#December 2020 to March 2021 Calendar

Explore tagged Tumblr posts

Text

Know your Destiel/Cockles history: a calendar

As a newcomer on Tumblr and on the Supernatural fandom, I first had trouble following all the past events that were regularly reminded and celebrated.

On this very special day (December 14th, European time), the following post is an attempt at listing those events, focusing on Destiel and Cockles (with a hint of Jenmisheel). Feel free to advise me for more (or less) dates!

Acknowledgement: The idea came from @youchangedmedestiel who also contributed to the content. The present post would never have been possible without @livebloggingmydescentintomadness 's Cockles masterlist. Color code: Destiel / Cockles

Honorary periodic event: FIMMF (Finger In My Mouth Friday)

January

12th: "Mish. Dee." (2021) - 1

16th: Broadcast of 15x09 “The Trap” (2020) - /

17th: ‘Isn't the season you met Misha?’ ‘Taste the rainbow’ JaxCon (2016) - 1

18th: The abandoned Jenmisheel podcast (2022) - 1

24th: Dean's birthday + ‘Jensen's the horse’ HousCon (2015) - / + 1

February

2nd: Broadcast of 12x10 “Lily Sunder Has Some Regrets” (2017) - /

14th: Destiel wedding anniversary (2021)

16th: Broadcast of 12x12 “Stuck in the Middle (With You)” (2017) - /

26th: ‘Which is funny, because so do I’ JIB11 (2023) - 1

28th: ‘Misha's been working out’ ‘He has though, hasn't he?’ NashCon (2016) - 1

March

1st: Jensen Ackles' birthday (1978) - 1 2 3 4

18th: Danneel Ackles' birthday (1979)

20th: Broadcast of 8x17 “Goodbye Stranger” + Gag reel (2013) - / + 1

23rd: Broadcast of 7x17 “The Born-Again Identity” (2012) + Broadcast of 15x13 “Destiny’s Child” + Gag reel (Jensen's infamous fart joke) (2020) - / + 1

April

1st: Mishapocalypse (2013) + Mishapocalypse 2.0 (2023) - 1 2 + 3

10th: “When Harry Met Sally” JIB2 (2011) - 1

13th: Season 15 EW Photoshoot (2020) - 1 2

15th: Broadcast of 5x18 “Point of No Return” + Gag reel (blowjob+‘we’re missing the gay angel’+‘confetti it’s a parade’) (2010) - 1 + 2 3 4

15th: Bishagate 2.0 NJCon (2023) + Misha’s Cas essay (2022) - 1 2 + 3

23th: Bishagate ‘I’m all three’ NJCon (2022) - 1

25th: ‘I happen to be straight’ (2022) - 1 2

27th: Broadcast of 12x19 “The Future” (2017) - 1 2 3 4

28th: ‘Balls deep’ CR8 (2024) - 1

29th: Broadcast of 6x19 “Mommy Dearest” + Gag reel (2011) - 1

May

6th: Broadcast of 6x20 “The Man Who Would Be King” (2011) - /

7th: First release of 'Watching Over Me' (2021) - 1

19th: Straddlegate JIB10 (2019) - 1 2 3 4

21st: Jensen's bear underwear reveal JIB8 (2017) - 1

23rd: ‘Okay babe’ (2021) - 1

24th: Misha tenderly rescuing Jensen+’We like you the best’+Hitch scene JIB5 (2014) - 1 2 3

26th: ‘It’s not a subtext. It was clear text.’ PurCon8 (2024) - 1

27th: ‘I talked to Jensen and Danneel this morning because I couldn’t sleep’ PurCon7 (2023) - 1

June

July

1st: ‘I miss my blanky’ + ‘I love you’ VS ‘I need you’ (2021 (yes, on the same fucking day)) + ‘Also, Cas is gay.’ (2023) - 1 2 3 + 4

14th: 'Destiel is Cockles Fault' Day SFCon (2024) - 1

24th: ‘Wow, that was really informative. Thank you.’ SDCC (2011) + ‘How do you know’ SDCC (2016) - 1 + 2

August

9th: Destiel fanfics first ship to reach the milestone of 100,000 stories 'I have to admit, I like being on top' (2021)

13th: ‘I’d love to do a Western…slash romcom with Misha’ VanCon (2017) - 1

17th: Cockles day at sea (2015) + ‘I would probably choose to be the car, because Dean would ride me all day’ SPNDEN (2018) - 1 2 + 3

18th: Destiel winning TV Choice Best Chemistry (2015) - 1

20th: Misha Collins' birthday (1974) - 1

September

8th: Release of "Some things I Still Can't Tell You", poetry book by Misha Collins - Men in the Woods (2021) - 1

13th: First broadcast of Supernatural (2005) - /

18th: Broadcast of Lazarus Rising, first appearance of Castiel (2008) + First release of Jensen publicly singing 'Angeles' (2012) (+Bonus: Jensen serenading Misha at JIB11 (2023)) - 1 + 2 3 4

24th: Broadcast of 5x03 “Free to Be You and Me” (2009) (Bonus: reference of ‘personal space’ at SFCon (2024)) - 1

October

11th: Danneel Ackles, sharing a picture of Jensen, reading "Some things I still can't tell you" by the fire, Misha tagged on his heart (2021) - 1 2

13th: Broadcast of 12x01 “Keep Calm and Carry On” + ‘You're poking me’ Gag reel (2016) - 1

16th: ‘He’s like an angel plushie’ DenCon (2021) - 1

20th: ‘I can say whatever I want because Danneel is in love with you' HCCB (2024) - 1

21st: Broadcast of 10x03 “Soul Survivor” + ‘Aloha cowboy’ Gag reel (2014) - 1 2

23rd: ‘I should have said ‘I love you too’ and hugged him’ VanCon (2022) - 1

28th: Broadcast of 11x04 “Baby” (2015) (Bonus: reenactment of the CasDean scene at JIB7 (2016))

November

5th: Broadcast of 15x18 "Despair" - Destiel's anniversary (2020) - /

8th: ‘Homosexual declaration of love’ Darklight Online Con (2020) + 'I live it' (2021) - 1 (no official proof because the panel has mysteriously been deleted from social medias around the 26th) + 2

11th: Broadcast of 10x05 “Fan Fiction” (2014) - /

12th: Broadcast of 9x06 “Heaven Can't Wait” (2013) - /

16th: Broadcast of 13x06 “Tombstone” (2017) + ‘Release the tapes!’ Day (2020) - / + 1

19th: Broadcast of 15x20 "Carry on" -> Last episode of Supernatural (so far 🕯🤞🏻) (2020) + Misha sharing by mistake (?) “The epic love story of Jensen Ackles and Misha Collins” blog (2013) - / + 1 2

24-25th: 'y yo a ti' (2020) - 1

24th: ‘His ferret goes other places’ (2024) - 1

26th: Misha having to live stream and do PR during Thanksgiving, in mid divorce, following 'y yo a ti' (2020) - 1

December

1st: Danneel sharing a post to promote "The Adventurous Eaters Club", featuring Jensen and their kids (2019) - 1 2

5th: ‘I love you, not like a brother, but like a lover’ CCXP (2024) - 1 2

6th: ‘Cas was supposed to have his arm around Dean in the bar’ CCXP (2024) - 1 2

14th: Cockles anniversary (2009) + Introduction of 'Eyes Like The Sky' beer (2020) - 1 2 3 + 4

19th: Jenmisheel holiday package (2017) - 1 2

#cockles#destiel#destiel is cockles fault#misha collins#jensen ackles#happy 15th anniversary#let's celebrate!

119 notes

·

View notes

Text

My 2024 Art Year in Review!

My main goal this year was to do a bit more than I had in '23, and happily, I did manage that!

24 pieces done, most of them full pieces. 78 individuals. Contributed to several big projects this year (one of which isn't even on here, because we can't show the art yet). As it is, some of these are fudged a little with respect to when I finished them, but largely they correspond to when I did a lot of work on them. I only have one month where I had to put in a photograph instead, as I didn't have a finished drawing for that month; but I think that's because I was working on something else that got completed later.

I hope I can keep the streak going in the coming year, although there's going to be some challenges to my free time; so, we'll see.

Links below the cut.

2023, 2022, 2021, 2020, 2019, 2018, 2017

January: Stanuary 2024: Week 4, Strangers and Brothers

February: Gravity Falls finale anniversary polaroid redraw

March: Ford by firelight

April: Sea Grunks in orange and blue

May: Photo of the aurora borealis in Massachusetts, May 10

June: Stan and Ford's birthday: canoeing in NJ

July: 2026 Hunkles Calendar, Feb: Stan and Ford in the Mystery Shack kitchen

August: Mabel and Dipper's birthday: hiking with Bigfoot

September: Sea Grunks portraits in teal

October: Halloween: Mystery Trio and Over the Garden Wall crossover

November: Pines and Bigfoot sitting around some scampfires

December: Gravity Falls cryptids sticker sheet for the Mystery Twin Mystery Bags project

Template by @mossygator

90 notes

·

View notes

Text

It's been 10 years since I first watched Frozen!🌻❄️⛏️☃️🦌

(Swedish DVD-copy of Frozen)

November 20th, 2014. It seems like forever ago. I remember watching this movie through my desktop ASUS PC (remember when computers used to have actual DVD-drives?) on a by today's standards pretty crappy Philips monitor. It didn't matter. The movie was like nothing else I had seen before. Even though I don't even have a sibling and can't fully relate to the conflict, Anna and Elsa's adventure is IMO one of the best stories ever told💕

I was 22 back then. A young man and totally in love with this Disney movie. Now I'm 32 and it continues to be among my favourite movies of all time. Even now, ten years later, I still live and breathe Frozen every day! It is a part of who I became and it is the way I wish to remain 😄

I have become a devoted fan of all things Frozen and I'm trying my best to be a part-time Frozen-analyst, mapmaker, worldbuilder and collector. I'm also known for using too many emotes and exclamation marks!

Below, I have tried to summarise some important and meaningful keepsakes and events from the past ten years. I hope you enjoy scrolling!✨✨✨

I believe this was the first ever Frozen-related pic that I saved (it's the oldest in my album) (April 2015)

I was equally in love with the OUAT Frozen arc and no one can tell me Georgina and Elizabeth were anything but perfect for their roles (April 2015)

🥹🥹🥹

(March 2015)

In just a couple of years we saw the franchise grow (did anyone else prefer the original logo for the musical?) (February 2016)

The official announcement we'd all been waiting for (April 2017)

The architect in me loved the castle! (2017)

I mean, who could ever forget this moment? (December 2018)

AJHFSJASJFKAGKJFGSKFDSGSJF!?!?!?!?!?!? (February 2019)

What are those????? (February 2019)

My first piece of "big" Frozen merch (April 2019)

I made a custom calendar just to count down the remaining days to Frozen II (I also avoided spoilers for the last 6 1/2 months) (December 2019)

🥹🥰😭

(December 2019)

Perfectly balanced, as it should be (February 2020)

Me collecting stuff! (February 2020)

Me going crazy saving as much Frozen content as possible 😅 (August 2020)

I joined r/Frozen (June 2021)

I started my deep-dive into Arendelle's geography in 2021 which ultimately lead to "An odyssey through Frozen geography", the first of many fandom projects! (July 2021)

Together with a group of equally dedicated Frozen nerds fans, I helped building the @arendelle-archives server and later tumblr-blog! (2021)

Collecting more things! (October 2021)

A Frozen comic writer responded to my reddit post?😲(December 2021)

I started developing ideas for a Frozen fanfic (2022)

Frozen III-announcement! Finally! (February 2023)

My Norway-trip of 2023. Without a doubt one of the most beautiful destinations on Earth and a must-go for anyone who wants to visit the real Arendelle!!! (July 2023)

I continue to delve into more map-related stuff in Wonderdraft (May 2024)

Together with the rest of the wonderful folks over at @frozen10fanzine, I helped create and design a fanzine summarising the memories of Frozen fans from the past decade! (July 2024)

A slice of my current Frozen collection! Some figures were very kindly donated to me by @yumeka-sxf 🙌 (July 2024)

And lastly, from today: the first snow of the season❄️🩵

If you made it this far, thank you for scrolling😅

Finally, a little shout-out to friends and acquaintances I've made through the likes of reddit, discord and tumblr in the past few years:

@bigfrozenfan @yumeka-sxf @greatqueenanna @queenritaofarendelle @saiten-gefroren @snowflaketale12 @cloudberriesforaqueen @theartoffrozen @secretsofthestorymakers

A big thank you also to the whole @arendelle-archives and @frozen10fanzine - teams! Y'all continue to inspire me!

#frozen#frozen 2#disney frozen#elsa#anna#frozen fandom#frozen10#frozen 3#frozen 4#arendelle archives#frozen memories#frozen fanzine#long post

41 notes

·

View notes

Text

List of Speak Now TV-related Easter eggs Taylor has dropped recently (just drop it already ffs)

NB: I'm only including hints that are obvious and don't require mental gymnastics. Your mileage might vary, of course.

27 February 2020: The Man music video is released, with the iconic graffitied wall showing Speak Now coming after Red.

26 October 2020: Taylor posts this TikTok.

I really think this is a really obvious hint, but nobody ever seems to talk about it... anyways notice how the colours of the garments she points at go purple > blue > green > black?

9 November 2021: Red (Taylor's Version) signed CDs go on sale. On her website, the price $20.10 is written in purple.

12 November 2021: "Red is about to be mine again, but it has always been ours."

13 December 2021: Taylor turns 32. Her AMA award for Speak Now can be seen in this photo she posts.

20 January 2021: Taylor is named 2022 Record Store Day Ambassador. The logo uses purple text and we lose our minds.

5 May 2022: Taylor Nation drops Speak Now (and 1989) merch for some reason.

Apparently, this was to show the Speak Now trademark was still being used, but I'm still putting it here.

21 October 2022: Anti-Hero music video released.

The koi fish guitar from the Speak Now World Tour makes an appearance.

Also, in the official YouTube video for the TSAntiHeroChallenge thing, she wears the purple dress from the Speak Now tour.

25 October 2022: Bejeweled music video released.

This day is the 12th anniversary of Speak Now.

Enchanted plays at the beginning.

Laura Dern says "Speak not".

Taylor presses the 3 button in the elevator, which is coloured purple.

The 13 button and the 13th indicator light (representing the album after Midnights) are also purple.

Taylor's hairpin says "SN".

Koi fish appears in the windows of the castle.

Long Live plays at the end.

1 November 2022: "I'm enchanted to announce my next tour..."

27 January 2023: Lavender Haze music video released.

The koi fish appears again.

29 January 2023: The official Taylor Swift 2024 calendar is shown on the publisher's website. It features photos from the Speak Now tour.

The cover picture is the same one used in the Eras Tour to represent the Speak Now era.

It will be available for purchase on July 20th.

17 March 2023: Taylor drops If This Was A Movie (TV), which was a deluxe track on Speak Now, and Safe & Sound and Eyes Open (TV), which were first performed live on the Speak Now tour.

9 April 2023: Photos from the set of a music video being filmed in Liverpool are leaked. The Speak Now tour flying balcony and piano can be seen.

13 April 2023: Taylor says that "recently one of my albums has been on my mind a lot" before performing Speak Now.

1 May 2023: Taylor posts this. The purple heart speaks for itself.

5 May 2023: WE WON. WE FINALLY WON.

207 notes

·

View notes

Note

I just wanted to say thank you for running this event for the past few years. It was what got me into this fandom and once I started writing one of my favourite events to participate in.

Thank you so much <3333

Thank you for your kind words 🥺

And to think this event was what got you into Maribat! 🥺 Very honored to know that this event got you to write for the fandom QuQ

When I first thought of wanting to start this event, I think I was just getting into Maribat myself, having a few fics out on A03 and seeing new tropes emerge in the fandom. And out of the tropes, I started to love the bio!dad trope, becoming a sucker for the damn trope and noticed there wasn't enough!

And I thought, oh, maybe I should write for it! And I did! But then I thought, should I start an event for it?

At this time, Maribat March, Angst April (or I think that was what it was called) and Daminette December were the major events and when I thought about those events... I became skeptical of myself.

Because I didn't have a large following like those blogs...I wasn't well known as other writers/artists in the fandom..

I remember asking the Maribat Insanity server if I should even do an event because...did anyone else like the trope?? After all, there were so little works...

And my god...the amount of support I got and the amount of people who encouraged me to give it a try...

So I gave it a shot.

I made an interest form May 2020 and by June 2020, the first calendar of the event was post and on September 2020, the event launched.

And so many people participated, writing fics on Tumblr, linking their works from A03, making art...

In 2021, people still participated and even extended the trope from Bruce being Mari's bio dad to other characters like Luka and Kagami.

In 2022 and 2023, not many people participated but I still hosted it because people were excited to create works for the fandom.

And I think...I think that is why I still hosted the event for the past four years...

The Maribat community was the first crossover community I dared to join after a friend introduced me to it and honestly was one of the most welcoming, most creative communities I've been a part of and a community I will always hold dearly to my heart.

They inspired me to write, to grow as a writer, as a person and knowing this event introduced you to this community and helped you start your journey as a fellow writer... it really means a lot and once again shows how the community just continues to inspire...

So again...thank you, from the bottom of my heart <3 and I'm happy you enjoyed writing for this event <3

Thank you.

6 notes

·

View notes

Text

How to calculate the Employee Retention Credit accurately?

In the evolving landscape of business and finance, understanding tax credits and incentives is crucial for organizations to optimize their fiscal responsibilities and ensure compliance. One such critical incentive is the Employee Retention Credit (ERC). This blog post will delve into the intricacies of calculating the Employee Retention Credit accurately, providing you with a comprehensive guide. Ignite HCM is dedicated to helping businesses navigate this complex terrain with ease and precision.

Understanding the Employee Retention Credit

The Employee Retention Credit is a refundable tax credit aimed at encouraging businesses to keep employees on their payroll during periods of economic distress. Initially introduced as part of the CARES Act in response to the COVID-19 pandemic, the ERC has undergone several modifications, making it essential for businesses to stay updated on the latest criteria and calculation methods.

Eligibility Criteria

Before diving into the calculation process, it’s essential to understand the eligibility criteria for claiming the Employee Retention Credit:

Business Operations:

The business must have been fully or partially suspended due to governmental orders related to COVID-19 during the applicable calendar quarter.

Gross Receipts Decline:

Alternatively, businesses can qualify if they experience a significant decline in gross receipts. For 2020, this means a 50% decline compared to the same quarter in 2019. For 2021, the threshold was reduced to a 20% decline compared to the same quarter in 2019.

Qualified Wages:

The definition of qualified wages depends on the size of the employer. For employers with more than 100 full-time employees, qualified wages are those paid to employees not providing services due to suspension or decline in business. For smaller employers, all employee wages qualify, whether the employee is providing services or not.

Calculation of the Employee Retention Credit

The ERC is calculated as a percentage of qualified wages paid to employees during eligible periods. The specific percentages and wage caps vary depending on the year:

For 2020:

The credit is 50% of qualified wages paid between March 13, 2020, and December 31, 2020.

The maximum amount of qualified wages for each employee is $10,000, making the maximum credit per employee $5,000 for the year.

For 2021:

The credit is 70% of qualified wages paid between January 1, 2021, and September 30, 2021.

The maximum amount of qualified wages per employee per quarter is $10,000, making the maximum credit per employee $7,000 per quarter.

For businesses that started operations after February 15, 2020, and have annual gross receipts of less than $1 million, the credit can be claimed for wages paid through December 31, 2021, under the "Recovery Startup Business" provision.

Detailed Steps to Calculate the Employee Retention Credit

Determine Eligibility:

Assess if your business qualifies based on the criteria outlined above. This involves reviewing government orders, gross receipts, and employee status during the relevant periods.

Identify Qualified Wages:

Once eligibility is established, identify the wages that qualify for the credit. This includes health plan expenses that are properly allocable to the qualified wages.

Calculate the Credit:

For 2020: Multiply the qualified wages by 50%. Ensure that the total qualified wages do not exceed $10,000 per employee for the entire year.

For 2021: Multiply the qualified wages by 70%. Ensure that the total qualified wages do not exceed $10,000 per employee per quarter.

Claim the Credit:

To claim the Employee Retention Credit, businesses must report the total qualified wages and the related health insurance costs on their quarterly employment tax returns (Form 941 for most employers). If the credit exceeds the amount of payroll taxes owed, the excess can be refunded by filing Form 941-X, Adjusted Employer's Quarterly Federal Tax Return or Claim for Refund.

Common Mistakes to Avoid

To ensure accuracy in calculating the Employee Retention Credit, it’s vital to avoid common pitfalls:

Incorrect Eligibility Assessment:

Misinterpreting the eligibility criteria can lead to incorrect claims. Ensure you understand the specific requirements for suspension of operations and gross receipts decline.

Misclassification of Qualified Wages:

Distinguish between qualified and non-qualified wages accurately. Include only those wages paid during eligible periods and for eligible employees.

Failing to Consider Health Plan Expenses:

Health plan expenses allocable to qualified wages are part of the credit calculation. Overlooking these can result in a lower credit amount.

Improper Filing:

Ensure that the credit is claimed on the correct forms and within the stipulated time frames. Late or incorrect filings can delay refunds or lead to penalties.

Ignite HCM: Your Partner in Navigating ERC

Calculating the Employee Retention Credit accurately requires a deep understanding of the applicable laws and diligent record-keeping. Ignite HCM specializes in helping businesses optimize their HR and payroll processes, including the accurate calculation and claiming of tax credits like the ERC.

Expert Guidance:

Our team of experts stays abreast of the latest regulatory updates, ensuring that your business remains compliant and maximizes its credit potential.

Comprehensive Solutions:

Ignite HCM offers comprehensive payroll and HR solutions that streamline the process of identifying eligible wages and calculating the ERC. Our integrated systems ensure that all relevant data is accurately captured and reported.

Customized Support:

We understand that every business is unique. Our tailored support services ensure that your specific circumstances are considered in the calculation and claiming of the Employee Retention Credit.

Practical Example

To illustrate the calculation process, let’s consider a practical example:

Scenario: ABC Corp has 50 full-time employees. In Q2 2020, the company’s operations were partially suspended due to a state mandate. The gross receipts for Q2 2020 declined by 60% compared to Q2 2019. ABC Corp continued to pay wages to all employees during the suspension.

Step-by-Step Calculation:

Eligibility:

ABC Corp qualifies based on both suspension of operations and a significant decline in gross receipts.

Qualified Wages:

Since ABC Corp has less than 100 employees, all wages paid during the suspension period are qualified wages. Assume the total qualified wages paid in Q2 2020 is $400,000.

Calculate the Credit:

For Q2 2020, the credit is 50% of $400,000, which equals $200,000.

Claim the Credit:

ABC Corp reports the qualified wages and claims the $200,000 credit on its Q2 2020 Form 941.

For 2021, assume ABC Corp experienced a 25% decline in gross receipts in Q1 and Q2. The total qualified wages in each quarter were $500,000.

Step-by-Step Calculation:

Eligibility:

ABC Corp qualifies based on the gross receipts decline.

Qualified Wages:

Assume the total qualified wages in Q1 and Q2 2021 is $500,000 each quarter.

Calculate the Credit:

For Q1 2021, the credit is 70% of $500,000, which equals $350,000. The same calculation applies for Q2 2021.

Claim the Credit:

ABC Corp reports the qualified wages and claims $350,000 each for Q1 and Q2 2021 on its respective Form 941 filings.

Conclusion

Accurate calculation of the Employee Retention Credit can significantly impact your business’s financial health, providing much-needed relief during challenging times. Ignite HCM is here to support you through every step of the process, ensuring that you maximize your credit potential while maintaining compliance with all regulatory requirements.

For more information on how Ignite HCM can assist you in calculating and claiming the Employee Retention Credit, visit our website or contact our expert team today. Together, we can navigate the complexities of tax credits and optimize your business’s financial strategy.

Website : https://www.ignitehcm.com/solutions/employee-retention-credit

Phone : +1 301-674-8033

#Employee Retention Credit#Business Tax Credit#Tax Credit#Business Incentives#Payroll Tax Credit#Employee Retention#Tax Relief#BusinessTax Savings

1 note

·

View note

Text

FAQs About The California Employee Retention Credit

California employers are encouraged to take advantage of the California Employee Retention Credit before it expires. But what is this tax credit? Who qualifies? Is ERC taxable in California? In this article, Dominion Enterprise Services’ CPA Skyler Kressin breaks down the ERC and how it can benefit your business.

Like many business owners, California employers were subjected to extreme challenges during 2020 and 2021 and even extending into 2022. Business operations often were fully or partially suspended due to state or local health orders, revenue swings occurred unexpectedly, labor shortages abounded, and the unknowns related to global economic conditions created a difficult environment for businesses of all stripes due to COVID-19.

In the midst of these difficult times, various federal programs were created to mitigate these challenges, including the CARES Act and the American Rescue Plan Act. Each of these had provisions for relief, such as advance payment programs or forgivable business loans such as the Payment Protection Program (PPP loan).

While many businesses took advantage of these relief provisions, the sheer volume of legislation signed into law in the last several years has resulted in some of the key relief provisions for employers to be overlooked in the effort to keep the lights on and business flowing.

One such relief provision that consistently has been overlooked was created specifically for employers who continued to pay wages and federal employment taxes throughout the official “pandemic period” (March 12, 2020, through the third quarter of 2021) in the form of an employer tax credit, officially called the Employee Retention Credit (ERC).

The good news is, for California employers specifically, this federal tax credit may be much easier to obtain than for those who own and operate businesses in other states, due to how eligibility works.

High-level Features of the ERC for California Employers:

• The credit is up to $26,000 per employee for a fully eligible employer.

• The credit is a federal refundable tax credit, meaning you can claim a refund directly in the form of a check from the IRS, and the ERC is NOT a loan or grant through a bank like the PPP.

• That said, the other relief programs, (such as the PPP) do interact with the ERC but importantly, do NOT make you ineligible for the ERC as was previously widely believed – even those who received both rounds of PPP funding are still potentially eligible for the ERC.

• The claim is made through federal payroll tax filings and entails tax calculations customarily performed by tax professionals.

• The eligible filing period for the ERC begins to expire in April 2023 as the statute of limitations for refunds begins to sunset.

Who is Eligible for the ERC?

Eligibility for the ERC is determined on a calendar quarter basis (corresponding to each federal filing period) and can be achieved in one of two ways:

1. Gross Receipts Test

Employers must show a specified percentage decline in gross receipts, quarter-over-quarter when comparing a given quarter in 2019 to the same quarter in 2020 or 2021. For example, the quarter ending December 31, 2019, compared to the quarter ending December 31, 2020, must show a specific percentage decline. Specifically, 2020 needs to show a decline of 50% in at least one quarter, and 2021 needs to show a decline of 20% in at least one quarter – BOTH compared to the equivalent quarters in 2019.

2. Trade or Business Operations Disruption Test

This test is where there may be advantages for the California Employee Retention Credit as opposed to the relative eligibility in other states. Eligibility under this test all hinges on whether direct state or local government orders restricted business operations for employers during the pandemic period. California was one of the more restrictive jurisdictions as compared to other U.S. states and localities, so ERC eligibility is more likely to be achieved for California employers than in other jurisdictions.

As with all federal legislation and tax law, there are nuances and fine print to the above eligibility tests that go beyond the scope of this article and edge cases that require parsing through grey areas. This is where working with a qualified and licensed tax professional who specializes in tax credits comes into play. Many who are otherwise eligible for the ERC may be leaving money on the table, or otherwise working off an incomplete assessment of the full scope of their eligibility.

Is ERC Taxable in California?

Another benefit of the ERC is that, in general, it is not taxable on your California income tax return, as per FTB Publication 1001. That said, given it is a federal credit, it does directly impact your federal income tax filing and may result in the need to modify your federal income tax filing.

Dominion Can Help

Dominion Enterprise Services, PLLC is a full-service licensed CPA firm, with broad experience in helping California employers with various tax credits and consulting and has broad familiarity with the Employee Retention Credit specifically for the state and local legislative and regulatory environment in California during the pandemic period.

Our model is based on a transparent assessment of the facts and circumstances of each business we work with and working with existing tax preparers and payroll providers in ensuring the maximum claim for the ERC in California is pursued under the law.

Given the unique regulatory landscape of California, don’t miss out on this opportunity to claim the California Employee Retention Tax Credit before the eligible filing period ends in April 2023. If you would like us to help with this process, please click on the button below and fill out our quick, one-minute questionnaire.

#dominion enterprise services in usa#employee retention credit for business in usa#employee retention tax credit in usa#tax consulting services in usa#new employee retention credit rules in usa

0 notes

Text

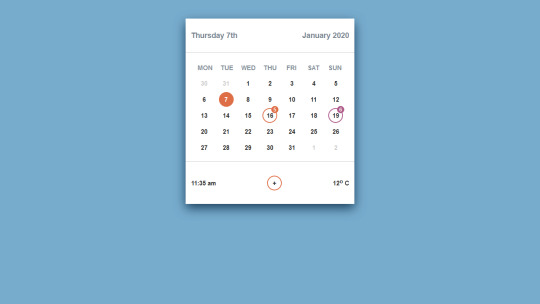

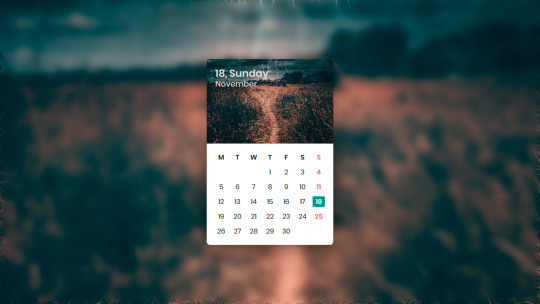

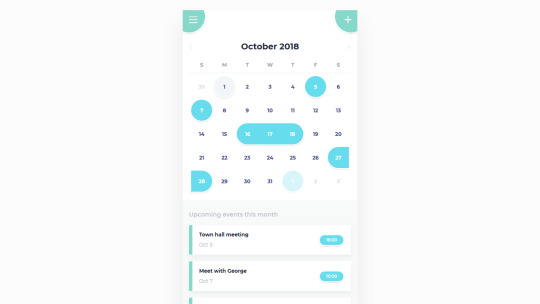

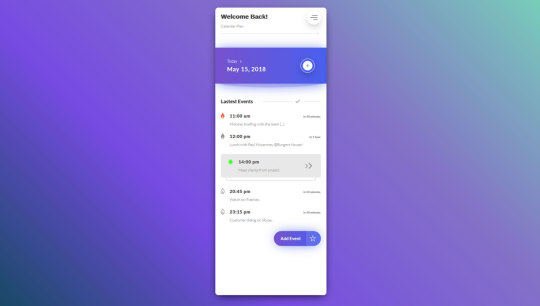

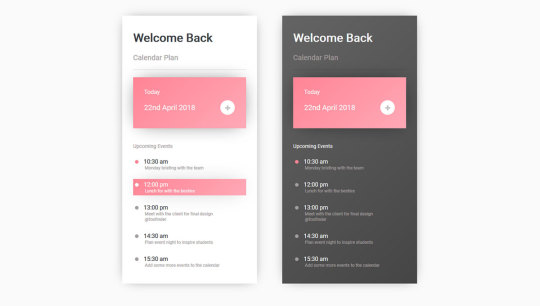

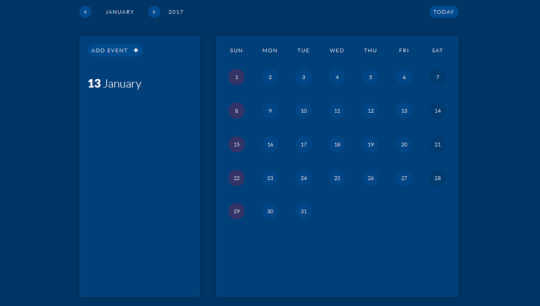

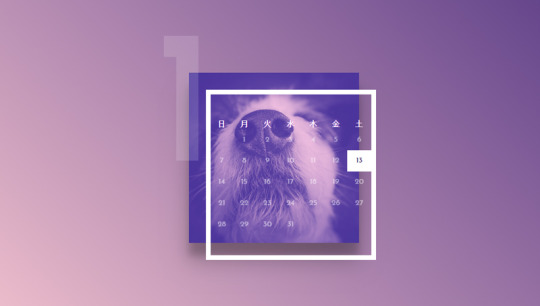

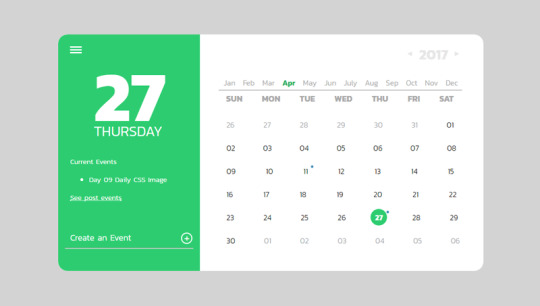

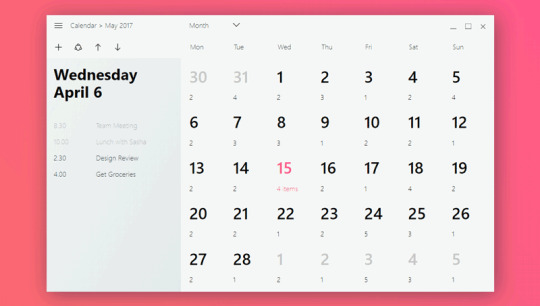

Explore 40+ CSS Calendars

Welcome to CSS Monster, your go-to destination for exploring our latest collection of CSS calendars, thoughtfully curated for July 2023. This collection showcases the creativity and innovation of HTML and CSS with six new items hand-picked from various reputable resources like CodePen and GitHub. Each calendar code example in this collection is not only visually appealing but also functional, providing a powerful demonstration of what can be achieved with HTML and CSS. CSS calendars stand as indispensable tools for web developers and designers alike. They offer an elegant solution for tracking events, appointments, or deadlines within a website or application. The true beauty of CSS calendars lies in their adaptability; with the prowess of CSS, these calendars can be seamlessly styled to complement any aesthetic or theme, making them a versatile addition to any project. We invite you to delve into our collection of CSS calendars, where inspiration meets education. Whether you're a seasoned developer or just embarking on your coding journey, these code examples are crafted to be both inspiring and instructive. It's worth noting that all items in our collection are freely available for use. Feel empowered to incorporate them into your projects or leverage them as a starting point for crafting your own unique creations. Happy coding, and may your projects flourish with the dynamic functionality and aesthetic appeal of CSS calendars!

Author Shraddha October 19, 2022 Links Just Get The Demo Link How To Download - Article How To Download - Video Made with HTML (Pug) / CSS (SCSS) About a code CSS WINTER ANIMATION CALENDAR Compatible browsers:Chrome, Edge, Firefox, Opera, Safari Responsive:no Dependencies:-

Author Pepita K. February 17, 2022 Links Just Get The Demo Link How To Download - Article How To Download - Video Made with HTML / CSS (SCSS) About a code CALENDAR Compatible browsers:Chrome, Edge, Firefox, Opera, Safari Responsive:no Dependencies:-

Author Cătălin George Feștilă February 15, 2022 Links Just Get The Demo Link How To Download - Article How To Download - Video Made with HTML / CSS About a code DAYS Compatible browsers:Chrome, Edge, Firefox, Opera, Safari Responsive:yes Dependencies:-

Author Josiah Thomas February 14, 2022 Links Just Get The Demo Link How To Download - Article How To Download - Video Made with HTML / CSS About a code CALENDAR Compatible browsers:Chrome, Edge, Firefox, Opera, Safari Responsive:yes Dependencies:-

Author Una Kravets March 15, 2021 Links Just Get The Demo Link How To Download - Article How To Download - Video Made with HTML / CSS (SCSS) About a code CSS-ONLY CALENDAR LAYOUT Compatible browsers:Chrome, Edge, Firefox, Opera, Safari Responsive:no Dependencies:-

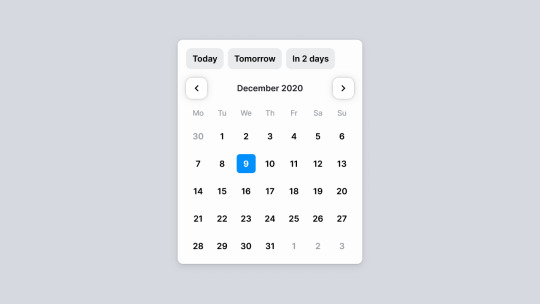

Author Håvard Brynjulfsen January 16, 2021 Links Just Get The Demo Link How To Download - Article How To Download - Video Made with HTML / CSS (SCSS) About a code DATEPICKER Compatible browsers:Chrome, Edge, Firefox, Opera, Safari Responsive:no Dependencies:-

Author Tutul July 4, 2020 Links Just Get The Demo Link How To Download - Article How To Download - Video Made with HTML / CSS (SCSS) About a code CALENDAR UI Compatible browsers:Chrome, Edge, Firefox, Opera, Safari Responsive:no Dependencies:-

Author Mark Eriksson June 3, 2020 Links Just Get The Demo Link How To Download - Article How To Download - Video Made with HTML / CSS (SCSS) About a code CALENDAR Compatible browsers:Chrome, Edge, Firefox, Opera, Safari Responsive:no Dependencies:-

Author mrnobody November 18, 2018 Links Just Get The Demo Link How To Download - Article How To Download - Video Made with HTML / CSS (SCSS) About a code CSS CALENDAR UI DESIGN Compatible browsers:Chrome, Edge, Firefox, Opera, Safari Responsive:yes Dependencies:-

Author Eliza Rajbhandari December 10, 2018 Links Just Get The Demo Link How To Download - Article How To Download - Video Made with HTML / CSS (SCSS) About a code CALENDAR MOBILE APP UI Compatible browsers:Chrome, Edge, Firefox, Opera, Safari Responsive:yes Dependencies:ionicons.css

Author Ahmed Nasr May 25, 2018 Links Just Get The Demo Link How To Download - Article How To Download - Video Made with HTML / CSS (SCSS) About a code CALENDAR PLAN - TASKS EVENTS APP

Author BradleyPJ April 22, 2018 Links Just Get The Demo Link How To Download - Article How To Download - Video Made with HTML / CSS (SCSS) About a code LIGHT & DARK CALENDAR

Author jpag October 25, 2017 Links Just Get The Demo Link How To Download - Article How To Download - Video Made with HTML About a code SIMPLE CALENDAR

Author yumeeeei August 6, 2017 Links Just Get The Demo Link How To Download - Article How To Download - Video Made with HTML About a code DUOTONE CALENDAR

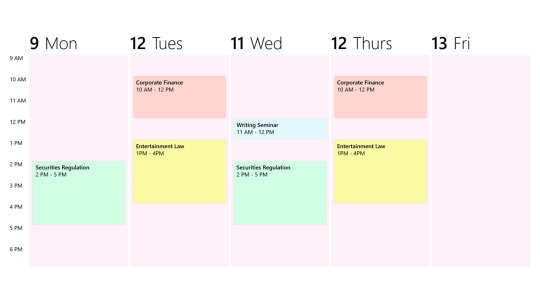

Author Antoinette Janus June 12, 2017 Links Just Get The Demo Link How To Download - Article How To Download - Video Made with HTML (Pug) / CSS (SCSS) / JavaScript About a code FLUENT DESIGN: CALENDAR

Author Alex Cramer June 8, 2017 Links Just Get The Demo Link How To Download - Article How To Download - Video Made with HTML About a code CALENDAR UI

Author Tom May 15, 2017 Links Just Get The Demo Link How To Download - Article How To Download - Video Made with HTML About a code WINDOWS FLUENT DESIGN CALENDAR

Author Davide Francesco Merico May 11, 2017 Links Just Get The Demo Link How To Download - Article How To Download - Video Made with HTML/Pug About a code CALENDAR UI

Author Jocelyn April 11, 2017 Links Just Get The Demo Link How To Download - Article How To Download - Video Made with HTML About a code CALENDAR Read the full article

0 notes

Text

Methods for Calculating the Employee Retention Credit

In order to help businesses recover from the effects of the COVID-19 epidemic, the government has created a tax credit known as the Employee Retention Credit (ERC). In order to survive and recover from the economic depression caused by the epidemic, the ERC provides considerable subsidies to qualifying enterprises that retain employment. This piece will describe how Employee Retention Credit works, along with its prerequisites and advantages.

What is the Employee Retention Credit?

The Employee Retention Credit is a tax credit that allows eligible businesses to offset a portion of their payroll taxes against their tax liability. The ERC helps businesses retain employees during the COVID-19 pandemic by providing them with a financial incentive to keep their staff on the payroll. Cares Act, in March 2020, introduced the ERC.

Who is eligible for the Employee Retention Credit?

Businesses impacted by the COVID-19 pandemic may be eligible for the Employee Retention Credit. Eligible businesses include those that:

Had to fully or partially suspend their operations due to a government order related to COVID-19, OR

Have experienced a significant decline in gross receipts (at least 20%) compared to the same calendar quarter in 2019.

How much is the Employee Retention Credit worth?

The Employee Retention Credit is worth up to 70% of eligible wages paid to each employee, up to a maximum of $10,000 per employee per quarter. Besides, you can also claim the credit for wages paid between March 13, 2020, and December 31, 2021.

How to claim the Employee Retention Credit?

Businesses can claim the Employee Retention Credit by filing Form 941, Employer's Quarterly Federal Tax Return. Employers can apply for the credit against their Social Security taxes. Alternatively, businesses can request an advance credit payment by filing Form 7200, Advance Payment of Employer Credits Due to COVID-19.

What are the requirements for claiming the Employee Retention Credit?

To claim the Employee Retention Credit, businesses must meet certain ERC requirements, including:

The business must have operated for all or part of the calendar year 2020 or 2021.

They must have experienced a full or partial suspension of operations due to a government order related to COVID-19 OR a significant decline in gross receipts.

The business must have paid eligible wages to eligible employees during the covered period.

The business must not have received a Paycheck Protection Program (PPP) loan, or if it did receive a PPP loan, it must have used the loan proceeds for expenses other than those that qualify for PPP loan forgiveness.

Can businesses claim both the PPP and the ERC?

Yes, businesses can claim both the PPP and the ERC, but they cannot use the same wages for both programs. This means businesses can use the PPP loan funds for certain expenses and claim the ERC for other eligible wages. However, businesses must ensure they do not double-dip and use the same wages for both programs. It is important to consult with a tax professional to determine the best strategy for maximizing the benefits of both programs.

What are the benefits of the Employee Retention Credit?

The Employee Retention Credit (ERC) is a tax credit that significantly benefits eligible businesses. Some of the ERC benefits include:

Cash refund

The ERC is refundable, meaning eligible businesses can receive a cash refund for any credit amount that exceeds their payroll tax liability.

Tax credit

The ERC is a tax credit that can be applied against payroll taxes, including Social Security and Medicare taxes.

Retention of employees

The ERC incentivizes businesses to retain their employees by providing a credit for eligible wages paid during the pandemic.

Up to $33,000 per employee

Eligible businesses can claim a credit of up to $7,000 per employee per quarter, for a total credit of up to $33,000 per employee for wages paid between March 13, 2020, and December 31, 2021.

Expanded eligibility

The American Rescue Plan Act expanded the ERC eligibility to include businesses that received PPP loans as long as they met certain ERC requirements.

How Does the Employee Retention Credit Work?

The Employee Retention Credit (ERC) is a tax credit that provides financial assistance to eligible businesses affected by the COVID-19 pandemic. The ERC is designed to encourage businesses to retain employees and continue paying wages during the pandemic. Here's how it works:

Eligibility

To be eligible for the ERC, a business must have experienced a significant decline in gross receipts or have been partially or fully suspended due to a government order during the pandemic.

Calculation of credit

The ERC is calculated based on the wages paid to eligible employees during the qualifying period. For wages paid between March 13, 2020, and December 31, 2020, the credit is 50% of eligible wages, up to a maximum of $5,000 per employee. For wages paid between January 1, 2021, and December 31, 2021, the credit is increased to 70% of eligible wages.

Qualified wages

Eligible wages for the ERC include wages paid to employees during the qualifying period, including health benefits.

Claiming the credit

Businesses can claim the ERC on their quarterly employment tax returns, including Form 941. You can use a payroll tax credit to offset payroll taxes or to get a refund if the credit exceeds payroll taxes.

Interaction with PPP

As of March 2021, businesses that received a PPP loan can also claim the ERC. But not for the same wages used to calculate PPP loan forgiveness. This means businesses can receive both the PPP loan and the ERC for different wages.

0 notes

Link

0 notes

Text

FAQs About The California Employee Retention Credit

California employers are encouraged to take advantage of the California Employee Retention Credit before it expires. But what is this tax credit? Who qualifies? Is ERC taxable in California? In this article, Dominion Enterprise Services’ CPA Skyler Kressin breaks down the ERC and how it can benefit your business.

Like many business owners, California employers were subjected to extreme challenges during 2020 and 2021 and even extending into 2022. Business operations often were fully or partially suspended due to state or local health orders, revenue swings occurred unexpectedly, labor shortages abounded, and the unknowns related to global economic conditions created a difficult environment for businesses of all stripes due to COVID-19.

In the midst of these difficult times, various federal programs were created to mitigate these challenges, including the CARES Act and the American Rescue Plan Act. Each of these had provisions for relief, such as advance payment programs or forgivable business loans such as the Payment Protection Program (PPP loan).

While many businesses took advantage of these relief provisions, the sheer volume of legislation signed into law in the last several years has resulted in some of the key relief provisions for employers to be overlooked in the effort to keep the lights on and business flowing.

One such relief provision that consistently has been overlooked was created specifically for employers who continued to pay wages and federal employment taxes throughout the official “pandemic period” (March 12, 2020, through the third quarter of 2021) in the form of an employer tax credit, officially called the Employee Retention Credit (ERC).

The good news is, for California employers specifically, this federal tax credit may be much easier to obtain than for those who own and operate businesses in other states, due to how eligibility works.

High-level Features of the ERC for California Employers:

• The credit is up to $26,000 per employee for a fully eligible employer.

• The credit is a federal refundable tax credit, meaning you can claim a refund directly in the form of a check from the IRS, and the ERC is NOT a loan or grant through a bank like the PPP.

• That said, the other relief programs, (such as the PPP) do interact with the ERC but importantly, do NOT make you ineligible for the ERC as was previously widely believed – even those who received both rounds of PPP funding are still potentially eligible for the ERC.

• The claim is made through federal payroll tax filings and entails tax calculations customarily performed by tax professionals.

• The eligible filing period for the ERC begins to expire in April 2023 as the statute of limitations for refunds begins to sunset.

Who is Eligible for the ERC?

Eligibility for the ERC is determined on a calendar quarter basis (corresponding to each federal filing period) and can be achieved in one of two ways:

1. Gross Receipts Test

Employers must show a specified percentage decline in gross receipts, quarter-over-quarter when comparing a given quarter in 2019 to the same quarter in 2020 or 2021. For example, the quarter ending December 31, 2019, compared to the quarter ending December 31, 2020, must show a specific percentage decline. Specifically, 2020 needs to show a decline of 50% in at least one quarter, and 2021 needs to show a decline of 20% in at least one quarter – BOTH compared to the equivalent quarters in 2019.

2. Trade or Business Operations Disruption Test

This test is where there may be advantages for the California Employee Retention Credit as opposed to the relative eligibility in other states. Eligibility under this test all hinges on whether direct state or local government orders restricted business operations for employers during the pandemic period. California was one of the more restrictive jurisdictions as compared to other U.S. states and localities, so ERC eligibility is more likely to be achieved for California employers than in other jurisdictions.

As with all federal legislation and tax law, there are nuances and fine print to the above eligibility tests that go beyond the scope of this article and edge cases that require parsing through grey areas. This is where working with a qualified and licensed tax professional who specializes in tax credits comes into play. Many who are otherwise eligible for the ERC may be leaving money on the table, or otherwise working off an incomplete assessment of the full scope of their eligibility.

Is ERC Taxable in California?

Another benefit of the ERC is that, in general, it is not taxable on your California income tax return, as per FTB Publication 1001. That said, given it is a federal credit, it does directly impact your federal income tax filing and may result in the need to modify your federal income tax filing.

Dominion Can Help

Dominion Enterprise Services, PLLC is a full-service licensed CPA firm, with broad experience in helping California employers with various tax credits and consulting and has broad familiarity with the Employee Retention Credit specifically for the state and local legislative and regulatory environment in California during the pandemic period.

Our model is based on a transparent assessment of the facts and circumstances of each business we work with and working with existing tax preparers and payroll providers in ensuring the maximum claim for the ERC in California is pursued under the law.

Given the unique regulatory landscape of California, don’t miss out on this opportunity to claim the California Employee Retention Tax Credit before the eligible filing period ends in April 2023. If you would like us to help with this process, please click on the button below and fill out our quick, one-minute questionnaire.

#Tax Consulting Services in USA#dominion enterprise services in usa#employee retention credit for business in usa#employee retention tax credit in usa

0 notes

Text

How To Claim Up To $26,000 ERC Credit Per W-2 Employee

Employee Retention Credit is a great way for employers to save money while keeping their employees. It's an incentive that can help with hiring and retaining workers during these tough economic times. Employers who qualify can get up to $5,000 per employee in tax credits.

Let’s take a closer look at what this https://www.applyercrefund.com/ credit is all about and how it works.

Employee Retention Credit is available through the Coronavirus Aid, Relief, and Economic Security (CARES) Act of 2020. This act was passed by Congress as part of the federal government's response to the financial crisis caused by COVID-19. The credit helps businesses keep their employees on payroll even if they're having financial trouble due to the pandemic.

Employers who are eligible may receive up to $5,000 in tax credits for each employee they retain from March 13th 2020 until December 31st 2020.

Overview Of The Credit Program

The Employee Retention Credit is a great way for businesses to save money. It helps companies keep employees on staff when times are tough. Companies can get up to $5,000 per employee depending on their size and other factors.

It's easy to apply for the credit. Businesses just need to fill out some paperwork and provide proof of wages paid during the relevant tax period. They also have to make sure they meet all eligibility criteria. The IRS has guidance available online that explains everything in detail.

Applying for the credit may be worth it since it could lead to substantial savings over time. Plus, many states offer additional credits or incentives based on this federal program too! So even if you don't qualify at the federal level, there may still be ways to benefit from the program locally.

Qualifications For The Credit

The Employee Retention Credit program is an important one that employers should consider. It can help businesses keep their employees during these difficult times.

Now, let's take a look at who qualifies for the credit.

First off, any business with fewer than 500 full-time employees in 2020 can qualify. You may also be eligible if you're self-employed and looking to get this credit.

The credit covers up to 50% of wages paid from March 12th, 2020 through December 31st, 2020 up to $10,000 per employee annually. Wages include salary, health benefits and other compensation as well.

You'll need to make sure your gross receipts have declined by more than 20%. This means that compared to a previous quarter or year before 2020, your earnings must have decreased significantly.

Once you've met these qualifications and determined how much money you'd like back on your taxes, you can start claiming the credit!

Calculating Eligible Wages

Figuring out which wages qualify for the Employee Retention Credit can be tricky. It's important to understand what counts and how much you can get.

The credit applies to wages paid after March 12, 2020 and before January 1, 2021.

Eligible employers are those that experienced a full or partial suspension of their operations during this period due to orders from an appropriate governmental authority related to COVID-19, or if they saw a significant decline in gross receipts compared to the same quarter in 2019.

Wages used for calculating the credit must be qualified wages paid by the employer that aren’t more than $10,000 per employee for all calendar quarters.

Employers cannot receive both PPP loans and credits under this program at the same time - they have to pick one option or another.

To sum it up, eligible employers need to meet certain criteria regarding their business operations plus make sure any wages used toward the ERC don't exceed $10K/employee in order to take advantage of these credits. That's why understanding eligibility is so important!

Claiming The Credit

Employers who are looking to take advantage of the Employee Retention Credit can start by filling out Form 941-X.

This form is used for claiming wages and other payments that were covered under this credit.

It’s important to make sure all information on the form is accurate, as any mistakes could delay approval of the claim.

There may be additional forms needed depending on an employer’s specific situation.

For example, if a company has employees with different types of compensation, they will need to fill out more than one form.

Employers should consult their accountant or tax advisor before submitting any claim related to the Employee Retention Credit.

Once employers have completed the necessary paperwork, they can submit it to their local IRS office or file it electronically through the IRS website.

Once approved, businesses can receive up to 50% of qualified wages in credits against payroll taxes owed over a period of time.

Recordkeeping Requirements

The employee retention credit is now available for employers to take advantage of. It's important that they keep records of any payments made and wages paid, so they can prove their eligibility when filing taxes.

Employers must retain documents such as payroll tax filings, Form 941 reports, state income tax withholding forms, and more. They also need to show that they have not taken other credits related to the same expenses.

Keeping accurate records will help ensure everything goes smoothly when it comes time to file taxes. It's always best practice to make sure all paperwork is properly filed away in a safe place. This way if there are ever any questions or issues with the credit, the necessary information is easily accessible and ready for review by an auditor or IRS agent.

Conclusion

The Employee Retention Credit is a great way to help employers keep their staff employed during the pandemic. It can be used to cover some of the costs associated with employee wages and salaries, making it easier for businesses to stay afloat.

To get started claiming this credit, you need to make sure your business meets all the qualifications and then figure out how much eligible wages you're entitled to claim.

Once that's done, you'll need to file for the credit on your taxes and keep accurate records in case of an audit.

Overall, taking advantage of this program can be beneficial for both employers and employees alike.

As long as you meet all the requirements, calculate your eligible wages correctly and maintain proper recordkeeping, you’ll be able to take full advantage of this credit and use it towards keeping your workers employed.

1 note

·

View note

Link

#Dec 2020 Mar 2021 Calendar#Dec 2020 Calendar#January 2021 Calendar#March 2021 Calendar#Four Month Dec 2020 to Mar 2021 Calendar#December 2020 to March 2021 Calendar

0 notes

Link

#print december 2020 to march 2021 calendar#December 2020#December 2020 to March 2021 Calendar#March 2021 Calendar#Dec 2020 Mar 2021 Calendar#Four Month Dec 2020 to Mar 2021 Calendar

0 notes