#Decentralized Energy System Market

Explore tagged Tumblr posts

Text

The Future of Energy: How Decentralization is Reshaping Power

Decentralized Energy System Market is projected to achieve a value of USD 12,443.6 million in 2023, with a linear behavior in the market growth it is forecasted to achieve a value of USD 21,377.6 million by 2033 with a CAGR of 12.5% during the forecast period 2023-2033.

The report presents an in-depth assessment of the ‘Decentralized Energy System Market’. This includes enabling technologies, key trends, market drivers, challenges, standardization, regulatory landscape, deployment models, competitive analysis, operator case studies, opportunities, future trends, value chains, ecosystem player profiles, and strategies included. The report also presents a SWOT analysis and forecast for Decentralized Energy System investments from 2024 to 2033.

Click the link to get a sample copy of the report: https://wemarketresearch.com/sample-request/decentralized-energy-system-market/1296

Top Companies in the Decentralized Energy System Market:

ABB Ltd

Siemens

Schneider Electric

General Electric

Honeywell

Tesla

Sonnenbatterie

LG Chem

Panasonic

BYD

Enphase Energy

Global Decentralized Energy System Market Segments:

By Type

Wind Power

Hydropower

Solar Power

CHP and Other Thermal Power Stations

Bioenergy

Geothermal Energy

Others

By Application

Industries

Commercial Areas

Large Buildings

Residential

Municipalities

Others

By End-user

Utility Providers

Independent Power Producers

Microgrid Operators

Others

Decentralized Power Generation Market Share:

The decentralized power generation industry's major players are making large investments in R&D to broaden their product offerings, introduce new goods, sign contracts, buy out businesses, increase their investment levels, and collaborate with other organizations to expand internationally.

Frequently Asked Questions:

Asia Pacific Decentralized energy system market value?

Which are the upcoming countries within the Europe Decentralized energy system market?

Which are the top 3 companies in Decentralized energy system market?

What is the cost of Decentralized Energy System?

Regional Analysis for Decentralized Energy System Market:

For a comprehensive understanding of market dynamics, the global Decentralized Energy System market is analysed across key geographies namely North America, Europe, China, Japan, Southeast Asia, India, Central & South America. Each of these regions is analyzed based on market research findings for the key countries in the region for a macro-level understanding of the market.

Important sections of the TOC

Economic Impact Variables on Decentralized Energy System Market: Illuminates the consequences of environmental, political and economic fluctuations, and explains changes in customer and consumer requirements. We also provide a detailed report of Decentralized Energy System on the technology risks and advancements in the global market.

Forecasts based on macro- and micro-economy: ensuring price, revenue and volume EV charging service forecasts for the market. It also includes, in addition to forecasting growth, revenue and import volume for the region, with revenue forecasting for the Decentralized Energy System application, along with revenue forecasting by cost, revenue and type.

Marketing Strategy Analysis: In this section, Decentralized Energy System analysis aims at niche positioning and provides information regarding target audience, new strategies and pricing strategies. We provide a comprehensive Decentralized Energy System marketing station analysis that investigates the problem. Marketing channel development trends, direct marketing as well as indirect marketing.

Business Intelligence: The Decentralized Energy System companies studied in this section are also assessed by key business, gross margin, price, sales, revenue, product category, applications and specifications, Decentralized Energy System competitors, and manufacturing base.

Directly Buy a Copy of this Decentralized Energy System Market research report at@https://wemarketresearch.com/purchase/decentralized-energy-system-market/1296?license=single

Why to buy this Report?

The report provides valuable insights into market trends, growth opportunities, and competitive landscapes. By reading a technology report, businesses and investors can gain a better understanding of the market they are operating in or considering entering, and make more informed decisions based on data and analysis.

The report reports provide detailed information on competitors' strengths, weaknesses, and strategies, which can help businesses identify potential threats and opportunities in the market.

The report provides insights into emerging technologies and trends, which can help businesses stay up-to-date with the latest developments and make informed decisions about where to invest their resources.

The report can be used by investors and acquirers as part of their due diligence process when considering investing in or acquiring a technology company. These reports can provide valuable information on the company's financials, technology, market position, and other key factors.

About We Market Research:

WE MARKET RESEARCH is an established market analytics and research firm with a domain experience sprawling across different industries. We have been working on multi-county market studies right from our inception. Over the time, from our existence, we have gained laurels for our deep rooted market studies and insightful analysis of different markets.

Our strategic market analysis and capability to comprehend deep cultural, conceptual and social aspects of various tangled markets has helped us make a mark for ourselves in the industry. WE MARKET RESEARCH is a frontrunner in helping numerous companies; both regional and international to successfully achieve their business goals based on our in-depth market analysis. Moreover, we are also capable of devising market strategies that ensure guaranteed customer bases for our clients.

Contact Us:

Mr. Robbin Joseph

Corporate Sales, USA

We Market Research

USA: +1-724-618-3925

Websites: https://wemarketresearch.com/

Email: [email protected]

#Decentralized Energy System Market#Decentralized Energy System Market Demand#Decentralized Energy System Market Share#Decentralized Energy System Market Growth#Decentralized Energy System Market Analysis#Decentralized Energy System Market Forecast

0 notes

Text

THE ALL-IN-ONE SOLUTION FOR YOUR ONLINE BUSINESS!

You can also try this product MARKETING SOFTWARE

The all-in-one software for creating effective sales funnels - including conversion elements and many innovative tools such as:

Page Builder -CRM

Email marketing tool (tag-based)

Split testing tool

Mouse tracking

Conversion pixels

Optimized video player

Member areas

Video funnels

Webinar tool and much more…

You can also try this product MARKETING SOFTWARE

#agencies#doctor's offices#car dealerships#coaches#consultants#decentralized energy systems#energy supplier#event industry#gyms#photography & film#franchising#drinks & Food#craft terrace construction#craftcarpenter#real estate agent#info marketer#engineering offices#farmers#mechanical and plant engineering#online conference organizer#expert#seminar provider#software & IT#speaker#tax consultant#therapists#coach#trainer#business consultant#associations

1 note

·

View note

Text

Fuel Cell Generator Market Is Driven by Minimalization of Carbon Residues

The size of the fuel cell generator market was USD 330 million in 2022, and the figure is set to rise at a CAGR of 17.50% from 2022 to 2030 and reach USD 1,199 million by the end of this decade.

There are several reasons for this development, including the minimalization of CO2 emissions, the easy availability of fuel cells, and their ability to renew energy. The snowballing need for the production of clean power along with minimal releases from CO2 will drive the market.

Numerous regions and nations throughout the globe are targeting to decrease overall releases of CO2 to zero by 2050, To achieve CO2 neutrality. The government's focus has amplified on making a decarbonized civilization in the past few years. To achieve this aim, the introduction of renewable sources, including solar, biomass, hydro, wind, and geothermal, is vital.

The production of electricity with the support of solar and wind has a few drawbacks, like the lack of ability to regulate the generation and huge quantity of output disparities reliant on weather conditions.

Aquaculture is the fastest-rising end-user developing at a CAGR of approximately 19.2%, credited to the increasing quantity of aquaculture amenities and increasing ecological impacts related to it such as the consumption of electricity and water. Mainly to lessen the environmental effects, governments have taken numerous steps to utilize fuel cell-based generators as an alternative to diesel generators.

North America is dominating the fuel cell generator market and is projected to continue with this dominance throughout the decade. This can be ascribed to the growing concentration and fast acceptance of clean sources.

In North America, the U.S. is leading the market, and it will develop with a CAGR of 18.1%, credited to solid economic support. The innovative growth in the usage of renewable sources and snowballing electricity needs from the aquaculture and data centers industry are the major reasons that will boost the industry in the future as well.

Hence, the minimalization of CO2 emissions, the easy availability of fuel cells, and their ability to renew energy are the major factors contributing to the growth of the fuel cell generator market.

#Fuel Cell Generator Market#Market Trends#Fuel Cell Technologies#Clean Power Generation#Backup Power Systems#Mobile Applications#Market Dynamics#Key Players#Emerging Opportunities#Energy Solutions#Telecommunications#Automotive Industries#Sustainability#Resilience#Decentralized Power Generation

0 notes

Text

Excerpt from this Op-Ed from the New York Times:

At first glance, Xi Jinping seems to have lost the plot.

China’s president appears to be smothering the entrepreneurial dynamism that allowed his country to crawl out of poverty and become the factory of the world. He has brushed aside Deng Xiaoping’s maxim “To get rich is glorious” in favor of centralized planning and Communist-sounding slogans like “ecological civilization” and “new, quality productive forces,” which have prompted predictions of the end of China’s economic miracle.

But Mr. Xi is, in fact, making a decades-long bet that China can dominate the global transition to green energy, with his one-party state acting as the driving force in a way that free markets cannot or will not. His ultimate goal is not just to address one of humanity’s most urgent problems — climate change — but also to position China as the global savior in the process.

It has already begun. In recent years, the transition away from fossil fuels has become Mr. Xi’s mantra and the common thread in China’s industrial policies. It’s yielding results: China is now the world’s leading manufacturer of climate-friendly technologies, such as solar panels, batteries and electric vehicles. Last year the energy transition was China’s single biggest driver of overall investment and economic growth, making it the first large economy to achieve that.

This raises an important question for the United States and all of humanity: Is Mr. Xi right? Is a state-directed system like China’s better positioned to solve a generational crisis like climate change, or is a decentralized market approach — i.e., the American way — the answer?

How this plays out could have serious implications for American power and influence.

Look at what happened in the early 20th century, when fascism posed a global threat. America entered the fight late, but with its industrial power — the arsenal of democracy — it emerged on top. Whoever unlocks the door inherits the kingdom, and the United States set about building a new architecture of trade and international relations. The era of American dominance began.

Climate change is, similarly, a global problem, one that threatens our species and the world’s biodiversity. Where do Brazil, Pakistan, Indonesia and other large developing nations that are already grappling with the effects of climate change find their solutions? It will be in technologies that offer an affordable path to decarbonization, and so far, it’s China that is providing most of the solar panels, electric cars and more. China’s exports, increasingly led by green technology, are booming, and much of the growth involves exports to developing countries.

From the American neoliberal economic viewpoint, a state-led push like this might seem illegitimate or even unfair. The state, with its subsidies and political directives, is making decisions that are better left to the markets, the thinking goes.

But China’s leaders have their own calculations, which prioritize stability decades from now over shareholder returns today. Chinese history is littered with dynasties that fell because of famines, floods or failures to adapt to new realities. The Chinese Communist Party’s centrally planned system values constant struggle for its own sake, and today’s struggle is against climate change. China received a frightening reminder of this in 2022, when vast areas of the country baked for weeks under a record heat wave that dried up rivers, withered crops and was blamed for several heatstroke deaths.

144 notes

·

View notes

Text

Uranus Awakens: How the Rebellious Bull Shakes Up Business and Finance in 2024

Prepare for disruption, fellow stargazers! As the revolutionary planet Uranus stations direct in the grounded sign of Taurus on January 27, 2024, a cosmic earthquake ripples through the world of business and finance. Get ready for unexpected twists, innovative breakthroughs, and a complete reshaping of the economic landscape. Buckle up, entrepreneurs, investors, and everyone in between — Uranus is here to shake things up!

The Cosmic Cocktail:

Imagine the stoic, earth-loving Taurus as a well-established bank, steeped in tradition and conservative practices. Now, picture the rebellious Uranus, bursting in with a briefcase full of digital currency and blockchain ideas. That’s the essence of this transit — a clash between old and new, stability and revolution, practicality and radical transformation.

Impacts to Expect:

Technological Disruption: Brace yourself for a wave of innovation in finance and business. Cryptocurrency, blockchain, and decentralized finance (DeFi) will take center stage, challenging traditional banking systems and pushing the boundaries of what’s possible.

Prepare for a digital gold rush as Uranus throws open the vault of financial innovation! Cryptocurrency will erupt into mainstream commerce, blockchain will become the new ledger, and DeFi will democratize finance like never before. Traditional banks better dust off their abacus and learn to code, because digital cowboys are charging onto the financial frontier, redefining how we value, exchange, and invest. From peer-to-peer microloans to fractionalized real estate ownership, the possibilities are as limitless as your imagination. Buckle up, because the tectonic plates of finance are shifting, and the digital revolution is rewriting the rules of the game!

Shifting Market Dynamics: Expect volatility and unexpected shifts in established industries. Old guard companies might scramble to adapt, while nimble startups with innovative ideas flourish. Think green energy disrupting fossil fuels, or AI revolutionizing the service industry.

Be prepared for market earthquakes! Uranus, the cosmic trickster, will send shockwaves through established industries, causing titans to tremble and upstarts to dance. Picture fossil fuels choking on the dust of solar panels, brick-and-mortar stores gasping as virtual bazaars boom, and customer service bots replacing flustered clerks. AI will infiltrate every corner, from crafting personalized shopping experiences to streamlining logistics, while sustainable solutions crack open resource-hungry giants. It’s a Darwinian playground for businesses — adapt or face extinction. This isn’t just a market shuffle, it’s a complete reshuffle of the deck, and the cards are dealt anew. Get ready for the thrill of the unexpected, because the only constant in this dynamic landscape is change itself!

Evolving Values: Sustainability, ethical practices, and social responsibility will become increasingly important for consumers and investors alike. Businesses that prioritize these values will thrive, while those stuck in outdated models might struggle.

Get ready for a values revolution! Consumers and investors will turn from price tags to purpose tags, demanding businesses that go beyond profit and prioritize sustainability, ethical sourcing, and social responsibility. Imagine carbon-neutral factories replacing smog-belching behemoths, fair-trade coffee beans eclipsing exploitative practices, and employee well-being becoming a non-negotiable bottom line. Businesses that cling to outdated models will find themselves gasping for air as ethical alternatives steal the oxygen. It’s not just a trend, it’s a tidal wave of conscious consumerism sweeping away the tide of greed. So, businesses, listen up: embrace responsible practices, champion inclusivity, and weave sustainability into your very fabric, or risk being swept away by the rising tide of conscious capitalism. The future belongs to those who do good, not just those who do well!

Collaborative Entrepreneurship: Collaboration and community-driven ventures will rise in prominence. Shared workspaces, cooperatives, and peer-to-peer platforms will gain traction, challenging the traditional top-down corporate structure.

Picture the corporate pyramid crumbling as the cosmic crane hoists the collaborative flag! Uranus, the revolutionary, encourages a seismic shift: from isolated silos to thriving beehives. Shared workspaces buzz with creative collisions, cooperatives blossom out of shared passions, and peer-to-peer platforms become the new marketplace, fueled by trust and mutual aid. The top-down hierarchy shivers as horizontal networks rise, blurring the lines between boss and worker, replacing command with consensus. Collaboration takes center stage, not competition, as communities band together to tackle challenges and build innovative solutions. So, entrepreneurs, shed your solopreneur capes and embrace the power of the collective! In this new social business ecosystem, where synergy triumphs over supremacy, the future belongs to those who share, empower, and co-create a brighter tomorrow. Let the collaborative revolution begin!

Focus on Personal Values: Individuals will increasingly prioritize work that aligns with their personal values and passions. Entrepreneurship fueled by purpose and authenticity will flourish, shaping a more diverse and fulfilling business landscape.

Prepare for a workplace metamorphosis! Uranus, the cosmic butterfly, flutters wings of purpose, urging individuals to shed the career chrysalis and soar towards fulfilling their true potential. Gone are the days of soul-sucking jobs; now, personal values take center stage as the compass guiding career choices. Imagine passionate bakers opening community cafes, eco-conscious designers launching upcycled fashion lines, and tech whizzes crafting apps that tackle social issues. Authenticity becomes the new currency, with entrepreneurs weaving their passions into the fabric of their ventures, creating a mosaic of purpose-driven businesses that cater to every corner of the human experience. This isn’t just a career shift, it’s a heart shift, transforming the business landscape into a vibrant tapestry of diverse talents and fulfilled souls. So, listen to your inner compass, embrace your unique spark, and let your passion ignite the world — the future of work belongs to those who dare to be true to themselves!

Tips for Navigating the Cosmic Chaos:

Embrace innovation: Don’t cling to the old ways. Stay open to new technologies, trends, and business models. Be curious, explore, and experiment.

Adapt and evolve: Be prepared to change course quickly. Agility and responsiveness will be key to success in this dynamic environment.

Prioritize sustainability and ethics: Integrate environmental and social responsibility into your business practices. Consumers and investors are increasingly drawn to values-driven companies.

Collaborate and connect: Build partnerships, join communities, and leverage the power of collective action. Collaboration will be crucial for navigating the changing landscape.

Follow your passion: Don’t be afraid to pursue your entrepreneurial dreams. Uranus encourages authenticity and purpose-driven ventures.

Remember, Uranus isn’t about chaos for chaos’ sake. It’s about dismantling outdated structures and paving the way for a more progressive, sustainable, and fulfilling economic future. By embracing the change, staying adaptable, and aligning your business with your values, you can not only survive this cosmic revolution but thrive in the exciting new world it creates. So, let your inner rebel loose, embrace the disruption, and ride the wave of innovation — the economic future is bright for those who dare to dream big!

#uranus in taurus#taurus uranus#business astrology#astrology business#astrology finance#finance astrology#astrology updates#astro#astrology facts#astro notes#astrology#astro girlies#astro posts#astrology community#astrology observations#astropost#astro community#astrology notes

14 notes

·

View notes

Text

Elon Musk, the renowned CEO of Tesla and SpaceX, recently addressed a crowd during a town hall meeting in Pittsburgh, sharing insights about cryptocurrency's role in preserving individual freedoms. Although he refrained from explicitly endorsing XRP, Musk emphasized how digital currencies like it can play a pivotal role in counteracting centralized control. His remarks resonated with supporters of XRP, particularly as Ripple Laboratories continues its ongoing legal tussle with the SEC regarding the classification of XRP as a security. Musk’s comments highlighted a growing realization in the financial landscape: the significance of cryptocurrencies extends beyond mere investment opportunities; they offer a potential pathway toward a more decentralized economic system. For instance, XRP advocates believe that the currency’s unique features can facilitate faster cross-border transactions compared to traditional banking systems. As transaction speeds increase and costs decrease, XRP could stand out as a practical solution amidst the challenges of global remittances. Moreover, the legal implications surrounding XRP cannot be ignored. Ripple’s CEO, Brad Garlinghouse, supported Musk's viewpoint, insisting that cryptocurrency regulations should evolve to foster innovation rather than hinder it. Garlinghouse contends that many voters are starting to recognize cryptocurrencies not just as financial instruments, but as essential tools for enabling innovation and empowering individuals in a digital economy. This aligns with a broader narrative—one where regulatory frameworks are increasingly evaluated on their impact on technological advancement. During the event, Musk also pointed to Tesla’s substantial financial maneuvers involving cryptocurrency. Recently, Tesla executed a transfer of $765 million worth of Bitcoin into new wallets. This strategic move signals Tesla's continued engagement with cryptocurrencies despite its earlier decision to halt Bitcoin payments over environmental concerns in 2021. Notably, the company has pivoted to accepting Dogecoin for certain merchandise, further solidifying Musk’s ongoing involvement in the crypto market. The mining process and energy consumption connected to cryptocurrencies have raised significant concerns, particularly in the context of environmental sustainability. Musk’s comments added an important dimension, suggesting that while there may be challenges, innovation in the energy efficiency of blockchain technology remains crucial for the future of cryptocurrencies. As digital currencies become mainstream, discussions surrounding them reflect evolving societal values. In democratic setups, voters are prioritizing policies that encourage responsible innovation and individual autonomy in financial transactions. The growing interest in cryptocurrencies may prompt legislators to comprehensively review existing financial regulations to create a more conducive environment for crypto technologies. Furthermore, Musk's assertions tie into a fundamental ethos of cryptocurrencies: empowering individuals against the backdrop of centralized banking entities and governmental authority. Histories of economic crises have often made populations more receptive to alternatives like cryptocurrencies, which promise greater control over personal finances. This is evident in emerging economies where citizens are increasingly turning to digital currencies as a means of preserving wealth against hyperinflation. In conclusion, the intersection of cryptocurrency and politics is indeed an area to watch. Musk's acknowledgment of cryptocurrencies' role in decentralization aligns with sentiments shared by an ever-growing community of advocates pushing for regulatory advancements. The path forward will necessitate engagement from not just corporate entities, but also governments and civil societies in harmonizing regulatory frameworks and promoting transparency. The future of cryptocurrencies, especially XRP, will undoubtedly involve navigating these complex dynamics.

If adequately harnessed, crypto has the potential to transform economies by fostering innovation and supporting the autonomy of individuals over their financial futures. As this narrative unfolds, the discourse surrounding digital currencies will likely serve as a bellwether for broader economic transformations poised to affect various sectors worldwide.

#News#SECBitcoinEthereumCryptocurrencyRegulations#BitcoinCryptocurrencyBlockchainInvestingMarketTrends#ElonMusk#EthereumCryptocurrencyInvestingBlockchainDigitalFinance#RippleXRPSECCryptocurrencyLegalUpdate

3 notes

·

View notes

Text

Bitcoin: The Dawn of a New Digital Age

Throughout history, transformative technologies have reshaped society by dismantling barriers and expanding human potential. The printing press democratized knowledge during the Renaissance, while the internet revolutionized information sharing in our time. Bitcoin represents the next step in this evolution—a technology that could fundamentally transform our financial system, though not without important challenges to consider.

The Current Financial Landscape

Today's financial system faces significant challenges. In Venezuela, where inflation exceeded 200% in 2023, citizens watched their savings evaporate within months. In Lebanon, banks imposed strict withdrawal limits during the financial crisis, effectively trapping people's money. Meanwhile, approximately 1.4 billion adults remain unbanked globally, unable to access basic financial services due to geographical, economic, or political barriers.

Bitcoin's Practical Solutions

Bitcoin offers concrete solutions to these challenges. During Venezuela's hyperinflation, thousands of citizens converted their bolivars to Bitcoin, preserving their purchasing power despite the national currency's collapse. In Afghanistan, where women face restrictions on banking access, organizations like Code to Inspire have used Bitcoin to pay female programmers, circumventing traditional barriers.

The technology's core features enable these solutions:

Decentralization: No single entity can freeze accounts or block transactions.

Programmability: Smart contracts enable transparent, automated financial services.

Borderless nature: Transfers work the same whether sending money across the street or across continents.

Fixed supply: The 21 million coin limit provides a hedge against inflation.

Real-World Impact and Adoption

The adoption of Bitcoin as a practical tool is already showing promising results:

El Salvador's Bitcoin adoption has enabled faster, cheaper remittances for its citizens.

The Lightning Network processes millions of small Bitcoin transactions daily, with fees under a cent.

Companies like Strike are using Bitcoin's rails to enable instant, nearly free cross-border payments.

However, significant challenges remain:

Price volatility makes Bitcoin a risky store of value in the short term.

Energy consumption of Bitcoin mining raises environmental concerns.

Technical complexity creates adoption barriers for many users.

Regulatory uncertainty in many jurisdictions.

The Path Forward

Rather than an instant golden age, Bitcoin's impact will likely unfold gradually:

Near term (1-5 years):

Continued integration with traditional financial systems.

Improved user interfaces and education.

Development of clearer regulatory frameworks.

Growth of Lightning Network adoption for small payments.

Medium term (5-10 years):

Stabilization of price volatility as market matures.

Broader institutional adoption.

More energy-efficient mining through renewable energy.

Integration with Internet of Things and autonomous systems.

Long term (10+ years):

Potential emergence as a global neutral settlement layer.

Evolution of new economic models enabled by programmable money.

Reduction of financial inequality through broader access.

Development of currently unimagined applications.

A Balanced Revolution

Bitcoin represents not just a new form of money, but a fundamental upgrade to how value moves and is stored in our digital age. While it won't solve all financial problems or create utopia, it offers real solutions to pressing challenges in our current system.

The true revolution lies not in overnight transformation, but in Bitcoin's steady empowerment of individuals. From the Venezuelan preserving their savings to the Afghan woman accessing the global economy, Bitcoin is already changing lives in measurable ways.

As we move forward, success will require:

Thoughtful development of the technology.

Balanced regulation that protects while innovating.

Focus on real-world problems and solutions.

Recognition of both possibilities and limitations.

The dawn of this new digital age isn't about blind optimism—it's about building pragmatic solutions to real problems. Bitcoin may not create a perfect world, but it offers tools to build a better one, one block at a time.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin: bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#Bitcoin#DigitalRevolution#FinancialFreedom#FutureOfMoney#Cryptocurrency#Decentralization#BlockchainTechnology#NewGoldenAge#EconomicEvolution#BitcoinAdoption#Unbanked#FinancialInclusion#DigitalAge#Empowerment#TechForGood#financial education#digitalcurrency#finance#globaleconomy#financial experts#financial empowerment#blockchain#unplugged financial

2 notes

·

View notes

Text

Exploring the Latest Breakthroughs in Technology

Introduction

Technology is evolving at a rapid pace, bringing with it groundbreaking innovations that are reshaping our world. From artificial intelligence to renewable energy solutions, these advancements are enhancing our lives in ways we never imagined. In this article, we'll explore some of the most exciting recent breakthroughs in technology that are set to transform various industries and everyday life.

1. Artificial Intelligence and Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) are at the forefront of technological innovation. AI and ML are being integrated into a myriad of applications, from healthcare diagnostics to personalized marketing. These technologies analyze vast amounts of data to make predictions, automate processes, and provide valuable insights.

AI in Healthcare

AI is revolutionizing healthcare by improving diagnostic accuracy and patient care. Machine learning algorithms can analyze medical images to detect diseases like cancer at early stages, enabling timely treatment and better patient outcomes.

AI in Everyday Life

In our daily lives, AI powers virtual assistants like Siri and Alexa, enhances customer service through chat-bots, and personalizes our online shopping experiences. The continuous improvement of AI algorithms is making these applications smarter and more efficient.

2. Quantum Computing

Quantum Computing promises to solve problems that are currently insurmountable for classical computers. By leveraging the principles of quantum mechanics, quantum computers perform complex calculations at unprecedented speeds.

Advancements in Cryptography

Quantum computing has the potential to revolutionize cryptography by breaking encryption codes that secure our digital communications. This breakthrough necessitates the development of new cryptographic methods to protect sensitive information.

Applications in Drug Discovery

In the pharmaceutical industry, quantum computing can simulate molecular interactions at a granular level, accelerating the drug discovery process and leading to the development of new, effective medications.

3. Renewable Energy Technologies

The shift towards renewable energy technologies is crucial in combating climate change. Innovations in solar, wind, and battery technologies are making renewable energy more efficient and accessible.

Solar and Wind Energy

Recent advancements in solar panel efficiency and wind turbine design are increasing the amount of energy harvested from natural sources. These improvements are making renewable energy a viable alternative to fossil fuels.

Energy Storage Solutions

Enhanced battery technologies are crucial for storing renewable energy, ensuring a consistent power supply even when the sun isn't shining or the wind isn't blowing. Breakthroughs in battery capacity and lifespan are driving the adoption of renewable energy systems.

4. Internet of Things (IoT)

The Internet of Things (IoT) connects devices and systems, enabling them to communicate and share data. This connectivity is transforming homes, industries, and cities into smarter, more efficient environments.

Smart Homes

IoT technology is making homes smarter by automating lighting, heating, and security systems. Smart home devices can be controlled remotely, offering convenience and energy savings.

Industrial IoT

In industrial settings, IoT devices monitor equipment health and optimize manufacturing processes. Predictive maintenance enabled by IoT sensors can reduce downtime and improve efficiency.

5. Blockchain Technology

Blockchain is revolutionizing how we handle transactions and data security. This decentralized ledger technology ensures transparency and security in various applications.

Financial Transactions

Blockchain is streamlining financial transactions by eliminating the need for intermediaries. It provides a secure and transparent way to transfer funds and verify transactions.

Supply Chain Management

In supply chains, blockchain offers traceability and transparency, reducing fraud and ensuring the authenticity of products. This technology is particularly beneficial in industries like pharmaceuticals and food.

6. 5G Technology

The roll-out of 5G technology is set to enhance connectivity with faster speeds and lower latency. This advancement will support the growth of IoT, autonomous vehicles, and smart cities.

Enhanced Mobile Connectivity

5G technology promises to improve mobile experiences with seamless streaming and quick downloads. It will also enable new applications in virtual and augmented reality.

Smart Cities

5G will facilitate the development of smart cities, where real-time data exchange enhances urban management systems, traffic control, and emergency services.

7. Autonomous Vehicles

Autonomous vehicles are set to transform transportation. Advances in AI and sensor technology are bringing self-driving cars closer to reality, offering safer and more efficient travel options.

Safety and Efficiency

Autonomous vehicles can reduce accidents caused by human error and optimize traffic flow, reducing congestion and emissions. They hold the potential to revolutionize the logistics and delivery sectors.

Delivery Services

Self-driving delivery vehicles and drones are making logistics faster and more reliable. These innovations are particularly beneficial in urban areas, where they can reduce traffic and pollution.

8. Biotechnology

Biotechnology is advancing rapidly, offering solutions in healthcare, agriculture, and environmental management. Innovations in gene editing, synthetic biology, and bio-engineering are opening new possibilities.

Gene Editing

CRISPR technology is enabling precise gene editing, offering potential cures for genetic diseases and innovations in agriculture. This technology is paving the way for new treatments and sustainable farming practices.

Synthetic Biology

Synthetic biology is creating new biological systems and organisms, leading to advancements in medicine, bio-fuels, and sustainable materials. This field holds promise for addressing global challenges such as disease and climate change.

9. Augmented Reality (AR) and Virtual Reality (VR)

AR and VR technologies are providing immersive experiences in entertainment, education, and various professional fields. These technologies are creating new ways to interact with digital content.

Gaming and Entertainment

AR and VR are enhancing gaming experiences by creating immersive environments and interactive game-play. These technologies are also being used in movies and virtual concerts, offering new forms of entertainment.

Professional Training

In education and professional training, AR and VR offer realistic simulations for hands-on learning. Fields like medicine, engineering, and aviation benefit from these technologies by providing safe and effective training environments.

Conclusion

The latest breakthroughs in technology are driving significant changes across various sectors. From AI and quantum computing to renewable energy and autonomous vehicles, these innovations are shaping the future and improving our lives. Staying informed about these developments is crucial for individuals and businesses alike to leverage the benefits of these technological advancements. As we look to the future, these game-changing technologies will continue to evolve, offering new opportunities and solutions to the challenges we face.

#technology#artificial intelligence#virtual reality#immersive technology#renewableenergy#ai algorithm#valuable insights#internet of things#technological advancements

2 notes

·

View notes

Text

"A great deal of the offshored industrial production at the other end of the extended supply chains celebrated in People’s Republic of Walmart is actually carried out in comparatively small job shops that would be more efficiently collocated with local market areas. The technology at the actual point of production, in such cases, is modest in scale and best suited for local or regional production. But it’s enclosed within a corporate institutional framework of extended logistic chains through the framework of copyright, patent, and trademark law which gives corporations a legal monopoly on disposal of an outsourced product. The only reason the facilities in China aren’t all producing identical goods directly for the local market, and selling at a price without the trademark and patent markups, is the enclosure of decentralized production technology within a centralized corporate legal framework. And the only reason the production facilities making goods for people in Iowa are sited in China instead of in Iowa is that the labor there is cheaper.

(...)

Lean production guru James Womack observed that “oceans and lean production are not compatible.” Simply shifting inventories from giant warehouses of finished product or intermediate goods to warehouses disguised as trucks and container ships isn’t really reducing overall inventory stocks at all. It’s just sweeping the batch and-queue bloat of Sloanism under the rug. The outsourced component manufacturers “are located on the wrong side of the world from both their engineering operations and their customers… [in order] to reduce the cost per hour of labor.” To properly apply lean principles it is necessary “to locate both design and physical production in the appropriate place to serve the customer.”49

In his Foreword to Waddell’s and Bodek’s The Rebirth of American Industry (something of a bible for American devotees of the Toyota Production System), H. Thomas Johnson (an expert in lean accounting) writes:

Some people see lean as a pathway to restoring the large manufacturing giants the United States economy has been famous for in the past half century…. The cheap fossil fuel sources that have always supported such production operations cannot be taken for granted any longer. One proposal that has great merit is that of rebuilding our economy around smaller scale, locally-focused organizations that provide just as high a standard living [sic] as people now enjoy, but with far less energy and resource consumption. Helping to create the sustainable local living economy may be the most exciting frontier yet for architects of lean operations.

So except in a few cases like geographically situated mineral resources, microprocessor production, and the like that require long-distance shipping for genuine technical reasons, most of what goes on in the logistic chains Phillips loves so much is just waste production. And that’s a lot of waste production. To put it simply, Walmart’s and Amazon’s increasingly automated inventory systems and just-in-time global logistic chains achieve “efficiency” only in a relative sense. To borrow a phrase from Peter Drucker, they’re the most efficient way of doing a very inefficient thing that ought not to be done at all.

(...)

Capitalism is not in crisis because, as per the orthodox Marxist model, its productivity so great that it undermines capitalist relations of production. It is in crisis because it has chosen models of technological development and organizing production that are unproductive in terms of how efficiently they use inputs. Capitalism is a system founded on extensive growth — that is, on the addition of ever larger quantities of resource inputs, inputs which are artificially cheap and abundant because of the enclosure of land and natural resources. Now that we are in the age of Peak Oil, and approaching the age of Peak Coal, Peak Gas, and analogous limits to a wide range of other material inputs, capitalism is experiencing a crisis of extensive development.

Post-capitalist transition is not simply a matter of celebrating mass production factories and global logistic chains as the “colossal forces of production” Marx wrote of, and saying “Thank you, capitalists, but we’ll take over from here.” Those mass production factories and global logistic chains are the prime examples of the kinds of inefficiency created by a system that treated material inputs as artificially cheap and abundant and pursued growth by throwing more of them on the pile instead of using existing inputs more efficiently."

-Kevin Carson, “We Are All Degrowthers. We Are All Ecomodernists. Analysis of a Debate” (2019)

9 notes

·

View notes

Text

Bitcoin Cryptocurrencies: Unraveling the Revolution of Digital Gold

In the world of cryptocurrencies, Bitcoin stands as the undisputed pioneer, heralding a new era of digital finance and challenging traditional notions of money and value. Since its inception over a decade ago, Bitcoin has captivated the imagination of millions, evolving from a niche experiment to a globally recognized asset class with a market capitalization surpassing that of many Fortune 500 companies. Let's delve into the intricacies of Bitcoin cryptocurrencies and their profound impact on the financial landscape. Check their site to know more details criptomoedas bitcoin

At its core, Bitcoin represents a decentralized digital currency, free from the control of any central authority or intermediary. Powered by blockchain technology, Bitcoin transactions are recorded on a public ledger, immutable and transparent, ensuring trust and security without the need for intermediaries. This groundbreaking innovation not only eliminates the inefficiencies and vulnerabilities inherent in traditional financial systems but also empowers individuals with unparalleled financial sovereignty and autonomy.

One of Bitcoin's most defining features is its scarcity. With a maximum supply capped at 21 million coins, Bitcoin is often likened to digital gold—a store of value immune to inflationary pressures and government manipulation. This scarcity, coupled with increasing global demand and institutional adoption, has propelled Bitcoin's price to unprecedented heights, garnering attention from investors, speculators, and institutions seeking a hedge against economic uncertainty and currency debasement.

Moreover, Bitcoin's decentralized nature makes it resistant to censorship and confiscation, providing a safe haven for individuals in jurisdictions plagued by political instability or oppressive regimes. From remittances and philanthropy to wealth preservation and capital flight, Bitcoin has emerged as a lifeline for those seeking financial freedom and inclusion in an interconnected yet fractured world.

However, Bitcoin is not without its challenges. Scalability, energy consumption, and regulatory scrutiny remain persistent hurdles on its path to mainstream adoption. The debate over Bitcoin's environmental impact, fueled by its energy-intensive proof-of-work consensus mechanism, underscores the need for sustainable alternatives and technological innovation to mitigate its carbon footprint.

Furthermore, regulatory uncertainty poses a significant risk to Bitcoin's long-term viability. While some countries have embraced Bitcoin as a legitimate asset class, others have imposed stringent regulations or outright bans, casting a shadow of uncertainty over its future. Clear and coherent regulatory frameworks are essential to fostering investor confidence, encouraging innovation, and ensuring the responsible growth of the cryptocurrency ecosystem.

Despite these challenges, the future of Bitcoin cryptocurrencies appears bright. The ongoing development of layer-two solutions, such as the Lightning Network, promises to enhance scalability and efficiency, enabling faster and cheaper transactions on the Bitcoin network. Additionally, advancements in privacy and security features aim to bolster Bitcoin's fungibility and resilience against emerging threats.

Moreover, the convergence of Bitcoin with traditional finance through avenues like exchange-traded funds (ETFs) and institutional-grade custody solutions is paving the way for broader adoption and integration into traditional investment portfolios. As Bitcoin matures and evolves, its role as a global reserve asset and digital gold is poised to solidify, reshaping the financial landscape for generations to come.

In conclusion, Bitcoin cryptocurrencies represent a paradigm shift in the way we perceive and interact with money. As a decentralized, scarce, and censorship-resistant digital asset, Bitcoin transcends borders and ideologies, offering a beacon of hope for financial empowerment and freedom in an increasingly digitized world. While challenges abound, the resilience and innovation of the Bitcoin community continue to propel the revolution of digital gold forward, unlocking new possibilities and redefining the future of finance.

#preço bitcoin#criptomoeda#comprar bitcoin#1 btc#livecoins#coin market cap brasil#investing noticias#portal bitcoin#notícias sobre moeda digital#qual criptomoeda comprar hoje#criptomoedas bitcoin#quanto custa 1 bitcoin#coinmarketcap brasil#cotacao criptomoedas#mercado coin#cripto moedas#notícias sobre livecoins#grafico criptomoedas#mercado de criptomoedas#mineracao de criptomoedas

2 notes

·

View notes

Text

5 Megatrends Impacting Power Transformation Globally

In a period of rapid technological development and growing sustainability concerns, the global power industry confronts a significant evolution. Traditional power systems are being modified by several megatrends that promote creativity, effectiveness, and long-term viability.

Here, we’ll look at five major megatrends that are affecting the global transformation of power

1. Transition in global economic power

Global economic dominance is evolving, with emerging economies gaining prominence. Despite their remarkable economic development, nations like China, India, and Brazil are experiencing a rise in energy consumption. The power industry will be greatly affected by this shift in economic power. To meet the expanding energy needs of these burgeoning economies, new power infrastructure, transmission networks, and sustainable energy sources must be developed.

2. Population dynamics

The demographic shift is an important megatrend that has a major effect on the power transition. Due to population growth, urbanization, and changing demographics, there is a growing need for power, particularly in developed nations. Countries with established economies and aging populations require continuous electricity for essential services like healthcare. To deal with these developments, the power industry must invest in efficient, environmentally friendly energy generation and distribution systems.

3. Rapid Urbanization

Urbanization is altering the global power industry. Megacities’ expansion has resulted in an upsurge in the amount of energy required by the residential, commercial, and industrial sectors. The creation of smart cities must be given top priority by the electricity sector to meet these objectives. This entails constructing efficient power networks, utilizing renewable energy sources, and deploying innovative technology for optimal power generation and delivery.

4. Technological advancement

Technology is revolutionizing production, transmission, and consumption in the power sector. Blockchain, Internet of Things, big data, and AI innovations optimize power systems for dependability and efficiency. Consumers are empowered by decentralized generation, grid automation, and smart energy management. These developments lead to lower expenses and greater authority in the changing electricity landscape.

5. Climate Change/Resource Scarcity

The evolution of the electricity sector is being fueled by climate change and resource scarcity. To minimize greenhouse gas emissions, emphasis is put on renewable energy sources. Enhancing energy efficiency, studying energy storage, and alternate fuels are also prioritized. These initiatives are meant to encourage sustainability and alleviate the consequences of climate change.

Conclusion

Lastly, the five megatrends highlighted have a substantial worldwide impact on power transition. Adapting to these megatrends is critical for the power industry to meet growing energy demands, promote economic growth, and resolve the environmental challenges of the twenty-first century.

MEC, an established engineering consultant, offers clients across the globe with highly specialized and performance-oriented technical proficiency. We’ve got you addressed, from conception to commission to production. Engage with us to develop optimal strategies that boost productivity and radiate prospects for success. Explore our website to learn more about our services and expertise in a wide range of market sectors.

2 notes

·

View notes

Text

In real estate, what kinds of technology are used?

Real estate technology is a broad term for the tools used to look for, buy, sell, and manage properties. Big data, artificial intelligence, machine learning, and virtual reality are some of these tools. Historically, transactions, underwriting, and asset management are ready to be changed by property development technologies that help teams make important decisions quickly and accurately.

Artificial Intelligence (AI) is very important in the real estate industry. It helps businesses streamline their processes and give better service to their customers. AI can look at transaction data and predict how the market will move in the future. It can also be used to help real estate agents find the best homes for buyers and improve their marketing.

It can also be used to make faster and more accurate property documents and land records. It can also be used to make it easier to handle rental payments and maintenance requests. AI is also used to improve the safety of business buildings. It can let building managers and property owners know about possible threats to their properties. It can also keep track of renter activity and late payments to prevent problems in the future.

Machine learning is a type of artificial intelligence that can automate tasks and make smart suggestions. This technology is used by a lot of businesses because it helps them analyze data more quickly and accurately. Machine learning can be used to find patterns in a lot of data and spot trends that people might not be able to see. It is also used to guess what will happen in the future.

The Internet of Things (IoT) is a network of smart devices that can talk to each other in real time. It can be used for many things, like making the customer experience better and cutting down on operational costs. IoT sensors can be used by property management companies to find problems with infrastructure and other risks. This can help them cut costs and make more money in the long run.

IoT can also make buildings safer by letting security cameras and other systems be watched. The information gathered can be sent to emergency workers to help them respond to a situation as soon as possible. IoT is also good because it can save energy, which is a big plus. Smart lighting systems can be set up to only turn on lights when they are needed. This means that lights don't have to be on all the time in an entire building or floor. This could cut energy costs by a lot.

Blockchain is a system that records transactions in a way that can't be changed and is safe. It also makes it easier to share information and makes fraud less likely. Blockchain is being used by real estate companies to improve how they market, search for, buy, sell, and invest in properties. Some are even using it to turn real estate assets into tokens to make them more liquid.

Blockchain is a decentralized ledger system that stores information in blocks of data that are stamped with the time and linked together. It can be used to record all kinds of transactions and data in a way that can't be changed, such as the title, deed, land registry, details about co-ownership, and more.

2 notes

·

View notes

Text

Simple tool for newsletters, SMS and marketing automation for experts who market knowledge

Create and send professional newsletters and highly profitable automated marketing campaigns. KlickTipp wins new recipients for you 24/7 and turns them into enthusiastic, paying customers.

You can also try this product The KlickTipp

You can also try this product The KlickTipp

DISCLAIMER There are an affliate link of best product in this article which may make some profit for me

#agencies#doctor's offices#car dealerships#coaches#consultants#decentralized energy systems#energy supplier#event industry#gyms#photography & film#franchising#drinks & Food#craft terrace construction#craftcarpenter#real estate agent#info marketer#engineering offices#farmers#mechanical and plant engineering#online conference organizer#expert#seminar provider#software & IT#speaker#tax consultant#therapists#coach#trainer#business consultant#associations

1 note

·

View note

Text

I see this attitude from a lot of people nowadays "Why should I have to pay money just to live? The basic necessities should be free!"

Let me tell you why. The answer is efficiency and sustainability. Basic necessities cost resources to produce, food, housing, clothing, it takes labor, material costs, energy, and other resources to produce these things, and it also takes resources to get these things to the people who need them. And it takes societal structures, businesses, organizations, infrastructures, to do it. And some methods of production and distribution are more efficient than others.

When people have limited money, and have to buy basic necessities, they shop around for the lowest price and for deals. And the act of doing this, helps to select for more efficient ways of producing and distributing goods. It also creates incentives to preserve things, like keeping clothing or equipment longer instead of just throwing it out. All of these things create incentives for protecting the environment too, because things that cost more to make often are using more energy or material resources that have negative environmental impact.

When people don't have enough money to buy basic necessities, instead of saying that the problem is that the necessities cost money, you could say that the problem is that they don't have money. Money is power to buy things, and the problem is that some people are so disempowered that they cannot even get their basic needs met.

Solutions like UBI or various social welfare programs address this by simply giving people money regularly.

I think this is often a better solution than simply giving people resources for free. If something is free, people will be more likely waste it, or to take more than they need. This makes the program more expensive than if people bought only what they needed. Someone is still paying for those free things, and if it's funded by a government grant, the whole supply chain of producing and distributing it probably isn't going to be as efficient. So even if no one took more free handouts than they needed, it still would be more expensive than simply giving people money and allowing people to shop around for deals.

Note also that the existence of ultra-rich people undermines the efficiency created by markets and the money system. If someone is rich past a certain point, they become insensitive to the cost of most goods, and they end up buying things for whatever prices they are available at. As a result they often end up buying things that took incredible amounts of resources to produce, and they thus end up having a disrpoportionate environmental impact too. This is why we see all this stuff about how the richest people are responsible for the most carbon emissions and pollution. It's also why you have problems like billionaires buying up tons of properties in London and driving up the cost of living, shaping the whole housing market so that developers build luxury housing instead of affordable housing.

The problem with our world isn't that money exists or that it rules the economy, the problem is simply that the money has been ridiculously concentrated in the hands of a tiny portion of people, and that the economic system and tax system and laws are designed such that it stays that way. Some people have too much money and others have too little and it creates problems on both ends. The solution isn't to eliminate money, it's to eliminate the regressive aspects of our tax code, laws, and economic system.

If there were only modest wealth disparities between people, all people had enough money to comfortably buy basic necessities, and no people had so much wealth as to be insensitive to cost, it wouldn't be a grave injustice that you need to pay for these things. It would just be part of the system that helps society to run more efficiently. And I think that would be a much better society to live in than one where we try to (centrally or decentrally) coordinate how to care for people without money.

#economics#markets#free market#efficiency#sustainability#ubi#injustice#capitalism#wealth disparity#wealth inequality#inequality#poverty#the rich

4 notes

·

View notes

Photo

Article about Solar Panel Savings:

Is it Worth the Cost? Solar panels have been around for decades, but their popularity has surged in recent years. As technology has advanced, solar panel prices have dropped, making them more accessible to homeowners and businesses alike. The question remains, however, whether the cost of solar panels is worth it in terms of the savings they provide. In this article, we discuss solar panel savings and whether investing in solar makes sense for you. The Cost of Solar Panels Before we dive into the savings potential of solar panels, it's essential to understand the cost associated with purchasing and installing them. Solar panel costs can vary significantly depending on the size of your installation, the type of solar panels used, and your location. On average, a...residential solar panel system can cost anywhere from $15,000 to $35,000 after tax credits and incentives. However, this investment can result in long-term savings on your electricity bills and increased home value. Solar Panel Savings The amount of money you will save by installing solar panels depends largely on the size of your solar panel system, the amount of energy you use, and your location. Solar panel savings are typically calculated by estimating the amount of electricity you will generate over time and comparing it to the cost of purchasing that electricity from your utility company. In general, the larger your solar panel system, the more energy it will produce, and the greater your savings potential. If your system is large enough that you can generate excess electricity, you..may be able to sell it back to your utility company through a process called net metering. This can further decrease your electricity bill and potentially even earn you money. Additionally, the cost of electricity from your utility company tends to rise over time, while the cost of solar energy remains relatively constant. This means that your savings on electricity bills will increase over time as you continue to use your solar panel system. Increase in Home Value Installing a solar panel system can also increase the value of your home. Studies have shown that homes with solar panels sell for higher prices than comparable homes without solar panels. Furthermore, a solar panel system is a durable and long-lasting investment, which can increase the appeal of your home to potential buyers. Installing a solar panel system.....can also differentiate your home from others on the market, attracting environmentally-conscious buyers who are willing to pay a premium for a home with a solar panel system. Environmental Benefits Another benefit of solar panels is their positive impact on the environment. Solar panels generate electricity without emitting harmful pollutants or greenhouse gases, which is a significant advantage over traditional sources of electricity such as coal or natural gas. By installing a solar panel system, you can reduce your carbon footprint and help combat climate change, which is becoming an increasingly pressing global issue. Energy Independence Finally, installing a solar panel system can give you a greater sense of energy independence. With a solar panel system, you can generate your own electricity, which means you are less reliant on your utility company for your..energy needs. This can be especially beneficial during power outages or other emergencies when the electrical grid may be down. In addition, solar panel systems can help decrease the demand for electricity from traditional sources, which can reduce the need for new power plants and infrastructure. This can lead to a more decentralized and sustainable energy system. In Summary : Overall, installing a solar panel system in your home can provide numerous benefits. It can save you money on your energy bills, increase your home's value, reduce your carbon footprint, and give you a greater sense of energy independence. If you are interested in installing a solar panel system, it's important to do your research and find a reputable installer. You should also consider your home's location, orientation, and shading to..determine if solar energy is a viable option for your specific situation. Many cities and states also offer incentives and rebates for installing solar panel systems, so be sure to check if any are available in your area. Overall, solar energy is a promising and renewable energy source that can provide significant benefits for homeowners who choose to install a solar panel system. Not only can it help save money on energy bills, but it can also contribute to a more sustainable and environmentally conscious future.

1 note

·

View note

Text

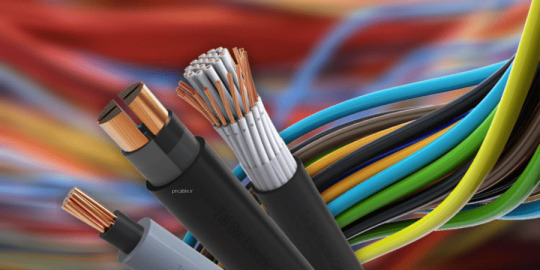

Wire & Cable Market In-depth Insights, Business Strategies and Huge Demand by 2034

The wire and cable market is a critical component of global infrastructure, enabling electricity transmission, telecommunications, and data networking across industries. With advancements in technology and a growing focus on renewable energy, this market is poised for significant growth.

The global wire and cable market is expected to increase at a compound annual growth rate (CAGR) of 3.8% between 2024 and 2034. Based on an average growth pattern, the market is expected to reach USD 302.35 billion in 2034. In 2024, the worldwide wire and cable industry is projected to generate USD 233.59 billion in revenue.

Get a Sample Copy of Report, Click Here: https://wemarketresearch.com/reports/request-free-sample-pdf/wire-and-cable-market/1611

Wire & Cable Market Growth Drivers:

Infrastructure Development:

Massive investments in smart cities and industrial facilities.

Need for efficient electrical grids to support urbanization and electrification in developing nations.

Renewable Energy Integration:

Growth in solar and wind power generation demands advanced power cables for energy transmission.

High-voltage direct current (HVDC) systems are becoming prevalent, necessitating specialized cables.

Technological Advancements:

Adoption of fiber optic technology for high-speed communication and 5G infrastructure.

Introduction of smart cables equipped with sensors to monitor and optimize energy flow.

Electrification of Mobility:

Increasing demand for electric vehicles (EVs) and associated charging infrastructure.

High-performance cables required for EV batteries, inverters, and onboard systems.

Wire & Cable Market Challenges:

Raw Material Dependency:

Prices of copper and aluminum, which make up a large part of cable production, fluctuate based on supply constraints and geopolitical tensions.

Environmental Concerns:

Cable manufacturing involves processes that can have environmental impacts, urging the need for sustainable alternatives.

Technological Obsolescence:

Rapidly evolving technology means older products risk becoming outdated.

Wire & Cable Market Technological Innovations

Fiber Optic Cables:

Essential for modern telecommunications, offering high-speed data transmission for 5G and internet applications.

Wavelength-division multiplexing (WDM) technology is boosting bandwidth capacity.

High-Temperature Cables:

Designed for environments requiring durability under extreme conditions, such as industrial plants and renewable energy applications.

Eco-Friendly and Halogen-Free Cables:

Growing focus on sustainability has led to the development of cables with recyclable materials and low environmental impact.

Submarine Cables:

Used for offshore wind farms and intercontinental data transmission.

Increasing deployment for renewable energy and global connectivity.

Smart Cables with IoT Integration:

Advanced cables that can track voltage, temperature, and performance, enabling predictive maintenance and operational efficiency.

Wire & Cable Market Emerging Trends

Focus on Miniaturization:

Compact, lightweight cables are being developed for applications like aerospace, automotive, and wearable devices.

Increased Adoption of HVDC Cables:

Long-distance energy transmission projects are increasingly relying on HVDC cables for efficient and loss-free transmission.

Microgrid Expansion:

Growth of decentralized energy systems requires advanced cable infrastructure.

Key companies profiled in this research study are,

The Global Wire & Cable Market is dominated by a few large companies, such as

Prysmian Group

Southwire Company, LLC

Nexans

Prysmian Group

Leoni AG

Sumitomo Electric Industries, Ltd.

Furukawa Electric Co., Ltd.

LS Cable & System Ltd.

Incab

Kabel Deutschland GmbH

Turktelekom

Belden Inc.

Amphenol Corporation

Helukabel GmbH

Nexans Cabling Solutions

Wire & Cable Market Segmentation,

By Cable Type

Low Voltage Energy Cables

Power Cables

Fiber Optic Cables

Signal & Control Cables

Others

By Installation

Overhead

Underground

Submarine

By Voltage

Low Voltage

Medium Voltage

High Voltage

Extra High Voltage

By End-Use Industry

Aerospace & Defense

Building & Construction

Oil & Gas

Energy & Power

IT & Telecommunication

Automotive

Others

Wire & Cable Industry: Regional Analysis

Forecast for the North American Market

It is projected that North America would rise rapidly due to rising investments in renewable energy, especially in solar and wind projects in the United States and Canada. The demand from industries like electronics, industrial machinery, and automobiles is a major driver of the region's growth. Market expansion has also been aided by continuous improvements to energy transmission infrastructure and efforts to lower losses brought on by blackouts.

Forecast for the European Market

Europe is a significant player in the industry as well, gaining from rising investments in infrastructure for renewable energy sources and the requirement to update current electrical systems. IT services and industrial machinery have been two industries that have consistently increased demand for wires and cables in the area. The need for specialized power lines is driven by the region's emphasis on high-voltage direct current (HVDC) systems and smart grid technology. Fiber-optic cables and signal & control cables are becoming more and more necessary as 5G networks are being deployed in key European nations including Germany, France, and the United Kingdom.

Forecasts for the Asia Pacific Market

With over 40% of the market, Asia Pacific is the biggest market for wire and cable. Large-scale infrastructure development is taking place in nations like China, India, and Japan, which raises demand for a variety of cables, including fiber-optic, power, and low-voltage energy cables. Significant investment is being made in power generating and renewable energy projects as the region's need for electricity rises, particularly in China, the world's largest producer of wind and solar energy. The need for fiber-optic cables and signal and control cables is being driven by Asia-Pacific's leadership in the 5G rollout.

Conclusion

The wire and cable market is a cornerstone of modern infrastructure, playing a pivotal role in powering industries, enabling telecommunications, and driving technological advancements. With growing investments in renewable energy, 5G networks, and electric vehicles, the market is poised for robust growth in the coming years. However, challenges such as raw material volatility and environmental concerns underscore the need for innovation and sustainable practices.

Companies that focus on developing eco-friendly, high-performance, and technologically advanced solutions will be well-positioned to capitalize on the market's opportunities. As the world shifts toward a more connected and sustainable future, the wire and cable industry will remain an essential enabler of progress, supporting global energy needs, digital transformation, and green initiatives.

0 notes