#Credit Risk

Explore tagged Tumblr posts

Text

AI and Identity Theft Protection: Safeguarding Your Credit

Introduction

In a digital age fraught with cyber threats, Daniel Reitberg delves into how AI is reshaping the landscape of identity theft protection, offering individuals robust defenses against this increasingly sophisticated menace. With an eye on the critical importance of credit safety, this article explores the pivotal role that AI plays in safeguarding your financial well-being.

The Evolving Face of Identity Theft

Identity theft has taken on new forms and complexities, with criminals constantly adapting to exploit vulnerabilities. From phishing scams to data breaches, the techniques are as diverse as they are cunning.

AI-Powered Security Solutions

Artificial Intelligence (AI) has emerged as a potent weapon against these evolving threats. AI-driven identity theft protection services leverage machine learning to detect unusual patterns and behaviors in your financial activities. This capability is a game-changer in the fight against identity theft.

Real-time Threat Detection

One of the striking features of AI in this context is its real-time threat detection. AI algorithms continuously monitor your financial transactions, searching for signs of suspicious activity. Whether it's an unfamiliar credit card charge or an application for a new loan in your name, AI is vigilant.

Predictive Analysis

AI doesn't just react to known threats; it also predicts potential risks. By analyzing your past financial behavior, AI can detect when something doesn't align with your typical patterns. This predictive analysis is invaluable for stopping identity theft before it wreaks havoc.

Mitigation and Response

In case of a threat, AI doesn't just alert you; it also assists in the mitigation and response. It can, for instance, guide you through the process of freezing your credit, reporting fraud to the relevant authorities, and even recovering your identity.

Educational Resources

AI-powered identity theft protection isn't just about security; it's also about empowering users with knowledge. These services often offer resources and guidance on how to protect your personal information online and enhance your overall digital security.

The Ethical Dimension

As AI becomes a central player in safeguarding our identities, ethical considerations come into play. The responsible use of data and transparency in how AI analyzes personal information is critical for maintaining public trust.

The Future of Identity Theft Protection

The synergy between AI and identity theft protection holds immense promise. As AI algorithms become more sophisticated, users can expect even more robust security and seamless experiences.

Daniel Reitberg: A Voice for AI in Identity Protection

Daniel Reitberg is a staunch advocate for the intersection of AI and identity theft protection. His deep understanding of technology's potential in ensuring financial security underscores the transformative role of AI in safeguarding individuals' credit. In a world where digital threats loom large, the partnership between AI and identity theft protection offers a beacon of hope.

#artificial intelligence#machine learning#deep learning#technology#robotics#credit restoration#credit rating#credit report#credit repair#credit risk#credit score#identity theft

4 notes

·

View notes

Text

Understanding Debt Mutual Funds: Risks and Benefits Explained

Overview: Debt mutual funds invest in fixed-income securities such as government and corporate bonds, money market instruments and similar assets. These funds are generally perceived as lower risk compared to equity mutual funds due to their focus on secured, less volatile investments that often provide fixed returns. Reasons for Perceived Low Risk: Secured Investments: Debt mutual funds are…

0 notes

Text

And she had worked with programmers to design computer systems to improve banks' management information on international credit risks.

"Westpac: The Bank That Broke the Bank" - Edna Carew

#book quote#westpac#edna carew#nonfiction#louise jackson#job history#programmer#computer systems#banking#management#information#credit risk#finance

0 notes

Text

The Mortgage Lending Process Decoded with Comprehensive Research Findings

#mortgage#risk management#magistral consulting#credit risk#riskmitigation#financialservices#loans#lending

0 notes

Text

NBFCs and Rule-Based Lending in India

The Indian NBFC sector has been an important pillar of credit growth and an aide to the banks, since long. Especially, in areas like micro-finance, small medium enterprises, factoring, and infrastructure, NBFCs are able to cater to niches that banks may not be able to, purely by virtue of their size and risk protocols. The total credit extended by NBFCs has jumped from approximately one-sixth of…

View On WordPress

0 notes

Text

Navigating Credit Landscapes with Confidence: BCT Digital's Credit Risk Management Solutions

In the dynamic world of finance, managing credit risk is a cornerstone of prudent decision-making and sustainable growth. Whether you’re a financial institution, lender, or fintech company, understanding and mitigating credit risk is essential for protecting assets, maintaining profitability, and ensuring long-term success. BCT Digital, a leader in fintech solutions, offers innovative Credit Risk Management solutions designed to empower businesses with actionable insights, predictive analytics, and strategic decision-making capabilities to navigate credit landscapes with confidence and precision.

Comprehensive Risk Assessment with Advanced Analytics

BCT Digital’s Credit Risk Management solutions leverage advanced analytics and machine learning algorithms to provide businesses with comprehensive tools for risk assessment. By analyzing vast volumes of data, including customer demographics, transaction history, credit scores, and market trends, our solutions enable businesses to assess creditworthiness, identify potential risks, and make informed lending decisions. With predictive analytics capabilities, businesses can anticipate credit defaults, detect early warning signs, and proactively mitigate risks, minimizing losses and maximizing returns.

Customized Risk Models for Precise Risk Evaluation

Every business has unique risk profiles and lending criteria, and BCT Digital understands the importance of tailored solutions. Our Credit Risk Management solutions offer customizable risk models that can be tailored to align with the specific needs and objectives of each client. Whether you’re assessing consumer credit, commercial lending, or mortgage risk, our team collaborates closely with you to develop customized risk models that factor in your business goals, risk appetite, regulatory requirements, and industry dynamics, empowering you to optimize credit risk management strategies effectively.

Real-time Monitoring and Alerts for Proactive Risk Management

In today’s fast-paced lending environment, timely intervention is critical for mitigating credit risk effectively. BCT Digital’s Credit Risk Management solutions provide real-time monitoring and alerts that enable businesses to identify and respond to emerging risks promptly. By monitoring key risk indicators, detecting anomalies, and generating actionable alerts, our solutions empower businesses to take proactive measures to mitigate risks, prevent losses, and protect their bottom line. With real-time insights and alerts, businesses can stay ahead of the curve and adapt quickly to changing credit landscapes.

Regulatory Compliance and Risk Governance

Compliance with regulatory requirements is a top priority for businesses in the financial sector, and BCT Digital’s Credit Risk Management solutions ensure adherence to regulatory standards and best practices. Our solutions offer built-in compliance checks, risk governance frameworks, and audit trails that help businesses demonstrate compliance with regulatory requirements such as Basel III, Dodd-Frank, and GDPR. By implementing robust risk governance mechanisms and compliance controls, businesses can mitigate regulatory risks, avoid penalties, and maintain trust with regulators and stakeholders.

Continuous Innovation for Future-proof Risk Management

Innovation is at the core of BCT Digital’s ethos, and we are committed to continuously enhancing our Credit Risk Management solutions to address emerging challenges and opportunities in the financial industry. Our dedicated team of experts leverages the latest technologies, such as artificial intelligence, blockchain, and big data analytics, to develop innovative solutions that empower businesses to stay ahead of the curve and future-proof their credit risk management strategies. With BCT Digital as your partner, you can leverage the power of innovation to navigate credit landscapes with confidence and precision.

BCT Digital’s Credit Risk Management solutions empower businesses to navigate credit landscapes with confidence and precision. With comprehensive risk assessment, customized risk models, real-time monitoring and alerts, regulatory compliance, and continuous innovation, our solutions offer a holistic approach to credit risk management that enables businesses to protect assets, maintain profitability, and achieve long-term success in today’s dynamic lending environment. Experience the power of BCT Digital’s Credit Risk Management solutions and unlock new possibilities for your business today.

0 notes

Text

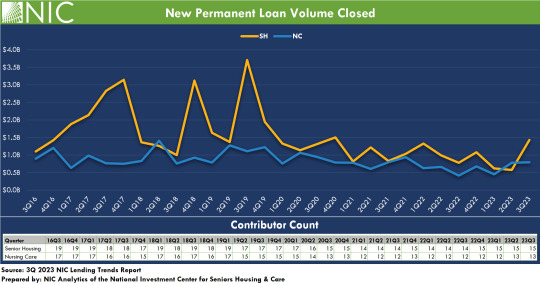

Wednesday Feature: Lending Trends Still Reflecting a Tight Capital Environment

Happy Hump Day! The National Investment Center released its third quarter 2023 lending trends report and while the data is a bit old, it is reflective of current market conditions. The report is available here: NIC_Lending__Trends_Report_3Q2023 Suffice to say since I last provided an update on this subject area, things have not improved. Capital access and credit remain tight, all sources. The…

View On WordPress

#2024#Assisted Living#Banks#Borrowing#Capital#Credit#credit markets#credit risk#Debt#default#delinquency#Economics#Federal Reserve#Industry Outlook#Interest Rates#Lending#Loans#Management#Market Trends#Money#National Investment Center#New Construction#NIC#Nursing Care#Outlook#Policy#real estate#Senior Housing#SNF#Trends

0 notes

Text

Restore Your Credit with Confidence: Nab Solutions - Your Credit Restoration Specialist

Is a poor credit score impeding your ability to make financial progress? There's nowhere else to look! The best credit restoration firm, Nab Solutions, is here to assist you in getting your credit back on track. They can help you achieve financial stability. We'll help you through the credit restoration process. We have years of experience and a track record of accomplishment. We also have the ability to achieve better interest rates. You can also qualify for loans and credit cards, and negotiate reduced insurance premiums. Become one of the many pleased customers who have improved their financial situation. Take the first step toward a better financial future by hiring Nab Solutions today!

Rebuilding credit is a step toward financial security.

Credit restoration is about taking charge of your financial destiny. It's not just about raising your credit score. You may take advantage of more chances and have more options when your credit score is high. You can get better loan interest rates and greater credit card limits. You can even get lowered insurance premiums.

Now you can finally reach your financial objectives. You can save money, start a business, or buy a home with a rebuilt credit score. You can arrive more quickly and easily with the aid of credit restoration.

However, restoring credit can be a difficult and drawn-out procedure. For this reason, it's crucial to work with a respectable Credit Restoration Specialist like Nab Solutions. With our experience and knowledge, we can guide you through the credit restoration process. We can also help you reach your objectives.

Together, we'll find the unfavourable things on your credit report. Then, we'll create a strategy to have them removed. We'll also assist you in developing healthy credit practices. This will help keep your credit score high in the future.

Understanding your credit score: the key to success

To take charge of your financial destiny, you must understand your credit score. Lenders consider your credit score, which ranges from 300 to 850, as a number that shows if you can repay debts. A higher credit score signals a lesser chance of default, making it easier to secure loans and credit cards with favourable terms.

When calculating your credit score, your payment history, credit utilisation, length of credit history, credit mix, and new credit are all taken into account. Your payment history is the most important factor, making up 35% of your score.

Making on-time payments on a regular basis shows that you are a reliable debt manager. Thirty percent of your score is determined by your credit usage. This means how much of your available credit you are really using, compared to your total credit limits. Maintaining a low credit utilisation rate is indicative of sound credit management.

Fifteen percent of your score is determined by the duration of your credit history. Lenders use more information to judge your creditworthiness when your credit history is longer. Ten percent of your score is attributed to your credit mix. It's the variety of credit accounts you have, including loans, mortgages, and credit cards.

A varied credit mix demonstrates to lenders that you can handle different credit kinds sensibly. The final 10% of your score is attributed to new credit. New credit is freshly started credit accounts or inquiries. Applying for too much credit in a short amount of time will lower your credit score.

You may raise your credit score by being aware of the variables that influence it. It's crucial to frequently review your credit report for mistakes or inconsistencies. Additionally, you want to concentrate on paying your bills on time. Also, lower your credit utilisation and accumulate a varied credit history. Consider collaborating with a trustworthy Credit Repair Business. They can help you dispute or remove unfavourable items from your credit report. These include late payments and collections.

Although it takes time, it is worthwhile to restore your credit score. A high credit score can help you access many financial options. It can also help you reach your financial goals faster and more successfully.

Pros and drawbacks of DIY credit restoration and when to get expert assistance

Doing credit restoration on your own may seem difficult. However, success is achievable if you are prepared to invest the necessary time and energy. You can get started with a plethora of resources from your local library and the internet. Before deciding if DIY credit repair is best for you, it’s crucial to weigh its benefits and drawbacks.

Saving money is one of the main benefits of doing credit restoration on your own. Credit repair businesses may charge hundreds or even thousands of dollars for their services. Do-it-yourself credit restoration could be a more cost-effective choice if money is scarce. Furthermore, DIY credit repair allows you to have greater control over the procedure. You have the freedom to choose which items to dispute and how to get in touch with the credit bureaus. If you want more control over the process of getting your credit restored, or if you are concerned about your privacy, this may be advantageous.

But there are drawbacks to doing credit restoration yourself. The fact that it can take a lot of time is among the main obstacles. It takes a lot of patience and perseverance to restore credit, and it may take months or even years. Furthermore, credit restoration on your own can be difficult. To succeed, there are numerous laws and guidelines that you must be aware of. It can be easy to make mistakes when you're unfamiliar with the credit restoration procedure. This could cause delays or even damage to your credit.

For these reasons, before determining if DIY credit repair is the best course of action for you, it's crucial to carefully consider the benefits and drawbacks of the process. It could be wise to get professional assistance if you don't think you can complete the process on your own. A trustworthy credit repair business can help you create a customised credit repair strategy and improve your credit score . They may mentor you through the procedure.

Nab Solutions is unique because of its knowledge, experience, and outcomes.

Nab Solutions is a leading company in the credit repair market with more than ten years of experience. Our team of highly qualified and licensed experts understands the intricacies of credit reporting and restoration well. We are devoted to helping our clients reach their credit restoration objectives and to provide them the best possible service and assistance.

Our customised approach is one of the main things that separates Nab Solutions from other credit repair businesses. Each client's financial condition is different. We customise our Credit Restoration Services to match their particular demands. We take the time to get to know our clients and learn about their financial objectives. Then, we create specialised credit restoration plans that are intended to assist them in reaching their goals as fast as feasible.

Working with us also benefits from our dedication to honesty and openness. We firmly think that our clients should be fully informed about the steps we are taking. We want to help them rebuild their credit. We are available to address any inquiries they might have. We keep our clients informed on the status of their credit restoration on a regular basis, and we are available to address any worries they may have.

We are dedicated to giving our clients the instruments and resources they require to succeed. We think everyone should have the opportunity to repair their credit and enhance their financial future.

Customer success stories: actual clients, actual changes

At Nab Solutions, we're proud of our clients' accomplishments. Many people and families have benefited from our help. We've helped them rebuild their credit and reach their financial goals. Here are just a handful of instances where we have improved our clients' lives:

Sarah, a mother of two living alone, consulted with us and had a credit score in the lower 500s. She was having financial difficulties and was not eligible for a loan to purchase a car. After a six-month engagement with Nab Solutions, Sarah's credit score increased by more than 200 points. It was simpler for her to commute to work and drop her kids off at school when she was able to obtain a loan for a dependable vehicle.

John, a recent hire with a credit score in the mid-600s, approached us. He was angry that he could not get a mortgage to purchase a house. After an eight-month engagement with Nab Solutions, John saw his credit score increase by more than 100 points. He was successful in getting a mortgage and buying the house of his dreams.

These are but a handful of the numerous triumphs we at Nab Solutions have experienced. We take great pride in assisting our clients. We help them enhance their quality of life and reach their financial objectives. We urge you to get in touch with us right now if you are having credit issues. We can assist you in realizing your financial goals and restoring your credit.

0 notes

Text

What Are the Types of Credit Risks?

Breaking down credit risk The banking and financial services industries are prone to market fluctuations; this causes various types of credit risk

0 notes

Text

How AI Can Empower Lenders to Make Smarter, Fairer Lending Decisions

This often resulted in qualified borrowers, particularly those from underserved communities, being unfairly excluded from accessing the credit they need to fuel their dreams and climb the economic ladder.

But the tides are turning. Enter Artificial Intelligence (AI), a transformative force poised to revolutionize the lending landscape.

By leveraging the power of machine learning and big data, AI can empower lenders to move beyond the limitations of traditional models and make smarter, fairer lending decisions.

Imagine a world where AI-powered algorithms, trained on vast datasets that holistically encompass financial habits, employment trends, and alternative data sources, paint a much richer picture of each borrower's potential.

This allows lenders to identify creditworthy individuals who might have been overlooked by traditional methods, expanding access to capital and fostering financial inclusion.

The benefits of AI extend far beyond simply increasing loan approval rates. Lenders can utilize AI to:

Reduce bias and discrimination:

By relying on objective data analysis, AI can help mitigate the inherent biases that can creep into human decision-making, paving the way for fairer and more equitable lending practices.

Personalize lending solutions:

AI can tailor loan terms and interest rates to individual borrowers' unique circumstances, ensuring fairer access to appropriate credit.

Improve risk assessment:

AI algorithms can continuously learn and adapt, leading to more accurate risk assessments and better management of loan portfolios.

Streamline the lending process:

AI-powered automation can significantly reduce paperwork and processing times, making the entire loan application process smoother and more efficient for both lenders and borrowers.

Of course, like any powerful tool, AI in lending comes with its own set of challenges. Concerns around data privacy, algorithmic bias, and the potential for job displacement need to be addressed through responsible development and ethical implementation.

But the potential rewards are undeniable. By embracing AI and harnessing its transformative power, lenders can move from gatekeepers to guides, opening doors to opportunity and paving the way for a more inclusive and equitable financial future.

If you're a professional in the credit risk industry or simply passionate about financial inclusion, then be sure to mark your calendar!

The Credit Risk Management Summit and Awards, taking place on March 7th, 2024, at the Taj Santacruz in Mumbai, promises to be a thought-provoking platform to explore the latest advancements in AI-powered lending and connect with industry leaders shaping the future of this dynamic field.

Don't miss this chance to join the conversation and be a part of the journey towards a brighter, fairer financial landscape.

Visit Credit risk summit 2024 for more information and to register for the summit. Let's unlock the potential of AI together and build a world where everyone has access to the financial tools they need to thrive

#business summits#credit risk management#credit risk#credit lender#business conference#business networking

0 notes

Text

Risks Inherent in Financial Institutions.

The major risks faced by banks and related financial institutions include credit risks, interest rate risks, market risk, and operating and liquidity risks. The other risks include residual, dilution, settlement, compliance, concentration, country, foreign exchange, strategic, and reputational risks. The major tools of a risk management system used by banks are stress testing and asset and liability management. The different forms of interest rate risk are gap or mismatch risk, basis risk, embedded-option risk, yield curve risk, price risk reinvestment risk, and others. The instruments for credit risk management consist of estimating expected loan losses, multitiered credit-approving systems, prudential limits, risk ratings, risk pricing, portfolio models, loan review mechanisms, and the like. The instruments for measurement of interest rate risk are maturity gap analysis, duration gap analysis, and simulation analysis. The basic model for measurement of market risk is value at risk. Liquidity risks are measured through various ratios. The risks in major non-banking financial institutions such as insurance includes underwriting and investment risks along with market, credit, and provisioning risks. Pension fund risks consist of firm specific risks, funding risks, investment risks, plan termination risks, and compliance risks. Mutual fund risks consist of market risks, liquidity risks, call risks, and currency risks.

Learn more about Risks Inherent in Financial Institutions related to the publication - Strategies of Banks and Other Financial Institutions: Theories and Cases.

#liquidity risk#credit risk#financial risk management#operational risk#legal risk#non-banking financial institutions#interest rate risk#credit risk management#4 december#international day of banks#currency risk#mutual funds

0 notes

Text

AI-Powered Credit Repair Apps: Your Pocket-Sized Financial Advisor

Introduction

In a world where financial well-being is paramount, Daniel Reitberg explores the transformative impact of AI-powered credit repair apps. These pocket-sized financial advisors are changing the way individuals approach credit repair, offering customized solutions and empowering users to take control of their financial futures.

The Rise of AI in Credit Repair

Artificial Intelligence (AI) has made its mark in various industries, and credit repair is no exception. AI-powered apps bring a new level of efficiency and effectiveness to the often complex and time-consuming process of improving one's credit score.

Understanding Your Financial Landscape

AI-powered credit repair apps start by analyzing your financial landscape. They scrutinize credit reports, identify errors or discrepancies, and provide a comprehensive overview of your credit standing.

Tailored Action Plans

One of the remarkable features of these apps is their ability to create personalized action plans. These plans outline steps you can take to boost your credit score. Whether it's disputing inaccuracies, setting up a payment plan, or negotiating with creditors, AI tailors recommendations to your unique situation.

Automation and Efficiency

AI automates much of the credit repair process. It can send automated dispute letters to credit bureaus, track responses, and manage various tasks, allowing users to save time and avoid the intricacies of credit repair.

Educational Resources

AI-powered apps are not just tools for repair but also education. They offer resources and guidance, helping users understand the factors that influence their credit scores and how to make financial decisions that positively impact their credit.

Building a Positive Credit History

Positive credit history is essential for financial well-being. AI-driven apps provide insights into how you can build a robust credit history. They advise on the types of credit to use and how to manage credit responsibly.

Challenges and Ethical Considerations

While the AI revolution in credit repair is exciting, it's not without challenges. Ethical considerations, data security, and ensuring that users fully understand the process are essential aspects to address.

The Future of Credit Repair

The future of credit repair is in the palm of your hand. AI-powered apps will continue to advance, offering even more sophisticated features and simplifying the credit repair journey.

Daniel Reitberg: A Voice for AI-Powered Finance

Daniel Reitberg passionately advocates for the power of AI in the financial world. His insights into AI-powered credit repair apps highlight the potential of technology to democratize financial well-being. In a world where financial stability is a common goal, these pocket-sized financial advisors are a revolutionary step towards that reality.

#artificial intelligence#machine learning#deep learning#technology#credit risk#credit restoration#credit repair#credit rating#credit report#credit score

1 note

·

View note

Text

Credit Risk Modelling: Understanding and Mitigating Financial Uncertainties

In the ever-changing landscape of the financial industry, one aspect remains constant: the importance of credit risk modelling. Financial institutions and lenders continuously face the challenge of assessing the creditworthiness of their clients to make informed lending decisions. This process is critical to maintain a healthy balance between maximizing profits and safeguarding against potential losses. In this blog, we will delve into the concept of credit risk modelling, its significance, and how it aids in mitigating financial uncertainties.

What is Credit Risk Modelling?

Credit risk modelling is a sophisticated analytical approach used by banks, credit card companies, and other financial institutions to quantify the likelihood of borrowers defaulting on their credit obligations. This predictive method involves a combination of statistical techniques, historical data analysis, and economic factors to calculate the probability of a borrower's default. It essentially helps lenders identify high-risk borrowers, make informed credit decisions, and set appropriate interest rates.

Significance of Credit Risk Modelling

Risk Assessment: Credit risk modelling provides a robust framework for assessing the creditworthiness of borrowers. By evaluating a range of factors like credit history, income, debt-to-income ratio, and other relevant variables, lenders can determine the level of risk associated with a particular borrower.

Optimal Pricing: Accurate credit risk assessment enables lenders to set interest rates that correspond to the level of risk posed by the borrower. Low-risk borrowers are offered lower interest rates, while high-risk borrowers may be subject to higher interest rates to compensate for the additional risk.

Portfolio Management: Financial institutions often manage a diverse portfolio of loans. Credit risk modelling helps in creating a well-balanced portfolio by diversifying credit exposure across various risk profiles, thus minimizing the overall risk of the portfolio.

Regulatory Compliance: Credit risk modelling plays a vital role in regulatory compliance. Many financial regulators mandate banks and other lending institutions to maintain a certain level of capital to cover potential losses from credit risk. Accurate credit risk assessment ensures compliance with these regulations.

Business Strategy: Understanding credit risk allows financial institutions to make strategic decisions regarding expanding or contracting their lending activities, entering new markets, or targeting specific customer segments.

youtube

Types of Credit Risk Models

Probability of Default (PD): PD models estimate the likelihood of a borrower defaulting on their credit obligations over a specific time horizon, typically one year. It provides a probability score for each borrower, indicating the chance of default.

Loss Given Default (LGD): LGD models assess the potential loss a lender may incur if a borrower defaults. It considers the expected recovery rate on the outstanding loan amount after default.

Exposure at Default (EAD): EAD models estimate the outstanding exposure a lender faces at the time of default. It helps in determining the potential loss magnitude in the event of a borrower's default.

Stress Testing Models: Stress testing models evaluate the resilience of a financial institution's portfolio under adverse economic conditions. It helps in assessing the impact of severe economic downturns on credit risk.

Challenges in Credit Risk Modelling

While credit risk modelling offers significant advantages, it is not without challenges:

Data Quality: The accuracy of credit risk models heavily relies on the quality and relevance of historical data. Incomplete or outdated data can lead to inaccurate predictions.

Model Complexity: Advanced credit risk models can be complex, and their interpretation and implementation require specialized skills and expertise.

Black Swan Events: Credit risk models are typically based on historical data and may not account for extreme events or "black swan" occurrences that deviate significantly from historical patterns.

Regulatory Changes: Evolving regulatory requirements can necessitate constant updates to credit risk models, adding complexity to the modelling process.

Conclusion

Credit risk modelling is a fundamental aspect of risk management for financial institutions. It provides a quantitative framework for assessing and managing credit risk, enabling lenders to make well-informed decisions, optimize pricing, and maintain a healthy loan portfolio. However, it's essential to acknowledge the limitations and challenges associated with these models and continuously improve them to adapt to the dynamic financial landscape. By striking the right balance between risk and reward, credit risk modelling helps financial institutions navigate uncertainties, ensuring a stable and sustainable future in the world of finance.

1 note

·

View note

Text

Importance of Credit Risk Management-Credgenics

Credit risk management is a crucial aspect of the financial industry that involves identifying, assessing, and mitigating the potential risks associated with lending money or extending credit to individuals, businesses, or other entities. Effective credit risk management plays a fundamental role in the stability and success of financial institutions and has broader implications for the overall economy. Here are some key reasons why credit risk management is of utmost importance:

1. Financial Stability of Lenders: Credit risk management is essential for the financial stability of lending institutions, such as banks, credit unions, and other financial intermediaries. By carefully evaluating the creditworthiness of borrowers, these institutions can minimize the chances of loan defaults and non-performing assets. This, in turn, ensures that they maintain a healthy balance sheet and can continue to serve their customers and fulfill their obligations.

2. Minimizing Losses and Enhancing Profitability: Proper credit risk management allows lenders to avoid excessive exposure to high-risk borrowers. By setting appropriate credit limits and interest rates based on risk assessments, lenders can reduce the potential losses from loan defaults. At the same time, they can identify low-risk borrowers and offer them more favorable terms, leading to improved profitability for the institution.

3. Maintaining Liquidity and Capital Adequacy: Sound credit risk management practices ensure that financial institutions have sufficient liquidity to meet their obligations when loans are repaid or during times of economic stress. Moreover, by managing credit risks effectively, banks can maintain adequate capital reserves as required by regulatory authorities, enhancing their ability to weather economic downturns.

4. Safeguarding Deposit Holders and Investors: For deposit-taking institutions, such as banks, credit risk management is crucial in safeguarding the interests of depositors and investors. By minimizing the risks associated with lending activities, these institutions can instill confidence among their stakeholders and protect their funds from potential losses.

5. Mitigating Systemic Risks: In the broader, importance of credit risk management practices contribute to mitigating systemic risks within the financial system. A well-managed credit market is less susceptible to cascading defaults and contagion effects, reducing the chances of financial crises and stabilizing the overall economy.

6. Supporting Economic Growth: Access to credit is vital for economic growth and development. By managing credit risks prudently, financial institutions can extend credit to creditworthy borrowers, facilitating investments, entrepreneurship, and consumer spending. This, in turn, stimulates economic activity and promotes job creation.

7. Regulatory Compliance: Credit risk management is closely monitored and regulated by financial authorities to ensure the stability and integrity of the financial system. Compliance with credit risk management regulations helps financial institutions maintain their licenses to operate and avoids potential penalties and reputational damage.

8. Building Customer Trust: Transparent and effective credit risk management builds trust between financial institutions and their customers. When borrowers perceive that their credit applications are evaluated fairly and accurately, they are more likely to establish long-term relationships with the institution, fostering customer loyalty.

In conclusion, credit risk management is a vital component of the financial industry, contributing to the stability of financial institutions, the overall economy, and the well-being of individual borrowers. By prudently assessing and managing credit risks, lenders can optimize their loan portfolios, protect their financial health, and contribute to sustainable economic growth.

1 note

·

View note

Text

Learn More About Effective Credit Risk Management Strategies

Effective credit risk management is essential for businesses to mitigate financial risks and protect their interests. By adhering to these principles, businesses can maintain healthy credit profiles and ensure sustainable financial performance.

0 notes

Text

Credit Risk Management: Understanding Steps, Principles, and Examples

Credit risk management is a critical aspect of the banking industry, and BCT Digital, a leading technology solutions provider, offers innovative tools and expertise to effectively manage credit risk. In this article, we will explore the meaning of credit risk, delve into the steps involved in credit risk management, discuss key principles, and provide examples of how BCT Digital can assist in optimizing credit risk management processes.

Understanding Credit Risk: Credit risk refers to the potential loss a bank may face if a borrower fails to fulfill their financial obligations. It arises from the uncertainty of borrowers' ability to repay loans, meet interest payments, or honor contractual agreements. Managing credit risk is vital for banks to safeguard their financial stability, profitability, and maintain regulatory compliance.

Steps in Credit Risk Management:

Risk Identification: BCT Digital's credit risk management solutions assist banks in identifying potential credit risks by evaluating borrowers, analyzing their financial profiles, and assessing the risk factors associated with each lending transaction.

Risk Measurement and Assessment: BCT Digital provides tools to measure and assess credit risk, including credit scoring models, financial analysis algorithms, and statistical methodologies. These enable banks to quantify the probability of default, potential loss severity, and determine appropriate risk ratings.

Risk Mitigation and Control: BCT Digital's credit risk management solutions help banks implement risk mitigation strategies such as setting appropriate credit limits, establishing risk-based pricing, and implementing collateral management mechanisms. These measures minimize the impact of credit risk on the bank's portfolio.

Monitoring and Reporting: BCT Digital's advanced monitoring and reporting capabilities enable banks to continuously monitor credit risk exposures, track borrower performance, and generate comprehensive reports. These tools facilitate proactive decision-making and timely intervention in managing credit risk.

Key Principles in Credit Risk Management:

Diversification: BCT Digital emphasizes the importance of diversifying credit exposures to reduce concentration risk. By spreading lending activities across different sectors, industries, and geographies, banks can mitigate the impact of potential defaults.

Prudent Underwriting: BCT Digital promotes sound underwriting practices, ensuring proper assessment of borrowers' creditworthiness, collateral evaluation, and adherence to robust lending standards. This principle helps banks make informed decisions when extending credit.

Proactive Risk Management: BCT Digital encourages proactive monitoring and early identification of credit risk indicators, allowing banks to take timely actions to mitigate potential risks. This approach includes ongoing surveillance of borrower financials, industry trends, and macroeconomic factors.

Examples of Credit Risk Management with BCT Digital:

Risk Analytics: BCT Digital offers advanced risk analytics tools that provide banks with real-time insights into credit risk exposures. These tools help identify high-risk borrowers, monitor credit portfolios, and optimize risk-based pricing strategies.

Credit Risk Scoring: BCT Digital's credit risk scoring models evaluate borrower creditworthiness based on various factors, including credit history, income stability, and debt-to-income ratios. This enables banks to make accurate credit decisions and allocate appropriate loan provisions.

Credit Risk Fund: BCT Digital facilitates the establishment and management of credit risk funds, enabling banks to set aside provisions to cover potential credit losses. These funds act as a buffer against unexpected defaults, enhancing the bank's financial resilience.

Credit risk management is a crucial component of banking operations, and BCT Digital offers comprehensive solutions to effectively manage credit risk. By leveraging BCT Digital's expertise, banks can enhance their risk identification, measurement, and control processes. Through advanced analytics, prudent underwriting, and proactive risk management principles, BCT Digital empowers banks to optimize credit risk management, protect their financial stability, and drive sustainable growth.

0 notes