#Energy Trading and Risk Management Market

Explore tagged Tumblr posts

Text

Energy Trading and Risk Management Market: Role in Enhancing Decision-Making for Energy Traders

The Energy Trading And Risk Management (ETRM) Market size was USD 37.1 billion in 2023 and is expected to reach USD 57.5 billion by 2032, growing at a CAGR of 5.0% over the forecast period of 2024–2032.

The Energy Trading and Risk Management (ETRM) market has been experiencing significant growth as the energy sector becomes increasingly complex, with rising demand for efficient tools and solutions to manage trading and risks across various energy commodities. Energy companies and traders are leveraging ETRM solutions to optimize their energy portfolios, manage price volatility, and ensure compliance with ever-evolving regulations. The growing integration of renewable energy sources and the global push for digitalization are key drivers of the market’s expansion.

Market Segmentation

By Type

Software:

ETRM software solutions are designed to help energy traders manage their trading activities, from procurement to sales, across a wide range of energy commodities. These platforms allow real-time monitoring, price optimization, portfolio management, and risk assessment. Software tools are often modular, allowing customization to meet specific market needs and regulatory requirements.

Service:

ETRM services include implementation, consulting, and ongoing support, ensuring that organizations can effectively deploy and use energy trading platforms. These services often involve integration with existing IT systems, training for staff, and continuous updates to keep up with market changes and technological advancements.

By Application

Natural Gas Trading:

Natural gas trading is one of the largest applications of ETRM solutions. With the volatility of natural gas prices and regulatory compliance requirements, energy firms are increasingly adopting ETRM software to manage trading positions, monitor risk, and ensure transparent reporting.

Coal Trading:

Coal trading involves complex logistics and price forecasting. ETRM solutions help companies track coal prices, manage trading positions, and mitigate risks from price fluctuations in global coal markets. These solutions are important as coal remains a significant energy source in many regions.

Power Trading:

Power trading is another major area for ETRM solutions. Given the volatility in electricity prices and regulatory constraints, power traders require advanced systems to manage energy dispatch, forecast demand, and deal with price fluctuations efficiently. ETRM software in this space also helps in managing the integration of renewable energy sources into the grid.

Oil Trading:

Oil trading is a critical part of the global energy market, and ETRM solutions play a key role in managing large-scale transactions and price risk. ETRM software in oil trading helps organizations track oil price changes, maintain compliance with global regulations, and optimize trading strategies.

Renewable Energy Trading:

As the share of renewable energy sources like wind, solar, and hydropower increases in the global energy mix, the need for specialized ETRM solutions for renewable energy trading is growing. These solutions address the complexities associated with renewable energy generation, grid integration, and fluctuations in supply and demand.

Others (Commodities & Carbon Emissions Trading):

In addition to the traditional energy sources, other applications of ETRM include trading in commodities like hydrogen, carbon emissions, and biofuels. As carbon trading schemes and environmental regulations become more widespread, companies are increasingly adopting ETRM solutions to track carbon credits and ensure compliance.

By Region

North America:

North America is one of the largest markets for ETRM solutions, driven by the extensive natural gas, oil, and power trading activities in the U.S. and Canada. With the region’s large energy consumption, complex regulatory environment, and rapidly advancing technological adoption, the demand for ETRM software and services is high.

Europe:

Europe also holds a significant share of the global ETRM market, with a growing focus on renewable energy trading and compliance with EU energy regulations. The transition to clean energy and the integration of renewable sources into the grid are driving the need for sophisticated risk management and trading solutions.

Asia-Pacific:

Asia-Pacific is expected to witness substantial growth in the ETRM market, fueled by the increasing energy demand from emerging markets like China and India. The shift toward renewable energy, along with growth in natural gas and coal trading, is contributing to the adoption of ETRM systems across the region.

Latin America:

Latin America is a growing market for ETRM solutions, with increasing investments in energy trading and risk management. The region’s energy sector is becoming more diversified, with oil, natural gas, and renewable energy trading playing key roles. There is also an emphasis on modernizing energy infrastructure.

Middle East & Africa (MEA):

The Middle East is a significant player in oil and gas trading, which is driving the demand for ETRM solutions. As the region diversifies into renewable energy, such as solar power, the adoption of ETRM systems is expected to grow as energy trading becomes more dynamic.

Key Market Drivers

Market Volatility and Price Fluctuations:

Energy markets are known for their volatility. ETRM solutions are essential for managing these fluctuations, helping companies make informed decisions, hedge risks, and maximize profits. Price forecasting tools and real-time data analytics provided by ETRM systems are in high demand.

Regulatory Compliance:

With governments and international bodies imposing stricter regulations on energy trading and emissions, ETRM systems are vital for ensuring compliance. Companies need systems that can automate reporting and manage the complexities of energy trading regulations.

Adoption of Renewable Energy:

The rise of renewable energy sources, like wind, solar, and hydroelectric power, is leading to changes in trading strategies. ETRM solutions are essential for managing the integration of renewables, ensuring efficient trading, and dealing with fluctuations in supply and demand.

Technological Advancements in Data Analytics and AI:

The integration of artificial intelligence (AI), machine learning, and big data analytics in ETRM systems is helping energy traders optimize their portfolios, predict market trends, and assess risks more accurately. These advancements are driving the evolution of ETRM platforms.

Market Challenges

High Initial Investment:

The initial investment required to implement ETRM systems, especially for large-scale companies, can be substantial. The cost of software, integration with existing systems, and training personnel may deter smaller companies from adopting ETRM solutions.

Complexity of Integration:

Integrating ETRM solutions with existing infrastructure, especially in large, established energy companies, can be complex and time-consuming. The need for customization, data migration, and system compatibility can delay implementation.

Cybersecurity Concerns:

Energy trading platforms are vulnerable to cyber-attacks, which could compromise sensitive trading data. Ensuring robust cybersecurity measures in ETRM solutions is a major concern for companies operating in the energy sector.

Market Outlook and Forecast

The ETRM market is expected to grow significantly from 2024 to 2032, driven by the increasing complexity of energy markets, advancements in technology, and the rising demand for efficient risk management tools. The growing integration of renewable energy sources into the global energy mix will continue to push the demand for specialized ETRM solutions.

Key Forecasts:

Software will dominate the market due to the increasing need for automation and real-time analytics.

Natural Gas and Oil Trading will remain the largest application sectors for ETRM systems, although Renewable Energy Trading will see the highest growth rates as more countries adopt green energy goals.

North America and Europe will continue to be the leading regions for ETRM software adoption, while Asia-Pacific will experience the fastest growth.

Conclusion

The Energy Trading and Risk Management (ETRM) market is evolving rapidly with the transition to more sustainable and diverse energy sources. As energy markets become more volatile and interconnected, the demand for advanced ETRM software and services will grow. The next decade is expected to see significant advancements in trading technologies, driving the market’s expansion and fostering a more resilient and efficient global energy sector.

Report Insights:

Detailed market size, growth trends, and forecasts.

In-depth analysis of ETRM software and services.

Regional breakdown of market dynamics and forecasts.

Competitive landscape and emerging players in the market.

Read Complete Report Details of Energy Trading And Risk Management (ETRM) Market 2024–2032@ https://www.snsinsider.com/reports/energy-trading-and-risk-management-market-4199

About Us:

SNS Insider is a global leader in market research and consulting, shaping the future of the industry. Our mission is to empower clients with the insights they need to thrive in dynamic environments. Utilizing advanced methodologies such as surveys, video interviews, and focus groups, we provide up-to-date, accurate market intelligence and consumer insights, ensuring you make confident, informed decisions. Contact Us: Akash Anand — Head of Business Development & Strategy [email protected] Phone: +1–415–230–0044 (US) | +91–7798602273 (IND)

0 notes

Text

Top Features to Look for in Energy Trading Automation Software

It is extremely important for the companies involved to adapt and make changes where needed. Increased and innovative development in technologies has been the key cause of the emergence of Energy Trading Automation Software, a global phenomenon that has changed the direction of how energy commodities are traded.

Often incorporating high levels of computational sophistication and mimicking aspects of artificial intelligence, these systems raise organizational productivity, precision, and revenue.

However, within thousands of programs and applications, how to find the right one for your specific issue? Allow me to guide you to the most important factors that must be considered in energy trading automation software to help you make the right choice.

The Role of AI in Energy Trading Automation Software

The objective of the top energy trading automation software is centered on the AI functioning as its underpinning. The implementation of artificial intelligence in these systems enables them to process big data, determine market behavior and Trading decisions independently. Through services offered by companies like AI Development services, energy traders profit from the coveted tools and skill set required to pioneer sophisticated next generation AI solutions for energy trading.

Key Features to Consider

1. Advanced Analytics and Forecasting

Fluctuation is the primary characteristic of energy markets characterized by unpredictable patterns. Foreseeing trends is an incredible asset in this world because when one their problems are solved by another, it is just a time gain. Be on the look-out for software with high analytical data and forecasting probabilities. These features work with data of price fluctuations and market request with the usage of AI to let traders make choices wisely. For example, technologies such as AI-aided predictive analysis can help in the forecast of demand fluctuations and price drops, thereby helping the trader to make a good strategy to facilitate the negotiation.

2. Real-Time Data Integration

Timing is often critical in energy trading because it can make the difference between a successful deal and a loss. Real-time data integration should be one of the key features of your software to allow you to have access to the most up-to-date information to analyze on the market. This feature is very helpful in trading because it makes sure the right trade is done at the right time to make profits. Real-time data provides traders with immediate information allowing them to act much faster, shift their tactics more quickly and prevent likely misfortunes arising from latency.

3. Automated Trading

Inability to automate trade leads to Energy Trading Automation Software being incomplete without the abilities to do so. This feature enables the software to automatically trade in the financial market when certain conditions have triggered a particular trade. They make sure that the trades that are made are done so in a timely manner, in order to help develop profits. The use of the algorithms and automated trading system minimizes the chances of mistakes and emotional trading, which are factors that not only swerve traders from their trading plans but also lowers their profitability on average.

4. Risk Management Tools

This is why the overall management of risk is a critical requirement in energy trading. It is also important for the software to feature strong risk management capabilities to assess risks and troubleshoot them. This could include the placement of stop order, in change of investment portfolios and the risk assessment of exposure. Several risk control tools are available for use in trading to ensure that traders’ exposure to high risk is controlled hence ensure stability in trading.

5. Integration with Other Technologies

If integrated with other technologies, energy trading automation software can yield as much return as expected out of this investment. For example, incorporating the best custom chatbot development service can help improve customer engagement and the flow of customer support. Furthermore, working with a web development company guarantees the convenient navigation and some operations functionality. The integration is such that they provide traders with a full-fledged ecosystem of utilities and services that improve trading itself.

6. Scalability and Flexibility

If you grow your active trading volume, the software has to be able to match it and handle it. Other important criteria are extensibility, which determines the ability of the software system to expand and incorporate additional functionalities or data volumes. Also, versatility to support variation in trading patterns and operation of the system in various market environments is crucial. Whether you are an ordinary trader or a high-stake businessman handling portfolios and dealing in stocks, exchange software can suit all your capacities and requirements and can expand as your business grows.

7. User-Friendly Interface

A complicated working environment with a lot of mechanisms to understand, does not allow the achievement of high performance. The best Energy Trading Automation Software provides an interface fits well to the trader’s eye to easily operate the system with out any hitches. Usability factors include the capability to create clear and interesting dashboards, integrated reports, and straightforward flexibilities. A good interface helps in improving the overall experience of a user, in most cases, it also helps in reducing the training period when the users have to be trained to use the system; such a system can assist the traders in doing just that which they are supposed to do best—trade.

8. Security Features

As energy trading has high stakes involved, the security that is provided has to be very strong and effective. The software should have an option for data encryption, multiple factor authentication and should regularly update for security purposes in order to protect both the transactions and the data that is inputted. Secured protection keeps your data safe from internet risks and third-party interference while promoting the confidentiality of all your trading transactions.

9. Support and Maintenance

Finally, consider the level of support and maintenance offered by the software provider. Ongoing support is crucial for troubleshooting issues and ensuring the software remains up-to-date with the latest market developments and technological advancements. It would be impossible for a team to foresee all the challenges it could face in the future; thus, working with a generative AI development company can guarantee that your software is constantly adapting. Reliable support and maintenance let you deal with issues where there is a technical problem and reduce time wasted on business disruptions.

Conclusion

It is always important to select an appropriate Energy Trading Automation Software that may affect your trading performance. These aspects like advanced analytics or real time data integration, trading automation, risk management can improve your trading plan as well as product quality of energy in the competitive market. Do not forget how crucial such factors as scalability, integration with user needs and preferences, security and, most notably, consistent support are to sustainability.

0 notes

Text

Energy transition to change centre of global power, expert says

Energy policy expert Jason Bordoff says the energy transition is one of the greatest economic opportunities since the Industrial Revolution, World Economic Forum reports.

Investment in renewable energy reached a record $1.3 trillion in 2022, a 70 per cent increase from 2019. This is expected to rise further in the coming years as the global community seeks to reduce greenhouse gas emissions and limit global warming to 1.5°C compared to pre-industrial levels.

Speaking at a special World Economic Forum session on global co-operation, growth and energy for development, Bordoff, founding director of the Centre for Global Energy Policy at Columbia University’s School of International and Public Affairs, said the growing push for renewable energy could shift the centre of global power.

From economic opportunity to the urgent need for sustainable investment in green infrastructure, here is Bordoff’s take on the changing geopolitics of the energy transition.

Read more HERE

#world news#world politics#news#jason bordoff#bordoff#economy#global news#global politics#global market#worldwide#current events#energy#energy transition#energy transfer#energy trading and risk management market#renewables#renewableenergy#green energy#green economy#green earth#lng#lng exports#lng market size#oil and gas#crude oil

0 notes

Text

#Energy Trading and Risk Management Market#Energy Trading and Risk Management Market Size#Energy Trading and Risk Management Market Trends#Energy Trading and Risk Management Market Growth#Energy Trading and Risk Management Market Analysis

0 notes

Text

#Energy Trading & Risk Management (ETRM) Market#Energy Trading & Risk Management (ETRM) Size#Energy Trading & Risk Management (ETRM) Growth#Energy Trading & Risk Management (ETRM) Trend#Energy Trading & Risk Management (ETRM) segment#Energy Trading & Risk Management (ETRM) Opportunity#Energy Trading & Risk Management (ETRM) Analysis 2024#Energy Trading & Risk Management (ETRM) Forecast

0 notes

Text

Tennessee Titans: Best/Worse Case Scenarios 2024 NFL Season

Bottom Line: This Team Will Be Better Than Most Expect

Themes:

• A: Development of Will Levis

• B: New Key Pieces

• C: Coaching Change/Culture Shift

Call it “homerism,” but being a small market NFL team often means being underestimated. However, if you’re not paying attention to the Tennessee Titans, you’re missing out. The Titans are doing what most teams do when they believe they’ve found their quarterback: building a solid roster around him and creating an environment for success. With a quietly strong roster on both sides of the ball—featuring an upgraded offensive line, a reinforced wide receiver room, and an improved secondary—this team is poised to win games this year, even with Mike Vrabel no longer at the helm. Before the mainstream media writes this team off, here are some key factors to consider:

A: New Key Pieces

Titans GM/VP of Football Operations Ran Carthon has had a stellar offseason, acquiring talent through the draft, free agency, and trades. Let’s break down the additions:

Free Agents/Trades:

• Calvin Ridley (WR)

• Lloyd Cushenberry (C)

• L’Jarius Sneed (CB)

• Chidobe Awuzie (CB)

• Tony Pollard (RB)

• Sebastian Joseph-Day (DT)

• Kenneth Murray (LB)

• Jamal Adams (S)

• Quandre Diggs (S)

• Tyler Boyd (WR)

Draft Picks:

• JC Latham (OL)

• T’Vondre Sweat (DL)

• Jaylen Harrell (LB)

• Jha’Quan Jackson (WR)

• Jarvis Brownlee (CB)

Clearly, this team is heading in a new direction, and I’m not mad at it. Times change, and the Titans are adapting. Pairing Ridley with Hopkins seems almost unfair, and when you add a solid receiver like Boyd along with Treylon Burks, who’s ready to take the next step, the wide receiver room is no longer among the league’s worst. All of this has been achieved without sacrificing the run game. Both Pollard and Spears can run the ball the way Callahan wants it done, and I believe they’ll prove their worth this season.

On the defensive side, the moves made almost brought tears of joy. Drafting T’Vondre Sweat, who is unbelievably fast and agile for his size, was a masterstroke. Sweat is a certified run-stopper and will also affect the passer, drawing double-teams a solid percentage of the time. Pairing him with Jeffery Simmons, who also requires double-teams, will force opposing offensive lines into some tough decisions. Adding a talented, budding linebacker like Kenneth Murray to an already physical Arden Key will secure the middle of the field and boost the pass rush.

Then there’s the secondary, which has been reinvigorated with the additions of Sneed, Awuzie, Adams, and Diggs, alongside preexisting talent like Elijah Molden and Roger McCreary. This group has the potential to lock down a lot of yardage this year. Bottom line: the Titans’ defense has improved significantly.

Before I forget, let’s talk about the offensive line. With the addition of first-round pick JC Latham and the continued development of Peter Skoronski under new offensive line coach Bill Callahan, this unit should be miles ahead of where it was last year. Improved blocking, especially from the right side of the line, has been a highlight of the preseason, addressing one of the major issues from last year.

B: Coaching Change/Culture Shift

Please note, I am not a Mike Vrabel hater. I appreciate everything he’s done for this franchise—instilling a culture of toughness and grit, leading the team to an AFC Championship run, and managing an injury-riddled roster. However, I acknowledge that change was needed. The league is evolving, and the Titans were at risk of being left behind.

Brian Callahan and his staff bring a fresh perspective, new energy, and a balanced approach to Nashville. Players are reportedly thrilled with new defensive coordinator Denard Wilson and offensive line coach Bill Callahan. The emphasis on physicality and toughness remains, but there’s also a focus on balance, which I believe will help the Titans adapt and thrive in this new era.

C: Development of Will Levis

One crucial factor for the team’s success is the continued development of second-year quarterback Will Levis. Levis showed a lot of promise last year, stepping in for the injured Ryan Tannehill and pushing the ball downfield with confidence. He clearly won the team over, and his growth will drive this team as far as it can go. With a strong supporting cast around him and improved protection, Levis has the tools to succeed.

One concern is Levis taking unnecessary hits. We get it—you’re tough. But we’d also like you to have a long, successful career. All in all, I believe he’s ready to take the next step.

Best Case Scenario:

In the best-case scenario, the offensive line gels quickly, Levis makes sound decisions, and the defensive line dominates early by stopping the run and pressuring the passer. If everything clicks, a 10-win season and a playoff berth are within reach.

Worst Case Scenario:

On the flip side, if the offensive line takes most of the regular season to figure things out, if Levis regresses, if the run game falters, and if the defense spends too much time on the field, the team could be exposed. An undisciplined, sloppy defense could result in a 6-7 win season, or worse, and no playoffs. However, I highly doubt that happens, given the personalities and talent on this team.

The Tennessee Titans are primed to surprise many this upcoming season. There’s a fresh energy, new vibes, and a modern approach in Nashville. The Titans are changing with the times, and as a fan, I couldn’t be more excited for what’s to come.

If you liked what you read from this article, feel free to give us a follow, leave feedback, and share it out! Let’s grow the audience! Head on over to my friend @chompinatthebit and check some of his great content as well!!

#football#nfl#sports#women in sports#nflnetwork#sports blog#blog#contentcreator#Tennessee Titans#afc south#afc

5 notes

·

View notes

Text

At the Argus conference in Istanbul, someone asked me if I had ever thought about hedging the fertiliser business through agricultural commodities trading. I tried to recall which major agricultural trading houses had ever ventured into the fertiliser market.

It’s intriguing that giants like Dreyfus, ADM, Toepfer, or Bunge haven’t found the same success in fertiliser trading despite their dominance in agricultural commodities. One might think their deep market knowledge and extensive networks in grain trading would position them for success in fertilisers, but the reality is more complex.

Fertilisers are closely tied to energy markets, especially natural gas, and mined resources like potash and phosphates. While these companies handle agricultural commodities, where pricing is more transparent, fertilisers operate in opaque markets driven by local factors, regulations, and geopolitical issues. This makes fertiliser hedging through agricultural commodities less effective.

Logistics further complicate things. Fertilisers are bulky, need to be transported across vast distances, and must arrive within specific planting windows. The precision needed in fertiliser distribution is far more challenging than that of grains, where storage and delivery are more flexible.

Moreover, the fertiliser market is dominated by a few large players, making it difficult for newcomers like ADM or Dreyfus to gain ground. Unlike grain trading, fertilisers involve dealing with strong regional players, less transparent pricing systems, and complex regulations.

Then there’s the issue of risk management. Hedging fertiliser positions with agricultural commodities seems logical, but the two markets aren’t perfectly correlated. Fertiliser prices depend on energy costs and mining outputs, which make hedging across commodities complicated and often unreliable.

Despite their vast resources and networks, these companies faced challenges they weren’t fully equipped to overcome in fertilisers. Their experience highlights the complexity of the fertiliser market, where success requires mastering logistics, risk management, and navigating a unique set of market dynamics.

And yes, I do remember Ameropa.

#agicommodities #fertilisers #adm #ameropa #bunge #toepfer #hedging #dreyfus #logistics #marketvolatility #trading

#agriculture#fertilizer#fertilization#urea#corn#usa#wheat#india#vessel#nola#imstory#adm#bunge#ameropa#hedge#agribusiness#logistics

2 notes

·

View notes

Text

Moses may have parted the Red Sea, but now, thanks to a wave of Houthi missile attacks, shipping companies are departing it in droves.

So far, the Iran-backed Yemeni group has launched at least 100 missile and drone attacks against a dozen ships in the Red Sea, according to U.S. officials, and threatened to target all vessels heading toward Israel, whether or not they are Israeli-owned or operated. To avoid suffering the same fate, major energy and shipping companies, including BP and Maersk, have halted their operations there—rattling energy markets and driving up global oil prices and soon everything else. The Red Sea is what connects Asia to Europe, in terms of cargo ships, so disruptions are felt around the world.

The Houthi attacks “have created worries for global freight markets, for the flows of energy commodities, other commodities, goods,” said Richard Bronze, the head of geopolitics at Energy Aspects, a research firm. “It’s a really critical shipping route, so any disruption risks adding delays and costs, which have a sort of knock-on effect in many corners of the global economy.”

Washington is reportedly mulling striking the Houthi base in Yemen, just days after announcing a multinational task force to safeguard navigation in the Red Sea. But the pledge did little to deter the Houthis, who instead vowed to ramp up their attacks and target U.S. warships if Washington executed attacks in Yemen.

As the threat of escalation looms over wary shipping companies and energy markets, Foreign Policy broke down the Red Sea crisis—and what it could mean for global trade.

You lost me at Houthis.

Backed by Iran, the Houthi rebel group controls vast swaths of northern Yemen, following a yearslong effort to gain power that ultimately plunged the country into a devastating civil war in 2014. After years of fighting between the Iran-armed Houthis and a Saudi-led coalition, at least 377,000 people had been killed by the end of 2021, 70 percent of whom were children younger than 5, according to U.N. estimates.

Experts say the Houthis’ Red Sea attacks are part of a bid to shore up domestic support and strengthen the group’s regional standing, while the Houthis’ popularity has only grown since they began waging these attacks. As part of Iran’s “Axis of Resistance,” the Houthis have vowed to attack ships transiting the Red Sea until Israel ends its bombardment of Gaza. They’re Iran’s JV team, but they can make a splash at times.

“They seek to accomplish a more prestigious status in the region, as a resistance movement integral to the Iranian Axis of Resistance,” said Ibrahim Jalal, a nonresident scholar at the Washington-based Middle East Institute. The Houthis also “want to be framed as a disruptive actor that’s capable of also offering security by halting attacks,” he said.

By attacking ships heading toward Israel, Iran, through its Houthi proxies, is essentially doing what Washington and the West does with economic sanctions—turn the screws. “What they’ve done is very architecturally similar to Western secondary sanctions,” said Kevin Book, the managing director of ClearView Energy Partners, an energy consultancy. “They have essentially tried to make it so that anyone who has nexus to, or trades with, Israel is subject to attack or risk of an attack.”

Why is the Red Sea so important?

Tucked between Saudi Arabia, Egypt, and Sudan, the Red Sea is an entryway to the Suez Canal and one of the world’s key global trade corridors, overseeing some 12 percent of global trade and nearly one-third of global container traffic. With as many as 19,000 ships crossing through the Suez Canal annually, the inlet is a strategic pressure point in the energy and commodity trade.

“There’s always been a lot of interest in oil and freight chokepoints because they may be relatively small geographically but they have global impact,” Book said. “Adversaries of the U.S. and Western allies sometimes seek to capitalize on those chokepoints because it can exert such a significant influence over global dynamics.”

Worried by the Houthi attacks, a growing list of major energy companies and shipping firms—including BP, Equinor, Maersk, Evergreen Line, and HMM—have rerouted their ships or suspended operations in the Red Sea. Rather than steaming through the narrow sea, at least 100 ships have instead traveled around the bottom of southern Africa—a detour that can extend ship journeys by thousands of miles and delay freight by weeks.

For now, that will just mean delays, higher costs, and continued disruptions—not the complete upending of global trade. The attacks have “been enough to make certain shippers hesitant to continue using the Red Sea,” said Bronze of Energy Aspects. “But we’re not at a stage where all shipping is being halted or rerouted or that there’s any sort of likelihood of that scale of disruption.”

How is Washington responding?

Washington, which currently has at least three destroyers stationed by the Red Sea, has shot down countless Houthi drones and intercepted missiles launched at transiting ships. To ensure freedom of navigation, Washington also announced this week that it mobilized 10 other countries to form a new task force called Operation Prosperity Guardian.

The operation is set to include Bahrain, Canada, France, Greece, Italy, the Netherlands, Norway, Seychelles, Spain, and the United Kingdom, U.S. officials said, although details are still murky and there remains ongoing confusion about what it will look like. Italy, for example, has said it is sending a frigate to the Red Sea under its long-standing plans—not as part of Operation Prosperity Guardian, Reuters reported. According to the Associated Press, several other countries also agreed to take part in the task force but preferred to remain anonymous. (Many Arab countries don’t want to be seen as defending Israel just now.)

That “underline[s] how tricky it’s been to assemble this coalition and perhaps the limited enthusiasm for many countries for being too visible in confronting this threat and in standing sort of shoulder to shoulder with the U.S. on this issue,” Bronze said.

Apparently undeterred, the Houthis have vowed to continue the fight. “Even if America succeeds in mobilizing the entire world, our military operations will not stop unless the genocide crimes in Gaza stop and allow food, medicine, and fuel to enter its besieged population, no matter the sacrifices it costs us,” Mohammed al-Bukaiti, a senior Houthi official, posted on X, formerly Twitter.

That could mean continued uncertainty for energy and shipping companies, many of which are waiting for more robust reassurances and greater stability until they feel comfortable resuming operations in the Red Sea.

“From a shipping company or a tanker company perspective, I think it’s probably safe to say that they’re going to err on the side of caution until they have some sense that the underlying risks have changed,” said Book of ClearView. Maersk, for instance, acknowledged that its shipping diversions would disrupt operations but stressed that the safety of its crews is paramount.

More fireworks could soon come. Washington is reportedly considering military strikes targeting the Houthis’ base in Yemen if the task force fails to thwart future attacks. The Houthis have threatened to strike U.S. warships in response, potentially paving the way for future escalations.

The United States could also snap back previously levied sanctions on key Houthi figures as a dissuasive measure—but Saudi Arabia isn’t sold on that idea, since Riyadh is trying to negotiate an end to the yearslong quagmire in Yemen and worries that heavy-handed U.S. tactics could complicate its withdrawal.

What exactly is Saudi Arabia’s calculus here?

After years of involvement in the Yemen war, Riyadh wants out. Saudi Arabia has been working to extricate itself from that war and to make peace with both Tehran—the two powers normalized relations in March—and the Houthis.

As Saudi Arabia and the Houthis inch closer to securing a peace agreement, experts say Riyadh has adopted a cautious approach, wary of taking any steps that could jeopardize its fragile detente with Tehran or derail peace talks. But continued escalations in the Red Sea could throw a wrench in Riyadh’s plans.

“If the U.S. were to attack targets in Yemen, not only could it threaten the truce that Saudi Arabia has struck with the Houthis, but it could interfere with that detente between Iran and the kingdom,” Book said. And that could threaten what is still one of the world’s biggest oil producers and exporters at a time when crude oil is already trading north of $70 a barrel.

“If that were to happen,” Book said, “then risks to production could come back, and that would change the picture, potentially adding more upside risk to the crude price.”

7 notes

·

View notes

Text

Understanding Blockchain Technology: Beyond Bitcoin

Introduction

Blockchain technology, often synonymous with Bitcoin, is a revolutionary system that has far-reaching implications beyond its initial use in cryptocurrency. While Bitcoin introduced the world to the concept of a decentralized ledger, blockchain's potential extends well beyond digital currencies. This article explores the fundamentals of blockchain technology and delves into its various applications across different industries.

What is Blockchain Technology?

At its core, blockchain is a decentralized, distributed ledger that records transactions across many computers in such a way that the registered transactions cannot be altered retroactively. This ensures transparency and security. Each block in the chain contains a list of transactions, and once a block is completed, it is added to the chain in a linear, chronological order.

Key features of blockchain include:

Transparency: All participants in the network can see the transactions recorded on the blockchain.

Immutability: Once data is recorded on the blockchain, it cannot be altered or deleted.

Security: Transactions are encrypted, and the decentralized nature of blockchain makes it highly secure against hacks and fraud.

Blockchain Beyond Bitcoin

While Bitcoin brought blockchain into the spotlight, other cryptocurrencies like Ethereum and Ripple have expanded its use cases. Ethereum, for example, introduced the concept of smart contracts—self-executing contracts where the terms are directly written into code. These smart contracts enable decentralized applications (DApps) that operate without the need for a central authority.

Applications of Blockchain Technology

Finance:

Decentralized Finance (DeFi): DeFi platforms leverage blockchain to create financial products and services that are open, permissionless, and transparent. These include lending, borrowing, and trading without intermediaries.

Cross-border Payments: Blockchain simplifies and speeds up cross-border transactions while reducing costs and increasing security.

Fraud Reduction: The transparency and immutability of blockchain make it harder for fraud to occur, as all transactions are visible and verifiable.

Supply Chain Management:

Tracking and Transparency: Blockchain provides end-to-end visibility of the supply chain, ensuring that all parties can track the movement and origin of goods.

Reducing Fraud: By recording every transaction, blockchain helps prevent fraud and counterfeiting, ensuring the authenticity of products.

Healthcare:

Secure Data Sharing: Blockchain allows for secure sharing of patient data between healthcare providers while maintaining privacy and consent.

Drug Traceability: Blockchain helps track pharmaceuticals through the supply chain, reducing the risk of counterfeit drugs.

Voting Systems:

Secure Elections: Blockchain can provide a transparent and tamper-proof system for voting, ensuring that each vote is recorded and counted accurately.

Increasing Voter Participation: The security and convenience of blockchain-based voting could lead to higher voter turnout and greater confidence in electoral systems.

Real Estate:

Property Transactions: Blockchain can streamline property transactions by reducing paperwork, ensuring transparency, and preventing fraud.

Record-Keeping: Immutable records of property ownership and transactions enhance security and trust in the real estate market.

Challenges and Limitations

Despite its potential, blockchain technology faces several challenges:

Scalability: The ability of blockchain networks to handle a large number of transactions per second is limited, impacting its adoption in high-volume industries.

Energy Consumption: Blockchain, particularly proof-of-work systems like Bitcoin, requires significant energy, raising concerns about its environmental impact.

Regulatory Challenges: The decentralized and borderless nature of blockchain poses regulatory and legal challenges, as governments and institutions seek to manage and control its use.

The Future of Blockchain Technology

The future of blockchain looks promising, with continuous advancements and innovations. Potential developments include improved scalability solutions like sharding and proof-of-stake consensus mechanisms, which aim to reduce energy consumption and increase transaction speeds. As blockchain technology matures, its adoption across various industries is expected to grow, potentially transforming the way we conduct business, manage data, and interact with digital systems.

Conclusion

Blockchain technology, initially popularized by Bitcoin, holds immense potential beyond cryptocurrencies. Its applications in finance, supply chain management, healthcare, voting, and real estate demonstrate its versatility and transformative power. While challenges remain, ongoing innovations and growing interest in blockchain suggest a future where this technology plays a crucial role in various aspects of our lives.

#blockchain#Bitcoin#blockchaintechnology#cryptocurrency#decentralizedfinance#DeFi#supplychain#healthcare#votingsystems#realestate#blockchainapplications#smartcontracts#DApps#digitalledger#blockchainsecurity#blockchainfuture#blockchainadoption#techinnovation#financial education#financial empowerment#financial experts#finance#digitalcurrency#unplugged financial#globaleconomy

4 notes

·

View notes

Text

What is ESG Investing? What is the Best Way to Get Started?

ESG is the next big thing in investing. It offers real-world performance factors that help investors consider how companies impact the regional community when making investment decisions. They also develop strategic thinking to work toward sustainable development goals (SDGs). This post will discuss what matters in ESG investing and to get started.

What Is ESG Investing?

ESG investing means investors utilize the three types of compliance metrics of corporate impact metrics to screen the target companies’ stocks or funds. Moreover, corporations seek to attract such investments through responsible and sustainable business practices.

If investors want data on the beneficial effect of a company’s operations on the local community, they can use ESG services. They can get reports from a data-driven survey concerning the environmental, social, and governance (ESG) compliance standards.

ESG audits enable informed investment decisions and portfolio management strategies. Investors can monitor whether a firm delivers its promised SDG metrics using such inspections. Likewise, consider the investors who invest their capital into the businesses that provide their employees with fair wages and respect.

How to Get Started with ESG Investing?

1| Specify Which Metrics Matter the Most to You

Investors must identify the ESG metrics, like forest preservation or tax transparency, before selecting a stock or asset class. They must also consider how all metrics have a unique significance in several industries. For example, carbon and greenhouse gas (GHG) emission risks will differ across data centers, agricultural businesses, and construction firms.

If an organization wants to attract investors using sustainability performance, it can benefit from ESG consulting. Consultants understand the investors’ conceptualization of an ESG-first enterprise of investors and how companies can work towards improving their operations to fulfill them.

2| Determine Realistic Goals

Depending on the scope of the energy transition, adopting greener resources and production technologies can financially burden a business at the initial stage. So, investors, regulators, and entrepreneurs must use real-world data to estimate the progress rate of compliance improvement initiatives.

An organization or exchange-traded fund (ETF) can fail to retain investors if the compliance milestones remain distant. Accordingly, administrators involved in regulatory policy changes that can impact an industry’s ESG dynamics must consider how long the corporate world will need to modify its operations.

3| Mitigate Greenwashing Risks

Companies might advertise their brand as “eco-friendly” or socially responsible. However, investors must watch out for the greenwashing attempts. Greenwashing refers to magnifying a company’s sustainability commitments with no on-ground implementation.

An enterprise might declare it opposes discriminatory practices while showing inaction when an employee experiences workplace harassment. Another example can be an energy distributor not reducing its usage of coal and petroleum derivatives as fuel.

Therefore, investors and fund managers must cross-verify the “green claims” that a target company makes during press releases or marketing campaigns.

4| Get ESG Ratings Using Multiple Frameworks

To test the legitimacy of a corporation’s SDG commitments, a rating mechanism based on multi-variate performance analytics can help in ESG investing. Today, many sustainability accounting frameworks exist. For example, the global reporting initiative (GRI) allows sectorial modules.

Each GRI criterion addresses a family of interdependent services and products. So, an agricultural business will use a separate GRI standard, differing from the modules used in technology, finance, and manufacturing firms.

How can investors get started with ESG score comparisons? Some online databases offer preliminary insights into how different brands and ETFs compete in this space. However, more extensive data becomes available through paid platforms or experienced consultants.

Conclusion

ESG criteria will empower investors to evaluate the ecological or social risks associated with how an enterprise handles its operations. Fund managers and similar financial institutions can gain a more objective outlook on stock screening using industry-relevant assistance.

Furthermore, combating the greenwashing risks will be challenging if you are a sustainability investor, but extensive analytical models will come to your rescue. Finally, investors must refer to multiple sustainability accounting frameworks or databases to check a firm’s compliance ratings. This approach is how you get started with ESG investing.

Nevertheless, manual inspection is time-consuming, and ESG ratings keep changing due to mergers and new projects. So, collaborating with data partners capable of automating compliance tracking, controversy analytics, and carbon credit assessments is vital.

3 notes

·

View notes

Text

Why Gen Z Should Start Learning About the Stock Market: Top 5 Reasons to Invest

Discover the top 5 reasons why Gen Z should start investing in the stock market today. From building wealth to gaining financial independence, learn why stocks are a smart choice for young investors.

Hello, Gen Zers!

You’re already a generation known for disrupting norms and rewriting rules.

Why not apply that fearless energy to conquering the stock market?

With today’s technology, investing is at your fingertips, and starting young gives you a massive advantage. Think about it: more time for your investments to grow, early lessons in financial resilience, and the first steps towards an abundant future.

Ready to see why the stock market could be your new playground?

Let’s dive into the five irresistible reasons you should start investing now.

1. Harness the Power of Compounding Early- The sooner you start, the richer you get. Compounding means making money on your initial investment and then making more money on the earnings. Starting in your teens or early twenties means you have time on your side. Imagine this: invest $1,000 now with an average growth of 8% annually, and by the time you hit 50, that could swell into a sizable nest egg without adding another dollar. Now, imagine making regular contributions. We’re talking serious money!

2. Tech-Savvy Advantage- You’re digital natives. Use it. Gen Z is the first generation to grow up with technology from the get-go. You’re already adept at navigating apps and online platforms, which are essential tools in today’s trading world. Tools like Robinhood, Acorns, or E*TRADE are designed for intuitive navigation and making trading a breeze. Plus, you have access to heaps of online resources and communities to learn from and share trading tips.

3. Economic and Social Change- Invest in what you believe. More than any previous generation, Gen Z investors are likely to align their investments with their social and environmental values. Whether it’s renewable energy, tech innovations, or companies with strong ethics, your investments can reflect your commitment to making the world a better place, all while growing your wealth.

4. Financial Independence- Break free from the 9-to-5 grind. Understanding and participating in the stock market can be your ticket to financial independence. Mastering investing now could mean the option to retire early or pursue a passion project without financial constraints. Imagine living life on your terms, powered by smart, early investments.

5. Weather Economic Storms- Build your financial umbrella. The reality is, economic downturns, recessions, and market volatility are part of life. By investing young, you learn to ride out these storms without panic. Diversifying your investments in stocks, bonds, and other assets can protect you from financial rain and help you learn critical lessons about risk and resilience.

Ready to Rule the Market?

Alright, Gen Z, the ball is in your court. Investing in the stock market is not just about making money; it’s about building a secure, independent, and empowered future.

Start small, learn continuously, and stay committed.

The journey to financial freedom and becoming a savvy investor begins with your decision to act now. Are you ready to make your mark and watch your fortunes grow?

Frequently Asked Questions (FAQs):

Q1: How much money do I need to start investing?

You can start with as little as $50 or $100. Many platforms allow fractional shares, so even a small amount can get you started.

Q2: Isn’t investing risky?

All investments carry some risk, but diversifying your portfolio and investing for the long term can help manage and mitigate these risks.

Q3: How do I choose what stocks to invest in?

Start by researching companies or funds that align with your interests and values. Consider using tools and resources like financial news, investment apps, and financial advisors to make informed decisions.

#investing stocks#stock trading#option trading#share market#nseindia#stock tips#trading tips#investing#gen z humor#finance#income#profit

2 notes

·

View notes

Text

Super Boom Spring Break Easter Sale!

Few at Dow 10,000 believed me in May 2010 when I forecasted a 500+% market rise that would put DJIA at 38,820 by the year 2025 in my Almanac Investor Newsletter. My 2011 book Super Boom took a deeper dive into the history and analysis of this groundbreaking forecast and the iconic market cycle and pattern that it’s based on. Now that Dow 38,820 has come true, what’s next? AI is clearly the culturally enabling, paradigm-shifting technology I predicted would drive the next phase of this generational Super Boom. Come find out what I expect to happen next. Get my latest outlook on how and why the AI Super Boom will drive the economy full steam ahead and the market higher and higher.

Sign up Today! Save up to 55% Off! Get the 2024 Stock Trader’s Almanac as a FREE Bonus! And find out the update on my 100% accurate bullseye 2010 Super Boom forecast for Dow 38820 and learn what’s next for the market and the AI Super Boom!

1-Year @ $179 – over 48% Off vs. Quarterly - Use promo code 1YRSBSB24

2-Years @ $299 – MY BEST DEAL – 55% Off - Use promo code 2YRSBSB24

MoneyShow Easter Sale

Come down to Miami for spring break and join me in person at MoneyShow’s Investment Masters Symposium – The Big Money Pivot – East. April 10-12, 2024, at the Hyatt Regency Miami. They have a special Easter Sale this weekend! Join us for 3 days filled with market education from the nation’s top experts on stocks, bonds, real estate, precious metals, cryptocurrencies, technology, energy, & more. Use $99 Standard Pass Coupon Code HOP99

Register here to join:

https://www.miamisymposium.com/speakers/ed8d429050d5486abc818182ac141048/jeffrey-hirsch/?scode=062467

Rally Respite After Big Best Six Months Gains

Monday is the beginning of the last month of the “Best Six Months (BSM)” (November-April) for the Dow and S&P 500 – and what a banner one it’s been so far. From our Seasonal MACD Buy Signal on October 9, 2023, through the close on March 28, 2024, DJIA is up 18.46% and S&P 500 is up 21.19% – more than double the historical average BSM gains. Our Best Six Months Seasonal MACD Sell Signal can trigger anytime on or after the first trading day of April, which is Monday April 1st this year. NASDAQ’s Best 8 Months end in June, which is up 21.47% since our buy signal, not quite double the average but give it time.

The big rewards we have reaped this Best Six Months and year-to-date so far have not left much on the table until later this year. Risks are more elevated now. Sentiment continues to run high. Valuations are extended. Geopolitical tensions have not eased. And persistent inflation pressures have the Fed in no rush to cut rates. As the election campaign rhetoric heats up and the Best Six Months comes to a close be prepared to shift to a more cautious stance when we issue our Best Six Months Seasonal MACD Sell Signal. We do not expect a bear market or major correction. We do not Sell in May and go away. We sell some things, tighten stops and consider defensive positions if warranted.

So sign up today to receive my Best Six Months Seasonal MACD Sell Signal as soon as it triggers!

Get the 2024 Stock Trader’s Almanac As a FREE Bonus! And Profit From Market History!

This limited time offer is open to everyone, regardless of current subscription status. Lock in an additional 1- or 2-year subscription at our lowest available price.

For over five decades, top traders, investors and money managers have relied upon Stock Trader’s Almanac. The 2024, 57th Annual Edition shows you the cycles, trends, and patterns you need to know in order to trade and/or invest with reduced risk and for maximum profit.

This indispensable guide is organized in a calendar format. Proprietary strategies include the Hirsch Holdings’ “Best Six Months Switching Strategy” (frequently referred to as “Sell in May”), the January Barometer, the Four-Year Presidential Election/Stock Market Cycle, top Sector Seasonalities and much more.

Trusted by Barron's, The Wall Street Journal, the New York Times, and many other respected market authorities, this indispensable guide has helped generations of investors make smart, profitable market moves since 1968.

Weekly Almanac Investor email Issues and a Monthly Webinar deliver the latest market analysis, new trade ideas (long and short), portfolio updates, new research, technical, fundamental, seasonal, monetary policy and sentiment analysis.

Subscribe or Renew Today Two ways save:

1-Year @ $179 – over 48% Off vs. Quarterly - Use promo code 1YRSBSB24

2-Years @ $299 – MY BEST DEAL – 55% Off - Use promo code 2YRSBSB24

Almanac Investor Includes:

Opportune ETF & Stock Trading Ideas with specific buy & sell price limits

Timely Data-Rich & Data-Driven Market Analysis

Market-Tested and Time-Proven Short- & Long-term Trading strategies

“Best Six Months” Switching Strategy MACD Buy & Sell Signals

Free 2024 Stock Trader’s Almanac for new members

Free Stock Trader’s Almanac for each additional active year

Access to my proprietary Almanac-based Tools (Market data beginning in 1901):

Market Probability Calendar: Discover the best and worst days of any month

MACD Calculator: Track the market momentum & test your own parameters

Year-at-a-Glance: DJIA, S&P 500, NASDAQ, Russell 1000 & 2000 daily prices

Monthly Data Bank: monthly closes, price change and percentage change

Best & Worst: Days, Weeks, Months & Years

Daily Performance: Weekly performance broken down into days of the week

Market Volatility: Identify past periods of volatility and streaks of positive or negative performance

All of this and more is delivered weekly to your inbox via email Issues and webinars!

Act Now – this is a limited-time offer that will expire soon.

If your email address is associated with an account at https://www.stocktradersalmanac.com and you forgot your password it can be reset here. Once logged in, navigate to “My Account”, add/update payment information and renew your old subscription (annual subscriptions) in just one click or use “Subscribe Now” links on the homepage to take advantage of this offer.

Some fine print: Hirsch Holdings offers a pro-rated refund on all cancelled annual subscriptions. Annual subscriptions cancelled within the first three (3) months may have their refund reduced by up to $75 if an annual Stock Trader’s Almanac has been shipped. Quarterly subscriptions are non-refundable. Quarterly subscribers may cancel at any time.

Yours truly,

Jeffrey A. Hirsch CEO: Hirsch Holdings | Editor: Stock Trader’s Almanac & Almanac Investor

3 notes

·

View notes

Text

The Modern Way to Secure Loans, Invest, and Make Payments

In a world buzzing with options, making the right choices for your financial needs can be overwhelming. From securing loans to making seamless payments, the landscape of financial services is evolving. Muthoot FinCorp ONE - a digital financial platform is designed to revolutionize the way you access loans, invest, and manage payments.

A World of Offerings Tailored for You

Gold Loans - Anytime, Anywhere Secure quick Gold Loans effortlessly, either from the comfort of your home or at any of our 4500+ branches across India. Experience doorstep service in just 30 minutes*, benefit from low-interest rates starting at 0.83%* per month and enjoy a hassle-free process with zero* processing fees.

Digital Gold - Begin Your Investment Journey Dive into Digital Gold investments starting from as low as Re. 1. With gold purity rated at 99.99%, sell your digital holdings at market prices, securely stored for your peace of mind.

NCD: Building Financial Stability Construct your investment portfolio with as little as Rs. 10,000 and receive high returns of up to 9.43%*. Enjoy a fast-track process without extensive KYC requirements, providing financial stability with low-risk investments and flexible tenure durations.

Forex Simplified Exchange forex securely at competitive rates, ensuring hassle-free international money transfers with our 24-hour* guaranteed service and buy-back guarantee.

Payments and Recharges - Swift and Secure Seamlessly pay for anything, anytime, with zero wait time and 24x7 availability. From recharging your mobile or DTH connection to paying electricity, mobile, internet bills, and even vendor payments - experience a zero-

The Muthoot FinCorp ONE app is your key to unlocking a world of financial possibilities. Whether you need Gold Loans, wish to invest in Digital Gold, or trade Forex, the app delivers convenience at your fingertips. Expect regular updates and expanded services, as we strive to make financial management effortless for you.

At Muthoot FinCorp ONE, we're dedicated to simplifying your financial journey. From accessing loans and investments to managing payments, our goal is to provide a secure and reliable financial environment while enhancing your user experience.

Join the Muthoot FinCorp ONE community today and witness firsthand the ease and efficiency that modern financial services can offer. Your financial freedom begins here.

About Muthoot FinCorp ONE

Muthoot FinCorp ONE is an all-in-one digital financial platform that makes getting an MSME & a Gold Loan, investing in Digital gold & NCDs, making payments & remittances, buying insurance & exchanging forex, simple and convenient.

As an SBU of Muthoot FinCorp Limited, Muthoot FinCorp ONE is backed by a legacy stretching back over 135 years, and the trust of more than 1 crore customers and is building a holistic financial ecosystem using the latest digital products for lending, investing, protection and payments.

Muthoot FinCorp ONE continues to uphold the values of the parent, the Muthoot Pappachan Group (Muthoot Blue) by providing its customers with easily accessible services, replete with unmistakable quality. The Muthoot Pappachan Group is among India’s most reputed names in the financial services industry, with customers in diverse segments like Automotive industry, Financial Services, Hospitality, Alternate Energy, Real Estate, and Precious Metals.

So what are you waiting for? Head to the Play Store and download the Muthoot FinCorp ONE app. You can also visit the website today to know more.

Alternatively, you can also follow us on Facebook, Instagram, Twitter or LinkedIn to stay tuned to our latest offerings.

Chat on Whatsapp | Branch Locator | Email us - [email protected] | Download App

2 notes

·

View notes

Text

#Energy Trading and Risk Management (ETRM) Market#Energy Trading and Risk Management (ETRM) Size#Energy Trading and Risk Management (ETRM) Growth#Energy Trading and Risk Management (ETRM) Trend#Energy Trading and Risk Management (ETRM) segment#Energy Trading and Risk Management (ETRM) Opportunity#Energy Trading and Risk Management (ETRM) Analysis 2024#Energy Trading and Risk Management (ETRM) Forecast

0 notes

Text

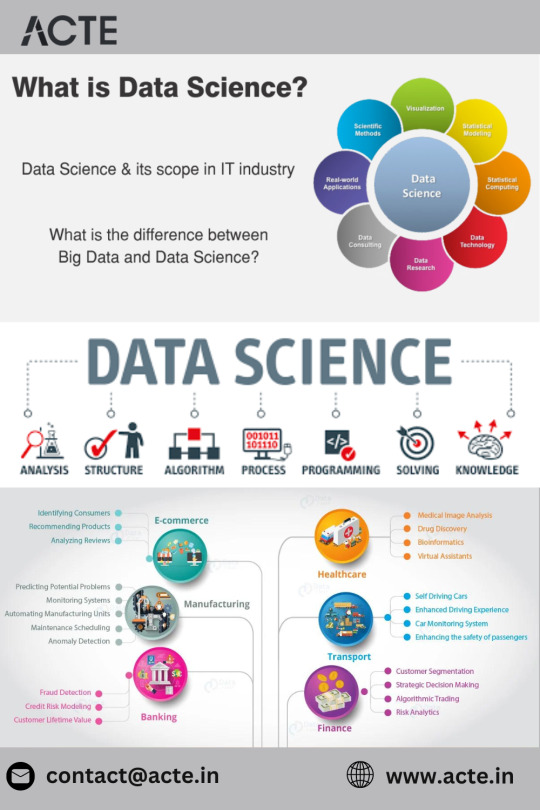

Data Science Unveiled: A Journey Across Industries

In the intricate tapestry of modern industries, data science stands as the master weaver, threading insights, predictions, and optimizations. From healthcare to finance, e-commerce to education, the applications of data science are as diverse as the sectors it transforms. Choosing the Top Data Science Institute can further accelerate your journey into this thriving industry. In this exploration, we'll embark on a journey to unravel the pervasive influence of data science across various domains, witnessing its transformative power and impact on decision-making in the digital age.

Healthcare: Pioneering Precision Medicine

In the healthcare sector, data science acts as a beacon of innovation. It plays a pivotal role in patient diagnosis, treatment optimization, and personalized medicine. By analyzing vast datasets, healthcare professionals can identify patterns, predict disease outcomes, and tailor treatments to individual patients. This not only enhances the efficiency of healthcare delivery but also contributes to groundbreaking advancements in medical research.

Finance: Navigating Risk and Detecting Fraud

The financial landscape is ripe for data science applications, particularly in risk management, fraud detection, and algorithmic trading. Data-driven models analyze market trends, assess risk exposure, and identify fraudulent activities in real-time. This not only safeguards financial institutions but also empowers them to make informed investment decisions, optimizing portfolios for better returns.

E-commerce: Crafting Personalized Experiences

In the bustling world of e-commerce, data science is the engine driving personalized experiences. Recommendation systems powered by data analysis understand user behavior, preferences, and purchase history. This results in tailored product suggestions, optimized pricing strategies, and a seamless shopping journey that boosts sales and enhances customer satisfaction.

Telecommunications: Enhancing Connectivity and Predicting Maintenance

Telecommunications companies leverage data science for network optimization, predictive maintenance, and customer churn analysis. By analyzing vast datasets, they can optimize network performance, predict potential issues, and proactively address concerns. This not only enhances the reliability of communication networks but also improves the overall customer experience.

Marketing: Precision in Targeting and Campaign Optimization

Marketers rely on data science for precision in targeting and campaign optimization. Customer segmentation, behavior analysis, and predictive modeling help marketers tailor their strategies for maximum impact. This ensures that marketing efforts are not only more effective but also cost-efficient, yielding higher returns on investment.

Education: Tailoring Learning Experiences

In the realm of education, data science is reshaping how students learn. Personalized learning experiences, performance analytics, and resource optimization are made possible through data analysis. By understanding student behavior and learning patterns, educators can tailor educational strategies to individual needs, fostering a more adaptive and effective learning environment.

Manufacturing: Predictive Maintenance and Quality Control

Manufacturing enterprises harness data science for predictive maintenance, quality control, and supply chain optimization. Analyzing data from sensors and production lines allows for predictive maintenance, minimizing downtime and reducing defects. This not only enhances operational efficiency but also contributes to cost savings. Choosing the best Data Science Courses in Chennai is a crucial step in acquiring the necessary expertise for a successful career in the evolving landscape of data science.

Energy: Sustainability and Operational Efficiency

Data science is a driving force in the energy sector, contributing to sustainability and operational efficiency. Predictive maintenance of equipment, analysis of energy consumption patterns, and optimization of energy production are facilitated through data-driven insights. This not only ensures reliable energy supply but also contributes to the global push for sustainable practices.

Transportation and Logistics: Optimizing Routes and Operations

In transportation and logistics, data science is instrumental in optimizing routes, predicting demand, and managing fleets efficiently. By analyzing data on traffic patterns, delivery times, and inventory levels, companies can optimize logistics operations, reduce costs, and improve overall service delivery.

Human Resources: Talent Acquisition and Workforce Planning

Human Resources (HR) departments utilize data science for talent acquisition, employee engagement analysis, and workforce planning. Analyzing data on employee performance, satisfaction, and recruitment processes enables HR professionals to make informed decisions, attract top talent, and optimize organizational performance.

Social Media: Enhancing User Engagement and Content Recommendation

Social media platforms leverage data science for enhancing user engagement and content recommendation. Algorithms analyze user interactions, preferences, and behaviors to recommend personalized content and improve overall user experience. This not only keeps users engaged but also enhances the platform's ability to deliver relevant content.

Government and Public Policy: Informed Decision-Making

In the realm of government and public policy, data science aids in informed decision-making. Analyzing data on various facets, including crime rates, resource allocation, and citizen services, enables governments to optimize policies for the welfare of the public. This data-driven approach enhances governance and contributes to more effective public services.

As we traverse the vast landscape of industries, it becomes evident that data science is not merely a tool but a transformative force that connects and elevates diverse sectors. Its ability to extract insights, predict outcomes, and optimize processes is reshaping the way businesses and institutions operate. In an era defined by data, data science stands as a thread weaving through the fabric of innovation, connecting industries and shaping the future of decision-making. As we continue to explore the frontiers of technology, the influence of data science is set to expand, leaving an indelible mark on the evolution of industries across the globe.

3 notes

·

View notes