#GST Service Provider

Explore tagged Tumblr posts

Text

#gst services#taxes#business#gst#gst filing#capital gains tax#finance#gst registration#business growth#business ideas#ITR#ROC#GST#tax services#tax consultant#finances#taxation#services#gst service provider#gst filing chennai#company registration#efiletax#Efiletax#llp#private limited company registration in chennai#best gst registration company chennai

0 notes

Text

Hassle-Free GST Filing

We handle all your GST compliance needs so you can focus on growing your business!

🔹 Timely Return Filing

Avoid penalties with our on-time GST return filing services.

🔹 Expert Assistance

Get guidance from tax professionals for error-free filings.

🔹 Affordable Pricing

Cost-effective GST solutions tailored for businesses of all sizes.

🔹 24/7 Support

Got GST queries? We’re here to help anytime, anywhere!

🔹 Automated Reminders

Contact Now @+91-9312888823 Never miss a deadline with our proactive filing reminders.

#income tax#gst registration#gst filing#gst service provider in Noida#gst compliance#new gst services

0 notes

Text

#ESI#EPF#provident#EMPLOYEE STATE INSURANCE#gst services#digital signature#accounting#finance#income tax

0 notes

Text

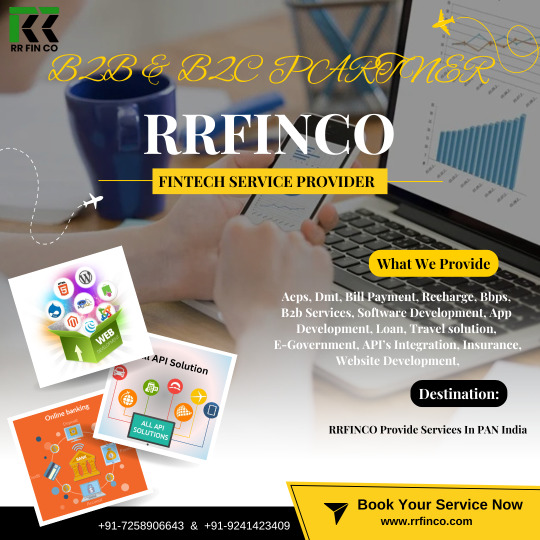

B2B Fintech Service Provider

Making Life Simple, RR Fin Co. bridges the gap between untouched market segments and service providers, offering a wide range of financial and utility services to simplify your life.

#gst services#aeps software#account opening#api integration#b2b service#b2c services#api solution#dmt software#loan service#recharge software#bill payment#b2b lead generation#mobile app design bd#best aeps service provider#aeps#fintech app development company#app development company#mobile app development#distributor#fintech solutions#fintech industry#fintech company#mutual fund#fintech software#software company#it company#credit card#commercial#dmt#gamming software

1 note

·

View note

Text

Best SAP B1 & ERP Consulting | WBC Software Lab

WBC Software Lab a decade old organization an offshore software development center, entered into ERP Consulting partnered with SAP, as a SAP open ecosystem service partner.

WBC has its center of excellence built to support all its customer's needs onsite and remote. WBC offers consulting services on SAP B1 Implementation, customization, Integration and support. And with WBC's ODC it caters the other needs of the customer beyond ERP implementation on Web / Mobile application development and support services.

URL: https://wbcsconsulting.com/

Focus

Enterprise & Extended Enterprise solutions

Technical Services

Implementations and support

Track record

Long-term client-relationships

Multiple platforms and varied Functional Domains

Close to 100% successful ERP Implementations

People

Key managers involved in the implementation have over 9 years of B1 experience. Involved with SAP B1 since the time it was launched in India

Highly experienced Functional and Technical Consultants will be engaged

On an average each consultant have experience of working for over 10 successful implementation

Product

We are confident about our depth of product knowledge

Have explored and extended the product to its limits during some complex implementations

Have designed and constructed over 30 complex add-ons collectively

Have integrated SAP B1 with various external systems and applications

Have delivered mobility integrated solutions for marquee customers

Capability

Since incorporation partners has over 30 customers

We have implemented extensible solutions for Manufacturing, Sales and Distribution, Healthcare & Services

Have implemented solutions with over 25 localizations

We are very good at Rescue of failed implementation

Extensive domain expertise in finance and productions

Experience

As a team, collectively we have been involved over 150 implementations

The team has handles implementations with cycle time from 2 months to 16+ months

Average overlap of members in the proposed team is 3 years (number of years they have worked together)

#sap business one partner#sap business one cloud#sap business one hana#sap b1 pricing#sap business one solution#sap business one implementation#sap business one partners in karaikudi#sap business one erp software#sap b1 integration#erp consulting services#sap b1 consultant#wbc consulting#connect with wbc#erp expert#erp software consultant#sap implementation consultant#erp business consultant in karaikudi#consulting on erp#SAP ERP Provider#GST Implementation#SAP B1 implementation company#IT company in karaikudi#support services in karaikudi

0 notes

Text

Simplify Your GST and ESI Registrations in Hyderabad with KVR TAX KVR TAX Services is the best GST registration service providers in Kukatpally, Gachibowli, Filmnagar, Kondapur, Lingampally, Hyderabad. To get a GST registration certificate switch your existing VAT & CST registration.

#gst registration process in hyderabad#gst registration online in hyderabad#gst registration certificate in hyderabad#goods and service tax registration in hyderabad#apply for gst number online in hyderabad#gst new registration process in hyderabad#company gst registration in hyderabad#new gst registration online in hyderabad#gst registration service provider in hyderabad#esi registration process in hyderabad

0 notes

Text

Expert GST Services | GST Consultant in India

Paper Tax a reliable GST advisory and consultancy services. We assist with GST registration, returns, refunds, and compliance issues efficiently. Call: 0731 4629991 https://bit.ly/4ch9Jdt

#finance#investing#startup#economy#GST Advisory#GST Advisory Service Provider#GST Advisory Service#GST and Tax Consultant#GST Consultant Online#GST Consultant

0 notes

Text

Get GST return filing with Delhi’s top online services! Our user-friendly platforms offer quick submission, efficient document management, and automated accuracy checks. Stay updated with real-time status notifications and secure your data with advanced encryption. Simplify your GST compliance today with the best services near you.

#GST Return Filing Online#Online GST Return Filing in Delhi#GST Return Filing Service Provider#GST Return Filing Consultants Near Me#GST Filing Services Near Me

0 notes

Text

Understanding the GST Registration Process in Hyderabad

Navigating the GST registration process can be daunting, especially if you're a business owner in Hyderabad looking to ensure compliance while focusing on growth. At KVRTaxServices, we specialize in simplifying the GST registration process in Hyderabad, offering comprehensive support and guidance to help you obtain your GST registration certificate efficiently. Here's how we can assist you with your GST needs.

GST Registration Online: A Seamless Experience

Applying for GST registration online in Hyderabad can save you significant time and effort. Our team at KVRTaxServices ensures that the GST new registration process in Hyderabad is straightforward and hassle free. We guide you through every step, from filling out the necessary forms to submitting required documents, ensuring that you can focus on running your business.

Goods and Services Tax Registration in Hyderabad: Why It’s Essential

It is essential to acquire a current GST registration certificate if you operate any company in Hyderabad. It not only gives your company legitimacy, but it also enables you to bill clients for GST and obtain input tax credits. Our professionals can assist you if you need to renew your current registration or are wanting to apply for a GST registration online in Hyderabad for the first time.

Comprehensive GST Registration Services in Hyderabad

Company GST Registration Tailored Solutions

Every business is unique, and so are its GST requirements. Our company, we provides tailored company GST registration in Hyderabad, ensuring that your business meets all legal requirements and avoids potential penalties. Our personalized approach guarantees that your registration process aligns with your specific business needs.

New GST Registration Online Quick and Efficient

If you’re starting a new business or expanding your operations, getting a new GST registration online in Hyderabad is a crucial step. Our efficient services ensure that you receive your GST registration certificate without unnecessary delays, allowing you to commence your business activities promptly.

Expert GST Filing Services in Hyderabad

GST Filing Services: Stay Compliant

Once you have your GST registration, staying compliant with regular filings is essential. Our GST filing services in Hyderabad are designed to help you stay on top of your obligations, avoiding hefty fines and penalties. We manage everything from GST e-filing to ensuring accurate and timely submissions of your GST returns.

GST Return Filing Service Hassle Free Management

Managing GST return filings can be complex and time consuming. With our GST return filing service in Hyderabad, we take the burden off your shoulders. Our experts ensure that all your GST returns are filed accurately and on time, helping you stay compliant and focus on your core business activities.

Why Choose KVRTaxServices for GST Registration and Filing in Hyderabad?

Expertise and Experience

At KVRTaxServices, we pride ourselves on our deep understanding of the GST registration process in Hyderabad. Our team of experienced professionals stays updated with the latest regulations and ensures that your business is always compliant with GST laws.

Customer Centric Approach

Our customer centric approach sets us apart as a leading GST registration service provider in Hyderabad. We believe in building long term relationships with our clients by offering personalized services and dedicated support.

End to End Solutions

From the initial application to ongoing filing requirements, we provide end to end GST solutions for businesses of all sizes. Our comprehensive services ensure that you never have to worry about GST compliance again.

Provide Necessary Information

Share the required documents and information with us. We’ll handle the rest, ensuring a smooth and efficient GST registration process.

Receive Your GST Registration Certificate

Once your application is processed, you’ll receive your GST registration certificate. We’ll also assist you with any subsequent filings to keep your business compliant.

Ongoing Support and Filing Services

Continue to benefit from our expert GST filing services in Hyderabad. We'll make sure your GST returns are correctly submitted on schedule, allowing you to concentrate on expanding your company.

Conclusion

Navigating the GST registration process in Hyderabad doesn’t have to be a challenge. With KVRTaxServices, you get expert guidance, efficient service, and ongoing support to keep your business compliant with GST laws. Contact us today to learn more about our GST registration and filing services in Hyderabad and let us help you simplify your GST journey.

Whether you're applying for GST registration online in Hyderabad or need assistance with GST return filing, KVRTaxServices is your trusted partner for all your GST needs.

For more information, please contact.www.kvrtaxservices.in

#gst registration process in hyderabad#gst registration online in hyderabad#gst registration certificate in hyderabad#goods and service tax registration in hyderabad#apply for gst number online in hyderabad#gst new registration process in hyderabad#company gst registration in hyderabad#new gst registration online in hyderabad#gst registration service provider in hyderabad#gst filing services in hyderabad#gst return in hyderabad#gst efiling in hyderabad#GST Return Filing Service in hyderabad#GST Return Filing online in hyderabad#GST Return Filing in hyderabad

0 notes

Text

Say Goodbye to Old Billing Accounting Software!!!!! Invest RS 300 Per Month and get the Following Business and Accounting Automation!!!! 1. How can I open software? A. Mobile Login, No PC Require, Unlimited Login 2. Can my staff log in and use it? A. Yes, the Department wise login is available 3. Can I make multiple business entries? A. Yes 4. Can I see my sales target report? A. Yes 5. Can I see my telecaller lead calling report? A. Yes 6. Can I see my daily and monthly counter sale POS Report? Yes 7. Can I see my Sales, Purchases, Inventory In & Out, and Return Report? Yes 8. Can I mark staff attendance and generate a payroll report? Yes 9. Can I manage my site projects, and daily business tasks assigned to staff reports? Yes 10. Can I register my customer booking and see the report in the calendar? A. Yes 11. Can I maintain my AMC, Service Call, Repair Call, and Subscription Call? A. Yes 12. Can I manage my production or manufacturing and get its report? A. Yes We are a registered company since 2019, MSME, MCA, GST Registered. 100% Quality, 100% Trial, and 100% Genuine Call: 9321319079, 7847884495 Mail: [email protected] » » Visit: ttinfotechs.com

#Popular Billing Software Dealers in Bhubaneshwar#Accounting & Billing Software in Bhubaneswar#Top Accounting Software Dealers in Bhubaneshwar#Billing Software In Bhubaneswar#Gst Software In Bhubaneswar#Marg Billing Software#Top Accounting Software Companies in Bhubaneswar#Accounting and GST Billing Software#Accounts & Inventory Management Software#Best Billing Software Services Company in Bhubaneswar#Retail Billing#GST#Accounting Software Sales in Bhubaneswar#Best Wholesale & Billing Management Software Company#Billing Software System Service Provider from Bhubaneswar

0 notes

Text

efiletax | Solution Provider For All Your Business Needs.

#Tax Service Provider#Best Tax Service Provider#GST Service Provider#efiletax#Efiletax#Business#GST Service Provider Chennai#GST Filing#Company Registration#LLP#ROC#GST#ITR#Incometax#Filing#Finance

0 notes

Text

GST registration Service Provider in Delhi

When a company organization registers under the GST Law, it must acquire a unique number from the relevant tax authorities. This number is used to collect taxes on behalf of the government and to claim an Input Tax Credit for taxes paid on the business's inbound supply.

GST Registration

For businesses operating in India, it is necessary to register for GST. If your business revenues exceed certain criteria or fit into a specific category that otherwise requires simple registration, you will need to register in accordance with the rules. With the help of CA Nakul Singhal and Associates, it is easy to get your desired registration. Well, these basic GST registration tips will help you in registering for GST for your business and getting your GST admission done.

Overview of GST Registration Online

Regarding taxpayers with yearly turnover below 1.5 crore, the GST framework provides an option for a composition scheme. With this arrangement, they can pay taxes at a predetermined rate based on their turnover and go through simplified GST procedures. The GST system functions at several phases of the supply chain. This includes acquiring raw materials, production, wholesale, retail, and the eventual sale to the end consumer. Notably, GST registration is imposed at every one of these steps. For instance, the GST money collected is allotted to Uttar Pradesh when a product is produced in West Bengal and used there, highlighting the consumption-based nature of GST. The Goods and Services Tax (GST) is a mandatory tax that has been in effect since July 1st, 2017, for all manufacturers, traders, service providers, and independent contractors that operate in India. Service tax, excise duty, CST, entertainment tax, luxury tax, and VAT were among the state and federal taxes that were replaced by the GST system, which expedited the tax filing procedure. An option for a composition plan is provided by the GST framework for taxpayers with an annual revenue of less than? 1.5 crore. With the help of this program, they can pay taxes at a set rate based on their turnover and go through simplified GST processes. At several points in the supply chain, the GST process is in effect. Purchasing raw supplies, manufacturing, selling at wholesale and retail, and finally making the final sale to the customer are all included. Notably

Service Providers' GST Registration

In India, service providers with a revenue of less than 20 lakhs who supply items either intrastate or interstate are exempt from registration requirements. The decision, made at the 23rd GST Council meeting, modifies the previous rule that required interstate suppliers to file returns and register for GST regardless of their level of revenue.

Person Taxable on a Casual Basis

Under GST, all casual taxable persons are entitled to special treatment. In a State or Union territory where the entity does not have a fixed place of business, the GST Act defines a casual taxable person as someone who periodically engages in transactions involving the supply of goods or services, or both, in the course or furtherance of business, whether as a principal, agent, or in any other capacity. Therefore, individuals operating seasonal enterprises or transient firms at fairs or exhibitions would be considered casual taxable persons for the purposes of the GST. This article examines casual taxable persons' GST registration.

Non-resident Taxable Individual

A non-resident taxable person is an individual who engages in the supply and receipt of commodities without having a permanent business or place of abode in the nation. There is no turnover cap, just like with a Casual Taxable person. In contrast to other taxpayers, an unregistered individual does not need to supply their pan number; instead, they must provide their unique identification number or tax identification number, which can be used to confirm their identity. The individual in question is required to register at least five days before to the start of their business and pay the requisite advance money, for which they are responsible. Notably, a non-registered tax person should submit an application using form GST-REG-09, a shortened version of the standard form.

Throughout the supply chain, the GST system is operational at multiple stages. This includes obtaining raw materials, producing, distributing, selling at retail, and making the last sale to the client. Particularly, a casual taxable person is someone who occasionally conducts business in a state or territory without an established place of business involving the delivery of goods and/or services. No matter how much business they bring in, they have to pay taxes. These taxpayers are not subject to the composition levy. At least five days before the commencement of operation, the interested party must submit an application for registration. In the event that they are accountable, they have to prepay the taxes. He'll be allowed to carry on offering

Extra Guidelines

To register for GST, an individual must have registered for any of the previous tax systems, such as VAT, service tax, or excise duty. When a firm is transferred from one person to another, the new owner of the rights has to register for GST. employees of a supplier. Operator of an online store. anyone who supplies through an online retailer. Anybody providing a non-registered Indian citizen with specific information from any place outside of India.

GST Registration for Several Locations

The CGST Act mandates that all providers of taxable goods and services register with the GST in the State or Union territory where the taxable supply of goods or services occurs. In addition, the GST Registration Rules include provisions for branches to get GST registration. We take a close look at branch GST registration in this article.

Records Needed for Enrollment

The following paperwork is needed to register for GST in India: All Directors' Aadhar cards Each Director's PAN card A working mobile number in India an active email address Required Paperwork Proof of business address a. Rental agreement or lease agreement if the firm is located in a rental b. A NOC from the owner or landlord (even in cases where the location is one of the directors') A recent electricity bill OR a receipt for property taxes An authorized signatory who resides in India and possesses the required documentation, including a valid PAN number At least one member, proprietor, partner, trustee, or Karta with a current PAN The bank's Indian financial system code (IFSC) and valid Indian bank account number Details of the jurisdiction PAN number for the company Memorandum of Association (MoA) and Incorporation Certificate For a list of all necessary documents, see this link.

Visit - https://canakulsinghalassociates.com/

Contact us - +9199537 75505

Email ID - [email protected]

1 note

·

View note

Text

#gst registration#gst registration in bhubaneswar#Taxation Service In Bhubaneswar#GST service Provider in Odisha

0 notes

Text

B2B & B2C Partner

All Type Fintech services like: AEPS, DMT, recharge, Bill Payment, Loan, Insurance, b2B Service, Whitelabel, reseller panel, Bbps, UPI/QR, Software & Application Development services result in tailored and easy-to-evolve solutions for automated financial service delivery.

#rrfinco #rrfinpay #b2bservice #whitelabelservice #resellerservices #b2bsoftware #whitelabelsoftware #b2bSoftwareCompany #whitelabelSoftwareCompany

#aeps #appserviceprovider #aepsservice #top10aepsservice #fintech #fintechservice #softwarecompany #rechargesoftware #dmt #bbps #billpayment #pancard #giftcard #fasttag #insurance #dthrecharge #mobilerecharge #whitelabelSoftware #b2bsoftware #resellersoftware #b2bservice #whitelabelservice #mobileapplication #gameapplication #loan #DematAccountOpening #PayLICpremium #softwarecompany #websitecompany #softwaredevelopmentCompany #fintechsoftware #b2bsoftware #whitelabelsoftware #mlmsoftware #mlmsoftwaredevelopment #b2bsoftwaredevelopment #fintechsoftwaredevelopment #AePS #dmt #aepsservice #apes #upi #loan #loanservices #Payment #paymentgateway #eGoverment #travels #insurance #insurancecoverage #DTHrecharge #mobilerecharge #billpayments #Adharpay #paymentgateway #paymentsolutions #CMS #HotelBookings #ticketbookings #API

#account opening#aeps software#gst services#api solution#api integration#recharge software#loan service#dmt software#b2b service#b2c services#whitelabel software development#white label services#white label agency#white label solution#whitelabel service#bill payment software#best aeps service provider#bill payment#b2b lead generation#e commerce software#software company#mlm software

0 notes

Text

What is the Difference Between a Vendor and a Merchant?

#What is the Difference Between a Vendor and a Merchant?#how to become a merchant exporter#the merchant of venice#the merchant#merchant account#what is the best point of sale system#merchant services#what is the best pos system#merchant fulfilled and fulfillment by amazon#merchant#merchant account providers#is this a cold call#merchant fulfilled#how to rent a container to ship overseas#is this a sales call#vendor central#how to build a shopify store#what is distribution management#merchant exporter in gst

1 note

·

View note

Text

Simplify Your GST and ESI Registrations in Hyderabad with KVR TAX

Navigating the gst registration process in hyderabad can be daunting for businesses, but with KVR TAX, it becomes straightforward and hassle-free. Whether you are a new business or an established company, our experts provide comprehensive guidance to ensure a smooth experience when applying for GST and ESI registrations. Here's a step-by-step look at how to get your gst registration online in hyderabad and understand the essential requirements.

Understanding the GST Registration Process

The goods and service tax registration in hyderabad is mandatory for businesses with an annual turnover exceeding the specified threshold. GST registration enables businesses to collect tax from customers and claim input tax credits on purchases. At KVR TAX, we assist businesses in every step of the gst new registration process in hyderabad, ensuring they comply with all legal requirements.

Step-by-Step Guide to GST Registration

apply for gst number online in hyderabad: The first step is to apply for GST registration through the official GST portal. You need to create a temporary reference number (TRN) to begin the application process.

company gst registration in hyderabad: For companies, the registration process involves submitting documents such as PAN, proof of business registration, address proof, and bank account details. Our experts can help you compile and submit these documents correctly.

Verification: Once the documents are submitted, the GST officer will verify them, and you may be asked for additional information if needed.

Issuance of gst registration certificate in hyderabad: Upon successful verification, the GST registration certificate will be issued, which includes your GSTIN (GST Identification Number). This certificate is crucial for your business operations.

KVR TAX provides end-to-end support throughout this process, making it easier to obtain your GST registration without any delays or complications.

Benefits of Choosing KVR TAX for GST Registration

We pride ourselves on being a reliable gst registration service provider in hyderabad, offering personalized assistance tailored to your business needs. Our team is experienced in handling all aspects of the GST registration process, making the experience seamless for you. With KVR TAX, you don’t just get registration services but also ongoing support for any GST-related queries or compliance needs.

How to Apply for ESI Registration in Hyderabad

Apart from GST registration, KVR TAX also offers guidance on the esi registration process in hyderabad. ESI (Employee State Insurance) is a health insurance scheme for employees, which is mandatory for companies with more than ten employees. The ESI registration process involves submitting various employee and company details through the ESIC portal.

Conclusion

KVR TAX stands as a trusted partner for businesses looking for efficient and reliable tax and registration services in Hyderabad. Whether you need assistance with the new gst registration online in hyderabad or require guidance on the ESI registration process, we have got you covered. Our team ensures that your registration is completed quickly, accurately, and with minimal hassle, helping your business stay compliant with all necessary regulations.

Let KVR TAX take care of your gst registration process in hyderabad and ESI registration process in Hyderabad so that you can focus on growing your business. Contact us today to learn more about our services and get started on your registration journey!

#gst registration process in hyderabad#gst registration online in hyderabad#gst registration certificate in hyderabad#goods and service tax registration in hyderabad#apply for gst number online in hyderabad#gst new registration process in hyderabad#company gst registration in hyderabad#new gst registration online in hyderabad#gst registration service provider in hyderabad#esi registration process in hyderabad

0 notes