease Study (GBD) 2021, published today in The Lancet [May 17, 2024], forecast that global life expectancy will increase by 4.9 years in males and 4.2 years in females between 2022 and 2050.

Increases are expected to be largest in countries where life expectancy is lower, contributing to a convergence of increased life expectancy across geographies. The trend is largely driven by public health measures that have prevented and improved survival rates from cardiovascular diseases, COVID-19, and a range of communicable, maternal, neonatal, and nutritional diseases (CMNNs)...

Global life expectancy is forecasted to increase from 73.6 years of age in 2022 to 78.1 years of age in 2050 (a 4.5-year increase). Global healthy life expectancy (HALE) – the average number of years a person can expect to live in good health – will increase from 64.8 years in 2022 to 67.4 years in 2050 (a 2.6-year increase).

[Note: I cut out significant chunks of this article because they're being really shitty about "disability-adjusted life years," where they explicitly say that years lived as a disabled person don't count/don't count as much. Fuck that! Our lives are worth living!!!! Sincerely, your local disabled blogger.]

“In addition to an increase in life expectancy overall, we have found that the disparity in life expectancy across geographies will lessen,” said Dr. Chris Murray, Chair of Health Metrics Sciences at the University of Washington and Director of the Institute for Health Metrics and Evaluation (IHME). “This is an indicator that while health inequalities between the highest- and lowest-income regions will remain, the gaps are shrinking, with the biggest increases anticipated in sub-Saharan Africa.” ...

The Global Burden of Disease Study (GBD) is the largest and most comprehensive effort to quantify health loss across places and over time. It draws on the work of nearly 12,000 collaborators across more than 160 countries and territories. GBD 2021 – the newly published most recent round of GBD results – includes more than 607 billion estimates of 371 diseases and injuries and 88 risk factors in 204 countries and territories. The Institute for Health Metrics and Evaluation coordinates the study."

-via Institute for Health Metrics and Evaluation, May 17, 2024

--

Note: Obviously we need to make these gaps/disparities close completely!!! And it's also really good to see that we're on the right track.

I genuinely believe that the medical revolution that has just started this decade, along with the huge increase and revolution in communication technology, will make improvements in health and life expectancy come even faster than forecasted. Especially in low-income and low-life-expectancy countries

135 notes

·

View notes

Text

This article is the result of a collaboration with Estonian publishing partner Postimees. You can find Postimees’ corresponding piece here.

A young woman dressed in a school uniform poses in front of a bag resembling breadcrumbs. A phone number, an email, and two QR codes are listed above her head. At the center of the image, in large yellow-and-red font, is the word “Isotonitazene”.

The description says “delivery is guaranteed” and that the brown powder can be shipped safely to Europe, the US, the UK and beyond: “If you are interested,” it says, “kindly contact with me.”

The advertisement appears harmless, but it is far from it: isotonitazene is a type of nitazene, a class of synthetic opioids up to 40 times stronger than fentanyl and up to 500 times more powerful than heroin.

Nitazenes were developed in the 1950s by a Swiss chemical company as a new type of painkiller, but the drug was so potent that it was never approved as a medicine. Even trace quantities can cause an overdose.

Decades later, nitazenes have re-emerged in the underground drug market: they have been detected in counterfeit prescription medicines, including fake oxycodone and benzodiazepines pills, and in street drugs, including cocaine, heroin and ketamine.

The UN drugs agency and countries around the world have warned of the major health risks posed by nitazenes. The super-strength opioid has already caused hundreds of deaths in Europe, the UK and North America.

A months-long open source investigation by Bellingcat and publishing partner Postimees has identified a trove of more than 1,000 online adverts selling six of the most common types of nitazenes and offering worldwide delivery.

The investigation team analysed the websites, social media accounts and contact details related to the ads, and searched business registries for information on companies associated with the drug sales.

It established that a series of entities linked to the advertisements match listings for companies on China’s corporate register — including one registered company that is advertising scores of nitazenes online.

Requests for public information, including court files and customs records, uncovered additional evidence linking nitazenes shipments seized in Europe back to China.

The findings come as recent geopolitical events threaten to exacerbate the flood of nitazenes globally. In 2019 China banned all variants of fentanyl, a potent opioid that is fuelling the most lethal drug crisis in America’s history. And in 2022, a “poppy ban” imposed by the Taliban led to a massive drop in opium production in Afghanistan, the source of virtually all the heroin supplied to Europe.

Experts say these factors have opened up a vacuum for alternative synthetic opioids – such as nitazenes – to emerge. “At some stage we know for sure heroin will dry out, and then there’s a danger that some of those people [drug users] may go into nitazenes,” said Thomas Pietschmann, a senior research officer with the United Nations Office on Drugs and Crime. “And that’s a particular danger because of its high potency.”

17 notes

·

View notes

Text

Mastering forex signals for trend following: a comprehensive guide

The foreign exchange market, or Forex, is a dynamic and ever-changing arena where traders seek to capitalize on currency price movements. One popular trading strategy is trend following, which involves identifying and following the prevailing market direction. Forex signals play a crucial role in assisting traders to navigate the complexities of trend following. In this comprehensive guide, we will explore the intricacies of Forex signals for trend following, helping you understand how to leverage them effectively for successful trading.

Understanding Trend Following

Trend following is a strategy that seeks to capitalize on the directionality of market prices. The basic premise is simple: identify the prevailing trend and place trades in the same direction. Trends can be upward (bullish), downward (bearish), or sideways (range-bound). Successful trend following involves entering a trade at the beginning of a trend and exiting when the trend shows signs of reversal.

The Role of Forex Signals

Forex signals serve as triggers for traders, indicating opportune moments to enter or exit a trade. These signals are generated through a thorough analysis of market data, including technical indicators, fundamental factors, and sometimes a combination of both. For trend following, signals become particularly crucial as they guide traders on when to jump on a trend and when to step aside.

Key Components of Forex Signals for Trend Following

1. Technical Indicators:

Moving Averages: These are fundamental tools in trend following. A moving average smoothens price data to create a single flowing line. Traders often look for crossovers, where short-term moving averages cross above long-term ones, as a signal to enter a trade.

Relative Strength Index (RSI): RSI measures the speed and change of price movements. A high RSI may indicate overbought conditions, suggesting a potential reversal, while a low RSI may indicate oversold conditions, signaling a potential buying opportunity.

Moving Average Convergence Divergence (MACD): MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price.

2. Fundamental Analysis:

While trend following is predominantly a technical strategy, incorporating fundamental analysis can enhance the accuracy of signals. Economic indicators, interest rates, and geopolitical events can significantly impact currency trends.

3. Price Action:

Pure price action analysis involves studying the historical price movements of a currency pair. Identifying patterns, such as higher highs and higher lows in an uptrend, can provide strong signals for trend following.

Choosing a Reliable Signal Provider

With the plethora of signal providers available, it's essential to choose a reliable one. Consider the following factors:

Track Record: A provider's historical performance is a crucial indicator of their reliability. Look for providers with a consistent track record of accurate signals.

Transparency: Transparent signal providers disclose their methods, including the criteria for generating signals and their risk management strategies.

Risk-Reward Ratio: A good signal provider should have a clear risk-reward ratio for each signal, helping you manage your trades effectively.

Implementing Forex Signals for Trend Following

Once you've selected a signal provider or developed a reliable system, the implementation phase is critical. Here are some tips:

Risk Management: Set clear risk parameters for each trade. This includes defining the percentage of your trading capital you're willing to risk on a single trade.

Position Sizing: Adjust the size of your positions based on the strength of the signal and the volatility of the market.

Stay Informed: While signals provide valuable insights, staying informed about broader market trends and events is crucial. Unexpected news can impact the Forex market.

Continuous Evaluation: Regularly assess the performance of your chosen signals and be prepared to adjust your strategy if market conditions change.

Conclusion

Forex signals for trend following can be powerful tools in a trader's arsenal, helping to identify and capitalize on market trends. However, success in Forex trading requires a comprehensive understanding of both the strategy and the market itself. By combining technical indicators, fundamental analysis, and a disciplined approach to risk management, traders can use Forex signals to navigate the complex world of trend following with confidence. Remember, no strategy guarantees success, and ongoing learning and adaptation are essential for long-term success in the Forex market.

Source:

#TradeSignals#FinancialFreedom#StockMarketAlerts#InvestingWisdom#ProfitableTrades#MarketAnalysis#TradingSignals#DayTrading#ForexProfit#CryptoSignals#MarketTrends#InvestmentTips#SmartTrading#TradeSmart#TechnicalAnalysis#RiskManagement#ProfitPotential#TradingStrategies#StockPicks#EconomicIndicators#TradingEducation#MarketInsights#OptionsTrading#MarketWatch#TradeStrategy#FinancialMarkets#ForexTrading#CryptoInvesting#AlgorithmicTrading#StockMarketNews

28 notes

·

View notes

Text

When today's guest was last on this program back in November, he predicted we'd see continued momentum geopolitically away from globalization and towards mercantilism and protectionism.

That has proven to be the case worldwide, and particularly so for the US, where Donald Trump's "America First' agenda has kicked off at warp speed -- shocking citizens, allies and enemies alike with its violent & swift disruption of what was Business As Usual just a month ago.

How is this wave of nationalism around the world likely to impact the global economy?

What are the biggest opportunities it may open up for investors?

And what are its biggest risks?

To discuss, we're fortunate to be able to spend the next hour with Michael Every, Global Strategist at Rabobank, who joins us from Thailand.

Michael warns that VERY few players in the financial markets are currently factoring this new geopolitical playbook into their calculations — because it’s so new and moving so fast that most don’t understand what’s going on.

Also, he is kindly making his latest Rabobank report on this topic available free to Thoughtful Money members. You can access it here.

2 notes

·

View notes

Text

Which is the best XAUUSD signal provider?

When it comes to trading gold (XAUUSD), finding the right signal provider can make all the difference in maximizing profits and minimizing risks. If you're looking to trade XAUUSD effectively, you'll want a reliable signal provider that can give you accurate, timely insights without the guesswork.

What is XAUUSD?

XAUUSD represents the price of gold in US dollars. It’s one of the most traded commodities in the forex market, and its value is influenced by economic events, inflation, and geopolitical developments. Trading gold can be highly profitable, but it requires precise market timing and expertise.

Why Use XAUUSD Signals?

Gold trading can be complex, with price movements influenced by various factors such as interest rates, inflation fears, and market sentiment. For traders who don’t have the time or expertise to constantly analyze the market, XAUUSD trading signals are a game-changer. These signals provide expert recommendations on when to buy or sell gold, making it easier to capitalize on profitable opportunities without spending all day in front of a screen.

What Makes a Good XAUUSD Signal Provider?

The best XAUUSD signal providers offer:

Accuracy: High-quality signals based on a thorough analysis of market conditions.

Real-Time Alerts: Instant notifications that keep you updated on potential trades.

Risk Management: Clear stop-loss and take-profit levels to protect your capital.

Proven Track Record: Transparent results that show consistency and reliability.

User-Friendly Interface: Easy-to-follow signals, even for beginners.

Why SureShotFX is the Best XAUUSD Signal Provider:

If you’re wondering which XAUUSD signal provider stands out from the rest, SureShotFX is a top choice. Here’s why:

Expert Analysis: SureShotFX delivers signals based on in-depth technical and fundamental analysis, ensuring you get accurate and timely trade recommendations.

Real-Time Notifications: You’ll receive instant updates through Telegram, so you never miss an opportunity.

Proven Performance: SureShotFX provides transparent performance reports, so you can trust their signals to deliver results.

Risk Management: Every signal comes with clear stop-loss and take-profit levels, helping you manage your risk effectively.

Beginner-Friendly: Whether you're new to trading or a seasoned pro, SureShotFX’s signals are designed to be easy to follow and implement.

Conclusion:

Finding the best XAUUSD signal provider can be a game-changer for your trading success. SureShotFX offers accurate, reliable, and easy-to-follow signals that take the guesswork out of gold trading. Whether you're looking to save time or boost your profitability, SureShotFX provides the tools and support you need to trade gold confidently.

Ready to take your XAUUSD trading to the next level? SureShotFX could be the partner you’ve been looking for!

#SureShotFX#SSF#xauusd#xauusd buy#xauusdsell#xauusd live#xauusdbuy#XAUUSD trading#XAUUSD signals#XAUUSD signal provider#currency markets#investing#economy#livetrading

2 notes

·

View notes

Text

Which is Better: Forex, Crypto, or Stock? A Deep Dive into Prop Firm Tech

INTRODUCTION

The financial landscape is constantly changing, and with new changes comes the production of more choices than ever for traders. The most common include Forex, cryptocurrency, and stock trading. Each market has special characteristics and advantages but carries difficulties, so the emergence of prop firm tech allowed trading to become more accessible and efficient. In this blog, we will be talking about the pros and cons of

Forex, crypto, and stock trading and how prop firm tech can enhance your trading experience.

Underlying the Markets

Forex Market

Forex represents the world’s largest financial market, referring to that market where currency trades occur.

High Liquidations: Forex offers a level of liquidation that is high. Its trading volumes exceed $6 trillion, allowing the traders to comfortably enter and leave positions. Forex is traded 24 hours a day on weekdays, thus offering ample convenience for the traders.

Leverage: Most Forex brokers are highly leveraged. This means that a trader controls much larger positions with lesser capital.

Challenges despite the advantages:

The leverage might create a highly volatile currency price and the highest risk it causes is that it is an effect of its highly volatile nature.

There is an overwhelming complexity in managing economic indicators, and there are geopolitical factors too, which are not easy to handle for new traders.

Crypto Market

The crypto market is trading in digital currencies such as Bitcoin, Ethereum, and more than 5,000 altcoins.

Benefits:

Volatility: The crypto market is volatile. Within a very short duration, one can gain tremendous returns.

Decentralized: With cryptocurrencies, there is a decentralized peer-to-peer network so that no banks are used to monitor transactions.

It is open: All it needs is an internet connection to create opportunities with this kind of market, and it reaches across the globe.

Regulatory Risks: The regulation of the crypto market is not well-established, so it is an uncertain area.

Security Risks: Crypto space is highly prevalent with hackers as well as scams. Hence, the traders must beware of the same.

Stock Market

Definition: the stock market represents an entity where shares of publicly traded companies are traded

Benefits

Governance and Transparency: Since the stock market is very well governed, it offers some kind of security for investors.

Dividends: Most stocks pay dividends thereby ensuring that the investor earns some income from the shares.

Research and Analysis: There is much information to make stock analysis hence helping the traders come to a conclusion.

Drawbacks

Market Hours: the stock market only operates within fixed hours thereby limiting trading.

Lesser Volatility Stock prices often exhibit much slower movements in comparison to Forex and crypto price swings, potentially leading to reduced profit margins.

Prop Firm Tech: Revolutionizing Trading

There has always been a high level of diversity in markets, and for this reason, prop firm tech has emerged as the real deal. Proprietary firms provide capital to traders while engaging them with the latest technology to enhance their trading strategy.

This is how prop firm tech is revolutionizing the game of trading:

Access to Capital

Prop firms also enable traders to gain access to significant capital, thus they can take bigger positions and can hence gain larger profits. Such is truly rewarding for Forex and crypto traders who may not have that much money required to trade even in the best possible way.

Sophisticated Trading Platforms

Proprietary trading firms invest in advanced trading technology that gives traders cutting-edge platforms offering a high level of data provision, sophisticated charting tools, and automated trading features. This tech can significantly enhance the trading experience across Forex, crypto, and stocks.

Risk Management Tools

Prop firm tech also features powerful risk management tools, which can help in minimizing the trader’s loss and ensure the safety of capital. Such tools are quite essential in volatile markets like Forex or even cryptocurrencies, whose prices tend to change rapidly.

Education and Training

Alarge number of prop firms offer educational resources, mentorship, or training for the development of a required skill base by the traders. Support is highly important to any new traders entering Forex, crypto, or even the stock market.

Community and Networking

Trading with a prop firm usually involves trading with other people. This facilitates several things: you will have to have a community of fellow traders, exchanging insights and ideas, strategies you’re implementing, and support you give someone else.

Feature | Forex | Cryptocurrency | Stock Market

Liquidity | High | Varies by asset | High (for major stocks)

Volatility | Moderate to High | High | Moderate

Trading Hours | 24/5 | 24/7 | Limited (specific hours)

Leverage | High | Varies | Low to Moderate

Regulation | High | Low (still evolving) | High

Education | Available (varied by broker) | Limited (varies widely) | Extensive (research available)

Technology | Advanced prop firm tech available | Emerging tools | Established trading platforms

Conclusion

Is Forex, cryptocurrency, or stock trading the best?

The above question doesn’t have a definitive answer, since each market has specific positives and negatives suited to different types of trading. However, with the help of rising prop firm tech, the tools and resources available to every trader can improve trading experiences across all markets.

If you are looking for high liquidity and flexibility, Forex may be the choice. For people who seek high returns and have no fear of volatility, then cryptocurrency may be the way to go. Meanwhile, for those wanting a more regulated environment with an abundance of readily available research, stock trading may be the way to go.

Based on which one is best depends on the trading style of the individual, his risk tolerance, and preferences, you could consider your options while maximizing your trading potential with the benefits of prop firm tech, irrespective of the market.

#proptech#forex prop firms funded account#fxproptech#prop firms#best prop firms#funded#prop trading firms#funded trading accounts#my funded fx#best trading platform#propfirmtech

2 notes

·

View notes

Text

At the Argus conference in Istanbul, someone asked me if I had ever thought about hedging the fertiliser business through agricultural commodities trading. I tried to recall which major agricultural trading houses had ever ventured into the fertiliser market.

It’s intriguing that giants like Dreyfus, ADM, Toepfer, or Bunge haven’t found the same success in fertiliser trading despite their dominance in agricultural commodities. One might think their deep market knowledge and extensive networks in grain trading would position them for success in fertilisers, but the reality is more complex.

Fertilisers are closely tied to energy markets, especially natural gas, and mined resources like potash and phosphates. While these companies handle agricultural commodities, where pricing is more transparent, fertilisers operate in opaque markets driven by local factors, regulations, and geopolitical issues. This makes fertiliser hedging through agricultural commodities less effective.

Logistics further complicate things. Fertilisers are bulky, need to be transported across vast distances, and must arrive within specific planting windows. The precision needed in fertiliser distribution is far more challenging than that of grains, where storage and delivery are more flexible.

Moreover, the fertiliser market is dominated by a few large players, making it difficult for newcomers like ADM or Dreyfus to gain ground. Unlike grain trading, fertilisers involve dealing with strong regional players, less transparent pricing systems, and complex regulations.

Then there’s the issue of risk management. Hedging fertiliser positions with agricultural commodities seems logical, but the two markets aren’t perfectly correlated. Fertiliser prices depend on energy costs and mining outputs, which make hedging across commodities complicated and often unreliable.

Despite their vast resources and networks, these companies faced challenges they weren’t fully equipped to overcome in fertilisers. Their experience highlights the complexity of the fertiliser market, where success requires mastering logistics, risk management, and navigating a unique set of market dynamics.

And yes, I do remember Ameropa.

#agicommodities #fertilisers #adm #ameropa #bunge #toepfer #hedging #dreyfus #logistics #marketvolatility #trading

#agriculture#fertilizer#fertilization#urea#corn#usa#wheat#india#vessel#nola#imstory#adm#bunge#ameropa#hedge#agribusiness#logistics

2 notes

·

View notes

Text

Bitter Truth: Climate Crisis Threatens Europe’s Beer Tradition

Europe’s rich beer heritage is under threat as the ongoing climate crisis is poised to transform the taste, quality, and pricing of this cherished beverage. Scientists warn that the ingredients vital to brewing beer, especially hops, are increasingly vulnerable due to the global rise in temperatures.

The Hop Problem

Beer is a tapestry of flavors, and hops play a pivotal role in that blend. These green, cone-shaped flowers impart a characteristic aroma and bitterness, distinguishing one brew from another. However, climate changes are altering the very essence of this ingredient.

A new study indicates a bleak future for hop yields in European cultivation regions, predicting a drop between 4-18% by 2050, unless farmers adjust to the rising temperatures and changing rain patterns. Further, the alpha acids that contribute to beer’s unique scent and flavor could decline by a whopping 20-31%.

“The consequences of climate change will reverberate through our breweries and pubs,” says Dr. Miroslav Trnka from the Global Change Research Institute of the Czech Academy of Sciences, who was involved in the study. «The data points to an unsettling future where the very soul of beer could be compromised.»

A Historical and Cultural Legacy at Risk

Oktoberfest, the world-renowned beer festival in Germany, exemplifies the significance of beer in European culture. The event annually draws millions from across the globe, eager to savor authentic European brews. But the essence of these beers is now at risk.

Weather, Politics, and the Changing Flavor Profile

Though beer debates across European pubs often revolve around taste preferences, discussions may soon shift towards the changing climate and its effect on the beloved beverage. Despite global commitments to mitigate climate change, the constant emission of greenhouse gases is altering Earth’s climate at an alarming rate.

Farmers are already feeling the heat. Andreas Auernhammer, a hop cultivator from southern Germany, laments the unpredictable rain patterns. While overall rainfall has remained relatively stable, it isn’t always available when the crops need it most. To counteract this, many farmers like Auernhammer have resorted to irrigation systems. «Adapting to these changes is our only hope,» he says.

The Bigger Picture

While the focus is on hops, it’s crucial to recognize that the entire brewing process is susceptible to climate change. From water scarcity to grain cultivation, every step could be impacted, potentially driving up costs and altering taste profiles.

Moreover, other external factors, like geopolitical tensions and energy prices, further complicate the brewing industry’s landscape. The recent surge in energy costs, especially after Russia’s invasion of Ukraine, has overshadowed the climate threat to beer prices.

As Auernhammer points out, «While hops are essential, they aren’t the most significant cost factor. Currently, the energy needed for brewing is a more pressing concern.»

Conclusion

Europe’s beer is at a crossroads. As the climate crisis unfolds, the brewing industry faces unprecedented challenges. Addressing these concerns requires a concerted effort from farmers, brewers, policymakers, and consumers. While beer has survived for thousands of years, ensuring its future might be one of the biggest challenges yet.

©eco-guardians.org

7 notes

·

View notes

Text

The Role of Bitcoin in Global Stability

In a world increasingly defined by financial instability and geopolitical tension, the search for a reliable, stable store of value has never been more urgent. Traditional financial systems, once considered bastions of stability, have shown cracks under the weight of economic crises, excessive money printing, and political uncertainty. Amidst this backdrop, Bitcoin has emerged not only as a revolutionary financial technology but as a potential anchor of stability in an unstable world.

Bitcoin as a Hedge Against Inflation

Inflation is a silent thief that erodes the purchasing power of hard-earned money. In countries where hyperinflation has taken hold, such as Venezuela and Zimbabwe, local currencies have become nearly worthless, driving people to seek refuge in more stable assets. Bitcoin, with its fixed supply of 21 million coins, offers a stark contrast to fiat currencies that can be printed at will. This scarcity makes Bitcoin an effective hedge against inflation, preserving value over time.

The recent surge in Bitcoin adoption in countries experiencing economic turmoil highlights its growing role as a lifeline for those seeking financial security. As governments continue to devalue their currencies through reckless monetary policies, Bitcoin’s inherent deflationary nature becomes increasingly attractive.

Decentralization as a Source of Stability

One of Bitcoin's most powerful features is its decentralization. Unlike traditional financial systems controlled by central banks and governments, Bitcoin operates on a peer-to-peer network, free from centralized control. This decentralization provides a level of security and resilience that is unmatched by any other financial system.

In a world where trust in institutions is waning, Bitcoin offers a transparent and tamper-proof alternative. Its blockchain technology ensures that transactions are secure, verifiable, and immutable, reducing the risk of fraud and corruption. This trustless system is particularly valuable in regions where financial corruption and instability are rampant, offering a reliable store of value and medium of exchange.

Bitcoin's Impact on Global Trade

The global trade system, burdened by currency fluctuations and the complexities of cross-border transactions, is ripe for disruption. Bitcoin, with its ability to transcend national borders and operate independently of any one country's monetary policy, has the potential to streamline international trade.

By reducing the need for costly currency exchanges and lowering transaction fees, Bitcoin can facilitate smoother and more efficient global trade. This efficiency not only benefits large corporations but also small businesses and individuals who can now participate in the global economy without the barriers imposed by traditional financial systems.

As Bitcoin adoption grows, its role in global trade could become a key factor in stabilizing international relations and fostering economic growth, particularly in developing nations.

The Environmental Impact: A Double-Edged Sword

Bitcoin’s environmental impact has been a topic of heated debate. Critics often point to the significant energy consumption associated with Bitcoin mining, raising concerns about its sustainability. However, this narrative overlooks a critical aspect of Bitcoin's relationship with energy: its potential to stabilize energy grids and contribute to the development of renewable energy sources.

Bitcoin miners often set up operations in regions with abundant but underutilized energy resources, such as hydroelectric power in remote areas. By converting excess energy that would otherwise go to waste into Bitcoin, these miners not only create economic value but also contribute to grid stability. In times of high energy demand, mining operations can be temporarily scaled back, allowing that energy to be redirected to where it is most needed.

Moreover, Bitcoin mining is increasingly being integrated with renewable energy projects, turning what was once seen as an environmental liability into a potential asset. As the world transitions to more sustainable energy sources, Bitcoin’s role in this ecosystem could prove to be a game-changer.

The Future of Bitcoin in Global Finance

Looking ahead, Bitcoin’s potential to serve as a cornerstone of global finance is becoming more apparent. As more institutions, corporations, and even governments begin to recognize Bitcoin's value, its adoption could lead to a more stable and equitable financial system worldwide.

Imagine a world where Bitcoin serves as a universal reserve asset, underpinning national currencies and fostering a new era of financial stability. This is not just a pipe dream; it is a real possibility as the global financial landscape continues to evolve. Bitcoin’s transparent, decentralized, and deflationary nature makes it uniquely suited to play this role.

Conclusion

Bitcoin is more than just a digital currency; it is a force for global stability in a world fraught with uncertainty. Its role as a hedge against inflation, its decentralized nature, and its potential to revolutionize global trade all point to a future where Bitcoin plays a central role in the global financial system.

Furthermore, Bitcoin’s interaction with energy grids and renewable resources adds a new dimension to its potential as a stabilizing force, not just in finance but in the broader context of global sustainability. As we move forward, the world will increasingly look to Bitcoin as a beacon of stability and a foundation for a more secure and equitable future.

Now is the time to recognize the transformative power of Bitcoin and consider its broader implications beyond mere price speculation. The future of global stability may well rest on the shoulders of this remarkable technology, and those who understand and embrace it will be at the forefront of a new era in human history.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin: bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

Thank you for your support!

#Bitcoin#Cryptocurrency#GlobalStability#FinancialRevolution#Decentralization#InflationHedge#Blockchain#GlobalTrade#DigitalCurrency#SoundMoney#EnergyInnovation#Sustainability#EconomicFreedom#CryptoAdoption#BitcoinMining#financial experts#finance#financial empowerment#financial education#globaleconomy#unplugged financial

2 notes

·

View notes

Text

Teodoro Obiang Nguema Mbasogo of Equatorial Guinea is 82 and has been in power for 45 years. Denis Sassou Nguesso of Congo, 79, has held on to power for 40 years. Cameroon’s Paul Biya is 91 and has been president for 42 years.

Their extended tenures are largely due to a lack of constitutional limits on presidential age and terms in their countries. These three cases of political endurance aren’t unprecedented in Africa: Félix Houphouët-Boigny led Côte d'Ivoire for 33 years, Gnassingbé Eyadema remained at the helm in Togo for 40 years and Omar Bongo Ondimba reigned over Gabon for 42 years.

As such leaders approach an end-of-reign phase, intense succession rivalries tend to play out. These rivalries are fuelled by deep-seated conflicts within presidential families, and can lead to prolonged social and political instability.

I have researched the geopolitical issues in central Africa and explored political transition prospects in Equatorial Guinea, Congo and Cameroon. In a recent article, I analysed the risks of destabilisation posed by succession conflicts in these three countries – and their potential impact on neighbouring regions.

The potential for political transition in Equatorial Guinea, Congo and Cameroon is notable given the “twilight” phase of their long-serving leaders. This transition was also seen in the last years of power of the long-serving Ivorian, Togolese and Gabonese presidents.

The signs of a twilight phase include:

frequent and increasingly extended health-related absences of the heads of state

growing discord and dissonance within decision-making circles of the ruling camps

intensified power struggles within the president’s political and family networks

rising ambitions within the presidential camp to attain the highest office

a noticeable detachment from the public’s basic concerns.

How things might pan out

Equatorial Guinea’s and Congo’s regimes favour dynastic power transitions. In contrast, hereditary succession is unlikely to play out in Cameroon, but party power struggles could complicate the political transition.

Presidential clans come with complexity. They have intricate alliances and networks centred on the leader. As the leader’s authority wanes due to age or illness, unity within these clans fractures. This is driven by:

power struggles among the leader’s children from different mothers

disputes over economic monopolies and resources

growing conspiracies within the inner circle

the disgrace and repression of perceived “traitors” and their allies.

These factors could contribute to unstable succession prospects in Equatorial Guinea and the Congo.

Teodoro Obiang Nguema Mbasogo succeeded his uncle Francisco Macias Nguema Biyogo, the first president of Equatorial Guinea, following a coup d'état in 1979. With the exception of Pascal Lissouba (1992-1997), who was a native of the south of the country, presidential power in the Congo has been in the hands of the northerners since a 1968 coup d'état. The significant political influence wielded by Mbasogo’s many children fuels the potential of an upcoming hereditary succession.

The push for family succession aims to protect the presidential clan’s interests in the state and military apparatus after the leader’s death. This is driven by the memory of disinheritance faced by past ruling families (such as Central African Republic’s Jean Bedel Bokassa, Democratic Republic of Congo’s Mobutu Sese Seko, Angola’s José Eduardo Dos Santos and Gabon’s Omar Bongo). There are also often fears of political and judicial repercussions.

In Cameroon, the president has excluded his family from political roles. Instead, Biya has maintained tight control and eliminated internal rivalries. Despite this, his political record offers no assurance of a smooth transition.

The impending departure of the current leaders in all three countries – Equatorial Guinea, the Congo and Cameroon – could jeopardise their stability. This could spill over into the region.

Rivalry in Equatorial Guinea

Mbasogo’s successor will likely be a member of his clan. The question is who. Will it be Teodorin Nguema Obiang, the eldest son, better known for his spending sprees than his statesmanship? His rise to strategic positions (vice-president of the republic) and the overt support of his mother, the first lady, seem to signal his potential ascent to head of state.

There’s also Gabriel Mbega Obiang Lima, the youngest son, with a mother from São Tomé and Príncipe. He has held several ministerial dockets, and currently oversees mines and oil. Lima’s perceived “seriousness” has made him a favourite among influential Chinese and western investors in the country.

Conflict over inheritance in Congo

In Congo, succession is complicated by family conflicts. President Nguesso’s son, Denis Christel Sassou Nguesso, is rumoured to be seeking the presidency. His mother is from the neighbouring Democratic Republic of the Congo. But Denis faces opposition from his cousins: Jean-Dominique Okemba, head of the intelligence service, and Edgard Nguesso, a senior military officer and director of presidential assets.

Congo’s turbulent political history heightens concerns about the upcoming transition. A north-south ethno-political divide has fostered deep-seated resentment among local communities, particularly between their elites. Political dissent is now prevalent, especially in the north, which has traditionally been the regime’s stronghold.

After he regained power through military means in 1997, the president refocused on his ethnic group, the Mbochis. This shift has alienated other ethnic groups from Nguesso’s home region. They include the Kouyou, Makoua and Téké who have increasingly voiced their grievances. These northern elites are feeling marginalised and are, therefore, likely to oppose any perceived attempts at dynastic succession.

In the south, the civil war (1997-2001) deepened the long-standing mistrust of the “northern regime” among the Kongo-Lari ethnic group. The prospect of dynastic succession is likely to stir up old grievances.

The reactivation of dissent in the southern region after Nguesso’s contentious re-election in 2016 highlights the lingering threat of civil war in the country. Although the suppression of political and military forces from contested regions reduces the likelihood of opposition, the dynastic handover plan could still provoke significant unrest.

There are still residual armed factions in the south. This supports the possibility of a resurgence of resistance in areas opposed to the regime.

Cameroon’s inter-community tensions

With Biya excluding his family from political roles, the possibility of dynastic succession is unlikely. However, with Cameroon due to hold presidential elections in 2025, two major challenges to a smooth transition stand out:

the lack of an official successor within the ruling party

uncertainty about the process of selecting a party candidate for the presidential election.

This could lead to numerous claimants for the position, potentially igniting internal conflicts within the party. These power struggles could deepen existing identity-based divisions.

The rivalry between the Bulu-Béti (south) and Bamiléké (west) communities epitomises the inter-community tensions threatening the country’s stability. This rivalry is driven by a quest for dominance among political and intellectual elites.

Traditionally focused on economic activities, the Bamiléké are now increasingly showing national political ambitions. This has raised concerns among the Bulu-Béti elite.

The contested 2018 presidential election results and the ethnic slurs that followed highlight ongoing tensions in the country. These dynamics are likely to shape the political landscape leading up to the 2025 elections.

2 notes

·

View notes

Text

Global Market Meltdown: What Caused the Panic?

Lately, there's been a lot of buzz about the significant downturn in global markets. It's hard not to notice when investors from Japan to India and the United States are losing billions. I wanted to dig deeper into what exactly caused this economic upheaval, so I watched an insightful video that breaks down the primary reasons behind this panic. Here’s a more detailed look at the key points discussed.

Global Market Downturn

The global markets have been on a rollercoaster, but lately, it's been a steep downhill ride. From Japan to India, and even the mighty United States, markets have experienced significant declines. Investors are feeling the heat, with billions of dollars seemingly evaporating overnight. The sense of unease is palpable, and everyone is asking the same question: what's causing this chaos?

Impact on India

India, with its rapidly growing economy, hasn't been immune to this downturn. In fact, the Indian markets saw a substantial loss, with approximately 17 lakh crores wiped off, equating to over $2 billion in a single day. That's an astronomical figure, and it's left many investors and analysts scratching their heads.

Weak Corporate Earnings

One of the primary reasons for this downturn in India is the disappointing first-quarter results from the country’s top 50 companies. There was minimal growth and a decline in profits, which has spooked investors. When corporate giants fail to meet expectations, the ripple effect can be severe, leading to a widespread market selloff.

Rupee Devaluation

Adding to the woes, the Indian rupee hit an all-time low against the US dollar, trading at nearly 84 rupees per dollar. A weak rupee makes imports more expensive and exacerbates inflation, which in turn can erode consumer confidence and spending. This devaluation has added another layer of complexity to an already volatile market.

Recession Fears in the US

Over in the United States, the fear of a looming recession is causing major jitters. Rising unemployment and a slowdown in the manufacturing sector are key indicators that all is not well. Recent data shows that 4.3% of Americans are unemployed, the highest rate in nearly three years. This spike in unemployment, coupled with other economic slowdowns, has investors on edge.

Manufacturing Slowdown

The US manufacturing sector, a critical component of the economy, has been experiencing a significant slowdown. This sector's health often serves as a bellwether for the broader economy. When manufacturing slows down, it not only impacts the sector itself but also sends shockwaves through supply chains, affecting various other industries.

Tensions in West Asia

The geopolitical landscape is another major factor contributing to the market instability. The worsening situation in West Asia, particularly involving Iran and its proxies targeting Israel, has escalated tensions. These geopolitical conflicts create uncertainty and risk, which markets despise. The potential for conflict in this volatile region adds to the already heavy load of negative sentiment.

Impact on Global Markets

The negative sentiment isn't confined to India and the US; it's a global phenomenon. Markets worldwide are facing headwinds. The decline in oil prices and a significant selloff in cryptocurrencies are clear indicators that investors are skittish. The interconnectedness of global markets means that turmoil in one region can quickly spread, creating a domino effect.

Decline in Oil Prices

Oil prices have been another critical factor. Traditionally, oil is seen as a barometer for global economic health. A decline in oil prices can signal weakening demand and economic slowdown. This recent drop in oil prices has only added to the growing list of concerns for investors.

Cryptocurrency Selloff

Cryptocurrencies, once the darlings of the investment world, have not been spared either. A significant selloff in cryptocurrencies has been observed, which further highlights the risk-averse sentiment prevailing among investors. The volatility of these digital assets can be both a cause and a consequence of broader market instability.

Climate Change Concerns

Interestingly, the video also touched on an often-overlooked aspect: climate change. While not directly related to the market meltdown, the mention of climate change serves as a reminder that long-term environmental issues can and will have economic repercussions. The call for action, starting with individual efforts like planting trees, underscores the need for a collective approach to combat these challenges.

Individual Efforts

It's easy to feel helpless in the face of such overwhelming economic and environmental issues. However, small actions, such as planting trees and adopting sustainable practices, can collectively make a significant impact. The idea is to start a revolution from the ground up, emphasizing that everyone has a role to play.

Conclusion

The global market meltdown is a multifaceted issue with no single cause. From weak corporate earnings and currency devaluation in India to recession fears in the US and geopolitical tensions in West Asia, several factors have converged to create the current economic turmoil. The interconnected nature of global markets means that instability in one region can quickly spread, affecting economies worldwide.

For those looking to navigate these turbulent times, staying informed is crucial. Websites like TickerInvest.com provide invaluable insights into stock market investments and the latest financial news. Their expert analysis can help you make informed decisions and stay ahead of the curve.

FAQs

What caused the global market meltdown in 2024? The meltdown was caused by a combination of factors, including weak corporate earnings in India, recession fears in the US, geopolitical tensions in West Asia, and a decline in oil prices and cryptocurrencies.

How has the downturn impacted India? India saw a significant loss, with approximately 17 lakh crores wiped off the market. Contributing factors include weak corporate earnings and the devaluation of the rupee.

Why are recession fears rising in the US? Rising unemployment and a slowdown in the manufacturing sector are key indicators of potential recession, causing concern among investors.

What role do geopolitical tensions play in market instability? Tensions in regions like West Asia create uncertainty and risk, which negatively impact market stability and investor confidence.

How are oil prices and cryptocurrencies affecting the market? A decline in oil prices and a selloff in cryptocurrencies reflect broader economic concerns and risk-averse sentiment among investors.

What can individuals do to help combat climate change? Individual efforts like planting trees and adopting sustainable practices can collectively make a significant impact in addressing climate change.

About TickerInvest.com

TickerInvest.com is a premier platform for financial news, stock market analysis, and investment strategies. Whether you're a seasoned investor or just starting out, TickerInvest.com offers a wealth of resources to help you make informed decisions. Their expert analysis, in-depth articles, and real-time market data ensure you stay ahead of the curve. For anyone looking to maximize their investment returns, TickerInvest.com is an invaluable tool. Check them out today and take your investing game to the next level!

#stock market#stock trading#finance#investing stocks#indian stock market#stock market crash#investing

2 notes

·

View notes

Text

The Growing Popularity of Gold Bar Investments in the UAE

Investing in pamp gold has long been considered a haven for investors worldwide, offering stability and security during uncertain economic times. In the UAE, the allure of gold is particularly strong due to the region’s rich history with the precious metal and its status as a global trading hub. This blog explores why gold bar investment in the UAE is gaining traction and how investors can make informed decisions.

Why Invest in Gold Bars? 1. Stability and Security Gold is known for its ability to maintain value over time, making it a popular choice for preserving wealth. Unlike stocks or real estate, which can be subject to market volatility, buy gold bullion a stable investment that can protect against inflation and currency fluctuations.

2. Tangible Asset valcambi gold bars are a tangible asset that investors can physically hold, providing a sense of security that digital investments cannot match. This tangibility is particularly appealing in a world of unpredictable financial markets.

3. Portfolio Diversification Investing in gold bars can diversify an investment portfolio, reducing risk by offsetting potential losses in other asset classes. Gold often performs well when other markets struggle, providing a balancing effect.

The UAE Advantage 1. Tax-Free Investment One of the key benefits of investing in gold bullion bar price in the UAE is the tax-free environment. Investors can purchase gold without worrying about capital gains taxes, which can significantly impact overall returns.

2. Access to High-Quality Gold The UAE is renowned for its high-quality gold, with Dubai often referred to as the “City of Gold.” Investors can access a wide range of gold bars from reputable dealers, ensuring the authenticity and purity of their investments.

3. Strong Market Infrastructure The UAE’s robust market infrastructure supports gold trading, with numerous exchanges and platforms facilitating the buying and selling of gold bars. This accessibility makes it easier for investors to enter and exit the market as needed.

Factors to Consider Before Investing 1. Purity and Weight When purchasing gold bars, it’s essential to consider their purity and weight. Look for bars that are at least 99.5% pure, commonly known as 24-karat gold, to ensure you are getting the highest quality.

2. Reputable Dealers Choose reputable dealers with a proven track record in the gold market. Conduct thorough research and verify their credentials to avoid potential scams or counterfeit products.

3. Storage and Insurance Consider the storage and insurance of your gold bars. Secure storage is crucial to protect your investment, and insurance can provide additional peace of mind against theft or loss.

4. Market Trends Stay informed about market trends and factors influencing gold prices, such as geopolitical events, economic data, and currency fluctuations. Understanding these trends can help you make informed investment decisions.

Steps to Invest in Gold Bars in the UAE Research and Education Educate yourself about the gold market, investment strategies, and the factors influencing gold prices. Knowledge is key to making informed decisions.

Set Investment Goals Define your investment goals, whether long-term wealth preservation, short-term gains, or portfolio diversification. Clear objectives will guide your investment strategy.

Choose a Reputable Dealer Select a reputable gold dealer in the UAE with a strong market presence and positive customer reviews. Verify their credentials and ensure they offer high-quality gold bars.

Monitor Market Trends Keep an eye on market trends and economic indicators that could impact gold prices. Stay informed to make timely investment decisions.

Secure Storage and Insurance Arrange for secure storage of your gold bars and consider insurance to protect against potential risks. Proper storage is essential to safeguard your investment.

Conclusion Gold bullion price investment in the UAE offers numerous advantages, from tax-free benefits to access to high-quality gold. By considering factors such as purity, reputable dealers, and market trends, investors can make informed decisions that align with their financial goals. As the UAE continues to be a global leader in the gold market, investing in gold bars remains a viable and attractive option for preserving wealth and securing a stable financial future.

#gold bar#gold bullion#gold bars#gold#valcambi gold#gold buyer#pamp gold#Gold bullion price#gold bullion bar price#Gold Coins

2 notes

·

View notes

Text

The growing strength of Chinese-Russian alignment—and how to counter it—is one of the major issues occupying Western strategic minds. It is commonly acknowledged that Beijing and Moscow have drawn closer together since the start of Russia’s war in Ukraine in 2022, with China’s economic and technological support of crucial importance to Russia’s war efforts.

But there is still much debate over how strong the Sino-Russian relationship really is and what drives it. Mutual mistrust based on the two powers’ difficult history still runs deep, and it is uncertain how comfortable Moscow is with its growing dependency on China. Beijing, in turn, has been put in an awkward position vis-à-vis one of its largest trading partners, the European Union, by Russia’s war. Some Western strategists seem to hope that Sino-Russian disaffection could lead to a split reminiscent of the famous Sino-Soviet fracture in the 1960s and early 1970s.

It is therefore a useful exercise to assess the strength of the current Beijing-Moscow axis by comparing it to the Cold War’s Sino-Soviet alliance. Oct. 2 marks 75 years since the Soviet Union became the first country to recognize the newly founded People’s Republic of China and established diplomatic relations with the new regime. In December 1949, China’s paramount leader, Mao Zedong, traveled to Moscow for his first state visit abroad. The two-month visit culminated with Mao signing a 30-year friendship treaty with his Soviet counterpart, Joseph Stalin. However, this quasi-alliance only lasted about one decade. In 1961, Beijing officials denounced Soviet communism as the work of “traitors,” and an undeclared Sino-Soviet border war erupted in 1969. Later, in 1971, China switched sides by aligning with the United States.

A similar collapse of Sino-Russian ties and switch of alignment seems much less likely today. When Russian President Vladimir Putin boasted in March that Russia’s relationship with China was at its “best,” he was not expressing mere propaganda. It is actually true. Indeed, by comparing today’s Sino-Russian ties to the past Sino-Soviet alignment along five key factors—geopolitics, economics, ideology, leadership, and institutions—it becomes obvious that the Beijing-Moscow axis is stronger today on all accounts.

First and foremost, the Beijing-Moscow axis now rests on a more solid geopolitical foundation. Just like during the early Cold War, their adversarial relationship with the United States drives them together. But today, the two have less to fear from each other than during the Cold War. The strength and global reach of Soviet military power made it a potential security risk to Beijing all throughout the Cold War. Today, China is the more powerful partner, but its limited geographic reach makes it less of a threat to Russia. China is in no position to encircle Russia. In addition, Moscow knows that China will be preoccupied for the foreseeable future with its naval rivalry with the United States, which reduces Beijing’s willingness and ability to flex its muscles on land in Russia’s neighborhood.

Second, whereas Soviet economic and technical aid dominated the Sino-Soviet friendship phase, Beijing and Moscow have formed an economic relationship over the course of the past decade that builds on the complementary nature of their economies. Russia is now China’s largest source of crude oil and its second-largest source of natural gas (after Australia), while China is Russia’s largest source of imported technology. Beijing and Moscow have also agreed on enhanced cooperation in sectors such as satellite navigation, space, and atomic energy. There is no denying that Western sanctions on Russia are an obstacle to their trade relationship, but China and Russia are reportedly trying to skirt financial-sector sanctions by switching to a system of barter transactions to facilitate trade.

Third, ideology mattered during the Cold War. A shared belief in communism underpinned the Sino-Soviet alliance. Ideological differences then helped propel their split, with Mao highly critical of Soviet leader Nikita Khrushchev’s post-Stalin reforms. Today, ideology is simply a less intense factor in world politics. It still helps bind China and Russia together, with both authoritarian regimes concerned about the ability of Western ideas to undermine their political stability. But it is difficult to imagine ideological differences leading to a breakdown of Sino-Russian relations today.

Fourth, leadership matters in foreign policy, and the dialogue between the top leadership in Beijing and Moscow is much stronger today than it was during the Cold War. There was never a great deal of trust between Mao and his Soviet counterparts, Stalin and Khrushchev. For instance, Mao was angered by Stalin’s demands during the friendship treaty negotiations, and he intentionally humiliated Khrushchev during the Soviet leader’s visit to China in 1958. The contrast to today was underlined in 2018, when Putin became the first recipient of China’s friendship medal. One should probably not put too much value into Putin and Chinese leader Xi Jinping continuously referring to the other as close friends. More importantly, the two have met more than 40 times since 2012, when Xi became general secretary of the Chinese Communist Party.

Fifth, the institutional links between China and Russia are both wider and deeper today than during the Cold War. When China and the Soviet Union signed the friendship treaty in 1950, their respective communist parties had close ties going back to the early 1920s. However, those ties were not frictionless, and beyond them the scope of collaboration was limited to the Soviet experts dispatched to China in the 1950s to help it industrialize. In contrast, even though the current Sino-Russian relationship is still mainly top-down, there are strong links across a wide range of government agencies.

At the highest political level, China and Russia have established regular meetings between their presidents and prime ministers. They have also conducted 18 rounds of strategic security consultations at a high level, most recently in Moscow in 2023, and they run a number of other intergovernmental commissions and working groups. The military ties between the two are now arguably stronger than ever. Since China and Russia first participated in a military exercise together in 2003, they have conducted more than 100 joint military exercises involving land, air, sea, cyber, and paramilitary forces. This level of joint activity across their various services contributes to cement ties.

The current Sino-Russian relationship is not all top-down; it also consists of expanded people-to-people relations, including local initiatives, academic collaboration, student exchanges, and tourism. These links have now developed uninterrupted for more than three decades since the Cold War ended in 1991. Institutional and people-to-people links by themselves are not a driver of alignment, but they do inform the stability of a bilateral relationship.

Given that the United States managed to play the China card against the Soviet Union in the 1970s, it is tempting to explore the possibilities of weakening the current Chinese-Russian alignment. However, the relatively strong basis for Sino-Russian cooperation just discussed reduces the likelihood of a Cold War-type split.

It makes sense for the United States and Europe to pressure Beijing to reduce its support of Russia’s war efforts in Ukraine. But any endeavor to sway China away from Russia more broadly will most likely fail, as Beijing’s Russia policy is driven, above all, by its superpower rivalry with the United States. It would be like attempting to woo the Soviet Union away from China during the Cold War.

In theory, a wedge strategy has a better chance of success if it targets the weaker member of the partnership. During the Cold War, that was China; today, it is Russia. But despite Western sanctions, Russia is in a stronger position now than China was in the early 1970s. When Mao decided to align with Washington, his country had been economically isolated since the split with Moscow in the early 1960s and had recently fought a border war with the Soviet Union. The incentive for Beijing to strike a deal with Washington was, therefore, high and the cost to Washington was low.

Today, however, Russia is much more aligned with China and greatly benefits from its strong support. If Washington attempted to woo Moscow away from Beijing, the Russian leadership would drive a hard bargain to extract a high price that would likely come at great cost to European security. But even a sweet deal allowing Russia to enhance its position in Europe might not be enough to sway it away from China. Why should Moscow abandon its strong relationship with Beijing when it does not perceive China to be a serious threat to Russian security? Moscow knows that Beijing is preoccupied with Washington. Would Russia’s total defeat in Ukraine and possible collapse of its economy change the calculus for the Russian leadership? Perhaps, but China would likely be much keener than the United States and Europe to help Russia rebuild its economic and military power.

The United States was only able to play the China card against the Soviet Union because of the Sino-Soviet split one decade earlier, with Beijing perceiving Moscow as a considerable security threat. The Sino-Soviet alliance unraveled from within—and not because the United States applied outside pressure or offered an irresistible deal. While the Sino-Russian relationship is unlikely to ever be perfectly stable, it is difficult to see anything like the Sino-Soviet breakdown threatening their alignment. In stark contrast to the Cold War, the current Beijing-Moscow axis rests on a solid geopolitical foundation with strong economic ties, freedom from ideological friction, strong relations between the two countries’ leaders, and a well-established web of bilateral and institutional links.

2 notes

·

View notes

Text

Unlocking Success with International Finance Assignment Help

Celebrating one year of academic triumphs with FinanceAssignmentHelp.com and their exceptional international finance assignment help! As a student navigating the intricate world of international finance, I stumbled upon this academic haven when the challenges seemed insurmountable. Today, on my one-year anniversary with their services, I can't help but reflect on how they have been instrumental in shaping my academic journey.

How FinanceAssignmentHelp.com Helped Me:

International finance is a labyrinth of concepts, theories, and practical applications. Navigating through the complexities of exchange rates, capital flows, and risk management can be daunting for even the most dedicated students. That's where FinanceAssignmentHelp.com stepped in to illuminate the path to success.

This online platform offers unparalleled international finance assignment help, providing customized solutions tailored to individual needs. Whether it's understanding the intricacies of foreign exchange markets or deciphering the nuances of global investment strategies, their team of experts has consistently delivered top-notch assistance.

Why I Needed This Service:

The realm of international finance demands a comprehensive understanding of economic principles, market dynamics, and geopolitical factors. As a student with a fervent desire to excel, I found myself grappling with the intricate details of my international finance assignments. The need for clarity and expert guidance became evident, and that's when I turned to FinanceAssignmentHelp.com.

This service became my academic anchor, offering a lifeline when the waters of financial theories seemed too turbulent. Their team not only possesses profound knowledge of international finance but also has a knack for simplifying complex concepts, making them accessible to students at any level.

How to Find This Service:

Discovering FinanceAssignmentHelp.com was a game-changer for me, and it's a journey that began with a simple online search. The website's user-friendly interface and transparent approach stood out immediately. Navigating through their services, I found a dedicated section for international finance assignment help, complete with testimonials from satisfied students.

The process of finding this service is straightforward. A quick search using keywords like "international finance assignment help" led me straight to their website. The clear layout and detailed information about their services instilled confidence from the start. It's evident that they understand the unique challenges students face in international finance courses and are committed to providing targeted assistance.

Steps to Submitting Assignments and Receiving Solutions:

One of the aspects that sets FinanceAssignmentHelp.com apart is the seamless process they've established for submitting assignments and receiving solutions. The user-friendly interface ensures that even those new to online academic assistance can navigate the process effortlessly.

Place an Order:

Start by placing an order on their website, specifying the details of your international finance assignment. This includes the topic, deadline, and any specific requirements provided by your instructor.

Receive a Quote:

Shortly after submitting your order, you'll receive a quote outlining the cost of the service. The transparent pricing model ensures that you know exactly what to expect, with no hidden fees.

Make Payment:

Once you approve the quote, proceed to make the payment securely through their platform. Multiple payment options are available for convenience.

Work Commences:

The moment your payment is processed, their team of experts starts working on your international finance assignment. Regular updates and communication ensure that you're in the loop throughout the process.

Review and Feedback:

Before the final solution is delivered, you have the opportunity to review the work and provide feedback. This collaborative approach ensures that the solution aligns with your expectations.

Receive the Solution:

Once the assignment is finalized and reviewed, you'll receive the solution promptly. The comprehensive and well-explained answers serve as a valuable learning resource, enhancing your understanding of international finance concepts.

Conclusion:

As I celebrate one year of academic excellence with FinanceAssignmentHelp.com, I can confidently say that their international finance assignment help has been a cornerstone of my success. The journey from grappling with complex concepts to mastering the intricacies of international finance has been transformative, thanks to their unwavering support.

For any student navigating the challenging waters of international finance, I wholeheartedly recommend FinanceAssignmentHelp.com. Their commitment to academic excellence, transparent processes, and a team of knowledgeable experts make them the go-to destination for those seeking not just answers, but a profound understanding of international finance. Here's to many more years of partnership and continued success!

#International Finance Assignment Help#Help With International Finance Assignment#Online International Finance Assignment Help#International Finance Assignment Help Service

10 notes

·

View notes

Text

Unveiling the Job Market: How Many Jobs Are Available in Finance Services in 2024?

In the ever-evolving landscape of finance, the job market plays a pivotal role in shaping career aspirations and industry trends. As we step into 2024, professionals and aspiring individuals are eager to uncover the opportunities awaiting them in the realm of finance services, particularly in the United States. This article sheds light on the abundance of opportunities available in the finance services.

Exploring the Finance Job Market Landscape:

Quantifying Opportunities:

How many jobs are available in finance in the USA?

Analyzing recent statistics and projections to gauge the scale of employment opportunities.

Factors influencing job availability, such as economic conditions, technological advancements, and regulatory changes.

Diverse Sectors, Diverse Opportunities:

Breaking down the finance sector into subcategories, including banking, investment management, insurance, and consumer services.

Highlighting the unique job prospects within each sector and the skill sets required to excel.

Identifying emerging roles and specialties that are gaining prominence in response to market demands and industry shifts.

Finance in the Digital Age:

Examining the impact of technology on job creation and the transformation of traditional finance roles.

The rise of fintech companies and their contribution to job growth, particularly in areas like digital banking, payment processing, and financial analytics.

The demand for professionals with expertise in data analysis, cybersecurity, and artificial intelligence within the finance sector.

Investment Management: A Thriving Field:

How many jobs are available in investment management?

Unveiling the job opportunities within investment firms, asset management companies, and hedge funds.

The significance of skilled portfolio managers, financial analysts, and risk assessment specialists in driving investment strategies and maximizing returns.

Exploring the global reach of investment management careers and the potential for growth in international markets.

Consumer Services: Meeting the Needs of Individuals:

Evaluating the job market within consumer-focused finance services, including retail banking, wealth management, and financial advising.

The demand for client relationship managers, financial planners, and retirement advisors in assisting individuals with their financial goals.

The role of personalized financial services and digital platforms in catering to the diverse needs of consumers and enhancing their financial literacy.

Trends Shaping the Future:

Anticipating future job trends in finance services and the skills that will be in high demand.

The growing importance of sustainable finance and environmental, social, and governance (ESG) investing, leading to opportunities in green finance and impact investing.

The influence of geopolitical factors, regulatory reforms, and demographic shifts on the finance job market landscape.

Conclusion:

As we go through 2024, the finance job market in the United States continues to offer a lot of opportunities across various sectors. Whether aspiring to go into investment management, consumer services, or the dynamic world of fintech, individuals with the right skills and expertise are well-positioned to thrive in this ever-evolving industry. By staying abreast with market trends, honing relevant skills, and embracing innovation, professionals can seize the abundant opportunities awaiting them in the realm of finance services.

5 notes

·

View notes