#Financial safety

Explore tagged Tumblr posts

Text

This whole issue of whether the “vetted“ crowdfund campaigns for Gaza’s families are legitimate really points up a pretty basic tenet of Internet and financial safety that a whole lot of people have either never been taught or have forgotten.

Only give money directly to individuals with whom you have a relationship of trust, or to people who are personally known and trusted by people with whom you have a relationship of trust.

This should also be your standard offline.

Now I’m not talking about giving a few dollars to a stranger outside the Burger King asking for help to get food.

But campaigns trying to raise thousands of dollars? Those demand special scrutiny.

And if you are 3 degrees or more removed from the person who will benefit, or can only rely on the word of a virtual stranger about legitimacy, it makes much more sense to give money to a trustworthy organization instead, so you can be sure that your money will actually help people and not line the pockets of a scammer.

230 notes

·

View notes

Text

Top Reasons to Choose Fixed Deposits for Guaranteed Financial Safety

In today’s world, where economic uncertainties and market fluctuations are common, securing your hard-earned money in safe and reliable financial instruments is more important than ever. Fixed Deposits (FDs) are one of the most trusted and popular investment options for individuals looking to ensure the safety of their savings while earning a steady return. Here’s why fixed deposits are an excellent choice for guaranteed financial safety.

1. Guaranteed Returns

One of the biggest advantages of fixed deposits is that they offer guaranteed returns. When you invest in an FD, you know exactly how much you will earn at the end of the term. Unlike stocks, mutual funds, or other market-linked instruments, the returns from FDs are not subject to market volatility. The interest rate is locked in at the time of investment, ensuring that your money grows steadily over time without any surprises.

2. Low-Risk Investment

Fixed deposits are one of the safest investment options available. Banks and financial institutions are regulated by government bodies, and the chances of defaults are minimal. The safety of your investment is further enhanced by deposit insurance schemes, which ensure that even if a bank faces difficulties, your deposit is protected up to a certain limit (e.g., ₹5 lakh in India).

3. Flexible Tenure

Fixed deposits come with flexible tenures, allowing you to choose a period that best suits your financial needs. Whether it’s a short-term FD for a few months or a long-term one for several years, you can select the tenure based on your goals and liquidity requirements. This flexibility gives you control over when you want to access your funds while still earning a fixed interest rate.

4. Regular Income Option

For those looking for a steady income stream, fixed deposits offer the option of receiving interest payouts on a monthly, quarterly, or annual basis. This feature makes FDs an ideal choice for retirees or anyone who wants a regular income from their investments without worrying about fluctuating market conditions.

5. Tax Benefits

In some countries, including India, certain types of fixed deposits offer tax benefits. For example, tax-saving FDs allow you to claim deductions under Section 80C of the Income Tax Act. These FDs have a lock-in period of five years and can help reduce your taxable income while growing your savings.

6. No Impact from Market Volatility

Unlike stocks, mutual funds, or other equity-based investments, fixed deposits are not affected by market fluctuations. This makes them a safe option for conservative investors who prefer a stable, predictable return. Regardless of how the market behaves, your FD will continue to earn the same interest, ensuring the safety of your principal amount.

7. Easy to Open and Manage

Opening a fixed deposit account is a simple and hassle-free process. Most banks and financial institutions offer online facilities, allowing you to open an FD from the comfort of your home. Additionally, once you’ve invested in an FD, it’s easy to manage. You don’t need to constantly monitor the performance, as you do with stock investments, and there’s no need for frequent decision-making.

8. Liquidity with Premature Withdrawal

While FDs are designed to lock in your money for a fixed tenure, they also offer a certain degree of liquidity. In case of an emergency, you can withdraw your FD before the maturity date, although you may face a penalty in the form of lower interest rates. This makes FDs a relatively liquid investment, providing access to funds in urgent situations.

9. Low Minimum Investment Requirement

Another reason why fixed deposits are a popular choice is their low minimum investment requirement. You can start with a small amount, which makes FDs accessible to people from all financial backgrounds. This is particularly beneficial for those who are just starting to save or invest but want to ensure their money is in a safe and reliable option.

10. Ideal for Goal-Oriented Savings

Fixed deposits are an excellent choice for those who want to save for specific financial goals, such as buying a house, funding education, or planning for retirement. Since FDs offer guaranteed returns, you can calculate exactly how much money you will have at the end of the term and plan your finances accordingly.

Conclusion

In an unpredictable financial landscape, fixed deposits offer peace of mind by providing a safe and reliable avenue for growing your wealth. With guaranteed returns, low risk, and a flexible tenure, FDs are an ideal option for conservative investors who prioritize financial security over high-risk, high-reward investments. Whether you’re saving for a rainy day, a specific goal, or simply looking for a safe place to park your savings, fixed deposits are a smart choice for guaranteed financial safety.

Investing in fixed deposits ensures that your money is in safe hands, allowing you to focus on other aspects of your life without worrying about market risks or fluctuating returns. Start today and enjoy the security and peace of mind that come with fixed deposits!

#Fixed Deposits#Financial Safety#Guaranteed Returns#Secure Investments#Savings Plans#Safe Investment Options#Financial Stability#Fixed Deposit Benefits#Risk-Free Investment#Investment Strategy

0 notes

Text

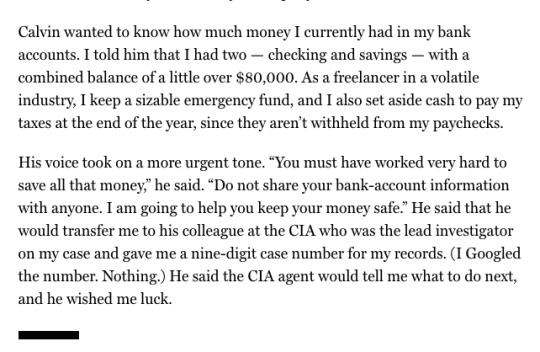

by the way

read these thread - they help u identify which of those asks u receive are scams or not! I'll be using these posts as reference myself from now on

0 notes

Text

And here’s a good video on the topic of scam safety

youtube

what is going on at NY magazine

#scam safety#scams#scammers#fuck scammers#safety#psa#public service announcement#public safety announcement#stay safe#financial advice#financial safety#that dang dad#ny magazine#new york magazine#shoebox#shoe box#charlotte cowles#the cut#fbi#cia#Youtube

9K notes

·

View notes

Text

10 Money Hacks Every Millennial Needs to Know !

1. Millennial Money Mindset: Embracing Financial Freedom As millennials, we face a unique set of financial challenges that our parents and grandparents never encountered. From the burden of student loan debt to the rising cost of living, it can feel like an uphill battle to achieve financial freedom. However, with the right mindset and strategies, we can overcome these obstacles and pave the…

View On WordPress

0 notes

Text

Keeping Your Accounts Safe: Detecting Identity Fraud And Financial Crimes

0 notes

Text

Discover essential tips to safeguard your demat account from potential fraud in this insightful blog. Learn how to protect your investments and secure your financial future with expert advice from TradingBells. Don't let fraudsters jeopardize your hard-earned assets – arm yourself with the knowledge to stay safe in the digital age! For more such blogs: Visit our blog site today: https://tradingbells.com/blogs And for Finanacial Advice reach us at: https://tradingbells.com/ Phone: +91 932 953 6100

0 notes

Text

"In today's digital landscape, the threat of fraud has grown exponentially. Cybercriminals are becoming increasingly sophisticated, utilizing advanced technology to exploit vulnerabilities in online transactions and personal information sharing.

To combat this evolving menace, real-time fraud detection has emerged as a critical defense mechanism.

Gone are the days of traditional fraud schemes involving fake checks and elaborate disguises. Contemporary fraudsters operate from behind screens, employing complex algorithms and stolen data to orchestrate their cybercrimes. This necessitates the adoption of equally advanced methods for detecting and preventing fraud in real time.

Real-time detection is akin to a race against the clock, as traditional methods of fraud detection, which rely on manual reviews and retrospective analysis, no longer suffice. Real-time fraud detection involves continuous monitoring of transactions as they occur, leveraging AI-powered algorithms to analyze patterns and identify anomalies. This proactive approach allows for immediate action, flagging suspicious activities before they can escalate into major security breaches.

1 note

·

View note

Text

thoughts on "tradwives" as a 19th-century social historian

It's great until it's not.

It's great until he develops an addiction and starts spending all the money on it.

It's great until you realize he's abusive and hid it long enough to get you totally in his power (happened to my great-great-aunt Irene).

It's great until he gets injured and can't work anymore.

It's great until he dies and your options are "learn a marketable skill fast" or "marry the first eligible man you can find."

It's great until he wants child #7 and your body just can't take another pregnancy, but you can't leave or risk desertion because he's your meal ticket.

It's great until he tries to make you run a brothel as a get-rich-quick scheme and deserts you when you refuse, leaving your sisters to desperately fundraise so your house doesn't get foreclosed on (happened to my great-great-aunt Mamie).

It's great until you want to leave but you can't. It's great until you want to do something else with your life but you can't. It's great. Until. It's. Not.

I won't lie to you and say nobody was ever happy that way. Plenty of women have been, and part of feminism is acknowledging that women have the right to choose that sort of life if they want to.

But flinging yourself into it wholeheartedly with no sort of safety net whatsoever, especially in a period where it's EXTREMELY easy for him to leave you- as it should be; no-fault divorce saves lives -is naive at best and dangerous at worst.

Have your own means of support. Keep your own bank account; we fought hard enough to be allowed them. Gods willing, you never need that safety net, but too many women have suffered because they needed it and it wasn't there.

#history#women's history#pregnancy mention#my mother (born 1953) drilled this into me from an early age: have a safety net. have a skill and keep it up to date. have your own money#NEVER join bank accounts. keep a hold on your assets.#well and good to be a stay-at-home wife and mother- I know other lesbians who want that even!#but if your partner is your sole financial support...you're courting danger IMO

3K notes

·

View notes

Text

#every time I talk about the long-standing bot/scammer problem on here and remind people of basic internet/financial safety#there's always at least one clown going “BUT WHAT ABOUT THE REAL PEOPLE WHO NEED HELP YOU MONSTER?”#well now there's a due warning posted right where anyone can see it#so either they're asking every blog they see for money without even checking bios (which is still spam)#or they're *GASP* a bot

2K notes

·

View notes

Text

Successful You—How to Overcome Financial Difficulties

The financial difficulties are attributed to an individual, not a bad economy. Any economic situation could not be problematic if you have healthy finances—low debt, enough savings, stagnant active and passive income, and extra cash.

The financial difficulties are attributed to an individual, not a bad economy. Any economic situation could not be problematic if you have healthy finances—low debt, enough savings, stagnant active and passive income, and extra cash. In my case, I often faced financial difficulties during my 20s and 30s. But, strangely, I didn’t know why such financial problems occurred to me repeatedly. So, I…

View On WordPress

#active income#bad economy#budget#debt#extra cash#Financial difficulties#financial safety#healthy finances#passtive income#planning#savings#Spending Pattern

0 notes

Text

sorry to all of you white middle aged man lovers out there but shane madej subtly shifting the blame with the whole 'steven, talk about money' feels like a pathetic way to salvage the hip leftist uncle persona he's got going on and you all are waiting for him to return to your embrace like some prodigal son who was forced and didn't go on his own accord

#watcher#they've literally spoken about how all the financial issues fell on steven to figure out#even if steven was the only one pushing for this (which i doubt) shane should've put in time and effort to learn more about his company#you can't put him in a safety bubble saying he didn't want this if all he can do is stay passive#all three of them suck equal amounts of ass in this situation stop telling ryan and shane to separate#they literally own 2/3rds of the company if they didn't want this they could've said so

110 notes

·

View notes

Text

Craig Harrington at MMFA:

The economic policy provisions outlined by Project 2025 — the extreme right-wing agenda for the next Republican administration — are overwhelmingly catered toward benefiting wealthier Americans and corporate interests at the expense of average workers and taxpayers. Project 2025 prioritizes redoubling Republican efforts to expand “trickle-down” tax cuts for the wealthy and deregulation across the economy. The authors of the effort’s policy book, Mandate for Leadership: A Conservative Promise, recommend putting key government agencies responsible for oversight of large sectors of the economy under direct right-wing political control and empowering those agencies to prioritize right-wing agendas in dealing with everything from consumer protections to organized labor activity. [...]

Project 2025 would chill labor unions' abilities to engage in political activity. Project 2025 suggests that the National Labor Relations Board change its enforcement priorities regarding what it describes as unions using “members' resources on left-wing culture-war issues.” The authors encourage allowing employees to accuse union leadership of violating their “duty of fair representation” by having “political conflicts of interest” if the union engages in political activity that the employee disagrees with. [Project 2025, Mandate for Leadership, 2023; National Labor Relations Board, accessed 7/8/24]

Project 2025 would make it easier for employers to classify workers as “independent contractors.” The authors recommended reinstating policies governing the classification of independent contractors that the NLRB implemented during the Trump administration. Those Trump-era NLRB regulations were amended in 2023, expanding workplace and labor organizing protections to previously exempt American workers. [Project 2025, Mandate for Leadership, 2023; The National Law Review, 6/19/23; National Labor Relations Board, 6/13/23]

Project 2025 would reduce base overtime pay for workers. The authors recommend changing overtime protections to remove nonwage compensatory and other workplace benefits from calculations of their “regular” pay rate, which forms the basis for overtime formulations. If that change is enacted, every worker currently given overtime protections could be subject to a slight reduction in the value of their overtime pay, which the authors claim will encourage employers to provide nonwage benefits but would effectively just amount to a pay cut. The authors also propose other changes to the way overtime is calculated and enforced, which could result in reduced compensation for workers. Overtime protections have long been a focus of right-wing media campaigns to reduce protections afforded to American workers. [Project 2025, Mandate for Leadership, 2023, Media Matters, 7/9/24]

Project 2025 proposes capping and phasing out visa programs for migrant workers. Project 2025’s authors propose capping and eventually eliminating the H-2A and H-2B temporary work visa programs, which are available for seasonal agricultural and nonagricultural workers, respectively. Even the Project 2025 authors admit that these proposals could threaten many businesses that rely on migrant workers and could result in higher prices for consumers. [Project 2025, Mandate for Leadership, 2023]

Project 2025 recommends institutionalizing the “Judeo-Christian tradition” of the Sabbath. Under the guise of creating a “communal day of rest,” Project 2025 includes a policy proposal amending the Fair Labor Standards Act to require paying workers who currently receive overtime protections “time and a half for hours worked on the Sabbath,” which it said “would default to Sunday.” Ostensibly a policy that increases wages, the proposal is specifically meant to disincentivize employers from providing services on Sundays as an explicitly religious overture. [Project 2025, Mandate for Leadership, 2023]

[...]

International Trade

Project 2025 contains a lengthy debate between diametrically opposed perspectives on international trade and commerce.Over the course of 31 pages, disgraced former Trump adviser and current federal inmate Peter Navarro outlines various proposals to fundamentally transform American international commercial and domestic industrial policy in opposition to China, primarily by using tariffs. He dedicates well over a dozen pages to obsessing over America’s trade deficit with China, even though Trump’s trade war with China was a failure and as he focused on China, the overall U.S. trade deficit exploded. Much of the rest of Navarro’s section is economic saber-rattling against “Communist China’s economic aggression and quest for world domination.”In response, Kent Lassman of the conservative Competitive Enterprise Institute promotes a return to free trade orthodoxy that was previously pursued by the Republican Party but has fallen out of favor during the Trump era.

The Heritage Foundation’s Project 2025 agenda would be a boon for the wealthy and a disaster for the working class folk.

See Also:

MMFA: Project 2025’s dystopian approach to taxes

#Economy#Project 2025#The Heritage Foundation#Donald Trump#Income Inequality#Mandate For Leadership#Federal Reserve#IRS#Student Loan Debt#Unions#Labor#Overtime Pay#Independent Contractors#H2A Visa#H2B Visa#Sabbath#Workplace Safety#Gender Pay Gap#Trade#Consumer Financial Protection Bureau

63 notes

·

View notes

Text

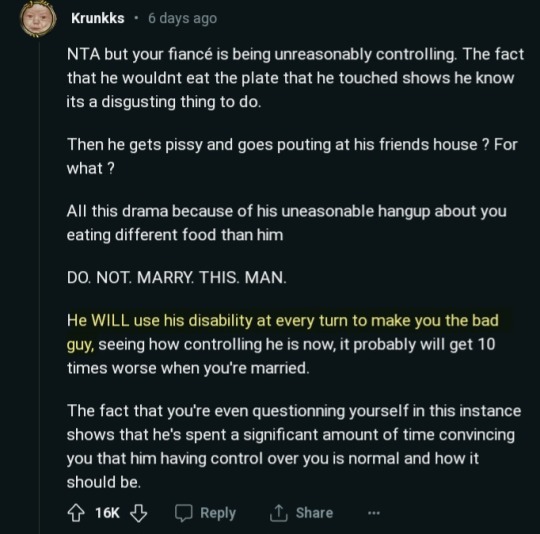

Disabled men can know how to use their disability to be controlling

#Reddit#Aita#Dump him#Disabled men can still be abusive#Men not knowing what financial abuse really is#Men not respecting boundaries#When take a bit of my partners meal I don't take it with bare hands#We just got out of a pandemic and he's doing touching her food with bare hands?#Men are less likely to wash their hands after using the bathroom#Men and food safety

212 notes

·

View notes

Text

Yes, Katsuki Bakugou may have died today but, I encourage you all to get more excited about the fact that the International Court of Justice has officially declared Israel an apartheid state as of yesterday and has ordered them to remove all existing settlements from the West Bank🥳

#from river to sea palestine will be free#FREE PALESTINE#I know the death of your favorite (or least favorite) character is important to you#but ensuring the freedom and safety of millions of people is far more important#I know I don’t talk about it much on this blog but I am an activist#however this news doesn’t mean you should stop protesting and advocating for Palestines freedom!!#especially if you live in the US#KEEP BOTHERING YOUR LOCAL POLITICIANS#ISRAEL IS BREAKING INTERNATIONAL LAW#THEREFORE THE UNITES STATES IS TOO BY GIVING FINANCIAL SUPPORT#bnha#bakugou katsuki

27 notes

·

View notes

Text

Here's the thing about street circuits. I also think they don't suit the current size of F1 cars and should be special and unique not the norm. But if F1 is going to keep adding new tracks they need to be either street circuits or older circuits renovated to be up to modern FIA standards. We cannot keep building new circuits it uses up so many resources and takes up so much space and then is functionally useless for most of the year. It's like a golf course but worse, and almost all of the major new circuits built for F1 in the 2010s are now literally abandoned and rotting because F1 moved on to someone else with more money.

In an ideal world F1 would stop adding new circuits altogether and it would rotate existing circuits to keep the calendar exciting, whilst helping new destinations without a certified fia track to revitalize and upgrade existing tracks to add them to that rotation cycle. Places with absolutely zero race tracks would make street race destinations - again, to be cycled on the calendar. This would be better for the environment, better for the Motorsport community as a whole, MASSIVE for motorsport heritage, and better for the racing tbh as we would see tracks adapted from a VARIETY of architects on the calendar.

But f1 won't do this for the same reason it left those 2010 tracks high and dry. Its own greed. They want new flashy destinations without having to consider the culture, the space, and existing Motorsport in those destinations. (SEE: building Miami and Vegas when the us has so many suitable tracks.) They want The Most Races Ever every year. They want to expand and expand and expand BC that's what you DO under capitalism, line goes up forever. So until the ballooning money involved in F1 and the FIA as a whole is brought under control, this isn't going to happen. They know building new circuits is 1) unsustainable and therefore unpopular for their image 2) hard to convince people to spend money on right now. But they still want to expand, and they sure as fuck don't want to HELP fund their destination unless it's Miami where millionaires will pay to be seen on the grid.

So, I can't help but expect we're just going to keep seeing more and more street circuits on the calendar until either the F1 bosses are visited by 3 ghosts or the sport collapses under its own weight.

#long post#sorry I think about this a lot#if you're asking why places with outdated tracks would need financial help to upgrade them#consider that even Spa - SPA - struggled to fund necessary vital safety alterations#consider that the NURBURGRING couldn't afford the fees f1 charges

210 notes

·

View notes