#tax consulting services in usa

Explore tagged Tumblr posts

Text

Free Money Exists: Catherine Tindall of Dominion Enterprise Services

As a restaurant owner, if you have not pursued the Employee Retention Credit, you need to lock out two hours to get the analysis done for your company. Dollar for dollar is the most significant ROI activity any restaurant owner can do now if you haven’t taken advantage of the program. It’s based on headcount. If you have a decent-sized headcount, this could be a massive shot in the arm for your business. – Catherine Tindall, CPA CTC

1:05 [Josh Kopel]

Welcome to Full Comp! A show offers insight into the hospitality industry. We are featuring restaurateurs, thought leaders, and innovators. We served up on the house.

1:22 [Josh Kopel]

You could be sitting on a winning lottery ticket and not even know it. I’m talking about the Employee Retention Credit. I witnessed fellow restaurateurs receive six-digit checks by taking advantage of this extraordinary opportunity. As I’m sure you can imagine, I lack the expertise to discuss the ins and outs of the program, but I know someone who can. Her name is Catherine Tindall, and her company Dominion Enterprise Services specializes in helping restaurants get the most money from the credit with the least effort. I hope you came hungry because our old Uncle Sam is baking some bread today.

2:05 [Catherine]

I always use analogies. A bookkeeper’s your mom who knows first aid. A CPA is your general practitioner who’s going to be able to give you antibiotics. Your mom will be there with band-aids and that’s all you’ll need, those little reports. When it comes to making bigger decisions or strategizing around what’s going on in your business, a CPA can be much more helpful because they have much more professional experience and training than a bookkeeper.

2:51 [Josh Kopel]

Let’s talk about that. A CPA can do everything a bookkeeper can do, but a bookkeeper cannot do everything that a CPA can do.

3:00 [Catherine]

The other distinction is that a CPA can do things that a bookkeeper can do but do you want to pay your doctor to put on band-aids? That’s the analogy. Many people try to get their CPAs to do things that are a little too menial rather than just having a bookkeeper or having other people in place to handle certain parts of what’s going on financially. Accounting is a very broad field, and there are many pieces to it. To have me, a tax specialist, do things that a bookkeeper can do doesn’t make sense.

3:45 [Josh Kopel]

What was your path to entrepreneurship? What problem did you feel you were solving when you created Dominion?

3:52 [Catherine]

When I was in school, I originally started in medicine. I wanted what I was doing to change people’s lives and help them. I wanted to be helping people as my profession. As I went further into it, I realized that it wasn’t going to be a good fit for a number of reasons. My parents were both CPAs and had a tax practice. They told me to take an accounting course, and you can see where that ended. I enjoyed it, and I found this special thing with accounting. I enjoyed the numbers. I enjoyed the logic of it, and I really enjoy the fact that people are so intimidated by it and feel so out of control with it. And I can bridge that gap for them and use the knowledge I have to make it intelligible, especially with the tax side of things, because I’m primarily a tax planner and a tax specialist.

People are so intimidated by taxes, and it’s so expensive and painful to be able to bridge that gap and help them understand how it works. To help them reduce how much they’re paying in a way that really moves the needle for their business. I find it extremely satisfying. What pushed me to start my firm is my experiences where there’s not a lot of thought leadership that comes from accountants. They tend to be very “in the box” thinkers, very backward-looking, historically oriented, and just trying to be compliance oriented. So I found that what I wanted to do was help business owners, and I needed to start my own firm to structure the relationships in a way that we’re not just filling out forms for people. That we’re doing things that advance their business and advance their personal life forward by being able to save them cash with tax reduction strategies, that was the path there.

5:41 [Josh Kopel]

In the gap, you’re talking about. Specifically, I believe that’s the gap between bridging yesterday’s numbers and how that influences decisions today and tomorrow, right?

5:53 [Catherine]

Absolutely. There’s kind of three pieces that go into what people do in their business. You try to increase your top line through doing marketing and advertising, and things that you try to decrease your bottom line by reducing expenses. Then the third piece, which many people don’t think about, is that everything is going to flow through the tax funnel, and you’re going to pay tax. So do things to optimize how your income flows through the tax funnel to ensure you’re not paying too much in tax. For my firm, we’ve emphasized that third piece. We’re a tax planning firm mostly, and that’s the piece that many people never get around to doing because they wait until the end of the year to talk to their accountant. Or their accountant is just concerned with ensuring they’re compliant with the IRS rather than finding efficiencies and how they operate to lower how much they pay.

6:43 [Josh Kopel]

You were interested in connecting with independent restaurant owners and operators when you reached out. Why choose that niche because we’re so easy to work with?

6:52 [Catherine]

The main thing we’re up to right now is to become a specialty practice for doing the Employee Retention Credit. I do these for all sorts of industries. Still, in particular, I saw that the restaurant, especially independent operators, is just largely missing out on this credit. It’s because they fall in that weird zone, where their tax practitioner is probably really small and isn’t able to handle a lot more than just filing their returns. I’ve been coming across many of these clients whose accountants just dropped the ball and going after this credit for them, especially for restaurant owners who were so impacted by the pandemic. They have this opportunity. For many of the clients I’ve been seeing, it’s a six-figure tax credit, a six-figure check that comes back in the mail. I thought we would be a good connection because if I could just get one person to reach out to their accountant or be able to take advantage of this credit, I feel I’ve accomplished something.

7:59 [Josh Kopel]

I want to talk about tax strategy at large because, in the abstract, I don’t know how many of us know what that means. Typically tax planning starts on January 1st for payment in April, and we’re talking about last year’s taxes. What tax planning strategies do you guys use to help mitigate attack implications for independent restaurant owners and operators?

8:32 [Catherine]

The first strategy is to be proactive and consider how taxes work. You’re incurring a tax bill as you earn money because its profits will flow through that tax funnel. If you just wait until the end of the year to do anything, that money is already flowing through that funnel, and there’s not much you can do to get it back. That’s why for many people, it’s in January or February that they figure out what their tax bill was from the previous year. And they’re always in this game of catch up and what we do in the firm for our tax planning clients is we start with an onboarding. We need to look forward to where your business is going. We need to understand what you’re trying to achieve strategically with your business to ensure it’s going through the tax funnel as efficiently as possible. If somebody is going to grow to sell, that’s a very different kind of strategy than if somebody is going to grow to hand it off to a kid. If they know, they’re just going to be operating the business for 20 years, starting spidering out and getting a bunch of different businesses, or pivoting into franchising or licensing. Those are very different end games from an operation and tax planning standpoint. Overlaying a deep understanding of what’s happening in the business to how the tax code works and how we make this the most efficient path through the tax funnel. The first thing we always go after is tax credits ’cause it’s a dollar-for-dollar thing. Usually, once you start those programs, they go year after year, so there are different payroll tax credits.

There are other incentives out there that are just easy wins for the client and usually some instant cash injection. The next piece is entity structure: percentage points say you’re getting taxed at 40% effective, and we can bump that down to 25%- 30%. That’s a huge swing for a matter of just shifting or forming some entities, closing some entities, doing some elections, and filing some paperwork. You can get that stuff wrapped up in a month, and I can move your whole percentage points. We analyze what’s going on with your entities. For most people, if you structured your business more than five years ago or experienced some significant growth, that’s something that you want to have an ongoing analysis done. It’s not one of those things you wanna set it and forget because if all of your work is getting pushed through this inefficient tunnel, you’re losing percentage points. And if you’re working safely, it’s 15% more than you’re paying. How many months out of the year working for the government could have gone to you just to fill some forms? Then it just goes into maximizing deductions and ensuring that people can be as efficient as possible with things that they’re already spending money on. Suppose you’re paying family members, paying for health benefits during retirement. All those kinds of things, but those are kind of after the fact, and it all has to be in the frame of what’s the strategy? What are you trying to do as a business? And how do we get you there the most efficiently?

11:58 [Josh Kopel]

For the folks listening that is going, is this me? Am I one of these people with an issue? What are some of the red flags? What are some common mistakes you see people making when they come to you?

12:08 [Catherine]

At least the most common mistake I see on the credit side is people not taking advantage of the Employee Retention Credit. If you haven’t had that one, you need to have an analysis done for regular tax planning issues. First one’s entity structure, if you’re getting over 100K a year on your business and you’re not operating out of an entity that’s when you want to start having that kind of conversation. Do I need to change my entity structure? Another common mistake is they don’t get their legal structures set up right on the front end for liability purposes, so people will just operate under their name instead of being in something like an LLC where you’re going to have some legal separation liability. And just other things like not buttoning up their compliance work on the front end and paying people under the table. Those are the most common mistakes I see people make on the front end of the restaurant industry.

13:18 [Josh Kopel]

The federal government did this alphabet soup task when the pandemic hit, and it was just rolling out program after program. I know that there’s a massive opportunity for the Employee Retention Credit. We’re gonna dig deep into it, but I’m wondering what other opportunities did the pandemic present?

13:39 [Catherine]

Most of them now are wrapped up. People got to take advantage of things like the payroll protection program, multiple rounds of that. A lot of restaurant grants, also state and local aid that came out, and it was just tough for everybody because you had all these programs coming out. There was no guidance for tax practitioners to know how things would work, and it just turned into a crazy money grab. The one nice thing is the Employee Retention Credit is baked into the code, so it’s not like the PPP, where it’s a fund that gets exhausted if you don’t take advantage of it. We have a three-year window for it, and if you didn’t get to take advantage of a lot of those other programs, it helps increase that credit. Because one of the things that happens is if you got PPP or if you’ve got these other programs, it’ll reduce your Employee Retention Credit. The alphabet soup is a good way of putting it because they’re coming from all sorts of agencies, state and local, and federal. It was just nuts.

14:53 [Josh Kopel]

Let’s get into the Employee Retention Credit specifically. For those that don’t know, can you explain what it is?

15:01 [Catherine]

It’s a payroll tax credit. It’s a reimbursement to employers who experienced hardship during the pandemic. If your company, especially restaurant owners, had operations limited by government orders or you had revenue discrepancies. So it’s not just year-over-year revenue declines but just uneven revenues you could be eligible for the credit. I have not had a restaurant come to me that wasn’t eligible for it just because of the factors of what happened during the pandemic. ‘Cause almost everybody had some kind of operational impact through the government orders, and that’s one of the qualifying factors. It’s up to $26,000 per employee. You can imagine if you have a good headcount in your operation, above ten people, it can be a substantial credit. It depends on your headcount, but people with 15 employees get a quarter of $1,000,000 back, even on a smaller scale. It’s a check that comes back in the mail, so it’s not credited towards future years. It’s a reimbursement of the money you paid in 2020 and 2021, and it’s still available. It will start phasing out about a year from now, but it’s still available even though it’s related to tax years 2020 and 2021.

16:13 [Josh Kopel]

I want some of that. How difficult is it to get?

16:16 [Catherine]

You just have to work with a practitioner for it. One of the decision points is knowing the right person to work with. A lot of people have tried to work with their payroll providers. I don’t recommend it just because my experience with payroll providers is they have a hard enough time just doing regular payroll. Many of the cases I’ve seen with payroll providers have been under-claiming. Then on the opposite side of things, I see people trying to work with their regular CPA. Many regular CPAs don’t handle a high volume because they are complex. They interact with your payroll protection program loans and other grants and aid. They all interact with each other. I recommend people work with specialty providers. My firm is a specialty provider; we do them for other CPA firms because it’s become our specialty. Still, those are, in general, the people that you can work with for it. Also, I should warn you that there are a lot of bad actors in the space right now because we’ve got an information gap between people filing these claims and then the IRS. The IRS is still so behind from what happened during the pandemic. A couple of days ago, I was reading an article that one of the bigger players in this space for doing these credits got raided by the IRS. It’s one of those things where you just want to work with somebody that’s a licensed CPA firm. They do a good amount of them because it’s big dollar figures. I’ve got several restaurants where they’ve got a quarter of $1,000,000 back, and when it’s that much money on the line.

You’re paying for the placement. You’re not just paying for the Botox, and that’s the thing with the credit. When you work with somebody reputable, it’s an easy process for you because it’s just once we get the reports. It’s just a matter of us doing the calculations and having everything buttoned up for what the IRS wants to see.

19:20 [Josh Kopel]

How do you suss out between someone suspect and someone working in the space with integrity?

19:27 [Catherine]

For the most part, the biggest red flag is if they’re CPA firms or not. There are a lot of people out there that are just marketers for this, and then they pass the work off to two small CPAs, or they’re working with people that aren’t. I had a case come across my desk from somebody where the person doing the filing was a real estate attorney. They weren’t professional attacks, so that becomes a big red flag. The other red flag is if they’re charging contingent fees. As a CPA firm, we’re not allowed to charge a contingency fee, and if you encounter a person doing these credits and they say well, we’re gonna charge you 25% of the credit. That’s a red flag for the most part.

For the other partitioners in this space that I see, the range isn’t contingent. Still, the fee tends to be between 10 to 15% of the credit, so if you see somebody that’s kind of outside that range or they’re just sales if you feel that sales thing going on. It’s not a tax practitioner where they’re asking you a lot of questions, too, because many things interact. We’ll get your credit if they’re not asking you many questions. Just send us these two reports. You’re going to be eligible for half of $1,000,000. It’s fishy versus OK we’re gonna need some payroll reports. We’re gonna need some financial reports asking you detailed questions about your company ownership. You’ll get that feeling. If you’re being sold versus OK, this is an actual tax professional that knows what they’re doing. The other thing I see people doing wrong is anybody can have a website, a convincing marketing copy and flashy stuff, and testimonials saying we’ve filed so many claims. Still, it comes down to who’s doing the work. Who owns the company? How long have these guys been around? Are they going to be gone when the IRS comes back, or what’s the feel of this? And I’d say, for the most part, if you already have a tax professional and they can’t handle it. I loop them into the conversation. They know how taxes work. They’ll know if something feels wrong because they can talk shop to the other company that’s doing it and lean on your tax pro to say hey can you be in this conversation with me and these people for this credit because that tax Pro is going to have a good Spidey sense of no this feels off. This is very salty versus no. This is another CPA firm, and when we get into the weeds and talk shop, they pass the mustard. That’s the advice that I would give people in general.

22:01 [Josh Kopel]

For context, what does your specific process look like? When somebody reaches out and wants help. How do you help?

22:10 [Catherine]

We start with just a conversation. I do make sure that the person that we’re working with understands just the general program of how the credit works, and they don’t have any confusion about what they could be pursuing because there are some interactions that happen with things like your income taxes, so we go through all of that and then, in general, we collect the reports we do an assessment to see OK do you meet the eligibility requirements with flying colors and then if you do then how much roughly are you eligible for? And that’s something we do on the front end of the engagement. Then once we know roughly what they’re eligible for, we say, OK, this would be our fee if you want us to do the work, file the claim, and track it with the IRS. Here’s how the cash flow would work if it doesn’t make sense for you. That’s how we approach it, and once we’ve got all the reports and the client wants to engage with us, we then finish calculations, file a claim with the IRS, and then track it with the IRS, and that’s our basic process. Usually, for people, it only takes these initial conversations, but then maybe it’s a couple of hours an hour or two getting those reports together that we need to get that precise calculation done, and that’s it. It can be a couple of hours of work for 250K. That’s pretty good. It’s a pretty good ROI for anybody. That’s what we’ve seen for the restaurant owners; they tend to get really high credit amounts for this.

23:27 [Josh Kopel]

What are the eligibility requirements?

23:32 [Catherine]

There are two ways a company can be eligible. The first way is that if you have certain revenue declines, it’s different rules for the different years, so I just tell people the rule of thumb is if you have more than five employees and you experience discrepancies, so your quarters are uneven, get yourself analyzed because it’s such high potential, high dollar volumes on the table. That it’s just worth it to have yourself formally assessed on that so you can either have revenue declines, and that’s one way you can be eligible, or if you had government orders that forced you to modify your operations. That’s the other piece of it, so for restaurants, very common to reduce capacity, and it’s usually state orders or local orders. Those orders make you have to change your operations. That way, if it’s more than a 10% effect on your business during the period for which that was going on, you’ll be eligible. If you’re in a state that was restrictive during COVID, California, Massachusetts, or New York, where we weren’t allowed to operate at full capacity for the whole year, then you would be eligible for the whole year because it’s a government order. Those are the two ways that companies can be eligible, and it’s an either-or test, and in some quarters, it’ll be government orders. In other quarters then you have the revenue issues. You can be eligible through the whole duration of the pandemic for a mix of those, and that’s part of the analysis we do on the front end.

25:02 [Josh Kopel]

One of the things that hold independent restaurateurs back from participating in things is the fear of an audit.

25:11 [Catherine]

True, I should mention that part of what we do as our process is included in our engagement is that we will support the client through the audit at no additional expense just because I’ve been through them. I know how they go, the auditor comes in, they see the kind of paperwork we have, the credentials, we have a conversation with them, and they open and close the case. Because it’s just that’s the level to which we keep our documentation, and that’s the name of the game. It’s when you’re vetting out practitioners it’s for that purpose. I want the worst-case scenario to be the auditor. We get a notice from the IRS, and they must write a letter. That’s going to be the worst thing that happens, and that’s why working with somebody who’s really oriented around. OK, how are we going to get through compliance ’cause that’s really the problem, but it’s not getting the money back. It’s making sure that the IRS isn’t gonna come back later. Most restaurants passed with flying colors because the government orders were so restrictive and just the way the credits are written. I’ve never really been concerned about the restaurant owners having audit issues just because it’s so easy to document. There’s a government order from my governor that we were at 45% capacity or 75% capacity, and here it is. This is what it was, and that’s just how the credit is written. There’s no risk for the restaurateurs as long as you have your documentation in order, which we work with a good practitioner going to have. It’s good to be concerned about it, but it will not be a problem if you work with somebody reputable.

26:41 [Josh Kopel]

The years that are covered are 2020-2021.

26:47 [Catherine]

It’s still gonna be open for another year, so if you missed out on it for 2020 and 2021, we can still file those returns and go back and get it, which is great.

27:00 [Josh Kopel]

How quickly from the first phone call is it typically to get the check in the mail?

27:06 [Catherine]

The problem with the IRS is that they’re still messed up. It’s a very manual process on their end. When filing the actual returns, we must mail them to the IRS. Once we get all the documentation in place, we get claims turned around in under two weeks, but then it goes to the IRS and sits with them. Previously they were projecting that it was 9 to 12 months. The last time I talked to somebody, they reallocated personnel to that department. It’s looking more than five months, but it just depends on the size of the credit because those of a certain size have to have a second set of eyes on them from the IRS standpoint. I’d say for most people. It’s about a five-month wait.

27:49 [Josh Kopel]

I wanna talk at a high level about tax planning because this tax credit represents a massive missed opportunity, and you don’t know what you don’t know. Talk to me about tax planning in general and why you believe it’s one of the highest return investment activities you can spend your time on as an entrepreneur.

28:10 [Catherine]

The biggest reason is it’s a high ROI activity and takes little time as long as you’re intentional about doing it. You may do it a couple of hours out of the year. Still, I said earlier that by having things in an efficient entity structure, you move the needle percentage points and when you think about it, spending a couple of hours each quarter with your CPA going through, distributions, retirement contributions? breaking off separate businesses with different entities. Those kinds of questions and checking in and asking for that level of analysis to be done. It can move the needle, and getting into that practice will be helpful, especially if you haven’t done any planning. Really how you want to approach that professional is to say you need tax planning and taxes done. I will need a minimum of four meetings during the year where we’re making planning conversations and you’re running forecasts for me. That’s the service you want to ask for . A lot of people don’t realize that if you’ve just asked them to do your taxes that is all they’re going to do. And by asking for more, you’ll get more. I’d say if you’re not paying at least ten grand a year on tax planning work and that level of activity going on, you’re not getting it. Because it’s asking them to do a quadrupled if not more of the work that they’re doing just to file returns to run projections, to run calculations, and to be the quarterback of making sure that you’re operating efficiently. If you don’t plan, you’re paying 40% effectively between Social Security taxes and income taxes and state taxes, which could be well over 40% if you’re working half the year for the government. It’s right now. We’re recording this. It’s the end of Ma and you’re listening to this. You’ve been working for the government for the last five months. Just take a couple of hours to engage with somebody and say, “Hey, should I be an S corp or should my catering business be a C Corp? How should we have this setup? Should I buy my building? Those kinds of things, maybe you could have only been working for the government for the first three months out of the year instead of the first 5-6. It’s just deciding you’re gonna do it and then getting the right people to quarterback it for you where you’re not quarterbacking it.

31:22 [Josh Kopel]

It’s worth bringing up mindset because I can easily look at what you do for a living and see it as an expense. Still, at the end of the day, I would assume that your clients don’t see you as an expense. They see you as a way to make more money, not spend more money.

31:43 [Catherine]

Honestly, that’s what accounting should be as a function in your business, and that was one of the founding principles I had for my firm. I want every client I work with to be a profit center because if I’m not making them money, they’re not the right client for me. After all, I cannot use my skills to improve their business by increasing their cash flow. That’s not a good use of my ability. It’s your general practitioner putting on bandaids. It’s not that I wanna be healing people, and for a lot of business owners, they get in that mindset of bookkeeping being expensive, so I’m gonna do it myself and really, especially with the tax planning, it’s a return on investment. If you invest in it and you work with somebody who knows what they’re doing, it’s going to be a profit center for your business without you actually having to do very much. Because it’s just a matter of finding the right person, having the conversations, and having the relationship. I always say if you haven’t found that person yet, find them because it will make a really big difference.

32:45 [Josh Kopel]

At the end of every episode, I give the guests an opportunity to speak directly to the audience. You worked with so many restaurant owners and operators out there for those that haven’t had an opportunity to work with you. What advice or words of encouragement do you have for them?

33:01 [Catherine]

My biggest piece of advice for them is if you have not pursued the Employee Retention Credit. You need to really block out two hours to get that done and get the analysis done for your company. I’m a CPA firm who works for other CPA firms, so we work really nicely with other tax professionals, but I’d say go back to your tax professional, see if they can handle it and see if they’re competent. And if they can’t, you want to reach out to a specialty firm to get it done ’cause dollar for dollar that’s the biggest ROI activity that any restaurant owner can do right now. If you have a decent-sized headcount, it could be a really big shot in the arm for your business.

#dominion enterprise services in usa#employee retention credit for business in usa#employee retention tax credit in usa#tax consulting services in usa#new employee retention credit rules in usa

0 notes

Text

Simplify Your Finances with Expert Accounting and Tax Consultancy

Managing your taxes and accounting can be overwhelming, especially with ever-changing regulations. Whether you're a business owner or an individual, hiring a professional tax consultant can save you time, money, and stress. From maximizing deductions to ensuring compliance, experts help streamline your financial journey.

If you're looking for reliable guidance, explore our services. Let us take the complexity out of taxes so you can focus on what matters most. To get the Best Tax consultant in USA please visit the link theaccountingandtax.com

#accounting#Tax consultant in Toronto#Best Tax consultant in Canada#Best Tax consultant in USA#Tax preparation expert in USA#Tax preparation expert in canada#Tax consultation service in Toronto#US Tax consultants in Toronto#Canadian Tax Consulting Service#International Tax Consultants in Toronto#Expats Tax Consultant in Toronto#tax consulting services

1 note

·

View note

Text

October 15th Tax Filing Deadline

Don't miss the final opportunity to file your taxes. Our team at SBA Tax Consultants is here to help you avoid penalties and ensure you maximize your savings. Whether it's personal or business taxes, we've got you covered! Visit us at: 8500 N Stemmons Fwy, Dallas, Texas 75247 Call: +1 469 722 5480 Email: [email protected] Learn more: sbataxconsultants.com

#sba tax consultants#tax consultants#tax services#tax filing#companies#taxiservice#taxes#financial#gst#deadline#usa news

0 notes

Text

We offer a full suite of tax, accounting, payroll, financial reporting, loan consulting, tax relief services, etc. to help our client’s enterprise grow and thrive. We have been providing Business Accounting Services in USA for years successfully.

#Business Accounting Services USA#corporate tax preparation services usa#investment advice for us businesses#us market investment consulting#tr-usa tax treaty services

0 notes

Text

1 note

·

View note

Text

Navigating Financial Compliance in the UAE: US Tax Advisors, VAT Consultants, and Economic Substance Regulations

However, companies might have trouble navigating the complex laws pertaining to economic substance and taxation in the United Arab Emirates. To guarantee compliance and financial success, many turn to US Tax Advisors in Dubai and VAT Consultants in Abu Dhabi. In this article, we'll examine how these specialists are crucial in helping businesses navigate the complexities of the economic substance regulations in the United Arab Emirates.

Acknowledging the Economic Substance Regulations in UAE

The UAE passed the Economic Substance Regulations in 2019 to demonstrate its resolve to stop unfair taxation practices and to align itself with global norms. These regulations require organizations that perform specific activities to participate in meaningful activities.

Economic Substance Regulations' principal elements include:

Key Income-Generating Activities: In order to show economic substance, businesses in the UAE must carry out key income-generating activities.

Sufficient Staff and Expenses: In order to support their operations, entities need to have a sufficient number of full-time staff members and operating expenses.

Relevant Records and Reporting: To demonstrate compliance with the regulations, comprehensive records and yearly reports must be kept up to date.

Following these rules is crucial because breaking them can lead to penalties, fines, and reputational harm.

The Role of US Tax Advisors in Dubai

US tax advisors with a focus on Dubai assist companies in comprehending and navigating the intricate tax ramifications of doing business in the United Arab Emirates. They are knowledgeable about US tax law, double taxation avoidance agreements, and international tax treaties. Their proficiency encompasses aiding enterprises in handling their worldwide tax obligations while guaranteeing adherence to the UAE's economic substance guidelines.

The following services are provided by US Tax Advisors:

Tax Planning: Offering guidance to businesses in the United Arab Emirates on the best tax structure to reduce their tax obligations.

Compliance: Making sure that companies follow the economic substance laws of the United Arab Emirates as well as US tax law.

Tax Reporting: Filing and preparing tax returns in accordance with UAE and US tax laws.

Support for Audits: Ensuring a seamless audit process while representing companies in tax audits.

VAT Consultant in Abu Dhabi: Guaranteeing Compliance with VAT In 2018, Value Added Tax (VAT) was implemented in the United Arab Emirates. Businesses that want to stay in compliance with the law and fulfill their VAT obligations must enlist the services of VAT consultants in Abu Dhabi. In order to comply with VAT regulations, they help businesses prepare VAT returns, comprehend the nuances of VAT, and keep accurate records.

Important services that VAT Consultants offer are as follows:

VAT Registration: Helping companies comply with UAE tax law by registering them for VAT.

VAT Filing: Getting ready and sending in VAT returns for companies.

Making sure companies fulfill their VAT obligations and stay out of trouble is known as VAT compliance.

VAT Planning: Offering guidance on ways to lower tax obligations while maintaining compliance with VAT laws.

To sum up, US Tax Advisors in Dubai and VAT Consultants in Abu Dhabi are invaluable partners for companies doing business in the United Arab Emirates. They guarantee VAT compliance, assist in navigating the complexities of the UAE's economic substance regulations, and provide knowledgeable tax planning advice. Businesses can prosper in the fast-paced business climate of the United Arab Emirates while abiding by the law by enlisting their help.

0 notes

Text

Setting up a Business in USA with MAS LLP: Your Path to Success

Establishing a business in the USA can be a rewarding endeavor, offering access to one of the world’s largest and most dynamic markets. However, navigating the complexities of the American business environment requires expertise and strategic planning. This is where MAS LLP steps in. With years of experience and a dedicated team, MAS LLP provides comprehensive support to entrepreneurs and businesses aiming to set up their operations in the USA.

Why Choose the Setting up business in USA? The USA is an attractive destination for businesses due to its: Robust Economy: As the world's largest economy, the USA offers immense opportunities for growth and expansion. Innovation Hub: Home to Silicon Valley and other innovation centers, the USA is at the forefront of technological advancements. Diverse Market: With a diverse population, businesses can target various demographics and niches. Supportive Legal Framework: The country offers a supportive legal and regulatory framework for businesses. Steps to Setting Up a Business in the USA Setting up a business in the USA involves several critical steps. MAS LLP is here to guide you through each phase, ensuring compliance and efficiency.

Business Plan Development Before anything else, a solid business plan is essential. This plan should outline your business goals, target market, competition analysis, financial projections, and operational strategies. MAS LLP can assist in crafting a robust business plan tailored to the US market.

Choosing the Right Business Structure The next step is selecting the appropriate business structure, such as: Sole Proprietorship: Simple and easy to establish, suitable for small businesses. Partnership: Ideal for businesses with multiple owners. Limited Liability Company (LLC): Provides liability protection and flexible tax options. Corporation: Suitable for larger businesses, offering strong liability protection and easier access to capital. MAS LLP provides expert advice on the best structure for your business needs.

Registering Your Business Once the business structure is chosen, the next step is registration. This involves: Choosing a unique business name. Filing the necessary documents with state authorities. Obtaining an Employer Identification Number (EIN) from the IRS for tax purposes. MAS LLP handles all the paperwork, ensuring a smooth registration process.

Understanding Tax Obligations Navigating the US tax system can be complex. Businesses must comply with federal, state, and local tax requirements. MAS LLP offers comprehensive tax advisory services, helping you understand and meet your tax obligations efficiently.

Compliance with Legal and Regulatory Requirements Compliance is crucial to avoid legal pitfalls. This includes: Obtaining the necessary licenses and permits. Adhering to labor laws and regulations. Ensuring compliance with industry-specific regulations. MAS LLP ensures that your business is fully compliant with all legal and regulatory requirements. How MAS LLP Can Help MAS LLP is dedicated to supporting your business journey in the USA. Here’s how we can assist: Consultation and Advisory Services: Expert advice on business setup and growth strategies. Business Plan Development: Crafting a comprehensive business plan tailored to the US market. Legal and Regulatory Compliance: Ensuring your business meets all legal and regulatory requirements. Tax Advisory Services: Comprehensive tax planning and compliance support. Ongoing Support: Continuous support to help your business thrive in the US market. Success Stories MAS LLP has a proven track record of helping businesses succeed in the USA. Here are a few success stories: Tech Startup: Assisted a tech startup in Silicon Valley with business setup, securing funding, and achieving rapid growth. Manufacturing Firm: Helped a manufacturing firm from Asia establish operations in the US, resulting in a 200% increase in sales within two years. Retail Business: Guided a retail business through the complexities of the US market, leading to successful market penetration and expansion. Get Started with MAS LLP Setting up business in USA is a significant step towards global growth. With MAS LLP by your side, you can navigate the complexities with confidence and ease. Contact us today to learn more about how we can help you achieve success in the US market.

#accounting & bookkeeping services in india#audit#businessregistration#chartered accountant#foreign companies registration in india#income tax#auditor#taxation#ap management services

5 notes

·

View notes

Note

are in game currencies you can buy with real money covered under the same laws that make nfts and bitcoin taxable?

DISCLAIMER

I am not an international tax expert. Tax laws are obviously different in different jurisdictions; something that's true in the USA might not be true in the UK or Ukraine or India or Japan or Kenya or whatever. Also, the details of individual games can affect their legal standing. You may wish to consult a local tax expert before filing your return.

Disclaimers aside, probably not.

The thing about NFTs is that you can resell them. If you buy an ugly ape for etherium, you can later sell that ape for etherium and sell the etherium for cash, hopefully more than you paid in. That's what makes crypto stuff taxable; it's an investment.

Most in-game currencies cannot be exchanged for real-world money. You can't buy Fortnite VBucks at 5¢ to the buck and resell it at 7¢ to make a profit, and you can't sell anything for real-world cash. (This the main reason why gambling regulations usually don't apply to lootboxes.)

As far as the law is concerned, buying VBucks in Fortnite is no different from buying DLC on Steam.

Aside from blockchain games like the infamous Axie Infinity, the only ways I can think of for in-game currency purchases to result in taxable transactions probably violate the terms of service. Back in ye olde World of Warcraft days, people would sell their in-game gold for real-world money—profitable, despite (or because of?) being against the TOS.

Obviously, people can buy premium video game currency with their own money; that's what premium currency is for. But hypothetically, if you used that currency to buy an in-game item that you sold for real-world money, that would be a taxable transaction. The amount you sold it for minus the price initially paid for in-game currency would be taxable game.

Again, this is probably a violation of the terms of service you agreed to without reading, which would make this a breach of contract. In the US, you are required to report illegal income; however, as per the fifth amendment, you don't have to report anything that would incriminate yourself. How you report such income without self-incrimination is an exercise for any reader running a Fortnite money laundering business.

3 notes

·

View notes

Text

FAQs About The California Employee Retention Credit

California employers are encouraged to take advantage of the California Employee Retention Credit before it expires. But what is this tax credit? Who qualifies? Is ERC taxable in California? In this article, Dominion Enterprise Services’ CPA Skyler Kressin breaks down the ERC and how it can benefit your business.

Like many business owners, California employers were subjected to extreme challenges during 2020 and 2021 and even extending into 2022. Business operations often were fully or partially suspended due to state or local health orders, revenue swings occurred unexpectedly, labor shortages abounded, and the unknowns related to global economic conditions created a difficult environment for businesses of all stripes due to COVID-19.

In the midst of these difficult times, various federal programs were created to mitigate these challenges, including the CARES Act and the American Rescue Plan Act. Each of these had provisions for relief, such as advance payment programs or forgivable business loans such as the Payment Protection Program (PPP loan).

While many businesses took advantage of these relief provisions, the sheer volume of legislation signed into law in the last several years has resulted in some of the key relief provisions for employers to be overlooked in the effort to keep the lights on and business flowing.

One such relief provision that consistently has been overlooked was created specifically for employers who continued to pay wages and federal employment taxes throughout the official “pandemic period” (March 12, 2020, through the third quarter of 2021) in the form of an employer tax credit, officially called the Employee Retention Credit (ERC).

The good news is, for California employers specifically, this federal tax credit may be much easier to obtain than for those who own and operate businesses in other states, due to how eligibility works.

High-level Features of the ERC for California Employers:

• The credit is up to $26,000 per employee for a fully eligible employer.

• The credit is a federal refundable tax credit, meaning you can claim a refund directly in the form of a check from the IRS, and the ERC is NOT a loan or grant through a bank like the PPP.

• That said, the other relief programs, (such as the PPP) do interact with the ERC but importantly, do NOT make you ineligible for the ERC as was previously widely believed – even those who received both rounds of PPP funding are still potentially eligible for the ERC.

• The claim is made through federal payroll tax filings and entails tax calculations customarily performed by tax professionals.

• The eligible filing period for the ERC begins to expire in April 2023 as the statute of limitations for refunds begins to sunset.

Who is Eligible for the ERC?

Eligibility for the ERC is determined on a calendar quarter basis (corresponding to each federal filing period) and can be achieved in one of two ways:

1. Gross Receipts Test

Employers must show a specified percentage decline in gross receipts, quarter-over-quarter when comparing a given quarter in 2019 to the same quarter in 2020 or 2021. For example, the quarter ending December 31, 2019, compared to the quarter ending December 31, 2020, must show a specific percentage decline. Specifically, 2020 needs to show a decline of 50% in at least one quarter, and 2021 needs to show a decline of 20% in at least one quarter – BOTH compared to the equivalent quarters in 2019.

2. Trade or Business Operations Disruption Test

This test is where there may be advantages for the California Employee Retention Credit as opposed to the relative eligibility in other states. Eligibility under this test all hinges on whether direct state or local government orders restricted business operations for employers during the pandemic period. California was one of the more restrictive jurisdictions as compared to other U.S. states and localities, so ERC eligibility is more likely to be achieved for California employers than in other jurisdictions.

As with all federal legislation and tax law, there are nuances and fine print to the above eligibility tests that go beyond the scope of this article and edge cases that require parsing through grey areas. This is where working with a qualified and licensed tax professional who specializes in tax credits comes into play. Many who are otherwise eligible for the ERC may be leaving money on the table, or otherwise working off an incomplete assessment of the full scope of their eligibility.

Is ERC Taxable in California?

Another benefit of the ERC is that, in general, it is not taxable on your California income tax return, as per FTB Publication 1001. That said, given it is a federal credit, it does directly impact your federal income tax filing and may result in the need to modify your federal income tax filing.

Dominion Can Help

Dominion Enterprise Services, PLLC is a full-service licensed CPA firm, with broad experience in helping California employers with various tax credits and consulting and has broad familiarity with the Employee Retention Credit specifically for the state and local legislative and regulatory environment in California during the pandemic period.

Our model is based on a transparent assessment of the facts and circumstances of each business we work with and working with existing tax preparers and payroll providers in ensuring the maximum claim for the ERC in California is pursued under the law.

Given the unique regulatory landscape of California, don’t miss out on this opportunity to claim the California Employee Retention Tax Credit before the eligible filing period ends in April 2023. If you would like us to help with this process, please click on the button below and fill out our quick, one-minute questionnaire.

#dominion enterprise services in usa#employee retention credit for business in usa#employee retention tax credit in usa#tax consulting services in usa#new employee retention credit rules in usa

0 notes

Text

Exploring Nursing Opportunities Abroad: Top Countries for Indian Nurses

Nursing is one of the most in-demand jobs inside and outside India. A profession that is in most demand in GCC countries for Indians is the nursing job. For Indian nurses, who are looking to broaden their horizons, many countries are waiting with promising career opportunities. If you are a skilled nurse and have multilingual capabilities then wide opportunities will be there. The overseas opportunities will give you high pay as well as a high-standard working environment. The respect for nurses outside India is much higher than inside India. Nurses are being recruited through top nursing consultancy in Kerala and here is a list of the top countries that offer promising careers.

Five top countries that offer promising nursing career

United Arab Emirates: Dubai which is an opulent city right due to cultural and development richness hires nurses from India. A large part of nurses who work in Dubai are Indian and they a decent pay but not much higher than European and American countries. But the most attractive feature of Dubai is that the nurses can take their entire income to their homeland since there are no taxes. In Dubai, there are many world-class hospitals, medical centers, and clinics that offer good employment prospects for Indian and other nationalities.

Saudi Arabia: In Saudi Arabia, there are a plethora of job opportunities for nurses in both the private and Government sectors. They offer good pay, accommodation facilities and also travel allowances. Saudi Arabia is one of the largest nations in GCC countries and also the pilgrimage place for Muslims, the demand for medical facilities is very high. The demand for trained professionals especially from India is of high demand in Saudi. However, finding the right opportunity is a bit challenging since there is a high scam in the field of recruitment.

Canada: Canada is a country that offers a healthcare system with the highest standard. This country is facing staff shortages and is now actively recruiting nurses worldwide. The high-quality life and the welcoming stances towards immigrants make Canada an excellent choice for nurses. The medical facilities and education are completely free for immigrants.

Australia: Australia's flourishing healthcare industry and stunning landscapes attract nurses worldwide. With modern facilities and advanced technology, nurses can work efficiently. During leisure time, they can explore the country's picturesque natural environment. Competitive salaries and excellent benefits make it a lucrative career option. To work as a nurse in Australia, one must register with the AHPRA (Australian Health Practitioner Regulation Agency) and pass English language proficiency tests.

United States of America (USA): The USA boasts a robust healthcare system with a significant demand for skilled nurses across various specialties. Indian nurses aspiring to work in the USA can pursue opportunities through programs like the H-1B visa for skilled workers or the EB-3 visa for professionals with tertiary education. Opportunities exist in hospitals, clinics, long-term care facilities, and community health settings throughout the country.

United Kingdom (UK): With its National Health Service (NHS), the UK offers extensive opportunities for Indian nurses to work in both public and private healthcare sectors. The UK's Nursing and Midwifery Council (NMC) oversees the registration process for international nurses, which includes passing the Occupational English Test (OET) or International English Language Testing System (IELTS) and meeting other requirements. Work settings range from hospitals and nursing homes to community healthcare centers.

Conclusion

If you are planning for an overseas nursing job, first research the rules and regulations for immigrants. Based on it decide which country is most suitable for you. There will be medical tests, mandatory examinations, and other verifications for each country. It is better to connect with any nursing consultancy in Kerala before you plan to move, they will guide you through the process and also provide you with data regarding the recruitment.

3 notes

·

View notes

Text

Hillary Clinton

This Biography is about one of the best Professional Politician of the world Hillary Clinton including her Height, weight, Age & Other Detail… Express info Real Name Hillary Diane Rodham Clinton Nickname Hillary, Hill, HRod, Mrs. Clinton Profession Politician Age (as in 2023) 75 Years old Physical Stats & More Info Party Democratic Party Political Journey • In January 1979, Hillary Clinton became First Lady of Arkansas and retained the title for twelve years (1979-1981, 1983-1992). • She became the First Lady of the United States in January 1993. • In the year 2000, she was chosen by the Democratic Party to run in the Senate Election. • She won the Senate Election with 55% of vote on November 7, 2000. • On January 3, 2001, Hillary Clinton was sworn in as US Senator. • She gave her service on five senate committees - Committee on Budget (2001–2002), Committee on Armed Services (2003–2009), Committee on Environment and Public Works (2001–2009), Committee on Health, Education, Labor and Pensions (2001–2009) and Special Committee on Aging. • In November 2004, she announced to run for a second senate term. • She won the senate election for the second time with 67% of the vote on November 7, 2006. • On January 20, 2007, Hillary Clinton announced her candidacy for the United States Presidential Election of 2008. • She lost South Carolina primary to Obama by two-to-one. • She supported Obama at the 2008 Democratic National Convention by giving a passionate speech. • On December 1, 2008, Obama announced Hillary Clinton as his nominee for Secretary of State. • She took the oath of office of Secretary of State of USA on January 21, 2009. • She has announced her candidacy for the United States Presidential Election of 2016 and at present she is campaigning for the same. • On 8 November 2016, she was defeated by the Republican Donald Trump in the 2016 United States Presidential Election. Biggest Rival Donald Trump Physical Stats & More Of Hillary Clinton Height in centimeters- 167 cm in meters- 1.67 m in Feet Inches- 5’ 6” Weight in Kilograms- 60 kg in Pounds- 132 lbs Eye Colour Blue Hair Colour Blonde Personal Life Of Hillary Clinton Date of Birth October 26, 1947 Birth Place Edgewater Hospital in Chicago, Illinois Zodiac sign/Sun sign Scorpio Nationality American Hometown Chicago, Illinois, USA School Park Ridge, Maine East High School (1964), Maine South High School (1964–1965) College Wellesley College (1965–1969), Yale Law School (1969–1973) Educational Qualifications Bachelor of arts with Departrmental honors in Political Science Debut 1996 Family Father- Hugh Ellsworth Rodham (American businessman) Mother- Dorothy Howell Rodham (American Homemaker) Brothers- Tony Rodham (Consultant), Hugh Rodham (Lawyer) Sisters- N/A Religion Methodist Address 55 West 125th Street New York, USA Hobbies Swimming, Home decor, gardening, playing scrabble, doing crossword puzzles Controversies • Her email controversy is at the top on the list of Hillary Clinton's controversy where she has been criticized for using her personal account to send classified documents during her tenure as United States Secretary of States. • In 1978, Hillary and Bill Clinton were criticized for buying acres of riverfront land to form Whitewater Development Corp. through wrong means. • Clinton Foundation has been criticized for the errors in its tax returns. • She has been criticized in Benghazi case for failing to protect US interests abroad. • She has been criticized for delivering a speech on inequality by wearing a Giorgio Armani jacket worth 12000 USD. Favourite Things Of Hillary Clinton Favorite Politician Martin Luther King Jr. Favorite Quote "Human rights are women's rights. Women's rights are human rights". Favorite Food Hot sauces, DeFrazio’s Pizzeria in Troy, apple, burgers, ice creams, wine Favorite Film Casablanca, The Wizard of Oz, Out of Africa Favorite Book Fyodor Dostoyevsky's 'The Brothers Karamazov', The Return of the Prodigal Son Boys, Affairs and More Of Hillary Clinton Marital Status Married Affairs/Boyfriends Not Known Husband Bill Clinton (married 1975) Children Daughter- Chelsea Clinton (born February 27, 1980) Earning Money Of Hillary Clinton Net Worth 22 million USD This Biography written by www.welidot.com Read the full article

1 note

·

View note

Text

Looking for Tax service in USA? The Financezoom is an international tax audit company providing US and international tax consulting, software solutions and customized services. Contact us.

#Corporate Tax Preparation Services USA#investment advice for us businesses#us market investment consulting#tr-usa tax treaty services#small business accounting services in us

0 notes

Text

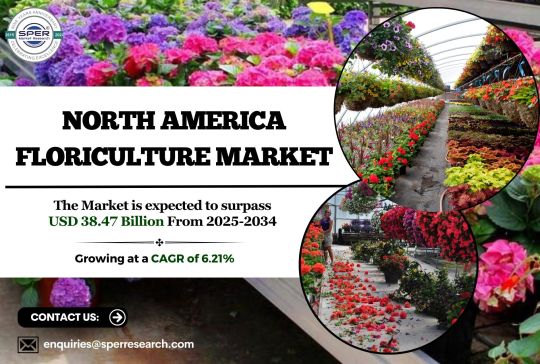

North America Floriculture Market Analysis, Demand, Business Scope, Outlook and Future Opportunities: SPER Market Research

Floriculture is an area of horticulture that focuses on the management and production of ornamental and flowering plants. The production, processing, marketing, and distribution of flowers and ornamental plants, such as cut flowers, bedding plants, houseplants, and potted flowering plants, are all included in this field. With the Netherlands being the world's top flower exporter, followed by Germany and Italy, floriculture is a major contributor to the worldwide economy. The industry has a significant economic impact due to a variety of operations, including flower delivery, marketing, and arrangement. Through landscaping and the creation of green areas, floriculture also improves soil quality, increases biodiversity, and purifies the air.

According to SPER market research, ‘North America Floriculture Market Size- By Product, By Distributional Channel, By End User - Regional Outlook, Competitive Strategies and Segment Forecast to 2034’ state that the North America Floriculture Market is predicted to reach 38.47 billion by 2034 with a CAGR of 6.21%.

Drivers:

The floriculture market in North America is expanding significantly due to a number of important factors. The efficiency and quality of flower production have been improved by technological developments in greenhouse management and horticulture. Demand from consumers for locally grown, fresh flowers and plants is increasing, and they are increasingly drawn to unusual and exotic types. The proliferation of e-commerce platforms has increased the accessibility of floral products while providing individualized services and convenience. Further driving market expansion is the growing appeal of indoor plants and home gardening, particularly among city people. Holidays and cultural events continue to fuel seasonal demand, which supports the market's overall growth.

Request a Free Sample Report: https://www.sperresearch.com/report-store/north-america-floriculture-market.aspx?sample=1 Restraints:

Growth and sustainability in the North American floriculture market are impacted by a number of issues. Inventory and production planning are made more difficult by seasonal demand swings, which cause sales peaks and troughs, especially during holidays like Mother's Day, Valentine's Day, and Christmas. Furthermore, a hurdle for small-scale farmers and newcomers is the high initial cost of sophisticated cultivating equipment, such as greenhouse structures and climate control systems. Fresh floriculture products may become less popular as a result of competition from artificial flowers, which are less expensive and have longer shelf life. The physically taxing nature of floriculture employment also discourages potential workers, which creates operational difficulties for the sector.

Floriculture market is primarily controlled by the United States. The floriculture industry in the United States is fiercely competitive, and major firms are concentrating on ways to increase their market share and satisfy rising customer demand. Some significant market players are Kurt Weiss Greenhouses, Inc., Costa Farms, The Queen’s Flowers, Green Circle Growers, Greenheart Farms, MONROVIA NURSERY COMPANY, Larksilk, Sun Valley Floral Farms, TERRA NOVA Nurseries, Inc. and Benary.

For More Information, refer to below link: –

North America Floriculture Market Growth

Related Reports:

Bee Pollen Market Growth, Size, Trends Analysis - By Type, By Application - Regional Outlook, Competitive Strategies and Segment Forecast to 2034

Waterproof Makeup Market Growth, Size, Trends Analysis - By Product, By Form, By Distribution Channel, By End User - Regional Outlook, Competitive Strategies and Segment Forecast to 2034

Follow Us –

LinkedIn | Instagram | Facebook | Twitter

Contact Us:

Sara Lopes, Business Consultant — USA

SPER Market Research

+1–347–460–2899

#North America Floriculture Market#North America Floriculture Market Growth#North America Floriculture Market Segmentation#North America Floriculture Market Future Outlook#North America Floriculture Market Scope#North America Floriculture Market Challenges#North America Floriculture Market Competition#North America Floriculture Market forecast#North America Floriculture Market Share#North America Floriculture Market Size#North America Floriculture Market Revenue#North America Floriculture Market Demand#North America Floriculture Market Analysis

0 notes

Text

Verified Massachusetts Lawyers Email List

Verified Massachusetts Lawyers Email List

Verified Massachusetts Lawyers Email List: The Key to Effective Legal Marketing. In the competitive legal industry, reaching the right audience is crucial for success. Whether you're a law firm, legal consultant, or legal service provider, having access to a Verified Massachusetts Lawyers Email List can significantly enhance your marketing efforts. At Lawyersdatalab.com, we provide a comprehensive, up-to-date, and verified email database of Massachusetts attorneys, helping businesses connect with legal professionals efficiently.

Key Data Fields in the Massachusetts Lawyers Email List

Our Verified Massachusetts Lawyers Email List includes essential contact details such as:

- Attorney Name

- Law Firm Name

- Practice Area (Corporate Law, Family Law, Criminal Defense, etc.)

- Bar Association Membership Details

- Email Address (Verified & Updated)

- Phone Number

- Law Firm Address (Street, City, ZIP Code, State)

- Website URL

- Years of Experience

- License Status

This structured data allows businesses to target attorneys based on their specialty, location, and professional standing for more effective outreach.

Benefits of Using a Verified Massachusetts Lawyers Email List

1. Targeted Marketing for Law Firms

If you're a law firm looking to network with other attorneys, this verified email list helps in building strong professional connections and potential partnerships.

2. Legal Services Outreach

Companies offering legal software, case management tools, or legal research services can use this email list to promote their products directly to lawyers in Massachusetts.

3. Increased Lead Generation & Conversion

A verified contact database ensures that your emails reach the right legal professionals, improving response rates and increasing potential client conversions.

4. Law Firm Growth & Client Referrals

Law firms looking for referral partnerships with attorneys in other specialties can utilize the email list for collaborations and business growth.

5. Efficient CRM & Database Management

A clean and structured attorney contact database helps firms maintain an organized CRM system, ensuring accurate and up-to-date client information.

6. Legal Recruiters & Hiring Firms

For legal recruiters, having access to a Massachusetts attorneys database allows them to target potential candidates for law firms or corporate legal departments.

7. Cost-Effective & Time-Saving

Instead of spending hours manually searching for attorneys' contact information, our ready-to-use email list saves time and increases marketing efficiency.

How This Email List is Useful for Law Firm Marketing?

- Promote Legal Events & Webinars – Invite Massachusetts attorneys to legal conferences, networking events, and training sessions.

- Expand Your Client Base – Reach out to lawyers who may need outsourced legal support, consultancy, or case referrals.

- Boost Digital Marketing Efforts – Use the email list for personalized email campaigns, newsletters, and legal service promotions.

Why Choose LawyersDataLab.com?

At LawyersDataLab.com, we provide verified, accurate, and updated attorney email lists tailored to your marketing needs. Our lists are:

✔ Regularly Updated for Accuracy

✔ Filtered & Verified to Avoid Bounce Rates

✔ Customized Based on Specific Legal Niches

✔ Compliant with Data Protection Regulations

Popular Lawyers Email List

New Mexico Attorney Email Database

Verified Texas Lawyers Email List

Verified Wyoming Lawyers Email List

Verified Washington Attorney Email Database

New York Lawyers Email Database

Verified South Dakota Attorneys Email List

Michigan Attorneys Email Database

Canada Tax Attorneys Email List

Verified Alaska Lawyers Email Database

Verified Alabama Lawyers Email List

Best Verified Massachusetts Lawyers Email List in USA

Charlotte, Tulsa, Oklahoma City, Los Angeles, Omaha, Orlando, Kansas City, Arlington, Milwaukee, Portland, Bakersfield, Atlanta, Long Beach, Nashville, Chicago, Washington D.C., Raleigh, Sacramento, Philadelphia, Austin, Las Vegas, Colorado Springs, Tucson, Virginia Beach, Fort Worth, Detroit, Wichita, Honolulu, Louisville, Miami, Columbus, Houston, Fresno, San Antonio, Indianapolis, New Orleans, Baltimore, Phoenix, Albuquerque, Denver, Seattle, Dallas, Memphis, New York, San Francisco, El Paso, Boston, San Jose, San Diego, Jacksonville and Mesa.

Conclusion

The Verified Massachusetts Lawyers Email List is an invaluable asset for law firms, legal service providers, and businesses looking to connect with attorneys. If you want to enhance your law firm marketing or build a strong legal network, our comprehensive email database is the perfect solution.

For more details, contact [email protected] or visit Lawyersdatalab.com today! 🚀

#verifiedmassachusettslawyersemaillist#massachusettsattorneyemaildatabase#legalmarketing#lawfirmmarketing#lawyersmarketing#legalindustry#targetedmarketing#legalservices#businessgrowth#lawyersdatalab#lawyersemaillistscraping

0 notes

Text

Introduction

The USA is one of the largest import markets in the world, making it a lucrative destination for Indian exporters. With a diverse range of industries and a high demand for quality products at competitive prices, exporting to the USA can be a game-changer for businesses in India. However, navigating the complex regulatory landscape, ensuring compliance, and optimizing costs are crucial to profitability.

In this guide, we will take you through a step-by-step process on how to export to the USA profitably. Whether you are a small business or an established exporter in India, this guide will help you maximize your opportunities while minimizing risks.

Understanding the Export Market in the USA

Who is the Biggest Exporter to the USA?

The USA imports goods from various countries, but the biggest exporters to the USA include:

China – Electronics, machinery, textiles

Mexico – Vehicles, machinery, agricultural products

Canada – Oil, minerals, vehicles

India – Pharmaceuticals, textiles, gems, IT services

India is a significant trade partner, with exports to the USA growing steadily due to strong demand in various sectors. Understanding market demand and key competitors will help you position your products effectively.

Steps to Export to the USA from India

1. Identify Profitable Products to Export

Certain products have a high demand in the USA, including:

Pharmaceuticals

Textiles & Apparel

Gems & Jewelry

Engineering Goods

Spices & Agro Products

Handicrafts & Home Decor

Conduct market research to determine demand trends, competition, and pricing strategies before finalizing your export product.

2. Register Your Export Business

To legally export from India, follow these steps:

Register your company with the Ministry of Corporate Affairs (MCA).

Obtain an Importer Exporter Code (IEC) from the Directorate General of Foreign Trade (DGFT).

Register with the GST Department for tax compliance.

Obtain necessary certifications depending on your product, such as FDA approval for pharmaceuticals.

3. Comply with USA Import Regulations

The USA has stringent import regulations. Ensure compliance with:

Food and Drug Administration (FDA) for food, drugs, and cosmetics.

US Customs and Border Protection (CBP) for tariff classifications and duties.

Consumer Product Safety Commission (CPSC) for safety standards.

Environmental Protection Agency (EPA) for eco-friendly products.

Hiring a compliance expert or consultant can help navigate regulatory complexities and avoid penalties.

4. Find Reliable Buyers and Distributors

Connecting with the right buyers and distributors is key to success. Consider:

B2B platforms like Exporters Worlds, IndiaMART, and Global Sources.

Trade fairs and exhibitions such as MAGIC Las Vegas (apparel) or JCK Las Vegas (jewelry).

Chambers of commerce and export promotion councils for networking.

Building strong relationships and offering competitive pricing will help secure long-term business deals.

5. Choose the Right Shipping and Logistics Partner

Efficient logistics ensure timely delivery and cost-effectiveness. Key factors to consider:

Select between air freight (fast but expensive) or sea freight (cost-effective for bulk orders).

Work with reliable freight forwarders like DHL, FedEx, or Maersk.

Ensure proper packaging and labeling to meet US standards.

Get insurance coverage to mitigate transit risks.

6. Manage Costs and Optimize Pricing

To maintain profitability, focus on:

Reducing costs through bulk shipping and negotiating with suppliers.

Taking advantage of export incentives like MEIS (Merchandise Exports from India Scheme).

Setting competitive yet profitable pricing based on market demand and competitor analysis.

7. Handle Payments Securely

International transactions should be secure and hassle-free. Consider:

Letter of Credit (LC) for guaranteed payments.

PayPal, Stripe, or international bank transfers for online transactions.

Partnering with financial institutions that offer export credit insurance.

Common Challenges and How to Overcome Them

Challenge 1: Stringent Compliance Regulations

Solution: Work with legal experts and compliance consultants who specialize in US import laws.

Challenge 2: High Shipping and Tariff Costs

Solution: Optimize logistics, use Free Trade Agreements (FTAs), and explore bonded warehouses in the USA.

Challenge 3: Finding Trustworthy Buyers

Solution: Leverage trade fairs, B2B portals, and government trade facilitation programs.

Conclusion

Exporting to the USA from India can be a highly profitable venture if done strategically. By choosing the right products, ensuring compliance, optimizing logistics, and building strong buyer relationships, Indian exporters can establish a successful and sustainable export business.

If you found this guide helpful, subscribe to our newsletter for more export insights, or leave a comment below with your questions!

#Exporters in India#How to export from India to USA#Profitable export business to USA#Indian export products in demand in USA#USA import regulations for Indian exporters#Best Indian products to export to USA#Export business opportunities in USA#Indian exporters to USA market#Shipping and logistics for USA exports#USA import compliance for Indian businesses

0 notes

Text

Streamline Your Business with Outsource bookkeeping services in USA by MAS LLP

Introduction: In today's fast-paced business environment, staying on top of your financial records is crucial. However, managing bookkeeping in-house can be time-consuming and costly. That's where outsource bookkeeping services come into play. If you're looking to Outsource bookkeeping services in USA, MAS LLP offers comprehensive solutions designed to meet your business needs. In this blog, we'll explore the benefits of outsourcing bookkeeping and how MAS LLP can help streamline your financial operations.

The Benefits of Outsourcing Bookkeeping Services

Cost Savings Outsourcing bookkeeping can significantly reduce your overhead costs. By partnering with MAS LLP, you eliminate the need for hiring full-time staff, training expenses, and costly accounting software. This allows you to allocate resources more efficiently and invest in other critical areas of your business.

Expertise and Accuracy At MAS LLP, our team of professional bookkeepers possesses extensive experience and knowledge in managing financial records. We ensure that your books are accurate, up-to-date, and compliant with the latest regulations. With our expertise, you can avoid costly errors and ensure your financial data is reliable.

Time Efficiency Outsourcing bookkeeping frees up valuable time for you and your team. Instead of spending hours on data entry and financial reconciliations, you can focus on core business activities such as sales, marketing, and customer service. MAS LLP takes care of your bookkeeping needs, allowing you to concentrate on growing your business.

Scalability As your business grows, so do your bookkeeping needs. MAS LLP provides scalable solutions that can adapt to your changing requirements. Whether you're a startup or a large corporation, our services can be tailored to meet the demands of your business at every stage.

Advanced Technology MAS LLP utilizes cutting-edge accounting software and technology to streamline bookkeeping processes. Our cloud-based solutions offer real-time access to your financial data, ensuring transparency and enabling you to make informed decisions quickly. Why Choose MAS LLP for Outsource bookkeeping services in USA?

Comprehensive Services MAS LLP offers a wide range of bookkeeping services, including accounts payable and receivable, bank reconciliations, financial statement preparation, payroll processing, and tax filing. Our comprehensive approach ensures that all aspects of your financial management are covered.

Customized Solutions We understand that every business is unique. MAS LLP provides customized bookkeeping solutions tailored to your specific needs and industry requirements. Our personalized approach ensures that you receive the support necessary to achieve your financial goals.

Reliable Support At MAS LLP, we pride ourselves on delivering exceptional customer service. Our dedicated team is always available to address your queries and provide the support you need. We build strong relationships with our clients, ensuring that your business receives the attention it deserves.

Compliance and Security Maintaining compliance with financial regulations is critical for any business. MAS LLP ensures that your financial records are in line with the latest standards and regulations. Additionally, we prioritize data security, employing robust measures to protect your sensitive financial information. How to Get Started with MAS LLP Getting started with MAS LLP's outsource bookkeeping services is simple. Here's a step-by-step guide: Initial Consultation: Contact us to schedule a consultation. We'll discuss your business needs and determine how our services can best support you. Customized Plan: Based on our discussion, we'll create a customized bookkeeping plan tailored to your specific requirements. Onboarding: Our team will guide you through the onboarding process, ensuring a smooth transition to our services. Ongoing Support: Once onboard, you'll receive continuous support and regular updates on your financial records. Conclusion Outsource bookkeeping services in USA with MAS LLP can transform the way you manage your business finances. With cost savings, expert accuracy, time efficiency, and scalability, our services offer a strategic advantage for businesses of all sizes. Contact MAS LLP today to learn more about how we can streamline your financial operations and help your business thrive.

#accounting & bookkeeping services in india#businessregistration#chartered accountant#foreign companies registration in india#income tax#auditor#audit#taxation#ap management services

6 notes

·

View notes