#Economic Savings

Explore tagged Tumblr posts

Text

5 Effective Ways to Successfully Quit Smoking

Tips toSuccessfully Quit Smoking Quitting smoking is no small feat. It demands perseverance, motivation, and a solid strategy. If you’re aiming to kick the habit for good, here are five effective ways to help you navigate the journey: Estimated reading time: 3 minutes Photo by George Morina on Pexels.com 1. Ask Yourself the Vital Question Begin with introspection. Frequently ask yourself,…

View On WordPress

#Economic Savings#Family Wellbeing#Health Benefits#Healthy Lifestyle#Quitting Tips#Self-motivation#Smoke-Free Life#Smoking Cessation

0 notes

Text

Solar Solutions for Business - Benefits of the Switch

Explore why businesses are adopting solar solutions: from economic savings and brand image to environmental impact and energy independence.

#Solar Energy#Business Sustainability#Renewable Energy#Economic Savings#Green Business#Solar Solutions

0 notes

Text

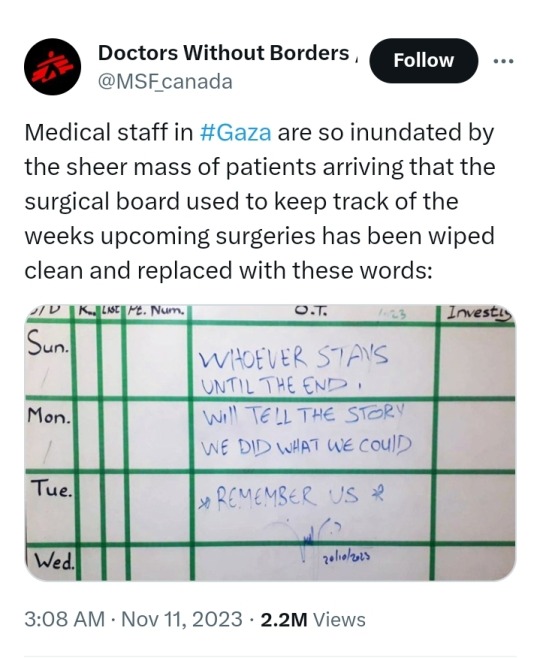

People seem to think this is fake because it's written in English. Apart from the racism in believing that Arab doctors and nurses aren't fluent in English (a second or official language for half of Asia), Palestinians have deliberately been addressing their audience in English on every social media, from journalists to children, because they know speaking English to Westerners immediately makes people more human in their eyes. Because language is one of the ways the imperial cultural hegemony conditions us (yes, everyone in the world) to see who qualifies as "people" and who are simply a mass of bodies who were always made to suffer and die. Gazans know this deeply, which is why they have been using English to beg and plead through social media, "We're not numbers! We're not numbers! We're people like you, we speak your language, we deserve to live!" all the while they're systematically slaughtered.

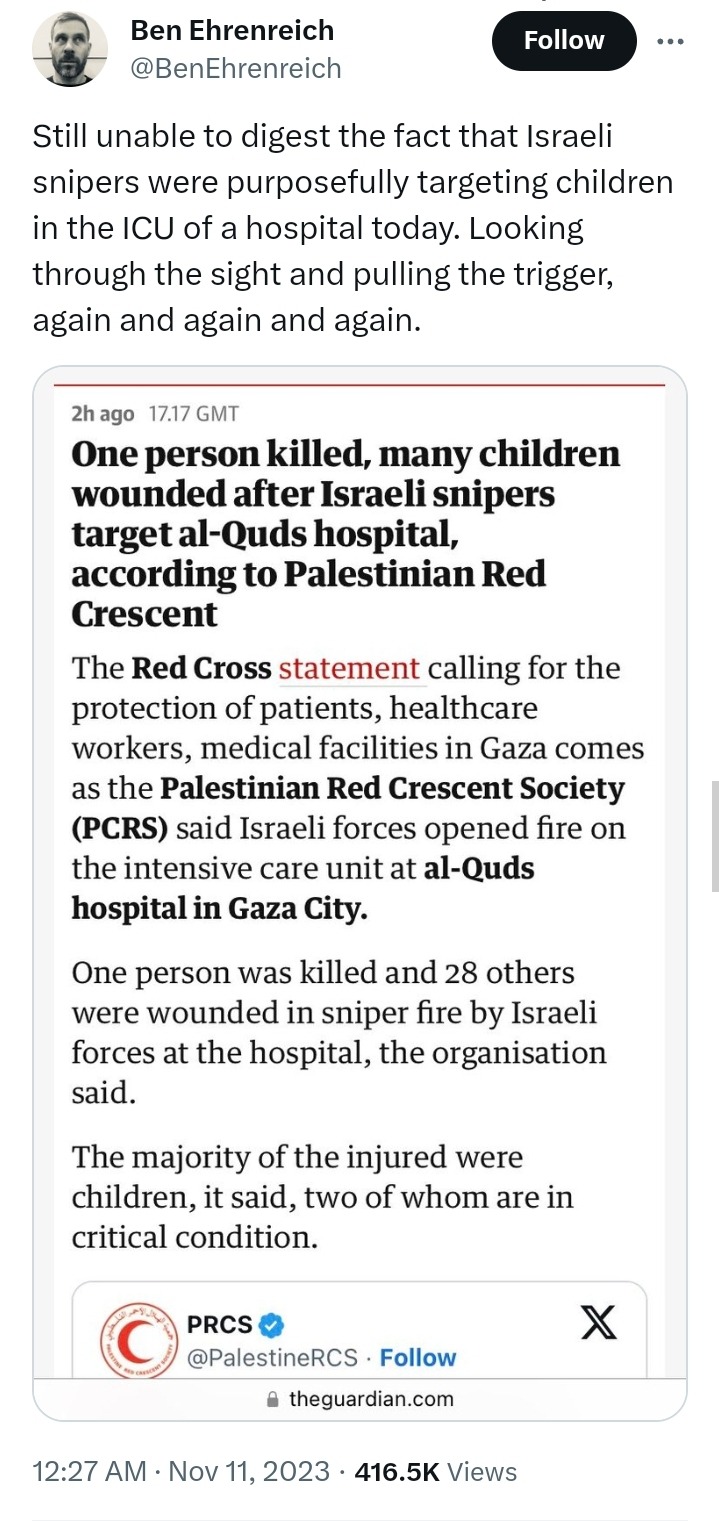

Israeli forces also encircled Al Shifa Hospital yesterday and bombed it for several hours while shooting dead anyone trying to flee including medical staff moving between buildings. Not sure whether it's still continuing because WHO lost all communications with its staff there a few hours after. The last new report said that thirty-nine babies had been removed from the incubators before the power went out. It's extremely unlikely they will survive.

Please understand that these atrocities depend on the war of attrition between governments and public attention. The momentum of public outcry is difficult to sustain through repeated stonewalling and bureaucratic intractability. When we're flooded with these reports and a sense of futility and despair replaces the anger, it allows compassion fatigue to set in and the violence to become normalized. Massacring hospitals, killing sick children and openly targeting humanitarian aid workers (Netanyahu just declared the UNRWA is in league with Hamas) will become simply more news articles that fade into the background, and open genocides will soon become part of the "lesser evil".

Take care of yourselves how you can, take distance where needed, but please never tune out and give up on the two million people for whom we are the only witness and hope. Never stop boosting and sharing the news and posts you find, never stop getting out there and joining every protest you can, however small. Anger burns out, which is why activism must depend on an immovable sense of justice and uncompromising value for human life. It's not just about Gaza, it's about the kind of evil our generation will be coerced into accepting as unchangeable and inevitable hereafter.

#but also like it's a lot about us and especially you in the West#every bomb dropped on Gaza brings us closer to the brink of‚ if not a world war‚ an eruption of regional conflict#with devastating economic and environmental effects across the world#I'm tired of repeating this and my followers are prob tired of seeing it#but someone has to#war of attrition like I said#free Palestine#tw child murder#tw child death#tw baby killing#tw ableism#disability justice#war crimes#gaza genocide#save gaza#gaza under attack#palestinian genocide#israel is a terrorist state#knee of huss

7K notes

·

View notes

Text

WORDS TO REMEMBER AS WE DEAL WITH THIS ATTACK ON OUR GREAT NATION!!!

We need to remind all of we patriots about this! Please like and reblog!

#the great awakening#government corruption#fjb#wef#world economic forum#democrats#joe biden#illegal immigration#bill gates#donald trump#democrats are corrupt#democrat socialists#save democracy#kamala harris#kamalatoe harris

1K notes

·

View notes

Text

nah man that’s not me sympathizing with the uhc ceo that’s simply being sexy as always and correct. everything reverts to the mean unless you boil the frog, and you’re proud of the fact that you don’t even know how to use the stove.

#hey uh did you know that systemic problems require systemic solutions and all policy is economic policy#this person tagged this with ‘scratched liberals’ but i don’t bleed. stop trying to get your fascist little nails in me#blacked out the other person’s url bc I don’t want them to get shooter discourse#everyone wants to save the world and no one wants to do the dishes#do them anyways.

147 notes

·

View notes

Text

whiskey & writing this thesis bc the introduction chapter is taking more linguistical creativity than what I have with just caffeine (idk what to write in this without it sounding like a 3rd grader’s essay yikes)

#also I ran out of whiskey :( been saving this last glass for ages bc whiskey expensive#but the cravings got the best of me (if i was being economical I would’ve had the cheap vodka I have in my fridge but it’s so bad I cant)#and I just mmmight be financially irresponsible and go buy a new one tonight#tho no clue which one#my budget is not high#but I am not fucking buying jameson#bookblr#studyblr#booklr#aesthetic#books#study#reading#read#book#tw alcohol#alcohol tw#dark academia#february 2024#2024

342 notes

·

View notes

Text

#trump#donald trump#trump 2024#president trump#donald j. trump#ohio#us taxes#death and taxes#bailout#student loans#loans#debt#debt consolidation#gop#college#university#ownership#money management#money making#money#banks#interest rates#nyse#world economic forum#economy#anti capitalism#freedom#shopping#credit cards#saving 6

39 notes

·

View notes

Text

Hiiii. My apartment will accept my application but they want two months of a deposit upfront by Wednesday, and because I've had to do repairs on my car that's stretching my money tight. So I am again bumping my Kofi (ko-fi.com/rosebijoumme) and making mention that I am willing to short fanfic writing commissions of properties I am familiar with (say, 500 words for $15). If you appreciate the funny words I say, drawings, or my research posts about Egypt, helping me out with this is a nice way to express that. I do hate to rattle my tincan but they want around $90 dollars more than I have on hand, and I do need gas back and forth until my next check on December (which is often around 150-200$, it's been on the lower side lately and having to pay so much is why I'm moving).

#cipher talk#Cars are an economic drain. Ultimately it's good for my independence that I was talked into this but jfc#I had a lot of savings before this damn thing that have gone poof especially with my mom begging me for money so often#I can probably come up with the total but like I said. Money is tight#Ideally next month will be better bc I won't have to pay 500+ on a car repair or give out money to my mom because I'll just tell her no#And cite those whole problem as to why

233 notes

·

View notes

Text

What I came to realise was that these men are actually the losers. The billionaires who called me out to the desert to evaluate their bunker strategies are not the victors of the economic game so much as the victims of its perversely limited rules. More than anything, they have succumbed to a mindset where “winning” means earning enough money to insulate themselves from the damage they are creating by earning money in that way. It’s as if they want to build a car that goes fast enough to escape from its own exhaust.

Yet this Silicon Valley escapism – let’s call it The Mindset – encourages its adherents to believe that the winners can somehow leave the rest of us behind.

Never before have our society’s most powerful players assumed that the primary impact of their own conquests would be to render the world itself unliveable for everyone else. Nor have they ever before had the technologies through which to programme their sensibilities into the very fabric of our society. The landscape is alive with algorithms and intelligences actively encouraging these selfish and isolationist outlooks. Those sociopathic enough to embrace them are rewarded with cash and control over the rest of us. It’s a self-reinforcing feedback loop. This is new.

Amplified by digital technologies and the unprecedented wealth disparity they afford, The Mindset allows for the easy externalisation of harm to others, and inspires a corresponding longing for transcendence and separation from the people and places that have been abused.

Instead of just lording over us for ever, however, the billionaires at the top of these virtual pyramids actively seek the endgame. In fact, like the plot of a Marvel blockbuster, the very structure of The Mindset requires an endgame. Everything must resolve to a one or a zero, a winner or loser, the saved or the damned. Actual, imminent catastrophes from the climate emergency to mass migrations support the mythology, offering these would-be superheroes the opportunity to play out the finale in their own lifetimes. For The Mindset also includes a faith-based Silicon Valley certainty that they can develop a technology that will somehow break the laws of physics, economics and morality to offer them something even better than a way of saving the world: a means of escape from the apocalypse of their own making.

— The super-rich ‘preppers’ planning to save themselves from the apocalypse

#douglas rushkoff#the super-rich ‘preppers’ planning to save themselves from the apocalypse#economics#capitalism#wealth#class#apocalypse#survivalism#technology#climate change#ethics#silicon valley

21 notes

·

View notes

Text

So we’re in a “selective recession” because wealthy people are still doing just fine? The vast majority of Americans are struggling to pay bills and working extra part-time jobs (or stringing together part-time gigs because they can’t find a full-time job), but it’s all OK because rich people can still afford luxury vacations? By this definition, the 1930’s were a “Selective Great Depression” because a few wealthy people were still out sailing their yachts. How stupid do they think we are? Who believes this propaganda?

#save america#leadership#biden economy#economic collapse#bidenomics#bidenflation#debt slavery#americans are angry#Americans are fed up#propaganda#official lies

46 notes

·

View notes

Text

Solar Solutions for Businesses: Why Companies are Making the Switch

In the ever-evolving world of business, companies are perpetually seeking methods to streamline operations, cut costs, and reduce their environmental footprint. Enter: solar solutions. As the clamor for sustainability grows louder, more businesses are turning to solar power not just as an alternative energy source, but as the primary solution to their energy needs. But what's driving this shift to solar solutions for businesses? Let's explore the compelling reasons.

1. Economic Savings

Arguably, the most direct benefit of adopting solar solutions is the potential for substantial economic savings. With the cost of solar panels steadily decreasing over the past decade, the initial investment is no longer as daunting as it used to be. Businesses can now recoup their installation costs faster through energy savings, and in some regions, even sell excess power back to the grid. When you couple this with potential tax incentives, grants, and rebates, the financial case for solar becomes even more enticing.

2. Predictable Energy Costs

Utility prices fluctuate, and the unpredictability can wreak havoc on a business's budgeting and financial forecasting. Solar solutions offer a level of predictability. Once the installation cost is covered, the ongoing maintenance of solar systems is relatively minimal, and more importantly, the sun's energy remains free. This allows businesses to have better control over their monthly and yearly expenditure, providing an edge in financial planning.

3. Enhancing Brand Image

Today's consumers are more environmentally conscious than ever. They're not only choosing to support green businesses but are also willing to pay a premium for sustainable products and services. By adopting solar solutions, companies send a clear message about their commitment to environmental stewardship. This boosts their brand image, fosters customer loyalty, and can be a significant differentiator in a competitive market.

4. Reducing Carbon Footprint

Climate change is no longer a distant threat but a pressing reality. By integrating solar solutions, businesses can substantially reduce their carbon emissions. Transitioning to solar energy means relying less on fossil fuels, thereby reducing greenhouse gas emissions. This not only helps in the global fight against climate change but also ensures businesses comply with stringent environmental regulations.

5. Energy Independence

Relying heavily on grid power, especially in areas with frequent outages or unstable supply, can be detrimental to business operations. Solar solutions provide businesses with a degree of energy independence. With battery storage systems, companies can store excess solar energy and use it during non-sunny days or peak usage times, ensuring uninterrupted operations.

6. Scalability

One of the beautiful aspects of solar solutions is their scalability. Businesses can start with a system that meets their current needs and then expand as they grow. This modular nature of solar installations means that as a business expands its operations or facilities, its solar system can grow in tandem.

7. Technological Advancements

The field of solar energy isn't static. Innovations such as bifacial solar panels, solar tracking systems, and efficiency-enhancing technologies have made solar solutions more effective and appealing. Businesses that adopt solar power can benefit from these advancements, ensuring they always have access to top-tier technology.

8. Long-Term Security

With finite fossil fuel resources and the global push towards renewable energy, the future landscape of energy is destined to change. By investing in solar solutions now, businesses are future-proofing themselves, ensuring they remain ahead of the curve and not subject to the vulnerabilities of a non-renewable energy-dominated market.

Conclusion

The shift towards solar solutions in the business realm is not just a passing trend but a strategic move driven by both economic and environmental factors. Companies that recognize the myriad benefits of solar energy position themselves for financial savings, operational efficiency, and positive brand perception.

In the end, solar solutions offer a win-win proposition: a win for businesses in terms of cost and reliability, and a win for the planet in terms of sustainability and reduced carbon emissions. The question is no longer if companies should make the switch, but how soon they can integrate solar solutions into their operations. Contact us for more information here: https://sternsolar.ca/contact-us/.

#Solar Energy#Renewable Energy#Economic Savings#Green Business#Solar Solutions#Business Sustainability

0 notes

Text

Ko-Fi prompt from Isabelo:

Hi! I'm new to the workforce and now that I have some money I'm worried it's losing its value to inflation just sitting in my bank. I wanted to ask if you have ideas on how to counteract inflation, maybe through investing?

I've been putting this off for a long time because...

I am not a finance person. I am not an investments person. I actually kinda turned and ran from that whole sector of the business world, at first because I didn't understand it, and then once I did understand it, because I disagreed with much of it on a fundamental level.

But... I can describe some factors and options, and hope to get you started.

I AM NOT LEGALLY QUALIFIED TO GIVE FINANCIAL ADVICE. THIS IS NOT FINANCIAL ADVICE.

What is inflation, and what impacts it?

Inflation is the rate at which money loses value over time. It's the reason something that cost 50 cents in the 1840s costs $50 now.

A lot of things do impact inflation, like housing costs and wage increases and supply chains, but the big one that is relevant here is federal interest rates. The short version: if you borrow money from the government, you have to pay it back. The higher the interest rates on those loans, the lower inflation is. This is for... a lot of reasons that are complicated. The reason I bring it up is less so:

The government offers investments:

So yeah, the feds can impact inflation, but they also offer investment opportunities. There are three common types available to the average person: Bonds, Bills, and Notes. I'll link to an article on Investopedia again, but the summary is as follows: You buy a bill, bond, or note from the government. You have loaned them money, as if you are the bank. Then, they give it back, with interest.

Treasury Bills: shortest timeframe (four weeks to a year), and lowest return on investment. You buy it at a discount (let's say $475), and then the government returns the "full value" that the bond is, nominally (let's say $500). You don't earn twice-yearly interest, but you did earn $25 on the basis of Loaning The Government Some Cash.

Treasury Notes: 2-10 year timeframe. Very popular, very stable. Banks watch it to see how they should plan the interest rates for mortgages and other large loans. Also pretty high liquidity, which means you can sell it to someone else if you suddenly need the cash before your ten-year waiting period is up. You get interest payments twice a year.

Treasury Bonds: 20-30 years. This is like... the inverse of a house mortgage. It takes forever, but it does have the highest yield. You get interest payments twice a year.

Why invest money into the US Treasury department, whether through the above or a different government paper? (Savings bonds aren't on sold the set schedule that treasury bonds are, but they only come in 30-year terms.)

It is very, very low risk. It is pretty much the lowest risk investment a person can make, at least in the US. (I'm afraid I don't know if you're American, but if you're not, your country probably has something similar.)

Interest rates do change, often in reaction or in relation to inflation. If your primary concern is inflation, not getting a high return on investment, I would look into government papers as a way to ensure your money is not losing value on you.

This is the website that tells you the government's own data for current yield and sales, etc. You can find a schedule for upcoming auctions, as well.

High-yield bank accounts:

Savings accounts can come with a pretty unremarkable but steady return on investment; you just need to make sure you find one that suits you. Some of the higher-yield accounts require a minimum balance or a yearly fee... but if you've got a good enough chunk of cash to start with, that might be worth it for you.

They are almost as reliable as government bonds, and are insured by the government up to $250,000. Right now, they come with a lower ROI than most bonds/bills/notes (federal interest rates are pretty high at the moment, to combat inflation). Unlike government papers, though, you can deposit and withdraw money from a savings account pretty much any time.

Certificates of Deposit:

Okay, imagine you are loaning money to your bank, with the fixed term of "I will get this money back with interest, but only in ten years when the contract is up" like the Treasury Notes.

That's what this is.

Also, Investopedia updates near-daily with the highest rates of the moment, which is pretty cool.

Property:

Honestly, if you're coming to me for advice, you almost definitely cannot afford to treat real estate as an investment thing. You would be going to an actual financial professional. As such... IDK, people definitely do it, and it's a standby for a reason, but it's not... you don't want to be a victim of the housing bubble, you know? And me giving advice would probably make you one. So. Talk to a professional if this is the route you want to take.

Retirement accounts:

Pension accounts are a kind of savings account. You've heard of a 401(k)? It's that. Basically, you put your money in a savings account with a company that specializes in pensions, and they invest it in a variety of different fields and markets (you can generally choose some of this) in order to ensure that the money grows enough that you can hopefully retire on it in fifty years. The ROI is usually higher than inflation.

These kinds of accounts have a higher potential for returns than bonds or treasury notes, buuuuut they're less reliable and more sensitive to market fluctuations.

However, your employer may pay into it, matching your contribution. If they agree to match up to 4%, and you pay 4% of your paycheck into an pension fund, then they will pay that same amount and you are functionally getting 8% of your paycheck put into retirement while only paying for half of it yourself.

Mutual Funds:

I've definitely linked this article before, but the short version is:

An investment company buys 100 shares of stock: 10 shares each in 10 different "general" companies. You, who cannot afford a share of each of these companies, buy 1 singular share of that investment company. That share is then treated as one-tenth of a share of each of those 10 "general" companies. You are one of 100 people who has each bought "one stock" that is actually one tenth of ten different stocks.

Most retirement funds are actually a form of mutual fund that includes employer contributions.

Pros: It's more stable than investing directly in the stock market, because you can diversify without having to pay the full price of a share in each company you invest in.

Cons: The investment company does get a cut, and they are... often not great influences on the economy at large. Mutual funds are technically supposed to be more regulated than hedge funds (which are, you know, often venture capital/private equity), but a lot of mutual funds like insurance companies and pension funds will invest a portion of their own money into hedge funds, which is... technically their job. But, you know, capitalism.

Directly investing in the stock market:

Follow people who actually know what they're doing and are not Evil Finance Bros who only care about the bottom line. I haven't watched more than a few videos yet, but The Financial Diet has had good energy on this topic from what I've seen so far, and I enjoy the very general trends I hear about on Morning Brew.

That said, we are not talking about speculative capital gains. We are talking about making sure inflation doesn't screw with you.

DIVIDENDS are profit that the company shares to investors every quarter. Did the company make $2 billion after paying its mortgages, employees, energy bill, etc? Great, that $2 billion will be shared out among the hundreds of thousands of stocks. You'll probably only get a few cents back per stock (e.g. Walmart has been trading at $50-$60 for the past six months, and their dividends have been 57 cents and then 20.75 cents), but it adds up... sort of. The Walmart example is listed as having dividends that are lower than inflation, so you're actually losing money. It's part of why people rely on capital gains so much, rather than dividends, when it comes to building wealth.

Blue Chip Stocks: These are old, stable companies that you can expect to return on your investment at a steady rate. You probably aren't going to see your share jump from $5 to $50 in a year, but you also probably won't see it do the reverse. You will most likely get reliable, if not amazing, dividends.

Preferred Stocks: These are stock shares that have more reliable dividends, but no voting rights. Since you are, presumably, not a billionaire that can theoretically gain a controlling share, I can't imagine the voting rights in a given company are all that important anyway.

Anyway, hope this much-delayed Intro To Investing was, if not worth the wait, at least, a bit longer than you expected.

Hey! You got interest on the word count! It's topical! Ish.

#economics#capitalism#phoenix talks#ko fi#ko fi prompts#research#business#investment#finance#treasury bonds#savings bonds#certificate of deposit#united states treasury#stocks#stock market#mutual funds#pension funds

68 notes

·

View notes

Text

kai smith ninjago jerma posing

#i will do anything but study for my economics exam#somebody help me#ninjago#ninjago fanart#lego ninjago#kai smith#kai jiang#kai ninjago#i am so in love with him kai smith ninjago save me

43 notes

·

View notes

Text

one of my favorite trivia about homura is that she has the equivalent of one trillion yen in military arsenal

#causing economic prejudice to the government to save your pink-haired gf? more likely than you think!!#puella magi madoka magica#madoka magica#pmmm

28 notes

·

View notes

Text

God I love used hardware. If you live in the US it is your moral obligation to buy used hardware

#mhwd#idk the economic situation in other places but it's especially true here because it literally saves you money 99% of the time#if you must buy#buy used

16 notes

·

View notes

Text

it just breaks my heart that palestinian families are raising such insane amounts of money that less than a year ago would’ve transformed their lives for the better, let them pursue their dream degrees, open businesses, pay off their mortgages and various debts, only to travel just a few kilometres and live in precarious penury in egypt. it is so cruel.

#the economic cost of this is devastating. their entire extended families living outside of Palestine are also losing all of their savings#their retirement funds#money for university and for medical treatment and for housing#and for WHAT#to bribe the fucking egyptian military

39 notes

·

View notes