Don't wanna be here? Send us removal request.

Text

Form 2290 Due date for the tax year 2022-2023

What is Form 2290?

IRS Form 2290 is a Heavy Vehicle Use Tax (HVUT), it should be filed if you run vehicles with a taxable gross weight of 55,000 pounds or more. And also you should file 2290 tax if your vehicle exceeds 5,000 miles or 7,500 miles (for agricultural vehicles) in a tax period.

When is the Form 2290 Due date?

Form 2290 due date for 2022-2023 tax year is August 31.

Failing to file HVUT will result in penalties and interest, which is assessed on a monthly basis.

Late filers not paying HVUT will also face an additional monthly penalty.

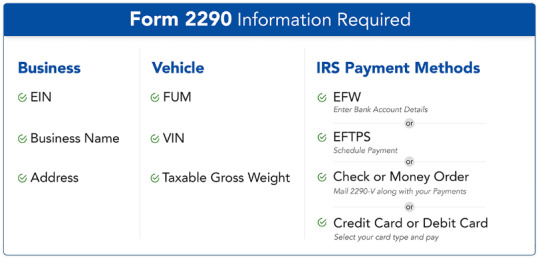

Information required to file Form 2290

Business Name, Address and Employer Identification Number (EIN).

Vehicle Identification Number (VIN), First Used Month (FUM), Taxable Gross Weight, Suspended vehicles (if any).

Review and transmit.

Benefits of filing Form 2290 with ExpressTruckTax

File Form 2290 with ExpressTruckTax, and avail several benefits such as,

Guaranteed Schedule 1 or money back

Free VIN Checker and VIN Correction

Bulk information upload

Copy last year’s return

0 notes

Text

IRS Form 2290 Due date for 2022 - 2023 is August 31

Form 2290 - An Overview

IRS Form 2290 should be filed if you run a vehicle with a combined gross weight of 55,000 pounds or more. Also you should file tax, If your vehicle exceeds 5,000 miles or 7,500 miles for agricultural purposes in a given tax period.

Due date for Form 2290

The due date to file Form 2290 for the year 2022 - 2023 is August 31, 2022.

Due date should be filed based on the First Used Month (FUM) of the vehicle.

If your FUM is July 1, then your due date is August 31.

If you fail to file Form 2290, you are liable for penalties and interest.

Steps to file Form 2290

Step 1:

Enter your Business Name, Address and Employer Identification Number (EIN)

Step 2:

Fill your Form 2290 by submitting your Vehicle Identification Number (VIN), Taxable Gross Weight, First Used Month (FUM), Suspended Vehicle (if any), Third party Designee detail, etc.

Review and Transmit your IRS Form 2290

Benefits of filing Form 2290 with ExpressTruckTax

Filing Form 2290 with ExpressTruckTax is Easy. Benefits include

Receive stamped Schedule 1 in minutes

Guaranteed Schedule 1 or your money back

Instant Error Check

Free VIN Checking and VIN Correction

Bulk Information Upload

Multi User Access

1 note

·

View note