#Form 2290 due Date

Explore tagged Tumblr posts

Text

🚚📝 Trucker's Guide to Hassle-Free 2290 Form Filing! 📝🚚

Are you a hardworking trucker looking for a smoother way to handle your 2290 Form filing? Well, look no further! Truck2290 is here to provide you with an easy and interactive online filing service that will save you time, effort, and the headaches that often come with tax season.

1. Say Goodbye to Tedious Paperwork! 📑

Gone are the days of drowning in mountains of paperwork. With Truck2290's online filing service, you can complete your 2290 Form in just a few simple steps. Say farewell to long hours of filling out forms manually, and say hello to a user-friendly digital solution.

2. File Anywhere, Anytime! 🌐🕒

As a trucker, you're always on the move, and we understand that. That's why Truck2290's platform is accessible 24/7 from any device with an internet connection. No more waiting in line at the IRS office or rushing to find a computer. File your 2290 Form wherever and whenever you please!

3. Prompt and Precise Filing! ⏰✅

Late filing can lead to penalties, and inaccuracies can cause unnecessary complications. Our platform ensures that your 2290 Form is filed promptly and accurately, saving you from potential penalties and worries. Rest easy, knowing your tax responsibilities are well taken care of.

4. Professional Support at Your Fingertips! 💼📞

Got a question or need assistance? Our friendly support team is just a call or click away! Truck2290 is committed to providing you with the support you need throughout the filing process. Whether you have a query about the form or need help with any technical issues, we've got your back!

5. Secure and Confidential! 🔒🤐

We understand the importance of safeguarding your sensitive information. Rest assured that your data is handled with utmost security and confidentiality. Our platform employs state-of-the-art encryption and security measures to protect your privacy.

6. Convenient Payment Options! 💳💵

We know how important it is to have flexible payment options. That's why Truck2290 offers multiple payment methods, making it easy for you to complete your tax filing without any unnecessary hassle.

7. Stay Updated and Informed! 📢📊

Taxes can be complex, and regulations may change. But don't worry, we've got you covered. Truck2290 keeps you informed about any updates or changes that may affect your tax filing, ensuring you stay compliant with the latest regulations.

So, dear truckers, make your life easier and stress-free by choosing Truck2290 for your 2290 Form filing needs. Let us handle the paperwork while you hit the road with confidence! 🚛💨

Visit our website now (www.truck2290.com) and experience the convenience of hassle-free 2290 Form filing. Join thousands of satisfied truckers who have already made the switch to Truck2290!

0 notes

Text

Underst

Renewing your IRS Form 2290 is crucial for truck owners with vehicles weighing 55,000 pounds or more. The process is simple, especially when using eForm2290.com.

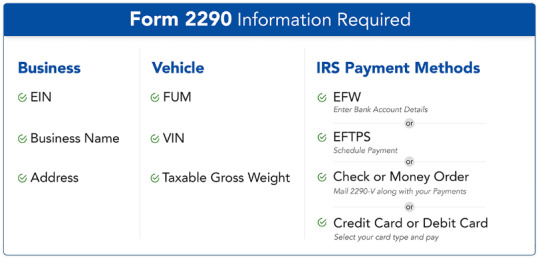

You can start by registering, adding your business details, and providing vehicle information. You'll choose your filing type, add the necessary details, and review everything before submitting. Payment options include Electronic Funds Withdrawal (EFW), EFTPS, debit/credit card, or check/money order. After filing, you’ll receive your stamped Schedule 1 via email. It’s important to renew by August 31 each year to avoid penalties, which can be significant.

eForm2290.com offers timely reminders and 24/7 customer support to ensure you never miss a deadline and can file your HVUT return easily and accurately.

0 notes

Photo

Tomorrow is the last date to report pro-rated form 2290 HVUT for December used heavy vehicles. E-file pro-rated form 2290 at Tax2290.com and get your schedule 1 copy now! More Visit at: https://blog.tax2290.com/tomorrow-is-the-last-date-to-e-file-pro-rated-form-2290-taxes-for-december-used-vehicles/

#Tax2290#Form 2290#Form 2290 Prorated Tax#Prorated Tax Deadline is Tomorrow#Form 2290 Partial Period Tax#Form 2290 pro-rated truck taxes#2290 prorated tax due date#December 2022 is due on January 31st 2023

0 notes

Text

Empowering Logistics Companies | Form 2290

Welcome to the 2024 Key Tax Deadline and Strategies Season!

As we approach January 29th, the begin of the e-filing season, it’s time to center on proficient and stress-free assess filing.

We are committed to directing you through this prepare, guaranteeing a smooth involvement. Our group is here to oversee your monetary obligations with mastery and care, making assess recording direct and worry-free.

Forms to Anticipate by the Conclusion of January or the Starting of February Form W-2G: For detailing betting winnings. Form 1099-C: For announcing obligation of $600 or more canceled by certain monetary substances counting monetary teach, credit unions, and government government agencies. Form 1099-DIV: For announcing profits and selling distributions. Form 1099-G: For announcing certain government installments, counting unemployment recompense and state and nearby charge discounts of $10 or more.

Form 1099-INT: For detailing intrigued, counting intrigued on conveyor certificates of deposit. Form 1099-K: For announcing installments gotten from a third-party settlement entity. Form 1099-LS: For detailing reportable approach deals of life insurance. Form 1099-LTC: For announcing long-term care and quickened passing benefits. Form 1099-MISC: For detailing eminence installments of $10 or more, lease or other commerce installments of $600 or more, prizes and grants of $600 or more, edit protections continues of $600 or more, angling pontoon continues, restorative and wellbeing care installments of $600 or more.

Form 1099-NEC: For announcing nonemployee compensation. Form 1099-OID: For announcing unique issue discount. Form 1099-PATR: For announcing assessable disseminations gotten from cooperatives. Form 1099-Q: For detailing conveyances from 529 plans and Coverdell ESAs. Form 1099-QA: For detailing disseminations from ABLE accounts. Form 1099-R: For detailing conveyances from retirement or profit-sharing plans, IRAs, SEPs, or protections contracts. Form 1099-SA: For announcing conveyances from HSAs, Toxophilite MSAs, or Medicare Advantage MSAs. Form 1098: For announcing $600 or more of contract interest. Form 1098-E: For detailing $600 or more of understudy advance interest. Form 1098-MA: For announcing contract help payments. Form 1098-T: For announcing qualified educational cost and expenses. Form 8300: For announcing exchanges of more than $10,000 in cash (counting computerized resources such as virtual cash, cryptocurrency, or other advanced tokens speaking to value).

Form 8308: For detailing trades of a organization intrigued in 2023 that included unrealized receivables or significantly acknowledged stock items. Form 5498: For announcing IRA commitments, counting conventional, Roth, SEPs, and SIMPLEs, and giving the December 31, 2023, reasonable advertise esteem of the account and required least dispersion (RMD) if applicable. For proficient handling of your assess return, it is fundamental that we accumulate all essential data. It would be ideal if you fill out the brief Admissions Sheet.

Your precise reactions on the Admissions Sheet will empower us to give you with the best conceivable benefit and guarantee compliance with charge regulations. Convenient Arrangements and Custom fitted Assistance: Tax Deadline Understanding the complexities of assess season, G&S Bookkeeping offers helpful arrangements for record accommodation.

If you’re in the Rancho Cucamonga range, feel free to drop off your printed material at our office. Alternatively, secure online transfers are accessible. Our objective is to make your assess due date encounter as consistent as conceivable. For organizations with financial year plans, we give custom-made bolster to help in recognizing and assembly particular assess due date, guaranteeing prompt compliance. Conclusion: Set out on a Smooth Charge Journey: As the charge season unfurls, let us at G&S Bookkeeping ease your travel. With our mastery and personalized approach, we’re committed to guaranteeing a smooth and effective charge recording involvement for you.

Ready to begin? Provide us a call, and take the to begin with step towards a worry-free charge season.

0 notes

Text

Form 2290 Penalties and Fees: What To Look Forward To

This is very important Form for any person who drives heavy vehicles on public highways as it is related to the Heavy Vehicle Use Tax (HVUT). Nevertheless, incorrect or late filing of these forms can attract severe penalties and fees. One must have a good knowledge of these effects in order to avoid unnecessary expenses and complications

As a result, amounts due from delayed submission could snowball into considerable sums. More often than not, the Internal Revenue Service (IRS) levies fines for not filing the 2290 form by its due date which usually falls on the last day of the month that succeeds the month when you started using your vehicle(s). A penalty of up to 4.5 % per month can accumulate if you fail to meet this deadline up to five months, this also mounts up greatly. Furthermore, $100 is imposed as a minimum fine just in case the tax remains unpaid after it becomes overdue.

Furthermore, interest rates are applied on unpaid taxes besides late filing penalties. The interest rate is equal to federal short term rate plus 3% and starts accruing from the date when return was due until such time as tax is fully paid back. This may significantly increase your liability especially if payment is seriously delayed. For an individual to avoid this kinds of fines including interests there’s need to promptly file his/her Form 2290 and ensure that all taxes have been paid in full. Consistently checking IRS updates while employing digital methods helps simplify everything while minimizing any chances for errors

0 notes

Text

Tax Compliance Tips For Trucking Companies

Tax compliance for trucking companies requires diligence, strategic planning, and adherence to regulatory requirements specific to the industry. Trucking companies often benefit from partnering with an accountant for truck drivers who specializes in navigating the complexities of taxation and financial management within the trucking sector. Here are essential tax compliance tips tailored specifically for trucking businesses:

Understanding Tax Obligations

Income Tax Requirements:

Trucking companies are subject to federal, state, and local income taxes based on their taxable income, which includes revenue from freight hauling and other related services.

Income tax rates and regulations vary by jurisdiction, requiring careful calculation and reporting to ensure compliance.

Fuel Taxes:

Fuel taxes, such as the federal excise tax (FET) on diesel fuel, are significant for trucking operations. Companies must file Form 2290 for heavy highway vehicles and comply with International Fuel Tax Agreement (IFTA) requirements for reporting fuel usage across multiple states.

Keeping accurate records of fuel purchases and mileage is essential for calculating and reporting fuel tax liabilities accurately.

Employment Taxes:

Trucking companies must comply with employment tax requirements, including withholding federal income tax, Social Security, and Medicare taxes from employee wages.

Proper classification of drivers as employees or independent contractors is critical to avoid misclassification penalties and ensure compliance with payroll tax obligations.

Tax Planning Strategies

Depreciation and Equipment Costs:

Take advantage of accelerated depreciation methods, such as Section 179 deductions and bonus depreciation, for trucks, trailers, and other equipment purchases.

Regularly review and update depreciation schedules to reflect changes in asset values and tax laws, maximizing tax savings opportunities.

Deductions and Credits:

Identify and claim deductions related to ordinary and necessary business expenses, including fuel costs, maintenance, repairs, insurance premiums, and administrative expenses.

Utilize tax credits available to trucking companies, such as the biodiesel and alternative fuel credits, to offset tax liabilities and improve cash flow.

Record-Keeping and Documentation:

Maintain thorough and organized records of income, expenses, mileage logs, fuel purchases, and other financial transactions.

Electronic logging devices (ELDs) and automated record-keeping systems help streamline documentation processes and ensure accuracy in tax reporting.

Compliance Tips

Stay Updated on Tax Laws and Regulations:

Monitor changes in federal, state, and local tax laws that impact the trucking industry, including updates on fuel tax rates, deduction limits, and compliance requirements.

Attend industry seminars, consult with tax professionals specializing in trucking, and leverage resources from industry associations to stay informed.

File Accurate and Timely Tax Returns:

File tax returns, including income tax, fuel tax, and payroll tax filings, accurately and before the due dates to avoid late penalties and interest charges.

Electronically file tax returns where possible to expedite processing and reduce the risk of errors associated with manual filings.

Engage with Tax Professionals:

Collaborate with certified public accountants (CPAs) or tax advisors experienced in trucking industry taxation to develop effective tax planning strategies, ensure compliance, and navigate complex tax issues.

Seek guidance on tax audits, respond promptly to IRS inquiries, and maintain open communication with tax professionals to address potential issues proactively.

Conclusion

Tax compliance for trucking companies requires diligence, strategic planning, and adherence to regulatory requirements specific to the industry. By understanding tax obligations, implementing effective tax planning strategies, maintaining accurate records, and collaborating with tax professionals, trucking companies can optimize tax efficiency, mitigate risks, and ensure financial stability. Proactive compliance not only minimizes tax liabilities but also enhances operational efficiency and supports long-term growth in the competitive trucking industry landscape.

0 notes

Text

Complete HVUT Filing by August 31 to Secure Schedule 1 and Send in Form 2290 Copy

Up to the deadline: Utilize Truck2290.com to submit Form 2290 before the due date Truck2290.com, an IRS-authorized e-file service, is contacting truckers to remind them of the impending due date and to promote the hassle-free alternatives they offer for a flawless filing experience as the annual deadline for filing Form 2290 approaches. The Form 2290 submission date is quickly approaching, therefore time is of the importance. To ensure timely submission and stay clear of any fines, truckers are recommended to take advantage of Truck2290.com's quick and effective services. Form 2290 must be submitted by August 31, 2023.

For many truckers, submitting Form 2290 can be a difficult task that is fraught with difficulties like difficult paperwork, perplexing processes, and protracted processing times. Truck2290 is aware of these difficulties and has created a platform that offers workable answers.

AutoMagic2290 — Data entering work is made easier: The creative AutoMagic2290 is one of the platform's distinguishing qualities. Users can have their Form 2290 automatically pre-filled by uploading a copy of their prior year Schedule 1, which drastically minimizes the time and effort needed for data entry. Modern technology speeds up the procedure and makes sure that reliable data is submitted quickly.

Tailored interfaces for all needs: Truck2290 offers specialized interfaces for both single- and multiple-vehicle filing because they are aware that truckers' needs can differ. This specialized method guarantees that each user's particular needs are satisfied, streamlining the procedure and reducing misunderstanding.

Truck2290 uses clever IRS validations to find any problems and inconsistencies before submission. This is a step toward reducing rejections. This feature is intended to lessen the likelihood of rejection due to errors, as well as the necessity for re-filing and other delays.

As the deadline for Form 2290 draws near, Alex from Truck2290 underlined the value of moving quickly, adding, "We want to make sure that truckers have a pleasant and trouble-free experience while e-filing. Our platform is made to take care of the frequent problems encountered in this procedure, giving truckers a convenient answer that reduces time and unneeded stress.

Truck2290 is a trustworthy partner in navigating the difficulties of tax filing for truckers looking for a dependable and expedient solution to e-file Form 2290 and get their Schedule 1 copy right away.

About Truck2290: Truck2290.com is an IRS-approved e-file company that specializes in helping truckers submit Form 2290 electronically without any hassle. Truck2290 wants to make the tax filing process for truckers simpler and less stressful with its cutting-edge features.

#2290duedate#trucktax#irsform2290#taxfiling#form2290#irs2290#truck2290#hvut#heavyvehicletax#taxseason

0 notes

Text

For heavy vehicles with a taxable gross weight of 55,000 pounds or more, the IRS form 2290 due date is by August 31 of every year. For newly purchased vehicles, form 2290 must be filed by the last day of the month following the month of first use.

1 note

·

View note

Video

tumblr

Form2290filing.com provides 100%Accurate & 100%Simple to file E-file IRS Form 2290. It's easy to file form 2290 tax for 2021. Call: (316) 869-0948

1 note

·

View note

Text

The countdown begins now! Don't wait until the last minute to submit HVUT Form 2290

E-file now with simple steps.

website: https://truck2290.com/

mail: [email protected]

0 notes

Text

IRS Form 2290 Due Dates: Stay Compliant with eForm2290

Discover essential IRS Form 2290 due dates at eForm2290. Stay updated on deadlines for heavy vehicle owners to file their taxes and ensure compliance with federal regulations. Our comprehensive guide provides clear, concise information on when and how to submit Form 2290, avoiding penalties and ensuring timely tax payments. Whether you're a fleet manager or an owner-operator, our resources simplify the process, helping you stay on track with your tax obligations. Trust eForm2290 for accurate due date information and reliable filing support, ensuring your vehicles remain compliant with IRS requirements throughout the tax year

0 notes

Photo

Dear truckers! The last date to e-file form 2290 HVUT on a pro-rated basis for your December used heavy vehicles is January 31, 2023. As the deadline is just a week away, you must e-file form 2290 at Tax2290.com today!

#Tax2290#Form 2290#Form 2290 Prorated Tax#Form 2290 Partial Period Tax#Form 2290 pro-rated truck taxes#2290 prorated tax due date

0 notes

Link

File the IRS form2290 with Affordable and best online tax filing service provider for your HVUT, Use ROAD20 to get 20% off, File your tax and schedule1 within a minutes

2 notes

·

View notes

Text

Form 2290 Due date for the tax year 2022-2023

What is Form 2290?

IRS Form 2290 is a Heavy Vehicle Use Tax (HVUT), it should be filed if you run vehicles with a taxable gross weight of 55,000 pounds or more. And also you should file 2290 tax if your vehicle exceeds 5,000 miles or 7,500 miles (for agricultural vehicles) in a tax period.

When is the Form 2290 Due date?

Form 2290 due date for 2022-2023 tax year is August 31.

Failing to file HVUT will result in penalties and interest, which is assessed on a monthly basis.

Late filers not paying HVUT will also face an additional monthly penalty.

Information required to file Form 2290

Business Name, Address and Employer Identification Number (EIN).

Vehicle Identification Number (VIN), First Used Month (FUM), Taxable Gross Weight, Suspended vehicles (if any).

Review and transmit.

Benefits of filing Form 2290 with ExpressTruckTax

File Form 2290 with ExpressTruckTax, and avail several benefits such as,

Guaranteed Schedule 1 or money back

Free VIN Checker and VIN Correction

Bulk information upload

Copy last year’s return

0 notes

Video

tumblr

Form 2290 taxes for Truck are simple, Affordable & convenient with Form2290OnlineFiling. Start filing form 2290 Online and Get Schedule 1 Proof In Minutes. More: https://www.form2290onlinefiling.com/

#E-File 2290#Heavy Highway Use Tax#2290 Tax Form#Tax Form 2290#2290 Online#Form 2290 Due Date#IRS Form 2290

0 notes

Text

When Taxes are Due on Form 2290

Form 2290 is used to report and pay the Heavy Vehicle Use Tax (HVUT) for vehicles operating on public highways with a gross weight of 55,000 pounds or more. The due date for Form 2290 taxes varies based on the tax period and when the vehicle was first used during that period.

Here are the general deadlines:

Annual Filing Deadline: For most vehicles, the tax period begins on July 1st and ends on June 30th of the following year. The annual filing deadline for Form 2290 is typically August 31st of each year. This means that if your vehicle falls within this tax period, you would need to file Form 2290 by August 31st.

First Used Month Deadline: If a heavy vehicle is first used in any month other than July, the HVUT is prorated for that tax year. In this case, the Form 2290 filing deadline is the last day of the month following the month in which the vehicle was first used. For example, if a vehicle is first used in October, the deadline to file Form 2290 for that vehicle would be November 30th.

#truck2290#irs2290#irsform2290#hvut#trucktax#2290duedate#form2290#taxfiling#taxseason#heavyvehicletax

0 notes