#Distribution: -

Explore tagged Tumblr posts

Text

Contributory Pensions: Concept and Importance

Definition and Mechanism of Contributory Pensions Definition: The Core Principle The Mechanism of Contributory Pensions1. Accumulation Stage 2. Fund Management Stage 3. Distribution Stage Variations in Structure and RegulationMandatory vs. Voluntary Contributions Tax Advantages Employer Incentives An Example of Contributory Pensions in Practice Advantages of Contributory Pension Schemes Challenges and Criticisms The Role of Governments and Policy Interventions Future Perspectives Conclusion The Concept and Importance of Contributory Pensions A contributory pension scheme represents a structured approach to retirement savings, wherein both employees and employers (or individuals alone) make regular financial contributions to a pension fund throughout the employee's working life. This essay explores the concept, advantages, and challenges associated with contributory pensions, emphasizing their role in securing financial stability in old age and fostering economic resilience.

Definition and Mechanism of Contributory Pensions Contributory pension systems are structured financial arrangements designed to provide individuals with a stable income post-retirement. These systems are characterized by the requirement that participants actively contribute to their pension funds during their working years. This section delves deeper into the principles, operations, and variations in contributory pension systems to explain how they function and why they are an integral part of retirement planning. Definition: The Core Principle At its core, a contributory pension system is based on the principle of shared responsibility between individuals and, often, their employers or the government. Participants allocate a portion of their current earnings to a pension fund, which is typically managed by professional entities or government agencies. This fund is designed to grow over time through regular contributions, compound interest, and investment returns. Upon reaching retirement age, participants access these savings in the form of regular payments (annuities) or lump sums, providing financial security when they are no longer earning a regular income. The Mechanism of Contributory Pensions The operation of contributory pension systems can be divided into three primary stages: accumulation, management, and distribution. 1. Accumulation Stage During the working years, participants regularly contribute to their pension fund. Contributions are usually deducted directly from an employee’s salary, ensuring consistency and minimizing default risks. The specifics of the accumulation process include: - Employee Contributions: A fixed percentage of the individual’s earnings is allocated to the pension fund. For instance, an employee may contribute 5-10% of their gross salary. - Employer Contributions: In many contributory systems, employers match or supplement employee contributions, doubling the rate of accumulation. This not only incentivizes employee participation but also builds a larger retirement corpus. - Self-Employment Contributions: For self-employed individuals, contributions are voluntary or mandated by regulatory authorities. These individuals bear the sole responsibility for contributing to their pension fund. Contributions are often tax-advantaged, meaning they are deducted from pre-tax income or are eligible for tax rebates, further incentivizing savings. 2. Fund Management Stage Once contributions are made, they are pooled into a pension fund managed by professionals or regulatory entities. The effectiveness of this stage determines the long-term viability and growth of the fund. Key aspects of fund management include: - Investment Diversification: Pension funds are invested in a mix of financial instruments, such as stocks, bonds, real estate, and government securities. The aim is to balance risk while ensuring steady growth. - Compound Interest Growth: Contributions benefit from compound interest over time, significantly amplifying the fund's value as the years progress. - Risk Mitigation: To minimize risks, fund managers often adhere to strict guidelines, such as capping exposure to high-risk investments or ensuring a balanced portfolio. - Government Oversight: In most jurisdictions, regulatory frameworks ensure transparency, accountability, and security in the management of pension funds, protecting participants’ interests. 3. Distribution Stage Upon reaching the specified retirement age, participants begin to receive benefits. The method of disbursal varies depending on the system’s structure and the individual’s preferences: - Annuities: Regular monthly or yearly payments that continue for the remainder of the retiree’s life. Some plans offer inflation-adjusted annuities to maintain purchasing power. - Lump-Sum Payments: In some systems, retirees can opt to withdraw their entire savings at once, often for large expenditures or investments. - Hybrid Models: A combination of lump-sum withdrawals and regular annuities to balance immediate needs with long-term income security. Variations in Structure and Regulation Contributory pension systems are not uniform and are adapted to suit the economic, cultural, and regulatory contexts of different regions. Common features and variations include: Mandatory vs. Voluntary Contributions - Mandatory Systems: In many countries, participation in contributory pension schemes is legally required for employees and employers. This ensures universal coverage and reduces the risk of old-age poverty. - Voluntary Systems: Self-employed individuals or workers in informal sectors often contribute voluntarily. Governments may encourage participation by offering incentives, such as tax deductions or co-contributions. Tax Advantages Tax policies play a critical role in contributory pension schemes. Contributions are often tax-deductible, reducing the individual’s taxable income. Similarly, the growth within the pension fund is typically exempt from capital gains tax, and in some cases, payouts are taxed at a reduced rate or exempt entirely. Employer Incentives Governments often incentivize employers to contribute to pension funds by offering subsidies or tax breaks. For example, employers who participate in pension programs may receive reduced payroll taxes or other financial benefits. An Example of Contributory Pensions in Practice Consider a contributory pension system where: - An employee contributes 5% of their monthly salary. - The employer matches this contribution with an additional 5%. - The pension fund invests in diversified assets that yield an annual return of 6%. Over a 30-year career with consistent contributions and compound interest, the accumulated fund can grow significantly, ensuring a comfortable retirement income. This model demonstrates the cumulative power of joint contributions, disciplined savings, and professional fund management. The definition and mechanism of contributory pension systems embody a partnership between individuals, employers, and governments to secure financial stability in retirement. By pooling contributions, leveraging investment growth, and adhering to regulatory standards, these systems transform small, consistent savings into substantial retirement funds. Their adaptability across jurisdictions underscores their importance as a cornerstone of modern financial planning, balancing individual responsibility with collective support. Advantages of Contributory Pension Schemes - Financial Security in Old Age A contributory pension ensures that individuals have a reliable source of income after retiring from active employment. This reduces dependence on family members or state welfare systems, fostering dignity and self-reliance. - Encouragement of Savings Culture By requiring regular contributions, these schemes inculcate a culture of long-term financial planning. This disciplined saving mechanism benefits individuals by ensuring financial stability even in unforeseen circumstances. - Employer-Employee Relationship Employers who match employee contributions often cultivate stronger relationships with their workforce. Such benefits enhance job satisfaction and employee loyalty, fostering a productive work environment. - Economic Stability On a macroeconomic scale, contributory pension funds serve as significant pools of capital for investment. Managed prudently, these funds can finance infrastructure projects, stabilize financial markets, and spur economic growth. - Inflation Adjustment Many modern contributory pension plans are designed to adjust payouts to reflect inflation, ensuring that retirees maintain their purchasing power over time. Challenges and Criticisms Despite their many advantages, contributory pension schemes face several challenges: - Affordability and Coverage Low-income workers or those in informal employment sectors often struggle to contribute regularly, leading to inadequate retirement savings. This issue underscores the need for inclusive policies and flexible contribution structures. - Investment Risks Pension funds are typically invested in financial markets, making them vulnerable to market volatility. Economic downturns or mismanagement of funds can jeopardize retirees' savings. - Longevity Risks As life expectancy increases globally, pension funds must support retirees for longer periods. This places additional pressure on fund sustainability and necessitates regular adjustments to contribution rates and payout structures. - Employer Non-Compliance In some cases, employers may fail to remit their share of contributions, especially in countries with weak regulatory oversight. Such practices can compromise the effectiveness of contributory pension schemes. - Transition Challenges In nations transitioning from non-contributory to contributory pension systems, individuals nearing retirement may not have sufficient time to accumulate adequate savings, necessitating supplementary measures. The Role of Governments and Policy Interventions Governments play a pivotal role in ensuring the success of contributory pension systems. Key interventions include: - Regulation and Oversight: Establishing robust regulatory frameworks to monitor fund management, prevent fraud, and ensure transparency. - Incentives: Providing tax breaks or subsidies to encourage participation, particularly among low-income earners. - Public Education: Enhancing awareness about the benefits of contributory pensions to promote enrollment and understanding. - Support for Informal Sectors: Creating tailored solutions to extend pension benefits to informal workers and marginalized groups. Future Perspectives The demographic shifts toward aging populations in many parts of the world underscore the increasing importance of contributory pensions. Innovations in digital finance and artificial intelligence offer promising avenues for improving fund management, increasing accessibility, and personalizing pension plans to meet diverse needs. Moreover, the integration of sustainable investment principles into pension fund management can align financial goals with broader societal objectives, such as combating climate change and promoting social equity. Conclusion Contributory pension schemes are an indispensable tool for securing financial stability and promoting economic well-being, both at the individual and societal levels. While challenges such as coverage gaps and investment risks persist, strategic interventions by governments, coupled with technological innovations, can enhance the inclusivity and sustainability of these systems. By fostering a culture of shared responsibility and disciplined saving, contributory pensions not only protect individuals in their twilight years but also contribute to broader economic resilience. Read the full article

#contributorypension#distribution#fundmanagement#lumpsumpayment#pension#pensiondistribution#pensionfund#pensionsystem

0 notes

Photo

Read Full recipe here 👉⋆🦋 {{Hawaiian Roll French Toast}}🦋⋆

#moodboard#hawaiianrollfrenchtoast#Recipe#mood#Homemade#cozy#Easy recipes#food photography#Baking#Food#healthy eating#FoodPorn#Delicious#pizza#vegan#png#cute#explore#tasty#chicken#italy#france#japan#america#aesthetic

440 notes

·

View notes

Photo

PORTO ROCHA

1K notes

·

View notes

Photo

Legendary Boulder ~ WrestlerCheetah

Next sketch for cheetahgirlmuscles Another entry on the Mia cosplaying as Guilty Gear characters book~ I hope you like it

76 notes

·

View notes

Photo

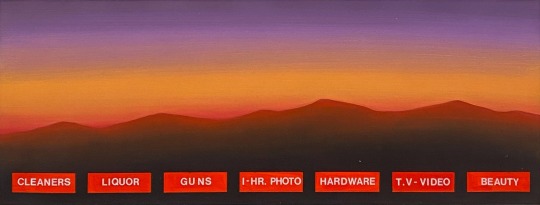

(vía Another America 50 by Phillip Toledano)

79 notes

·

View notes

Text

don’t call me whiny baby if you didn’t care about my whiny baby feelings already, which you didn’t care about!!! shocker!!!

54 notes

·

View notes

Quote

もともとは10年ほど前にTumblrにすごくハマっていて。いろんな人をフォローしたらかっこいい写真や色が洪水のように出てきて、もう自分で絵を描かなくて良いじゃん、ってなったんです。それで何年も画像を集めていって、そこで集まった色のイメージやモチーフ、レンズの距離感など画面構成を抽象化して、いまの感覚にアウトプットしています。画像の持つ情報量というものが作品の影響になっていますね。

映画『きみの色』山田尚子監督×はくいきしろい対談。嫉妬し合うふたりが語る、色と光の表現|Tokyo Art Beat

155 notes

·

View notes

Photo

No one wants to be here and no one wants to leave, Dave Smith (because)

111 notes

·

View notes

Photo

PORTO ROCHA

773 notes

·

View notes

Text

GENERAL MEMES: Vampire/Immortal Themed 🩸🦇🌹

↳ Please feel free to tweak them.

Themes: violence, death, blood, murder, depression/negative thoughts

SYMBOLS: ↳ Use “↪”to reverse the characters where applicable!

🦇 - To catch my muse transforming into a bat 🌞 - To warn my muse about/see my muse in the sunlight. 🩸 - To witness my muse drinking blood from a bag. 🐇 - To witness To catch my muse drinking blood from an animal. 🧔🏽 - To witness To catch my muse drinking blood from a human. 🦌 - For our muses hunt together for the first time. 🏃🏿♀️ - To see my muse using super speed. 🏋🏼♂️ - To see my muse using their super strength. 🧛🏻♂️ - To confront my muse about being a vampire. 🌕 - For my muse to lament missing the sun. ⏰ - For my muse to tell yours about a story from their long, immortal life. 🤛🏽 - To offer my muse your wrist to drink from. 👩🏿 - For my muse to reminisce about a long lost love. 👩🏽🤝👩🏽 - For your muse to look exactly like my muse's lost love. 👄 - For my muse to bite yours. 👀 - For my muse to glamour/compel yours. 🧄 - To try and sneakily feed my muse garlic to test if they're a vampire. 🔗 - To try and apprehend my muse with silver chains. 🔪 - To try and attack my muse with a wooden stake. 👤 - To notice that my muse doesn't have a reflection. 🌹 - For my muse to turn yours into a vampire. 🌚 - For my muse and yours to spend time together during the night. 🧛🏼♀️ - For my muse to tell yours about their maker/sire.

SENTENCES:

"I've been alive for a long time [ name ], I can handle myself." "I'm over a thousand years old, you can't stop me!" "Lots of windows in this place, not exactly the greatest place for a vampire." "Do you really drink human blood? Don't you feel guilty?" "Vampires are predators, [ name ] hunting is just part of our nature, you can't change that." "You just killed that person! You're a monster!" "Tomorrow at dawn, you'll meet the sun [ name ]." "Can you make me like you?" "Do you really want to live forever?" "You say you want to live forever, [ name ], but forever is a long time, longer than you can imagine." "What was it like to live through [ historic event / time period ]?" "Did people really dress like that when you were young?" "What were you like when you were human?" "We’re vampires, [ name ], we have no soul to save, and I don’t care." "How many people have you killed? You can tell me, I can handle it." "Did you meet [ historic figure ]?" "Everyone dies in the end, what does it matter if I... speed it along." "Every time we feed that person is someone's mother, brother, sister, husband. You better start getting used to that if you want to survive this life." "[ she is / he is / they are ] the strongest vampire anyone has heard of, no one knows how to stop them, and if you try you're going to get yourselves killed." "Vampire hunters are everywhere in this city, you need to watch your back." "Humans will never understand the bond a vampire has with [ his / her / their ] maker, it's a bond like no other." "Here, have this ring, it will protect you from the sunlight." "I get you're an immortal creature of the night and all that, but do you have to be such a downer about it?" "In my [ centuries / decades / millennia ] of living, do you really think no one has tried to kill me before?" "Vampires aren't weakened by garlic, that's a myth." "I used to be a lot worse than I was now, [ name ], I've had time to mellow, to become used to what I am. I'm ashamed of the monster I was." "The worst part of living forever is watching everyone you love die, while you stay frozen, still, constant." "I've lived so long I don't feel anything any more." "Are there more people like you? How many?" "Life has never been fair, [ name ], why would start being fair now you're immortal?" "You want to be young forever? Knock yourself out, I just hope you understand what you're giving up." "You never told me who turned you into a vampire. Who were they? Why did they do it?" "I could spend an eternity with you and never get bored." "Do you really sleep in coffins?" "There are worse things for a vampire than death, of that I can assure you [ name ]." "You need to feed, it's been days. You can drink from me, I can tell you're hungry." "The process of becoming a vampire is risky, [ name ], you could die, and I don't know if I could forgive myself for killing you." "I'm a vampire, I can hold a grudge for a long time, so believe me when I say I will never forgive this. Never." "You were human once! How can you have no empathy?" "You don't have to kill to be a vampire, but what would be the fun in that." "You can spend your first years of immortality doing whatever you want to whoever you want, but when you come back to your senses, it'll hit you harder than anything you've felt before." "One day, [ name ], everything you've done is going to catch up to you, and you're never going to forgive yourself." "Stop kidding yourself, [ name ], you're a vampire, a killer, a predator. You might as well embrace it now because you can't keep this up forever." "You can't [ compel / glamour ] me, I have something to protect me." "When you've lived as long as me, there's not much more in life you can do." "You want me to turn you? You don't know what you're asking me to do." "You really have to stop hissing like that, it's getting on my nerves." "I'm going to drive this stake through your heart, [ name ], and I'm going to enjoy it."

#ask meme#symbol meme#roleplay sentence meme#sentence starter meme#rp sentence prompts#vampire ask meme#ask box#ask memes#vampires#tw : blood#tw: violence#tw: death#tw: depression#tw: vampires#tw: murder

176 notes

·

View notes

Photo

--

#catherine elizabeth#princess catherine#princess of wales#princess catherine of wales#catherine the princess of wales#kensington palace

57 notes

·

View notes

Quote

よく「発明は1人でできる。製品化には10人かかる。量産化には100人かかる」とも言われますが、実際に、私はネオジム磁石を1人で発明しました。製品化、量産化については住友特殊金属の仲間たちと一緒に、短期間のうちに成功させました。82年に発明し、83年から生産が始まったのですから、非常に早いです。そしてネオジム磁石は、ハードディスクのVCM(ボイスコイルモーター)の部品などの電子機器を主な用途として大歓迎を受け、生産量も年々倍増して、2000年には世界で1万トンを超えました。

世界最強「ネオジム磁石はこうして見つけた」(佐川眞人 氏 / インターメタリックス株式会社 代表取締役社長) | Science Portal - 科学技術の最新情報サイト「サイエンスポータル」

81 notes

·

View notes

Photo

The Delian League, Part 2: From Eurymedon to the Thirty Years Peace (465/4-445/4 BCE)

This text is part of an article series on the Delian League.

The second phase of the Delian League's operations begins with the Hellenic victory over Mede forces at Eurymedon and ends with the Thirty Years Peace between Athens and Sparta (roughly 465/4 – 445/4 BCE).The Greek triumph at Eurymedon resulted in a cessation of hostilities against the Persians, which lasted almost six years. Whether or not this peace or truce followed from some formal treaty negotiated by Cimon, son of Miltiades, remains unknown.

Nevertheless, the Greek success at Eurymedon proved so decisive, the damage inflicted on Persia so great, and the wealth confiscated so considerable that an increasing number of League members soon began to wonder if the alliance still remained necessary. The Persians, however, had not altogether withdrawn from the Aegean. They still had, for example, a sizeable presence in both Cyprus and Doriscus. They also set about to build a great number of new triremes.

REDUCTION OF THASOS & THE BATTLE OF DRABESCUS

A quarrel soon erupted between the Athenians and Thasians over several trading ports and a wealth-producing mine (465 BCE). Competing economic interests compelled the rich and powerful Thasos to revolt from the Delian League. The Thasians resisted for almost three years. When the polis finally capitulated, the Athenians forced Thasos to surrender its naval fleet and the mine, dismantle defensive walls, pay retributions, and converted the future League contributions to monetary payments: 30 talents annum. Some League members became disaffected with the Athenian reduction of Thasos. Several poleis observed the Athenians had now developed a penchant for using "compulsion." They started to see Athens acting with both "arrogance and violence." On expeditions, furthermore, the other members felt they "no longer served as equals" (Thuc. 1.99.2).

The Athenians, meanwhile, attempted to establish a colony on the Strymon river to secure timber from Macedon, which shared its borders with the west bank. The location also proved a critical strategic point from which to protect the Hellespont. The Thracians, however, repelled the League forces at Drabescus. The Athenians soon realized the threats from both Thrace and Macedon made permanent settlements in the region difficult as they were essentially continental powers, and the League fleet could not reach them easily. Designs for the region, however, would not change, and the Athenians would return there again.

The Delian League had by this time demonstrated an inherent conflict from its beginnings: on the one hand, it engaged in heroic struggles against the Mede and extended its influence, reaping enormous benefits (especially for its poorer members). On the other hand, it also suppressed its members and soon demanded obedience from them.

The League engaged from the outset in a form of soft imperialism, collecting and commanding voluntary naval contributions and tribute while Athens used those resources and led all expeditions, enforcing continued membership but also showing little or no interest to interfere with the internal mechanisms of any member polis (unless it openly rebelled).

Continue reading...

35 notes

·

View notes

Text

Dame Maggie Smith Has Passed Away at 89

New Post has been published on https://www.mugglenet.com/2024/09/dame-maggie-smith-has-passed-away-at-89/

Dame Maggie Smith Has Passed Away at 89

We are deeply saddened to report that Dame Maggie Smith, beloved actress known to Harry Potter fans for portraying Professor McGonagall, has passed away at the age of 89.

Her two sons, Toby Stephens and Chris Larkin have released a statement saying“It is with great sadness we have to announce the death of Dame Maggie Smith.”

She passed away peacefully in hospital early this morning, Friday 27th September. An intensely private person, she was with friends and family at the end. She leaves two sons and five loving grandchildren who are devastated by the loss of their extraordinary mother and grandmother. We would like to take this opportunity to thank the wonderful staff at the Chelsea and Westminster Hospital for their care and unstinting kindness during her final days. We thank you for all your kind messages and support and ask that you respect our privacy at this time.

Our deepest sympathies are with Smith’s family, friends, and loved ones at this difficult time.

51 notes

·

View notes