#Financial Advisor Software

Explore tagged Tumblr posts

Text

The top Mutual Fund Software in India Help MFDs?

Managing finances accurately is one of the most critical aspects of being a Mutual Fund Distributor (MFD). Yet, many MFDs find themselves bogged down with endless calculations and paperwork. These tasks often consume the entire day, leaving little room for strategic planning or client interaction. Despite the effort, there’s still room for error, which can harm both client trust and business efficiency. This is why MFDs need reliable mutual fund software for distributors to streamline their processes and enhance accuracy.

Challenges MFDs Face with Manual Calculations

Every day, MFDs deal with complex calculations, market updates, and client demands. Managing these tasks manually presents several challenges:

Error-Prone Processes

Manual calculations are susceptible to mistakes, especially when dealing with large volumes of data. Even a minor error can lead to inaccurate reports and decisions, which can negatively impact clients’ investments.

Time-Consuming Tasks

Manually managing portfolios, calculating returns, and tracking performance can take up a significant amount of time. This leaves MFDs with less time to focus on client engagement and growing their business.

Keeping Up with Market Trends

The financial market is dynamic, with constant changes in fund performance, interest rates, and new investment opportunities. Staying updated while managing daily tasks is a major challenge for MFDs without the right tools.

Why MFDs Need Accuracy and How Technology Helps

With multiple calculations involved in their day-to-day tasks, they need the right technology to make their job easier, quicker, and less error-prone, and the top mutual fund software in India is designed to address these challenges by offering tools that simplify financial management and improve accuracy. The best software provides advanced features like research tools, compare funds, model portfolios, and fund factsheets to help MFDs manage their work more efficiently.

Research Tools

Research tools help MFDs identify the potential performance of mutual funds with different calculators, and also help in financial planning so investors know how much amount they need to invest for their goals.

Compare Funds

The compare funds feature enables MFDs to evaluate different mutual fund schemes side by side. This makes it easier to find better-performing funds and improves decision-making.

Model Portfolios

Creating model portfolios helps MFDs plan investment strategies for clients with similar financial goals. These ready-to-use templates reduce the time spent on manual portfolio building while ensuring clients’ investments align with their objectives.

Fund Factsheets

A fund factsheet provides a snapshot of a mutual fund’s performance, including its returns, risk level, and portfolio composition. MFDs can use these factsheets to explain fund details to their investors so that they have a clear idea of what and what are they investing in.

Benefits of Using Technology in Improving Financial Accuracy

Using wealth management software offers several advantages for MFDs in enhancing financial accuracy and efficiency:

Eliminates Errors: Automated tools ensure precise calculations, reducing the risk of mistakes in reports and transactions.

Saves Time: By automating repetitive tasks, MFDs can focus on client engagement and strategy planning.

Enhanced Decision-Making: With reliable data at their fingertips, MFDs can make well-informed investment decisions that align with their clients’ financial goals.

Conclusion

If done manually calculations can consume time, energy, and focus for MFDs, which might be fine for a day or two but can lead to poor business growth in the future. Using reliable software, on the other hand, can help MFDs perform research quickly while maintaining financial accuracy with ease. So, now it's for MFDs to make the right decision, for themselves and their business.

#Mutual Fund Software#Mutual Fund Software for Distributors#Mutual Fund Software for Ifa#Mutual Fund Software in India#Top Mutual Fund Software in India#Best Mutual Fund Software in India#Best Mutual Fund Software for Distributors#Best Mutual Fund Software for Distributors in India#Top Mutual Fund Software for Distributors in India#Best Mutual Fund Software#Mutual Fund Software for Distributors in India#Financial Planning Software#Wealth Management Software#Financial Planning Software in India#Wealth Management Software in India#Best Wealth Management Platform#CRM Software for Mutual Fund Distributor#Financial Advisor Software#Best Mutual Fund Software for Ifa in India#Best online platform for mutual fund distributor

0 notes

Text

Discover the benefits of working with a fee-based financial advisor and how this model can offer you transparent and unbiased financial advice. Vantage Financial Partners explains the structure behind fee-based services, helping you understand how advisors are compensated and why it aligns with your best interests for long-term financial planning.

#financial planner in wisconsin#wealth management consultant#top rated financial planning firm#senior wealth advisor in wisconsin#college savings plan#fiduciary financial planner#best financial advisors in wisconsin#educational savings plan#529 college savings plan#fee-based financial advisor#529 plan#financial advisor reno nv#financial advisor software#company registration#financial advisor near me#income tax return#investing#finance#financialplanning

0 notes

Text

6 Hacks Every MFD Should Know About Mutual Fund Software

Many mutual fund distributors (MFDs) still rely on old ways to run their business. While these traditional methods might have worked in the past, they often come with challenges such as a heavy manual burden, high operational costs, and time-consuming processes. To overcome these challenges, MFDs need to embrace modern solutions. Mutual fund software in India offers various tools and features to streamline operations and enhance efficiency.

Challenges for MFDs in 2024

Manual Burden

Manual processes like filling out forms, verifying documents, and managing records can be extremely time-consuming and prone to errors. This not only slows down operations but also impacts the quality of service provided to clients.

High Operational Costs

Maintaining paper records, handling physical documents, and other manual processes can increase operational costs. These costs can reduce the overall efficiency of the business.

Time-Consuming Processes

Traditional methods often require more time for tasks such as client onboarding, report generation, and communication. This delays important activities and can lead to lower client satisfaction.

Life-Saving Hacks Like Never Before With Mutual Fund Software

Mutual fund software for distributors can address these challenges by automating and streamlining various processes. This software is designed to simplify tasks, reduce manual work, and enhance overall efficiency. Here are six hacks that every MFD should know about mutual fund software.

1. Replace Paperwork with Digital KYC

Faster Onboarding: Digital KYC (Know Your Customer) speeds up the client onboarding process by allowing clients to submit their documents online.

Reduced Errors: Automated verification reduces the chances of errors and ensures accurate data collection.

Convenience: Clients can complete the KYC process from the comfort of their homes, improving their overall experience.

2. Lure in Potential Investors with IPOs

Attractive Investment Opportunities: Initial Public Offerings (IPOs) are often seen as lucrative investment opportunities. Offering IPOs can attract potential investors.

Increased Client Base: Highlighting upcoming IPOs can bring in new clients looking to invest in these opportunities.

Enhanced Engagement: When clients are informed about IPOs, it keeps their excitement all hyped up.

3. Reduce Redemptions with Loans Against Mutual Funds

Immediate Liquidity: Offering loans against mutual funds provides clients with quick access to funds without needing to redeem their investments.

Stable AUM: By reducing the number of redemptions, MFDs can maintain a stable assets under management (AUM) level.

Client Retention: Providing this flexible financial solution can help retain clients by meeting their liquidity needs.

4. Keep AUM Stable with Goal-Based Planning

Personalized Planning: Goal-based planning helps clients set and achieve specific financial goals, ensuring they stay invested for the long term.

Increased Client Loyalty:When clients invest in their goals, they stay committed in the longer-run,increasing loyalty.

Consistent AUM: With clients committed to their financial plans, MFDs can enjoy more stable AUM levels.

5. Brand Your Software with White-Labeling

Professional Appearance: White-labeling allows MFDs to customize the software with their own branding, creating a professional look.

Enhanced Trust: Clients are more likely to trust a well-branded platform that reflects the MFD's identity.

Market Differentiation: White-labeling helps MFDs stand out from competitors by offering a unique and branded experience.

6. Leverage Research Tools and Calculators

Informed Decisions: Research tools and calculators provide valuable insights, helping MFDs and clients make informed investment decisions.

Time Savings: These tools automate complex calculations, saving time and reducing the risk of errors.

Client Confidence: Providing accurate and timely information increases client confidence in the MFD's recommendations.

Conclusion

Mutual fund software has many features that can greatly improve how efficiently MFDs work and how happy their clients are. By using digital KYC to replace paperwork, attracting investors with IPOs, offering loans against mutual funds to reduce redemptions, keeping AUM stable with goal-based planning, branding their software with white-labeling, and using research tools and calculators, MFDs can simplify their processes and grow their business.

#Mutual Fund Software#Mutual Fund Software for Distributors#Mutual Fund Software for Ifa#Mutual Fund Software in India#Top Mutual Fund Software in India#Best Mutual Fund Software in India#Best Mutual Fund Software for Distributors#Best Mutual Fund Software for Distributors in India#Best Mutual Fund Software for Ifa in India#Top Mutual Fund Software for Distributors in India#Best Mutual Fund Software#Mutual Fund Software for Distributors in India#Best online platform for mutual fund distributor#Financial Planning Software#Wealth Management Software#Financial Planning Software in India#Wealth Management Software in India#Best Wealth Management Platform#CRM Software for Mutual Fund Distributor#Financial Advisor Software

0 notes

Text

What does the Online ATM in mutual fund software for distributors in India offer?

An online ATM is a facility that allows investors to park their idle funds in liquid mutual funds. It offers features like:

Almost 2x returns than savings

Instant redemption in case of emergencies

Attract new investors with FD-like returns

For More Information, Visit: https://wealthelite.in/

#best mutual fund software#financial planning software in india#best mutual fund software for ifa in india#best online platform for mutual fund distributor#financial advisor software#best wealth management platform#best mutual fund software for distributors#crm software for mutual fund distributor#best mutual fund software in india#financial planning software

0 notes

Text

Finpace | Financial Advisor Software

Finpace is cutting-edge Financial Advisor Software designed to empower financial professionals with efficient tools for portfolio management, investment analysis, and client collaboration. With its user-friendly interface and powerful features, Financial Advisor Software streamlines workflows, enhances decision-making, and ensures superior client experiences.

1 note

·

View note

Text

Why is Mutual Fund Software So Expensive for Mutual Fund Distributors?

Wealth management software is a crucial tool that helps mutual fund distributors manage client accounts, track performance, and comply with regulations. However, it might have a high cost. Here's why:

First, developing and maintaining mutual fund software for distributors is a complex and costly process. Especially for smaller distributors, this can be a significant expense.

Second, the software requires robust servers to handle large amounts of data and transactions. Regular updates and reliable uptime are necessary for accurate investor and distributor information, further adding to the cost.

Third, mutual fund software must adhere to various regulations, such as those related to securities, privacy, and anti-money laundering. Ensuring compliance increases the software's overall cost.

Additionally, supporting the software requires a team of experts who can assist distributors in effectively utilizing it. This support adds to the overall expense.

Apart from these factors, the cost of financial management software can also vary depending on the included features and functionality. For instance, software with portfolio management tools or customer relationship management (CRM) systems tends to be pricier than software without these features.

Despite the high cost, it offers valuable benefits to distributors. It provides access to data, tools, and support, which can enhance distributors' efficiency and effectiveness. Consequently, the software's cost can be justified by the benefits it brings.

Check out these advantages of using portfolio management software:

Greater efficiency: The software can automate many tasks involved in managing mutual fund investments, freeing up distributors' time to focus on other important responsibilities, such as providing financial advice and business development to clients.

Improved accuracy: It reduces errors in transaction processing and report generation, protecting distributors from regulatory fines and penalties.

Enhanced customer service: The software enables distributors to offer better customer service by granting clients access to account information and tools like online trading and account transfers.

Increased compliance: Software helps distributors comply with regulations governing securities, privacy, and anti-money laundering, shielding them from legal liabilities.

Overall, fund management software is a valuable asset for distributors, enhancing efficiency, accuracy, customer service, and compliance. Before buying software it’s important for the distributors to check the cost and the benefits it provides.

To choose the right wealth management software, consider the following tips:

Assess your needs: Before starting your search, think about your specific requirements. What features are you looking for? How many clients do you have? What is your budget?

Compare prices: Once you know what you need, compare prices from different vendors. Remember to include support and maintenance costs in your decision-making process.

Read reviews: Take the time to read reviews of various financial software options. By reading the reviews you can know what others think about the software and its offerings.

Get a demo: If possible, request a demo of the software before making a purchase. You can check out the demo if it meets your needs or not.

By following these tips, you can select the appropriate investment software that suits your requirements and budget. Wealth Elite is a top software for distributors that can fulfill all the needs of the MFDs including mutual fund transactions, reporting, planning, and performance.

#Mutual Fund Software#Mutual Fund Software for Distributors#Mutual Fund Software for Ifa#Mutual Fund Software in India#Top Mutual Fund Software in India#Best Mutual Fund Software in India#Best Mutual Fund Software for Distributors#Best Mutual Fund Software for Distributors in India#Top Mutual Fund Software for Distributors in India#Best Mutual Fund Software#Mutual Fund Software for Distributors in India#Financial Planning Software#Wealth Management Software#Financial Planning Software in India#Wealth Management Software in India#Best Wealth Management Platform#CRM Software for Mutual Fund Distributor#Financial Advisor Software#Best Mutual Fund Software for Ifa in India#Best online platform for mutual fund distributor

0 notes

Text

Wealth Management Consultant: Your Path to Financial Success with Zenith Financial

Managing wealth effectively is crucial for ensuring long-term financial security and achieving your goals. A wealth management consultant plays a pivotal role in guiding individuals and families through the complexities of investment strategies, retirement planning, tax optimization, and more. If you’re looking for expert financial advice, Zenith Financial is your trusted partner in navigating the world of wealth management.

A wealth management consultant is a professional who offers personalized financial advice tailored to your unique situation. Whether you're preparing for retirement, building a diversified investment portfolio, or planning for major life events, they provide invaluable insights to help you make informed decisions. Their expertise goes beyond just managing investments—they offer holistic financial solutions that address every aspect of your financial well-being.

At Zenith Financial, our wealth management consultants take a comprehensive approach to financial planning. We begin by understanding your financial goals, risk tolerance, and future aspirations. With this information, we create a customized strategy that includes investment management, estate planning, tax strategies, and retirement planning. Our consultants work closely with you to ensure your wealth grows while minimizing risks and optimizing tax benefits.

The importance of working with a wealth management consultant cannot be overstated. With their expert guidance, you can make sound decisions that align with your long-term goals, helping you achieve financial freedom and security. At Zenith Financial, we pride ourselves on offering the highest level of personalized service, ensuring that your financial future is in capable hands.

If you’re ready to take control of your financial future, contact Zenith Financial today. Our wealth management consultants are here to help you build a path to financial success that’s tailored to your unique needs.

#family financial advisor#free financial planning software#meet with a financial advisor#family wealth management#financial planning companies#looking for a financial advisor#zenithfinancial

0 notes

Text

5 Omni-Channel Funnel Trends to Watch in 2025

In the fast-paced world of digital marketing, staying ahead of trends is critical. As businesses strive to meet customers where they are, omni-channel funnels have become a vital tool for delivering seamless and personalized experiences. These funnels are no longer just a "nice-to-have"; they are a must-have strategy for businesses looking to thrive in today’s competitive market.

In this blog, we will explore five key trends shaping omni-channel funnels in 2025. By understanding and implementing these trends, your business can stay ahead of the curve and provide exceptional value to your customers.

What Are Omni-Channel Funnels?

Omni-channel funnels refer to the journey customers take as they interact with a brand across multiple online and offline channels. The goal is to create a consistent and cohesive experience for customers, whether they are shopping on your website, engaging with your social media, visiting your store, or contacting your support team.

Unlike multi-channel strategies that treat each platform as separate, omni-channel funnels focus on integrating all channels. This ensures that customers receive a seamless experience, regardless of how or where they engage with your brand.

Now, let’s dive into the trends you need to watch in 2025.

1. Hyper-Personalization Will Dominate

Why Personalization Matters

Customers today expect more than a one-size-fits-all approach. They want to feel understood and valued by the brands they interact with. Hyper-personalization takes this to the next level by using data and technology to deliver highly customized experiences at every stage of the funnel.

How It’s Changing Omni-Channel Funnels

Hyper-personalization involves leveraging customer data such as purchase history, browsing behavior, and preferences. With this information, businesses can tailor messages, offers, and content to suit individual customers.

For example:

Personalized Emails: Send product recommendations based on past purchases.

Custom Landing Pages: Design web pages that reflect the customer’s interests.

Dynamic Content: Update website banners and ads based on real-time user behavior.

Actionable Tips

Use AI-driven tools like chatbots and recommendation engines to deliver personalized experiences.

Regularly analyze customer data to refine your strategies.

Avoid being intrusive; ensure customers are comfortable with how their data is used.

2. AI and Automation Are Revolutionizing Funnels

The Role of AI in Omni-Channel Funnels

Artificial intelligence (AI) and automation have been transforming the way businesses operate, and in 2025, they’re set to play an even bigger role in omni-channel funnels. These technologies make it easier to manage customer interactions across multiple platforms while providing real-time insights.

Applications in Marketing

Chatbots: Provide instant support and guide customers through their journey.

Predictive Analytics: Identify what customers are likely to do next and prepare for it.

Marketing Automation: Schedule and send emails, texts, and social media posts automatically based on customer behavior.

Actionable Tips

Invest in AI tools to streamline repetitive tasks.

Use predictive analytics to anticipate customer needs and adjust your strategy.

Train your team to work alongside AI systems for better results.

3. Voice and Visual Search Are Growing

What Are Voice and Visual Search?

Voice and visual search technologies allow customers to find products using spoken commands or images. As smart devices and AI assistants like Alexa and Google Assistant become more common, these search methods are gaining popularity.

How It Affects Omni-Channel Funnels

Customers are increasingly using voice and visual search to discover brands and products. Incorporating these technologies into your omni-channel strategy can help you capture a larger audience and provide a smoother user experience.

For example:

Voice Search Optimization: Ensure your content is optimized for natural language queries.

Visual Search Features: Allow customers to upload images to find similar products on your site.

Actionable Tips

Optimize your website for voice search by using conversational keywords.

Add visual search capabilities to your online store.

Ensure product descriptions and metadata are detailed and accurate to improve search results.

4. Integrated Social Commerce Will Expand

What Is Social Commerce?

Social commerce refers to selling products directly through social media platforms like Instagram, Facebook, and TikTok. These platforms are becoming more than just places to connect with friends—they’re full-fledged shopping destinations.

Why It Matters for Omni-Channel Funnels

Social commerce makes it easier for customers to discover, research, and purchase products without leaving their favorite social platforms. This simplifies the funnel and creates a frictionless shopping experience.

Examples

Shoppable Posts: Tag products in Instagram posts so customers can buy directly.

Live Shopping: Host live streams where viewers can purchase featured products in real-time.

Social Ads: Use targeted ads to drive traffic to your store or website.

Actionable Tips

Set up a shop on platforms like Instagram and Facebook.

Create engaging content that encourages social sharing.

Use analytics tools to track performance and improve your social commerce strategy.

5. Seamless Omnichannel Analytics Will Be Essential

The Need for Better Analytics

Tracking customer behavior across multiple channels can be challenging, but it’s essential for optimizing your omni-channel funnels. In 2025, businesses will rely more heavily on unified analytics platforms to understand their customers’ journeys.

How Analytics Improves Funnels

Integrated analytics allow you to see how customers interact with your brand across various touchpoints. This helps identify strengths and weaknesses in your funnel so you can make data-driven decisions.

For example:

Cross-Channel Tracking: Monitor how customers move between channels before making a purchase.

Performance Metrics: Measure key metrics like conversion rates and customer lifetime value.

A/B Testing: Experiment with different strategies to see what works best.

Actionable Tips

Use tools like Google Analytics 4 or specialized omni-channel analytics platforms.

Regularly review your data to identify trends and opportunities.

Share insights with your team to align everyone on strategy.

Conclusion

Omni-channel funnels are evolving rapidly, and the trends in 2025 will shape how businesses engage with their customers. By embracing hyper-personalization, leveraging AI and automation, incorporating voice and visual search, expanding into social commerce, and using seamless analytics, your business can create a more effective and customer-centric strategy.

Staying ahead of these trends isn’t just about keeping up with the competition; it’s about building lasting customer relationships. Start integrating these trends into your marketing efforts today, and watch your business thrive in the years to come.

0 notes

Text

Discover the top 5 financial planning software for advisors, including Xplan, AdviceOS, AdviserLogic, Platformplus, and Dash.

#top 5#Financial Planning Software Tools#financial advisors#x plane#AdviceOS#Adviserlogic#Platformplus#Dash

1 note

·

View note

Text

Complete Guide To Fintech App Development

#Financial#Financial business#best financial advisors#finance#2024#Top Finance platform#software#development#app#app development#app development in usa#fintech#fintech app development#art and animation#game development#unity game#game

0 notes

Text

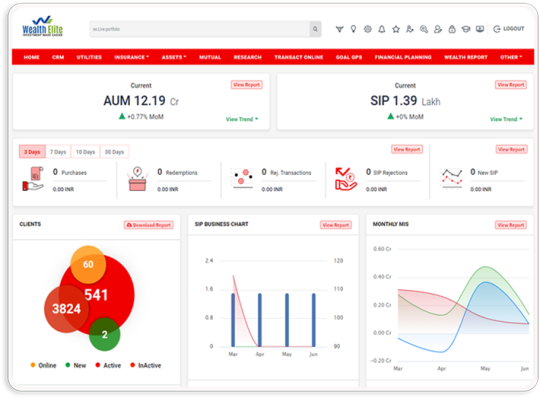

The top mutual fund software in India investment management for advisors?

Advisors rely on automation and reporting features within the top mutual fund software in India to streamline investment management. Real-time analytics and consolidated dashboards help them provide more accurate advice while saving time, and enabling better client outcomes. For more information, visit https://wealthelite.in/

#Mutual Fund Software#Mutual Fund Software for Distributors#Mutual Fund Software for Ifa#Mutual Fund Software in India#Top Mutual Fund Software in India#Best Mutual Fund Software in India#Best Mutual Fund Software for Distributors#Best Mutual Fund Software for Distributors in India#Top Mutual Fund Software for Distributors in India#Best Mutual Fund Software#Mutual Fund Software for Distributors in India#Financial Planning Software#Wealth Management Software#Financial Planning Software in India#Wealth Management Software in India#Best Wealth Management Platform#CRM Software for Mutual Fund Distributor#Financial Advisor Software#Best Mutual Fund Software for Ifa in India#Best online platform for mutual fund distributor

0 notes

Text

Why Analyzing Financial Data is Crucial for Your Trucking Business

Photo by Pixabay on Pexels.com If you’re having a tough time keeping your business on track. We get it—running a trucking company is no easy feat. There’s so much to juggle: maintenance, fuel costs, routes, driver management, and on top of that, financials. It’s overwhelming, and we know the last thing you want to think about is diving into those spreadsheets and financial reports. But let me…

View On WordPress

#accounting software#avoid bankruptcy#business#business decisions#business forecasting#business growth#business strategies#business success#cash flow management#cost savings#expense tracking#financial advisor#financial analysis#financial planning#financial tools#Freight#freight industry#Freight Revenue Consultants#fuel efficiency#increase profitability#logistics#optimize routes#profit margins#QuickBooks for truckers#reduce expenses#small business trucking#Transportation#truck fleet management#trucker tips#Trucking

0 notes

Text

How Does Mutual Fund Software Ensure Data Security?

While automation is the key to success today, data security is a major concern. Mutual fund distributors (MFDs) must ensure that their clients' sensitive information is protected. Mutual fund software for IFA can help MFDs tackle these challenges effectively.

Challenges for MFDs Regarding Data Security

Concerns from Investors

Investors are increasingly concerned about the safety of their personal and financial information. Data breaches can lead to significant losses.

Regulatory Compliance

MFDs must comply with stringent data protection regulations, and if not done right, it may lead to legal issues.

Risk of Cyber Attacks

The financial sector is a prime target for cybercriminals. MFDs need to protect their data from all kinds of cyber attacks.

Maintaining Client Trust

Data security is directly linked to client trust. Any issue related to security can result in a loss of client trust.

Mutual Fund Software Uses AWS Servers to Protect Data

Mutual fund software for distributors offers a great way to ensure that data is safe. They use the most secure servers out there - Amazon Web Services, which protects the data from all kinds of cyber attacks.

Secure Cloud Storage

Mutual fund software saves data on AWS servers, which offer very secure cloud storage. AWS offers data encryption, secure access controls, and regular security checks so that all your sensitive information stays safe from unauthorized access.

Data Encryption

Mutual fund software uses encryption to protect data both while it is being sent and while it is stored, which keeps it secure from cyber threats of all kinds.

Regular Security Updates

AWS continuously updates its security protocols to address emerging threats. Mutual fund software benefits from these updates, so that MFDs can always benefit from the latest software updates.

Access Controls

Strict access controls are implemented to ensure that only authorized personnel can access sensitive data. Mutual fund software uses security measures like multi-factor authentication so that no one can access data unauthorized.

Compliance with Regulations

AWS servers comply with global data protection regulations, including GDPR and PCI-DSS, so that MFDs can reduce the risk of legal issues and penalties.

Benefits of Data Security with Mutual Fund Software

Enhanced Client Trust

Strong data security measures enhance client trust. When investors know that their information is protected, they are more likely to stay with their MFD and recommend their services to others.

Reduced Risk of Data Breaches

By using advanced security technology, mutual fund software greatly lowers the risk of data breaches. This keeps investors' information safe and also protects the MFD's reputation.

Compliance Assurance

Using mutual fund software ensures compliance with data protection regulations. This reduces the risk of legal issues and helps MFDs focus on growing their business without worrying about regulatory penalties.

Improved Operational Efficiency

Automated security measures streamline data management processes, allowing MFDs to operate more efficiently. When MFDs will save time, they can focus more on revenue-generating activities.

Competitive Advantage

MFDs that prioritize data security can differentiate themselves from competitors, and more investors will likely choose them for data security.

Conclusion

Mutual fund software helps MFDs protect investor data and investor trust with Amazon Web Services. If you wish to keep your data intact, this is a great option in today's time, where every minute calls for hundreds of cyber crimes.

#Mutual Fund Software#Mutual Fund Software for Distributors#Mutual Fund Software for Ifa#Mutual Fund Software in India#Top Mutual Fund Software in India#Best Mutual Fund Software in India#Best Mutual Fund Software for Distributors#Best Mutual Fund Software for Distributors in India#Best Mutual Fund Software for Ifa in India#Top Mutual Fund Software for Distributors in India#Best Mutual Fund Software#Mutual Fund Software for Distributors in India#Best online platform for mutual fund distributor#Financial Planning Software#Wealth Management Software#Financial Planning Software in India#Wealth Management Software in India#Best Wealth Management Platform#CRM Software for Mutual Fund Distributor#Financial Advisor Software

0 notes

Text

How Does The Document Vault Work In a Mutual Fund Software?

The document vault in mutual fund software is a feature that helps advisors store documents of their clients that are secured with a password. This helps them to perform instant transactions with the permission of clients. They don't need to wait for any documents. For More Information, Visit https://wealthelite.in/

#finance#Mutual Fund Software#Mutual Fund Software for Distributors#Mutual Fund Software for Ifa#Mutual Fund Software in India#Top Mutual Fund Software in India#Best Mutual Fund Software in India#Best Mutual Fund Software for Distributors#Best Mutual Fund Software for Distributors in India#Best Mutual Fund Software for Ifa in India#Top Mutual Fund Software for Distributors in India#Top Mutual Fund Software for IFA in India#Mutual Fund Software for Distributors in India#Best Mutual Fund Software#Mutual Fund Distributor software#MF Distributors software#Best online platform for mutual fund distributor#Financial Planning Software#Wealth Management Software#Financial Planning Software in India#Wealth Management Software in India#Best Wealth Management Platform#CRM Software for Mutual Fund Distributor#Financial Advisor Software

0 notes

Text

The Skills Needed to Be a Strategic Financial Advisor

Be a Financial Advisor: Building your advisory practice can take some time, but adding advisory to your firm gives you, your team, and your firm a chance to grow, so it’s a good move. Many businesses are requesting advisory services along with standard compliance services from their accounting firms. This is your firm’s chance to provide the type of value your clients are looking for. It also gives you and your team the ability to grow professionally with new skills and do more face-to-face work with clients.

But advisory requires a different set of skills than compliance work. Here are the key skills you need to become a successful strategic advisor.

Client Relationship Management

If you rarely met with clients for compliance work, that will change with advisory. Long-term success in advisory requires connecting with clients and building trust. The businesses, finances, and potential growth of your clients are in your hands. You need to maintain trust by earning and reaffirming it regularly.

You must start the advisory relationship with a professional tone, because you don’t know your client yet. Then adjust how you work with them as you get to know them better. Emotional intelligence is an important skill in advisory.

For more information read our blog at https://pathquest.com/knowledge-center/blogs/the-skills-needed-to-be-a-strategic-financial-advisor/

0 notes

Text

How can I use mutual fund software for IFA to manage my clients’ portfolios?

REDVision Global is the best client portfolio management mutual fund software for IFA, there are several factors to consider such as features, Functionality, User Interface, Ease of Use, Customization, Scalability, Security, Customer Support, Data Management, and Cost. Now request a demo or trial to assess on https://www.redvisionglobal.com/

#Mutual Fund Software#Mutual Fund Software for Distributors#Mutual Fund Software for Ifa#Mutual Fund Software in India#Top Mutual Fund Software in India#Best Mutual Fund Software in India#Best Mutual Fund Software for Distributors#Best Mutual Fund Software for Distributors in India#Top Mutual Fund Software for Distributors in India#Best Mutual Fund Software#Mutual Fund Software for Distributors in India#Financial Planning Software#Wealth Management Software#Financial Planning Software in India#Wealth Management Software in India#Best Wealth Management Platform#CRM Software for Mutual Fund Distributor#Financial Advisor Software#Best Mutual Fund Software for Ifa in India#Best online platform for mutual fund distributor

0 notes