#Debt Negotiations

Explore tagged Tumblr posts

Text

Overdraft Lines of Credit: Debt Relief for Canadian Businesses

Dealing with consumer debt in Canada, whether it's overdraft, credit lines, or business debt, can be stressful. But with the right debt relief solutions, you can take control of your finances. Discover the options available to you in our latest blog!

Get on the road to financial recovery—read the full blog here: https://www.credit720.ca/consumer-debt-relief-canada-overdraft-lines-business/

#debt consolidation calgary#debt negotiations#debt settlement edmonton#debt consolidation companies Toronto#financial debt help in alberta

0 notes

Text

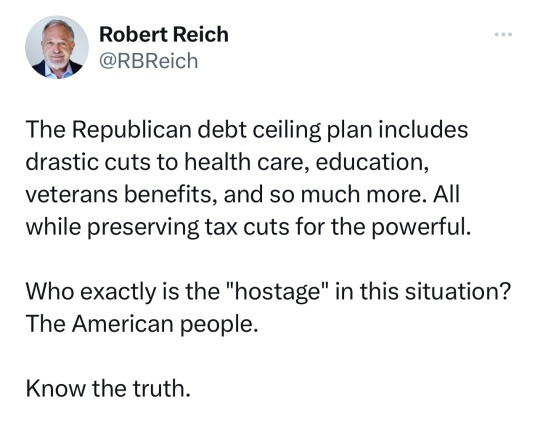

Just so we are all really clear: Republicans are using the manufactured debt ceiling “crisis” as a bargaining chip, threatening to blow up the U.S. (and world?) economy unless Biden caves in to cutting things like food benefits for women, children, the poor and the working poor. Got it? That’s their deal—either eviscerate the social safety net, or economy go boom!

No doubt, a lot of liberals are pressuring Biden to acquiesce, because 1) the economy will absolutely positively go boom! and 2) because they will blame Biden if the economy crashes

BUT..! Here’s the thing: If Biden does cave in and give Republicans even a little bit of what they are demanding, I fuckn promise you that in October and November of next year, Republican ads are going to be like: “Vote for Trump! Remember how Biden cut food benefits for women and children? Trump won’t do that”

And it will not matter how many 8k high quality videos you have showing that it was really Republicans who took the economy hostage and demanded those cuts. By time the general election rolls around in ‘24, Republicans will be airing ChatGPT AI political ads where it looks like Biden was the one asking for all the cuts to SNAP and demanding ridiculously harder work requirements

Believe that!!

Did you even see those ignorant charlatans eating from Trump’s hands on CNN?? These are bomb throwers. They enjoy blowing up the economy, especially when it hurts poor people! You cannot in good faith make any policy decision about what to do based off of what Republican voters “might think” when it’s election time! They don’t “think” AT ALL, and even if they did, they still do not care! They’re unscrupulous deplorables. They will always always always find a way to blame Biden and the Democrats, no matter what, so Biden may as well go on and do what’s right while he can, and try actually fighting against these cartoonishly evil Republicans

AND..! Do I even need to remind anyone what happens when you cave in to bullies?? If Biden caves now, then Republicans will bully every Democrat from here on out, and the programs they take hostage next time will be Social Security, Medicare and Medicaid

Caving in to the whims of Kevin pickme! McCarthy and Marjorie Traitor Greene is bad politics, and it will only get worse in the future if Biden folds now

#politics#kevin mccarthy#joe biden#republicans#debt ceiling#bullies#odin rants#hostage negotiations 101#debt crisis#national debt#manufactured crisis#bullying

267 notes

·

View notes

Text

i think they should just give every single person a one time payment of 100.000 $ (or rather the local adjusted equivalent) and see where it goes. they say that will just lead to inflation but i know that economics are a scam so i feel like we should just try it

#i feel like… for rich people it wont make a difference#middle class will probably pay off their credit put some money aside go on a really expensive vacation#and all the exploitative industries would crumble because the exploited lower class#would not be set for life with 100k and still had to work but now they have more negotiating power regarding working conditions and salary#and a lot of money would go back to the economy anyways and they could invest in making better working conditions#which they have to if they want to keep employees who are now able to pay off debt and take time off#mine

16 notes

·

View notes

Text

Cheque Bounce Grievance: Legal Actions in Uttar Pradesh

Grievance Status for registration number : GOVUP/E/2024/0091021Grievance Concerns ToName Of ComplainantSantosh Kumar MauryaDate of Receipt13/12/2024Received By Ministry/DepartmentUttar PradeshGrievance DescriptionTo Superintendent of Police District Mirzapur , Uttar Pradesh PIN Code 231001Subject- For taking action in the matter cheque bounced.Most respected Sir, Please take a glance of Return…

#criminal-law#etc.#featured#insufficiency#law#negotiable-instruments#news#penalizes the dishonor of a cheque issued to pay a debt or liability#Section 138 of the Negotiable Instruments Act

4 notes

·

View notes

Photo

Mike Luckovich

* * * *

LETTERS FROM AN AMERICAN

June 2, 2023

HEATHER COX RICHARDSON

JUN 3, 2023

Three years ago today, on June 2, 2020, days after then–Minneapolis police officer Derek Chauvin murdered George Floyd by kneeling on his neck for nearly nine minutes, Martha Raddatz of ABC snapped the famous and chilling photograph of law enforcement officers in camouflage, their names and units hidden, standing in rows on the steps of the Lincoln Memorial. Mr. Floyd’s murder sparked protests across the country, and Trump used those protests as a pretext to crack down on his opponents. Just the day before, after a call with Russian president Vladimir Putin, Trump told state governors on a phone call: “You have to dominate. If you don’t dominate, you’re wasting your time.... You’ve got to arrest people, you have to track people, you have to put them in jail for 10 years and you’ll never see this stuff again.” Then he used a massive police presence wielding tear gas, rubber bullets, and flash-bang explosives to clear peaceful Black Lives Matter protesters from Lafayette Square across from the White House. Tonight, President Joe Biden addressed the nation from the Oval Office to emphasize that democracy depends on bipartisanship.” [W]hen I ran for President,” he began, “I was told the days of bipartisanship were over and that Democrats and Republicans could no longer work together. But I refused to believe that, because America can never give in to that way of thinking…. [T]he only way American democracy can function is through compromise and consensus, and that’s what I worked to do as your President…to forge a bipartisan agreement where it’s possible and where it’s needed.” While he noted that he has signed more than 350 bipartisan laws in his time in office, his major focus today was on the bipartisan budget agreement passed by the House and Senate after months of wrangling to get House Republicans to agree to lift the debt ceiling. Biden will sign it tomorrow, averting the nation’s first-ever default. Biden characterized those threatening to force the U.S. into default as “extreme voices,” who were willing to cause a catastrophe. The economy, which continues to add jobs at a cracking pace—another 339,000 in May, according to the numbers released today by the U.S. Bureau of Labor—would have been thrown into recession. As many as 8 million Americans would have lost their jobs, retirement savings would have been decimated, borrowing for everything from mortgages to government funding would have become much more expensive, and “America’s standing as the most trusted, reliable financial partner in the world would have been shattered.” “It would have taken years to climb out of that hole,” he said. But the extremists were sidelined, and the House Republicans and the White House reached an agreement. Biden went out of his way to praise House speaker Kevin McCarthy (R-CA) and his team, saying that the two negotiating teams “were able to get along and get things done. We were straightforward with one another, completely honest with one another, and respectful with one another. Both sides operated in good faith. Both sides kept their word.” This was not entirely true—McCarthy constantly attacked Biden in the media—but Biden was hammering on the image of bipartisanship. Yesterday, Jonathan Lemire, Adam Cancryn, and Jennifer Haberkorn of Politico reported that Biden and his team plan to make the case for reelection on their ability to negotiate deals that get things done for the American people, acting as the “adults in the room” in contrast to Republican extremists. The budget deal that led to the suspension of the debt ceiling is a major illustration of that position. Biden also praised House minority leader Hakeem Jeffries (D-NY), Senate majority leader Chuck Schumer (D-NY), and Senate minority leader Mitch McConnell (R-KY), claiming that “[t]hey acted responsibly and put the good of the country ahead of politics.” The solution to the debt ceiling crisis is a major victory for Biden’s team not only because it happened, but also because it leaves Biden’s key priorities intact, not least because they are popular and Republicans did not want to go into 2024 having demanded unpopular cuts. Biden noted that the measure will cut spending as Republicans wanted (although not necessarily through the measures they insisted on adding), but reiterated that it is the Republican Party that has been on a spending spree. “We’re all on a much more fiscally responsible course than the one I inherited when I took office,” Biden said. “When I came to office, the deficit had increased every year the previous four years. And nearly $8 trillion was added to the national debt in the last administration,” while the deficit fell by $1.7 trillion in his first two years in office. Biden laid out that the deal protects his reworking of the U.S. economy to support ordinary Americans. It protects Social Security and Medicare, as well as healthcare and veterans’ services. It protects the investments in the economy that have enabled the country to add more than 13 million new jobs, including 800,000 jobs in manufacturing. It protects investments in addressing climate change. Finally, Biden vowed to make the wealthy—those who earn more than $400,000 a year—pay their fair share in taxes. “I know bipartisanship is hard and unity is hard,” he concluded, “but we can never stop trying, because in moments like this one—the ones we just faced, where the American economy and the world economy is at risk of collapsing—there is no other way. “No matter how tough our politics gets, we need to see each other not as adversaries, but as fellow Americans. Treat each other with dignity and respect. To join forces as Americans to stop shouting, lower the temperature, and work together to pursue progress, secure prosperity, and keep the promise of America for everybody.” What a difference three years can make.

—

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

#Mike Luckovich#political cartoons#Biden#Debt ceiling#negotiations#compromise#Biden Administration Accomplishments#job growth#fiscal responsibility#Democratic accomplishments

14 notes

·

View notes

Text

why did my brain only register that we're on month 8 now

#whaat the heck#i was negotiating the college debts and one of the payments is gonna be on january but i only divided it by 5#then my brain went galactic

4 notes

·

View notes

Text

speaking of credit card debt, watch out for companies called things like "Accreddited Debt Relief". they offer to consolidate your debt and get you a lower monthly payment, which they will do. the catch is, they basically let all of your debt go into default, and your credit score is TRASHED for years to come.

#they let it all go default then negotiate with the companies to lower the debt on your behalf#which is something you can do yourself#they straight lied to me on the phone about how it will affect my credit score

1 note

·

View note

Text

How to Negotiate Interest Rate on Credit Card and Save Thousands

Credit card interest rates can quickly add up, making it difficult to pay off debt. However, negotiating your interest rate can save you hundreds or even thousands of dollars. Many cardholders don’t realize that credit card companies are often willing to lower rates if you know how to ask. In this comprehensive guide, we’ll show you how to negotiate interest rate on credit card effectively and…

#Credit Card APR#Credit Card Interest Rate Negotiation#Lower Credit Card Interest Rate#Negotiate Credit Card Rate#Reduce Credit Card Debt

0 notes

Text

#debt consolidation calgary#debt consolidation red deer#debt negotiations#financial debt help in alberta#budgeting service edmonton#debt settlement edmonton#debt negotiation red deer

0 notes

Text

Republican hostage demands include:

Increasing and not cutting the defense budget, nor the Border Patrol budget

Cut funding to the following programs and agencies by 51 percent: Supplemental Nutrition Assistance Program (SNAP), the Social Security Administration, Environmental Protection Agency, Veteran’s Assistance Program, Health and Human Services, Department of Education, Department of Housing and Urban Development, the Justice Department, the State Department, the Department of Transportation, NASA, the Labor Department, and more (source)

Rescind any student loan relief and make borrowers pay back any payments that were paused or recently forgiven

Defund the IRS so that it cannot go after wealthy tax evaders

New, harsher work requirements for Medicaid recipients

Raise the work retirement age for people enrolled in the SNAP, from 50 to 55 years old

More stringent work requirements for food stamp recipients

Deregulation of drilling and mining permitting

Repeal any tax breaks that encouraged using renewable energy sources

Pledges to increase domestic production of oil and other fossil fuels

In short, the Republican demands to raise the debt ceiling is a manufactured crisis. It’s yet another GOP wish list to attack poor people by eviscerating the social safety net, while simultaneously deregulating big businesses and defunding the government agencies that could hold polluters and exploiters accountable

👉🏿 https://www.pbs.org/newshour/politics/heres-whats-in-the-gop-bill-to-lift-the-u-s-debt-limit

👉🏿 https://www.dataforprogress.org/blog/2022/12/12/voters-want-congress-to-raise-the-debt-ceiling-and-protect-social-programs

👉🏿 https://www.cbsnews.com/amp/news/debt-ceiling-house-republicans-bill-limit-save-grow-act/

113 notes

·

View notes

Text

Can a Bank Seize Your Assets for Unpaid Personal Loans?

A personal loan is an unsecured loan, meaning it does not require collateral. However, failing to repay the loan on time can have serious consequences, including legal action, asset seizure, and credit damage. Many borrowers worry whether banks can seize their assets if they default on a personal loan.

In this article, we will explore what happens when you fail to repay a personal loan, whether banks can legally seize your assets, and what steps you can take to avoid loan default consequences.

1. Can Banks Seize Your Assets for an Unpaid Personal Loan?

Since personal loans are unsecured, banks cannot directly seize your assets like they can with a secured loan (e.g., home loan or car loan). However, if you continuously default, banks may take legal action to recover their money, which could eventually lead to asset seizure under court orders.

Here’s how it works:

If you miss a few EMIs, the bank will send you reminders via calls, emails, and letters.

If you continue defaulting, the bank may report the default to the credit bureau and initiate a loan recovery process.

If the bank fails to recover the loan amount, they may take legal action under the SARFAESI Act, Debt Recovery Tribunal (DRT), or Civil Court.

If the court rules in the bank’s favor, the lender may get approval to seize your assets to recover the unpaid amount.

Although banks cannot seize assets directly, prolonged defaults may lead to legal enforcement and eventual asset attachment by the court.

2. What Happens When You Default on a Personal Loan?

Failing to repay your personal loan can lead to the following consequences:

2.1. Late Payment Fees and Penalties

Banks charge late payment fees if you miss EMI payments. The penalty amount depends on the lender’s policy and the delay period.

2.2. Negative Impact on Credit Score

When you default on a loan, the lender reports the missed payments to credit bureaus (CIBIL, Experian, etc.). This lowers your credit score, making it difficult to get future loans or credit cards.

2.3. Legal Action by the Bank

If you fail to repay the loan even after multiple reminders, the bank may:

Issue a legal notice demanding payment.

File a civil suit in court or approach the Debt Recovery Tribunal (DRT).

Seek a court order for repayment or asset attachment.

2.4. Asset Seizure via Court Orders

Although banks cannot directly seize assets for an unsecured personal loan, they can:

File a lawsuit and obtain a court ruling for repayment.

If the borrower ignores the court ruling, the court may allow asset attachment or wage garnishment.

3. When Can a Bank Seize Your Assets?

A bank can only seize assets in the following cases:

3.1. If the Loan is Secured with Collateral

If your loan is a secured personal loan (e.g., gold loan, loan against property, or fixed deposit loan), the bank has the legal right to seize the pledged asset if you default.

3.2. If the Bank Gets a Court Order for Asset Attachment

For unsecured personal loans, banks cannot seize assets directly. However, they can:

Take legal action and obtain a court order.

If the borrower fails to comply, the court may allow asset attachment to recover dues.

3.3. If a Guarantor is Involved

If someone co-signed your loan as a guarantor, the bank can demand repayment from the guarantor and take legal action if they also fail to pay.

4. How to Avoid Loan Default and Asset Seizure?

If you are struggling to repay your loan, here are some steps you can take to prevent legal action and asset seizure:

4.1. Contact the Bank Immediately

If you are unable to pay your EMIs, inform your bank as soon as possible. Many banks offer:

Loan restructuring (adjusting EMI amounts)

Temporary EMI moratoriums

Flexible repayment plans

4.2. Request a Loan Settlement

If you are in serious financial distress, you can request a one-time settlement where the bank agrees to reduce the outstanding amount in exchange for a lump sum payment. However, this may negatively impact your credit score.

4.3. Refinance or Balance Transfer Your Loan

If you find it difficult to repay your current loan, consider:

Refinancing with another lender offering lower interest rates.

Transferring your balance to a lender with better repayment options.

🔗 Check Balance Transfer Options:

IDFC First Bank Personal Loan

Axis Bank Personal Loan

4.4. Avoid Taking Multiple Loans

Taking multiple loans at once can increase your financial burden, making it harder to manage EMIs. Always borrow within your repayment capacity.

4.5. Consider Debt Consolidation

If you have multiple loans, you can consolidate them into one lower-interest loan. This helps in managing EMIs efficiently.

🔗 Explore Personal Loan Consolidation Options:

Bajaj Finserv Personal Loan

Tata Capital Personal Loan

5. Legal Rights of Borrowers in Case of Loan Default

If you default on a loan, you still have legal rights under consumer protection laws:

5.1. Banks Cannot Harass Borrowers

The RBI guidelines prohibit banks from using abusive or threatening language for loan recovery.

Borrowers can file a complaint with RBI if they face harassment from recovery agents.

5.2. Right to Fair Loan Recovery Process

The bank must notify you in advance before taking legal action.

If you receive a legal notice, you have the right to seek legal assistance before responding.

5.3. Right to Settle Loans Amicably

Borrowers can negotiate with the bank for loan restructuring or settlement options before legal action is taken.

How to Protect Yourself from Loan Default Risks

While personal loans are unsecured, defaulting on payments can lead to serious consequences such as credit damage, legal action, and potential asset seizure through court orders. To avoid this:

✅ Always borrow within your repayment capacity. ✅ Stay updated on your loan terms and repayment schedule. ✅ Contact your bank if you face financial difficulties. ✅ Consider balance transfers or loan restructuring if needed. ✅ Understand your legal rights against unfair loan recovery practices.

🔗 Looking for a Personal Loan? Check the Best Options Here:

Explore Personal Loans

By staying financially responsible and proactive, you can avoid loan defaults and protect your assets from legal risks.

#Can a bank seize assets for unpaid personal loans?#What happens if you default on a personal loan?#Personal loan default consequences#Legal action for personal loan non-payment#Can banks take legal action for unpaid loans?#Personal loan repayment failure#What happens if I stop paying my personal loan?#Bank loan recovery process#Debt recovery tribunal for personal loans#Unsecured loan default legal implications#finance#personal loan online#loan services#personal loan#bank#personal loans#fincrif#nbfc personal loan#loan apps#personal laon#Personal loan non-payment penalties#Can banks freeze accounts for unpaid loans?#Personal loan foreclosure and settlement#How to avoid legal action for loan default#Loan recovery process in India#Personal loan EMI default impact on credit score#How to negotiate loan repayment with a bank#Debt consolidation for loan defaulters#Personal loan settlement options#Bank recovery agents and borrower rights

0 notes

Text

Exploring Bankruptcy Alternatives and Debt Negotiation with the Bureau of Debt Settlement

When faced with mounting debt, many people think bankruptcy is their only way out. While bankruptcy can provide relief, it comes with significant long-term consequences, such as damaged credit and limited financial opportunities. Thankfully, organizations like the Bureau of Debt Settlement specialize in offering bankruptcy alternatives that provide a path to financial recovery without the lasting stigma.

One of the key services provided by the Bureau of Debt Settlement is debt negotiation. This process involves working with creditors to reduce the total amount owed or establish more manageable repayment terms. Debt negotiation is a collaborative approach, ensuring that both the debtor and creditor reach a mutually beneficial agreement. With expert negotiators advocating on your behalf, you can often secure better terms than attempting to handle these discussions alone.

The Bureau of Debt Settlement also educates clients on other bankruptcy alternatives that may be better suited to their unique situations. These can include debt consolidation, credit counseling, or even creating personalized repayment plans. By exploring these options, individuals and businesses can avoid the financial and emotional toll of bankruptcy.

What sets the Bureau of Debt Settlement apart is its client-focused approach. Their team of seasoned professionals takes the time to understand your financial situation thoroughly before crafting a tailored solution. This ensures that the strategy aligns with your goals, whether it's reducing debt burdens, protecting assets, or rebuilding credit.

The Bureau of Debt Settlement empowers individuals and businesses to take control of their finances through informed decision-making. By offering comprehensive services like debt negotiation and presenting effective bankruptcy alternatives, they provide a lifeline for those seeking to overcome financial challenges.

If you're feeling overwhelmed by debt, consider exploring the services offered by the Bureau of Debt Settlement. Bankruptcy doesn't have to be your only option—there are better paths to a brighter financial future.

0 notes

Photo

Biden’s steady hand.June 1, 2023

ROBERT B. HUBBELL

JUN 1, 2023

On Wednesday, the House passed a budget bill that suspends the debt ceiling through January 2025. The bill passed with support from 149 Republicans and 165 Democrats. It will take days to untangle the sundry motivations for votes against the bill, especially on the Democratic side of the House. But the primary reason for Republican unhappiness is clear. As Presidential candidate Tim Scott (R-SC) said, the deal “gives Biden an open checkbook”—an assessment shared by the NYTimes. See NYTimes, The Big Part of the Debt Ceiling Deal Congress Isn’t Talking About.

Per the Times, the bill not only suspends the debt ceiling (i.e., there is no debt ceiling through 2025) but also mandates future spending on bills expected to be passed over the next several months. The cost of those future bills is unknown but may exceed $500 million, reducing the GOP’s targeted deficit reduction from $4.8 trillion to $1 trillion (over a decade). The Times writes,

[T]he agreement struck by House Speaker Kevin McCarthy and President Biden will require Congress to authorize much more spending as part of a second set of bills expected to pass in coming months.

[¶]

Those future changes, which the White House is calling “agreed-upon adjustments,” and which many observers have called side deals or even gimmicks, would increase federal spending in unconventional ways and then direct that money into the part of the budget that the current bill cuts the deepest.

And, as noted yesterday, the Congressional Budget Office published a report estimating that SNAP benefits would increase under the deal—deflating a key GOP talking point. As the Freedom Caucus began to absorb the CBO’s report, the number of Republicans voting against the bill—and McCarthy’s leadership—increased steadily throughout the day. See Politico, McCarthy tries to hold off last-minute rebellion over work requirements in debt deal.

Per Politico,

House Republican leaders are trying to stave off another wave of GOP defections just hours before a final vote on a deal to avert a national default — this time over the work requirements for aid programs that Republican leaders have publicly touted as a win for their party.

The latest rebellion was spurred by a Congressional Budget Office report released Tuesday night that estimates spending on the food aid program that Republicans attempted to cut during the debt ceiling negotiations would actually increase under the agreement reached by Speaker Kevin McCarthy and President Joe Biden. That has set off a firestorm among conservative lawmakers — threatening a larger revolt within their fractious caucus hours before a final vote on the legislation to raise the debt ceiling and avoid a default.

In the end, the House GOP could barely muster two-thirds of its caucus to pass a bill to save the nation from defaulting on its debt—despite a constitutional obligation to do so. McCarthy thus needed support from Democrats to pass the bill—although Democrats had a co-equal constitutional obligation to lift the debt ceiling. It is a fair characterization to say that Democrats “saved” Republicans from their inability to govern.

But as readers noted yesterday in the Comments section of this newsletter, the passage of a bill to prevent default is not a “partisan” victory. It is a victory for the American people, who deserve nothing less from their representatives. Indeed, they deserve a heck of a lot more than staving off a default with two or three days to spare.

So, what do these developments mean? The answer to that question is above my pay grade—I am not a political journalist, and I rely on analysis by others. But since it is too early for most of that analysis to be available, I will make a few blazingly obvious comments. In doing so, I don’t mean to reduce the bill's passage to “winners” and “losers.”

With that throat-clearing and self-deprecation out of the way, here are my observations:

Joe Biden was disciplined and patient, even as Kevin McCarthy held daily whining sessions with a White House press corps eager for content.

Biden played a “long game” to benefit all Americans, while Republicans were focused on “owning the libs.” The former usually prevails over the latter.

Biden has a deep and talented team—a sign of Biden’s skillful leadership. Special credit goes to Shalanda Young, director of the Office of Management and Budget.

Incredibly, Biden negotiated a deal that suspends the debt ceiling until 2025. In the past, Congress has merely raised the debt ceiling by a specified amount.

Biden also averted a possible government shutdown in September 2023 by agreeing to a spending bill through January 2025.

Although it remains to be seen, Biden may have masterfully played all of us—including the media—by saying he would not negotiate the debt limit and acting coy on using the 14th Amendment. Both of those positions may have been designed to misdirect Republicans and the media about his ultimate strategy.

McCarthy could not secure 150 votes—about two-thirds of his caucus—to support the bill. While he survived, he is weakened. He needed sixty-nine Democratic votes to pass the first significant bill of his tenure. Those votes were not a sign of bipartisanship but a sign of maturity and discipline by Democrats.

Also weakened is the Freedom Caucus, which learned that it could not control McCarthy as it had hoped. The Freedom Caucus was exposed as a paper tiger unwilling to use its ability to call for a vote of “no confidence” on McCarthy.

Ron DeSantis entered the fray late and backed the losing Freedom Caucus. His political judgment is unerringly wrong. Even the impulsive and undisciplined Trump managed to stay quiet despite secretly hoping for a default.

There is undoubtedly more that needs to be said, but the above observations stand out to me tonight. But the biggest takeaway is that all Americans can breathe easier because of Joe Biden’s steady hand.

Trump caught on tape admitting he took classified documents and understood that he could not disseminate them after leaving office.

CNN broke a story on Wednesday that suggests special counsel Jack Smith may have Trump cornered in the Mar-a-Lago documents case. The story is here: CNN, EXCLUSIVE: Trump captured on tape talking about classified document he kept after leaving the White House.

In short, as Trump was being interviewed by researchers for an autobiography by Mark Meadows, the former president acknowledged that he understood he could not share secret documents with persons not authorized to see them. Per CNN:

The recording indicates Trump understood he retained classified material after leaving the White House, according to multiple sources familiar with the investigation. On the recording, Trump’s comments suggest he would like to share the information but he’s aware of limitations on his ability post-presidency to declassify records, two of the sources said.

Trump claimed possession of a classified document that undermined public statements by Chairman of the Joint Chiefs Mark Milley about the general’s alleged plans to attack Iran. Per CNN, General Milley testified before a grand jury convened by special prosecutor Jack Smith.

It is possible that Trump was lying about having a battle plan created by Mark Milley to attack Iran—a fact that may be beside the point. Even in his lies about Milley, Trump acknowledged that he was still bound by classification rules that applied to national defense documents. Such a statement is an admission that contradicts Trump's public statement that documents were “automatically declassified” if he removed them from the White House.

Legal commentators are predicting that the existence of the tape could be “game over” for Trump on charges of illegally retaining national defense documents.

The tape's existence was not the only significant development on Wednesday relating to Trump's legal jeopardy. Read on!

Special counsel Jack Smith interviews Trump's election security expert.

Disclosures about the Mar-a-Lago documents case suggest that Trump is in serious jeopardy and that an indictment may be coming this month. But a second disclosure shows that Jack Smith is not ignoring Trump's effort to prevent the peaceful transition of power.

The NYTimes reported on Wednesday that Jack Smith has taken grand jury testimony from Christopher Krebs, a White House election security adviser who contradicted Trump's baseless claims that the 2020 election was marred by fraud. See NYTimes, Trump White House Aides Subpoenaed in Firing of Election Security Expert. (This article is accessible to all.)

If Jack Smith is working to prove that Trump knew his claims of a rigged election were untrue, what better source than Trump's own election security adviser, Christopher Krebs? You may recall that Krebs described the 2020 election as “the most secure election” in US history. Trump promptly fired Krebs.

Per the Times, Jack Smith is also investigating Trump’s use of the White House personnel office to fire any administration employees perceived as “disloyal” to Trump and hostile to his claims of a rigged election. Evidence that such firings were motivated by a desire to unlawfully remain in office could add to Jack Smith’s proof regarding Trump's state of mind.

The report about Christopher Krebs's testimony suggests that Jack Smith is still investigating Trump for possible crimes relating to insurrection, election interference, obstruction, and defrauding the US—in addition to crimes relating to the Mar-a-Lago documents case. Both developments are encouraging, although the timing of charges is becoming increasingly fraught. Trump responded to the CNN report (above) by claiming that Smith is “interfering” in the 2024 election.

Concluding Thoughts.

Remember when President Biden outsmarted congressional Republicans during the State of the Union address? Biden managed to trick Republicans into taking “off the table” cuts to Social Security and Medicare. That maneuver by Biden is a substantial part of the reason those programs were not part of the spending cuts in the debt ceiling bill.

But Republicans haven’t given up the idea of cutting Social Security and Medicare. During an appearance this week, McCarthy proposed a “commission” to examine additional spending cuts he failed to negotiate as part of his deal with Biden. The “commission” proposal is a sop to unhappy Freedom Caucus members. But that is beside the point. In suggesting the commission, McCarthy also suggested that cuts to Social Security and Medicare should be back on the table. See Raw Story, McCarthy suggests new commission could look at Social Security and Medicare cuts.

So, add to Biden’s negotiating accomplishments the protection of Social Security and Medicare through 2025. After that, it is up to us to ensure that Republicans never regain control Congress. If they do, McCarthy has revealed their true intentions. We must stop them. Biden’s steady hand has shown us the way—with seriousness of purpose and determination focused on helping all Americans.

#Robert B. Hubbell#Robert B. Hubbell Newsletter#debt ceiling negotiations#Biden Administration#election 2024

3 notes

·

View notes

Text

Mastering Negotiation Skills: A Review of The Art of Negotiation

Business is kicking back up at work and the winter doldrums have me feeling kind of bummed out as well. Regardless, I’m sorry for not posting last week. I apparently needed the break, but I didn’t give you guys a heads up and that’s on me. I’ll do better next time. Recently at work I’ve had more reasons to look into the art of negotiations, which is something I’ve surprisingly not read much…

0 notes

Text

Maurits Hennen: Het belang van onderhandelingsvaardigheden bij incasso

Maurits Hennen, de visionaire oprichter van Juristu, heeft een reputatie opgebouwd voor uitmuntendheid in de incasso- en juridische sector. Met een passie voor innovatie en een diepgaand begrip van de complexiteit van de sector, benadrukt Hennen de cruciale rol die onderhandelingsvaardigheden spelen bij effectieve incasso. Nu het juridische landschap zich blijft ontwikkelen, benadrukt Maurits Hennens aanpak hoe het beheersen van onderhandelingen uitdagende incassosituaties kan transformeren in wederzijds voordelige oplossingen.

De rol van onderhandelingen bij incasso

Incasso is meer dan alleen het innen van openstaande bedragen; het gaat om het opbouwen van vertrouwen, het begrijpen van de omstandigheden van de schuldenaar en het vinden van een oplossing die voor beide partijen werkt. Maurits Hennen gelooft dat onderhandelen een kerncompetentie is in dit proces, waardoor incassobureaus delicate gesprekken kunnen voeren en tegelijkertijd optimale resultaten kunnen behalen.

Relaties opbouwen door communicatie

Succesvolle incasso vereist meer dan juridische expertise: het vereist sterke interpersoonlijke en communicatieve vaardigheden. Hennens aanpak van onderhandelen richt zich op empathie en actief luisteren, waardoor incassobureaus de financiële situatie en motivaties van de schuldenaar beter kunnen begrijpen. Door een positieve relatie te bevorderen, zorgt Maurits Hennen ervoor dat discussies niet vijandig maar juist samenwerkend zijn.

Omgaan met complexiteit en conflicten

Incassozaken gaan vaak gepaard met verschillende uitdagingen, van juridische geschillen tot persoonlijke meningsverschillen. Maurits Hennen benadrukt dat onderhandelingen incassobureaus in staat stellen om deze complexiteiten effectief te beheren. Door strategische dialoog kunnen oplossingen worden afgestemd op unieke situaties, waardoor de kans op langdurige juridische gevechten wordt verkleind en onnodige wrijving wordt geminimaliseerd.

Oplossingen creëren die beide partijen ten goede komen

De kern van Maurits Hennens onderhandelingsfilosofie is het idee om win-winoplossingen te vinden. Door rekening te houden met de langetermijngevolgen van incassobeslissingen, kunnen incassobureaus betalingsplannen, schikkingsopties of flexibele voorwaarden aanbieden die zowel aan de behoeften van de schuldeiser als de schuldenaar voldoen. Deze evenwichtige aanpak verbetert de klanttevredenheid en zorgt tegelijkertijd voor duurzame zakelijke relaties.

Continue leer- en aanpassingsvaardigheden

Maurits Hennen erkent dat onderhandelingsvaardigheden moeten evolueren met de trends in de industrie in een voortdurend veranderend juridisch en financieel landschap. Hij pleit voor continue professionele ontwikkeling en moedigt incassoprofessionals aan om op de hoogte te blijven van de nieuwste technieken en technologieën om de onderhandelingsresultaten te verbeteren.

Conclusie

Maurits Hennens nadruk op onderhandelen als een essentieel onderdeel van incasso heeft nieuwe normen gesteld in de juridische sector. Door empathie, effectieve communicatie en strategische oplossingen te promoten, heeft Hennen Juristu geholpen om opmerkelijk succes te behalen bij het oplossen van complexe financiële geschillen. Nu onderhandelingen de toekomst van incasso blijven vormgeven, biedt Maurits Hennens expertise onschatbare inzichten in het creëren van een meer samenwerkend en effectief incassoproces.

1 note

·

View note

Text

And if Biden is in a walking coma, how is it that he outmaneuvered Republicans mid state-of-the-union over the defunding social security issue? Are Republicans admitting they are so stupid they can't outwit a walking corpse?

“About ten paragraphs in it notes in passing that of the more than 45 people the reporters spoke to for the piece over several months “most of those who said Biden performed poorly were Republicans.” The use of Johnson and McCarthy as the two main fact witnesses is extraordinary on a few levels. The first and most obvious is that “Biden archrivals currently running against him say he’s way old and losing his edge” doesn’t have quite the punch of the article as presented. The other is that Biden famously managed to overmatch McCarthy in the debt ceiling negotiations that led to his fall from power and Biden’s personal lobbying seems to have played a key role in the eventual passage of Ukraine aid this spring. In other words, if Biden’s really losing it, he still managed to handle both guys pretty well.”

—

Breaking from the Journal: Kev McCarthy and Mike Johnson Say Biden’s WAY Old

A couple of lying clowns told lies about President Biden, and the WSJ dutifully reprinted the lies without context or criticism.

This shit is crazy. Huge papers like the WSJ and NYT are just constantly presenting right wing lies – easily disproved lies, at that – as a matter of opinion, not a colossal and horrifyingly effective effort to gaslight and mislead voters.

It’s exhausting, and now that the Washington Post is on its way to being consumed by the British tabloid cancer its new editorial team is bringing to America from the Murdoch Bullshit factory, it’s only going to get worse.

#politics#Joe Biden#negotiations#strategy#legislation#democrat#debt ceiling#social security#ukraine#military spending

391 notes

·

View notes