#2290duedate

Explore tagged Tumblr posts

Text

Who Needs to File Heavy Vehicle Use Tax?

Who needs to file Heavy Vehicle Use Tax (HVUT)? If you own or plan to register a heavy vehicle, filing Form 2290 is mandatory. Additionally, any vehicle weighing 55,000 pounds or more, regardless of load, must comply with HVUT requirements. Understanding these obligations ensures compliance with IRS regulations.

0 notes

Text

Form 2290 E-Filing is mandatory if you are Filing Form 2290 for 25 or more vehicles

Find out Here: https://www.truck2290.com/hvut/e-file-form-2290/

0 notes

Text

Benefits to File IRS Form 2290 Online for 2019-20

You will get a lot of benefits to File IRS Form 2290 online for 2019-20. Filing your 2290 Form in an Online saves a lot of time & money. Filers no need to go to IRS office, by sitting at one place you can complete IRS Tax Form 2290 Online Filing. You can File 2290 Form Online any time from any device. Stamped 2290 Schedule 1 Proof will be available in minutes through 2290 Online Filing. Complete your IRS Form 2290 online Filing in minutes with Authorized E File Provider Form2290Filing & get 2290 Schedule 1 proof instantly for 2019-20. Visit https://www.form2290filing.com to check out all the benefits to File IRS Form 2290 Online for 2019-20

#Form2290Filing#IRSForm2290Online#2290Form2019#Form2290#2290Online#IRSForm2290#2290Online2019#2290TruckTax#Form2290OnlineFiling#2290DueDate

0 notes

Text

#truck2290#form2290#irs2290#2290duedate#taxfiling#trucktax#hvut#irsform2290#heavyvehicletax#taxseason

0 notes

Text

#irs2290#2290duedate#taxfiling#hvut#trucktax#irsform2290#taxseason#form2290#heavyvehicletax#truck2290

0 notes

Text

Streamlining Your 2290 Forms with an IRS-Approved Provider Simplify the process of filing your 2290 forms by choosing an IRS-approved provider. As an accountant at Form 1099 Online Filing, we offer unparalleled services with competitive pricing, ensuring filers receive the best value. Discover the numerous advantages for both employees and customers at Truck2290.com, your go-to destination for efficient and cost-effective 2290 form solutions."

0 notes

Text

How To Correct a VIN Error After the Deadline: Form 2290 Amendments Correcting a VIN error post-deadline? Discover the step-by-step guide to rectify your Vehicle Identification Number mistakes efficiently. From navigating online platforms to submitting revised forms, ensure a seamless correction process for accurate records.

0 notes

Text

Truck2290 is an IRS-approved & leading form 2290 e-file provider. Also, it has won millions of truckers’ trust in the most recent years. Choose us to file truck 2290 Returns & pay Heavy vehicle use taxes securely to the IRS.

#irs2290#trucktax#taxfiling#2290duedate#irsform2290#hvut#form2290#heavyvehicletax#taxseason#truck2290

0 notes

Text

Ready to file HVUT return for 2023-24? Then, hurry up! Truck2290 is the best among IRS-certified e-file providers. Choose us to submit bulk 2290s at a single click. https://www.truck2290.com

#form2290#trucktax#irsform2290#taxfiling#2290duedate#hvut#irs2290#truck2290#heavyvehicletax#taxseason

0 notes

Text

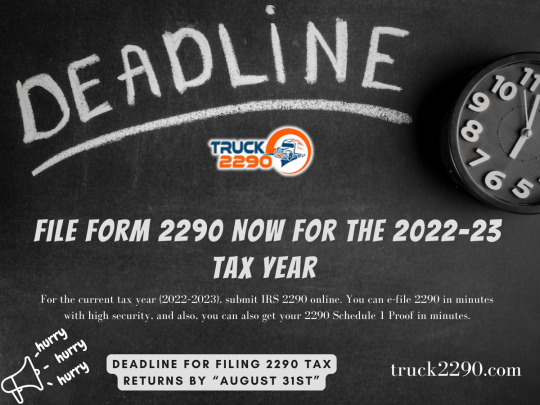

Complete HVUT Filing by August 31 to Secure Schedule 1 and Send in Form 2290 Copy

Up to the deadline: Utilize Truck2290.com to submit Form 2290 before the due date Truck2290.com, an IRS-authorized e-file service, is contacting truckers to remind them of the impending due date and to promote the hassle-free alternatives they offer for a flawless filing experience as the annual deadline for filing Form 2290 approaches. The Form 2290 submission date is quickly approaching, therefore time is of the importance. To ensure timely submission and stay clear of any fines, truckers are recommended to take advantage of Truck2290.com's quick and effective services. Form 2290 must be submitted by August 31, 2023.

For many truckers, submitting Form 2290 can be a difficult task that is fraught with difficulties like difficult paperwork, perplexing processes, and protracted processing times. Truck2290 is aware of these difficulties and has created a platform that offers workable answers.

AutoMagic2290 — Data entering work is made easier: The creative AutoMagic2290 is one of the platform's distinguishing qualities. Users can have their Form 2290 automatically pre-filled by uploading a copy of their prior year Schedule 1, which drastically minimizes the time and effort needed for data entry. Modern technology speeds up the procedure and makes sure that reliable data is submitted quickly.

Tailored interfaces for all needs: Truck2290 offers specialized interfaces for both single- and multiple-vehicle filing because they are aware that truckers' needs can differ. This specialized method guarantees that each user's particular needs are satisfied, streamlining the procedure and reducing misunderstanding.

Truck2290 uses clever IRS validations to find any problems and inconsistencies before submission. This is a step toward reducing rejections. This feature is intended to lessen the likelihood of rejection due to errors, as well as the necessity for re-filing and other delays.

As the deadline for Form 2290 draws near, Alex from Truck2290 underlined the value of moving quickly, adding, "We want to make sure that truckers have a pleasant and trouble-free experience while e-filing. Our platform is made to take care of the frequent problems encountered in this procedure, giving truckers a convenient answer that reduces time and unneeded stress.

Truck2290 is a trustworthy partner in navigating the difficulties of tax filing for truckers looking for a dependable and expedient solution to e-file Form 2290 and get their Schedule 1 copy right away.

About Truck2290: Truck2290.com is an IRS-approved e-file company that specializes in helping truckers submit Form 2290 electronically without any hassle. Truck2290 wants to make the tax filing process for truckers simpler and less stressful with its cutting-edge features.

#2290duedate#trucktax#irsform2290#taxfiling#form2290#irs2290#truck2290#hvut#heavyvehicletax#taxseason

0 notes

Text

Simplify Truck2290's online 2290 filing with a user-friendly step-by-step guide. Easily submit and pay heavy vehicle taxes for 2023–24 to the IRS through a free e-file account, receiving an IRS-watermarked Schedule 1 in minutes.

#trucktax#irsform2290#taxfiling#hvut#2290duedate#irs2290#heavyvehicletax#form2290#truck2290#taxseason

0 notes

Text

When Taxes are Due on Form 2290

Form 2290 is used to report and pay the Heavy Vehicle Use Tax (HVUT) for vehicles operating on public highways with a gross weight of 55,000 pounds or more. The due date for Form 2290 taxes varies based on the tax period and when the vehicle was first used during that period.

Here are the general deadlines:

Annual Filing Deadline: For most vehicles, the tax period begins on July 1st and ends on June 30th of the following year. The annual filing deadline for Form 2290 is typically August 31st of each year. This means that if your vehicle falls within this tax period, you would need to file Form 2290 by August 31st.

First Used Month Deadline: If a heavy vehicle is first used in any month other than July, the HVUT is prorated for that tax year. In this case, the Form 2290 filing deadline is the last day of the month following the month in which the vehicle was first used. For example, if a vehicle is first used in October, the deadline to file Form 2290 for that vehicle would be November 30th.

#truck2290#irs2290#irsform2290#hvut#trucktax#2290duedate#form2290#taxfiling#taxseason#heavyvehicletax

0 notes

Text

Master the art of Form 2290 filing to sidestep penalties effortlessly. Our expert tips empower you to gather accurate information, choose the right filing method, and meet deadlines like a pro. Stay penalty-free and keep your business on track with our foolproof guide. File 2290 with: https://www.truck2290.com

0 notes

Text

Unravel the complexity of heavy use tax reporting with our expert guide. Seamlessly navigate Form 2290 instructions and conquer heavy vehicle tax reporting like a pro. File with: https://www.truck2290.com

#form2290#2290duedate#irsform2290#taxfiling#irs2290#hvut#heavyvehicletax#truck2290#taxseason#trucktax

0 notes

Text

Truckers can now quickly and securely file the 2290 tax form for the 2023-24 tax year while driving through an IRS-certified Truck2290 e-file provider. File Now: https://truck2290.com/

#truck2290#irs2290#trucktax#taxfiling#irsform2290#heavyvehicletax#form2290#hvut#2290duedate#taxseason

0 notes

Text

Using an approved 2290 provider offers a streamlined and compliant approach to filing heavy vehicle taxes, saving time and reducing the risk of errors. Enjoy the convenience of electronic filing, quick processing, and expert assistance, ensuring accurate submissions and avoiding potential penalties. Rely on the expertise of an approved provider to navigate complex regulations, providing peace of mind and efficient management of your trucking tax obligations. File with: https://www.truck2290.com

0 notes