#Eddie Mauldin

Explore tagged Tumblr posts

Text

Super excited to share “Sleepytime Snorlax” a commissioned mashup of Snorlax as the sleepytime tea bear. This one took a ton of work, but it’s my biggest painting to date!

Click the pic to check out this design in my shop!

#Eddie Mauldin#mashup#Pokémon#Snorlax#popart#painting#digital painting#sleepy#sleepy time#tea#pokémon art#art#artwork#illustration#artist#cartoon#cartoonist#sleepytime tea#paint#anime#anime fanart#fanart#relax#relaxing#comic#original art#pop art#pokemon#Japan#pokemon fanart

1K notes

·

View notes

Photo

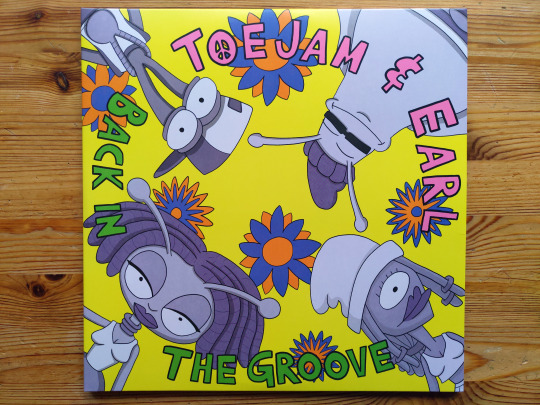

Cody Wright & Nick Stubblefield - Toejam & Earl: Back In The Groove | Enjoy The Ride Records | 2019 | Gray | /150

#cody wright#nick stubblefield#toejam and earl#toejam and earl: back in the groove#enjoy the ride records#vinyl#colored vinyl#lp#music#records#record collection#vgm#video game music#soundtrack#eddie mauldin#humanature studios

10 notes

·

View notes

Text

Dr. Dolittle (1998)

A mercifully short running time of 85 minutes makes the 1998 Dr. Dolittle far more bearable than the 1967 adaptation, with which it shares few strands of DNA (though keen eyes will spot the pushmi-pullyu in on background shot). It benefits greatly from Eddie Murphy - who was in his heyday at the time - but only the youngest audience members will tolerate the menagerie of annoying animals found throughout.

Dr. John Dolittle (Murphy) nearly hits a dog with his car one night and is shocked when the pooch (voiced by Norm MacDonald) angrily shouts at him in a language he understands. Dolittle discovers he can understand the language of animals. Wondering if he’s losing his mind, Dolittle must make sense of this “gift” in time to finalize the sale of his practice to Mr. Calloway (Peter Boyle).

If you grew up in the ‘90s, you’ve seen this movie: A working father with no time for his daughters (played by Kyla Pratt and Raven-Symoné) or his beautiful wife (Kristen Wilson) sees his world turned upside down by a supernatural event. Hilarity ensues as the magical gift he’s been given wreaks havoc on his day-to-day responsibilities. His co-workers look at him cock-eyed, his family wonders what’s happening but give it time and you’ll see, what he believed was a curse is actually a gift that’ll help him realize where his priorities should lie. Between the familiar beats, we get a bunch of recognizable voices playing overly quirky characters: Chris Rock as a randy Guinea Pig, John Leguizamo and Reni Santoni as a couple of fast-talking rats, Gilbert Gottfried as a dog, Julie Kavner (whom you’ll recognize from The Simpsons) and Garry Shandling as argumentative pigeons, and so on.

The disappointment to anyone watching is the lack of imagination. Anytime we see a movie in which someone talks to animals, it’s always the same thing. The animals are not REALLY animals, they’re people dressed up in furry suits that sing pop songs, crack jokes and say what we imagine a dog would say when given a rectal thermometer (there’s a lot of butt stuff in this movie). It’s good for some chuckles but isn't enough for a whole movie. It’s only a matter of time before you start asking questions like “if these animals are all so smart and they understand each other, why are they being served up at McDonald’s?”

There are some nice warm moments in which Dolittle bonds with his youngest daughter. You wish the movie delved deeper into those emotions because you know Eddie Murphy can handle material that’s richer than this kiddie stuff. At least the special effects are solid. They hold up and feature solid puppet work from the Jim Henson company.

If it weren’t for Murphy’s performance, this family comedy would be completely forgettable and as is, Dr. Dolittle still doesn’t make much of an impact. There are some nuggets of goodness here and there but you leave feeling underwhelmed. (January 23, 2020)

#Dr. Dolittle#Dr.Dolittle#Dolittle#Doctor Dolittle#Betty Thomas#movies#films#reviews#movie reviews#film reviews#larry levin#nat mauldin#eddie murphy#ossie davis#oliver platt#1998 movies#1998 films

2 notes

·

View notes

Video

youtube

MODERN DAY ADVENTURING

#new#original#cartoon#animated#short#eddiemauldin#Eddie Mauldin#cartoonist#comedian#comedy#funny#nerd#geek#gamer#video games#inspired#link#zelda#legend of zelda#games#potion shop#rat#king#work#experience#job#shit#office#companies#first time

10 notes

·

View notes

Photo

William Mauldin "Bo" Hopkins (February 2, 1938 – May 28, 2022) Film and television actor. He was known for playing supporting roles in a number of major studio films between 1969 and 1979, and appeared in many television shows and TV movies.

Hopkins starred or co-starred in a number of made-for-television movies of the mid-1970s, including Gondola (1973), Judgment: The Court Martial of Lieutenant William Calley (1975), The Runaway Barge (1975), The Kansas City Massacre (1975), The Invasion of Johnson County (1976), Dawn: Portrait of a Teenage Runaway (1976), Woman on the Run (1977), Thaddeus Rose and Eddie (1978), Crisis in Sun Valley (1978), and The Busters (1978).

When Gretchen Corbett left the television series The Rockford Files in 1978, Hopkins replaced her character as Rockford's attorney John Cooper, ultimately appearing in three episodes. In 1981, Hopkins appeared in the first season of the prime time drama Dynasty as Matthew Blaisdel. His many other appearances on television included in miniseries Aspen (1977) and Beggarman, Thief (1979), and in episodes of Gunsmoke, Bonanza, The Virginian, Nichols, The Rat Patrol (replacing Justin Tarr as the jeep driver for three episodes), The Mod Squad, Hawaii Five-O, Paul Sand in Friends and Lovers, The Rookies, Charlie's Angels, Fantasy Island, The A-Team, Scarecrow and Mrs. King, The Fall Guy, Crazy Like a Fox, Murder, She Wrote, and Doc Elliot. (Wikipedia)

8 notes

·

View notes

Photo

Thank God It’s Friday!

Friday (the 13th) by Eddie Mauldin

35 notes

·

View notes

Photo

Event Recap: Jermaine Dupri X WE tv Host Exclusive Screening [Photos] - Jermaine Dupri and So So Def Recordings teamed up with WE tv to host an exclusive red carpet event and screening of the new documentary “Power, Influence & Hip Hop: The Remarkable Rise of So So Def” at The London Hotel in Los Angeles. JD was joined by his father Michael Mauldin, mother Tina Mauldin, daughter Shaniah Mauldin, and celebrity friends Usher, Bow Wow, Da Brat, Larenz Tate, Mona Scott-Young, Jackie Long, Datari Turner, Angel Brinks, Drea Kelly, Buku Abi, ReeMarkable, Eddie George, Miss Lawrence and Antoine Harris as they celebrated the premiere along with guests, media and influencers. The documentary airs on WE tv this Thursday, July 18th. Adding to the excitement of the evening, attendees also commemorated Season 3 of “Growing Up Hip Hop: Atlanta” which airs on Thursdays at 9/8c. Please Reblog!

#Angel Brinks#Antoine Harris#Bow Wow#Buku Abi#Da Brat#Datari Turner#Debra Atney#Drea Kelly#Eddie George#EVENT RECAP#Jackie Long#Jermaine Dupri#Larenz Tate#Lil Mama#Mariah Carey#Masika Kalysha#Michael Mauldin#Miss Lawrence#Mona Scott Young#Nelly#photos#ReeMarkable#Shaniah Mauldin#Snoop Dogg#Tina Mauldin#Usher#WAKA FLOCKA#WE tv#Will.i.am#Celebrity Stalking

0 notes

Photo

Event Recap: Jermaine Dupri X WE tv Host Exclusive Screening [Photos] - Jermaine Dupri and So So Def Recordings teamed up with WE tv to host an exclusive red carpet event and screening of the new documentary “Power, Influence & Hip Hop: The Remarkable Rise of So So Def” at The London Hotel in Los Angeles. JD was joined by his father Michael Mauldin, mother Tina Mauldin, daughter Shaniah Mauldin, and celebrity friends Usher, Bow Wow, Da Brat, Larenz Tate, Mona Scott-Young, Jackie Long, Datari Turner, Angel Brinks, Drea Kelly, Buku Abi, ReeMarkable, Eddie George, Miss Lawrence and Antoine Harris as they celebrated the premiere along with guests, media and influencers. The documentary airs on WE tv this Thursday, July 18th. Adding to the excitement of the evening, attendees also commemorated Season 3 of “Growing Up Hip Hop: Atlanta” which airs on Thursdays at 9/8c. Please Reblog!

#Angel Brinks#Antoine Harris#Bow Wow#Buku Abi#Da Brat#Datari Turner#Debra Atney#Drea Kelly#Eddie George#EVENT RECAP#Jackie Long#Jermaine Dupri#Larenz Tate#Lil Mama#Mariah Carey#Masika Kalysha#Michael Mauldin#Miss Lawrence#Mona Scott Young#Nelly#photos#ReeMarkable#Shaniah Mauldin#Snoop Dogg#Tina Mauldin#Usher#WAKA FLOCKA#WE tv#Will.i.am#Celebrity Stalking

0 notes

Text

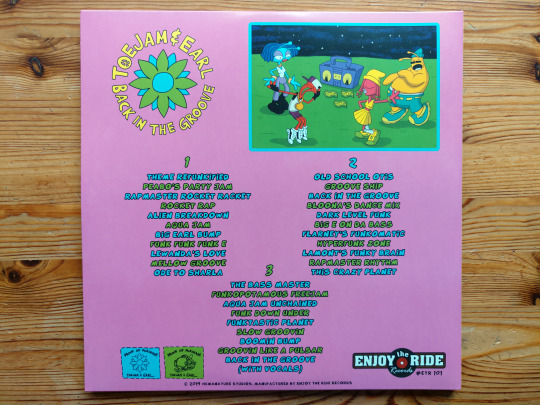

Peabo Bryson

Peabo Bryson (born Robert Peapo Bryson; April 13, 1951, given name changed from "Peapo " to Peabo c. 1965) is an American R&B and soul singer-songwriter, born in Greenville, South Carolina, United States. He is well known for singing soul ballads (often as a duo with female singers) and has contributed to two Disney animated feature soundtracks. Bryson is a winner of two Grammy Awards.

Career

He had two sisters and a brother and spent much of his childhood on his grandfather's farm in Mauldin, South Carolina. His love for music stemmed from his mother, who often took the family to concerts of well-known African-American artists at the time.

Bryson marked his professional debut at age 14, singing backup for Al Freeman and the Upsetters, a local Greenville group. It was Freeman's difficulty in pronouncing Bryson's French West-Indian name, "Peapo", that led Bryson to change its spelling to Peabo. Two years later, he left home to tour the Chitlin' Circuit with another local band, Moses Dillard and the Tex-Town Display. Bryson's first break came during a recording session at Atlanta's Bang Records. Although Bang was not impressed with Dillard's band, the young backup singer caught the ear of the label's general manager, Eddie Biscoe. Biscoe signed Bryson to a contract as a writer, producer, and arranger and encouraged Bryson to perform his own songs. For several years, Bryson worked with hometown bands and wrote and produced for Bang. In 1976, he launched his own recording career with "Underground Music" on the Bang label. His first album, Peabo, followed shortly thereafter. Although only a regional success, Bryson signed to Capitol Records in 1977.

Bryson's greatest solo hits include 1977's "Feel the Fire" and "Reaching for the Sky", 1978's "I'm So Into You" and "Crosswinds", 1982's "Let the Feeling Flow", 1984's "If Ever You're in My Arms Again" (his first Top 10 pop single, at #10 in the US), 1989's "Show and Tell", and the 1991 hit "Can You Stop the Rain". In 1985, he appeared on the soap opera One Life to Live to sing a lyrical version of its theme song. Bryson's vocals were added to the regular theme song in 1987 and his voice was heard daily until 1992. He recorded the successful album of romantic love duets with Roberta Flack (Born to Love) in 1983. In partnership with Regina Belle, Bryson recorded two hit duets: "Without You", the love theme from the comedy film Leonard Part 6, recorded in 1987 and "A Whole New World", the main theme of the Disney's animated feature film Aladdin, recorded in 1992. Bryson and Belle recorded four duets over the years: "Without You" (in 1987), "I Can't Imagine" (in 1991), "A Whole New World" (in 1992) and "Total Praise" (in 2009).

Among his romantic love songs and duets are:

"Gimme Some Time", with Natalie Cole

"What You Won't Do for Love", with Natalie Cole

"Here We Go", with Minnie Riperton

"Lovers After All", with Melissa Manchester

"Tonight I Celebrate My Love", with Roberta Flack

"You're Lookin' Like Love to Me", with Roberta Flack

"I Just Came Here to Dance", with Roberta Flack

"There's Nothin' Out There", with Chaka Khan

"Without You", with Regina Belle (theme from Leonard Part 6)

"For You and I" with Angela Bofill

"Beauty and the Beast", with Celine Dion (theme from Beauty and the Beast)

"I Can't Imagine", with Regina Belle

"A Whole New World", with Regina Belle (theme from Aladdin)

"You Are My Home", with Linda Eder (theme from The Scarlet Pimpernel)

"By the Time This Night Is Over", with Kenny G

"Light the World", with Deborah Gibson

"The Gift", with Roberta Flack

"Wishes", with Kimberley Locke (for the album Disney Wishes!)

"The Best Part", with Nadia Gifford

"As Long As There's Christmas", with Roberta Flack (theme from Beauty and the Beast: The Enchanted Christmas)

"I Have Dreamed", with Lea Salonga (theme from The King and I)

"Make It Til Tomorrow", with Sandi Patty

Bryson won two Grammy Awards: in 1992 for his performance of the song "Beauty and the Beast" with Celine Dion and in 1993 for "A Whole New World" with Regina Belle.

In Spring 1998, Bryson contributed his voice to Barney's Great Adventure: Original Motion Picture Soundtrack, with the song "Dream (Twinken's Tune)".

Bryson performed in theater and operatic productions, most notably the tenor role of "Sportin' Life" in the Michigan Opera Theater of Detroit's version of Porgy and Bess. His tax problems caught up with him on August 21, 2003, when the U.S. Internal Revenue Service seized property from his Atlanta, Georgia, home. He is reported to owe $1.2 million in taxes dating back to 1984. The IRS auctioned many of his possessions, including both Grammy Awards, electronic equipment, his grand piano and multiple pairs of shoes including the 2 Versace pair purchased by Nashville Bassist and Florida native Justin Lowry.

In 2002, Bryson's "Beauty and the Beast" music video was included on the platinum and Blu-ray edition of Beauty and the Beast. His "A Whole New World" music video was included on the platinum edition DVD release of Aladdin. Bryson's CD, Missing You, was released on October 2, 2007 on Peak Records, a division of Concord Music Group.

September 4, 2016 was declared "Peabo Bryson Day" in Charleston, SC and North Charleston, SC during the LowCountryJazzFest. The annual jazzfest is presented by ClosingTheGapInHealthCare.org, founded by Dr. Thaddeus Bell.

In 2018, Bryson released his new album Stand For Love, which was produced by Jimmy Jam and Terry Lewis. The project was released on Jam & Lewis' newly reactivated label, Perspective Records.

Personal life

Before marrying his present wife, former singer and member of English R&B group The 411 Tanya Boniface, Bryson was engaged several times to Juanita Leonard, the former wife of boxing great Sugar Ray Leonard. In the 1990s, he became engaged to Angela Thigpen, former Miss Virginia Teen USA and later a model/actress. Bryson and Boniface have a son, Robert, born January 1, 2018.

Bryson also has a daughter, Linda (born c. 1968), from a previous relationship, along with three grandchildren.

On April 29 2019, it was reported that Bryson had suffered a heart attack, and had been taken to Atlanta hospital where he was said to be in a stable condition. However he has since made a full recovery and is currently touring.

Discography

Peabo (1976)

Reaching for the Sky (1977)

Crosswinds (1978)

We're the Best of Friends (with Natalie Cole) (1979)

Paradise (1980)

Turn the Hands of Time (1981)

I Am Love (1981)

Don't Play with Fire (1982)

Born to Love (with Roberta Flack) (1983)

Straight from the Heart (1984)

Take No Prisoners (1985)

Quiet Storm (1986)

Positive (1988)

All My Love (1989)

Can You Stop the Rain (1991)

Through the Fire (1994)

Peace on Earth (1997)

Unconditional Love (1999)

Christmas with You (2005)

Missing You (2007)

Stand for Love (2018)

10 notes

·

View notes

Text

The Living Legends Foundation Announces its 2019 Annual Awards Gala, Phil Thornton Among Honorees

Top Row -- Left to Right:

Dyana Williams, Sidney Miller, Hymen Childs, Dedra N. Tate

Middle Row -- Left to Right:

Frank Ski, Steve Hegwood, Maurice White, Karen Lee

Bottom Row -- Left to Right:

Phil Thornton, Sheila Coates, Ray Chew and Vivian Scott Chew, DeDe McGuire

(Los Angeles, CA – June 4, 2019) — The Living Legends Foundation, Inc. (LLF) today announces its 2019 Annual Awards Dinner and Gala. This year’s event will be held on Friday, October 4, 2019, at 6:30 p.m. at Taglyan Cultural Complex, 1201 N. Vine Street, Hollywood, CA.

The distinguished honorees include Dyana Williams, CEO of Influence Entertainment, who will be presented with the Lifetime Achievement Award; Frank Ski, Broadcast Personality, V-103 Radio Atlanta, and Steve Hegwood, CEO and President, Core Communications, will both receive the Jerry Boulding Radio Executive Award; Maurice White, Vice President of Promotion, eOne Entertainment Group, will be presented with the Music Label Executive Award; Sheila Coates, founder and creator of BYOB (Be Your Own Brand), will receive the Entrepreneur Award; Dedra N. Tate, President and CEO, Unlimited Contacts, will be the second recipient of the Mike Bernardo Executive Award; Sidney Miller, founder and Publisher, BRE (Black Radio Exclusive), will be presented with the A.D. Washington Chairman’s Award; Hymen Childs, Owner, Service Broadcasting Group (SBG), including K-104 Radio, KRNB Radio, Dallas and the nationally syndicated DeDe In The Morning, will receive the Broadcast Icon Award; Phil Thornton, Senior Vice President/General Manager, RCA Inspiration, will be presented with the Gospel Music Executive Award; and Karen Lee, Senior Vice President, W&W Public Relations, will receive the Media Executive Award.

The Chairpersons of this year’s Awards Dinner and Gala are husband-and-wife team Ray Chew and Vivian Scott Chew, Partners, Chew Entertainment. Award-winning radio personality DeDe McGuire, of the syndicated show DeDe In The Morning, is returning as host.

The LLF continues its mission to honor the best and the brightest in the ever-changing and evolving music and entertainment industries. The foundation’s core mission is to honor pioneers and professionals who have broken new ground in the areas of broadcasting, recorded music, marketing, retail, publicity, publishing, digital, creative, and philanthropy.

“The Living Legends Board of Directors is proud to continue its tradition of recognizing the greatest in the music and record industries,” says David C. Linton, Chairman of the LLF. “We continue to raise the bar and celebrate the unsung heroes of our industry who have helped to lay the foundation for black music, black artists, and black executives of the 20th and 21st century. We remain steadfast in our efforts to raise much-needed funds to assist the less fortunate among us. We look forward to another exceptional event and year.”

In 1991, record industry pioneer Ray Harris had the vision for an organization that would not only salute the achievements of black music executives but would assist them in their time of need. During the same year, Harris worked with record executives Barbara Lewis and C.C. Evans and radio programming legend, the late Jerry Boulding, and founded the Living Legends Foundation.

Over the years, the organization has recognized and honored more than 100 distinguished leaders in music, radio, retail, and media. Past honorees include, in alphabetical order: Brenda Andrews, Larkin Arnold, Clarence Avant, Lee Bailey, Big Boy, Jamie Brown, Troy Carter, Ray Chew and Vivian Scott Chew, Keith Clinkscales, Kenny Gamble, Jack “The Rapper” Gibson, Tony Gray, Ethiopia Habtemariam, Jeffrey Harleston, Denise Brown Henderson, Esq., Stephen Hill, Leon Huff, Cathy Hughes, Don Jackson, Hal Jackson, Larry Jackson, Cynthia Johnson, Varnell Johnson, Quincy Jones, Larry Khan, Morace Landy, Vicki Mack Lataillade and Claude Lataillade, Miller London, Michael Mauldin, Rushion McDonald, Kendall Minter, Esq., Jon Platt, Gwendolyn Quinn, Pat Shields, Eddie Sims and Belinda Wilson, Antonio “L.A.” Reid, Ruben Rodriguez, Aundrae Russell, Herb Trawick, Charles Warfield, Dr. Logan H. Westbrooks, Tyrone Williams, and numerous others.

The LLF is a registered 501 (c) (3) non-profit, tax-exempt organization and has been funded primarily with corporate contributions and individual donations. The 28-year-old organization has expanded its mission to assist those who have served the music industry and who have a confirmable need. This assistance is provided in a manner that maintains the dignity of those who may receive financial help. Many former music industry employees worked during a time when 401Ks and retirement packages were not available—and even today, in this era of downsizing and mergers, the industry’s lack of long-term career stability has become more commonplace. Proceeds from the event will enable the LLF to continue to aid those in need, as well as fund the Living Legends Foundation Scholarship Program, which helps the educational pursuits of the next generation of music makers and marketers at three HBCUs.

The LLF Officers and Board Members include Chairman David Linton, Chairman Emeritus and founder Ray Harris, President Varnell Johnson, Vice-President Jacqueline Rhinehart, Recording Secretary Pat Shields, founder and Treasurer C.C. Evans, and General Counsel Kendall Minter, Esq. Board Members include Vinny Brown, Sheila Eldridge, Marcus Grant, Tony Gray, Ken Johnson, Barbara Lewis, Miller London, Sidney Miller, Kathi Moore, Jon Platt, Gwendolyn Quinn, Sam Weaver, and Colleen Wilson.

The Living Legends Foundation Advisory Board includes a list of distinguished entertainment executives, including Monica Alexander, Don Cody, George Daniels, Brad Davidson, Michael Dawson, Esq., Skip Dillard, Kevin Fleming, Shannon Henderson, Jay Johnson, James Leach, Vicki Mack Lataillade, Gail Mitchell, Azim Rashid, Lionel Ridenour, Kevin Ross, A.J. Savage, Vivian Scott Chew, Phil Thornton, Brian Wallace, Irene Ware, Tyrone Williams, Buzzy Willis, and Tony Winger.

For tickets and sponsorship information, please contact Pat Shields at 310.568.9091 or [email protected].

For additional information on the Living Legends Foundation, please visit www.livinglegendsfoundation.com.

www.livinglegendsfoundation.com

www.facebook.com/thelivinglegendsfoundation

www.twitter.com/TheLLFInc

www.instagram.com/livinglegendsfoundation

www.youtube.com/TheLivingLegendsFdn

# # #

#Music#living legends foundation#livinglegendsfoundation#naomi richard#naomijrichard#naomi jean richard#RCV#RCVFashion#Frank Ski#Dyana Williams#Phil Thornton#Steve Hegwood#Maurice White#Dedra N. Tate#Sheila Coates#Syndey Miller#Karen Lee#Hymen Childs

1 note

·

View note

Text

Happy Black History Month! If you want a depiction of real heroism look no further than my mashup “Kaeptain America.”

#Black History Month#pop art#colin kaepernick#Eddie Mauldin#black history#art#artwork#illustration#artist#illustrator#comics#comic books#captain america#mashup#comic art#super hero#hero#america#football#nfl football#portrait#digital art#comic#fanart#fashion#clothing

45 notes

·

View notes

Text

Real Estate - Recession Signs Everywhere

Real Estate - Recession Signs Everywhere

Real Estate - Recession Signs Everywhere

By John Mauldin Real Estate - This month, the Federal Reserve joined its global peers by turning decisively dovish. Jerome Powell and friends haven’t just stopped tightening. Soon they will begin actively easing by reinvesting the Fed’s maturing mortgage bonds into Treasury securities. It’s not exactly “Quantitative Easing I, II, and III,” but it will have some of the same effects.

Why are they doing this? One theory, which I admit possibly plausible, was that Powell simply caved to Wall Street pressure. The rate hikes and QT were hitting asset prices and liquidity, much to the detriment of bankers and others to whom the Fed pays keen attention. But that doesn’t truly square with his 2018 speeches and actions. The Fed’s March 20 announcement suggests more is happening. I think two other factors are driving the Fed’s thinking. One is increasing recognition of the same slowing global growth that made other central banks turn dovish in recent months. The other is the Fed’s realization that its previous course risked inverting the yield curve, which was violently turning against its fourth-quarter expectations and possibly toward recession (see chart below, courtesy of WSJ’s “Daily Shot”). That would not have looked good in the history books, hence the backtracking.

On the second point... too late. The yield curve inverted, and recession forecasts became suddenly de rigueuramong the same financial punditry that was wildly bullish just weeks ago. My own position has been consistent: Recession is approaching but not just yet. Yet like the Fed, I am data-dependent and the latest data are not encouraging. Today, we’ll examine this and consider what may have changed. Cracks Appearing Let’s start with a step back. The global economy clearly hasn’t recovered from the last recession like it did in previous cycles. Yes, the stock market performed well. So has real estate. We’ve seen some economic growth, which in a few places you might even call a “boom,” but for the most part it’s been pretty mild. Unemployment is low, but wage growth has been sluggish at best. Rising asset prices, fueled by almost a decade of easy monetary policy, also contributed to wealth and income inequality, which fueled populist and now semi-socialist movements around the world. This slow recovery began fading in the last few quarters. The first cracks appeared overseas, leaving the US as an island of stability. Not coincidentally, we also had (slightly) positive interest rates and thus attracted capital from elsewhere. This let our growth continue longer. But now, signs of weakness are mounting here, too. Recall, this follows years of astonishing, amazing, unprecedented, and astronomically huge monetary stimulus by the Federal Reserve, Bank of Japan, European Central Bank, and others. In various and sundry ways, they opened the spigots and left them running full speed for almost a decade. And all it produced was the above-mentioned weak recovery. (Chart below from my friend Jim Bianco, again via “The Daily Shot”)

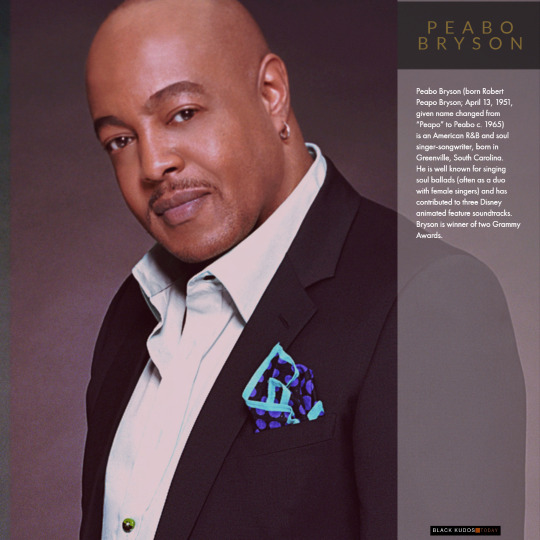

That, alone, should tell you that putting your faith in central bankers is probably a mistake. We can’t know how much worse the last decade would have been without their “help,” but does this feel like success? Yet here we are, with millions still in the hole from the last recession and another one possibly looming. We also can’t rely on historical precedent to identify where, when, or why it will start. But we can make some educated guesses. First Domino Earlier, I called the US an “island of stability.” Other such islands exist, too, and Australia is high on the list. The last Down Under recession was 27—yes, 27—years ago in 1991. No other developed economy can say the same. The long streak has a lot to do with being one of China’s top raw material suppliers during that country’s historic boom. But Australia has done other things right, too. Alas, all good things come to an end. While not officially in recession yet, Australia’s growth is slowing. University of New South Wales professor Richard Holden says it is in “effective recession” with per-capita GDP having declined in both Q3 and Q4 of 2018. (By the way, Italy is similarly in a “technical recession.” Expect more such euphemisms as governments try to avoid uttering the “R-word.”) As often happens, real estate is involved. Australia’s housing boom/bubble could unravel badly. Last week, Grant Williams highlighted a video by economist John Adams, Digital Finance Analytics founder Martin North, and Irish financial adviser Eddie Hobbs, who say Australia’s economy looks increasingly like Ireland’s just before the 2007 housing collapse. The parallels are a bit spooky. Australia’s household debt to GDP was 120.5 per cent as of September last year, according to the Bank for International Settlements, one of the highest in the world. In 2007, Ireland was sitting at around 100 per cent. At the same time, the RBA puts Australia’s household debt to disposable income at 188.6 per cent. Ireland was 200 per cent in 2007, while the US was only 116.3 per cent at the start of 2008. RBA figures also show more than two thirds of the country’s net household wealth is invested in real estate. In 2008, that figure was 83 per cent in Ireland and 48 per cent in the US. Meanwhile, 60 per cent of all lending by Australian financial institutions is in the property sector. In 2007, the International Monetary Fund gave the Irish economy and banking system a clean bill of health and suggested that a “soft landing” was the most likely outcome. Last month, the IMF said Australia’s property market was heading for a “soft landing”. House prices in Sydney and Melbourne have fallen nearly 14 per cent and 10 per cent from their respective peaks in July and November 2017, coinciding with sharp drop-off in credit flowing into the housing sector both for owner-occupiers and investors. Real estate is, by nature, credit-driven. Few people pay cash for land, homes, or commercial properties. So when credit dries up, so does demand for those assets. Falling demand means lower prices, which is bad when you are highly leveraged. It gets worse from there as the banking system gets dragged into the fray. Losses can quickly spread as defaults affect lenders far from the source. This is not only an Australian problem. Similar slowdowns are unfolding in New Zealand, Canada, Europe, and China.It’s a global problem, and one company reveals the impact. Constrained Hiring Shipping and transport stocks are kind of a “canary in the coal mine” because they are among the first to signal slowing growth. Last week, FedEx reported its international shipping revenue was down and cut its full-year earnings guidance. Its CFO blamed the economy, reported CNBC. Slowing international macroeconomic conditions and weaker global trade growth trends continue, as seen in the year-over-year decline in our FedEx Express international revenue,” Alan B. Graf, Jr., FedEx Corp. executive vice president and chief financial officer, said in statement. Despite a strong U.S. economy, FedEx said its international business weakened during the second quarter, especially in Europe. FedEx Express international was down due primarily to higher growth in lower-yielding services and lower weights per shipment, Graf said. To compensate for lower revenue, Graf said FedEx began a voluntary employee buyout program and constrained hiring. It is also “limiting discretionary spending” and is reviewing additional actions. FedEx shares have dropped roughly 27 percent in the past year, lagging the XLI industrial ETF’s 1 percent decline. This little snippet overflows with implications. Let’s unpack some of them. Revenue fell due to “higher growth in lower-yielding services.” So those who ship international packages have decided lower costs outweigh speed. Likewise, “lower weights per shipment” signals they are shipping only what they must, when they must. FedEx is responding with an employee buyout program and “constrained hiring.” The company is overstaffed for its present requirements. This might also reflect increased automation of work once done by humans. In any case, it won’t help the employment stats. In addition, FedEx is “limiting discretionary spending.” I’m not sure what that means. Every business always limits discretionary spending, or it doesn’t stay in business long. If FedEx is taking additional steps, then whoever would have received that spending will also see lower revenues. They might have to “constrain hiring,” too. Obviously, FedEx is just one company, although a large and critically positioned one. But statements like this add up to recession if they grow more common… and they are. Tariff Trouble One reason FedEx is in the vanguard is that it’s uniquely exposed to world trade, the growth of which is diminishing for multiple reasons. Part of it is technology. The things we “ship” internationally are increasingly digital, and they travel via wires and satellite links instead of ships and planes. These sorts of goods aren’t easily valued for inclusion in the trade stats. Energy is another factor. Between US shale production and renewable energy sources, we don’t import as much oil and gas from across the seas as we otherwise would. That shows up in both trade and currency values. The US dollar is stronger now, in part because we send fewer dollars to OPEC. Note the massive (and stealthy!) growth in LNG (liquified natural gas) exports in the past few years. Think what this will look like in a few years, with not one but four LNG export terminals on the US coasts. Natural gas is also the basis for much of the chemical and fertilizer industry. Abundant US supplies (and prices less than half the cost of Russian gas in Germany) help many US industries compete.

Those are just signs of normal progress and change. The economy can adapt to them. The greater threat is artificially constrained international trade, which is what the Trump administration’s trade war is creating. Last year, I explained how trade wars can spark recession and trade deficits are nothing to fear. I won’t repeat all that here. But we have since seen several market swoons/rallies as harsher trade restrictions looked more/less likely. Whether you like it or not, asset values depend on the (relatively) free flow of goods and services across international borders. Interfere with that and all kinds of assets become less valuable. Starting a trade war, at the same time growth is slowing for other reasons, is more than a little unwise. Agricultural tariffs have already ripped through US farm country to devastating effect, leaving losses some farmers may never recover. The president’s tariff threats had other impact as well. Companies raced to import foreign-supplied components and inventory before the tariffs took effect. This jammed ports and highways last year, not with new demand but future demand shifted forward in time. This is important, and I think we will see the impact soon (if we are not already). Transport and logistics companies geared up for last year’s surge, expanding their facilities and hiring new workers. Importers built up inventory in an effort to avoid tariffs that were supposed to take effect in January. The deadline was extended, but the threat is still alive. At some point, all this has to stop. Carrying inventory is expensive and will eventually outweigh the benefit of avoiding tariffs. Then the boom will come to a screeching halt. Imports will fall as companies work down inventory. All those jobs and construction projects will disappear. That, combined with the other cyclical factors and high debt loads everywhere, could easily add up to a recession. Exactly when is hard to say. Recessions usually get pronounced in hindsight, so there’s some possibility we are in one right now. But I still think we’ll avoid it this year. Getting into this box took a long time and so will getting out of it. Regardless, we’ll have a recession at some point. I think the next subprime crisis will be in corporate debt. Next week, we’ll look deeper into the timing question, what the yield curve tells us, and why the next decade will bring little or no economic growth. I realize this is not a happy conclusion, but I call them as I see them. I’ll leave you with one final but critically important thought: Prepare, don’t despair. Tough times are coming but we can handle them. You have a chance to get ready. I highly suggest you take it. Read more https://global.goreds.today/real-estate-markets-brace-for-near-crisis-level-drop-in-retail-property-values/ Read the full article

0 notes

Video

youtube

Twig & Ash - Ep. 11 “Fat Head”

By: Daniel Cole. Voices by: Bianca Wasson, Rachel Chapman, Megan Moran, George Kaplan, Rachel Cole, Eddie Mauldin, Kristian Lugo.

3 notes

·

View notes

Photo

Eddie Mauldin http://ARRE.ST/AZ-112675081

0 notes

Text

Player Spotlight: Justin Simmons

Today EA released the next group of Player Spotlight player items and solo challenges. In order to activate the Player Spotlight Week 8 solo challenges, you will need to have at a minimum the Spotlight Defense Tier 3 chemistry in your lineup. Once you complete the Week 8 Player Spotlight solo challenges you will receive a 99 NAT Jalen Ramsey and 6,000 coins.

If you need more information on how the Player Spotlight program works, check out this news post. Here are all of today's new player items:

Elite Player Items

Justin Simmons

Lorenzo Mauldin IV

Henry Anderson

Eddie Goldman

Kevin Byard

Gold Player Items

Justin Simmons

Lorenzo Mauldin IV

Henry Anderson

Eddie Goldman

Kevin Byard

What do you think of today's Spotlight Players? Will you be adding any to your lineup?

from Muthead

via Blogger http://ift.tt/2vtwM4Z http://ift.tt/1Tdc4tu

0 notes

Text

New Petition

Create a Roger Rabbit Sequel Movie or TV Series

he story follows Eddie Valiant, a private detective who must exonerate "Toon" Roger Rabbit, who is accused of murdering a wealthy businessman.

I watch This film long time Ago and That Film inspired me to make my own Live Action /Animation Films in the Near and I would Love it if they can make a sequel or a TV Series.

With the film's critical and financial success, Disney and Spielberg felt it was obviously time to plan a second installment. J. J. Abrams says that he met Spielberg in 1989 to discuss working on a sequel, to the extent of preparing an outline and storyboards.[70] More substantial work was done by Nat Mauldin, who wrote a prequel titled Roger Rabbit: The Toon Platoon, set in 1941. Similar to the previous film, Toon Platoon featured many cameo appearances by characters from the golden Age of American animation. It began with Roger Rabbit's early years, living on a farm in the Midwestern United States.[57] With human Richie Davenport, Roger travels west to seek his mother, in the process meeting Jessica Krupnick (his future wife), a struggling Hollywood actress. While Roger and Ritchie are enlisting in the Army, Jessica is kidnapped and forced to make pro-Nazi Germany broadcasts. Roger and Ritchie must save her by going into Nazi-occupied Europe accompanied by several other toons in their Army platoon. After their triumph, Roger and Ritchie are given a Hollywood Boulevard parade, and Roger is finally reunited with his mother, and father: Bugs Bunny.[57][71]

Mauldin later re-titled his script Who Discovered Roger Rabbit. Spielberg left the project when deciding he could not satirize Nazis after directing Schindler's List.[72][73] Eisner commissioned a rewrite in 1997 with Sherri Stoner and Deanna Oliver. Although they kept Roger's search for his mother, Stoner and Oliver replaced the WWII subplot with Roger's inadvertent rise to stardom on Broadway and Hollywood. Disney was impressed and Alan Menken was hired to write five songs for the film and offered his services as executive producer.[73] One of the songs, "This Only Happens in the Movies", was recorded in 2008 on the debut album of Broadway actress Kerry Butler.[74] Eric Goldberg was set to be the new animation director, and began to redesign Roger's new character appearance.[73]

Spielberg had no interest in the project because he was establishing DreamWorks, although Frank Marshall and Kathleen Kennedy decided to stay on as producers. Test footage for Who Discovered Roger Rabbit was shot sometime in 1998 at the Disney animation unit in Lake Buena Vista, Florida; the results were a mix of CGI, traditional animation and live-action that did not please Disney. A second test had the toons completely converted to CGI; but this was dropped as the film's projected budget escalated well past $100 million. Eisner felt it was best to cancel the film.[73] In March 2003, producer Don Hahn was doubtful about a sequel being made, arguing that public tastes had changed since the 1990s with the rise of computer animation. "There was something very special about that time when animation was not as much in the forefront as it is now."[75]

In December 2007, Marshall stated that he was still "open" to the idea,[76] and in April 2009, Zemeckis revealed he was still interested.[77] According to a 2009 MTV News story, Jeffrey Price and Peter S. Seaman were writing a new script for the project, and the animated characters would be in traditional 2D, while the rest would be in motion capture.[78]However, in 2010, Zemeckis said that the sequel would remain hand-drawn animated and live-action sequences will be filmed, just like in the original film, but the lighting effects on the cartoon characters and some of the props that the toons handle will be done digitally.[79] Also in 2010, Don Hahn, who was the film's original associate producer, confirmed the sequel's development in an interview with Empire. He stated, "Yeah, I couldn't possibly comment. I deny completely, but yeah... if you're a fan, pretty soon you're going to be very, very, very happy."[80] In 2010, Bob Hoskins stated he was interested in the project, reprising his role as Eddie Valiant.[81] However, he retired from acting in 2012 after being diagnosed with Parkinson's disease a year earlier, and died from those complications in 2014.[82] Marshall has confirmed that the film is a prequel, similar to earlier drafts, and that the writing was almost complete.[83] During an interview at the premiere of Flight, Zemeckis stated that the sequel was still possible, despite Hoskins' absence, and the script for the sequel was sent to Disney for approval from studio executives.[84]

In February 2013, Gary K. Wolf, writer of the original novel, said that he, as well as Erik Von Wodtke were working on a development proposal for an animated Disney buddy comedy starring Mickey Mouse and Roger Rabbit called The Stooge, based on the 1952 film of the same name. The proposed film is set to a prequel, taking place five years before Who Framed Roger Rabbit and part of the story is about how Roger met Jessica, his future wife. Wolf has stated the film is currently wending its way through Disney.[85]

In November 2016, while promoting his latest film, Allied, in England, Zemeckis took some time to have an interview with Robbie Collin of The Daily Telegraph. As the conversation shifted focus to the Roger Rabbit sequel, Zemeckis stated that the sequel "moves the story of Roger and Jessica Rabbit into the next few years of period film, moving on from film noir to the world of the 1950s". He also stated that the sequel would feature a "digital Bob Hoskins", as Eddie Valiant would return in "ghost form". While the director went on to state that the script is "terrific" and the film would still utilize hand-drawn animation, Zemeckis thinks that the chances of Disney green-lighting the sequel are "slim". As he explained more in detail, "The current corporate Disney culture [the current studio management of The Walt Disney Company] has no interest in Roger, and they certainly don't like Jessica at all."[86]

I was thinking for A Pitch of Roger Rabbit Tv Series Project of Roger Rabbit met his Future Wife and Have Some Crazy Adventures in Toon Town

So Help Me Convince Walt Disney Pictures and Walt Disney Company to Make a Roger Rabbit Sequel or a TV Series

Spread the word

https://www.change.org/p/the-walt-disney-company-create-a-roger-rabbit-sequel-movie-or-tv-series

0 notes