#EXPENSES TRACKER

Explore tagged Tumblr posts

Text

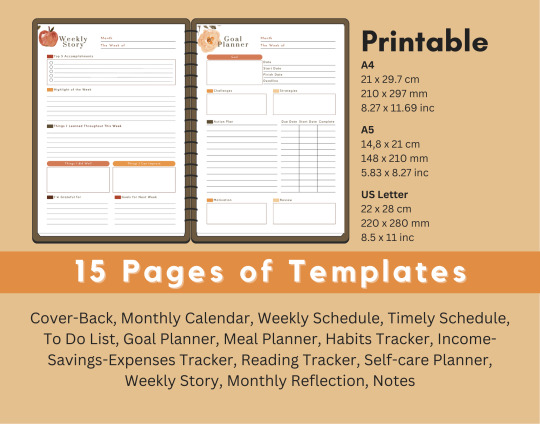

🌟 Dream in Colors, Plan with Passion! 🌟 Meet ChromaPlan Pro, the monthly digital planner that brings a burst of color to your routines. With 16 stunning templates and both printable & digital options, get ready to conquer your goals in style! 🎉📝

Plus, it's printable in A4, A5, and US Letter sizes, giving you the freedom to plan your way! 🖨️📐

Don't wait—boost your productivity and creativity today! 🚀💫

Check it out on: https://etsy.me/45bRZNZ

#digital#planner#digital planner#printable#printable planner#printable monthly planner#monthly planner#Calendar#Weekly Schedule#Timely Schedule#To Do List#Goal Planner#Habits Tracker#Workout Planner#Meal Planner#Recipe Journal#Income Tracker#Savings Tracker#Expenses Tracker#Debt Tracker#Weekly Story#Monthly Reflection#Notes#digital products#digitalgoodsf

6 notes

·

View notes

Text

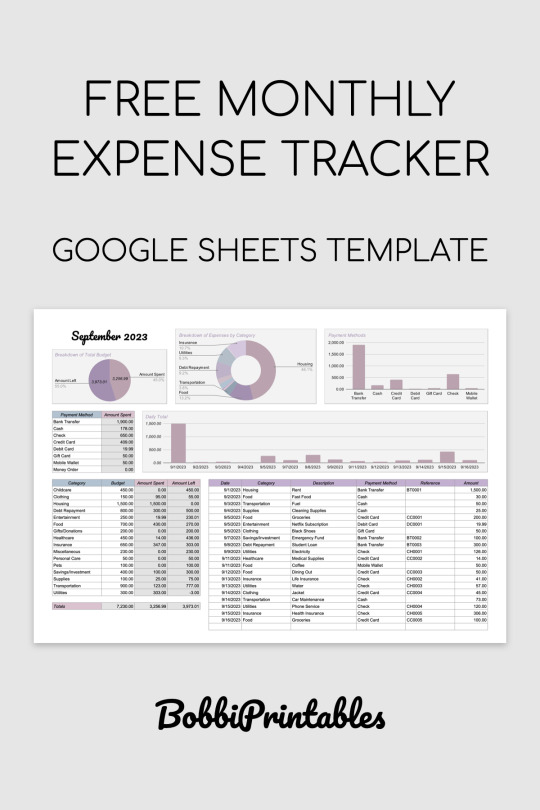

Free Monthly Expense Tracker - Google Sheets Template

Download Here

#free#monthly tracker#expense#tracker#expense tracker#budget#finance#template#spreadsheet#google sheets#budgeting#monthly

78 notes

·

View notes

Text

One thing about Tobias is that you cannot gift him food and expect him to eat it. Not because he's picky (*he's actually the opposite, he eats a bit of everything) but because of his position. It's pretty hard to kill a guy who knows how to fight as well as he does and who has a bunch of equally competent people working to keep him safe, so the best bet for his opps is to try and kill him via poison (*happened plenty of times 😒) which is why if he doesn't trust you, he's not eating jack shit you're giving him. You could've spent an entire day cooking something for him and the most he'd do is accept it and then toss it into the nearest trashbin when you're no longer looking. Maybe even while you're looking if he dgaf about you to that extent. This goes for full-course meals and for snacks. It's why he typically orders food under different names than his own, from restaurants he doesn't usually frequent, and when it comes to his own chefs he makes their dear friends taste the food first because in that way the chiefs can't put anything in there without also killing their loved ones, and if the food isn't poisoned those people get to eat part of a great meal For Free. How kind of him! (/lhj) ❤️

#◜✧ . ❪ muse. tobias. ❫#◜✧ . ❪ tobias ; meta. ❫#Remembered I didn't yap abt this. VDay is coming up and whatever snacks (pocky / chocolates / etc) he receives from sb he doesn't trust#ARE unfortunately getting thrown into the dumpster. :/ Don't make the mistake of gifting him anything too expensive bc it WILL go to waste#Tbh he's so careful abt assassination attempts of any sort that he's not really keeping Anything. Even normal gifts are getting stored#somewhere Else than in his house. Can't risk there being substances hidden in the flowers or trackers hidden in the other items!#He's not even being paranoid per se it's all stuff that HAS previously happened to him or to sb he knows 😭 dangerous ass life he's leading#You think YOU'RE careful until you meet Tobias. And then you realize how outclassed you actually are in this aspect#Sb: Wow you've got some beautiful flowers there!#Tobias: Yeah. By the way if you touch them you'll die of cyanide poisoning in half an hour. Anyways do you want a drink

4 notes

·

View notes

Text

Maximize Efficiency with Expert Cash Management Solutions

In today’s fast-paced business environment, effective cash management is crucial for maintaining financial stability and supporting growth. Expert cash management solutions can help businesses streamline their operations, optimize liquidity, and enhance overall financial efficiency. This article explores how leveraging advanced cash management solutions can maximize efficiency and drive business success.

What is Cash Management?

Cash management involves the collection, handling, and use of cash in a business. The goal is to ensure that a company has enough cash on hand to meet its short-term obligations while optimizing the use of its funds. Effective cash management helps businesses avoid liquidity problems, reduce financing costs, and invest surplus cash wisely.

Key Benefits of Expert Cash Management Solutions

Improved Cash Flow Visibility

Expert cash management solutions provide real-time insights into cash flow. By integrating these solutions with your financial systems, you can gain a comprehensive view of your cash position, including incoming and outgoing funds. This visibility allows for better forecasting and planning, helping you anticipate cash needs and avoid potential shortfalls.

Enhanced Liquidity Management

Managing liquidity effectively is essential for ensuring that your business can meet its obligations without holding excessive cash. Advanced cash management tools help optimize liquidity by analyzing cash flow patterns and recommending strategies to manage working capital more efficiently. This includes managing accounts receivable and payable, optimizing cash reserves, and reducing idle cash.

Streamlined Cash Collection and Disbursement

Automated cash management solutions streamline the collection and disbursement processes. For example, electronic invoicing and payment systems can accelerate the receipt of payments, reducing the time it takes to convert receivables into cash. Similarly, automated disbursement systems help manage outgoing payments, ensuring that bills and payroll are processed efficiently and on time.

Enhanced Fraud Prevention and Security

Security is a critical aspect of cash management. Expert solutions offer robust security features to protect against fraud and unauthorized transactions. This includes encryption, multi-factor authentication, and transaction monitoring. By implementing these security measures, businesses can safeguard their cash and reduce the risk of financial losses due to fraud.

Optimized Investment Opportunities

Efficient cash management doesn’t just involve managing daily transactions; it also includes investing surplus cash to generate returns. Expert cash management solutions help identify and evaluate investment opportunities that align with your company’s risk tolerance and financial goals. Whether it’s investing in short-term instruments or managing liquidity portfolios, these solutions provide insights to make informed investment decisions.

Regulatory Compliance

Adhering to regulatory requirements is essential for avoiding penalties and maintaining financial integrity. Advanced cash management systems help ensure compliance with relevant regulations by automating reporting and record-keeping. This includes managing tax-related cash flows, regulatory filings, and maintaining accurate financial records.

Implementing Expert Cash Management Solutions

To maximize efficiency with expert cash management solutions, consider the following steps:

Assess Your Needs

Begin by evaluating your business’s cash management needs. Identify areas where improvements are needed, such as cash flow forecasting, liquidity management, or fraud prevention. This assessment will help you choose the right solutions that align with your business objectives.

Choose the Right Tools

Select cash management solutions that offer the features and functionality you need. Look for tools that integrate with your existing financial systems, provide real-time insights, and offer robust security measures. Consider solutions that are scalable and can grow with your business.

Implement and Integrate

Once you’ve selected the appropriate solutions, implement them within your organization. This may involve integrating the solutions with your current financial systems, training staff on how to use the tools, and establishing processes for managing cash flow effectively.

Monitor and Optimize

Regularly monitor the performance of your cash management solutions to ensure they are delivering the expected benefits. Use the insights provided by these tools to make data-driven decisions, optimize cash flow, and adjust your strategies as needed.

Review and Adjust

Periodically review your cash management practices and solutions to ensure they remain effective. As your business evolves, your cash management needs may change, requiring adjustments to your strategies and tools.

Conclusion

Expert cash management solutions are essential for maximizing efficiency and achieving financial stability in today’s competitive business landscape. By leveraging advanced tools and strategies, businesses can gain better visibility into their cash flow, optimize liquidity, streamline processes, and enhance security. Implementing these solutions helps ensure that your business can meet its financial obligations, invest wisely, and maintain a strong financial position. Embracing expert cash management practices not only improves day-to-day operations but also supports long-term growth and success.

For more details, visit us:

expense tracker software

Expense Management Software

invoice management system

best expense reimbursement software

3 notes

·

View notes

Text

#finace#finance tracker#expense tracker#expenses#productivity#100 days of productivity#notion dashboard#notion template#notion#budget#2024 planner#financial planner#money

5 notes

·

View notes

Text

the way i've been coping with joshua's recent absence across all platforms is by buying more of his photocards [no one is surprised]

#my expense tracker... ridiculous.........#but it's just so funny to me that kfans have been selling his pcs for much lower ever since That#i may be a joshushushushsushsuhsus but i am also an opportunist you see 🤓☝️#💬 kai rambles

18 notes

·

View notes

Text

friendly reminder that patreon is only $5 a month, it charges you on the same day each month, so if you subscribed today, for example, you wouldn’t be charged again until Dec. 27th!

I post 2-3, sometimes 4, times a month and the updates are all usually pretty long. If they’re short (under 10k) that’s usually when I’ll post up to 4 times so you’re getting your money’s worth. Not only that, but once you subscribe you then have access to my entire patreon masterlist, so you can read some oldies while you wait for the next update!

the little community on patreon is a super positive space. my peeps on there make me feel comfortable enough to dabble in different kinds of tropes and smut that I wouldn’t feel comfortable posting on here because even though I have minors DNI in my description, we all know minors can still find a way. Whereas on patreon, you must be 18+ to subscribe to my page. I genuinely value the feedback I get on there, and will often post polls to see what everyone wants to see next. Yall are paying for a service and I want to post what you’re paying for. I love how collaborative I get to be with everyone on there

I’d like to think I do a pretty good job of posting on there. I mean, you’d pay $10+ dollars to buy a book that’s 30k+ long, right? I post almost double that in a month sometimes, so I do feel like $5 is a decent price for what you get from me. I try to post at the beginning, middle, and end of each month. If it takes me longer to post at the beginning, I usually post a PSA to let yall know what I’ve got cooking and I post sneakies so you know I’m actually working on things

Anyways, this is the time of year where a lot of money gets spent, I know you all have your own bills to pay and whatnot, but I need the money from patreon each month to literally afford to live. Without the money I get from patreon each month, I wouldn’t be able to afford my phone or my car payments/car insurance, all things that are essential for me to do my day job.

So, this is me asking if you can lend your support to me for a simple $5 a month, that would be great. I’ve dipped to only getting around $280 a month, and other months I’ve gotten close to $400. That’s a huge difference in income. I know not everyone can afford it each month. Believe me I’ve been looking at some of the things I’m subscribed to to try and cut back on expenses, so I get it. You can leave and come back any time to patreon, which is something I love about it.

I love you all lots and am so beyond grateful that there are people who like my silly little fics enough to pay for them. It means the world to me, truly.

Please consider boosting this! I could really use a bump in extra cash for the next few months.

#went over my monthly expense tracker and uhhhhhhhh#why is living so expensive#I’ve been able to cut back on a few things AND I’ve been clipping more coupons#like any time I go grocery shopping or to cvs I have my coupons ready to go#patreon peeps if you wanna reblog and maybe say why you’re subbed to me that would be super helpful!!#boost!

5 notes

·

View notes

Text

took both our cats to the vet this morning, gato for his regular check up (cuz hes got a longterm blood condition) and bully because shes been lethargic and behaving unnaturally. good news is that gato's blood tests are better this time around, and bad news is that bully ate some kind of unidentified object that showed in her xray as denser than bone, shes confined for observation and if it doesnt pass naturally she'll have to get surgery...

on that note, with how often and Muchly our cat medical expenses are due to one maintenance tests & meds cat and another cat who keeps EATING STUFF SHES NOT SPOSED TO, my sister and i are looking into buying frigging pet care hmo jhvdoiflLHVSDF

anyhoo pls send best recovery vibes to our bully kitty ;-;

#to be loved is to be charged or some shit OTL#ive got a finance tracker notion page and the 2nd top expense is the cats hdkfjsripufbsaf;g. i dont mind bcuz i love them w all my heart#but yeah we probly need to get an hmo just to help a bit#dootdootdoot

19 notes

·

View notes

Video

youtube

Ultimate Finance Tracker Notion Template | Finance Dashboard | Notion Personal & Business Finance Tracker for 2023 | Debt and Bill Tracker | Subscription Tracker | Digital Finance Planner | Finance Tracker This dashboard will help you manage all your finances in one place. Register expenses, and income & make transfers on multiple accounts. Track your debt, set expense categories, and income; manage subscriptions, wishlist & more. ▷ WHAT IS NOTION? ◉ Notion is an all-in-one workspace where you plan, write, organize, and collaborate. It provides its users the building blocks to create customized layouts to get work done. Notion is free for a personal plan and is accessible through any device connected to the Internet - be it a smartphone, tablet, laptop, or computer. ▷ WHAT'S INCLUDED? ➜ Accounts ✵ Banks ✵ Cash ✵ Credit Cards ✵ Investment ➜ Transactions ✵ Expenses ✵ Income ✵ Transfer ➜ Categories ✵ Income Categories ✵ Expenses Categories ➜ Debt & Bill Tracker ➜ Subscription Tracker ✵ Upcoming Reminder ✵ Next Month Reminder ➜ Wishlist ➜ Months at a Glance ➜ Reports ➜ Database

#notion#notion template#finance#financetracker#debt tracker#subscription#expense#income#wishlist#notion finance#bill tracker#finance planner#digital planner#business#personal#finance dashboard#dashboard#notion dashboard#monthly report#investment#upcoming reminder#transactions

11 notes

·

View notes

Text

🍂 Embrace the beauty of fall while staying organized with the Fall Monthly Planner! 📅🍁 With its stunning color palette inspired by the season and a range of planning resources, it's your digital companion for a productive fall.

🌟 Available in printable (A4, A5, and US Letter) giving you the freedom to choose how you interact with your planner and digital versions with hyperlinks seamlessly connecting each month and topic, you can effortlessly navigate through your planner's extensive 400 pages, spanning four months of Fall-inspired planning.

Go and check it out on: https://etsy.me/451QX7b

#digital#planner#digital planner#printable#printable planner#printable monthly planner#monthly planner#Monthly Calendar#Weekly Schedule#weekly planner#Timely Schedule#To Do List#Goal Planner#Meal Planner#Habits Tracker#Income Tracker#Savings Tracker#Expenses Tracker#Reading Tracker#Self-care Planner#Weekly Story#Monthly Reflection#Notes#digital products#digitalgoodsf

2 notes

·

View notes

Text

lost earbud event 6 dead dozens wounded

#first off expensive to replace second i use them so i don't have panic attacks in walmart. i straight up can't function without them#the tracker says it's at my friend's house i just hope his dogs didn't find it 😭#nessie posting

2 notes

·

View notes

Text

A trip expenditure tracker is a tool which can be used by travelers to keep track of and manage the expenses incurred during a trip. A trip expense tracker lets users enter spending, categorize expenses, set budgets, and monitor total travel costs. So this tool, allowing travelers to help them stick with their budget, see their spending in real-time, and discover where they spend money on the go.

0 notes

Text

5 Benefits of Using a Weekly Spending Tracking App as a Parent

Parenting is all about juggling expenses, right? You’ve got expenses they never seem to end from school fees to groceries to that toy your kid just has to have! Managing expenses is no less than a full-time job for parents. You’ve got so many expenses you need to meet and in all those spendings you make, your budget manages to slip somehow. With a weekly spending app, you’ve got nothing to worry about. Kashify simplifies all your expenses and organizes everything at your fingertips. This makes money management easier for you, helping you make informed decisions. Here are five benefits of using a budget calculator app:

1-Knowing Where the Money Goes

As a parent you’ve got a lot to manage. Weekly expenses could add up in no time. From snacks to school supplies, you can lose track of your money in no time! This is where Kashify steps in. With an expense tracking app you can say goodbye to the guessing game and know exactly what you’re spending on. Furthermore, you can also categorize your expenses on Kashify to know exactly what drains your wallet the most each week. This can also help you in cutting back on any unnecessary purchases for the future.

2-Set Family Budget Goals

Have you got a family vacation planned up or are you just willing to stop overspending on takeouts, well, this is your chance to start saving up. A weekly tracker is all you need! Kashify can help you set realistic goals and stick with them. Get creative and save different targets on the application such as allotting a section to family fun funds and another to back-to-school supplies. The app not only motivates you to save more but also sends friendly reminders to help you stay motivated.

3-Keeping a Check on Impulsive Purchases

We all know how easy it is to give into that “just one more toy” game but with a spending tracker, you’ll get reminders on savings and a summary of how much you’ve already spent for the week. In this way, you can make better decisions considering your dedication to budget planning. Kashify gives you that “Do I really need that” reminder before any extra purchase you make.

4-Teaching Kids About the Finances

If you want to pass on some good spending habits to your kids without all those boring lectures, you need Kashify. The app can be used as a fun more practical way of teaching your kids about budget planning. Let your kids know how much toys really cost and why savings matter with Kashify. The children could even make budget plans of their weekly allowance to learn more about finance management.

5-Reduce Financial Stress

Parenting is a full-time job that already comes with loads of stress. Kashify is here to help you with the financial stress with its smart budget planning software. With Kashify you’ll know exactly where you stand each week and what’s costing you the most. Smarty manage your expenses with a weekly spending tracking app that helps you with budgeting and saving.

A weekly spending tracker makes managing family finances a lot easier, smarter and a little fun. You can evaluate your spending habits by the end of every month and set achievable goals to save up for whatever’s coming up! By teaching your kids about finances you can use Kashify to develop smart money management skills in your children. So, with Kashify make budgeting one less thing to worry about as a parent. So, download Kashify today and start the tracking.

Blog Source:https://kashify.app/5-benefits-of-using-a-weekly-spending-tracking-app-as-a-parent/

0 notes

Text

Best Expense Tracking Software: Top Tools for Managing Your Finances

Best Expense Tracking Software: Top Tools for Managing Your Finances #ExpenseTracking #FinanceManagement #BudgetingTools #PersonalFinance #FinancialPlanning #ExpenseManagement #MoneyManagement #FinanceApps #BudgetTracker #SmartSpending #FinancialTools #TrackYourExpenses #MoneyMatters #FinancialWellness #ExpenseReports #SavingsGoals #InvestSmart #FinancialFreedom #DebtManagement #CashFlow #FinanceTips #MoneySaving #FinancialLiteracy #ExpenseTracker #Budgeting101 #WealthBuilding #FinancialSuccess #ExpenseSoftware #FinanceGoals #SmartFinance #MoneyMindset #ExpenseTracking #FinanceManagement #BudgetingTools #PersonalFinance #FinancialPlanning #ExpenseManagement #MoneyManagement #FinanceApps #TrackYourExpenses #BestFinanceSoftware #FinancialTools #SmartBudgeting #ExpenseTracker #MoneySaver #FinancialFreedom #BudgetingApp #FinanceTips #ExpenseReport #FinancialWellness #MoneyMatters #InvestInYourself #FinancialLiteracy #SaveMoney #WealthBuilding #FinancialGoals #ExpenseControl #CashFlowManagement #DebtFreeJourney #FinanceForAll #MoneyMindset #SmartSpending

Table of Contents Introduction Why Use Expense Tracking Software? Top Expense Tracking Software for 2024 QuickBooks Online – Best for Small Businesses Key Features: Expensify – Best for Automated Expense Reporting Key Features: Mint – Best Free Personal Expense Tracker Key Features: Zoho Expense – Best for Businesses with Global Teams Key Features: FreshBooks – Best for Freelancers &…

#best expense tracking software#expense tracker#expense tracking software#manage expenses#track expenses

0 notes

Text

I literally have like 7k left and that's it. Like there's no other money whatsoever and I don't get paid till the next month

#i booked flight tickets today and it just hit me. that this is terrible. im OVER OVER OVER SPENDING and earning in peanuts. i need to fix it#made a whole ass tracker but adding expenses is giving me so much anxiety i will literally not spend anything again#personal

0 notes

Text

Create an Expense Tracker Website with This Template!

In today's fast-paced world, managing finances effectively can make a significant difference in achieving personal and business financial goals. An expense tracker website serves as a vital tool in this journey, offering a centralized platform to monitor and control spending. With the increasing reliance on digital solutions, having an intuitive and efficient website dedicated to expense tracking can streamline budgeting efforts and enhance financial discipline.

Whether you are an individual looking to improve personal finance habits or a small business aiming to optimize cash flow, an expense tracker website can provide the insights needed to make informed decisions. By leveraging technology, such platforms empower users to track expenses in real-time, categorize spending, and generate detailed reports that highlight spending patterns.

Our template for creating an expense tracker website is designed to offer a seamless experience, integrating cutting-edge features that simplify financial management. Built with user-friendly interfaces and customizable options, this template ensures that users can tailor their expense tracking to suit their unique needs.

Ready to take control of your finances and experience effortless savings? Download Vala today and start managing your budget with ease!

Benefits Of Using An Expense Tracker Template

youtube

Utilizing an expense tracker template offers numerous advantages that can transform the way you manage your finances. One of the most significant benefits is the ability to maintain financial transparency. By consistently recording every transaction, users gain a clear picture of where their money is going, which helps in identifying unnecessary expenditures and areas for potential savings.

Another key advantage is the time efficiency these templates bring. Unlike traditional methods of tracking expenses, which can be time-consuming and prone to errors, a well-designed template automates many of these processes. This allows users to spend less time on manual entries and more time analyzing their financial data to make strategic decisions.

Moreover, an expense tracker template can greatly enhance budgeting accuracy. With features that allow categorization and visualization of expenses, users can set realistic budgets based on historical spending patterns and adjust them as needed. These insights can prevent overspending and ensure that financial goals are met.

Additionally, using a template can promote better financial discipline. Regular tracking and reviewing of expenses instill a habit of mindful spending, which is essential for both short-term financial management and long-term wealth accumulation.

Key Features Of Our Expense Tracker Template

Our expense tracker template is designed with a variety of features that cater to both individuals and small businesses, ensuring an intuitive and comprehensive financial management experience. One of the standout features is its user-friendly interface. Whether you're tech-savvy or a beginner, navigating through the template is simple and straightforward, allowing you to focus on what truly matters—tracking your expenses effectively.

Another significant feature is the customizable categories. Users can tailor the template to fit their unique financial situations by creating specific categories that reflect their spending habits. This flexibility ensures that every transaction is accurately logged and analyzed, providing valuable insights into spending patterns.

Our template also includes automated calculations, which significantly reduce the chances of human error and save time. With automated sum-ups of expenses across different categories, you can quickly get a snapshot of your total spending and how it aligns with your budget.

Additionally, the template provides visual data representation through charts and graphs. These visual aids make it easy to understand financial data at a glance, helping users identify trends and make informed decisions about their spending. Furthermore, the template supports regular updates and backups, ensuring that your financial data is always secure and up-to-date.

Step-By-Step Guide To Create Your Website

Building your own expense tracker website using our template is a seamless process, designed to empower you in managing your finances like a pro. Start by downloading the template and ensuring that you have the necessary software, such as a code editor and a web server, installed on your computer.

Step 1: Extract the downloaded files into a dedicated folder on your computer. This will be the root directory of your website, containing all necessary HTML, CSS, and JavaScript files.

Step 2: Open the HTML files in your preferred code editor. Customize the content to reflect your personal or business branding. This includes updating the text, changing colors, and adding your logo to personalize the site.

Step 3: Configure the expense categories and settings in the JavaScript files. This step ensures that the tracker aligns with your specific financial needs, allowing for an accurate tracking experience.

Step 4: Test the website locally by running it on a web server. Ensure all features, such as data entry and visualizations, are functioning correctly. Use developer tools to troubleshoot any issues that arise.

Step 5: Once satisfied with the local version, deploy your website to a live server. This will make your expense tracker accessible online, enabling you and others to utilize its features from anywhere, anytime.

Following these steps will not only get your website up and running but also equip you with the knowledge to maintain and update it as your financial tracking needs evolve.

Customization Tips For Your Expense Tracker

Personalizing your expense tracker website template can make all the difference in creating a tool that truly fits your needs. Here are some valuable tips to help you tailor your expense tracker to maximize its usefulness and efficiency.

1. Adjust the User Interface: Customize the layout and color scheme to match your personal or brand aesthetic. A visually appealing interface not only enhances user experience but also increases engagement, making it more likely that you'll consistently use the tracker.

2. Define Personalized Categories: Ensure the expense categories reflect your unique spending habits. Whether you need to track business expenses separately or monitor personal spending on specific hobbies, adjust the categories to provide meaningful insights into your financial behavior.

3. Set Budget Alerts: Implement alerts for when you're approaching or exceeding your budget limits. This feature can be a game-changer in maintaining control over your spending and ensuring you stay on track with your financial goals.

4. Integrate Data Visualization Tools: Visual representations of your spending can offer quick and clear insights. Consider integrating charts and graphs that automatically update with your input, giving you an at-a-glance understanding of your financial situation.

5. Enhance Security Measures: Incorporate additional security features such as password protection or encryption. Safeguarding your financial data is crucial, and enhanced security can offer peace of mind.

By implementing these customization tips, you can transform a basic template into a robust financial tool tailored specifically to your needs, making it an indispensable part of your financial management toolkit.

Enhance User Experience With Vala's Platform

In today's fast-paced digital world, providing an exceptional user experience is crucial for any financial management tool. **Vala's platform** is designed with this in mind, offering features that not only simplify budget management but also make the process more engaging and intuitive.

Seamless Integration: Vala's platform effortlessly integrates with your existing financial ecosystem. With the ability to connect to various financial institutions, users can easily sync their accounts and track transactions in real-time, ensuring that their budget is always up-to-date.

Personalized Insights: By leveraging advanced algorithms, Vala provides personalized financial insights that help users make informed decisions. These insights are tailored to individual spending habits, offering a clear path to achieving financial goals.

Intuitive Interface: The platform's user-friendly interface is designed for both simplicity and functionality. With a clean and organized layout, users can navigate through their financial data effortlessly, making the budgeting process less daunting and more manageable.

Responsive Support: Vala prioritizes customer-centricity, offering responsive support to address any user concerns. Whether it's through live chat, email, or a comprehensive FAQ section, assistance is readily available, ensuring a smooth user experience.

Ready to take control of your finances and experience effortless savings? Download Vala today and start managing your budget with ease!

#budget app#best budget apps#expense tracker#top budgeting apps#budgeting apps#best budget apps for android#best budget app for iphone#Youtube

0 notes