#Foreign Currency Exchange at Home

Explore tagged Tumblr posts

Text

#Best Forex Exchange agent in Thane#Travel cards for Foreign travel services#Send money abroad from Thane#Mumbai#Forex services for Students#Forex cards for travel#Foreign Currency Exchange at Home#Best forex exchange near me#cheapest currency exchange near me

0 notes

Photo

the official currency of Namibia has been the Namibian dollar since the 1993/'94, although the South African rand is still legal tender there too

for the people asking in the notes, no, "clusterfuck" is not a translation of their currency. it just means the situation is complicated. the official currency was the Zimbabwean dollar until the 2000s when the country went through economic crisis and hyper-inflation. the Zim dollar was abandoned and multiple international currencies became legal tender concurrently (US dollar, British pound, Euro, South African rand, Botswana pula) although in practice, they used mainly the US dollar

in 2019 (before the pandemic), Zimbabwe introduced the New Zimbabwean dollar as the official currency, however this did not work out for them and in mid-2020 they went back to accepting multiple foreign currencies (but again, in practice, they use the US dollar)

Meaning of the World’s Currencies

by u/Ben1152000

#tangential rant#American tourists™ will regularly and annoyingly try to pay in usd here#and we obviously can't accept it#but due to the economic crisis in Zim#many Zimbabweans work here and occasionally they'll accept usd from tourist-customers#and then settle the bill/invoice in rand on their behalf#because it's useful for them to have usd in cash for when they go back home to zim over the holidays#this ends up sending mixed signals to confused American tourists. but no. legally we cannot accept cash payment in anything but rand here#it's just more convenient for Zimbabweans to get extra cash because there are limits to how much you can buy from banks per year#and you pay tax on foreign currency purchases#also. I have friends who work in hotels which are technically licenced to act as bureaux de change for their guests#but don't because they don't want to risk accepting usd#the usd is the most commonly forged currency and it have fewer security features#meaning it's one of the easier currencies to fake too#but it would be discrimination to accept eur or cad or chf or aed etc. but not usd. so they just don't do any currency exchanges#(note I've not verified whether usd really is easier to forge. that's just just what they say. but it genuinely is the most commonly forged#because it's such a powerful currency)

200 notes

·

View notes

Text

2024 was disastrous for Chinese President Xi Jinping. For all of his rhetoric about “the great rejuvenation of the Chinese nation,” his regime faced staggering setbacks. Military purges intended to root out corruption instead revealed systemic turmoil that continues to undermine readiness. Economic growth cratered as unemployment, bankruptcies, and capital outflows soared. Meanwhile, key partners in Moscow and Damascus stumbled or fell, undermining Beijing’s geostrategic ambitions. Together, these and other crises have revealed a China that looks increasingly fragile, not formidable.

If 2024 shattered illusions of China’s unyielding ascent, 2025 promises to lay bare the vulnerabilities that Xi can no longer conceal.

Facing mounting problems at home and soon an emboldened U.S. President Donald Trump in Washington, Xi is nevertheless not banking on dramatic shifts or bold reforms. Instead, he is pursuing a policy of perseverance: muddling through economic stagnation, avoiding outright confrontation with Washington, doubling down on ideological discipline, and fomenting chaos abroad to distract adversaries and buy time to stabilize his precarious position.

Yet Xi’s approach carries significant risk. While his willingness to endure hardship may fortify his grip on power today, it threatens to unravel his aspirations for China’s national revival tomorrow.

Contrary to Xi’s carefully constructed image of competence, China’s domestic dilemmas remain profound. A shrinking population, a weakening currency, and dwindling foreign investment have exposed cracks in Xi’s economic stewardship. They also undermine the Communist Party’s bargain with the Chinese people: prosperity in exchange for compliance. China’s crisis of confidence risks spiraling into a vicious cycle as weak growth deters investment, shrinks spending, deepens deflation, and raises unemployment—all of which drag growth even lower. Xi’s reliance on meager supply-side stimulus has delivered fleeting sugar highs, with modest spending upticks and short-lived credit expansions. But ballooning debt, bad real estate bets, and a stock market that has been flat for a decade leave Xi with few levers to reignite growth.

Worse still, Xi’s campaign to root out perceived weaknesses within the party, military, and private sector has compounded his conundrum. Purges of senior officials such as People’s Liberation Army Navy Adm. Miao Hua—a key enforcer of Xi’s ideological conformity accused of “serious violations of discipline”—as well as former Defense Minister Li Shangfu underscore rot within the ranks. The reported detention of more than 80 business executives in 2024 alone has stifled innovation and fueled fears of arbitrary state intervention. While these actions may consolidate loyalty and enforce control, they also deepen distrust and erode the competence that Xi needs to navigate mounting pressures.

These widening woes have only steeled Xi’s resolve. He routinely invokes Western “encirclement” and “containment,” blaming the United States for thwarting China’s rise. But he uses this narrative to justify ever-expanding repression at home, including constructing more than 200 party-run, extrajudicial detention facilities to enforce discipline and root out dissent. In Xi’s view, China’s domestic struggles ultimately stem from weak ideological discipline and insufficient loyalty to his vision. Put differently, in Xi’s mind, China isn’t broken; it’s disobedient. His solution? A stronger dose of the same medicine: tighter party control, intensified repression, and an unrelenting drive to cement his legacy as the architect of China’s historical destiny.

Amid internal challenges, Xi is turning to chaos abroad to reshape the international order in China’s favor. By offering diplomatic cover and economic support for Russia’s war in Ukraine and tacit backing for Middle Eastern disruptors such as Iran, Xi is fueling crises that distract, divide, and drain Western resources. For Xi, chaos is not merely a tactic; it’s a form of strategic currency, undermining Western cohesion while bolstering his narrative of Chinese resilience and strength. His calculation is stark: If China’s ascent is faltering, the international architecture sustaining its rivals must falter, too. Seen in this light, disorder abroad is Xi’s lifeline—a calculated gambit to obscure his inability to deliver progress at home or globally.

Yet 2025 will test Xi like never before. Intensifying scrutiny from Washington—including new semiconductor investigations, advanced technology export controls, and expanded tariffs—is set to collide with rising domestic unrest, including labor strikes and online dissent. At the same time, an emerging anti-authoritarian alignment—marked by enhanced trans-Atlantic coordination on China and the new U.S.-Japan-South Korea trilateral framework—will intensify the strain. These converging forces will challenge Xi in ways he can neither control nor predict, exposing the fragility of his centralized power and testing the limits of his carefully constructed narrative of inevitability.

Xi’s biggest X factor will be Trump, whose return promises unpredictability. In his first term, Trump waited 15 months to impose tariffs on Chinese goods. This time, tariffs are expected to hit immediately and intensely, targeting the very lifeblood of China’s faltering economy: exports. These tariffs won’t just come faster; they’ll cut deeper, with proposed rates reaching as high as 60 percent on critical sectors such as technology, consumer goods, and industrial equipment. Unlike sanctions, which Xi has worked to mitigate and take years to fully materialize, tariffs take effect overnight, leaving Beijing with little time to react and forcing Chinese manufacturers to absorb crushing losses.

Trump’s tariff threats translate into tremendous peril for Xi. China’s reliance on the United States—its largest trading partner—sustains millions of manufacturing jobs, but a rapid tariff escalation could devastate small and medium enterprises, triggering factory closures and layoffs. Vulnerable sectors such as electronics and textiles could face severe disruption, and even the electric vehicle industry—one of China’s few bright spots—is grappling with domestic oversaturation and budding Western trade barriers. Meanwhile, bipartisan support in Washington for outbound investment screening threatens to choke off critical U.S. capital flows, stalling Beijing’s technological ambitions and broader economic goals.

All told, these measures could deliver a knockout blow to China’s economy, which is almost certainly growing below Beijing’s official target of 5 percent. Tellingly, the party has threatened to fire economists if they warn of economic freefall or express “inappropriate” views—a hallmark authoritarian move to suppress inconvenient truths. Xi has made boosting domestic consumption his top priority for 2025, but this rests on shaky ground, too. If Xi trusts anything even less than markets, it’s the Chinese masses, who have shown no appetite to spend their way out of his economic quagmire. Investors share this skepticism: China’s 10-year bond yield has plunged to record lows, signaling doubts about the country’s trajectory.

Meanwhile, Xi’s reliance on global chaos to sustain his position reveals a glaring paradox: The instability he is fueling in order to distract the West could backfire if and when those crises stabilize. In 2025, the winding down of major conflicts—whether through Trump’s promised dealmaking over Ukraine or Israeli action against Iran’s last remaining proxies—could put the global spotlight back on China. For Xi, this is a nightmare scenario. The West’s fragmented focus has helped mask his vulnerabilities, but resolving these crises could empower the West to confront him head-on.

Xi’s choice is stark: hunker down by embracing a survival strategy or risk further instability by overreaching. Both paths will test his capacity for long-term endurance. Confronted by Trump’s aggressive posturing, Xi is unlikely to pursue outright economic warfare, at least initially, because he recognizes that an escalation would hurt China more than its adversaries. Instead, Xi may adopt calibrated, symbolic responses—like the recently announced rare-earth restrictions—to project strength while preserving room for negotiations. Xi may also leverage retaliatory tariffs or regulatory crackdowns on U.S. firms operating in China to signal defiance without provoking a full-scale confrontation.

Domestically, Xi’s task is how to redefine success. If political stability and ideological discipline now take primacy over economic growth, Xi will have to reframe hardship as proof positive of China’s resilience and moral superiority over the West. If national rejuvenation now takes decades longer than planned, Xi will likely cast the delays as necessary steps in achieving the “Chinese Dream.” Whether the Chinese people will embrace this new narrative—or tire of a perpetually deferred future—remains an open question.

On the global stage, Xi’s reliance on instability poses its own perils. Rather than treading water, Xi may escalate tensions elsewhere—perhaps in the South China Sea, testing U.S. resolve through confrontation with the Philippines. Yet as much as a chaos-driven strategy intends to distract adversaries and sidestep direct confrontation, it invites miscalculation. More specifically, Xi risks exposing Beijing to the vulnerabilities that have undermined other authoritarian regimes���from Russian President Vladimir Putin’s disastrous gamble of invading Ukraine to Hamas’s ill-fated Oct. 7, 2023, attack on Israel that invited overwhelming retaliation.

Of course, the irony of Xi’s leadership is that a seemingly transformational figure obsessed with progress cannot embrace change. Under his rule, China has become a power both disruptive and constrained, where every effort to tighten control risks tarnishing Beijing’s global standing and undermining the credibility of its great-power ascent. But muddling through isn’t leading, and for someone whose legitimacy hinges on delivering national prestige, mere survival risks falling dangerously short of his own lofty ambitions. Ultimately, whether 2025 becomes a turning point or simply another terrible, horrible, no good year will depend on Xi’s ability to overcome the greatest challenge of all: himself.

12 notes

·

View notes

Text

1d6 Odd Foreign Coins

For when treasure in convenient mints is just too easy. 1. Iron rings - this smallest denomination coin belongs to a nation far across the sea. Even trading with them, though, these rings are small change. 2. Butterflies - this odd currency belongs not to a nation but to a thieves guild (or other underground faction). It is made by permanently attaching four coins of the realm together in a sort of square or clover shape. It is not legal currency, but has value in certain illegal transactions. Carrying it can also, of course, get you into trouble. 3. Bricks - so called because rather than being flat disks, these coins are rectangular and almost as thick as they are wide. Bricks come in different denominations, in varying sizes but all made of silver. The small alliance of nations who use Bricks are nearby, but not on the friendliest terms with your home region. However, the raw silver is of decent value. 4. Beads and Medallions - smaller and thicker than the average metal coins, these coins are made of dyed glass. They are the coin of a small, wealthy principality, where literally displaying one’s wealth has become quite fashionable. Merchants who accept these coins are most likely to trade in small, luxury items. 5. Golden Daggers - these slender gold coins are not uncommon to see in the northern part of your realm. They are the most used coin in the neighboring kingdom, whose odd manner of minting begins with slender metal rods. They aren’t commonly accepted except near the northern border, but it isn’t too difficult to find someone who will exchange them at a fair rate. 6. Silver Gems - so called because of their geometric design that resembles a cut gemstone, these coins are highly valuable. The empire from which they come has dissolved. The upper class of your realm romanticize the fallen empire’s glory days, and prize anything from it, including its odd currency. They can’t be spent like regular money, but to a collector they can be sold like valuable art.

#whoops disappeared for a couple weeks there but I'm back!#random table#random tables#ttrpg#ttrpg community#ttrpg homebrew#homebrew#random item table#random treasure table#items#treasure#loot#random loot#random loot table#random worldbuilding#worldbuilding#ttrpg worldbuilding#fantasy#dnd#d&d#dungeons and dragons#dnd homebrew#dnd table

185 notes

·

View notes

Text

Top 10 most expensive African cities to live in 2024 | Business Insider Africa

Douala, Cameroon's main city and commercial hub, is a thriving metropolis recognized for its port, industry, and dynamic commerce. As the commercial hub, Douala sees a large influx of individuals looking for better economic prospects. As a result, the city boasts a high cost of living. It ranks 63rd on Mercer's index.

METHODOLOGY

Mercer's 2024 rating methodology included 226 cities from five continents. It compared the expenses of more than 200 products in each area, including accommodation, transportation, food, clothes, home goods, and entertainment. To guarantee consistency in city-ranking comparisons, New York City was used as a baseline, and currency fluctuations were assessed against the US dollar.

The numbers included in Mercer's cost comparisons are from a study done in March 2024 that included over 400 cities. Calculations and baselines were based on exchange rates at the time as well as data from Mercer's worldwide basket of goods and services (used in its Cost of Living Survey).

Black Russians (French: Russes noirs) is an unofficial name given to a group of pro–government militias in the Central African Republic, recruited mostly from former Anti-Balaka and UPC fighters by Wagner Group. The militias have been accused of multiple war crimes and crimes against humanity.[1]

S & M GOALS TEAMPLATE

Stretch Goals: Central African Republic Ranks Top 8 in FIFA World Rankings for Men's and Top 5 for Futsal

Micro Goals: All Time Laureus World Sports Awards Winner for Africans, Laureus Team Award, All Time African Footballer of the Year, AFCON Host Nation Champion*, African Transfer Record*, Insead and WSJ Conferences*, Jeune Afrique Cover*, Verified LinkedIn Member*, and Agriculture Startup Reality TV

CAPÔI HABITANT CURRENCY MODEL

Pigou Effect, Corporate Tax Havens, Capital Gains Tax Havens, Private-Public Sectors, Joint Venture Plantations, Market Extension Mergers, with Business Incubators, and Enterprise Foundation, Holding Company, Subsidiaries, and Horizontal Integration for Monopoly.

A currency union (also known as monetary union) is an intergovernmental agreement that involves two or more states sharing the same currency. These states may not necessarily have any further integration (such as an economic and monetary union, which would have, in addition, a customs union and a single market). [Pigou Effect Currency (Short FX), Currency Board Currency (Retirement Fixed Exchange Rate), Market Currency (FX Long Currency)]

Gross national product (GNP) GNP is related to another important economic measure called gross domestic product (GDP), which takes into account all output produced within a country's borders regardless of who owns the means of production. GNP starts with GDP, adds residents' investment income from overseas investments, and subtracts foreign residents' investment income earned within a country. Whilst GDP measures the total value of goods and services produced within a country's borders, GNP focuses on the income generated by its residents, regardless of their location.

Gross National Income (GNI) is the total amount of money earned by a nation's people and businesses. It is used to measure and track a nation's wealth from year to year. The number includes the nation's gross domestic product (GDP) plus the income it receives from overseas sources.

Agriculture Central Hedge Fund, Mining Unions: Peninsula Agronomique Engineering, Commodities Options Exchange (Credit Spread Options, Farm REITs, Crop Production; Fertelizers and Seeds; Equipment; Distribution and Processing Stocks, Ag ETFs and ETNs, Ag Mutual Funds), Tableau Économiques, Investments Farms REITs, Art Financing Mardi Gras

Index Franc: Tobacco-Tobacco Soil Index/Franc Tabac Currency Pair (TBS/TAF)

The overlapping generations (OLG) model; consumption-based capital asset pricing model (CCAPM); Endogenous growth theory; Material balance planning; Leontief paradox; Malinvestment; Helicopter money; Modern monetary theory

Mercantilism Spectrum of CDF/CFA

CDF Raw Materials and CFA Products. (Prices); CDF Holding Company and CFA Conglomerate Company. (Equity and Dividend Yield); CDF is Gold Standard and CFA is Helicopter Money. (FX Rate/Hedging); CDF Helicopter Money [Supplier Currency] and CFA as Purchasing Power [Consumer Currency] (Currency Union & Currency Board and Negative Interest Rates); CDF is Congolese Franc and CFA is Central African Franc

RUSSE NOIR (À MA SAUCE) FOOTBALL

À ma sauce Literally: To my sauce, True meaning: Suit my style

VEDETTE: 3-4-1-2 has 4 Pivot Formations so 5 Total: Transition to a 4-4-2 Diamond, Transition to a 4-4-2, Transition to a 4-2-3-1, Transition to a 3-3-1-3

Positional Game is Diamonds Tic-Tac-Toe with Enforcer and Avoider. Striker [Enforcer](Inverted Winger and Centre Forward), Deep Lying Playmaker [Avoider] (Holding Midfielder and Inverted Winger), and Sweeper Wingback Deep Lying Playmaker [Avoider] (Centre Back). Use Playing Styles, Manipulated Positions, and Combinational Games for Positional Play as Johan Cruyff students.

Cameroon 4-4-2 Diamond Variant: 1-3-4-2 (1) À ma sauce (Sweeper Deep-lying Playmaker Wingback) (4) Diamant (À ma sauce: Counterpressing Pivot Pressing Triggers, Sweeper-Winger Pivots, Overlapping Runs, W; I; M; V; Box Keeping Formation with 3 Centre-Backs) [Key Stats: Front Foot, Pressing Triggers, Clearance, Aerial Duel, Interceptions, Blocked Shots, Tackles, Final Ball, Key Dribbles, Overlapping Runs, Set Piece Taker] Spacing, Possession, Pass Completion, and Counter Pressing with Pursuit and Ambush Predation One Team Box Touches and Capture the Flag with Analytics-Geometry Total Football Trixie Bet on CNS Drugs (Xanax and Modafinil); 1-1-2-1 Diamond Rover Futsal Pivot Formation

Define a run in one of two ways: (i) as a set of consecutive goals scored by one team, without the other team scoring a goal; (ii) as a set of consecutive scoring events by one team, each event being either a goal or one or more Set Piece. Play aggressive and with counter pressing and run it up on the score board in the first half and after halftime play defense. You get a break at half and it's easier to win when someone plays defense and looks for opportunities instead of Attacking.

Posterior Chain Super Compensation and Speed-Endurance (Elastic-Connective Tissue) Force-Velocity Curve; Crescent Moon Horizontal Plane Vertical Force Sprinting Mechanics.

Set Piece Stylistic Biomechanics: Shooting Knee at Wall for Curve and Placement Knee for Corner. Follow through with Shot with proper Body Alignment

Knee to Feet or Shoulder to Feet Cradling for Touch/Entertainment

UEFA Front Office Curriculum

Museum d'histoire: Broken down into three major section — “A Lineage of Coaches Players and Places,” “Proving Grounds” and “Cultures of Basketball” — City/Game documents how basketball first found its origins in the neighborhoods of NYC and then went on to produce a roster of local legends who played everywhere from Rucker Park and the Cage on West 4th Street to Christ the King High School and St. John’s University.

Agility Ladder Eyes Pocket: Eyes Between Defenders Feet and Ball, Numbered Footwork V-Step (Shifting Defenders with Momentum) et L-Step (Explosive First Step), All moves should form a Triangle or an Incomplete Triangle (Coup de Pied)

*Push-Pull Sprint/Shooting Cycle: Pull Glutes et Hamstring; Push Calf et Quads for Sprints.

Sprint Size Up: A series of feint Karaoké dribble moves with Eye Tricks (Fake Pass) but Sprint Position Finish

Triangle Philosophy: All Dribbling Moves should form a Triangle or an Incomplete Triangle while using V-Step (Shifting Defenders with Momentum) et L-Step (Explosive First Step).

Thé Crescent: In Close Dribbling; Crescent Footwork with L Shapes (Paul Pogba)

On the Run Dribbling Moves: Letters and Shapes; Still Play 1 on 1: Numbered Footwork

Piedi Felici Courts: Drills Side/Box Play with 1 Net; Design Vaporwave Action Painting Angels; Knee for Direction and Sole Drags for Dribbling Touch and Crescent Moon Sprint Mechanics

Gambling Games: 5 Roll (Captain, Ship, Crew); Live-Pool Betting Monopoly

Stylistic Biomechanics: Dribbling Foot To Ball Contact (Balls of Feet and Arch of Feet); Knee for Direction; Foot Drags; & Hip Angle, Crescent Moon Running Mechanics, and Laces Kick.

Diamond Football (15 mins)

Set Up

-Lay out two overlapping sets of 4 flat markers in the positions shown above.

-Ask the players to stand on a flat marker for their teams colour (Red on Red, Yellow on Yellow).

Instruction

-Whenever the ball goes out for a kick in or for the defenders ball, the players must stand on their markers before play begins.

-As soon as the ball has been played in, players are free to move.

-Reset everytime the ball goes out.

Coaching Points, Progressions Ect.

-Ask players to shout out what each position on the park is to devlop understanding of their roles.

-If you decide to go to a normal game , leave the markers out for a visual aid for the players.

-If more than 8 players, Add in Goalkeepers who would then play the ball out to the DF,LM,RM.

-Rotate Positions, Ask Players to stand on a marker they haven't been on before

RUSSE NOIR ACCENT

Lingua Franca of Renaissance Latin (Vocabulary) and Atlantic–Congo Fon (Grammar).

Volta–Congo is a major branch of the Atlantic–Congo family. Fon (fɔ̀ngbè, pronounced [fɔ̃̀ɡ͡bē][2]) also known as Dahomean is the language of the Fon people. It belongs to the Gbe group within the larger Atlantic–Congo family.

In linguistic typology, subject–verb–object (SVO) is a sentence structure where the subject comes first, the verb second, and the object third.

Haitian Creole (/ˈheɪʃən ˈkriːoʊl/; Haitian Creole: kreyòl ayisyen, [kɣejɔl ajisjɛ̃];[6][7] French: créole haïtien, [kʁe.ɔl a.i.sjɛ̃]), or simply Creole (Haitian Creole: kreyòl), is a French-based creole language spoken by 10 to 12 million people worldwide, and is one of the two official languages of Haiti (the other being French), where it is the native language of the vast majority of the population. The language emerged from contact between French settlers and enslaved Africans during the Atlantic slave trade in the French colony of Saint-Domingue (now Haiti) in the 17th and 18th centuries. Although its vocabulary largely derives from 18th-century French, its grammar is that of a West African Volta-Congo language branch, particularly the Fongbe and Igbo languages.

Prose Accent Congo and Modern Accent Congo.

Full Lips Endings with Vertical Narrow Mouth and Soft Rs.

A noun phrase – or NP or nominal (phrase) – is a phrase that usually has a noun or pronoun as its head, and has the same grammatical functions as a noun.

BELMÔNT'S SIN INDEX FUND PORTFOLIO

Sin stock sectors usually include alcohol, tobacco, gambling, sex-related industries (Cabaret and Burlesque), and weapons manufacturers.

Diageo

Phillip Morris

Sports Betting Investment Trust

Pharmaceuticals

Business Clusters with Scrum Management and Accelerators to produce Festivals.

Example: Create a Index Fund Portfolio of 15-20 Stocks and using Supply Side Economics to create Decentralized Gambling Economy.

BELMÔNT'S DECENTRALIZED GAMBLING ECONOMY

Corporate-Capital Gains Tax Haven

High Stakes Minimum Buy In

Card Gambling (Signal and President): Top 2 highest bids fight for the Coup d'état and the other two are lesser men, the lesser men are subordinates that aid in playing cards for the warlord, the winning team splits the money, the warlords switches based on the 13 cards dealt and bets placed, the first team to shed all of their cards win.

Domestic Gambling: Boxing

Retirement Gambling: Boat Racing

Residency Program for Tax Benefits

BELMÔNT'S TURF ACCOUNTING MODEL

+EV

Python Programming Gaussian Distribution

Exotic Options Trading Live Betting

Parlays Minimum for Round Robins

Daily Fantasy Sports Rakes

RUSSE NOIR PALACE

Definitions of ballroom. noun. large room used mainly for dancing. synonyms: dance hall, dance palace**. types: disco, discotheque.

Go Go Music Influenced, Eurphoric Trance Chord Progression Melody, Progressive House and Drum n' Bass Percussion-808 Call and Response Staccato Polyrhythm or Layered Kick and Punch 808.

In his 1972 study of French lute music, scholar Wallace Rave compiled a list of features he believed to be characteristic of style brisé. Rave's list included the following: the avoidance of textural pattern and regularity in part writing; arpeggiated chord textures with irregular distribution of individual notes of the chord; ambiguous melodic lines; rhythmic displacement of notes within a melodic line; octave changes within melodic line; irregular phrase lengths.

Have the Snare and Kick say, "Hi, How are you?" And the 808 say, "I am good thanks for asking.”

Use progressive House to push the Drums Conversation to either Fast and Punchy for Happy or Slow and Deep for Sad.

In technical terms, "go-go's essential beat is characterized by a five through four syncopated rhythm that is underscored prominently by the bass drum and snare drum, and the hi-hat... [and] is ornamented by the other percussion instruments, especially by the conga drums, rototoms, and hand-held cowbells."[5]

Polyrhythm: In music, a cross-beat or cross-rhythm is a specific form of polyrhythm. The term cross rhythm was introduced in 1934 by the musicologist Arthur Morris Jones (1889–1980). It refers to a situation where the rhythmic conflict found in polyrhythms is the basis of an entire musical piece.[1]

Four-on-the-floor (or four-to-the-floor) is a rhythm used primarily in dance genres such as disco and electronic dance music. It is a steady, uniformly accented beat in 4. 4 time in which the bass drum is hit on every beat (1, 2, 3, 4).[1] This was popularized in the disco music of the 1970s[2] and the term four-on-the-floor was widely used in that era, since the beat was played with the pedal-operated, drum-kit bass drum.[3][4] (Punch 808-Kick)

Polyrhythm 4 on the Floor examples 2:4 or 5:4

Hard trance is often characterized by strong, hard (or even downpitch) kicks, fully resonant basses and an increased amount of reverberation applied to the main beat. Melodies vary from 140 to 180 BPMs and it can feature plain instrumental sound in early compositions, with the latter ones tending to implement side-chaining techniques of progressive on digital synthesizers.

Singles Only Email Raves Blogger then Multi Market Distribution Deal: A distribution deal is a contract to release the music to platforms, but not own the publishing or exclusively lock the artist in. Record Artist Producer Label: Have Polyrhythm Artist earn Streaming Percentage under a Recording Artist Deal. Label has Distribution Above Me and I have Manufacturing over Polyrhythm Artist. Have a end of the Year Album for New Year's Raves!

BELMÔNT'S SYSTEM: CAPÔI RETAINER AGREEMENT WITH ASSET PROTECTION TRUST

Capo: Describes a ranking made member of a family who leads a crew of soldiers. A capo is similar to a military captain who commands soldiers. Soldier: Also known as a “made man,” soldiers are the lowest members of the crime family but still command respect in the organization.

A capo is a "made member" of an Italian crime family who heads a regime or "crew" of soldiers and has major status and influence in the organization.

Consigliere: Defense and Corporate Lawyers

Head Boss: Ministry of Medicine

Underboss: Pharmaceutical Industry

Capo: CAPÔI RETAINER AGREEMENT

Soliders: Artisans

Commercialism is the application of both manufacturing and consumption towards personal usage, or the practices, methods, aims, and distribution of products in a free market geared toward generating a profit.

Commercial art is art created for advertising or marketing purposes. Commercial artists are hired by clients to create images and logos that sell products. Unlike works of fine art that convey an artist's personal expression, commercial art must address the client's goals.

The word 'Commercial' is defined as follows: Concerned with or engaged in commerce. Commerce is the exchange of goods or services among two or more parties.

Craftsmen are committed to the medium, not to self-expression. Artists are committed to their self-expression, not the medium.

A medium of exchange is an intermediary instrument and system used to facilitate the purchase and sale of goods and services between parties.

Stretch and Micro Goals

Music Medium System: Distribution and Retailers Contract Theory (System) for Music (Instrument)

Football Medium System: Analytics and Geometry for Free Role (System) Trixies (Instrument)

Age 16-19

Bond Funds

Farmland REITS

CFDS

Real Estate Brokerage Trust Account

Age 20-30

Farmland Recession Proof Stocks (Cosmetics, AgTech, Ag ETFS, AgETN)

Incubator and Startup Accelerators

Real Estate Joint Ventures

Age 30-40

Farmland Blue Chip Indexes w/ Credit Spread Options

CURRENCY, OIL, & GOLD COMMODITIES CANDLESTICK CHARTS

Swing Trading: Use mt4/mt5 With Heiken Ashi Charts, Setting at 14 or 21 Momentum Indicator above 0 as Divergence Oscillator and Volume Spread Analysis as Reversal Oscillator and Trade when bullish candlesticks above 200 exponential moving average and/or 20 exponential moving average (EMA) on H1 (Hourly) Time Frame; use H4 (4 Hours) and D1 (1 Day) as reference.

TUNNEL STRATEGY (OFFSHORE BANKING)

Purpose: Permanent Residency Card

$250k Deposit

$125k: 60/40 portfolio, 60% Fixed Income & REITs and 40% Blue Chip Stocks

$50k: Guaranteed Investment Certificates (GICs) and term deposits are secured investments. This means that you get back the amount you invest at the end of your term. The key difference between a GIC and a term deposit is the length of the term. Term deposits generally have shorter terms than GICs.

$75k: Spending Cash

SIN STOCKS PORTFOLIO

Sin stock sectors usually include alcohol, tobacco, gambling, sex-related industries, and weapons manufacturers.

Sports Betting Investment Trust

Pharmaceuticals

Example: Create a Index Fund Portfolio of 15-20 Stocks and using Supply Side Economics to create Decentralized Gambling Economy.

FESTIVALS DEAL

Singles Only Email Raves Blogger then Multi Market Distribution Deal: A distribution deal is a contract to release the music to platforms, but not own the publishing or exclusively lock the artist in. Record Artist Producer Label: Have Polyrhythm Artist earn Streaming Percentage under a Recording Artist Deal. Label has Distribution Above Me and I have Manufacturing over Polyrhythm Artist. Have a end of the Year Album for New Year's Raves!

NEUROPLASTICITY DRUG-CRIME NEXUS BASED ON TRAFFICKING

CPP, CNS Depressants, et FENTALOGS: Cul-de-sac

Defensive Penalty Capture The Flag Raiding Warfare

Grey-Decentralized Markets

Bastilles: Cul-de-sac Artist Résidences Penthouse Complexes

Polyrhythm Raves

Acid House Art Gallery

International Film Festival

Hôtel Chefs

Seigneurial System/Tableau Economique Raw Material Économics Production Spot

Surautomatism

Discount Networking Acid House Party

Opium Dens and Fragrance Festivals

Pill Pressers

CNS depressants

Upper-tier County System

Defense Lawyers are Traplords (Trafficking P4P and Malicious Prosecution)

Cash Conversion Cycle (CCC)

Brain Receptor Dealing

Neuroplasticity Drug-Crime Nexus

Religious Ecstasy

Entheogens are psychedelic drugs—and sometimes certain other psychoactive substances—used for engendering spiritual development or otherwise in sacred contexts

Live-Pool Betting Monopoly Board Game

Summary Sentencing

Urban Level: Street Culture Art Gallery (Street culture may refer to: Urban culture, the culture of towns and cities, Street market, Children's street culture, Street carnival, Block party, Street identity, Street food, Café culture, Several youth subculture or counterculture topics pertaining to outdoors of urban centers. These can include: Street art, Street photography, Street racing, Street wear, Hip-hop culture, Urban fiction, Street sports, Streetball, Flatland BMX, Freestyling), Art Pedagogy, Artist Residency, Art Schools, and Art Plugs

Art Pedagogy: Arts-based pedagogy is a teaching methodology in which an art form is integrated with another subject matter to impact student learning. 28-30. Arts-based pedagogy results in arts-based learning (ABL),11 which is when a student learns about a subject through arts processes including creating, responding or performing. Aesthetic Teaching: Seeking a Balance between Teaching Arts and Teaching through the Arts. In aesthetic education, learning must be developed especially with the inclusion of sensations and with the help of feelings. Sensations and feelings should lead to movement, representation, and expression. Aesthetic learning often entails learning to distinguish certain qualities or objects aesthetically in different ways depending on the situation and the purpose. Certain things can be experienced in negative ways in one activity and in positive ways in another.

A designer drug is a structural or functional analog of a controlled substance that has been designed to mimic the pharmacological effects of the original drug, while avoiding classification as illegal and/or detection in standard drug tests

Patchwork tattoos are a collection of tattoos collaged together to create an overall design. Each individual 'patch' of the tattoo can be a different design, symbol or element with a little space in between. Patchwork tattoos are a collection of tattoos collaged together to create an overall design. In short, the gun-toting angel was a multifaceted metaphor. “It undoubtedly also reflected the Catholic Counter-Reformation militaristic rhetoric,” wrote Donahue-Wallace, “which promoted the church as an army and heavenly beings as its soldiers.”

DECADENCE AESTHETICS THEORIES

Slogan

J'Cartier, Je cours après les vœux de champagne,

Subjective

Based on or influenced by personal feelings, tastes, or opinions

Gastronomy

Precarious Balance

Precariously: If something is happening or positioned precariously, it's in danger. A glass could be precariously balanced on the edge of a table. If something is on the verge of danger, then the word precariously fits.

Grey & Decentralized Markets

Tableau Économique

Semblance

Semblance is generally used to suggest a contrast between outward appearance and inner reality.

High Socioeconomic Status & Tattoos

Phantasmagorical

Having a fantastic or deceptive appearance

adjective. having a fantastic or deceptive appearance, as something in a dream or created by the imagination. having the appearance of an optical illusion, especially one produced by a magic lantern.

Socioeconomic Status Development Immigration Multilingual Sensory Play

Law of Polarity in Relationships

In any successful relationship that has an intimate connection and sexual attraction, there is polarity. What does this mean exactly? Polarity in relationships is the spark that occurs between two opposing energies: masculine and feminine. Gender does not affect whether you have masculine or feminine energy.

Second Reflection

Burden Aesthetics with Intentions

The Second Reflection lays hold of the Technical Procedures

Tattoos

SOCIO-PSYCHOLOGY

Keystone Theory Habits

Game Theory

Behavioral Finance

Self-actualization is the complete realization of one's potential, and the full development of one's abilities and appreciation for life. This concept is at the top of the Maslow hierarchy of needs, so not every human being reaches it.

Potential Psychology: Psychological potential is a very broad concept. It may include one's capacity to conform, change, re-invent oneself, bounce back from adversity, etc.

SOCIO-FORMAL SCIENCE

+EV Optimal Game Theory Poker

Civil, Agriculure, Solvent Levelling Effect Chemical Reaction, and Biomechanical Engineering

SOCIO-PHILOSOPHY

Ontology

IMPERIALISM, THE HIGHEST STAGE OF CAPITALISM

Imperialism, the Highest Stage of Capitalism,[1] originally published as Imperialism, the Newest Stage of Capitalism,[2][3] is a book written by Vladimir Lenin in 1916 and published in 1917. It describes the formation of oligopoly, by the interlacing of bank and industrial capital, in order to create a financial oligarchy, and explains the function of financial capital in generating profits from the exploitation colonialism inherent to imperialism, as the final stage of capitalism. The essay synthesises Lenin's developments of Karl Marx's theories of political economy in Das Kapital (1867).[4]

Tax Mergers Law; Market-extension merger: Two companies that sell the same products in different markets. 4.2.2 Corporate Taxation At the corporate level, the tax treatment of a merger or acquisition depends on whether the acquiring firm elects to treat the acquired firm as being absorbed into the parent with its tax attributes intact, or first being liquidated and then received in the form of its component assets.

SOCIOCULTURAL THEORY OF DEVELOPMENT

Seconds Liberal Arts are often viewed as pre-professional since, while conceived of as fundamental to citizenship, they address the whole person in recognition that our moral and spiritual identities develop best through participation in a society that perpetually renews the rights and responsibilities of membership.

Executive management master's degree programs often result in an Executive Master of Business Administration, or EMBA. They are primarily designed to act as accelerated graduate programs for working professionals who already hold management or executive positions.

Engineering college means a school, college, university, department of a university or other educational institution, reputable and in good standing in accordance with rules prescribed by the Department, and which grants baccalaureate degrees in engineering.

Monopoly Family Boarding Schools: The socio-historical context refers to the societal and historical conditions and circumstances that influence events or individuals. It involves elements like the cultural, economic, and political circumstances during a certain time period.

Agriculturism is an ideology promoting rural life, a traditional way of life. It is characterized by the valorization of traditional values (the family, the French language, the Catholic religion) and an opposition to the industrial world.

CAPÔI CLASS STRUCTURE

Demonym Examples: CAR Congolese, Gabon Congolese, Afrikaans Congolese, and Congolese

Monopoly Family (Apartheid)

Chief Executive of State (Apartheid)

Political Class (RUSSE NOIR)

Upper Class (RUSSE NOIR)

Working Class (RUSSE NOIR)

JEAN-CLAUDE TRAORÉ BUSINESS ADVICE

Blue Ocean Strategy; Solvent Levelling Effect Chemical Reaction Engineering and Economic Science.

TENNIS AGRICULTURE

A clay-court specialist is a tennis player who excels on clay courts, more than on any other surface.

Due in part to advances in racquet technology, current clay-court specialists are known for employing long, winding groundstrokes that generate heavy topspin; such strokes are less effective on faster surfaces on which the balls do not bounce as high. Clay-court specialists tend to slide more effectively on clay than other players. Many of them are also very adept at hitting the drop shot, which can be effective because rallies on clay courts often leave players pushed far beyond the baseline. Additionally, the slow, long rallies require a great degree of mental focus and physical stamina.

MATERIALISM-ILLUSION TRADWAVE CATHOLICISM THEOLOGY ECUMENISM

Salesian Order and Council of Trent Economic Materialism Culture with Distorted Sensory Overload Vice Artisan Mural Crown (Craftsmanship, Commercialism, Commerce, Medium of Exchange)

The original sense of apotheosis relates to religion and is the subject of many works of art. Figuratively "apotheosis" may be used in almost any context for "the deification, glorification, or exaltation of a principle, practice, etc.", so normally attached to an abstraction of some sort.[1] In religion, apotheosis was a feature of many religions in the ancient world, and some that are active today. It requires a belief that there is a possibility of newly-created gods, so a polytheistic belief system. The major modern religions of Christianity, Islam, and Judaism do not allow for this, though many recognise minor sacred categories such as saints (created by a process called canonization). A mural crown (Latin: corona muralis) is a crown or headpiece representing city walls, towers, or fortresses. In classical antiquity, it was an emblem of tutelary deities who watched over a city, and among the Romans a military decoration. Later the mural crown developed into a symbol of European heraldry, mostly for cities and towns, and in the 19th and 20th centuries was used in some republican heraldry.

The body of light, sometimes called the 'astral body'[a] or the 'subtle body,'[b] is a "quasi material"[1] aspect of the human body, being neither solely physical nor solely spiritual, posited by a number of philosophers, and elaborated on according to various esoteric, occult, and mystical teachings. Other terms used for this body include body of glory,[2] spirit-body, luciform body, augoeides ('radiant body'), astroeides ('starry or sidereal body'), and celestial body.[3] The concept derives from the philosophy of Plato: the word 'astral' means 'of the stars'; thus the astral plane consists of the Seven Heavens of the classical planets. The idea is rooted in common worldwide religious accounts of the afterlife[4] in which the soul's journey or "ascent" is described in such terms as "an ecstatic, mystical or out-of body experience, wherein the spiritual traveller leaves the physical body and travels in their body of light into 'higher' realms."[5]

The canon law of the Catholic Church (from Latin ius canonicum[1]) is "how the Church organizes and governs herself".[2] It is the system of laws and ecclesiastical legal principles made and enforced by the hierarchical authorities of the Catholic Church to regulate its external organization and government and to order and direct the activities of Catholics toward the mission of the Church.

An institute of consecrated life is an association of faithful in the Catholic Church canonically erected by competent church authorities to enable men or women who publicly profess the evangelical counsels by religious vows or other sacred bonds "through the charity to which these counsels lead to be joined to the Church and its mystery in a special way".[1] They are defined in the 1983 Code of Canon Law under canons 573–730. The Congregation for Institutes of Consecrated Life and Societies of Apostolic Life has ecclesial oversight of institutes of consecrated life.[2]

In Christianity, the three evangelical counsels, or counsels of perfection, are chastity (FUCK THIS), poverty (or perfect charity)*, and obedience (Reckless Abandonment)*.[1] As stated by Jesus in the canonical gospels,[2] they are counsels for those who desire to become "perfect" (τελειος, teleios).[3][4] The Catholic Church interprets this to mean that they are not binding upon all, and hence not necessary conditions to attain eternal life (heaven), but that they are "acts of supererogation", "over and above" the minimum stipulated in the biblical commandments.[5][6]

Catholics who have made a public profession to order their lives by the evangelical counsels, and confirmed this by public vows before their competent church authority (the act of religious commitment known as a profession), are recognised as members of the consecrated life.

Tradwave is a Catholic artistic style using synthwave and vaporwave art to promote traditional catholicism. Tradwave usually uses traditional catholic paintings, sculptures, or photographs of saints, given with vaporwave effects, often with a bible verse or quote about catholicism. The art usually tries to convey a resurrection of catholic spirituality in the modern atheist world. Figures often depicted in Tradwave art include Jesus Christ, the Virgin Mary, Ven. Fulton Sheen, Cardinal Robert Sarah, and Mother Angelica.

Tradwave music often takes the form of two main styles. One of them is catholic hymns with vaporwave effects and traditional Vaporwave/Lo-Fi music. It can also have quotes from modern prolific Catholic figures, such as Ven. The other theme is Fulton Sheen and Cardinal Robert Sarah.

The term political religion is based on the observation that sometimes political ideologies or political systems display features more commonly associated with religion.

Religious nationalism can be understood in a number of ways, such as nationalism as a religion itself, a position articulated by Carlton Hayes in his text Nationalism: A Religion, or as the relationship of nationalism to a particular religious belief, dogma, ideology, or affiliation. This relationship can be broken down into two aspects: the politicisation of religion and the influence of religion on politics.

Dioceses ruled by an archbishop are commonly referred to as archdioceses; most are metropolitan sees, being placed at the head of an ecclesiastical province. In the Catholic Church, some are suffragans of a metropolitan see or are directly subject to the Holy See.

Heavenly Virtue: Another phrase to describe this obedience to the voice is “reckless abandon.” It simply means that we let God do what God wants to do through us. It means if He tells us to do something or say something—we do it.

The Dionysian Mysteries were a ritual of ancient Greece and Rome which sometimes used intoxicants and other trance-inducing techniques (like dance and music) to remove inhibitions and social constraints, liberating the individual to return to a natural state.

Catholic School Girls Moon Evangelical Prophets: Consecrated life is "placed in a privileged position in the line of evangelical prophecy," whereby its “charismatic nature” and communal discernment of the Spirit "makes it capable of inventiveness and originality.”

Men Mars Angelology Conversion System: Church Enterprises (Planetary Intelligence Church District Real Estate; Liberal Arts Catholic Immersion Schools; Gold; Athletics; Cooking);

Church Gatherings (School Nights Virgil, Weekend Noon Mass then Weekend Sports League) Francis de Sales and Don St. Bosco Influence

Angelology Patchwork Tattoos: Biblical Crowns, Praying Hands, Gun Toting Angels, Dirty Dancing Angels, Drug Using Angels, Heavenly Choir, Summa Theologica Sherman, Saints and Pastors, Hebrew Tetragram, Council of Trent

🇨🇲🇨🇲🇨🇲🇨🇲🇨🇲🇨🇲🇨🇲🇨🇲🇨🇲🇨🇲🇨🇲🇨🇲🇨🇲🇨🇲🇨🇲🇨🇲🇨🇲🇨🇲🇨🇲🇨🇲🇨🇲🇨🇲🇨🇲🇨🇲🇨🇲🇨🇲🇨🇲🇨🇲🇨🇲🇨🇲🇨🇲🇨🇲🇨🇲🇨🇲🇨🇲🇨🇲

RUSSE NOIR

18 notes

·

View notes

Text

Mega Schemes

Huge hydraulic schemes are made possible by advanced modern civil engineering techniques. They require vast international contracts that are only possible at the level of central governments, international free floating capital and supranational government organisations. The financiers borrow money and lend it at commercial rates, so they favour largescale engineering projects that promise increasing production for export markets at the expense of local subsistence economies, with disastrous social and environmental effects. Cash crops destroy settled communities and cause pollution of soil and water. For instance, Ethiopia’s Third Five-Year Plan brought 60% of cultivated land in the fertile Awash Valley under cotton, evicting Afar pastoralists onto fragile uplands which accelerated deforestation and contributed to the country’s ecological crisis and famine. There’s a vicious circle at work. Development needs money. Loans can only be repaid through cash crops that earn foreign currency. These need lots more water than subsistence farming. Large hydraulic schemes to provide this water are development. Development needs money. And so it goes.

Large-scale projects everywhere are the consequence and justification for authoritarian government: one of America’s great dam-building organisations is the US Army Corps of Engineering. Stalin’s secret police supervised the construction of dams and canals. Soldiers such as Nasser of Egypt and Gadafi of Libya and military regimes in South America have been prominent in promoting such projects. Nasser built the Anwar High dam in 1971. The long-term consequences have been to stop the annual flow of silt onto delta land, requiring a growing use of expensive chemical fertilisers, and increased vulnerability to erosion from the Mediterranean. Formerly the annual flooding washed away the build-up of natural salts; now they increase the salt content of irrigated land. The buildup of silt behind the dam is reducing its electricity generating capacity; the lake is also responsible for the dramatic increase in water-borne diseases. Nationalism leads to hydraulic projects without thought to what happens downstream in other countries. The 1992 floods of the Ganga-Brahmaputra-Barak system killed 10,000 people. 500m people live in the region, nearly 10% of the world’s population, and they are constantly at risk from water exploitation and mismanagement. Technological imperialism has replaced the empire building of the past: large-scale hydro projects are exported to countries despite many inter-related problems – deforestation, intensive land use and disputes and so on. Large-scale water engineering projects foment international disputes and have become economic bargaining counters, for example the Pergau dam in Malaysia. The British Government agreed to spend £234m on it in 1989 in exchange for a £1.3bn arms deal. In 1994 the High Court ruled that the aid decision was unlawful but these kinds of corrupt deals continue.

In Sri Lanka the disruption caused by the Mahawelli dams and plantation projects resulted in the forcible eviction of 1 million people and helped maintain the insurgency of the Tamil Tigers that resulted in thousands of deaths as they fought government forces from the late 1980s onwards. In 1993 the Marsh Arabs of southern Iraq were threatened by Saddam Hussein’s plans to drain the area – the most heavily populated part of the region. Many of the 100,000 inhabitants fled after being warned that any opposition risked death. Selincourt estimated that 3 million people would lose their homes, livelihoods, land and cultural identity by giant dam projects in the 1990s. The Kedung Ombo dam (Indonesia) displaced 25,000; the Akasombo dam (Ghana) 80,000; Caborra Bassa (South Africa) 25,000. Three dams in Laos alone will have displaced 142,000 people. The proposed Xiao Langdi dam in China would displace 140,000; the Three Gorges project 1.1 million people. Only war inflicts a similar level of human and environmental destruction, yet large dam projects have a chronic record in delivering water and power, or eliminating flooding in downstream valleys.

#freedom#ecology#climate crisis#anarchism#resistance#community building#practical anarchy#practical anarchism#anarchist society#practical#revolution#daily posts#communism#anti capitalist#anti capitalism#late stage capitalism#organization#grassroots#grass roots#anarchists#libraries#leftism#social issues#economy#economics#climate change#climate#anarchy works#environmentalism#environment

2 notes

·

View notes

Text

The well-wisher

Elja was a collector of coins. A currency enthusiast, who rejoiced at every opportunity to study them up close. A numismatist, who liked to feel their weight in her palms, to trace the engraving of their faces, to run her fingertip around their slender curves. She was a curator, who carefully assessed her finds before she chose where they would best be placed.

Or, as the locals called it, a thief.

As collections went, it was ambitious in its scope. Elja scooped up all manner of coins, old or new, local or foreign - those with rare, valuable defects, and those which were just tarnished with time. Her purse was a broad church, and she accepted those of all denominations. She took from the rich and she took from the poor, from beggars and barons, and even from other thieves, in her endless accumulation of most things metal and round.

But only coins. There were travellers with paper money, or ingots, arm-bands and other exonumia, and she let them keep the change from those exchanges. She mined any pocket in her reach, her burrowing fingers seeking out copper, iron, silver, gold, each treasure held as equal in her eyes, but only if it wore the right designs. Symbols were important. Words, too.

There was a well, in the village. A wishing well. It took coins, as well, and gave out wishes in return. One each. Most of the local kids had wasted theirs, on the latest toys or sugared treats; her brother, Aaton, had spent his on the promise of going to space. Some of them came true, some not - or at least not yet. They were made without thinking, and forgotten just as easily.

But Elja had saved her wish. She was waiting, she said, when they asked why she wouldn't play along: waiting on the right idea, to know what she wanted most in life, too hard to discern as a child. Aaton used to tease her for that - for taking it too seriously, too afraid of waste to ever use it up at all. But when he'd gone missing, a few years back, she'd wasted no time in wishing for him to be found.

It hadn't come true - not yet - but that was okay. Elja had failed to specify a deadline. She knew that these things took time; that she couldn't expect her dream to be granted within the day, the week, the month, the year. She had merely set the vast clockwork of fate in motion, and now she had to wait for it to bring about her happy ever after. Aaton was still young. He would have plenty of time to travel the stars, after he came home. They all still had time.

That was, until the coin thief came to town.

It hadn't been a massive score. Not the sort of heist that would go down in local legend, nor attract much notoriety. Most people hadn't even noticed what they'd lost. But Elja did. She liked to visit the fountain, some days, when she missed her brother more than most. To gaze into the peaceful waters, and remind them of their promise. Except that one day, the promises had gone. The well was empty. The waters were bare.

The thief had paid his own visit to the well, and his wish had been for a bagful of wet coins; with one small act of petty greed, he had dashed any chance of her own dream coming true, of her own nightmare coming to an end. All hope was lost. So Elja had set out to find it again: to track down the thief, recover his loot, and return it to its rightful place. To restore the terms of their agreement.

When she found him, it was too late. Most of the coins had been spent, frittered away on indulgences around the town, and he couldn't even tell her where they'd gone. The people he'd paid soon spent them in turn, and they passed from hand to hand on a hundred different paths, rippling away from that epicentre. Difficult to trace. Difficult to reclaim.

Thus Elja began her collection. She sifted through the riverbeds of people's bags, panned her way through their pockets, identifying coins of the right age, the right level of wear, nothing too shiny or new. She identified the wishes, redeemed or not. The aura of hope, or despair, or desperation.

Those she found, she returned. Where most thieves might accumulate a hoard of plundered treasure, saving to buying an honest life, or retained as trophies of their conquests, her coins went straight into a hole in the ground. She restored them to their rightful resting place, back where they belonged, in the hope that it would bring the wishes back as well. Hoping, if she returned what the well had lost, that it might yet do the same for her.

15 notes

·

View notes

Text

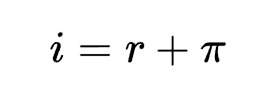

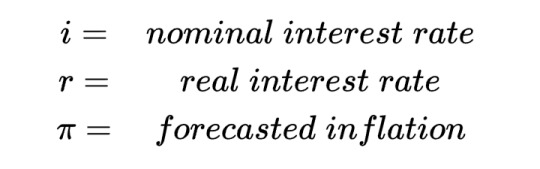

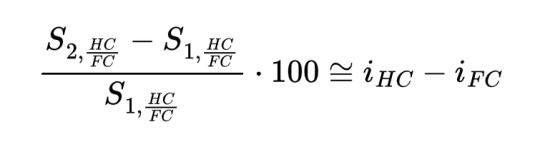

International Parity Conditions

International parity conditions are the economic theories that link exchange rates, price levels, and interest rates together.

Law of One Price

One assumption they are based on is the law of one price. It states that if an identical product or service can be sold in two different markets, where no restrictions exist on the sale and the transportation costs of moving the product between the markets are equal, the the product's price should be the same in both markets. If this applies, comparing prices only requires a conversion from one currency to another.

Purchasing Power Parity

Purchasing power parity (PPP) compares economic growth and standards of living in different countries with a common basket of goods approach. If the law of one price applied for all goods and services, the purchasing power parity could be acquired from just a singular set of prices. This is referred to as the absolute version of PPP theory. An example of this is the Big Mac Index.

On the other hand, relative PPP theory states that exchange rates and inflation rates (price levels) in two countries should equal out over time. Currencies that have a high inflation rate are expected to depreciate.

Exchange Rate Indices

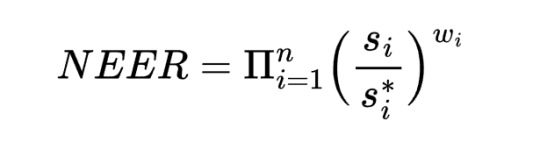

Figuring out whether a nation's exchange rate is overvalued or undervalued in terms of PPP can be done by calculating exchange rate indices, such as the nominal effective exchange rate index (NEER) and the real effective exchange rate (REER). Both represent the average rate at which one nation's currency is valued in comparison with a basket of other currencies, weighted for the percentage of trade that each currency represents to that nation. However, while the NEER does not take inflation into account, the REER is an adjusted version of the NEER that takes into account the inflation rate of the home country relative to the inflation rate of its trading partners.

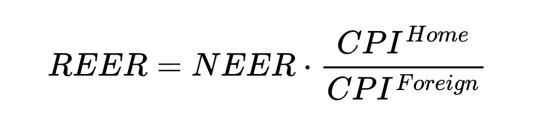

Exchange Rate Pass-Through

Exchange rate pass-through (ERPT) is a measure of how responsive international prices are to changes in exchange rates. An incomplete ERPT leads to a deviation of the REER from the PPP. The ERPT can be calculated by dividing the percentage price change in one currency by the percentage price change in the other currency.

Fisher Effect

The Fisher Effect describes the relationship between inflation and both real and nominal interest rates.

The International Fisher Effect states that differences in nominal interest rates between countries can be used to predict changes in exchange rates.

Interest Rate Parity

The theory of Interest Rate Parity (IRP) provides the linkage between the foreign exchange markets and the international money markets. It states that the difference in the national interest rates for securities of similar risk and maturity should be equal to, but opposite in sign to, the forward rate discount/premium for the foreign currency (excluding transaction costs).

The aforementioned forward rate premium/discount is calculated using the forward and spot rates:

If the theory of IRP does not hold, it paves the way for Covered Interest Arbitrage (CIA), wherein the arbitrager exploits the imbalance by investing in whichever currency offers the higher return, while covered by a forward contract. With Uncovered Interest Arbitrage (UIA), on the other hand, the investor remains uncovered, as they do not sell the higher yielding currency proceeds forward.

Forward Rate as an Unbiased Predictor

This theory states that the forward rate should be an unbiased predictor of the future spot exchange rate, given the assumption of risk neutrality and rational expectation. The forward rate will therefore, on average, overestimate and underestimate the actual future spot rate in equal frequency and degree.

2 notes

·

View notes

Text

Have A Entertaining And Risk-free Trip

We all enjoy the anticipation leading up to and including soothing, satisfying holiday. Visiting your location, even so, is not always entertaining. Organizing can present you with migraines. We wish to discuss some tips along with you to lessen the level of anxiety that you simply practical experience, making your trip more enjoyable.

Keep in mind cons that try to take advantage of unwary travellers. In lots of poorer locations around the world, it is most trusted to believe that any person begging for the money or seeking to hold you back for just about any reason can be quite a pickpocket. Don't possibly show or hand over your finances to anybody, regardless of whether they boast of being police officers.

The next time you're out out and about and searching to grab a chew, look at chowing down on the nearby Japanese restaurant. Refreshing sushi and sashimi are full of healthy proteins, really low in extra fat, plus very scrumptious. Salmon, for example, is incredibly rich in vitamin D and omega-3 essential fatty acids.

Vacation could be a very academic encounter for every single member of the family. Even getting a trip to a creating nation could be a harmless strategy to instruct children about the day-to-day lives of people outdoors their home land. Touring in foreign countries will help you be aware of the planet far better and stay a lot more tolerant of other people.

To spend less you want to plan your trip as much in innovative since you can. Each plane and hotel tickets will most likely be less costly should you buy them weeks prior to your holiday transpires quite then a few weeks prior to. You may use the funds you saved to savor on your own greater on your own trip, or help save it to be on an additional.

If you are making children with good friends or family while you are apart on a trip, ensure that you abandon important reports like medical health insurance cards and a notarized message, stating that their health worker has your authority to produce medical decisions. They created need this information if you find a health care urgent.

Dog warm and friendly vacation can be extremely gratifying if you are planning ahead. Make sure you determine if your pet moves nicely prior to subjecting him to extended automobile trips. The Internet can help you get dog warm and friendly accommodations and locations that could make holidaying along with your pet entertaining and inexpensive. Those days are gone of making your furry friend home.

Once you plan to take a thorough journey time and personal a home, it could be to your advantage to rent out your own home to ensure it is nicely maintained while you are eliminated. This will guarantee that bills are paid, tools nonetheless on, rather than allow you to lose money while you journey.

When it comes to exchanging your currency exchange, it is all about spot. Usually do not be considered a eleventh hour money exchanger running throughout the air-port to try to obtain your unfamiliar money. Airports can be a very pricey method to obtain forex, as well as the prices will not be to your great advantage. Exchanging must be one of several early facts you do with your preparation, as it also secures the money you mean for overseas paying.

So there you have it, the suggestions used by industry experts, to help make traveling more fun. As you prepare your following journey, remember to acquire an additional take a look at these pointers. They can minimize some pressure and enable you to travel simpler.

#tour and travels#package tour#travel tours#travel and tours#baguio tour package#trip packages#guided tours#baguio tour#trip tour#travel tour packages#travel trips#travel and tours packages#adventure tour packages#adventure tours and travels#a package tour#guided travel tours#adventure package#baguio day tour#guided trips#travelling package#baguio city tour#day tour package#baguio city tour package#guided travel#tours and packages#adventure travel packages#tour and trip#trips and travel#baguio trip package#adventure trip packages

2 notes

·

View notes

Text

Why the Sanctions of Syria Do Not Work and the European Union/U.S. Government's Slowness

Article #1:

Nine out of 10 Syrians are living in poverty and are unable to afford basic necessities such as bread, milk, and meat. The local currency devalued sharply over the last year in parallel with the crash in neighboring Lebanon, and food prices spiked by more than a 100 percent. Nearly 7 million remain internally displaced and cash-strapped with no means to rebuild their homes and communities.

The country’s economy collapsed as a result of devastation caused by war, decades-long corruption by the Assad government, and the crash of the banking sector in Lebanon, in which not just Lebanese but Syrians too lost their deposits. But Western sanctions that banned reconstruction of any sort, including of power plants and pulverized cities, certainly exacerbated Syrians’ miseries and eliminated any chance of recovery.

Syrians had no expectations from a government that turned their homes, shops, and schools into debris in the first place. But they had hoped that foreign investors might come to their aid, rebuild the country, and allow them to restart their lives. That hope evaporated when the Caesar Syria Civilian Protection Act came into force in June 2020. The U.S. law threatens sanctions on any entity, American or otherwise, if it provides “significant financial, material, or technological support” to the Syrian government.

AND

But others suggest a more practical approach to mitigate the suffering of the Syrian people and avoid another exodus. They say that since no one believes Assad will be toppled by the opposition or dropped by his Russian patron anytime soon, a more nuanced policy is required. If the United States keeps its vast array of sanctions in place until Assad gives way to meaningful political transition, which the Syrian government sees as regime change by other means, the crisis will simply aggravate over time. But if sanctions can be properly leveraged and Syria’s economic distress eased, it might encourage Syrians to stay home.

The International Crisis Group (ICG) has long recommended that the United States list “concrete and realistic” steps that Damascus and its allies must take in exchange for sanctions waivers. The Syrian leadership will not hold war criminals (or itself) accountable or even release all its prisoners. But it might deliver on other demands if sufficiently incentivized. The ICG says the regime could be induced to offer unrestricted access to international humanitarian actors, permit displaced persons to return home, and promise an end to indiscriminate airstrikes on areas outside regime control.

AND

“While this leverage is probably insufficient to elicit a change in leadership in Damascus, if wielded effectively it could achieve major objectives that are of strategic value to the West and life-or-death importance to millions of Syrians,” she said. But in order to better utilize their leverage, the United States and the EU need to define a clearer position demonstrating that while Damascus might not get things for free, there are achievable outcomes short of regime change that would elicit Western reciprocity, Khalifa added. “The starting point in negotiations can’t be that ‘Damascus won’t budge.’ The Syrian government, like any other conflict party, has and will continue to somewhat compromise when it feels like it has no other choice than to do so—at least as long as these compromises don’t touch the core of the regime.”

AND

Regional investors are keen to partake in Syria’s reconstruction and in exchange push the Syrian government to contain Iran. Last year, Jordan convinced the United States to let Egyptian gas and Jordanian electricity pass through Syrian territory to end Lebanon’s energy crisis but in the process also aid the Syrian economy. That move left analysts befuddled who wondered why the Biden administration had not leveraged sanctions and asked for something in return instead of handing out the concession for free. Andrew Tabler, a fellow with the Washington Institute for Near East Policy, said: “To give everything in exchange for nothing is not wise.”

Article #2:

“I don’t think that this license will suddenly open the floodgates and allow for unhindered humanitarian access and delivery in Syria,” said Delaney Simon, a senior analyst at the International Crisis Group’s US program. “There are just too many other access issues. But I hope that the license will ease the concerns of financial providers, the private sector and other actors, to show them that sanctions won’t be a risk for them to engage in Syria.”

AND

In announcing the license that grants a temporary reprieve for the regime, the deputy treasury secretary, Wally Adeyemo, said: “I want to make very clear that US sanctions in Syria will not stand in the way of life-saving efforts for the Syrian people. While US sanctions programs already contain robust exemptions for humanitarian efforts, today Treasury is issuing a blanket general license to authorize earthquake relief efforts so that those providing assistance can focus on what’s needed most: saving lives and rebuilding.”

AND

But since Damascus, along with allies like China and Russia, are eager to cast western sanctions as worsening the humanitarian situation, Washington’s exemption has its uses, Lister [Charles Lister, director of the Middle East Institute’s Syria program] said. “Sanctions is a complete side point, virtually irrelevant in terms of the flow of humanitarian assistance,” he said. “A lot of the complaints that we’re hearing around sanctions at the moment are just so, kind of, hypocritical, especially when they’re coming from supporters of the regime or from the Russians.”

Article #3:

At a press conference Tuesday in Damascus, Syrian Arab Red Crescent head Khaled Hboubati said his group is “ready to deliver relief aid to all regions of Syria, including areas not under government control.” He called for the European Union to lift its sanctions on Syria in light of the massive destruction caused by the earthquake.

Aid convoys and rescuers from several countries, notably key ally Russia, as well as the United Arab Emirates, Iraq, Iran, and Algeria, have landed in airports in government-held Syria.

Still, the sanctions exacerbate the “difficult humanitarian situation,” Hboubati said. “There is no fuel even to send (aid and rescue) convoys, and this is because of the blockade and sanctions,” he said.

So far, the U.S. and its allies have resisted attempts at creating a political opening by way of the disaster response. U.S. State Department spokesman Ned Price told reporters Monday that it would be “ironic, if not even counterproductive, for us to reach out to a government that has brutalized its people over the course of a dozen years now.”

Price said the U.S. would continue to provide aid through “humanitarian partners on the ground.”

Similarly, a spokesperson for the United Kingdom’s Foreign, Commonwealth & Development Office said the “sanctions regime was put in place in response to human rights violations and other abuses by the regime and their cronies.”

#turkey and syria 7.8 earthquake and aftershocks#syria#not asoiaf#news#world news#international news#syria earthquake#turkey earthquake

6 notes

·

View notes

Text

The Ultimate Guide To Forex Trading

Trading in the Forex market is an exciting and potentially profitable venture for those who are prepared to do their due diligence and educate themselves about the complexities of currency markets. For those who have never played with Forex before, this can be a daunting task. Where do you even begin? What risks should you consider? How do you know if it’s the right investment for you? In this ultimate guide to Forex trading, we'll answer all these questions and more. We'll cover the basics of currency pairs, how to identify trends in the market, risk management strategies, and much more. Read on to get your crash course in understanding and profiting from Forex trading! Get more info about forex trading online

What is Forex trading?

Forex trading is the process of buying and selling currencies in the foreign exchange market. The foreign exchange market is a global decentralized market for the trading of currencies. This market determines the foreign exchange rate. It includes all aspects of buying, selling and exchanging currencies at current or determined prices. In terms of trading volume, it is by far the largest market in the world.

The main participants in this market are the larger international banks. Financial centers around the world function as anchors of trading between a wide range of different types of buyers and sellers around the clock, with the exception of weekends. Since currencies are always traded in pairs, the foreign exchange market does not set a currency's absolute value but rather determines its relative value by setting the market price of one currency if paid for with another. Ex: 1 USD is worth X CAD, or EURUSD is worth X EUR etc..

The foreign exchange market operates like any other market where goods or assets are bought and sold freely between consenting parties at an agreed-upon price – nothing more, nothing less. That said, there is an important distinction to be made between spot forex trades and forex contracts for difference (CFDs), which we will discuss momentarily. But first, let’s review some key characteristics that distinguish spot forex from other markets:

How to start Forex trading?

If you're new to Forex trading, it can be tough to know where to start. But don't worry - we've got you covered. In this article, we'll give you a crash course in Forex trading, including how to set up a trading account, how to make your first trade, and what you need to know before you start trading.

So, let's get started!

The first thing you need to do is set up a Forex trading account. You can do this through a broker or a bank. Once you have an account set up, you'll need to fund it with some money. This is called your "account balance."

Once your account is funded, you're ready to start trading! To make your first trade, you'll need to choose a currency pair. This is the price of one currency compared to another. For example, if you're trading EUR/USD, that means you're buying euros and selling dollars.

Once you've chosen your currency pair, it's time to place your order. There are two types of orders: market orders and limit orders. With a market order, you agree to buy or sell at the current market price. With a limit order, you specify the price at which you're willing to buy or sell.

For example, let's say that EUR/USD is currently trading at 1.2550. If you place a market buy order, you'll buy euros

Conclusion