#FinancialTimes

Explore tagged Tumblr posts

Text

FKA twigs in Financial Times - 9/5/24

Wearing:

FW06 Stamped Leather Breastplate by Issey Miyake from Artifact New York

Boa earrings by Panconesi

#fkatwigs#fkatwigsfashion#fkatwigsstyle#fka twigs#twigs#tahliah barnett#tahliah debrett barnett#2024#editorial#panconesi#financialtimes#jewelry#issey miyake#Artifact new york#sothebys

13 notes

·

View notes

Text

Japon Sigorta Devleri Global Genişlemeye Odaklanıyor Tokyo, 13 Aralık (Financial Times) - Japonya merkezli büyük sigorta şirketleri, düşük büyüme oranları ve yaşlanan nüfus gibi yerel piyasa sorunlarını aşmak içi...

2 notes

·

View notes

Text

2 notes

·

View notes

Text

“The final version of the agreement, dated Feb. 24, establishes a fund to which Ukraine will contribute 50% of proceeds from the ‘future monetization’ of state-owned mineral resources, including oil, gas, and related logistics. The fund will invest in projects within Ukraine.” ~ @kyivindependent_official 🇺🇦💙💛🇺🇸

#Repost @kyivindependent_official with @use.repost_ . . . . . . . . . . . . According to the Financial Times report, Ukraine has secured more favorable terms and framed the deal as a way to strengthen ties with the U.S.

Zelensky is expected to head to Washington for a signing ceremony in the coming weeks, according to the Financial Times.

Read the full report at the link in bio.

Photo: Oliver Contreras / Getty Images

9h

#ukraine#agreementwithus#mineralsdeal#mineralresources#morefavorableterms#strengthentieswithus#halfofproceeds#futuremonetization#oil#gas#relatedlogistics#fundtoinvestinukraine#nosecurityguarantees#ukrainianpresident#volodymyrzelensky#signingceremony#washingtondc#financialtimes#ukrainewarlatest#kyivindependent#kyivindependent_official#armukrainenow#peacethroughstrength#standwithukraine#supportukraine#untilvictory

0 notes

Link

The Financial Times is stepping up its game for readers with new, flexible subscription options. Dive into top-notch journalism starting with a 4-week trial for just £1! If you’re looking for deep insights on current events, their full digital package is just £59/month, or grab a standard plan for £39/month with a sweet annual discount. Whether you’re an individual or part of an organization, FT has tailored features to keep you on top of your industry. With over a million subscribers, it's clear that people trust FT for credible news that impacts decision-makers everywhere. Curious? Take the plunge and see what you’ve been missing! Sign Up to the free newsletter here www.investmentrarities.com.

#FinancialTimes#journalism#subscription#news#currentevents#insightfulreading#digitalnews#crediblejournalism#freetrial#newsletter#readers#industrynews

0 notes

Text

#ftse100#ftse#ftse100index#stockmarket#stockmarkettoday#ftse100today#financialtimes#nikkei225#nikkeiindex#markets#ftse100live#TrumpTariffs#StockMarketCrash#DollarSurge#FTSE100#GlobalStocks#Economy2025#MarketUpdate#TariffImpact#InvestingTips#FinancialNews#BreakingNews#StockMarket#DollarStrong#TrumpNews#MoneyMoves#Drake#Grammys#Kendrick#billie

1 note

·

View note

Text

Japon Sigorta Devleri Global Genişlemeye Odaklanıyor Tokyo, 13 Aralık (Financial Times) - Japonya merkezli büyük sigorta şirketleri, düşük büyüme oranları ve yaşlanan nüfus gibi yerel piyasa sorunlarını aşmak içi...

0 notes

Text

Me, in the FT, on the Chateau Marmont

"The Marmont feels like the stable fixture in an ever-chaotic, spinning world of Hollywood mischief and La La Land foibles, a place you can always go to Sleep It All Off. I want to be where the wild people are, always, but I also want to be alone, forever, and the Marmont does both lurid excess and luxurious anonymity perfectly.

And for someone whose family has mastered the art of bursting unannounced into rooms, the Marmont’s “privacy, laxity, eccentricity and thickness of walls” that allow you to “enjoy your trouble away from prying ears and eyes” especially appeals. It’s a world away from my ex-teen bedroom in the suburbs, where writing at my desk is often interrupted by a family member, or disturbed by the glowing ember of my phone. In the Marmont’s 1970s heyday, there were no phones, certainly no Instagram or TikTok, and it is still forbidden to take photos while staying or dining there today — nor can you post on social media. Heaven!

The Marmont was home to the beautiful, rich and famous, but it was not a paean to perfection. Its lampshades didn’t match and it had an aura of “romantic depressiveness” according to Babitz.

It wasn’t a place that exuded polished glamour either ��� she wrote that it was frequented and loved by the “kind of people who liked to spill things, things like wine, blood, whisky, cocaine, ashes and bodily fluids”. Like Babitz, I have never been one for perfection and have ruined more carpets than I care to remember. My perfect stay at the Marmont would include ordering the eggs Florentine, then heading down to the pool for a swim — in the same pool where Sofia Coppola celebrated her 21st birthday party, and where much of her film Somewhere was shot. After that I would pen my girl-about-town vignettes, regarding men with champagne eyes and wolfish smiles. I’d do this sitting at a desk overlooking the huge Marlboro Man sign, just as actor and writer Griffin Dunne used to while living there.

At night I would lounge in the velvet-draped bar, listening to live piano, with no one to bother me, the ping of my WhatsApp notifications fading like a bad dream."

1 note

·

View note

Text

NYT Connection

NYT Connections Hints are subtle clues or tips provided to assist players in solving the popular word-based puzzle game "Connections" by The New York Times. In this game, players are presented with 16 words and tasked with grouping them into four sets of four words that share a common NYT connection, such as a category, theme, or concept. The challenge lies in identifying these connections, which can range from straightforward to highly abstract or ambiguous.

The hints aim to make the puzzle more accessible by guiding players without giving away the answers outright. They can help players recognize patterns or relationships between words, such as synonyms, categories (e.g., colors, fruits, or famous authors), or more subtle themes like puns or homophones. For example, if the puzzle includes the words "apple," "banana," "grape," and "orange," a hint might nudge players to consider a category like "fruits."

Hints are useful for overcoming the trickier aspects of the game, where some words may belong to multiple plausible groups, or when the connection between certain words is particularly obscure. By focusing attention on certain aspects, such as shared prefixes, cultural references, or linguistic similarities, hints encourage players to think critically and systematically about the relationships between words.

These hints might be available directly through The New York Times website or external communities where fans discuss and share insights about the puzzles. For players who enjoy a balance of challenge and guidance, hints provide a helpful middle ground, allowing them to progress without fully spoiling the satisfaction of solving the puzzle independently. This makes NYT Connections an engaging blend of logic, vocabulary, and deductive reasoning.

#nyt#art#nytimes#nyc#miami#miamibeach#artsy#artnet#artmiami#artnews#fridgeartfair#artbaselmiami#miaminewtimes#newyorktimes#financialtimes#artbasel#financialtimesmagazine#theartnewspaper#artfair#nada#untitledartfair#scopeartfair#hypoallergenic#artbaselmiamibeach#miamiherald#cultureowlmiami#rubellmuseum#esquinadeabuela#espacio#fridgeartfairmiami

1 note

·

View note

Text

Los mejores libros de economía y negocios de 2024 según Financial Times

El Financial Times ha seleccionado una serie de libros que exploran temas clave en la economía mundial actual, desde la inteligencia artificial hasta la desigualdad.Temas recurrentes:* Futuro del trabajo: La automatización, la inteligencia artificial y los cambios en la fuerza laboral son temas centrales en varios libros.* Desigualdad económica: Se abordan las crecientes desigualdades y las…

View On WordPress

#desarrolloeconomico#economia#emprendedor#financialtimes#inanzas#inversor#lecturarecomendada#libros#librosdeeconomia#negocios#recomendacionesdelibros

0 notes

Link

#wupples#wupplesinvest#financialfreedom#financial#financialtimes#financialplanning#financialeducation#financialliteracy#FinancialAdvisor#finance

0 notes

Text

ReduxStock: Photo of Kamala Harris by Elena Dorfman/Redux on the cover of the UK’s FT Weekend Magazine, October 12/13, 2024. Via our UK partner, eyevine.

0 notes

Text

Exploring the Nexus of the Dollar, US Debt, and Cryptocurrency

In the ever-evolving landscape of global finance, the interplay between the US dollar, US debt, and cryptocurrencies has emerged as a topic of paramount importance. This essay delves into the intricate dynamics and interconnectedness of these elements, shedding light on their multifaceted relationship and implications for the global economy.

The Dollar: A Beacon of Stability Amidst Uncertainty

The US dollar, often regarded as the cornerstone of the international monetary system, serves as a benchmark for global trade and investment. Its value is influenced by a myriad of factors, including economic indicators, geopolitical events, and monetary policy decisions. Despite periodic fluctuations, the dollar’s status as a safe haven asset and reserve currency remains largely unchallenged, underpinned by the strength of the US economy and the credibility of its institutions.

US Debt: Balancing Act in Fiscal Policy

Conversely, the ballooning US national debt presents a nuanced challenge to the stability of the dollar. While debt accumulation has been a common tool for financing government spending and stimulating economic growth, sustained increases raise concerns about fiscal sustainability and inflationary pressures. The intricate balance between fiscal stimulus and debt management underscores the delicate dance policymakers must navigate to maintain investor confidence and preserve the dollar’s hegemonic status.

Cryptocurrencies: Disruptive Innovations or Speculative Bubbles?

In parallel, the rise of cryptocurrencies has introduced a new dimension to the global financial ecosystem. Powered by blockchain technology and decentralized networks, these digital assets promise greater transparency, security, and autonomy in financial transactions. However, their volatile nature and regulatory uncertainties have fueled debates about their legitimacy and long-term viability. While proponents herald cryptocurrencies as a democratizing force in finance, skeptics warn of speculative excesses and systemic risks that could reverberate across traditional markets.

Intersections and Implications: Unraveling the Tapestry of Global Finance

The convergence of the dollar, US debt, and cryptocurrencies underscores the complexity of contemporary economic dynamics. Fluctuations in one element can trigger ripple effects across the others, amplifying market volatility and reshaping investor sentiment. As policymakers and market participants navigate this intricate web of interdependencies, a nuanced understanding of the underlying forces driving these phenomena is imperative for informed decision-making and risk management strategies.

Conclusion: Navigating the Crosscurrents of Financial Evolution

In conclusion, the nexus of the dollar, US debt, and cryptocurrencies epitomizes the multifaceted nature of modern finance. As we traverse the ever-shifting currents of global economic dynamics, vigilance, adaptability, and foresight will be paramount. By embracing innovation while upholding prudence, stakeholders can chart a course towards a more resilient and inclusive financial future, where stability, sustainability, and prosperity converge on a global scale.

elaborado com inteligência artificial

#GlobalFinance#USDynamics#USDebtChallenge#CryptocurrencyTrends#EconomicInterplay#FinancialInnovation#MarketVolatility#RegulatoryUncertainty#FinancialTimes#EconomicPerspectives

0 notes

Photo

Kina Fokuserar på Nya Marknader: Investeringar i Väst Avtar | CeBoz.com

Kina har vänt blicken från västvärlden och satsar nu på andra marknader. Läs om hur Kinas investeringsstrategi förändras och vilka områden de prioriterar.

0 notes

Text

“Russia’s new intermediate-range ballistic missile, the Oreshnik, recently fired at Ukraine, was developed using advanced manufacturing equipment from Western companies, despite sanctions, The Financial Times reported on Dec. 27.” ~ @kyivindependent_official 🇺🇦💙💛🇺🇦

#Repost @b4ukraine with @use.repost_ . . . The Russian experimental Oreshnik missile, fired against Ukraine last month, was made by Russian companies that used high-precision #CNC machines produced by Western companies such as #Fanuc (Japan), #Siemens (Germany), and #Heidenhain (Germany), @financialtimes reports.

Computer Numerical Control is a critical technology for #Oreshnik’s production, enabling factories to rapidly and precisely shape materials like metal by using computers to control machining tools.

While export controls have slowed the flow of these goods into Russia, FT analysis of Russian filings suggests at least $3mn of shipments, which include Heidenhain components, has flowed into Russia since the start of 2024.

@DenysHutyk, executive director at the Economic Security Council of Ukraine (a B4Ukraine member), stated: “The development of the Oreshnik shows how reliant the Russian military-industrial complex still is on high-end western equipment. Western governments should be pushing to stem the flow of these goods, which we saw last month in Dnipro directly contribute to the Russian assault on Ukrainian life.”

#DisarmRussia

16h

#ukraine#oreshnik#russianballisticmissile#advancedmanufacturingequipment#westerncompanies#sanctionsloophole#highprecision#cncmachines#criticaltechnology#reliantonwesternequipment#financialtimes#b4ukraine#kyivindependent_official#armukrainenow#closesanctionsloopholes#standwithukraine#supportukraine#untilvictory

0 notes

Text

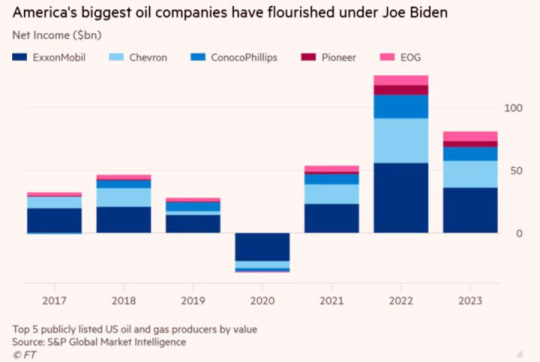

Profitti miliardari per l'industria Americana del gas e petrolio

I profitti del petrolio e del gas triplicano sotto Joe Biden anche se l’industria lo denigra. Bonanza mostra un ruolo presidenziale limitato nel guidare i rendimenti nonostante l’avvertimento di un secondo mandato “disastroso”. I profitti dei maggiori produttori statunitensi di petrolio e gas sono quasi triplicati sotto la presidenza di Joe Biden, anche se l’industria rimprovera le politiche “ostili” della sua amministrazione e avverte che un secondo mandato sarebbe “disastroso” per il settore. I primi 10 operatori quotati del paese per valore, che finiranno di pubblicare i loro utili del 2023 questa settimana, sono sulla buona strada per aver accumulato un utile netto combinato di 313 miliardi di dollari nei primi tre anni dell'amministrazione Biden, rispetto ai 112 miliardi di dollari dello stesso periodo. sotto Donald Trump. La capitalizzazione di mercato collettiva del gruppo – che comprende ExxonMobil, Chevron, ConocoPhillips, EOG, Pioneer Natural Resources, Occidental Petroleum, Hess, Devon Energy, Diamondback Energy e Coterra Energy – è aumentata del 132% nel periodo a oltre 1,1 trilioni di dollari, rispetto a un calo del 12% nei primi tre anni di Trump. I dati sui profitti del 2023 si basano sui rapporti sugli utili, ad eccezione di Devon, che dovrebbe pubblicare martedì i risultati del quarto trimestre, i cui ultimi dati sui profitti trimestrali sono stime di consenso. La produzione statunitense ha infranto record negli ultimi anni: a novembre, la produzione di petrolio ha raggiunto la cifra senza precedenti di 13,3 milioni di barili al giorno, mentre il gas naturale ha superato per la prima volta i 105 miliardi di piedi cubi al giorno. Lo scorso anno la nazione ha superato il Qatar diventando il più grande esportatore di gas naturale liquefatto al mondo. La sovraperformance sotto Biden sottolinea il ruolo limitato della Casa Bianca nel dettare le fortune del settore. La recente fortuna dei profitti è stata in parte determinata dall’invasione su vasta scala dell’Ucraina da parte della Russia, che ha fatto salire i prezzi del petrolio e del gas. Anche la forte ripresa della domanda globale di energia, reduce dallo shock del Covid-19 nel 2020, ha sostenuto i prezzi. Il West Texas Intermediate, il benchmark del greggio statunitense, ha registrato una media di circa 80 dollari al barile durante i primi tre anni di Biden rispetto ai 58 dollari al barile di Trump.

Le grandi compagnie americane di gas e petrolio sono fiorite con Joe Biden Ciò si scontra anche con le argomentazioni repubblicane secondo cui l’amministrazione Biden ha soffocato l’industria e con i terribili avvertimenti secondo cui una vittoria democratica nelle elezioni presidenziali di novembre metterebbe a rischio la sicurezza energetica americana. “Fin dal suo primo giorno in carica, il presidente Biden ha preso di mira i nostri produttori di energia nazionali e ha indebolito attivamente gli sforzi dell’America per essere indipendenti dal punto di vista energetico”, ha affermato questo mese il presidente repubblicano della Camera Mike Johnson. Biden ha condotto una campagna sulla piattaforma climatica più ambiziosa di qualsiasi presidente americano nella storia, promettendo di guidare una “transizione dal petrolio”. Appena entrato in carica, ha implementato una serie di politiche che hanno fatto infuriare l’industria: dalla sospensione temporanea di nuovi contratti di locazione per lo sviluppo di combustibili fossili su terreni pubblici al fallimento dell’oleodotto Keystone XL. Durante il suo mandato, tuttavia, ha ridimensionato parte di quella retorica iniziale, esortando l’industria a trivellare di più per contrastare i prezzi elevati alla pompa e incoraggiando le esportazioni di gas naturale liquefatto per arginare una crisi energetica in Europa. “Per reprimere l’inflazione, Biden ha sostenuto una produzione record per mantenere bassi i prezzi del petrolio e del gas, pur favorendo maggiori esportazioni di gas per aiutare l’UE”, ha affermato Paul Bledsoe, docente presso l’American University ed ex consigliere sul clima dell’amministrazione Bill Clinton. “Non puoi fare di meglio da un presidente democratico”. Eppure la campagna di Biden è stata riluttante a pubblicizzare il successo del settore per paura di contraccolpi da parte dell’ala progressista del Partito Democratico e si è affrettata a criticare gli operatori. Con l’impennata dei prezzi del petrolio nel 2022, il presidente ha criticato Exxon per aver guadagnato “più soldi di Dio”. L’anno scorso l’amministrazione ha imposto severe restrizioni sul leasing offshore e a gennaio ha sospeso le autorizzazioni per nuovi terminali GNL, facendo arrabbiare i leader del settore.

L’industria del petrolio e del gas contribuisce con decine di milioni di dollari ai repubblicani ad ogni ciclo elettorale Mike Sommers, amministratore delegato dell’American Petroleum Institute, ha affermato che il successo dei produttori di petrolio e gas negli ultimi tre anni è avvenuto nonostante l’agenda politica “ostile” del presidente, che minerebbe la sicurezza energetica della nazione se lasciata senza controllo. “Anche se non si vede un impatto in questo momento, penso che stiano gettando i semi per una diminuzione della produzione in futuro. Ogni settimana vediamo un altro regolamento sotto questa amministrazione che penso potrebbe essere molto dannoso”, ha detto Sommers. Questo mese l’API ha citato in giudizio l’amministrazione Biden per la sua decisione di limitare il leasing offshore, evidenziando una crescente reazione del settore contro le sue politiche climatiche ed energetiche. Trump e i suoi delegati hanno fatto del sostegno all’industria del petrolio e del gas una parte fondamentale della sua campagna di rielezione, sostenendo che il recente successo del settore è incastonato nell’agenda di deregolamentazione della precedente amministrazione. “Conosciamo la politica del percorso dei profitti. L’industria energetica sta raccogliendo i benefici dell’amministrazione Trump”, ha affermato Carla Sands, importante donatrice di Trump ed ex ambasciatrice in Danimarca. In realtà, dicono gli analisti, i presidenti in carica hanno un impatto minimo sulla performance a breve termine del settore. “In generale, i rendimenti di una data presidenza hanno ben poco a che fare con chi è in carica. Si tratta più dei fondamentali”, ha affermato Bob McNally, presidente della società di consulenza Rapidan Energy ed ex consigliere energetico di George W. Bush. “Penso che le conseguenze di un’elezione negli Stati Uniti per la politica energetica e climatica saranno probabilmente sopravvalutate ed esagerate”.

La produzione statunitense di petrolio e gas naturale ha raggiunto nuovi record sotto la presidenza di Joe Biden © FT montage/Bloomberg Trump ha promesso di stracciare gran parte della legislazione sul clima di Biden se vincesse a novembre, cosa che secondo alcuni analisti potrebbe danneggiare la posizione degli Stati Uniti all’estero e danneggiare le esportazioni energetiche del paese. “Una vittoria di Trump si tradurrebbe in una massiccia rottura con il mondo sulla politica climatica globale, ironicamente aumentando la pressione pubblica contro le esportazioni statunitensi, soprattutto in Europa”, ha affermato Bledsoe. Nonostante alcuni dubbi nell’industria nei confronti di Trump e del suo programma anti-libero commercio, i grandi donatori di petrolio e gas continuano a schierarsi in grande maggioranza dalla parte del suo partito. Secondo una ricerca di OpenSecrets, i repubblicani hanno ricevuto 126,4 milioni di dollari in donazioni elettorali dal ciclo elettorale del 2020 dall’industria, rispetto ai soli 23,6 milioni di dollari ricevuti dai democratici. Harold Hamm, magnate americano dello shale e miliardario donatore repubblicano, ha dichiarato al Financial Times che una vittoria di Biden sarebbe “disastrosa” per il settore. Ha detto che il presidente sta implementando politiche che porterebbero alla “morte per mille tagli” per l’industria, citando le sue restrizioni alle trivellazioni sui terreni federali, una pausa sulle approvazioni del GNL e regolamenti più severi. “Se Trump sarà il candidato prescelto dal processo delle primarie, lo seguiremo sicuramente . . . sarebbe disastrosa”, ha detto Hamm, che ha anche fatto una donazione ai candidati repubblicani Nikki Haley e Ron DeSantis. Reporting aggiuntivo di Eva Xiao a New York Read the full article

#CasaBianca#donaldtrump#financialtimes#gasnaturale#greendeal#industriaamericana#JoeBiden#petrolio#StatiUnitiAmerica

0 notes